Attached files

| file | filename |

|---|---|

| 8-K - 8-K - WSFS FINANCIAL CORP | wsfs-20210422.htm |

| EX-99.1 - EX-99.1 - WSFS FINANCIAL CORP | exhibit991earningsrelease0.htm |

1 WSFS Financial Corporation 1Q 2021 Investor Update April 2021 Exhibit 99.2

2 Forward Looking Statements: This presentation contains estimates, predictions, opinions, projections and other "forward-looking statements" as that phrase is defined in the Private Securities Litigation Reform Act of 1995. Such statements include, without limitation, references to the Company's predictions or expectations of future business or financial performance as well as its goals and objectives for future operations, financial and business trends, business prospects, and management's outlook or expectations for earnings, revenues, expenses, capital levels, liquidity levels, asset quality or other future financial or business performance, strategies or expectations. The words “believe,” “expect,” “anticipate,” “plan,” “estimate,” “target,” “project” and similar expressions, among others, generally identify forward-looking statements. Such forward-looking statements are based on various assumptions (some of which may be beyond the Company's control) and are subject to significant risks and uncertainties (which change over time) and other factors, including our pending acquisition of Bryn Mawr Bank Corporation and the uncertain effects of the COVID-19 pandemic and actions taken in response thereto on our business, results of operations, capital and liquidity, which could cause actual results to differ materially from those currently anticipated. Such risks and uncertainties are discussed in detail in the Company's Form 10-K for the year ended December 31, 2020, and other documents filed by the Company with the Securities and Exchange Commission from time to time. We caution readers not to place undue reliance on any such forward-looking statements, which speak only as of the date on which they are made, and the Company disclaims any duty to revise or update any forward-looking statement, whether written or oral, that may be made from time to time by or on behalf of the Company for any reason, except as specifically required by law. As used in this presentation, the terms "WSFS", "the Company", "registrant", "we", "us", and "our" mean WSFS Financial Corporation and its subsidiaries, on a consolidated basis, unless the context indicates otherwise. Non-GAAP Financial Measures: This presentation contains financial measures determined by methods other than in accordance with accounting principles generally accepted in the United States (“GAAP”). These non-GAAP measures include core earnings per share (“EPS”), core net income, core return on equity (“ROE”), core efficiency ratio, pre-provision net revenue (“PPNR”), core PPNR, PPNR to average assets ratio, core PPNR to average assets ratio, core return on assets (“ROA”), core net interest income, core net interest margin (“NIM”), return on tangible common equity (“ROTCE”), core ROTCE, core fee revenue and core fee revenue as a percentage of total core net revenue. The Company’s management believes that these non-GAAP measures provide a greater understanding of ongoing operations, enhance comparability of results of operations with prior periods and show the effects of significant gains and charges in the periods presented. The Company’s management believes that investors may use these non-GAAP measures to analyze the Company’s financial performance without the impact of unusual items or events that may obscure trends in the Company’s underlying performance. This non-GAAP data should be considered in addition to results prepared in accordance with GAAP, and is not a substitute for, or superior to, GAAP results. For a reconciliation of these non-GAAP measures to their comparable GAAP measures, see the Appendix. Forward Looking Statements & Non-GAAP

3 Table of Contents 1Q 2021 Highlights Page 4 Loan & Deposit Growth Page 5 Net Interest Margin Trends Page 6 Core Fee Revenue Trends Page 7 ACL Overview Page 8 2021 Core Outlook Page 9 WSFS Franchise and Markets Page 10 Lines of Business Page 17 Selected Financial and Performance Metrics Page 23 Capital Management Page 30 WSFS Mission, Vision, Strategy, and Values Page 33 Appendix: Reconciliation of Non-GAAP Financial Information Page 34

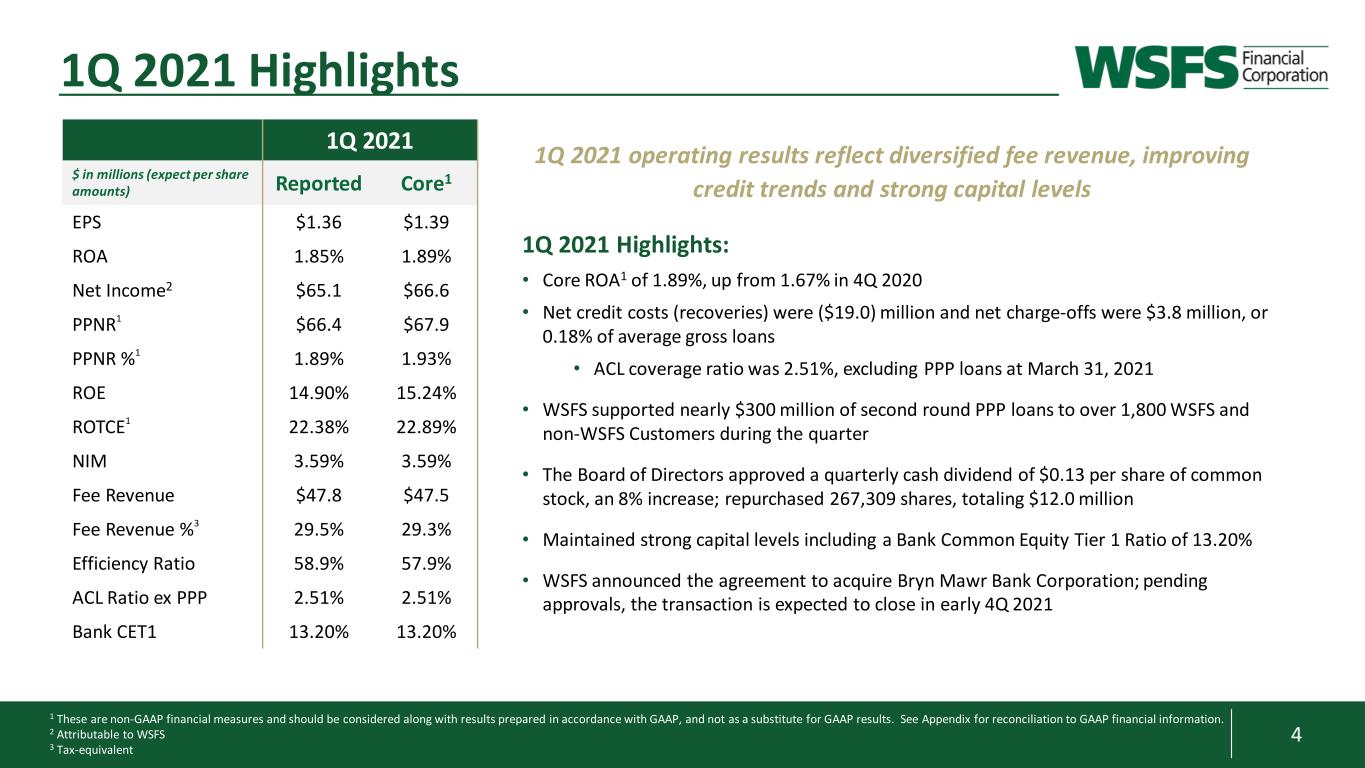

4 1 These are non-GAAP financial measures and should be considered along with results prepared in accordance with GAAP, and not as a substitute for GAAP results. See Appendix for reconciliation to GAAP financial information. 2 Attributable to WSFS 3 Tax-equivalent 1Q 2021 Highlights 1Q 2021 $ in millions (expect per share amounts) Reported Core1 EPS $1.36 $1.39 ROA 1.85% 1.89% Net Income2 $65.1 $66.6 PPNR1 $66.4 $67.9 PPNR %1 1.89% 1.93% ROE 14.90% 15.24% ROTCE1 22.38% 22.89% NIM 3.59% 3.59% Fee Revenue $47.8 $47.5 Fee Revenue %3 29.5% 29.3% Efficiency Ratio 58.9% 57.9% ACL Ratio ex PPP 2.51% 2.51% Bank CET1 13.20% 13.20% 1Q 2021 operating results reflect diversified fee revenue, improving credit trends and strong capital levels 1Q 2021 Highlights: • Core ROA1 of 1.89%, up from 1.67% in 4Q 2020 • Net credit costs (recoveries) were ($19.0) million and net charge-offs were $3.8 million, or 0.18% of average gross loans • ACL coverage ratio was 2.51%, excluding PPP loans at March 31, 2021 • WSFS supported nearly $300 million of second round PPP loans to over 1,800 WSFS and non-WSFS Customers during the quarter • The Board of Directors approved a quarterly cash dividend of $0.13 per share of common stock, an 8% increase; repurchased 267,309 shares, totaling $12.0 million • Maintained strong capital levels including a Bank Common Equity Tier 1 Ratio of 13.20% • WSFS announced the agreement to acquire Bryn Mawr Bank Corporation; pending approvals, the transaction is expected to close in early 4Q 2021

5 Loan and Deposit Growth Loans reflect purposeful run-off portfolios and PPP forgiveness; Significant excess customer liquidity continues • Commercial run-off portfolios acquired from Beneficial Bancorp Inc. are down to $55 million; remaining run-off portfolio is primarily residential mortgage • Continued focus on strategy to optimize our balance sheet mix towards relationship-based commercial loans and deposits • Customer funding levels remain elevated and increased $581 million during 1Q 2021 primarily due to funding of PPP 2.0 program and stimulus deposits ($ in millions) Mar 2021 Dec 2020 Mar 2020 1Q21 $ Growth Annualized % Growth YOY $ Growth YOY % Growth Noninterest Demand $3,858 $3,415 $2,315 $443 53% $1,543 67% Interest Demand Deposits $2,659 $2,636 $2,093 $23 4% $566 27% Savings $1,886 $1,774 $1,595 $112 26% $291 18% Money Market $2,722 $2,654 $2,149 $68 10% $573 27% Total Core Deposits $11,125 $10,479 $8,152 $646 25% $2,973 36% Customer Time Deposits $1,094 $1,159 $1,272 ($65) (23%) ($178) (14%) Total Customer Deposits $12,219 $11,638 $9,424 $581 20% $2,795 30% Deposits - 1Q 2021 vs 4Q 2020 and 1Q 2020 ($ in millions) Mar 2021 Dec 2020 Mar 2020 1Q21 $ Growth Annualized % Growth YOY $ Growth YOY % Growth C & I Loans $3,213 $3,299 $3,412 ($86) (11%) ($199) (6%) PPP Loans $527 $751 $0 ($224) (121%) $527 100% Commercial Mortgages $1,976 $2,086 $2,223 ($110) (21%) ($247) (11%) Construction Loans $784 $716 $626 $68 39% $158 25% Commercial Leases $265 $249 $202 $16 26% $63 31% Total Commercial Loans $6,765 $7,101 $6,463 ($336) (19%) $302 5% Residential Mortgage (HFS/HFI/Rev Mgt) $829 $955 $1,055 ($126) (54%) ($226) (21%) Consumer Loans $1,140 $1,166 $1,118 ($26) (9%) $22 2% Total Gross Loans $8,734 $9,222 $8,636 ($488) (21%) $98 1% Residential Mortgage (HFI) $671 $764 $956 ($93) (49%) ($285) (30%) Student Loans Acquired from BNCL $115 $117 $123 ($2) (7%) ($8) (7%) Auto Loans Acquired From BNCL $16 $22 $40 ($6) (111%) ($24) (60%) Participation portfolios (CRE) from BNCL $55 $98 $210 ($43) (178%) ($155) (74%) Leveraged Loans (C&I) from BNCL $0 $12 $12 ($12) (406%) ($12) (100%) Total Run-Off Portfolios $857 $1,013 $1,341 ($156) (62%) ($484) (36%) Gross Loans ex Run-Off Portfolios $7,877 $8,209 $7,295 ($332) (16%) $582 8% PPP Loans $527 $751 $0 ($224) (121%) $527 100% Gross Loans ex Run-Off & PPP Portfolios $7,350 $7,458 $7,295 ($108) (6%) $55 1% Loans - 1Q 2021 vs 4Q 2020 and 1Q 2020

6 Negative Excess Liquidity Impact on NIM 0.00% 0.05% 0.14% 0.21% 0.39% 0.0% 0.1% 0.2% 0.3% 0.4% 0.5% 1Q 2020 2Q 2020 3Q 2020 4Q 2020 1Q 2021 3.85% 3.58% 3.35% 3.36% 3.10% 0.53% 0.43% 0.39% 0.51% 0.37% 2.75% 3.00% 3.25% 3.50% 3.75% 4.00% 4.25% 4.50% 1Q 2020 2Q 2020 3Q 2020 4Q 2020 1Q 2021 NIM Ex PAA/PPP PAA PPP 0 4.38% 3.93%1 3.66%1 Net Interest Margin Trends NIM impacted by customer liquidity, purchase accretion variability, PPP forgiveness, and low funding costs 3.93% 3.59% Average Deposit Cost2 and Loan Yield3 1 Negative 8 bps impact related to PPP in 2Q 2020 and 3Q 2020 as forgiveness of PPP loans and accelerated fee accretion started in 4Q 2020 2 Includes non-interest and interest-bearing; interest-bearing deposits include demand, money market, savings, and customer time deposits 3 Average gross loans yield excludes PAA and PPP 32 0.58% 0.35% 0.28% 0.21% 0.14% 4.95% 4.46% 4.33% 4.39% 4.30% 3.0% 3.5% 4.0% 4.5% 5.0% 0.0% 0.2% 0.3% 0.5% 0.6% 0.8% 1Q 2020 2Q 2020 3Q 2020 4Q 2020 1Q 2021 Lo an Y ie ld (% ) Cu st om er D ep os it Co st (% ) Total Deposit Cost Gross Loans Yield

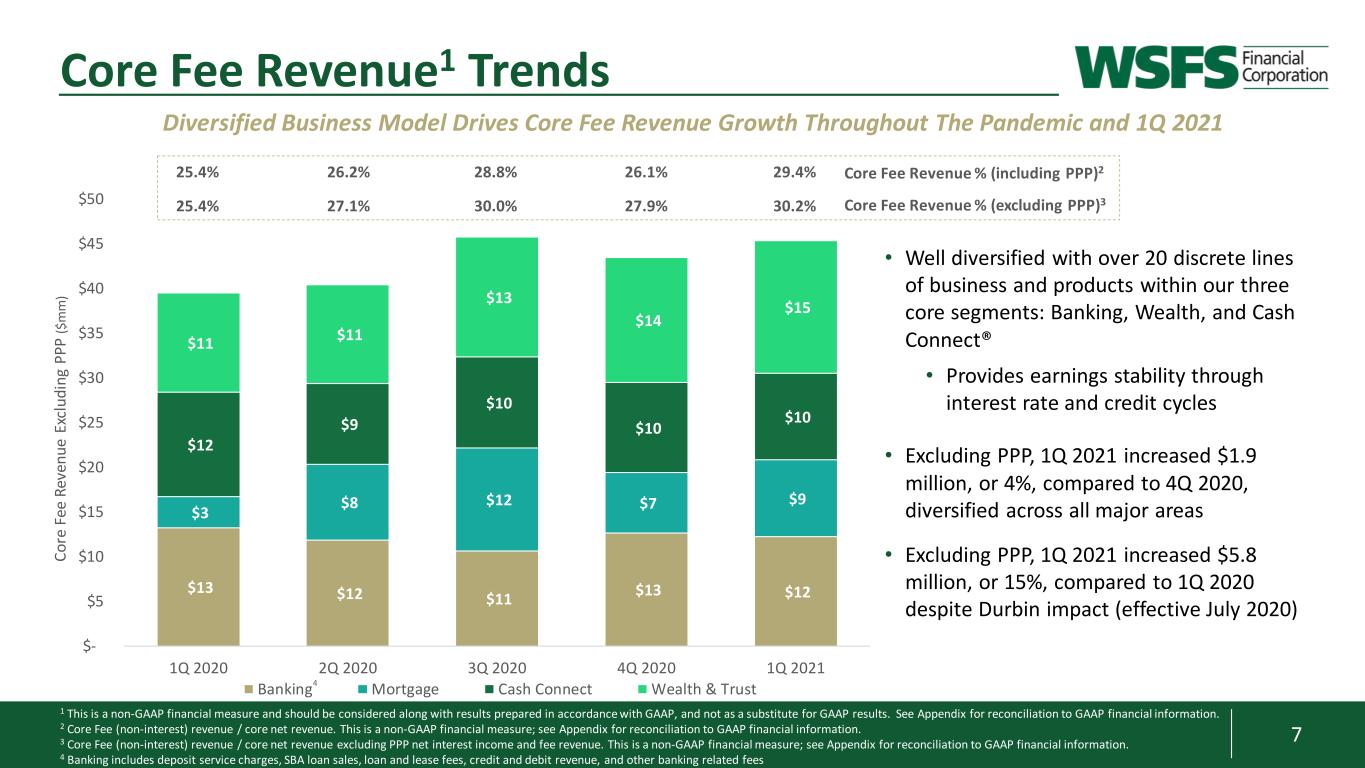

7 $13 $12 $11 $13 $12 $3 $8 $12 $7 $9 $12 $9 $10 $10 $10 $11 $11 $13 $14 $15 $- $5 $10 $15 $20 $25 $30 $35 $40 $45 $50 1Q 2020 2Q 2020 3Q 2020 4Q 2020 1Q 2021 Co re F ee R ev en ue E xc lu di ng P PP ($ m m ) Banking Mortgage Cash Connect Wealth & Trust 1 This is a non-GAAP financial measure and should be considered along with results prepared in accordance with GAAP, and not as a substitute for GAAP results. See Appendix for reconciliation to GAAP financial information. 2 Core Fee (non-interest) revenue / core net revenue. This is a non-GAAP financial measure; see Appendix for reconciliation to GAAP financial information. 3 Core Fee (non-interest) revenue / core net revenue excluding PPP net interest income and fee revenue. This is a non-GAAP financial measure; see Appendix for reconciliation to GAAP financial information. 4 Banking includes deposit service charges, SBA loan sales, loan and lease fees, credit and debit revenue, and other banking related fees • Well diversified with over 20 discrete lines of business and products within our three core segments: Banking, Wealth, and Cash Connect® • Provides earnings stability through interest rate and credit cycles • Excluding PPP, 1Q 2021 increased $1.9 million, or 4%, compared to 4Q 2020, diversified across all major areas • Excluding PPP, 1Q 2021 increased $5.8 million, or 15%, compared to 1Q 2020 despite Durbin impact (effective July 2020) Core Fee Revenue1 Trends Diversified Business Model Drives Core Fee Revenue Growth Throughout The Pandemic and 1Q 2021 4 Core Fee Revenue % (excluding PPP)325.4% 27.1% 30.0% 27.9% 30.2% Core Fee Revenue % (including PPP)225.4% 26.2% 28.8% 26.1% 29.4%

8 $0 $50 $100 $150 $200 $250 12/31/2020 Economic Forecast Impact Net Growth / NCO / Other 3/31/2021 3% 4% 5% 6% 7% 1Q21 2Q21 3Q21 4Q21 1Q22 2Q22 3Q22 4Q22 4Q20 Forecast 1Q21 Forecast Coverage Ratio (ex PPP) 1 Source: Oxford Economics as of March 2021 2 Hotel loan balances are included in the C&I and Construction segments ACL Overview ACL by Segment (ex PPP) Full-Year GDP forecast of 7.0% in 2021 and 3.0% in 20221 Year-End Unemployment forecast of 4.6% in 2021 and 4.2% in 20221 1Q 2021 ACL Commentary • Coverage ratio of 2.51% excluding PPP loans and 2.86% including estimated remaining credit mark on the acquired loan portfolio • ACL declined $24.0 million in 1Q 2021 driven by: • Positive developments in the economic forecast • Core loan growth offset by purposeful portfolio run-off, net migration, and net charge-offs 2.73% 2.51% GDP Growth by Quarter Unemployment by Quarter 1Q 2021 ACL ($mm) Economic Forecast Impact $0 $229 $205 -$24 ($ millions) $ % $ % $ % C&I2 $62.3 2.96% $142.4 7.32% $119.4 6.38% Construction2 $5.2 0.82% $12.2 1.70% $14.3 1.82% CRE Investor $26.6 1.19% $31.1 1.49% $30.5 1.55% Owner Occupied $9.4 0.72% $9.6 0.72% $9.6 0.72% Leases $3.6 1.34% $8.5 3.41% $6.5 2.43% Mortgage $11.6 1.22% $6.9 0.90% $5.7 0.85% HELOC & HEIL $12.6 1.69% $11.0 1.35% $13.2 1.61% Installment - Other $4.4 5.17% $3.8 4.64% $2.8 4.16% Other $3.4 0.81% $3.3 0.87% $2.8 0.79% TOTAL $139.1 1.60% $228.8 2.73% $204.9 2.51% March 31, 2020 December 31, 2020 March 31, 2021 -5% 0% 5% 10% 15% 1Q21 2Q21 3Q21 4Q21 1Q22 2Q22 3Q22 4Q22 4Q20 Forecast 1Q21 Forecast

9 3 2021 Core Outlook (as originally presented in 4Q 2020 Presentation) Loan Growth Mid single digit growth excluding PPP and non-relationship run-off portfolios primarily driven by C&I, leasing and consumer; 90% of PPP loans assumed forgiven by 4Q 2021 and approximate $200M decline from run-off portfolios Deposit Growth Mid single digit core deposit growth offset by purposeful reduction of time deposits, excluding the impact of elevated customer liquidity Net Interest Margin Range of 3.65% - 3.80%; assumes no short-term interest rate changes; approximately 24-28 bps of purchased loan accretion; approximately 6-10 bps positive PPP impact; assumes 11 bps negative impact from elevated customer liquidity Fee Income Growth1 Mid single digit growth excluding Durbin (effective July 2020) and lower Mortgage compared to outsized 2020; double digit Wealth and mid-high single digit core banking growth; flat including Durbin and Mortgage Provision Costs $20-25 million reflecting new loan growth; opportunity for reserve release if economic recovery accelerates Efficiency Ratio1 Low 60s driven by items described above combined with franchise growth and continued talent and Delivery Transformation investments Tax Rate Approximately 24% 2021 Core Outlook Outlook assumes a gradual and uneven economic recovery, franchise growth, and continued investments in our talent and technology 1 The Company is not able to reconcile the forward-looking non-GAAP estimates set forth above to their most directly comparable GAAP estimates without unreasonable efforts because it is unable to predict, forecast or determine the probable significance of the items impacting these estimates with a reasonable degree of accuracy

10 WSFS Franchise and Markets

11 1 As of 3/31/2021 2 AUA represents Assets Under Administration and AUM represents Assets Under Management 3 AUM includes advisory businesses (West Capital Management, Cypress Capital Management, and WSFS Wealth Investments) The WSFS Franchise1 Largest independent bank & trust company HQ in Delaware-Greater Philadelphia region • $14.7 billion in assets • $24.7 billion in combined AUA2 and AUM2, including $2.3 billion in AUM3 • 111 offices, including 88 branches • One of largest ATM networks in our market with 625 branded-ATMs Founded in 1832, WSFS is one of the ten oldest banks in the U.S. Major Business Lines National Presence Commercial Retail Wealth Cash Connect® Equipment Leasing Mortgage Regional Presence

12 Manufacturing 6% Trade, Transportation & Utilities 18% Financial Activities 8% Professionl & Business Services 16% Educational & Health Services 23% Leisure & Hospitality 7% Other 10% Government 12% ~10-20% higher income than the U.S. overall 1 Bureau of Labor Statistics, as of February 2021: Employees on nonfarm payrolls by industry supersector; Philadelphia-Camden-Wilmington MSA; not seasonally adjusted 2 Unemployment rate for the Philadelphia-Camden-Wilmington MSA, as of February 2021. Not seasonally adjusted 3 U.S. Census Bureau: 2019 American Community Survey; Philadelphia-Camden-Wilmington MSA 4 Bureau of Labor Statistics, as of May 2019: Occupational Employment and Wages, Philadelphia-Camden-Wilmington, MSA Diversity of industries drives stable and favorable employment and economic growth in our markets Regional Employment Composition1 Regional Statistics3 The WSFS Franchise - Our Markets Philadelphia-Camden-Wilmington MSA Over 4% of U.S. within branch network 6.1M Population 2.3M Households 2.5M Housing Units $40.9K Per Capita Income $264K Median Home Value ~10% higher household value than the U.S. overall 38.9 Median Age 67% Housing Owner Occupied 7.8% Unemployment2 • 47% improvement since 2Q 2020 peak Purchasing power vs. US Avg Income $27.69 Mean Hourly Wage4 $74.5K Median Home Income

13 • 4th largest metro in the Northeast –$444 billion regional economy • 6th largest MSA population in the U.S • 4th largest depository MSA in the U.S. 1 Sources: FDIC and S&P Global Market Intelligence. Market Share data excludes brokered deposits, credit unions, and non-traditional banks (e.g. credit card companies); as of June 30, 2020. Philadelphia-Camden-Wilmington MSA (includes Cecil County, MD) 2 Sources: U.S Bureau of Economic Analysis, U.S. Census Bureau, Select Greater Philadelphia Council, U.S Bureau of Labor Statistics. Philadelphia-Camden-Wilmington MSA (includes Cecil County, MD) At $14.7 billion in assets at 3/31/21, WSFS fills a long-standing service gap in our market between larger regional/national banks and smaller community banks The WSFS Franchise – Strategic Opportunity Regional Highlights2 • 45% YOY improvement in branch efficiency (deposits per branch) • 11% YOY deposit growth • 79 institutions with ~$355M average deposits outside of MSA’s top 15 WSFS Highlights1 # Institution Name Net Deposits ($mm) Market Share % Deposits / Branch ($mm) Branch Count 1 Wells Fargo Bank $35,311 16.7% $196.2 180 2 TD Bank $32,871 15.6% $236.5 139 3 Bank of America $22,412 10.6% $287.3 78 4 PNC Bank $20,752 9.8% $141.2 147 5 Citizens Bank $19,346 9.2% $119.4 162 6 M & T Bank $10,891 5.2% $242.0 45 7 WSFS Bank $9,680 4.6% $125.7 77 8 Santander Bank $6,966 3.3% $96.8 72 9 Truist Bank $5,852 2.8% $80.2 73 10 Univest Bank and Trust $4,317 2.0% $134.9 32 11 Bryn Mawr Trust $4,081 1.9% $99.5 41 12 Fulton Bank $3,933 1.9% $74.2 53 13 Republic First Bank $3,425 1.6% $126.9 27 14 Firstrust Savings Bank $3,138 1.5% $184.6 17 15 KeyBank $2,230 1.06% $62.0 36 Remaining 79 Institutions $28,026 13.3% $81.5 344 MSA: Philadelphia-Camden- Wilmington1 2020

14 1 This is a non-GAAP financial measure and should be considered along with results prepared in accordance with GAAP, and not as a substitute for GAAP results. See Appendix for reconciliation to GAAP financial information Note: GAAP ROA is the following: 2018 – 1.92%, 2019 – 1.30%, and 2020 – 0.87% The WSFS Franchise – Growth & Performance M ill io ns

15 • Maximizing data-driven analytics to deliver personalized campaigns leading to customer acquisitions • Implementing Salesforce© for improved 360-degree views of Customers for cross-sell opportunities • Lower new customer acquisition cost while improving Net Promoter Score Optimization of our physical footprint driving accelerating investments into our digital capabilities, consistent with our brand, to provide best-in-industry solutions and better serve Customers Delivery Transformation • Redesigning the account opening process focused on the Customer Experience • Delivering a true omnichannel experience that reduces application time and processing requirements • Improving synergies with marketing campaigns and reduced physical signatures • Digital documentation and retention • Improving AML and fraud detection success through Verafin© • Incorporating robotic processing automation into organization design reducing manual turnaround times and decreasing cost • Creating a flexible technology stack for future growth and broader capabilities Identify & target new Customers Enable our Customers to bank as they want Transforming for the evolving digital age OneWSFS Identify & Target Enable Customers Transform $17.5M 2021 Expected Net Investment

16 #1 “Top Bank” in Delaware nine years in a row; The News Journal “Best of Biz” for Business Banking; South Jersey Magazine 2020 Annual World’s Best Banks & America’s Best Banks honoree; Forbes “Soaring 76’s Fastest Growing Companies”; Philadelphia Business Journal “Best Community Involvement”; DE Small Business Chamber 10th Ranked Bank in America for 2021; Forbes 2020 Gallup Culture Transformation Award; Gallup Organization 1 Completed by the Gallup Organization, as of December 31, 2020 2 Per Bloomberg; closing price as of March 31, 2021 Recognitions and Total Shareholder Returns “Top Workplace” fifteen years in a row and #1 in 2020; The News Journal “Top Workplace” six years in a row; Inquirer.com “4th Ranked Bank Overall”; Bank Director 2021 Gallup Exceptional Workplace Award; Gallup Organization Engaged Associates, living our culture, making a better life for all we serve Total Shareholder Returns2 “Best Board and Technology Strategy”; Bank Director 0% 50% 100% 150% 200% 250% 300% 1 Year 3 Year 5 Year 7 Year 10 Year 1 Year 3 Year 5 Year 7 Year 10 Year WSFS 102.9% 7.8% 60.9% 123.1% 249.2% KBW Bank 90.1% 23.7% 113.8% 98.1% 193.2% SNL U.S. Bank > $10B 66.9% 13.1% 87.9% 79.3% 162.9% NASDAQ Bank 91.6% 21.4% 91.9% 100.0% 211.9% S&P 500 56.3% 59.2% 112.6% 143.9% 267.6%

17 Lines of Business

18 Disciplined Credit and Underwriting Philosophy • Conservative lending and concentration limits • CRE1: 300% limit; 202% actual • Construction2: 100% limit; 68% actual • Concentration limits by industry, CRE, project and individual borrower • House Limit: $70 million at 3/31/2021 (No Relationships Exceed) • 5 relationships >$50 million Business Banking Middle Market Comm. Real Estate Small Business SBA Lending Revenues: $3 million - $20 million+ Revenues: $20 million-$150 million Revenues: N/A Revenues: $250,000 - $5 million+ Profit: Up to $5 million Loan Exposure: $1 million – $15 million+ Loan Exposure: $5 million – $30 million+ Loan Exposure: $3 million – $30 million+ Loan Exposure: up to $1.5 million Loan Exposure: up to $5 million Average Relationship Exposure: $2.3 million Average Relationship Exposure: $5.8 million Average Relationship Exposure: $7.6 million Average Loan Exposure: $0.1 million Average Loan Exposure: $0.2 million 40 Relationship Managers 6 Relationship Managers 14 Relationship Managers 17 Relationship Managers 7 Relationship Managers Local, relationship-focused lending including cash management, wealth management, and private banking services 1 Defined as the sum of CRE and Construction (excluding owner occupied) exposures divided by the sum of Tier 1 Capital and ACL; as of 3/31/21 2 Defined as Construction (excluding owner occupied) exposure divided by the sum of Tier 1 Capital and ACL; as of 3/31/21 3 As of 12/31 each year Commercial Banking 37 35 41 6 6 6 14 15 15 12 19 17 4 5 7 25 40 55 70 85 2018 2019 2020 Business Banking Middle Market CRE Small Business SBA Lending Relationship Managers3 73 80 86

19 Branch & ATM Network Online & Mobile Banking Lending Mortgage Locations across Delaware, southeastern Pennsylvania and southern New Jersey Over 128K active online banking users and over 83K active mobile banking users Providing Customers with a wide range of options to make banking simple, intuitive and seamless Meeting Customers’ borrowing needs through in-house originations and strategic partnerships Offering a full range of mortgage products with national capabilities, world-class service and local-decision making Operates universal banking model to maximize staffing efficiencies while providing a superior Customer experience Highly rated mobile banking application that provides a range of functionality including WSFS SnapShot Deposit, Zelle®, MyWSFS and WSFS Mobile Cash Deposit Products: • Noninterest DDA • Interest DDA • Savings • Money Market • Time Deposits Consumer Loan Products: • Installment • HELOC • Personal Lines • Credit Cards • Student Loans Significant contributor to fee revenue through our originate and sell mortgage model 1 As of March 31st 2 Completed by the Gallup Organization; as of December 31, 2020 3 Excludes Brokered Deposits; as of March 31st of each year Relationship-focused community banking model with 88 banking offices & 625 ATMs1 Retail Banking Customer engagement survey places WSFS at the 66th percentile2 60% of WSFS Customers surveyed rated us a “5” out of 5, saying “WSFS is the perfect bank for people like me”2 Customer Engagement $87 $104 $139 $- $20 $40 $60 $80 $100 $120 $140 1Q 2019 1Q 2020 1Q 2021 Average Customer Deposits Per Branch ($mm)3

20 WSFS Wealth 1 AUM includes advisory businesses (West Capital Management, Cypress Capital Management, and WSFS Wealth Investments) 2 As of March 31st of each year Financial Highlights 1Q 2021 total revenue of $19.2 million 1Q 2021 pre-tax income of $9.3 million $24.7 billion in combined Assets Under Management and Administration, including $2.3 billion in AUM1 at 3/31/2021 $19.0 $21.1 $24.7 $5 $10 $15 $20 $25 1Q 2019 1Q 2020 1Q 2021 Bi lli on s Total AUM and AUA2

21 • Oldest and second largest vault cash provider in the ATM industry - over $1.7 billion in vault cash supplied or supported at 3/31/2021 • Approximately 33,000 non-bank ATMs & retail safes in all 50 states1 • ~9,000 devices utilizing armored car management and/or cash forecasting1 • Support over 70 ATM ISOs and ~940 deposit safe customers with over 4,900 safes1 • Supports over 6001 branded ATMs for WSFS Bank; one of the largest networks in our footprint • $10.1 million in net revenue (fee revenue less funding costs) and $1.7 million in pre-tax income in 1Q 2021 • 1Q 2021 ROA of 1.29% • 5-year CAGR2 for net revenue of 9.5% • 77% growth in dollars managed since 2018 1 As of 3/31/2021 2 5 years ending 3/31/2021 3 As of March 31st of each year ATM Vault Cash “Bailment” Smart Safes Armored Carrier Management Cash Forecasting & Reconcilement Services Loss Protection Fees WSFS Branded ATMs Leading National Provider of Cash Logistics and Services Cash Connect® An innovation center for the company, both expanding core ATM offerings and additional payment, processing and software-related activities (i.e., launched WSFS Mobile Cash) Dollars Managed ($mm)3 $1,254 $1,368 $1,729 $0 $400 $800 $1,200 $1,600 $2,000 1Q 2019 1Q 2020 1Q 2021

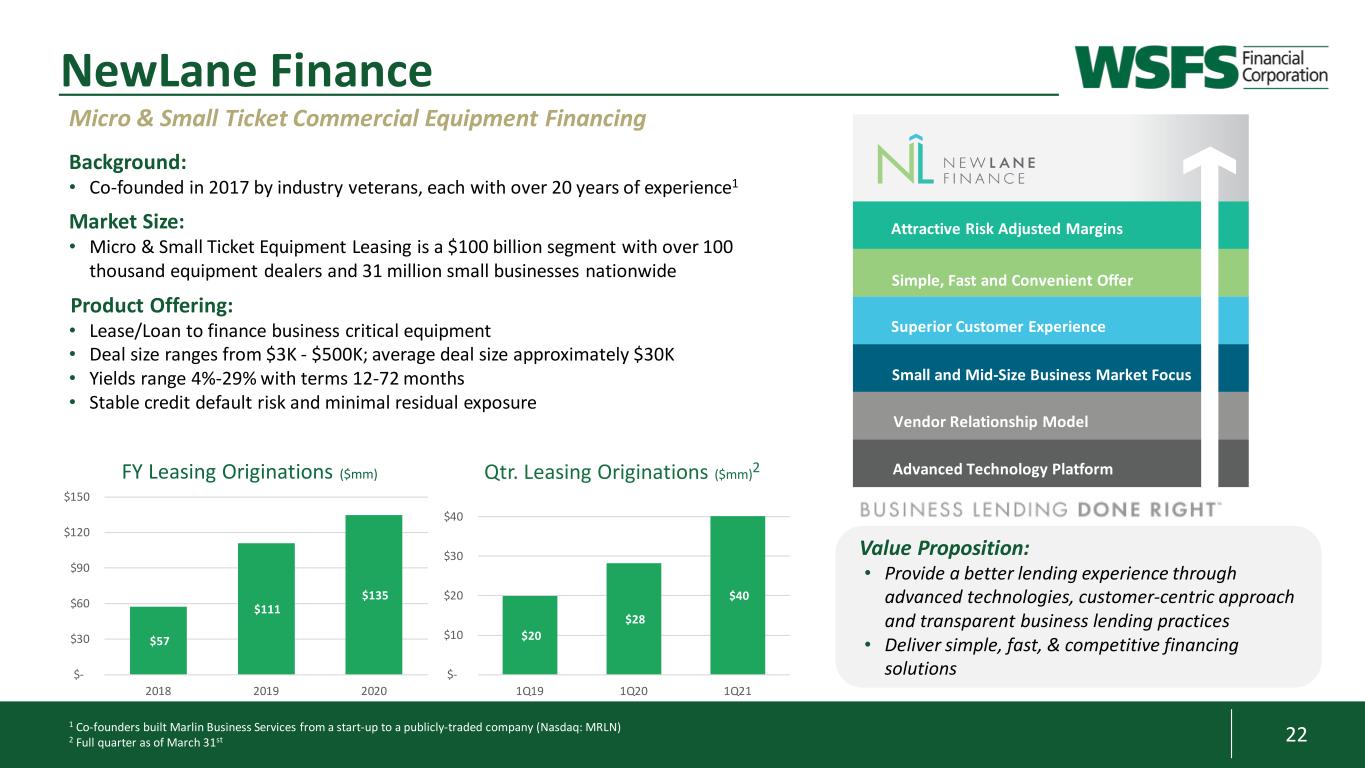

22 NewLane Finance Background: • Co-founded in 2017 by industry veterans, each with over 20 years of experience1 Market Size: • Micro & Small Ticket Equipment Leasing is a $100 billion segment with over 100 thousand equipment dealers and 31 million small businesses nationwide Product Offering: • Lease/Loan to finance business critical equipment • Deal size ranges from $3K - $500K; average deal size approximately $30K • Yields range 4%-29% with terms 12-72 months • Stable credit default risk and minimal residual exposure Vendor Relationship Model Small and Mid-Size Business Market Focus Advanced Technology Platform Superior Customer Experience Simple, Fast and Convenient Offer Attractive Risk Adjusted Margins Micro & Small Ticket Commercial Equipment Financing Value Proposition: • Provide a better lending experience through advanced technologies, customer-centric approach and transparent business lending practices • Deliver simple, fast, & competitive financing solutions $57 $111 $135 $- $30 $60 $90 $120 $150 2018 2019 2020 FY Leasing Originations ($mm) 1 Co-founders built Marlin Business Services from a start-up to a publicly-traded company (Nasdaq: MRLN) 2 Full quarter as of March 31st $20 $28 $40 $- $10 $20 $30 $40 1Q19 1Q20 1Q21 Qtr. Leasing Originations ($mm)2

23 Selected Financial and Performance Metrics

24 Time 9% Non-interest DDA 31% Money Market & Savings 38% Interest DDA 22% Customer Funding increased $0.6 billion in 1Q 2021 elevated by excess liquidity Balance Sheet Composition at March 31, 2021 C&I 39% CRE 24% Construction 10% Commerical Leasing 3% Residential Mortgage 10% Consumer 14% Investments 22% Cash Connect 3% Other Non- Earning Assets 19% Net Loans (ex PPP) 56% • Commercial loans comprise 75% of the gross loan portfolio, excluding PPP • $11.4 million credit card exposure Equity 12% Customer Deposits 83% Investments are composed of high quality, marketable investment grade securities with low credit risk; more than 95% in MBS issued by GNMA, FNMA or FHLMC 1 Excludes $526.8 million of PPP loans at March 31, 2021 2 Excludes brokered deposits $14.2B Assets $8.0B Net Loans Asset Composition (ex PPP)1 13% YOY Asset Growth Funding Composition $12.2B Deposits2 70% Loan-to-Deposit 30% YOY Deposit Growth Other Borrowings 3% Other Liabilities 2% Consumer 52% Wealth & Trust 7% Commercial 24% Small Business 14% Other 3% Funding By LOB

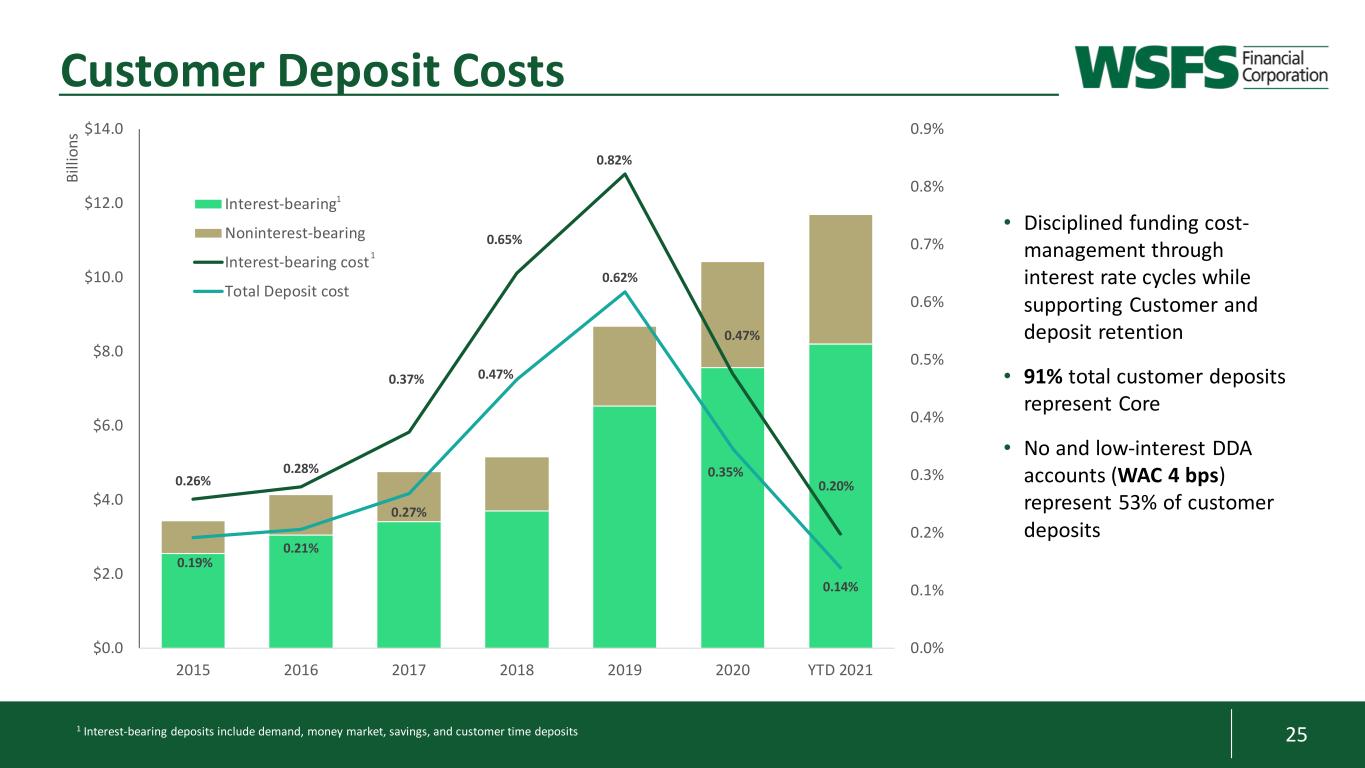

25 0.26% 0.28% 0.37% 0.65% 0.82% 0.47% 0.20% 0.19% 0.21% 0.27% 0.47% 0.62% 0.35% 0.14% 0.0% 0.1% 0.2% 0.3% 0.4% 0.5% 0.6% 0.7% 0.8% 0.9% $0.0 $2.0 $4.0 $6.0 $8.0 $10.0 $12.0 $14.0 2015 2016 2017 2018 2019 2020 YTD 2021 Bi lli on s Interest-bearing Noninterest-bearing Interest-bearing cost Total Deposit cost Customer Deposit Costs 1 Interest-bearing deposits include demand, money market, savings, and customer time deposits • Disciplined funding cost- management through interest rate cycles while supporting Customer and deposit retention • 91% total customer deposits represent Core • No and low-interest DDA accounts (WAC 4 bps) represent 53% of customer deposits 1 1

26 $30 $33 $37 $40 $55 $48 $6 $7 $6 $6 $11 $30 $30 $36 $43 $51 $51 $41 $23 $27 $36 $41 $44 $50 $0 $20 $40 $60 $80 $100 $120 $140 $160 $180 2015 2016 2017 2018 2019 2020 To ta l C or e 1 Fe e Re ve nu e $ in M ill io ns Bank Segment Mortgage Cash Connect Trust & Wealth 1 This is a non-GAAP financial measure and should be considered along with results prepared in accordance with GAAP, and not as a substitute for GAAP results. See Appendix for reconciliation to GAAP financial information. 2 %s represent core fee (noninterest) revenue / total net revenue Note: GAAP Fee Revenue is the following: 2018 – $201.0M, 2019 – $188.1M, and 2020 - $162.5M; GAAP Fee Revenue/Total Net Revenue is the following: 2018 – 40%, 2019 – 30%, and 2020 – 30% • Core Fee revenue is well diversified with over 20 discrete products and services within our lines of business 2020 Notables: • Cash Connect fees impacted by the lower interest rate environment, fully offset by reduced funding costs • Bank Segment included the first year of Durbin, which had a $6.5M negative impact • Strong historical growth in each segment; 5-year CAGR (2016-2020): • Trust & Wealth: 17% • Cash Connect: 6% • Bank: 10% • Total: 14% Diversified & Robust Core Fee Revenue 27%2 27%2 36%2 36%2 35%2 34%2

27 0.0% 0.2% 0.4% 0.6% 0.8% 2Q 15 3Q 15 4Q 15 1Q 16 2Q 16 3Q 16 4Q 16 1Q 17 2Q 17 3Q 17 4Q 17 1Q 18 2Q 18 3Q 18 4Q 18 1Q 19 2Q 19 3Q 19 4Q 19 1Q 20 2Q 20 3Q 20 4Q 20 1Q 21 0.2% 0.4% 0.6% 0.8% 1.0% 1.2% 2Q 15 3Q 15 4Q 15 1Q 16 2Q 16 3Q 16 4Q 16 1Q 17 2Q 17 3Q 17 4Q 17 1Q 18 2Q 18 3Q 18 4Q 18 1Q 19 2Q 19 3Q 19 4Q 19 1Q 20 2Q 20 3Q 20 4Q 20 1Q 21 10% 20% 30% 40% 50% 60% 2Q 15 3Q 15 4Q 15 1Q 16 2Q 16 3Q 16 4Q 16 1Q 17 2Q 17 3Q 17 4Q 17 1Q 18 2Q 18 3Q 18 4Q 18 1Q 19 2Q 19 3Q 19 4Q 19 1Q 20 2Q 20 3Q 20 4Q 20 1Q 21 Classified Loans Criticized Loans Delinquencies1 / Gross Loans Net Charge-Offs3 1 Includes non-accruing loans 2 One large $15.4 million, highly-seasonal relationship that was exited in 3Q 2016 3 Ratio of quarterly net charge-offs to average gross loans Criticized & Classified Loans / Tier-1 + ACL NPAs / Total Assets 47.1% 32.9% 0.35% 0.19% Credit Metrics (ex PPP) 0.0% 0.2% 0.4% 0.6% 0.8% 1.0% 1.2% 2Q 15 3Q 15 4Q 15 1Q 16 2Q 16 3Q 16 4Q 16 1Q 17 2Q 17 3Q 17 4Q 17 1Q 18 2Q 18 3Q 18 4Q 18 1Q 19 2Q 19 3Q 19 4Q 19 1Q 20 2Q 20 3Q 20 4Q 20 1Q 21 Delinquencies Large Relationship Govt. Guaranteed Student Loans 0.86% 2

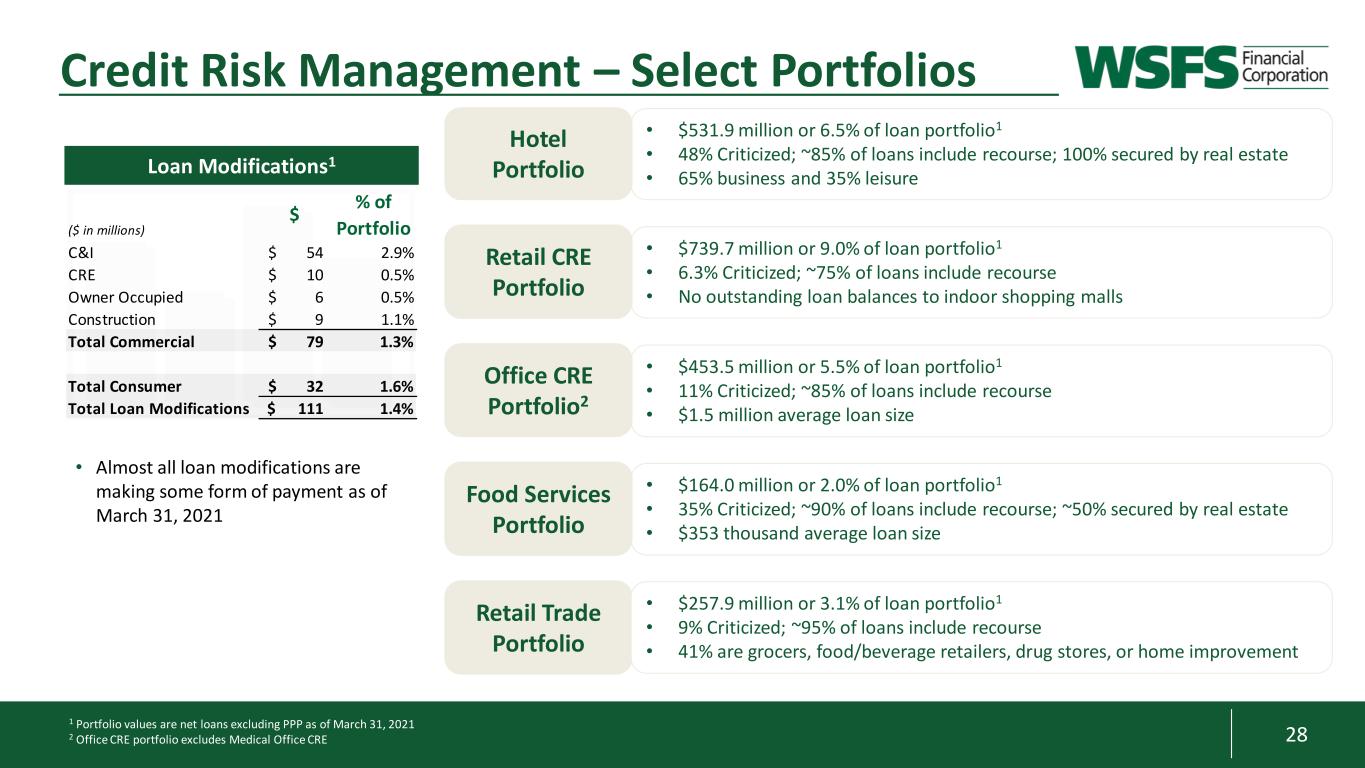

28 3 Credit Risk Management – Select Portfolios • Almost all loan modifications are making some form of payment as of March 31, 2021 • $531.9 million or 6.5% of loan portfolio1 • 48% Criticized; ~85% of loans include recourse; 100% secured by real estate • 65% business and 35% leisure • $739.7 million or 9.0% of loan portfolio1 • 6.3% Criticized; ~75% of loans include recourse • No outstanding loan balances to indoor shopping malls • $164.0 million or 2.0% of loan portfolio1 • 35% Criticized; ~90% of loans include recourse; ~50% secured by real estate • $353 thousand average loan size • $453.5 million or 5.5% of loan portfolio1 • 11% Criticized; ~85% of loans include recourse • $1.5 million average loan size Hotel Portfolio Retail CRE Portfolio Office CRE Portfolio2 Food Services Portfolio Retail Trade Portfolio • $257.9 million or 3.1% of loan portfolio1 • 9% Criticized; ~95% of loans include recourse • 41% are grocers, food/beverage retailers, drug stores, or home improvement Loan Modifications1 1 Portfolio values are net loans excluding PPP as of March 31, 2021 2 Office CRE portfolio excludes Medical Office CRE ($ in millions) $ % of Portfolio C&I 54$ 2.9% CRE 10$ 0.5% Owner Occupied 6$ 0.5% Construction 9$ 1.1% Total Commercial 79$ 1.3% Total Consumer 32$ 1.6% Total Loan Modifications 111$ 1.4%

29 • Branch Net Promoter Score (NPS) improved to 77.6 in 1Q 2021, the highest quarter performance since program inception. Contact Center Net Promotor Score (NPS) improved in 1Q 2021 to 60.0. Surveys are conducted utilizing Medallia • Since COVID-19 pandemic, WSFS supported consistent volumes of total deposit transactions with a significant shift from physical to mobile • Increased digital and remote banking volume demonstrates versatile and adaptable channel strategy, while managing a significant increase in contact center volume due to COVID-19 impact and relief programs • MyWSFS, launched in 2019, offers a secure mobile application that enables communication directly and in real-time with a WSFS Associate to support Customer’s banking needs from any location 1 Chart reflects monthly volume in 2020 indexed to average monthly 2019 volume 2 Chart reflects cumulative growth since COVID-19 and through March 31, 2021 Channel Strategy and Digital Adoption 99% 92% 83% 58% 66% 61% 66% 65% 67% 70% 59% 71% 66% 55% 71% 100% 102% 96% 105% 123% 95% 105% 111% 100% 92% 93% 88% 104% 111% 85% 106% 115% 105% 128% 141% 162% 186% 172% 166% 159% 162% 160% 187% 166% 144% 182% 0% 25% 50% 75% 100% 125% 150% 175% 200% 2019 Avg Jan-20 Feb-20 Mar-20 Apr-20 May-20 Jun-20 Jul-20 Aug-20 Sep-20 Oct-20 Nov-20 Dec-20 Jan-21 Feb-21 Mar-21 Channel Volumes1 Branch Transactions Contact Center Call Handled Mobile Deposits - 5,000 10,000 15,000 myWSFS Adoption and Usage Growth2 Conversations Adoptions

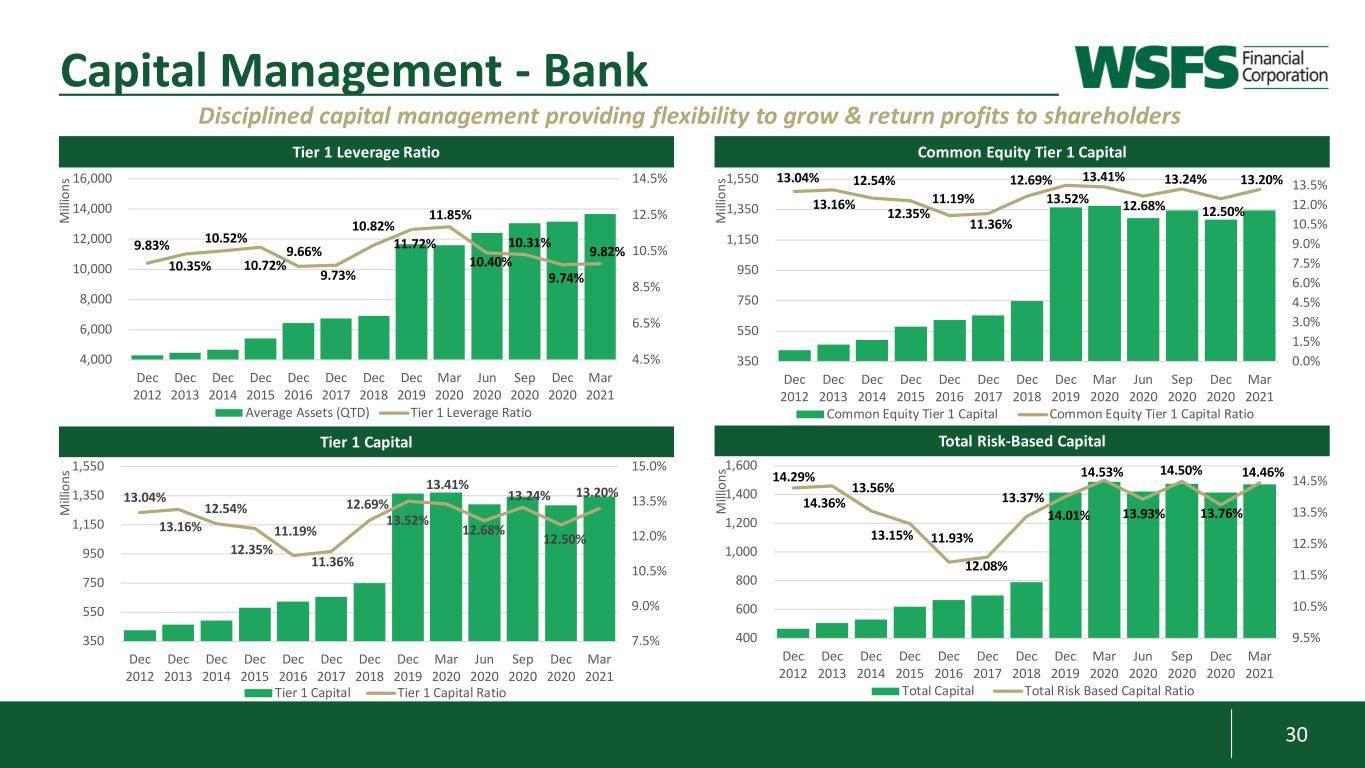

30 Capital Management - Bank Disciplined capital management providing flexibility to grow & return profits to shareholders Tier 1 Leverage Ratio Common Equity Tier 1 Capital Tier 1 Capital Total Risk-Based Capital M ill io ns M ill io ns M ill io ns M ill io ns 9.83% 10.35% 10.52% 10.72% 9.66% 9.73% 10.82% 11.72% 11.85% 10.40% 10.31% 9.74% 9.82% 4.5% 6.5% 8.5% 10.5% 12.5% 14.5% 4,000 6,000 8,000 10,000 12,000 14,000 16,000 Dec 2012 Dec 2013 Dec 2014 Dec 2015 Dec 2016 Dec 2017 Dec 2018 Dec 2019 Mar 2020 Jun 2020 Sep 2020 Dec 2020 Mar 2021 Average Assets (QTD) Tier 1 Leverage Ratio 13.04% 13.16% 12.54% 12.35% 11.19% 11.36% 12.69% 13.52% 13.41% 12.68% 13.24% 12.50% 13.20% 7.5% 9.0% 10.5% 12.0% 13.5% 15.0% 350 550 750 950 1,150 1,350 1,550 Dec 2012 Dec 2013 Dec 2014 Dec 2015 Dec 2016 Dec 2017 Dec 2018 Dec 2019 Mar 2020 Jun 2020 Sep 2020 Dec 2020 Mar 2021 Tier 1 Capital Tier 1 Capital Ratio 13.04% 13.16% 12.54% 12.35% 11.19% 11.36% 12.69% 13.52% 13.41% 12.68% 13.24% 12.50% 13.20% 0.0% 1.5% 3.0% 4.5% 6.0% 7.5% 9.0% 10.5% 12.0% 13.5% 350 550 750 950 1,150 1,350 1,550 Dec 2012 Dec 2013 Dec 2014 Dec 2015 Dec 2016 Dec 2017 Dec 2018 Dec 2019 Mar 2020 Jun 2020 Sep 2020 Dec 2020 Mar 2021 Common Equity Tier 1 Capital Common Equity Tier 1 Capital Ratio 14.29% 14.36% 13.56% 13.15% 11.93% 12.08% 13.37% 14.01% 14.53% 13.93% 14.50% 13.76% 14.46% 9.5% 10.5% 11.5% 12.5% 13.5% 14.5% 400 600 800 1,000 1,200 1,400 1,600 Dec 2012 Dec 2013 Dec 2014 Dec 2015 Dec 2016 Dec 2017 Dec 2018 Dec 2019 Mar 2020 Jun 2020 Sep 2020 Dec 2020 Mar 2021 Total Capital Total Risk Based Capital Ratio

31Note: 2015 adjusted to reflect 3 for 1 stock split in May 20151 As defined in our most recent proxy as of March 12, 2021 (dollars in 000s) 2015 2016 2017 2018 2019 2020 Total Capital Returned $37,606 $22,061 $21,165 $44,419 $113,780 $179,313 Total Shares Repurchased 1,152,233 449,371 255,000 691,742 2,132,390 3,950,855 $0.21 $0.25 $0.30 $0.42 $0.47 $0.48 $- $0.10 $0.20 $0.30 $0.40 $0.50 $0.60 $- $20,000 $40,000 $60,000 $80,000 $100,000 $120,000 $140,000 $160,000 $180,000 $200,000 2015 2016 2017 2018 2019 2020 A nn ua l D iv id en ds P ai d pe r Sh ar e Ca pi ta l R et ur ne d ($ in 0 00 s) Dividends Routine buybacks Incremental buybacks Annual Dividend Per Share Capital Management / Ownership Alignment • Executive management incentive compensation and equity awards aligned with shareholder performance ROA, ROTCE and EPS growth – equally weighted • Insider ownership1 is approximately 2% Board of Directors and Executive Management ownership guidelines in place and followed • Repurchased 267,309 shares in 1Q 2021 Approximately 9% of common shares outstanding still available for repurchase, under the Board authorization approved in 1Q 2020, that allows for the purchase of 15% of outstanding shares • The Board of Directors approved a quarterly cash dividend of $0.13 per share of common stock which will be paid in May 2021

32 1 WSFS IRR model estimates: Static Balance Sheet / Instantaneous Rate Shocks 2 Includes PPP loans • High % of variable/adjustable rate to total loan portfolio: 53% excluding PPP • Approximately half of variable rate loans tied to 30- day LIBOR • High % core deposits: 91%; high % non-interest bearing and low-interest DDA: 53% • Solid brand and position / strong and diversified low-cost funding across all lines of business • Assumes long-term historical deposit beta of approximately 50% Interest Rate Risk1 at March 31, 2021 WSJ Prime @ 3.25% Balance Sheet Drivers 12-Month IRR2 BPs change NII Impact (%) NII Impact ($) -100 (3.3%) ($13.6 million) -50 (2.0%) ($8.4 million) -25 (1.4%) ($5.7 million) Static Base +25 1.7% $7.0 million +50 3.5% $14.3 million +100 7.2% $29.4 million

33 WSFS Mission, Vision, Strategy, and Values

34 Appendix: Non-GAAP Financial Information

35 Non-GAAP Information This presentation contains financial measures determined by methods other than in accordance with accounting principles generally accepted in the United States (GAAP). This presentation may include the following non-GAAP measures: • Adjusted net income (non-GAAP) attributable to WSFS is a non-GAAP measure that adjusts net income determined in accordance with GAAP to exclude the impact of securities gains, realized/unrealized gains on equity investments, net, corporate development and restructuring expenses, and Contribution to WSFS Community Foundation; • Core noninterest income, also called core fee revenue, is a non-GAAP measure that adjusts noninterest income as determined in accordance with GAAP to exclude the impact of securities gains and realized/unrealized gains on equity investments, net; • Core fee revenue percentage is a non-GAAP measure that divides (i) core fee revenue by (ii) core net revenue (tax-equivalent); • Core net interest income is a non-GAAP measure that adjusts net interest income to exclude the impact of FHLB special dividend; • Core earnings (loss) per share is a non-GAAP measure that divides (i) adjusted net income (non-GAAP) attributable to WSFS by (ii) weighted average shares of common stock outstanding for the applicable period; • Core net revenue is a non-GAAP measure that adds (i) core net interest income and (ii) core fee revenue; • Core noninterest expense is a non-GAAP measure that adjusts noninterest expense as determined in accordance with GAAP to exclude corporate development and restructuring expenses, and contribution to WSFS Community Foundation; • Core efficiency ratio is a non-GAAP measure that divides (i) core noninterest expense by (ii) the sum of core interest income and core fee revenue; • Core return on average assets (ROA) is a non-GAAP measure that divides (i) adjusted net income (non-GAAP) attributable to WSFS by (ii) average assets for the applicable period; • Tangible common equity is a non-GAAP measure and is defined as total average stockholders’ equity less goodwill, other intangible assets; • Return on average tangible common equity (ROTCE) is a non-GAAP measure and is defined as net income allocable to common stockholders divided by tangible common equity; • Pre-provision net revenue (PPNR) is a non-GAAP measure that adjusts net income determined in accordance with GAAP to exclude the impacts of (i) income tax provision and (ii) (recovery of) provision for credit losses; • Core PPNR is a non-GAAP measure that excludes the impact of securities gains, realized/unrealized gains on equity investments, net, corporate development and restructuring expenses, and Contribution to WSFS Community Foundation; • PPNR percentage is a non-GAAP measure that divides (i) PPNR (annualized) by (ii) average assets for the applicable period; • Core PPNR percentage is a non-GAAP measure that divides (i) core PPNR (annualized) by (ii) average assets for the applicable period; and • Core return on average equity (ROE) is a non-GAAP measure that divides (i) adjusted net income (non-GAAP) attributable to WSFS by (ii) average stockholders’ equity for the applicable period

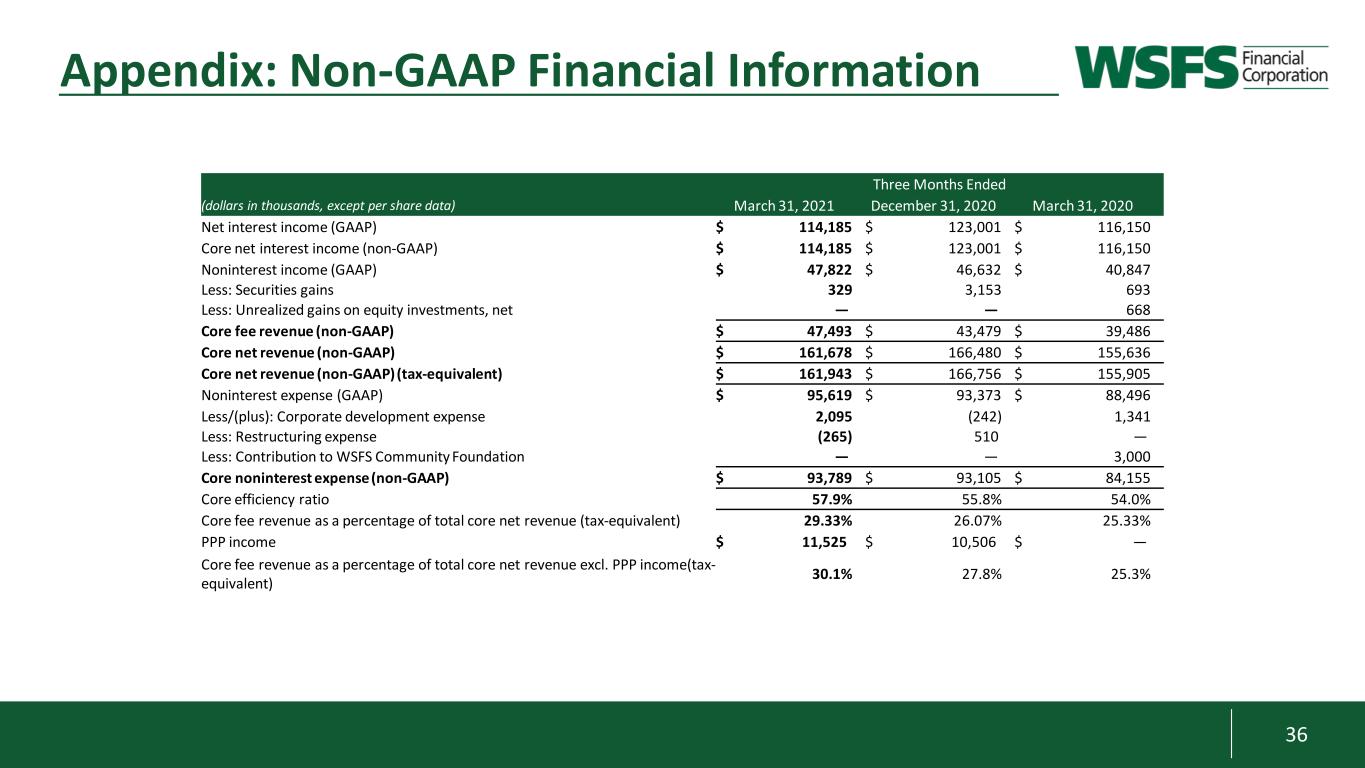

36 Appendix: Non-GAAP Financial Information Three Months Ended (dollars in thousands, except per share data) March 31, 2021 December 31, 2020 March 31, 2020 Net interest income (GAAP) $ 114,185 $ 123,001 $ 116,150 Core net interest income (non-GAAP) $ 114,185 $ 123,001 $ 116,150 Noninterest income (GAAP) $ 47,822 $ 46,632 $ 40,847 Less: Securities gains 329 3,153 693 Less: Unrealized gains on equity investments, net — — 668 Core fee revenue (non-GAAP) $ 47,493 $ 43,479 $ 39,486 Core net revenue (non-GAAP) $ 161,678 $ 166,480 $ 155,636 Core net revenue (non-GAAP) (tax-equivalent) $ 161,943 $ 166,756 $ 155,905 Noninterest expense (GAAP) $ 95,619 $ 93,373 $ 88,496 Less/(plus): Corporate development expense 2,095 (242) 1,341 Less: Restructuring expense (265) 510 — Less: Contribution to WSFS Community Foundation — — 3,000 Core noninterest expense (non-GAAP) $ 93,789 $ 93,105 $ 84,155 Core efficiency ratio 57.9% 55.8% 54.0% Core fee revenue as a percentage of total core net revenue (tax-equivalent) 29.33% 26.07% 25.33% PPP income $ 11,525 $ 10,506 $ — Core fee revenue as a percentage of total core net revenue excl. PPP income(tax- equivalent) 30.1% 27.8% 25.3%

37 Appendix: Non-GAAP Financial Information (dollars in thousands, except per share data) GAAP net income attributable to WSFS $ 65,082 $ 59,813 $ 10,927 Plus/(less): Pre-tax adjustments1 2,980 (Plus)/less: Tax impact of pre-tax adjustments Adjusted net income (non-GAAP) attributable to WSFS $ 66,594 $ 57,615 $ 11,887 Net income (GAAP) $ 65,141 $ 59,741 $ 10,567 Plus: Income tax provision 1,288 Plus/(less): (Recovery of) provision for credit losses 56,646 PPNR (Non-GAAP) 68,501 Plus/(less): Pre-tax adjustments1 2,980 Core PPNR (Non-GAAP) $ 67,889 $ 73,375 $ 71,481 Average Assets PPNR % (Non-GAAP) 1.89% 2.21% 2.27% Core PPNR % (Non-GAAP) 1.93% 2.12% 2.36% GAAP return on average assets (ROA) 0.36% Plus/(less): Pre-tax adjustments1 0.10 (Plus)/less: Tax impact of pre-tax adjustments Core ROA (non-GAAP) 0.39% Earnings per share (GAAP) $ 1.36 $ 1.20 $ 0.21 Plus/(less): Pre-tax adjustments1 0.06 (Plus)/less: Tax impact of pre-tax adjustments Core earnings per share (non-GAAP) $ 1.39 $ 1.16 $ 0.23 1,501 (2,885) March 31, 2021 December 31, 2020 March 31, 2020 11 687 21,407 17,455 (2,020) 1,501 (2,885) 14,256,209$ 13,752,900$ 12,159,524$ (20,160) (936) 66,388 76,260 0.02 1.89% 1.67% (0.07) 1.85% 1.73% 0.04 (0.08) 0.03 (0.06) — 0.02 (0.04) Three Months Ended — 1 Pre-tax adjustments include securities gains, realized/unrealized gains on equity investments, corporate development and restructuring expense, loss on early extinguishment of debt, and contribution to WSFS Community Foundation.

38 Appendix: Non-GAAP Financial Information (dollars in thousands, except per share data) Calculation of return on average tangible common equity: GAAP net income attributable to WSFS $ 65,082 $ 59,813 $ 10,927 Plus: Tax effected amortization of intangible assets 2,103 Net tangible income (non-GAAP) $ 67,086 $ 61,903 $ 13,030 Average stockholders' equity of WSFS Less: average goodwill and intangible assets 556,344 558,750 567,695 Net average tangible common equity Return on average common equity (GAAP) 14.90% 13.00% 11.08% Return on average tangible common equity (non-GAAP) 22.38% 19.37% 4.13% Calculation of core return on average tangible common equity: Adjusted net income (non-GAAP) attributable to WSFS $ 66,594 $ 57,615 $ 11,887 Plus: Tax effected amortization of intangible assets 2,103 Core net tangible income (non-GAAP) Net average tangible common equity Core return on average common equity (GAAP) 15.24% 12.52% 2.60% Core return on average tangible common equity (non-GAAP) 22.89% 18.68% 4.44% 1,835,501$ 1,267,806$ 13,990$ 1,267,806$ 1,215,478$ 1,271,494$ March 31, 2020 Three Months Ended 2,004 2,090 68,598$ 59,705$ 1,771,822$ 1,830,244$ 1,215,478$ 1,271,494$ 2,004 2,090 March 31, 2021 December 31, 2020

39 Appendix: Non-GAAP Financial Information 1 For details on our core adjustments for full-year 2010 through 2020 refer to each years’ respective fourth quarter Earnings Release filed at Exhibit 99.1 on Form 8-K (dollars in thousands, except per share data) 2010 2011 2012 2013 Net Income (GAAP) 14,117$ 22,677$ 31,311$ 46,882$ Adj: Plus/less core (after-tax)1 420 (2,664) (11,546) (4,290) Adjusted net income (non-GAAP) 14,537$ 20,013$ 19,765$ 42,592$ Average Assets 3,796,166$ 4,070,896$ 4,267,358$ 4,365,389$ GAAP ROA 0.37% 0.56% 0.73% 1.07% Core ROA 0.38% 0.49% 0.46% 0.98% (dollars in thousands, except per share data) 2014 2015 2016 2017 Net Income (GAAP) 53,757$ 53,533$ 64,080$ 50,244$ Adj: Plus/less core (after-tax)1 (4,632) 4,407 4,323 32,597 Adjusted net income (non-GAAP) 49,125$ 57,940$ 68,403$ 82,841$ Average Assets 4,598,121$ 5,074,129$ 6,042,824$ 6,820,471$ GAAP ROA 1.17% 1.05% 1.06% 0.74% Core ROA 1.07% 1.14% 1.13% 1.21% (dollars in thousands, except per share data) 2018 2019 2020 Net Income (GAAP) 134,743$ 148,809$ 114,774$ Adj: Plus/less core (after-tax)1 (20,436) 36,295 (18,126) Adjusted net income (non-GAAP) 114,307$ 185,104$ 96,648$ Average Assets 7,014,447$ 11,477,856$ 13,148,317$ GAAP ROA 1.92% 1.30% 0.87% Core ROA 1.63% 1.61% 0.74% For the year ended December 31, For the year ended December 31, For the year ended December 31,

40 Appendix: Non-GAAP Financial Information 1 Completed on a fully tax-equivalent basis (dollars in thousands, except per share data) Net interest income (as reported) Adj: FHLB special dividend Adj: Tax-equivalent income 2,298 Core net interest income1 Average Interest-Earning Assets Net interest margin 3.87% Core net interest margin 3.85% Noninterest income (as reported) Adj: Securities gains Adj: Realized gain on sale of equity investment, net - - - Adj: Unrealized gains on equity investment, net - - - Core fee revenue Core net revenue Core net revenue (tax-equivalent) Core fee revenue % 34.3% Core fee revenue % (tax-equivalent) 34.0% 2015 2016 (808) For the year ended December 31, (1,478) 86,777$ 255,769$ 255,067$ 193,745$ - 196,715$ 5,072,473$ 105,061$ 102,692$ 296,437$ 4,368,223$ 168,290$ 166,800$ 88,255$ 2018 221,271$ - 2,991 224,262$ 34.6% 34.3% 5,684,724$ 3.95% 299,407$ 2,970 3.88% 3.88% (2,369) 3.95% 124,644$ 2017 (21) 138,037$ 384,492$ 385,852$ 35.9% 35.8% (3,757) (20,745) 1,360 247,834$ 6,052,145$ 4.09% 4.09% 162,541$ 246,474$ - (1,984) 122,660$ 343,931$ 346,922$ 35.7% 35.4% 606,549$ 607,764$ 26.6% 26.6% 2019 2020 465,955$ - 1,151 467,106$ 4.44% 188,109$ (333) - (26,175) 161,601$ 444,948$ - 1,215 446,163$ 10,057,074$ 4.44% 636,242$ 26.6% 26.6% 11,804,926$ 3.96% 3.96% 201,025$ (9,076) (22,052) (761) 169,136$ 635,091$ (dollars in thousands, except per share data) Core fee revenue (non-GAAP) Less: PPP fee revenue Core fee revenue excl. PPP Core net revenue (non-GAAP) Less: PPP income Core net revenue excl. PPP Core fee revenue as a percentage of core net revenue excl. PPP March 31, 2021 December 31, 2020 June 30, 2020 March 31, 2020 Three Months Ended September 30, 2020 30.2% 43,479$ 45,745$ 40,246$ 39,486$ 43,479$ 45,745$ 40,246$ 39,486$ 47,493$ 2,159 45,334$ 161,678$ 11,525 150,153$ 149,346$ 27.1% - - 155,636$ 25.4% 155,974$ 27.9% - 6,373 152,420$ 30.0% 166,480$ 158,793$ 154,182$ 155,636$ - 10,506 - 4,836

41 Stockholders or others seeking information regarding the Company may call or write: WSFS Financial Corporation Investor Relations WSFS Bank Center 500 Delaware Avenue Wilmington, DE 19801 302-504-9857 stockholderrelations@wsfsbank.com www.wsfsbank.com Rodger Levenson Chairman, President and CEO 302-571-7296 rlevenson@wsfsbank.com Dominic C. Canuso Chief Financial Officer 302-571-6833 dcanuso@wsfsbank.com