Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - SIMMONS FIRST NATIONAL CORP | f8k_042021.htm |

| EX-99.1 - EXHIBIT 99.1 - SIMMONS FIRST NATIONAL CORP | exh_991.htm |

Exhibit 99.2

Contents 4 Loan Portfolio & Asset Quality 14 Capital, Deposits, Liquidity & Investments 21 1 st Quarter Earnings Highlights 32 Corporate Profile and Company Highlights 41 Appendix 1 st Quarter 2021 Investor Presentation | NASDAQ: SFNC

2 Forward - Looking Statements and Non - GAAP Financial Measures Forward - Looking Statements . Certain statements by Simmons First National Corporation (the “Company”, which where appropriate includes the Company’s wholly - owned banking subsidiary, Simmons Bank) contained in this presentation may not be based on historical facts and should be considered "forward - looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995 . These forward - looking statements may be identified by reference to a future period(s) or by the use of forward - looking terminology, such as "anticipate," "estimate," "expect," "foresee,“ “project,” "may," "might," "will," "would," "could,“ “likely” or "intend," future or conditional verb tenses, and variations or negatives of such terms . These forward - looking statements include, without limitation, those relating to the Company’s future growth ; revenue ; expenses (including interest expense and non - interest expenses) ; assets ; asset quality ; profitability ; earnings ; critical accounting policies ; accretion ; net interest margin ; non - interest revenue ; market conditions related to and impact of the Company's common stock repurchase program ; adequacy of the allowance for loan losses ; income tax deductions ; credit quality ; level of credit losses from lending commitments ; net interest revenue ; interest rate sensitivity ; loan loss experience ; liquidity ; capital resources ; market risk ; the expected benefits, milestones, or costs associated with the Company’s acquisition strategy ; the Company’s ability to recruit and retain key employees ; the ability of the Company to manage the impact of the COVID - 19 pandemic ; the impacts of the Company’s and its customers participation in the Paycheck Protection Program (“PPP”) ; increases in the Company’s security portfolio ; legal and regulatory limitations and compliance and competition ; anticipated loan principal reductions ; fees associated with the PPP ; plans for investments in securities ; statements under the caption “Management’s Outlook” on slides 25 and 26 ; the charges, gains, and savings associated with completed and future branch closures and branch sales ; expectations and projections regarding the Company’s COVID - 19 loan modification program ; and projected dividends . Readers are cautioned not to place undue reliance on the forward - looking statements contained in this presentation in that actual results could differ materially from those indicated in or implied by such forward - looking statements, due to a variety of factors . These factors include, but are not limited to, changes in the Company's operating or expansion strategy ; the availability of and costs associated with obtaining adequate and timely sources of liquidity ; the ability to maintain credit quality ; the effect of steps the Company takes in response to the COVID - 19 pandemic ; the severity and duration of the pandemic, including the effectiveness of vaccination efforts ; the pace of recovery when the pandemic subsides and the heightened impact it has on many of the risks described herein ; the effects of the pandemic on, among other things, the Company’s operations, liquidity, and credit quality ; general market and economic conditions ; unemployment ; possible adverse rulings, judgments, settlements and other outcomes of pending or future litigation (including litigation arising from the Company’s participation in and administration of programs related to the COVID - 19 pandemic (including the PPP)) ; the ability of the Company to collect amounts due under loan agreements ; changes in consumer preferences and loan demand ; effectiveness of the Company's interest rate risk management strategies ; laws and regulations affecting financial institutions in general or relating to taxes ; the effect of pending or future legislation ; the ability of the Company to repurchase its common stock on favorable terms ; the ability of the Company to successfully implement its acquisition and branch strategy ; changes in interest rates, deposit flows, real estate values, and capital markets ; inflation ; customer acceptance of the Company's products and services ; changes or disruptions in technology and IT systems (including cyber threats, attacks and events) ; changes in accounting principles relating to loan loss recognition (current expected credit losses, or CECL) ; the benefits associated with the Company’s early retirement program and completed and future branch closures and sales ; and other risk factors . Other relevant risk factors may be detailed from time to time in the Company's press releases and filings with the U . S . Securities and Exchange Commission, including, without limitation, the Company’s Form 10 - K for the year ended December 31 , 2020 . Any forward - looking statement speaks only as of the date of this Report, and the Company undertakes no obligation to update these forward - looking statements to reflect events or circumstances that occur after the date of this Report . Annualized, pro forma, projected and estimated numbers are used for illustrative purpose only, are not forecasts and may not reflect actual results . Non - GAAP Financial Measures . This document contains financial information determined by methods other than in accordance with U . S . generally accepted accounting principles (GAAP) . The Company's management uses these non - GAAP financial measures in their analysis of the company's performance . These measures adjust GAAP performance measures to, among other things, include the tax benefit associated with revenue items that are tax - exempt, as well as exclude from income available to common shareholders, non - interest income, and non - interest expense certain expenses related to significant non - core activities, such as merger - related expenses, expenses related to the Company’s early retirement program, gain on sale of branches, and net branch right - sizing expenses . In addition, the Company also presents certain figures based on tangible common stockholders’ equity, tangible assets, and tangible book value, which exclude goodwill and other intangible assets . The Company further presents certain figures that are exclusive of the impact of PPP loans . The Company’s management believes that these non - GAAP financial measure are useful to investors because they, among other things, present the results of the Company’s ongoing operations without the effect of mergers or other items not central to the Company’s ongoing business, as well as normalize for tax effects . Management, therefore, believes presentations of these non - GAAP financial measures provide useful supplemental information that is essential to a proper understanding of the operating results of the Company's core businesses . These non - GAAP disclosures should not be viewed as a substitute for operating results determined in accordance with GAAP, nor are they necessarily comparable to non - GAAP performance measures that may be presented by other companies . Where non - GAAP financial measures are used, the comparable GAAP financial measure, as well as the reconciliation to the comparable GAAP financial measure, can be found in the appendix to this presentation .

This page intentionally left blank Will Zalatoris 2021 Masters 2 nd Place, nine under par

LOAN PORTFOLIO AND ASSET QUALITY 4

Loans – Including PPP Loans as of December 31, 2020 as of March 31, 2021 $ in millions Balance $ % of Total Loans Balance $ % of Total Loans Classified $ Non - performing $ ACL % Unfunded Commitment $ Unfunded Commitment Reserve Total Loan Portfolio Consumer - Credit Card 189 1% 175 2% 1 1 1.2% - Consumer - Other 202 2% 173 1% 1 1 0.7% 19 Real Estate - Construction 1,596 12% 1,452 12% 15 2 1.5% 573 Real Estate - Commercial 5,747 45% 5,638 46% 214 42 2.8% 176 Real Estate - Single - family 1,881 15% 1,730 14% 33 27 0.9% 217 Commercial 2,574 20% 2,444 20% 99 45 1.4% 929 Agriculture 176 1% 156 1% 1 1 0.3% 124 Other 536 4% 427 4% - - 0.3% 1 Total Loan Portfolio 12,901 100% 12,195 100% 364 119 1.93% 2,039 1.1% Loan Concentration : C&D 68% 60% CRE 241% 227% Select Loan Categories Retail 1,243 10% 1,156 9% 24 3 4.7% 85 Nursing / Extended Care 445 3% 452 4% 3 - 1.2% 44 Healthcare 588 5% 546 4% 11 2 0.7% 72 Multifamily 764 6% 735 6% 21 1 0.9% 59 Hotel 969 8% 959 8% 117 17 6.6% 22 Restaurant 496 4% 515 4% 3 1 3.5% 14 Energy Loans Upstream 198 2% 173 2% 53 30 10.8% 42 Midstream 35 0% 34 0% 16 - 15.8% 7 Services 14 0% 10 0% 1 - 0.8% 1 Total Energy 247 2% 217 2% 70 30 11.1% 50 5

Loans – Excluding PPP Loans as of December 31, 2020 as of March 31, 2021 $ in millions Balance $ % of Total Loans Balance $ % of Total Loans Classified $ Non - performing $ ACL % Unfunded Commitment $ Unfunded Commitment Reserve Total Loan Portfolio (1) Consumer - Credit Card 189 2% 175 2% 1 1 1.2% - Consumer - Other 202 2% 173 2% 1 1 0.7% 19 Real Estate - Construction 1,596 13% 1,452 13% 15 2 1.5% 573 Real Estate - Commercial 5,747 48% 5,638 49% 214 42 2.8% 176 Real Estate - Single - family 1,881 16% 1,730 15% 33 27 0.9% 217 Commercial 1,669 14% 1,647 14% 99 45 2.1% 929 Agriculture 176 1% 156 1% 1 1 0.3% 124 Other 536 4% 427 4% - - 0.3% 1 Total Loan Portfolio 11,996 100% 11,398 100% 364 119 2.06% 2,039 1.1% Loan Concentration : C&D 68% 60% CRE 241% 227% Select Loan Categories Retail 1,211 10% 1,133 10% 24 3 4.7% 85 Nursing / Extended Care 427 4% 436 4% 3 - 1.2% 44 Healthcare 470 4% 443 4% 11 2 0.8% 72 Multifamily 762 6% 733 6% 21 1 0.9% 59 Hotel 948 8% 933 8% 117 17 6.6% 22 Restaurant 385 3% 388 3% 3 1 3.7% 14 Energy Loans Upstream 184 2% 161 2% 53 30 11.6% 42 Midstream 35 0% 33 0% 16 - 16.3% 7 Services 11 0% 8 0% 1 - 0.9% 1 Total Energy 230 2% 202 2% 70 30 11.9% 50 6 (1) All PPP loans were categorized as commercial

Loan Pipeline Trend by Category (1) 7 $ in millions (1) Quarterly amounts adjusted for branches sold in South Texas and Colorado during 2020. $1,009 $641 $219 $192 $247 $487 $341 $220 $90 $112 $250 $408 $347 $291 $72 $70 $177 $285 5.10% 4.70% 4.10% 4.37% 4.12% 3.81% 0.00% 1.00% 2.00% 3.00% 4.00% 5.00% 6.00% $0 $200 $400 $600 $800 $1,000 $1,200 $1,400 $1,600 $1,800 Q419 Q120 Q220 Q320 Q420 Q121 Opportunity Proposal Ready to Close Rate - Ready to Close $1,697 $1,152 $381 $374 $674 $1,180

Mortgage Loan Volume – Closed and Pipeline 8 $ in millions $126 $224 $243 $181 $183 $319 $408 $399 $326 $77 $92 $86 $51 $145 $239 $307 $214 $166 $0 $100 $200 $300 $400 $500 $600 $700 $800 Q119 Q219 Q319 Q419 Q120 Q220 Q320 Q420 Q121 Mortgage Closed Loan Volume Mortgage Pipeline Volume Mortgage Loan Volume – Closed by year: - 2019 = $0.8B - 2020 = $1.3B

Credit Quality Focus 9 COVID - 19 Loan Modification Update ▪ COVID - 19 Modification requests have slowed significantly. ▪ Remaining loans under COVID - 19 modifications total $153,000,000 and consist of 86 loans. – Primarily centered in: • Consumer / Mortgage – 49 loans totaling $4,000,000 • Hotel / Hospitality – 15 loans totaling $112,000,000 ▪ Targeted efforts in Q1 2021 to ensure clients were aware opportunities to obtain COVID - 19 related Government assistance. ▪ All risk ratings reviewed and adjusted as needed on all COVID - 19 modified loans, and any impact is reflected within the Asset Qu ality Ratios and related Allowance. as of March 31, 2021 Non - Performing Loan Update ▪ Non - performing loans total $115,000,000. ▪ Balance has reduced by $41,500,000 since Q1 2020. ▪ 42% of current Non - Performing Loans are comprised of 5 loans: o 3 Energy, 2 Hospitality o $48,110,000 balance with related reserves of $9,300,000 ▪ Non - Performing Loans in excess of $100,000 are reviewed with Credit Officers and Special Asset oversight at least quarterly.

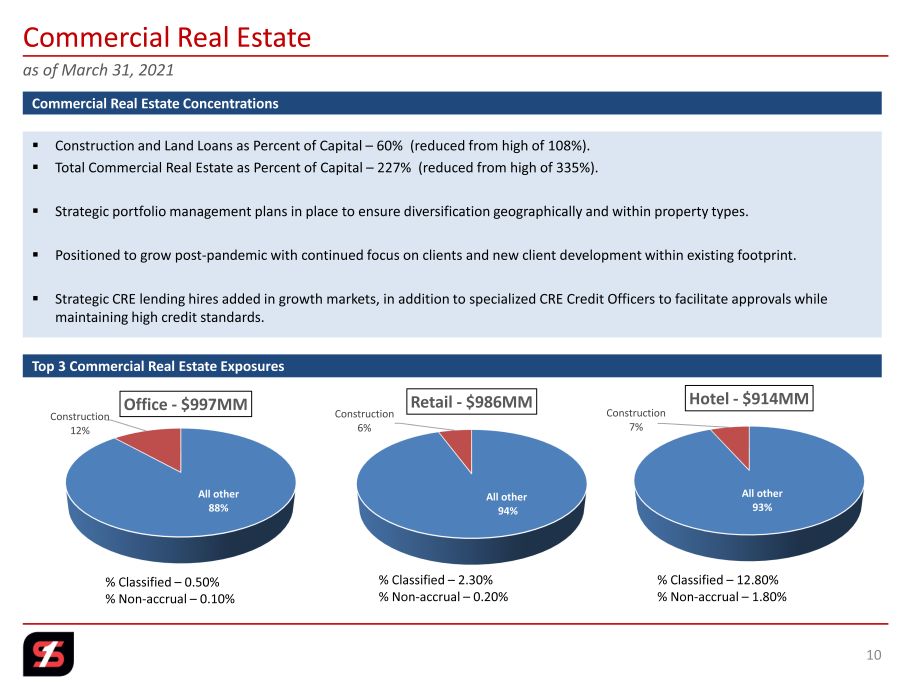

Commercial Real Estate 10 Commercial Real Estate Concentrations ▪ Construction and Land Loans as Percent of Capital – 60% (reduced from high of 108%). ▪ Total Commercial Real Estate as Percent of Capital – 227% (reduced from high of 335%). ▪ Strategic portfolio management plans in place to ensure diversification geographically and within property types. ▪ Positioned to grow post - pandemic with continued focus on clients and new client development within existing footprint. ▪ Strategic CRE lending hires added in growth markets, in addition to specialized CRE Credit Officers to facilitate approvals w hil e maintaining high credit standards. as of March 31, 2021 Top 3 Commercial Real Estate Exposures All other 93% Construction 7% Hotel - $914MM All other 94% Construction 6% Retail - $986MM All other 88% Construction 12% Office - $997MM % Classified – 12.80% % Non - accrual – 1.80% % Classified – 2.30% % Non - accrual – 0.20% % Classified – 0.50% % Non - accrual – 0.10%

Loan Balance $ in millions Original Balance 3/31/21 Balance # of Loans Originated Net Fees Remaining PPP Phase I $ 976 $ 570 8,208 $ 7.9 PPP Phase II 240 228 2,855 11.0 Total $ 1,216 $ 798 11,063 $ 18.9 PPP Loans 11 PPP Summary ▪ PPP Loans are assigned a risk weighting of zero percent. ▪ Average loan amount $110,000. ▪ Smallest loan amount $140. ▪ Loan yield 5.26% for first quarter 2021 (includes amortization of SBA fee income net of expenses). ▪ Forgiveness process in place. PPP Round 2 ▪ System and process in place for Round 2 of PPP. ▪ Funding started in January 2021. • PPP II is running about 25% of PPP I • Net fees as % of original balance: □ PPP I = 2.9% □ PPP II = 4.7%

ASSET QUALTY TRENDS Credit Quality $ in millions Source: S&P Global Market Intelligence 2013 - 2020 (which metrics are as of December 31 of the relevant year) (1) ALLL for 2013 – 2019 and ACL 2020 – 2021 Q1. (2) YTD annualized net charge - offs. Non - performing Loans / Loans 3.33% 2.50% 1.44% 1.68% 0.81% 0.67% 0.65% 0.96% 0.95% 0.00% 0.50% 1.00% 1.50% 2.00% 2.50% 3.00% 3.50% 2013 2014 2015 2016 2017 2018 2019 2020 2021 Q1 ACL/ALLL (1) / Loans (%) and ACL/ALLL ($) $27 $29 $31 $36 $42 $57 $68 $238 $235 1.14% 1.05% 0.63% 0.66% 0.39% 0.48% 0.46% 1.85% 1.93% 0.00% 0.50% 1.00% 1.50% 2.00% 2.50% $0 $25 $50 $75 $100 $125 $150 $175 $200 $225 $250 2013 2014 2015 2016 2017 2018 2019 2020 2021 Q1 Quarterly Trend 12/31/20 03/31/21 Change NPL / Loans 0.96% 0.95% (0.01%) Non - performing Loans $123.5 $115.5 ($8.0) NPA / Assets 0.64% 0.55% (9.0%) Non - performing Assets $143.9 $127.9 ($16.0) Past Due 30+ Days / Loans 0.21% 0.19% (0.03%) Net Charge - offs (2) / Loans (YTD) 0.45% 0.10% (0.35%) Credit Card Portfolio Net Charge - off Ratio (QTD) 1.15% 1.39% 0.24% ACL / Loans 1.85% 1.93% 0.08% Non - performing Assets / Assets 3.78% 2.71% 1.54% 1.45% 0.83% 0.64% 0.55% 0.64% 0.55% 0.00% 0.50% 1.00% 1.50% 2.00% 2.50% 3.00% 3.50% 4.00% 2013 2014 2015 2016 2017 2018 2019 2020 2021 Q1 12

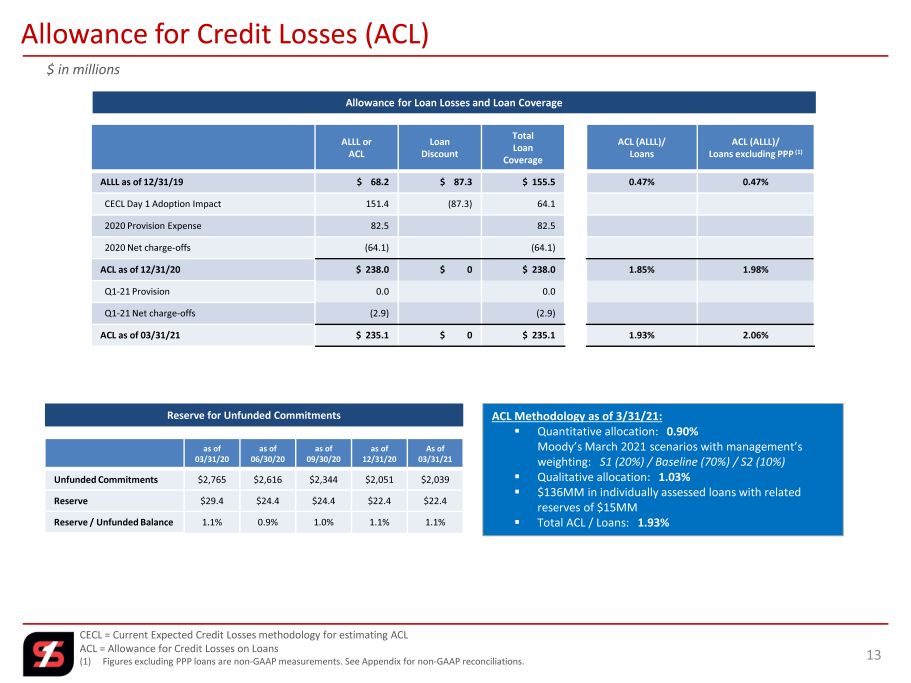

ALLL or ACL Loan Discount Total Loan Coverage ACL (ALLL)/ Loans ACL (ALLL)/ Loans excluding PPP (1) ALLL as of 12/31/19 $ 68.2 $ 87.3 $ 155.5 0.47% 0.47% CECL Day 1 Adoption Impact 151.4 (87.3) 64.1 2020 Provision Expense 82.5 82.5 2020 Net charge - offs (64.1) (64.1) ACL as of 12/31/20 $ 238.0 $ 0 $ 238.0 1.85% 1.98% Q1 - 21 Provision 0.0 0.0 Q1 - 21 Net charge - offs (2.9) (2.9) ACL as of 03/31/21 $ 235.1 $ 0 $ 235.1 1.93% 2.06% Allowance for Loan Losses and Loan Coverage 13 Allowance for Credit Losses (ACL) CECL = Current Expected Credit Losses methodology for estimating ACL ACL = Allowance for Credit Losses on Loans (1) Figures excluding PPP loans are non - GAAP measurements. See Appendix for non - GAAP reconciliations. $ in millions as of 03/31/20 as of 06/30/20 as of 09/30/20 as of 12/31/20 As of 03/31/21 Unfunded Commitments $2,765 $2,616 $2,344 $2,051 $2,039 Reserve $29.4 $24.4 $24.4 $22.4 $22.4 Reserve / Unfunded Balance 1.1% 0.9% 1.0% 1.1% 1.1% Reserve for Unfunded Commitments ACL Methodology as of 3/31/21: ▪ Quantitative allocation: 0.90% Moody’s March 2021 scenarios with management’s weighting: S1 (20%) / Baseline (70%) / S2 (10%) ▪ Qualitative allocation: 1.03% ▪ $136MM in individually assessed loans with related reserves of $15MM ▪ Total ACL / Loans: 1.93%

CAPITAL, DEPOSITS, LIQUIDITY AND INVESTMENTS 14

9.8% 10.2% 10.9% 13.4% 14.1% 4.0% 6.0% 8.0% 10.0% 12.0% 14.0% 16.0% 2017 2018 2019 2020 2021 Q1 W ELL C APITALIZED 8.0% 11.4% 13.4% 13.7% 16.8% 17.5% 4.0% 6.0% 8.0% 10.0% 12.0% 14.0% 16.0% 18.0% 20.0% 2017 2018 2019 2020 2021 Q1 9.8% 10.2% 10.9% 13.4% 14.1% 4.0% 6.0% 8.0% 10.0% 12.0% 14.0% 16.0% 2017 2018 2019 2020 2021 Q1 9.2% 8.8% 9.6% 9.1% 9.0% 4.0% 5.0% 6.0% 7.0% 8.0% 9.0% 10.0% 2017 2018 2019 2020 2021 Q1 (1) As of December 31, except where otherwise stated. (2) Figures excluding PPP loans are non - GAAP measurements. See Appendix for non - GAAP reconciliations. 15 Regulatory Capital Ratios TIER 1 LEVERAGE RATIO (1) TOTAL RISK - BASED CAPITAL RATIO (1) TIER 1 RISK - BASED CAPITAL RATIO (1) CET1 CAPITAL RATIO (1) W ELL C APITALIZED 5.0% W ELL C APITALIZED 10.0% W ELL C APITALIZED 6.5% 9.3% Excluding PPP Loans (2)

Stock Repurchase Program 16 $10.1 $93.3 $0.0 $0.0 $20.0 $3.1 $0.0 $10.0 $20.0 $30.0 $40.0 $50.0 $60.0 $70.0 $80.0 $90.0 Q419 Q120 Q220 Q320 Q420 Q121 REPURCHASE BY QUARTER (1) ▪ Summary of stock repurchases since reinitiating program in Q4 2019: – $127 million – 6.5 million shares or about 5.7% of outstanding – Average price $19.53 ▪ $53.5 million remaining under current plan. $0.0 $0.0 Suspended Plan 1) $ in millions

(1) As of December 31, except where otherwise stated. (2) Figures based on tangible book value (which excludes goodwill and other intangible assets) are non - GAAP measurements. See Append ix for non - GAAP reconciliations. 17 Book Value & Tangible Book Value BOOK VALUE ($ IN MILLIONS) (1) TANGIBLE BOOK VALUE PER SHARE (1)(2) BOOK VALUE PER SHARE (1) TANGIBLE BOOK VALUE ($ IN MILLIONS) (1)(2) $2,085 $2,246 $2,988 $2,976 $2,930 $500 $750 $1,000 $1,250 $1,500 $1,750 $2,000 $2,250 $2,500 $2,750 $3,000 2017 2018 2019 2020 2021 Q1 $22.65 $24.33 $26.30 $27.53 $27.04 $10.00 $12.00 $14.00 $16.00 $18.00 $20.00 $22.00 $24.00 $26.00 $28.00 2017 2018 2019 2020 2021 Q1 $12.34 $14.18 $15.89 $16.56 $16.13 $10.00 $12.00 $14.00 $16.00 $18.00 $20.00 2017 2018 2019 2020 2021 Q1 $1,136 $1,309 $1,805 $1,789 $1,748 $500 $750 $1,000 $1,250 $1,500 $1,750 $2,000 2017 2018 2019 2020 2021 Q1

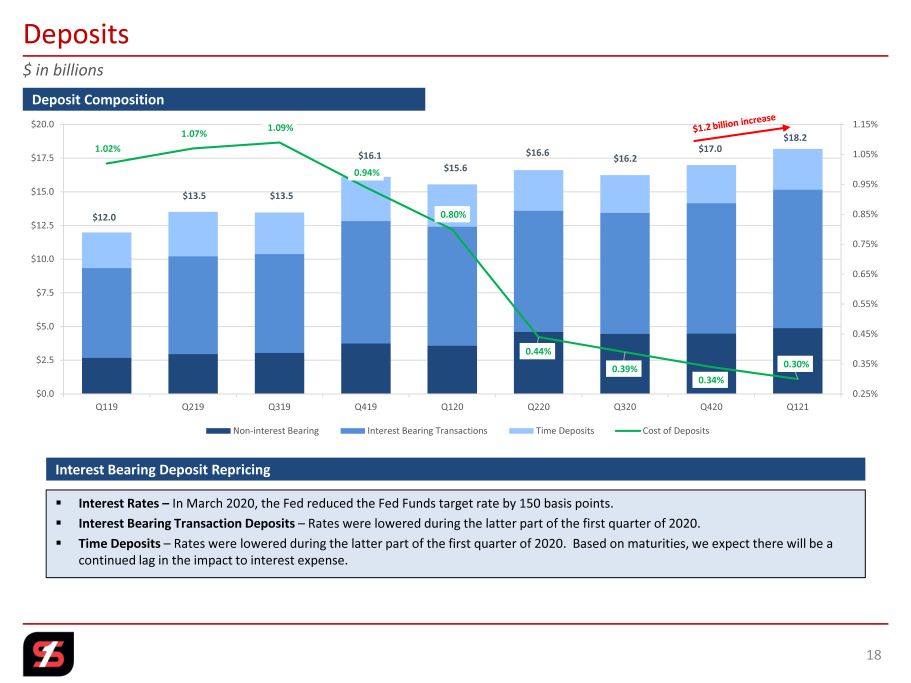

▪ Interest Rates – In March 2020, the Fed reduced the Fed Funds target rate by 150 basis points. ▪ Interest Bearing Transaction Deposits – Rates were lowered during the latter part of the first quarter of 2020. ▪ Time Deposits – Rates were lowered during the latter part of the first quarter of 2020. Based on maturities, we expect there will be a continued lag in the impact to interest expense. $ in billions Interest Bearing Deposit Repricing Deposit Composition Deposits 18 1.02% 1.07% 1.09% 0.94% 0.80% 0.44% 0.39% 0.34% 0.30% 0.25% 0.35% 0.45% 0.55% 0.65% 0.75% 0.85% 0.95% 1.05% 1.15% $0.0 $2.5 $5.0 $7.5 $10.0 $12.5 $15.0 $17.5 $20.0 Q119 Q219 Q319 Q419 Q120 Q220 Q320 Q420 Q121 Non-interest Bearing Interest Bearing Transactions Time Deposits Cost of Deposits $12.0 $13.5 $13.5 $16.1 $15.6 $16.6 $16.2 $17.0 $18.2

▪ Approximately $3.9 billion in Cash and Cash Equivalents as of 3/31/21. ▪ Over $5 billion of liquidity available in secondary borrowing sources as of quarter end. ▪ Substantial access to brokered deposits. ▪ Loan/Deposit Ratio of 67% as of 3/31/21 (63% excluding PPP loans (1) ). Liquidity $491 $655 $530 $997 $1,737 $2,545 $2,522 $3,472 $3,905 $0 $500 $1,000 $1,500 $2,000 $2,500 $3,000 $3,500 $4,000 $4,500 Q119 Q219 Q319 Q419 Q120 Q220 Q320 Q420 Q121 Cash and Cash Equivalents (In millions) 98% 97% 97% 90% 92% 88% 86% 76% 67% 60% 65% 70% 75% 80% 85% 90% 95% 100% Q119 Q219 Q319 Q419 Q120 Q220 Q320 Q420 Q121 Loans / Deposits 19 (1) Figures excluding PPP loans are non - GAAP measurements. See Appendix for non - GAAP reconciliations.

$ in millions Investment Security Portfolio ▪ In Q1 2020, sold ~$1 billion of investment securities to: – De - risk the balance sheet – Create liquidity – Recognize gains of over $30 million – Increase capital ▪ In Q3 2020, sold ~$500 million of investment securities. – Projected calls for the next 12 - 18 months and realized gains – Recognized gains of over $22 million ▪ In Q1 2021, sold ~$130 million of investments: – Sold $92MM , with gains of $0.6 million [small CUSIP clean - up] – Sold $38MM, with gains of $4.8 million, or 12.6% 2020 – 2021 Security Sales 20 Investment Portfolio Summary as of March 31, 2021 Par Value Projected Yield Duration in Years AFS HTM Treasury/Agency $ 504 1.70% 9.1 85% 15% MBS 1,924 1.40% 4.3 98% 2% Municipal 2,026 3.00% 8.7 76% 24% Corporate 325 3.11% 6.1 100% 0% Other 281 0.96% 2.0 100% 0% Total $5,061 2.15% 6.5 88% 12% Purchased $1.7 billion during Q1 2021 using a “Barbell Strategy” Book Value Yield Duration in Years Treasury/Agency $ 117 1.82% 7.3 MBS 1,007 1.22% 4.7 Municipal 380 2.55% 16.3 Corporate 204 2.15% 8.3 Other 20 1.13% 7.8 Total $1,728 1.66% 7.9

1 st Quarter 2021 Earnings Highlights 21

Note: Core figures (excluding Core NIM) exclude non - core income and expense items (e.g., early retirement program costs, gain on sale of banking operations, merger related costs and branch right - sizing costs). Core NIM excludes purchase accounting interest accretion. Core figures, as well as figures based on tangible common equity (which excl ude s goodwill and other intangible assets), are non - GAAP measurements. See Appendix for non - GAAP reconciliations. (1) Efficiency ratio is core non - interest expense before foreclosed property expense and amortization of intangibles as a percent of net interest income (fully taxable equivalent) and non - interest revenues, excluding gains and losses from securities transactions and non - core items, and is a non - GAAP measurement. See Appendix for non - GAAP reconcilia tions. 22 Financial Highlights QUARTERLY RESULTS Q4 2020 Q1 2021 CHANGE Q4 2020 Q1 2021 CHANGE $ IN MILLIONS, EXCEPT PER SHARE DATA EARNINGS EARNINGS $ % DILUTED EPS DILUTED EPS $ % GAAP Results $ 52.96 $ 67.41 $ 14.45 27.3% $ 0.49 $ 0.62 $ 0.13 26.5% Non - Core Items 9.02 (3.41) (12.43) (137.8%) 0.08 (0.03) (0.11) (137.5%) Non - GAAP Core Results $ 61.98 $ 64.00 $ 2.02 3.3% $ 0.57 $ 0.59 $ 0.02 3.5% ROA 0.96% 1.20% Core ROA 1.13% 1.14% ROACE 7.13% 9.20% Core ROACE 8.34% 8.73% ROTCE 12.48% 15.85% Core ROTCE 14.51% 15.08% Efficiency Ratio⁽¹⁾ 55.27% 57.77% NIM 3.22% 2.99% Core NIM 3.04% 2.86% YTD RESULTS (as of December 31) 2019 2020 CHANGE 2019 2020 CHANGE $ IN MILLIONS, EXCEPT PER SHARE DATA EARNINGS EARNINGS $ % DILUTED EPS DILUTED EPS $ % GAAP Results $ 237.83 $ 254.85 $ 17.02 7.2% $ 2.41 $ 2.31 $ (0.10) (4.1%) Non - Core Items 31.74 9.45 (22.29) (70.2%) 0.32 0.09 (0.23) (71.9%) Non - GAAP Core Results $ 269.57 $ 264.30 $ (5.27) (2.0%) $ 2.73 $ 2.40 $ (0.33) (12.1%) ROA 1.33% 1.18% Core ROA 1.51% 1.22% ROACE 9.93% 8.72% Core ROACE 11.25% 9.05% ROTCE 17.99% 15.25% Core ROTCE 20.31% 15.79% Efficiency Ratio⁽¹⁾ 50.33% 54.66% NIM 3.85% 3.38% Core NIM 3.59% 3.16%

As of and for the three months ended March 31, 2021 (1) Core figures (excluding Core NIM) exclude non - core income and expense items (e.g., early retirement program costs, gain on sale of branches, merger related costs and branch right - sizing costs). Core NIM excludes purchase accounting interest accretion. Core figures, as well as figures based on tangible common equity (which excl ude s goodwill and other intangible assets), are non - GAAP measurements. See Appendix for non - GAAP reconciliations. (2) Efficiency ratio is core non - interest expense before foreclosed property expense and amortization of intangibles as a percent of net interest income (fully taxable equivalent) and non - interest revenues, excluding gains and losses from securities transactions and non - core items, and is a non - GAAP measurement. See Appendix for non - GAAP reco nciliations. 23 2021 Financial Highlights NON - CORE ITEMS SELECTED HIGHLIGHTS (1)(2) ▪ Gain on sale of branches of $5.5 million ▪ Merger - related costs of $0.3 million ▪ Branch right - sizing costs of $0.6 million ▪ Total non - core items: $4.6 million pre - tax and $3.4 million after - tax ▪ Total Assets of $23.3 billion, Loans were $12.2 billion and Deposits were $18.2 billion ▪ ROAA of 1.20% and Core ROAA of 1.14% ▪ Efficiency Ratio of 57.77% ▪ ROACE of 9.20% and Core ROACE of 8.73 % ▪ ROTCE of 15.85% and Core ROTCE of 15.08% ▪ NIM of 2.99% and Core NIM of 2.86% ▪ Diluted EPS of $0.62 and Core Diluted EPS of $0.59 ▪ Equity to asset ratio of 12.6% and tangible common equity to tangible asset ratio of 7.9% ▪ Book value per share of $27.04, an increase of 3.6% compared to the same date in 2020 ▪ Tangible book value per share of $16.13, an increase of 6.0% compared to the same date in 2020 ▪ Since October 17, 2019, the Company repurchased approximately 6.5 million shares at a weighted average price of $19.53 ▪ Construction & Development concentration was 60% ▪ CRE concentration was 227%, down from a high of 335% at the end of the second quarter of 2019

HISTORICAL LOAN DISCOUNT BALANCE & ACCRETION INCOME (1) Fully tax equivalent using an effective tax rate of 26.135%. (2) Core loan yield and core net interest margin exclude accretion and are non - GAAP measurements. See Appendix for non - GAAP reconcil iations. 24 Net Interest Income 2021 SCHEDULED ACCRETION Q1 (Actual) Q2 (Estimated) Q4 (Estimated) Q3 (Estimated) FY21 (Estimated) $2.2 $6.6 $2.0 $2.4 $13.2 $ in millions 2020 2021 Q1 Q2 Q3 Q4 Q1 Loan Yield (1) 5.19% 4.84% 4.54% 4.74% 4.75% Core Loan Yield (1)(2) 4.86% 4.52% 4.29% 4.47% 4.53% Security Yield (1) 2.63% 2.50% 2.60% 2.48% 2.36% Cost of Interest Bearing Deposits 1.03% 0.59% 0.54% 0.47% 0.41% Cost of Deposits 0.80% 0.44% 0.39% 0.34% 0.30% Cost of Borrowed Funds 2.06% 1.84% 1.85% 1.88% 1.91% Net Interest Margin (1) 3.68% 3.42% 3.21% 3.22% 2.99% Core Net Interest Margin (1)(2) 3.42% 3.18% 3.02% 3.04% 2.86% Fed Funds Target Rate 0.25% 0.25% 0.25% 0.25% 0.25% $114 $77 $56 $36 $89 $49 $87 $40 $33 $40 $38 $46 $24 $28 $35 $41 $42 $7 $- $20 $40 $60 $80 $100 $120 2013 2014 2015 2016 2017 2018 2019 2020 2021 Q1 Loan Discount Balance Accretion Income

Category Q1 - 21 Linked Quarter Change Management’s Outlook Interest Income Down $9.7 million Primarily driven by lower loan volume and a $2.4 million decrease in accretion income, which was partially offset by a $4.4 million increase in the security portfolio. Management anticipates the following for the balance of 2021: 1) Organic loan growth in the mid single digits for Second Half 2021 2) PPP balances to be forgiven or paid - off by year - end 2021 3) Stable loan rates 4) New security yields at lower rates Interest Expense Down $1.4 million (improvement) Cost of deposits declined by 4 basis points. Cost of deposits decreased 64 basis points from 12/31/19 to 3/31/21. Anticipate slight additional decline in Q221. Net Interest Income Down $8.3 million We expect loans rates to be stable and deposit rates to decline slightly, but NIM will be effective by PPP forgiveness and liquidity. Trust Revenue Up $0.1 million Anticipate flat Trust revenue for Q2 and Q3, until our new staff is onboard and productive. Service Charges Down $1.1 million Decrease was primarily due to first quarter seasonality and the impact from the stimulus payments. We expect the stimulus to lead to further reductions in services charges in Q2 21. We are providing relief on some overdraft fees. Mortgage Revenue Up $3.5 million In Q4 20, Mortgage loan volume decline which resulted in lower revenue and a decrease in the fair value mandatory delivery adjustment. We expect mortgage volume to decline throughout 2021. We expect home purchase volume to be steady, but refinance volume to decline. Debit and Credit Card fees Up $0.3 million Credit card revenue was up slightly from Q420. Anticipate modest increase for the balance of 2021. Gain on Sale of Securities Up $5.5 million Sold securities with a gain of $5.3 million Management will continue to look for opportunities to maximize the value of the investment portfolio. Other income Down $0.3 million Gain on sale of Illinois branches of $5.5 million in Q1 21. Decrease from Q4 20 of approximant $5.8 million, primarily attributable to 2020 year - end adjustments in CRA related SBIC investment funds. Management expects other income to more closely track historical trends for the balance of 2021. Revenue 25

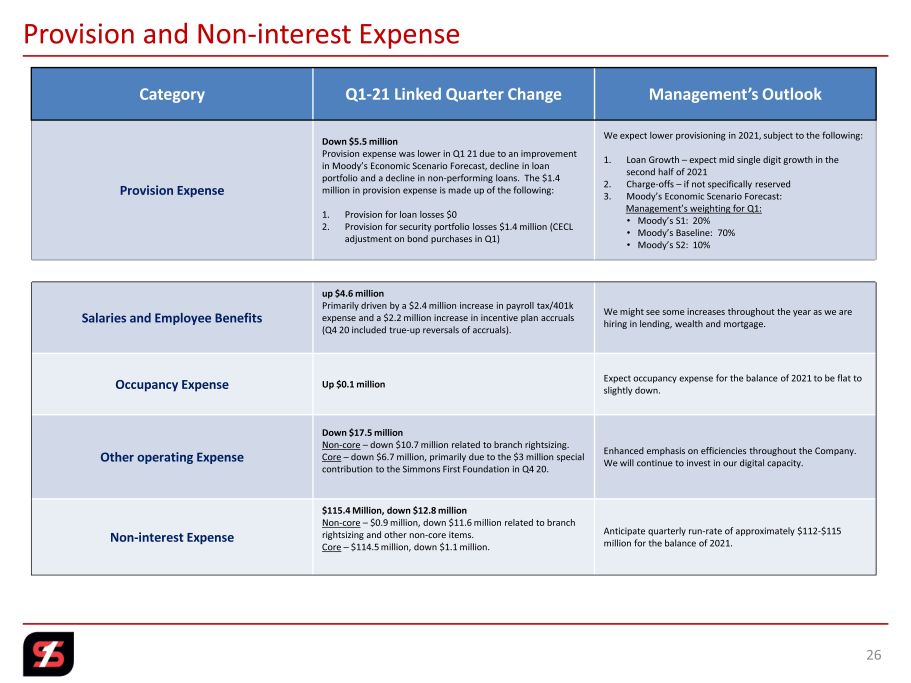

Category Q1 - 21 Linked Quarter Change Management’s Outlook Provision Expense Down $5.5 million Provision expense was lower in Q1 21 due to an improvement in Moody’s Economic Scenario Forecast, decline in loan portfolio and a decline in non - performing loans. The $1.4 million in provision expense is made up of the following: 1. Provision for loan losses $0 2. Provision for security portfolio losses $1.4 million (CECL adjustment on bond purchases in Q1) We expect lower provisioning in 2021, subject to the following: 1. Loan Growth – expect mid single digit growth in the second half of 2021 2. Charge - offs – if not specifically reserved 3. Moody’s Economic Scenario Forecast: Management’s weighting for Q1: • Moody’s S1: 20% • Moody’s Baseline: 70% • Moody’s S2: 10% Salaries and Employee Benefits up $4.6 million Primarily driven by a $2.4 million increase in payroll tax/401k expense and a $2.2 million increase in incentive plan accruals (Q4 20 included true - up reversals of accruals). We might see some increases throughout the year as we are hiring in lending, wealth and mortgage. Occupancy Expense Up $0.1 million Expect occupancy expense for the balance of 2021 to be flat to slightly down. Other operating Expense Down $17.5 million Non - core – down $10.7 million related to branch rightsizing. Core – down $6.7 million, primarily due to the $3 million special contribution to the Simmons First Foundation in Q4 20. Enhanced emphasis on efficiencies throughout the Company. We will continue to invest in our digital capacity. Non - interest Expense $115.4 Million, down $12.8 million Non - core – $0.9 million, down $11.6 million related to branch rightsizing and other non - core items. Core – $114.5 million, down $1.1 million. Anticipate quarterly run - rate of approximately $112 - $115 million for the balance of 2021. Provision and Non - interest Expense 26

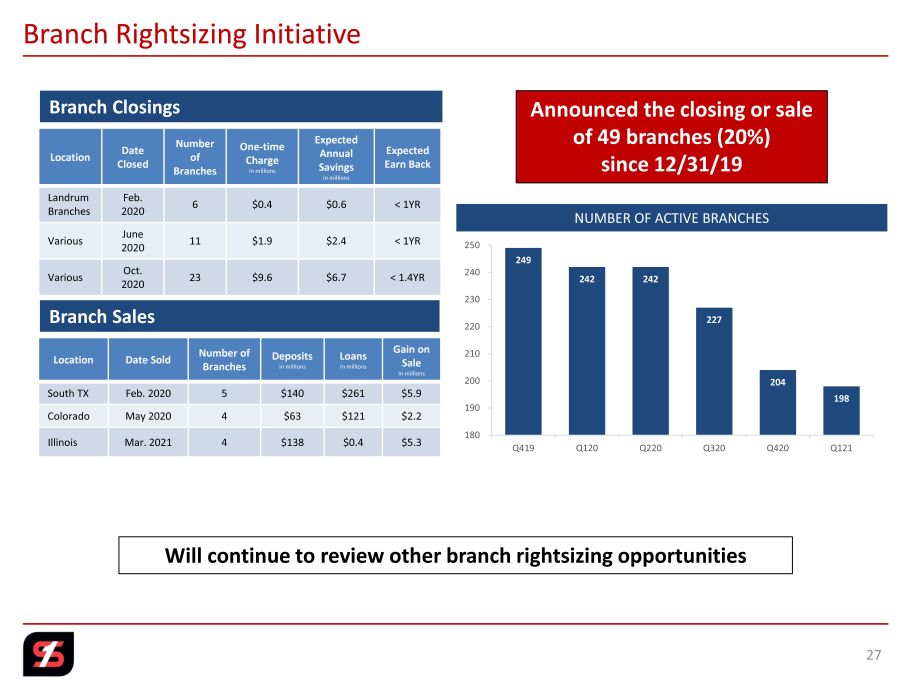

Branch Rightsizing Initiative 27 Branch Sales Branch Closings Will continue to review other branch rightsizing opportunities Location Date Sold Number of Branches Deposits in millions Loans in millions Gain on Sale in millions South TX Feb. 2020 5 $140 $261 $5.9 Colorado May 2020 4 $63 $121 $2.2 Illinois Mar. 2021 4 $138 $0.4 $5.3 Location Date Closed Number of Branches One - time Charge in millions Expected Annual Savings in millions Expected Earn Back Landrum Branches Feb. 2020 6 $0.4 $0.6 < 1YR Various June 2020 11 $1.9 $2.4 < 1YR Various Oct. 2020 23 $9.6 $6.7 < 1.4YR Announced the closing or sale of 49 branches (20%) since 12/31/19 NUMBER OF ACTIVE BRANCHES 249 242 242 227 204 198 180 190 200 210 220 230 240 250 Q419 Q120 Q220 Q320 Q420 Q121

As of and for the quarter ended March 31, 2021 Including PPP Loans Excluding PPP Loans (1) Loan yield 4.75% 4.71% Core Loan Yield (1) 4.53% 4.48% Allowance for Credit Losses to Total Loans 1.93% 2.06% Stockholders’ Equity to Total Assets 12.55% 13.00% Tangible Common Equity to Tangible Assets (1) 7.88% 8.18% Regulatory Tier 1 Leverage Ratio 8.95% 9.34% Loans / Deposits 67% 63% 28 Key Ratios Adjusted for PPP Loans (1) Core figures, figures based on tangible common equity and tangible assets, and figures excluding PPP loans are non - GAAP measurem ents. See Appendix for non - GAAP reconciliations.

(1) As of December 31, except where otherwise noted. (2) Efficiency ratio is core non - interest expense before foreclosed property expense and amortization of intangibles as a percent of net interest income (fully taxable equivalent) and non - interest revenues, excluding gains and losses from securities transactions and non - core items, and is a non - GAAP measurement. See Appendix for non - GAAP reconciliations. Note: Core figures exclude non - core income and expense items (e.g., early retirement program costs, gain on early retirement of trus t preferred securities, gain on sale of branches, gain on sale of insurance lines of business, donation to the Simmons Foundation, one - time tax adjustment, merger related costs and branch right - sizing costs). Core figures are non - GAAP meas urements. See Appendix for non - GAAP reconciliations. 29 Performance Trends TOTAL ASSETS (1) ($ IN BILLIONS) EFFICIENCY RATIO (2) NON - INTEREST INCOME / REVENUE TOTAL LOANS & DEPOSITS (1) ($ IN BILLIONS) $15.1 $16.5 $21.3 $22.4 $23.3 $5.0 $7.0 $9.0 $11.0 $13.0 $15.0 $17.0 $19.0 $21.0 $23.0 $25.0 2017 2018 2019 2020 2021 Q1 55.3% 52.9% 50.3% 54.7% 57.8% 30.0% 35.0% 40.0% 45.0% 50.0% 55.0% 60.0% 2017 2018 2019 2020 2021 Q1 $10.8 $11.7 $14.4 $12.9 $12.2 $11.1 $12.4 $16.1 $17.0 $18.2 $3.0 $4.5 $6.0 $7.5 $9.0 $10.5 $12.0 $13.5 $15.0 $16.5 $18.0 $19.5 2017 2018 2019 2020 2021 Q1 Loans Deposits 28.1% 20.7% 25.4% 28.0% 26.1% 27.5% 20.7% 25.4% 27.3% 24.0% 15.0% 17.0% 19.0% 21.0% 23.0% 25.0% 27.0% 29.0% 31.0% 33.0% 35.0% 2017 2018 2019 2020 2021 Q1 GAAP Core

Note: Core figures exclude non - core income and expense items (e.g., early retirement program costs, gain on early retirement of trust preferred securities, gain on sale of branches, gain on sale of insurance lines of business, donation to the Simmons Foundation, one - time tax adjustment, merger related costs and branch rig ht - sizing costs). Core figures, as well as figures based on tangible common equity (which excludes goodwill and other intangible assets), are non - GAAP measurements. See Appendix for non - GA AP reconciliations. 30 Performance Trends ROA ROTCE ROACE 6.68% 10.00% 9.93% 8.72% 9.20% 8.56% 10.21% 11.25% 9.05% 8.73% 5.00% 7.00% 9.00% 11.00% 2017 2018 2019 2020 2021 Q1 GAAP Core 11.26% 18.44% 17.99% 15.25% 15.85% 14.28% 18.81% 20.31% 15.79% 15.08% 5.00% 7.00% 9.00% 11.00% 13.00% 15.00% 17.00% 19.00% 21.00% 23.00% 2017 2018 2019 2020 2021 Q1 GAAP Core 0.92% 1.37% 1.33% 1.18% 1.20% 1.18% 1.40% 1.51% 1.22% 1.14% 0.50% 0.70% 0.90% 1.10% 1.30% 1.50% 2017 2018 2019 2020 2021 Q1 GAAP Core

(1) Per share information has been adjusted to reflect the effects of the Company’s two - for - one stock split, which occurred on Febr uary 8, 2018. Note: Core figures exclude non - core income and expense items (e.g., early retirement program costs, gain on early retirement of trust preferred securities, gain on sale of branches, gain on sale of insurance lines of business, donation to the Simmons Foundation, one - time tax adjustment, merger related costs and branch right - sizing costs). Core figures, as well as figur es based on tangible common equity (which excludes goodwill and other intangible assets), are non - GAAP measurements. See Appendix for non - GAAP reconciliations. 31 Performance Trends DILUTED EPS (1) NET INCOME ($ IN MILLIONS) $93 $216 $238 $255 $245 $119 $220 $270 $264 $255 $50 $75 $100 $125 $150 $175 $200 $225 $250 $275 2017 2018 2019 2020 LTM GAAP CORE $1.33 $2.32 $2.41 $2.31 $2.25 $1.70 $2.37 $2.73 $2.40 $2.34 $0.50 $0.75 $1.00 $1.25 $1.50 $1.75 $2.00 $2.25 $2.50 $2.75 2017 2018 2019 2020 LTM GAAP CORE

CORPORATE PROFILE AND COMPANY HIGHLIGHTS 32

(1) As of March 31, 2021, unless otherwise noted. (2) Based on April 13, 2021 closing stock price of $28.95 and number of shares outstanding as of that date. (3) Loan and deposit figures in billions. The balances include only those assigned to the division (the balances do not include o the r business units such as credit cards, equipment finance, energy, brokered and other). Company Profile (1) FINANCIAL HIGHLIGHTS BY DIVISION (3) 33 Division Geographic Footprint Branches Loans Deposits Arkansas Community Smaller Arkansas markets 45 $1.3 $3.5 Tennessee Community Smaller Tennessee markets 24 $0.7 $2.0 MO / OK / TX Community Smaller Missouri / Oklahoma / North Texas markets 48 $1.8 $4.7 Central AR & TN Metro Central Arkansas / Nashville / Memphis 22 $1.4 $2.2 Saint Louis Metro Saint Louis 19 $1.1 $1.6 Texas Metro Dallas / Fort Worth 16 $3.0 $1.6 Western Metro Northwest Arkansas / Kansas / Oklahoma 24 $1.4 $1.7 1903 Simmons Bank Founded in Pine Bluff, Arkansas 14.08% CET1 Ratio SFNC Ticker Symbol 17.50% Total Risk - based Capital Ratio $3.1 Billion Market Cap (2) 1.93% ACL / Loans $23 Billion Total Assets 2.99% Net Interest Margin 198 Locations 6 States 2.4% Dividend Yield AR Community TN Community MO / OK / TX Community Central AR & TN Metro Saint Louis Metro Texas Metro Western Metro

As of and for the quarter ended March 31, 2021 34 Selected Business Units ▪ $175 million nationwide credit card portfolio ▪ Loan yield (including fees): 13.2% ▪ History of excellent credit quality (1.39% YTD net charge - off ratio) INVESTMENTS ▪ Retail investments services provided through networking arrangement with LPL Financial – LPL platform, among other things, provides customers with online self - service trade option – Retail Group: $1.78 billion AUM ($385 million in fee - based / advisory assets) ▪ Profit Margin 21% INSURANCE (EMPLOYEE BENEFITS & LIFE) ▪ Revenue: $1.3 million ▪ Profit Margin: 33% ▪ Q1 2021 Mortgage Originations : $326 m illion ▪ 34% Purchase vs. 66% Refinance ▪ Revenue $15.6 million TRUST ▪ Total Assets: $5.9 billion – Managed Assets: $3.7 billion – Non - managed / Custodial Assets: $2.2 billion ▪ Revenue $6.1 million ▪ Profit Margin: 29% ▪ Growing investment management business ROYALTY TRUST ▪ Revenue: $580 thousand ▪ Profit Margin : 41%

35 Single Digital Platform Consolidated three legacy platforms into a single consistent digital experience for all Simmons Bank consumer customers Customer Experience Center New innovation space for testing our ideas with real users to deliver superior digital experiences for our customers Credit Cards in Digital Banking Added credit card accounts to mobile and online banking for a single view for consumer accounts Mobile Deposit Developed and deployed an enhanced mobile deposit solution allowing automated enrollment, larger deposit limits Digital Account Origination Developing customer focused platform that originates deposit accounts in approximately five minutes with automated ID Scan Digital Banking Accomplishments 2020

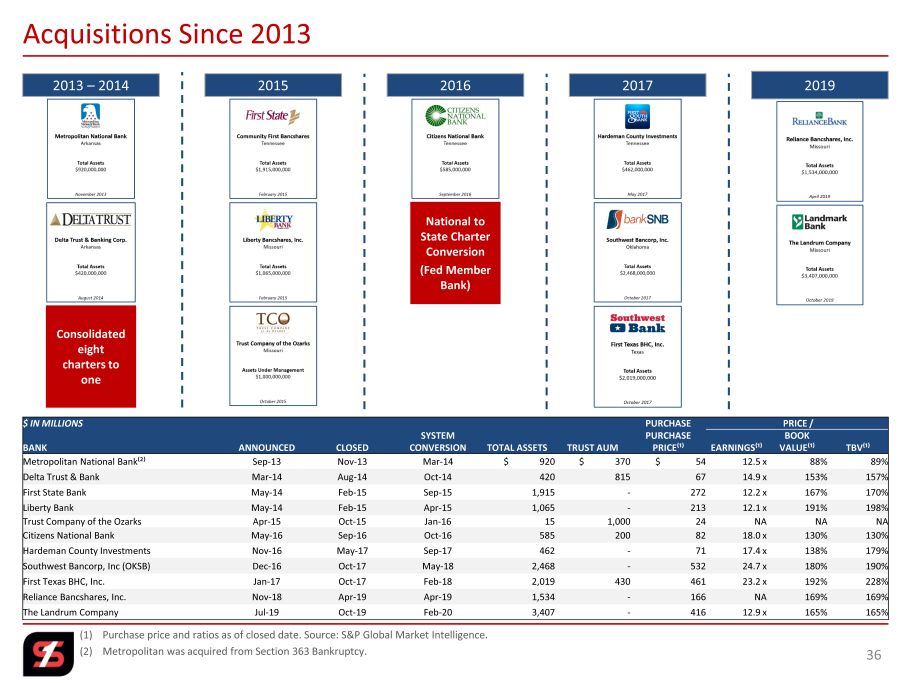

(1) Purchase price and ratios as of closed date. Source: S&P Global Market Intelligence. (2) Metropolitan was acquired from Section 363 Bankruptcy. 36 Acquisitions Since 2013 2013 – 2014 Consolidated eight charters to one National to State Charter Conversion (Fed Member Bank) 2015 2016 2017 2019 $ IN MILLIONS PURCHASE PRICE / BANK ANNOUNCED CLOSED SYSTEM CONVERSION TOTAL ASSETS TRUST AUM PURCHASE PRICE⁽¹⁾ EARNINGS⁽¹⁾ BOOK VALUE⁽¹⁾ TBV⁽¹⁾ Metropolitan National Bank⁽²⁾ Sep - 13 Nov - 13 Mar - 14 $ 920 $ 370 $ 54 12.5 x 88% 89% Delta Trust & Bank Mar - 14 Aug - 14 Oct - 14 420 815 67 14.9 x 153% 157% First State Bank May - 14 Feb - 15 Sep - 15 1,915 - 272 12.2 x 167% 170% Liberty Bank May - 14 Feb - 15 Apr - 15 1,065 - 213 12.1 x 191% 198% Trust Company of the Ozarks Apr - 15 Oct - 15 Jan - 16 15 1,000 24 NA NA NA Citizens National Bank May - 16 Sep - 16 Oct - 16 585 200 82 18.0 x 130% 130% Hardeman County Investments Nov - 16 May - 17 Sep - 17 462 - 71 17.4 x 138% 179% Southwest Bancorp, Inc (OKSB) Dec - 16 Oct - 17 May - 18 2,468 - 532 24.7 x 180% 190% First Texas BHC, Inc. Jan - 17 Oct - 17 Feb - 18 2,019 430 461 23.2 x 192% 228% Reliance Bancshares, Inc. Nov - 18 Apr - 19 Apr - 19 1,534 - 166 NA 169% 169% The Landrum Company Jul - 19 Oct - 19 Feb - 20 3,407 - 416 12.9 x 165% 165%

(1) Based on April 13, 2021 closing stock price of $28.95. (2) Q1 2021 EPS of $0.62. (3) Q1 2021 Core EPS of $0.59, excludes non - core income and expense items and is a non - GAAP measurement. See Appendix for non - GAAP r econciliations. Note: The future payment of dividends is not guaranteed and is subject to various factors, including approval by the Company’s boar d of directors. 37 112 Years of Consistent Dividend History $0.14 $0.16 $0.18 $0.20 $0.22 $0.24 $0.27 $0.29 $0.31 $0.34 $0.37 $0.38 $0.38 $0.38 $0.38 $0.40 $0.42 $0.44 $0.46 $0.48 $0.50 $0.60 $0.64 $0.68 $0.72 $- $0.05 $0.10 $0.15 $0.20 $0.25 $0.30 $0.35 $0.40 $0.45 $0.50 $0.55 $0.60 $0.65 $0.70 $0.75 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2021 CURRENT DIVIDEND YIELD⁽¹⁾ 2.5% 2021 DIVIDEND PAYOUT RATIO GAAP Earnings⁽²⁾ 29.0% Core Earnings⁽³⁾ 30.5% EXPECTED

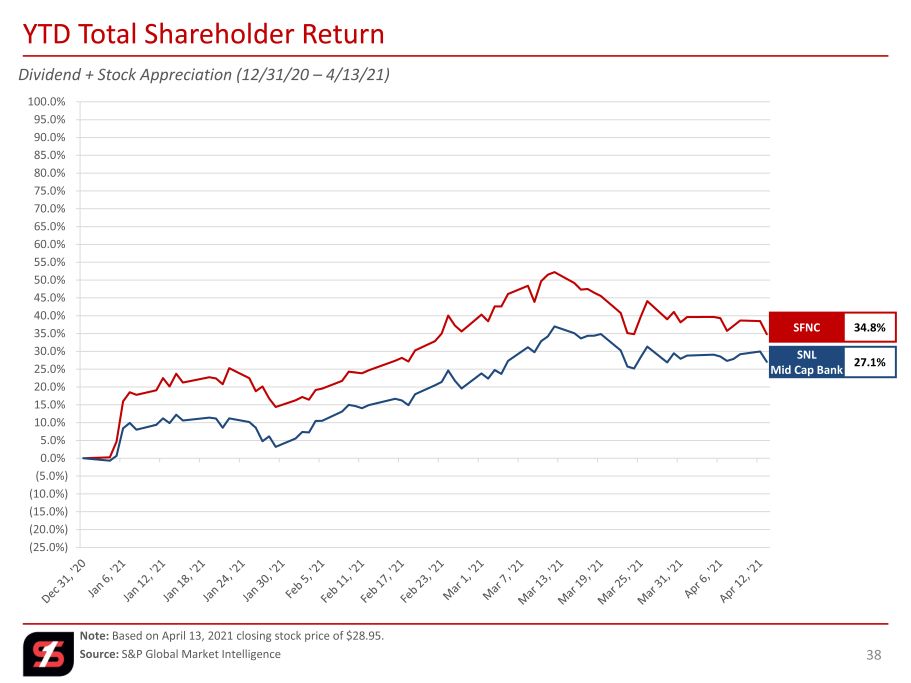

(25.0%) (20.0%) (15.0%) (10.0%) (5.0%) 0.0% 5.0% 10.0% 15.0% 20.0% 25.0% 30.0% 35.0% 40.0% 45.0% 50.0% 55.0% 60.0% 65.0% 70.0% 75.0% 80.0% 85.0% 90.0% 95.0% 100.0% Dividend + Stock Appreciation (12/31/20 – 4/13/21) Note: Based on April 13, 2021 closing stock price of $28.95. Source: S&P Global Market Intelligence 38 YTD Total Shareholder Return SFNC 34.8% SNL Mid Cap Bank 27.1%

(75.0%) (55.0%) (35.0%) (15.0%) 5.0% 25.0% 45.0% 65.0% 85.0% 105.0% 125.0% 145.0% 165.0% 185.0% 205.0% 225.0% 245.0% Dividend + Stock Appreciation (12/31/07 – 4/13/21) Note: Based on April 13, 2021 closing stock price of $28.95. Source: S&P Global Market Intelligence 39 Long - term Shareholder Return SFNC 208.4% SNL Mid Cap Bank 34.1%

Source: S&P Global Market Intelligence (1) Core EPS excludes non - core income and expense items and is a non - GAAP measurement. See Appendix for non - GAAP reconciliations. (2) Based upon the Company’s average six analyst consensus EPS of $2.13 for 2021 and $2.09 for 2022 (analyst’s published estimate s a s of 4/8/21). (3) Tangible book value (which excludes goodwill and other intangible assets) is a non - GAAP measurement. See Appendix for non - GAAP reconciliations. (4) The ratings provided by KBRA are subject to revision or withdrawal by KBRA at any time and are not recommendations to buy, se ll or hold these securities. Each rating should be evaluated independently of any other rating. 40 Investment Profile SENIOR UNSECURED DEBT SHORT - TERM DEBT SUBORDINATED DEBT SENIOR UNSECURED DEBT SHORT - TERM DEBT SUBORDINATED DEBT SHORT - TERM DEPOSIT DEPOSIT BBB+ BBB K2 SIMMONS FIRST NATIONAL CORPORATION SIMMONS BANK A - A - BBB+ K2 K2 2021 -- KROLL BOND RATING AGENCY (4) SFNC MARKET DATA AS OF APRIL 13, 2021 VALUATION & PER SHARE DATA Stock Price $28.95 52 - Week High $33.43 52 - Week Low $13.75 Common Shares Outstanding 108.3 (in millions) Market Cap. $3.1 (in billions) Institutional Ownership 71% Price / LTM EPS 12.9 X Price / LTM Core EPS (1) 12.4 X Price / 2021 Consensus EPS (2) 13.6 X Price / 2022 Consensus EPS (2) 13.9 X Price / Book Value 1.1 X Price / Tangible Book Value (3) 1.8 X

APPENDIX 41

(1) Effective tax rate of 26.135% for 2018 - 2021 and 39.225% for 2017, adjusted for non - deductible merger - related costs and deferr ed tax items on P&C insurance sale. (2) Tax adjustment to revalue deferred tax assets and liabilities to account for the future impact of lower corporate tax. 42 Non - GAAP Reconciliations Q4 Q1 $ in thousands 2017 2018 2019 2020 2020 2021 LTM Calculation of Core Earnings Net Income $ 92,940 $ 215,713 $ 237,828 $ 254,852 $ 52,955 $ 67,407 $ 243,036 Non - core items Gain on sale of banking operations - - - (8,368) (275) (5,477) (7,956) Gain on sale of P&C insurance business (3,708) - - - - - - Donation to Simmons Foundation 5,000 - - - - - - Merger related costs 21,923 4,777 36,379 4,531 731 233 3,696 Early Retirement Program - - 3,464 2,901 62 - 2,901 Branch right sizing 169 1,341 3,129 13,727 11,696 625 14,114 Tax Effect⁽¹⁾ (8,746) (1,598) (11,234) (3,343) (3,192) 1,207 (3,334) Net non - core items (before SAB 118 adjustment) 14,638 4,520 31,738 9,448 9,022 (3,412) 9,421 SAB 118 adjustment⁽²⁾ 11,471 - - - - - - Core earnings (non - GAAP) $ 119,049 $ 220,233 $ 269,566 $ 264,300 $ 61,977 $ 63,995 $ 254,457

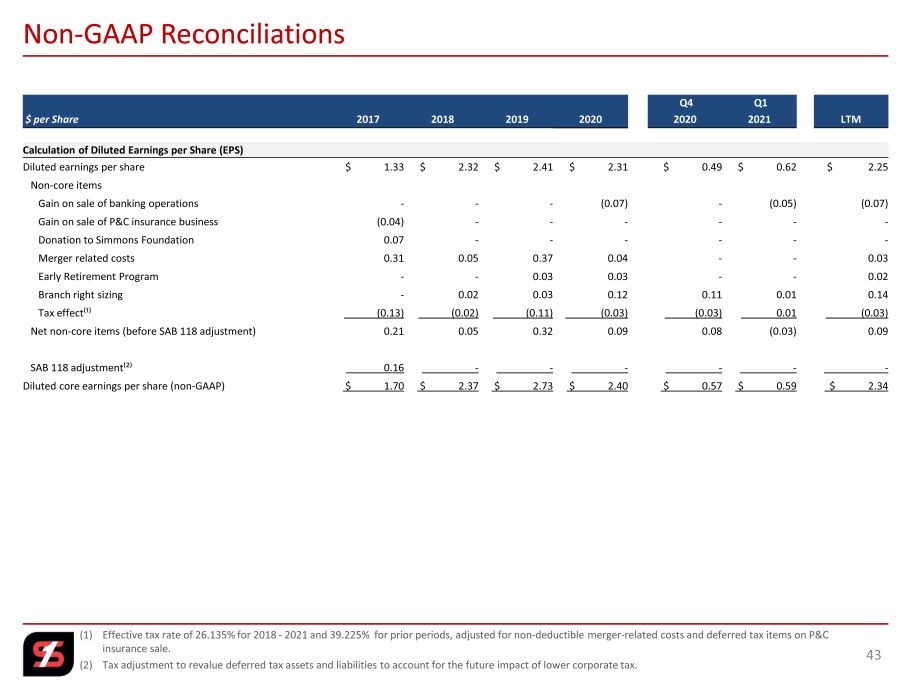

(1) Effective tax rate of 26.135% for 2018 - 2021 and 39.225% for prior periods, adjusted for non - deductible merger - related costs a nd deferred tax items on P&C insurance sale. (2) Tax adjustment to revalue deferred tax assets and liabilities to account for the future impact of lower corporate tax. 43 Non - GAAP Reconciliations Q4 Q1 $ per Share 2017 2018 2019 2020 2020 2021 LTM Calculation of Diluted Earnings per Share (EPS) Diluted earnings per share $ 1.33 $ 2.32 $ 2.41 $ 2.31 $ 0.49 $ 0.62 $ 2.25 Non - core items Gain on sale of banking operations - - - (0.07) - (0.05) (0.07) Gain on sale of P&C insurance business (0.04) - - - - - - Donation to Simmons Foundation 0.07 - - - - - - Merger related costs 0.31 0.05 0.37 0.04 - - 0.03 Early Retirement Program - - 0.03 0.03 - - 0.02 Branch right sizing - 0.02 0.03 0.12 0.11 0.01 0.14 Tax effect⁽¹⁾ (0.13) (0.02) (0.11) (0.03) (0.03) 0.01 (0.03) Net non - core items (before SAB 118 adjustment) 0.21 0.05 0.32 0.09 0.08 (0.03) 0.09 SAB 118 adjustment⁽²⁾ 0.16 - - - - - - Diluted core earnings per share (non - GAAP) $ 1.70 $ 2.37 $ 2.73 $ 2.40 $ 0.57 $ 0.59 $ 2.34

44 Non - GAAP Reconciliations Q1 Q1 $ in thousands 2017 2018 2019 2020 2020 2021 Calculation of Core Return on Average Assets Net income available to common stockholders $ 92,940 $ 215,713 $ 237,828 $ 254,852 $ 77,223 $ 67,407 Net non - core items, net of taxes, adjustment (non - GAAP) 26,109 4,520 31,738 9,448 (3,385) (3,412) Core earnings (non - GAAP) $ 119,049 $ 220,233 $ 269,566 $ 264,300 $ 73,838 $ 63,995 Average total assets $ 10,074,951 $ 15,771,362 $ 17,871,748 $ 21,590,745 $ 20,920,223 $ 22,738,821 Return on average assets 0.92% 1.37% 1.33% 1.18% 1.48% 1.20% Core return on average assets (non - GAAP) 1.18% 1.40% 1.51% 1.22% 1.42% 1.14% Calculation of Return on Tangible Common Equity Net income available to common stockholders $ 92,940 $ 215,713 $ 237,828 $ 254,852 $ 77,223 $ 67,407 Amortization of intangibles, net of taxes 4,659 8,132 8,720 9,968 2,521 2,470 Total income available to common stockholders (non - GAAP) $ 97,599 $ 223,845 $ 246,548 $ 264,820 $ 79,744 $ 69,877 Net non - core items, net of taxes (non - GAAP) 26,109 4,520 31,738 9,448 (3,385) (3,412) Core earnings (non - GAAP) 119,049 220,233 269,566 264,300 73,838 63,995 Amortization of intangibles, net of taxes 4,659 8,132 8,720 9,968 2,521 2,470 Total core income available to common stockholders (non - GAAP) $ 123,708 $ 228,365 $ 278,286 $ 274,268 $ 76,359 $ 66,465 Average common stockholders' equity $ 1,390,815 $ 2,157,097 $ 2,396,024 $ 2,921,039 $ 2,869,177 $ 2,972,689 Average intangible assets: Goodwill (455,453) (845,308) (921,635) (1,065,190) (1,055,498) (1,075,305) Other intangibles (68,896) (97,820) (104,000) (118,812) (125,746) (109,850) Total average intangibles (524,349) (943,128) (1,025,635) (1,184,002) (1,181,244) (1,185,155) Average tangible common stockholders' equity (non - GAAP) $ 866,466 $ 1,213,969 $ 1,370,389 $ 1,737,037 $ 1,687,933 $ 1,787,534 Return on average common equity 6.68% 10.00% 9.93% 8.72% 10.83% 9.20% Return on tangible common equity (non - GAAP) 11.26% 18.44% 17.99% 15.25% 19.00% 15.85% Core return on average common equity (non - GAAP) 8.56% 10.21% 11.25% 9.05% 10.35% 8.73% Core return on tangible common equity (non - GAAP) 14.28% 18.81% 20.31% 15.79% 18.19% 15.08%

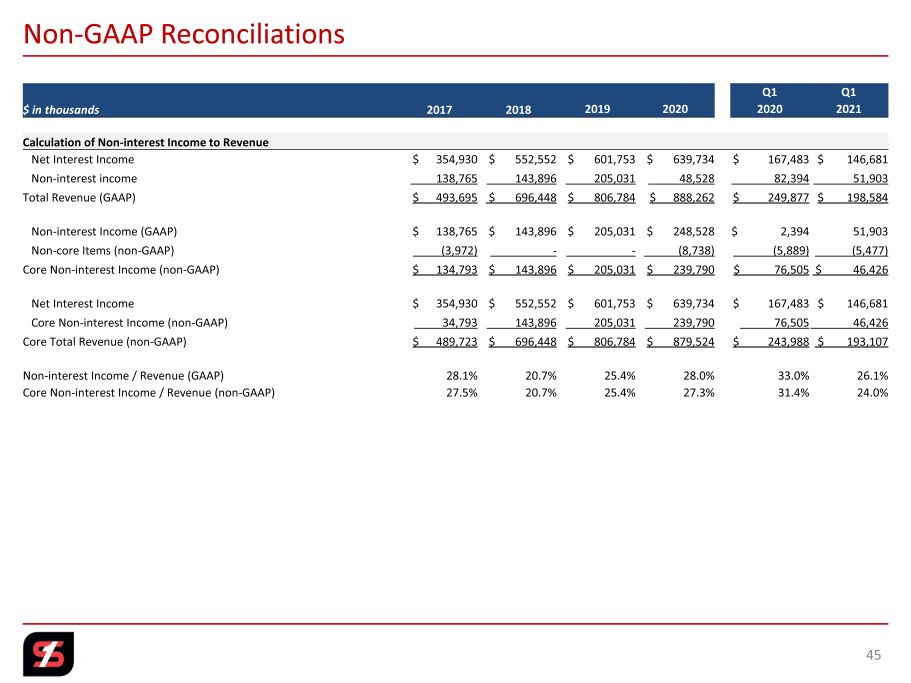

45 Non - GAAP Reconciliations Q1 Q1 $ in thousands 2017 2018 2019 2020 2020 2021 Calculation of Non - interest Income to Revenue Net Interest Income $ 354,930 $ 552,552 $ 601,753 $ 639,734 $ 167,483 $ 146,681 Non - interest income 138,765 143,896 205,031 48,528 82,394 51,903 Total Revenue (GAAP) $ 493,695 $ 696,448 $ 806,784 $ 888,262 $ 249,877 $ 198,584 Non - interest Income (GAAP) $ 138,765 $ 143,896 $ 205,031 $ 248,528 $ 2,394 51,903 Non - core Items (non - GAAP) (3,972) - - (8,738) (5,889) (5,477) Core Non - interest Income (non - GAAP) $ 134,793 $ 143,896 $ 205,031 $ 239,790 $ 76,505 $ 46,426 Net Interest Income $ 354,930 $ 552,552 $ 601,753 $ 639,734 $ 167,483 $ 146,681 Core Non - interest Income (non - GAAP) 34,793 143,896 205,031 239,790 76,505 46,426 Core Total Revenue (non - GAAP) $ 489,723 $ 696,448 $ 806,784 $ 879,524 $ 243,988 $ 193,107 Non - interest Income / Revenue (GAAP) 28.1% 20.7% 25.4% 28.0% 33.0% 26.1% Core Non - interest Income / Revenue (non - GAAP) 27.5% 20.7% 25.4% 27.3% 31.4% 24.0%

(1) Effective tax rate of 26.135% (2) Efficiency ratio is core non - interest expense before foreclosed property expense and amortization of intangibles as a percent of net interest income (fully taxable equivalent) and noninterest revenues, excluding gains and losses from securities transactions and non - core items. 46 Non - GAAP Reconciliations Q1 Q1 $ in thousands 2017 2018 2019 2020 2020 2021 Calculation of Efficiency Ratio Non - interest expense $ 312,379 $ 392,229 $ 461,112 $ 493,495 $ 128,813 $ 115,356 Non - core non - interest expense adjustment (27,357) (6,118) (42,972) (21,529) (1,306) (858) Other real estate and foreclosure expense adjustment (3,042) (4,240) (3,282) (1,706) (319) (343) Amortization of intangibles adjustment (7,666) (11,009) (11,805) (13,495) (3,413) (3,344) Efficiency ratio numerator $ 274,314 $ 370,862 $ 403,053 $ 456,765 $ 123,775 $ 110,811 Net - interest income $ 354,930 $ 552,552 $ 601,753 $ 639,734 $ 167,483 $ 146,681 Non - interest income 138,765 143,896 205,031 248,528 82,394 51,903 Non - core non - interest income adjustment (3,972) - - (8,738) (5,889) (5,477) Fully tax - equivalent adjustment⁽¹⁾ 7,723 5,297 7,322 11,001 2,305 4,163 (Gain) loss on sale of securities (1,059) (61) (13,314) (54,806) (32,095) (5,471) Efficiency ratio denominator $ 496,387 $ 701,684 $ 800,792 $ 835,719 $ 214,198 $ 191,799 Efficiency ratio⁽²⁾ 55.27% 52.85% 50.33% 54.66% 57.79% 57.77%

47 Non - GAAP Reconciliations Q1 Q2 Q3 Q4 Q1 $ in thousands, except per share and share count 2020 2020 2020 2020 2021 Calculation of Core Net Interest Margin Net interest income $ 167,483 $ 163,681 $ 153,610 $ 154,960 $ 146,681 Fully tax - equivalent adjustment 2,305 2,350 2,864 3,482 4,163 Fully tax - equivalent net interest income 169,788 166,031 156,474 158,442 150,844 Total accretable yield (11,837) (11,723) (8,948) (8,999) (6,630) Core net interest income (non - GAAP) $ 157,951 $ 154,308 $ 147,526 $ 149,443 $ 144,214 PPP loan and excess liquidity interest income (non - GAAP) (5,623) (6,131) (6,983) (12,257) Core net interest income adjusted for PPP loans and liquidity (non - GAAP) $ 160,408 $ 150,343 $ 151,459 $ 138,587 Average earning assets $ 18,581,491 $ 19,517,475 $ 19,415,314 $ 19,573,651 $ 20,484,908 Average PPP loan balance and excess liquidty (2,071,411) (2,359,928) (2,837,125) (3,617,567) Average earning assets adjusted for PPP loans and liquidity (non - GAAP) $ 17,446,064 $ 17,055,386 $ 16,736,526 $ 16,867,341 Net interest margin 3.68% 3.42% 3.21% 3.22% 2.99% Core net interest margin (non - GAAP) 3.42% 3.18% 3.02% 3.04% 2.86% Core net interest margin adjusted for PPP loans and liquidity (non - GAAP) 3.70% 3.51% 3.60% 3.33%

48 Non - GAAP Reconciliations Q1 $ in thousands, except per share and share count 2017 2018 2019 2020 2021 Calculation of Book Value and Tangible Book Value per Share Total common stockholders' equity $ 2,084,564 $ 2,246,434 $ 2,988,157 $ 2,975,889 $ 2,930,008 Intangible assets: Goodwill (842,651) (845,687) (1,055,520) (1,075,305) (1,075,305) Other intangible assets (106,071) (91,334) (127,340) (111,110) (107,091) Total intangibles (948,722) (937,021) (1,182,860) (1,186,415) (1,182,396) Tangible common stockholders' equity (non - GAAP) $ 1,135,842 $ 1,309,413 $ 1,805,297 $ 1,789,474 $ 1,747,612 Shares of common stock outstanding 92,029,118 92,347,643 113,628,601 108,077,662 108,345,732 Book value per common share $ 22.65 $ 24.33 $ 26.30 $ 27.53 $ 27.04 Tangible book value per common share (non - GAAP) $ 12.34 $ 14.18 $ 15.89 $ 16.56 $ 16.13 Stock Price as of April 13, 2021 $ 28.95 Price / Book Value per Share 1.07 x Price / Tangible Book Value per Share (non - GAAP) 1.80 x

49 Non - GAAP Reconciliations Q1 Q2 Q3 Q4 Q1 $ in thousands 2020 2020 2020 2020 2021 Calculation of Core Loan Yield Loan interest income (FTE) $ 187,566 $ 177,168 $ 163,379 $ 160,306 $ 146,601 Total accretable yield (11,837) (11,723) (8,948) (8,999) (6,630) Core loan interest income (non - GAAP) 175,729 165,445 154,431 151,307 $ 139,971 PPP loan interest income (3,733) (5,782) (6,457) (11,652) Core loan interest income excluding PPP loans (non - GAAP) $ 161,712 $ 148,649 $ 144,850 $ 128,319 Average loan balance $ 14,548,853 $ 14,731,306 $ 14,315,014 $ 13,457,077 $ 12,518,300 Average PPP loan balance (non - GAAP) (645,172) (967,152) (937,544) (891,070) Core loan interest income excluding PPP loans (non - GAAP) $ 14,086,134 $ 13,347,862 $ 12,519,533 $ 11,627,230 Core loan yield (non - GAAP) 4.86% 4.52% 4.29% 4.47% 4.53% Core loan yield excluding PPP loans (non - GAAP) 4.62% 4.43% 4.60% 4.48% Calculation of Loan Yield Adjusted for PPP Loans Loan interest income (FTE) $ 160,306 $ 146,601 PPP loan interest income (6,457) (11,652)) Loan interest income excluding PPP loans $ 153,849 $ 134,949 Average loan balance $ 13,457,077 $ 12,518,300 Average PPP loan balance (937,544) (891,070)) Average loan balance excluding PPP loans $ 12,519,533 $ 11,627,230 Loan yield 4.74% 4.75% Loan yield excluding PPP loans 4.89% 4.71% Calculation of Loans to Deposits excluding PPP Loans Loans $ 12,900,897 $ 12,195,873 PPP loans (904,673) (797,629) Loans excluding PPP Loans $ 11,996,224 $ 11,398,244 Deposits $ 16,987,026 $ 18,189,388 Loans to deposits 75.95% 67.05% Loans excluding PPP loans to deposits 70.62% 62.66%

Non - GAAP Reconciliations 50 Q1 $ in thousands 2021 Calculation of Tangible Common Equity to Tangible Assets Total stockholders' equity $ 2,930,775 Preferred stock (767) Total common stockholders' equity 2,930,008 Intangible assets: Goodwill (1,075,305) Other intangible assets (107,091) Total intangibles (1,182,396) Tangible common stockholders' equity (non - GAAP) $ 1,747,612 Total assets $ 23,348,117 Intangible assets: Goodwill (1,075,305) Other intangible assets (107,091) Total intangibles (1,182,396) Tangible assets (non - GAAP) $ 22,165,721 PPP loans (797,629) Total assets excluding PPP loans (non - GAAP) $ 22,550,488 Tangible assets excluding PPP loans (non - GAAP) $ 21,368,092 Ratio of equity to assets 12.55% Ratio of equity to assets excluding PPP loans (non - GAAP) 13.00% Ratio of tangible common equity to tangible assets (non - GAAP) 7.88% Ratio of tangible common equity to tangible assets excluding PPP loans (non - GAAP) 8.18%

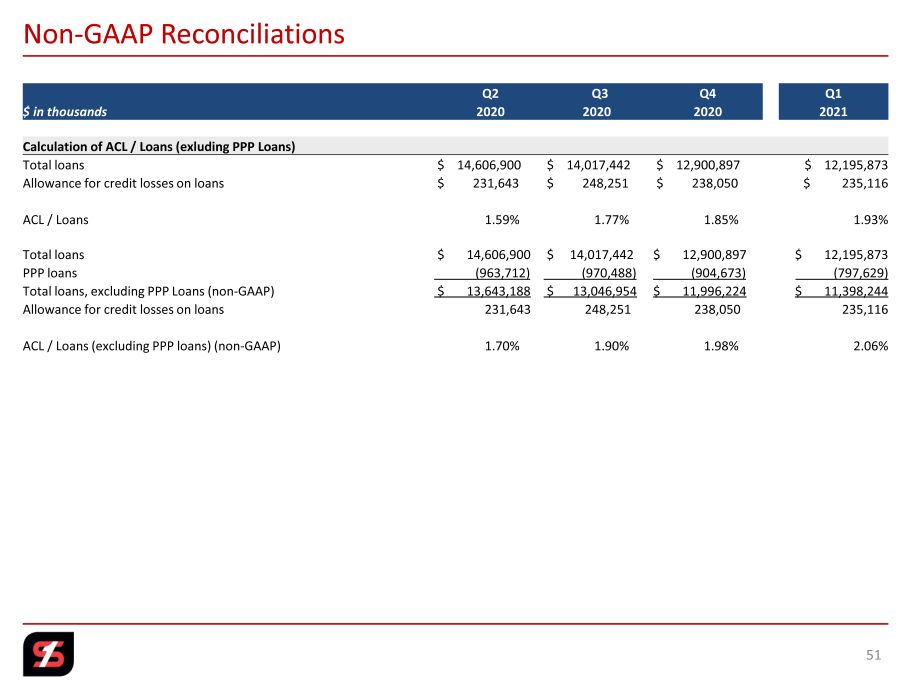

Non - GAAP Reconciliations 51 Q2 Q3 Q4 Q1 $ in thousands 2020 2020 2020 2021 Calculation of ACL / Loans (exluding PPP Loans) Total loans $ 14,606,900 $ 14,017,442 $ 12,900,897 $ 12,195,873 Allowance for credit losses on loans $ 231,643 $ 248,251 $ 238,050 $ 235,116 ACL / Loans 1.59% 1.77% 1.85% 1.93% Total loans $ 14,606,900 $ 14,017,442 $ 12,900,897 $ 12,195,873 PPP loans (963,712) (970,488) (904,673) (797,629) Total loans, excluding PPP Loans (non - GAAP) $ 13,643,188 $ 13,046,954 $ 11,996,224 $ 11,398,244 Allowance for credit losses on loans 231,643 248,251 238,050 235,116 ACL / Loans (excluding PPP loans) (non - GAAP) 1.70% 1.90% 1.98% 2.06%

Non - GAAP Reconciliations 52 Q1 $ in thousands 2021 Calculation of Regulatory Tier 1 Leverage Ratio Excluding Average PPP Loans Total Tier 1 capital $ 1,939,868 Adjusted average assets for leverage ratio $ 21,668,406 Average PPP loans (891,070) Adjusted average assets excluding average PPP loans (non - GAAP) $ 20,777,336 Tier 1 leverage ratio 8.95% Tier 1 leverage ratio excluding average PPP loans (non - GAAP) 9.34%

| NASDAQ: SFNC Our lights are red in honor of # RedCrossMonth