Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - MARINE PRODUCTS CORP | tm2119948d1_8k.htm |

Exhibit 99

Second Quarter 2021 Overview and Update June 17, 2021

Certain statements and information included in this presentation constitute “forward - looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Such forward - looking statements include statements that look forward in time or express management’s beliefs, expectations or hopes. In particular, such statements include, without limitation, the statement that we are looking forward to a very strong retail selling season; our optimism about the continued strength in the recreational boat market and our near - term financial results; and our belief that supply chain disruptions will impact our second quarter production and sales growth. These statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of Marine Products Corporation to be materially different from any future results, performance or achievements expressed or implied in such forward - looking statements. These risks include risks related to the supply chain disruptions that may impact our production and sales in 2021. Additional discussion of factors that could cause the actual results to differ materially from management’s projections, forecasts, estimates and expectations is contained in Marine Products’ Annual Report on Form 10 - K, filed with the U.S. Securities and Exchange Commission (the “SEC”) for the year ended December 31, 2020. FORWARD LOOKING STATEMENTS

• Headquartered in Atlanta • Manufacturing in Nashville, Georgia • NYSE: MPX • Current Dividend Yield: 3.1% • Long - term focus on Financial and Shareholder Returns • No debt, highly liquid balance sheet • Dividends in all but 2 years of our history as a public company CORPORATE PROFILE Marine Products Corporation operates over 1 million sq. ft. of manufacturing capacity.

• Marine Products Corporation is one of the largest manufacturers of recreational powerboats in the U.S., with leading market share in both of its brands. • Its Chaparral sterndrive brand holds the #2 market share in its category. • Its Robalo brand, holds the #2 market share in the outboard coastal offshore fishing boat market segment. • On a combined basis, Chaparral’s and Robalo’s outboards hold the #1 market share for outboard boats in their size range. • At the corporate level, we focus on long - term shareholder returns and capital stewardship. – 3% 20 - year Net sales CAGR – 4% 20 - year Net Income CAGR - 18% Average Return on Invested Capital, Inception to Date ABOUT MARINE PRODUCTS CORPORATION Marine Products Corporation has been manufacturing high - quality powerboats for over 55 years. Pictured at right: Chaparral’s first model, built in 1965. Chaparral’s first model, built in 1965.

Brand Names CHAPARRAL 20 MODELS 19 – 34 feet • Sterndrive Sport Boats • Outboard Sport Boats • Wake Surfing Boats • Sold through a network of 135 domestic dealers

Brand Names (cont.) ROBALO 24 Outboard Models 18 – 36 feet • Center Console • Dual Consoles • Bay Boats • Sold through a network of 125 domestic dealers

What You Should Know about Marine Products Corporation Strong Design Capabilities and Creativity • Keen ability to efficiently manufacture products made of fiberglass • Strong competence to leverage existing designs to create new products Marketing Strength and Intelligence • Historically Strong Boat Show Presences • Early pivot to digital marketing • Ongoing adaptation to post - COVID environment Dealer Relationship Management • Sales and service schools • Inventory management financial and operational support • Nationally advertised pricing Some Supply Chain Integration • Upholstery, cabinetry, canvas fabricated in house • Several component fabricators have located close to the manufacturing facility Focused Profitability Management • Constant adjustment of model mix and production scheduling to maximize throughput and optimize profitability based on order backlog Financial Strength and Management Continuity • Ability to endure extreme industry cycles • Consistent investment in new product R&D and quality improvement • Flexibility to pursue shareholder - friendly capital allocation and return strategies

A Summary of our Current Operating Environment . . . COVID has caused a surge in Retail Demand Starting in Second Quarter 2020 Americans fled large cities to more remote areas Summer camps, recreational activities in crowded environments cancelled Recreational boating emerged as an attractive socially distanced outdoor activity

. . . And its Positive and Negative Aspects Positive Aspects • A Surge in Demand Eclipsing the post 9/11 change in consumer demand • Over 30% of retail buyers in the past year have been first time buyers • Order Backlogs have reached historic highs • Clear Line of Sight for Production Scheduling • Most Boats are pre - sold at the retail level • Dealers and Retail Consumers less concerned about options and features • Provides ability to optimize profitability Negative Aspects • Supply Chain Issues • Timely deliveries of raw materials and parts • Transportation delays • Cost increases • Dealer Inventories • Low Inventories reduce dealer ability to show products and complete immediate sales • Marketing • In - person shows cancelled

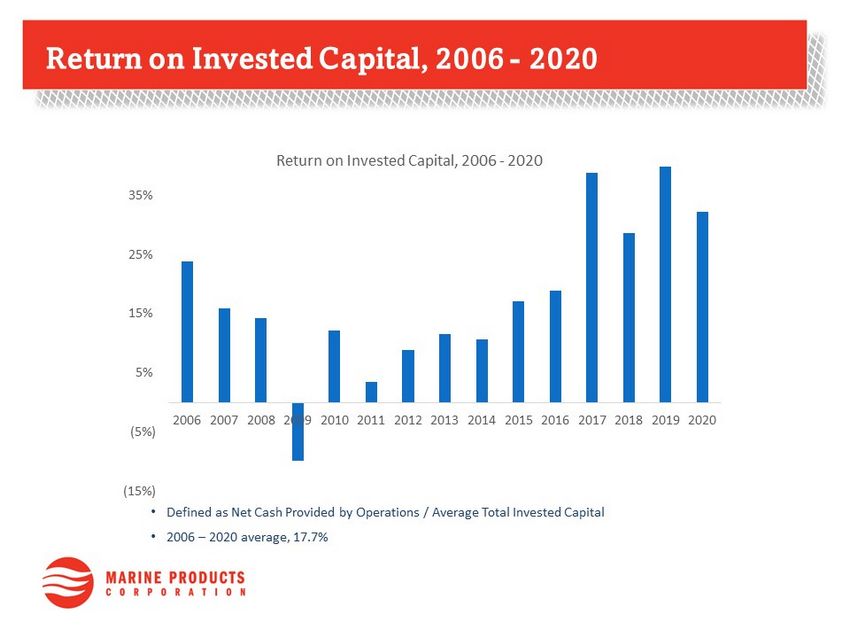

• Defined as Net Cash Provided by Operations / Average Total Invested Capital • 2006 – 2020 average, 17.7% Return on Invested Capital, 2006 - 2020 (15%) (5%) 5% 15% 25% 35% 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 Return on Invested Capital, 2006 - 2020

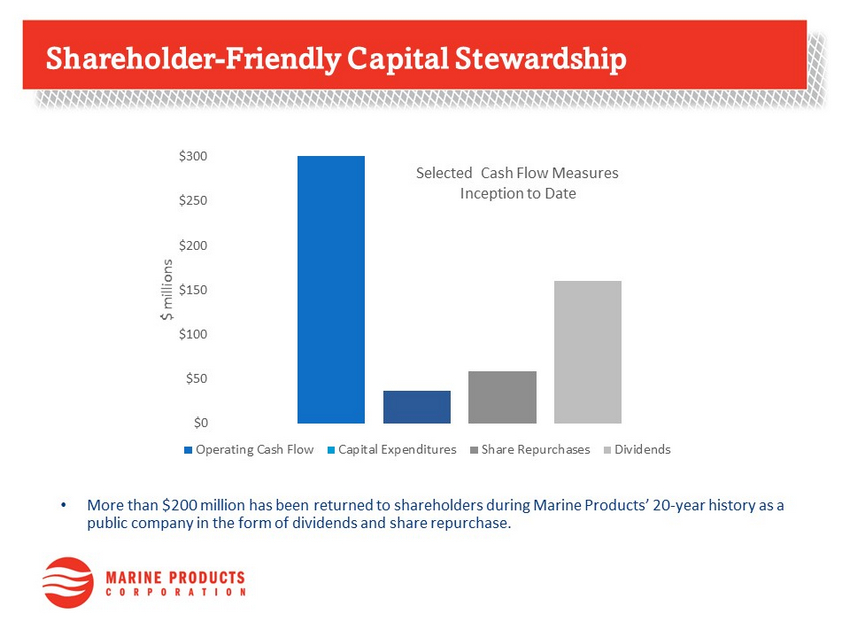

• More than $200 million has been returned to shareholders during Marine Products’ 20 - year history as a public company in the form of dividends and share repurchase. Shareholder - Friendly Capital Stewardship $0 $50 $100 $150 $200 $250 $300 $ millions Selected Cash Flow Measures Inception to Date Operating Cash Flow Capital Expenditures Share Repurchases Dividends

Marine Products Corporation 2801 Buford Highway NE Suite 300 Atlanta, GA 30329 404 - 321 - 7910 marineproductscorp.com CORPORATE HEADQUARTERS