Attached files

| file | filename |

|---|---|

| 8-K - 8-K - LAKELAND BANCORP INC | d183147d8k.htm |

| EX-99.2 - EX-99.2 - LAKELAND BANCORP INC | d183147dex992.htm |

| EX-2.1 - EX-2.1 - LAKELAND BANCORP INC | d183147dex21.htm |

INVESTOR PRESENTATION Acquisition of 1st Constitution Bancorp (NASDAQ: FCCY) Exhibit 99.1

Forward Looking Statements 0, 140, 153 75, 145, 170 0, 136, 168 220, 230, 240 255, 255, 150 166, 166, 166 33, 100, 181 192, 80, 77 Font: Arial Font Color: 89, 89, 89 Page This presentation contains forward-looking statements with respect to Lakeland Bancorp, Inc. (“Lakeland Bancorp”) and 1st Constitution Bancorp (“1st Constitution Bancorp”) that are made in reliance upon the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. The words “anticipates”, “projects”, “intends”, “estimates”, “expects”, “believes”, “plans”, “may”, “will”, “should”, “could” and other similar expressions are intended to identify such forward looking statements. These forward-looking statements are necessarily speculative and speak only as of the date made, and are subject to numerous assumptions, risks and uncertainties, all of which may change over time. Actual results could differ materially from such forward-looking statements. The following factors, among others, could cause actual results to differ materially and adversely from such forward-looking statements: failure to obtain necessary regulatory approvals (and the risk that such approvals may result in the imposition of conditions that could adversely affect the combined company); failure to obtain shareholder approvals or to satisfy any of the other conditions to the transaction on a timely basis or at all or other delays in completing the transaction; the magnitude and duration of the COVID-19 pandemic and its impact on the global economy and financial market conditions and the business, results of operations, and financial condition of Lakeland Bancorp or 1st Constitution Bancorp; the occurrence of any event, change or other circumstances that could give rise to the right of one or both of the parties to terminate the merger agreement; the outcome of any legal proceedings that may be instituted against Lakeland Bancorp or 1st Constitution Bancorp; failure to realize anticipated efficiencies and synergies if the merger is consummated; material adverse changes in Lakeland Bancorp’s or 1st Constitution Bancorp’s operations or earnings; decline in the economy in Lakeland Bancorp’s and 1st Constitution Bancorp’s primary market areas; potential adverse reactions or changes to business or employee relationships, including those resulting from the announcement or completion of the transaction; the dilution caused by Lakeland Bancorp’s issuance of additional shares of its capital stock in connection with the transaction; and other factors that may affect the future results of Lakeland Bancorp or 1st Constitution Bancorp. Additional factors that could cause results to differ materially from those described above can be found in Lakeland Bancorp’s Annual Report on Form 10-K for the year ended December 31, 2020 and in its subsequent Quarterly Reports on Form 10-Q, including in the respective Risk Factors sections of such reports, as well as in subsequent Securities and Exchange Commission (“Commission”) filings, each of which is on file with the Commission and available in the “Investors Relations” section of Lakeland Bancorp’s website, www.lakelandbank.com, under the heading “Documents” and in other documents Lakeland Bancorp files with the Commission, and in 1st Constitution Bancorp’s Annual Report on Form 10-K for the year ended December 31, 2020 and in its subsequent Quarterly Reports on Form 10-Q, including in the respective Risk Factors sections of such reports, as well as in subsequent Commission filings, each of which is on file with and available in the “Investor Relations” section of 1st Constitution Bancorp’s website, www.1stconstitution.com, under the heading “SEC Filings” and in other documents 1st Constitution Bancorp files with the Commission. Neither Lakeland Bancorp nor 1st Constitution Bancorp assumes any obligation for updating any such forward-looking statements at any time.

Additional Information 0, 140, 153 75, 145, 170 0, 136, 168 220, 230, 240 255, 255, 150 166, 166, 166 33, 100, 181 192, 80, 77 Font: Arial Font Color: 89, 89, 89 Page Additional Information and Where to Find It This presentation does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval. In connection with the proposed merger, Lakeland Bancorp intends to file with the Commission a registration statement that will include a joint proxy statement of Lakeland Bancorp and 1st Constitution Bancorp that also constitutes a prospectus of Lakeland Bancorp. INVESTORS AND SECURITY HOLDERS ARE ADVISED TO READ THE JOINT PROXY STATEMENT/PROSPECTUS WHEN IT BECOMES AVAILABLE, BECAUSE IT WILL CONTAIN IMPORTANT INFORMATION. Investors and security holders may obtain a free copy of the registration statement (when available) and other documents filed by Lakeland Bancorp and 1st Constitution Bancorp with the Commission at the Commission’s web site at www.sec.gov. These documents may be accessed and downloaded for free at Lakeland Bancorp’s website at www.lakelandbank.com or by directing a request to Investor Relations, Lakeland Bancorp, Inc., 250 Oak Ridge Road, Oak Ridge, New Jersey 07438 (973-697-2000). 1st Constitution Bancorp’s documents may be accessed and downloaded for free at 1st Constitution Bancorp’s website at www.1stconstitution.com or by directing a request to Investor Relations, 1st Constitution Bancorp, 2650 Route 130 P.O. Box 634 Cranbury New Jersey 08512 (609-655-4500). Participants in the Solicitation Lakeland Bancorp, 1st Constitution Bancorp and their respective directors and executive officers may be deemed to be participants in the solicitation of proxies from 1st Constitution Bancorp’s and Lakeland Bancorp’s shareholders in respect of the proposed transaction. Information regarding the directors and executive officers of Lakeland Bancorp may be found in its definitive proxy statement relating to its 2021 Annual Meeting of Shareholders, which was filed with the Commission on April 9, 2021 and can be obtained free of charge from Lakeland Bancorp’s website. Information regarding the directors and executive officers of 1st Constitution Bancorp may be found in its definitive proxy statement relating to its 2021 Annual Meeting of Shareholders, which was filed with the Commission on April 22, 2021 and can be obtained free of charge from 1st Constitution Bancorp’s website. Other information regarding the participants in the proxy solicitation and a description of their direct and indirect interest, by security holdings or otherwise, will be contained in the joint proxy statement/prospectus and other relevant materials to be filed with the Commission when they become available.

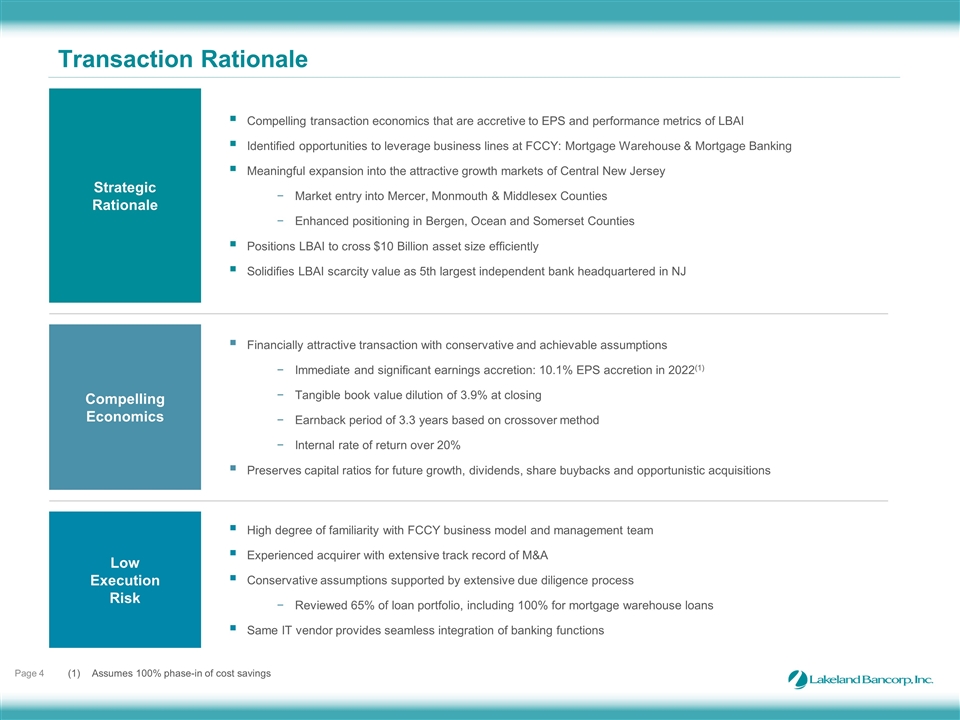

Transaction Rationale Strategic Rationale Compelling transaction economics that are accretive to EPS and performance metrics of LBAI Identified opportunities to leverage business lines at FCCY: Mortgage Warehouse & Mortgage Banking Meaningful expansion into the attractive growth markets of Central New Jersey Market entry into Mercer, Monmouth & Middlesex Counties Enhanced positioning in Bergen, Ocean and Somerset Counties Positions LBAI to cross $10 Billion asset size efficiently Solidifies LBAI scarcity value as 5th largest independent bank headquartered in NJ Compelling Economics Financially attractive transaction with conservative and achievable assumptions Immediate and significant earnings accretion: 10.1% EPS accretion in 2022(1) Tangible book value dilution of 3.9% at closing Earnback period of 3.3 years based on crossover method Internal rate of return over 20% Preserves capital ratios for future growth, dividends, share buybacks and opportunistic acquisitions Low Execution Risk High degree of familiarity with FCCY business model and management team Experienced acquirer with extensive track record of M&A Conservative assumptions supported by extensive due diligence process Reviewed 65% of loan portfolio, including 100% for mortgage warehouse loans Same IT vendor provides seamless integration of banking functions 0, 140, 153 75, 145, 170 0, 136, 168 220, 230, 240 255, 255, 150 166, 166, 166 33, 100, 181 192, 80, 77 Font: Arial Font Color: 89, 89, 89 Page Assumes 100% phase-in of cost savings

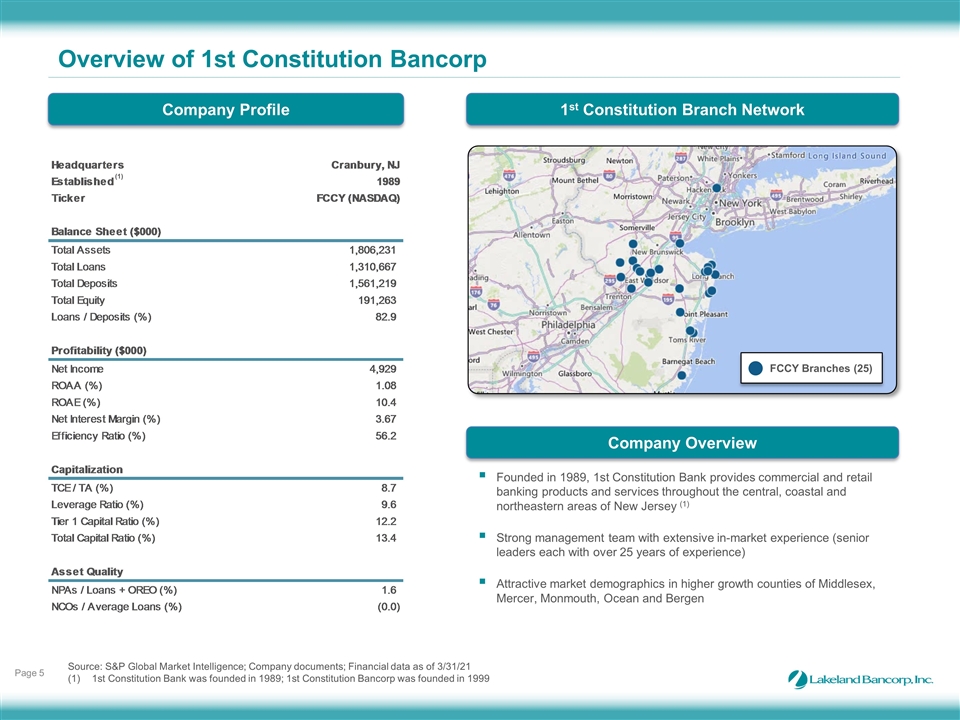

1st Constitution Branch Network Overview of 1st Constitution Bancorp Company Profile Company Overview Source: S&P Global Market Intelligence; Company documents; Financial data as of 3/31/21 1st Constitution Bank was founded in 1989; 1st Constitution Bancorp was founded in 1999 Founded in 1989, 1st Constitution Bank provides commercial and retail banking products and services throughout the central, coastal and northeastern areas of New Jersey (1) Strong management team with extensive in-market experience (senior leaders each with over 25 years of experience) Attractive market demographics in higher growth counties of Middlesex, Mercer, Monmouth, Ocean and Bergen FCCY Branches (25) 0, 140, 153 75, 145, 170 0, 136, 168 220, 230, 240 255, 255, 150 166, 166, 166 33, 100, 181 192, 80, 77 Font: Arial Font Color: 89, 89, 89 Page (1)

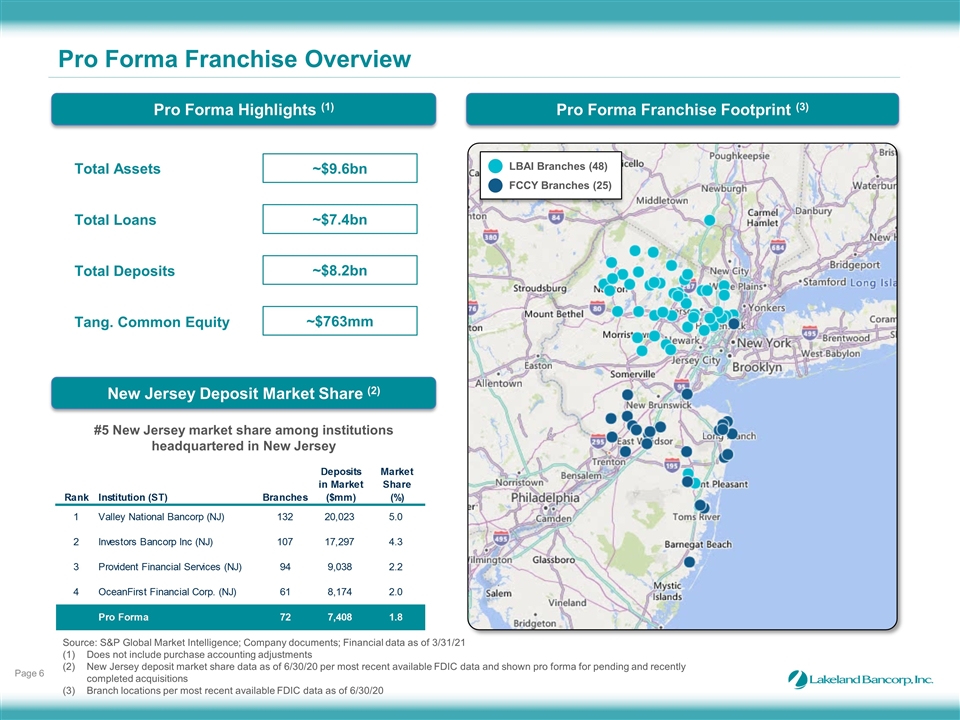

Pro Forma Franchise Overview 0, 140, 153 75, 145, 170 0, 136, 168 220, 230, 240 255, 255, 150 166, 166, 166 33, 100, 181 192, 80, 77 Font: Arial Font Color: 89, 89, 89 Page Pro Forma Franchise Footprint (3) Pro Forma Highlights (1) LBAI Branches (48) FCCY Branches (25) Source: S&P Global Market Intelligence; Company documents; Financial data as of 3/31/21 Does not include purchase accounting adjustments New Jersey deposit market share data as of 6/30/20 per most recent available FDIC data and shown pro forma for pending and recently completed acquisitions Branch locations per most recent available FDIC data as of 6/30/20 ~$763mm ~$8.2bn ~$7.4bn ~$9.6bn Total Assets Total Loans Total Deposits Tang. Common Equity New Jersey Deposit Market Share (2) #5 New Jersey market share among institutions headquartered in New Jersey

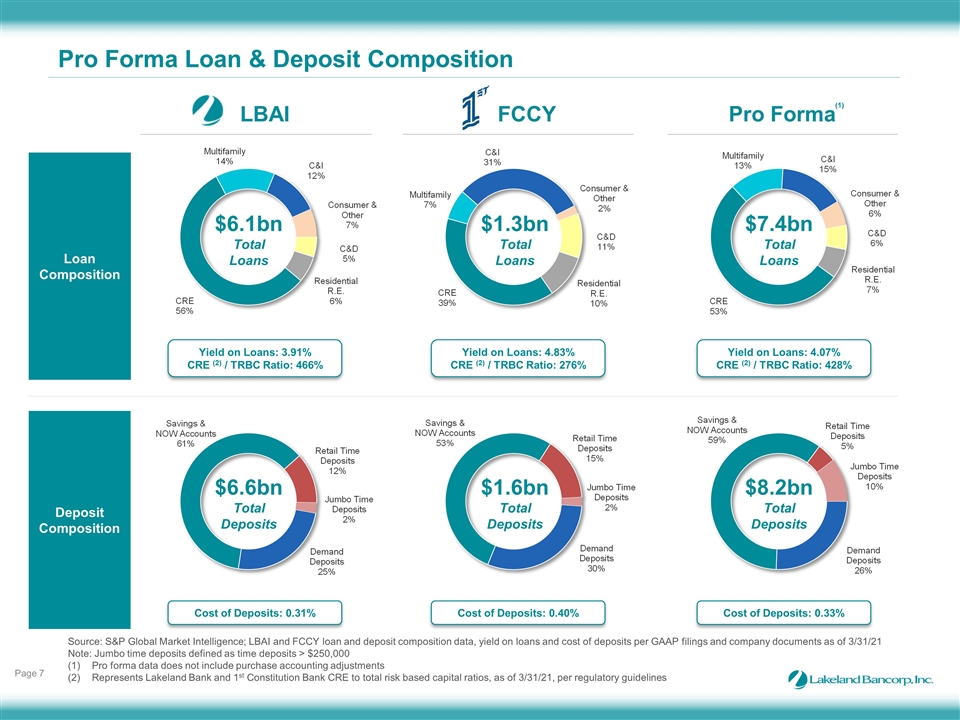

Pro Forma Loan & Deposit Composition 0, 140, 153 75, 145, 170 0, 136, 168 220, 230, 240 255, 255, 150 166, 166, 166 33, 100, 181 192, 80, 77 Font: Arial Font Color: 89, 89, 89 Page Source: S&P Global Market Intelligence; LBAI and FCCY loan and deposit composition data, yield on loans and cost of deposits per GAAP filings and company documents as of 3/31/21 Note: Jumbo time deposits defined as time deposits > $250,000 Pro forma data does not include purchase accounting adjustments Represents Lakeland Bank and 1st Constitution Bank CRE to total risk based capital ratios, as of 3/31/21, per regulatory guidelines Loan Composition Deposit Composition LBAI $6.1bn Total Loans $6.6bn Total Deposits Yield on Loans: 3.91% CRE (2) / TRBC Ratio: 466% Cost of Deposits: 0.31% FCCY $1.3bn Total Loans $1.6bn Total Deposits Yield on Loans: 4.83% CRE (2) / TRBC Ratio: 276% Cost of Deposits: 0.40% Pro Forma $7.4bn Total Loans $8.2bn Total Deposits Yield on Loans: 4.07% CRE (2) / TRBC Ratio: 428% Cost of Deposits: 0.33% (1)

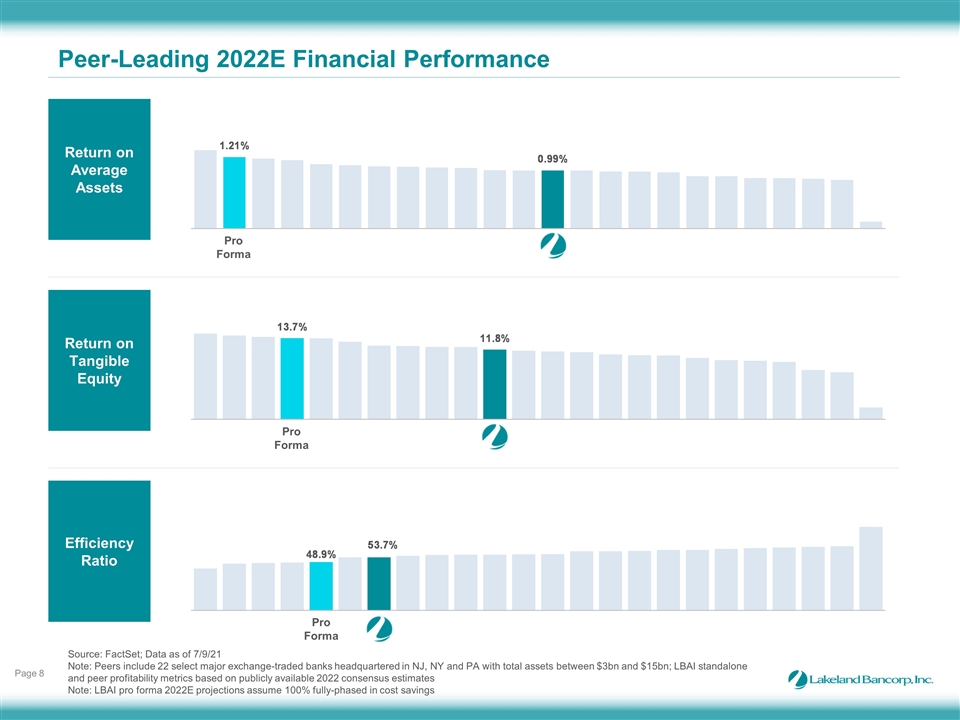

Peer-Leading 2022E Financial Performance 0, 140, 153 75, 145, 170 0, 136, 168 220, 230, 240 255, 255, 150 166, 166, 166 33, 100, 181 192, 80, 77 Font: Arial Font Color: 89, 89, 89 Page Source: FactSet; Data as of 7/9/21 Note: Peers include 22 select major exchange-traded banks headquartered in NJ, NY and PA with total assets between $3bn and $15bn; LBAI standalone and peer profitability metrics based on publicly available 2022 consensus estimates Note: LBAI pro forma 2022E projections assume 100% fully-phased in cost savings Pro Forma Return on Average Assets Pro Forma Return on Tangible Equity Pro Forma Efficiency Ratio

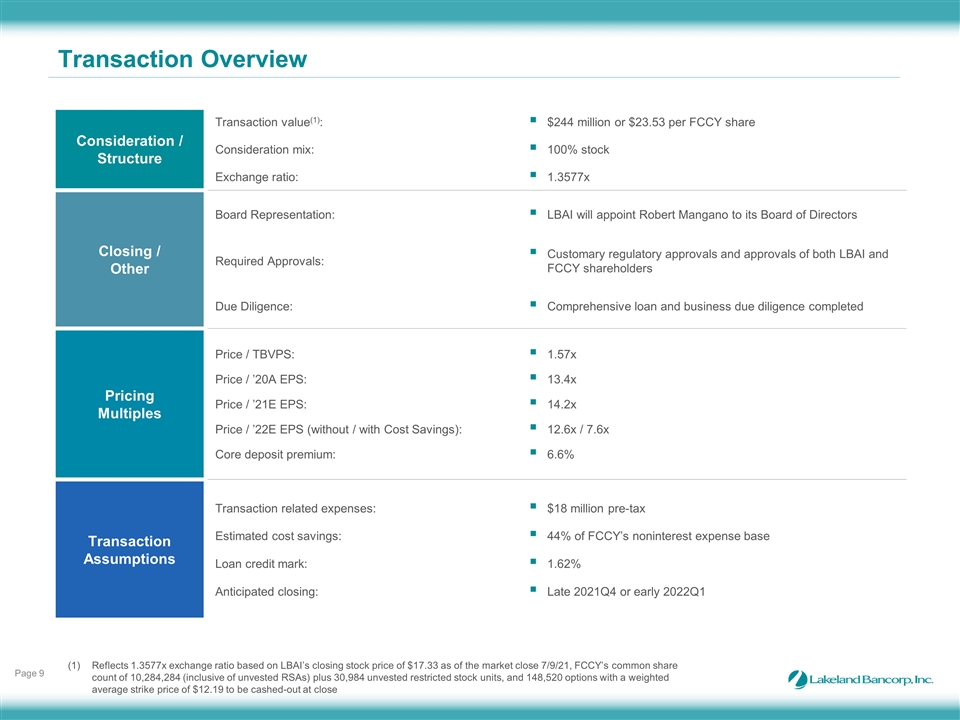

Transaction Overview Consideration / Structure Transaction value(1): $244 million or $23.53 per FCCY share Consideration mix: 100% stock Exchange ratio: 1.3577x Closing / Other Board Representation: LBAI will appoint Robert Mangano to its Board of Directors Required Approvals: Customary regulatory approvals and approvals of both LBAI and FCCY shareholders Due Diligence: Comprehensive loan and business due diligence completed Pricing Multiples Price / TBVPS: Price / ’20A EPS: Price / ’21E EPS: Price / ’22E EPS (without / with Cost Savings): Core deposit premium: 1.57x 13.4x 14.2x 12.6x / 7.6x 6.6% Transaction Assumptions Transaction related expenses: Estimated cost savings: Loan credit mark: Anticipated closing: $18 million pre-tax 44% of FCCY’s noninterest expense base 1.62% Late 2021Q4 or early 2022Q1 0, 140, 153 75, 145, 170 0, 136, 168 220, 230, 240 255, 255, 150 166, 166, 166 33, 100, 181 192, 80, 77 Font: Arial Font Color: 89, 89, 89 Page Reflects 1.3577x exchange ratio based on LBAI’s closing stock price of $17.33 as of the market close 7/9/21, FCCY’s common share count of 10,284,284 (inclusive of unvested RSAs) plus 30,984 unvested restricted stock units, and 148,520 options with a weighted average strike price of $12.19 to be cashed-out at close

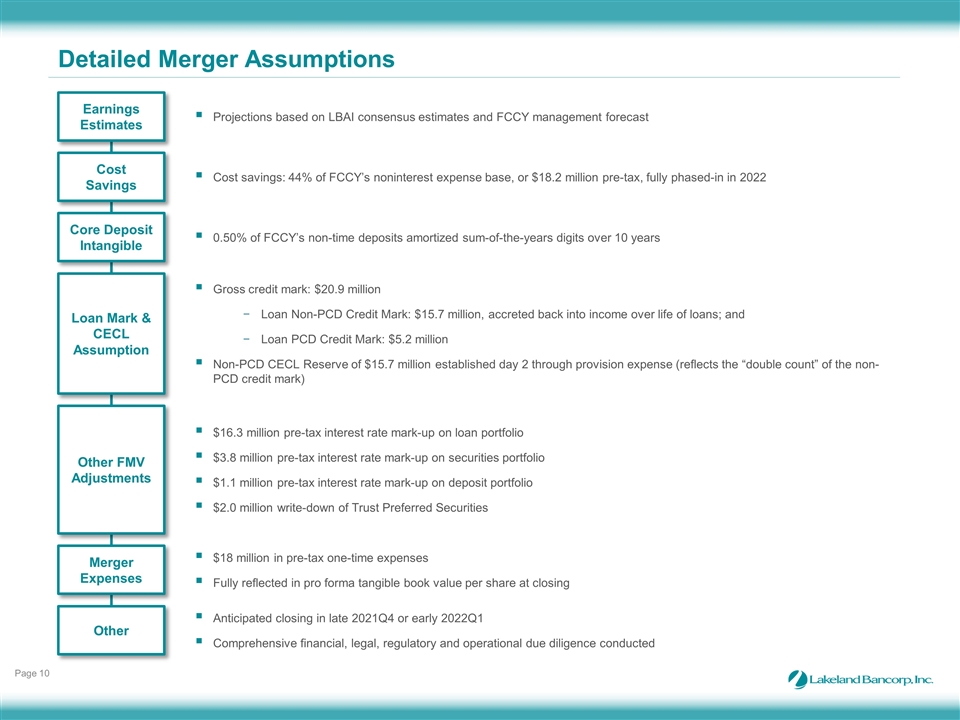

Detailed Merger Assumptions 0, 140, 153 75, 145, 170 0, 136, 168 220, 230, 240 255, 255, 150 166, 166, 166 33, 100, 181 192, 80, 77 Font: Arial Font Color: 89, 89, 89 Page Projections based on LBAI consensus estimates and FCCY management forecast Earnings Estimates Cost Savings Core Deposit Intangible Loan Mark & CECL Assumption Other FMV Adjustments Merger Expenses Other Cost savings: 44% of FCCY’s noninterest expense base, or $18.2 million pre-tax, fully phased-in in 2022 0.50% of FCCY’s non-time deposits amortized sum-of-the-years digits over 10 years Gross credit mark: $20.9 million Loan Non-PCD Credit Mark: $15.7 million, accreted back into income over life of loans; and Loan PCD Credit Mark: $5.2 million Non-PCD CECL Reserve of $15.7 million established day 2 through provision expense (reflects the “double count” of the non-PCD credit mark) $16.3 million pre-tax interest rate mark-up on loan portfolio $3.8 million pre-tax interest rate mark-up on securities portfolio $1.1 million pre-tax interest rate mark-up on deposit portfolio $2.0 million write-down of Trust Preferred Securities $18 million in pre-tax one-time expenses Fully reflected in pro forma tangible book value per share at closing Anticipated closing in late 2021Q4 or early 2022Q1 Comprehensive financial, legal, regulatory and operational due diligence conducted

Transaction Highlights 0, 140, 153 75, 145, 170 0, 136, 168 220, 230, 240 255, 255, 150 166, 166, 166 33, 100, 181 192, 80, 77 Font: Arial Font Color: 89, 89, 89 Page P Strong financial impacts, including substantial earnings accretion P Strengthens LBAI’s strategic position in New Jersey as one of the state’s largest independent community banks P Enhances presence in attractive central New Jersey markets P Low execution risk P Preserves strategic optionality and capital flexibility