Attached files

| file | filename |

|---|---|

| 8-K - SWK Holdings Corp | e21549_swkh-8k.htm |

1 Collaborative Approach to Life Science Financing Shareholder Presentation August 17, 2021

2 Forward - looking and Cautionary Statements Statements in this presentation that are not strictly historical, and any statements regarding events or developments that we be lieve or anticipate will or may occur in the future are "forward - looking" statements within the meaning of the federal securities laws. There are a number of important factors that could cause actual r esults, developments and business decisions to differ materially from those suggested or indicated by such forward - looking statements and you should not place undue reliance on any such forward - look ing statements. Additional information regarding the factors that may cause actual results to differ materially from these forward - looking statements is available in our SEC filings, including o ur Annual Report on Form 10 - K for the year ended December 31, 2020 and our Quarterly Reports on Form 10 - Q for subsequent periods. The Company does not assume any obligation to update or revise a ny forward - looking statement, whether as a result of new information, future events and developments or otherwise. Our specialty finance and asset management businesses are conducted through separate subsidiaries and the Company conducts it s o perations in a manner that is excluded from the definition of an investment company and exempt from registration and regulation under the Investment Company Act of 1940. This presentation is neither an offer to sell nor a solicitation of any offer to buy any securities, investment product or in ves tment advisory services, including such services offered by SWK Advisors LLC. This presentation does not contain all of the information necessary to make an investment decision, including, but not lim ited to, the risks, fees and investment strategies of investing in life science investments. Any offering is made only pursuant to the relevant information memorandum, a relevant subscription agre eme nt or investment management agreement, and SWK Advisors LLC’s Form ADV, all of which must be read in their entirety. All investors must be “accredited investors” and/or “qualified p urc hasers” as defined in the securities laws before they can invest with SWK Advisors LLC. Life science securities may rely on milestone payments and/or a royalty stream from an underlying drug, device, or product wh ich may or may not have received approval of the Food and Drug Administration (“FDA”). If the underlying drug, device, or product does not receive FDA approval, it could negatively impact the securities, including the payments of principal and/or interest. In addition, the introduction of new drugs, devices, or products onto the market could negatively impact the securities, since t hat may decrease sales and/or prices of the underlying drug, device, or product. Changes to Medicare reimbursement or third - party payor pricing could negatively impact the securities, since they could negatively impact the prices and/or sales of the underlying drug, device, or product. There is also risk that the licensing agreement that governs the payment of royalties may terminate, whic h c ould negatively impact the securities. There is also the risk that litigation involving the underlying drug, device, or product could negatively impact the securities, including payments of principal and /or interest on any securities.

SWK Holdings - Overview 3 Underserved, High - Need Market Demonstrated Success, Attractive Returns Focus on Shareholder Returns Custom financing solutions for commercial - stage healthcare companies and royalty owners • SWK targets $5mm to $20mm financings, a market niche that is largely ignored by larger market participants and generates attractive full - cycle returns • Business focus is secured financings and royalty monetizations, but will selectively consider equity - like opportunities and M&A • Experienced and aligned management and Board with extensive life science network • As of August 16, 2021, completed financings with 42 parties deploying $600mm of capital • Targets unlevered, mid - teens gross return on capital with a portfolio effective yield* of 13.9% for 2Q21 • 20 exits from inception through August 16, 2021 generating a 20% IRR and 1.3x MOIC • Specialty finance segment generated an 14.4% LTM adjusted return on finance segment tangible book value** • Compounded book value per share at a 10% CAGR from 4Q12 to 2Q21’s $20.18 • Demonstrated shareholder value creation: Enteris acquisition, share repurchases, and NASDAQ uplisting • Shareholder value creation strategy: – Increase book value per share at a 10%+ CAGR – Serve as partner of choice for life sciences companies and inventors seeking $20mm or less – Selective organic and inorganic investment in Enteris or other equity - like opportunities – Generate current income to utilize SWK’s substantial NOL asset, $289mm as of December 31, 2020 * Effective yield is the rate at which income is expected to be recognized pursuant to the Company’s revenue recognition poli cie s, if all payments are received pursuant to the terms of the finance receivable; excludes warrants ** Numerator is specialty finance division’s adjusted non - GAAP net income; Denominator is shareholders equity less the deferred tax asset and Enteris PP&E and net intangibles and goodwill, which adds - back the contingent consideration payable

4 SWK Holdings - Segments LIFE SCIENCE SPECIALTY FINANCE ENTERIS BIOPHARMA • Senior secured term loans • Royalties • Synthetic royalties • Product acquisitions • Peptelligence ® and ProPerma Б dosing technologies • CDMO services • 505b2 drug development SWK operates through two segments: Life Science Specialty Finance and Enteris BioPharma Centered on SWK’s core focus on monetizing revenue streams and intellectual property

5 Life Science Finance Opportunity Achieve high current yield from investment in non - correlated assets Access to capital is challenging for small/mid - sized life science companies - Few participants exist for sub - $20mm life science financings Life science products are highly portable - Approved & marketed products and/or royalty streams are valuable collateral Revenues are predictable and have low correlation to economic growth and macro factors Mitigate FDA & clinical trial risk by focusing on commercial opportunities

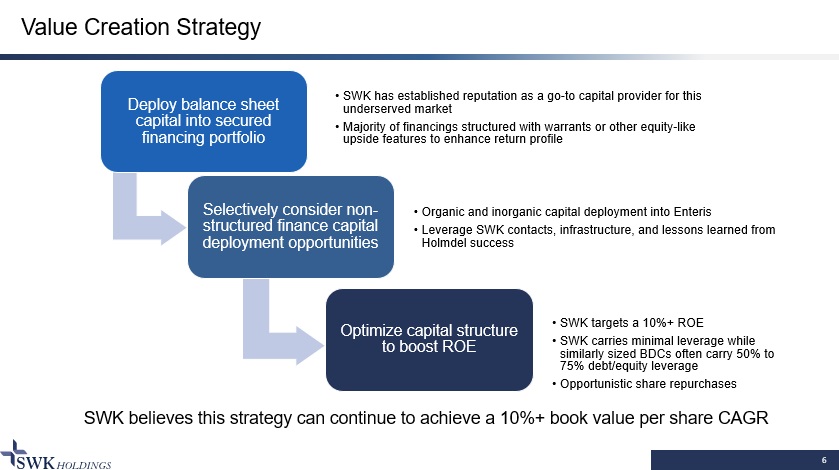

6 Value Creation Strategy Deploy balance sheet capital into secured financing portfolio • SWK has established reputation as a go - to capital provider for this underserved market • Majority of financings structured with warrants or other equity - like upside features to enhance return profile Selectively consider non - structured finance capital deployment opportunities • Organic and inorganic capital deployment into Enteris • Leverage SWK contacts, infrastructure, and lessons learned from Holmdel success Optimize capital structure to boost ROE • SWK targets a 10%+ ROE • SWK carries minimal leverage while similarly sized BDCs often carry 50% to 75% debt/equity leverage • Opportunistic share repurchases SWK believes this strategy can continue to achieve a 10%+ book value per share CAGR

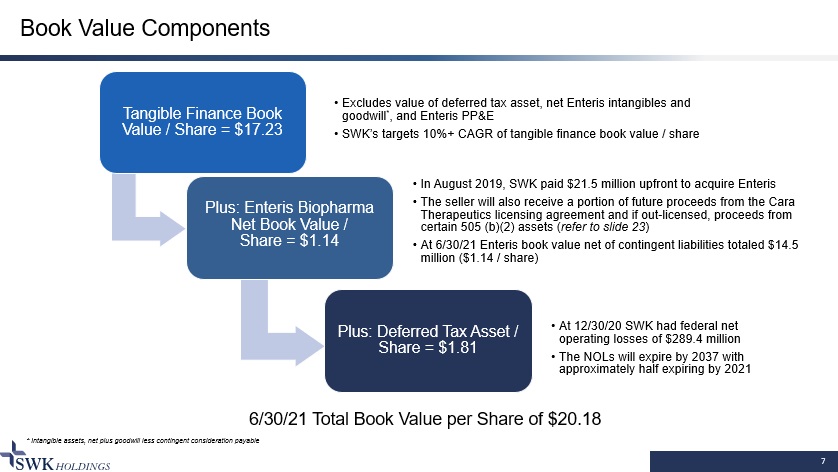

7 Book Value Components Tangible Finance Book Value / Share = $17.23 • Excludes value of deferred tax asset, net Enteris intangibles and goodwill * , and Enteris PP&E • SWK’s targets 10%+ CAGR of tangible finance book value / share Plus: Enteris Biopharma Net Book Value / Share = $1.14 • In August 2019, SWK paid $21.5 million upfront to acquire Enteris • The seller will also receive a portion of future proceeds from the Cara Therapeutics licensing agreement and if out - licensed, proceeds from certain 505 (b)(2) assets ( refer to slide 23 ) • At 6/30/21 Enteris book value net of contingent liabilities totaled $14.5 million ($1.14 / share) Plus: Deferred Tax Asset / Share = $1.81 • At 12/30/20 SWK had federal net operating losses of $289.4 million • The NOLs will expire by 2037 with approximately half expiring by 2021 6/30/21 Total Book Value per Share of $20.18 * Intangible assets, net plus goodwill less contingent consideration payable

8 Corporate Milestones 2014 x $113mm raised through private placement and rights offering x Ended year with $93mm yielding assets 2015 x Winston Black named CEO x 1/10 effective reverse stock split x Ended year with $99mm yielding assets 2016 x Team rebuilt and investment process improved x Ended year with $143mm yielding assets 2017 x Holmdel sold – 3.5x CoC return x Ended year with $154mm yielding assets 2018 2019 2020 x Secured $20mm credit facility with State Bank x Announced share repurchase program in 4Q18 x Ended year with $167mm yielding assets x 17th partner exit realized, bringing the weighted avg. IRR on all exits to 20% x Acquired Enteris BioPharma x Ended year with $173mm yielding assets x Uplisted to Nasdaq and added to Russell 2000 Index x Ended year with $206mm yielding assets x Dr. Rajiv Khosla hired as Enteris CEO x Enteris received $5.0m milestone payments from Cara 2021 x At 2Q21, had $206mm yielding assets x Completion of Enteris manufacturing expansion and launch of CDMO business x Board formed Strategic Review Committee to maximize value for stockholders

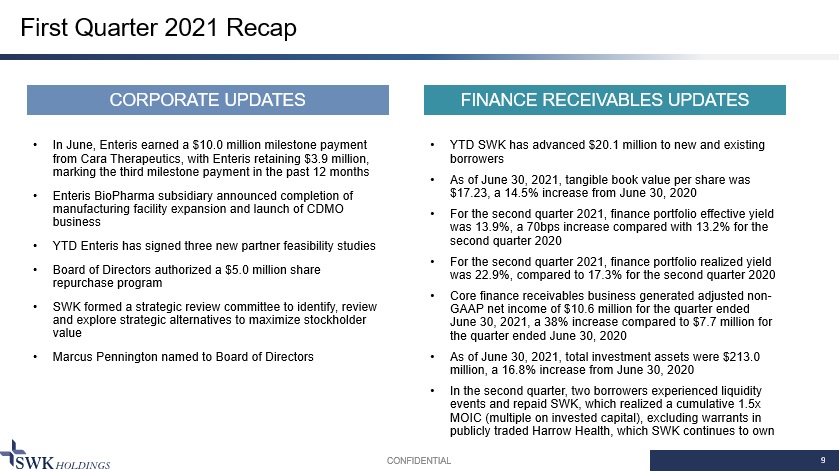

First Quarter 2021 Recap 9 CONFIDENTIAL CORPORATE UPDATES FINANCE RECEIVABLES UPDATES • In June, Enteris earned a $10.0 million milestone payment from Cara Therapeutics, with Enteris retaining $3.9 million, marking the third milestone payment in the past 12 months • Enteris BioPharma subsidiary announced completion of manufacturing facility expansion and launch of CDMO business • YTD Enteris has signed three new partner feasibility studies • Board of Directors authorized a $5.0 million share repurchase program • SWK formed a strategic review committee to identify, review and explore strategic alternatives to maximize stockholder value • Marcus Pennington named to Board of Directors • YTD SWK has advanced $20.1 million to new and existing borrowers • As of June 30, 2021, tangible book value per share was $17.23, a 14.5% increase from June 30, 2020 • For the second quarter 2021, finance portfolio effective yield was 13.9%, a 70bps increase compared with 13.2% for the second quarter 2020 • For the second quarter 2021, finance portfolio realized yield was 22.9%, compared to 17.3% for the second quarter 2020 • Core finance receivables business generated adjusted non - GAAP net income of $10.6 million for the quarter ended June 30, 2021, a 38% increase compared to $7.7 million for the quarter ended June 30, 2020 • As of June 30, 2021, total investment assets were $213.0 million, a 16.8% increase from June 30, 2020 • In the second quarter, two borrowers experienced liquidity events and repaid SWK, which realized a cumulative 1.5x MOIC (multiple on invested capital), excluding warrants in publicly traded Harrow Health, which SWK continues to own

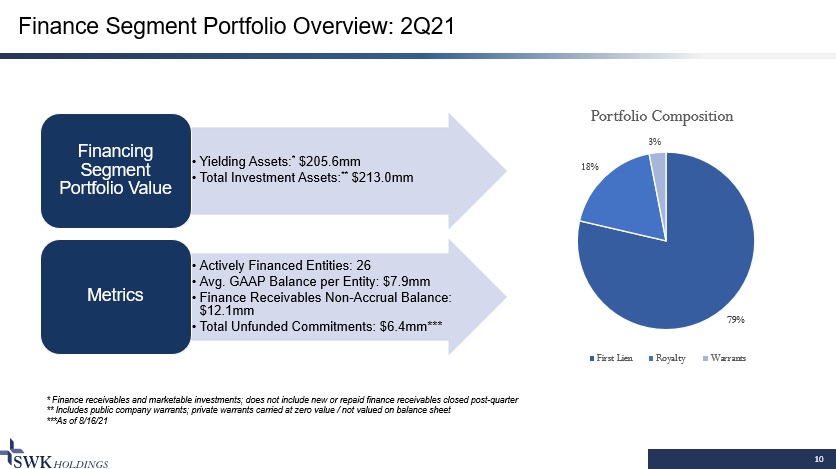

79% 18% 3% Portfolio Composition First Lien Royalty Warrants 10 Finance Segment Portfolio Overview: 2Q21 * Finance receivables and marketable investments; does not include new or repaid finance receivables closed post - quarter ** Includes public company warrants; private warrants carried at zero value / not valued on balance sheet ***As of 8/16/21 • Yielding Assets: * $205.6mm • Total Investment Assets: ** $213.0mm Financing Segment Portfolio Value • Actively Financed Entities: 26 • Avg. GAAP Balance per Entity: $7.9mm • Finance Receivables Non - Accrual Balance: $12.1mm • Total Unfunded Commitments: $6.4mm*** Metrics

11 Financial Snapshot * Defined as finance receivables plus marketable investments ** Eliminates provision for income taxes, Enteris intangibles amortization, and non - cash mark - to - market changes on warrant asset s and equity securities; see reconciliation on page 29; 2019 Non - GAAP Adjusted Net Income was reduced by $1.2mm of Enteris transaction expenses

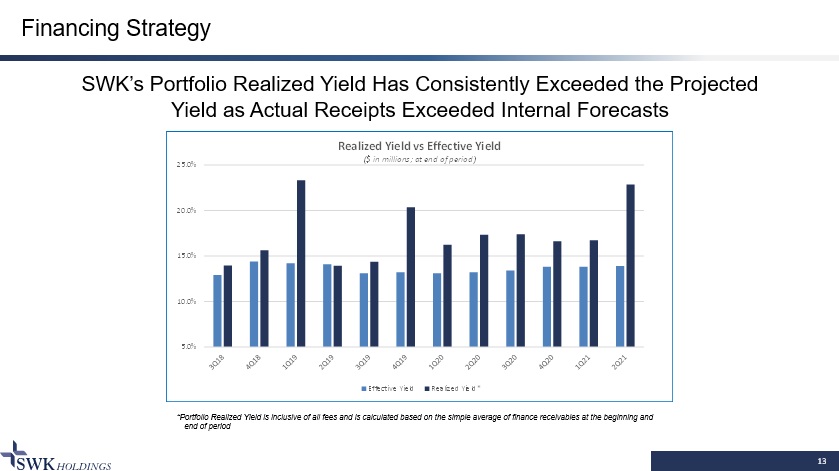

10.0% 12.5% 15.0% $150.0 $160.0 $170.0 $180.0 $190.0 $200.0 $210.0 $220.0 Yielding Portfolio and Weighted Effective Yield ($ in millions; at end of period) Yielding Portfolio* Effective Yield** 12 Financing Strategy SWK Targets Low - to - Mid Teens Effective Yields 2Q21 Finance Segment Effective Yield was 13.9% * Finance receivables plus marketable investment; includes non - accruals ** Effective yield is the rate at which income is expected to be recognized pursuant to the Company’s revenue recognition pol ici es, if all payments are received pursuant to the terms of the finance receivable; excludes warrants

5.0% 10.0% 15.0% 20.0% 25.0% Realized Yield vs Effective Yield ($ in millions; at end of period) Effective Yield Realized Yield* 13 Financing Strategy SWK’s Portfolio Realized Yield Has Consistently Exceeded the Projected Yield as Actual Receipts Exceeded Internal Forecasts *Portfolio Realized Yield is inclusive of all fees and is calculated based on the simple average of finance receivables at th e b eginning and end of period

14 Current Structured Credit Portfolio Trio Healthcare 07.01.2021 $9.5 million – Structured Credit

15 Current Royalty Portfolio

16 Portfolio Realizations As of August 16, 2021, SWK has exited 20 financings for a total 1.3x CoC return and 20% weighted average IRR ̶ 17 resulted in positive realizations with a cumulative 1.4x CoC and weighted average 30% IRR ̶ SynCardia position was sold to distressed private equity firm with SWK recouping 58% of principal ̶ Response Genetics exited via Chapter 11 and sold to a strategic buyer with SWK recouping 47% of principal ̶ Hooper and Hooper II loans cumulatively resulted in an aggregate $0.4mm loss/0.98x CoC return $ in 000s Investments Origination Payoff Cost* Proceeds CoC IRR Notes Nautilus 12/05/12 12/17/13 22,500$ 28,606$ 1.3x 28% Key asset was Cambia Parnell 01/23/14 06/27/14 25,000 27,110 1.1x 21% PDI 10/31/14 12/22/15 20,000 25,028 1.3x 23% Tribute 08/08/13 02/05/16 14,000 18,349 1.3x 18% Galil 10/31/14 06/15/16 12,500 16,601 1.3x 21% Nanosphere 05/14/15 06/30/16 10,000 14,362 1.4x 48% Syncardia First 12/13/13 06/24/16 12,688 8,524 0.7x -30% Syncardia Second 12/13/13 06/24/16 5,850 3,255 0.6x -39% Syncardia Preferred 09/15/14 06/24/16 1,500 - 0.0x -100% Response Genetics 07/30/14 10/07/15 12,257 5,780 0.5x -47% Holmdel 12/20/12 02/23/17 6,000 21,084 3.5x 63% Hooper 04/17/15 05/12/17 5,000 6,754 1.4x 20% Narcan 12/12/16 02/28/18 17,500 36,867 2.1x 81% Continue to own 10% of the royalty OraMetrix 12/15/16 05/01/18 8,500 10,603 1.2x 19% Parnell 11/22/16 07/30/18 13,500 19,327 1.4x 26% Hooper II 05/12/17 10/10/18 21,340 19,162 0.9x -16% EyePoint 03/28/18 02/13/19 20,000 25,168 1.3x 34% Continue to own warrants Thermedx 05/05/16 05/22/19 3,500 5,303 1.5x 18% Includes par value of $343k retained sub note Cheetah Medical 01/15/19 09/30/19 10,000 12,487 1.2x 32% Aimmune Therapeutics 02/12/19 10/20/20 3,686 4,430 1.2x 20% Tenex 07/01/16 04/01/21 8,300 13,066 1.6x 16% Harrow Health 07/19/17 04/20/21 10,328 15,413 1.5x 15% Continue to own warrants Total Realized / Wtd. Avg 263,947$ 337,279$ 1.3x 20%

17 Portfolio Realizations to Strategic Buyers 12 realizations to strategic buyers demonstrated a median 30 % LTV of SWK’s original loan value Nine of the 12 businesses were not profitable at time of sale, validating SWK’s revenue and IP - based underwriting methodology $ in mm Target Buyer Closing Date Transaction EV SWK Loan at Cost* SWK Loan / Transaction LTM Sales EV / LTM Sales Target Profitable Sale? Notes Nautilus Depomed 12/17/13 48.7$ 22.5$ 46% 15.4$ 3.2x N Response Genetics Cancer Genetics10/07/15 5.8 12.3 213% 16.7 0.3x N PDI Publicis 12/22/15 33.0 20.0 61% 129.3 0.3x Y CSO Division Only; Transaction EV assumes 50% near-term earn-outs achieved Tribute Aralez 2/1/16 147.6 14.0 9% 26.5 5.6x N Galil BTG plc 5/16/16 84.4 12.5 15% 22.7 3.7x N Transaction EV excludes $26mm of milestones Nanosphere Luminex 6/30/16 77.0 25.0 32% 23.1 3.3x N InnoPran XL** ANI Pharma 2/23/17 30.5 6.0 28% 11.1 2.7x Y Orametrix Dentsply Sirona 5/1/18 90.0 8.5 9% 20.0 4.5x Y Transaction EV excludes up to $60mm in earn-outs Hooper II Quest 10/10/18 27.8 26.6 96% 61.3 0.5x N Loan value includes non-SWK revolver ($8mm); Workout fees totaled $4mm Cheetah Medical Baxter 10/24/19 190.0 20.0 11% 22.2 8.6x N Transaction EV excludes up to $40mm in earn-outs Aimmune Therapeutics***Nestle 10/14/20 2,139.0 131.5 6% - NA N SWK partnered with KKR on the transaction Tenex Trice 4/1/21 25.0 8.3 33% 12.3 2.0x Y Excludes earn-outs Median 30% 3.2x * Cost measured as greatest of principal advanced at deal close and additional add-ons, including restructuring fundings ** InnoPran XL was the primary asset of Holmdel Pharmaceuticals, LP *** SWK owned 4.5% of the Aimmune loan.

18 Sourcing SWK has a well - developed and diversified sourcing network SWK balances proprietary opportunities with deal flow from trusted, boutique investment banks and brokers SWK typically faces limited competition due to proprietary sourcing network and focus on sub - $20mm financings From 2017 - 2020, SWK submitted terms on 96 transactions and closed 19% of submitted proposals Deals completed from 2017 through 2020 were sourced from a variety of relationships Boutique HC Ibanks 27% Private equity relationship 4% Prior financing discussion 14% Co - lender relationship 23% Board relationship 4% In - bound due to SWK being public 5% Refinance 5% Internally sourced 18%

Financing Structures 19 Product Acquisition • Primarily first lien senior secured loans, though will selectively evaluate second lien opportunities • Typically include covenants, prepayment penalties, origination and exit fees, and warrant coverage • Provide working capital to support product commercialization and M&A Hybrid Financing Synthetic Royalty Royalties Structured Debt • Companies: fund pipeline development & leverage a lower cost of capital for higher ROI projects • Institutions: capital planning for operating budgets, funding R&D initiatives, & financial asset diversification • Inventors: financial asset diversification, fund start - up company • Marketer creates a ‘royalty’ by selling an interest in a future revenue stream earned with a single product or basket of products in exchange for an upfront payment and potential future payments • Ability to structure tiered revenues, reverse tiers, minimum payments, caps, step - downs and buy - out options, similar to a license agreement between innovator and marketer • Combination of royalty and revenue - based financings • Can take on many forms, including structured debt and equity investments • Target legacy products with established revenue trends, minimal marketing and infrastructure requirements

20 Value Proposition to Partners Smaller companies often don’t have financial profile to qualify for traditional financing sources Companies in this niche often have few options outside of a dilutive equity raise The IPO market is largely closed to companies of this size requiring expensive and difficult private equity sourcing Many alternative financing sources have grown too large to care about smaller companies Some historical financing sources have been acquired by regulated financial institutions that due to regulatory constraints c ann ot lend to unprofitable companies and prohibit SWK - style transactions Venture lenders often require principal payback over a shorter period than SWK’s structures, often stressing borrowers by sap pin g valuable working capital from their businesses during periods of high growth, when they need the capital the most Through RIA arm and industry relationships, SWK can access additional capital to finance larger opportunities Structures financings to preserve liquidity and match a growing company’s revenue profile Provides its borrowers with access to its network of capital markets resources and operators Asset base and nimble structure position SWK to serve the sub - $20mm financing market

Historical Financing: Narcan Royalty 21 OPPORTUNITY SOLUTION • Opiant is a publicly - traded drug development company that receives a royalty on Narcan for developing the drug’s unique formulation • Novel formulation has a faster time to onset and more convenient and safer administration • Opiant needed capital to pursue development programs • At time of monetization, Opiant was a thinly traded OTC stock and management believed the share price did not reflect underlying asset value, thus a share offering was not an attractive option • SWK structured a capped royalty that was smaller than competing proposals, and allowed Opiant to retain tail economics • In December 2016, SWK funded $13.8mm in exchange for a royalty that was capped at a 1.5x CoC return • On August 8, 2017 upon achieving $25mm in cumulative sales during two consecutive quarters, SWK funded additional $3.8mm with a 1.5x CoC return cap • Narcan sales exceeded forecasts; CoC return cap achieved in February 2018 • SWK retains a residual royalty ranging from 5% to 10% through expiry of Narcan IP Narcan is the only FDA approved, intranasal Naloxone product for the treatment of opioid overdose Narcan is appropriately priced with revenue growth from expanded distribution, not price hikes

Historical Financing: Galil Medical 22 OPPORTUNITY SOLUTION • In 2014, Galil was on the cusp of accelerating revenue growth, but was not yet cash - flow positive and could not tap traditional financing channels • Galil needed additional capital to run clinical trials and expand its sales force • In December 2014, SWK provided a $12.5mm senior secured term loan structured to delay principal repayment until growth initiatives matured • In late 2015, SWK committed to provide additional financing to support Galil’s proposed acquisition of a competitor • The transaction was not consummated, but SWK’s support permitted opportunistic bid • By early 2016, the growth initiatives were bearing fruit, and in June 2016, Galil was acquired by BTG plc for $84mm plus up to $26mm in earn - outs • The SWK facility gave Galil capital to grow the business and garner a higher acquisition price while allowing the equity owners to capture maximum upside • SWK facility represented 15% LTV of the take - out price • SWK generated a 1.3x cash - on - cash return and 20% IRR Galil is a privately - held medical device company that delivers innovative cryotherapy solutions for tumor ablation

Enteris BioPharma Acquisition – A Transformational Opportunity 23 • Natural extension to SWK’s existing royalty monetization business, which generates income via royalties on life science products in a mix of structures • Enteris offers opportunity to create wholly - owned portfolio of milestones and royalties on IP - protected biotherapeutics with substantial upside optionality Synergistic & Value Enhancing Highly Favorable Deal Economics “Game - Changing” Platform Technology Strong Company; Positioned for Success • Attractive valuation with SWK buying undervalued portfolio of “call options” of current & future licenses, owned drug candidate assets, and CDMO operations • Risk - adjusted economics from existing/expected licenses anticipated to exceed purchase price – Q4 2020 Enteris received milestone payments of $5.0mm from Cara with SWK entitled to $3.0mm – Q2 2021, Enteris earned a $10.0 million milestone payment from Cara, with Enteris retaining $3.9 million • Peptelligence and ProPerma enable oral conversion of peptides and difficult to formulate small molecules • Targets substantial market and serves as cornerstone for “asset - light” licensing revenue model • Franchise - like model (“multiple shots on goal”) leverages partners’ significant R&D and marketing / commercialization spend • Existing 505(b)(2) pharmaceutical development candidates plus ability to internally expand owned - product portfolio creates engine for additional future licenses • Enteris possesses proven technology, clinical experience and in - house manufacturing which is unique compared with peers, some of which sport multi - hundred million dollar market values • Potential to expand Peptelligence and ProPerma platforms via acquisition of dosing technologies and CDMO assets • In Q1 2021, announced completion of manufacturing facility expansion and launch of CDMO business • Experienced management team buttressed by 2020 hiring of CMO and CEO

24 Enteris Corporate Overview Commercial Platform Proven Technology, Late - Stage Commercial Partnerships, and Internal Pipeline Drug Delivery Technology Internal 505(b)(2) Pipeline Company Highlights • Peptelligence and ProPerma allow for oral delivery of drugs that are typically injected, including peptides and BCS class II, III, and IV small molecules • Extensive intellectual property estate with protection through 2036 • Peptelligence licenses, including Cara Therapeutics, and development work with several large pharmaceutical partners • Generates revenue three ways: – Formulation and development work – Clinical trial tablet manufacturing – Technology licenses consisting of milestones and royalties • Upgraded high potency manufacturing cGMP operational in 2021 • Oral leuprolide – Indications: Pediatric rare disease and female health • Other candidates currently under evaluation • Dr. Gary Shangold hired in January 2020 to optimize 505(b)(2) strategy • Privately held company based in Boonton, New Jersey • To operate as a wholly - owned subsidiary, run by experienced management • Rajiv Khosla, Ph.D. appointed as Chief Executive Officer in May 2020 • Expected to be profitable including anticipated license - related revenue • Over time SWK anticipates Enteris will develop multiple “shots on goal” value proposition

Enteris: Cara Therapeutics and Oral KORSUVA Б 25 Oral KORSUVA Licensing Agreement Milestone Payment • Formulated with Enteris’ Peptelligence technology • Currently the subject of four late - stage clinical trials for pruritus • Phase 2 trial targeting pruritus in patients with CKD produced positive top - line results • Cara has indicated that it currently plans to initiate a Phase 3 program by year - end 2021 • Licensing agreement between Enteris and Cara announced in August 2019 • Non - exclusive, royalty - bearing license for Peptelligence to develop, manufacture and commercialize Oral KORSUVA worldwide, excluding Japan and South Korea • Enteris eligible to receive milestone payments and low single - digit royalties • In Q2 2021, Enteris earned a $10.0 million milestone payment from Cara, with Enteris retaining $3.9 million • In Q4 2020, Enteris received milestone payments of $5.0 million from Cara with SWK entitled to receive $3.0 million of this payment per Enteris acquisition agreement • SWK eligible to receive additional potential milestone payments over the next several quarters (subject to the achievement of certain development milestones) Successful completion of Cara milestones will validate both the Peptelligence platform and the breadth and depth of Enteris’ comprehensive pharmaceutical capabilities

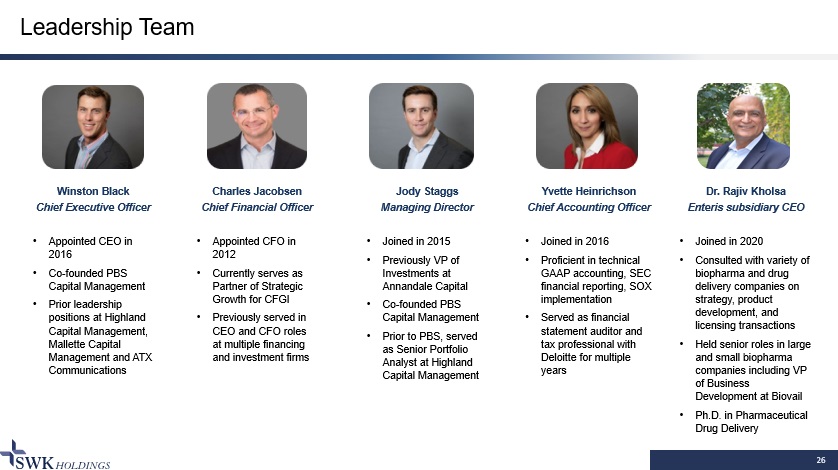

26 Leadership Team Winston Black Chief Executive Officer • Appointed CEO in 2016 • Co - founded PBS Capital Management • Prior leadership positions at Highland Capital Management, Mallette Capital Management and ATX Communications Charles Jacobsen Chief Financial Officer • Appointed CFO in 2012 • Currently serves as Partner of Strategic Growth for CFGI • Previously served in CEO and CFO roles at multiple financing and investment firms Jody Staggs Managing Director • Joined in 2015 • Previously VP of Investments at Annandale Capital • Co - founded PBS Capital Management • Prior to PBS, served as Senior Portfolio Analyst at Highland Capital Management Yvette Heinrichson Chief Accounting Officer • Joined in 2016 • Proficient in technical GAAP accounting, SEC financial reporting, SOX implementation • Served as financial statement auditor and tax professional with Deloitte for multiple years Dr. Rajiv Kholsa Enteris subsidiary CEO • Joined in 2020 • Consulted with variety of biopharma and drug delivery companies on strategy, product development, and licensing transactions • Held senior roles in large and small biopharma companies including VP of Business Development at Biovail • Ph.D. in Pharmaceutical Drug Delivery

27 Growth Opportunity LIFE SCIENCE SPECIALTY FINANCE ENTERIS BIOPHARMA • Potential to grow SWK’s B/V per share at >10% per year • Deal pipeline remains strong • Anticipate additional originations in the 2H 2021 • Working to add capacity to credit facility • Enhanced management team • Augmented BD function in place three feasibility studies signed YTD 2021 • Newly completed manufacturing expansion adds outsourced CDMO opportunity • Cara license continues to provide returns - recent $10.0M milestones 2021 represents a year of potentially substantial growth for SWK

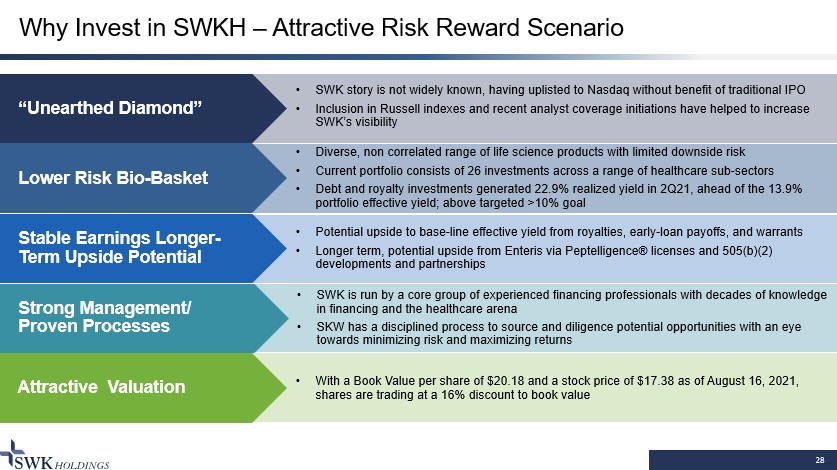

Why Invest in SWKH – Attractive Risk Reward Scenario 28 Attractive Valuation • SWK story is not widely known, having uplisted to Nasdaq without benefit of traditional IPO • Inclusion in Russell indexes and recent analyst coverage initiations have helped to increase SWK’s visibility Strong Management/ Proven Processes Stable Earnings Longer - Term Upside Potential Lower Risk Bio - Basket “Unearthed Diamond” • Diverse, non correlated range of life science products with limited downside risk • Current portfolio consists of 26 investments across a range of healthcare sub - sectors • Debt and royalty investments generated 22.9% realized yield in 2Q21, ahead of the 13.9% portfolio effective yield; above targeted >10% goal • Potential upside to base - line effective yield from royalties, early - loan payoffs, and warrants • Longer term, potential upside from Enteris via Peptelligence® licenses and 505(b)(2) developments and partnerships • SWK is run by a core group of experienced financing professionals with decades of knowledge in financing and the healthcare arena • SKW has a disciplined process to source and diligence potential opportunities with an eye towards minimizing risk and maximizing returns • With a Book Value per share of $20.18 and a stock price of $17.38 as of August 16, 2021, shares are trading at a 16% discount to book value

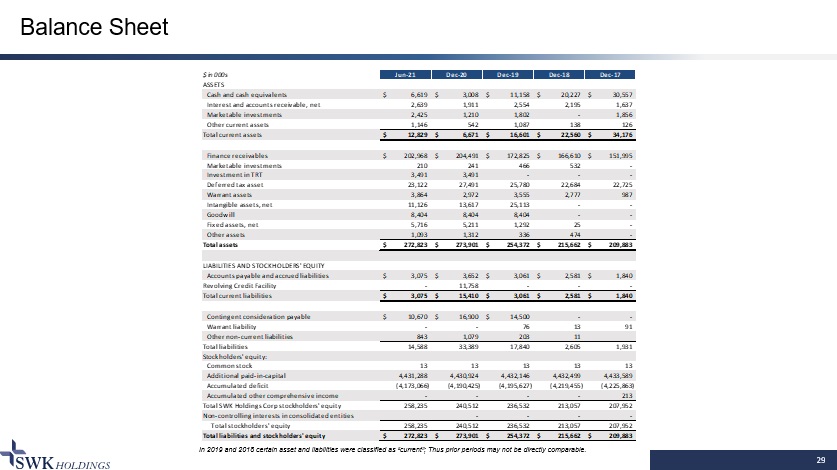

$ in 000s Jun-21 Dec-20 Dec-19 Dec-18 Dec-17 ASSETS Cash and cash equivalents 6,619$ 3,008$ 11,158$ 20,227$ 30,557$ Interest and accounts receivable, net 2,639 1,911 2,554 2,195 1,637 Marketable investments 2,425 1,210 1,802 - 1,856 Other current assets 1,146 542 1,087 138 126 Total current assets 12,829$ 6,671$ 16,601$ 22,560$ 34,176$ Finance receivables 202,968$ 204,491$ 172,825$ 166,610$ 151,995$ Marketable investments 210 241 466 532 - Investment in TRT 3,491 3,491 - - - Deferred tax asset 23,122 27,491 25,780 22,684 22,725 Warrant assets 3,864 2,972 3,555 2,777 987 Intangible assets, net 11,126 13,617 25,113 - - Goodwill 8,404 8,404 8,404 - - Fixed assets, net 5,716 5,211 1,292 25 - Other assets 1,093 1,312 336 474 - Total assets 272,823$ 273,901$ 254,372$ 215,662$ 209,883$ LIABILITIES AND STOCKHOLDERS' EQUITY Accounts payable and accrued liabilities 3,075$ 3,652$ 3,061$ 2,581$ 1,840$ Revolving Credit Facility - 11,758 - - - Total current liabilities 3,075$ 15,410$ 3,061$ 2,581$ 1,840$ Contingent consideration payable 10,670$ 16,900$ 14,500$ - - Warrant liability - - 76 13 91 Other non-current liabilities 843 1,079 203 11 Total liabilities 14,588 33,389 17,840 2,605 1,931 Stockholders' equity: Common stock 13 13 13 13 13 Additional paid-in-capital 4,431,288 4,430,924 4,432,146 4,432,499 4,433,589 Accumulated deficit (4,173,066) (4,190,425) (4,195,627) (4,219,455) (4,225,863) Accumulated other comprehensive income - - - - 213 Total SWK Holdings Corp stockholders' equity 258,235 240,512 236,532 213,057 207,952 Non-controlling interests in consolidated entities - - - - Total stockholders' equity 258,235 240,512 236,532 213,057 207,952 Total liabilities and stockholders' equity 272,823$ 273,901$ 254,372$ 215,662$ 209,883$ 29 Balance Sheet In 2019 and 2018 certain asset and liabilities were classified as “current”; Thus prior periods may not be directly comparabl e.

$ in 000s, except per share amounts LTM 2Q21 Dec-20 Dec-19 Dec-18 Dec-17 Revenues Finance receivable interest income, including fees 36,415$ 30,800$ 30,117$ 25,978$ 26,877$ Pharmaceutical development 16,264 5,903 621 - - Marketable investments interest income - - - - - Income related to investments in unconsolidated entities - - - - 10,530 Other 467 9 9 12 79 Total Revenues 53,146 36,712 30,747 25,990 37,486 Costs and expenses: Provision for loan credit losses - - 2,209 6,179 - Impairment expense - 163 - 7,875 8,509 General and administrative 11,103 10,546 7,430 4,866 4,101 Change in fair value of acquisition-related contingent consideration 2,463 4,400 - - - Depreciation and amortization 7,636 12,091 4,954 17 - Pharmaceutical manufacturing, research and development expense 5,200 4,268 1,176 - - Interest expense 430 455 338 160 - Total costs and expenses 26,832 31,923 16,107 19,097 12,610 Other income (expense), net: Unrealized net (loss) gain on derivatives 1,544 (586) 362 484 (1,115) Unrealized net gain (loss) equity securities 1,112 (591) 1,643 (1,035) - Gain (loss) on sale of investments 53 53 197 (105) 243 Income (loss) before income taxes 29,023 3,665 16,842 6,237 24,004 Income tax (benefit) expense 2,678 (1,537) (6,986) 42 15,753 Consolidated net income (loss) 26,345 5,202 23,828 6,195 8,251 Net income attributable to non-controlling interests - - - - 5,204 Net income (loss) attributable to SWK Holdings Corp Stockholders 26,345$ 5,202$ 23,828$ 6,195$ 3,047$ Net income (loss) per share attributable to SWK Holdings Corp Stockholders Basic 2.06$ 0.40$ 1.85$ 0.47$ 0.23$ Diluted 2.05$ 0.40$ 1.85$ 0.47$ 0.23$ Weighted Average Shares Basic 12,812 12,852 12,906 13,051 13,036 Diluted 12,845 12,862 12,911 13,054 13,040 30 Income Statement

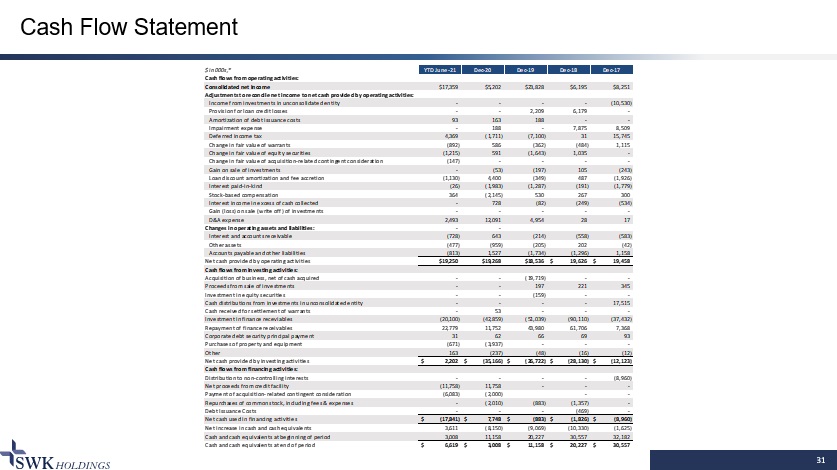

$ in 000s,* YTD June-21 Dec-20 Dec-19 Dec-18 Dec-17 Cash flows from operating activities: Consolidated net income $17,359 $5,202 $23,828 $6,195 $8,251 Adjustments to reconcile net income to net cash provided by operating activities: Income from investments in unconsolidated entity - - - - (10,530) Provision for loan credit losses - - 2,209 6,179 - Amortization of debt issuance costs 93 163 188 - - Impairment expense - 188 - 7,875 8,509 Deferred income tax 4,369 (1,711) (7,100) 31 15,745 Change in fair value of warrants (892) 586 (362) (484) 1,115 Change in fair value of equity securities (1,215) 591 (1,643) 1,035 - Change in fair value of acquisition-related contingent consideration (147) - - - - Gain on sale of investments - (53) (197) 105 (243) Loan discount amortization and fee accretion (1,130) 4,400 (349) 487 (1,926) Interest paid-in-kind (26) (1,983) (1,287) (191) (1,779) Stock-based compensation 364 (2,145) 530 267 300 Interest income in excess of cash collected - 728 (82) (249) (534) Gain (loss) on sale (write off) of investments - - - - - D&A expense 2,493 12,091 4,954 28 17 Changes in operating assets and liabilities: - - Interest and accounts receivable (728) 643 (214) (558) (583) Other assets (477) (959) (205) 202 (42) Accounts payable and other liabilities (813) 1,527 (1,734) (1,296) 1,158 Net cash provided by operating activities $19,250 $19,268 $18,536 19,626$ 19,458$ Cash flows from investing activities: Acquisition of business, net of cash acquired - - (19,719) - - Proceeds from sale of investments - - 197 221 345 Investment in equity securities - - (159) - - Cash distributions from investments in unconsolidated entity - - - - 17,515 Cash received for settlement of warrants - 53 - - - Investment in finance receviables (20,100) (42,859) (51,039) (90,110) (37,432) Repayment of finance receivables 22,779 11,752 43,980 61,706 7,368 Corporate debt security principal payment 31 62 66 69 93 Purchases of property and equipment (671) (3,937) - - - Other 163 (237) (48) (16) (12) Net cash provided by investing activities 2,202$ (35,166)$ (26,722)$ (28,130)$ (12,123)$ Cash flows from financing activities: Distribution to non-controlling interests - - - - (8,960) Net proceeds from credit facility (11,758) 11,758 - - - Payment of acquisition-related contingent consideration (6,083) (2,000) - - Repurchases of common stock, including fees & expenses - (2,010) (883) (1,357) - Debt Issuance Costs - - - (469) - Net cash used in financing activities (17,841)$ 7,748$ (883)$ (1,826)$ (8,960)$ Net increase in cash and cash equivalents 3,611 (8,150) (9,069) (10,330) (1,625) Cash and cash equivalents at beginning of period 3,008 11,158 20,227 30,557 32,182 Cash and cash equivalents at end of period 6,619$ 3,008$ 11,158$ 20,227$ 30,557$ 31 Cash Flow Statement

$ in 000s, except per share amounts LTM 2Q21 Dec-20 Dec-19 Dec-18 Dec-17 Consolidated net income (loss) 26,345$ 5,202$ 23,828$ 6,195$ 8,251$ Add: income tax expense (benefit) 2,678 (1,537) (6,986) 42 15,753 Add: Enteris intangibles amortization 7,299 11,735 4,816 - - Add : loss on remeasurement of contingent consideration 2,463 4,400 - - - Plus: loss (gain) on fair market value of equity securities (1,112) 591 144 1,035 - Add: loss (gain) on fair market value of warrants (1,544) 586 (362) (484) 1,115 Adjusted income before provision for income tax 36,129$ 20,977$ 21,440$ 6,788$ 25,119$ Plus: Adjusted provision for income tax - - - - - Non-GAAP consolidated net income 36,129$ 20,977$ 21,440$ 6,788$ 25,119$ Less: Non-GAAP adjusted net income attributable to non-controlling interest - - - - (5,204) Non-GAAP adjusted net income attributable to SWK Holdings Corporation stockholders 36,129$ 20,977$ 21,440$ 6,788$ 19,915$ 32 Reconciliation of Non - GAAP Adjusted Net Income The following tables provide a reconciliation of SWK's reported (GAAP) consolidated net income to SWK's adjusted consolidated ne t income (Non - GAAP) for the periods denoted in the table. The table eliminates provisions for income taxes, non - cash mark - to - market chang es on warrant assets and SWK's warrant, and Enteris amortization:

$ in 000s, except per share amounts Jun-21 Jun-21 SWK Specialty Finance Book Value, net Enteris Book Value, net* Stockholders' Equity (Book Value) 258,235$ Intangible assets, net 11,126$ Less: Deferred tax asset, net 23,122 Goodwill 8,404 Tangible book value 235,113$ Property and equipment, net 5,714 Less Enteris book value, net 14,574 Total Enteris-related assets 25,244$ Specialty Finance tangible book value 220,539$ Less: Contingent consideration payable 10,670 Book value per share 20.18$ Enteris book value, net 14,574$ Tangible book Value per share 18.37$ Specialty Finance tangible book value per share 17.23$ Enteris book value, net per share 1.14$ Diluted Shares outstanding 12,799 $ in 000s, except per share amounts LTM 2Q21 Dec-20 Dec-19 Dec-18 Dec-17 Adjusted income before provision for income tax 36,129$ 20,977$ 21,440$ 6,788$ 19,915$ Plus: Enteris acquisition expense - - 1,151 - - Plus: Enteris operating loss (gain), excluding amortization (6,179) 2,282 1,880 - - Adjusted specialty finance income before provision for income taxes 29,950$ 23,259$ 24,471$ 6,788$ 19,915$ Adjusted provision for income taxes - - - - - Non-GAAP specialty finance net income 29,950$ 23,259$ 24,471$ 6,788$ 19,915$ 33 Reconciliation of Non - GAAP Specialty Finance Net Income The following tables provide a reconciliation of SWK's consolidated adjusted income before provision for income taxes, listed in the table above, to the non - GAAP adjusted net income for the specialty finance business for the periods denoted below. The table eliminates expen ses associated with the acquisition of Enteris, and Enteris operating losses. The following tables provide a reconciliation of SWK’s book value per share to the non - GAAP adjusted book value per share for th e specialty finance business. The table eliminates the net deferred tax asset, and Enteris - related net intangibles, goodwill, and net proper ty, plant and equipment. Diluted shares outstanding are as of period end.

34 Contact Information CONFIDENTIAL SWK Senior Management Investor & Media Relations: Tiberend Strategic Advisor • Winston Black: ̶ Phone: 972.687.7251 ̶ Email: wblack@swkhold.com • Jody Staggs: ̶ Phone: 972.687.7252 ̶ Email: jstaggs@swkhold.com • Office address: ̶ 14755 Preston Road, Ste 105 Dallas, TX 75254 • Website: www.swkhold.com • Jason Rando (Media): ̶ Email: jrando@tiberend.com • Maureen McEnroe , CFA (Investors): ̶ Email: mmcenroe@tiberend.com

35 Collaborative Approach to Life Science Financing