Attached files

| file | filename |

|---|---|

| 8-K - 8-K - WELLS FARGO & COMPANY/MN | wfc-20210714.htm |

| EX-99.2 - EX-99.2 - QUARTERLY SUPPLEMENT - WELLS FARGO & COMPANY/MN | wfc2qer07-14x21ex992xsuppl.htm |

| EX-99.1 - EX-99.1 - EARNINGS RELEASE - WELLS FARGO & COMPANY/MN | wfc2qer07-14x21ex991xrelea.htm |

© 2021 Wells Fargo Bank, N.A. All rights reserved. 2Q21 Financial Results July 14, 2021 In second quarter 2021, we elected to change our accounting method for low-income housing tax credit (LIHTC) investments. We also elected to change the presentation of investment tax credits related to solar energy investments. Prior period financial statement line items have been revised to conform with the current period presentation. Prior period risk-based capital and certain other regulatory related metrics were not revised. For additional information, including the financial statement line items impacted by these changes, see page 16. Exhibit 99.3

22Q21 Financial Results • Helped 3.7 million consumer and small business customers by deferring payments and waiving fees • Funded approximately 282,000 loans totaling ~$14.0 billion under the Paycheck Protection Program (PPP) and facilitated an additional $234 million in liquidity for Community Development Financial Institutions (CDFIs) and African American owned Minority Depository Institutions (MDIs) – Average loan size of $50,000, the lowest among all large financial institutions1 – More than $6.5 billion, or 42% of the total number of PPP customers, to small businesses located in either a low-to-moderate income (LMI) area or a historically underserved census tract – In 2Q21, funded ~17,900 loans totaling $730 million ◦ Average loan size of $41,000 • Helped over 942,000 homeowners with new low-rate loans to either purchase a home or refinance an existing mortgage: over 364,000 purchases and over 578,000 refis Actively helping our customers and communities Supporting Our Customers Supporting Our Communities • Charitable Contributions: Deployed $656 million in philanthropic contributions, including support for the Open for Business Fund • Inclusive Small Business Recovery: Open for Business Fund provided grants to 127 CDFIs to help a projected 41,000 small business owners maintain more than 117,000 jobs (August 2020 - June 2021) • Investing in Minority Depository Institutions (MDIs): Completed investments in 13 black-owned banks, fulfilling $50 million pledge made in 2020 • Issued Inclusive Communities and Climate Bond: In May 2021, issued our first Sustainable Bond, raising $1 billion in capital to support housing affordability, socioeconomic advancement and empowerment, and renewable energy • Banking Inclusion Initiative: Announced a 10-year commitment to help unbanked individuals gain access to affordable, mainstream, digitally-enabled transactional accounts • Support for OneTen: Joined a coalition focused on hiring, retention, upskilling and advancement of Black and African American talent by creating one million family-sustaining careers over the next 10 years and fostering more diverse and inclusive corporate cultures • Development of Black Entrepreneurs: Anchored the launch of the Black Economic Alliance Entrepreneurs Fund with a $20 million investment focused on accelerating the growth of Black small businesses and owners • Access to Capital in Underserved Communities: Announced a $25 million grant to Opportunity Finance Network's Finance Justice Fund aimed at accelerating households, small businesses and community development in low-wealth communities All data cited on this slide is from January 1, 2020 – June 30, 2021, unless otherwise noted. 1. Source: U.S. Small Business Administration.

32Q21 Financial Results 2Q21 results Financial Results ROE: 13.6% ROTCE: 16.3%1 Efficiency ratio: 66%2 Credit Quality Capital and Liquidity CET1: 12.1%3 LCR: 123%4 • Provision for credit losses of $(1.3) billion, down $10.8 billion – Total net charge-offs of $379 million, down $735 million ◦ Net loan charge-offs of 0.18% of average loans (annualized) – Allowance for credit losses for loans of $16.4 billion, down $4.0 billion from 2Q20 and down $1.7 billion from 1Q21 • Common Equity Tier 1 (CET1) capital of $143.4 billion3 • CET1 ratio of 12.1% under the Standardized Approach and 12.7% under the Advanced Approach3 • Common stock dividend of $0.10 per share, or $411 million • Repurchased 35.3 million shares of common stock, or $1.6 billion, in the quarter Comparisons in the bullet points are for 2Q21 versus 2Q20, unless otherwise noted. 1. Tangible common equity and return on average tangible common equity (ROTCE) are non-GAAP financial measures. For additional information, including a corresponding reconciliation to GAAP financial measures, see the “Tangible Common Equity” table on page 17. 2. The efficiency ratio is noninterest expense divided by total revenue. 3. See page 18 for additional information regarding Common Equity Tier 1 (CET1) capital and ratios. CET1 is a preliminary estimate. 4. Liquidity coverage ratio (LCR) represents high-quality liquid assets divided by projected net cash outflows, as each is defined under the LCR rule. LCR is a preliminary estimate. 5. See page 16 for additional information regarding the accounting policy changes. ($ in millions, except EPS) Pre-tax Income EPS Change in the allowance for credit losses $1,639 0.30 Sale of student loans (Gain = $147 and goodwill write-down = $79) 68 0.01 • Effective income tax rate of 19.3% reflected accounting policy changes for certain tax-advantaged investments5 • Average loans of $854.7 billion, down 12% • Average deposits of $1.4 trillion, up 4% • Net income of $6.0 billion, or $1.38 per diluted common share – Revenue of $20.3 billion, up 11% ◦ Net gains from equity securities of $2.7 billion ($2.0 billion net of noncontrolling interests), up from $533 million in 2Q20 and $392 million in 1Q21 – Noninterest expense of $13.3 billion, down 8% – Results included:

42Q21 Financial Results 2Q21 earnings nm - not meaningful 1. Tangible common equity and return on average tangible common equity are non-GAAP financial measures. For additional information, including a corresponding reconciliation to GAAP financial measures, see the “Tangible Common Equity” table on page 17. $ in millions (mm), except per share data 2Q21 1Q21 2Q20 vs. 1Q21 vs. 2Q20 Net interest income $8,800 8,808 9,892 ($8) (1,092) Noninterest income 11,470 9,724 8,394 1,746 3,076 Total revenue 20,270 18,532 18,286 1,738 1,984 Net charge-offs 379 523 1,114 (144) (735) Change in the allowance for credit losses (1,639) (1,571) 8,420 (68) (10,059) Provision for credit losses (1,260) (1,048) 9,534 (212) (10,794) Noninterest expense 13,341 13,989 14,551 (648) (1,210) Pre-tax income (loss) 8,189 5,591 (5,799) 2,598 13,988 Income tax expense (benefit) 1,445 901 (2,001) 544 3,446 Effective income tax rate (%) 19.3 % 16.3 34.2 303 bps nm Net income (loss) $6,040 4,636 (3,846) $1,404 9,886 Diluted earnings (loss) per common share $1.38 1.02 (1.01) $0.36 2.39 Diluted average common shares (mm) # 4,156.1 4,171.0 4,105.5 (15) 51 Return on equity (ROE) 13.6 % 10.3 (10.2) 327 bps nm Return on average tangible common equity (ROTCE) 1 16.3 12.4 (12.3) 384 nm Efficiency ratio 66 75 80 (967) nm

52Q21 Financial Results Credit quality • Commercial net loan charge-offs down $69 million on broad-based declines • Consumer net loan charge-offs decreased $63 million primarily driven by lower losses in other consumer loans • Nonperforming assets decreased $695 million, or 8%, predominantly driven by a decline in commercial nonaccruals Provision for Credit Losses and Net Charge-offs ($ in millions) Allowance for Credit Losses for Loans ($ in millions) • Allowance for credit losses for loans down $1.7 billion due to continued improvements in the economic environment – Allowance coverage for total loans down 17 bps from 1Q21 and down 27 bps from 2Q20 Comparisons in the bullet points are for 2Q21 versus 1Q21, unless otherwise noted. 769 (179) (1,048) (1,260) 1,114 731 584 523 379 Provision for Credit Losses Net Charge-offs Net Loan Charge-off Ratio 2Q20 3Q20 4Q20 1Q21 2Q21 20,436 20,471 19,713 18,043 16,391 11,669 11,542 11,516 10,682 9,570 8,767 8,929 8,197 7,361 6,821 Commercial Consumer Allowance coverage for total loans 2Q20 3Q20 4Q20 1Q21 2Q21 0.46% 0.29% 0.24% 0.26% 0.18% 2.22%2.19% 2.22% 2.09% 1.92% 9,534

62Q21 Financial Results Average loans and deposits • Average loans down $116.6 billion, or 12%, year-over-year (YoY), and down $18.7 billion, or 2%, from 1Q21 on lower consumer loans predominantly driven by a $20.3 billion decline in consumer real estate loans • Total average loan yield of 3.33%, down 1 bp from 1Q21 and down 17 bps YoY reflecting the repricing impacts of lower interest rates, as well as lower consumer real estate loans • Average deposits up $49.1 billion, or 4%, YoY, and up $42.3 billion, or 3%, from 1Q21 as growth across a number of operating segments was partially offset by targeted actions to manage to the asset cap, primarily in Corporate and Investment Banking, and Corporate Treasury • Average deposit cost of 3 bps, stable from 1Q21 and down 14 bps YoY reflecting the lower interest rate environment Average Loans Outstanding ($ in billions) Average Deposits and Rates ($ in billions) 971.3 931.7 899.7 873.4 854.7 545.3 497.7 476.5 476.6 477.0 426.0 434.0 423.2 396.8 377.7 Commercial Loans Consumer Loans Total Average Loan Yield 2Q20 3Q20 4Q20 1Q21 2Q21 1,386.7 1,399.0 1,380.1 1,393.5 1,435.8 715.1 756.5 763.2 789.4 835.7 184.1 179.0 184.9 189.4 192.6 239.6 226.1 205.8 194.5 190.8 165.2 169.4 169.8 173.7 175.0 82.7 68.0 56.4 46.5 Corporate Wealth and Investment Management Corporate and Investment Banking Commercial Banking Consumer Banking and Lending 2Q20 3Q20 4Q20 1Q21 2Q21 3.50% 3.41% 3.43% 3.34% 3.33% Average Deposit Cost 0.17% 0.09% 0.05% 0.03% 0.03% 41.7

72Q21 Financial Results Net interest income • Net interest income decreased $1.1 billion, or 11%, YoY reflecting the impact of lower interest rates, lower loan balances due to soft demand and elevated prepayments, as well as higher mortgage-backed securities (MBS) premium amortization, partially offset by a decline in long-term debt – 2Q21 MBS premium amortization was $587 million vs. $548 million in 2Q20 and $616 million in 1Q21 • Net interest income was stable compared with 1Q21 as favorable hedge ineffectiveness accounting results, higher Paycheck Protection Program (PPP) income, and one additional day in the quarter were offset by lower loan balances and the impact of lower interest rates Net Interest Income ($ in millions) 9,892 9,379 9,355 8,808 8,800 Net Interest Income Net Interest Margin on a taxable-equivalent basis 2Q20 3Q20 4Q20 1Q21 2Q21 2.25% 2.13% 2.15% 2.05% 2.02% 1. Includes taxable-equivalent adjustments predominantly related to tax-exempt income on certain loans and securities. 1

82Q21 Financial Results Noninterest expense • Noninterest expense down 8% from 2Q20 – Personnel expense down 1% ◦ Lower deferred compensation expense and lower salaries expense on reduced headcount ◦ Partially offset by higher incentives and revenue-related compensation, including the impact of higher market valuations on stock-based compensation – Non-personnel expense down $1.1 billion, or 20%, primarily due to lower operating losses, as well as lower professional and outside services expense reflecting efficiency initiatives to reduce our spend on consultants and contractors ◦ 2Q21 included a $79 million goodwill write-down related to the sale of student loans • Noninterest expense down 5% from 1Q21 – Personnel expense down 8% from seasonally higher expenses in 1Q21, partially offset by one additional day in the quarter, as well as higher revenue-related compensation – Non-personnel expense up $92 million, or 2%, and included higher operating losses, professional and outside services expense, and advertising and promotion expense Noninterest Expense ($ in millions) 14,551 15,229 14,802 13,989 13,341 8,916 8,624 8,948 9,558 8,818 1,219 1,219 4,416 4,668 4,452 4,101 4,145 Goodwill Write-down All Other Expenses Restructuring Charges Operating Losses Personnel Expense 2Q20 3Q20 4Q20 1Q21 2Q21 Headcount ( Period-end, '000s) 2Q20 3Q20 4Q20 1Q21 2Q21 276 275 269 265 259 104 303 (4) 213 13781 621 718 79

92Q21 Financial Results Consumer Banking and Lending • Total revenue up 14% YoY and up modestly from 1Q21 – CSBB up 7% YoY and 4% from 1Q21 primarily driven by higher deposit-related fees and higher debit card transactions – Home Lending up 40% YoY driven by higher servicing income and higher mortgage origination and sales revenue; down 7% from 1Q21 as lower retail held-for-sale originations and gain-on-sale margins were partially offset by higher income related to the re-securitization of loans purchased from mortgage backed-securities – Credit Card up 14% YoY on higher point of sale volumes compared with a 2Q20 that had higher customer accommodations and fee waivers in response to the COVID-19 pandemic – Auto up 7% YoY and up 3% from 1Q21 on higher loan balances • Noninterest expense down 11% YoY predominantly due to lower operating losses and lower personnel expense 1. Return on allocated capital is segment net income (loss) applicable to common stock divided by segment average allocated capital. Segment net income (loss) applicable to common stock is segment net income (loss) less allocated preferred stock dividends. 2. Efficiency ratio is segment noninterest expense divided by segment total revenue. 3. Digital and mobile active customers is the number of consumer and small business customers who have logged on via a digital or mobile device, respectively, in the prior 90 days. Summary Financials $ in millions (mm) 2Q21 vs. 1Q21 vs. 2Q20 Revenue by line of business: Consumer and Small Business Banking (CSBB) $4,714 $164 313 Consumer Lending: Home Lending 2,072 (155) 595 Credit Card 1,363 17 167 Auto 415 12 27 Personal Lending 122 (6) (24) Total revenue 8,686 32 1,078 Provision for credit losses (367) 52 (3,469) Noninterest expense 6,202 (65) (731) Pre-tax income 2,851 45 5,278 Net income $2,138 $34 3,915 Selected Metrics 2Q21 1Q21 2Q20 Return on allocated capital 1 17.3 % 17.2 (15.5) Efficiency ratio 2 71 72 91 Retail bank branches # 4,878 4,944 5,300 Digital (online and mobile) active customers 3 (mm) 32.6 32.9 31.1 Mobile active customers 3 (mm) 26.8 26.7 25.2 Average Balances and Selected Credit Metrics $ in billions 2Q21 1Q21 2Q20 Balances Loans $331.9 353.1 369.6 Deposits 835.8 789.4 715.1 Credit Performance Net charge-offs as a % of average loans 0.43 % 0.42 0.60

102Q21 Financial Results Consumer Banking and Lending Mortgage Loan Originations ($ in billions) Auto Loan Originations ($ in billions) Credit Card POS Volume ($ in billions) Debit Card Point of Sale (POS) Volume and Transactions1 1. Debit card purchase volume and transactions reflect combined activity for both consumer and business debit card purchases. 59.2 61.6 53.9 51.8 53.2 30.5 32.8 32.3 33.6 36.9 28.7 28.8 21.6 18.2 16.3 Retail Correspondent Refinances as a % of Originations 2Q20 3Q20 4Q20 1Q21 2Q21 93.1 102.9 105.3 108.5 122.0 POS Volume ($ in billions) POS Transactions (billions) 2Q20 3Q20 4Q20 1Q21 2Q21 5.6 5.4 5.3 7.0 8.3 2Q20 3Q20 4Q20 1Q21 2Q21 17.5 21.3 22.9 21.1 25.5 2Q20 3Q20 4Q20 1Q21 2Q21 2.0 2.3 2.3 2.3 2.5 62% 51% 52% 64% 55%

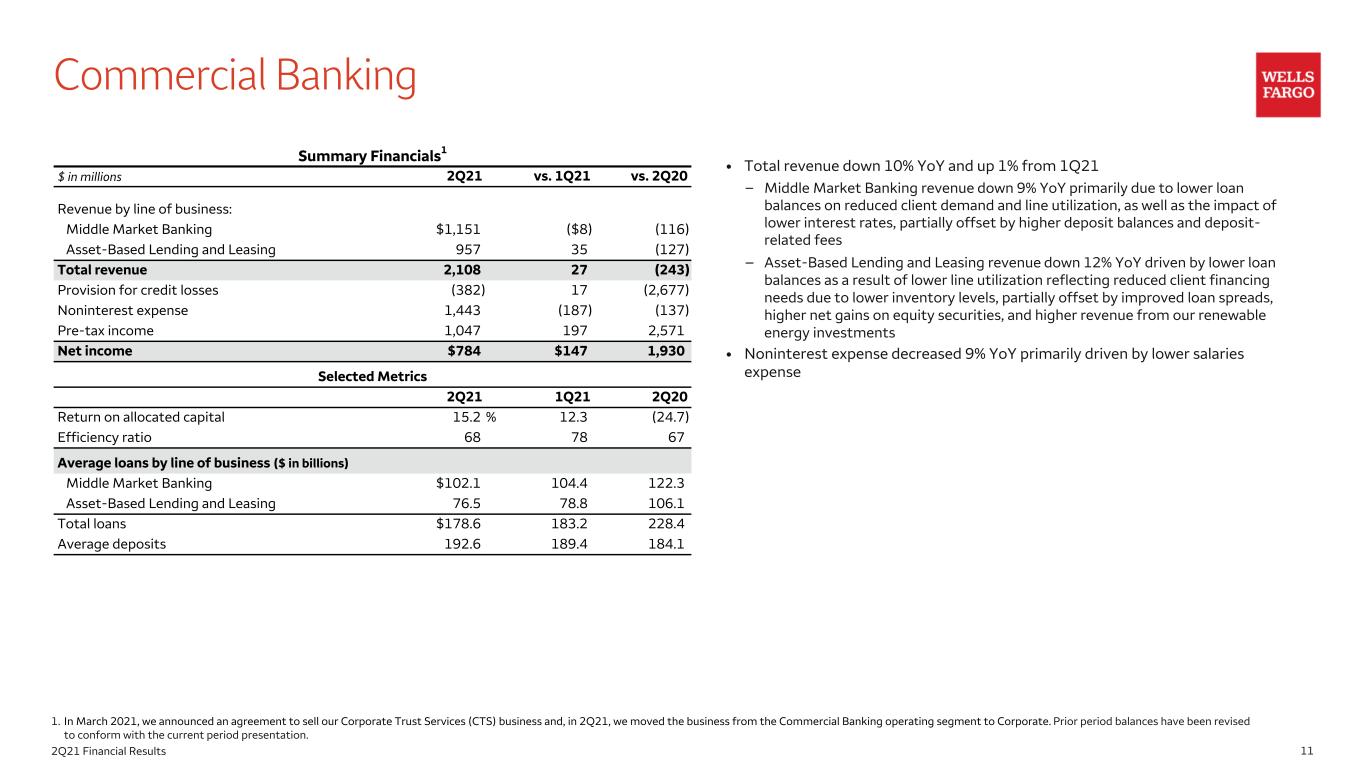

112Q21 Financial Results Commercial Banking • Total revenue down 10% YoY and up 1% from 1Q21 – Middle Market Banking revenue down 9% YoY primarily due to lower loan balances on reduced client demand and line utilization, as well as the impact of lower interest rates, partially offset by higher deposit balances and deposit- related fees – Asset-Based Lending and Leasing revenue down 12% YoY driven by lower loan balances as a result of lower line utilization reflecting reduced client financing needs due to lower inventory levels, partially offset by improved loan spreads, higher net gains on equity securities, and higher revenue from our renewable energy investments • Noninterest expense decreased 9% YoY primarily driven by lower salaries expense Summary Financials1 $ in millions 2Q21 vs. 1Q21 vs. 2Q20 Revenue by line of business: Middle Market Banking $1,151 ($8) (116) Asset-Based Lending and Leasing 957 35 (127) Total revenue 2,108 27 (243) Provision for credit losses (382) 17 (2,677) Noninterest expense 1,443 (187) (137) Pre-tax income 1,047 197 2,571 Net income $784 $147 1,930 Selected Metrics 2Q21 1Q21 2Q20 Return on allocated capital 15.2 % 12.3 (24.7) Efficiency ratio 68 78 67 Average loans by line of business ($ in billions) Middle Market Banking $102.1 104.4 122.3 Asset-Based Lending and Leasing 76.5 78.8 106.1 Total loans $178.6 183.2 228.4 Average deposits 192.6 189.4 184.1 1. In March 2021, we announced an agreement to sell our Corporate Trust Services (CTS) business and, in 2Q21, we moved the business from the Commercial Banking operating segment to Corporate. Prior period balances have been revised to conform with the current period presentation.

122Q21 Financial Results Corporate and Investment Banking • Total revenue down 18% YoY and down 7% from 1Q21 – Banking revenue down 6% YoY on lower debt capital markets, the impact of lower interest rates, and lower deposit balances predominantly due to actions taken to manage under the asset cap – Commercial Real Estate revenue up 21% YoY driven by higher commercial mortgage-backed securities gain-on-sale margins and volumes, as well as changes in the valuation of commercial mortgage servicing rights and improved results in our low-income housing business; up 11% from 1Q21 on higher capital markets activity primarily due to agency volumes, as well as higher servicing income – Markets revenue down 45% YoY and down 25% from 1Q21 on lower trading activity across most asset classes primarily due to market conditions • Noninterest expense down 12% YoY primarily driven by lower operating losses Summary Financials $ in millions 2Q21 vs. 1Q21 vs. 2Q20 Revenue by line of business: Banking: Lending $474 $21 10 Treasury Management and Payments 353 (17) (50) Investment Banking 407 (9) (37) Total Banking 1,234 (5) (77) Commercial Real Estate 1,014 102 177 Markets: Fixed Income, Currencies and Commodities (FICC) 888 (256) (618) Equities 206 (46) (96) Credit Adjustment (CVA/DVA) and Other (16) (52) (155) Total Markets 1,078 (354) (869) Other 12 (9) 48 Total revenue 3,338 (266) (721) Provision for credit losses (501) (217) (4,257) Noninterest expense 1,805 (28) (239) Pre-tax income 2,034 (21) 3,775 Net income $1,523 ($32) 2,856 Selected Metrics 2Q21 1Q21 2Q20 Return on allocated capital 17.0 % 17.6 (16.8) Efficiency ratio 54 51 50 Average Balances ($ in billions) Loans by line of business 2Q21 1Q21 2Q20 Banking $90.8 86.5 106.0 Commercial Real Estate 108.9 107.6 110.6 Markets 52.7 52.0 57.0 Total loans $252.4 246.1 273.6 Deposits 190.8 194.5 239.6 Trading-related assets 191.5 197.4 199.6

132Q21 Financial Results Wealth and Investment Management • Total revenue up 10% YoY – Net interest income down 15% YoY driven by the impact of lower interest rates, partially offset by higher deposit and loan balances – Noninterest income up 18% YoY primarily due to higher asset-based fees on higher market valuations, and up 1% from 1Q21 as higher asset-based fees were partially offset by lower retail brokerage transactional activity. Additionally, 2Q20 included higher deferred compensation plan investment results (largely P&L neutral) • Noninterest expense up 5% YoY as higher revenue-related compensation was partially offset by lower deferred compensation plan investment expense (largely P&L neutral), and down 5% from 1Q21 from seasonally higher personnel expense in 1Q21 • Total client assets increased 20% YoY to a record $2.1 trillion, primarily driven by higher market valuations Summary Financials $ in millions 2Q21 vs. 1Q21 vs. 2Q20 Net interest income $610 ($47) (109) Noninterest income 2,926 39 439 Total revenue 3,536 (8) 330 Provision for credit losses 24 67 (231) Noninterest expense 2,891 (137) 148 Pre-tax income 621 62 413 Net income $465 $46 309 Selected Metrics ($ in billions, unless otherwise noted) 2Q21 1Q21 2Q20 Return on allocated capital 20.7 % 18.9 6.6 Efficiency ratio 82 85 86 Average loans $81.8 80.8 78.1 Average deposits 175.0 173.7 165.1 Client assets Advisory assets 931 885 743 Other brokerage assets and deposits 1,212 1,177 1,042 Total client assets $2,143 2,062 1,785 Annualized revenue per advisor ($ in thousands) 1 1,084 1,058 898 Total financial and wealth advisors 12,819 13,277 14,206 1. Represents annualized segment total revenue divided by average total financial and wealth advisors for the period.

142Q21 Financial Results Corporate • Net interest income down YoY primarily due to the impact of lower interest rates and lower loan balances due to the sale of student loans • Noninterest income up both YoY and from 1Q21 and included higher net gains on equity securities from our affiliated venture capital and private equity businesses, a $147 million gain on the sale of student loans, as well as a modest gain on the sale of our Canadian equipment finance business • Noninterest expense down YoY primarily due to lower deferred compensation expense (largely P&L neutral) – 2Q21 included a $79 million goodwill write-down on the sale of student loans Summary Financials1 $ in millions 2Q21 vs. 1Q21 vs. 2Q20 Net interest income ($304) $86 (364) Noninterest income 3,327 1,910 2,009 Total revenue 3,023 1,996 1,645 Provision for credit losses (34) (131) (160) Noninterest expense 1,000 (231) (251) Pre-tax income (loss) 2,057 2,358 2,056 Income tax expense (benefit) 223 498 523 Less: Net income (loss) from noncontrolling interests 704 651 657 Net income (loss) $1,130 $1,209 876 Selected Metrics ($ in billions) 2Q21 1Q21 2Q20 Wells Fargo Asset Management assets under management $603 590 578 1. In March 2021, we announced an agreement to sell our Corporate Trust Services (CTS) business and, in 2Q21, we moved the business from the Commercial Banking operating segment to Corporate. Prior period balances have been revised to conform with the current period presentation.

Appendix

162Q21 Financial Results Accounting policy changes for tax-advantaged investments • Prior period financial statement line items have been revised to conform with the current period presentation – Impact was nominal on net income and retained earnings on an annual basis; $(0.03) and $0.02 per diluted share impact in 1Q21 and 2020, respectively – Changes improved our efficiency ratio and generally increased our effective income tax rate from what was previously reported • In 2Q21, we elected to change our accounting for low-income housing tax credit investments and our presentation of investment tax credits related to solar energy investments to better align the financial statement presentation of the economic impact of these investments with the related tax credits • We make investments in affordable housing and renewable energy to support our community development and sustainability efforts Prior Policy Impact New Policy Impact Income Statement Low-Income Housing Tax Credit (LIHTC) Investment Losses Recognized in noninterest income Recognized in income tax expense; netted against tax credits Solar Energy Investment Tax Credits Recognized in income tax expense Recognized in revenue; netted against investment losses/income 1Q21 2020 As previously reported Efficiency ratio 77 % 80 Effective income tax rate 6.4 % nm As revised Efficiency ratio 75 % 78 Effective income tax rate 16.3 % nm • For additional information, including the financial statement line items impacted by these changes, see page 30 of our 2Q21 Earnings Supplement nm - not meaningful

172Q21 Financial Results Tangible Common Equity Wells Fargo & Company and Subsidiaries TANGIBLE COMMON EQUITY We also evaluate our business based on certain ratios that utilize tangible common equity. Tangible common equity is a non-GAAP financial measure and represents total equity less preferred equity, noncontrolling interests, goodwill, certain identifiable intangible assets (other than MSRs) and goodwill and other intangibles on nonmarketable equity securities, net of applicable deferred taxes. One of these ratios is return on average tangible common equity (ROTCE), which represents our annualized earnings as a percentage of tangible common equity. The methodology of determining tangible common equity may differ among companies. Management believes that return on average tangible common equity, which utilizes tangible common equity, is a useful financial measure because it enables management, investors, and others to assess the Company’s use of equity. The table below provides a reconciliation of this non-GAAP financial measure to GAAP financial measures. Quarter ended (in millions, except ratios) Jun 30, 2021 Mar 31, 2021 Dec 31, 2020 Sep 30, 2020 Jun 30, 2020 Return on average tangible common equity: Net income applicable to common stock (A) $ 5,743 4,256 2,741 2,901 (4,160) Average total equity 190,968 189,074 185,444 181,377 184,072 Adjustments: Preferred stock (21,108) (21,840) (21,223) (21,098) (21,344) Additional paid-in capital on preferred stock 138 145 156 158 140 Unearned ESOP shares 875 875 875 875 1,140 Noncontrolling interests (1,313) (1,115) (887) (761) (643) Average common stockholders’ equity (B) $ 169,560 167,139 164,365 160,551 163,365 Adjustments: Goodwill (26,213) (26,383) (26,390) (26,388) (26,384) Certain identifiable intangible assets (other than MSRs) (310) (330) (354) (378) (402) Goodwill and other intangibles on nonmarketable equity securities (included in other assets) (2,208) (2,217) (1,889) (2,045) (1,922) Applicable deferred taxes related to goodwill and other intangible assets (1) 873 863 852 838 828 Average tangible common equity (C) $ 141,702 139,072 136,584 132,578 135,485 Return on average common stockholders’ equity (ROE) (annualized) (A)/(B) 13.6 % 10.3 6.6 7.2 (10.2) Return on average tangible common equity (ROTCE) (annualized) (A)/(C) 16.3 12.4 8.0 8.7 (12.3) (1) Determined by applying the combined federal statutory rate and composite state income tax rates to the difference between book and tax basis of the respective goodwill and intangible assets at period end.

182Q21 Financial Results Common Equity Tier 1 under Basel III Wells Fargo & Company and Subsidiaries RISK-BASED CAPITAL RATIOS UNDER BASEL III (1) Estimated (in billions, except ratio) Jun 30, 2021 Mar 31, 2021 Dec 31, 2020 Sep 30, 2020 Jun 30, 2020 Total equity (2) $ 193.1 188.0 185.7 181.7 178.6 Effect of accounting policy changes (2) — 0.3 0.2 0.3 1.5 Total equity (as reported) 193.1 188.3 185.9 182.0 180.1 Adjustments: Preferred stock (20.8) (21.2) (21.1) (21.1) (21.1) Additional paid-in capital on preferred stock 0.2 0.2 0.1 0.2 0.1 Unearned ESOP shares 0.9 0.9 0.9 0.9 0.9 Noncontrolling interests (1.9) (1.1) (1.0) (0.9) (0.7) Total common stockholders' equity $ 171.5 167.1 164.8 161.1 159.3 Adjustments: Goodwill (26.2) (26.3) (26.4) (26.4) (26.4) Certain identifiable intangible assets (other than MSRs) (0.3) (0.3) (0.3) (0.4) (0.4) Goodwill and other intangibles on nonmarketable equity securities (included in other assets) (2.3) (2.3) (2.0) (2.0) (2.1) Applicable deferred taxes related to goodwill and other intangible assets (3) 0.9 0.9 0.9 0.8 0.8 Current expected credit loss (CECL) transition provision (4) 0.9 1.3 1.7 1.9 1.9 Other (1.1) (0.7) (0.4) (0.1) (0.1) Common Equity Tier 1 (A) $ 143.4 139.7 138.3 134.9 133.0 Total risk-weighted assets (RWAs) under Standardized Approach (B) $ 1,188.8 1,179.0 1,193.7 1,185.6 1,213.1 Total RWAs under Advanced Approach (C) 1,126.6 1,109.4 1,158.4 1,172.0 1,195.4 Common Equity Tier 1 to total RWAs under Standardized Approach (A)/(B) 12.1 % 11.8 11.6 11.4 11.0 Common Equity Tier 1 to total RWAs under Advanced Approach (A)/(C) 12.7 12.6 11.9 11.5 11.1 (1) The Basel III capital rules for calculating CET1 and tier 1 capital, along with RWAs, are fully phased-in. However, the requirements for determining total capital are in accordance with transition requirements and are scheduled to be fully phased-in by the end of 2021. The Basel III capital rules provide for two capital frameworks: the Standardized Approach and the Advanced Approach applicable to certain institutions. Accordingly, in the assessment of our capital adequacy, we must report the lower of our CET1, tier 1 and total capital ratios calculated under the Standardized Approach and under the Advanced Approach. (2) In second quarter 2021, we elected to change our accounting method for low-income housing tax credit (LIHTC) investments. We also elected to change the presentation of investment tax credits related to solar energy investments. Prior period total equity was revised to conform with the current period presentation. Prior period risk-based capital and certain other regulatory related metrics were not revised. (3) Determined by applying the combined federal statutory rate and composite state income tax rates to the difference between book and tax basis of the respective goodwill and intangible assets at period end. (4) In second quarter 2020, the Company elected to apply a modified transition provision issued by federal banking regulators related to the impact of CECL on regulatory capital. The rule permits certain banking organizations to exclude from regulatory capital the initial adoption impact of CECL, plus 25% of the cumulative changes in the allowance for credit losses (ACL) under CECL for each period until December 31, 2021, followed by a three-year phase-out of the benefits. The impact of the CECL transition provision on our regulatory capital at June 30, 2021, was an increase in capital of $879 million, reflecting a $991 million (post-tax) increase in capital recognized upon our initial adoption of CECL, offset by 25% of the $7.5 billion increase in our ACL under CECL from January 1, 2020, through June 30, 2021.

192Q21 Financial Results Disclaimer and forward-looking statements Financial results reported in this document are preliminary. Final financial results and other disclosures will be reported in our Quarterly Report on Form 10-Q for the quarter ended June 30, 2021, and may differ materially from the results and disclosures in this document due to, among other things, the completion of final review procedures, the occurrence of subsequent events, or the discovery of additional information. This document contains forward-looking statements. In addition, we may make forward-looking statements in our other documents filed or furnished with the Securities and Exchange Commission, and our management may make forward-looking statements orally to analysts, investors, representatives of the media and others. Forward-looking statements can be identified by words such as “anticipates,” “intends,” “plans,” “seeks,” “believes,” “estimates,” “expects,” “target,” “projects,” “outlook,” “forecast,” “will,” “may,” “could,” “should,” “can” and similar references to future periods. In particular, forward-looking statements include, but are not limited to, statements we make about: (i) the future operating or financial performance of the Company, including our outlook for future growth; (ii) our noninterest expense and efficiency ratio; (iii) future credit quality and performance, including our expectations regarding future loan losses, our allowance for credit losses, and the economic scenarios considered to develop the allowance; (iv) our expectations regarding net interest income and net interest margin; (v) loan growth or the reduction or mitigation of risk in our loan portfolios; (vi) future capital or liquidity levels, ratios or targets; (vii) the performance of our mortgage business and any related exposures; (viii) the expected outcome and impact of legal, regulatory and legislative developments, as well as our expectations regarding compliance therewith; (ix) future common stock dividends, common share repurchases and other uses of capital; (x) our targeted range for return on assets, return on equity, and return on tangible common equity; (xi) expectations regarding our effective income tax rate; (xii) the outcome of contingencies, such as legal proceedings; (xiii) environmental, social and governance related goals or commitments; and (xiv) the Company’s plans, objectives and strategies. Forward-looking statements are not based on historical facts but instead represent our current expectations and assumptions regarding our business, the economy and other future conditions. Investors are urged to not unduly rely on forward-looking statements as actual results could differ materially from expectations. Forward- looking statements speak only as of the date made, and we do not undertake to update them to reflect changes or events that occur after that date. For more information about factors that could cause actual results to differ materially from expectations, refer to the “Forward-Looking Statements” discussion in Wells Fargo’s press release announcing our second quarter 2021 results and in our most recent Quarterly Report on Form 10-Q, as well as to Wells Fargo’s other reports filed with the Securities and Exchange Commission, including the discussion under “Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2020.