Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - Customers Bancorp, Inc. | q221pressrelease.htm |

| 8-K - 8-K - Customers Bancorp, Inc. | cubi-20210728.htm |

Second Quarter 2021 | Earnings Conference Call July 29, 2021 NYSE: CUBI “High Tech Forward-Thinking Bank Supported by High Touch” Customers Bancorp, Inc.

2 In addition to historical information, this presentation may contain “forward-looking statements” within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995. These forward-looking statements include statements with respect to Customers Bancorp, Inc.’s strategies, goals, beliefs, expectations, estimates, intentions, capital raising efforts, financial condition and results of operations, future performance and business. Statements preceded by, followed by, or that include the words “may,” “could,” “should,” “pro forma,” “looking forward,” “would,” “believe,” “expect,” “anticipate,” “estimate,” “intend,” “plan,” or similar expressions generally indicate a forward-looking statement. These forward-looking statements involve risks and uncertainties that are subject to change based on various important factors (some of which, in whole or in part, are beyond Customers Bancorp, Inc.’s control). Numerous competitive, economic, regulatory, legal and technological events and factors, among others, could cause Customers Bancorp, Inc.’s financial performance to differ materially from the goals, plans, objectives, intentions and expectations expressed in such forward-looking statements, including: the adverse impact on the U.S. economy, including the markets in which we operate, of the coronavirus outbreak, and the impact of a slowing U.S. economy and increased unemployment on the performance of our loan and lease portfolio, the market value of our investment securities, the demand for our products and services and the availability of sources of funding; the effects of actions by the federal government, including the Board of Governors of the Federal Reserve System and other government agencies, that affect market interest rates and the money supply; the actions that we and our customers take in response to these developments and the effects such actions have on our operations, products, services and customer relationships; and the effects of any changes in accounting standards or policies. Customers Bancorp, Inc. cautions that the foregoing factors are not exclusive, and neither such factors nor any such forward-looking statement takes into account the impact of any future events. All forward-looking statements and information set forth herein are based on management’s current beliefs and assumptions as of the date hereof and speak only as of the date they are made. For a more complete discussion of the assumptions, risks and uncertainties related to our business, you are encouraged to review Customers Bancorp, Inc.’s filings with the Securities and Exchange Commission, including its most recent annual report on Form 10-K for the year ended December 31, 2020, subsequently filed quarterly reports on Form 10-Q and current reports on Form 8-K, including any amendments thereto, that update or provide information in addition to the information included in the Form 10-K and Form 10-Q filings, if any. Customers Bancorp, Inc. does not undertake to update any forward- looking statement whether written or oral, that may be made from time to time by Customers Bancorp, Inc. or by or on behalf of Customers Bank, except as may be required under applicable law. This does not constitute an offer to sell, or a solicitation of an offer to buy, any security in any state or jurisdiction in which such offer, solicitation or sale would be unlawful. Forward-Looking Statements

I. Overview

4 Customers Bancorp: At a Glance Data as of 6/30/2021, unless otherwise noted. (1) Calculated based on shares outstanding of 32.4M. (2) The Bank’s Total Capital Ratio is estimated pending final Call Report. (3) Non-GAAP Measure, refer to Appendix for reconciliation. Lines of Business Community Banking: ▪ C&I ▪ Multi-Family ▪ CRE ▪ SMB Lending ▪ SBA (7(a), Express) ▪ Residential Specialty Lending: ▪ Warehouse Lending ▪ Lender Finance ▪ Fund Finance ▪ Real Estate Specialty Finance ▪ Healthcare Lending ▪ Equipment Finance Digital Banking: Consumer ▪ Checking & Savings ▪ Personal Installment ▪ Student Loan Refinancing ▪ Medical/Dental ▪ Credit Card Commercial ▪ Real Time Payments ▪ SMB Bundle ▪ Credit Card Headquarters West Reading, PA Branches 12 FTE Employees 594 Market Capitalization(1) (as of 7/27/21) $1.2B Bank Total Capital Ratio(2) 13.7% Tangible Book Value(3) $31.82 Customers Bancorp NYSE: CUBI

5 2Q 2021 Highlights: Exceptional Profitability and Growth 2Q 2021 Performance (vs. 2Q 2020) 1.30% vs. 0.68% in 2Q 2020 Core ROAA(1) $13.3B +1.5% Core Assets(1)(2) 0.24% -24 bps NPA Ratio 1.80% vs. 1.48% in 2Q 2020 Adjusted PTPP ROAA(1) $10.7B +1.3% Total Loans and Leases(1)(2) 1.61% -59 bps Reserve Coverage(1)(2) $13.9B +26.5% Total Deposits Profitability Balance Sheet Credit (1) Non-GAAP Measure, refer to Appendix for reconciliation. (2) Excluding PPP. Core EPS(1): $1.76 Core Earnings(1): $59.3M Core ROCE(1): 23.7%

6 (1) Non-GAAP Measure, refer to Appendix for reconciliation. Start up - to >$13Bn in assets in ~11 years Tech focused, Relationship driven Asset quality & Deposit Growth Experienced Management Team • The Bank was effectively launched in 2010 to clean up a $250 million- in-assets failing bank •Growth was paused for two years to build capital, take advantage of the Durbin exemption •BankMobile Technologies, Inc. (“BMT”) divestiture closed on January 4, 2021. • Single point of contact model: “Private Banking for Privately Held Businesses” • Industry leading in- house digital bank supported by a digital lending platform • Continuously improving the quality of the balance sheet and franchise • Continuing to invest in people and technology to focus on future customer needs • Keen focus on asset quality •NPA ratio of 0.24% •Reserve coverage ratio of 1.61%(1) • Core deposit growth at 46% year over year •Noninterest bearing DDAs are 19.5% and CDs are 4.5% of total deposits •Management team averages 30+ years in banking and financial services • Significant technology experience • Sam Sidhu appointed Customers Bank CEO effective July 1, 2021 • Continue to recruit new teams • In 2021 added key hires across teams including C&I teams, Fund Finance, RTP, Technology and Digital Customers Bancorp: – Overview

II. Business Highlights

8 2Q 2021 vs. 2Q 2020 Highlights Strong Earnings PPP Revenue High Asset Quality Growing Loan Portfolio Deposit Growth Profitability Bank Capital Ratios(1) Tangible Book Value • Diluted EPS of $1.72 in 2Q 2021 versus $0.61 in 2Q 2020 • Core EPS(2) of $1.76 in 2Q 2021 versus $0.68 in 2Q 2020 • GAAP Net income of $58.0M • Core Earnings(2) of $59.3M in 2Q 2021 • Expect to earn over $400+ million in total pre-tax net revenue • $118 million of pre-tax net revenue recognized to date • The NPAs ratio was 0.24% and coverage ratio excluding PPP was 1.61%(2). • Provision expense of $3.3M in 2Q 2021 compared to a provision benefit of ($2.9)M in the prior quarter • Total P&I deferrals were only 0.91% of total loans and leases, excluding PPP balances(2) • Total loans and leases increased $1.7B or 11% over 2Q 2020 • Core C&I growth at 13.1% over 2Q 2020 • Consumer installment growth at 25.4% over 2Q 2020 • Total deposit growth of $2.9B up 27% over 2Q 2020 • Demand deposits up 52% over 2Q 2020 • Total average cost of deposits down 44 bps YOY to 0.47% • NIM of 3.0%(2) in 2Q 2021, up 33 bps over 2Q 2020 • NIM excl. PPP of 3.3%(2) in 2Q 2021 up 33 bps over 2Q 2020 • Core efficiency ratio of 44.3%(2) in 2Q 2021 versus 47.8% in 2Q 2020 • CET 1: 12.4% • Tier 1 Risk Based Capital: 12.4% • Total Risk Based Capital: 13.7% • Tier 1 Leverage: 9.07% • CUBI TCE: 5.2%(2) • CUBI TCE (excl. PPP): 7.7%(2) • Tangible Book Value(2) at $31.82 up 29% over 2Q 2020 • Tangible Equity of $1.2 billion(2) • $1.0 billion Common Equity • $217 million Preferred Equity (1) The Bank’s Regulatory Capital Ratios are estimated pending final Call Report. (2) Non-GAAP Measure, refer to Appendix for reconciliation.

9 Balance Sheet: Loan Growth & Mix (1) Excludes PPP loan balances, Non-GAAP Measure, refer to Appendix for reconciliation. (2) CAGR calculated based on 2.5 years. Highly Diversified Portfolio with Core C&I and Consumer Installment Loan Growth YoY of 17% - Strong and Growing Pipeline • Management re-affirms loan growth expectations in the mid to high single digit growth rate for 2021 • Strong core C&I growth of $342 million or 13.1% over 2Q 2020 • Strong consumer installment growth of $320 million or 25.4% over 2Q 2020 • Targeting total consumer loans of 15-20% of loan portfolio • Pipelines remain strong; on track to hit 2021 growth targets Loan Growth 2Q 2021 Loan Mix(1) $ in Billions 28% 13% 18% 27% 14% Commercial & Industrial Investment CRE Consumer Loans Mortgage Warehouse Multi-Family $1.9 $2.4 $2.9 $2.9 $1.2 $1.3 $1.4 $1.4$0.7 $1.6 $1.6 $1.9 $1.5 $2.3 $3.7 $2.9 $3.3 $2.4 $1.8 $1.5 $4.6 $6.3 $8.5 $10.1 $15.8 $17.0 2018 2019 2020 2Q '21 Commercial & Industrial Investment CRE Consumer Loans Mortgage Warehouse Multi-Family PPP Loans CAGR(excl. PPP) = 9.3% (1)(2)

10 Balance Sheet: Deposit Growth & Mix Continued Significant Funding Mix Improvement Achieved • Total deposit growth of $2.9B (27%) YoY, which included $2.4B (52%) increase in demand deposits • CD’s declined $1.2B (66%) YoY, making up only 4.5% of total deposits at 6/30/2021 • Average cost of deposits dropped to 0.47% for 2Q 2021 from 0.91% in the year-ago quarter • Spot cost of deposits as of July 15, 2021 of 0.44% • Took action to extend and lock in $200 million of core deposits for 7 years; expected to provide future margin benefit Deposit Growth 2Q 2021 Deposit Mix $ in Billions (1) CAGR calculated based on 2.5 years. 19.5% 30.3% 35.4% 10.3% 4.5% Noninterest Bearing DDAs Interest Bearing DDAs Money Market Accounts Savings Accounts Certificates of Deposit (CD's) $1.1 $1.3 $2.4 $2.7$0.8 $1.2 $2.4 $4.2 $3.1 $3.5 $4.6 $4.9 $0.4 $0.9 $1.3 $1.4 $1.7 $1.7 $0.7 $0.6 $7.1 $8.6 $11.3 $13.9 2018 2019 2020 2Q '21 Noninterest Bearing DDAs Interest Bearing DDAs Money Market Accounts Savings Accounts Certificates of Deposit (CD's) CAGR = 30% (1)

11 Income Statement: Margin Trend Significant Improvement Achieved Due to Maintaining Loan Yields While Reducing Funding Costs • Net interest income (excl. PPP) was $103.0M(1) and increased 25% over 2Q20 • Net interest margin (excl. PPP)(1) improved to 3.3% • Overall loan yields increased by 8 basis points over 2Q 2020 due to efforts to improve the loan mix and maintaining credit quality during the pandemic rate environment • Total deposit cost declined by 44 basis points over 2Q 2020 as a result of on-going efforts to reduce deposit cost Net Interest Margin Growth (Excl. PPP)(1) Loan Yield (Excl. PPP)(1) & Deposit Cost (1) Excludes PPP loan balances, Non-GAAP Measure, refer to Appendix for reconciliation (2) Total Deposit Cost includes non-interest bearing deposits $61.5 $59.3 $64.7 $75.7 $77.6 $81.3 $82.7 $87.5 $97.7 $98.0 $103.0 2.6% 2.6% 2.6% 2.8% 2.9% 3.0% 3.0% 2.9% 3.0% 3.0% 3.3% 4Q '18 1Q '19 2Q '19 3Q '19 4Q '19 1Q '20 2Q '20 3Q '20 4Q '20 1Q '21 2Q '21 Net Interest Income (Excl. PPP) NIM TE (Excl. PPP) 4.4% 4.5% 4.6% 4.8% 4.7% 4.9% 4.3% 4.1% 4.1% 4.3% 4.4% 1.7% 1.7% 1.8% 1.8% 1.6% 1.5% 0.9% 0.7% 0.6% 0.5% 0.5% 4Q '18 1Q '19 2Q '19 3Q '19 4Q '19 1Q '20 2Q '20 3Q '20 4Q '20 1Q '21 2Q '21 Loan Yield (Excl. PPP) Total Deposit Cost Spread - 2.7% Spread - 3.9% (2)

12 Strategic Priorities Geographic Expansion • Added new teams in Florida, Texas and Pennsylvania and a reboot of Chicago • Conversations to add additional teams within next 6-12 months SBA Growth • Planned launch of digital 7(a) program in 3Q 2021 • Capitalize on increase to 90% guaranty on traditional 7(a) • 2021 GOS revenue expected to be 4x 2020 levels Deepen Specialty Lending • Added Fund Finance Team • Pipelines building across nearly all specialty lending verticals • Target ~10% growth across most verticals Gain on Sale Revenue • First sale in 2Q 2021 resulted in $475K GOS revenue • Continued sales to occur quarterly in 2021 Fintech Banking • Seek to become partner bank with existing MPL partners in 2022 • Potential to add several million dollars in annual fee income New Products • Enhanced credit card launch in next 6 months • Evaluating additional loan verticals to be launched in 4Q 2021/1Q 2022 Tech Reorg. and Talent Acquisition • Flattened technology organization increasing agility: turning cost center into profit center • Introduced product ownership and delivery groups commonly used in technology industry • Key hires include Head of Digital Marketing, Head of RTP Platform, CDO, CTO, engineers Digital SMB • New products to include digital 7(a), term loan, credit card as part of digital SMB bundle • Expect to begin launching products in 3Q 2021 Realtime Payments (RTP) • Expected soft launch within the next 60 days • Full launch expected in 4Q 2021 Branding and Website Re-Launch • Engaged leading digital consultancy to rebrand and relaunch omnichannel online presence • Expect to implement by year end C o m m e rc ia l C o n su m e r D ig it al

13 Fee Revenue Growth SBA Revenue Summary ($ in millions) Lo an V o lu m e G ai n o n S al e 2020 volume excludes PPP Consumer Installment Fee Revenue Initiative Significant fee revenue growth opportunities across SBA 7(a) and consumer installment loan portfolios enabled by Tech team • YTD gain on sale revenue from these products has already far surpassed 2020 levels • Expected to earn up to $10 million in combined gain on sale revenue in 2021 • Both products are expected to continue to grow in the coming years ($ in millions) Lo an V o lu m e G ai n o n S al e $23.1 $41.5 ~$80.0 $1.5 $3.1 ~$6.0 2020 June 2021 YTD 2021 E Loan Volume Sold Gain on Sale Revenue $0.0 $28.8 ~$85.0 $0.0 $0.5 ~$4.0 2020 June 2021 YTD 2021 E Loan Volume Sold Gain on Sale Revenue

14 Credit: Credit Quality and Reserves Remain Above Average Recent Credit Quality Metrics Highlights: • Credit quality remains strong as evidenced by NPAs/Total Assets of only 0.24% at 6/30/21. • Bolstered by the adoption of CECL on January 1, 2020, the coverage ratio, excluding PPP loans(1), was 1.61% at 6/30/21. • Due to the Bank’s history of focusing on lower credit risk businesses, we expect near-term credit outlook to remain stable. Note: The coverage of credit losses reserves for loans and leases held for investment, excludes PPP loans, mortgage warehouse loans reported at fair value, and loans held for sale. (1) Non-GAAP Measure, refer to Appendix for reconciliation. 0.24% 0.00% 0.20% 0.40% 0.60% 0.80% 0.00% 0.50% 1.00% 1.50% 2.00% 2.50% 3Q 19 4Q 19 1Q 20 2Q 20 3Q 20 4Q 20 1Q 21 2Q 21 Peer NPAs / Assets NPAs / Assets Reserves / Loans R es er ve s / Lo an s N PA s / A ss et s CECL Adoption Impact

15 Credit: Loan & Lease Deferments (1) The 6/30/2021 figures are all actual deferrals with none pending. (2) "% of Portfolio" ratio excludes PPP loans. • Principal deferments were only 0.9% of total portfolio (excluding PPP) • Loans in COVID-19 At Risk Industries represent only 10% of total loans and deferrals in these industries totaled only 0.6% of total loans Principal % of Principal % of ($'s in millions) Deferred Portfolio(2) Deferred Portfolio(2) C&I and Investment CRE: Commercial & Industrial $5.4 0.2% $0.0 0.0% SBA $7.3 7.6% $3.4 3.5% Investment CRE & Multi-Family $13.7 0.6% $4.4 0.2% Hotels $125.9 31.4% $59.2 14.8% Equipment Finance: Motor Coach $22.7 63.1% $21.7 61.4% Transportation $1.1 1.0% $1.1 1.0% Franchise $0.0 0.0% $0.0 0.0% Equipment Finance - Other $0.0 0.0% $0.0 0.0% Mortgage Warehouse: Mortgage Warehouse $0.0 0.0% $0.0 0.0% Consumer: Consumer Installment $6.7 0.5% $4.9 0.3% Residential Mortgage $5.7 1.9% $3.4 1.2% Manufactured Housing $0.6 1.0% $0.1 0.2% Total Deferred $189.1 1.7% $98.2 0.9% 3/31/21 6/30/21 (1) Total Loan & Lease Deferments

16 Credit: Allowance for Credit Losses for Loans and Leases (1) Utilized Moody’s June 2021 Baseline forecast with qualitative adjustments for 2Q 2021 provision. (2) Excludes Mortgage Warehouse loans reported at fair value, loans held for sale and PPP Loans. ($ in thousands) Amortized Cost Allowance for Credit Losses Lifetime Loss Rate Annualized Net Charge Off Ratio Loans and Leases Receivable: Commercial Multi-Family $1,497,485 $5,028 0.34% 0.00% Commercial & Industrial $2,360,656 $8,127 0.35% -0.05% Commercial Real Estate Owner Occupied $653,649 $4,464 0.68% 0.00% Commercial Real Estate Non-Owner Occupied $1,206,646 $7,374 0.61% -0.02% Construction $179,198 $2,643 1.47% -0.25% Total Commercial Loans and Leases Receivable $5,897,634 $27,636 0.64% -0.03% Consumer Consumer Installment $1,549,693 $91,129 5.90% 1.82% Residential Mortgage $266,911 $2,299 0.84% -0.02% Manufactured Housing $57,904 $4,372 7.55% 0.00% Total Consumer Loans Receivable $1,874,508 $97,800 5.26% 1.50% Total Loans and Leases HFI (2) $7,772,142 $125,436 1.61% 0.34% CECL Method (1) June 30, 2021

IV. Technology Driven Business Model

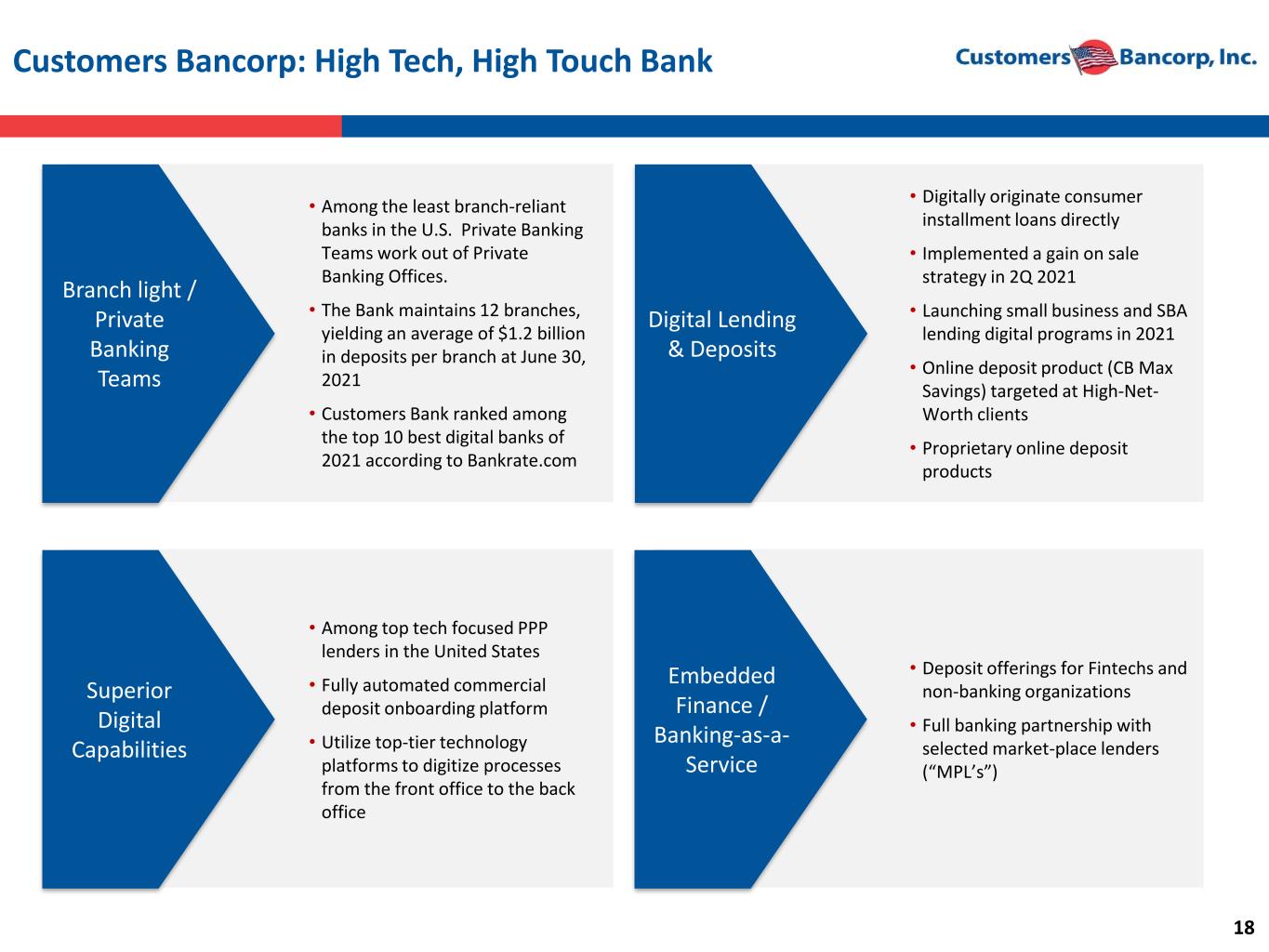

18 Customers Bancorp: High Tech, High Touch Bank Branch light / Private Banking Teams Superior Digital Capabilities Digital Lending & Deposits Embedded Finance / Banking-as-a- Service • Among the least branch-reliant banks in the U.S. Private Banking Teams work out of Private Banking Offices. • The Bank maintains 12 branches, yielding an average of $1.2 billion in deposits per branch at June 30, 2021 • Customers Bank ranked among the top 10 best digital banks of 2021 according to Bankrate.com • Among top tech focused PPP lenders in the United States • Fully automated commercial deposit onboarding platform • Utilize top-tier technology platforms to digitize processes from the front office to the back office • Digitally originate consumer installment loans directly • Implemented a gain on sale strategy in 2Q 2021 • Launching small business and SBA lending digital programs in 2021 • Online deposit product (CB Max Savings) targeted at High-Net- Worth clients • Proprietary online deposit products • Deposit offerings for Fintechs and non-banking organizations • Full banking partnership with selected market-place lenders (“MPL’s”)

19 Loan Volume ($B) Loan Count Avg. Loan Size PPP 1/2 $5.11 102,799 $49,732 PPP 3 $4.37 222,057 $19,692 Total PPP $9.49 324,856 $29,198 Paycheck Protection Program $400M+ in Anticipated Pre-Tax Revenue Industry-Leading PPP Program • Completed approximately 325,000 PPP loan applications totaling about $9.5 billion(1) • Focused on providing access to the smallest and most underserved businesses with an average loan size of ~$30,000 • Top 5 bank by number of loans • Forgiveness efforts are well underway, have processed 55% of PPP1/2 and have achieved 99.6% forgiveness • To date, industry analysis suggests the SBA has forgiven approximately 50% of PPP loans (1) As of 07/19/2021 Includes all PPP loans facilitated by Customers Bank (originated and purchased) Program Overview(1)

V. Outlook

21 Sling Shot – Increase in Tangible Common Equity & Total Risk Based Capital Customers Bancorp: Actual & Projected Capital Metrics (1) 2Q 21 Total Capital Ratio estimated pending Final Call Report & FRY9C. (2) Refers to tangible common equity-to-tangible assets excluding PPP loans. This is a non- GAAP measure; refer to the Appendix for reconciliation. Note: The “Actual & Projected Capital Metrics” chart includes our estimates of future performance and does not consider any stock buyback or redemptions. Please refer to the Forward-Looking Statements slide for more information. Highlights: • Our participation in the Paycheck Protection Program, as well as strong core earnings, will have a “sling shot” effect on tangible common equity(2). • TCE/TA Ratio(2) excluding PPP loans is expected to be ~9% and Total Risk Based Capital Ratio is expected to be ~14% by year-end 2021. • Pro forma for full expected PPP net revenue, year-end 2021 TCE/TA Ratio(2) excluding PPP loans would be ~10% 6.0% 7.0% 8.0% 9.0% 10.0% 11.0% 13.0% 15.0% 17.0% 1Q '21 2Q '21 3Q '21E 4Q '21E TC E / TA e xc l. P P P (2 ) TRB ProForma TRB TCE/TA excl. PPP ProForma TCE/TA Pro forma TCE/TA ~10%(2) Pro forma TRB ~16%(1) To ta l R is k B as ed C ap it al (1 ) (1)

22 Tangible Book Value Tangible Book Value Per Share(1) 29.0% YoY Growth TBV/Share(1) $31.82 Stock Price(2) $37.73 Value Proposition Trading at 119% of TBV Highlights: • Significant potential upside based on peer trading levels (1) Non-GAAP Measure, refer to Appendix for reconciliation. (2) As of July 27, 2021. $24.62 $25.97 $27.92 $30.01 $31.82 2Q 2020 3Q 2020 4Q 2020 1Q 2021 2Q 2021 4Q 2021E TBV/Share ProForma TBV/Share with Total PPP Revenue (1) $40.00+

23 2021 YE Outlook • The balance of commercial loans to mortgage companies is expected to decline to $1.6- $2.4 billion at December 31, 2021. • Continued NIM expansion driven by combination of increased yield and lower funding costs • Increasing 2021 and 2022 Core EPS guidance to $6.00 • Meaningful capital accretion continuing through core earnings and PPP revenue recognition Loans excl. PPP & Mortgage Warehouse(1) $7.6B Mid to High Single Digit Growth Net Interest Margin excl. PPP(2) 2.96% 3.25% - 3.50% Core EPS(2) $3.49 $6.00 Core EPS excl. PPP(2) $2.20 $4.00 Total Risk Based Capital(3) / TCE excl. PPP(2) 11.9% / 6.4% 14.0% / 9.0% Effective Tax Rate 24.7% 23% - 25% Metric YE 2020 2021 YE Outlook (1) Excludes PPP & Mortgage warehouse loan balances, Non-GAAP Measure, refer to Appendix for reconciliation. (2) Non-GAAP Measure, refer to Appendix for reconciliation. (3) 2Q 21 Total Capital Ratio estimated pending Final Call Report & FRY9C.

24 Long Term Guidance Note: The “Path to Core EPS of $6.00 by 2025” includes our estimates of future performance. Please refer to the Forward-Looking Statements slide for more information. (1) Excludes PPP loan balances, a non-GAAP measure. Please refer to the Appendix for reconciliation. Path to Core EPS of $6.00 in 2025 Position at 6/30/21 Growth Assumptions Expectations in 2025 • $13.3 billion in core assets(1) • 33.7 million average diluted shares outstanding •Asset growth of 7.0%-10.0% per year on average in the 2021-2025 period •Diluted shares outstanding growth of 1.0% per annum • $18-$20 billion in assets with about $1.9 billion in common equity • ~35.2 million average diluted shares outstanding •At a Return on Assets of ~1.10% • ~$210 million in core net income • ~$6.00 in Core EPS annualized

25 Investment Thesis (1) As of June 30, 2021. Consolidated Bancorp, Inc. Total Capital Ratio estimated pending Final Call Report & FRY9C. (2) As of June 30, 2021. Refers to Consolidated Bancorp, Inc. tangible common equity to tangible assets excluding PPP loans. This is a non-GAAP measure; refer to the Appendix for reconciliation. Clear and Unique Strategy Executed by an Experienced Team: A high tech forward- thinking bank supported by high touch Record Earnings Performance: Now expect to report about $6.00 per share in core earnings by 2025, one year sooner than previous guidance High Growth Franchise: Core C&I and consumer installment loan growth YoY of 17% and deposit growth of 26.5% with continued robust pipelines Unique Tech Driven Business Model: Digital lending / deposit franchises combined with superior technology-facilitated high-touch lending Healthy and Increasing Capital Levels: TRB and TCE ratios of 13.2%(1) and 7.7%(2) respectively, and expected to expand to ~14.0% and ~9.0% by the end of 2021 Exceptional Credit Quality: 0.24% NPA ratio with continued stable credit outlook

VI. Appendix

27 Environmental, social and governance (ESG) considerations are integrated across our business units and incorporated into the policies and principles that govern how our company operates. We continuously seek to address some of the practical challenges in balancing short- and long-term business trade-offs in order to ensure that our stakeholders and shareholders prosper together. Customers Bank’s approach to ESG management includes promoting sound corporate governance, risk management and controls, investing in our Team Members and cultivating a diverse and inclusive work environment, strengthening the communities in which our Team Members live and work, and operating our business in a way that demonstrates Customers’ dedication to environmental sustainability. Environmental, Social & Governance Report Our Communities Use of investment and philanthropic capital to expand access to economic opportunity in the communities where we do business has been core to Customers since its founding more than 10 years ago. Our Team Members Customers Bank is committed to developing high performing Team Members and fostering a richly diverse and inclusive workplace culture. Our Environment Customers Bank provides financing solutions that generate positive environmental and social impacts and actively manages the environmental impacts of the company’s branches and office locations. Our Risk Culture Customers Bank’s tone at the top and risk culture underpins our ability to function with integrity and accountability and to systematically and independently review risks and opportunities while building sustainable value for the company. Our Corporate Governance & Ethics Supported by unwavering management commitment and an engaged Board, Customers Bank is continually focused on enhancing the structures, processes and controls in place that support and promote accountability, transparency and ethical behavior.

28 2020 ESG Milestones Just days after the death of George Floyd, the bank held a company-wide virtual “Family Meeting” to provide an outlet of support to our Team Members. Executive leaders addressed over 600 Team Members who were then invited to share their stories, feelings and concerns. Customers Bank was one of the nation’s leading lenders in the Paycheck Protection Program (PPP). From passage of the CARES act on March 27, 2020 to date, the Bank funded approximately 325 thousand loans totaling $9.5 billion(1). These loans helped save hundreds of thousands of jobs. Customers Bank joined the Federal Home Loan Bank of Pittsburgh in making 120 First Front Door home loans worth more than $12 million, providing affordable housing to families across the market. In total, Customers Bank invested more than $2.6 million in 2020 through CRA investments, charitable donations, and community sponsorships. Customers Bank was the winner of the highly coveted 2020 Best Example of Making an Impact on Business Award presented by Everbridge, an organization focused on lifesaving efforts through its global Critical Event Management (CEM) platform. The bank stood out for its commitment to life safety, operational resilience and business continuity due to its efforts to communicate with Team Members, clients and the community during the onset of the pandemic. Customers Bank contributed nearly $400,000 to help feed those most in need during the pandemic. In addition to combating food insecurity, Customers Bank contributed an additional $250,000 to other pandemic-related programs including supplying PPE for hospitals and educational opportunities for inner-city children. Customers has become an active lender for several land-based wind projects, providing $126 million in financing. * As of 6/30/2021 (1) As of 07/19/2021 Includes all PPP loans facilitated by Customers Bank (originated and purchased)

29 Liquidity Liquidity Sources ($000's) 2Q 20 3Q 20 4Q 20 1Q 21 2Q 21 YOY Change Cash and Cash Equivalents $1,022,753 $325,594 $615,264 $512,241 $393,663 ($629,090) FHLB Available Borrowing Capacity $1,078,520 $929,508 $684,936 $713,673 $1,466,067 $387,547 FRB Available Borrowing Capacity $152,410 $215,000 $220,000 $180,000 $197,000 $44,590 Investments (MV) US Gov't & Agency $0 $40,008 $20,034 $20,053 $20,114 $20,114 MBS &CMO $290,137 $333,845 $361,850 $590,485 $661,823 $371,686 Municipals $18,389 $18,260 $18,291 $18,527 $8,554 ($9,836) Corporates $356,232 $363,872 $396,744 $257,924 $350,420 ($5,812) ABS $0 $375,381 $409,512 $550,087 $485,881 $485,881 Other AFS $16,623 $2,466 $3,853 $4,827 $0 ($16,623) Less: Pledged Securities ($16,924) ($20,053) ($18,849) ($17,589) ($15,988) $936 Net Unpledged Securities $664,458 $1,113,778 $1,191,436 $1,424,314 $1,510,804 $846,346 $2,918,141 $2,583,881 $2,711,636 $2,830,229 $3,567,534 $649,393

30 Consumer Installment Loans Well Diversified Insignificant exposure to stressed professions $91K Avg Income740 Avg FICO Portfolio average DTI is 20.8% (1) FICO score at time of origination. Note: Data as of June 30, 2021. (1) 17.2% 26.8% 21.8% 11.4% 4.4% 0.6% 17.8% Debt to Income Ratio 0-9.99% 10 – 19.99% 20 – 29.99% 30 – 39.99% 40 – 49.99% > 50% Unknown 30.7% 51.4% 17.9% FICO Score 750+ 700-749 660-699 24.3% 43.9% 31.8% Borrower Income <$49,999 $50K -$99,999 >$100K 22.2% 10.1% 18.6% 26.4% 22.8% Geography West Southwest Midwest Southeast Northeast 94.2% 3.8% 0.8% 1.3% Profession Non COVID-19 Impacted Segments Non-Professional Retail & Restaurants Transportation, Travel and Entertainment 8.8% 79.1% 6.9% 5.3% Purpose Home Improvement Personal Loan Specialty Student Loan

31 Consumer Installment Loans Performance Note: Customers Bancorp’s impairment percentages are considered 1 day+ delinquent or in forbearance. Industry chart is from DV01 Insights COVID-19 Performance Report dated June 30, 2021. Continued Outperformance • At industry peak for consumer forbearance, CB overall remained less than half the industry average • Further, CB Direct was approximately 70% below industry average 4.46% 0.9% 0.0% 4.0% 8.0% 12.0% 16.0% 01 /3 1/ 19 02 /2 8/ 19 03 /3 1/ 19 04 /3 0/ 19 05 /3 1/ 19 06 /3 0/ 19 07 /3 1/ 19 08 /3 1/ 19 09 /3 0/ 19 10 /3 1/ 19 11 /3 0/ 19 12 /3 1/ 19 01 /3 1/ 20 02 /2 9/ 20 03 /3 1/ 20 04 /3 0/ 20 05 /3 1/ 20 06 /3 0/ 20 07 /3 1/ 20 08 /3 1/ 20 09 /3 0/ 20 10 /3 1/ 20 11 /3 0/ 20 12 /3 1/ 20 01 /3 1/ 21 02 /2 8/ 21 03 /3 1/ 21 04 /3 0/ 21 05 /3 1/ 21 06 /3 0/ 21 CUBI Industry

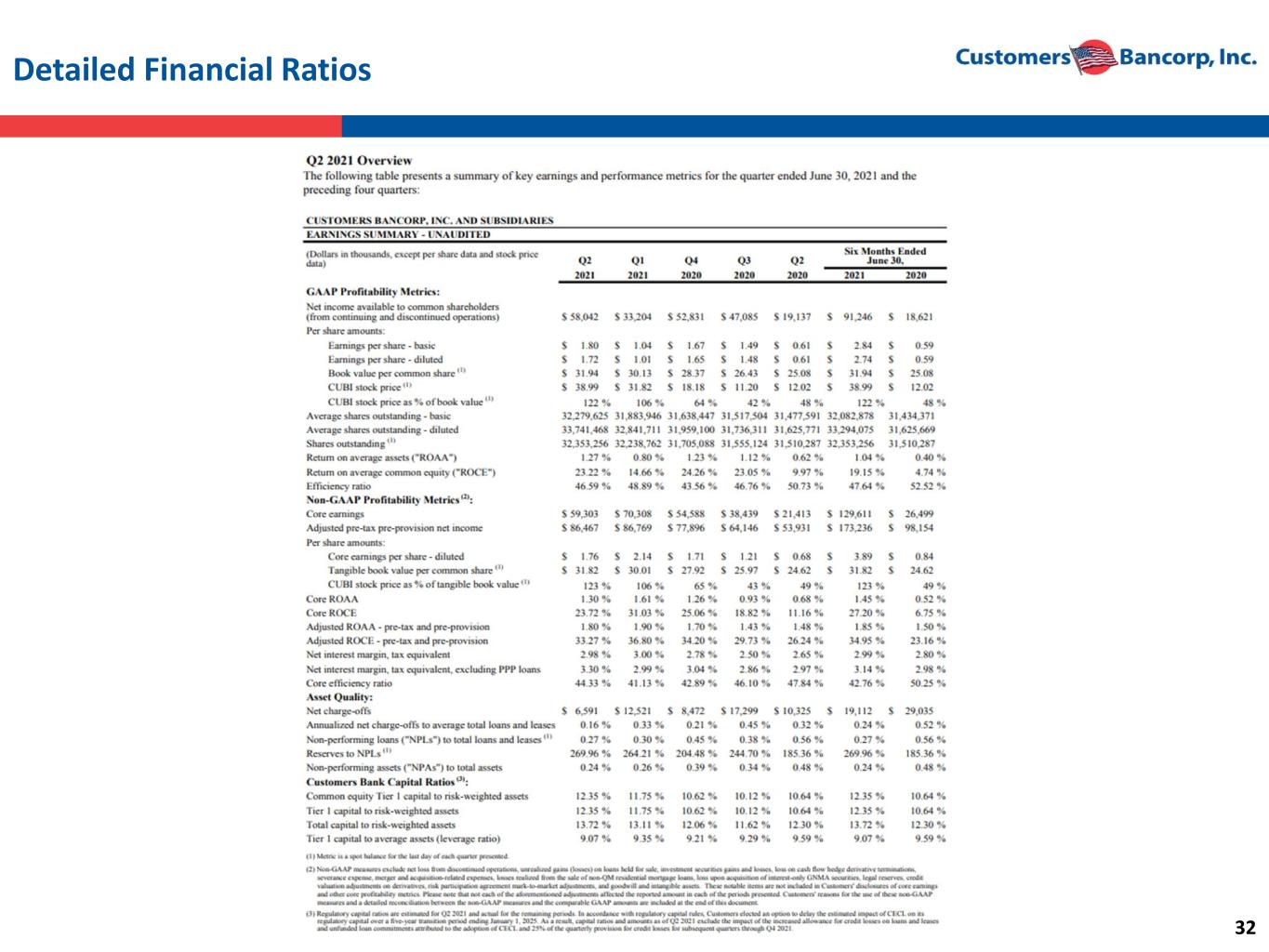

32 Detailed Financial Ratios

33 Customers believes that the non-GAAP measurements disclosed within this document are useful for investors, regulators, management and others to evaluate our core results of operations and financial condition relative to other financial institutions. These non-GAAP financial measures are frequently used by securities analysts, investors, and other interested parties in the evaluation of companies in Customers' industry. These non-GAAP financial measures exclude from corresponding GAAP measures the impact of certain elements that we do not believe are representative of our ongoing financial results, which we believe enhance an overall understanding of our performance and increases comparability of our period to period results. Investors should consider our performance and financial condition as reported under GAAP and all other relevant information when assessing our performance or financial condition. The non-GAAP measures presented are not necessarily comparable to non-GAAP measures that may be presented by other financial institutions. Although non-GAAP financial measures are frequently used in the evaluation of a company, they have limitations as analytical tools and should not be considered in isolation or as a substitute for analysis of our results of operations or financial condition as reported under GAAP. The following tables present reconciliations of GAAP to non-GAAP measures disclosed within this document. Reconciliation of Non-GAAP Measures - Unaudited

34 Reconciliation of Non-GAAP Measures – Unaudited (Cont.) ($ in thousands, not including per share amounts) Q2 2021 Q1 2021 Q4 2020 Q3 2020 Q2 2020 USD Per Share USD Per Share USD Per Share USD Per Share USD Per Share GAAP net income to common shareholders $58,042 $ 1.72 $33,204 $ 1.01 $52,831 $ 1.65 $47,085 $ 1.48 $19,137 $ 0.61 Reconciling items (after tax): Net loss from discontinued operations - - 38,036 1.16 2,317 0.07 532 0.02 2,258 0.07 Severance expense 1,517 0.04 - - - - - - - - Merger and acquisition related expenses - - 320 0.01 508 0.02 530 0.02 - - Legal reserves - - - - - - 258 0.01 - - (Gains) losses on investment securities (2,694) (0.08) (18,773) (0.57) (1,419) (0.04) (9,662) (0.30) (4,543) (0.14) (Gain) losses on sale of foreign subsidiaries 2,150 0.06 - - - - - - - - Loss on cash flow hedge derivative terminations - - 18,716 0.57 - - - - - - Derivative credit valuation adjustment 288 0.01 (1,195) (0.04) (448) (0.01) (304) (0.01) 4,527 0.14 Risk participation agreement mark-to-market adjustment - - - - - - - - (1,080) (0.03) Unrealized losses on loans held for sale - - - - 799 0.03 - - 1,114 0.04 Core earnings $59,303 $ 1.76 $70,308 $ 2.14 $54,588 $ 1.71 $38,439 $ 1.21 $21,413 $ 0.68 Core Earnings - Customers Bancorp Core Return on Average Asset ($ in thousands) Q2 2021 Q1 2021 Q4 2020 Q3 2020 Q2 2020 GAAP net income $ 61,341 $ 36,595 $ 56,245 $ 50,515 $ 22,718 Reconciling items (after tax): Net loss from discontinued operations - 38,036 2,317 532 2,258 Severance expense 1,517 - - - - Merger and acquisition related expenses - 320 508 530 - Legal reserves - - - 258 - (Gains) losses on investment securities (2,694) (18,773) (1,419) (9,662) (4,543) Loss on sale of foreign subsidiaries 2,150 - - - - Loss on cash flow hedge derivative terminations - 18,716 - - - Derivative credit valuation adjustment 288 (1,195) (448) (304) 4,527 Risk participation agreement mark-to-market adjustment - - - - (1,080) Unrealized losses on loans held for sale - - 799 - 1,114 Core net income $ 62,602 $ 73,699 $ 58,002 $ 41,869 $ 24,994 Average total assets $ 19,306,948 $ 18,525,721 $ 18,250,719 $ 17,865,574 $ 14,675,584 Core return on average assets 1.30% 1.61% 1.26% 0.93% 0.68%

35 Reconciliation of Non-GAAP Measures – Unaudited (Cont.) Adjusted Net Income and Adjusted ROAA - Pre-Tax Pre-Provision - Customers Bancorp ($ in thousands) Q2 2021 Q1 2021 Q4 2020 Q3 2020 Q2 2020 GAAP net income $ 61,341 $ 36,595 $ 56,245 $ 50,515 $ 22,718 Reconciling items (after tax): Income tax expense 20,124 17,560 23,447 12,016 7,980 Provision (benefit) for credit losses on loans and leases 3,291 (2,919) (2,913) 12,955 20,946 Provision (benefit) for credit losses on unfunded commitments 45 (1,286) (968) (527) (356) Severance expense 2,004 - - - - Net loss from discontinued operations - 38,036 2,317 532 2,258 Merger and acquisition related expenses - 418 709 658 - Legal reserves - - - 320 - (Gains) losses on investment securities (3,558) (24,540) (1,431) (11,945) (5,553) (Gain) losses on sale of foreign subsidiaries 2,840 - - - - (Gains) losses on hedge deriative terminations - 24,467 - - - Derivative credit valuation adjustment 380 (1,562) (625) (378) 5,895 Risk participation agreement mark-to-market adjustment - - - - (1,407) Unrealized losses on loans held for sale - - 1,115 - 1,450 Adjusted net income - pre-tax pre-provision $ 86,467 $ 86,769 $ 77,896 $ 64,146 $ 53,931 Average total assets $19,306,948 $18,525,721 $18,250,719 $17,865,574 $14,675,584 Adjusted ROAA - pre-tax pre-provision 1.80% 1.90% 1.70% 1.43% 1.48% Core Return on Average Common Equity ($ in thousands) Q2 2021 Q1 2021 Q4 2020 Q3 2020 Q2 2020 GAAP net income to common shareholders $ 58,042 $ 33,204 $ 52,831 $ 47,085 $ 19,137 Reconciling items (after tax): Net loss from discontinued operations - 38,036 2,317 532 2,258 Severance expense 1,517 - - - - Merger and acquisition related expenses - 320 508 530 - Legal reserves - - - 258 - (Gains) losses on investment securities (2,694) (18,773) (1,419) (9,662) (4,543) Loss on sale of foreign subsidiaries 2,150 - - - - Loss on cash flow hedge derivative terminations 0 18,716 - - - Derivative credit valuation adjustment 288 (1,195) (448) (304) 4,527 Risk participation agreement mark-to-market adjustment - - - - (1,080) Unrealized losses on loans held for sale - - 799 - 1,114 Core earnings $ 59,303 $ 70,308 $ 54,588 $ 38,439 $ 21,413 Average total common shareholders' equity $ 1,002,624 $ 918,795 $ 866,411 $ 812,577 $ 771,663 Core return on average common equity 23.72% 31.03% 25.06% 18.82% 11.16%

36 Reconciliation of Non-GAAP Measures – Unaudited (Cont.) Core Efficiency Ratio ($ in thousands) Q2 2021 Q1 2021 Q4 2020 Q3 2020 Q2 2020 GAAP net interest income $138,757 $132,731 $122,946 $107,439 $ 91,982 GAAP non-interest income $ 16,822 $ 18,468 $ 16,083 $ 24,864 $ 11,711 (Gains) losses on investment securities (3,558) (24,540) (1,431) (11,945) (5,553) Derivative credit valuation adjustment 380 (1,562) (625) (378) 5,895 Risk participation agreement mark-to-market adjustment - - - - (1,407) Unrealized losses on loans held for sale - - 1,115 - 1,450 Loss on cash flow hedge derivative terminations - 24,467 - - - Loss on sale of foreign subsidiaries 2840 - - - - Core non-interest income 16,484 16,833 15,142 12,541 12,096 Core revenue $155,241 $149,564 $138,088 $119,980 $104,078 GAAP non-interest expense $ 70,823 $ 61,927 $ 59,933 $ 56,285 $ 49,791 Severance expense $ (2,004) - - - - Legal reserves - - - (320) - Merger and acquisition related expenses - (418) (709) (658) - Core non-interest expense $ 68,819 $ 61,509 $ 59,224 $ 55,307 $ 49,791 Core efficiency ratio (1) 44.33% 41.13% 42.89% 46.10% 47.84% (1) Core efficiency ratio calculated as core non-interest expense divided by core revenue.

37 Reconciliation of Non-GAAP Measures – Unaudited (Cont.) Tangible Equity ($ in thousands) Q2 2021 Q1 2021 Q4 2020 Q3 2020 Q2 2020 GAAP - Total shareholders' equity 1,250,729$ 1,188,721$ 1,117,086$ 1,051,491$ 1,007,847$ Reconciling items: Goodwill and other intangibles (3,853) (3,911) (14,298) (14,437) (14,575) Tangible equity 1,246,876$ 1,184,810$ 1,102,788$ 1,037,054$ 993,272$ Tangible Book Value per Common Share - Customers Bancorp ($ in thousands, except per share data) Q2 2021 Q1 2021 Q4 2020 Q3 2020 Q2 2020 GAAP -Total shareholders' equity 1,250,729$ 1,188,721$ 1,117,086$ 1,051,491$ 1,007,847$ Reconciling items: Preferred stock (217,471) (217,471) (217,471) (217,471) (217,471) Goodwill and other intangibles (1) (3,853) (3,911) (14,298) (14,437) (14,575) Tangible common equity 1,029,405$ 967,339$ 885,317$ 819,583$ 775,801$ Common shares outstanding 32,353,256 32,238,762 31,705,088 31,555,124 31,510,287 Tangible book value per common share 31.82$ 30.01$ 27.92$ 25.97$ 24.62$ (1) Includes goodwill and other intangibles reported in assets of discontinued operations. (1)

38 Reconciliation of Non-GAAP Measures – Unaudited (Cont.) Tangible Common Equity to Tangible Assets - Customers Bancorp ($ in thousands) Q2 2021 Q1 2021 Q4 2020 Q3 2020 Q2 2020 GAAP - Total shareholders' equity 1,250,729$ 1,188,721$ 1,117,086$ 1,051,491$ 1,007,847$ Reconciling items: Preferred stock (217,471) (217,471) (217,471) (217,471) (217,471) Goodwill and other intangibles (1) (3,853) (3,911) (14,298) (14,437) (14,575) Tangible common equity 1,029,405$ 967,339$ 885,317$ 819,583$ 775,801$ GAAP - Total assets 19,635,108$ 18,817,660$ 18,439,248$ 18,778,727$ 17,903,118$ Reconciling items: Goodwill and other intangibles (3,853) (3,911) (14,298) (14,437) (14,575) Tangible assets 19,631,255$ 18,813,749$ 18,424,950$ 18,764,290$ 17,888,543$ Tangible common equity to tangible assets 5.24% 5.14% 4.80% 4.37% 4.34% Tangible Common Equity to Tangible Assets, Excluding PPP - Customers Bancorp ($ in thousands) Q2 2021 Q1 2021 Q4 2020 Q3 2020 Q2 2020 GAAP - Total shareholders' equity 1,250,729$ 1,188,721$ 1,117,086$ 1,051,491$ 1,007,847$ Reconciling items: Preferred stock (217,471) (217,471) (217,471) (217,471) (217,471) Goodwill and other intangibles (1) (3,853) (3,911) (14,298) (14,437) (14,575) Tangible common equity 1,029,405$ 967,339$ 885,317$ 819,583$ 775,801$ GAAP - Total assets 19,635,108$ 18,817,660$ 18,439,248$ 18,778,727$ 17,903,118$ Reconciling items: Goodwill and other intangibles (3,853) (3,911) (3,911) (14,298) (14,437) PPP loans (6,305,056) (5,178,089) (4,561,365) (4,964,105) (4,760,427) Tangible assets 13,326,199$ 13,635,660$ 13,873,972$ 13,800,324$ 13,128,254$ Tangible common equity to tangible assets 7.72% 7.09% 6.39% 5.94% 5.91% (1) (1) Includes goodwill and other intangibles reported in assets of discontinued operations.

39 Reconciliation of Non-GAAP Measures – Unaudited (Cont.) Core Assets ($ in thousands) Q2 2021 Q1 2021 Q4 2020 Q3 2020 Q2 2020 GAAP - Total assets 19,635,108$ 18,817,660$ 18,439,248$ 18,778,727$ 17,903,118$ Reconciling items: Loans receivable, PPP (6,305,056) (5,178,089) (4,561,365) (4,964,105) (4,760,427) Core assets 13,330,052$ 13,639,571$ 13,877,883$ 13,814,622$ 13,142,691$ Total loans and leases, excluding PPP ($ in thousands) Q2 2021 Q1 2021 Q4 2020 Q3 2020 Q2 2020 Total loans and leases 16,967,022$ 16,168,306$ 15,832,251$ 16,605,279$ 15,290,202$ PPP loans (6,305,056) (5,178,089) (4,561,365) (4,964,105) (4,760,427) Loans and leases, excluding PPP 10,661,966$ 10,990,217$ 11,270,886$ 11,641,174$ 10,529,775$ Total loans and leases, excluding PPP & mortgage warehouse Mortgage warehouse loans $ 2,922,217 $ 3,463,490 $ 3,657,350 $ 3,947,828 $ 2,832,112 Loans and leases, excluding PPP & mortgage warehouse 7,739,749$ 7,526,727$ 7,613,536$ 7,693,346$ 7,697,663$ Coverage of credit loss reserves for loans and leases held for investment, excluding PPP ($ in thousands) Q2 2021 Q1 2021 Q4 2020 Q3 2020 Q2 2020 Loans and leases receivable 14,077,198$ 12,714,578$ 12,136,733$ 12,664,997$ 12,032,874$ Loans receivable, PPP (6,305,056) (5,178,089) (4,561,365) (4,964,105) (4,760,427) Loans and leases held for investment, excluding PPP 7,772,142$ 7,536,489$ 7,575,368$ 7,700,892$ 7,272,447$ Allowance for credit losses on loans and leases 125,436$ 128,736$ 144,176$ 155,561$ 159,905$ Coverage of credit loss reserves for loans and leases held for investment, excluding PPP 1.61% 1.71% 1.90% 2.02% 2.20%

40 Reconciliation of Non-GAAP Measures – Unaudited (Cont.) Net Interest Margin, Tax Equivalent, Excluding PPP - Customers Bancorp ($ in thousands, except per share data) Q2 2021 Q1 2021 Q4 2020 Q3 2020 Q2 2020 GAAP net interest income 138,757$ 132,731$ $ 122,946 $ 107,439 $ 91,982 PPP net interest income (35,785) (34,842) (25,257) (20,018) (9,308) Tax-equivalent adjustment 289 292 219 225 225 Net interest income, tax equivalent, excluding PPP 103,261$ 98,181$ 97,908$ 87,646$ 82,899$ GAAP average total interest earning assets 18,698,996$ 17,943,944$ 17,601,999$ 17,121,145$ 13,980,021$ Average PPP loans (6,133,184) (4,623,213) (4,782,606) (4,909,197) (2,754,920) Adjusted average total interest earning assets 12,565,812$ 13,320,731$ 12,819,393$ 12,211,948$ 11,225,101$ Net interest margin, tax equivalent, excluding PPP 3.30% 2.99% 3.04% 2.86% 2.97% Loan Yield, excluding PPP ($ in thousands, except per share data) Q2 2021 Q1 2021 Q4 2020 Q3 2020 Q2 2020 Total interest on loans and lease 153,608$ 152,117$ $ 145,414 $ 132,107 $ 118,447 Interest on PPP loans (41,137) (38,832) (29,465) (24,337) (11,706) Interest on loans and leases, excluding PPP 112,471$ 113,285$ 115,949$ 107,770$ 106,741$ Average loans and leases 16,482,802$ 15,329,111$ 15,987,095$ 15,403,838$ 12,791,633$ Average PPP loans (6,133,184) (4,623,213) (4,782,606) (4,909,197) (2,754,920) Adjusted average total interest earning assets 10,349,618$ 10,705,898$ 11,204,489$ 10,494,641$ 10,036,713$ Loan yield, excluding PPP 4.36% 4.29% 4.12% 4.09% 4.28%

41 Reconciliation of Non-GAAP Measures – Unaudited (Cont.) Deferments to Total loans and leases, excluding PPP ($ in thousands) Q2 2021 Q1 2021 Total loans and leases 16,967,022$ 16,168,306$ PPP loans (6,305,056) (5,178,089) Loans and leases, excluding PPP 10,661,966$ 10,990,217$ Commercial deferments 89,800$ 176,100$ Consumer deferments 8,400 13,000 Total deferments 98,200$ 189,100$ Commercial deferments to total loans and leases, excluding PPP 0.8% 1.7% Consumer deferments to total loans and leases, excluding PPP 0.1% 0.1% Total deferments to total loans and leases, excluding PPP 0.9% 1.7%

42 Contacts Leadership: Carla Leibold CFO of Customers Bancorp, Inc and Customers Bank Jay Sidhu Chairman & CEO of Customers Bancorp, Inc and Executive Chairman of Customers Bank Sam Sidhu President of Customers Bancorp, Inc and President & CEO of Customers Bank Andrew Bowman EVP & Chief Credit Officer Analysts: B. Riley Financial Steve Moss D.A. Davidson Company Russell Gunther Hovde Group Will Curtiss Jefferies LLC Casey Haire Keefe, Bruyette & Woods Michael Perito Maxim Group Michael Diana Piper Sandler Companies Frank Schiraldi Wedbush Peter Winter