Attached files

| file | filename |

|---|---|

| 8-K - 8-K - FIRST FINANCIAL BANCORP /OH/ | ffbc-20210816.htm |

Investor Presentation Second Quarter 2021 Exhibit 99.1

Forward Looking Statement Disclosure 2 Certain statements contained in this report which are not statements of historical fact constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Words such as ‘‘believes,’’ ‘‘anticipates,’’ “likely,” “expected,” “estimated,” ‘‘intends’’ and other similar expressions are intended to identify forward-looking statements but are not the exclusive means of identifying such statements. Examples of forward-looking statements include, but are not limited to, statements we make about (i) our future operating or financial performance, including revenues, income or loss and earnings or loss per share, (ii) future common stock dividends, (iii) our capital structure, including future capital levels, (iv) our plans, objectives and strategies, and (v) the assumptions that underlie our forward-looking statements. As with any forecast or projection, forward-looking statements are subject to inherent uncertainties, risks and changes in circumstances that may cause actual results to differ materially from those set forth in the forward-looking statements. Forward-looking statements are not historical facts but instead express only management’s beliefs regarding future results or events, many of which, by their nature, are inherently uncertain and outside of management’s control. It is possible that actual results and outcomes may differ, possibly materially, from the anticipated results or outcomes indicated in these forward-looking statements. Important factors that could cause actual results to differ materially from those in our forward-looking statements include the following, without limitation: • economic, market, liquidity, credit, interest rate, operational and technological risks associated with the Company’s business; • future credit quality and performance, including our expectations regarding future loan losses and our allowance for credit losses; • the effect of and changes in policies and laws or regulatory agencies, including the Dodd-Frank Wall Street Reform and Consumer Protection Act and other legislation and regulation relating to the banking industry; (iv) management’s ability to effectively execute its business plans; • mergers and acquisitions, including costs or difficulties related to the integration of acquired companies; • the possibility that any of the anticipated benefits of the Company’s acquisitions will not be realized or will not be realized within the expected time period; • the effect of changes in accounting policies and practices; • changes in consumer spending, borrowing and saving and changes in unemployment; • changes in customers’ performance and creditworthiness; • the costs and effects of litigation and of unexpected or adverse outcomes in such litigation; • current and future economic and market conditions, including the effects of declines in housing prices, high unemployment rates, U.S. fiscal debt, budget and tax matters, geopolitical matters, and any slowdown in global economic growth; • the adverse impact on the U.S. economy, including the markets in which we operate, of the novel coronavirus, which causes the Coronavirus disease 2019 (“COVID-19”), global pandemic, and the impact of a slowing U.S. economy and increased unemployment on the performance of our loan and lease portfolio, the market value of our investment securities, the availability of sources of funding and the demand for our products; • our capital and liquidity requirements (including under regulatory capital standards, such as the Basel III capital standards) and our ability to generate capital internally or raise capital on favorable terms;

Forward Looking Statement Disclosure 3 • financial services reform and other current, pending or future legislation or regulation that could have a negative effect on our revenue and businesses, including the Dodd-Frank Act and other legislation and regulation relating to bank products and services; • the effect of the current interest rate environment or changes in interest rates or in the level or composition of our assets or liabilities on our net interest income, net interest margin and our mortgage originations, mortgage servicing rights and mortgage loans held for sale; • the effect of a fall in stock market prices on our brokerage, asset and wealth management businesses; • a failure in or breach of our operational or security systems or infrastructure, or those of our third-party vendors or other service providers, including as a result of cyber attacks; • the effect of changes in the level of checking or savings account deposits on our funding costs and net interest margin; and • our ability to develop and execute effective business plans and strategies. Additional factors that may cause our actual results to differ materially from those described in our forward-looking statements can be found in our Form 10-K for the year ended December 31, 2020, as well as our other filings with the SEC, which are available on the SEC website at www.sec.gov. All forward-looking statements included in this filing are made as of the date hereof and are based on information available at the time of the filing. Except as required by law, the Company does not assume any obligation to update any forward-looking statement.

Presentation Contents About First Financial Bancorp Financial Performance Appendix 4

Our Franchise 5 Commercial C&I, O-CRE, ABL, Equipment Finance, Treasury, Bannockburn Global Forex Retail Banking Consumer, Small Business Mortgage Banking NASDAQ: FFBC Headquarters: Cincinnati, Ohio Founded: 1863 Banking Centers: 139 Employees: 2,053 Market Cap (06/30/21): $2.3B Dividend Yield (06/30/21): 3.9% TCE Ratio: 8.37% Wealth Management / Affluent Banking Investment Commercial Real Estate Commercial Finance Lines of Business 1.62% Adj. PTPP ROAA(1) $16.0B in assets $9.5B/$12.5B loans / deposits $4.9B wealth management 1 Non-GAAP financial measure which management believes facilitates a better understanding of the Company’s financial condition. See Appendix for Non-GAAP reconciliation.

Key Investment Highlights Proven & sustainable business model spanning 150+ years • Well managed through past credit cycles • Conservative operating philosophy • Consistent profitability – 123 consecutive quarters Premier Midwest franchise with top quartile performance High quality balance sheet & robust capital position (11.78% CET1 / 8.37% TCE) Prudent risk management & credit culture with strong asset quality Increased scale to continue investments in technology Track record of well-executed acquisitions with a well-defined M&A strategy Experienced and proven management team 6

Complementary Market Centric Strategies Loans $3.1B / Deposits $5.0B Loans $1.4B / Deposits $4.3B Loans $3.6B / Deposits $3.0B 7 Note: Headquarters loan and deposit balances include special assets, loan marks, and other out of market and corporately held balances. Loan balances exclude PPP balances. Loans $1.1B / Deposits $0.2B

8 Diversified Lines of Business The number of Trust & Investments and RPS relationships are updated as of 12/31/20. All other data as of 6/30/21.

9 Revenue Growth Strategies Distribution Technology Talent Product & Pricing • Regional pricing strategy • Treasury Management product investments • Investments in Product Management DefinedModels • Community • Metro • Headquarters • National • Digital Enterprise Data Management • Investment in data warehouse • Enabling data as a strategic asset • Connection into CRM platform StaffingModel • Defined new company FTE targets • Larger salesforce intargeted Lines of Business Culture • Diversity and inclusion is a strategic priority • Change Management through merger • Refreshed Corporate Strategic Intent • Attraction/recruitment engagement and retention programs Capacity Plans • Increased physical distribution network • Closed 56 locations since merger • Aligned sales teams to distribution models Expanded Capabilities • Acquired Bannockburn enabling us to provide foreign exchange services • Rollout of “in-house” derivatives desk capabilities • Exploit untapped Wealth Management opportunities for expanded client base Talent Expansion • Up-Market Commercial talent acquisition • Added Chief DigitalOfficer; building out team • Added Enterprise ProductExecutive • Added Client Experience Executive Enterprise CRM • Company-wide implementation of SFDC • Marketing automation and sales enablement programdevelopment • Sales Management • Operational Integration Client Experience • Improved Cash Management Platform • Improved Online Banking Product • Blend – MortgageOrigination • nCino – Commercial loan origination and online account opening Digital Transformation • Roadmap Creation • Increased Resource Allocation • Enhanced Client Experience LOB | Go-to-Market

10 Digital + Technology Investments enabling simple, consistent & seamless customer experience across channels & making it easy for associates to provide best-in-class customer service. “

11 Expanded Salesforce CRM across enterprise 1Q 2019 Enterprise Digital Solutions formed, led by new Chief Digital Officer 2Q 2019 Digital commercial loan origination 4Q 2019 Commercial online banking upgrade 3Q 2021 1Q 2019 Enterprise workflow platform across bank operations 3Q 2019 Digital mortgage origination 1Q 2020 Office of Intelligent Automation 3Q 2020 Digital PPP forgiveness application Continued investment in digital solutions, automation + data enablement Early successes include mortgage, PPP origination + enhanced OLB experience Digital + Technology Investments Consumer online banking upgrade 2Q 2020 2Q 2020 Digital PPP loan origination + e- signature Digital consumer deposit origination upgrade 1Q 2020 2Q 2020 Online chat + chatbot support Digital marketing platform upgrade 2Q 2020 1Q 2021 Digital PPP loan origination 3.0 Digital wealth platform upgrade 4Q 2021 4Q 2021 Mortgage e-closing Redesigned bankatfirst.com 4Q 2020 Secure chat – consumer online banking 1Q 2021 2Q 2021 Integration Services Platform 3Q 2021 Digital small business lending

12 Bank Transformation All dollars shown in millions Tech Spend consists of Data Processing, Communications & Equipment Depreciation expenses, plus departmental expenses (primarily salaries & benefits) for the Technology, Digital & Info Security teams. Tech Spend / Total Expense $57.7 $55.5 $48.6 $40.8 $31.5 15.6% 14.9%14.8% 14.1% 13.6% YTD 2021 (Ann.)2020201920182017 Tech Spend % of Total Expense

Presentation Contents About First Financial Bancorp Financial Performance Appendix 13

2Q 2021 Results 123rd Consecutive Quarter of Profitability 14 EOP assets decreased $137.2 million compared to the linked quarter to $16.0 billion EOP loans decreased $422.5 million compared to the linked quarter to $9.5 billion Average deposits increased $339.3 million compared to the linked quarter to $12.7 billion EOP investment securities increased $190.2 million compared to the linked quarter Balance Sheet Profitability Asset Quality Income Statement Capital Noninterest income - $43.0 million Noninterest expense - $99.6 million; $91.8 million as adjusted Efficiency ratio - 63.46%. Adjusted1 efficiency ratio - 58.42% Effective tax rate of 17.4%. Adjusted1 effective tax rate of 19.1% Net interest income - $114.0 million. Net interest margin of 3.27% on a GAAP basis; 3.31% on a fully tax equivalent basis1 Net income - $50.9 million or $0.52 per diluted share. Adjusted1 net income - $56.3 million or $0.58 per diluted share2 Return on average assets - 1.26%. Adjusted1 return on average assets - 1.39% Return on average shareholders’ equity - 9.02%. Adjusted1 return on average shareholders’ equity - 9.97% Return on average tangible common equity - 16.31%1. Adjusted1 return on average tangible common equity - 18.03% Provision recapture - $4.2 million. Net charge-offs - $5.6 million. NCOs / Avg. Loans - 0.23% annualized Nonperforming Loans / Total Loans - 1.03%. Nonperforming Assets / Total Assets - 0.62% ACL / Nonaccrual Loans - 184.77%. Classified Assets / Total Assets - 1.14% ACL / Total loans - 1.68%; 1.75% of loans excluding PPP Total capital ratio - 15.31% Tier 1 common equity ratio - 11.78% Tangible common equity ratio - 8.37%; 8.61% excluding PPP loans Tangible book value per share - $13.08 Repurchased 1,308,945 shares during the quarter 1 Non-GAAP financial measure which management believes facilitates a better understanding of the Company’s financial condition. See Appendix for Non-GAAP reconciliation. 2 See Slide 39 for Adjusted Earnings detail. 1

2Q 2021 Highlights Quarterly earnings driven by strong fee income and lower credit costs Adjusted1 earnings per share - $0.58 Adjusted1 return on assets - 1.39% Adjusted1 pre-tax, pre-provision return on assets - 1.62% Adjusted1 return on average tangible common equity - 18.03% Loan balances declined primarily due to PPP payoffs/forgiveness; strong core deposit growth Loan balances decreased $422.5 million compared to the linked quarter; PPP loan balances decreased $288.8 million Average transactional deposit balances grew $469.6 million compared to the linked quarter; 17.8% on an annualized basis Noninterest bearing deposits were 31.2% of total deposits at June 30, 2021 Net interest margin (FTE) in line with expectations 9 bp decrease from first quarter driven by lower asset yields, higher securities balances and day count Net interest margin, excluding loan fees and loan accretion, decreased 7 bp compared to the linked quarter Strong adjusted1 noninterest income of $43.1 million, with record foreign exchange income Foreign exchange income of $12.0 million, an increase of $1.3 million, or 11.9%, compared to the linked quarter Wealth management fees of $6.2 million, an increase of $0.6 million, or 10.4%, compared to the linked quarter Bankcard income of $3.7 million, an increase of $0.6 million, or 19.3%, compared to the linked quarter Mortgage banking revenue remained elevated at $8.5 million; decline from the linked quarter due to lower premiums Core expenses increased $1.8 million from the linked quarter, driven by increase in employee related costs and increases in marketing and professional services expenses Adjusted1 noninterest expense of $91.8 million; Adjusted1 for $3.8 million of legal settlement costs, $2.8 million of branch consolidation costs and $1.2 million of tax credit investment writedowns Efficiency ratio of 63.5%; 58.4% as adjusted1 Allowance for credit loss (ACL) and provision expense declined compared to linked quarter Loans and leases - ACL of $159.6 million; 1.68% of total loans, 1.75% excluding PPP; $4.8 million provision recapture Unfunded Commitments - ACL of $13.6 million; $0.5 million provision expense Lower provision expense driven by improved credit outlook, as well as lower net charge-offs and classified asset balances Effective tax rate of 17.4% positively impacted by tax credit investment; 19.1% as adjusted1 Strong capital ratios Total capital of 15.31%; Tier 1 common equity of 11.78%; Tangible common equity of 8.37% Tangible book value increased by $0.30 to $13.08 Tangible common equity of 8.61% excluding PPP 1,308,945 shares repurchased in second quarter 1 Non-GAAP financial measure which management believes facilitates a better understanding of the Company’s financial condition. See Appendix for Non-GAAP reconciliations. 15

Adjusted Net Income1 16 The table below lists certain adjustments that the Company believes are significant to understanding its quarterly performance. 1 Non-GAAP financial measure which management believes facilitates a better understanding of the Company’s financial condition. See Appendix for Non-GAAP reconciliations. All dollars shown in thousands, except per share amounts As Reported Adjusted As Reported Adjusted Net interest income 114,026$ 114,026$ 113,876$ 113,876$ Provision for credit losses-loans and leases (4,756)$ (4,756)$ 3,450$ 3,450$ Provision for credit losses-unfunded commitments 517$ 517$ 538$ 538$ Noninterest income 42,987$ 42,987$ 40,322$ 40,322$ less: gains (losses) on investment securities - (104) A - (54) A less: other - - A - 193 A Total noninterest income 42,987$ 43,091$ 40,322$ 40,183$ Noninterest expense 99,643$ 99,643$ 92,506$ 92,506$ less: severance and merger-related expenses - 98 A - 1,261 A less: tax credit investment - 1,156 A - 208 A less: legal settlement - 3,825 A - - A less: other - 2,772 A - 1,054 A Total noninterest expense 99,643$ 91,792$ 92,506$ 89,983$ Income before income taxes 61,609$ 69,564$ 57,704$ 60,088$ Income tax expense 10,721$ 10,721$ 10,389$ 10,389$ plus: after-tax impact of tax credit investment @ 21% - 913 - 164 plus: tax effect of adjustments (A) @ 21% statutory rate - 1,671 - 501 Total income tax expense 10,721$ 13,305$ 10,389$ 11,054$ Net income 50,888$ 56,259$ 47,315$ 49,034$ Net earnings per share - diluted 0.52$ 0.58$ 0.48$ 0.50$ Pre-tax, pre-provision return on average assets 1.42% 1.62% 1.56% 1.62% 2Q 2021 1Q 2021

Profitability 17 Return on Average Assets Return on Avg Tangible Common Equity Diluted EPS 1 Non-GAAP financial measure which management believes facilitates a better understanding of the Company’s financial condition. See Appendix for Non-GAAP reconciliation. Efficiency Ratio $0.52$0.48$0.49 $0.42$0.38 $0.58 $0.50 $0.51 $0.44 $0.40 2Q211Q214Q203Q202Q20 Diluted EPS Adjusted EPS 1 1.26%1.20%1.20% 1.04%0.96% 1.39% 1.24%1.23% 1.09% 1.00% 2Q211Q214Q203Q202Q20 ROA Adjusted ROA 1 16.31%15.24%15.50% 13.61%12.90% 18.03% 15.80%15.94% 14.18%13.47% 2Q211Q214Q203Q202Q20 ROATCE Adjusted ROATCE 1 57.5% 60.3% 63.8% 60.0% 63.5% 56.1% 58.9% 56.8% 58.4% 58.4% 2Q20 3Q20 4Q20 1Q21 2Q21 Efficiency Ratio Adjusted Efficiency Ratio 1

Net Interest Income & Margin 18 Net Interest Margin (FTE) 2Q21 NIM (FTE) Progression Net Interest Income All dollars shown in millions $3.4$3.2$5.5$3.8$3.3 $3.5$3.4$3.9$5.4$5.8 $9.2$10.0 $12.5 $6.2$4.5 $114.0$113.9 $118.5 $112.2$111.6 2Q211Q214Q203Q202Q20 Loan Fees Loan Accretion PPP Interest/Fees 2.89%2.96%2.91%2.97% 3.09% 0.10% 0.09%0.15%0.11% 0.10% 0.10% 0.10%0.12%0.16% 0.17% 0.22% 0.25% 0.31%0.12% 0.08% 3.31% 3.40% 3.49% 3.36% 3.44% 2Q211Q214Q203Q202Q20 Basic Margin (FTE) Loan Fees Loan Accretion PPP Fees 1Q21 3.40% Increase in securities -0.03% PPP and other loan fees -0.02% Asset yields/mix -0.05% Deposit/funding costs/mix 0.03% Day count -0.02% 2Q21 3.31%

Diverse and Growing Fee Revenues 19 Noninterest Income 2Q21 Highlights All dollars shown in thousands Total fee income 27.4% of net revenue Record foreign exchange income of $12.0 million; increased $1.3 million, or 11.9%, from the linked quarter Record trust and wealth management fees of $6.2 million; increased $0.6 million, or 10.4%, from the linked quarter Bankcard income of $3.7 million; increased $0.6 million, or 19.3%, from the linked quarter Mortgage banking income of $8.5 million; decreased $1.0 million, or 10.2%, from the linked quarter Service Charges $7,537 18% Wealth Mgmt $6,216 14% Bankcard income $3,732 9% Client derivative fees $1,795 4% Foreign exchange income $12,037 28% Mortgage origination income $8,489 20% Other $3,181 7% Total $43.0 million

Well Managed Expenses 20 Noninterest Expense 2Q21 Highlights All dollars shown in thousands Core expenses increased $1.8 million from the linked quarter, driven by higher employee costs, marketing costs and professional services Operating adjustments include: $3.8 million legal settlement $2.8 million of branch consolidation costs $1.2 million tax credit investment write-down Salaries and benefits $60,784 61%Occupancy and equipment $8,906 9% Data processing $7,864 8% Professional services $2,029 2% Intangible amortization $2,480 2% Other $17,580 18% Total $99.6 million

Average Balance Sheet 21 Average Loans Average Securities Average Deposits All dollars shown in millions 1 Includes loans fees and loan accretion $12,711$12,372$11,925$11,563$11,731 0.12%0.14% 0.20% 0.27% 0.40% 2Q211Q214Q203Q202Q20 Total Deposits Cost of Deposits $4,130$3,783$3,404$3,163$3,164 2.37% 2.54% 2.71% 2.86%2.97% 2Q211Q214Q203Q202Q20 Average Investment Securities Investment Securities Yield $9,832$9,952 $10,128$10,253 $10,002 3.98%4.03% 4.18% 4.00% 4.25% 2Q211Q214Q203Q202Q20 Gross Loans Loan Yield (Gross)1

Attractive Deposit Portfolio 22 Deposit Product Mix (Avg) 2Q21 Average Deposit Progression All dollars shown in millions Total growth/(decline): $339.3 million Interest-bearing demand $1,789 14% Noninterest- bearing $3,790 30% Savings $1,251 10% Money Markets $2,294 18% Retail CDs $1,020 8% Brokered CDs $541 4% Public Funds $2,026 16% Total $12.7 billion $53.2 $136.9 $97.3 $1.3 -$44.4 -$76.8 $171.8 Interest-bearing demand Noninterest-bearing Savings Money Markets Retail CDs Brokered CDs Public Funds

Loan Portfolio 23 Loan LOB Mix (EOP) Net Loan Change-LOB (Linked Quarter) 1 Net of unearned fees of $16.6 million All dollars shown in millions Total growth/(decline): ($422.5 million) -$44.9 -$27.4 $14.5 -$16.3 -$40.2 -$19.4 -$288.8 ICRE Commercial & Small Business Banking Consumer Mortgage Oak Street Franchise PPPICRE $3,959 42% Commercial & Small Business Banking $2,401 25% Consumer $820 9% Mortgage $999 10% Oak Street $545 6% Franchise $387 4% PPP $401 4% Total $9.5 Billion 1

Loan Concentrations 24 C&I Loans by Industry 1 CRE Loans by Collateral 2 1 Industry types included in Other representing greater than 1% of total C&I loans include Agriculture, Transportation & Warehousing, Public Administration, Arts & Recreation, and Waste Management. Includes owner-occupied CRE. 2 Collateral types included in Other representing greater than 1% of total CRE loans include Medical Office, Residential Multi Family 5+ Construction, Student Housing, Real Estate IUB Other, and Commercial Lot. Residential, Multi Family 5+ 24% Retail 20% Office 14% Hotel/Motel 12% Nursing/Assisted Living 6% Restaurant 3% Industrial Facility 3% Residential, 1-4 Family 3% Warehouse 2%Other 13% CRE Loans: $3.9B Finance & Insurance 16% Manufacturing 14% Real Estate 12% Accommodation & Food Services 11% Health Care 7% Construction 7% Professional & Tech 5% Wholesale Trade 5% Retail Trade 5%Other Services 4% Other 14% C&I Loans: $3.7B

CARES Act Modifications as of 6/30/21 $182 million of total active modifications; 2% of total loans $181 million of loan modifications making interest only payments $0.6 million, or 0.3% full payment deferrals 100% of active commercial deferrals are interest only payments $118 million, or 65% of total deferrals are hotel loans Deferral portfolio running off as expected $93 million, or 51% of remaining deferrals are expected to expire in December of 2021 All deferrals expected to expire by end of year No material credit issues among loans that have exited deferral 25 All dollars shown in millions Active deferrals by round Active modifications by category Hotel $118 65% Other $29 16% Franchise $35 19% Round 1 $0.4 0% Round 2 $9.9 6% Round 3 $171.4 94%

Area of Focus - Hotel Portfolio $450 million balance represents 4.7% of the total loan portfolio $118 million, or 100% of total hotel deferrals, making interest only payments as of 6/30/21 Continued improvement in hotel performance, trending toward pre-pandemic levels Limited deterioration in average LTV reflected in updated appraisals received Minimal exposure to large convention center hotels $45.5 million rated substandard or worse 26 All dollars shown in millions Hotels by Flag Hotels by Geography $154 34% $160 36% $63 14% $35 8% $38 8% Marriott Hilton IHG Choice Other $348 77% $102 23% Footprint Out of Footprint

Area of Focus - Franchise Portfolio $387 million in balances or 4% of total loans Drive thru and delivery continue to provide strong performance while a portion of our sit- down book navigates pandemic related headwinds $35 million, or 9% of total franchise loans are in deferral as of 6/30/2021; all sit down concepts $100% are making interest only payments $20.0 million rated substandard or worse 27 Top 10 Concepts Sit-down ConceptsRestaurant Type All dollars shown in millions Delivery $107 28% Drive Thru $170 44% Sit Down $110 28% $0 $5 $10 $15 $20 $25 $30 $35 $40 Golden Corral Denny's Jersey Mike's IHOP five guys Subway QDOBA Other B al an ce s Deferral Making full payments 0.0% 5.0% 10.0% 15.0% 20.0% 25.0% $0 $20 $40 $60 $80 $100 $120 % o f P o rt fo lio B al an ce s Balances % of Portfolio

Current Expected Credit Losses - Loans and Leases 28 ACL / Total Loans 2Q21 Highlights All dollars shown in thousands $159.6 million ACL – loans and leases, or 1.68% of loan balances; 1.75% excluding PPP $4.8 million provision recapture; decline driven by improved credit outlook, lower net charge-offs and classified asset balances Utilized June Moody’s baseline forecast in quantitative model $13.6 million ACL – unfunded commitments; $0.5 million provision expense for this portion of the ACL ACL by Loan Type 1 $159.6 $169.9$175.7$168.5 $158.7 1.68% 1.71% 1.77% 1.65% 1.56% 2Q211Q214Q203Q202Q20 Allowance for Credit Losses ACL / Total Loans 2Q20 3Q20 4Q20 1Q21 2Q21 Loans Commercial and industrial 50,421$ 50,516$ 51,454$ 45,139$ 46,797$ Lease financing 1,431 1,287 995 1,015 1,457 Real estate -construction 15,357 18,970 21,736 22,734 20,359 Real estate - commercial 62,340 72,207 76,795 78,669 70,305 Real estate - residential 10,581 9,286 8,560 7,748 6,879 Home equity 14,236 12,530 11,869 10,760 9,684 Installment 1,226 1,237 1,215 1,235 1,211 Credit card 3,069 2,511 3,055 2,623 2,898 ACL-loan and lease losses 158,661$ 168,544$ 175,679$ 169,923$ 159,590$ ACL-unfunded commitments 16,678$ 14,753$ 12,503$ 13,040$ 13,558$ All dollars shown in millions

Asset Quality 29 Nonperforming Assets / Total AssetsClassified Assets / Total Assets Net Charge Offs & Provision Expense1 . 1 Provision includes both loans & leases and unfunded commitments All dollars shown in millions 1 1 $182.5 $196.8 $142.0$134.0$125.5 1.14% 1.22% 0.89%0.84% 0.79% 2Q211Q214Q203Q202Q20 Classified Assets Classified Assets / Total Assets $98.8$97.7 $89.1$87.3 $78.1 0.62%0.60% 0.56%0.55% 0.49% 2Q211Q214Q203Q202Q20 NPAs NPAs / Total Assets $3.1 $5.4 $6.6 $9.2 $5.6 $20.2 $13.4 $11.5 $4.0 -$4.2 0.23% 0.38% 0.26%0.21% 0.12% 2Q20 3Q20 4Q20 1Q21 2Q21 NCOs Provision Expense NCOs / Average Loans

30 Investment Portfolio Composition Investment Portfolio Quality Total: $4.2B Duration: ~3.6 Yrs Liquidity Sources In addition to deposits, First Financial has approximately $7.0 billion of readily available funding sources to meet customer needs through the following sources: Fed funds FHLB funding Brokered CDs Highly liquid securities Fed discount window First Financial has the following sources of liquidity at the holding company: $133.2 million in cash as of June 30, 2021 $148.1 million dividend capacity from First Financial Bank without prior regulatory approval Investment Portfolio and Liquidity Municipal bond securities 24% Commercial MBSs 18% Agency pass- through securities 15% Asset-backed securities 14% Agency CMOs 10% Non-Agency CMOs 9% Corporate securities 3% Regulatory stock 3% Debt obligations of U.S. Gov't Agency 2% Non-Agency pass- through securities 1% Other 1% Agency 42% AAA 15% A 5% AA 4% AA- 4% AA+ 3% Regulatory Stock 3% Treasury 2% A+ 2% Other 20%

Capital 31 Tier 1 Common Equity Ratio Total Capital Ratio Tangible Common Equity Ratio 6/30 Risk Weighted Assets = $11,318,590 All capital numbers are considered preliminary. Tier 1 Capital Ratio 8.37% 8.22% 8.47% 8.25% 8.09% 2Q211Q214Q203Q202Q20 Tangible Common Equity Ratio 11.78%11.81%11.82%11.63%11.49% 7.00% 2Q211Q214Q203Q202Q20 Tier 1 Common Equity Ratio Basel III minimum 15.31%15.41%15.55%15.37%15.19% 10.50% 2Q211Q214Q203Q202Q20 Total Capital Ratio Basel III minimum 12.16%12.19%12.20%12.02%11.87% 8.50% 2Q211Q214Q203Q202Q20 Tier 1 Capital Ratio Basel III minimum

Capital Strategy 32 Strategy & DeploymentTangible Book Value Per Share 3.9% annualized dividend yield 1,308,945 shares repurchased in second quarter at an average price of $25.11 98% of adjusted(1) earnings returned to shareholders in 2Q21 through common dividend and share repurchases Most recent internal stress testing indicates capital ratios above regulatory minimums in all modeled scenarios Common dividend expected to remain unchanged in near-term $13.08 $12.78 $12.93 $12.56 $12.26 2Q211Q214Q203Q202Q20 Tangible Book Value per Share 1 Non-GAAP financial measure which management believes facilitates a better understanding of the Company’s financial condition.

Outlook Commentary1 Loan balance growth expected to be in low single digits, excluding impact of PPP, over the remainder of the year Securities balances expected to remain consistent with 6/30/21 balances Deposit balances expected to remain stable over the near-term 33 Expected to be $91-93 million, but will fluctuate with fee incomeNoninterest Expense Net Interest Margin Balance Sheet Credit Provision recapture expected for remainder of the year Allowance for credit losses expected to decline in second half of 2021 Noninterest Income Mortgage banking income expected to decline due to lower premiums Foreign exchange income expected to be $10-11 million Total fee income expected to be $39-41 million 1 See Forward Looking Statement Disclosure on page 2-3 of this presentation for a discussion of factors that could affect management’s expectations and results in future periods. Will be impacted by timing of PPP forgiveness fees Expected to be under modest pressure from the low interest rate environment, excess liquidity on the balance sheet and increases to the securities portfolio Capital Will continue to evaluate capital deployment opportunities Share repurchases expected to continue in 3Q21

Presentation Contents About First Financial Bancorp Financial Performance Appendix 34

Appendix: Our Markets 35 Greater Cincinnati/Dayton Loans $4.1 billion Deposits $5.0 billion Deposit Market Share #4 (3.0%) Banking Centers 50 Fortune 500 Companies 8 Indianapolis Loans $1.1 billion Deposits $1.9 billion Deposit Market Share #14 (1.4%) Banking Centers 10 Fortune 500 Companies 2 Columbus, OH Loans $1.1 billion Deposits $0.4 billion Deposit Market Share #15 (0.6%) Banking Centers 6 Fortune 500 Companies 5 National Loans $1.1 billion Deposits $0.2 billion Louisville Loans $0.4 billion Deposits $0.8 billion Deposit Market Share #13 (1.5%) Banking Centers 9 Fortune 500 Companies 3 Community Markets Loans $1.4 billion Deposits $4.3 billion Banking Centers 64 All numbers as of 06/30/2021 except deposit market share which is as of 6/30/2020. Greater Cincinnati/Dayton and deposit balances include special assets, loan marks, and other out of market and corporately held balances. Loan balances exclude PPP balances.

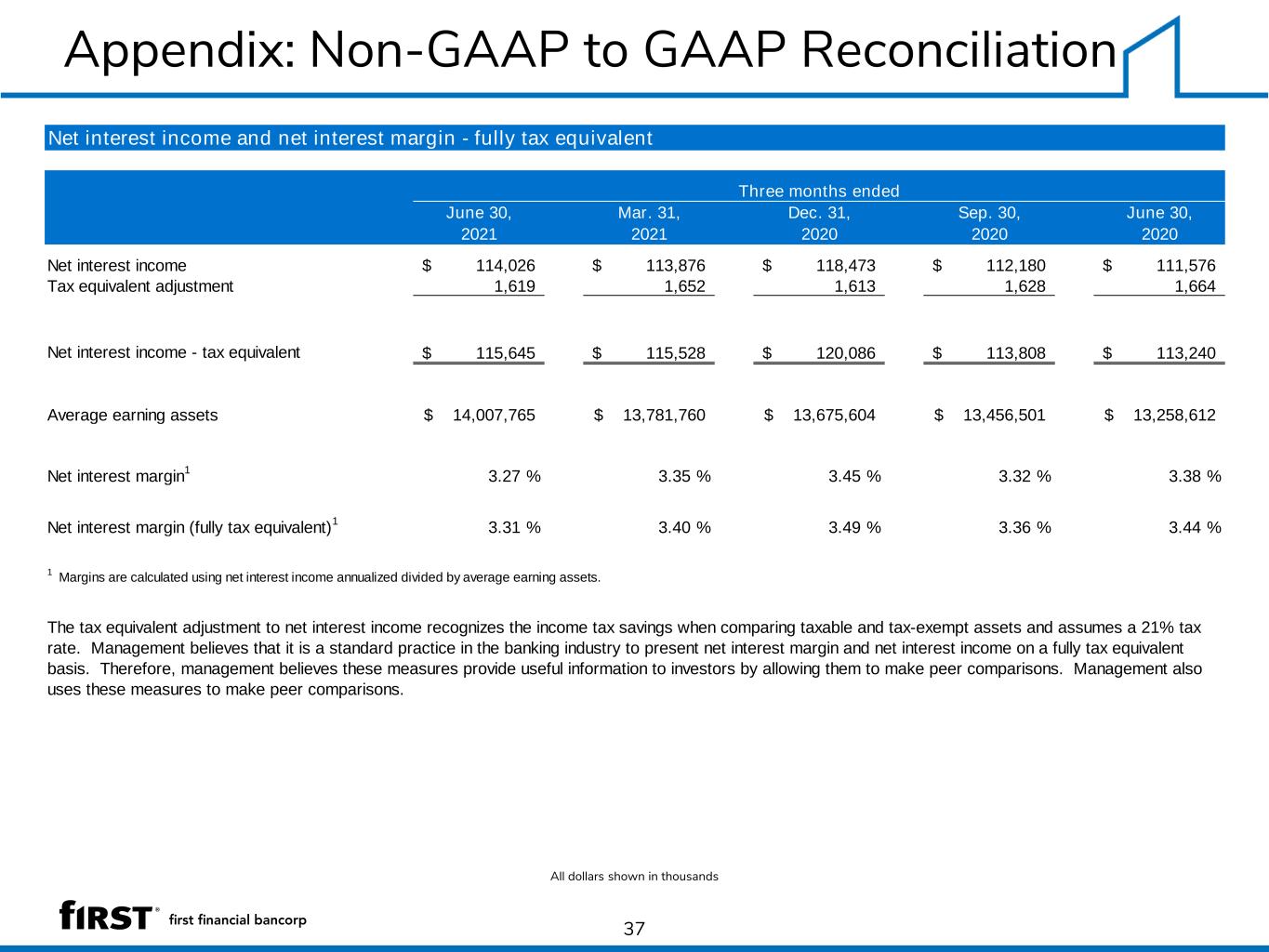

The Company’s Investor Presentation contains certain financial information determined by methods other than in accordance with accounting principles generally accepted in the United States (GAAP). Such non-GAAP financial information should be considered supplemental to, and not as a substitute for, or superior to, financial measures calculated in accordance with GAAP. However, we believe that non-GAAP reporting provides meaningful information and therefore we use it to supplement our GAAP information. We have chosen to provide this supplemental information to investors, analysts and other interested parties to enable them to perform additional analyses of operating results, to illustrate the results of operations giving effect to the non-GAAP adjustments and to provide an additional measure of performance. We believe this information is helpful in understanding the results of operations separate and apart from items that may, or could, have a disproportional positive or negative impact in any given period. For a reconciliation of the differences between the non-GAAP financial measures and the most comparable GAAP measures, please refer to the following reconciliation tables. to GAAP Reconciliation 36 Appendix: Non-GAAP Measures

Appendix: Non-GAAP to GAAP Reconciliation 37 All dollars shown in thousands Net interest income and net interest margin - fully tax equivalent June 30, Mar. 31, Dec. 31, Sep. 30, June 30, 2021 2021 2020 2020 2020 Net interest income 114,026$ 113,876$ 118,473$ 112,180$ 111,576$ Tax equivalent adjustment 1,619 1,652 1,613 1,628 1,664 Net interest income - tax equivalent 115,645$ 115,528$ 120,086$ 113,808$ 113,240$ Average earning assets 14,007,765$ 13,781,760$ 13,675,604$ 13,456,501$ 13,258,612$ Net interest margin 1 3.27 % 3.35 % 3.45 % 3.32 % 3.38 % Net interest margin (fully tax equivalent) 1 3.31 % 3.40 % 3.49 % 3.36 % 3.44 % Three months ended 1 Margins are calculated using net interest income annualized divided by average earning assets. The tax equivalent adjustment to net interest income recognizes the income tax savings when comparing taxable and tax-exempt assets and assumes a 21% tax rate. Management believes that it is a standard practice in the banking industry to present net interest margin and net interest income on a fully tax equivalent basis. Therefore, management believes these measures provide useful information to investors by allowing them to make peer comparisons. Management also uses these measures to make peer comparisons.

Appendix: Non-GAAP to GAAP Reconciliation 38 All dollars shown in thousands Additional non-GAAP ratios June 30, Mar. 31, Dec. 31, Sep. 30, June 30, (Dollars in thousands, except per share data) 2021 2021 2020 2020 2020 Net income (a) 50,888$ 47,315$ 48,312$ 41,477$ 37,393$ Average total shareholders' equity 2,263,687 2,272,749 2,256,062 2,230,422 2,185,865 Less: Goodwill (937,771) (937,771) (937,771) (937,771) (937,771) Other intangibles (60,929) (63,529) (66,195) (69,169) (72,086) MSR's (13,310) (12,749) (12,186) (11,274) (10,254) Average tangible equity (b) 1,251,677 1,258,700 1,239,910 1,212,208 1,165,754 Total shareholders' equity 2,269,507 2,258,942 2,282,070 2,247,815 2,221,019 Less: Goodwill (937,771) (937,771) (937,771) (937,771) (937,771) Other intangibles (59,391) (61,984) (64,552) (67,419) (70,325) MSR's (14,142) (13,156) (12,810) (12,011) (11,250) Ending tangible equity (c) 1,258,203 1,246,031 1,266,937 1,230,614 1,201,673 Total assets 16,037,919 16,175,071 15,973,134 15,925,647 15,870,890 Less: Goodwill (937,771) (937,771) (937,771) (937,771) (937,771) Other intangibles (59,391) (61,984) (64,552) (67,419) (70,325) MSR's (14,142) (13,156) (12,810) (12,011) (11,250) Ending tangible assets (d) 15,026,615 15,162,160 14,958,001 14,908,446 14,851,544 Risk-weighted assets (e) 11,318,590 11,304,012 11,219,114 11,119,560 11,034,570 Total average assets 16,215,469 16,042,654 16,030,986 15,842,010 15,710,204 Less: Goodwill (937,771) (937,771) (937,771) (937,771) (937,771) Other intangibles (60,929) (63,529) (66,195) (69,169) (72,086) MSR's (13,310) (12,749) (12,186) (11,274) (10,254) Average tangible assets (f) 15,203,459$ 15,028,605$ 15,014,834$ 14,823,796$ 14,690,093$ Ending shares outstanding (g) 96,199,509 97,517,693 98,021,929 97,999,763 98,018,858 Ratios Return on average tangible shareholders' equity (a)/(b) 16.31% 15.24% 15.50% 13.61% 12.90% Ending tangible equity as a percent of: Ending tangible assets (c)/(d) 8.37% 8.22% 8.47% 8.25% 8.09% Risk-weighted assets (c)/(e) 11.12% 11.02% 11.29% 11.07% 10.89% Average tangible equity as a percent of average tangible assets (b)/(f) 8.23% 8.38% 8.26% 8.18% 7.94% Tangible book value per share (c)/(g) 13.08$ 12.78$ 12.93$ 12.56$ 12.26$ Three months ended

Appendix: Non-GAAP to GAAP Reconciliation 39 Additional non-GAAP measures 4Q20 3Q20 2Q20 As Reported Adjusted As Reported Adjusted As Reported Adjusted As Reported Adjusted As Reported Adjusted Net interest income (f) 114,026$ 114,026$ 113,876$ 113,876$ 118,473$ 118,473$ 112,180$ 112,180$ 111,576$ 111,576$ Provision for credit losses-loans and leases (j) (4,756) (4,756) 3,450 3,450 13,758 13,758 15,299 15,299 17,859 17,859 Provision for credit losses-unfunded commitments (j) 517 517 538 538 (2,250) (2,250) (1,925) (1,925) 2,370 2,370 Noninterest income 42,987 42,987 40,322 40,322 61,515 61,515 49,499 49,499 42,725 42,725 less: gains (losses) on sale of investment securities (104) (54) 196 20 128 less: gains from the redemption of Visa B shares - - 13,397 - - less: other - 193 (157) - - Total noninterest income (g) 42,987 43,091 40,322 40,183 61,515 48,079 49,499 49,479 42,725 42,597 Noninterest expense 99,643 99,643 92,506 92,506 114,798 114,798 97,511 97,511 88,689 88,689 less: severance and merger-related expenses 98 1,261 29 95 35 less: tax credit investments 1,156 208 5,071 - - less: contribution to First Financial Foundation - - 5,000 - - less: debt extinguishment - - 7,257 - - less: legal settlement 3,825 - - - - less: COVID-19 and other 2,772 1,054 2,877 2,126 2,167 Total noninterest expense (e) 99,643 91,792 92,506 89,983 114,798 94,564 97,511 95,290 88,689 86,487 Income before income taxes (i) 61,609 69,564 57,704 60,088 53,682 60,480 50,794 52,995 45,383 47,457 Income tax expense 10,721 10,721 10,389 10,389 5,370 5,370 9,317 9,317 7,990 7,990 plus: tax effect of adjustments 913 501 1,428 462 436 plus: after-tax impact of tax credit investments @ 21% 1,671 164 4,005 Total income tax expense (h) 10,721 13,305 10,389 11,054 5,370 10,803 9,317 9,779 7,990 8,426 Net income (a) 50,888$ 56,259$ 47,315$ 49,034$ 48,312$ 49,677$ 41,477$ 43,216$ 37,393$ 39,031$ Average diluted shares (b) 97,010 97,010 97,728 97,728 98,021 98,021 98,009 98,009 97,989 97,989 Average assets (c) 16,215,469 16,215,469 16,042,654 16,042,654 16,030,986 16,030,986 15,842,010 15,842,010 15,710,204 15,710,204 Average shareholders' equity 2,263,687 2,263,687 2,272,749 2,272,749 2,256,062 2,256,062 2,230,422 2,230,422 2,185,865 2,185,865 Less: Goodwill and other intangibles (1,012,010) (1,012,010) (1,014,049) (1,014,049) (1,016,152) (1,016,152) (1,018,214) (1,018,214) (1,020,111) (1,020,111) Average tangible equity (d) 1,251,677 1,251,677 1,258,700 1,258,700 1,239,910 1,239,910 1,212,208 1,212,208 1,165,754 1,165,754 Ratios Net earnings per share - diluted (a)/(b) 0.52$ 0.58$ 0.48$ 0.50$ 0.49$ 0.51$ 0.42$ 0.44$ 0.38$ 0.40$ Return on average assets - (a)/(c) 1.26% 1.39% 1.20% 1.24% 1.20% 1.23% 1.04% 1.09% 0.96% 1.00% Pre-tax, pre-provision return on average assets - ((a)+(j)+(h))/(c) 1.42% 1.62% 1.56% 1.62% 1.62% 1.79% 1.61% 1.67% 1.68% 1.73% Return on average tangible shareholders' equity - (a)/(d) 16.31% 18.03% 15.24% 15.80% 15.50% 15.94% 13.61% 14.18% 12.90% 13.47% Efficiency ratio - (e)/((f)+(g)) 63.5% 58.4% 60.0% 58.4% 63.8% 56.8% 60.3% 58.9% 57.5% 56.1% Effective tax rate - (h)/(i) 17.4% 19.1% 18.0% 18.4% 10.0% 17.9% 18.3% 18.5% 17.6% 17.8% (Dollars in thousands, except per share data) 2Q21 1Q21

40 First Financial Bancorp First Financial Center 255 East Fifth Street Cincinnati, OH 45202