Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - TELEFLEX INC | ex991toreq12021earningsrel.htm |

| 8-K - 8-K - TELEFLEX INC | tfx-20210429.htm |

1 Teleflex Incorporated Q1 2021 Earnings Conference Call

2 The release, accompanying slides, and replay webcast are available online at www.teleflex.com (click on “Investors”) Telephone replay is available by dialing (800) 585-8367 or for international calls, (416) 621-4642, conference ID 6194708 Conference Call Logistics

3 Today’s Speakers Liam Kelly Chairman, President and CEO Jake Elguicze Treasurer and VP, Investor Relations Thomas Powell Executive VP and CFO

4 This presentation contains forward-looking statements, including, but not limited to, our expectations with respect to the 2021 national direct-to- consumer campaign related to the UroLift® System; our expectations with respect to the commercialization of, and a decision on reimbursement with respect to, the UroLift System in Japan; charges we expect to incur in connection with the restructuring program we commenced in the first quarter of 2021 (the “2021 restructuring program”) and our other ongoing restructuring programs; estimated annualized pre-tax savings we expect to realize in connection with the 2021 restructuring program and our other ongoing restructuring programs and a similar initiative within our OEM segment (the “OEM initiative”); our expectations with respect to when we will begin to realize savings from the 2021 restructuring program, our other ongoing restructuring programs and the OEM initiative and when those programs will be substantially completed; our assumptions with respect to the euro to U.S. dollar exchange rate for 2021, our effective tax rate for 2021 and our adjusted weighted average shares for 2021; our forecasted 2021 GAAP and constant currency revenue growth, GAAP and adjusted gross and operating margins and GAAP and adjusted earnings per share and, in each case, the factors expected to impact those forecasted results; and other matters which inherently involve risks and uncertainties which could cause actual results to differ from those projected or implied in the forward–looking statements. These risks and uncertainties are addressed in our SEC filings, including our most recent Form 10-K. We expressly disclaim any obligation to update forward-looking statements, except as otherwise specifically stated by us or as required by law or regulation. Note on Non-GAAP Financial Measures This presentation refers to certain non-GAAP financial measures, including, but not limited to, constant currency revenue growth, adjusted diluted earnings per share, adjusted gross and operating margins and adjusted tax rate. These non-GAAP financial measures should not be considered replacements for, and should be read together with, the most comparable GAAP financial measures. Tables reconciling these non-GAAP financial measures to the most comparable GAAP financial measures are contained within this presentation and the appendices at the end of this presentation. Additional Notes This document contains certain highlights with respect to our Q1 2020 performance and developments and does not purport to be a complete summary thereof. Accordingly, we encourage you to read our Earnings Release for the quarter ended March 28, 2021 located in the investor section of our website at www.teleflex.com and our Quarterly Report on Form 10-Q for the quarter ended March 28, 2021 to be filed with the Securities and Exchange Commission. Unless otherwise noted, the following slides reflect continuing operations. Note on Forward-Looking Statements

5 Executive Overview Liam Kelly Chairman, President and CEO

6 Business Performance Estimated COVID-19 Impact Q4 Summary Business Performance • Q1'21 constant currency revenue growth showed continued sequential improvement on a day-sales adjusted basis • Q1'21 adjusted gross and operating margins expanded significantly year-over-year • Q1'21 adjusted earnings per share increased 5.5% as compared to the prior year period Q1 Performance Summary • Raising 2021 as reported and constant currency revenue guidance ranges • Raising 2021 adjusted EPS guidance range Financial Guidance Update Q1'21 Highlights

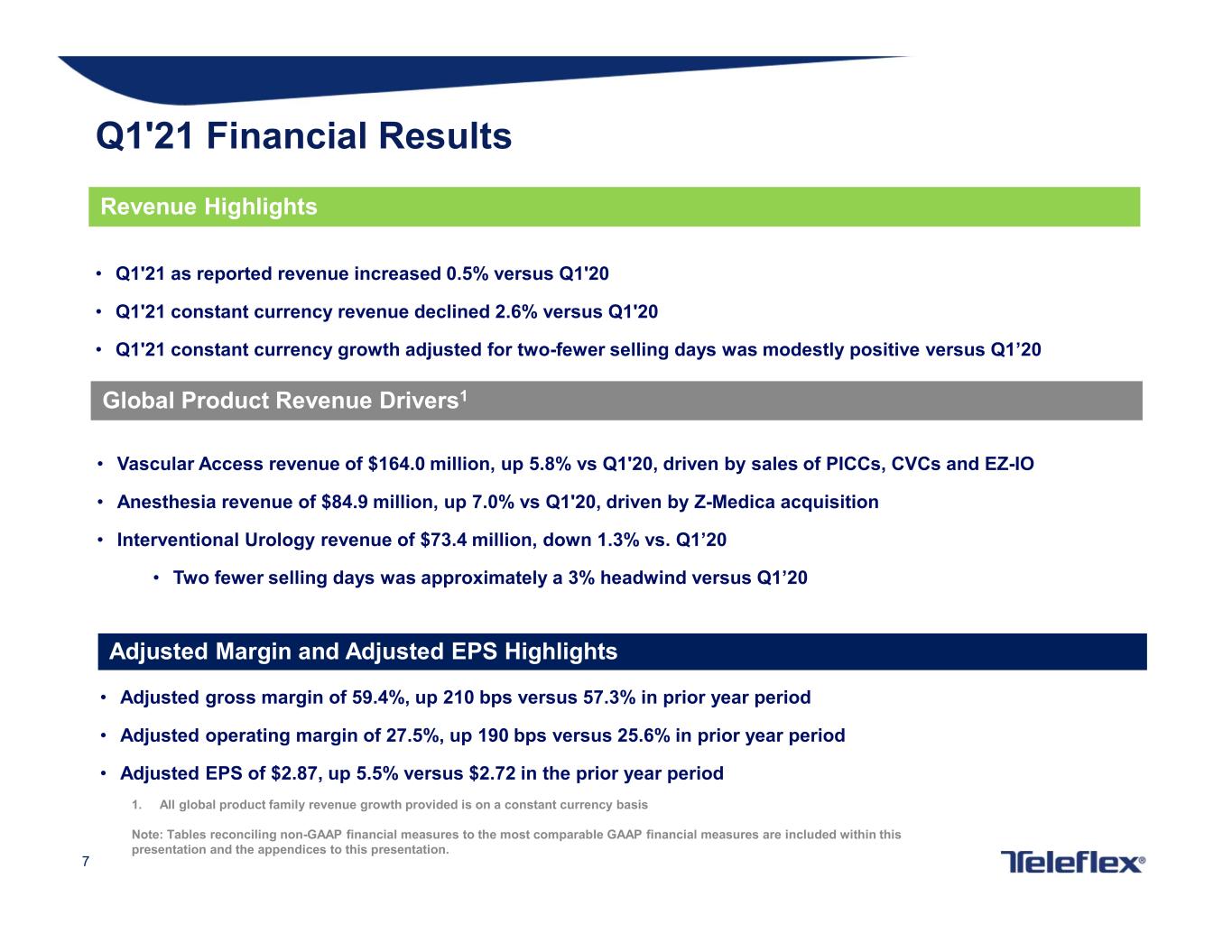

7 Q1'21 Financial Results • Adjusted gross margin of 59.4%, up 210 bps versus 57.3% in prior year period • Adjusted operating margin of 27.5%, up 190 bps versus 25.6% in prior year period • Adjusted EPS of $2.87, up 5.5% versus $2.72 in the prior year period Adjusted Margin and Adjusted EPS Highlights Revenue Highlights Global Product Revenue Drivers1 1. All global product family revenue growth provided is on a constant currency basis Note: Tables reconciling non-GAAP financial measures to the most comparable GAAP financial measures are included within this presentation and the appendices to this presentation. • Q1'21 as reported revenue increased 0.5% versus Q1'20 • Q1'21 constant currency revenue declined 2.6% versus Q1'20 • Q1'21 constant currency growth adjusted for two-fewer selling days was modestly positive versus Q1’20 • Vascular Access revenue of $164.0 million, up 5.8% vs Q1'20, driven by sales of PICCs, CVCs and EZ-IO • Anesthesia revenue of $84.9 million, up 7.0% vs Q1'20, driven by Z-Medica acquisition • Interventional Urology revenue of $73.4 million, down 1.3% vs. Q1’20 • Two fewer selling days was approximately a 3% headwind versus Q1’20

8 Dollars in Millions Q1'21 Revenue Q1'20 Revenue Reported Revenue Growth Currency Impact Constant Currency Growth Americas $375.5 $358.0 4.9% 0.2% 4.7% EMEA $141.2 $156.1 (9.5)% 7.4% (16.9)% Asia $63.7 $53.1 19.9% 9.6% 10.3% OEM $53.5 $63.4 (15.6)% 1.5% (17.1)% TOTAL $633.9 $630.6 0.5% 3.1% (2.6)% Q1'21 Segment Revenue Review

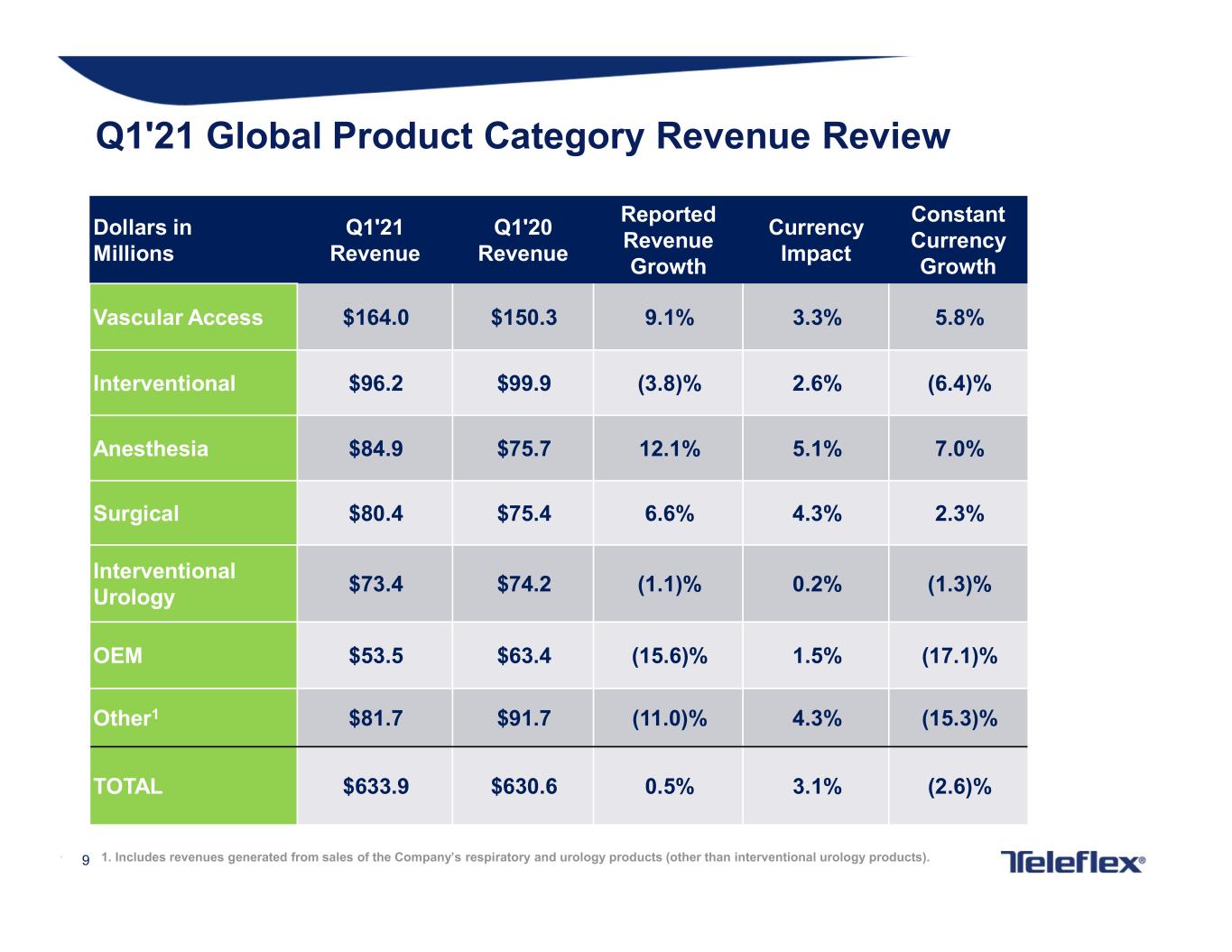

9• 1. Includes revenues generated from sales of the Company’s respiratory and urology products (other than interventional urology products). Dollars in Millions Q1'21 Revenue Q1'20 Revenue Reported Revenue Growth Currency Impact Constant Currency Growth Vascular Access $164.0 $150.3 9.1% 3.3% 5.8% Interventional $96.2 $99.9 (3.8)% 2.6% (6.4)% Anesthesia $84.9 $75.7 12.1% 5.1% 7.0% Surgical $80.4 $75.4 6.6% 4.3% 2.3% Interventional Urology $73.4 $74.2 (1.1)% 0.2% (1.3)% OEM $53.5 $63.4 (15.6)% 1.5% (17.1)% Other1 $81.7 $91.7 (11.0)% 4.3% (15.3)% TOTAL $633.9 $630.6 0.5% 3.1% (2.6)% Q1'21 Global Product Category Revenue Review

10 Interventional Urology - UroLift® System KEY TAKEAWAYS Launched 2021 National DTC Campaign ◦ Investment expected to be slightly more than double the 2020 campaign amount ◦ Expect advertisements to be on air throughout most 2021 ◦ Builds upon successful 2020 campaign that doubled brand awareness for targeted men w/ BPH ◦ Optimized existing network selection, testing new networks and programming UroLift® 2 and UroLift® ATC Commercial Progress ◦ Controlled U.S. commercialization initiated, with positive clinician feedback ◦ Production capacity ramping to support demand Japan Progress ◦ Japan commercialization remains on track, with reimbursement still expected in 2H 2021 Clinical and Commercial Updates

11 Interventional - Manta® Vascular Closure Device KEY TAKEAWAYS Manta® Vascular Closure Device MARVEL Registry ◦ Prospective real-world study of 500 patients who underwent transfemoral large bore percutaneous procedures in 10 hospitals across Europe and Canada ◦ Primary performance endpoint: 50 seconds median time from deployment to hemostasis ◦ Primary endpoint: MANTA use associated with a 4% VARC-2 major vascular complication rate, which closely matches the 4.2% VARC-2 major vascular complication rate demonstrated in the SAFE MANTA IDE clinical trial ◦ The SAFE trial applied more stringent inclusion/exclusion criteria, with a ~50% smaller sample size (n=263) compared to MARVEL. MARVEL therefore appears to confirm MANTA safety in a broader patient population and its feasibility in real world clinical practice. Clinical and Commercial Updates Kroon, HG, Tonino, PAL, Savontaus, M, et al. Dedicated plug based closure for large bore access –The MARVEL prospective registry. Catheter Cardiovasc Interv. 2020; 1– 9. https://doi.org/10.1002/ccd.29439

12 Interventional - Manta® Vascular Closure Device KEY TAKEAWAYS Manta® Vascular Closure Device MANTA Meta-Analysis ◦ Patient-level pooled analysis including data from 2 medical device approval studies (CE mark, SAFE) and 1 post-approval registry (MARVEL), with large bore procedures performed by 71 operators at 28 investigational sites across North America and Europe from 2015 to 2019. ◦ Results: ▪ Technical success rate: 96.4% ▪ Hemostasis: 31 seconds median time from deployment to hemostasis ▪ Low complication rates*: 4.4% major access complications and 4.7% minor access complication rates Clinical and Commercial Updates *composite of MANTA related access site complications of which definitions were adapted from the derived from VARC-2 criteria Nuis R, Wood D, Kroon H, van Wiechen M, et al. Frequency, impact and predictors of access complications with plug-based large-bore arteriotomy closure - A patient level meta-analysis. Cardiovasc Revasc Med. 2021 Feb 15; https://doi.org/10.1016/j.carrev.2021.02.017

13 Financial Overview Thomas Powell Executive VP and CFO

14 Note: See appendices for reconciliations of non-GAAP information • GAAP gross margin of 54.3%, up 140 bps vs. prior year period • Adjusted gross margin of 59.4%, up 210 bps vs. prior year period • GAAP operating margin of 16.3%, down 860 bps vs. prior year period • Adjusted operating margin of 27.5%, up 190 bps vs. prior year period Gross margin performance Operating margin performance Global revenue generation of $633.9 million • GAAP tax rate of 14.2%, compared to 7.8% in prior year period • Adjusted tax rate of 13.9%, up 140 bps vs. prior year period Effective tax rate • GAAP EPS of $1.58 vs. $2.78 in prior year period • Adjusted EPS of $2.87, down 5.5% vs. prior year period Earnings per share Q1'21 Financial Review • Revenue increased 0.5% vs. prior year period on an as-reported basis • Revenue decreased 2.6% vs. prior year period on a constant currency basis

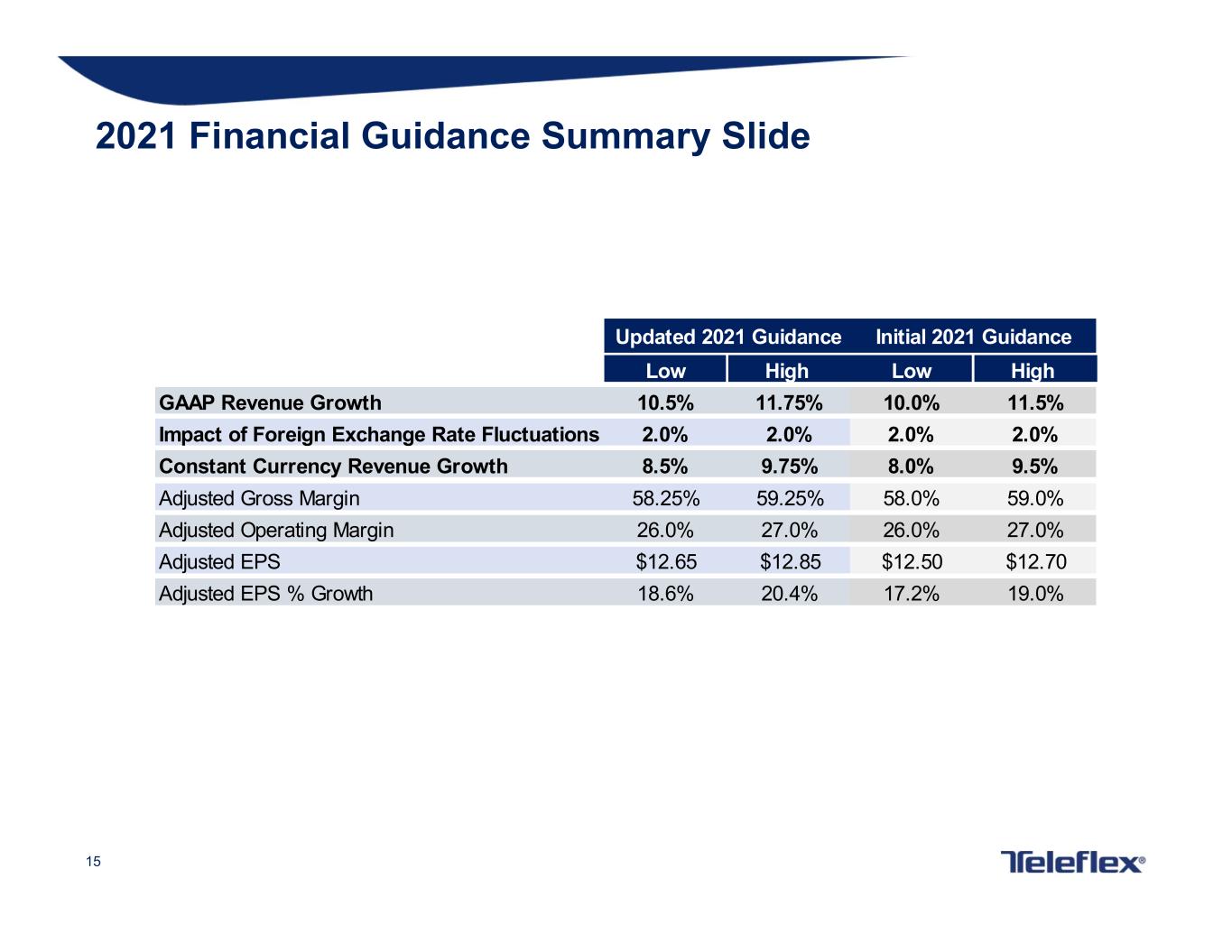

15 2021 Financial Guidance Summary Slide Low High Low High GAAP Revenue Growth 10.5% 11.75% 10.0% 11.5% Impact of Foreign Exchange Rate Fluctuations 2.0% 2.0% 2.0% 2.0% Constant Currency Revenue Growth 8.5% 9.75% 8.0% 9.5% Adjusted Gross Margin 58.25% 59.25% 58.0% 59.0% Adjusted Operating Margin 26.0% 27.0% 26.0% 27.0% Adjusted EPS $12.65 $12.85 $12.50 $12.70 Adjusted EPS % Growth 18.6% 20.4% 17.2% 19.0% Updated 2021 Guidance Initial 2021 Guidance

16 Key Takeaways ◦ Teleflex exceeded the externally provided first quarter 2021 revenue and adjusted earnings per share expectations provided in February ◦ Announced new restructuring program and remain on track to generate significant long term margin expansion ◦ Raised as reported and constant currency revenue guidance ranges, and adjusted EPS guidance range, given year-to-date performance and outlook for remainder of the year

17 THANK YOU

18 Appendices

19 Non-GAAP Financial Measures The presentation to which these appendices are attached and the following appendices include, among other things, tables reconciling the following applicable non-GAAP financial measures to the most comparable GAAP financial measure: • Constant currency revenue growth. This non-GAAP measure is based upon net revenues, adjusted to eliminate the impact of translating the results of international subsidiaries at different currency exchange rates from period to period. The impact of changes in foreign currency may vary significantly from period to period, and generally are outside of the control of our management. We believe that this measure facilitates a comparison of our operating performance exclusive of currency exchange rate fluctuations that do not reflect our underlying performance or business trends. • Adjusted diluted earnings per share. This non-GAAP measure is based upon diluted earnings per share from continuing operations, the most directly comparable GAAP measure, adjusted to exclude, depending on the period presented, the impact of (i) restructuring, restructuring related and impairment items; (ii) acquisition, integration and divestiture related items; (iii) “other items” identified in note (C) to the reconciliation tables appearing in Appendices D and E; (iv) certain costs associated with the registration of medical devices under the European Union Medical Device Regulation; (v) intangible amortization expense; and (vi) tax adjustments. Management does not believe that any of the excluded items are indicative of our underlying core performance or business trends. • Adjusted gross profit and margin. These measures exclude, depending on the period presented, the impact of (i) restructuring, restructuring related and impairment items, (ii) acquisition, integration and divestiture related items and (iii) “other items” identified in note (C) to the reconciliation table appearing in Appendix A. • Adjusted operating profit and margin. These measures exclude, depending on the period presented, the impact of (i) restructuring, restructuring related and impairment items; (ii) acquisitions, integration and divestiture related items; (iii) “other items” identified in note (C) to the reconciliation table appearing in Appendix B; (iv) intangible amortization expense; and (v) certain costs associated with the registration of medical devices under the European Union Medical Device Regulation. • Adjusted tax rate. This measure is the percentage of the Company’s adjusted taxes on income from continuing operations to its adjusted income from continuing operations before taxes. Adjusted taxes on income from continuing operations excludes, depending on the period presented, the impact of tax benefits or costs associated with (i) restructuring, restructuring related and impairment items; (ii) acquisition, integration and divestiture related items; (iii) “other items” identified in note (A) to the reconciliation table appearing in Appendix C; (iv) certain costs associated with the registration of medical devices under the European Union Medical Device Regulation; (v) intangible amortization expense; and (vi) tax adjustments.

20 The following is an explanation of certain of the adjustments that are applied with respect to one or more of the non-GAAP financial measures that appear in the presentation to which these appendices are attached: Restructuring, restructuring related and impairment items - Restructuring programs involve discrete initiatives designed to, among other things, consolidate or relocate manufacturing, administrative and other facilities, outsource distribution operations, improve operating efficiencies and integrate acquired businesses. Depending on the specific restructuring program involved, our restructuring charges may include employee termination, contract termination, facility closure, employee relocation, equipment relocation, outplacement and other exit costs associated with the restructuring program. Restructuring related charges are directly related to our restructuring programs and consist of facility consolidation costs, including accelerated depreciation expense related to facility closures, costs to transfer manufacturing operations between locations, and retention bonuses offered to certain employees as an incentive for them to remain with our company after completion of the restructuring program. Impairment charges occur if, due to events or changes in circumstances, we determine that the carrying value of an asset exceeds its fair value. Impairment charges do not directly affect our liquidity, but could have a material adverse effect on our reported financial results. Acquisition, integration and divestiture related items - Acquisition and integration expenses are incremental charges, other than restructuring or restructuring related expenses, that are directly related to specific business or asset acquisition transactions. These charges may include, among other things, professional, consulting and other fees; systems integration costs; legal entity restructuring expense; inventory step-up amortization (amortization, through cost of goods sold, of the increase in fair value of inventory resulting from a fair value calculation as of the acquisition date); fair value adjustments to contingent consideration liabilities; and bridge loan facility and backstop financing fees in connection with loan facilities that ultimately were not utilized. Divestiture related activities involve specific business or asset sales. Depending primarily on the terms of a divestiture transaction, the carrying value of the divested business or assets on our financial statements and other costs we incur as a direct result of the divestiture transaction, we may recognize a gain or loss in connection with the divestiture related activities. Other items - These are discrete items that occur sporadically and can affect period-to-period comparisons. See footnote C to the reconciliation tables set forth below. European medical device regulation - The European Union (“EU”) has adopted the EU Medical Device Regulation (“MDR”), which replaces the existing Medical Devices Directive (“MDD”) and imposes more stringent requirements for the marketing and sale of medical devices in the EU, including requirements affecting clinical evaluations, quality systems and post-market surveillance. Manufacturers of currently marketed medical devices will have until May 2020 to meet the MDR requirements, although certain devices that previously satisfied MDD requirements can continue to be placed on the EU market until May 2024, subject to certain limitations. Significantly, the MDR will require the re-registration of previously approved medical devices. As a result, Teleflex will incur expenditures in connection with the new registration of medical devices that previously had been registered under the MDD. Therefore, these expenditures are not considered to be ordinary course expenditures in connection with regulatory matters (in contrast, no adjustment has been made to exclude expenditures related to the registration of medical devices that were not registered previously under the MDD). Intangible amortization expense - Certain intangible assets, including customer relationships, intellectual property, distribution rights, trade names and non- competition agreements, initially are recorded at historical cost and then amortized over their respective estimated useful lives. The amount of such amortization can vary from period to period as a result of, among other things, business or asset acquisitions or dispositions. Tax adjustments - These adjustments represent the impact of the expiration of applicable statutes of limitations for prior year returns, the resolution of audits, the filing of amended returns with respect to prior tax years and/or tax law or certain other discrete changes affecting our deferred tax liability. Non-GAAP Adjustments

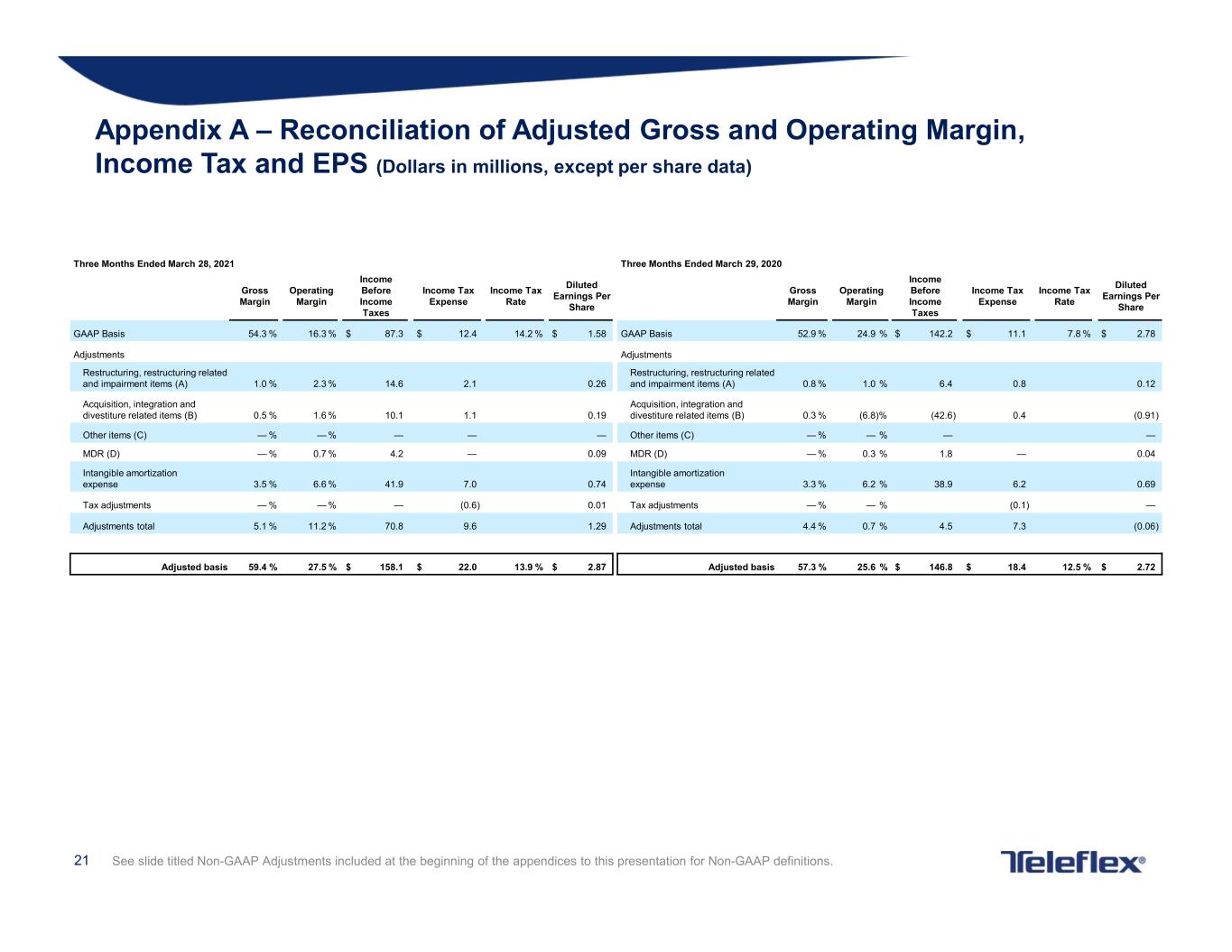

21 See slide titled Non-GAAP Adjustments included at the beginning of the appendices to this presentation for Non-GAAP definitions. Appendix A – Reconciliation of Adjusted Gross and Operating Margin, Income Tax and EPS (Dollars in millions, except per share data) Three Months Ended March 28, 2021 Three Months Ended March 29, 2020 Gross Margin Operating Margin Income Before Income Taxes Income Tax Expense Income Tax Rate Diluted Earnings Per Share Gross Margin Operating Margin Income Before Income Taxes Income Tax Expense Income Tax Rate Diluted Earnings Per Share GAAP Basis 54.3 % 16.3 % $ 87.3 $ 12.4 14.2 % $ 1.58 GAAP Basis 52.9 % 24.9 % $ 142.2 $ 11.1 7.8 % $ 2.78 Adjustments Adjustments Restructuring, restructuring related and impairment items (A) 1.0 % 2.3 % 14.6 2.1 0.26 Restructuring, restructuring related and impairment items (A) 0.8 % 1.0 % 6.4 0.8 0.12 Acquisition, integration and divestiture related items (B) 0.5 % 1.6 % 10.1 1.1 0.19 Acquisition, integration and divestiture related items (B) 0.3 % (6.8)% (42.6) 0.4 (0.91) Other items (C) — % — % — — — Other items (C) — % — % — — MDR (D) — % 0.7 % 4.2 — 0.09 MDR (D) — % 0.3 % 1.8 — 0.04 Intangible amortization expense 3.5 % 6.6 % 41.9 7.0 0.74 Intangible amortization expense 3.3 % 6.2 % 38.9 6.2 0.69 Tax adjustments — % — % — (0.6) 0.01 Tax adjustments — % — % (0.1) — Adjustments total 5.1 % 11.2 % 70.8 9.6 1.29 Adjustments total 4.4 % 0.7 % 4.5 7.3 (0.06) Adjusted basis 59.4 % 27.5 % $ 158.1 $ 22.0 13.9 % $ 2.87 Adjusted basis 57.3 % 25.6 % $ 146.8 $ 18.4 12.5 % $ 2.72

22 Appendix A tickmarks See slide titled Non-GAAP Adjustments included at the beginning of the appendices to this presentation for Non-GAAP definitions. A. Restructuring, restructuring related and impairment items – For the three months ended March 28, 2021, pre-tax restructuring charges were $8.0 million, pre-tax restructuring related charges were $6.6 million, and pre-tax impairment charges were $0.0 million. For the three months ended March 29, 2020, pre-tax restructuring charges were $1.3 million, pre-tax restructuring related charges were $5.1 million, and pre-tax impairment charges were $0.0 million. B. Acquisition, integration and divestiture related items – For the three months ended March 28, 2021, these charges primarily related to contingent consideration liabilities; and the reversal of previously recognized income related to a distributor conversion in Japan; and charges primarily related to our acquisition of Z-Medica, LLC. For the three months ended March 29, 2020, these items primarily related to the reversal of contingent consideration liabilities; and changes related to our acquisition of IWG High Performance Conductors, Inc. There were no divestiture related activities for the three months ended March 28, 2021 and March 29, 2020. C. Other items – For the three months ended March 28, 2021 and March 29, 2020, there were no adjustments made for other items. D. MDR – These costs were associated with our efforts to comply with the European Medical Device Regulation (MDR).

23 Appendix B – Restructuring and Similar Cost Savings Initiatives Summary Dollars in Millions Estimated Total Actual results through December 31, 2020 Estimated Amount Remaining Restructuring charges $102 - $118 $89 $13 - $29 Restructuring related charges1 119 - 146 74 45 - 72 Total charges $221-$264 $163 $58 - $101 OEM initiative annual pre-tax savings $6 - $7 $2 $4 - $5 Pre-tax savings – ongoing restructuring plans2 81 - 94 32 49 - 62 Total annual pre-tax savings $87 - $101 $34 $53 - $67 2021 Restructuring plan During the first quarter of 2021, we committed to a restructuring plan designed to streamline various business functions and consolidate manufacturing operations. We estimate that we will incur aggregate pre-tax restructuring charges of $7 million to $9 million, consisting primarily of termination benefits, and $3 million to $4 million in restructuring related charges. Most of restructuring related charges are expected to be recognized in cost of sales and primarily consist of project management costs, costs to transfer of manufacturing operations to existing lower- cost locations and accelerated depreciation. We expect this program will be substantially completed by the end of 2021. As of March 28, 2021, we had a restructuring reserve of $6.4 million related to this plan, all of which related to termination benefits. We expect to begin realizing plan-related savings in 2021 and expect to achieve annual pre-tax savings of $13 million to $16 million once the plan is fully implemented. In addition to the 2021 Restructuring plan, we have ongoing restructuring programs primarily related to the consolidation of our manufacturing operations (referred to as our 2019, 2018 and 2014 Footprint realignment plans). We also have similar ongoing activities to relocate certain manufacturing operations within our OEM segment (the "OEM initiative") that do not meet the criteria for a restructuring program under applicable accounting guidance; nevertheless, the activities should result in cost savings (we expect only minimal costs to be incurred in connection with the OEM initiative). With respect to our currently ongoing restructuring programs (including the 2021 Restructuring plan) and the OEM initiative, the table below summarizes charges incurred or estimated to be incurred and estimated annual pre-tax savings to be realized as follows: (1) with respect to charges (a) the estimated total charges that will have been incurred once the restructuring programs and OEM initiative are completed; (b) the charges incurred through December 31, 2020; and (c) the estimated charges to be incurred from January 1, 2021 through the last anticipated completion date of the restructuring programs and OEM initiative, and (2) with respect to estimated annual pre-tax savings, (a) the estimated total annual pre-tax savings to be realized once the restructuring programs and OEM initiative are completed; (b) the estimated annual pre-tax savings realized based on the progress of the restructuring programs and OEM initiative through December 31, 2020; and (c) the estimated additional annual pre-tax savings to be realized from January 1, 2021 through the last anticipated completion date of the restructuring programs and the OEM initiative. Estimated charges and pre-tax savings are subject to change based on, among other things, the nature and timing of restructuring activities and similar activities, changes in the scope of restructuring programs and the OEM initiative, unanticipated expenditures and other developments, the effect of additional acquisitions or dispositions, and other factors that were not reflected in the assumptions made by management in previously estimating restructuring and restructuring related charges and estimated pre-tax savings. Moreover, estimated pre-tax savings constituting efficiencies with respect to increased costs that otherwise would have resulted from business acquisitions involve, among other things, assumptions regarding the cost structure and integration of businesses that previously were not administered by our management, which are subject to a particularly high degree of risk and uncertainty. It is likely that estimates of charges and pre-tax savings will change from time to time, and the table below may reflect changes from amounts previously estimated. In addition, the table below reflects the estimated charges and pre-tax savings related to our ongoing programs. Additional details, including estimated charges expected to be incurred in connection with our restructuring programs and the anticipated completion dates, are described in Note 5 to the condensed consolidated financial statements included in this report.

24 (1) Represents charges that are directly related to restructuring programs and principally constitute costs to transfer manufacturing operations to existing lower-cost locations, project management costs and accelerated depreciation, as well as a charge that is expected to be imposed by a taxing authority as a result of our exit from facilities in the authority's jurisdiction. Most of these charges (other than the tax charge) are expected to be recognized as cost of goods sold. (2) Most of the pre-tax savings are expected to result in reductions to cost of goods sold. Appendix B – Footnotes

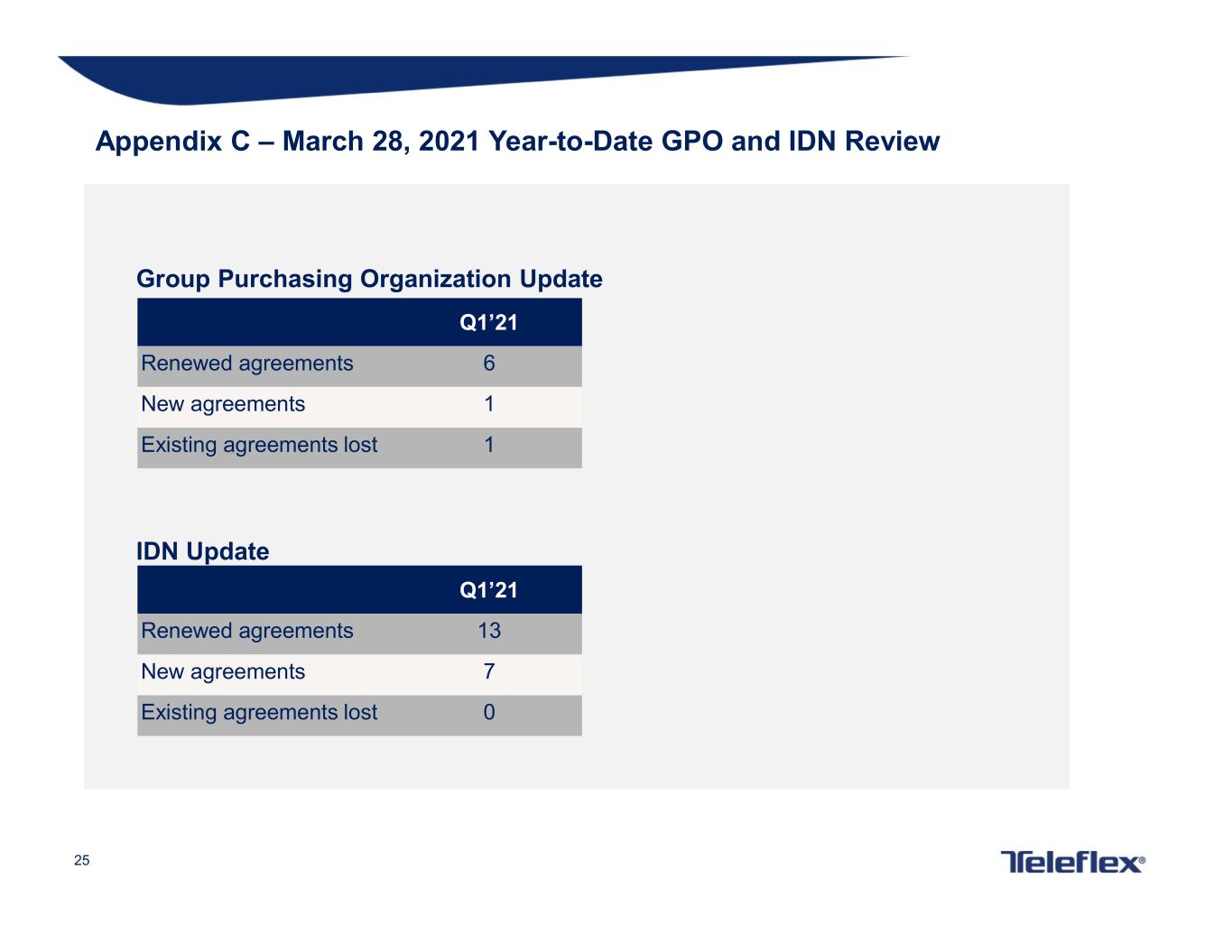

25 Appendix C – March 28, 2021 Year-to-Date GPO and IDN Review Group Purchasing Organization Update IDN Update Q1’21 Renewed agreements 6 New agreements 1 Existing agreements lost 1 Q1’21 Renewed agreements 13 New agreements 7 Existing agreements lost 0

26 Appendix D - 2021 Adj. Gross and Operating Margin Guidance Reconciliations 2021 Guidance Low High Forecasted GAAP Gross Margin 53.95% 55.10% Estimated restructuring, restructuring related and impairment items 0.95% 0.90% Estimated acquisition, integration, and divestiture related items 0.15% 0.10% Estimated other items - - Estimated intangible amortization expense 3.20% 3.15% Forecasted Adjusted Gross Margin 58.25% 59.25% 2021 Guidance Low High Forecasted GAAP Operating Margin 17.00% 18.20% Estimated restructuring, restructuring related and impairment items 1.40% 1.35% Estimated acquisition, integration, and divestiture related items 0.65% 0.60% Estimated other items - - Estimated MDR 0.85% 0.80% Estimated intangible amortization expense 6.10% 6.05% Forecasted Adjusted Operating Margin 26.00% 27.00%

27 Appendix E – Reconciliation of 2021 Adjusted Earnings Per Share Guidance

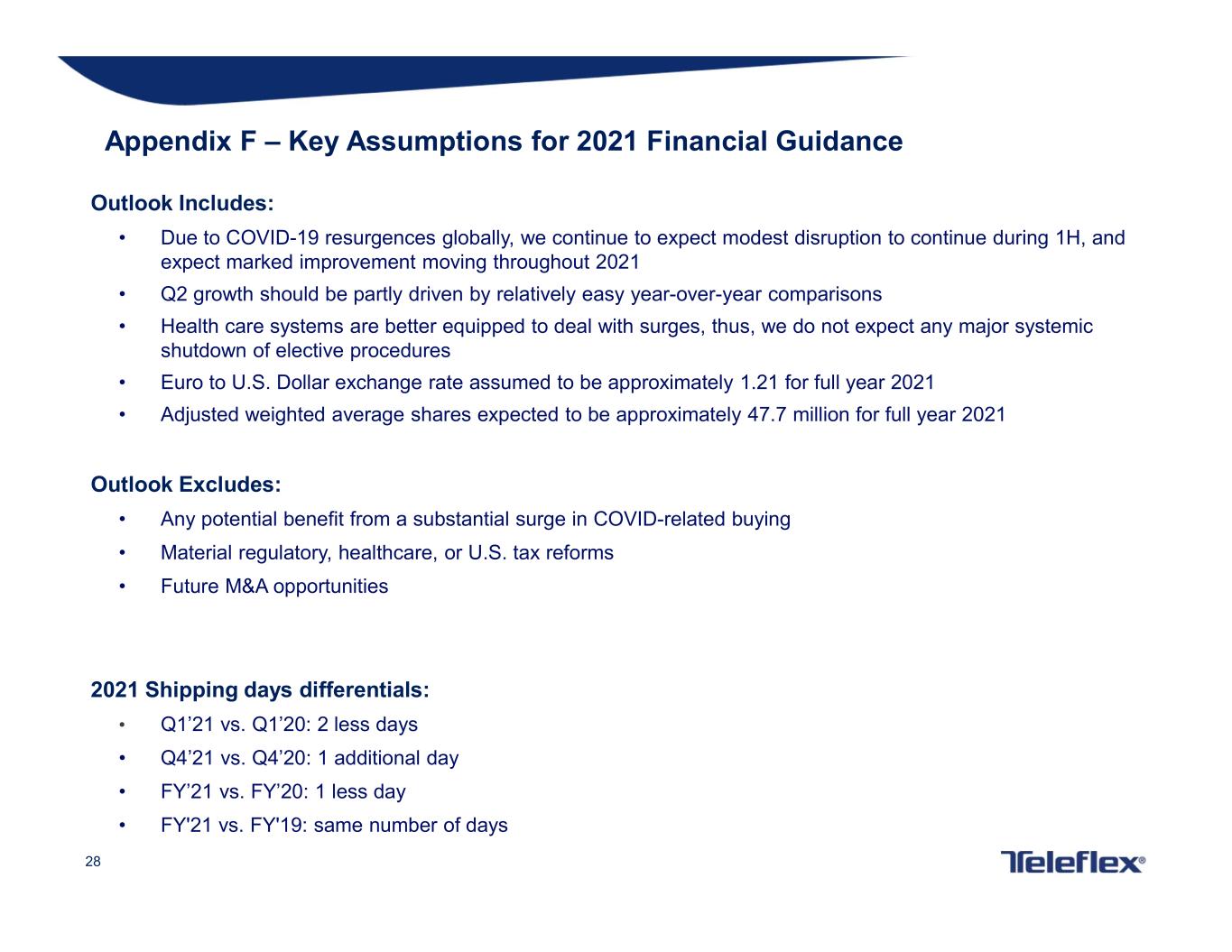

28 Outlook Includes: • Due to COVID-19 resurgences globally, we continue to expect modest disruption to continue during 1H, and expect marked improvement moving throughout 2021 • Q2 growth should be partly driven by relatively easy year-over-year comparisons • Health care systems are better equipped to deal with surges, thus, we do not expect any major systemic shutdown of elective procedures • Euro to U.S. Dollar exchange rate assumed to be approximately 1.21 for full year 2021 • Adjusted weighted average shares expected to be approximately 47.7 million for full year 2021 Outlook Excludes: • Any potential benefit from a substantial surge in COVID-related buying • Material regulatory, healthcare, or U.S. tax reforms • Future M&A opportunities 2021 Shipping days differentials: • Q1’21 vs. Q1’20: 2 less days • Q4’21 vs. Q4’20: 1 additional day • FY’21 vs. FY’20: 1 less day • FY'21 vs. FY'19: same number of days Appendix F – Key Assumptions for 2021 Financial Guidance