Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - Santander Consumer USA Holdings Inc. | a2021q2exhibit991.htm |

| 8-K - 8-K - Santander Consumer USA Holdings Inc. | sc-20210728.htm |

Second Quarter 2021 July 28, 2021 Exhibit 99.2

IMPORTANT INFORMATION 2 Forward-Looking Statements This press release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Any statements about our expectations, beliefs, plans, predictions, forecasts, objectives, assumptions, or future events or performance are not historical facts and may be forward-looking. These statements are often, but not always, made through the use of words or phrases such as anticipates, believes, can, could, may, predicts, potential, should, will, estimates, plans, projects, continuing, ongoing, expects, intends, and similar words or phrases. Although we believe that the expectations reflected in these forward-looking statements are reasonable, these statements are not guarantees of future performance and involve risks and uncertainties that are subject to change based on various important factors, some of which are beyond our control. For additional discussion of these risks, refer to the section entitled Risk Factors and elsewhere in our Annual Report on Form 10-K and our Quarterly Reports on Form 10- Q or Current Reports on Form 8-K, or other applicable documents that are filed or furnished with the U.S. Securities and Exchange Commission (collectively, our "SEC filings"). Among the factors that could cause the forward-looking statements in this press release and/or our financial performance to differ materially from that suggested by the forward- looking statements are: (a) the adverse impact of COVID-19 on our business, financial condition, liquidity and results of operations; (b) continually changing federal, state, and local laws and regulations could materially adversely affect our business; (c) adverse economic conditions in the United States and worldwide may negatively impact our results; (d) a reduction in our access to funding; (e) significant risks we face implementing our growth strategy, some of which are outside our control; (f) our agreement with FCA US LLC may not result in currently anticipated levels of growth and is subject to certain conditions that could result in termination of the agreement; (g) our business could suffer if we are unsuccessful in developing and maintaining relationships with automobile dealerships; (h) our financial condition, liquidity, and results of operations depend on the credit performance of our loans; (i) loss of our key management or other personnel, or an inability to attract such management and personnel; (j) certain regulations, including but not limited to oversight by the Office of the Comptroller of the Currency, the Consumer Financial Protection Bureau, the European Central Bank, and the Federal Reserve, whose oversight and regulation may limit certain of our activities, including the timing and amount of dividends and other limitations on our business; (k) there can be no assurance that the proposed acquisition of all of our outstanding common stock by SHUSA will be agreed upon, approved and ultimately consummated, and the terms of any such transaction may differ materially from those originally proposed by SHUSA; and (l) other future changes in our relationship with SHUSA and Banco Santander that could adversely affect our operations. If one or more of the factors affecting our forward-looking information and statements proves incorrect, our actual results, performance or achievements could differ materially from those expressed in, or implied by, forward-looking information and statements. Therefore, we caution the reader not to place undue reliance on any forward-looking information or statements. The effect of these factors is difficult to predict. Factors other than these also could adversely affect our results, and the reader should not consider these factors to be a complete set of all potential risks or uncertainties as new factors emerge from time to time. Any forward- looking statements only speak as of the date of this document, and we undertake no obligation to update any forward-looking information or statements, whether written or oral, to reflect any change, except as required by law. All forward-looking statements attributable to us are expressly qualified by these cautionary statements.

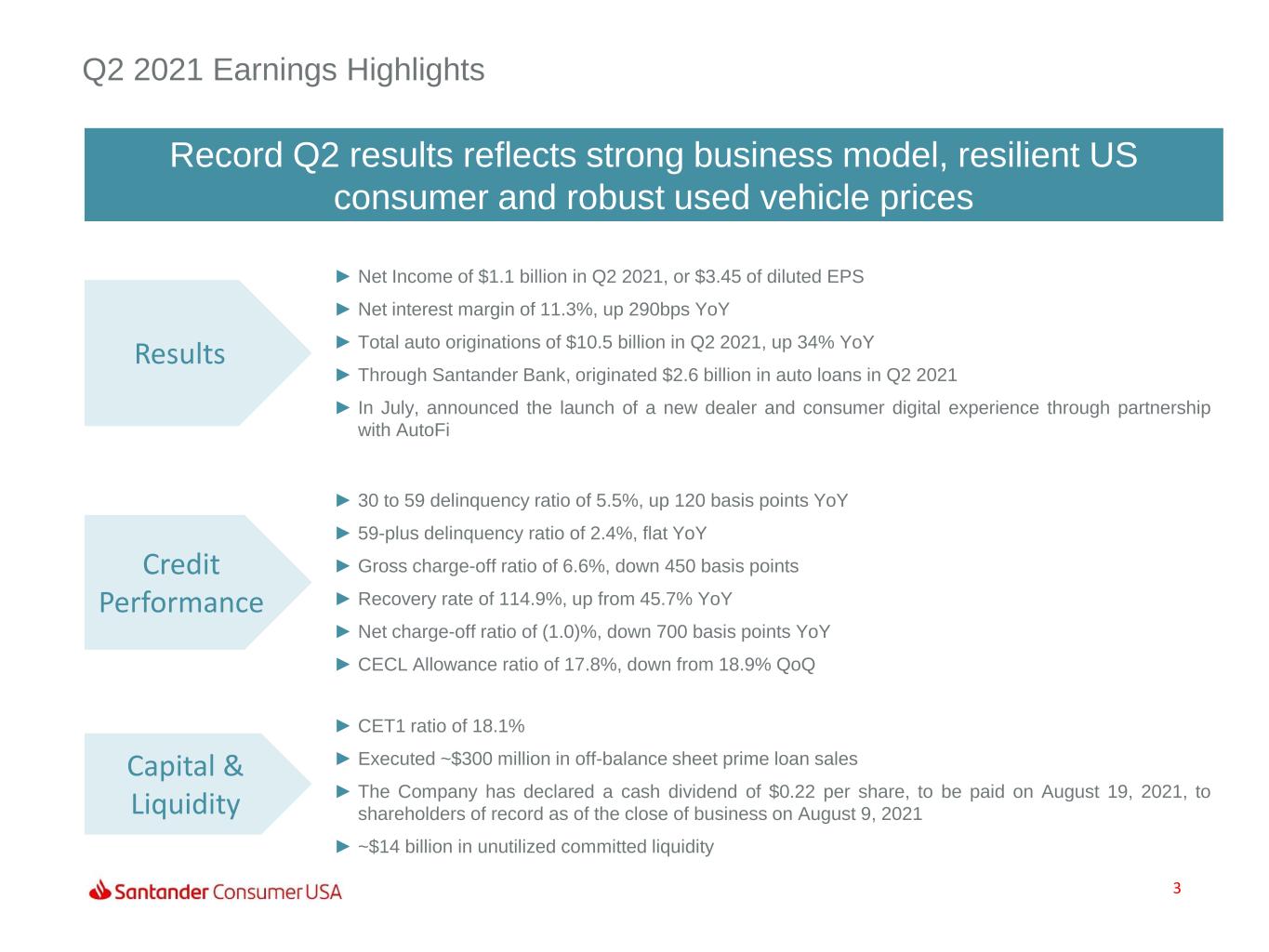

Record Q2 results reflects strong business model, resilient US consumer and robust used vehicle prices 3 Q2 2021 Earnings Highlights Results Capital & Liquidity Credit Performance ► Net Income of $1.1 billion in Q2 2021, or $3.45 of diluted EPS ► Net interest margin of 11.3%, up 290bps YoY ► Total auto originations of $10.5 billion in Q2 2021, up 34% YoY ► Through Santander Bank, originated $2.6 billion in auto loans in Q2 2021 ► In July, announced the launch of a new dealer and consumer digital experience through partnership with AutoFi ► CET1 ratio of 18.1% ► Executed ~$300 million in off-balance sheet prime loan sales ► The Company has declared a cash dividend of $0.22 per share, to be paid on August 19, 2021, to shareholders of record as of the close of business on August 9, 2021 ► ~$14 billion in unutilized committed liquidity ► 30 to 59 delinquency ratio of 5.5%, up 120 basis points YoY ► 59-plus delinquency ratio of 2.4%, flat YoY ► Gross charge-off ratio of 6.6%, down 450 basis points ► Recovery rate of 114.9%, up from 45.7% YoY ► Net charge-off ratio of (1.0)%, down 700 basis points YoY ► CECL Allowance ratio of 17.8%, down from 18.9% QoQ

0.8% -4.1% 2.7% 1.7% 2.5% 0.9% 2.6% 2.7% 1.2% 2.6% 4.2% 2.0% -31.4% 7.6% 08 09 10 11 12 13 14 15 16 17 18 19 20 21 Jun Jun Jun Jun Jun Jun Jun Jun Jun Jun Jun Jun Jun Jun 5.6% 9.5% 9.4% 9.1% 8.2% 7.5% 6.1% 5.3% 4.9% 4.3% 4.0% 3.7% 11.1% 5.9% 50.4 49.3 52.9 58.5 62.0 81.4 85.2 101.4 98.0 118.9 126.4 121.5 98.1 127.3 4 Economic Indicators Consumer Confidence1 U.S. Unemployment Statistics2 U.S. GDP QoQ Change3 Consumer confidence index increased to 127.3, the highest level since the onset of the pandemic Unemployment rate of 5.9% in June lowest since the beginning of the pandemic but remains above pre- pandemic levels US GDP increased 7.6% in Q2 2021 vs. Q1 2021, as the economy reopens 1 The Conference Board’s consumer confidence index, monthly data as of June 30, 2021 2 U.S. Bureau of Labor Statistics, monthly data as of June 30, 2021 3 U.S. Bureau of Economic (BEA) Analysis, quarterly data as of March 31, 2021 * U.S. GDP Q2 2021: Federal Reserve Bank of Atlanta, GDPNow advance estimate as of July 19, 2021 *

140.5 139.9 141.1 141.9 149.3 161.2 161.1 179.2 200.4 122.0 121.8 117.9 121.6 126.8 139.5 135.1 151.4 184.2 39.8 39.8 40.0 32.0 36.0 38.0 38.0 40.5 39.0 2Q 2019 3Q 2019 4Q 2019 1Q 2020 2Q 2020 3Q 2020 4Q 2020 1Q 2021 2Q 2021 17.2 17.1 16.6 11.4 13.0 17.0 16.3 17.7 15.4 1 U.S. Bureau of Economic Analysis, Light Weight Vehicle Sales: Autos and Light Trucks, monthly data as of June 30, 2021 2 Cox Automotive, 13-Month Rolling Used-Vehicle SAAR, monthly data as of June 30, 2021 3 Manheim, Inc.; Indexed to a basis of 100 at 1995 levels; JD Power Used-Vehicle Price Index (not seasonally adjusted), both monthly, quarter end 5 Auto Industry Overview Used Vehicle Price Indices3 Used Vehicle SAAR2 Used vehicle prices moderated slightly in June from the record levels at the beginning of the quarter as demand outpaced supply Used auto sales of 39M, down 4% QoQ driven by continued pressure on used car supply JDP Manheim New Vehicle SAAR1 Auto sales of 15.4M, down 13% QoQ driven by significant inventory shortage

6 Quarterly Originations 1 Approximate FICOs 2 Includes nominal capital lease originations 3 4 Includes SBNA Originations SBNA Originations remain off of SC’s balance sheet in the Service For Others portfolio Three Months Ended Originations ($ in Millions) Q2 2021 Q1 2021 Q2 2020 QoQ YoY Total Core Retail Auto 3,812$ 2,797$ 2,135$ 36% 79% Chrysler Capital Loans (<640) 1 1,597 1,317 1,131 21% 41% Chrysler Capital Loans (≥640) 1 3,021 2,343 3,557 29% (15%) Total Chrysler Capital Retail 4,618 3,660 4,688 26% (2%) Total Leases 2 2,070 2,157 989 (4%) 109% Total Auto Originations 3 10,500$ 8,614$ 7,812$ 22% 34% SBNA Originations 4 2,558$ 1,977$ 1,724$ 29% 48% % Variance

$0 $200 $400 $600 $800 $1,000 $1,200 $1,400 Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec '20 v '21 YoY 9% 68% 126% 2% -17% -32% '19 v '21 YoY 33% 104%228%128% 48% -1% Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec '20 v '21 YoY -6% -6% 41% 106% 27% 11% '19 v '21 YoY -12% -18% 24% 23% -3% 5% $0 $100 $200 $300 $400 $500 $600 $700 Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec '20 v '21 YoY -8% -12% 47% 258%127% 29% '19 v '21 YoY 5% 2% 20% -3% -17% -33% $0 $200 $400 $600 $800 $1,000 Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec '20 v '21 YoY 5% 3% 52% 174% 58% 44% '19 v '21 YoY 1% -11% 26% 54% 44% 77% $0 $200 $400 $600 $800 $1,000 $1,200 $1,400 $1,600 Core Retail Auto ($ in Millions) Chrysler Lease ($ in Millions) Chrysler Capital Loans, <6401 ($ in Millions) Chrysler Capital Loans, ≥6401 ($ in Millions) 2019 2020 2021 7 Monthly Originations 1 Approximate FICOs

37.1% 32.5% 28.0% 36.2% 33.8% 2Q 2020 3Q 2020 4Q 2020 1Q 2021 2Q 2021 367 507 499 470 485 2Q 2020 3Q 2020 4Q 2020 1Q 2021 2Q 2021 8 Stellantis Relationship Stellantis Sales1 (units in ‘000s) Chrysler Capital Penetration Rate SC continues to partner with Stellantis to drive sales • Support both retail and lease incentives • Penetration rate of 33.8%, down 330 bps due to fewer CCAP exclusive incentives compared to the beginning of the pandemic 1 Stellantis filings; sales as reported on 07/01/2021

85% 83% 86% 74% 77% 15% 17% 14% 26% 23% $11,211 $11,511 $11,563 $14,216 $15,094 2Q 2020 3Q 2020 4Q 2020 1Q 2021 2Q 2021 Related Party 3rd Party 9 Serviced for Others (SFO) Platform Serviced for others balance growth driven by prime originations through Stellantis ~$2.6B in SBNA originations ~$300M in off-balance sheet prime loan sales also increased SFO balances Serviced for Others Balances, End of Period ($ in Millions)

9.4 11.0 2.4 0.8 $11.8 $11.8 1Q 2021 2Q 2021 Revolving Used Unused ► $5.3B of new issuance in Q2: 1 SDART, 1 DRIVE, 1 SRT Total unutilized capacity of approximately $14 billion at the end of Q2 2021 Diversified Funding and Liquidity Asset-Backed Securities1 ($ in Billions) Financings ($ in Billions) Santander2 ($ in Billions) SBNA Originations and Asset Sales ($ in Billions) ► 94% unused capacity on warehouse lines from 12 lenders ► $3.0B in unutilized revolving and contingent liquidity ► Executed ~$300M in off-balance sheet prime loan sales ► $2.6B of prime loans flowed to SBNA 1 2 1 Total outstanding as of June 30, 2021 2 Total commitment as of June 30, 2021 10 $20.0 $22.0 1Q 2021 2Q 2021

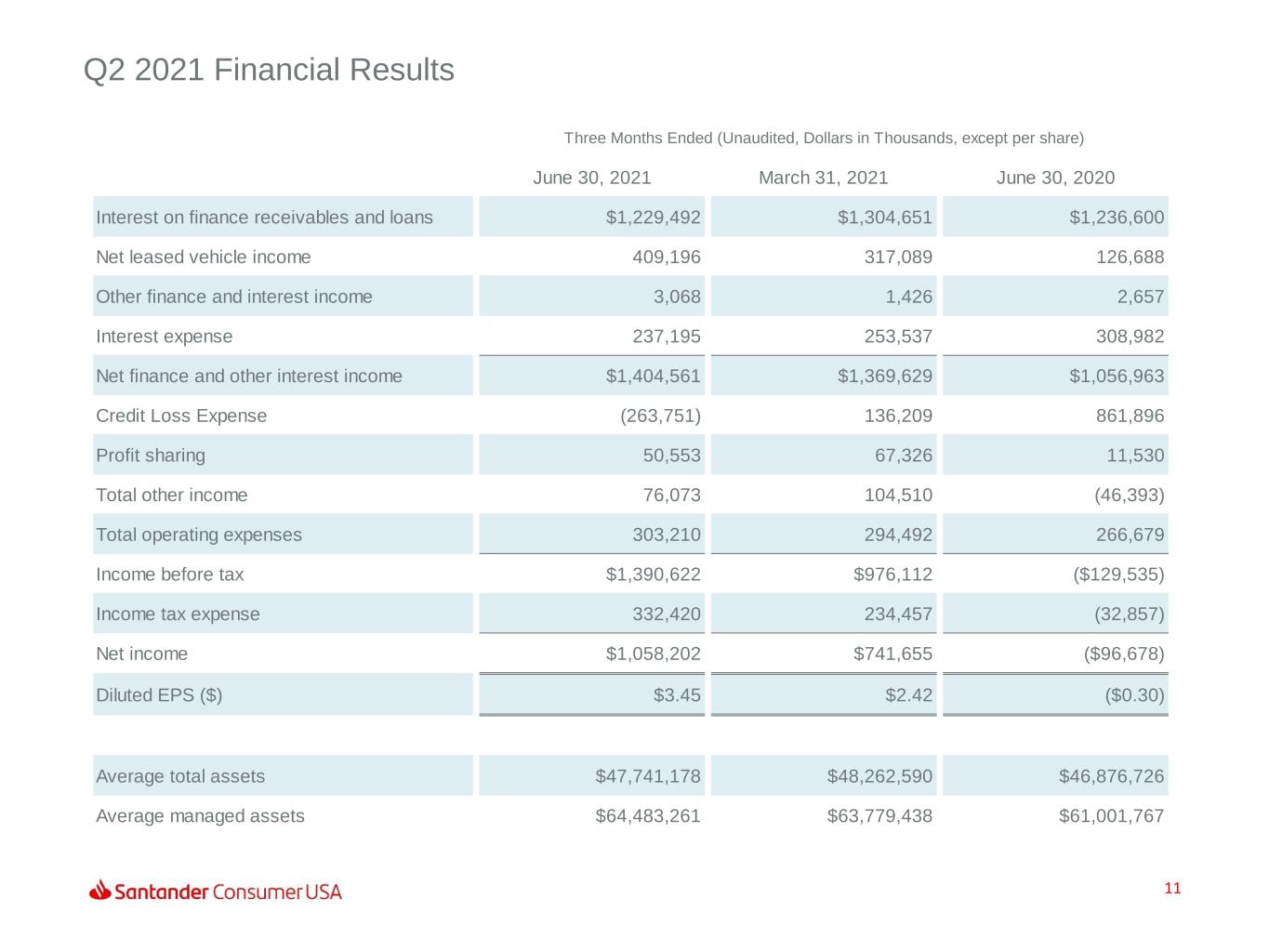

11 Q2 2021 Financial Results Three Months Ended (Unaudited, Dollars in Thousands, except per share) June 30, 2021 March 31, 2021 June 30, 2020 Interest on finance receivables and loans $1,229,492 $1,304,651 $1,236,600 Net leased vehicle income 409,196 317,089 126,688 Other finance and interest income 3,068 1,426 2,657 Interest expense 237,195 253,537 308,982 Net finance and other interest income $1,404,561 $1,369,629 $1,056,963 Credit Loss Expense (263,751) 136,209 861,896 Profit sharing 50,553 67,326 11,530 Total other income 76,073 104,510 (46,393) Total operating expenses 303,210 294,492 266,679 Income before tax $1,390,622 $976,112 ($129,535) Income tax expense 332,420 234,457 (32,857) Net income $1,058,202 $741,655 ($96,678) Diluted EPS ($) $3.45 $2.42 ($0.30) Average total assets $47,741,178 $48,262,590 $46,876,726 Average managed assets $64,483,261 $63,779,438 $61,001,767

6.4% 8.1% 8.3% 7.7% 6.0% 0.6% 3.5% 3.0% -1.0% Q2 2019 Q3 2019 Q4 2019 Q1 2020 Q2 2020 Q3 2020 Q4 2020 Q1 2021 Q2 2021 SC Recovery Rates1 (% of Gross Loss) Net Charge-off Rates2 12 Quarterly Delinquency & Loss Delinquency Ratios: 30-59 Days Delinquent, RICs, HFI Delinquency Ratios: >59 Days Delinquent, RICs, HFI Gross Charge-off Rates Late stage delinquencies flat YoY Gross charge-off rate decreased 450 bps YoY 1 Recovery Rate – Per the financial statements includes insurance proceeds, bankruptcy/deficiency sales, and timing impacts 2 Net Charge-off rates on retail installment contracts, held for investment SC’s Q2 recovery rate of 115% remains elevated due to low gross losses and continued strength in wholesale auction prices Net charge-off rate decreased 700 bps YoY Early stage delinquencies increased 120 bps YoY Delinquencies and charge-offs remain low due to disciplined underwriting, government stimulus and strong used vehicle prices 60.3% 55.9% 52.2% 50.1% 45.7% 91.4% 64.2% 69.1% 114.9% 16.1% 18.3% 17.3% 15.5% 11.1% 6.8% 9.9% 9.7% 6.6% 4.7% 4.7% 5.1% 4.6% 2.4% 2.4% 3.1% 2.2% 2.4% 9.4% 9.5% 9.7% 4.3% 5.0% 6.0% 4.4% 5.5%

0.0 5.0 10.0 15.0 20.0 25.0 Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec 2019 (%) 22.3 19.1 17.0 16.1 16.1 15.8 17.9 18.4 18.5 18.3 17.1 16.1 2020 (%) 17.2 15.6 13.7 12.9 12.6 8.1 6.7 5.5 7.9 9.5 9.5 10.7 2021 (%) 10.3 9.4 9.4 7.4 6.3 6.0 0.0 25.0 50.0 75.0 100.0 125.0 Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec 2019 (%) 49.0 54.6 66.1 62.5 62.4 56.0 55.2 59.2 53.2 52.9 57.5 46.2 2020 (%) 46.0 53.0 52.1 32.1 49.1 62.1 81.7 126.1 76.4 78.2 60.5 54.8 2021 (%) 58.9 63.1 86.8 110.8 127.0 107.1 13 Loss and Recovery Ratios (Annualized) Gross Charge-off Ratio (%) Recovery Rates (% of Gross Loss) Net Charge-off Ratio (%) 2019 2020 2021 (3.0) 0.0 3.0 6.0 9.0 12.0 15.0 Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec 2019 (%) 11.3 8.7 5.8 6.1 6.1 7.0 8.0 7.5 8.6 8.6 7.3 8.7 2020 (%) 9.3 7.3 6.6 8.7 6.4 3.1 1.2 -1.4 1.9 2.1 3.7 4.8 2021 (%) 4.2 3.5 1.2 -0.8 -1.7 -0.4

14 Loss Detail Net Charge-off Walk, ($ in Millions) Net recoveries of $79M, down $540M YoY $340M decrease due to improved recovery performance $167M decrease due to lower gross charge-off rate $51M decrease due to debt sales & other adjustments $18M increase due to higher loan balances $461 ($79) ($51) 2Q 2020 ($340) Gross Loss Performance $18 Recoveries ($167) Other 2Q 2021Balance

$6,001 $5,815 $188 ($283) ($91) 1Q 2021 Balance Credit Quality & Portfolio Mix Economic Factors 2Q 2021 15 Allowance Walk Q1 2021 to Q2 2021 Allowance for Credit Loss Walk (RICs, HFI 1 $ in Millions) Allowance for credit loss decreased by $186M QoQ $188M increase due to higher asset balances $283M decrease due to improvements in credit quality & portfolio mix $91M decrease due to improved macroeconomic factors Credit loss expense of ($264M) in Q2 2021 due to net recovery and reserve releases $1,126M decrease YoY driven by net recovery and reserve release in Q2 2021, compared to net charge-offs and reserve build in Q2 2020 Credit Loss Expense ($ in Millions) 1 Allowance for credit loss related to retail installment contracts, held for investment 461 48 296 243 (79) 400 293 (42) (107) (185) $862 $341 $254 $136 ($264) 2Q 2020 3Q 2020 4Q 2020 1Q 2021 2Q 2021 Net Charge-offs Build Release

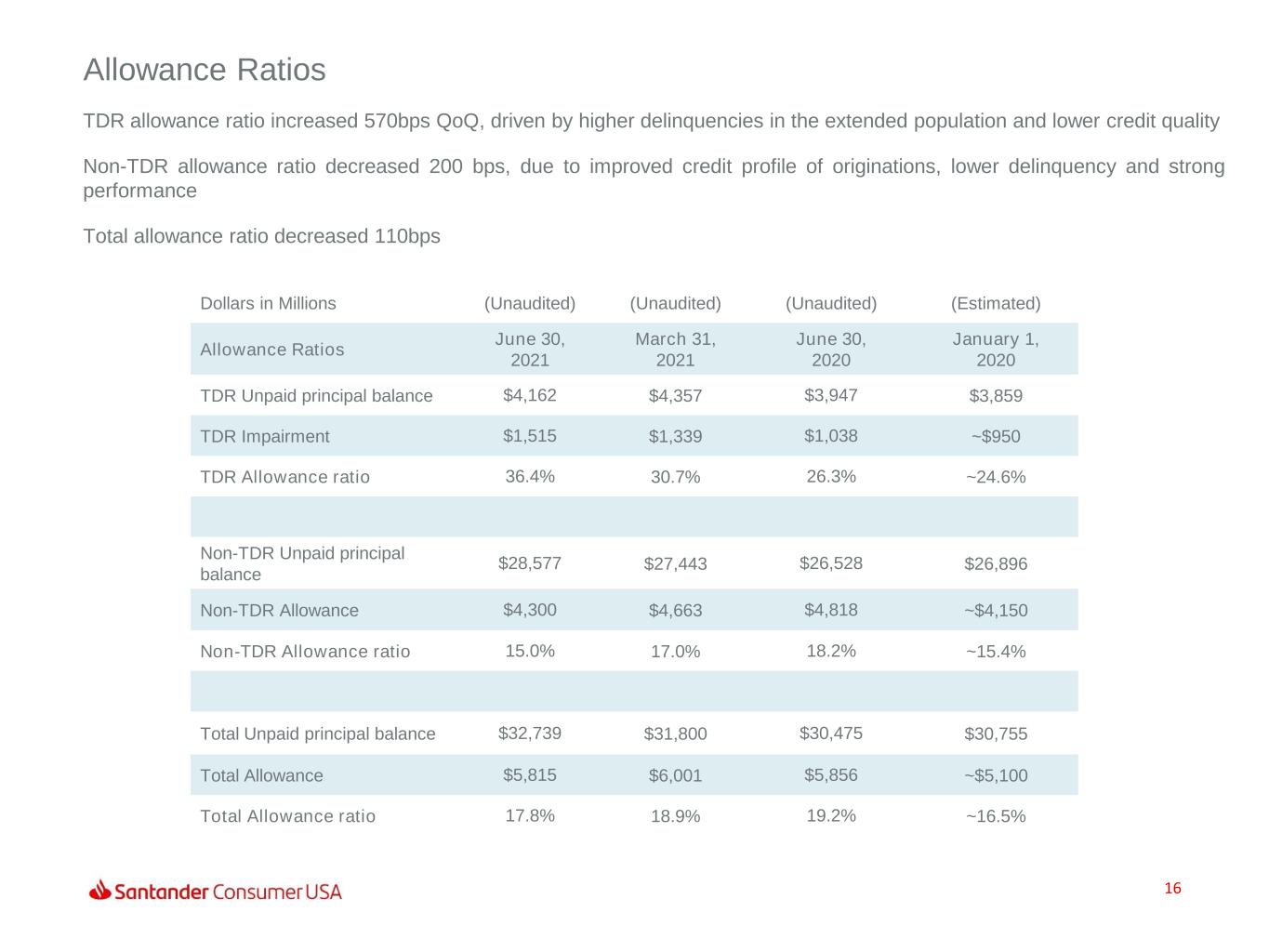

16 Allowance Ratios Dollars in Millions (Unaudited) (Unaudited) (Unaudited) (Estimated) Allowance Ratios June 30, 2021 March 31, 2021 June 30, 2020 January 1, 2020 TDR Unpaid principal balance $4,162 $4,357 $3,947 $3,859 TDR Impairment $1,515 $1,339 $1,038 ~$950 TDR Allowance ratio 36.4% 30.7% 26.3% ~24.6% Non-TDR Unpaid principal balance $28,577 $27,443 $26,528 $26,896 Non-TDR Allowance $4,300 $4,663 $4,818 ~$4,150 Non-TDR Allowance ratio 15.0% 17.0% 18.2% ~15.4% Total Unpaid principal balance $32,739 $31,800 $30,475 $30,755 Total Allowance $5,815 $6,001 $5,856 ~$5,100 Total Allowance ratio 17.8% 18.9% 19.2% ~16.5% TDR allowance ratio increased 570bps QoQ, driven by higher delinquencies in the extended population and lower credit quality Non-TDR allowance ratio decreased 200 bps, due to improved credit profile of originations, lower delinquency and strong performance Total allowance ratio decreased 110bps

$267 $264 $318 $294 $303 1.7% 1.7% 2.0% 1.8% 1.9% -2.0% 0.0% 2.0% 4.0% 6.0% 8.0% 10.0% $- $50 $100 $150 $200 $250 $300 $350 $400 2Q 2020 3Q 2020 4Q 2020 1Q 2021 2Q 2021 Operating Expense Expense Ratio 17 Expense Management Operating Expenses ($ in Millions) Operating expenses increased $36M YoY driven by benefits, insurance costs and repo expense as business activities normalize Expense ratio up 20bps YoY

18 CET1 Ratio Record quarterly results led to an increase in CET1 ratio of 160bps, offset by risk weighted assets growth Ordinary dividend of $0.22 declared 1 CET1 is calculated under Basel III regulations required as of January 1, 2015. Please see the appendix for further details related to CECL phase-in impact. 2 Under the banking agencies' risk-based capital guidelines, assets and credit equivalent amounts of derivatives and off-balance sheet exposures are assigned to .broad risk .categories. The aggregate dollar amount in each risk category is multiplied by the associated risk weight of the category. The resulting weighted values are added together with the measure for market risk, resulting in the Company's and the Bank's total Risk weighted assets Common Equity Tier 1 Capital Ratio 1 2

APPENDIX

11% 7% 9% 10% 9% 12% 7% 8% 8% 8% 23% 15% 21% 22% 21%15% 10% 14% 15% 15% 39% 61% 48% 45% 47% $6,823 $6,525 $5,486 $6,456 $8,430 2Q20 3Q20 4Q20 1Q21 2Q21 No FICOs <540 540-599 600-639 >=640 2 20 Diversified Underwriting Across Full Credit Spectrum Originations by Credit (RICs)1 New/Used Originations 1 RIC; Retail Installment Contract 2 No FICO score obtained; Includes commercial loans. $28,820 $25,781 $26,584 $26,725 $28,861 Average Loan Balance in Dollars

2 .6 % 1 0 .1 % 1 6 .7 % 3 2 .6 % 1 9 .2 % 1 8 .8 % 2 .5 % 1 0 .1 % 1 5 .3 % 3 0 .8 % 1 8 .3 % 2 3 .0 % 2 .6 % 9 .8 % 1 5 .3 % 3 1 .7 % 1 9 .0 % 2 1 .6 % 2 .8 % 9 .8 % 1 5 .6 % 3 3 .4 % 2 0 .1 % 1 8 .3 % 2 .9 % 9 .7 % 1 5 .4 % 3 4 .1 % 2 0 .5 % 1 7 .4 % Commercial No FICOs <540 540-599 600-639 >=640 Q2 2020 Q3 2020 Q4 2020 Q1 2021 Q2 2021 21 Held for Investment Credit Trends Retail Installment Contracts1 1 Held for investment; excludes assets held for sale

1 The losses for the three months ended March 31, 2021 were primarily driven by $39 million of lower of cost or market adjustments related to ..the held for sale personal lending portfolio, comprised of $65 million in customer default activity, and a $26 million decrease in market ..discount, consistent with typical seasonal patterns. The losses for the three months ended June 30, 2020 were primarily driven by $122 million of lower of cost or market adjustments related to ..the held for sale personal ..lending portfolio, comprised of $87 million in customer default activity, and a $35 million in market discount. 22 Excluding Personal Lending Detail Total Personal Lending Excluding Personal Lending Total Personal Lending Excluding Personal Lending Total Personal Lending Excluding Personal Lending Interest on finance receivables and loans $ 1,229,492 $ - $ 1,229,492 $ 1,304,651 $ 88,260 $ 1,216,391 $ 1,236,600 $ 83,808 $ 1,152,792 Net leased vehicle income 409,196 - 409,196 317,089 - 317,089 126,688 - 126,688 Other finance and interest income 3,068 - 3,068 1,426 - 1,426 2,657 - 2,657 Interest expense 237,195 - 237,195 253,537 9,566 243,971 308,982 11,016 297,966 Net finance and other interest income $ 1,404,561 $ - $ 1,404,561 $ 1,369,629 $ 78,694 $ 1,290,935 $ 1,056,963 $ 72,792 $ 984,171 Provision for credit losses $ (263,751) $ (23) $ (263,728) $ 136,209 $ (12) $ 136,221 $ 861,896 $ - $ 861,896 Profit sharing 50,553 - 50,553 67,326 29,234 38,092 11,530 6,587 4,943 Investment gains (losses), net1 $ 2,414 $ (1,262) $ 3,676 $ (14,711) $ (38,603) $ 23,892 $ (147,582) (121,642)$ $ (25,940) Servicing fee income 22,812 - 22,812 18,694 - 18,694 19,120 - 19,120 Fees, commissions and other 50,847 - 50,847 100,527 45,299 55,228 82,069 36,911 45,158 Total other income $ 76,073 $ (1,262) $ 77,335 $ 104,510 $ 6,696 $ 97,814 $ (46,393) $ (84,731) $ 38,338 Average gross individually acquired retail installment contracts, held for investment and held for sale $ 32,462,553 $ - $ 32,853,151 - $ 31,193,215 - Average gross personal loans - - - $ 1,016,007 - $ 1,307,609 Average gross operating leases $ 17,118,763 $ - $ 17,281,874 $ - $ 17,492,255 $ - June 30, 2020 Three Months Ended, (Unaudited, Dollars in Thousands) June 30, 2021 March 31, 2021

23 Reconciliation of Non-GAAP Measures a Under the banking agencies' risk-based capital guidelines, assets and credit equivalent amounts of derivatives and off-balance sheet exposures are assigned to broad risk categories. The aggregate dollar amount in each risk category is multiplied by the associated risk weight of the category. The resulting weighted values are added together with the measure for market risk, resulting in the Company's total Risk weighted assets. b CET1 is calculated under Basel III regulations required as of January 1, 2015. The fully phased-in capital ratios are non-GAAP financial measures. c As described in our 2020 annual report on Form 10-K, on January 1, 2020, we adopted ASU 2016-13, Financial Instruments -Credit Losses (“CECL”), which upon adoption resulted in a reduction to our opening retained earnings balance, net of income tax, and increase to the allowance for credit losses of approximately $2 billion. As also described in our 2019 10-K, the U.S. banking agencies in December 2018 had approved a final rule to address the impact of CECL on regulatory capital by allowing banking organizations, including the Company, the option to phase in the day-one impact of CECL until the first quarter of 2023. In March 2020, the U.S. banking agencies issued an interim final rule that provides banking organizations with an alternative option to delay for two years an estimate of CECL’s effect on regulatory capital, relative to the incurred loss methodology’s effect on regulatory capital, followed by a three-year transition period. The Company elected this alternative option instead of the one described in the December 2018 rule. Jun 30, 2021 Mar 31, 2021 Dec 31, 2020 Sep 30, 2020 Jun 30, 2020 Total equity $7,229,630 $6,231,853 $5,621,961 $5,094,812 $4,895,465 Deduct: Goodwill and intangibles 153,239 147,889 144,184 136,397 127,215 Tangible common equity $7,076,391 $6,083,964 $5,477,777 $4,958,415 $4,768,250 Total assets $48,245,934 $47,234,002 $48,887,493 $48,448,921 $47,268,695 Deduct: Goodwill and intangibles 153,239 147,889 144,184 136,397 127,215 Tangible assets $48,092,695 $47,086,113 $48,743,309 $48,312,524 $47,141,480 Equity to assets ratio 15.0% 13.2% 11.5% 10.5% 10.4% Tangible common equity to tangible assets 14.7% 12.9% 11.2% 10.3% 10.1% Total equity $7,229,630 $6,231,853 $5,621,961 $5,094,812 $4,895,465 Add: Adjustment due to CECL capital relief (c) 1,759,037 1,805,720 1,832,099 1,842,536 1,769,430 Deduct: Goodwill and other intangible assets, net of DTL 164,585 163,359 163,659 159,907 154,943 Deduct: Accumulated other comprehensive income, net (36,855) (41,818) (50,566) (56,882) (63,705) Tier 1 common capital $8,860,937 $7,916,032 $7,340,967 $6,834,323 $6,573,657 Risk weighted assets (a)(c) $49,014,663 $47,995,845 $50,424,476 $49,882,540 $48,997,902 Common Equity Tier 1 capital ratio (b)(c) 18.1% 16.5% 14.6% 13.7% 13.4% Three Months Ended (Unaudited, Dollars in Thousands)

Our purpose is to help people and business prosper. Our culture is based on believing that everything we do should be: Thank You