Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - eHealth, Inc. | exhibit9912021q1earningsre.htm |

| 8-K - 8-K - eHealth, Inc. | ehth-20210429.htm |

April 29, 2021 Q1 2021 Financial Results Conference Call Slides

Safe Harbor Statement Forward-Looking Statements This presentation includes forward-looking statements within the meaning of the federal securities laws. Forward-looking statements generally relate to future events or our future financial or operating performance. Forward-looking statements in this presentation include, but are not limited to, the following: our operational focus in Q2 2021, including our plans to increase the effectiveness of our telesales organization, our online capabilities and our strategy to improve lifetime values; our expected cash collections for Medicare Advantage plans and member turnover rate; our estimated memberships; our estimates regarding constrained lifetime values of commissions per approved member; our annual enrollment opportunity; and our guidance for the full year ending December 31, 2021, including our guidance for Adjusted EBITDA, profit from our Medicare segment and profit from our Individual, Family and Small Business segment. Our expectations and beliefs regarding these matters may not materialize, and actual results in future periods are subject to risks and uncertainties that could cause actual results to differ materially from those projected. These risks include those set forth in our filings with the Securities and Exchange Commission, including our latest Form 10-Q and 10-K. The forward-looking statements in this presentation are based on information available to us as of today, and we disclaim any obligation to update any forward-looking statements, except as required by law. Non-GAAP Information This presentation includes both GAAP and non-GAAP financial measures. The presentation of non-GAAP financial information is not intended to be considered in isolation or as a substitute for results prepared in accordance with GAAP. A reconciliation of the non-GAAP financial measures included in this presentation to the most directly comparable GAAP financial measures is available in the Appendix to this presentation. Management uses both GAAP and non-GAAP information in evaluating and operating its business internally and as such has determined that it is important to provide this information to investors. 1

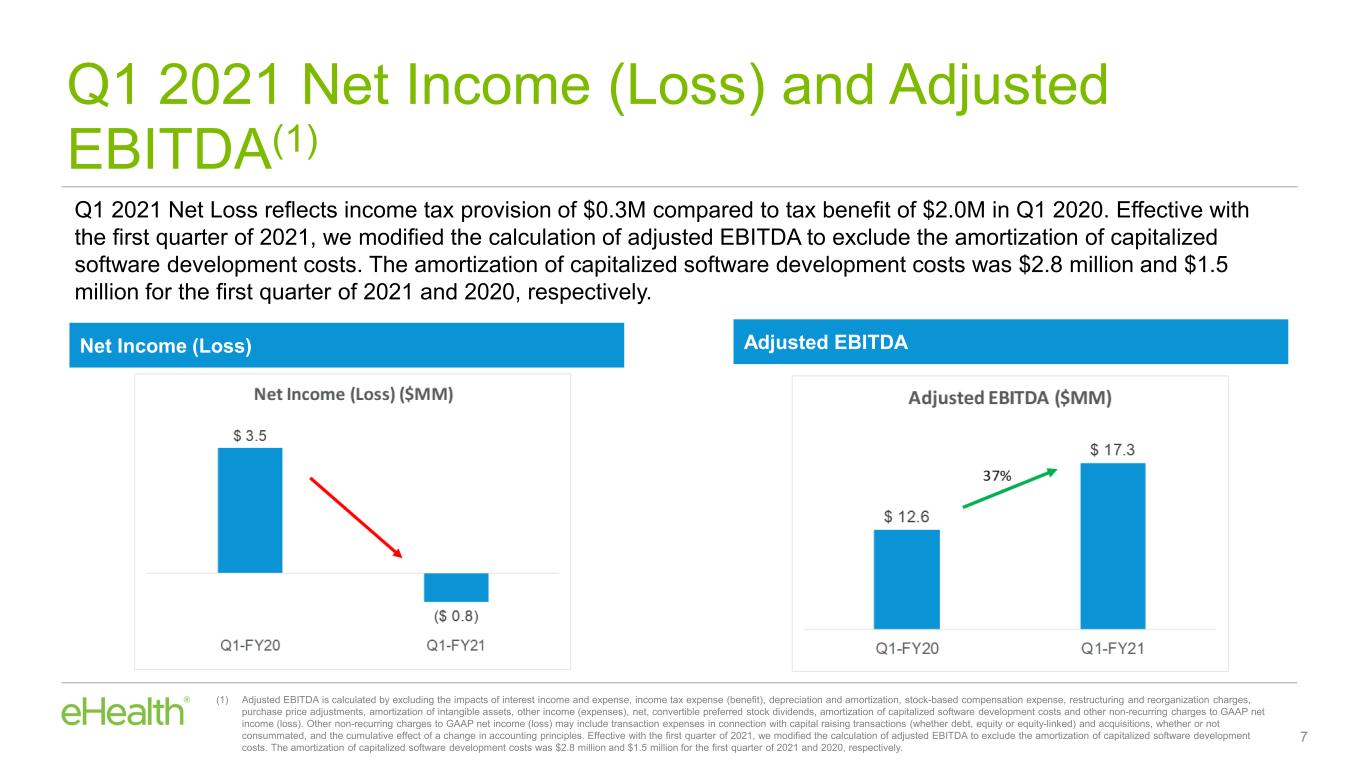

eHealth Q1 2021 Highlights First quarter revenue and adjusted EBITDA(2) significantly exceeded our expectations. Enhancements to call center operations led to a meaningful increase in our agent productivity Total acquisition costs per approved Medicare member declined 12% with agent cost per approved member down 24% compared to Q1 2020 Revenue of $134.2M grew 26% compared to Q1 2020 (1) Major Medicare plans include Medicare Advantage and Medicare Supplement plans; Online submission % represents a combination of unassisted and partially agent-assisted online enrollments. (2) Adjusted EBITDA is calculated by excluding the impacts of interest income and expense, income tax expense (benefit), depreciation and amortization, stock-based compensation expense, restructuring and reorganization charges, purchase price adjustments, amortization of intangible assets, other income (expenses), net, convertible preferred stock dividends, amortization of capitalized software development costs and other non-recurring charges to GAAP net income (loss). Other non-recurring charges to GAAP net income (loss) may include transaction expenses in connection with capital raising transactions (whether debt, equity or equity-linked) and acquisitions, whether or not consummated, and the cumulative effect of a change in accounting principles. Effective with the first quarter of 2021, we modified the calculation of adjusted EBITDA to exclude the amortization of capitalized software development costs. The amortization of capitalized software development costs was $2.8 million and $1.5 million for the first quarter of 2021 and 2020, respectively. 35% of Medicare major medical applications submitted online, compared to 24% in Q1 2020(1) Net cash provided by operating activities of $42.8M compared to $8.9M in Q1 2020 Adjusted EBITDA(2) of $17.3M, compared to $12.6M in Q1 2020; Net Loss of $0.8M Medicare Advantage approved members grew 65% year-over- year 2 Effective with the first quarter of 2021, we modified the calculation of adjusted EBITDA to exclude the amortization of capitalized software development costs. The amortization of capitalized software development costs was $2.8 million and $1.5 million for the first quarter of 2021 and 2020, respectively.

$ 106.4 $ 134.2 Q1-FY20 Q1-FY21 Revenue ($MM) 26% 3 Q1 2021 Revenue Q1 revenue growth driven primarily by an increase in approved Medicare Advantage members of 65% in Q1 2021 compared to Q1 2020 Positive impact of Medicare enrollment growth was partially offset by a decline in Medicare Advantage LTVs of 4% and lower “tail” revenue in Q1 2021 compared to Q1 2020 Revenue

Q1 2021 Medicare Advantage Approved Members(1) and New Paying Members(2) Q1 2021 Medicare Advantage approved members grew 65% YoY and Medicare Advantage new paying members grew by 63% YoY (1) Approved members consist of the number of individuals on submitted applications that were approved by the relevant insurance carrier for the identified product during the period presented. Approved members may not pay for their plan and become paying members. (2) New Paying Members consist of approved members from the period presented and any periods prior to the period presented from whom we have received an initial commission payment during the period presented. Medicare Advantage Approved Members Medicare Advantage New Paying Members 4

7.3m Our Enrollment Remains a Small Portion of Total Medicare Advantage Annual Opportunity 5 3.3m 4.0m Estimated New to MA (Age-ins + shifted from traditional Medicare) Estimated Switchers Within MA Estimated Medicare Advantage Opportunity for FY 2020 (1) (2) 388k eHealth’s 388k Approved Medicare Advantage Members in FY2020 represented 5% of total estimated annual enrollment opportunity (1) We estimate the New to MA opportunity as follows: 2020 MA enrollment growth (~2.1m, Source: CMS) with the addition of our assumption for consumers who left MA or died in 2020 (5% of 2019 ending enrollment = ~1.2m). 2020 New to MA estimate is ~3.3m. (2) We estimate 2020 Switchers within MA as follows: total 2019 MA enrollments (Source: CMS) multiplied by an assumed 17% annual switching rate, based on 12% switching during the AEP and 5% during OEP(Source: Deft). Estimate is ~4m. (3) Sum of estimated Switchers and Estimated New to MA members: ~7.3m. Tapping into a large greenfield opportunity. New to MA members represented ~47% of our total MA policies with effective date of Jan 1, 2021 eHealth’s Approved MA members for FY 2020 (3)

24.4% 35.2% Q1-FY20 Q1-FY21 Medicare Major Medical Online Application % 44% Medicare Major Medical Online Application%(1) Achieved online penetration for Q1 2021 of 35%, compared to 24% for Q1 2020 Fully unassisted online applications for Medicare major medical products grew 106% (1) Major Medicare plans include Medicare Advantage and Medicare Supplement plans; online % represents a combination of unassisted and partially agent-assisted online enrollments. Medicare Major Medical Online Application % 6

Q1 2021 Net Loss reflects income tax provision of $0.3M compared to tax benefit of $2.0M in Q1 2020. Effective with the first quarter of 2021, we modified the calculation of adjusted EBITDA to exclude the amortization of capitalized software development costs. The amortization of capitalized software development costs was $2.8 million and $1.5 million for the first quarter of 2021 and 2020, respectively. Q1 2021 Net Income (Loss) and Adjusted EBITDA(1) (1) Adjusted EBITDA is calculated by excluding the impacts of interest income and expense, income tax expense (benefit), depreciation and amortization, stock-based compensation expense, restructuring and reorganization charges, purchase price adjustments, amortization of intangible assets, other income (expenses), net, convertible preferred stock dividends, amortization of capitalized software development costs and other non-recurring charges to GAAP net income (loss). Other non-recurring charges to GAAP net income (loss) may include transaction expenses in connection with capital raising transactions (whether debt, equity or equity-linked) and acquisitions, whether or not consummated, and the cumulative effect of a change in accounting principles. Effective with the first quarter of 2021, we modified the calculation of adjusted EBITDA to exclude the amortization of capitalized software development costs. The amortization of capitalized software development costs was $2.8 million and $1.5 million for the first quarter of 2021 and 2020, respectively. Exceeded expectations due to significant growth in Medicare enrollments Net Income (Loss) Adjusted EBITDA 7

Q1 2021 Medicare Segment Revenue and Profit (1) Medicare Segment Revenue grew 26% in Q1 2021 compared to Q1 2020 Medicare Segment Profit grew 6% in Q1 2021 compared to Q1 2020 Medicare Segment Revenue Medicare Segment Profit 8 (1) During the first quarter of 2021, we modified the calculation of segment profit and adjusted EBITDA to exclude the amortization of capitalized software development cost. Amortization of capitalized software development costs were $2.8 million and $1.5 million for the first quarter of 2021 and 2020, respectively. For additional information, see the earnings release issued by eHealth, Inc. on April 29, 2021 announcing its first quarter results for Revised Segment Profit Summary and Revised Adjusted EBITDA Reconciliation.

Q1 2021 IFP Segment Revenue and Profit (1) IFP Segment Revenue IFP Segment Profit 9 (1) During the first quarter of 2021, we modified the calculation of segment profit and adjusted EBITDA to exclude the amortization of capitalized software development cost. Amortization of capitalized software development costs were $2.8 million and $1.5 million for the first quarter of 2021 and 2020, respectively. For additional information, see the earnings release issued by eHealth, Inc. on April 29, 2021 announcing its first quarter results for Revised Segment Profit Summary and Revised Adjusted EBITDA Reconciliation.

Trailing Twelve Months (“TTM”) Medicare Segment Commissions Cash Collections 10 Q1 21 TTM Medicare Segment commissions cash collections increased by 39% year-over-year Q1 21 TTM Medicare Segment commissions cash collections per MA equivalent member(1) of $431 grew 11% year-over- year ($MM) TTM Medicare Segment Commissions Cash Collections (1) MA Equivalent member is calculated as the total number of estimated Medicare Advantage and Medicare Supplement membership and 25% of the estimated Medicare Part D membership during the period presented. (TTM)

Medicare Advantage Unit Economics – Historical Trend 11 Constrained LTV LTV / Adjusted Marketing COALTV / Marketing COA (1) Constrained lifetime value ("LTV") of commissions per approved MA member represents commissions estimated to be collected over the estimated life of an approved member's policy after applying constraints in accordance with our revenue recognition policy. The estimate is driven by multiple factors, including but not limited to, contracted commission rates, carrier mix, estimated average plan duration, the regulatory environment, and cancellations of insurance plans offered by health insurance carriers with which we have a relationship. These factors may result in varying values from period to period. (2) Marketing COA (“Cost of Acquisition”) defined as variable marketing cost used to obtain approved members divided by MA equivalent Approved Members. (3) Adjusted Marketing COA (“Cost of Acquisition”) defined as variable marketing cost used to obtain approved members less the sum of carrier advertising revenue and carrier lead generation revenue divided by MA equivalent Approved Members. See Appendix 1 for reconciliation. (1) (2) (3) Adjusted Marketing COA was impacted by seasonally lower sponsorship revenue in the first quarter relative historically observed patterns in subsequent quarters

MA Q4 18 Q1 19 Q2 19 Q3 19 Q4 19 Q1 20 Q2 20 Q3 20 Q4 20 Q1 21 Approved Members(1) 83,376 40,741 36,576 35,171 167,073 64,898 60,477 44,999 217,278 106,884 Estimated Beginning (Paying) Membership(2) 235,268 276,357 280,763 291,171 309,180 404,694 384,513 407,243 421,237 533,282 New Paying Members(3) 62,817 49,531 36,122 33,974 116,351 86,299 57,232 44,528 136,857 140,997 Estimated Ending (Paying) Membership(4) 276,357 280,763 291,171 309,180 404,694 384,513 407,243 421,237 533,282 538,716 Medicare Advantage Plan Member Turnover(5) 21,728 45,125 25,714 15,965 20,837 106,480 34,502 30,534 24,812 135,563 Trailing Twelve Month Member Turnover(6) 95,065 89,357 102,403 108,532 107,641 168,996 177,783 192,353 196,328 225,411 Average Trailing Twelve Month Estimated Membership Plus New Paying Members(7) 262,856 276,948 296,490 316,501 348,362 389,638 420,853 452,510 485,651 531,472 Trailing Twelve Month Member Turnover Rate(8) 36% 32% 35% 34% 31% 43% 42% 43% 40% 42% Medicare Advantage Plan Member Turnover Trend Since Q4 2018 12 * *As previously disclosed, we learned subsequent to reporting for the three months ended March 31, 2020 that estimated Medicare Advantage membership as of March 31, 2020 was 384,513, a decrease of 19,749 or 4.9% relative to the previously reported estimated membership of 404,262, due to additional membership attrition during the quarter ended March 31, 2020 that was observed after the reporting period. Taking that adjustment into account, the resulting Q1 20 trailing twelve-month member turnover rate was 43% vs. reported 38%. The average variance of actual vs. reported estimated membership for all other quarters since Q4 18 is less than 1% and is shown as previously reported in the table. *

Medicare Advantage Plan Member Turnover Trend Since Q4 2018 (cont’d) 13 (1) Approved members consist of the number of individuals on submitted applications that were approved by the relevant insurance carrier for the identified product during the period presented. Approved members may not pay for their plan and become paying members. (2) Estimated Beginning (Paying) Membership is the Estimated Ending Membership for the period prior to the period of estimation. Membership is estimated using the methodology described in our periodic filings with the Securities and Exchange Commission. (3) New Paying Members consist of approved members from the period presented and any periods prior to the period presented from whom we have received an initial commission payment during the period presented. (4) Estimated Ending (Paying) Membership is the number of members we estimate as of the end of the period. Membership is estimated using the methodology described in our periodic filings with the Securities and Exchange Commission. (5) Medicare Advantage Plan Member Turnover for the period is derived as follows: Estimated Beginning Membership plus New Paying Members minus Estimated Ending Membership. (6) Trailing Twelve Month Member Turnover is the sum of Medicare Advantage Plan Member Turnover for the prior twelve months. (7) Average Trailing Twelve Month Estimated Membership Plus New Paying Members is the sum of (i) trailing twelve month Estimated Beginning Membership, plus (ii) New Paying Members for the trailing twelve months, divided by 4. (8) Trailing Twelve Month Member Turnover Rate is Trailing Twelve Month Turnover divided by Average Trailing Twelve Month Estimated Membership Plus New Paying Members.

Key Areas of Operational Focus for Q2 2021 14 • Continue to increase effectiveness of our telesales organization as we begin to ramp up for AEP ─ Improve plan matching technology available to our predominately internal workforce ─ Enhance the agent onboarding and training process ─ Expand retention team • Emphasize LTV maximization measures ─ Reduce churn for all cohorts through expansion of our retention initiatives ─ Grow base of new to MA enrollees ─ Continue to expand enrollees acquired through online channels • Further expand our online/e-commerce capabilities with strong emphasis on personalization of consumer experience

2021 Guidance(1) For the full year ending December 31, 2021, we have increased our adjusted EBITDA and segment profit estimates to account for the change in methodology for calculating these financial metrics. Effective with the first quarter of 2021, we modified the calculation of adjusted EBITDA to exclude the amortization of capitalized software development costs. The amortization of capitalized software development costs was $2.8 million and $1.5 million for the first quarter of 2021 and 2020, respectively. We are maintaining guidance for all other metrics: • Adjusted EBITDA (2) is expected in the range of $110M to $125M compared to our previous guidance of $100M to $115M. The increase is due to the change in the calculation of adjusted EBITDA to exclude amortization of capitalized software development costs. • Medicare segment profit(3) is expected in the range of $147M to $164M compared to our previous guidance of $138M to $155M • Individual, Family and Small Business segment profit (3) is expected in the range of $19M to $20M compared to our previous guidance of $18M to $19M 15

2021 Guidance (cont’d) 16 (1) Guidance excludes the potential impact from the agreement with HIG Capital for a $225 million investment announced on January 29, 2021. (2) Adjusted EBITDA is calculated by excluding the impacts of interest income and expense, income tax expense (benefit), depreciation and amortization, stock-based compensation expense, restructuring and reorganization charges, purchase price adjustments, amortization of intangible assets, other income (expenses), net, convertible preferred stock dividends, amortization of capitalized software development costs and other non-recurring charges to GAAP net income (loss). Other non-recurring charges to GAAP net income (loss) may include transaction expenses in connection with capital raising transactions (whether debt, equity or equity-linked) and acquisitions, whether or not consummated, and the cumulative effect of a change in accounting principles. (3) Segment profit is calculated as revenue for the applicable segment less marketing and advertising, customer care and enrollment, technology and content and general and administrative operating expenses, excluding stock-based compensation expense, depreciation and amortization, restructuring charges, and amortization of intangible assets, that are directly attributable to the applicable segment and other indirect marketing and advertising, customer care and enrollment and technology and content operating expenses, excluding stock-based compensation expense, depreciation and amortization, restructuring charges, and amortization of intangible assets, allocated to the applicable segment based on usage.

2020 2019 2018 2017 2016 Estimated variable marketing cost per MA-equivalent approved member (2) $ 353 $ 349 384$ 330$ 297$ 337$ 372$ (-) Carrier advertising revenue $ 48 $ 72 150$ 97$ 74$ 46$ 43$ (-) Carrier lead generation revenue $ 6 $ 5 7$ 4$ 19$ 4$ 1$ Estimated adjusted variable marketing cost per MA-equivalent approved member (2) $ 299 $ 273 227$ 229$ 204$ 287 328$ Fiscal Year Ended December 31, (1) Medicare segment variable marketing cost is the portion of the respective operating expenses for marketing and advertising and customer care and enrollment that is directly related to member acquisition for our sale of Medicare Advantage, Medicare Supplement and Medicare Part D prescription drug plans (collectively, the “Medicare Plans”). (2) MA-equivalent approved members is a derived metric with a Medicare Part D approved member being weighted at 25% of a Medicare Advantage member and a Medicare Supplement member based on their relative LTVs at the time of our adoption of Accounting Standards Codification 606 – Revenue from Contracts with Customers (“ASC 606”). We calculate the number of approved MA-equivalent members by adding the total number of approved Medicare Advantage and Medicare Supplement members and 25% of the total number of approved Medicare Part D members during the period presented. RECONCILIATION OF ESTIMATED ADJUSTED VARIABLE MARKETING COST PER MA-EQUIVALENT APPROVED MEMBER Three Months Ended March 31, 2021 2020 Appendix 1 17 (1) (1)

Appendix 2 18 GAAP net income (loss) $ (800) $ 3,452 Stock-based compensation expense Amortization of intangible assets Restructuring charges Tax effect of non-GAAP adjustments Non-GAAP net income $ 9,383 $ 10,317 GAAP net income per diluted share $ (0.03) $ 0.13 Stock-based compensation expense Amortization of intangible assets Restructuring charges Tax effect of non-GAAP adjustments Non-GAAP net income per diluted share $ 0.36 $ 0.39 GAAP net income (loss) $ (800) $ 3,452 Stock-based compensation expense Depreciation and amortization (2) Amortization of intangible assets Restructuring charges Other income, net Provision (benefit) for income taxes Adjusted EBITDA (2) $ 17,311 $ 12,616 _______ (1) See Non-GAAP Financial Information section of the earnings press release for definitions of our non-GAAP financial measures. RECONCILIATION OF GAAP TO NON-GAAP FINANCIAL MEASURES (In thousands, except per share amounts, unaudited) Three Months Ended March 31, 2021 2020 11,402 8,714 176 547 2,431 — (3,826) (2,396) 0.43 0.33 0.01 0.02 0.09 — (0.14) (0.09) 11,402 8,714 3,944 2,324 176 547 (2) In the first quarter of 2021, we revised our calculation of the adjusted EBITDA to exclude amortization of capitalized software development costs. Amortization of capitalized software development costs were $2.8 million and $1.5 million for the first quarter of 2021 and 2020, respectively, which are included in depreciation and amortization. See Revised Adjusted EBITDA Reconciliation for additional information. 2,431 — (150) (373) 308 (2,048) (1)

Appendix 3 19 GAAP net income $ 42.0 $ 57.0 Stock-based compensation expense Restructuring charges Amortization of intangible assets Tax effect of non-GAAP adjustments Non-GAAP net income $ 76.1 $ 89.5 GAAP net income per diluted share $ 1.53 $ 2.08 Stock-based compensation expense Restructuring charges Amortization of intangible assets Tax effect of non-GAAP adjustments Non-GAAP net income per diluted share $ 2.77 $ 3.26 GAAP net income $ 42.0 $ 57.0 Stock-based compensation expense Depreciation and amortization (2) Restructuring charges Amortization of intangible assets Other income, net Provision for income taxes Adjusted EBITDA (2) $ 110.0 $ 125.0 _______ (1) See Non-GAAP Financial Information section of the earnings press release for definitions of our non-GAAP financial measures. (2) In the first quarter of 2021, we revised our calculation of adjusted EBITDA to exclude the amortization of capitalized software development costs. Amortization of capitalized software development costs is included in depreciation and amortization. Refer to Revised Adjusted EBITDA Reconciliation for additional information. (1.5) (2.5) 11.4 15.4 RECONCILIATION OF NON-GAAP FINANCIAL MEASURES TO GUIDANCE (1) (In millions, except per share amounts, unaudited) 15.5 14.5 2.1 2.1 1.42 1.35 0.08 0.08 0.05 0.05 1.5 1.5 (8.5) (8.1) 1.5 1.5 (0.31) (0.30) 39.0 37.0 Year Ending December 31, 2021 Low High 39.0 37.0 2.1 2.1