Attached files

| file | filename |

|---|---|

| 8-K - WEX INC. 8-K - WEX Inc. | a52420244.htm |

|

|

Exhibit 99.1

|

WEX First Quarter 2021 Earnings April 29, 2021

These materials contain forward-looking statements, including statements regarding: assumptions

underlying the Company's future financial performance, future operations; future growth opportunities and expectations; expectations for future revenue performance, future impacts from areas of investment, expectations for the macro

environment; and, expectations for volumes. Any statements that are not statements of historical facts may be deemed to be forward-looking statements. When used in this earnings release, the words “anticipate,” “believe,” “continue,” “could,”

“estimate,” “expect,” “intend,” “may,” “plan,” “project” and similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain such words. These forward-looking statements are subject

to a number of risks and uncertainties that could cause actual results to differ materially, including: the extent to which the coronavirus (COVID-19) pandemic and measures taken in response thereto impact our business, results of operations

and financial condition in excess of current expectations; the effects of general economic conditions, including those caused by the effects of COVID-19, on fueling patterns as well as payment and transaction processing activity; the impact

of foreign currency exchange rates on the Company’s operations, revenue and income; changes in interest rates; the impact of fluctuations in fuel prices, including the impact of any reductions in fuel prices and the resulting impact on our

revenues and net income; changes or limitations on interchange fees; failure to comply with the applicable requirements of MasterCard or Visa contracts and rules; the effects of the Company’s business expansion and acquisition efforts;

potential adverse changes to business or employee relationships, including those resulting from the completion of an acquisition; competitive responses to any acquisitions; uncertainty of the expected financial performance of the combined

operations following completion of an acquisition; the failure to complete or successfully integrate the Company’s acquisitions or the ability to realize anticipated synergies and cost savings from such transactions; unexpected costs, charges

or expenses resulting from an acquisition, specifically including the recent eNett and Optal acquisitions; the Company’s failure to successfully acquire, integrate, operate and expand commercial fuel card programs; the failure of corporate

investments to result in anticipated strategic value; the impact and size of credit losses; the impact of changes to the Company’s credit standards; breaches of the Company’s technology systems or those of our third-party service providers

and any resulting negative impact on our reputation, liabilities or relationships with customers or merchants; the Company’s failure to maintain or renew key commercial agreements; failure to expand the Company’s technological capabilities

and service offerings as rapidly as the Company’s competitors; failure to successfully implement the Company’s information technology strategies and capabilities in connection with its technology outsourcing and insourcing arrangements and

any resulting cost associated with that failure; the actions of regulatory bodies, including banking and securities regulators, or possible changes in banking or financial regulations impacting the Company’s industrial bank, the Company as

the corporate parent or other subsidiaries or affiliates; legal, regulatory, political and economic uncertainty surrounding the United Kingdom’s departure from the European Union and the resulting trade agreement; the impact of the future

transition from LIBOR as a global benchmark to a replacement rate; the impact of the Company’s recently amended and restated credit agreement and its presently outstanding notes on our operations; the impact of increased leverage on the

Company’s operations, results or borrowing capacity generally, and as a result of acquisitions specifically; the impact of sales or dispositions of significant amounts of our outstanding common stock into the public market, or the perception

that such sales or dispositions could occur; the possible dilution to our stockholders caused by the issuance of additional shares of common stock or equity-linked securities, whether as result of our convertible notes or otherwise; the

incurrence of impairment charges if our assessment of the fair value of certain of our reporting units changes; the uncertainties of litigation; as well as other risks and uncertainties identified in Item 1A of our annual report on Form 10-K

for the year ended December 31, 2020, filed with the Securities and Exchange Commission on March 1, 2021. The Company's forward-looking statements do not reflect the potential future impact of any alliance, merger, acquisition, disposition or

stock repurchases. The forward-looking statements speak only as of the date of this earnings release and undue reliance should not be placed on these statements. The Company disclaims any obligation to update any forward-looking statements as

a result of new information, future events or otherwise.Non-GAAP Information:For additional important information and disclosure regarding our use of non-GAAP metrics, specifically adjusted net income attributable to shareholders and adjusted

operating income, please see our most recent earnings release, issued on April 29, 2021. See the Appendix to this presentation for an explanation and reconciliation of (i) non-GAAP adjusted net income attributable to shareholders (or

“adjusted net income” or “ANI”) to GAAP net (loss) income attributable to shareholders, and (ii) ANI per diluted share to GAAP net (loss) income per diluted share.Note: The Company rounds amounts in the consolidated financial statements to

thousands and calculates all percentages and per-share data from underlying whole-dollar amounts. Thus, certain amounts may not foot, crossfoot, or recalculate exactly based on reported numbers due to rounding. WEX Forward-Looking

Statements

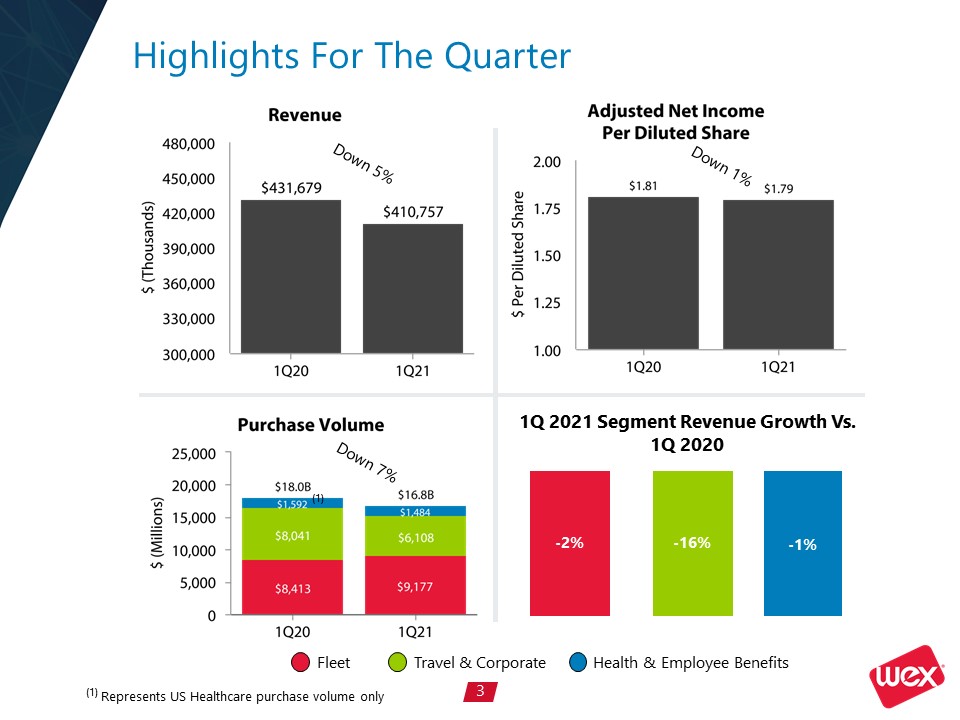

Highlights For The Quarter Fleet Travel & Corporate Health & Employee

Benefits Down 5% Down 1% Down 7% 1Q 2021 Segment Revenue Growth

Vs. 1Q 2020 -1% -16% -2% (1) (1) Represents US Healthcare purchase volume only (1)

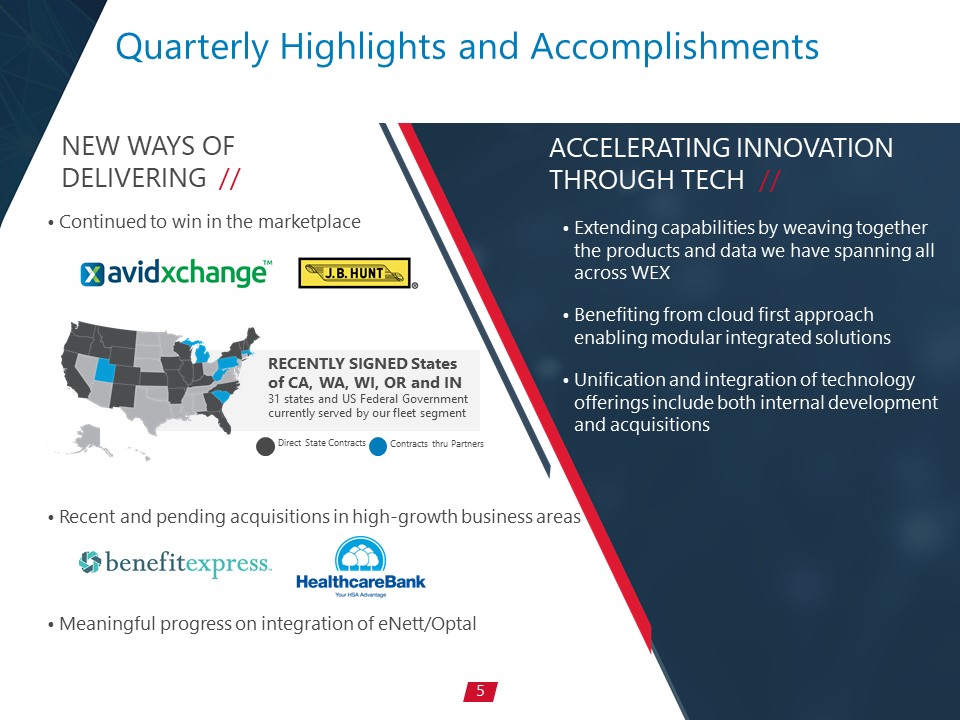

Executing on our Commitments ACHIEVEMENTS THIS QUARTER INNOVATION / EXECUTION / INTEGRITY /

RELATIONSHIPS / COMMUNITY STRATEGIC PILLARS & CORE VALUES Exceeded our revenue expectations and adjusted earnings grew 25% sequentiallyIn aggregate, Fleet, Corporate Payments and Health are above pre-pandemic revenue levelsStrong

volumes across the business, including $16.8 billion of purchase volume during the first quarterExecuting on our Strategic Pillars :Finding new ways to deliver value to customersAccelerating innovation using technologyBuilding upon our

values-based culture and empowering our employees

Quarterly Highlights and Accomplishments Continued to win in the marketplace

Recent and

pending acquisitions in high-growth business areas

Meaningful progress on integration of eNett/Optal

RECENTLY SIGNED States of CA, WA, WI, OR and IN31 states and US Federal Government currently served by our fleet

segment ACCELERATING INNOVATION

THROUGH TECH //

Extending capabilities by weaving together the products and data we have spanning all across WEXBenefiting from cloud first approach enabling modular integrated solutionsUnification and

integration of technology offerings include both internal development and acquisitions NEW WAYS OF DELIVERING //

Direct State Contracts Contracts thru Partners ACCELERATING INNOVATIONTHROUGH TECH //

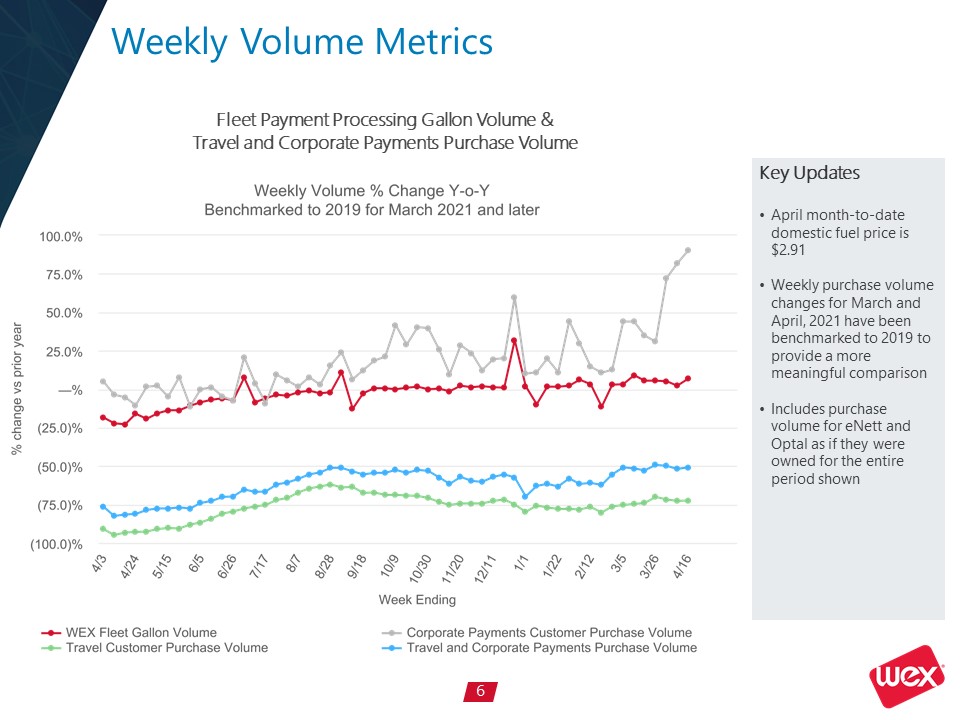

Weekly Volume Metrics Key UpdatesApril month-to-date domestic fuel price is $2.91Weekly purchase

volume changes for March and April, 2021 have been benchmarked to 2019 to provide a more meaningful comparisonIncludes purchase volume for eNett and Optal as if they were owned for the entire period shown Fleet Payment Processing Gallon

Volume & Travel and Corporate Payments Purchase Volume

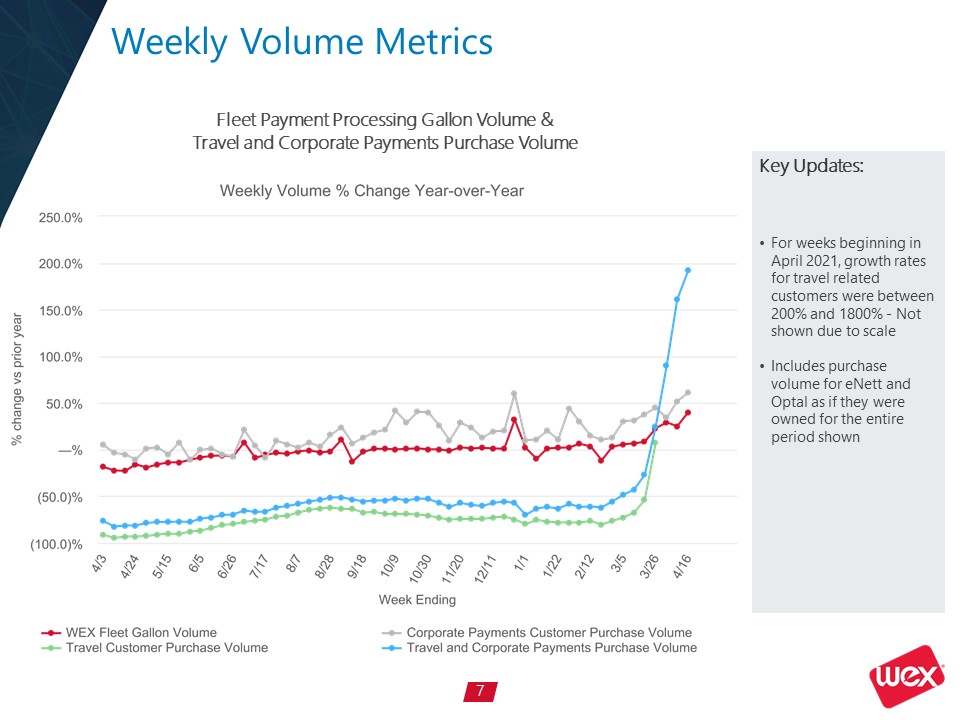

Weekly Volume Metrics Key Updates:For weeks beginning in April 2021, growth rates for travel related

customers were between 200% and 1800% - Not shown due to scaleIncludes purchase volume for eNett and Optal as if they were owned for the entire period shown Fleet Payment Processing Gallon Volume & Travel and Corporate Payments Purchase

Volume

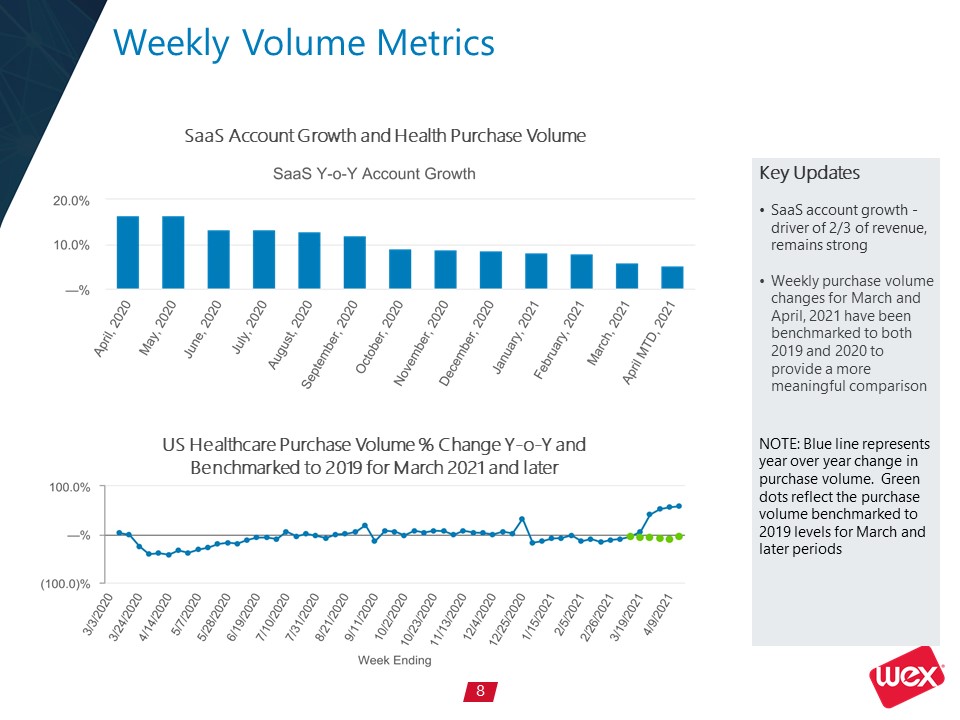

Weekly Volume Metrics Key Updates

SaaS account growth - driver of 2/3 of revenue, remains

strongWeekly purchase volume changes for March and April, 2021 have been benchmarked to both 2019 and 2020 to provide a more meaningful comparisonNOTE: Blue line represents year over year change in purchase volume. Green dots reflect the

purchase volume benchmarked to 2019 levels for March and later periods SaaS Account Growth and Health Purchase Volume US Healthcare Purchase Volume % Change Y-o-Y and Benchmarked to 2019 for March 2021 and later

WEX First Quarter 2021 Financial Results

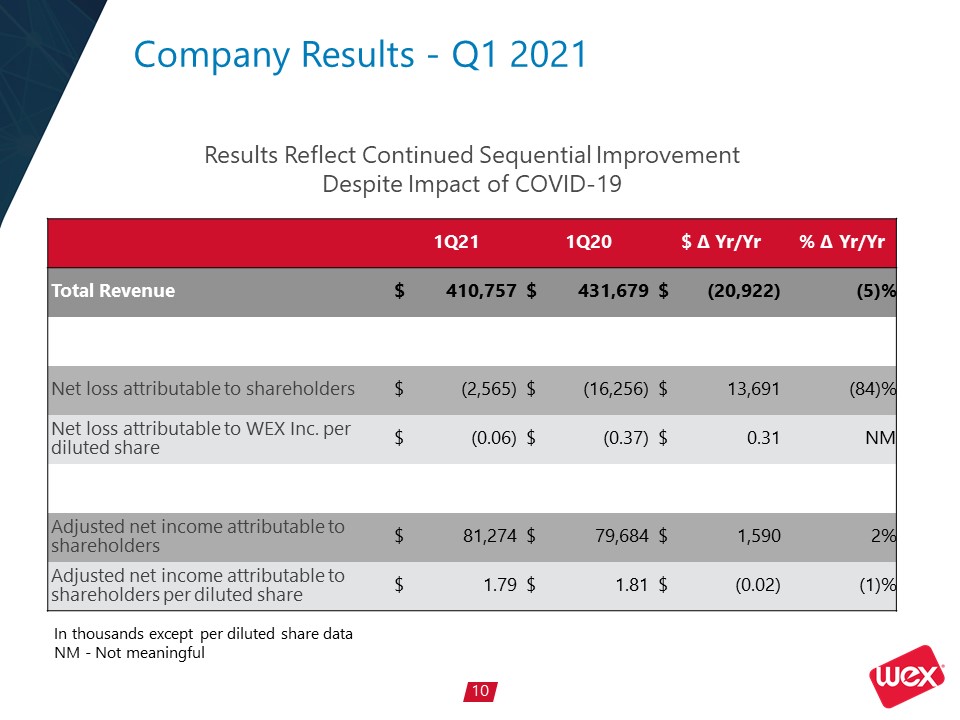

Company Results - Q1 2021 1Q21 1Q20 $ ∆ Yr/Yr % ∆ Yr/Yr Total

Revenue $ 410,757 $ 431,679 $ (20,922) (5)% Net loss attributable to shareholders $ (2,565) $ (16,256) $ 13,691 (84)% Net loss attributable to WEX Inc. per diluted

share $ (0.06) $ (0.37) $ 0.31 NM Adjusted net income attributable to shareholders $ 81,274 $ 79,684 $ 1,590 2% Adjusted net income attributable to shareholders per diluted

share $ 1.79 $ 1.81 $ (0.02) (1)% In thousands except per diluted share dataNM - Not meaningful Results Reflect Continued Sequential Improvement Despite Impact of COVID-19

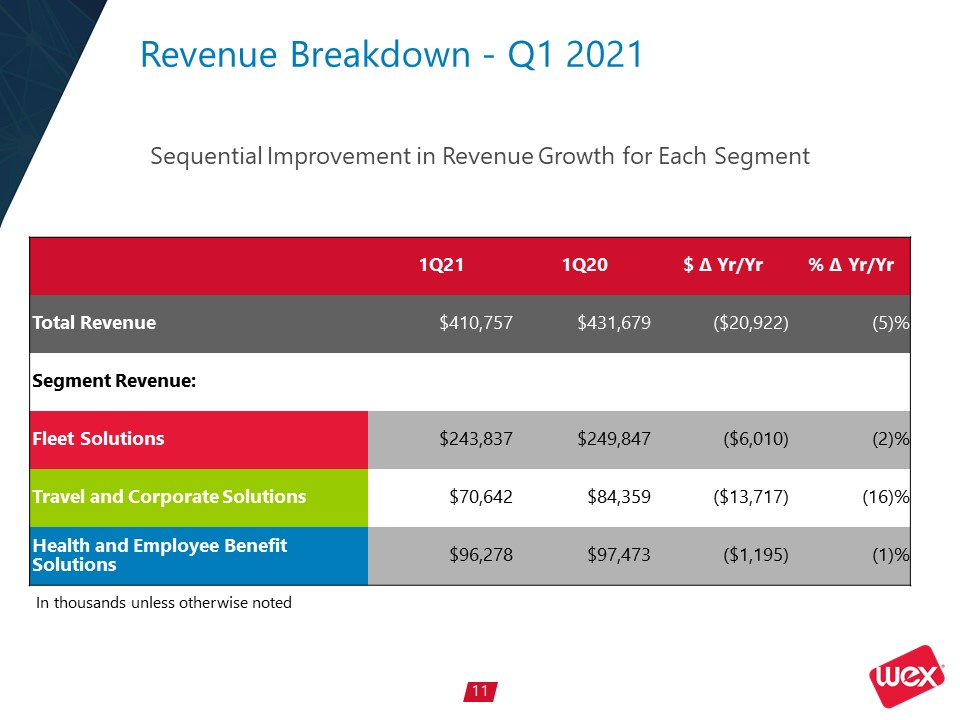

Revenue Breakdown - Q1 2021 1Q21 1Q20 $ ∆ Yr/Yr % ∆ Yr/Yr Total

Revenue $410,757 $431,679 ($20,922) (5)% Segment Revenue: Fleet Solutions $243,837 $249,847 ($6,010) (2)% Travel and Corporate Solutions $70,642 $84,359 ($13,717) (16)% Health and Employee Benefit

Solutions $96,278 $97,473 ($1,195) (1)% Sequential Improvement in Revenue Growth for Each Segment In thousands unless otherwise noted

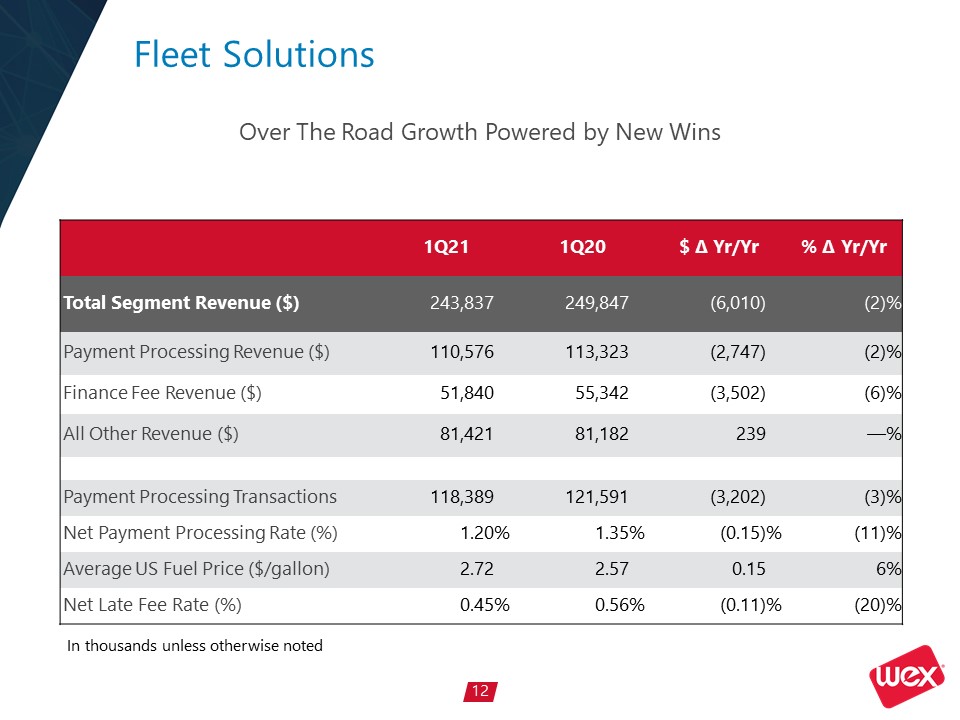

Fleet Solutions 1Q21 1Q20 $ ∆ Yr/Yr % ∆ Yr/Yr Total Segment Revenue

($) 243,837 249,847 (6,010) (2)% Payment Processing Revenue ($) 110,576 113,323 (2,747) (2)% Finance Fee Revenue ($) 51,840 55,342 (3,502) (6)% All Other Revenue

($) 81,421 81,182 239 —% Payment Processing Transactions 118,389 121,591 (3,202) (3)% Net Payment Processing Rate (%) 1.20 % 1.35 % (0.15) % (11)% Average US Fuel Price

($/gallon) 2.72 2.57 0.15 6% Net Late Fee Rate (%) 0.45 % 0.56 % (0.11) % (20)% Over The Road Growth Powered by New Wins In thousands unless otherwise noted

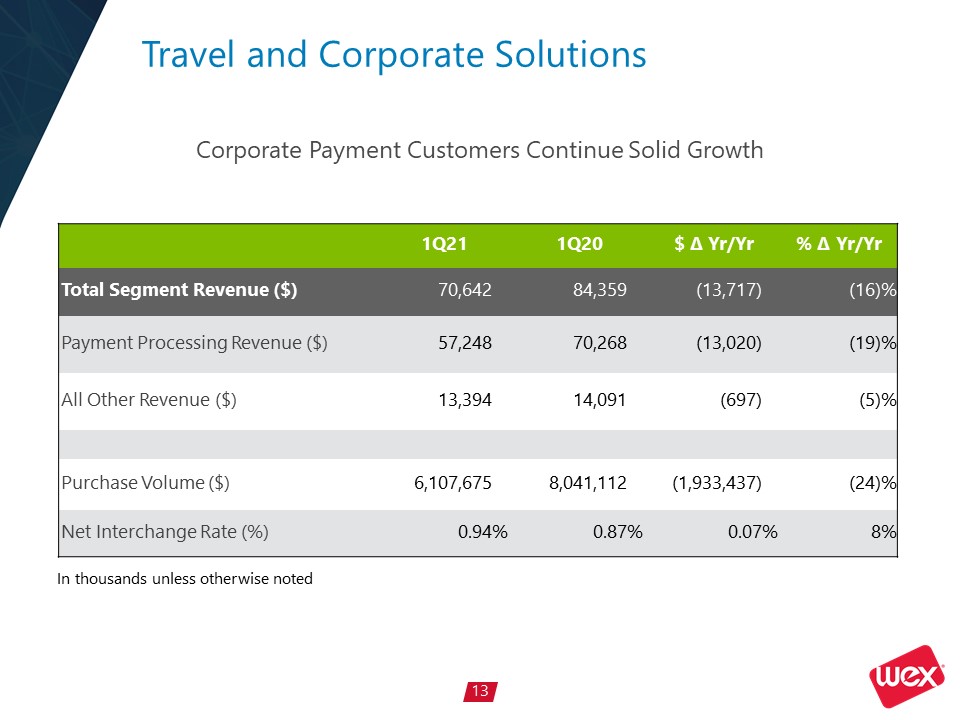

Travel and Corporate Solutions 1Q21 1Q20 $ ∆ Yr/Yr % ∆ Yr/Yr Total Segment Revenue

($) 70,642 84,359 (13,717) (16)% Payment Processing Revenue ($) 57,248 70,268 (13,020) (19)% All Other Revenue ($) 13,394 14,091 (697) (5)% Purchase Volume

($) 6,107,675 8,041,112 (1,933,437) (24)% Net Interchange Rate (%) 0.94 % 0.87 % 0.07 % 8% Corporate Payment Customers Continue Solid Growth In thousands unless otherwise noted

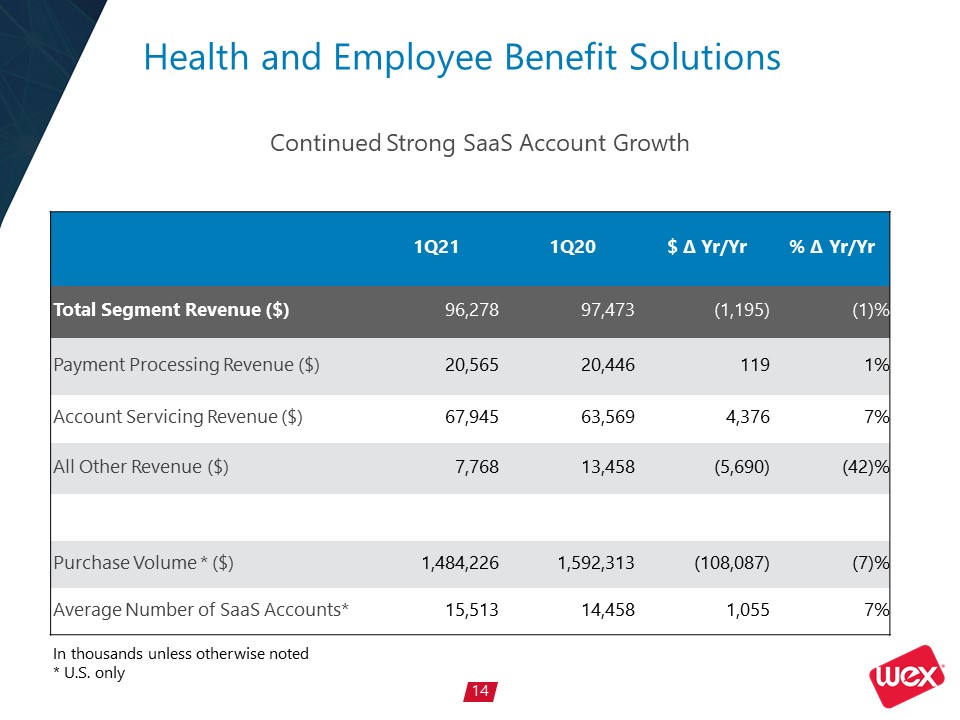

Health and Employee Benefit Solutions 1Q21 1Q20 $ ∆ Yr/Yr % ∆ Yr/Yr Total Segment Revenue

($) 96,278 97,473 (1,195) (1)% Payment Processing Revenue ($) 20,565 20,446 119 1% Account Servicing Revenue ($) 67,945 63,569 4,376 7% All Other Revenue

($) 7,768 13,458 (5,690) (42)% Purchase Volume * ($) 1,484,226 1,592,313 (108,087) (7)% Average Number of SaaS Accounts* 15,513 14,458 1,055 7% Continued Strong SaaS Account Growth In

thousands unless otherwise noted* U.S. only

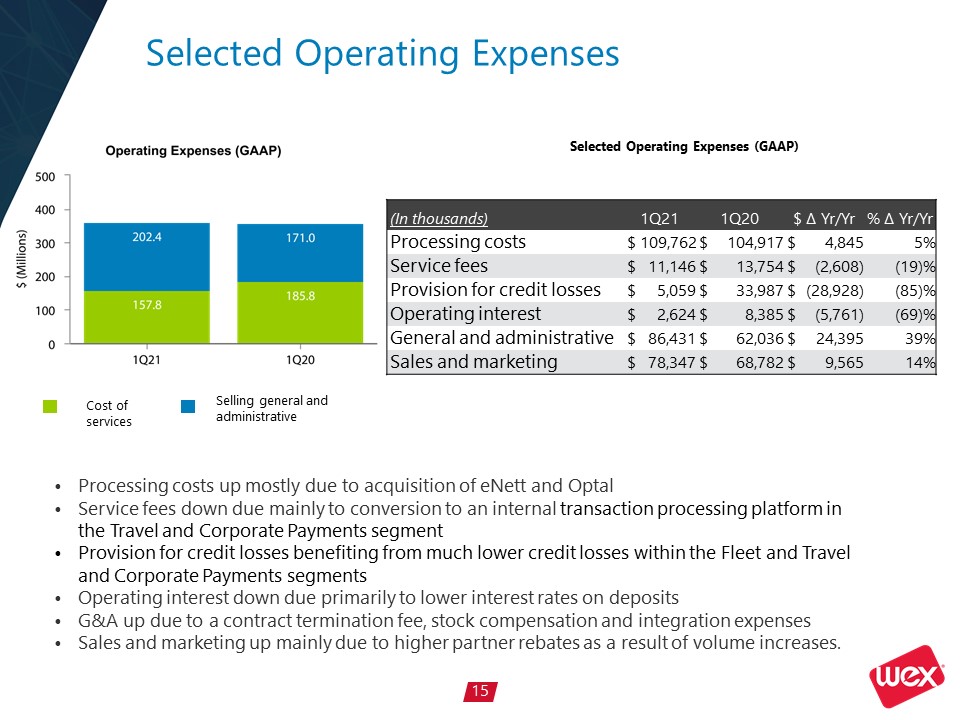

Selected Operating Expenses Processing costs up mostly due to acquisition of eNett and OptalService

fees down due mainly to conversion to an internal transaction processing platform in the Travel and Corporate Payments segmentProvision for credit losses benefiting from much lower credit losses within the Fleet and Travel and Corporate

Payments segments Operating interest down due primarily to lower interest rates on depositsG&A up due to a contract termination fee, stock compensation and integration expensesSales and marketing up mainly due to higher partner rebates as

a result of volume increases. (In thousands) 1Q21 1Q20 $ ∆ Yr/Yr % ∆ Yr/Yr Processing costs $ 109,762 $ 104,917 $ 4,845 5% Service fees $ 11,146 $ 13,754 $ (2,608) (19)% Provision for credit

losses $ 5,059 $ 33,987 $ (28,928) (85)% Operating interest $ 2,624 $ 8,385 $ (5,761) (69)% General and administrative $ 86,431 $ 62,036 $ 24,395 39% Sales and marketing $ 78,347 $ 68,782 $ 9,565 14% Cost

of services Selling general and administrative Selected Operating Expenses (GAAP)

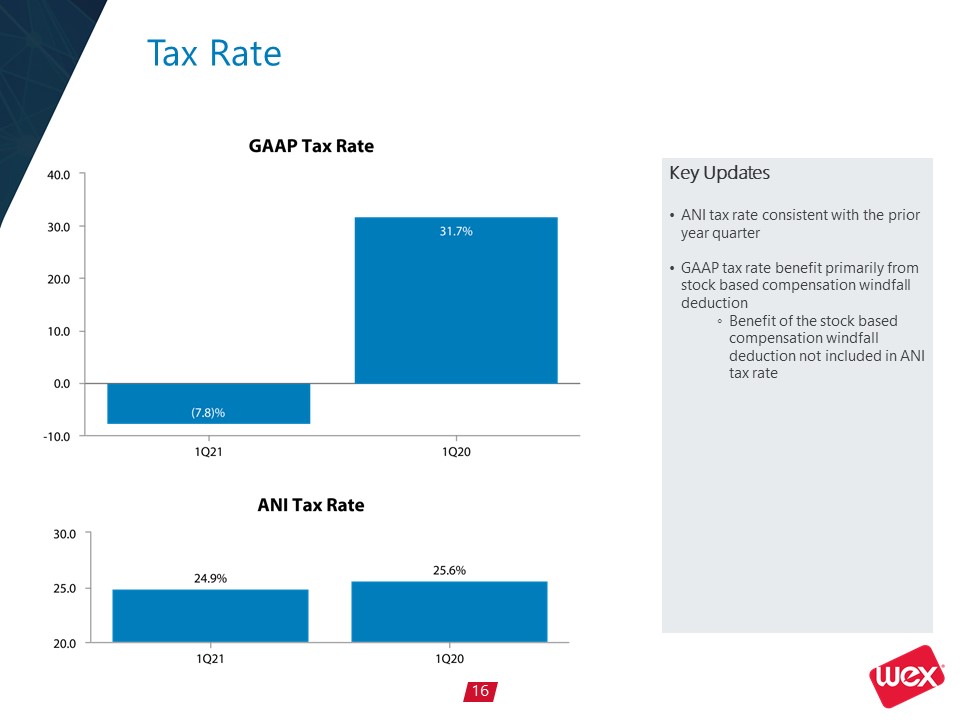

Tax Rate Key UpdatesANI tax rate consistent with the prior year quarterGAAP tax rate benefit primarily

from stock based compensation windfall deductionBenefit of the stock based compensation windfall deduction not included in ANI tax rate

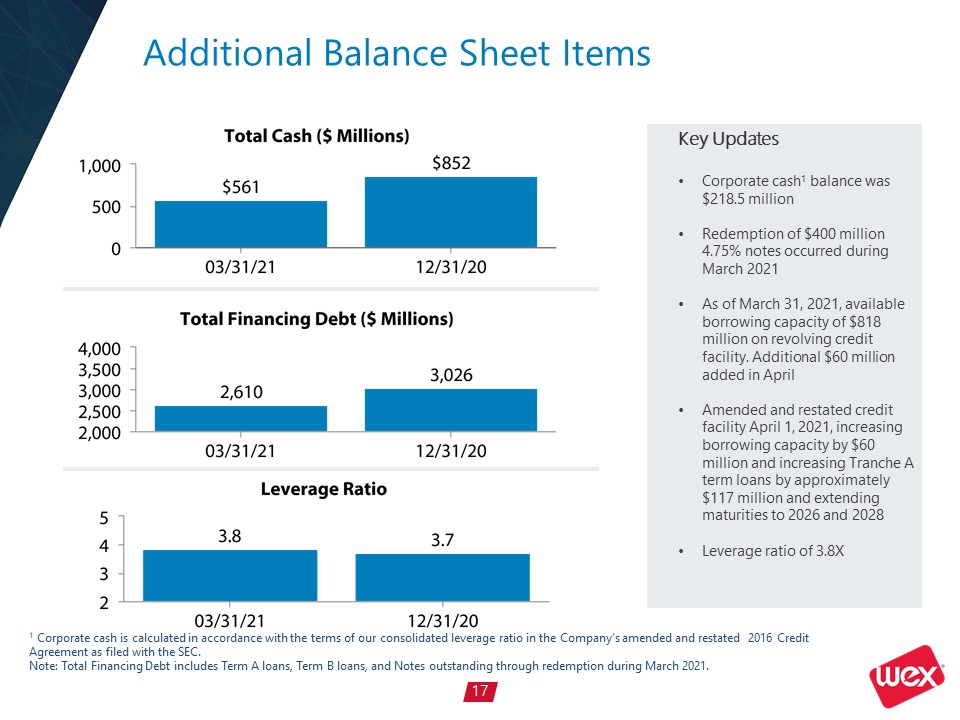

Additional Balance Sheet Items Key UpdatesCorporate cash1 balance was $218.5 million Redemption of

$400 million 4.75% notes occurred during March 2021As of March 31, 2021, available borrowing capacity of $818 million on revolving credit facility. Additional $60 million added in AprilAmended and restated credit facility April 1, 2021,

increasing borrowing capacity by $60 million and increasing Tranche A term loans by approximately $117 million and extending maturities to 2026 and 2028Leverage ratio of 3.8X 1 Corporate cash is calculated in accordance with the terms

of our consolidated leverage ratio in the Company’s amended and restated 2016 Credit Agreement as filed with the SEC.Note: Total Financing Debt includes Term A loans, Term B loans, and Notes outstanding through redemption during March 2021.

Appendix

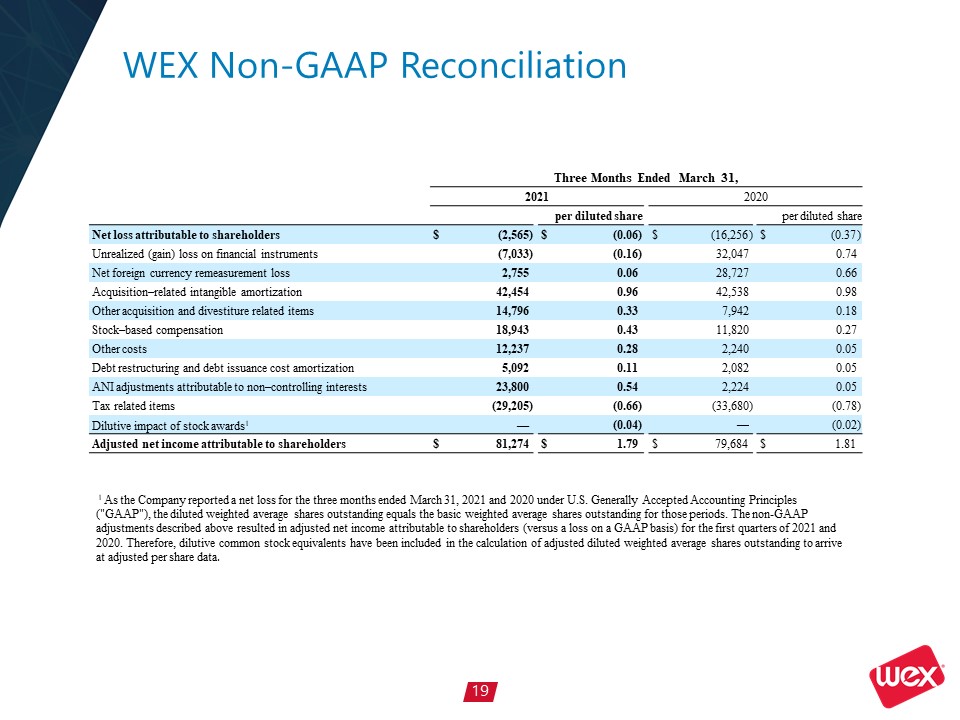

WEX Non-GAAP Reconciliation Three Months Ended March

31, 2021 2020 per diluted share per diluted share Net loss attributable to

shareholders $ (2,565 ) $ (0.06 ) $ (16,256 ) $ (0.37 ) Unrealized (gain) loss on financial instruments (7,033 ) (0.16 ) 32,047 0.74 Net foreign currency remeasurement

loss 2,755 0.06 28,727 0.66 Acquisition–related intangible amortization 42,454 0.96 42,538 0.98 Other acquisition and divestiture related

items 14,796 0.33 7,942 0.18 Stock–based compensation 18,943 0.43 11,820 0.27 Other costs 12,237 0.28 2,240 0.05 Debt restructuring and debt issuance cost

amortization 5,092 0.11 2,082 0.05 ANI adjustments attributable to non–controlling interests 23,800 0.54 2,224 0.05 Tax related

items (29,205 ) (0.66 ) (33,680 ) (0.78 ) Dilutive impact of stock awards1 — (0.04 ) — (0.02 ) Adjusted net income attributable to

shareholders $ 81,274 $ 1.79 $ 79,684 $ 1.81 1 As the Company reported a net loss for the three months ended March 31, 2021 and 2020 under U.S. Generally Accepted Accounting Principles ("GAAP"), the diluted weighted

average shares outstanding equals the basic weighted average shares outstanding for those periods. The non-GAAP adjustments described above resulted in adjusted net income attributable to shareholders (versus a loss on a GAAP basis) for the

first quarters of 2021 and 2020. Therefore, dilutive common stock equivalents have been included in the calculation of adjusted diluted weighted average shares outstanding to arrive at adjusted per share data.

WEX Non-GAAP Reconciliation The Company's non-GAAP adjusted net income excludes unrealized gains and

losses on financial instruments, net foreign currency gains and losses, acquisition-related intangible amortization, other acquisition and divestiture related items, stock-based compensation, other costs, debt restructuring and debt issuance

cost amortization, adjustments attributable to our non-controlling interests and certain tax related items. The Company's non-GAAP adjusted operating income excludes acquisition-related intangible amortization, other acquisition and

divestiture related items, stock-based compensation, other costs, and debt restructuring costs. Total segment adjusted operating income incorporates these same adjustments and further excludes unallocated corporate expenses.Although adjusted

net income, adjusted operating income and total segment adjusted operating income are not calculated in accordance with GAAP, these non-GAAP measures are integral to the Company's reporting and planning processes and the chief operating

decision maker of the Company uses segment adjusted operating income to allocate resources among our operating segments. The Company considers these measures integral because they exclude the above specified items that the Company's

management excludes in evaluating the Company's performance. Specifically, in addition to evaluating the Company's performance on a GAAP basis, management evaluates the Company's performance on a basis that excludes the above items because:

Exclusion of the non-cash, mark-to-market adjustments on financial instruments, including interest rate swap agreements and investment securities, helps management identify and assess trends in the Company's underlying business that might

otherwise be obscured due to quarterly non-cash earnings fluctuations associated with these financial instruments. Additionally, the non-cash mark-to-market adjustments on financial instruments are difficult to forecast accurately, making

comparisons across historical and future quarters difficult to evaluate.Net foreign currency gains and losses primarily result from the remeasurement to functional currency of cash, accounts receivable and accounts payable balances, certain

intercompany notes denominated in foreign currencies and any gain or loss on foreign currency hedges relating to these items. The exclusion of these items helps management compare changes in operating results between periods that might

otherwise be obscured due to currency fluctuations. The Company considers certain acquisition-related costs, including investment banking fees, warranty and indemnity insurance, certain integration related expenses and amortization of

acquired intangibles, as well as gains and losses from divestitures, to be unpredictable, dependent on factors that may be outside of our control and unrelated to the continuing operations of the acquired or divested business or the Company.

In addition, the size and complexity of an acquisition, which often drives the magnitude of acquisition-related costs, may not be indicative of such future costs. The Company believes that excluding acquisition-related costs and gains or

losses of divestitures facilitates the comparison of our financial results to the Company's historical operating results and to other companies in our industry. Stock-based compensation is different from other forms of compensation as it is a

non-cash expense. For example, a cash salary generally has a fixed and unvarying cash cost. In contrast, the expense associated with an equity-based award is generally unrelated to the amount of cash ultimately received by the employee, and

the cost to the Company is based on a stock-based compensation valuation methodology and underlying assumptions that may vary over time.We exclude certain other costs when evaluating our continuing business performance when such items are not

consistently occurring and do not reflect expected future operating expense, nor provide insight into the fundamentals of current or past operations of our business. These include costs related to certain identified initiatives (including

technology initiatives) to further streamline the business, improve the Company's efficiency, create synergies, and globalize the Company's operations, all with an objective to improve scale and efficiency and increase profitability going

forward. For the three months ended March 31, 2021, other costs additionally include a penalty of $10.3 million incurred on termination of a contract. For the three months ended March 31, 2020, other costs include certain costs incurred in

association with COVID-19, including the cost of providing additional health, welfare and technological support to our employees as they work remotely.Debt restructuring and debt issuance cost amortization are unrelated to the continuing

operations of the Company. Debt restructuring costs are not consistently occurring and do not reflect expected future operating expense, nor do they provide insight into the fundamentals of current or past operations of our business. In

addition, since debt issuance cost amortization is dependent upon the financing method, which can vary widely company to company, we believe that excluding these costs helps to facilitate comparison to historical results as well as to other

companies within our industry.The adjustments attributable to non-controlling interests, including adjustments to the redemption value of a non-controlling interest and non-cash adjustments related to the tax receivable agreement, have no

significant impact on the ongoing operations of the business. The tax related items are the difference between the Company’s U.S. GAAP tax provision and a pro forma tax provision based upon the Company’s adjusted net income before taxes as

well as the impact from certain discrete tax items. The methodology utilized for calculating the Company’s adjusted net income tax provision is the same methodology utilized in calculating the Company’s U.S. GAAP tax provision. The Company

does not allocate certain corporate expenses to our operating segments, as these items are centrally controlled and are not directly attributable to any reportable segment. For the same reasons, WEX believes that adjusted net income, adjusted

operating income and total segment adjusted operating income may also be useful to investors when evaluating the Company's performance. However, because adjusted net income, adjusted operating income and total segment adjusted operating

income are non-GAAP measures, they should not be considered as a substitute for, or superior to, net income, operating income or cash flows from operating activities as determined in accordance with GAAP. In addition, adjusted net income,

adjusted operating income and total segment adjusted operating income as used by WEX may not be comparable to similarly titled measures employed by other companies.