Attached files

| file | filename |

|---|---|

| EX-32.1 - Organicell Regenerative Medicine, Inc. | ex32-1.htm |

| EX-31.2 - Organicell Regenerative Medicine, Inc. | ex31-2.htm |

| EX-31.1 - Organicell Regenerative Medicine, Inc. | ex31-1.htm |

| EX-21.1 - Organicell Regenerative Medicine, Inc. | ex21-1.htm |

| EX-3.3 - Organicell Regenerative Medicine, Inc. | ex3-3.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| [X] | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended: October 31, 2016

| [ ] | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from: _____________________

Commission file number: 000-55008

BIOTECH PRODUCTS SERVICES AND RESEARCH, INC.

(Exact name of registrant as specified in its charter)

| Nevada | 47-4180540 | |

| (State or other jurisdiction of | (I.R.S. Employer | |

| incorporation or organization) | Identification No.) |

4045 Sheridan Ave, Suite 239

Miami, FL 33140

(Address of principal executive offices)

(888) 963-7881

(Issuer’s telephone number)

Securities registered under Section 12(b) of the Act:

| Title of each class | Name of each exchange on which registered | |

| None | N/A |

Securities registered under Section 12(g) of the Act:

Common Stock, $0.001 par value

(Title of class)

With a copy to:

Philip Magri, Esq.

Magri Law, LLC

2642 NE 9th Avenue

Fort Lauderdale, FL 33334

T: (646) 502-5900

F: (646) 826-9200

pmagri@magrilaw.com

www.MagriLaw.com

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes [ ] No [X]

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes [ ] No [X]

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes [ ] No [X]

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 229.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes [ ] No [X]

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K.

[ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “non-accelerated filer”, “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer | [ ] | Accelerated filer | [ ] | ||

| Non-accelerated filer | [ ] | Smaller reporting company | [ ] | ||

| Emerging growth company | [X] |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange act. [X]

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes [ ] No [X]

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of the registrant’s most recently completed second fiscal quarter. $723,724 based on the closing price of $0.028 per share of Common Stock and 25,847,294 shares of Common Stock of the Registrant held by non-affiliates on April 29, 2016, the last business day of the Registrant’s mostly recently completed second fiscal quarter.

As of July 7, 2017, there were 111,464,982 shares of Common Stock, $0.001 par value per share, issued and outstanding.

DOCUMENTS INCORPORATED BY REFERENCE: None

TABLE OF CONTENTS

| 2 |

This Annual Report on Form 10-K and certain information incorporated herein by reference contain forward-looking statements and information within the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, and Section 21E of the Securities Exchange Act of 1934. This information includes assumptions made by, and information currently available to management, including statements regarding future economic performance and financial condition, liquidity and capital resources, acceptance of our products by the market, and management’s plans and objectives. In addition, certain statements included in this and our future filings with the Securities and Exchange Commission (“SEC”), in press releases, and in oral and written statements made by us or with our approval, which are not statements of historical fact, are forward-looking statements. Words such as “may,” “could,” “should,” “would,” “believe,” “expect,” “expectation,” “anticipate,” “estimate,” “intend,” “seeks,” “plan,” “project,” “continue,” “predict,” “will,” “should,” and other words or expressions of similar meaning are intended by us to identify forward-looking statements, although not all forward-looking statements contain these identifying words. These forward-looking statements are found at various places throughout this report and in the documents incorporated herein by reference. These statements are based on our current expectations about future events or results and information that is currently available to us, involve assumptions, risks, and uncertainties, and speak only as of the date on which such statements are made.

Forward-looking statements include, but are not limited to, the following:

| ● | Our products’ advantages; |

| ● | Expectations regarding our future growth; |

| ● | Expectations regarding available cash resources to fund current operations and future growth; |

| ● | Our ability to receive regulatory approvals; |

| ● | Market opportunities for our services and products; |

| ● | Our ability to compete effectively; |

| ● | Our ability to respond to market forces; and |

| ● | Our ability to protect our intellectual property. |

Actual results and outcomes may differ materially from those expressed or implied in these forward-looking statements. Factors that may cause such a difference include, but are not limited to, those discussed in Part I, Item 1A, “Risk Factors,” below. Except as expressly required by the federal securities laws, we undertake no obligation to update any such factors, or to publicly announce the results of, or changes to any of the forward-looking statements contained herein to reflect future events, developments, changed circumstances, or for any other reason.

Unless otherwise noted, as used herein, the terms “Biotech Products Services and Research”, “BPSR”, the “Company”, “we”, “our” and “us” refer to Biotech Products Services and Research, Inc., a Nevada corporation, and its subsidiaries consolidated as a combined entity.

Overview

Since the change in control of our Company in June 2015 and change in the Company’s operations in July 2015, we have been engaged in the health care industry, principally focusing on supplying products and services related to the growing field of regenerative anti-aging medicine (“RAAM”). Our goal is to supply newly designed advanced biologically processed cellular and tissue-based products developed from internally-based research and development activities and/or from other state-of-the-art RAAM-related products developed by third parties under exclusive supply arrangements and to provide other related services used in the growing health care field of regenerative medicine (“RAAM Products”). We intend to distribute the RAAM Products and market RAAM-related services to the health care industry and a referral network of doctors and clinics (collectively, the “Providers”). In connection with the recent introduction of our newly developed product, Regen Anu Rheo, in February 2017, and our future products anticipated to be developed, we have implemented an in-house sales force and have commenced arrangements with newly identified independent distributors.

| 3 |

From July 2015 to October 2016, the Company’s main revenue stream was generated from patient referral fees and sales of products that were solely obtained through supply arrangements with third party manufacturers. Revenues from these activities during the fiscal year ended October 31, 2016 did not increase as projected primarily due to the Company’s ongoing cash restraints which limited the ability of the Company to attract and retain sales related personnel and the level of advertising and social media marketing efforts that could be deployed towards increasing revenues. In addition, costs charged from the suppliers of the Company’s products were higher than projected due to the Company’s inability to provide certain minimum guaranteed purchase commitments, which further impacted the Company’s ability to attract distributors to supply and market its products, primarily due to the lower commissions that could be offered to the potential distributors as a result of the higher products costs and the Company’s need to achieve minimum gross margins, and the inability for the Company to negotiate terms with these suppliers to provide the Company with private labeling and/or granting of exclusive sales territories, factors important to many distributors. As a result of the above, the Company determined during November 2016 that it would immediately focus on implementing its strategy to develop products internally in order to effectively position itself and compete in the RAAM market, provide the Company with improved margins obtained on the sale of its products, and to increase revenues resulting from the ability to differentiate its products as superior to its competitors combined with leveraging existing marketing programs and strategies aimed to attract distributors and Providers.

In connection with this strategy, during November 2016, the Company announced the additions to its executive management team, including Chief Operating Officer, Dr. Bruce Werber; Chief Financial Officer, Mr. Ian T. Bothwell; and Chief Science Officer, Dr. Maria Ines Mitrani, who joined Chief Executive Officer, Mr. Albert Mitrani. On March 8, 2017, the Company appointed Mr. Terrell Suddarth as the Chief Technology Officer. Messrs. Mitrani, Werber, Bothwell, and Suddarth and Ms. Mitrani are collectively referred to as the “Management Team.” The Company believes that the Management Team provides itself with significant industry, technical and financial related experience as the Company begins the launch and expansion of the supply of newly developed innovative amnion placental tissue products. Each member of the Management Team also serve as members of the Board of Directors of the Company and each has executed employment agreements with the Company.

During January 2017, Anu Life Sciences Inc., a Florida corporation and wholly-owned subsidiary of the Company (“Anu”), announced that it successfully completed several trial production runs of its first amnion placental tissue product (“New Amnio Product”). During February 2017, the Company received satisfactory validation for its first production batch of the New Amnio Product and commenced shipping the New Amnio Product to customers. The New Amnio Product is being sold through Anu’s designated distributor and affiliate, General Surgical Florida Inc., a Florida corporation and wholly-owned subsidiary of the Company (“General Surgical”), under the name “Regen Anu Rheo.” The Company expects to increase production of the New Amnio Product in quantities to ensure there is satisfactory inventory to meet anticipated demand.

The New Amnio Product represents the first of several amnion placental tissue derived products that the Company intends to develop, manufacture and supply to Providers in the health care industry in connection with the Company’s strategy to become a leading supplier of newly designed advanced biologically processed cellular and tissue based products and services used in the growing health care field of regenerative medicine.

In connection with the new regulations recently enacted as of November 8, 2016 by the Florida state legislature (“Amendment No. 2”) that permits Florida residents to apply to open Medical Marijuana Treatment Centers (“MMTC”) for defined MMTC licensed activities, the Company entered into a Participation Agreement, effective February 14, 2017 (the “Agreement”), with Mr. Peter Taddeo (“Taddeo”) and Mr. Wayne Rohrbaugh (“Rohrbaugh”), two then non-affiliated accredited investors (collectively, the “Investors”) for the purpose of obtaining a Florida license and operating a business to dispense medical cannabis. Pursuant to the terms of the Participation Agreement, the Company formed and capitalized Mint Organics, Inc., a Florida corporation and a 55% owned subsidiary of the Company (“Mint Organics”), and Mint Organics Florida, Inc., a Florida corporation and a subsidiary of Mint Organics (“Mint Organics Florida”), to explore, develop and to provide products and services in connection with the MMTC activities that they are licensed to operate.

| 4 |

On November 8, 2016, Amendment No. 2 was approved by 71% of the Florida voters. The goal of Amendment No. 2 is to alleviate those suffering from medical conditions, such as cancer, epilepsy, glaucoma, positive status for human immunodeficiency virus (“HIV”), acquired immune deficiency syndrome (“AIDS”), post-traumatic stress disorder (“PTSD”), amyotrophic lateral sclerosis (“ALS”), Crohn’s disease, Parkinson’s disease, multiple sclerosis, or other debilitating medical conditions of the same kind or class as or comparable to those enumerated. Amendment No. 2 protects qualifying patients, caregivers, physicians, and medical marijuana dispensaries and their staff from criminal prosecutions or civil sanctions under Florida law (but not under federal law). Under Amendment No. 2, the medical marijuana will not be given to the patient if the physician believes that the medical use of marijuana would likely outweigh the potential health risks for a patient.

The Company believes that expanding into the MMTC industry, and being one of the first group of companies to be granted a license to operate within Florida, will provide significant opportunities for increasing overall revenues and growth for the Company. In addition, the growing science and research regarding the regenerative health benefits associated with the use of marijuana integrates with the Company’s current operations and strategy to become a leading supplier of newly designed advanced biologically processed cellular and tissue based products and services used in the growing health care field of regenerative medicine.

Pursuant to Participation Agreement, Messrs. Taddeo and Rohrbaugh each invested $150,000 in the Company in exchange for the issuance to each of Taddeo and Rohrbaugh (a) 150 shares of Series A non-voting preferred stock of Mint Organics, convertible into a 22.5% equity interest in the common stock of Mint Organics or into common stock of the Company at a future date based on the value of the Company’s common stock at the time of conversion, and (b) a warrant to acquire up to 150,000 shares of common stock of the Company, exercisable for three years at an exercise price of $0.15 per share. In connection with the Agreement, $150,000 of the proceeds received from the Investors was obligated to be used to fund the operations of Mint Organics, Inc. and/or Mint Organics Florida, Inc. and the remainder was to be used for working capital of the Company.

In connection with the Participation Agreement, on February 28, 2017, Mr. Taddeo was appointed as the Chief Executive Officer and as a director of Mint Organics and Mint Organics Florida and Mr. Rohrbaugh was appointed as the Chief Operating Officer and as a director of Mint Organics and Mint Organics Florida. Also, on March 8, 2017, Mr. Taddeo was appointed as a member to the Board of Directors of the Company. On May 17, 2017, Mint Organics executed an employment agreement with Mr. Taddeo.

Currently, our RAAM-related operations are conducted through the following wholly-owned subsidiaries:

| ● | Anu Life Sciences, Inc., a Florida corporation formed with a business purpose to manufacture newly designed advanced biologically processed cellular and tissue based products developed from internally based research and development activities (“Anu”); |

| ● | Beyond Cells Corp., a Florida corporation formed with a business purpose to provide consumers with education regarding the field of regenerative and anti-aging and medicine and providing access to a specialized physician network (“Beyond Cells”); |

| ● | General Surgical Florida, Inc., a Florida corporation with a business purpose of selling and distributing regenerative biologic therapies based on amnion placental tissue derived products to doctors and hospitals (“General Surgical”). |

Currently, our MMTC activities are being conducted through the following subsidiaries*:

| ● | Mint Organics, Inc., a Florida corporation with a business purpose of operating Medical Marijuana Treatment Centers (“MMTC”) for defined MMTC licensed activities (“Mint Organics”); and |

| ● | Mint Organics Florida, Inc., a Florida corporation and subsidiary of Mint Organics with a business purpose of operating Medical Marijuana Treatment Centers (“MMTC”) for defined MMTC licensed activities within Florida (“Mint Organics Florida”). |

* Mint Organics and Mint Organics Florida have issued minority non-voting equity interests.

| 5 |

We also have two wholly-owned subsidiaries that are inactive:

| ● | Ethan New York, Inc., a New York corporation formed with a business purpose of selling clothing and accessories through a retail store in New York City (“Ethan NY”) and for which operations ended in June 2016; and |

| ● | BD Source and Distribution, Corp., a Florida corporation (“BD Source”) formed with a business purpose of selling cellular therapy products to doctors and hospitals and for which operations ended in October 2015. |

On September 3, 2015, Ethan NY entered into a five-year lease agreement (“Ethan Lease”) for a store located in New York City, New York (“Leased Premises”). During June 2016, Ethan NY exited from its Leased Premises. In connection with the lease exit, Ethan NY is negotiating with the landlord for settlement of past due amounts owing under the Ethan Lease and the release of all other obligations potentially owing under the Ethan Lease. Ethan NY has not made any of the required monthly lease payments since inception of the Ethan Lease. The total amount of minimum lease payments that Ethan NY is obligated to pay pursuant to this 5-year lease (the “Initial Term”) is $586,241 (excluding late fees and interest provided for under the Ethan Lease). All of Ethan NY’s obligations are recourse only to the assets at Ethan NY, except however, certain obligations under the Ethan Lease that were guaranteed by an outside party. Under the terms of the Ethan Lease, the obligations of the Ethan Lease may be mitigated based on the amount of any future rents that are received for the rental of the Leased Premises to other tenants during the Initial Term.

As previously disclosed in a Form 8-K filed on March 21, 2016, on February 23, 2016, our distribution agreement, dated August 11, 2015, between Amnio Technology, LLC (“Amnio Technology”) and our wholly-owned subsidiary, BD Source (“Distribution Agreement”), was terminated by Amnio Technology. Pursuant to the Distribution Agreement, Amnio Technology had engaged BD Source pursuant to the Distribution Agreement in connection with the marketing, sales and distribution of certain of Amnio Technology’s products. Amnio Technology is engaged in the business of human tissue procurement, processing and distribution to customers and third party distributors. Amnio Technology terminated the Distribution Agreement due to BD Source’s non-payment of the outstanding balance of $4,815 under the Distribution Agreement. BD Source has since paid such balance. Since the termination of the Distribution Agreement, BD Source has remained inactive.

Industry Overview

Health Care Industry Overview:

The traditional health care industry in the United States is predominantly controlled by the rules of the Centers for Medicare & Medicaid Services (“CMS”) (wwws.cms.gov) and commercial health insurance companies. This control limits patients access to alternative medical therapies, that recent medical literature demonstrates highly beneficial outcomes in the field of anti-aging and regenerative medicine. Traditional allopathic medicine of health care provided to patients in the United States relies on government and commercial health insurance for payment of the costs associated with their day-to-day health care. Because of this close relationship, physicians must follow government and commercial insurers guidelines in order to stay in the plans and receive reimbursement. Physicians are restricted in their ability to expand the nature of the treatments provided beyond industry practices because of legal ramifications and/or lack of knowledge concerning protocol of cutting edge anti-aging and regenerative medical treatments.

Despite the above, anecdotal and medical literature has shown an increased demand by patients for access to alternative medical therapies and treatments. Patients are seeking these alternatives to traditional allopathic medicine, due to the adverse events associated with traditional pharmaceuticals, risks associated with surgeries, and that traditional medicine and insurers are not addressing wellness or preventive medicine sufficiently. To address a wide variety of aging issues, safe alternatives to pathologies, including access to other treatments and pharmaceuticals and to achieve beneficial “elective” health treatments, we intend utilize the latest regenerative technologies. These alternative pathways to date have had significant restrictions because of regulations imposed by the FDA, other regulatory bodies and insurers due to lack of randomized controlled studies, yet many published case series demonstrate safety and efficacy. Patients and consumers are looking to safe alternatives compared more traditional medicine, including the following:

| 6 |

| ● | Cellular/ Tissue based therapies |

| ● | Adipose-derived stromal vascular fraction | |

| ● | Bone marrow-derived stem cell therapies | |

| ● | Peripheral blood derived therapies (i.e., platelet rich plasma); | |

| ● | Placental-based therapies |

| ● | Technology documented since 1910 for safety and efficacy, tissue processed from human amniotic membrane and fluid, donated by consenting mothers delivering a full-term healthy baby by scheduled Caesarean section, avoiding any ethical or moral concerns, proven safety record, case series documented success in a multitude of systemic and local pathologies |

| ● | Growth factor, cytokine therapies |

| ● | Anti-Aging |

| ● | Supplements |

| ● | Vitamin | |

| ● | Mineral | |

| ● | Medical foods |

| ● | Weight control | |

| ● | Topical lotions and creams for the largest organ the skin |

| ● | Nontraditional medical alternatives |

| ● | Acupuncture | |

| ● | Naturopathic | |

| ● | Chiropractic |

| ● | Self-directed |

| ● | Meditation | |

| ● | Yoga | |

| ● | Tai Chi |

Currently, patients who desire alternative treatments rely on the following options:

| ● | Medical Tourism |

| ● | In United States | |

| ● | Off-shore United States |

| ● | Central and South America | |

| ● | Caribbean | |

| ● | Europe |

| ● | Consulting directly with physicians knowledgeable in providing regenerative medical services |

| ● | Unlicensed life coaches |

Marijuana Industry Overview:

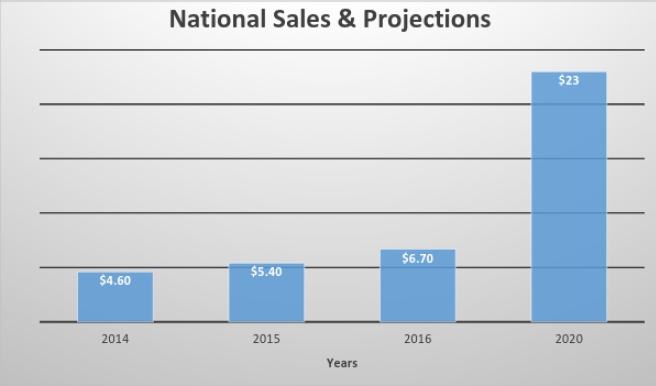

The legal marijuana industry is the fastest growing industry in America, as total national sales soared to $5.4 billion in 2015, up 17.4% from $4.6 billion in 2014, according to data released by the ArcView Group. The legal market grew another 24% to $6.7 billion in sales in 2016. Combined adult use and medical annual sales are predicted to reach nearly $23 billion nationally by 2020.

| 7 |

Figure 1: Marijuana industry sales and projects through 2020, via ArcView Market Data.

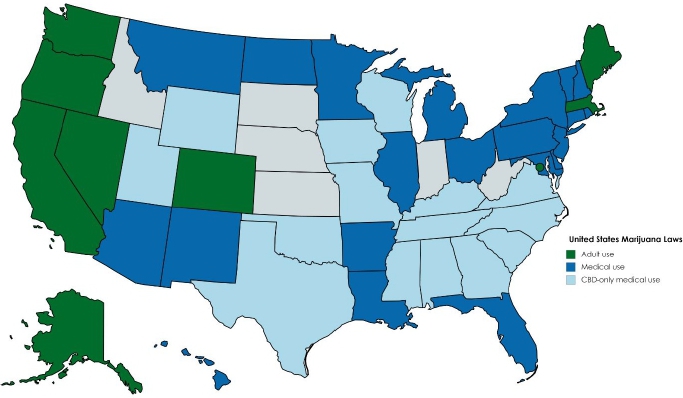

After Pennsylvania and Ohio’s legislature passed comprehensive medical marijuana legislation midway through 2016, and the overwhelming success of another seven marijuana legalization voter initiatives in November 2016, 95% of the U.S. population now lives in states with legal access to some form of medical marijuana.

Medical marijuana use is legal in 21 states and Washington, D.C., for approximately 135 million people. Adult recreational use is legal in another eight states, including Washington, D.C., for an additional 69 million people. Another 15 states have legalized limited, cannabidiol (“CBD”) only medical use, covering a population of 102 million people. CBD is one of the 400+ ingredients found in marijuana and is not psychoactive. A staggering percentage of members of Congress (93%) now represent constituents in markets where some form of marijuana use is legal. Of those, 334 members (276 representatives and 58 senators) or 62%, now represent states that have passed full medical or adult use laws.

| 8 |

Figure 2: A map of the United States showing state by state marijuana laws. Data by New Frontier. Graphic by Canna Advisors

Florida’s Medical Marijuana Industry Overview:

Florida Gov. Rick Scott signed a limited medical marijuana bill into law on June 16, 2014. SB 1030, also known as The Compassionate Medical Cannabis Act of 2014, allows for the limited use of a special strain of cannabidiol (“CBD”) to treat people suffering from epilepsy, cancer and amyotrophic lateral sclerosis (ALS), known as Lou Gehrig’s disease.

The Compassionate Medical Cannabis Act of 2014 charged the Florida Department of Health with overseeing the regulatory infrastructure for medical cannabis in the state. After the Act was signed into law by Governor Scott, the department established the Office of Compassionate Use (“OCU”) to write and implement the department’s rules for medical cannabis, oversee the statewide Compassionate Use Registry, and license Florida businesses to cultivate, process, and dispense medical cannabis to qualified patients. The law originally authorized five organizations to grow and dispense the low-THC marijuana (defined as cannabis which contains 0.8% or less of tetrahydrocannabinol (“THC”) by weight and more than 10% of CBD), one each in northwest Florida, northeast Florida, central Florida, southeast Florida, and southwest Florida. The Office of Compassionate Use accepted applications for dispensary organizations from June 17, 2015 to July 8, 2015. In November 2015, five dispensing organizations were approved. In April 2016, a sixth dispensing organization was approved. In December 2016, a seventh dispensing organization was approved.

Each dispensing organization is required to receive cultivation, processing, and dispensing authorizations before dispensing to patients. Six companies have received cultivation authorization, and are growing cannabis in their facilities around the state. Multiple dispensing organizations have either secured dispensing authorization or are in the final stages of authorization.

On November 8, 2016, Amendment No. 2 was approved by 71% of the Florida voters. The goal of Amendment No. 2 is to alleviate those suffering from medical conditions, such as cancer, epilepsy, glaucoma, positive status for HIV, AIDS, PTSD, ALS, Crohn’s disease, Parkinson’s disease, multiple sclerosis, or other debilitating medical conditions of the same kind or class as or comparable to those enumerated. Amendment No. 2 protects qualifying patients, caregivers, physicians, and medical marijuana dispensaries and their staff from criminal prosecutions or civil sanctions under Florida law (but not under federal law). Under Amendment No. 2, the medical marijuana will not be given to the patient if the physician believes that the medical use of marijuana would likely outweigh the potential health risks for a patient.

| 9 |

Currently, there are seven licensed dispensaries in the Florida and only two of them have been able to open their doors. These dispensaries are only allowed to distribute high-CBD cannabis to people who suffer from cancer and muscle spasms and high-THC cannabis to terminally ill patients (defined as those who are expected to die within one year of diagnosis without “life-sustaining procedures”). The program’s first dispensaries opened and began serving patients in July 2016. Smoking medical cannabis, which does not include use of a vaporizer, is prohibited for both groups of patients.

During a special session of the Florida State Legislature on June 9, 2017, the legislature approved a bill establishing a framework for Amendment No 2.

Highlights of Florida’s expanded medical marijuana bill include the following:

| 1. | Conditions Covered: Epilepsy, chronic muscle spasms, cancer and terminal conditions were allowed under bills passed in 2014 and 2016. The amendment now includes HIV and AIDS, glaucoma, post-traumatic stress disorder, ALS, Crohn’s disease, Parkinson’s disease, multiple sclerosis and similar conditions. |

| 2. | Patients & Caregivers: Patients and caregivers must be 21 and over. If a patient is a minor, a caregiver must be certified. Both must also receive an identification card. Advocates still would like to see caregivers not subject to penalties if they have to administer marijuana in the case of an emergency. |

| 3. | No Smoking: Smoking medical marijuana remains prohibited despite public demand. |

| 4. | Products: Besides vaping, medical marijuana products can be sold as edibles (as long as it is a food product and does not market or appeal to children), oils, sprays or tinctures. Vaping cartridges, especially whole-flower products, must be in a tamper-proof container. |

| 5. | Patient Supplies: Patients may receive an order for three 70-day supplies before having to visit a doctor again to get re-examined. A physician must recertify a patient at least once every 30 weeks. |

| 6. | No Waiting Period: The requirement that a patient be in the care of a certified doctor for 90 days has been removed. Also, the certification course for doctors has been reduced from eight hours to two. |

| 7. | Snowbirds Welcome: Seasonal residents –those who reside in Florida at least 31 straight days each year, maintain temporary residence and are registered to vote or pay income tax in another state– will be eligible to receive medical marijuana. |

| 8. | More Treatment Centers: There will be 10 additional medical marijuana treatment centers by October 2017. Five will be awarded by August 1, 2017 to nurseries that were narrowly defeated when the original distributors were selected in December 2015. Of the other five that will be awarded by October 2017, one will go to a group of black farmers with citrus growers given preference to two others. By the end of the year there could be as many as 19 treatment centers. There would be a cap of 25 dispensaries per medical marijuana treatment center. As medical marijuana patient registrations increase, new dispensaries will be added: four dispensaries per 100,000 patients. |

| 9. | New License Requirements Relaxed: Instead of a nursery needing to be in business for 30 years, any Florida business that has been operating five or more years and has a medical director on staff can file an application. |

| 10 |

| 10. | Growing Market: There is a cap of 25 retail facilities per medical marijuana treatment center but it allows for four more shops per 100,000 patients with that cap subject to expire in 2020. Four more centers will be licensed per 100,000 patients. The state forecasts 472,000 patients in five years. |

| 11. | No Sales Tax: There will not be a sales tax on medical marijuana products. (Florida does not tax other medications.) |

Amendment No. 2 has not been put into effect as of the filing date of this Annual Report. Amendment No. 2 states that laws must be in place by July 3, 2017 and enacted three months later.

Halfway through 2016, only 96 of Florida’s 51,071 total physicians — 0.001% — had completed the education requirement. As of December 2016, the state registry currently had 340 physicians and 1,495 registered patients but state officials anticipate a significant increase once the amendment is implemented. As of March 2017, more than 600 Florida physicians have already completed the eight-hour course.

Current and Future Operations:

Our current strategy is to achieve the following goals and milestones:

| ● | Research and Development and Product Development: |

| ● | Increase the number of RAAM product offerings for various modalities using proprietary processing, formulas and administration techniques; | |

| ● | Engage researchers that bring additional expertise and capacity to develop ongoing research and development and growth opportunities for additional RAAM-related products; | |

| ● | Increase the capacity our existing research and manufacturing lab facilities to accommodate additional expansion and product development; | |

| ● | Perform clinical based studies associated with our products and ongoing research and seek accelerated approval for each product application in accordance with the 21st Century Cures Act (“Cures Act”) and/or through the granting of an FDA-approved biologics application (“BLA”) to allow products to be lawfully marketed in the United States; and | |

| ● | Identify sources of exclusive and superior suppliers of raw materials | |

| ● | Acquisition of existing IP consistent with our product expansion strategy |

| ● | Develop and expand the distribution of our internally developed RAAM related products, including the New Amnio Product by: |

| ● | Extending the referral network of Providers; | |

| ● | Engaging additional in-house sales personnel; | |

| ● | Selectively engaging independent distributors; | |

| ● | Marketing Private Label to distributors; and | |

| ● | Developing and providing educational programs for Providers regarding our products |

| ● | Develop the MMTC business segment |

| ● | Engage consultants to lobby on behalf of the Company in our efforts to obtain a license to operate MMTC dispensaries; | |

| ● | Identify and establish key relationships with growers and processors of cannabis for the purpose of securing reliable and superior supply of products; | |

| ● | Develop sources of financing to fund the expected capital needed to comply with the financial requirements of license applicants and to be prepared to timely construct and operate dispensaries once a license is received; and | |

| ● | Identify potential partners that might facilitate and/or enhance opportunities to obtain licenses and/or enhance the operation of planned dispensaries. |

In connection with the change in control of our Company in June 2015, there was a change in the Company’s management, board of directors and line of business.

| 11 |

The Company incurred a net loss of $(1,253,201) for the fiscal year ended October 31, 2016. In addition, the Company had an accumulated deficit of $(2,113,611) at October 31, 2016. To date, our capital needs have been mostly funded from the private sale of debt and equity to “accredited investors” under Section 4(a)(2) of the Securities Act. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations.”

Services and Products

Since the change in control of our Company in June 2015 and change in the Company’s operations in July 2015, we have been engaged in the health care industry, principally focusing on supplying products and services related to the growing field of regenerative anti-aging medicine (“RAAM”). Our goal is to supply newly designed advanced biologically processed cellular and tissue based products developed from internally based research and development activities and/or from other state-of-the-art RAAM-related products developed by third parties under exclusive supply arrangements and to provide other related services used in the growing health care field of regenerative medicine (“RAAM Products”). We intend to distribute the RAAM Products and market RAAM-related services to Providers, through our newly established in-house sales force and/or through arrangements with independent distributors.

For the period July 2015 through the fiscal year ended October 31, 2016, our main revenue stream was generated from patient referral and product sales through our BD Source and Distribution Corp., General Surgical Florida Inc. (fiscal year ended October 31, 2015 only) and Beyond Cells Corp. subsidiaries. We also generated revenue from our Ethan NY subsidiary beginning December 2015 until June 2016, when the lease for Ethan NY’s sole store location was terminated.

As of February 2017, we had begun manufacturing our first product of several future expected lines of RAAM-related products that are used to treat a variety of musculoskeletal conditions. Prior to February 2017 and for the fiscal year ended October 31, 2016, we obtained supplies of all the RAAM products we sold from third party tissue banks and resold them directly to Providers within our network.

The Company has historically generated revenues from our Bespoke Tricycles, Ltd. subsidiary until October 30, 2015, the date that those operations were discontinued.

Until the generation of adequate revenues from our current RAAM related products, we intend to identify suitable partners and/or additional funding resources to expand our research and development activities to develop topical medications, skin and hair products, injectable and intravenous amnion placental tissue based products, intramuscular approved products that are novel and are FDA cleared technologies and to also develop an accredited tissue bank for a multitude of tissue-based products.

In connection with the new regulations recently enacted as of November 8, 2016 by the Florida state legislature that permits Florida residents to apply to open Medical Marijuana Treatment Centers (“MMTC”) for defined MMTC licensed activities, the Company formed and capitalized a new 55%-owned subsidiary, Mint Organics, Inc., a Florida corporation, (“Mint Organics”) to explore, develop and to provide products and services in connection with the MMTC activities that we may be licensed to operate.

On February 14, 2017, the Company entered into a participation agreement (“Agreement”) with Mr. Peter Taddeo (“Taddeo”) and Mr. Wayne Rohrbaugh (“Rohrbaugh”), two accredited investors (collectively, the “Investors”) in connection with the Company’s endeavor to obtain a license to dispense medical cannabis in Florida. Pursuant to the Agreement, Taddeo and Rohrbaugh each invested $150,000 in the Company in exchange for the issuance of equity in a newly formed subsidiary, Mint Organics Inc. and other consideration as more fully described below. In connection with the Agreement, $150,000 of the proceeds received from the Investors was obligated to be used to fund the operations of Mint Organics, Inc. and/or Mint Organics Inc.’s newly formed subsidiary Mint Organics Florida, Inc. and the remainder was to be used for working capital of the Company. Mint Organics Inc. will be responsible for exploring and evaluating the various MMTC opportunities within Florida and intends to obtain a license to participate in the necessary and desired MMTC Licensed Activities in the future.

The Company has no estimate on the total costs and time frame that it may actually take to submit and obtain the necessary licenses, or if it will be successful at all. The steps in granting of the licenses and/or potential requirements for prospective MMTC license applicants is not yet determined and the Company is not certain if it will qualify to apply and/or receive a license, including the expectation that prospective applicants will be required to demonstrate that they can meet certain financial and other requirements.

| 12 |

The Company believes that expanding into the MMTC industry and to leverage the growing science and research regarding the regenerative health benefits associated with the use of cannabis, integrates and is complimentary with the Company’s existing operations and strategy to become a leading supplier of newly designed advanced biologically processed cellular and tissue based products and services used in the growing health care field of regenerative medicine.

Market Overview

RAAM Business

The population of the United States and the developed world is getting older and living longer. According to a United States Consensus Bureau’s report, “An Aging World: 2015,” America’s 65-and-over population is projected to nearly double over the next three decades, ballooning from 48 million to 88 million by 2050 and that worldwide, the 65-and-over population will more than double to 1.6 billion by 2050. According to the report, in 2015, 14.9% of the U.S. population was 65 or over and the United States was the 48th oldest country out of 228 countries and areas in the world in 2015. Baby boomers began reaching age 65 in 2011 and by 2050 the older share of the U.S. population will increase to 22.1%.

The world average age of death has increased by 35 years since 1970, with declines in death rates in all age groups, including those aged 60 and older (Source: Institute for Health Metrics and Evaluation, 2013; Mathers et al., 2015). The leading causes of death are shifting, in part because of increasing longevity. Between 1990 and 2013, the number of deaths from non-communicable diseases (NCDs) has increased by 42%; and the largest increases in the proportion of global deaths took place among the population aged 80 and over. An estimated 42.8% of deaths worldwide occur in the population aged 70 and over, with 22.9% in the population aged 80 and over.

Also, according to the Center for Disease Control (“CDC”), “Medical Tourism” (a term commonly used to describe people traveling outside their home country for medical treatment) is a worldwide, multibillion-dollar phenomenon that is expected to grow substantially in the next 5–10 years. Studies have estimated that hundreds of thousands of medical tourists travel from the United States annually and that patients pursue medical care abroad for a variety of reasons, including a desire to receive a procedure or therapy not available in their country of residence. Common categories of procedures that US travelers pursue during medical tourism trips include orthopedic surgery, cosmetic surgery, cardiology (cardiac surgery), oncologic care, and dentistry. Common destinations include Thailand, Mexico, Singapore, India, Malaysia, Cuba, Brazil, Argentina, and Costa Rica.

If we are able to implement our intended business plan, we believe that we will be well situated to address this increased consumer demand for alternative medical treatments.

Medical Marijuana Industry

After Pennsylvania and Ohio’s legislature passed comprehensive medical marijuana legislation midway through 2016, and the overwhelmingly success of another seven marijuana legalization voter initiatives in November 2016, 95% of the U.S. population now lives in states (and the District of Columbia) with legal access to some form of medical marijuana.

Medical use is legal in 21 states and Washington, D.C., for approximately 135 million people. Adult use is legal in another eight states, including Washington, D.C., for an additional 69 million people. Another 15 states have legalized limited, CBD-only medical use, covering a population of 102 million people. A staggering percentage of members of Congress (93%) now represent constituents in markets where some form of marijuana is legal. Of those, 334 members (276 representatives and 58 senators) or 62%, now represent states that have passed full medical or adult use laws.

| 13 |

By 2020, the legal cannabis market in the U.S. is estimated to total $23 billion, according to data released by the ArcView Group and New Frontier.

According to the Florida Department of Health, the state registry now has 16,614 medical marijuana patients. A recent state revenue impact study projects that by 2022, there will be 472,000 medical cannabis patients and $542 million in sales in Florida.

By 2020, the state of Florida could have $1.6 billion in medical marijuana sales — and have a 7.5% share of the overall U.S. legal cannabis market and a 14% share of the U.S. medical marijuana market, according to New Frontier Data and The ArcView Group, firms that specialize in conducting market research of the burgeoning cannabis industry.

If Florida lawmakers and health officials adopt regulations that allow for efficient entry of physicians and patients, flexibility in licenses and permits to serve a growing patient population, and a variety of product forms, then the state could see medical marijuana sales of $10.7 million in 2017, $277.7 million in 2018, $1.1 billion in 2019 and $1.6 billion in 2020, according to the New Frontier and ArcView report.

At $1.6 billion in 2020, Florida would be about half the size of projected market leader California with its estimated $3.3 billion in medical sales, according to the report.

Florida’s projection is dependent on several variables, including moratoriums put in place at the local level and the development of advanced delivery services that would better serve the state’s large elderly population.

Florida is the third most populous state in the United States with a population of 20.3 million. It is the second-fastest growing state behind Texas. With an annual growth rate of 1.64%, the population is expected to reach 26 million by 2030, according to the Bureau of Economic and Business Research at the University of Florida. Florida has the largest percent of people 65 years of age and older among U.S. states. Although the large proportion of elderly population in Florida is a unique element of the state’s medical marijuana market, the sheer size of the state’s population will be a significant driver of the sector’s growth.

Marketing and Sales

Currently, we market our RAAM products and services to a network of Providers through in-house and/or contracted sales personnel and from independent distributors. As of October 31, 2016, we had three sales people who marketed our RAAM products and services by using social media and through our professional relationships. Since October 31, 2016, and in connection with the development of our Regen Anu Rheo product, we have increased our sales force to include a sales manager and have developed relationships with several independent distributors that intend to market our products. We intend in the future to expand our in-house sales force and independent distributors as our available products expand and volumes increase. We also intend to utilize social media outlets attend medical conferences and seminars. We also intend to develop and offer training seminars to provide the best possible information on the latest advances on anti-aging, and regenerative medicine to Providers.

The MMTC business has yet to commence operations. Mint Organics currently has engaged various consultants to assist Mint management in its efforts to obtain a license to operate MMTC centers from the state of Florida. Mint Organics expects that upon receiving a license to operate a MMTC, sales will be generated from point of sale transactions, social media and advertising and from referrals from Providers.

Sources and Availability of Raw Materials and the Names of Principal Suppliers

Currently, we purchase raw materials and supplies for our RAAM research and development and the manufacturing of our RAAM placental-related products from unaffiliated third-party laboratories pursuant to purchase orders or distribution agreements (“Supply Arrangements”). The Supply Arrangements are non-exclusive, do not obligate us to purchase minimum volumes and contain customary product pricing and payment terms. We are not dependent on any one supplier. In the event any one or more of our current suppliers are unwilling or unable to sell us required products, we believe that we will be able to purchase similar products from other suppliers with minimal, if any, interruption to our business operations.

| 14 |

The MMTC business has yet to commence operations. Mint Organics intends to acquire the products it will sell upon receiving a license to operate a MMTC from third party growers and processors.

Dependence on One or a Few Major Customers

Our RAAM business is not dependent on any one or more customers. We expect that our customer and consumers will be broad based and throughout the United States and worldwide.

Patents, Trademarks, Licenses, Franchises, Concessions, Royalty Agreements or Labor Contracts

The table below sets forth a summary of our intellectual property rights.

| Patents: | None | |

| Patent Applications: | None | |

| Trademarks: | Word Mark: Organicell Use: Non-medicated anti-aging serum; non-medicated skin serums Serial Number: 87311045 Filing Date: January 23, 2017 Owner: Anu Life Sciences, Inc. Status: Live | |

| Trademark Applications: | Word: Regen Anu Rheo Use: Human allograft tissue, human allograft tissue Serial Number: 87438212 Owner: Anu Life Sciences, Inc. Application Date: May 5, 2017 Status: Pending | |

Word: AnuGenX Use: Cryopreservation services; cryopreservation of human tissue; providing information regarding cryopreservation and related processes for handling donor tissue Serial Number: 8743833 Owner: Anu Life Sciences, Inc. Application Date: May 5, 2017 Status: Pending | ||

| Registered Copyrights: | None | |

| Domain Names: | www.bpsrhealth.com www.mint-organics.com | |

| IP Licenses: | None |

Pursuant to our employment agreements with our executives, including but not limited to, our Chief Operating Officer, Dr. Bruce Werber, and Chief Technology Officer, Terrell Suddarth, all work product that is created, prepared, produced, authored, edited, amended, conceived or reduced to practice by each executive individually or jointly with others during the period of their employment by the Company and relating in any way to the business or contemplated business, research or development of the Company (regardless of when or where the Work Product is prepared or whose equipment or other resources is used in preparing the same), as well as any and all rights in and to copyrights, trade secrets, trademarks (and related goodwill), patents and other intellectual property rights therein arising in any jurisdiction throughout the world and all related rights of priority under international conventions with respect thereto, including all pending and future applications and registrations therefor, and continuations, divisions, continuations-in-part, reissues, extensions and renewals thereof (collectively, “Intellectual Property Rights”), the sole and exclusive property of the Company. All of the Work Product consisting of copyrightable subject matter shall be deemed “work made for hire” as defined in 17 U.S.C. § 101 and such copyrights are therefore owned by the Company or if not applicable, deemed to be irrevocably assigned to the Company, for no additional consideration. The Intellectual Property Rights in any “Pre-existing Materials” included contained in the Work Product shall be retained by the executive but the executive shall be deemed to have granted to the Company an irrevocable, worldwide, unlimited, royalty-free license to use, publish, reproduce, display, distribute copies of, and prepare derivative works based upon, such Pre-Existing Materials and derivative works thereof. The Company may not assign, transfer and sublicense such rights to others without executive’s consent, other than to a wholly-owned subsidiary of the Company. The executive shall provide written notice to the Company’s Chief Executive Officer therein notifying the Company new intellectual property including the Pre-Existing Materials.

| 15 |

Under the respective employment agreement between the Company and each of Dr. Werber and Mr. Suddarth, in the event the agreement is terminated by the executive for “Good Reason” (as defined in the agreement) or by the Company without “Cause” (as defined in the agreement) or due to the Company not renewing the employment agreement, the Company shall assign all Intellectual Property Rights to the Work Product to the executive; provided, however, the Company shall be entitled to have an exclusive, perpetual, irrevocable, worldwide, unlimited, royalty-based license to use, publish, reproduce, display, distribute copies of, and prepare derivative works based upon, such Work Product materials and derivative works thereof. The royalty payable by the Company for the foregoing license shall be reasonably determined by the executive and Company in good faith and if the parties shall not agree on the royalty fee, such fee shall be established by mediation / arbitration pursuant to the employment agreement.

Competition

The regenerative medicine field is highly competitive and subject to rapid technological change and regulation. Companies compete on the basis of product efficacy, pricing, and ease of handling/logistics. A critically important factor for growth in the US market is third-party reimbursement, which is difficult to obtain, it can be time-consuming and expensive. We expect that it will take some time to get health insurance coverage, we intend to work towards a biologics license status from FDA to accelerate our acceptance in traditional insurance plans. Initially we are positioning ourselves as a cash based health care alternative for consumers. Offering higher levels of improvement, that is not available from traditional allopathic medicine at this time.

The Company competes in multiple areas of clinical treatment where regenerative biomaterials may be employed to modulate inflammation, enhance healing and reduce scar tissue formation: advanced wound care treatment, spine, orthopedic, surgery and sports medicine.

The primary competitive products in this space include other amniotic membrane allografts, tissue-engineered living skin equivalents, and porcine- or bovine-derived collagen matrix products, cadaveric engineered bone grafts, tendon and fascial grafts among others. Our competitors include MiMedix Group, Inc., Organogenesis Inc., TissueTech (“Amniox”), Osiris, and BioD (“dermaSciences”). Additionally, there are a variety of accredited bone and soft tissue banks most notably MFT that we will be competing against, but the demand is very high and expected to grow with the growing baby boomer generation getting older.

Competition in the cannabis industry is growing and becoming intense. Currently there are seven licensed dispensary organizations in Florida. We anticipate that upon the state allowing more licensees, competition will be intensified. We expect that many of our competitors will have more capital and human resources than we do.

Government Regulation

In connection with the Company’s intention to pursue research and development of RAAM-products, the Company will be subject to FDA regulations. We anticipate these regulations will be changed by the FDA in the future, and we intend to develop products expected to satisfy more restrictive regulations. A summary of the current FDA regulations is set forth below:

| 16 |

FDA Premarket Clearance and Approval Requirements

Tissue Products

The products that will be manufactured and processed by the Company are derived from human tissue. As discussed below, some tissue-based products are regulated solely under Section 361 of the Public Health Service Act as human cells, tissues and cellular and tissue-based products, or HCT/Ps, which do not require premarket clearance or approval by the FDA. Other tissue products are regulated as biologics and, in order to be lawfully marketed in the United States, require an FDA-approved BLA.

Though for some of our products this will be changing as the FDA is formulating new guidelines for this industry. Draft guidelines have been published, but the public outcry has been expansive, and the FDA has rescheduled public comment to a larger venue in September 2016.

Products Regulated as HCT/Ps

The FDA has specific regulations governing human cells, tissues and cellular and tissue-based products, or HCT/Ps. An HCT/P is a product containing or consisting of human cells or tissue intended for transplantation into a human patient. HCT/Ps that meet the criteria for regulation solely under Section 361 of the Public Health Service Act (so-called “361 HCT/Ps”) are not subject to approval requirements and they are subject to post-market regulatory requirements.

To be a 361 HCT/P, a product generally should meet following criteria:

| ● | Be minimally manipulated, no structural change, or be mixed with anything; |

| ● | Be intended for homologous use, essentially used for the same purpose that it was used in the donor; |

| ● | Its manufacture must not involve combination with another article, except for water, crystalloids or a sterilizing, preserving or storage agent; and |

| ● | It must not be dependent upon the metabolic activity of living cells for its primary function. |

Products Regulated as Biologics- The BLA Pathway

The typical steps for obtaining FDA approval of a BLA to market a biologic product in the U.S. include:

| ● | Completion of preclinical laboratory tests, animal studies and formulations studies under the FDA’s good laboratory practices regulations; |

| ● | Submission to the FDA of an Investigational New Drug Application (“IND”) for human clinical testing, which must become effective before human clinical trials may begin and which must include independent Institutional Review Board (“IRB”) approval at each clinical site before the trials may be initiated; |

| ● | Performance of adequate and well-controlled clinical trials in accordance with Good Clinical Practices to establish the safety and efficacy of the product for each indication; |

| ● | Submission to the FDA of a Biologics License Application for marketing the product, which includes, among other things, reports of the outcomes and full data sets of the clinical trials, and proposed labeling and packaging for the product; |

| ● | Satisfactory completion of an FDA Advisory Committee review; |

| 17 |

| ● | Satisfactory completion of an FDA inspection of the manufacturing facility or facilities at which the product is produced to assess compliance with Current Good Manufacturing Practices (“cGMP”) regulations, |

Generally, clinical trials are conducted in three phases:

| ● | Phase I trials typically involve a small number of healthy volunteers and are designed to provide information about the product safety. |

| ● | Phase II trials are conducted in a larger but limited group of patients afflicted with a specific diagnosis in order to determine preliminary efficacy, and to identify possible adverse effects. |

| ● | Dosage studies are designated as Phase IIA and efficacy studies are designated as Phase IIB. |

| ● | Phase III clinical trials are generally large-scale, multi-center, comparative trials conducted with patients who have a specific condition in order to provide statistically valid proof of efficacy, as well as safety and potency. |

| ● | In some cases, the FDA will require Phase IV, or post-marketing trials, to collect additional data after a product is on the market. |

The process of obtaining an approved BLA requires the expenditure of substantial time, effort and financial resources and may take years to complete.

FDA Post-Market Regulation

Tissue processors are required to register as an establishment with the FDA. We intend on becoming a registered establishment, and be accredited by the American Association of Tissue Banks (“AATB”). Once we are registered we will be required to comply with regulations regarding labeling, record keeping, donor eligibility, and screening and testing, process the tissue in accordance with established Good Tissue Practices, and report any adverse reactions attributed to our tissue. Our facilities will be subject to periodic inspections to assess our compliance with the regulations.

Products covered by a BLA, 510(k) clearance, or a PMA are subject to numerous additional regulatory requirements, which include, among others, compliance with cGMP, which imposes certain procedural, substantive and record keeping requirements, labeling regulations, the FDA’s general prohibition against promoting products for unapproved or “off-label” uses, and additional adverse event reporting.

Other Regulation Specific to Tissue Products

The AATB, has issued operating standards for tissue banking. Compliance with these standards is a requirement in order to become licensed, tissue bank.

21st Century Cures Act

During December 2016, President Obama signed the 21st Century Cures Act (the “Act”) into law. The Act includes many provisions that aim to speed up the process of bringing new drugs and devices to market. One of the Act’s most significant amendments to the Federal Food, Drug and Cosmetic Act will allow the FDA to grant accelerated approval to regenerative medicine products, while also providing the Agency with wide discretion on creating new approaches to regenerative medicine. This legislative development is the result of increased pressure from patients and other stakeholders to move regenerative medicine advancements more quickly from the lab into the clinic.

Specifically, the new accelerated approval pathway authorized by the Act allows certain regenerative medicine products to be designated as “regenerative advanced therapy” and become eligible for priority review by FDA. To qualify for this pathway, the product must be aimed at a serious disease and have the potential to deal with currently unmet medical needs. It must also meet the Act’s new definition of a regenerative advanced therapy, which is defined as “cell therapy, therapeutic tissue engineering products, human cell and tissue products, and combination products using any such therapies or products, except for those regulated solely under section 361 of the Public Health Service Act.” This broad definition would seem to encompass the majority of regenerative medicine products known to be currently in the development stages.

| 18 |

As with the existing accelerated approval pathway for drugs and biologics, this new regulatory pathway would allow a regenerative medicine product to be approved for marketing based on surrogate or intermediate clinical trial endpoints rather than longer term clinical outcomes. The use of such endpoints can decrease the number, duration, and complexity of clinical trials that are needed to prove a longer-term outcome. Subsequently, a sponsor would have to conduct confirmatory clinical trials to ensure that the surrogate or intermediate endpoint was in fact predictive of patients’ clinical response to the product, otherwise the accelerated approval could be withdrawn.

The Act also requires FDA to work with the National Institute of Standards and Technology (“NIST”) and other stakeholders to develop standards and consensus definitions for regenerative medicine products. Such standards are expected to play a large role in advancing this nascent industry by allowing companies to rely on FDA-recognized standards, rather than creating and validating their own as is the case today.

The Act attempts to create a research network and a public-private partnership to assist developers in generating definitive evidence about whether their proposed therapies indeed provide clinical benefits that are hoped for. The Act also requires FDA to track and report the number and type of applications filed for regenerative medicine products, including the number of products approved through the new accelerated approval pathway. The law also includes provisions that require FDA to publish guidance on how it will design and implement an approval process for regenerative medicine devices.

Fraud, Abuse and False Claims

We are directly and indirectly subject to various federal and state laws governing relationships with healthcare providers and pertaining to healthcare fraud and abuse, including anti-kickback laws. In particular, the federal Anti-Kickback Statute prohibits persons from knowingly and willfully soliciting, offering, receiving or providing remuneration, directly or indirectly, in exchange for or to induce either the referral of an individual, or the furnishing, arranging for or recommending a good or service for which payment may be made in whole or part under federal healthcare programs, such as the Medicare and Medicaid programs. (See 42 U.S.C. § 1320a-7b). Penalties for violations include criminal penalties and civil sanctions such as fines, imprisonment and possible exclusion from Medicare, Medicaid and other federal healthcare programs. The Anti-Kickback Statute is broad and prohibits many arrangements and practices that are lawful in businesses outside of the healthcare industry. In implementing the statute, the Office of Inspector General of the U.S. Department of Health and Human Services (“OIG”) has issued a series of regulations, known as the “safe harbors.” These safe harbors set forth provisions that, if all their applicable requirements are met, will assure healthcare providers and other parties that they will not be prosecuted under the Anti-Kickback Statute.

AdvaMed has established guidelines and protocols for medical device manufacturers in their relationships with healthcare professionals on matters including research and development, product training and education, grants and charitable contributions, support of third-party educational conferences, and consulting arrangements. Adoption of the AdvaMed Code by a medical device manufacturer is voluntary, and while the OIG and other federal and state healthcare regulatory agencies encourage its adoption and may look to the AdvaMed Code, they do not view adoption of the AdvaMed Code as proof of compliance with applicable laws. We have incorporated the principles of the AdvaMed Code in our standard operating procedures, sales force training programs, and relationships with health care professionals.

Manufacturing (Processing)

During November 2016, we opened our first placental tissue bank processing laboratory in Miami, Florida. On June 20, 2017, we relocated our placental tissue bank processing laboratory to a larger “good manufacturing practice” (“GMP”) laboratory in Sunrise, Florida. We intend to seek American Association Blood Banks (“AABB”) or AATB accreditation by end of 2017. We are registered with the FDA as a tissue establishment and are subject to the FDA’s quality system regulations, state regulations, and regulations promulgated by the European Union. Our facilities are expected to be subject to periodic unannounced inspections by regulatory authorities, and may undergo compliance inspections conducted by the FDA and corresponding state and foreign agencies.

| 19 |

Placental Donation Program

Currently we purchase placental tissue that is used in our minimally manipulated 361 compliant process to produce allografts to be used in regenerative therapy specialties. Depending on the expected reliability of placental supplies to meet our future processing needs, we expect to develop a comprehensive network of hospitals that participate in our placenta donation program, including a dedicated staff that works at these hospitals, collecting donated placentas from mothers who undergo Cesarean section births and consent to donation. We expect to be able to procure an adequate supply of tissue to meet anticipated demand.

Medical Marijuana Industry

Establishing an operating dispensary or cultivation center requires governmental approval, usually at the local and state levels. Such approval is obtained through a complex licensing process that, in most cases, is newly adopted by the states or local municipalities. We monitor these new and changing regulations. The regulatory framework includes a rule-making procedure with a period for public comment. This is traditionally followed by draft rules posted by the department of health for the state or other consumer affairs department charged by the state to facilitate the impending dispensary program.

The Controlled Substances Act (“CSA”) makes it illegal under federal law to manufacture, distribute, or dispense marijuana. Many states impose and enforce similar prohibitions. In 2014, the then U.S. Department of Justice Deputy Attorney General James M. Cole issued a memorandum (the “Cole Memo”) to all United States Attorneys providing updated guidance to federal prosecutors concerning marijuana enforcement under the CSA. The Cole Memo guidance applies to all of DOJ’s federal enforcement activity, including civil enforcement and criminal investigations and prosecutions, concerning marijuana in all states.

The Cole Memo reiterated Congress’s determination that marijuana is a dangerous drug and that the illegal distribution and sale of marijuana is a serious crime that provides a significant source of revenue to large-scale criminal enterprises, gangs, and cartels. The Cole Memo noted that DOJ is committed to enforcement of the CSA consistent with those determinations. It also notes that DOJ is committed to using its investigative and prosecutorial resources to address the most significant threats in the most effective, consistent, and rational way. In furtherance of those objectives, the Cole Memo provided guidance to DOJ attorneys and law enforcement to focus their enforcement resources on persons or organizations whose conduct interferes with any one or more of the following important priorities (the “Cole Memo priorities”):

| ● | Preventing the distribution of marijuana to minors; |

| ● | Preventing revenue from the sale of marijuana from going to criminal enterprises, gangs, and cartels; |

| ● | Preventing the diversion of marijuana from states where it is legal under state law in some form to other states; |

| ● | Preventing state-authorized marijuana activity from being used as a cover or pretext for the trafficking of other illegal drugs or other illegal activity; |

| ● | Preventing violence and the use of firearms in the cultivation and distribution of marijuana; |

| ● | Preventing drugged driving and the exacerbation of other adverse public health consequences associated with marijuana use; |

| ● | Preventing the growing of marijuana on public lands and the attendant public safety and environmental dangers posed by marijuana production on public lands; and |

| ● | Preventing marijuana possession or use on federal property. |

Concurrently with this FinCEN guidance, Deputy Attorney General Cole issued supplemental guidance directing that prosecutors also consider these enforcement priorities with respect to federal money laundering, unlicensed money transmitter, and BSA offenses predicated on marijuana-related violations of the CSA.

| 20 |

Providing Financial Services to Marijuana-Related Businesses

On February 14, 2014, the U.S. Department of the Treasury Financial Crimes Enforcement Network (“FinCEN”) provided guidance to financial institutions to clarify how they can provide services to marijuana- related businesses consistent with their BSA obligations. In general, the decision to open, close, or refuse any particular account or relationship should be made by each financial institution based on a number of factors specific to that institution. These factors may include its particular business objectives, an evaluation of the risks associated with offering a particular product or service, and its capacity to manage those risks effectively. Thorough customer due diligence is a critical aspect of making this assessment.

As part of its customer due diligence, a financial institution should consider whether a marijuana-related business implicates one of the Cole Memo priorities or violates state law. This is a particularly important factor for a financial institution to consider when assessing the risk of providing financial services to a marijuana-related business. Considering this factor also enables the financial institution to provide information in BSA reports pertinent to law enforcement’s priorities. A financial institution that decides to provide financial services to a marijuana-related business would be required to file suspicious activity reports (“SARs”) as described below. The obligation to file a SAR is unaffected by any state law that legalizes marijuana-related activity. A financial institution is required to file a SAR if, consistent with FinCEN regulations, the financial institution knows, suspects, or has reason to suspect that a transaction conducted or attempted by, at, or through the financial institution: (i) involves funds derived from illegal activity or is an attempt to disguise funds derived from illegal activity; (ii) is designed to evade regulations promulgated under the BSA, or (iii) lacks a business or apparent lawful purpose. Because federal law prohibits the distribution and sale of marijuana, financial transactions involving a marijuana-related business would generally involve funds derived from illegal activity. Therefore, a financial institution is required to file a SAR on activity involving a marijuana-related business (including those duly licensed under state law), in accordance with this guidance and FinCEN’s suspicious activity reporting requirements and related thresholds.

Currency Transaction Reports and Form 8300’s

Financial institutions and other persons subject to FinCEN’s regulations must report currency transactions in connection with marijuana-related businesses the same as they would in any other context, consistent with existing regulations and with the same thresholds that apply. For example, banks and money services businesses would need to file CTRs on the receipt or withdrawal by any person of more than $10,000 in cash per day. Similarly, any person or entity engaged in a non-financial trade or business would need to report transactions in which they receive more than $10,000 in cash and other monetary instruments for the purchase of goods or services on FinCEN Form 8300 (Report of Cash Payments Over $10,000 Received in a Trade or Business).

Research and Development Activities

For the fiscal year ended October 31, 2015, we spent $0 in connection with research and development activities. For the fiscal year ended October 31, 2016, we spent $36,256 in connection with the establishment of our current lab facilities and purchase of supplies to be used in our research and development activities. Since October 2016, we have spent additional money to complete the installation of our lab facilities and for the purchase of supplies to be used in our research and development activities. In February 2017, we successfully completed development and validation of our first product that we intend to manufacture and commercially deploy. Our ability to continue research and development is dependent on the our ability to generate sufficient working capital. Our intention is to dedicate the necessary cash resources towards our funding of research and development activities in order to build out our laboratories, tissue bank, produce our products over the next 12-18 months and to perform clinical studies in connection with our products developed.

Environmental Laws

The chemical and biomedical wastes that will be generated by our tissue processing operations will be placed in appropriately constructed and labeled containers and are segregated from other wastes. We plan on contracting with third parties for transport, treatment, and disposal of waste. We plan on being compliant with applicable laws and regulations promulgated by the Resource Conservation and Recovery Act, the U.S. Environmental Protection Agency and similar state agencies.

| 21 |

Employees

At October 31, 2016, we had one full-time employee, Mr. Albert Mitrani, our President and Chief Executive Officer. We also engaged Dr. Maria Ines Mitrani, Mr. Mitrani’s wife, and one other person as consultants, each assisting with administration services and sales. Prior to October 31, 2016, we also engaged an outside consultant for accounting and bookkeeping services. Subsequent to October 31, 2016, the Company has hired four additional executive officers and engaged the two aforementioned consultants as full-time employees. In addition, we hired an additional administrative person to provide bookkeeping services and a consultant to serve as our sales manager. There are no collective bargaining agreements.

Dividend Policy

We have never paid or declared dividends on our securities. The payment of cash dividends, if any, in the future is within the discretion of our Board and will depend upon our earnings, our capital requirements, financial condition and other relevant factors. We do not expect to pay dividends for the foreseeable future, and intend to retain future earnings, if any, towards the use in our business and growth strategies.

Corporate History and Change in Control