Attached files

| file | filename |

|---|---|

| 8-K - 8-K - OWENS & MINOR INC/VA/ | omi-20210914.htm |

Baird’s 2021 Global Healthcare Conference Baird’s 2021 Global Healthcare Conference September 14, 2021 | Ed Pesicka

Baird’s 2021 Global Healthcare Conference2 Safe Harbor This presentation is intended to be disclosure through methods reasonably designed to provide broad, non-exclusionary distribution to the public in compliance with the SEC's Fair Disclosure Regulation. This presentation contains certain ''forward-looking'' statements made pursuant to the Safe Harbor provisions of the Private Securities Litigation Reform Act of 1995. These statements include, but are not limited to, the statements in this presentation regarding our expectations with respect to our 2021 and 2022 financial performance and our 2026 financial targets, as well as other statements related to the Company’s expectations regarding the performance of its business and improvement of operational performance. Forward-looking statements involve known and unknown risks and uncertainties that may cause our actual results in future periods to differ materially from those projected or contemplated in the forward-looking statements. Investors should refer to Owens & Minor’s Annual Report on Form 10-K for the year ended December 31, 2020, filed with the SEC including the sections captioned “Cautionary Note Regarding Forward-Looking Statements” and “Item 1A. Risk Factors,” and subsequent annual reports on Form 10-K, quarterly reports on Form 10-Q and current reports on Form 8-K filed with or furnished to the SEC, for a discussion of certain known risk factors that could cause the company’s actual results to differ materially from its current estimates. These filings are available at www.owens-minor.com. Given these risks and uncertainties, Owens & Minor can give no assurance that any forward-looking statements will, in fact, transpire and, therefore, cautions investors not to place undue reliance on them. Owens & Minor specifically disclaims any obligation to update or revise any forward-looking statements, whether as a result of new information, future developments or otherwise. Owens & Minor uses its web site, www.owens-minor.com, as a channel of distribution for material Company information, including news releases, investor presentations and financial information. This information is routinely posted and accessible under the Investor Relations section.

Baird’s 2021 Global Healthcare Conference3 O&M Overview: Leading Healthcare Solutions Provider 15,000+ Teammates Worldwide 1,200+ Branded Manufacturers 4,000+ Healthcare Providers Served 95+ Facilities Worldwide A growth-focused, integrated healthcare solutions provider with broad medical distribution reach, proprietary products and services, and a leading home health business that empowers our customers to advance healthcare • 140 years of legacy service • Extensive medical distribution platform and network of trusted relationships • Large North American manufacturing footprint that serves the country’s PPE needs • Supported by value-added services and technology solutions that drive recurring revenue and “sticky” partnerships • Portfolio of proprietary products and emerging home health business that will fuel growth ESG Socially Responsible

Baird’s 2021 Global Healthcare Conference4 O&M Business Blueprint Performance & Achievement OUR RESULTS O&M Business System OUR DISCIPLINE Mission and Values Driven OUR CULTURE Investments & Expansion OUR FUTURE

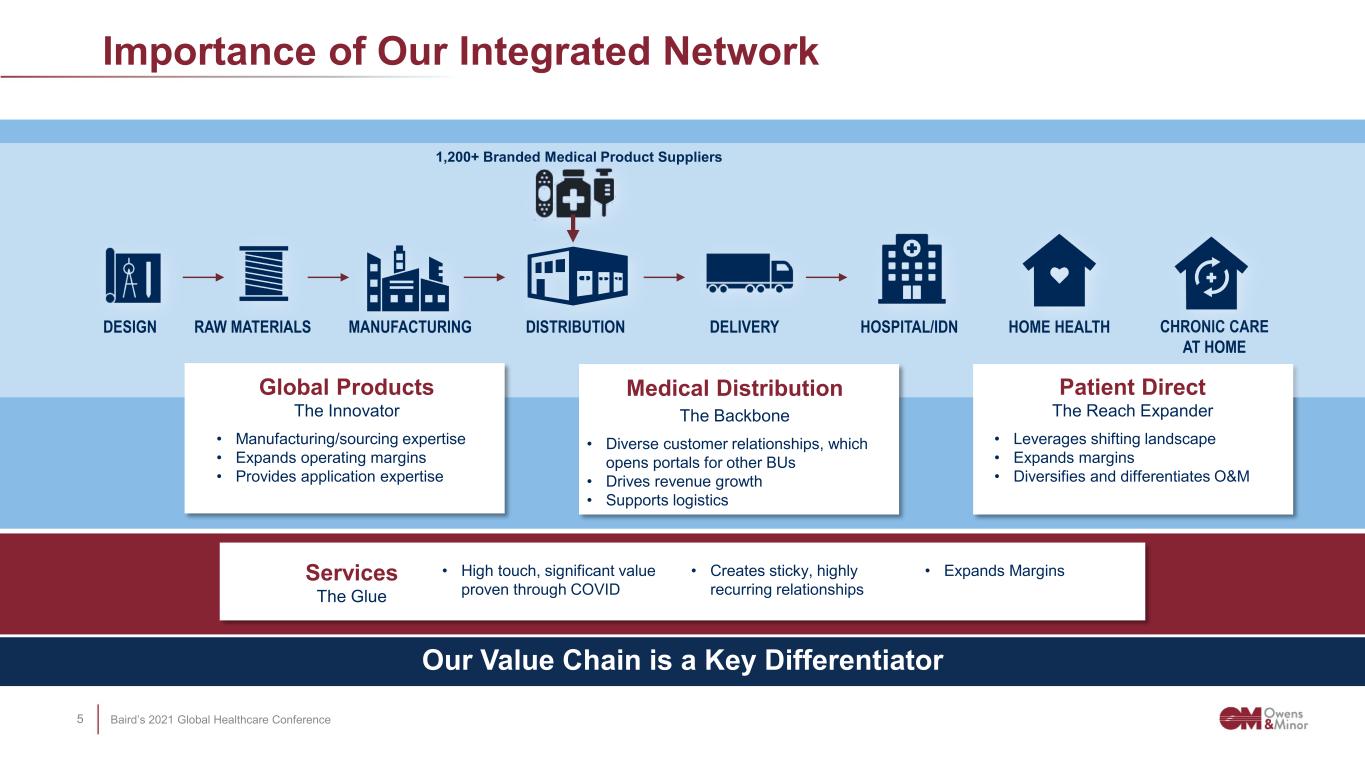

Baird’s 2021 Global Healthcare Conference5 Our Value Chain is a Key Differentiator Importance of Our Integrated Network • High touch, significant value proven through COVID • Creates sticky, highly recurring relationships • Expands MarginsServices The Glue 1,200+ Branded Medical Product Suppliers RAW MATERIALSDESIGN MANUFACTURING DISTRIBUTION DELIVERY HOSPITAL/IDN HOME HEALTH CHRONIC CARE AT HOME Medical Distribution The Backbone • Diverse customer relationships, which opens portals for other BUs • Drives revenue growth • Supports logistics Global Products The Innovator • Manufacturing/sourcing expertise • Expands operating margins • Provides application expertise Patient Direct The Reach Expander • Leverages shifting landscape • Expands margins • Diversifies and differentiates O&M

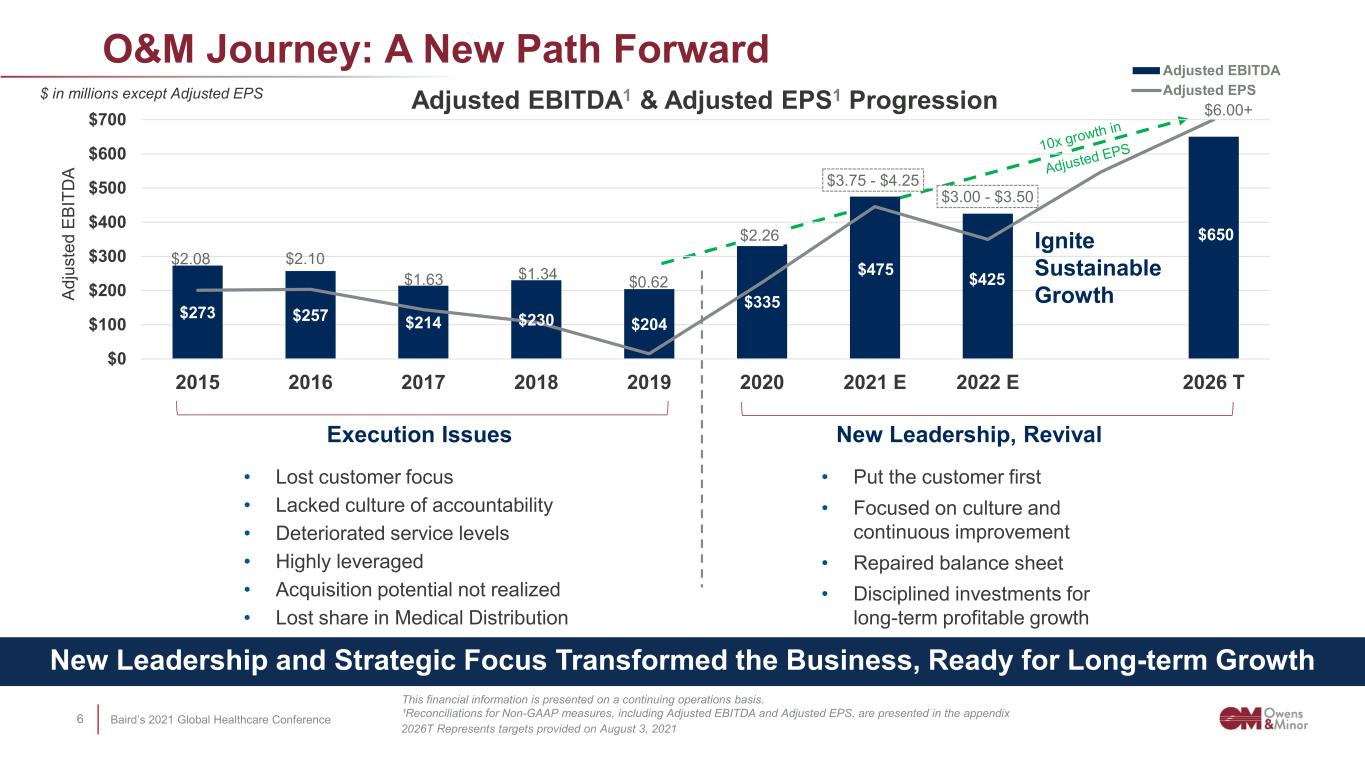

Baird’s 2021 Global Healthcare Conference6 $273 $257 $214 $230 $204 $335 $475 $425 $650 $2.08 $2.10 $1.63 $1.34 $0.62 $2.26 $3.75 - $4.25 $3.00 - $3.50 $6.00+ $0.50 $1.50 $2.50 $3.50 $4.50 $5.50 $0 $100 $200 $300 $400 $500 $600 $700 2015 2016 2017 2018 2019 2020 2021 E 2022 E 2026 T Adjusted EBITDA1 & Adjusted EPS1 Progression Adjusted EBITDA Adjusted EPS Ignite Sustainable Growth O&M Journey: A New Path Forward New Leadership and Strategic Focus Transformed the Business, Ready for Long-term Growth Execution Issues • Lost customer focus • Lacked culture of accountability • Deteriorated service levels • Highly leveraged • Acquisition potential not realized • Lost share in Medical Distribution New Leadership, Revival • Put the customer first • Focused on culture and continuous improvement • Repaired balance sheet • Disciplined investments for long-term profitable growth $ in millions except Adjusted EPS Ad ju st ed E PS Ad ju st ed E BI TD A 2026T Represents targets provided on August 3, 2021 This financial information is presented on a continuing operations basis. ¹Reconciliations for Non-GAAP measures, including Adjusted EBITDA and Adjusted EPS, are presented in the appendix

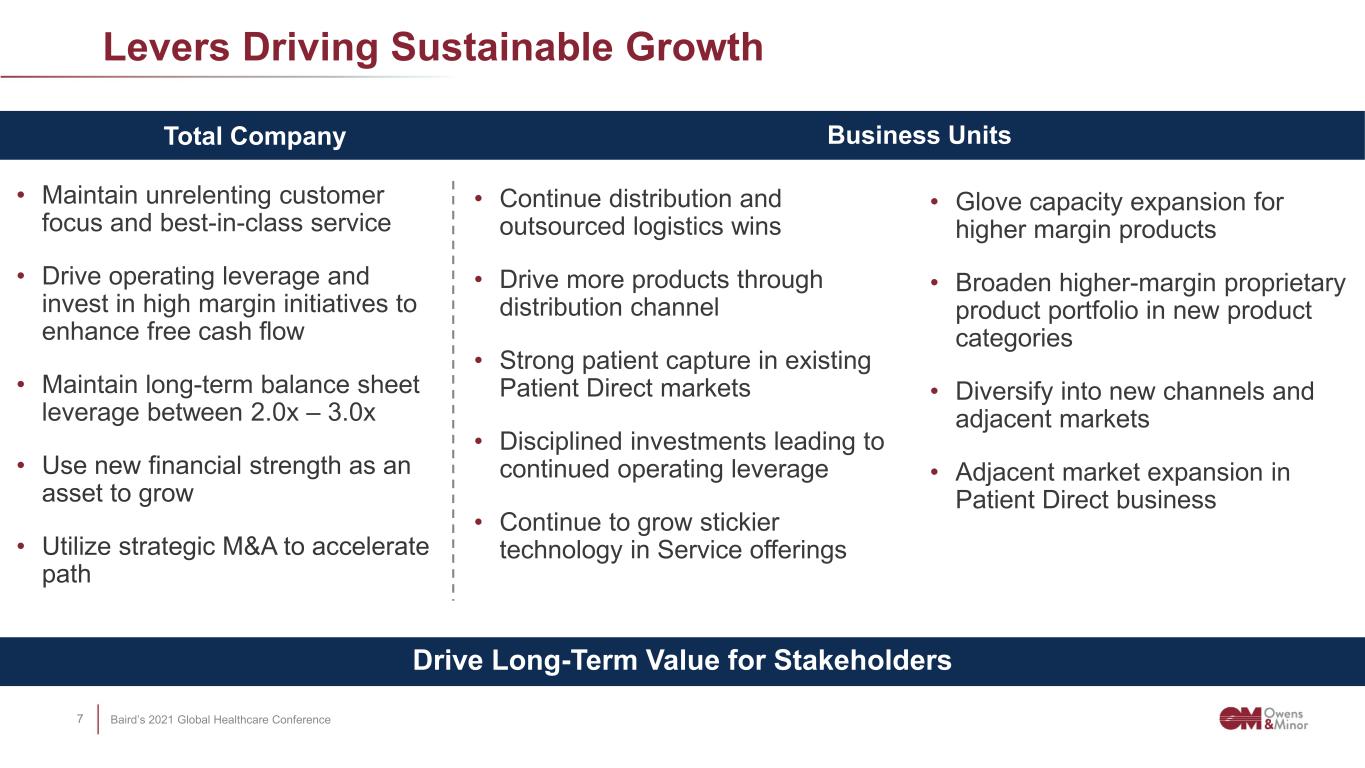

Baird’s 2021 Global Healthcare Conference7 • Maintain unrelenting customer focus and best-in-class service • Drive operating leverage and invest in high margin initiatives to enhance free cash flow • Maintain long-term balance sheet leverage between 2.0x – 3.0x • Use new financial strength as an asset to grow • Utilize strategic M&A to accelerate path • Glove capacity expansion for higher margin products • Broaden higher-margin proprietary product portfolio in new product categories • Diversify into new channels and adjacent markets • Adjacent market expansion in Patient Direct business • Continue distribution and outsourced logistics wins • Drive more products through distribution channel • Strong patient capture in existing Patient Direct markets • Disciplined investments leading to continued operating leverage • Continue to grow stickier technology in Service offerings Levers Driving Sustainable Growth Total Company Business Units Drive Long-Term Value for Stakeholders

Baird’s 2021 Global Healthcare Conference8 Thank You.

Baird’s 2021 Global Healthcare Conference9 Appendix

Baird’s 2021 Global Healthcare Conference10 Use of Non-GAAP Measures This presentation contains financial measures that are not calculated in accordance with U.S. generally accepted accounting principles ("GAAP"). In general, the measures exclude items and charges that (i) management does not believe reflect Owens & Minor, Inc.'s (the "Company") core business and relate more to strategic, multi-year corporate activities; or (ii) relate to activities or actions that may have occurred over multiple or in prior periods without predictable trends. Management uses these non-GAAP financial measures internally to evaluate the Company's performance, evaluate the balance sheet, engage in financial and operational planning and determine incentive compensation. Management provides these non-GAAP financial measures to investors as supplemental metrics to assist readers in assessing the effects of items and events on its financial and operating results and in comparing the Company's performance to that of its competitors. However, the non-GAAP financial measures used by the Company may be calculated differently from, and therefore may not be comparable to, similarly titled measures used by other companies. The non-GAAP financial measures disclosed by the Company should not be considered a substitute for, or superior to, financial measures calculated in accordance with GAAP, and the financial results calculated in accordance with GAAP and reconciliations to those financial statements set forth above should be carefully evaluated.

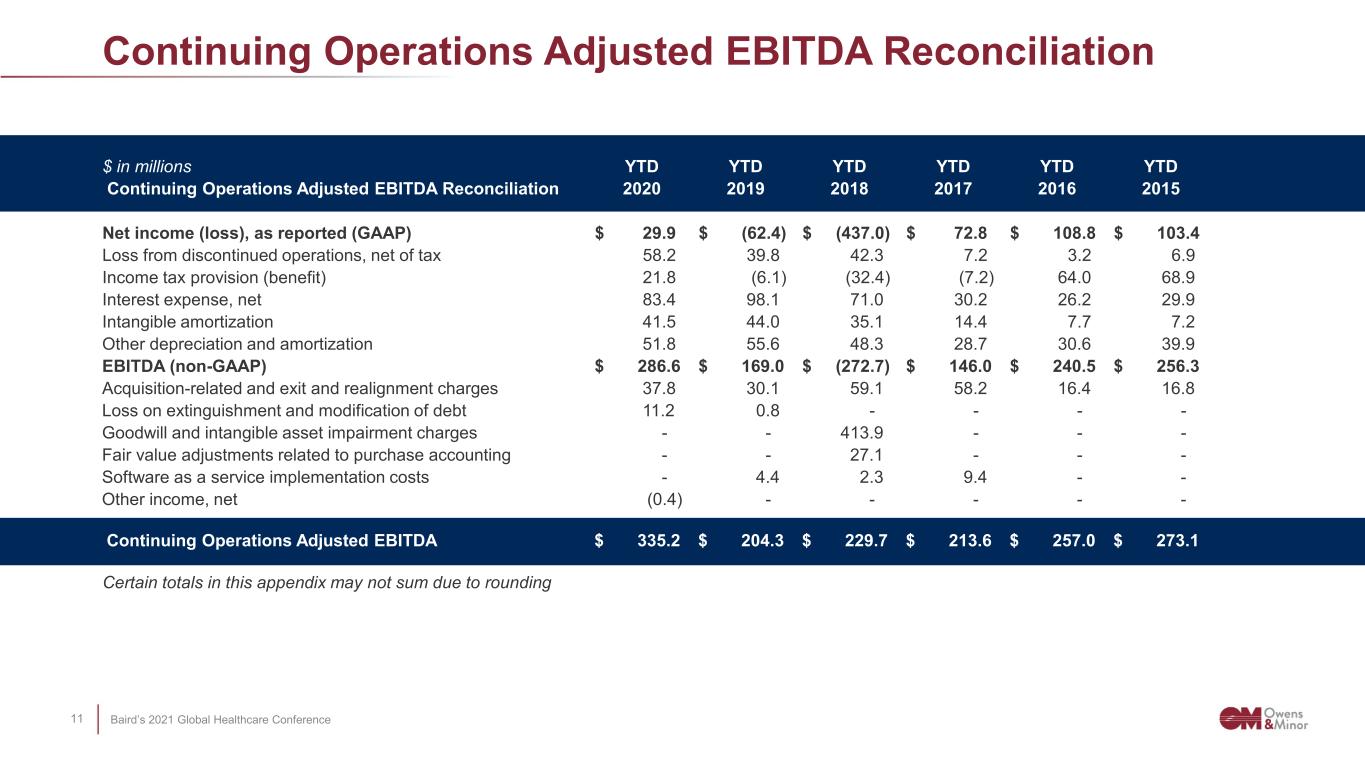

Baird’s 2021 Global Healthcare Conference11 Continuing Operations Adjusted EBITDA Reconciliation Certain totals in this appendix may not sum due to rounding $ in millions YTD YTD YTD YTD YTD YTD Continuing Operations Adjusted EBITDA Reconciliation 2020 2019 2018 2017 2016 2015 Net income (loss), as reported (GAAP) $ 29.9 $ (62.4) $ (437.0) $ 72.8 $ 108.8 $ 103.4 Loss from discontinued operations, net of tax 58.2 39.8 42.3 7.2 3.2 6.9 Income tax provision (benefit) 21.8 (6.1) (32.4) (7.2) 64.0 68.9 Interest expense, net 83.4 98.1 71.0 30.2 26.2 29.9 Intangible amortization 41.5 44.0 35.1 14.4 7.7 7.2 Other depreciation and amortization 51.8 55.6 48.3 28.7 30.6 39.9 EBITDA (non-GAAP) $ 286.6 $ 169.0 $ (272.7) $ 146.0 $ 240.5 $ 256.3 Acquisition-related and exit and realignment charges 37.8 30.1 59.1 58.2 16.4 16.8 Loss on extinguishment and modification of debt 11.2 0.8 - - - - Goodwill and intangible asset impairment charges - - 413.9 - - - Fair value adjustments related to purchase accounting - - 27.1 - - - Software as a service implementation costs - 4.4 2.3 9.4 - - Other income, net (0.4) - - - - - Continuing Operations Adjusted EBITDA $ 335.2 $ 204.3 $ 229.7 $ 213.6 $ 257.0 $ 273.1

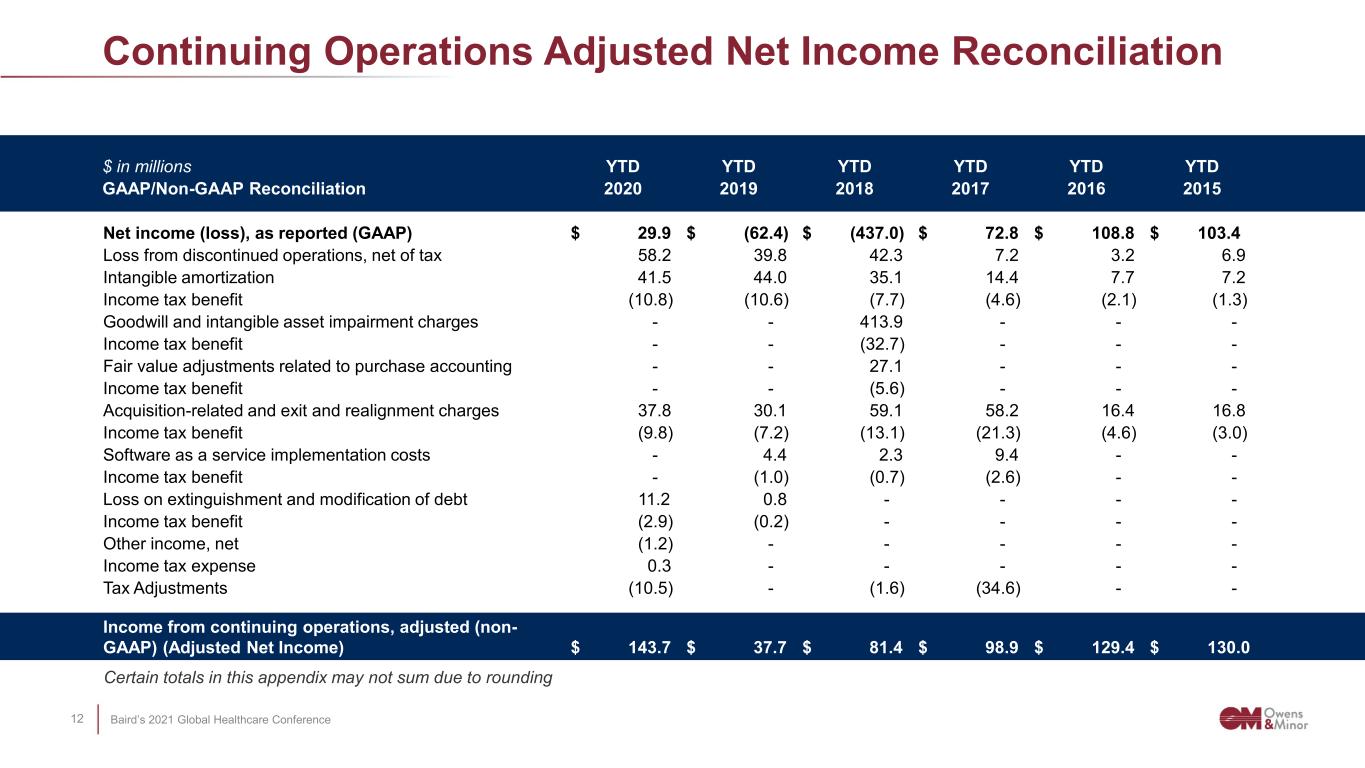

Baird’s 2021 Global Healthcare Conference12 Continuing Operations Adjusted Net Income Reconciliation $ in millions YTD YTD YTD YTD YTD YTD GAAP/Non-GAAP Reconciliation 2020 2019 2018 2017 2016 2015 Net income (loss), as reported (GAAP) $ 29.9 $ (62.4) $ (437.0) $ 72.8 $ 108.8 $ 103.4 Loss from discontinued operations, net of tax 58.2 39.8 42.3 7.2 3.2 6.9 Intangible amortization 41.5 44.0 35.1 14.4 7.7 7.2 Income tax benefit (10.8) (10.6) (7.7) (4.6) (2.1) (1.3) Goodwill and intangible asset impairment charges - - 413.9 - - - Income tax benefit - - (32.7) - - - Fair value adjustments related to purchase accounting - - 27.1 - - - Income tax benefit - - (5.6) - - - Acquisition-related and exit and realignment charges 37.8 30.1 59.1 58.2 16.4 16.8 Income tax benefit (9.8) (7.2) (13.1) (21.3) (4.6) (3.0) Software as a service implementation costs - 4.4 2.3 9.4 - - Income tax benefit - (1.0) (0.7) (2.6) - - Loss on extinguishment and modification of debt 11.2 0.8 - - - - Income tax benefit (2.9) (0.2) - - - - Other income, net (1.2) - - - - - Income tax expense 0.3 - - - - - Tax Adjustments (10.5) - (1.6) (34.6) - - Income from continuing operations, adjusted (non- GAAP) (Adjusted Net Income) $ 143.7 $ 37.7 $ 81.4 $ 98.9 $ 129.4 $ 130.0 Certain totals in this appendix may not sum due to rounding

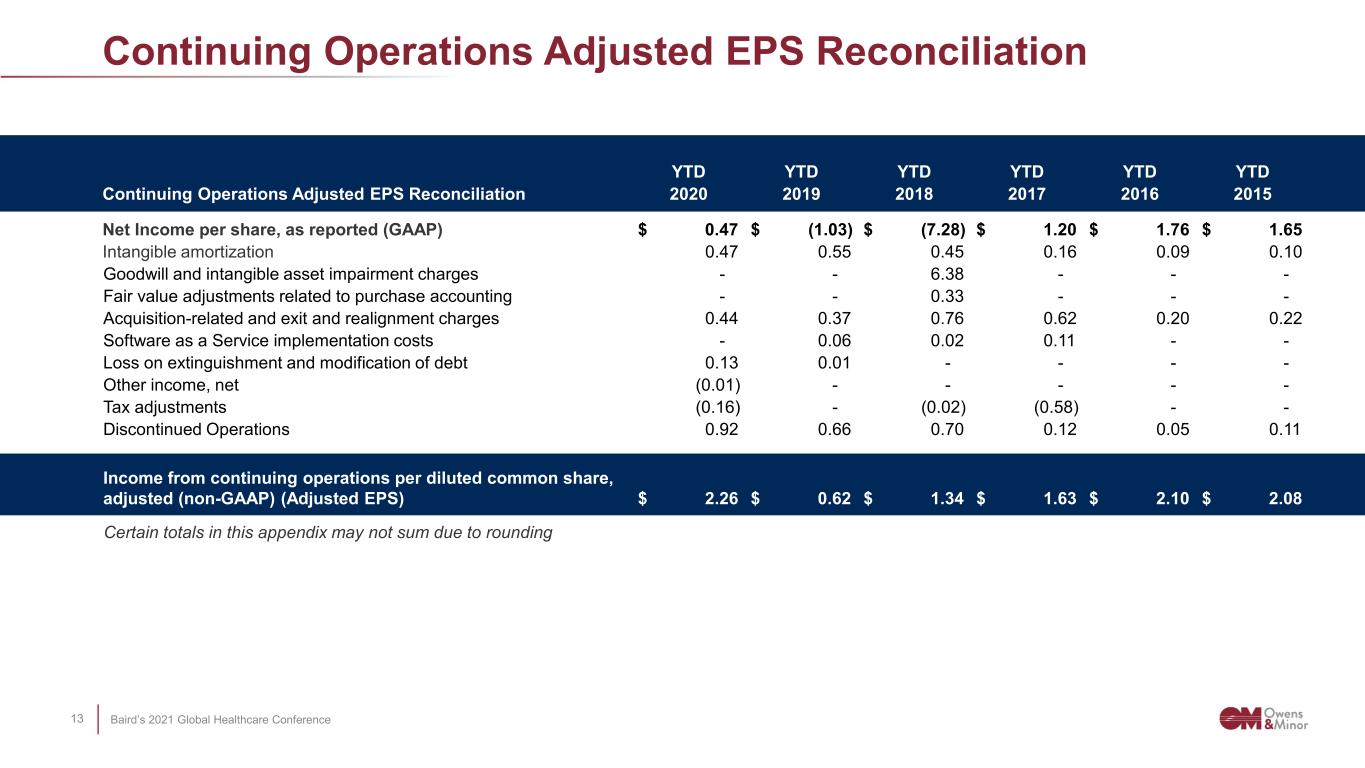

Baird’s 2021 Global Healthcare Conference13 Continuing Operations Adjusted EPS Reconciliation YTD YTD YTD YTD YTD YTD Continuing Operations Adjusted EPS Reconciliation 2020 2019 2018 2017 2016 2015 Net Income per share, as reported (GAAP) $ 0.47 $ (1.03) $ (7.28) $ 1.20 $ 1.76 $ 1.65 Intangible amortization 0.47 0.55 0.45 0.16 0.09 0.10 Goodwill and intangible asset impairment charges - - 6.38 - - - Fair value adjustments related to purchase accounting - - 0.33 - - - Acquisition-related and exit and realignment charges 0.44 0.37 0.76 0.62 0.20 0.22 Software as a Service implementation costs - 0.06 0.02 0.11 - - Loss on extinguishment and modification of debt 0.13 0.01 - - - - Other income, net (0.01) - - - - - Tax adjustments (0.16) - (0.02) (0.58) - - Discontinued Operations 0.92 0.66 0.70 0.12 0.05 0.11 Income from continuing operations per diluted common share, adjusted (non-GAAP) (Adjusted EPS) $ 2.26 $ 0.62 $ 1.34 $ 1.63 $ 2.10 $ 2.08 Certain totals in this appendix may not sum due to rounding

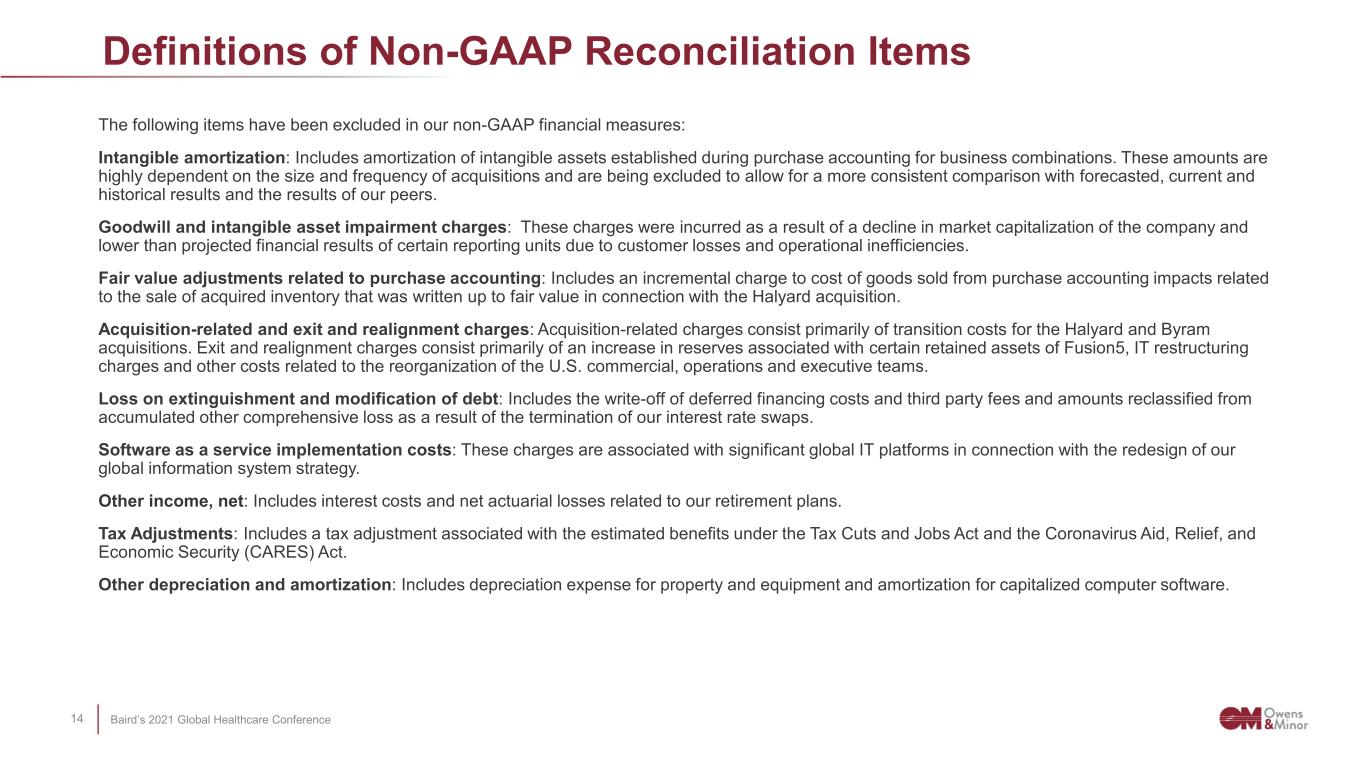

Baird’s 2021 Global Healthcare Conference14 Definitions of Non-GAAP Reconciliation Items The following items have been excluded in our non-GAAP financial measures: Intangible amortization: Includes amortization of intangible assets established during purchase accounting for business combinations. These amounts are highly dependent on the size and frequency of acquisitions and are being excluded to allow for a more consistent comparison with forecasted, current and historical results and the results of our peers. Goodwill and intangible asset impairment charges: These charges were incurred as a result of a decline in market capitalization of the company and lower than projected financial results of certain reporting units due to customer losses and operational inefficiencies. Fair value adjustments related to purchase accounting: Includes an incremental charge to cost of goods sold from purchase accounting impacts related to the sale of acquired inventory that was written up to fair value in connection with the Halyard acquisition. Acquisition-related and exit and realignment charges: Acquisition-related charges consist primarily of transition costs for the Halyard and Byram acquisitions. Exit and realignment charges consist primarily of an increase in reserves associated with certain retained assets of Fusion5, IT restructuring charges and other costs related to the reorganization of the U.S. commercial, operations and executive teams. Loss on extinguishment and modification of debt: Includes the write-off of deferred financing costs and third party fees and amounts reclassified from accumulated other comprehensive loss as a result of the termination of our interest rate swaps. Software as a service implementation costs: These charges are associated with significant global IT platforms in connection with the redesign of our global information system strategy. Other income, net: Includes interest costs and net actuarial losses related to our retirement plans. Tax Adjustments: Includes a tax adjustment associated with the estimated benefits under the Tax Cuts and Jobs Act and the Coronavirus Aid, Relief, and Economic Security (CARES) Act. Other depreciation and amortization: Includes depreciation expense for property and equipment and amortization for capitalized computer software.