Attached files

| file | filename |

|---|---|

| 8-K - 8-K - LAKELAND BANCORP INC | d168405d8k.htm |

Exhibit 99.1 F I R S T Q U A R T E R 2021 I N V E S T O R S P R E S E N T A T I O N Exhibit 99.1 F I R S T Q U A R T E R 2021 I N V E S T O R S P R E S E N T A T I O N

Forward-Looking Statements The information disclosed in this document includes various forward-looking the Company’s products and services, and competition. Further, given its statements that are made in ongoing and dynamic nature, it is difficult to predict the continuing effects that the COVID-19 pandemic will have on our business and results of operations. The reliance upon the safe harbor provisions of the Private Securities Litigation pandemic and related local and national economic disruption may, among other Reform Act of 1995. The effects, result in a material adverse change for the demand for our products words “anticipates,” “projects,” “intends,” “estimates,” “expects,” “believes,” and services; increased levels of loan delinquencies, problem assets and “plans,” “may,” “will,” “should,” “could,” and other similar expressions are foreclosures; branch disruptions, unavailability of personnel and increased intended to identify such forward-looking statements The Company cautions that cybersecurity risks as employees work remotely. Any statements made by the these forward-looking statements are necessarily speculative and speak only as Company that are not historical facts should be considered to be forward- of the date made, and are subject to numerous assumptions, risks and looking statements. The Company is not obligated to update and does not uncertainties, all of which may change over time. Actual results could differ undertake to update any of its forward-looking statements made herein. materially from such forward-looking statements. Accordingly, you should not place undue reliance on forward-looking statements. In addition to the specific risk factors disclosed in the Company's Annual Report on Form 10-K for the year ended December 31, 2020, the following factors, among others, could cause actual results to differ materially and adversely from such forward-looking statements: changes in the financial services industry and the U.S. and global capital markets, changes in economic conditions nationally, regionally and in the company’s markets, the nature and timing of actions of the Federal Reserve Board and other regulators, the nature and timing of legislation and regulation affecting the financial services industry, government intervention in the U.S. financial system, changes in federal and state tax laws, changes in levels of market interest rates, pricing pressures on loan and deposit products, credit risks of the Company’s lending and leasing activities, successful implementation, deployment and upgrades of new and existing technology, systems, services and products, customers’ acceptance of 2Forward-Looking Statements The information disclosed in this document includes various forward-looking the Company’s products and services, and competition. Further, given its statements that are made in ongoing and dynamic nature, it is difficult to predict the continuing effects that the COVID-19 pandemic will have on our business and results of operations. The reliance upon the safe harbor provisions of the Private Securities Litigation pandemic and related local and national economic disruption may, among other Reform Act of 1995. The effects, result in a material adverse change for the demand for our products words “anticipates,” “projects,” “intends,” “estimates,” “expects,” “believes,” and services; increased levels of loan delinquencies, problem assets and “plans,” “may,” “will,” “should,” “could,” and other similar expressions are foreclosures; branch disruptions, unavailability of personnel and increased intended to identify such forward-looking statements The Company cautions that cybersecurity risks as employees work remotely. Any statements made by the these forward-looking statements are necessarily speculative and speak only as Company that are not historical facts should be considered to be forward- of the date made, and are subject to numerous assumptions, risks and looking statements. The Company is not obligated to update and does not uncertainties, all of which may change over time. Actual results could differ undertake to update any of its forward-looking statements made herein. materially from such forward-looking statements. Accordingly, you should not place undue reliance on forward-looking statements. In addition to the specific risk factors disclosed in the Company's Annual Report on Form 10-K for the year ended December 31, 2020, the following factors, among others, could cause actual results to differ materially and adversely from such forward-looking statements: changes in the financial services industry and the U.S. and global capital markets, changes in economic conditions nationally, regionally and in the company’s markets, the nature and timing of actions of the Federal Reserve Board and other regulators, the nature and timing of legislation and regulation affecting the financial services industry, government intervention in the U.S. financial system, changes in federal and state tax laws, changes in levels of market interest rates, pricing pressures on loan and deposit products, credit risks of the Company’s lending and leasing activities, successful implementation, deployment and upgrades of new and existing technology, systems, services and products, customers’ acceptance of 2

Corporate Profile § LBAI - NASDAQ § Founded in 1969 § 48 Branches - Serving Northern/Central NJ & Hudson Valley, NY § 8 Regional Commercial Lending Centers § 1 Commercial Loan Production Office § Financial Snapshot § Assets $7.8 Billion § Loans $6.1 Billion § Deposits $6.6 Billion (1) § Market Cap $882 Million 1 Stock Price as of March 31, 2021 - $ 17.43 3Corporate Profile § LBAI - NASDAQ § Founded in 1969 § 48 Branches - Serving Northern/Central NJ & Hudson Valley, NY § 8 Regional Commercial Lending Centers § 1 Commercial Loan Production Office § Financial Snapshot § Assets $7.8 Billion § Loans $6.1 Billion § Deposits $6.6 Billion (1) § Market Cap $882 Million 1 Stock Price as of March 31, 2021 - $ 17.43 3

Who We Are For more than half a century, we have grown to a full service commercial bank, committed to meeting the financial needs of businesses & consumers, and are proud to be characterized as the following: Traditional Commercial Bank Conservative & Consistent Scarce & Valuable Franchise Banking Philosophy § Relationship Lender§ One of the Largest Publically § Diversified Commercial Real Estate Traded Banks in NJ § Low Risk Model Portfolio§ One of the Lowest Cost of Funds § Disciplined Acquirer (1) § Focus is NOT Multifamily Lending in the State (1) Source: S&P Global Q4 2020 for NJ headquartered banks with total assets greater 4 than $500 million.Who We Are For more than half a century, we have grown to a full service commercial bank, committed to meeting the financial needs of businesses & consumers, and are proud to be characterized as the following: Traditional Commercial Bank Conservative & Consistent Scarce & Valuable Franchise Banking Philosophy § Relationship Lender§ One of the Largest Publically § Diversified Commercial Real Estate Traded Banks in NJ § Low Risk Model Portfolio§ One of the Lowest Cost of Funds § Disciplined Acquirer (1) § Focus is NOT Multifamily Lending in the State (1) Source: S&P Global Q4 2020 for NJ headquartered banks with total assets greater 4 than $500 million.

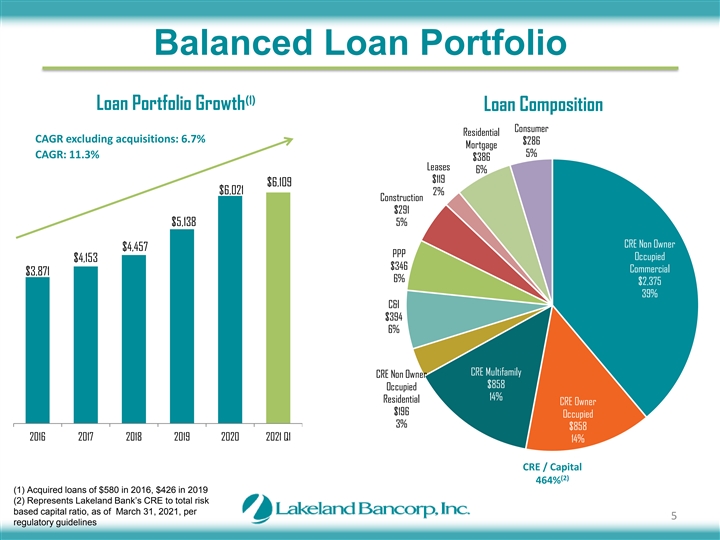

Balanced Loan Portfolio (1) Loan Portfolio Growth Loan Composition Consumer Residential CAGR excluding acquisitions: 6.7% $286 Mortgage 5% CAGR: 11.3% $386 Leases 6% $119 $6,109 $6,021 2% Construction $291 $5,138 5% CRE Non Owner $4,457 PPP Occupied $4,153 $346 Commercial $3,871 6% $2,375 39% C&I $394 6% CRE Multifamily CRE Non Owner $858 Occupied 14% Residential CRE Owner $196 Occupied 3% $858 2016 2017 2018 2019 2020 2021 Q1 14% CRE / Capital (2) 464% (1) Acquired loans of $580 in 2016, $426 in 2019 (2) Represents Lakeland Bank’s CRE to total risk based capital ratio, as of March 31, 2021, per 5 regulatory guidelinesBalanced Loan Portfolio (1) Loan Portfolio Growth Loan Composition Consumer Residential CAGR excluding acquisitions: 6.7% $286 Mortgage 5% CAGR: 11.3% $386 Leases 6% $119 $6,109 $6,021 2% Construction $291 $5,138 5% CRE Non Owner $4,457 PPP Occupied $4,153 $346 Commercial $3,871 6% $2,375 39% C&I $394 6% CRE Multifamily CRE Non Owner $858 Occupied 14% Residential CRE Owner $196 Occupied 3% $858 2016 2017 2018 2019 2020 2021 Q1 14% CRE / Capital (2) 464% (1) Acquired loans of $580 in 2016, $426 in 2019 (2) Represents Lakeland Bank’s CRE to total risk based capital ratio, as of March 31, 2021, per 5 regulatory guidelines

Commercial Loan Portfolio Commercial Portfolio Growth Commercial Loan Composition $5,437 Owner Occupied 19% $5,340 Multifamily 19% $4,468 Retail 17% $3,801 Industrial 10% $3,511 $3,184 Office 9% Mixed 9% Other 6% Commercial Constr. 5% Comm'l Res 1-4 Fam 4% Hotels/Resturants 1% 2016 2017 2018 2019 2020 2021 Residential Constr. 1% (1) CRE C&I Construction Equipment Finance (1) Includes PPP Loans 6Commercial Loan Portfolio Commercial Portfolio Growth Commercial Loan Composition $5,437 Owner Occupied 19% $5,340 Multifamily 19% $4,468 Retail 17% $3,801 Industrial 10% $3,511 $3,184 Office 9% Mixed 9% Other 6% Commercial Constr. 5% Comm'l Res 1-4 Fam 4% Hotels/Resturants 1% 2016 2017 2018 2019 2020 2021 Residential Constr. 1% (1) CRE C&I Construction Equipment Finance (1) Includes PPP Loans 6

Loan Deferment Exposures There were no loans on payment deferment as of 3/31/21 $200 $180 $160 $140 $120 $100 $80 $60 $40 $20 $0 At 3/31/2021 At 6/30/2020 At 9/30/2020 At 12/31/2020 $0.0 million $9.7 million $1.02 billion $155.0 million 7 In MillionsLoan Deferment Exposures There were no loans on payment deferment as of 3/31/21 $200 $180 $160 $140 $120 $100 $80 $60 $40 $20 $0 At 3/31/2021 At 6/30/2020 At 9/30/2020 At 12/31/2020 $0.0 million $9.7 million $1.02 billion $155.0 million 7 In Millions

Strong Asset Quality (1) (1)(2) Nonaccruals / Loans (%) NPAs / Loans + OREO (%) 1.40% 2.00% 1.05% 1.50% 1.14% 0.74% 0.71% 0.70% 1.00% 0.77% 0.51% 0.41% 0.62% 0.57% 0.53% 0.50% 0.33% 0.27% 0.35% 0.50% 0.00% 0.00% 2016 2017 2018 2019 2020 2021 Q1 2016 2017 2018 2019 2020 2021 Q1 Reserves / Nonaccrual Loans (%) NCOs / Avg. Loans (%) 0.50% 350.0% 310.7% 300.0% 0.40% 259.7% 250.0% 216.1% 0.30% 196.9% 189.2% 200.0% 150.0% 0.20% 122.4% 100.0% 0.10% 0.07% 0.06% 0.05% 0.05% 50.0% 0.03% 0.00% 0.00% 0.0% 2016 2017 2018 2019 2020 2021 Q1 2016 2017 2018 2019 2020 2021 Q1 (1) Non-accruals & NPAs include non-accrual purchased credit deteriorated loans from December 31, 2020 8 forward. (2) NPAs include Troubled Debt Restructurings. Strong Asset Quality (1) (1)(2) Nonaccruals / Loans (%) NPAs / Loans + OREO (%) 1.40% 2.00% 1.05% 1.50% 1.14% 0.74% 0.71% 0.70% 1.00% 0.77% 0.51% 0.41% 0.62% 0.57% 0.53% 0.50% 0.33% 0.27% 0.35% 0.50% 0.00% 0.00% 2016 2017 2018 2019 2020 2021 Q1 2016 2017 2018 2019 2020 2021 Q1 Reserves / Nonaccrual Loans (%) NCOs / Avg. Loans (%) 0.50% 350.0% 310.7% 300.0% 0.40% 259.7% 250.0% 216.1% 0.30% 196.9% 189.2% 200.0% 150.0% 0.20% 122.4% 100.0% 0.10% 0.07% 0.06% 0.05% 0.05% 50.0% 0.03% 0.00% 0.00% 0.0% 2016 2017 2018 2019 2020 2021 Q1 2016 2017 2018 2019 2020 2021 Q1 (1) Non-accruals & NPAs include non-accrual purchased credit deteriorated loans from December 31, 2020 8 forward. (2) NPAs include Troubled Debt Restructurings.

Core Deposit Focus (2) Deposit Growth Deposit Composition CAGR ex acquisitions: 7.8% $6,635 $7,000 $6,456 Jumbo Time CAGR: 12.0% $6,000 $159 $5,294 2% $4,620 $5,000 Retail Time $4,369 $4,093 $794 $4,000 12% $3,000 $2,000 $1,000 $0 Demand Savings and NOW 2016 2017 2018 2019 2020 2021 Q1 Deposits Accounts Core Deposits CDs $1,632 $4,050 25% 61% (3) Demand Deposit Growth $1,632 CAGR ex acquisitions: 11.0% $1,510 CAGR: 14.2% $1,124 Q1 Cost of Total Deposits: 0.32% $967 $950 Core Deposits: 86% $927 2016 2017 2018 2019 2020 2021 (1) Jumbo time deposits defined as time deposits above $250K (2) Acquired deposits in 2016 = $583, 2019 = $410 (3) Acquired demand deposits in 2016 = $108, 2019 = $81 9Core Deposit Focus (2) Deposit Growth Deposit Composition CAGR ex acquisitions: 7.8% $6,635 $7,000 $6,456 Jumbo Time CAGR: 12.0% $6,000 $159 $5,294 2% $4,620 $5,000 Retail Time $4,369 $4,093 $794 $4,000 12% $3,000 $2,000 $1,000 $0 Demand Savings and NOW 2016 2017 2018 2019 2020 2021 Q1 Deposits Accounts Core Deposits CDs $1,632 $4,050 25% 61% (3) Demand Deposit Growth $1,632 CAGR ex acquisitions: 11.0% $1,510 CAGR: 14.2% $1,124 Q1 Cost of Total Deposits: 0.32% $967 $950 Core Deposits: 86% $927 2016 2017 2018 2019 2020 2021 (1) Jumbo time deposits defined as time deposits above $250K (2) Acquired deposits in 2016 = $583, 2019 = $410 (3) Acquired demand deposits in 2016 = $108, 2019 = $81 9

(1) NJ Deposit Market Share Number Deposits Market of in Market Share Rank Institution Branches ($mm) (%) 1 Valley National Bancorp 137 20,023 22.9 2 Investors Bancorp Inc. 109 1 6,700 19.1 3 Provident Financial Services Inc. 97 9,038 10.3 4 OceanFirst Financial Corp. 65 8,174 9.3 5 Columbia Financial Inc. (MHC) 62 6,733 7.7 6 Lakeland Bancorp Inc. 48 5,998 6.8 7 ConnectOne Bancorp Inc. 20 5 ,238 6.0 8 Peapack-Gladstone Financial Corp. 21 4 ,864 5.6 9 Kearny Financial Corp. 49 4 ,820 5.5 10 CRB Group Inc. 2 3,039 3.5 Top 10 New Jersey Banks 610 84,627 96.6 Total NJ Banks In Market 1,031 87,621 100.0 (1) Banks headquartered in New Jersey Source: S&P Global as of June 2020. 10(1) NJ Deposit Market Share Number Deposits Market of in Market Share Rank Institution Branches ($mm) (%) 1 Valley National Bancorp 137 20,023 22.9 2 Investors Bancorp Inc. 109 1 6,700 19.1 3 Provident Financial Services Inc. 97 9,038 10.3 4 OceanFirst Financial Corp. 65 8,174 9.3 5 Columbia Financial Inc. (MHC) 62 6,733 7.7 6 Lakeland Bancorp Inc. 48 5,998 6.8 7 ConnectOne Bancorp Inc. 20 5 ,238 6.0 8 Peapack-Gladstone Financial Corp. 21 4 ,864 5.6 9 Kearny Financial Corp. 49 4 ,820 5.5 10 CRB Group Inc. 2 3,039 3.5 Top 10 New Jersey Banks 610 84,627 96.6 Total NJ Banks In Market 1,031 87,621 100.0 (1) Banks headquartered in New Jersey Source: S&P Global as of June 2020. 10

Investment Securities Portfolio Securities Composition § $1.07 billion, or 14% of assets CRA Equities Government & 1% § Primarily used for liquidity purposes Agencies 11% § Short term agencies, MBS, and municipals § Municipal Bond portfolio rated AA or higher 98% MBS/CMO/ABS Municipals 60% 25% § Average Yield for Q1: 1.90% § Weighted Average Life: 7.2 years § Effective Duration: 4.4 years Corporate Debt 3% § AFS is 92% of portfolio / HTM is 8% 11Investment Securities Portfolio Securities Composition § $1.07 billion, or 14% of assets CRA Equities Government & 1% § Primarily used for liquidity purposes Agencies 11% § Short term agencies, MBS, and municipals § Municipal Bond portfolio rated AA or higher 98% MBS/CMO/ABS Municipals 60% 25% § Average Yield for Q1: 1.90% § Weighted Average Life: 7.2 years § Effective Duration: 4.4 years Corporate Debt 3% § AFS is 92% of portfolio / HTM is 8% 11

Mergers & Acquisitions Highlands Bancorp Harmony Bank Pascack Bancorp Legacy Highlands (4) Legacy Harmony (3) Legacy Pascack (7) LPOs (2) LPOs (2) LPOs (2) Announcement Date: 8/23/2018 Announcement Date: 2/18/2016 Announcement Date: 8/4/2015 Assets: $488mm Assets: $295mm Assets: $403mm Deal Value: $56.7mm Deal Value: $32.0mm Deal Value: $43.8mm Price/TBV: 1.89x Price/TBV: 1.29x Price/TBV: 1.31x EPS Accretion: 4.0% EPS Accretion: 1.0% EPS Accretion: 4.5% TBV Dilution: ~1.5% TBV Dilution: ~0.5% TBV Dilution: ~2.7% TBV Earnback: < 2 Years TBV Earnback: 3.5 Years TBV Earnback: 3.5 Years Board Seats: None Board Seats: None Board Seats: Lawrence Inserra Jr. Rationale Rationale Rationale • Expanding presence in Sussex, Passaic and Morris • Expansion into Middlesex/Monmouth/Ocean • Growth opportunity in Bergen/Essex Counties counties Counties • Exclusive negotiations • Low execution risk and achievable cost savings • Leverage Existing Commercial Loan Production Office • Exclusive negotiations Note: Represents data at announcement date 12Mergers & Acquisitions Highlands Bancorp Harmony Bank Pascack Bancorp Legacy Highlands (4) Legacy Harmony (3) Legacy Pascack (7) LPOs (2) LPOs (2) LPOs (2) Announcement Date: 8/23/2018 Announcement Date: 2/18/2016 Announcement Date: 8/4/2015 Assets: $488mm Assets: $295mm Assets: $403mm Deal Value: $56.7mm Deal Value: $32.0mm Deal Value: $43.8mm Price/TBV: 1.89x Price/TBV: 1.29x Price/TBV: 1.31x EPS Accretion: 4.0% EPS Accretion: 1.0% EPS Accretion: 4.5% TBV Dilution: ~1.5% TBV Dilution: ~0.5% TBV Dilution: ~2.7% TBV Earnback: < 2 Years TBV Earnback: 3.5 Years TBV Earnback: 3.5 Years Board Seats: None Board Seats: None Board Seats: Lawrence Inserra Jr. Rationale Rationale Rationale • Expanding presence in Sussex, Passaic and Morris • Expansion into Middlesex/Monmouth/Ocean • Growth opportunity in Bergen/Essex Counties counties Counties • Exclusive negotiations • Low execution risk and achievable cost savings • Leverage Existing Commercial Loan Production Office • Exclusive negotiations Note: Represents data at announcement date 12

Franchise Growth (1) (2) Total Assets Tangible Book Value Per Share Core Earnings Per Share CAGR: 7.9% CAGR: 10.5 % $12.03 $11.97 $1.43 $7,772 $11.18 $7,664 $1.32 $10.22 $6,711 $1.17 $9.38 $1.11 $8.70 $5,806 $1.02 $5,406 $5,093 $0.45 2016 2017 2018 2019 2020 2021 Q1 2016 2017 2018 2019 2020 2021 Q1 2016 2017 2018 2019 2020 2021 Q1 (1) Acquired total assets of $732 in 2016, $496 in 2019 (2) Core earnings per share excludes non-recurring items, FHLB prepayment fees, gains/losses on 13 securities sales, and merger related expenses.Franchise Growth (1) (2) Total Assets Tangible Book Value Per Share Core Earnings Per Share CAGR: 7.9% CAGR: 10.5 % $12.03 $11.97 $1.43 $7,772 $11.18 $7,664 $1.32 $10.22 $6,711 $1.17 $9.38 $1.11 $8.70 $5,806 $1.02 $5,406 $5,093 $0.45 2016 2017 2018 2019 2020 2021 Q1 2016 2017 2018 2019 2020 2021 Q1 2016 2017 2018 2019 2020 2021 Q1 (1) Acquired total assets of $732 in 2016, $496 in 2019 (2) Core earnings per share excludes non-recurring items, FHLB prepayment fees, gains/losses on 13 securities sales, and merger related expenses.

Consistent Profitability (1) (1) Core Return on Assets (%) Core Return on Equity (%) 14.00% 1.22% 1.16% 1.25% 1.15% 12.20% 1.01% 12.00% 10.66% 10.48% 0.96% 1.00% 9.34% 9.35% 0.83% 10.00% 8.01% 0.75% 8.00% 6.00% 0.50% 4.00% 0.25% 2.00% 0.00% 0.00% 2016 2017 2018 2019 2020 2021 Q1 2016 2017 2018 2019 2020 2021 Q1 (2) Net Interest Margin (%) Efficiency Ratio (%) 3.75% 66.0% 62.0% 3.50% 3.41% 3.38% 3.36% 3.33% 58.0% 56.7% 56.1% 54.8% 54.5% 3.25% 3.19% 53.8% 53.4% 54.0% 3.09% 3.00% 50.0% 2016 2017 2018 2019 2020 2021 Q1 2016 2017 2018 2019 2020 2021 Q1 (1) Core income excludes non-recurring items, FHLB prepayment fees, gains/losses on securities sales, and merger related expenses. (2) Source: S&P Global through 2018. Company 14 records for 2019, 2020 & 2021.Consistent Profitability (1) (1) Core Return on Assets (%) Core Return on Equity (%) 14.00% 1.22% 1.16% 1.25% 1.15% 12.20% 1.01% 12.00% 10.66% 10.48% 0.96% 1.00% 9.34% 9.35% 0.83% 10.00% 8.01% 0.75% 8.00% 6.00% 0.50% 4.00% 0.25% 2.00% 0.00% 0.00% 2016 2017 2018 2019 2020 2021 Q1 2016 2017 2018 2019 2020 2021 Q1 (2) Net Interest Margin (%) Efficiency Ratio (%) 3.75% 66.0% 62.0% 3.50% 3.41% 3.38% 3.36% 3.33% 58.0% 56.7% 56.1% 54.8% 54.5% 3.25% 3.19% 53.8% 53.4% 54.0% 3.09% 3.00% 50.0% 2016 2017 2018 2019 2020 2021 Q1 2016 2017 2018 2019 2020 2021 Q1 (1) Core income excludes non-recurring items, FHLB prepayment fees, gains/losses on securities sales, and merger related expenses. (2) Source: S&P Global through 2018. Company 14 records for 2019, 2020 & 2021.

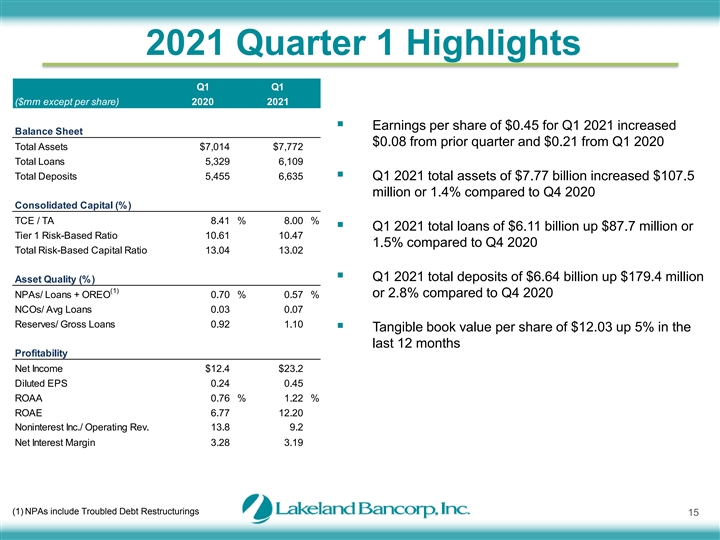

2021 Quarter 1 Highlights Q1 Q1 ($mm except per share) 2020 2021 § Earnings per share of $0.45 for Q1 2021 increased Balance Sheet $0.08 from prior quarter and $0.21 from Q1 2020 Total Assets $7,014 $7,772 Total Loans 5,329 6,109 Total Deposits 5,455 6,635§ Q1 2021 total assets of $7.77 billion increased $107.5 million or 1.4% compared to Q4 2020 Consolidated Capital (%) TCE / TA 8.41 % 8.00 % § Q1 2021 total loans of $6.11 billion up $87.7 million or Tier 1 Risk-Based Ratio 10.61 10.47 1.5% compared to Q4 2020 Total Risk-Based Capital Ratio 13.04 13.02 § Q1 2021 total deposits of $6.64 billion up $179.4 million Asset Quality (%) (1) or 2.8% compared to Q4 2020 NPAs/ Loans + OREO 0.70 % 0.57 % NCOs/ Avg Loans 0.03 0.07 Reserves/ Gross Loans 0.92 1.10 § Tangible book value per share of $12.03 up 5% in the last 12 months Profitability Net Income $12.4 $23.2 Diluted EPS 0.24 0.45 ROAA 0.76 % 1.22 % ROAE 6.77 12.20 Noninterest Inc./ Operating Rev. 13.8 9.2 Net Interest Margin 3.28 3.19 (1) NPAs include Troubled Debt Restructurings 152021 Quarter 1 Highlights Q1 Q1 ($mm except per share) 2020 2021 § Earnings per share of $0.45 for Q1 2021 increased Balance Sheet $0.08 from prior quarter and $0.21 from Q1 2020 Total Assets $7,014 $7,772 Total Loans 5,329 6,109 Total Deposits 5,455 6,635§ Q1 2021 total assets of $7.77 billion increased $107.5 million or 1.4% compared to Q4 2020 Consolidated Capital (%) TCE / TA 8.41 % 8.00 % § Q1 2021 total loans of $6.11 billion up $87.7 million or Tier 1 Risk-Based Ratio 10.61 10.47 1.5% compared to Q4 2020 Total Risk-Based Capital Ratio 13.04 13.02 § Q1 2021 total deposits of $6.64 billion up $179.4 million Asset Quality (%) (1) or 2.8% compared to Q4 2020 NPAs/ Loans + OREO 0.70 % 0.57 % NCOs/ Avg Loans 0.03 0.07 Reserves/ Gross Loans 0.92 1.10 § Tangible book value per share of $12.03 up 5% in the last 12 months Profitability Net Income $12.4 $23.2 Diluted EPS 0.24 0.45 ROAA 0.76 % 1.22 % ROAE 6.77 12.20 Noninterest Inc./ Operating Rev. 13.8 9.2 Net Interest Margin 3.28 3.19 (1) NPAs include Troubled Debt Restructurings 15

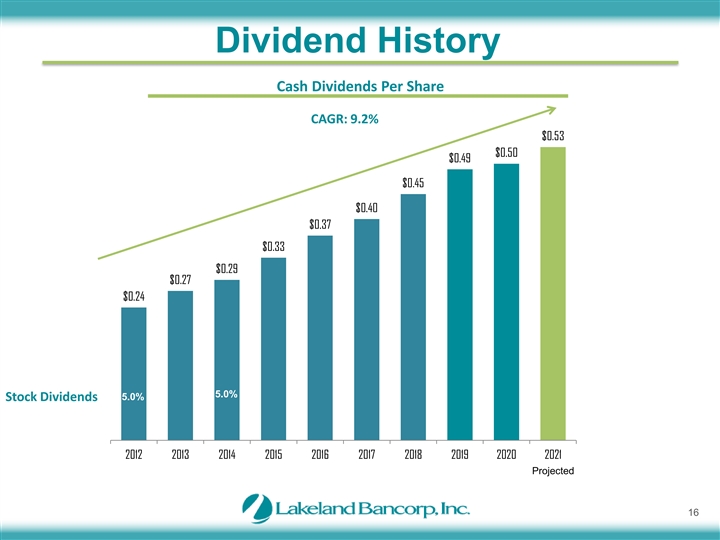

Dividend History Cash Dividends Per Share CAGR: 9.2% $0.53 $0.50 $0.49 $0.45 $0.40 $0.37 $0.33 $0.29 $0.27 $0.24 5.0% 5.0% Stock Dividends 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 Projected 16Dividend History Cash Dividends Per Share CAGR: 9.2% $0.53 $0.50 $0.49 $0.45 $0.40 $0.37 $0.33 $0.29 $0.27 $0.24 5.0% 5.0% Stock Dividends 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 Projected 16

LBAI Executive Summary We are proud to be characterized as follows: Industry Recognition growth § Recognized by Forbes as the Best Bank in New Jersey in 2020§ Conduct business with transparency, honesty and integrity § Named to Piper/Sandler Sm-All Stars Class of 2020§ Robust risk management infrastructure § Recognized as one of the 50 fastest growing companies by NJ Biz § Conservatively underwritten loan and lease portfolio in 2019 & 2020 § Diligent attention to capital management; mindful of all Positive Stock Performance constituencies § Annual increase in dividends Dedicated and Experienced Management Team and Board Above Peer-Level Performance Metrics§ Extensive in-market experience with deep community ties § Historical core profitability metrics: ROA, ROE, and efficiency ratio § Expanded depth of Management Team with larger bank experience exceed peer averages § Continued growth in net income and EPS § Stable low efficiency ratio Premier NJ Deposit Franchise § Singular focus on high quality core deposits § 23% of deposits in DDA, 83% in core (non-time) deposits Conservative Culture and Operating Philosophy § Relationship-based community bank § Track record of successful acquisitions and consistent organic 17LBAI Executive Summary We are proud to be characterized as follows: Industry Recognition growth § Recognized by Forbes as the Best Bank in New Jersey in 2020§ Conduct business with transparency, honesty and integrity § Named to Piper/Sandler Sm-All Stars Class of 2020§ Robust risk management infrastructure § Recognized as one of the 50 fastest growing companies by NJ Biz § Conservatively underwritten loan and lease portfolio in 2019 & 2020 § Diligent attention to capital management; mindful of all Positive Stock Performance constituencies § Annual increase in dividends Dedicated and Experienced Management Team and Board Above Peer-Level Performance Metrics§ Extensive in-market experience with deep community ties § Historical core profitability metrics: ROA, ROE, and efficiency ratio § Expanded depth of Management Team with larger bank experience exceed peer averages § Continued growth in net income and EPS § Stable low efficiency ratio Premier NJ Deposit Franchise § Singular focus on high quality core deposits § 23% of deposits in DDA, 83% in core (non-time) deposits Conservative Culture and Operating Philosophy § Relationship-based community bank § Track record of successful acquisitions and consistent organic 17

Honors & Accolades 2020 Bank & Thrift SM-ALL STARSHonors & Accolades 2020 Bank & Thrift SM-ALL STARS

250 Oak Ridge Road | Oak Ridge, NJ 07438 | t: 973-697-2000 | LakelandBank.com | Stock symbol: LBAI250 Oak Ridge Road | Oak Ridge, NJ 07438 | t: 973-697-2000 | LakelandBank.com | Stock symbol: LBAI