Attached files

| file | filename |

|---|---|

| EX-23.1 - EXHIBIT 23.1 - Organicell Regenerative Medicine, Inc. | organicellregen_ex23-1.htm |

File No. 333-______

As filed with the Securities and Exchange Commission on July 14, 2021

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

ORGANICELL REGENERATIVE MEDICINE, INC.

(Exact name of registrant as specified in its charter)

| Nevada | 2836 | 47-4180540 | ||

| (State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification No.) |

4045 Sheridan Avenue, Suite 239

Miami Beach, Florida 33140

(888) 963-7881

(Address, including zip code, and telephone number,

including area code, of registrant’s principal executive offices)

Albert Mitrani

Chief Executive Officer

4045 Sheridan Avenue, Suite 239

Miami Beach, Florida 33140

(888) 963-7881

(Name, address, including zip code, and telephone number,

including area code, of agent for service)

Copies to:

Dale S. Bergman, Esq.

Gutiérrez Bergman Boulris, PLLC

901 Ponce De Leon Blvd., Suite 303

Coral Gables, Florida 33134

(305) 358-5100

Approximate date of commencement of proposed sale to the public: From time to time after the effective date of this Registration Statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act, check the following box. ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer”, “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ☐ | Accelerated filer ☐ |

| Non-accelerated filer ☐ | Smaller reporting company ☒ |

| Emerging growth company ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ¨

CALCULATION OF REGISTRATION FEE

| Title of Each Class of Securities to be Registered | Amount to be Registered (1) | Proposed Maximum Aggregate Offering Price per Share (2) | Proposed Maximum Aggregate Offering Price (2) | Amount of Registration Fee (3) | ||||||||||||

| Common Stock, par value $0.001 per share | 73,358,039 | $ | 0.15 | $ | 11,003,709 | $ | 1,200.50 | |||||||||

| (1) | Represents shares of common stock held by the selling shareholders named in this registration statement, which shares are being registered for resale by the selling shareholders. In accordance with Rule 416 under the Securities Act of 1933, as amended (the “Securities Act”), this registration statement shall be deemed to cover any additional shares to be offered or issued from stock splits, stock dividends or similar transactions with respect to the shares being registered.. |

| (2) | Estimated solely for purposes of calculating the registration fee pursuant to Rule 457(c) under the Securities Act based on the price of $0.15, which was the average of the high and low prices for the Company’s common stock on July 12, 2021, as reported by OTC Markets Group, Inc. |

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The information in this preliminary prospectus is not complete and may be changed. We may not sell these securities nor may offers to buy these securities be accepted until the registration statement filed with the Securities and Exchange Commission becomes effective. This preliminary prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED JULY 14, 2021

PROSPECTUS

ORGANICELL REGENERATIVE MEDICINE, INC.

73,358,039 Shares of Common Stock

This prospectus relates to the proposed resale from time to time of up to an aggregate of 73,358,039 shares of common stock of Organicell Regenerative Medicine, Inc. (the “Company,” “Organicell,” “we” or “us”) by the selling shareholders named in this prospectus in amounts, at prices and on terms that will be determined at the time of the offering. We will not receive any of the proceeds from the sale of our common stock offered by the selling shareholders. The shares being sold were acquired by the selling shareholders from the Company in various transactions exempt from the registration requirements of the Securities Act of 1933, as amended (the “Securities Act”).

The selling shareholders named in this prospectus, and any of their pledgees, donees, transferees or other successors-in-interest, may offer and sell the shares from time to time through public or private transactions at prevailing market prices, at prices related to prevailing market prices or at privately negotiated prices. We will not receive any proceeds from the sale of the shares of common stock. The selling shareholders will sell the shares of common stock in accordance with the “Plan of Distribution” set forth in this prospectus.

The selling shareholders will bear all commissions and discounts, if any, attributable to the sales of shares of common stock. We will bear all costs, expenses and fees in connection with the registration of the shares of common stock.

Our common stock is currently quoted on the OTCPink tier of the over-the-counter market operated by OTC Markets Group, Inc. under the symbol “BPSR.” On July 13, 2021. the closing price for our common stock was $0.145, as reported by OTC Markets Group, Inc.

The purchase of the shares of common stock offered through this prospectus involves a high degree of risk. See the section of this prospectus entitled “Risk Factors” beginning at page 6.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

The date of this prospectus is ____ __, 2021

i

This prospectus is part of a registration statement that we filed with the Securities and Exchange Commission (the “SEC”) using the SEC’s registration rules for a delayed or continuous offering and sale of securities. Under the registration rules, using this prospectus and, if required, one or more prospectus supplements, the selling shareholders named herein may distribute the shares of common stock covered by this prospectus. This prospectus also covers any shares of common stock that may become issuable as a result of stock splits, stock dividends or similar transactions. A prospectus supplement may add, update or change information contained in this prospectus.

You should rely only on the information contained in this prospectus. We have not authorized any dealer, salesperson or other person to provide you with information concerning us, except for the information contained in this prospectus. The information contained in this prospectus is complete and accurate only as of the date on the front cover page of this prospectus, regardless when the time of delivery of this prospectus or the sale of any common stock. This prospectus is not an offer to sell, nor is it a solicitation of an offer to buy, our common stock in any jurisdiction in which the offer or sale is not permitted.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus contains “forward-looking statements” and information within the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, as amended (the “Securities Act”) and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). This information includes assumptions made by, and information currently available to management, including statements regarding future economic performance and financial condition, liquidity and capital resources, acceptance of our products by the market, and management’s plans and objectives. In addition, certain statements included in this and our future filings with the Securities and Exchange Commission (the “SEC”), in press releases, and in oral and written statements made by us or with our approval, which are not statements of historical fact, are forward-looking statements. Words such as “may,” “could,” “should,” “would,” “believe,” “expect,” “expectation,” “anticipate,” “estimate,” “intend,” “seeks,” “plan,” “project,” “continue,” “predict,” “will,” “should” and other words or expressions of similar meaning are intended by us to identify forward-looking statements, although not all forward-looking statements contain these identifying words. These forward-looking statements are found at various places throughout this prospectus. These statements are based on our current expectations about future events or results and information that is currently available to us, involve assumptions, risks, and uncertainties, and speak only as of the date on which such statements are made.

Forward-looking statements include, but are not limited to, the following:

| ■ | Our products’ advantages; |

| ■ | Expectations regarding our future growth; |

| ■ | Expectations regarding available cash resources to fund current operations and future growth; |

| ■ | Our ability to comply with regulations governing the production and sale of our products; |

| ■ | Our ability to receive regulatory approvals; |

| ■ | Market opportunities for our services and products; |

| ■ | Our ability to compete effectively; |

| ■ | Our ability to respond to market forces; and |

| ■ | Our ability to protect our intellectual property. |

Actual results and outcomes may differ materially from those expressed or implied in these forward-looking statements. Factors that may cause such a difference include, but are not limited to, those discussed in “Risk Factors.” Except as expressly required by the federal securities laws, we undertake no obligation to update or to publicly announce changes to any of the forward-looking statements contained herein to reflect future events, developments, changed circumstances, or for any other reason.

ii

This summary provides an overview of all material information contained in this prospectus. It does not contain all the information you should consider before making a decision to purchase the shares our selling shareholders are offering. You should very carefully and thoroughly read the more detailed information in this prospectus and review our financial statements and all other information that is incorporated by reference in this prospectus.

Unless the context otherwise requires, references in this prospectus to the “Company,” “Organicell,” “we,” “our” and “us” refer to Organicell Regenerative Medicine, Inc. and its subsidiaries.

Business Overview

We are a clinical-stage biopharmaceutical company principally focusing on the development of innovative biological therapeutics for the treatment of degenerative diseases and to provide other related services. Our proprietary products are derived from perinatal sources and manufactured to retain the naturally occurring microRNAs, without the addition or combination of any other substance or diluent (“RAAM Products”). Our RAAM Products and related services are principally used in the health care industry administered through doctors and clinics (“Providers”).

Since May 2019, Organicell has operated a placental tissue bank processing laboratory in Miami, Florida for the purpose of performing research and development and the manufacturing and processing of the anti-aging and cellular therapy derived products that we sell and distribute to our to its customers.

The Company’s leading product, Zofin™ (also known as OrganicellTM Flow), is an acellular, biologic therapeutic derived from perinatal sources and is manufactured to retain naturally occurring microRNAs, without the addition or combination of any other substance or diluent. This product contains over 300 growth factors, cytokines, chemokines, and 102 unique microRNAs as well as other exosomes/nanoparticles derived from perinatal tissues. Zofin™ is currently being tested in an U.S. Food and Drug Administration (“FDA”) authorized phase I/II randomized, double blinded, placebo trial to evaluate the safety and potential efficacy of intravenous infusion of Zofin™ for the treatment of moderate to severe SARS related to COVID-19 infection.

To date, the Company has obtained certain Investigation New Drug (“IND”), and emergency IND (“eIND”) approvals from the FDA, including applicable Institutional Review Board (“IRB”) approvals which authorized the Company to commence clinical trials or treatments in connection with the use of Zofin™ and related treatment protocols. The Company is pursuing efforts to complete ongoing clinical studies as well as obtaining approval to commence additional studies for other specific indications it has identified that the use of its products will provide more favorable and desired health related benefits for patients seeking alternative treatment options than are currently available.

New FDA guidance which was announced in November 2017 and which became effective in May 2021 (postponed from November 2020 due to the COVID -19 pandemic) require that the sale of products that fall under Section 351 of the Public Health Services Act pertaining to marketing traditional biologics and human cells, tissues and cellular and tissue based products (“HCT/Ps”) can only be sold pursuant to an approved biologics license application (“BLA”).

We have not obtained any opinion or ruling regarding the Company’s operations and whether the processing, sales and distribution of the products we currently produce would be subject to the FDA’s previously announced intended enforcement policies regarding HCT/P’s. However, we do not believe that our products fall within these guidelines and intend to vigorously defend against any adverse interpretation by the FDA on the classification of our products that may be deemed as falling under this defined regulation, if any. Notwithstanding the foregoing, we are undertaking efforts on an ongoing basis to mitigate any potential risks associated with an adverse ruling by the FDA and the subsequent limitations on our ability to continue to generate revenues from the sale of our products in the United States until the Company obtains the required licenses. The efforts include continuing with clinical trials, expanding sales internationally and developing new product offerings and/or designations of products that would not fall under these regulations.

The Company recently formed Livin’ Again Inc., a wholly owned subsidiary, for the purpose of among other things, providing independent education, advertising and marketing services, to Providers that provide medical and other healthcare, anti-aging and regenerative services. including FDA-approved IV vitamin and mineral liquid infusions. The Company intends to initially market such services by coordinating turnkey opportunities for Providers to provide IV Drip Therapies at select properties and locations.

1

Recent Developments

In March 2021, Organicell entered into a Material Cooperative Research and Development Agreement with the Centers for Disease Control and Prevention (the “CDC”) to determine the anti-inflammatory and anti-infective effectiveness of Zofin™ in experimental models of influenza infection. Pursuant to the agreement, Organicell will supply the CDC with Zofin™ and using well established in vitro and in vivo experimental models of influenza infection, the CDC will test the anti-infective and anti-inflammatory properties of Zofin™. All the proposed experiments will be performed in the appropriate biosafety levels and approved protocols at the Immunology and Pathogenesis Branch / Influenza Division of the CDC.

In April 2021, the Company entered into a similar agreement with Oklahoma State University to evaluate ZofinTM for the treatment of respiratory diseases caused by virus infections of pandemic potential and the FDA approved an Investigational New Drug (“IND”) application for Zofin™, in the treatment of knee osteoarthritis.

In April 2021, we announced that an initial trial of ten COVID -19 patients in India conducted by CWI India, our Indian partner, generated positive results. The trial had been conducted by CWI India, our Indian partner with whom we had entered a product testing and distribution agreement in February 2021, to collaborate on a study or studies to evaluate the effects of Zofin™ on moderate to severe COVID-19 patients in India. The ten patients in the initial trial were treated at hospitals in Bangalore, Kozhikode and Chennai, and all ten patients recovered from their symptoms and were discharged from the hospital. Based on the initial results of this trial, CWI India is conducting an expanded trial of sixty-five patients with moderate to severe COVID-19, who are being treated at these hospitals. We anticipate such trial to be completed by the end of October 2021. If the results of the expanded trial are similarly positive, Organicell and CWI India intend to file with the ICMR (Indian Council for Medical Research) for Emergency Use Approval to use Zofin™ in India as a therapeutic for treating COVID-19.

In May 2021, the Company announced that its ZofinTM therapy has been approved by Pakistani regulators to be used for a treatment of a named COVID-19 patient hospitalized at the Pakistan Institute of Medical Sciences on compassionate grounds. In addition to this compassionate grounds authorization, Organicell received further authorization from Pakistani regulators to begin a broader trial of ZofinTM with up to 60 additional patients suffering from moderate to severe COVID-19. The Company has already shared data with Pakistani regulatory authorities in the country in support of this effort and hopes to come to receive authorization to commence this trial in the near future. In addition, in May 2021, Organicell also entered into a one-year exclusive distribution agreement with Apex Services Pakistan to import and distribute ZofinTM to hospitals and clinics in the country, subject to the issuance of all necessary approvals and licenses by the Drug Regulatory Authority of Pakistan.

In June 2021, Organicell announced the results of its expanded access (EA) intermediate size patient population trial (NCT04657406) for treatment of COVID-19 patients with Zofin™, which EA trial had been authorized by the FDA in September 2020. The results of the EA trial indicated that treatment of participants with Zofin™:

| ● | met endpoints for safety and efficacy in patients with mild to moderate COVID-19; |

| ● | mitigated mild and moderate symptoms; |

| ● | improved pulmonary opacities detected in chest X-rays; and |

| ● | improved inflammatory biomarkers. |

The trial was conducted at United Memorial Medical Center in Houston, Texas. The administration of ZofinTM in the trial was well tolerated in all enrolled subjects, with no adverse events. Chest X-ray data demonstrated that 75% of subjects had bilateral opacities caused by COVID-19 infection at day 0 (baseline), prior to treatment with ZofinTM and thirty (30) days after ZofinTM treatment, chest X-ray data showed 83% of treated subjects had normal lung imaging, indicating complete recovery. Organicell intends to submit results of the trial for scientific peer review and publication, as well as to the FDA for approval of an amendment to the Company’s previously approved IND (NCT04384445) to perform a placebo-controlled Phase II clinical trial to confirm safety and efficacy in a randomized fashion.

On June 17, 2021, Organicell received a subpoena dated June 14, 2021, from the Atlanta Regional Office of the SEC requiring the production of certain documents and communications in connection with the treatment and results of various COVID-19 patients, as discussed in the Company’s Current Reports on Form 8-K filed with the SEC during the period from May 27, 2020 through May 11, 2021. The Company intends to fully cooperate with the SEC’s investigation and believes that it will be able to provide all of the information requested by the SEC. The Company can make no assurances as to the time or resources that will need to be devoted to this investigation or its final outcome, or the impact, if any, of this investigation or any proceedings on the Company’s current business, financial condition, results of operations, cash flows, or the Company’s future operations.

2

COVID-19 impact on Economy and Business Environment

The current outbreak of the novel coronavirus (“COVID-19”) and resulting impact to the United States economic environment began to take hold during March 2020. The adverse public health developments and economic effects of the COVID-19 outbreak in the United States, have adversely affected the demand for our products and services by our customers and from patients of our customers as a result of quarantines, facility closures and social distancing measures put into effect in connection with the COVID-19 outbreak and which currently still continue to have a negative impact to our business and the economy. These restrictions have adversely affected the Company’s sales, results of operations and financial condition. In response to the COVID-19 outbreak, the Company (a) has accelerated its research and development activities; (b) is seeking to raise additional debt and/or equity financing to support working capital requirements; and (c) continues to take steps to stabilize and increase revenues from the sale of its products.

There is no assurance as to when the adverse impact to the United States and worldwide economies resulting from the COVID-19 outbreak will be eliminated, if at all, and whether any new or recurring pandemic outbreaks will occur again in the future causing a similar or worse devastating impact to the United States and worldwide economies or our business.

Implications of Being a Smaller Reporting Company

We are a “smaller reporting company” as defined in Rule 12b-2 of the Exchange Act and have elected to take advantage of certain of the scaled disclosure available for smaller reporting companies.

Corporate Information

The Company was incorporated in the state of Nevada on August 9, 2011 under the name “Bespoke Tricycles Inc.,” changed its name to “Biotech Products Services and Research, Inc.” effective November 4, 2015,and assumed its current name of “Organicell Regenerative Medicine, Inc.”, by amendment to its Articles of Incorporation on June 20, 2018.

Our executive offices are located at 4045 Sheridan Avenue, Suite 239, Miami Beach, FL 33140 and our telephone number is (888) 963-7881. Our corporate website is www.organicell.com. Information appearing on our website is not part of this prospectus.

Selling Shareholders

The shares being sold were acquired by the selling shareholders from the Company in various transactions exempt from the registration requirements of the Securities Act pursuant to Section 4(a)(2) thereof and Regulation D thereunder, between March 2019 and May 2021. None of the selling shareholders has ever been an executive officer or director of the Company or has had a material relationship with us at any time within the past three (3) years.

The Offering

This prospectus relates to the resale from time to time by the selling shareholders named in this prospectus of 73,358,039 shares of our common stock, par value $0.001 per share. No shares are being offered for sale by the Company.

3

| Common stock offered by selling shareholders: | 73,358,039 shares of common stock | |

| Common stock outstanding as of the date of this prospectus: |

1,102,436,005 shares of common stock(1) | |

| Terms of the Offering: | The selling shareholders will determine when and how they will sell the shares of common stock offered in this prospectus. | |

| Use of Proceeds: | We will not receive any proceeds from the sale of common stock offered by the selling shareholders under this prospectus. | |

| Risk Factors: | The common stock offered hereby involves a high degree of risk and should not be purchased by investors who cannot afford the loss of their entire investment. These risks include, among others |

| · | Our history of losses, limited cash on hand and substantial doubt as to our ability to continue as a going concern; |

| · | Our limited operating history in our current business; |

| · | Our need for and the availability of additional capital; |

| · | The effects of the COVID-19 pandemic on our business, operations and financial condition; |

| · | Our dependence on our executive officers and key employees; |

| · | Our ability to compete effectively; |

| · | Our need for a steady supply of raw materials; |

| · | Potential obsolescence of our products; |

| · | Our ability to secure and protect our intellectual property; |

| · | Our need to comply with FDA and other significant government regulation; |

| · | The limited trading market for our common stock; and |

| · | The classification of our common stock as a “penny stock.” |

| (1) | Does not include (a) 50,000,000 shares of our common stock reserved for issuance upon the exercise of awards granted or which may be granted under our 2020 Stock Incentive Plan (the “Incentive Plan”); (b) 4,513,912 shares of our common stock reserved for issuance upon the exercise of awards granted or which may be granted under our Board Stock Compensation Plan (the “Board Plan”); (c) 582,500,000 shares of our common stock reserved for issuance upon the exercise of awards granted or which may be granted under our Management and Consultants Stock Performance Plan (“MCPP Plan”); and (d) 9,500,000 shares reserved for issuance upon the exercise of outstanding warrants. |

4

The following summary financial data should be read in conjunction with “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” and the Consolidated Financial Statements and Notes thereto, included elsewhere in this prospectus.

| For the Six Months Ended | For the Years Ended | |||||||||||||||

| April 30, | October 31, | |||||||||||||||

| Statement of Operations | 2021 | 2020 | 2020 | 2019 | ||||||||||||

| (Unaudited) | ||||||||||||||||

| Revenues | $ | 2,563,516 | $ | 1,305,178 | $ | 3,055,776 | $ | 1,702,271 | ||||||||

| Cost of revenues | 304,492 | 97,278 | 398,606 | 300,837 | ||||||||||||

| General and | ||||||||||||||||

| administrative expenses | 12,657,788 | 3,52,843 | 15,095,111 | 3,177,924 | ||||||||||||

| Other income (expense) | 9,264 | (60,741 | ) | 133,886 | (38,191 | ) | ||||||||||

| Income Tax Benefit/Provision | - | - | - | - | ||||||||||||

Net loss attributable to the non-controlling interest | - | - | - | 978 | ||||||||||||

| Net loss | $ | (10,389,500 | ) | $ | (2,159,404 | ) | $ | (12,582,967 | ) | $ | (1,737,321 | ) | ||||

| As of April 30, | As of October 31, | |||||||||||

| Balance Sheet Data | 2021 | 2020 | 2019 | |||||||||

| (Unaudited) | ||||||||||||

| Cash | $ | 195,915 | $ | 590,797 | $ | 132,557 | ||||||

| Total assets | $ | 1,308,167 | $ | 1,334,172 | $ | 649,073 | ||||||

| Total liabilities | $ | 3,826,620 | $ | 2,725,988 | $ | 2,211,622 | ||||||

| Total Stockholders’ deficit | $ | (2,518,453 | ) | $ | (1,391,816 | ) | $ | (1,562,549 | ) | |||

5

The shares of our common stock being offered for resale by the selling shareholders are highly speculative in nature, involve a high degree of risk and should be purchased only by persons who can afford to lose the entire amount invested in the common stock. Before purchasing any of the shares of common stock, you should carefully consider the following factors relating to our business and prospects. If any of the following risks actually occurs, our business, financial condition or operating results could be materially adversely affected. In such case, you may lose all or part of your investment. You should carefully consider the risks described below and the other information in this process before investing in our common stock.

Risks Related to the Company’s Business

We have incurred significant losses, have limited cash on hand and there is substantial doubt as to our ability to continue as a going concern.

The Company incurred net losses of $12,437,941 and $1,776,490 for the years ended October 31, 2020 and October 31, 2019, respectively and $8,165,361 and $688,785 for the six months ended April 30, 2021 and April 30, 2020, respectively. In addition, the Company had accumulated deficits of $32,257,689 and $28,868,189 at January 31, 2021 and October 31, 2020, respectively and negative working capital positions of $2,978,179 and $1,693,741 at April 30, 2021 and October 31, 2020, respectively. In their report for the fiscal year ended October 31, 2020, our auditors have expressed that there is substantial doubt as to our ability to continue as a going concern. We have incurred operating losses since our formation and expect to incur substantial losses and negative operating cash flows for the foreseeable future and may never become profitable. We also expect to continue to incur significant operating and capital expenditures for the next several years and anticipate that our expenses will increase substantially in the foreseeable future. We also expect to experience negative cash flow for the foreseeable future as we fund our operating losses and capital expenditures. As a result, we will need to generate significant revenues in order to achieve and maintain profitability. We may not be able to generate these revenues or achieve profitability in the future. Our failure to achieve or maintain profitability could negatively impact the value of our common stock.

We have a limited operating history in our current business upon which investors can evaluate our future prospects.

Our current business operations, including our laboratory and processing facility only began operations in May 2019. Therefore, we have limited operating history upon which an evaluation of our current business plan or performance and prospects can be made. The business and prospects of the Company must be considered in the light of the potential problems, delays, uncertainties and complications encountered in connection with a newly established business. The risks include, but are not limited to, the possibility that we will not be able to develop or identify functional and scalable products and services, or that although functional and scalable, our products and services will not be economical to market; that our competitors hold proprietary rights that preclude us from marketing such products; that our competitors market a superior or equivalent product; that we are not able to upgrade and enhance our technologies and products to accommodate new features and expanded service offerings; or the failure to receive necessary regulatory clearances for our products. To successfully introduce and market our products at a profit, we must establish brand name recognition and competitive advantages for our products. There are no assurances that the Company can successfully address these challenges. If it is unsuccessful, the Company and its business, financial condition and operating results could be materially and adversely affected.

Given the limited operating history, management has little basis on which to forecast future demand for our products from our existing customer base, much less new customers. The current and future expense levels of the Company are based largely on estimates of planned operations and future revenues rather than experience. It is difficult to accurately forecast future revenues because the business of the Company is new, and its market has not been developed. If the forecasts for the Company prove incorrect, the business, operating results and financial condition of the Company will be materially and adversely affected. Moreover, the Company may be unable to adjust its spending in a timely manner to compensate for any unanticipated reduction in revenue. As a result, any significant reduction in revenues would immediately and adversely affect the business, financial condition and operating results of the Company.

6

The ongoing COVID-19 outbreak and economic crisis has caused a significant disruption to the overall economy and there is no certainty as to when or how the situation will evolve, including whether or not the virus will be controlled and/or the state of our economy and business environment upon emerging from the crisis.

The current outbreak of the novel coronavirus (“COVID-19”) and resulting impact to the United States economic environment began to take hold during March 2020. The adverse public health developments and economic effects of the COVID-19 outbreak in the United States, have adversely affected the demand for our products and services by our customers and from patients of our customers as a result of quarantines, facility closures and social distancing measures put into effect in connection with the COVID-19 outbreak and which currently still continue to have a negative impact to our business and the economy. These restrictions have adversely affected the Company’s sales, results of operations and financial condition. In response to the COVID-19 outbreak, the Company (a) has accelerated its research and development activities, particularly in regards to potential health benefits of the Company’s products in addressing various health concerns associated with COVID-19; and (b) is seeking to raise additional debt and/or equity financing to support working capital requirements until sale for its products to providers resumes to levels pre COVID-19.

There is no assurance as to when the adverse impact to the United States and worldwide economies resulting from the COVID-19 outbreak will be eliminated, if at all, and whether any new or recurring pandemic outbreaks will occur again in the future causing similar or worse devastating impact to the United States and worldwide economies and our business.

There is no assurance that the COVID-19 crisis will be fully resolved or if resolved, that the overall economy will resume in a manner that allows the Company to resume operations as planned. We may not be able to generate revenues or achieve profitability in the future. Our failure to achieve or maintain profitability could negatively impact the value of our common stock.

We recently received a subpoena from the Atlanta Regional Office of the SEC and while we are complying with the subpoena, there can be no assurances as to the final outcome of the SEC’s investigation, or the impact, if any of this investigation or any proceedings on the Company’s current business, financial condition, results of operations, cash flows, or the Company’s future operations.

On June 17, 2021, Organicell received a subpoena dated June 14, 2021, from the Atlanta Regional Office of the SEC requiring the production of certain documents and communications in connection with the treatment and results of various COVID-19 patients, as discussed in the Company’s Current Reports on Form 8-K filed with the SEC during the period from May 27, 2020 through May 11, 2021. The Company intends to fully cooperate with the SEC’s investigation and believes that it will be able to provide all of the information requested by the SEC. The Company can make no assurances as to the time or resources that will need to be devoted to this investigation or its final outcome, or the impact, if any, of this investigation or any proceedings on the Company’s current business, financial condition, results of operations, cash flows, or the Company’s future operations.

We depend upon our officers and key personnel, the loss of which could seriously harm our business.

Our operating performance is substantially dependent on the continued services of our executive officers and key employees, in particular, Albert Mitrani, our Chief Executive Officer and President; and Ian T. Bothwell, our Chief Financial Officer. The unexpected loss of the services of any of them could have a material adverse effect on our business, operations, financial condition and operating results, as well as the value of our common stock.

We may not be able to compete successfully with current and future competitors.

We have many potential competitors in the regenerative medicine industry. We will compete, in our current and proposed businesses, with other established companies, most of which have far greater marketing and financial resources and experience than we do. We cannot guarantee that we will be able to penetrate our intended markets and be able to compete profitably, if at all. In addition to established competitors, there are moderate obstacles for competitors to enter this market, but they are not insurmountable if they have the financial resources and intellectual team. Effective competition could result in price reductions, reduced margins or have other negative implications, any of which could adversely affect our business and chances for success. Competition is likely to increase significantly as new companies enter the market and current competitors expand their services. Many of these potential competitors are likely to enjoy substantial competitive advantages, including, but not limited to, larger staffs, greater name recognition, larger and established customer bases and substantially greater financial, marketing, technical and other resources. To be competitive, we must respond promptly and effectively to industry dynamics, evolving standards and competitors’ innovations by continuing to enhance our services and sales and marketing channels. Any pricing pressures, reduced margins or loss of market share resulting from increased competition, or our failure to compete effectively, could fatally damage our business and chances for success.

We currently rely on non-exclusive supply arrangements with birth tissue recovery companies for obtaining the raw material used in manufacturing the products we sell.

If our current supply arrangements with birth tissue recovery companies or third party manufacturers or distributors of products from third party manufacturers are disrupted for any reason, we may not be able to provide products to our customers, or if other supply arrangements can be made, the products and terms may not be as favorable, and that will adversely impact our operations and profitability.

7

If we do not continually update our products and/or services, they may become obsolete and we may not be able to compete with other companies.

We cannot assure you that we will be able to keep pace with technological advances, or that our current suppliers will be able to keep pace with technological advances and as such, our products and/or services may become obsolete. We cannot assure you that competitors will not develop related or similar services and offer them before we do, or do so more successfully, or that they will not develop services and products more effective than any that we and/or our suppliers have or are intending to develop. In addition, although we may be able to identify new suppliers that can provide more effective services and products to be more competitive, we may not be able to arrange satisfactory arrangements in a timely manner, if at all. If that happens, our business, prospects, results of operations and financial condition will be materially adversely affected.

We enter into supply arrangements for the raw materials and/or products we sell, which make us vulnerable to the ability of such suppliers to remain current and innovative in their product offerings, to timely process and supply the products we desire to purchase, and to remain compliant with the current and changing regulatory environment. If our raw material and/or product suppliers are not successful in managing these responsibilities, it will have an adverse effect on our operations and profitability.

Our current birth tissue supply arrangements for manufacturing the products we sell and our third-party supply arrangements for the supply of products we sell provide for the supply and pricing for those products. There can be no assurance that our suppliers will continue to produce the products that we currently purchase under our existing arrangements, that our suppliers will be able to comply with the required FDA regulations for the manufacturing of such products, that our suppliers will continue to develop technology associated with their manufactured products to remain competitive with other companies, or that our suppliers will remain a going concern in the future. If any of our suppliers were to cause a disruption in our ability to obtain products as desired and expected and/or we are not provided advance notice of such potential disruption, we may not be able to timely identify and replace our current suppliers, if at all, and as a result, we may not be able to provide products to our customers, which will have an adverse impact to our operations.

In the event of default under our outstanding indebtedness, or we are unable to pay other obligations and accounts payable when due, our creditors may file a creditors petition or force us into involuntary bankruptcy which may have an adverse impact on our business.

The Company had a negative working capital positions of $2,978,179 and $1,693,741 at April 30, 2021 and October 31, 2020, respectively. In addition, the COVID-19 outbreak during March 2020 and the resulting adverse public health developments and economic effects to the United States business environments have adversely affected the demand for our products and services by our customers and from patients of our customers as a result of quarantines, facility closures and social distancing measures put into effect in connection with the COVID-19 outbreak and which currently still continue to have a negative impact to our business and the economy. The Company’s efforts to establish a stabilized source of sufficient revenues to cover operating costs has yet to be achieved and ultimately may prove to be unsuccessful unless additional sources of working capital through operations or debt and/or equity financings are realized. The Company has not repaid its outstanding indebtedness on the required due dates and the loans remain still outstanding. Management anticipates that the Company will remain dependent, for the near future, on additional investment capital to fund ongoing operating expenses. The Company does not have significant fixed and/or intangible assets to pledge for the purpose of borrowing additional capital. In addition, the Company relies on short term supply agreements to obtain the supply of raw materials used in manufacturing the products it currently sells and distributes to its customers. The Company’s current market capitalization and common stock liquidity will hinder its ability to raise equity proceeds to implement its business plan and could adversely affect the value of our securities, including the common stock.

8

We may be required to borrow funds in the future.

If the Company incurs indebtedness, a portion of its cash flow will have to be dedicated to the payment of principal and interest on such indebtedness. Typical loan agreements also might contain restrictive covenants, which may impair the Company’s operating flexibility. Such loan agreements would also provide for default under certain circumstances, such as failure to meet certain financial covenants. A default under a loan agreement could result in the loan becoming immediately due and payable and, if unpaid, a judgment in favor of such lender which would be senior to the rights of the Company’s stockholders. A judgment creditor would have the right to foreclose on any of the Company’s assets resulting in a material adverse effect on the Company’s business, operating results or financial condition.

Currently the Company has limited assets which could be used as collateral in obtaining future borrowings. Because of the Company’s inability to provide lenders with collateral and a limited history of successful operations, the Company may not be successful in its efforts to obtain additional funds though borrowings and as a result may not be able to fund required costs of operations.

Our growth depends on external sources of capital, which may not be available on favorable terms or at all.

Our access to capital will depend upon a number of factors over which we have little or no control, including general market conditions, government regulations and the market’s perception of our current and potential future earnings. If general economic instability or downturn leads to an inability to borrow at attractive rates or at all, our ability to obtain capital to finance working capital requirements could be negatively impacted.

If we are unable to obtain capital on terms and conditions that we find acceptable, we likely will have to scale back our business operations. In addition, our ability to refinance all or any debt we may incur in the future, on acceptable terms or at all, is subject to all of the above factors, and will also be affected by our future financial position, results of operations and cash flows, which additional factors are also subject to significant uncertainties, and therefore we may be unable to refinance any debt we may incur in the future, as it matures, on acceptable terms or at all. All of these events would have a material adverse effect on our business, financial condition, liquidity and results of operations.

Failure to establish or enhance our brand recognition could have a material adverse effect on our business and results of operations.

We believe we will need to expend significant time, effort and resources to enhance the recognition of our brands. We believe developing our brand will be important to our sales and marketing efforts. If we fail to establish or enhance the recognition of our brands, it could have a material adverse effect on our ability to sell our products and adversely affect our business and results of operations. If we fail to develop a positive public image and reputation, our business with our existing customers could decline and we may fail to develop additional business, which could adversely affect our results of operations.

Defects in the products we sell or failures in quality control related to our distribution of products could impair our ability to sell our products or could result in product liability claims, litigation and other significant events involving substantial costs.

Detection of any significant defects in our products that we sell or failure in our quality control procedures or the quality control procedures of our suppliers may result in, among other things, delay in time-to-market, loss of sales and market acceptance of our products, diversion of development resources, injury to our reputation and restrictions imposed by governmental agencies. The costs we may incur in correcting any product defects may be substantial and we may not be able to identify adequate remedies, if required. Additionally, errors, defects or other performance problems could result in financial or other damages to our customers, which could result in litigation. Product liability litigation, even if we prevail and/or our suppliers, would be time consuming and costly to defend, and if we and/or our product suppliers do not prevail, could result in the imposition of a damages award. We presently maintain product liability insurance and we are named insured on our suppliers’ insurance policy; however, it may not be adequate to cover any claims.

9

Our ability to become profitable and continue as a going concern will be dependent on our ability to attract, employ and retain highly skilled individuals to serve our clients.

The nature of our business requires that we employ skilled persons to perform highly skilled and specialized tasks for our Company. Our failure to retain such personnel could have a material adverse effect on our ability to offer services to clientele and could potentially have a negative effect on our business. There is no guarantee that skilled persons will be available and willing to work for us in the future, nor is there any guarantee that we could afford to retain them if they are available at a future time.

We may not be able to manage our growth effectively.

We must continually implement and improve our products and/or services, operations, operating procedures and quality controls on a timely basis, as well as expand, train, motivate and manage our work force in order to accommodate anticipated growth and compete effectively in our market segment. Successful implementation of our strategy also requires that we establish and manage a competent, dedicated work force and employ additional key employees in corporate management, product development, client service and sales. We can give no assurance that our personnel, systems, procedures and controls will be adequate to support our existing and future operations. If we fail to implement and improve these operations, there could be a material, adverse effect on our business, operating results and financial condition.

If we make any acquisitions or enter into a merger or similar transaction, our business may be negatively impacted.

We have no present plans for any specific acquisition. However, in the event that we make acquisitions in the future, we could have difficulty integrating the acquired companies’ personnel and operations with our own. In addition, the key personnel of the acquired business may not be willing to work for us. We cannot predict the effect expansion may have on our core business. Regardless of whether we are successful in making an acquisition, the negotiations could disrupt our ongoing business, distract our management and employees and increase our expenses. In addition to the risks described above, acquisitions, mergers and other similar transactions are accompanied by a number of inherent risks, including, without limitation, the following:

| ● | the difficulty of integrating acquired products, services or operations; | |

| ● | the potential disruption of the ongoing businesses and distraction of our Management and the management of acquired companies; | |

| ● | the difficulty of incorporating acquired rights or products into our existing business; | |

| ● | difficulties in disposing of the excess or idle facilities of an acquired company or business and expenses in maintaining such facilities; | |

| ● | difficulties in maintaining uniform standards, controls, procedures and policies; | |

| ● | the potential impairment of relationships with employees and customers as a result of any integration of new management personnel; | |

| ● | the potential inability or failure to achieve additional sales and enhance our customer base through cross-marketing of the products to new and existing customers; | |

| ● | the effect of any government regulations which relate to the business acquired; and | |

| ● | potential unknown liabilities associated with acquired businesses or product lines, or the need to spend significant amounts to retool, reposition or modify the marketing and sales of acquired products or the defense of any litigation, whether or not successful, resulting from actions of the acquired company prior to our acquisition. |

10

Our business could be severely impaired if and to the extent that we are unable to succeed in addressing any of these risks or other problems encountered in connection with these acquisitions, many of which cannot be presently identified, these risks and problems could disrupt our ongoing business, distract our management and employees, increase our expenses and adversely affect our results of operations.

There might be unanticipated obstacles to the execution of our business plan.

The Company’s business plans may change significantly. The Company’s potential business endeavours are capital intensive. Management believes that the Company’s chosen activities and strategies are achievable in light of current economic and legal conditions with the skills, background, and knowledge of the Company’s principals and advisors. Management reserves the right to make significant modifications to the Company’s stated strategies depending on future events.

We may engage in transactions that present conflicts of interest.

The Company’s officers and directors may enter into agreements with the Company from time to time which may not be equivalent to similar transactions entered into with an independent third party. A conflict of interest arises whenever a person has an interest on both sides of a transaction. While we believe that it will take prudent steps to ensure that all transactions between the Company and any officer or director is fair, reasonable, and no more than the amount it would otherwise pay to a third party in an “arms-length” transaction, there can be no assurance that any transaction will meet these requirements in every instance.

Our operating results may fluctuate significantly as a result of a variety of factors, many of which are outside of our control.

We are subject to the following factors, among others, that may negatively affect our operating results:

| ● | The announcement or introduction of new products by our competitors; |

| ● | Failure of Government and private health plans to adequately and timely reimburse the users of our products; |

| ● | Our ability to upgrade and develop our systems and infrastructure to accommodate growth; |

| ● | Our ability to attract and retain key personnel in a timely and cost-effective manner; |

| ● | The amount and timing of operating costs and capital expenditures relating to the expansion of our business, operations and infrastructure; |

| ● | Regulation by Federal, State or Local Governments; and |

| ● | General economic conditions (including fallout from current and future pandemics) as well as economic conditions specific to the healthcare industry. |

We have based our current and future expense levels largely on our investment plans and estimates of future events, although certain of our expense levels are, to a large extent, fixed. We may be unable to adjust spending in a timely manner to compensate for any unexpected revenue shortfall. Accordingly, any significant shortfall in revenue relative to our planned expenditures would have an immediate adverse effect on our business, results of operations and financial condition. Further, as a strategic response to changes in the competitive environment, we may from time to time make certain pricing, service or marketing decisions that could have a material and adverse effect on our business, results of operations and financial condition. Due to the foregoing factors, our revenue and operating results are and will remain difficult to forecast.

11

We are in a highly competitive and evolving field and face competition from well-established tissue processors and medical device manufacturers, as well as new market entrants.

Our business is in a very competitive and evolving field. Competition from other tissue processors, medical device companies and from research and academic institutions is intense, expected to increase, subject to rapid change, and could be significantly affected by new product introductions. The presence of this competition in our market may lead to pricing pressure, which would make it more difficult to sell our products at a price that will make us profitable or prevent us from selling our products at all. Our success will depend on our ability and/or the ability of our suppliers to perfect and protect their intellectual property rights related to their technologies as well as to develop new technologies and new applications for our technologies. Our failure to compete effectively would have a material and adverse effect on our business, results of operations and financial condition.

Rapid technological change could cause our products to become obsolete.

The technologies underlying the products we sell and intend to sell are subject to rapid and profound technological change. Competition intensifies as technical advances in each field are made and become more widely known. We can give no assurance that our suppliers will be able to develop services, products, or processes with significant advantages over the competing products, services, and processes. Any such occurrence could have a material and adverse effect on our business, results of operations and financial condition.

Our products are dependent on the availability of sufficient quantities of tissue from human donors, and any disruption in supply could adversely affect our business.

The success of the human tissue products we sell depends upon, among other factors, the availability of sufficient quantities of tissue from human donors. The availability of donated tissue could be adversely impacted by regulatory changes, public opinion of the donor process as well as our and our suppliers’ reputations in the industry. Any disruption in the supply of donated human tissue could restrict our growth and could have a material adverse impact on our business and financial condition. We cannot be sure that the supply of human tissue will continue to be available at current levels or will be sufficient to meet our future needs.

The products we offer are derived from human tissue and therefore have the potential for disease transmission.

The utilization of human tissue creates the potential for transmission of communicable disease, including, but not limited to, HIV, viral hepatitis, syphilis and other viral, fungal or bacterial pathogens. Our suppliers are required to comply with federal and state regulations intended to prevent communicable disease transmission.

Although we believe that our suppliers maintain strict quality controls over the procurement and processing of the human tissue used to make the products we sell, there is no assurance that these quality controls are or will continue to be adequate. In addition, negative publicity concerning disease transmission from other companies improperly processed donated tissue could have a negative impact on the demand for our products.

In order to grow revenues from certain of our products, we must expand our relationships with distributors and independent sales representatives.

We derive significant revenues through our relationships with distributors and independent sales representatives. If such relationships were terminated for any reason, it could materially and adversely affect our ability to generate revenues and profits. We intend to obtain the assistance of additional distributors and independent sales representatives to continue our sales growth with respect to certain of our products. We may not be able to find additional distributors and independent sales representatives who will agree to market and/or distribute those products on commercially reasonable terms, if at all. In addition, adding new distributors and independent sales representatives require additional administrative and accounting efforts for which the Company may not have sufficient resources to manage effectively. If we are unable to establish new distribution and independent sales representative relationships or renew current distribution and sales agency agreements on commercially acceptable terms or manage the growth effectively, our business, financial condition and results of operations could be materially and adversely affected.

12

We continue to invest significant capital in expanding our internal sales force, and there can be no assurance that these efforts will continue to result in significant increases in sales.

We are engaged in a major initiative to build and further expand our internal sales and marketing capabilities which has contributed to our increased sales. As a result, we continue to invest in a direct sales force for certain of our products to allow us to reach new customers. These expenses impact our operating results, and there can be no assurance that we will continue to be successful in significantly expanding the sales of our products.

Our revenues may need to depend on adequate reimbursement from public and private insurers and health systems.

Currently, a significant number of public and private insurers and health systems currently do not provide reimbursement for our products. Our success and extent of our growth depends on the extent to which reimbursement for the costs of our products and related treatments will be available from third party payers, such as public and private insurers and health systems. Government and other third-party payers attempt to contain healthcare costs by limiting both coverage and the level of reimbursement of new products. Therefore, significant uncertainty usually exists as to the reimbursement status of new healthcare products. If we are not successful in obtaining adequate reimbursement for our products from these third-party payers, the market's acceptance of our products could be adversely affected. Inadequate reimbursement levels also likely would create downward price pressure on our products. Even if we do succeed in obtaining widespread reimbursement for our products, future changes in reimbursement policies could have a negative impact on our business, financial condition and results of operations.

To be commercially successful, we must convince physicians that our products are compliant with regulations, safe and effective alternatives to existing treatments and that our products should be used in their procedures.

We believe physicians will only adopt our products if they determine, based on experience, clinical data and published peer reviewed journal articles, that the use of our products in a particular procedure is a favorable alternative to conventional methods. Physicians may be slow to change their medical treatment practices for the following reasons, among others:

| ● | Their lack of experience with prior procedures in the field using our products; |

| ● | Lack of evidence supporting additional patient benefits and our products over conventional methods; |

| ● | Perceived liability risks generally associated with the use of new products and procedures; |

| ● | Perceived exposure from regulatory agencies that monitor the use of our products; |

| ● | Limited availability of reimbursement from third party payers; and |

| ● | The time that must be dedicated to training. |

In addition, we believe recommendations for and support of our products by influential physicians are essential for market acceptance and adoption. If we do not receive this support or if we are unable to demonstrate favorable long-term clinical data, physicians and hospitals may not use our products, which would significantly reduce our ability to achieve expected revenue and would prevent us from sustaining profitability.

We will need to expand our organization and managing growth may be more difficult than expected.

Managing our growth may be more difficult than we expect. We anticipate that a period of significant expansion will be required to penetrate and service the market for our existing and anticipated future products and to continue to develop new products. This expansion will place a significant strain on management, operational and financial resources. To manage the expected growth of our operations and personnel, we must both modify our existing operational and financial systems, procedures and controls and implement new systems, procedures and controls. We must also expand our finance, administrative, and operations staff. Management may be unable to hire, train, retain, motivate and manage necessary personnel or to identify, manage and exploit existing and potential strategic relationships and market opportunities.

13

We may be unable to obtain or maintain adequate product liability insurance.

Our business exposes us to the risk of product liability claims that are inherent in the manufacturing, processing and marketing of human tissue products. We may be subject to such claims if the products we sell cause, or appear to have caused, an injury. Claims may be made by patients, healthcare providers or others selling our products. We currently maintain product liability insurance that contain limits of coverage for the insured. Defending a lawsuit, regardless of merit, could be costly, divert management attention and result in adverse publicity, which could result in the withdrawal of, or reduced acceptance of, our products in the market. There can be no assurance that adequate insurance will be available in the event of a lawsuit, if at all. A product liability claim could result in significant costs and significant harm to our business.

We may implement a product recall or voluntary market withdrawal, which could significantly increase our costs, damage our reputation and disrupt our business.

The manufacturing, marketing and processing of the tissue products we sell or intend to sell involve an inherent risk that they do not meet applicable quality standards and requirements. In that event, there may be recall or market withdrawal required by a regulatory authority. A recall or market withdrawal of one of our products would be costly and would divert management resources. A recall or withdrawal of one of the products we sell, or a similar product processed, also could impair sales of our products as a result of confusion concerning the scope of the recall or withdrawal, or as a result of the damage to our reputation for quality and safety.

Significant disruptions of information technology systems or breaches of information security could adversely affect our business.

We rely to a large extent upon sophisticated information technology systems to operate our business. In the ordinary course of business, we collect, store and transmit large amounts of confidential information (including, but not limited to, personal information and intellectual property). We also have outsourced significant elements of our operations to third parties, including significant elements of our information technology infrastructure and, as a result, we are managing many independent vendor relationships with third parties who may or could have access to our confidential information. The size and complexity of our information technology and information security systems, and those of our third-party vendors with whom we contract (and the large amounts of confidential information that is present on them), make such systems potentially vulnerable to service interruptions or to security breaches from inadvertent or intentional actions by our employees or vendors, or from malicious attacks by third parties. Such attacks are of ever-increasing levels of sophistication and are made by groups and individuals with a wide range of motives (including, but not limited to, industrial espionage and market manipulation) and expertise. While we have invested significantly in the protection of data and information technology, there can be no assurance that our efforts will prevent service interruptions or security breaches. Although we may obtain cyber-insurance coverage that may cover certain events described above, this insurance is subject to deductibles and coverage limitations and we may not be able to maintain this insurance. Also, it is possible that claims could exceed the limits of our coverage. Any interruption or breach in our systems could adversely affect our business operations and/or result in the loss of critical or sensitive confidential information or intellectual property, and could result in financial, legal, business and reputational harm to us or allow third parties to gain material, inside information that they use to trade in our securities.

New lines of business or new products and services may subject us to additional risks.

From time to time, we may implement or may acquire new lines of business or offer new products and services within existing lines of business. There are risks and uncertainties associated with these efforts, particularly in instances where the markets are not fully developed or are evolving. In developing and marketing new lines of business and new products and services, we may invest significant time and resources. External factors, such as regulatory compliance obligations, competitive alternatives, and shifting market preferences, may also impact the successful implementation of a new line of business or a new product or service. Failure to successfully manage these risks in the development and implementation of new lines of business or new products or services could have a material adverse effect on our business, results of operations and financial condition.

14

Risks Related to Our Intellectual Property

If we are unable to adequately protect our intellectual property, our ability to compete in the market will be harmed.

Our commercial success will depend in part on patents and other intellectual property protection. We have applied for and obtained a provisional patent, plan to file for additional patents with respect to our products and intend to defend our patents and other intellectual property against third party challenges. However, there can be no assurance that any patents applied for will be issued, that scope of protection afforded by any patents issued will be as broad as claimed or if challenged, patents may be found to be invalid or unenforceable. Moreover, there can be no assurance that we will have the financial resources to protect our intellectual property

There can be no assurances of protection for proprietary rights or reliance on trade secrets.

In certain cases, the Company may rely on trade secrets to protect intellectual property, proprietary technology and processes, which the Company has acquired, developed or may develop in the future. There can be no assurances that secrecy obligations will be honored or that others will not independently develop similar or superior products or technology. The protection of intellectual property and/or proprietary technology through claims of trade secret status has been the subject of increasing claims and litigation by various companies both in order to protect proprietary rights as well as for competitive reasons even where proprietary claims are unsubstantiated. The prosecution of proprietary claims or the defense of such claims is costly and uncertain given the uncertainty and rapid development of the principles of law pertaining to this area. The Company, in common with other firms, may also be subject to claims by other parties with regard to the use of intellectual property, technology information and data, which may be deemed proprietary to others.

Our suppliers’ ability to protect their intellectual property and proprietary technology through patents and other means is uncertain and may be inadequate, which could have a material and adverse effect on us.

We depend significantly on our suppliers’ ability to protect their proprietary rights to the technologies used in the products we purchase from them and resell. Traditional legal means afford only limited protection and may not adequately protect their rights or permit them to gain or keep any competitive advantage. To the extent that they are unable to protect their intellectual property against infringement by others or by claims of infringement by such suppliers, our business could be materially adversely affected.

We may be subject to damages resulting from claims that we, our employees, or our independent contractors have wrongfully used or disclosed alleged trade secrets of others.

Some of our employees were previously employed at other medical device or tissue companies. We may also hire additional employees who are currently employed at other medical device or tissue companies, including our competitors. Additionally, consultants or other independent agents with which we may contract may be or have been in a contractual arrangement with one or more of our competitors. Although no claims against us are currently pending, we may be subject to claims that these employees or independent contractors have used or disclosed any party's trade secrets or other proprietary information. Litigation may be necessary to defend against these claims. Even if we are successful in defending against these claims, litigation could result in substantial costs and be a distraction to management. If we fail to defend such claims, in addition to paying monetary damages, we may lose valuable intellectual property rights or personnel. A loss of key personnel or their work product could hamper or prevent our ability to market existing or new products, which could severely harm our business.

Risks Related to Regulatory Approval of Our Products and Other Government Regulation

Our business is subject to continuing regulatory compliance by the FDA and other authorities, which is costly and our failure to comply could result in negative effects on our business.

The FDA has specific regulations governing our tissue-based products, or HCT/Ps. The FDA has broad post-market and regulatory and enforcement powers. The FDA's regulation of HCT/Ps includes requirements for registration and listing of products, donor screening and testing, processing and distribution (“Current Good Tissue Practices”), labeling, record keeping and adverse-reaction reporting, and inspection and enforcement.

15

Biologics and medical devices are subject to even more stringent regulation by the FDA. Even if pre-market clearance or approval is obtained, the approval or clearance may place substantial restrictions on the indications for which the product may be marketed or to whom it may be marketed, may require warnings to accompany the product or impose additional restrictions on the sale and/or use of the product. In addition, regulatory approval is subject to continuing compliance with regulatory standards, including the FDA's quality system regulations.

If we fail to comply with the FDA regulations regarding our tissue products or medical devices, the FDA could take enforcement action, including, without limitation, any of the following sanctions and the manufacture of our products or processing of our tissue could be delayed or terminated:

| ● | Untitled letters, warning letters, fines, injunctions, and civil penalties; |

| ● | Recall or seizure of our products; |

| ● | Operating restrictions, partial suspension or total shutdown of production; |

| ● | Refusing our requests for clearance or approval of new products; |

| ● | Withdrawing or suspending current applications for approval or approvals already granted; |

| ● | Refusal to grant export approval for our products; and |

| ● | Criminal prosecution. |

It is likely that the FDA's regulation of HCT/Ps will continue to evolve in the future. Complying with any such new regulatory requirements may entail significant time delays and expense, which could have a material adverse effect on our business. The AATB has issued operating standards for tissue banking. Compliance with these standards is a requirement in order to become an accredited tissue bank. In addition, some states have their own tissue banking regulations.

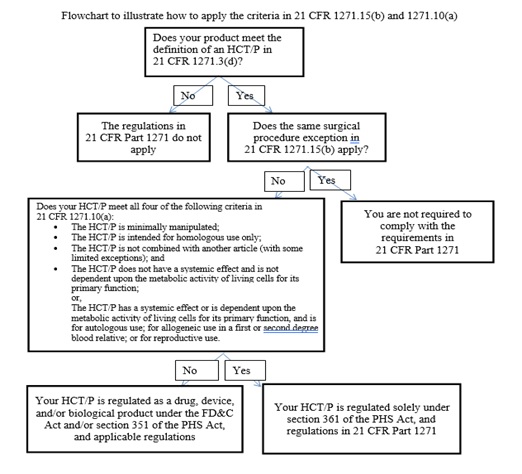

In November 2017, the FDA released four guidance documents (two final, two draft) in an effort to implement a “comprehensive policy framework” for existing laws and regulations governing regenerative medicine products, including HCT/Ps. These guidance documents build upon the previous regulatory framework for these products, which was completed in 2005. The comprehensive regenerative medicine policy framework intends to spur innovation, efficient access to potentially transformative products, while ensuring safety and efficacy.