Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - ManpowerGroup Inc. | man-ex991_7.htm |

| 8-K - 8-K - ManpowerGroup Inc. | man-8k_20210420.htm |

April 20, 2021 ManpowerGroup First Quarter Results Exhibit 99.2

FORWARD-LOOKING STATEMENT This presentation contains statements, including statements regarding economic uncertainty, the global recovery, financial outlook, the Company’s strategic initiatives and technology investments and its positioning for future growth, as well the potential impacts of the COVID-19 pandemic and the Company’s efforts to respond to such impacts, that are forward-looking in nature and, accordingly, are subject to risks and uncertainties regarding the Company’s expected future results. The Company’s actual results may differ materially from those described or contemplated in the forward-looking statements due to numerous factors. These factors include those found in the Company’s reports filed with the SEC, including the information under the heading “Risk Factors” in its Annual Report on Form 10-K for the year ended December 31, 2020, which information is incorporated herein by reference. The Company assumes no obligation to update or revise any forward-looking statements. We reference certain non-GAAP financial measures, which we believe provide useful information for investors. We include a reconciliation of these measures, where appropriate, to GAAP on the Investor Relations section of our website at manpowergroup.com.

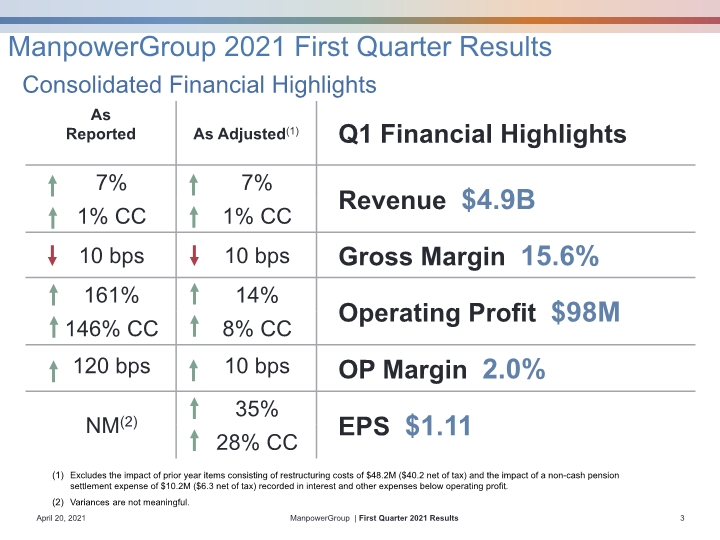

Consolidated Financial Highlights Excludes the impact of prior year items consisting of restructuring costs of $48.2M ($40.2 net of tax) and the impact of a non-cash pension settlement expense of $10.2M ($6.3 net of tax) recorded in interest and other expenses below operating profit. Variances are not meaningful.

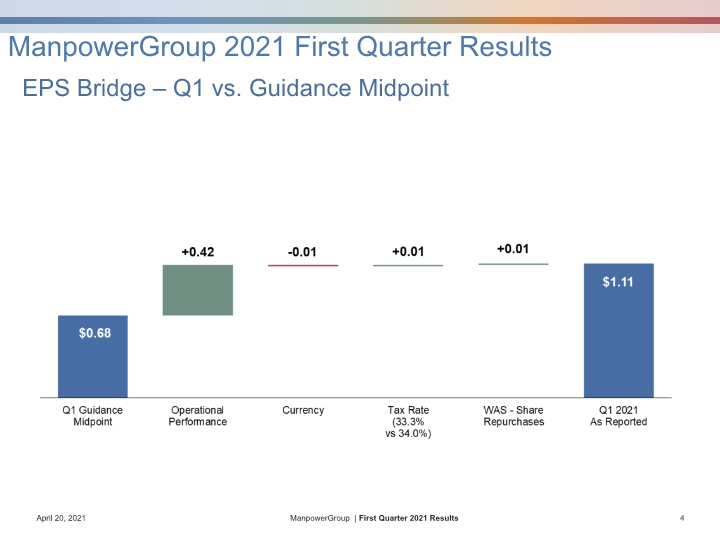

EPS Bridge – Q1 vs. Guidance Midpoint

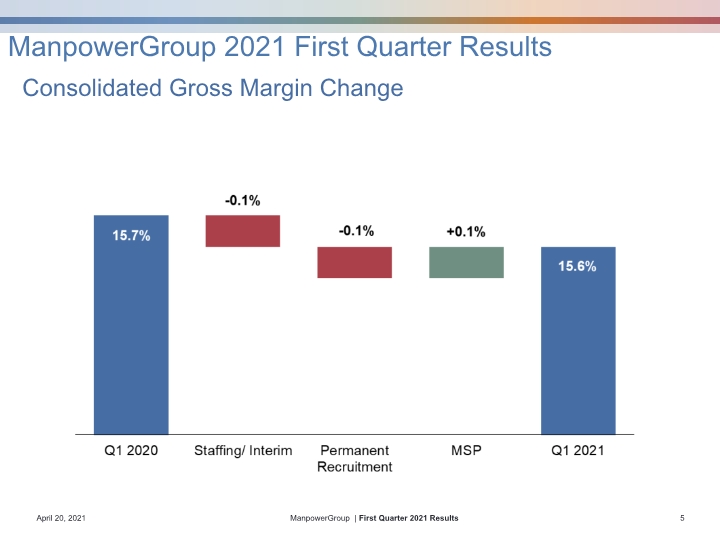

Consolidated Gross Margin Change

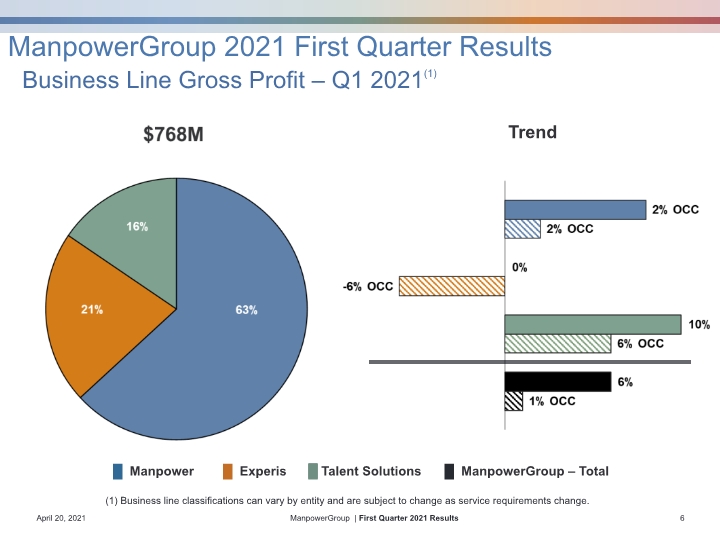

Trend Business Line Gross Profit – Q1 2021(1) (1) Business line classifications can vary by entity and are subject to change as service requirements change. █ Manpower █ Experis █ Talent Solutions █ ManpowerGroup – Total

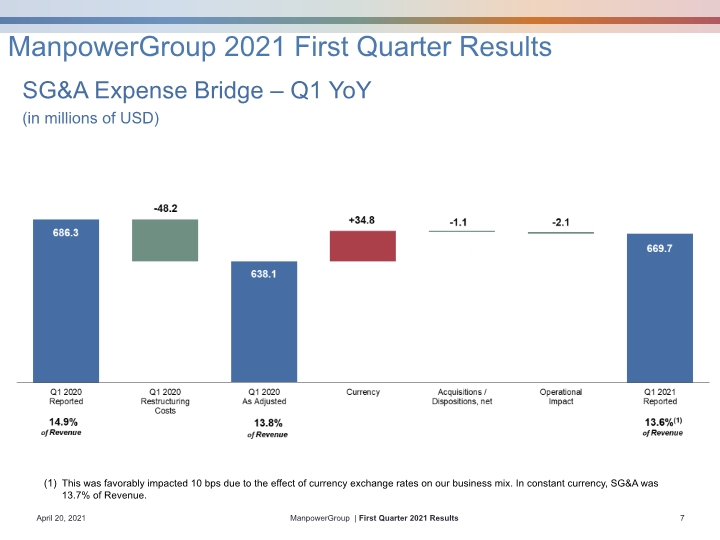

SG&A Expense Bridge – Q1 YoY (in millions of USD) This was favorably impacted 10 bps due to the effect of currency exchange rates on our business mix. In constant currency, SG&A was 13.7% of Revenue.

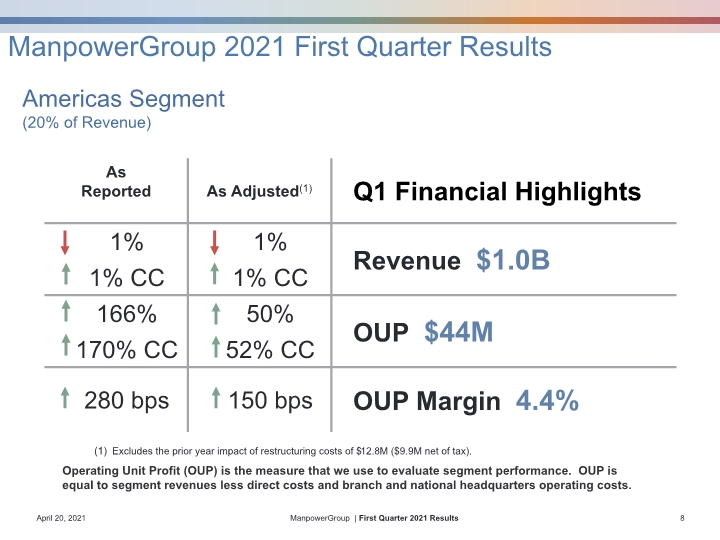

Operating Unit Profit (OUP) is the measure that we use to evaluate segment performance. OUP is equal to segment revenues less direct costs and branch and national headquarters operating costs. Americas Segment (20% of Revenue) Excludes the prior year impact of restructuring costs of $12.8M ($9.9M net of tax).

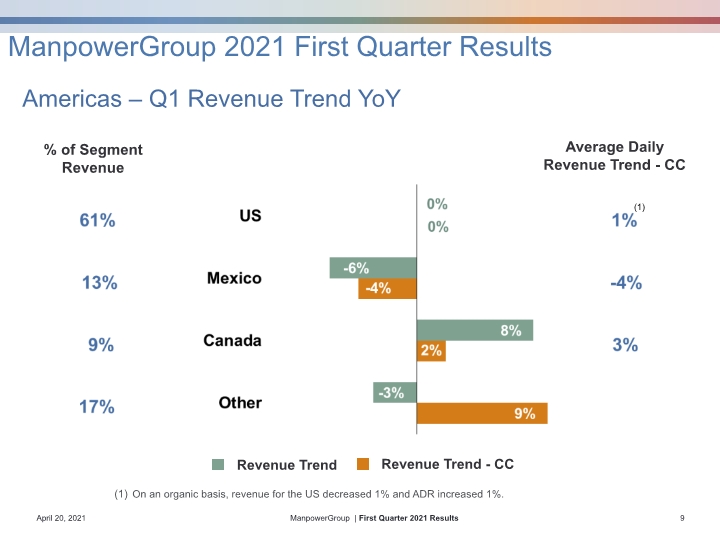

% of Segment Revenue Americas – Q1 Revenue Trend YoY Average Daily Revenue Trend - CC On an organic basis, revenue for the US decreased 1% and ADR increased 1%. (1)

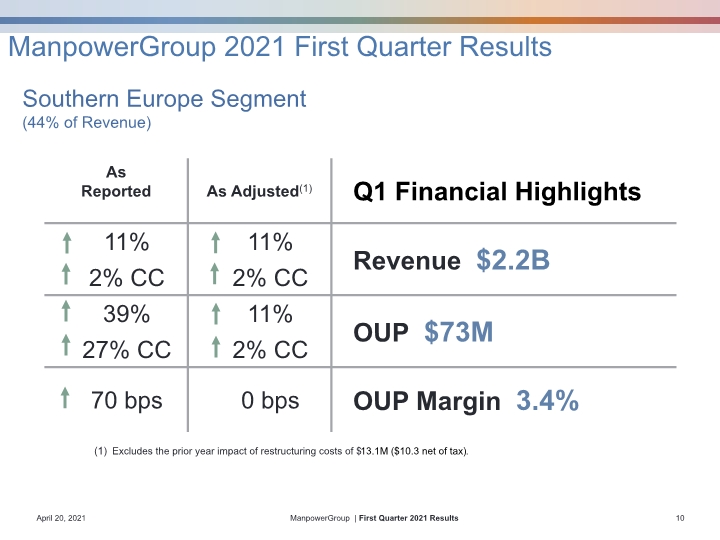

Southern Europe Segment (44% of Revenue) Excludes the prior year impact of restructuring costs of $13.1M ($10.3 net of tax).

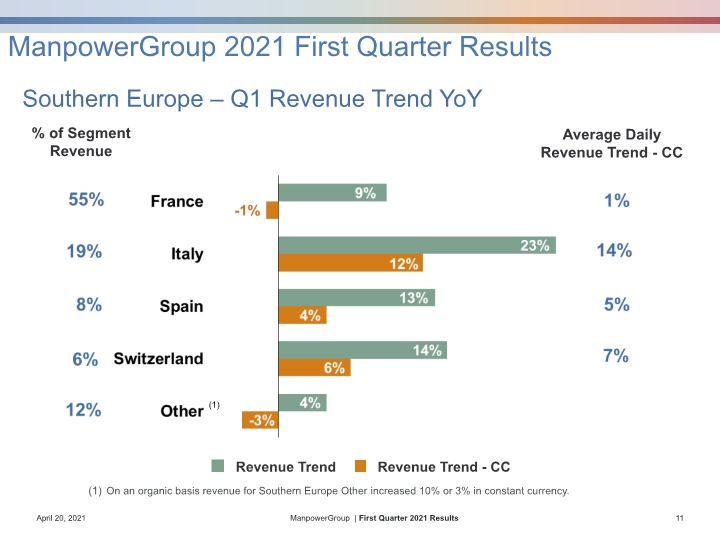

Southern Europe – Q1 Revenue Trend YoY % of Segment Revenue Average Daily Revenue Trend - CC On an organic basis revenue for Southern Europe Other increased 10% or 3% in constant currency. (1)

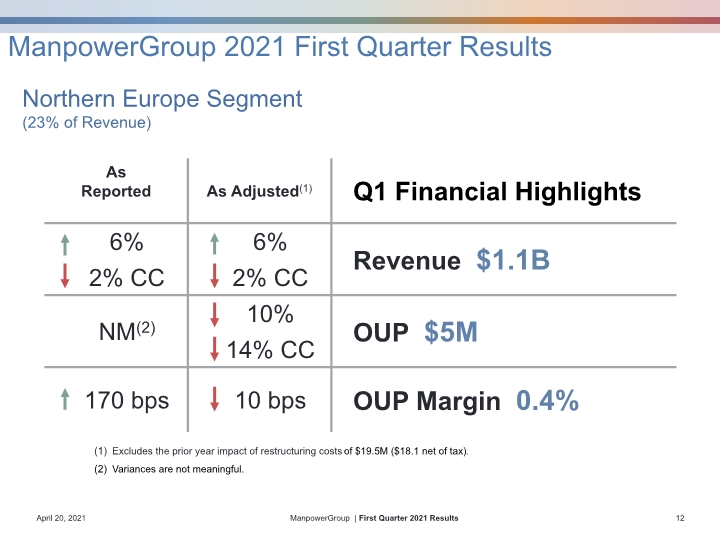

Northern Europe Segment (23% of Revenue) Excludes the prior year impact of restructuring costs of $19.5M ($18.1 net of tax). Variances are not meaningful.

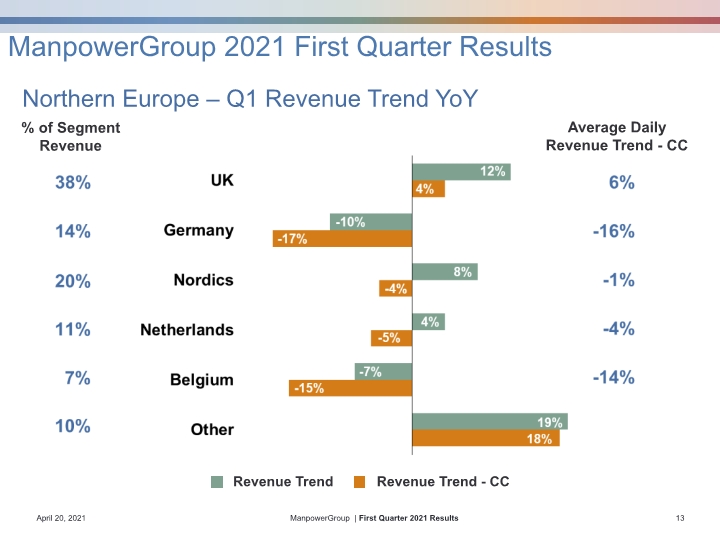

Northern Europe – Q1 Revenue Trend YoY % of Segment Revenue Average Daily Revenue Trend - CC

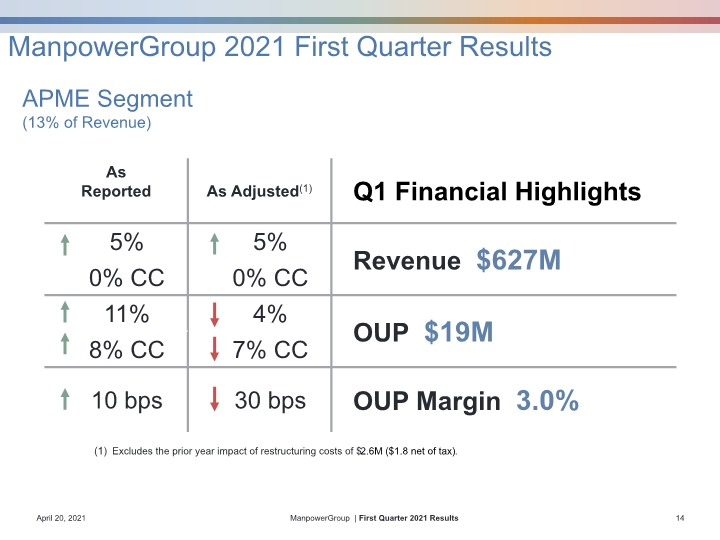

APME Segment (13% of Revenue) Excludes the prior year impact of restructuring costs of $2.6M ($1.8 net of tax).

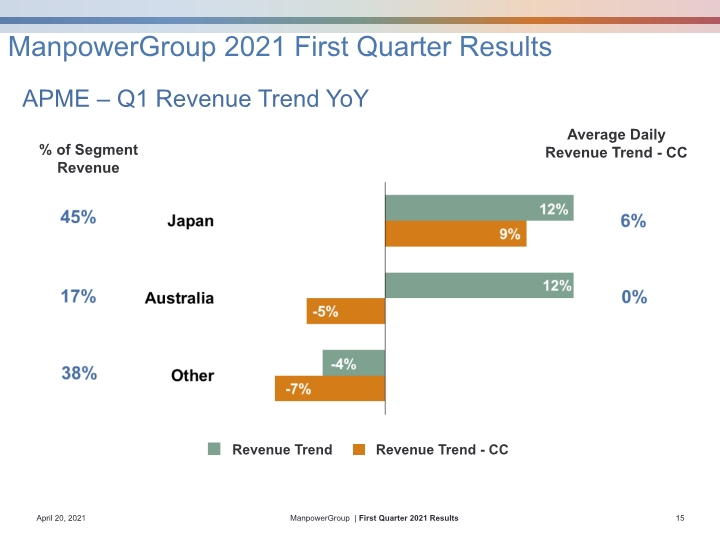

APME – Q1 Revenue Trend YoY % of Segment Revenue Average Daily Revenue Trend - CC (1)

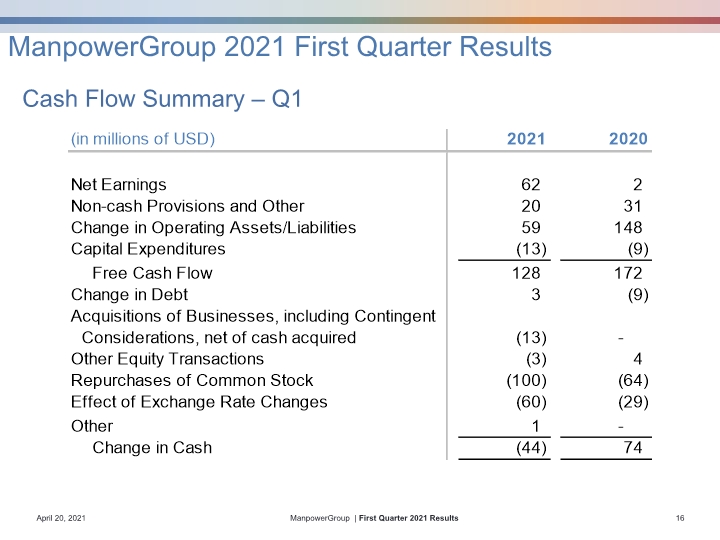

Cash Flow Summary – Q1

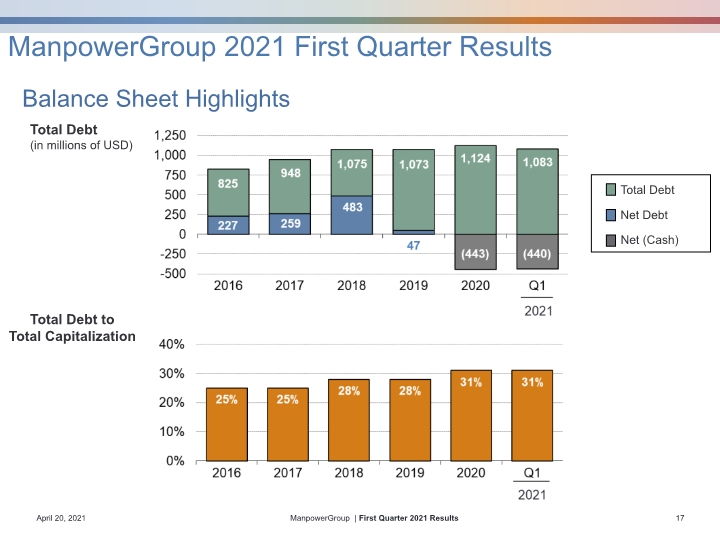

Balance Sheet Highlights Total Debt (in millions of USD) Total Debt to Total Capitalization Net (Cash)

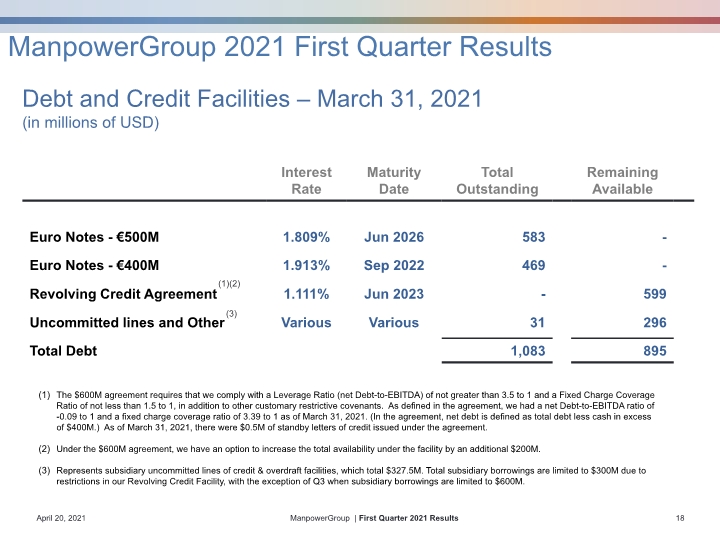

Debt and Credit Facilities – March 31, 2021 (in millions of USD) (3) (1)(2) The $600M agreement requires that we comply with a Leverage Ratio (net Debt-to-EBITDA) of not greater than 3.5 to 1 and a Fixed Charge Coverage Ratio of not less than 1.5 to 1, in addition to other customary restrictive covenants. As defined in the agreement, we had a net Debt-to-EBITDA ratio of -0.09 to 1 and a fixed charge coverage ratio of 3.39 to 1 as of March 31, 2021. (In the agreement, net debt is defined as total debt less cash in excess of $400M.) As of March 31, 2021, there were $0.5M of standby letters of credit issued under the agreement. Under the $600M agreement, we have an option to increase the total availability under the facility by an additional $200M. Represents subsidiary uncommitted lines of credit & overdraft facilities, which total $327.5M. Total subsidiary borrowings are limited to $300M due to restrictions in our Revolving Credit Facility, with the exception of Q3 when subsidiary borrowings are limited to $600M.

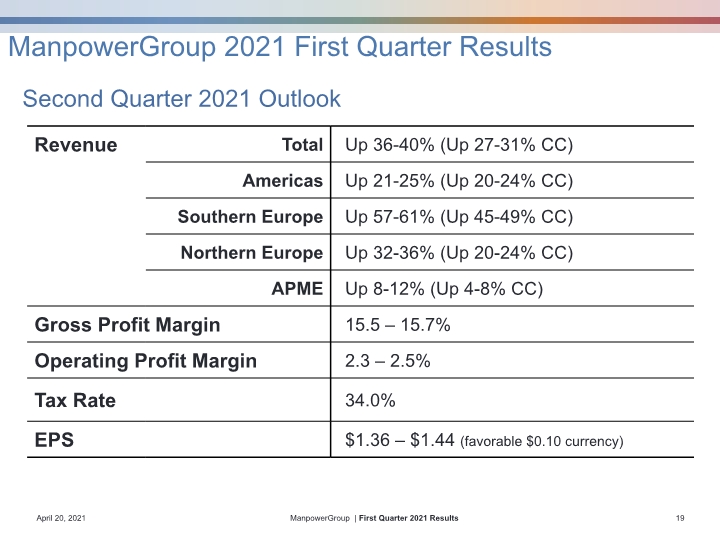

Second Quarter 2021 Outlook

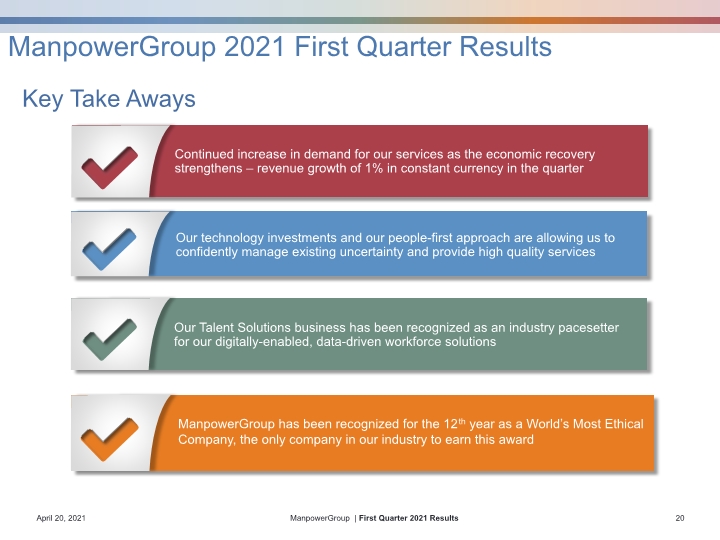

Key Take Aways

Appendix

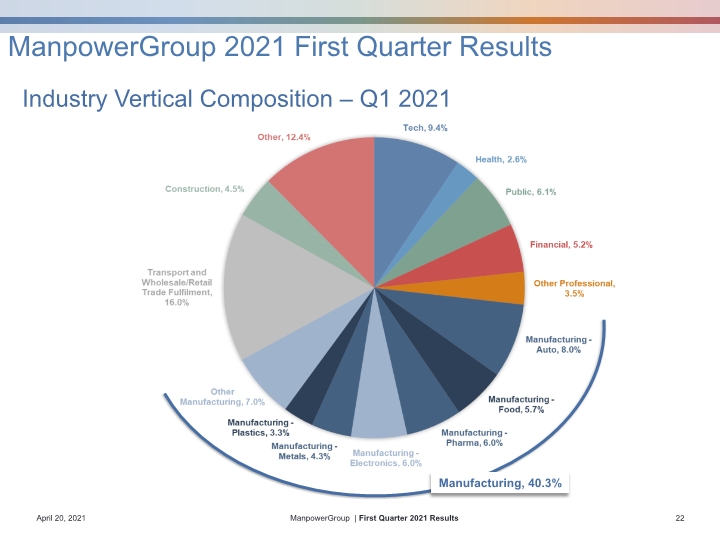

Industry Vertical Composition – Q1 2021 Manufacturing, 40.3%