Attached files

| file | filename |

|---|---|

| 8-K - 8-K - DEERE & CO | de-20210820x8k.htm |

| EX-99.2 - EX-99.2 - DEERE & CO | de-20210820xex99d2.htm |

| EX-99.1 - EX-99.1 - DEERE & CO | de-20210820xex99d1.htm |

Exhibit 99.3

| 3Q 2021 Earnings Call 20 August 2021 24 |

| John Deere | 3Q 2021 Earnings Call | August 20, 2021 2 Safe Harbor Statement & Disclosures The earnings call and accompanying material include forward-looking comments and information concerning the company’s plans and projections for the future, including estimates and assumptions with respect to economic, political, technological, weather, market acceptance, acquisitions and divestitures of businesses, anticipated transaction costs, the integration of new businesses, anticipated benefits of acquisitions, and other factors that impact our businesses and customers. They also may include financial measures that are not in conformance with accounting principles generally accepted in the United States of America (GAAP). Words such as “forecast,” “projection,” “outlook,” “prospects,” “expected,” “estimated,” “will,” “plan,” “anticipate,” “intend,” “believe,” or other similar words or phrases often identify forward-looking statements. Actual results may differ materially from those projected in these forward-looking statements based on a number of factors and uncertainties, including those related to the effects of the COVID-19 pandemic. Additional information concerning factors that could cause actual results to differ materially is contained in the company’s most recent Form 8-K and periodic report filed with the U.S. Securities and Exchange Commission, and is incorporated by reference herein. Investors should refer to and consider the incorporated information on risks and uncertainties in addition to the information presented here. The company, except as required by law, undertakes no obligation to update or revise its forward-looking statements whether as a result of new developments or otherwise. The call and accompanying materials are not an offer to sell or a solicitation of offers to buy any of the company’s securities. 25 |

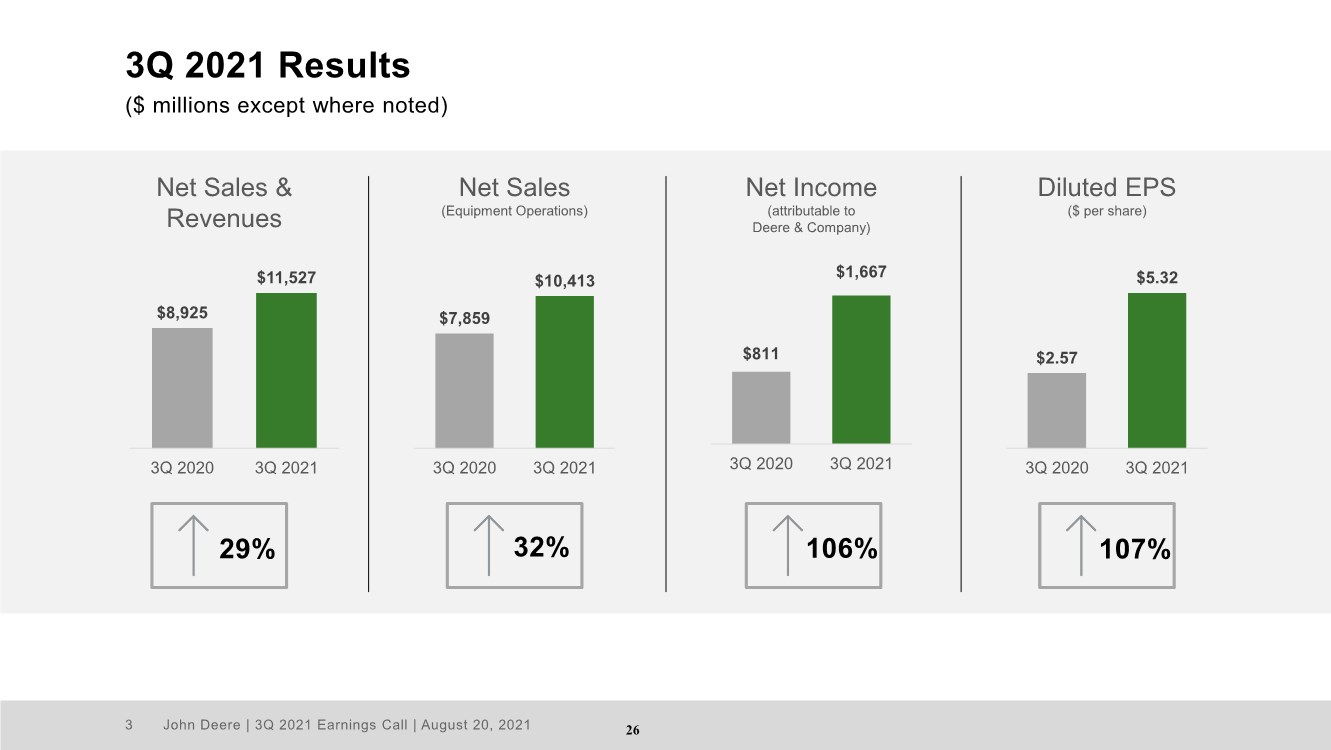

| John Deere | 3Q 2021 Earnings Call | August 20, 2021 3 3Q 2021 Results ($ millions except where noted) $8,925 $11,527 3Q 2020 3Q 2021 $7,859 $10,413 3Q 2020 3Q 2021 $811 $1,667 3Q 2020 3Q 2021 $2.57 $5.32 3Q 2020 3Q 2021 32% Net Sales & Revenues Net Sales (Equipment Operations) Net Income (attributable to Deere & Company) Diluted EPS ($ per share) 29% 106% 107% 26 |

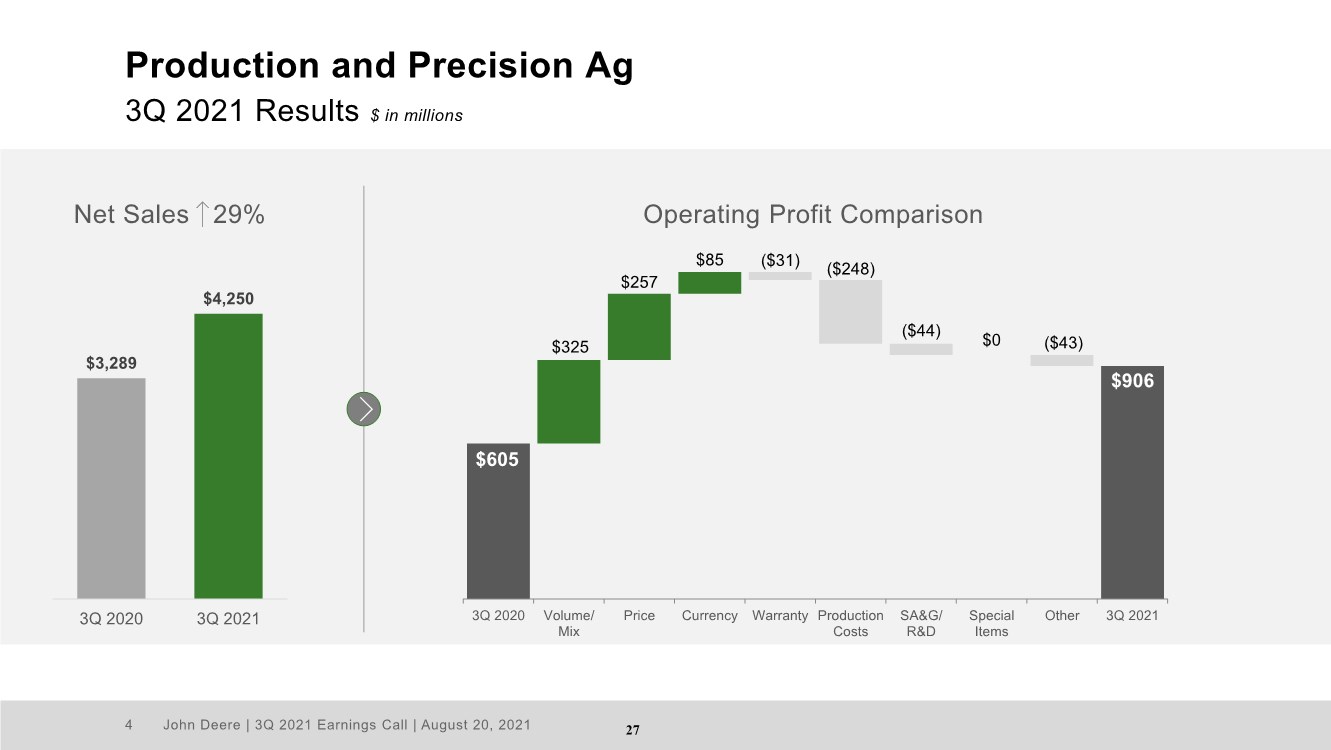

| John Deere | 3Q 2021 Earnings Call | August 20, 2021 4 Production and Precision Ag 3Q 2021 Results $ in millions $3,289 $4,250 3Q 2020 3Q 2021 Net Sales 29% Operating Profit Comparison $906 $325 $0 ($43) $605 $257 $85 ($31) ($248) ($44) 3Q 2020 Volume/ Mix Price Currency Warranty Production Costs SA&G/ R&D Special Items Other 3Q 2021 27 |

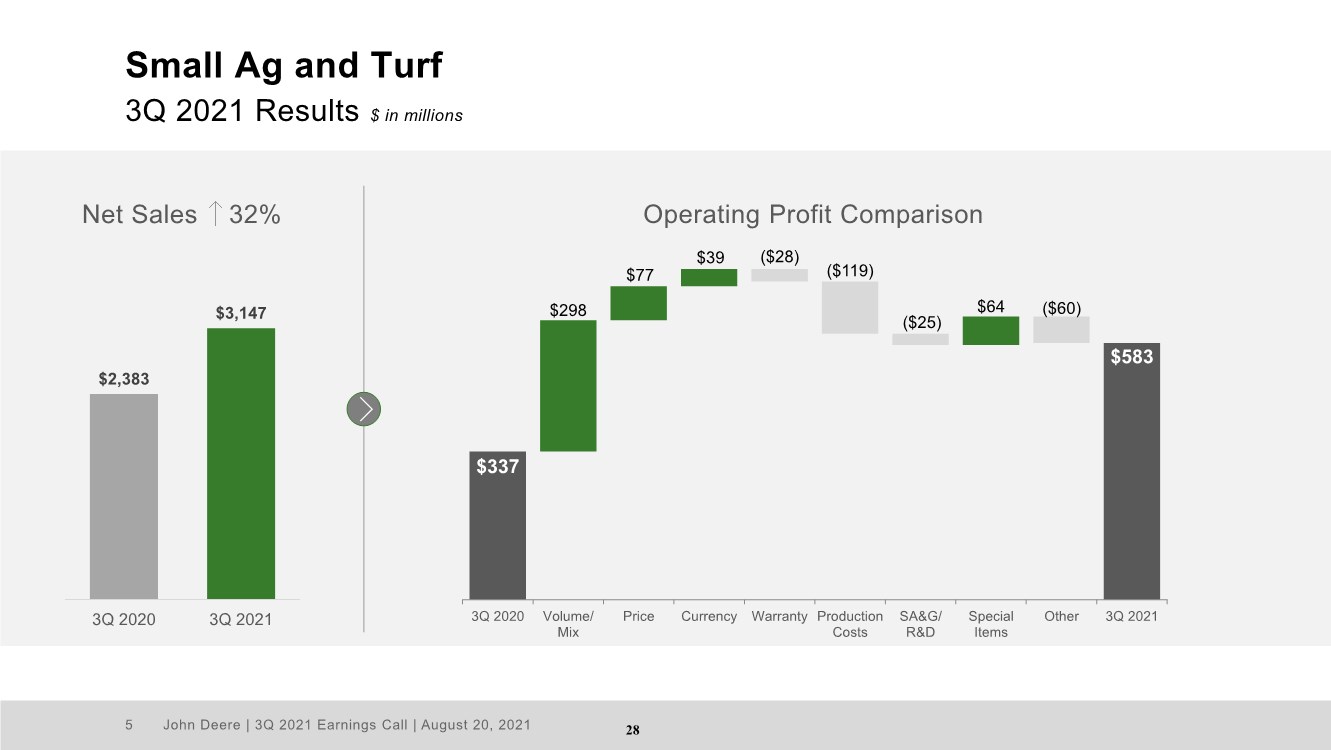

| John Deere | 3Q 2021 Earnings Call | August 20, 2021 5 Small Ag and Turf 3Q 2021 Results $ in millions $2,383 $3,147 3Q 2020 3Q 2021 Net Sales 32% Operating Profit Comparison $583 $298 $64 ($60) $337 $77 $39 ($28) ($119) ($25) 3Q 2020 Volume/ Mix Price Currency Warranty Production Costs SA&G/ R&D Special Items Other 3Q 2021 28 |

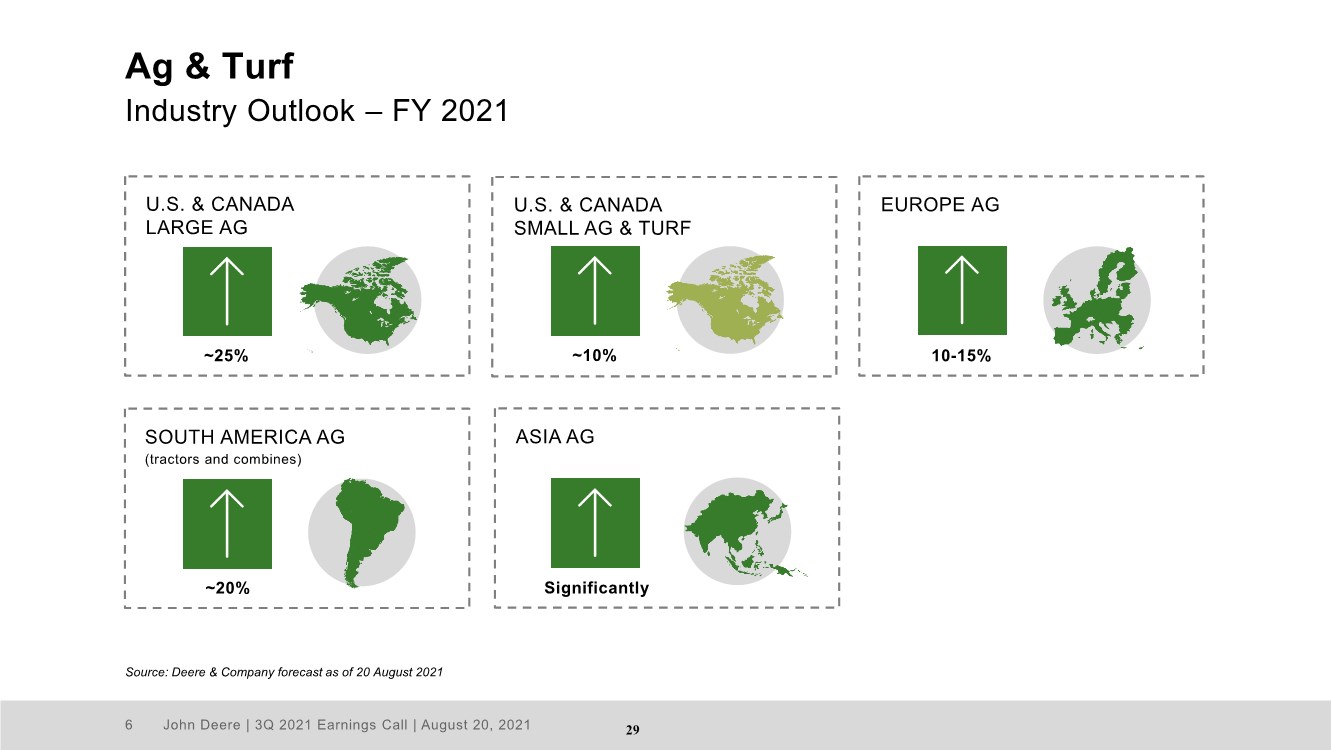

| John Deere | 3Q 2021 Earnings Call | August 20, 2021 6 Ag & Turf Industry Outlook – FY 2021 Source: Deere & Company forecast as of 20 August 2021 U.S. & CANADA LARGE AG ~25% EUROPE AG 10-15% SOUTH AMERICA AG (tractors and combines) ~20% U.S. & CANADA SMALL AG & TURF ~10% ASIA AG Significantly 29 |

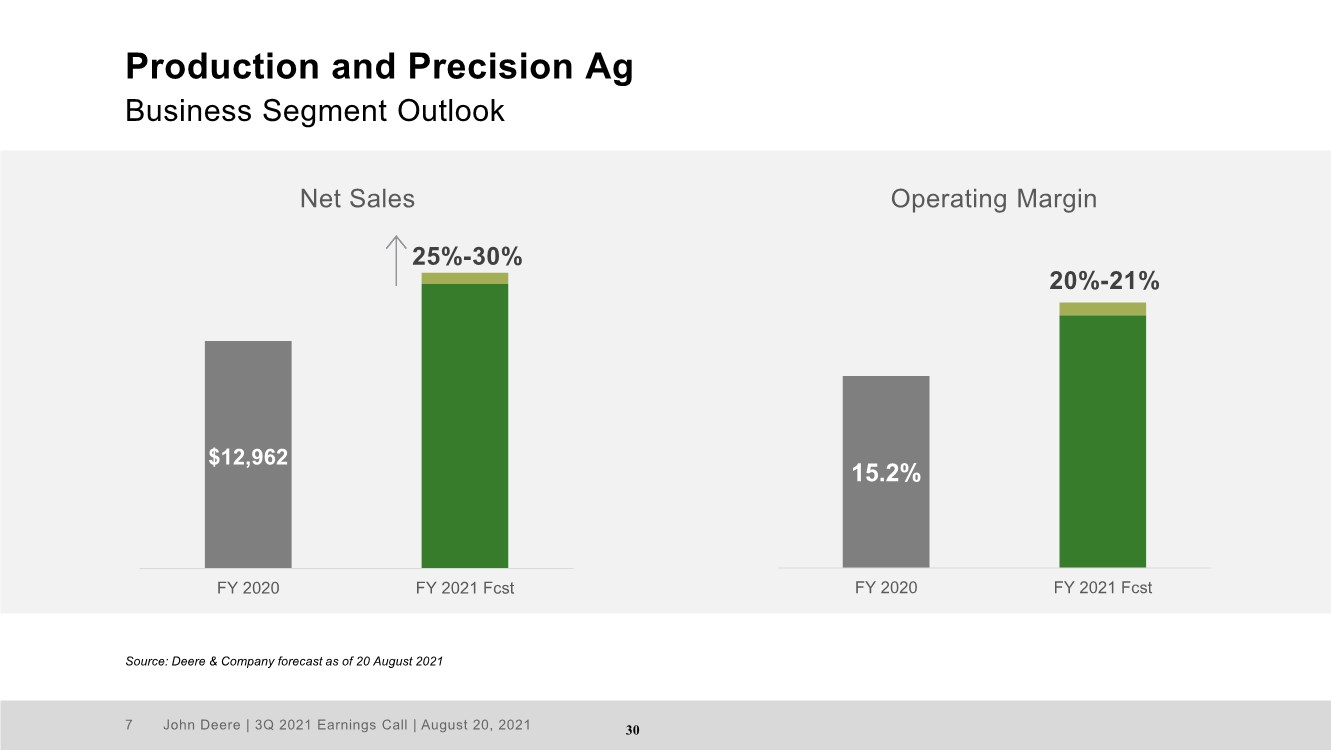

| John Deere | 3Q 2021 Earnings Call | August 20, 2021 7 Production and Precision Ag Business Segment Outlook Source: Deere & Company forecast as of 20 August 2021 15.2% FY 2020 FY 2021 Fcst $12,962 FY 2020 FY 2021 Fcst Net Sales 20%-21% Operating Margin 25%-30% 30 |

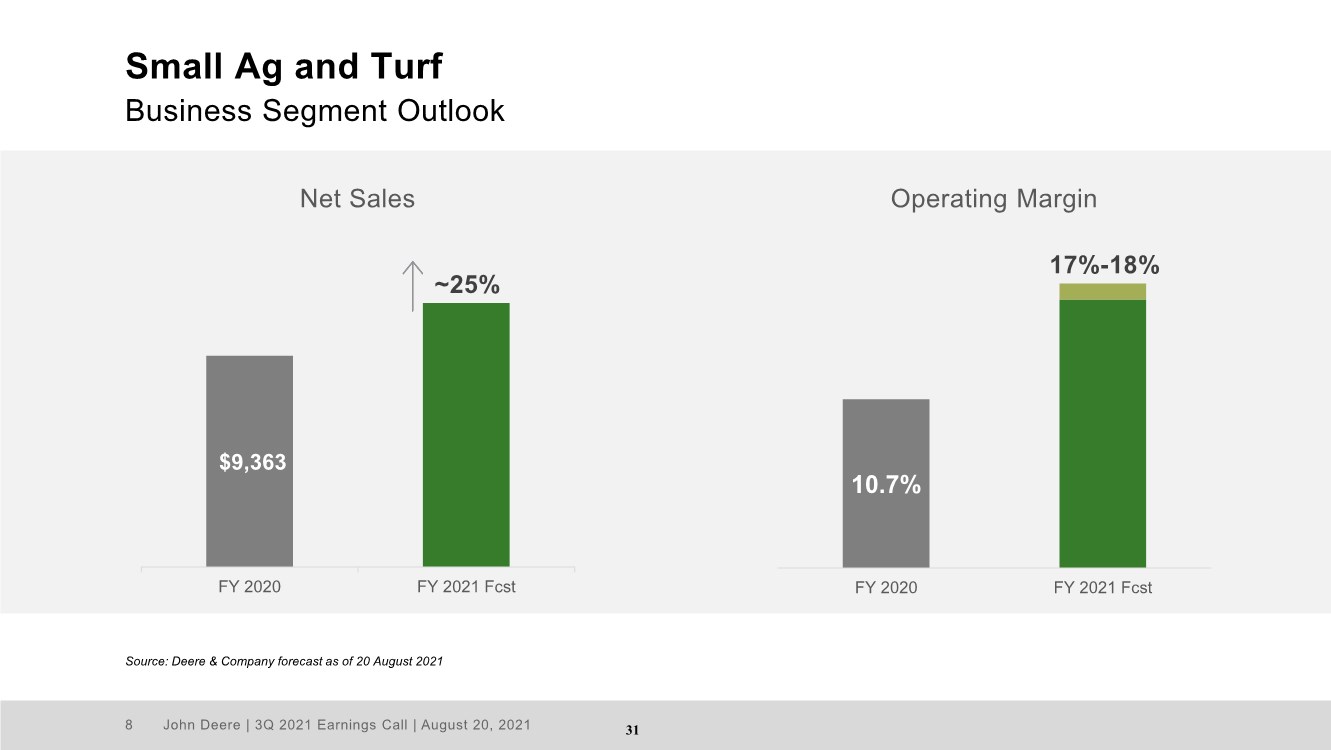

| John Deere | 3Q 2021 Earnings Call | August 20, 2021 8 Small Ag and Turf Business Segment Outlook Source: Deere & Company forecast as of 20 August 2021 10.7% FY 2020 FY 2021 Fcst $9,363 FY 2020 FY 2021 Fcst Net Sales 17%-18% Operating Margin ~25% 31 |

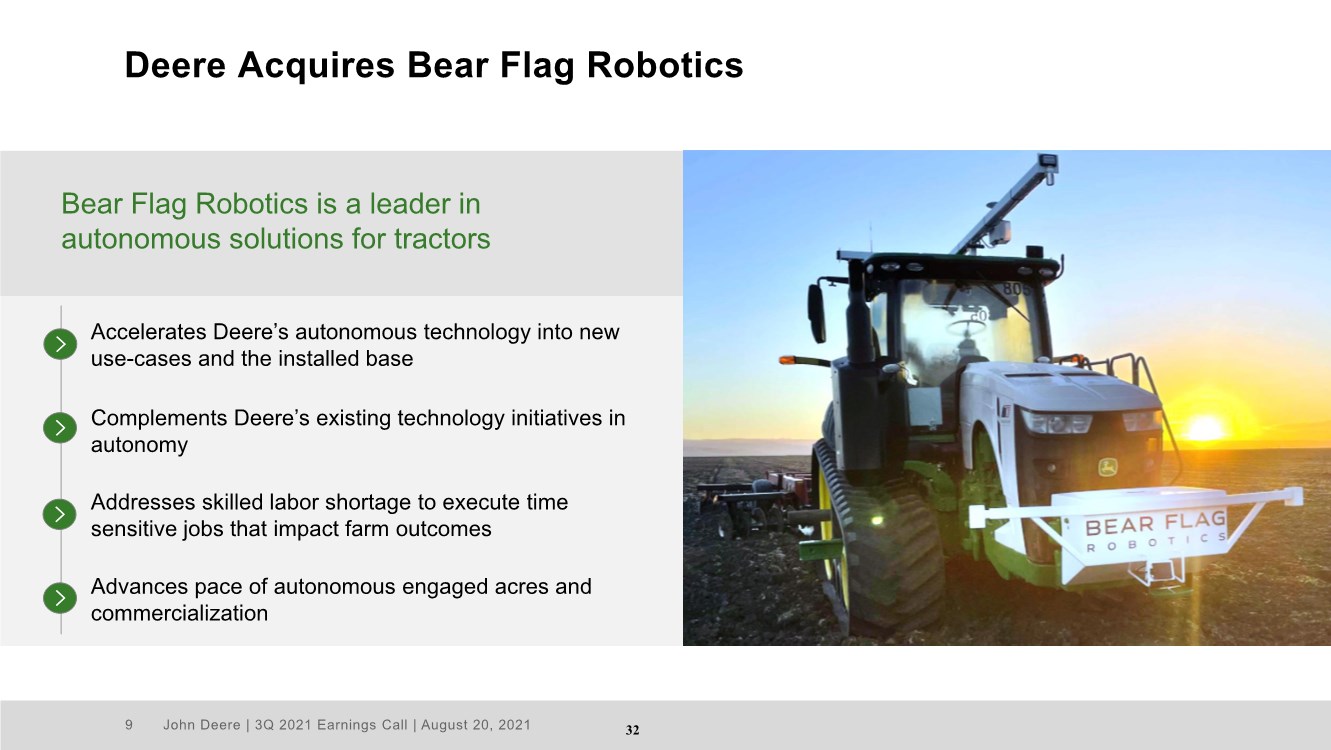

| John Deere | 3Q 2021 Earnings Call | August 20, 2021 9 Deere Acquires Bear Flag Robotics Accelerates Deere’s autonomous technology into new use-cases and the installed base Complements Deere’s existing technology initiatives in autonomy Addresses skilled labor shortage to execute time sensitive jobs that impact farm outcomes Advances pace of autonomous engaged acres and commercialization Bear Flag Robotics is a leader in autonomous solutions for tractors 32 |

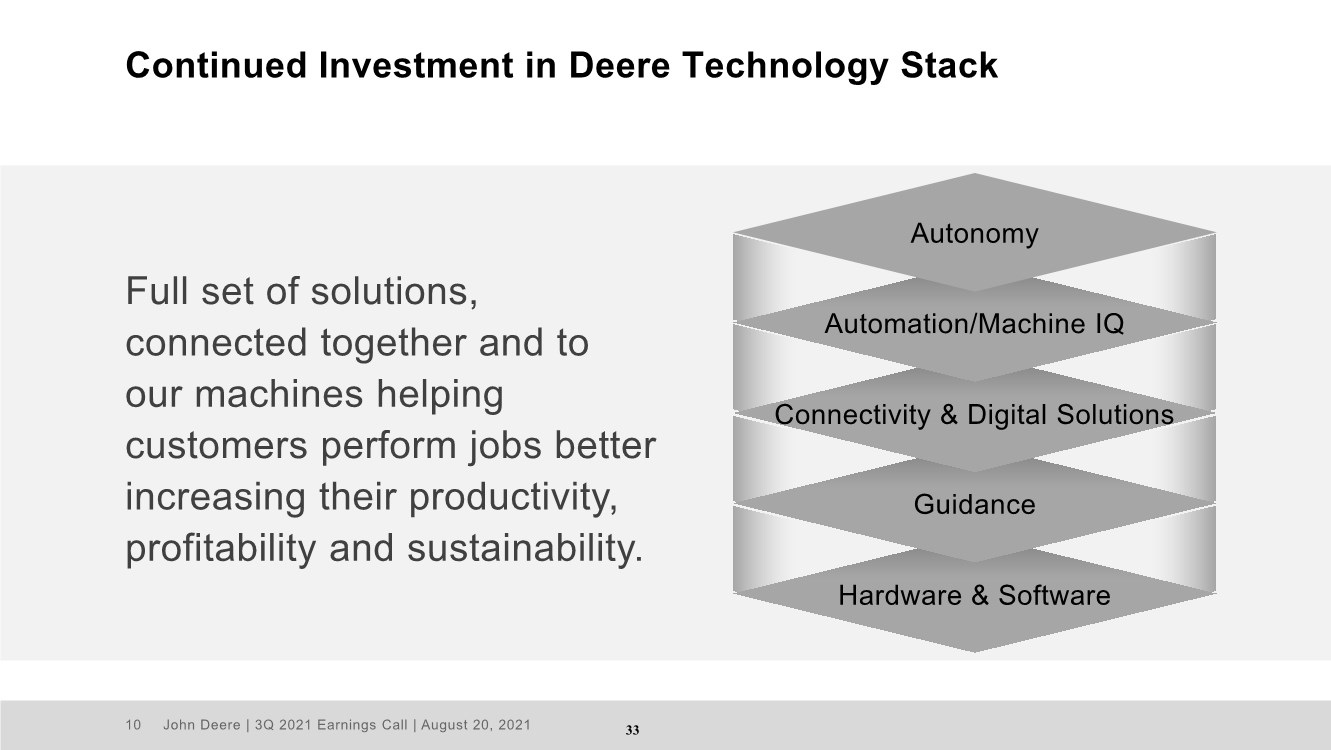

| John Deere | 3Q 2021 Earnings Call | August 20, 2021 10 Continued Investment in Deere Technology Stack Full set of solutions, connected together and to our machines helping customers perform jobs better increasing their productivity, profitability and sustainability. Hardware & Software Guidance Connectivity & Digital Solutions Automation/Machine IQ Autonomy 33 |

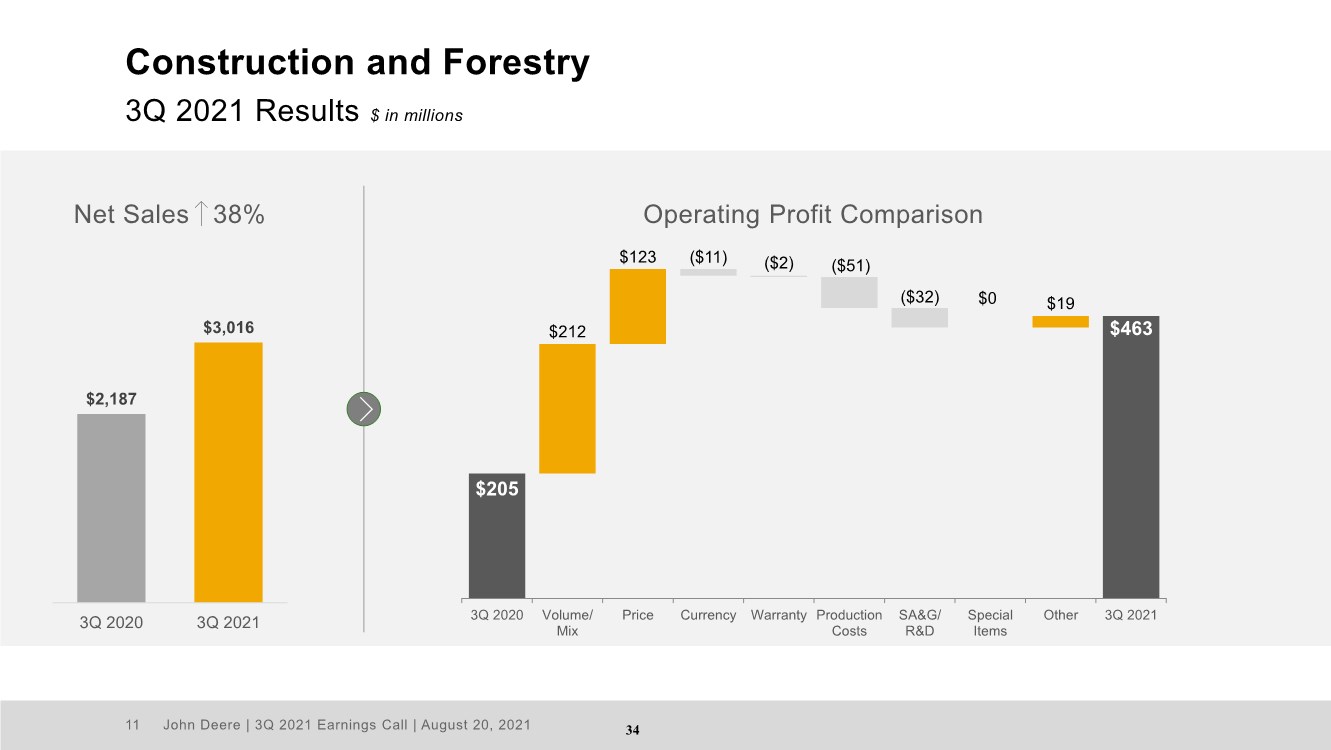

| John Deere | 3Q 2021 Earnings Call | August 20, 2021 11 Construction and Forestry 3Q 2021 Results $ in millions $2,187 $3,016 3Q 2020 3Q 2021 Net Sales 38% Operating Profit Comparison $463 $212 ($2) ($51) ($32) $0 $205 $123 ($11) $19 3Q 2020 Volume/ Mix Price Currency Warranty Production Costs SA&G/ R&D Special Items Other 3Q 2021 34 |

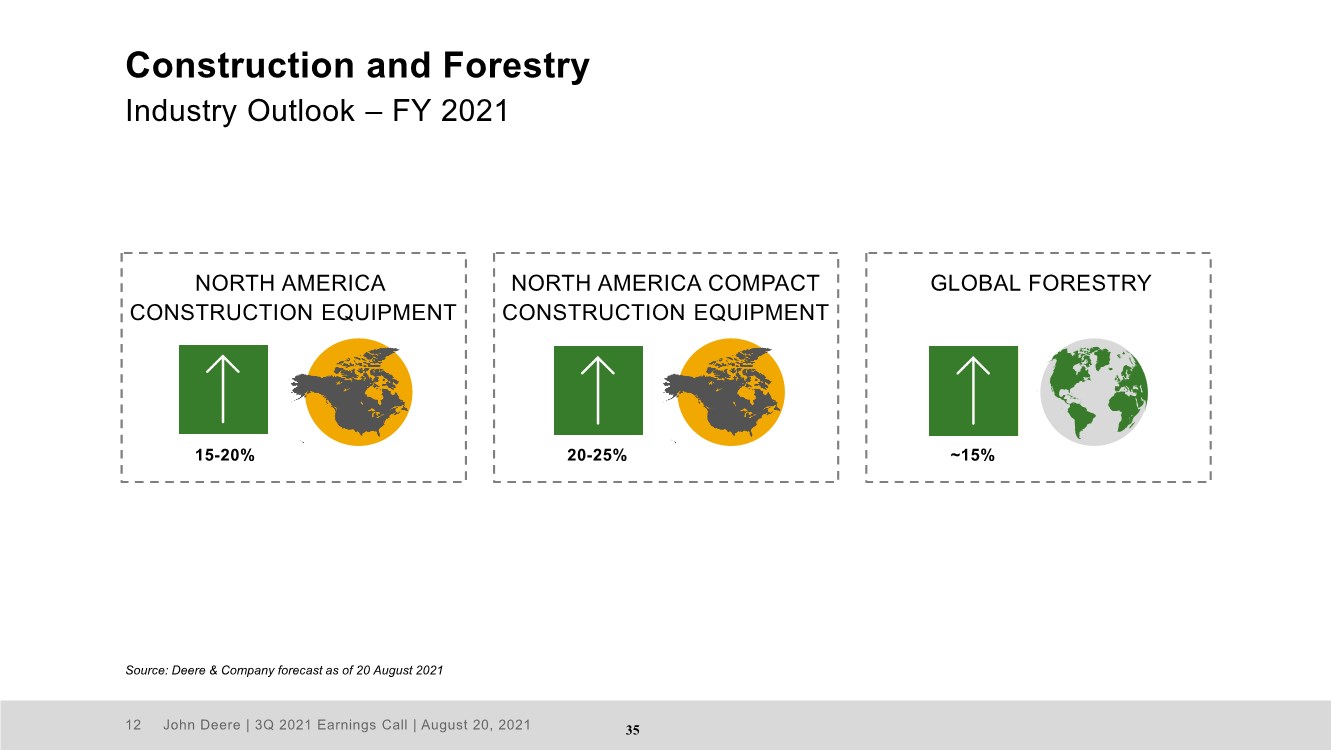

| John Deere | 3Q 2021 Earnings Call | August 20, 2021 12 Construction and Forestry Industry Outlook – FY 2021 Source: Deere & Company forecast as of 20 August 2021 NORTH AMERICA COMPACT CONSTRUCTION EQUIPMENT 20-25% GLOBAL FORESTRY ~15% NORTH AMERICA CONSTRUCTION EQUIPMENT 15-20% 35 |

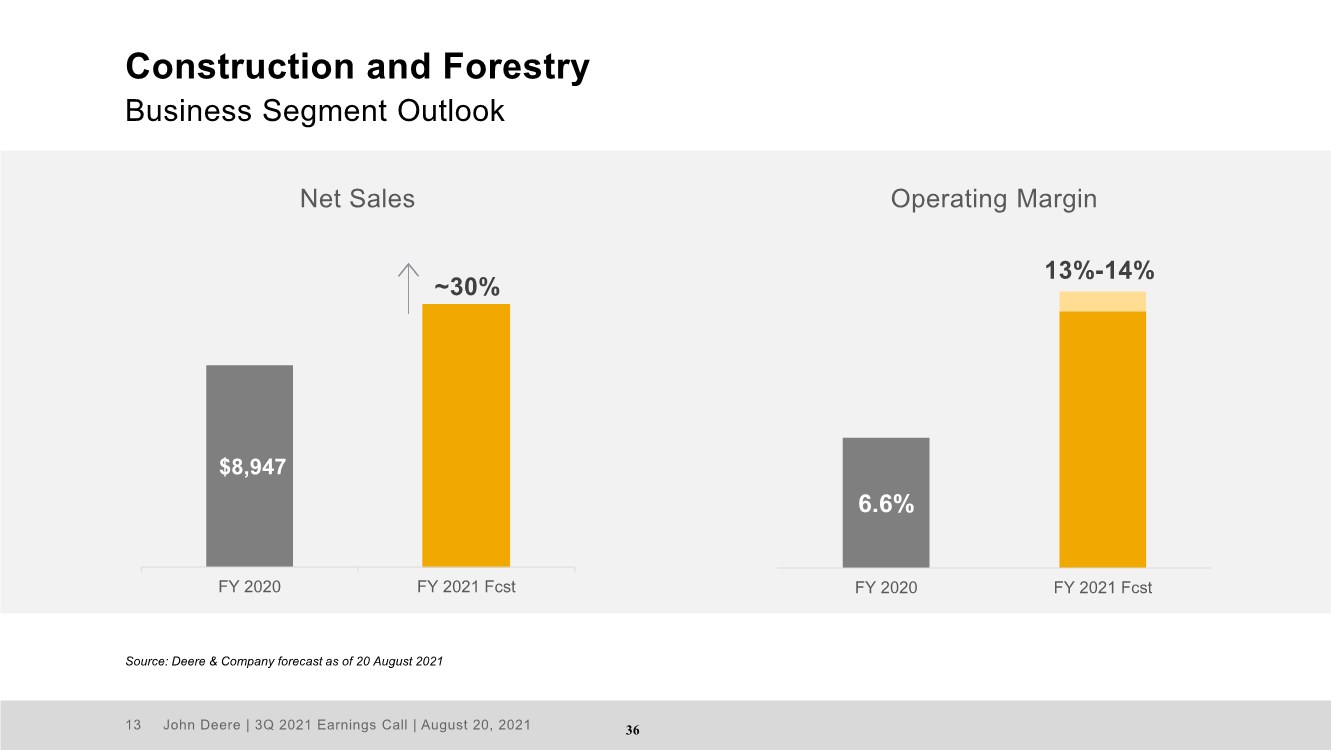

| John Deere | 3Q 2021 Earnings Call | August 20, 2021 13 Construction and Forestry Business Segment Outlook Source: Deere & Company forecast as of 20 August 2021 6.6% FY 2020 FY 2021 Fcst $8,947 FY 2020 FY 2021 Fcst Net Sales 13%-14% Operating Margin ~30% 36 |

| John Deere | 3Q 2021 Earnings Call | August 20, 2021 14 Margin Improvement Technology Differentiation Excavator Strategy Construction and Forestry Answering the fundamental need for smarter, safer and more sustainable construction so our customers can shape tomorrow’s world. 37 |

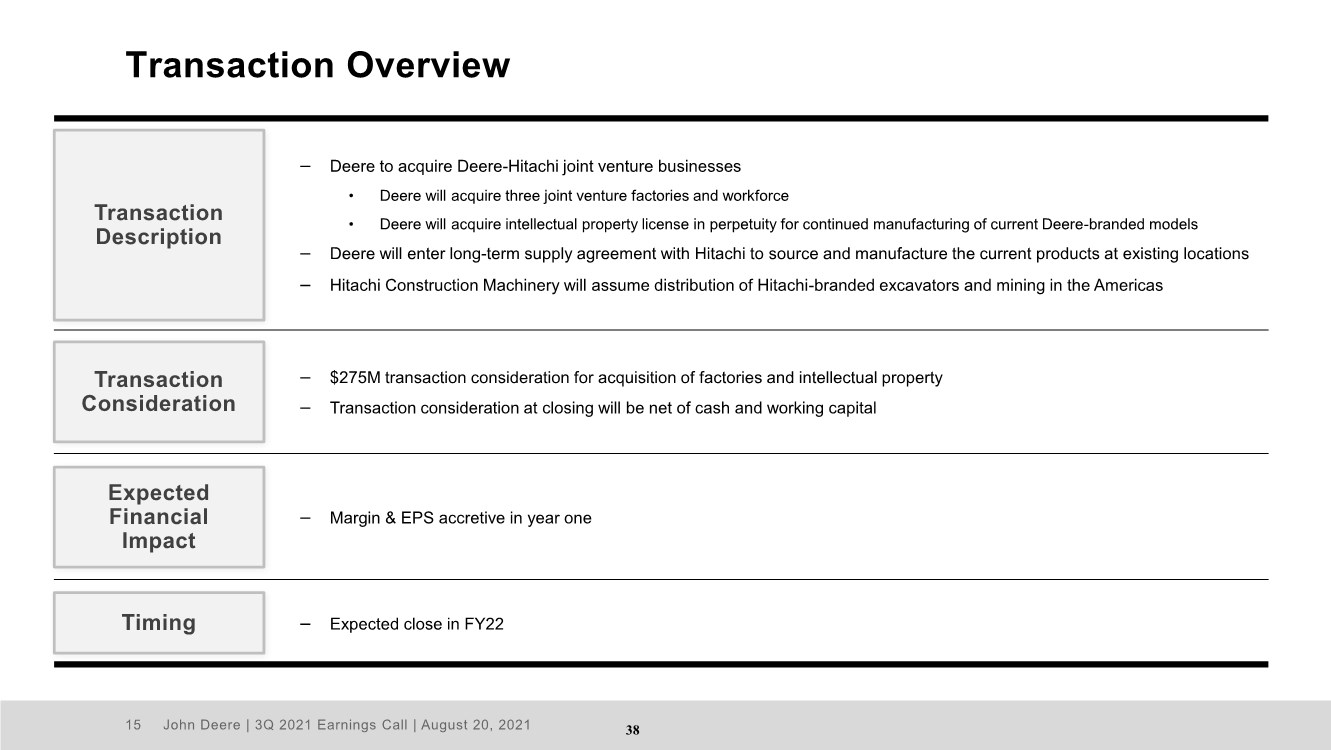

| John Deere | 3Q 2021 Earnings Call | August 20, 2021 15 − Deere to acquire Deere-Hitachi joint venture businesses • Deere will acquire three joint venture factories and workforce • Deere will acquire intellectual property license in perpetuity for continued manufacturing of current Deere-branded models − Deere will enter long-term supply agreement with Hitachi to source and manufacture the current products at existing locations − Hitachi Construction Machinery will assume distribution of Hitachi-branded excavators and mining in the Americas Transaction Overview − $275M transaction consideration for acquisition of factories and intellectual property − Transaction consideration at closing will be net of cash and working capital − Margin & EPS accretive in year one − Expected close in FY22 Transaction Description Transaction Consideration Expected Financial Impact Timing 38 |

| John Deere | 3Q 2021 Earnings Call | August 20, 2021 16 Enables ownership of tech stack integration on critical earthmoving machine form Enhances strategic position and financial profile Allows for managed transition with minimal disruption to customers, channel, and operations Strategic Rationale 39 |

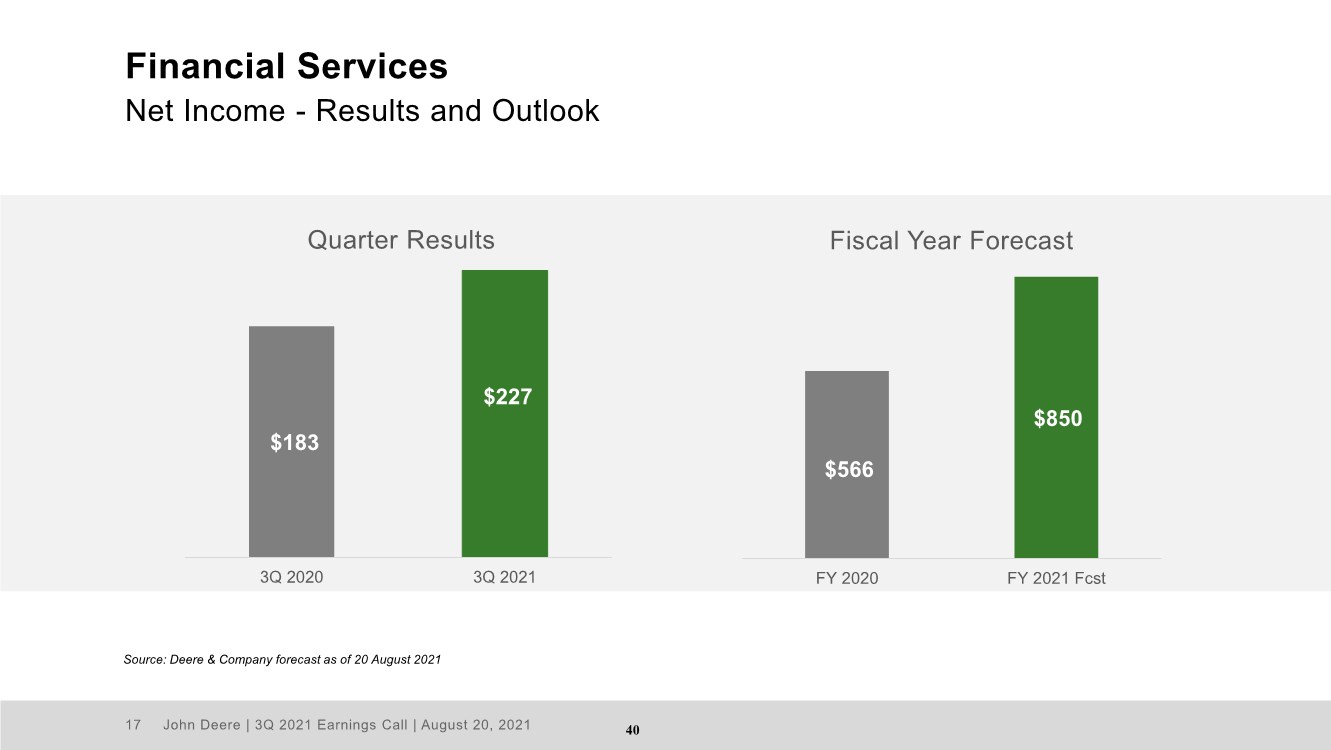

| John Deere | 3Q 2021 Earnings Call | August 20, 2021 17 Financial Services Net Income - Results and Outlook Source: Deere & Company forecast as of 20 August 2021 $183 $227 3Q 2020 3Q 2021 Quarter Results Fiscal Year Forecast $566 $850 FY 2020 FY 2021 Fcst 40 |

| John Deere | 3Q 2021 Earnings Call | August 20, 2021 18 Deere & Company Outlook Effective Tax Rate* Net Income (attributable to Deere & Co.) 22-24% $5.7-5.9B FY 2021 FORECAST Net Operating Cash Flow* $5.8-6.0B *Equipment Operations Source: Deere & Company forecast as of 20 August 2021 41 |

| John Deere | 3Q 2021 Earnings Call | August 20, 2021 19 Appendix 42 |

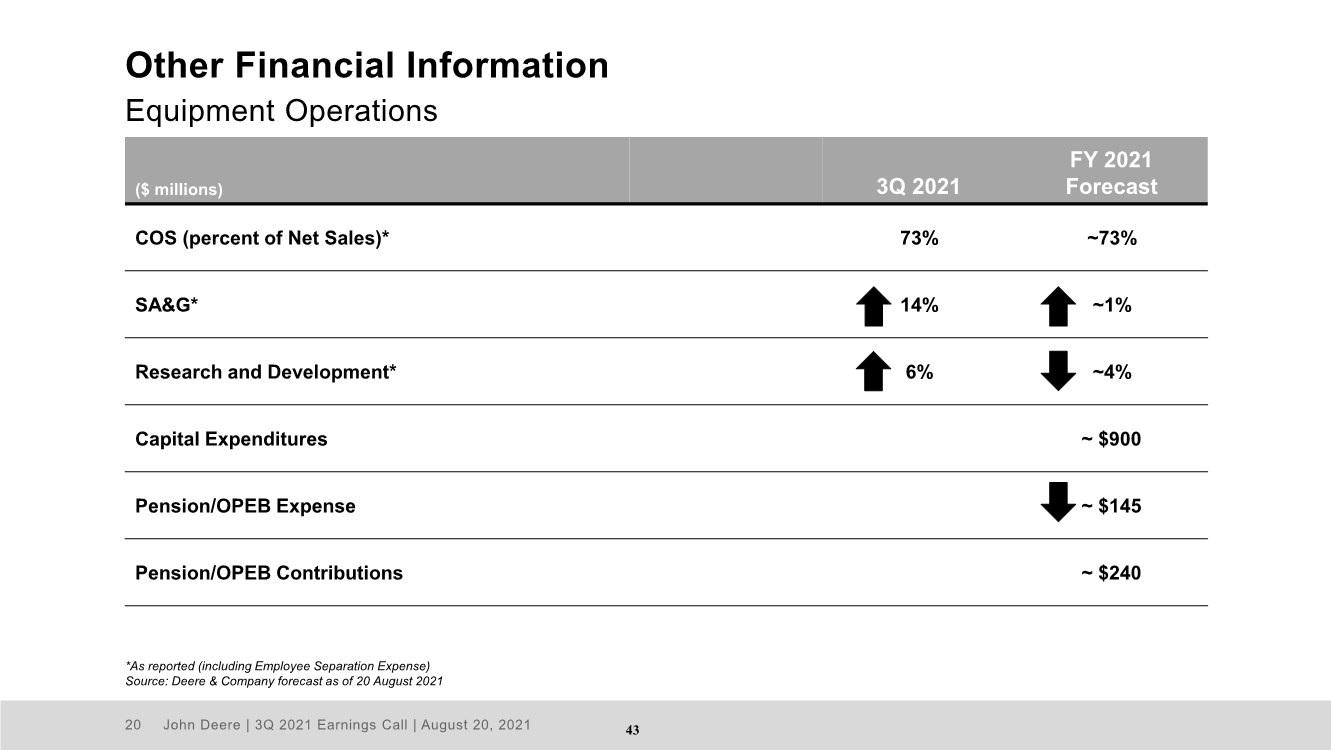

| John Deere | 3Q 2021 Earnings Call | August 20, 2021 20 ($ millions) 3Q 2021 FY 2021 Forecast COS (percent of Net Sales)* 73% ~73% SA&G* 14% ~1% Research and Development* 6% ~4% Capital Expenditures ~ $900 Pension/OPEB Expense ~ $145 Pension/OPEB Contributions ~ $240 Other Financial Information Equipment Operations *As reported (including Employee Separation Expense) Source: Deere & Company forecast as of 20 August 2021 43 |

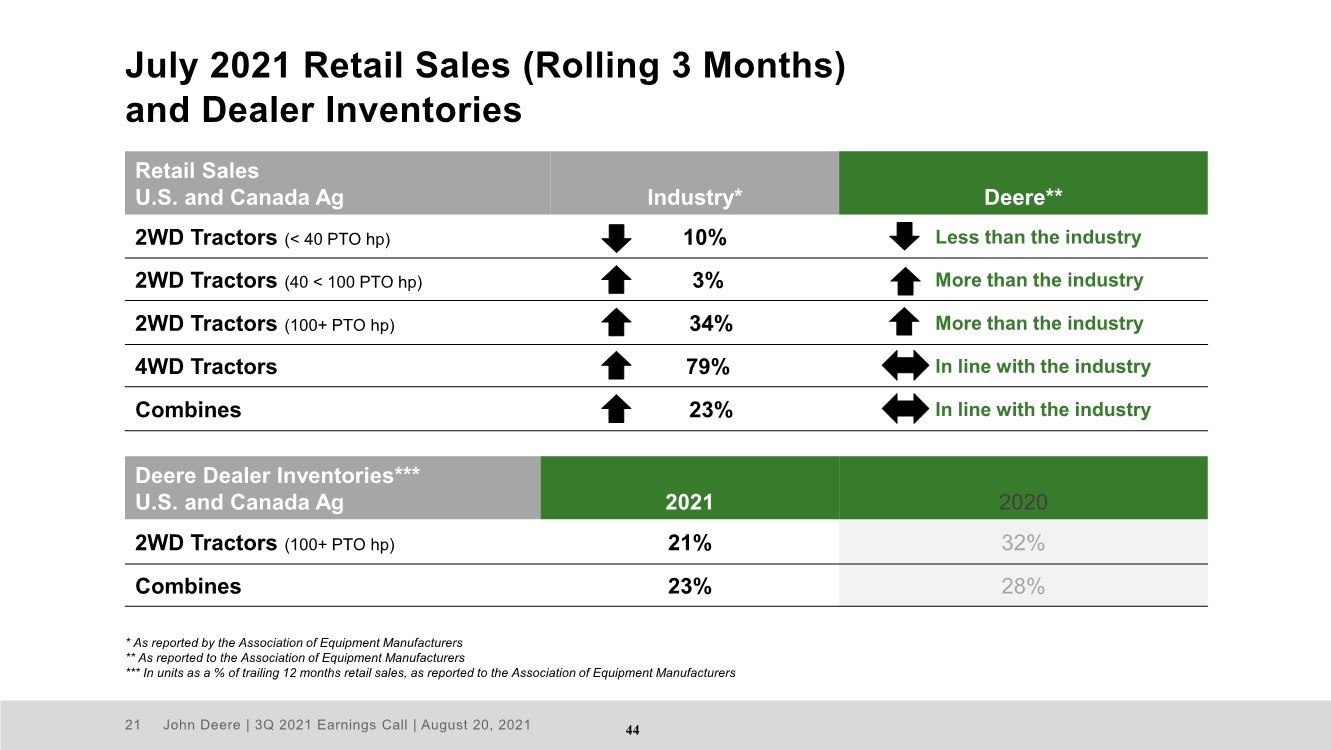

| John Deere | 3Q 2021 Earnings Call | August 20, 2021 21 July 2021 Retail Sales (Rolling 3 Months) and Dealer Inventories Retail Sales U.S. and Canada Ag Industry* Deere** 2WD Tractors (< 40 PTO hp) 10% Less than the industry 2WD Tractors (40 < 100 PTO hp) 3% More than the industry 2WD Tractors (100+ PTO hp) 34% More than the industry 4WD Tractors 79% In line with the industry Combines 23% In line with the industry Deere Dealer Inventories*** U.S. and Canada Ag 2021 2020 2WD Tractors (100+ PTO hp) 21% 32% Combines 23% 28% * As reported by the Association of Equipment Manufacturers ** As reported to the Association of Equipment Manufacturers *** In units as a % of trailing 12 months retail sales, as reported to the Association of Equipment Manufacturers 44 |

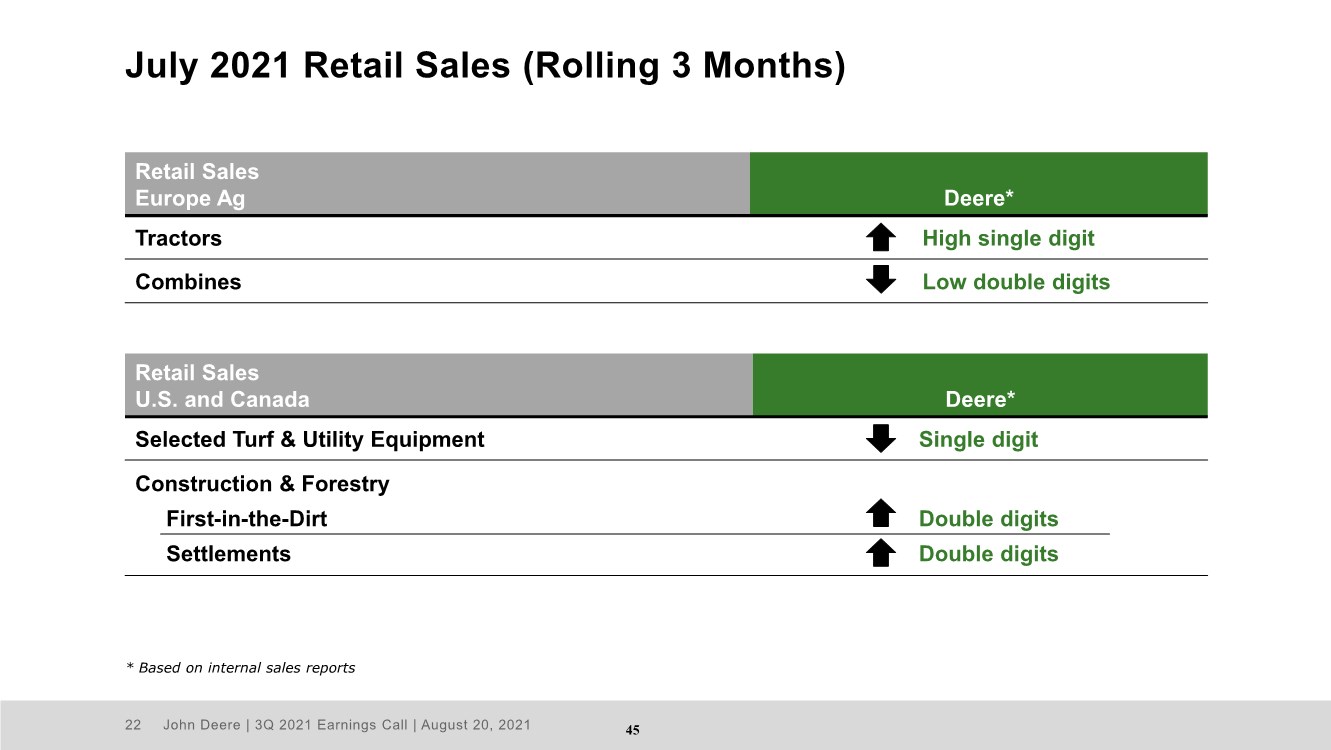

| John Deere | 3Q 2021 Earnings Call | August 20, 2021 22 Retail Sales U.S. and Canada Deere* Selected Turf & Utility Equipment Single digit Construction & Forestry First-in-the-Dirt Settlements Double digits Double digits July 2021 Retail Sales (Rolling 3 Months) Retail Sales Europe Ag Deere* Tractors High single digit Combines Low double digits * Based on internal sales reports 45 |

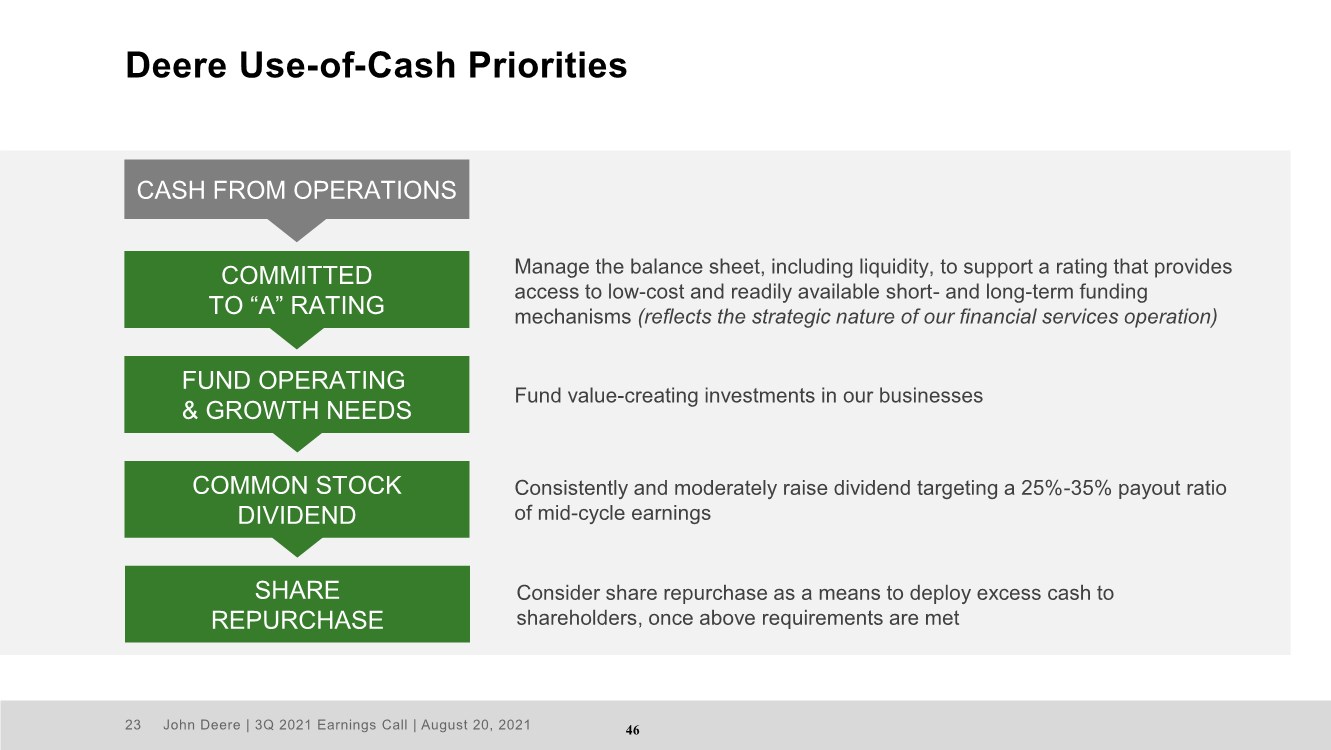

| John Deere | 3Q 2021 Earnings Call | August 20, 2021 23 Deere Use-of-Cash Priorities SHARE REPURCHASE Manage the balance sheet, including liquidity, to support a rating that provides access to low-cost and readily available short- and long-term funding mechanisms (reflects the strategic nature of our financial services operation) Fund value-creating investments in our businesses Consistently and moderately raise dividend targeting a 25%-35% payout ratio of mid-cycle earnings Consider share repurchase as a means to deploy excess cash to shareholders, once above requirements are met COMMITTED TO “A” RATING FUND OPERATING & GROWTH NEEDS COMMON STOCK DIVIDEND CASH FROM OPERATIONS 46 |

| John Deere | 3Q 2021 Earnings Call | August 20, 2021 24 Deere & Company’s 4Q 2021 earnings call is scheduled for 9:00 a.m. central time on Wednesday, 24 November 2021. 47 |

| 48 |