Attached files

| file | filename |

|---|---|

| 8-K - 8-K - KEYCORP /NEW/ | key-20210420.htm |

| EX-99.3 - EX-99.3 - KEYCORP /NEW/ | a1q21erex993.htm |

| EX-99.1 - EX-99.1 - KEYCORP /NEW/ | a1q21earningsrelease.htm |

KeyCorp First Quarter 2021 Earnings Review April 20, 2021 Chris Gorman Chairman and Chief Executive Officer Don Kimble Vice Chairman and Chief Financial Officer

FORWARD-LOOKING STATEMENTS AND ADDITIONAL INFORMATION This communication contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 including, but not limited to, KeyCorp’s expectations or predictions of future financial or business performance or conditions. Forward-looking statements are typically identified by words such as “believe,” “seek,” “expect,” “anticipate,” “intend,” “target,” “estimate,” “continue,” “positions,” “plan,” “predict,” “project,” “forecast,” “guidance,” “goal,” “objective,” “prospects,” “possible,” “potential,” “strategy,” “opportunities,” or “trends,” by future conditional verbs such as “assume,” “will,” “would,” “should,” “could” or “may”, or by variations of such words or by similar expressions. These forward-looking statements are based on assumptions that involve risks and uncertainties, which are subject to change based on various important factors (some of which are beyond KeyCorp’s control.) Actual results may differ materially from current projections. Actual outcomes may differ materially from those expressed or implied as a result of the factors described under “Forward-looking Statements” and “Risk Factors” in KeyCorp’s Annual Report on Form 10-K for the year ended December 31, 2020 and in other filings of KeyCorp with the Securities and Exchange Commission (the “SEC”). Such forward-looking statements speak only as of the date they are made, and we undertake no obligation to update any forward-looking statement to reflect events or circumstances after that date or to reflect the occurrence of unanticipated events. For additional information regarding KeyCorp, please refer to our SEC filings available at www.key.com/ir. Annualized, pro forma, projected and estimated numbers are used for illustrative purpose only, are not forecasts and may not reflect actual results. This presentation also includes certain non-GAAP financial measures related to “tangible common equity,” “cash efficiency ratio,” and “pre-provision net revenue.” Although Key has procedures in place to ensure that these measures are calculated using the appropriate GAAP or regulatory components, they have limitations as analytical tools and should not be considered in isolation, or as a substitute for analysis of results under GAAP. For more information on these calculations and to view the reconciliations to the most comparable GAAP measures, please refer to the appendix of this presentation, or page 87 of our Form 10-K dated December 31, 2020. GAAP: Generally Accepted Accounting Principles 2

3 1Q21 Highlights Credit Quality & Capital Strong credit quality: nonperforming loans, net cha rge-offs, and criticized loans all down from PQ Strong capital position: CET1 ratio of 9.8% (a) – above targeted range Returned capital to shareholders: − Repurchased $135 MM common shares (under repurchase authorization of up to $900 MM for 1Q21-3Q21) − Maintained dividend of $.185 per common share in 1Q21 Financial Results Positive operating leverage compared to the PY, dri ven by record first quarter revenue (+19% YoY) − All-time high first quarter for investment banking and debt placement fees of $162 MM − Consumer mortgage income of $47 MM, up 135% from 1Q20 Strong consumer loan originations − Record $3 B of consumer mortgage funded volume and $475 MM of production from Laurel Road Return on average tangible common equity of 18.2% i n 1Q21 (a) 3/31/21 ratio is estimated Strategy Execution Broad-based growth across the franchise − Continued growth in retail households and commercial clients − Raised $13 B capital for commercial clients in 1Q21; <20% retained on balance sheet Successful launch of national digital bank: Laurel Road for Doctors Acquired AQN Strategies: leading customer-focused analytics firm underscores commitment to data-driven approach Balancing physical infrastructure with digital deli very: ~70 branches identified for consolidation

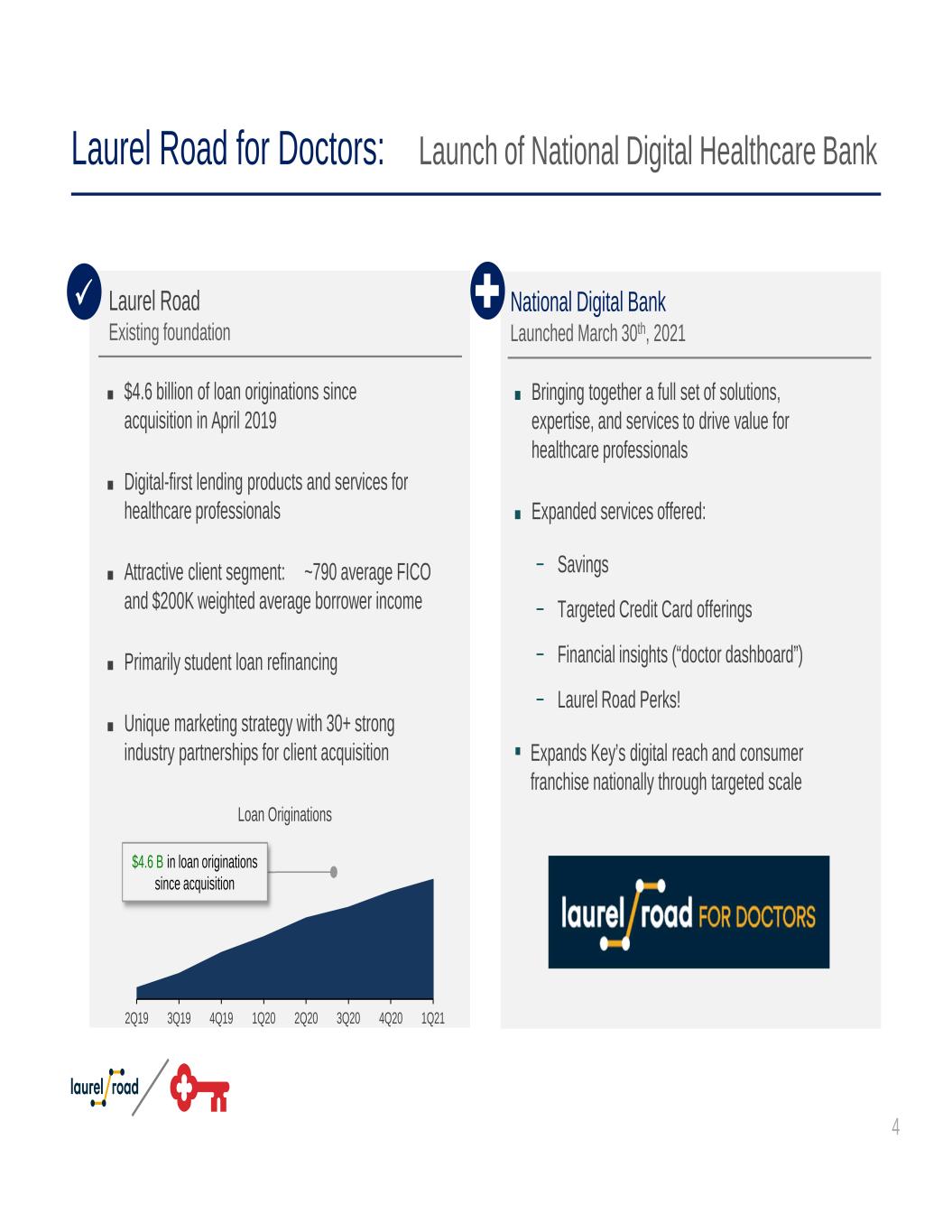

4 Laurel Road for Doctors: Launch of National Digital Healthcare Bank Laurel Road Existing foundation National Digital Bank Launched March 30th, 2021 ■ $4.6 billion of loan originations since acquisition in April 2019 ■ Digital-first lending products and services for healthcare professionals ■ Attractive client segment: ~790 average FICO and $200K weighted average borrower income ■ Primarily student loan refinancing ■ Unique marketing strategy with 30+ strong industry partnerships for client acquisition ■ Bringing together a full set of solutions, expertise, and services to drive value for healthcare professionals ■ Expanded services offered: − Savings − Targeted Credit Card offerings − Financial insights (“doctor dashboard”) − Laurel Road Perks! Expands Key’s digital reach and consumer franchise nationally through targeted scale Loan Originations 2Q19 3Q19 4Q19 1Q20 2Q20 3Q20 4Q20 1Q21 $4.6 B in loan originations since acquisition

Financial Review 5

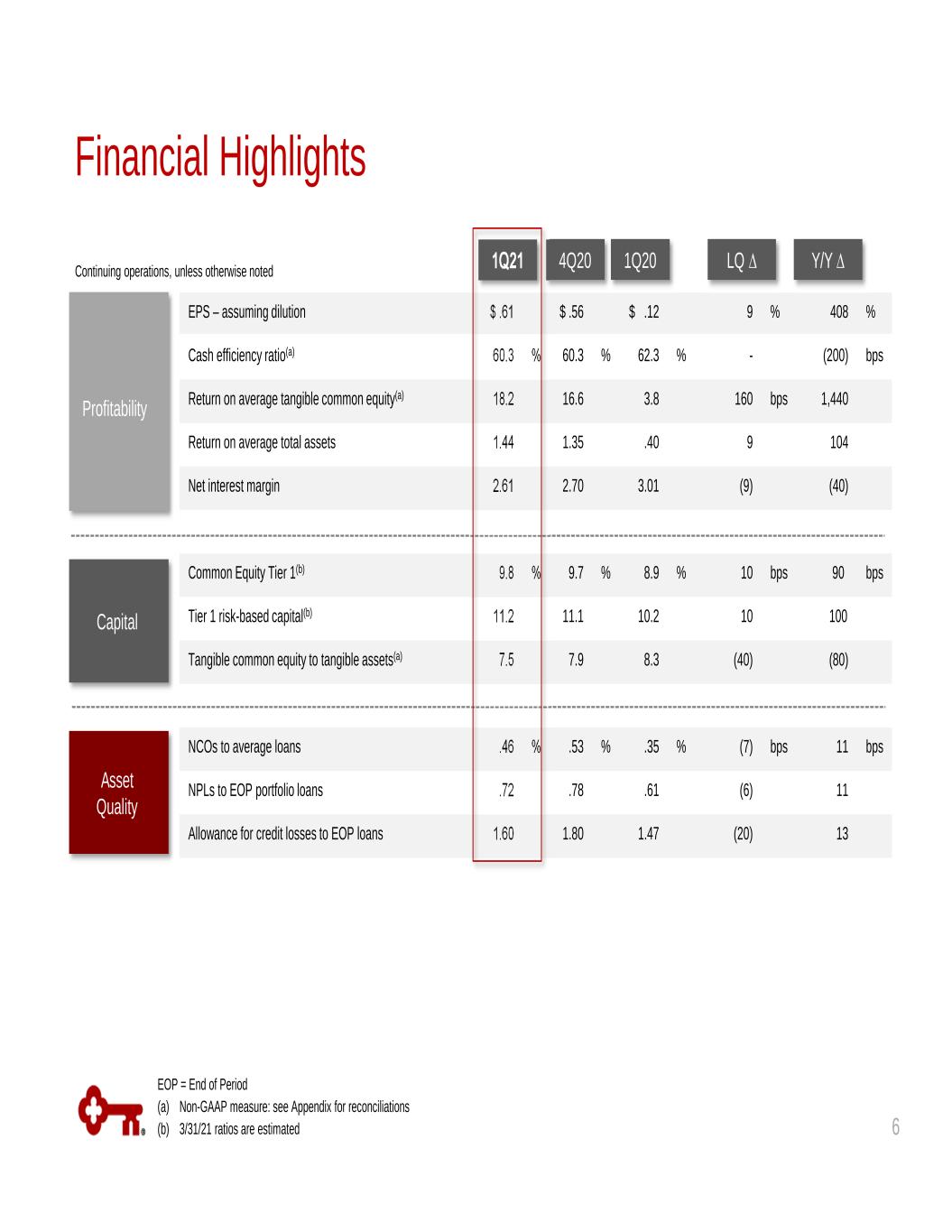

Financial Highlights EOP = End of Period (a) Non-GAAP measure: see Appendix for reconciliations (b) 3/31/21 ratios are estimated EPS – assuming dilution $ .61 $ .56 $ .12 9 % 408 % Cash efficiency ratio(a) 60.3 % 60.3 % 62.3 % - (200) bps Return on average tangible common equity(a) 18.2 16.6 3.8 160 bps 1,440 Return on average total assets 1.44 1.35 .40 9 104 Net interest margin 2.61 2.70 3.01 (9) (40) Common Equity Tier 1(b) 9.8 % 9.7 % 8.9 % 10 bps 90 bps Tier 1 risk-based capital(b) 11.2 11.1 10.2 10 100 Tangible common equity to tangible assets(a) 7.5 7.9 8.3 (40) (80) NCOs to average loans .46 % .53 % .35 % (7) bps 11 bps NPLs to EOP portfolio loans .72 .78 .61 (6) 11 Allowance for credit losses to EOP loans 1.60 1.80 1.47 (20) 13 Asset Quality Profitability Continuing operations, unless otherwise noted 1Q21 4Q20 1Q20 LQ ∆ Y/Y ∆ Capital 6

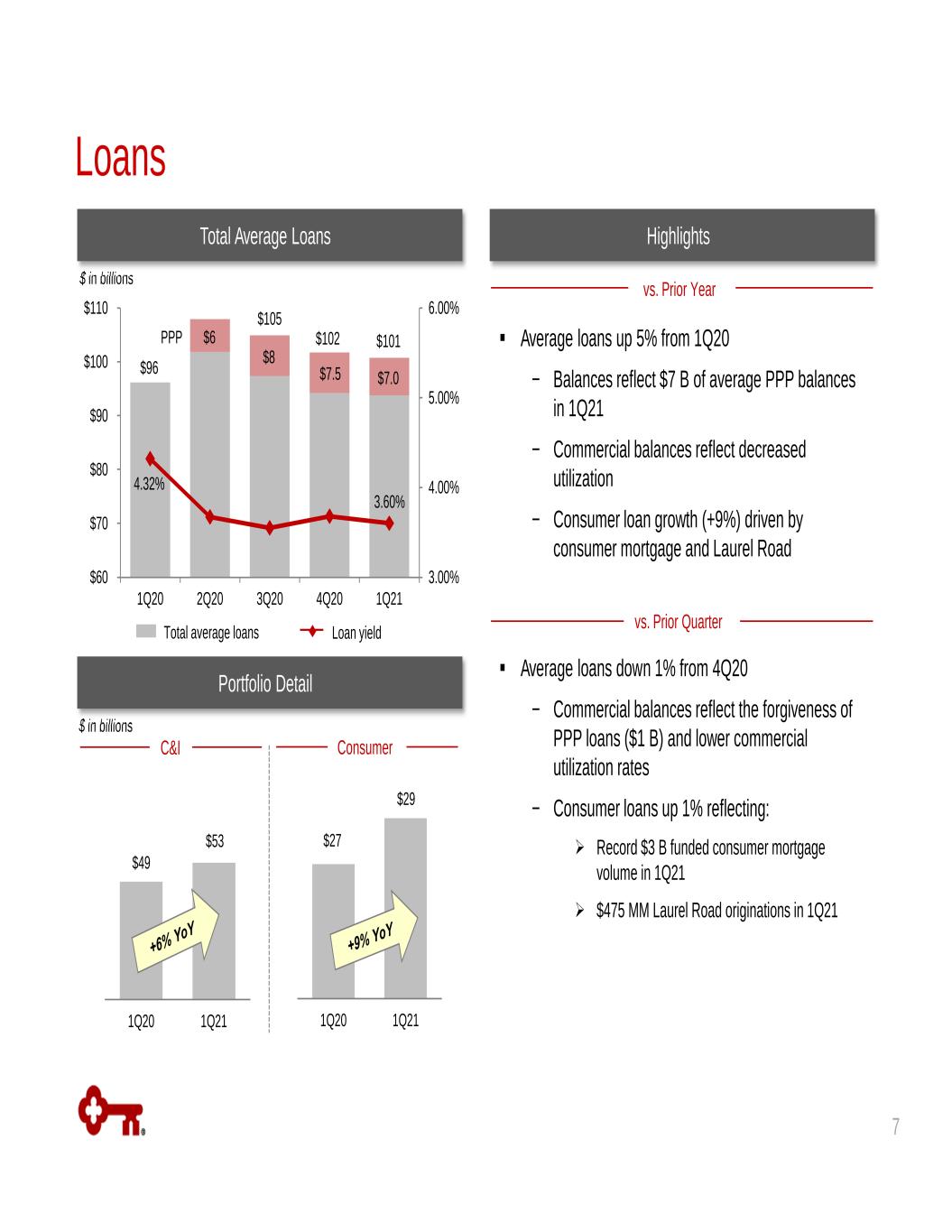

Loans $ in billions vs. Prior Year Total Average Loans Highlights Average loans up 5% from 1Q20 − Balances reflect $7 B of average PPP balances in 1Q21 − Commercial balances reflect decreased utilization − Consumer loan growth (+9%) driven by consumer mortgage and Laurel Road vs. Prior Quarter Average loans down 1% from 4Q20 − Commercial balances reflect the forgiveness of PPP loans ($1 B) and lower commercial utilization rates − Consumer loans up 1% reflecting: Record $3 B funded consumer mortgage volume in 1Q21 $475 MM Laurel Road originations in 1Q21 $ in billions Portfolio Detail $96 4.32% 3.60% 3.00% 4.00% 5.00% 6.00% $60 $70 $80 $90 $100 $110 1Q20 2Q20 3Q20 4Q20 1Q21 Loan yieldTotal average loans $49 $53 1Q20 1Q21 ConsumerC&I $27 $29 1Q20 1Q21 PPP $6 $105 $8 7 $102 $7.5 $101 $7.0

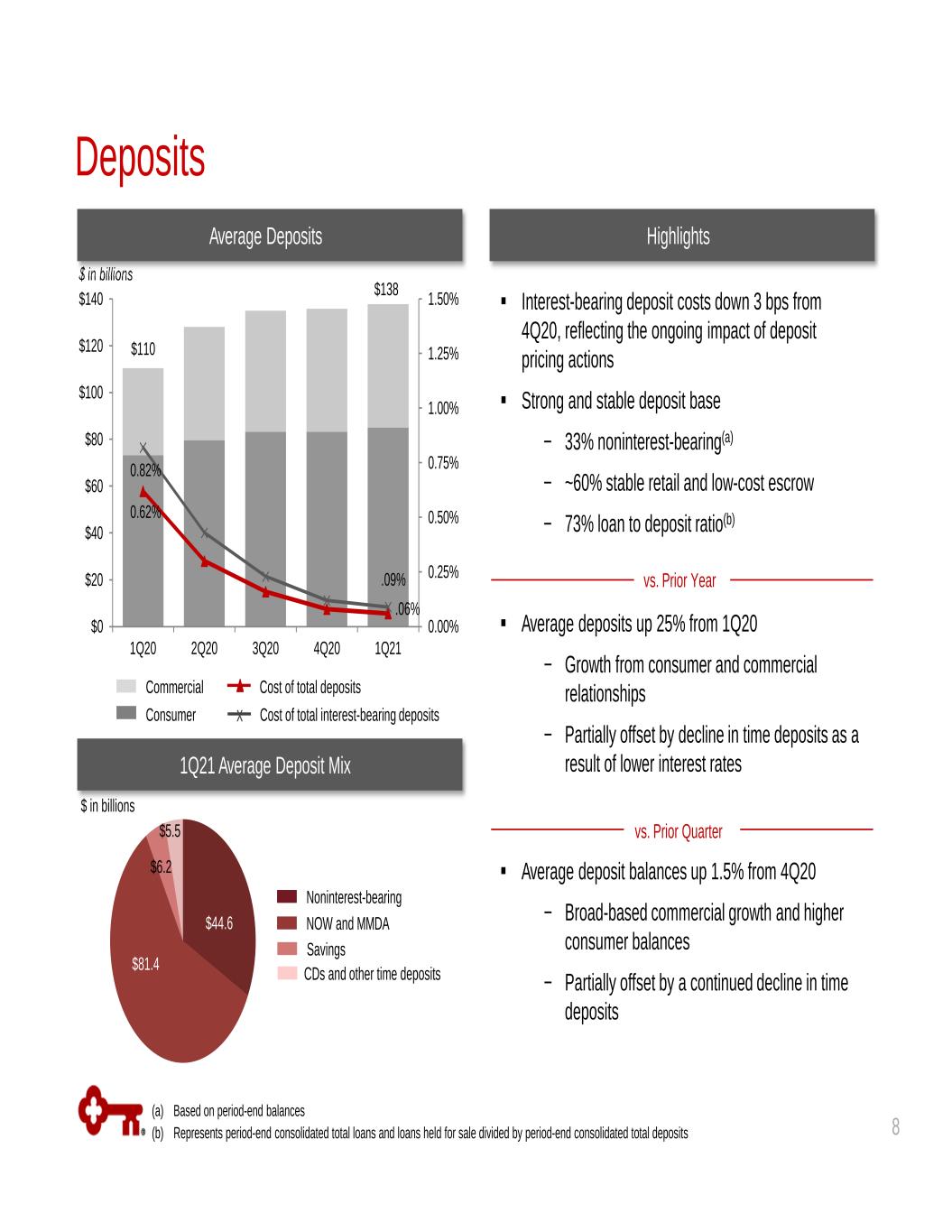

$44.6 $81.4 $6.2 $5.5 0.62% 0.82% 0.00% 0.25% 0.50% 0.75% 1.00% 1.25% 1.50% $0 $20 $40 $60 $80 $100 $120 $140 1Q20 2Q20 3Q20 4Q20 1Q21 Cost of total interest-bearing deposits Average deposit balances up 1.5% from 4Q20 − Broad-based commercial growth and higher consumer balances − Partially offset by a continued decline in time deposits 1Q21 Average Deposit Mix Average deposits up 25% from 1Q20 − Growth from consumer and commercial relationships − Partially offset by decline in time deposits as a result of lower interest rates Cost of total deposits CDs and other time deposits Savings Noninterest-bearing NOW and MMDA $ in billions $ in billions vs. Prior Year vs. Prior Quarter Consumer Commercial $110 .09% Average Deposits Highlights $138 .06% Interest-bearing deposit costs down 3 bps from 4Q20, reflecting the ongoing impact of deposit pricing actions Strong and stable deposit base − 33% noninterest-bearing(a) − ~60% stable retail and low-cost escrow − 73% loan to deposit ratio(b) (a) Based on period-end balances (b) Represents period-end consolidated total loans and loans held for sale divided by period-end consolidated total deposits x 8 Deposits

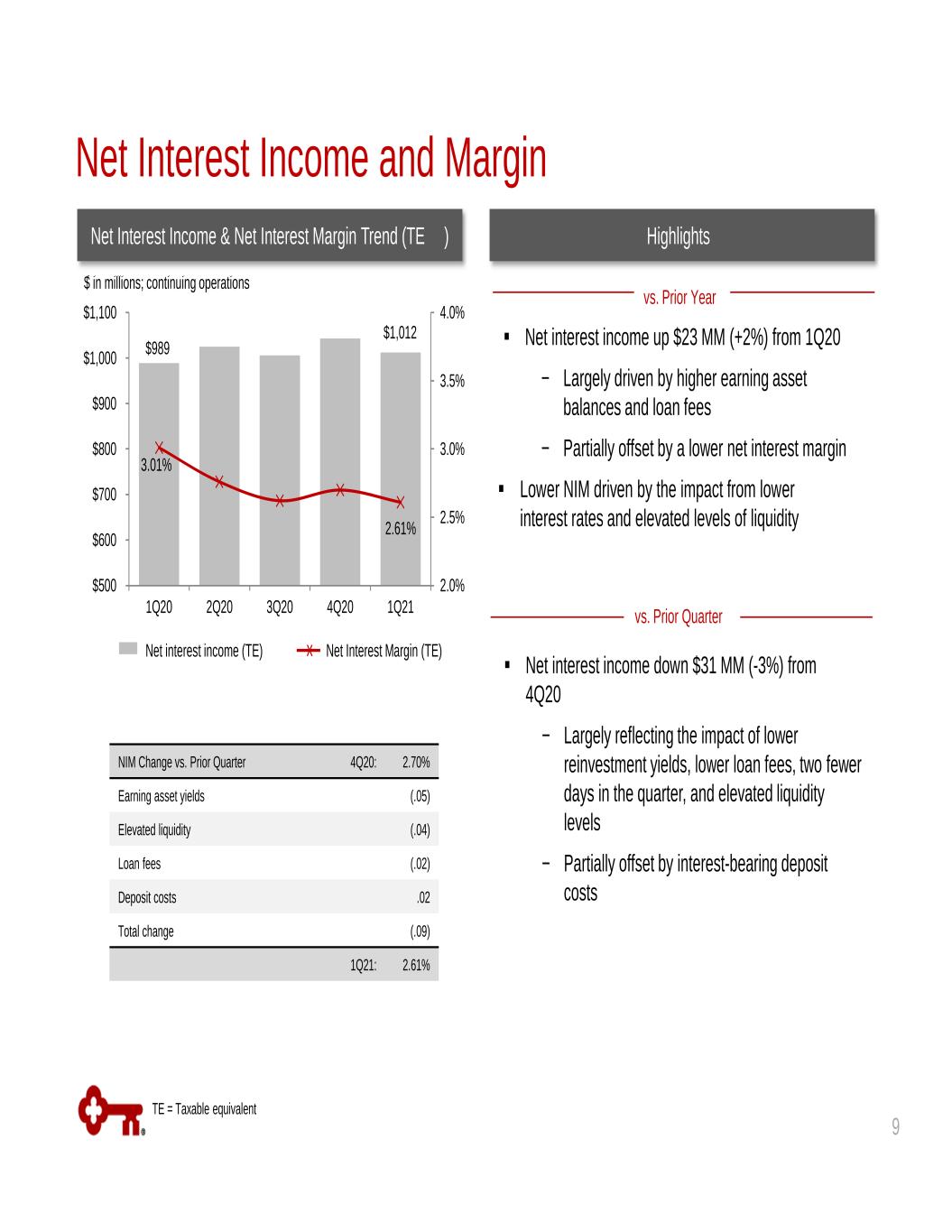

3.01% 2.61% 2.0% 2.5% 3.0% 3.5% 4.0% $500 $600 $700 $800 $900 $1,000 $1,100 1Q20 2Q20 3Q20 4Q20 1Q21 Net interest income down $31 MM (-3%) from 4Q20 − Largely reflecting the impact of lower reinvestment yields, lower loan fees, two fewer days in the quarter, and elevated liquidity levels − Partially offset by interest-bearing deposit costs TE = Taxable equivalent Net interest income (TE) Net Interest Margin (TE) Net Interest Income and Margin $ in millions; continuing operations vs. Prior Year vs. Prior Quarter $989 $1,012 Net Interest Income & Net Interest Margin Trend (TE ) Highlights x NIM Change vs. Prior Quarter 4Q20: 2.70% Earning asset yields (.05) Elevated liquidity (.04) Loan fees (.02) Deposit costs .02 Total change (.09) 1Q21: 2.61% Net interest income up $23 MM (+2%) from 1Q20 − Largely driven by higher earning asset balances and loan fees − Partially offset by a lower net interest margin Lower NIM driven by the impact from lower interest rates and elevated levels of liquidity 9

Noninterest income up $261 MM (+55%) from 1Q20 − Record first quarter of investment banking and debt placement fees (+$46 MM) − Investments made in Key’s mortgage business drove higher consumer mortgage income (+$27 MM) − Increase in cards and payments income (+$39 MM) driven by higher prepaid card activity − Other income (+$139 MM) included $92 MM of market-related valuation adjustments in 1Q20 Noninterest Income Noninterest Income Noninterest income down $64 MM (-8%) from 4Q20 − Lower investment banking and debt placement fees (-$81 MM) compared to all-time high ($243 MM) in 4Q20 − Partially offset by strong trust and investment services income (+$10 MM) and cards and payments income (+$8 MM) vs. Prior Year vs. Prior Quarter Highlights $ in millions up / (down) 1Q21 vs. 1Q20 vs. 4Q20 Trust and investment services income $ 133 $ - $ 10 Investment banking and debt placement fees 162 46 (81) Service charges on deposit accounts 73 (11) (9) Operating lease income and other leasing gains 38 8 (1) Corporate services income 64 2 1 Cards and payments income 105 39 8 Corporate-owned life insurance 31 (5) (7) Consumer mortgage income 47 27 4 Commercial mortgage servicing fees 34 16 2 Other income 51 139 9 Total noninterest income $ 738 $ 261 $ (64) 10

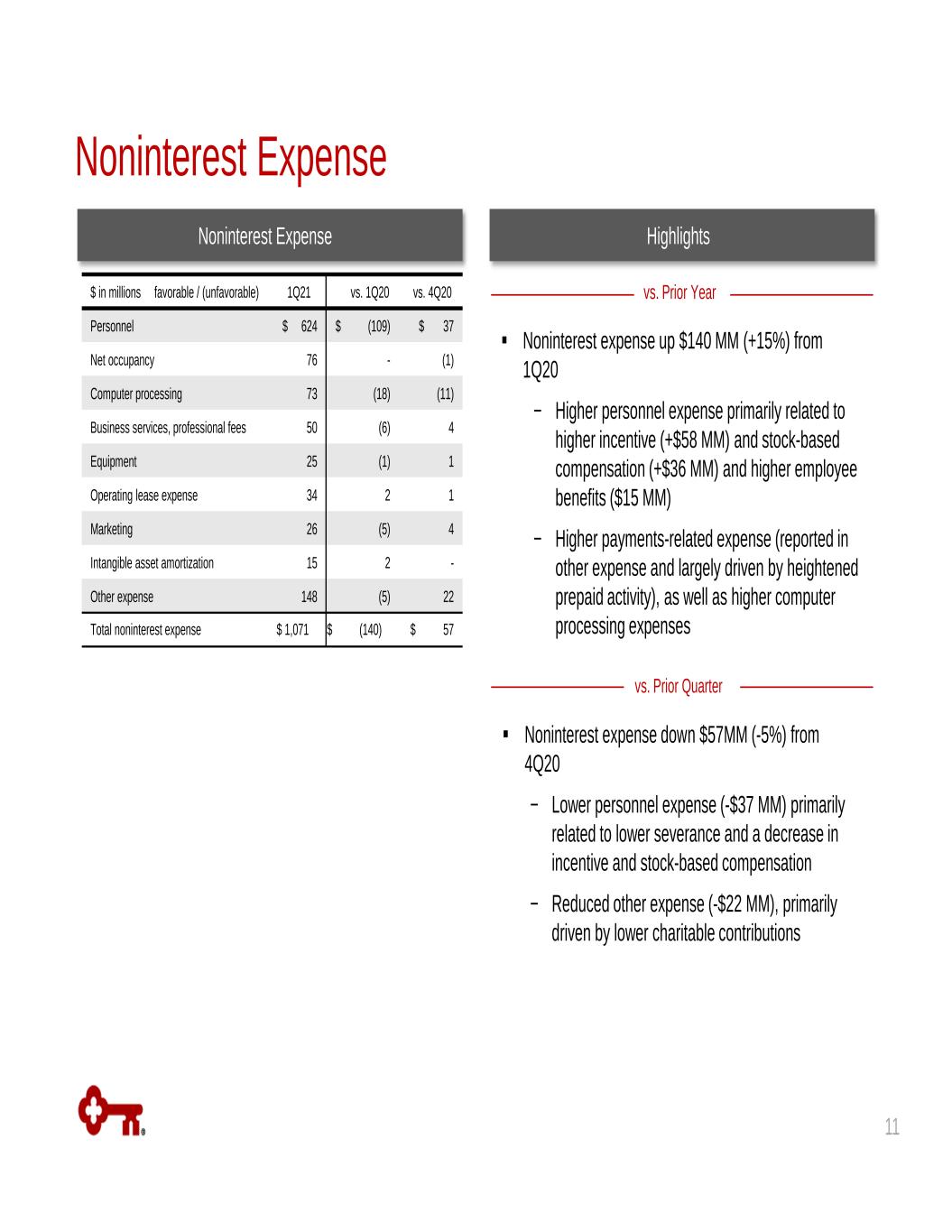

Noninterest Expense vs. Prior Year vs. Prior Quarter Noninterest Expense Highlights $ in millions favorable / (unfavorable) 1Q21 vs. 1Q20 vs. 4Q20 Personnel $ 624 $ (109) $ 37 Net occupancy 76 - (1) Computer processing 73 (18) (11) Business services, professional fees 50 (6) 4 Equipment 25 (1) 1 Operating lease expense 34 2 1 Marketing 26 (5) 4 Intangible asset amortization 15 2 - Other expense 148 (5) 22 Total noninterest expense $ 1,071 $ (140) $ 57 Noninterest expense up $140 MM (+15%) from 1Q20 − Higher personnel expense primarily related to higher incentive (+$58 MM) and stock-based compensation (+$36 MM) and higher employee benefits ($15 MM) − Higher payments-related expense (reported in other expense and largely driven by heightened prepaid activity), as well as higher computer processing expenses Noninterest expense down $57MM (-5%) from 4Q20 − Lower personnel expense (-$37 MM) primarily related to lower severance and a decrease in incentive and stock-based compensation − Reduced other expense (-$22 MM), primarily driven by lower charitable contributions 11

$84 $359 .35% .00% .20% .40% .60% .80% 1.00% ($100) $0 $100 $200 $300 $400 $500 1Q20 2Q20 3Q20 4Q20 1Q21 $ in millions Credit Quality $ in millions NCOs Provision for credit losses NCOs to avg loans $632 $728 .61% .72% .00% .40% .80% 1.20% 1.60% 2.00% $0 $300 $600 $900 1Q20 2Q20 3Q20 4Q20 1Q21 NPLs NPLs to period-end loans NCO = Net charge-off $1,520 $1,616 241% 222% 100% 150% 200% 250% 300% 350% 400% $0 $500 $1,000 $1,500 $2,000 $2,500 1Q20 2Q20 3Q20 4Q20 1Q21 Allowance for credit losses to NPLs Allowance for credit losses Nonperforming Loans 1Q21 allowance for credit losses to period-end loans of 1.60% (excl. PPP 1.71%) Allowance for Credit Losses (ACL) Net Charge-offs & Provision for Credit Losses $ in millions .46% $(93) $114 12

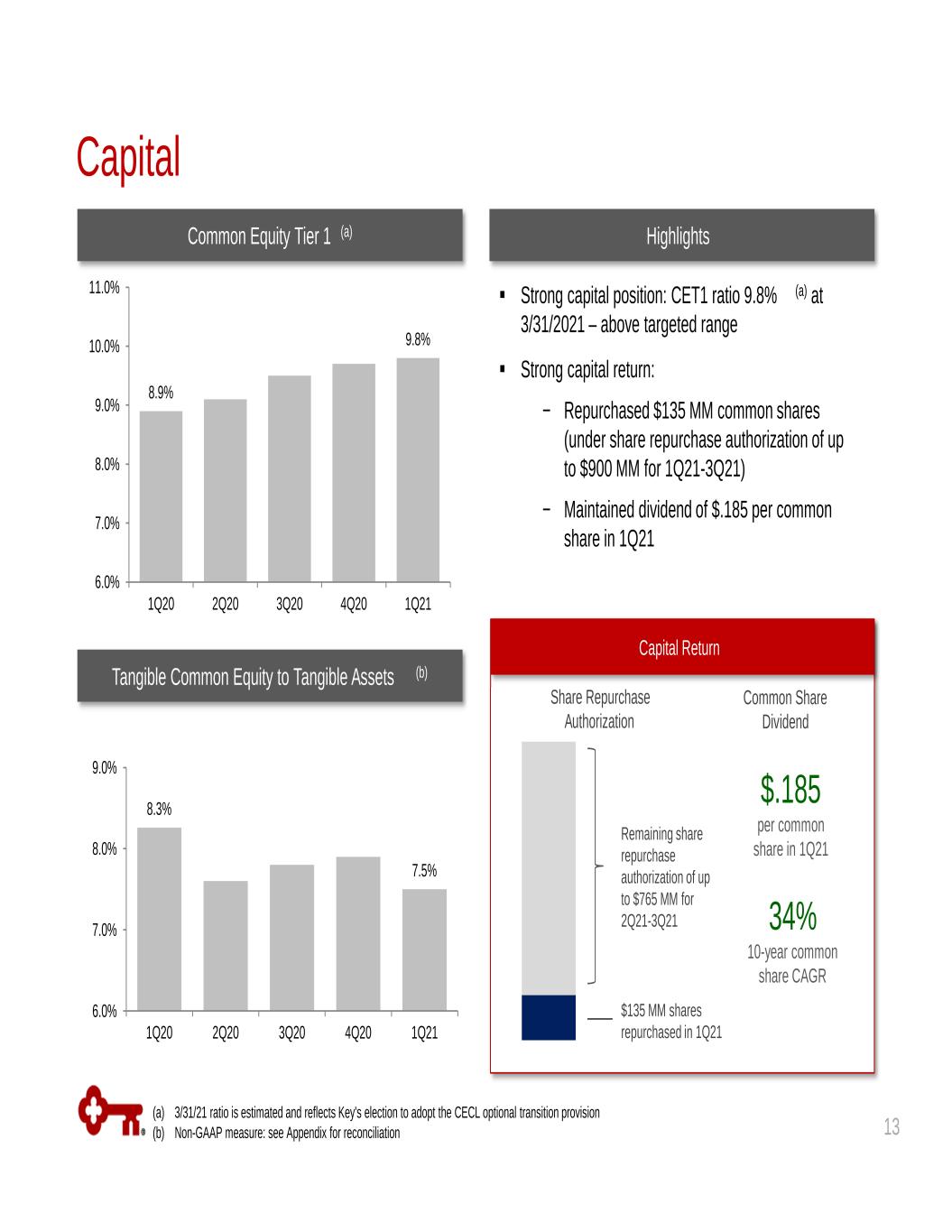

Common Equity Tier 1 (a) Strong capital position: CET1 ratio 9.8% (a) at 3/31/2021 – above targeted range Strong capital return: − Repurchased $135 MM common shares (under share repurchase authorization of up to $900 MM for 1Q21-3Q21) − Maintained dividend of $.185 per common share in 1Q21 Tangible Common Equity to Tangible Assets (b) (a) 3/31/21 ratio is estimated and reflects Key's election to adopt the CECL optional transition provision (b) Non-GAAP measure: see Appendix for reconciliation 8.9% 9.8% 6.0% 7.0% 8.0% 9.0% 10.0% 11.0% 1Q20 2Q20 3Q20 4Q20 1Q21 8.3% 7.5% 6.0% 7.0% 8.0% 9.0% 1Q20 2Q20 3Q20 4Q20 1Q21 Capital Highlights 13 Share Repurchase Authorization Remaining share repurchase authorization of up to $765 MM for 2Q21-3Q21 $135 MM shares repurchased in 1Q21 Capital Return Common Share Dividend $.185 per common share in 1Q21 34% 10-year common share CAGR

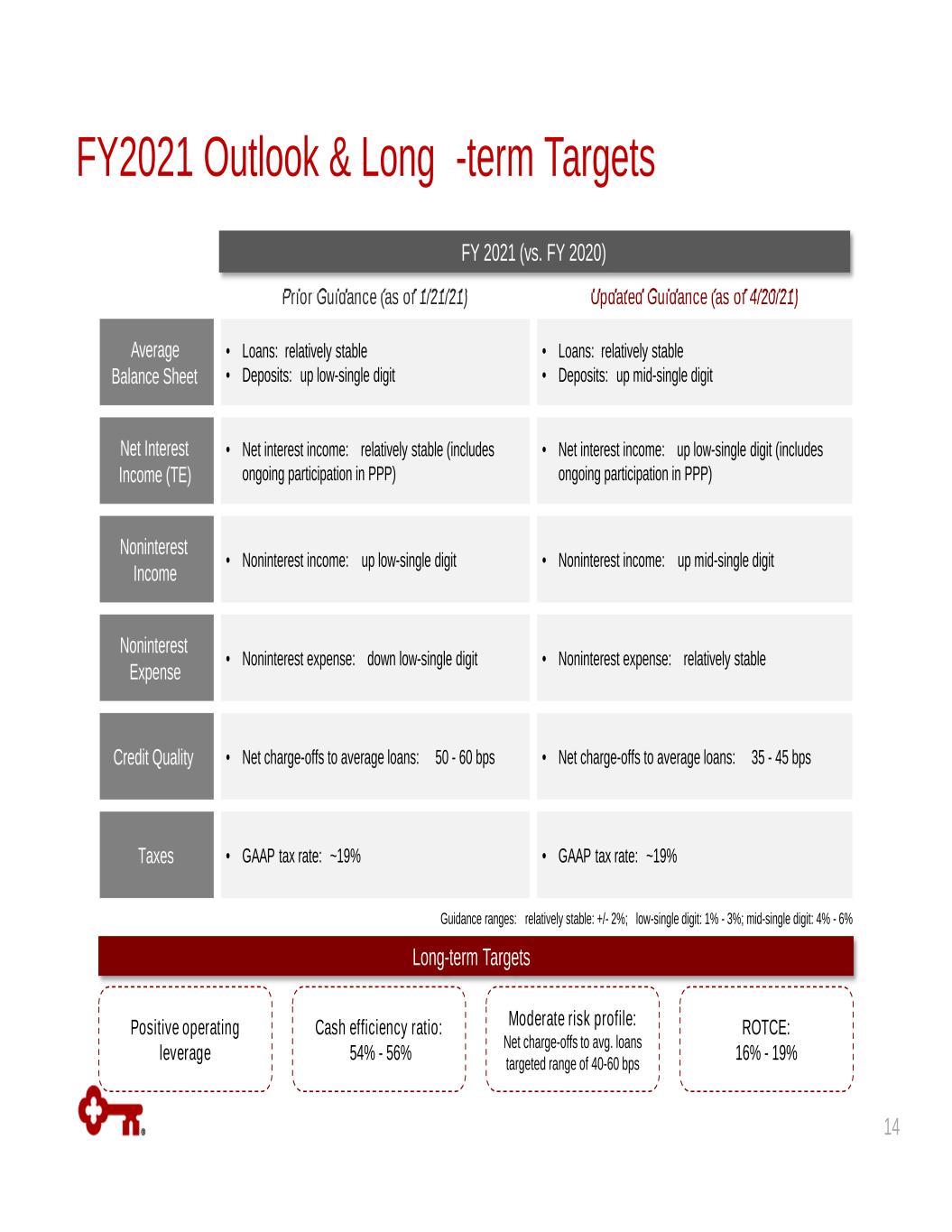

FY2021 Outlook & Long -term Targets Average Balance Sheet • Loans: relatively stable • Deposits: up low-single digit • Loans: relatively stable • Deposits: up mid-single digit Net Interest Income (TE) • Net interest income: relatively stable (includes ongoing participation in PPP) • Net interest income: up low-single digit (includes ongoing participation in PPP) Noninterest Income • Noninterest income: up low-single digit • Noninterest income: up mid-single digit Noninterest Expense • Noninterest expense: down low-single digit • Noninterest expense: relatively stable Credit Quality • Net charge-offs to average loans: 50 - 60 bps • Net charge-offs to average loans: 35 - 45 bps Taxes • GAAP tax rate: ~19% • GAAP tax rate: ~19% Long-term Targets Positive operating leverage Cash efficiency ratio: 54% - 56% Moderate risk profile: Net charge-offs to avg. loans targeted range of 40-60 bps ROTCE: 16% - 19% Guidance ranges: relatively stable: +/- 2%; low-single digit: 1% - 3%; mid-single digit: 4% - 6% 14 Prior Guidance (as of 1/21/21) Updated Guidance (as of 4/20/21) FY 2021 (vs. FY 2020)

Appendix 15

Total Commercial Loans C&I $40 CRE $18 $ in billions 3/31/21 % of total loans Commercial and industrial $ 52.5 52 Commercial real estate 14.8 15 Commercial lease financing 4.1 4 Total Commercial $ 71.4 71% Commercial Loan Portfolio Detail Solid middle market portfolio Aligning bankers to areas of market opportunity and growth - investing in strategic hires with industry vertical expertise High-quality borrowers Small, stable leveraged portfolio: <2% of total loans Portfolio Highlights Target specific client segments focused in 7 industry verticals Experienced bankers with deep industry expertise Focused on high quality clients Credit quality metrics remain strong and stable − Disciplined, consistent underwriting − Active surveillance with ongoing portfolio reviews − Dynamic assessment of ratings migration Strengthened credit risk profile with strategic exits and growth in targeted client segments to focus on relationships Significantly scaled back construction portfolio from pre- recession (42% in 2008 14% in 2021) Focused on relationships with owners and operators Strategic focus in CDLI and multifamily Commercial Real Estate (CRE) Commercial & Industrial (C&I) Consumer Energy Healthcare Industrial Public Sector Real Estate Technology Targeted Industry Verticals ~80% commercial bank credit exposure from relationship(a) clients (a) Relationship client is defined as having two or more of the following: credit, capital markets, or payments 16

$1.3 $2.2 $2.3 $2.5 $3.0 1Q20 2Q20 3Q20 4Q20 1Q21 Origination Volume $611 $706 $419 $590 $475 1Q20 2Q20 3Q20 4Q20 1Q21 Origination Volume Portfolio Highlights Prime & super prime client base focused on relationships Continued consumer originations bring more balance to portfolio Continuing to invest in digital to drive future growth weighted average FICO at origination Total Consumer Loans Consumer Loan Portfolio Detail C&I $40 CRE $18 $ in billions 3/31/21 % of total loans WA FICO at origination Consumer mortgage 10.3 10 770 Home equity 9.1 9 808 Consumer direct 4.9 5 790 Credit card 0.9 1 799 Consumer indirect 4.3 4 754(a) Total Consumer $ 29.5 29% 779 $ in millions East Other $ in billions High-quality client base: primarily healthcare professionals − Weighted average FICO at origination: ~790 − Weighted average borrower income: >$200 K Launched Laurel Road for Doctors on 3/30/21: expands Key’s digital reach and consumer franchise nationally through targeted scale Focused on prime/super-prime clients (FICO: 770) Investing in digital capabilities to enhance client experience and improve efficiency Continued momentum with record loan originations of $3 B in 1Q21 and $8.3 B in FY20 Laurel Road Consumer Mortgage Other East Other 779 17 (a) Indirect auto originations ceased in 4Q20; FICO score represents weighted average of remaining portfolio in 1Q21

Average Total Investment Securities Average AFS securities Investment Portfolio Average yield(a) Average HTM securities $ in billions Highlights 2.51% .50% 1.00% 1.50% 2.00% 2.50% 3.00% $0.0 $8.0 $16.0 $24.0 $32.0 $40.0 2Q19 3Q19 4Q19 1Q20 2Q20 3Q20 4Q20 1Q21 $31.0 $37.2 1.91% Securities Cash Flows (b) as a % of Total Securities Securities cash flows as a % of total securities(b) Mortgage rate(c) (a) Yield is calculated on the basis of amortized cost (b) Quarterly cash flows (c) Average 30-year Freddie Mac fixed mortgage rate Portfolio used for funding and liquidity management ‒ Portfolio composed primarily of fixed-rate GNMA and GSE-backed MBS and CMOs ‒ Portfolio yield excluding short-term Treasury investments was 2.03% Excess cash was put to work in portfolio in 1Q21 ‒ Invested in higher yielding Agency Mortgage Securities and Treasuries during the quarter (ending balance +$6.5 B) ‒ Continue to evaluate alternatives to deploy additional excess cash into securities while also maintaining flexibility to capitalize on higher interest rates as the economy continues to recover Strategically positioned the portfolio allocation t o provide greater yield stability in a lower interest rate environment: ‒ Grew allocation to bullet-like or locked-out cash flow securities backed by commercial mortgages ‒ Focused on investing in securities backed by residential and multi-family mortgage collateral with lower prepayment risks ‒ Limited exposure to net unamortized premiums on mortgage securities ‒ Quarterly mortgage security cash flows as a % of the portfolio increased a modest 4% with mortgage rates at historic lows Portfolio average life of 5.9 years and duration of 5.7 years at 3/31/2021(4.6 year duration including secu rities hedges) 18 3% 4% 4% 5% 5% 7% 8% 8% 8% 4.4% 4.0% 3.7% 3.7% 3.5% 3.3% 3.0% 2.8% 2.9% 0.0% 1.0% 2.0% 3.0% 4.0% 5.0% 0.0% 2.0% 4.0% 6.0% 8.0% 10.0% 12.0% 14.0% 16.0% 1Q19 2Q19 3Q19 4Q19 1Q20 2Q20 3Q20 4Q20 1Q21

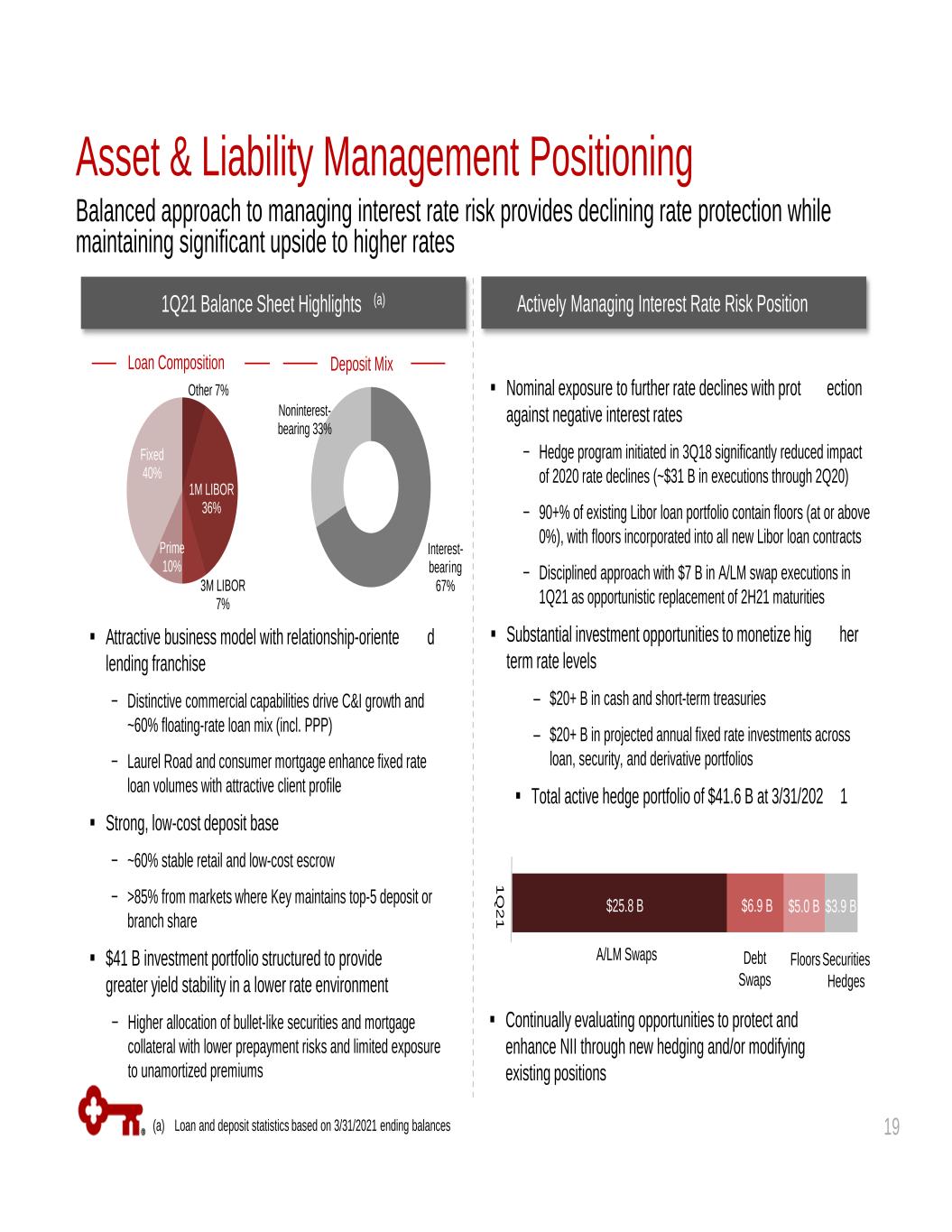

Prime 10% 1M LIBOR 36% 3M LIBOR 7% Other 7% Fixed 40% Balanced approach to managing interest rate risk provides declining rate protection while maintaining significant upside to higher rates 1Q21 Balance Sheet Highlights (a) Loan Composition Deposit Mix Attractive business model with relationship-oriente d lending franchise − Distinctive commercial capabilities drive C&I growth and ~60% floating-rate loan mix (incl. PPP) − Laurel Road and consumer mortgage enhance fixed rate loan volumes with attractive client profile Strong, low-cost deposit base − ~60% stable retail and low-cost escrow − >85% from markets where Key maintains top-5 deposit or branch share $41 B investment portfolio structured to provide greater yield stability in a lower rate environment − Higher allocation of bullet-like securities and mortgage collateral with lower prepayment risks and limited exposure to unamortized premiums Actively Managing Interest Rate Risk Position Nominal exposure to further rate declines with prot ection against negative interest rates − Hedge program initiated in 3Q18 significantly reduced impact of 2020 rate declines (~$31 B in executions through 2Q20) − 90+% of existing Libor loan portfolio contain floors (at or above 0%), with floors incorporated into all new Libor loan contracts − Disciplined approach with $7 B in A/LM swap executions in 1Q21 as opportunistic replacement of 2H21 maturities Substantial investment opportunities to monetize hig her term rate levels ‒ $20+ B in cash and short-term treasuries ‒ $20+ B in projected annual fixed rate investments across loan, security, and derivative portfolios Total active hedge portfolio of $41.6 B at 3/31/202 1 (a) Loan and deposit statistics based on 3/31/2021 ending balances Continually evaluating opportunities to protect and enhance NII through new hedging and/or modifying existing positions Interest- bearing 67% Noninterest- bearing 33% 19 Asset & Liability Management Positioning FloorsA/LM Swaps Debt Swaps 1 Q 2 1 $25.8 B $6.9 B $5.0 B $3.9 B Securities Hedges

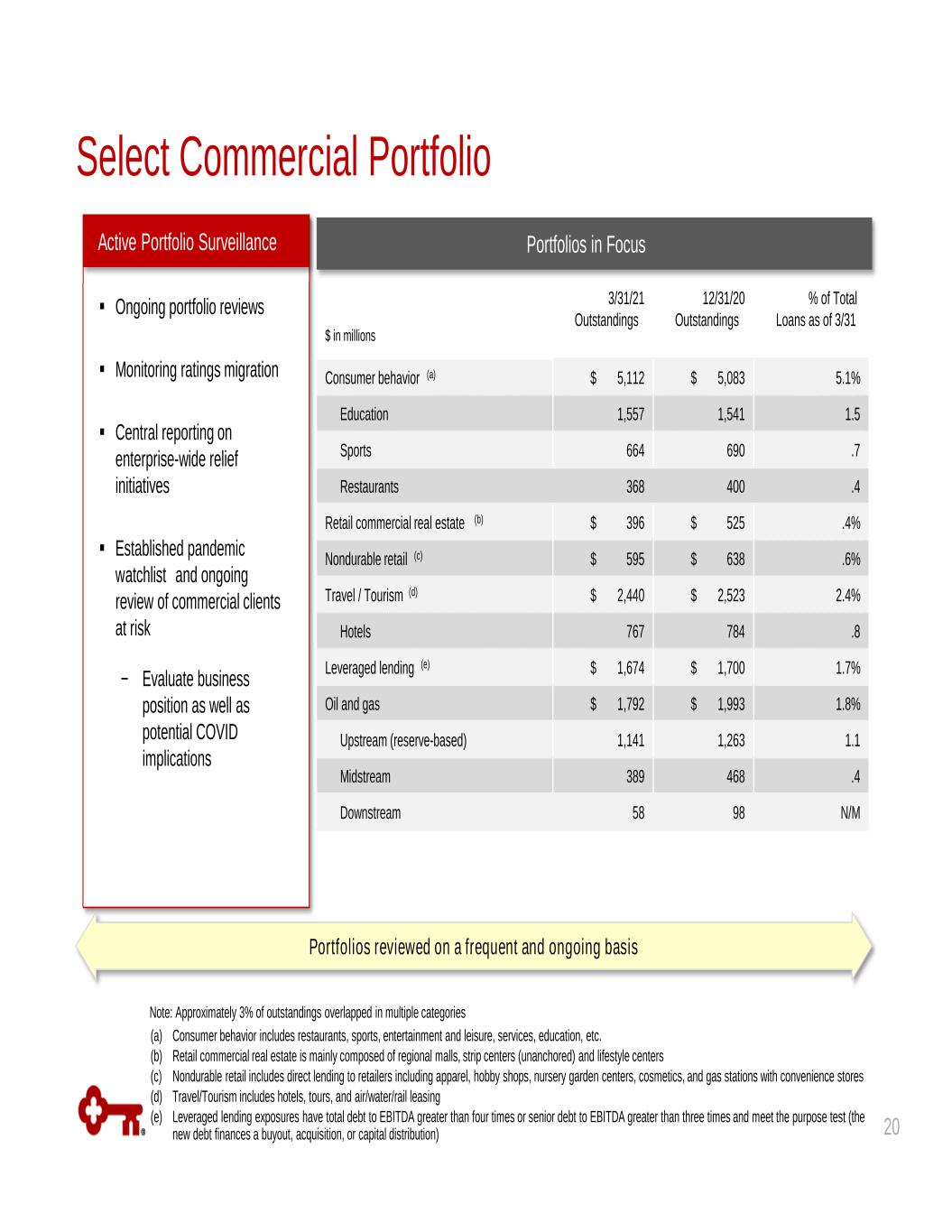

Portfolios in Focus Ongoing portfolio reviews Monitoring ratings migration Central reporting on enterprise-wide relief initiatives Established pandemic watchlist and ongoing review of commercial clients at risk − Evaluate business position as well as potential COVID implications Active Portfolio Surveillance Portfolios reviewed on a frequent and ongoing basis $ in millions 3/31/21 Outstandings 12/31/20 Outstandings % of Total Loans as of 3/31 Consumer behavior (a) $ 5,112 $ 5,083 5.1% Education 1,557 1,541 1.5 Sports 664 690 .7 Restaurants 368 400 .4 Retail commercial real estate (b) $ 396 $ 525 .4% Nondurable retail (c) $ 595 $ 638 .6% Travel / Tourism (d) $ 2,440 $ 2,523 2.4% Hotels 767 784 .8 Leveraged lending (e) $ 1,674 $ 1,700 1.7% Oil and gas $ 1,792 $ 1,993 1.8% Upstream (reserve-based) 1,141 1,263 1.1 Midstream 389 468 .4 Downstream 58 98 N/M (a) Consumer behavior includes restaurants, sports, entertainment and leisure, services, education, etc. (b) Retail commercial real estate is mainly composed of regional malls, strip centers (unanchored) and lifestyle centers (c) Nondurable retail includes direct lending to retailers including apparel, hobby shops, nursery garden centers, cosmetics, and gas stations with convenience stores (d) Travel/Tourism includes hotels, tours, and air/water/rail leasing (e) Leveraged lending exposures have total debt to EBITDA greater than four times or senior debt to EBITDA greater than three times and meet the purpose test (the new debt finances a buyout, acquisition, or capital distribution) Note: Approximately 3% of outstandings overlapped in multiple categories 20 Select Commercial Portfolio

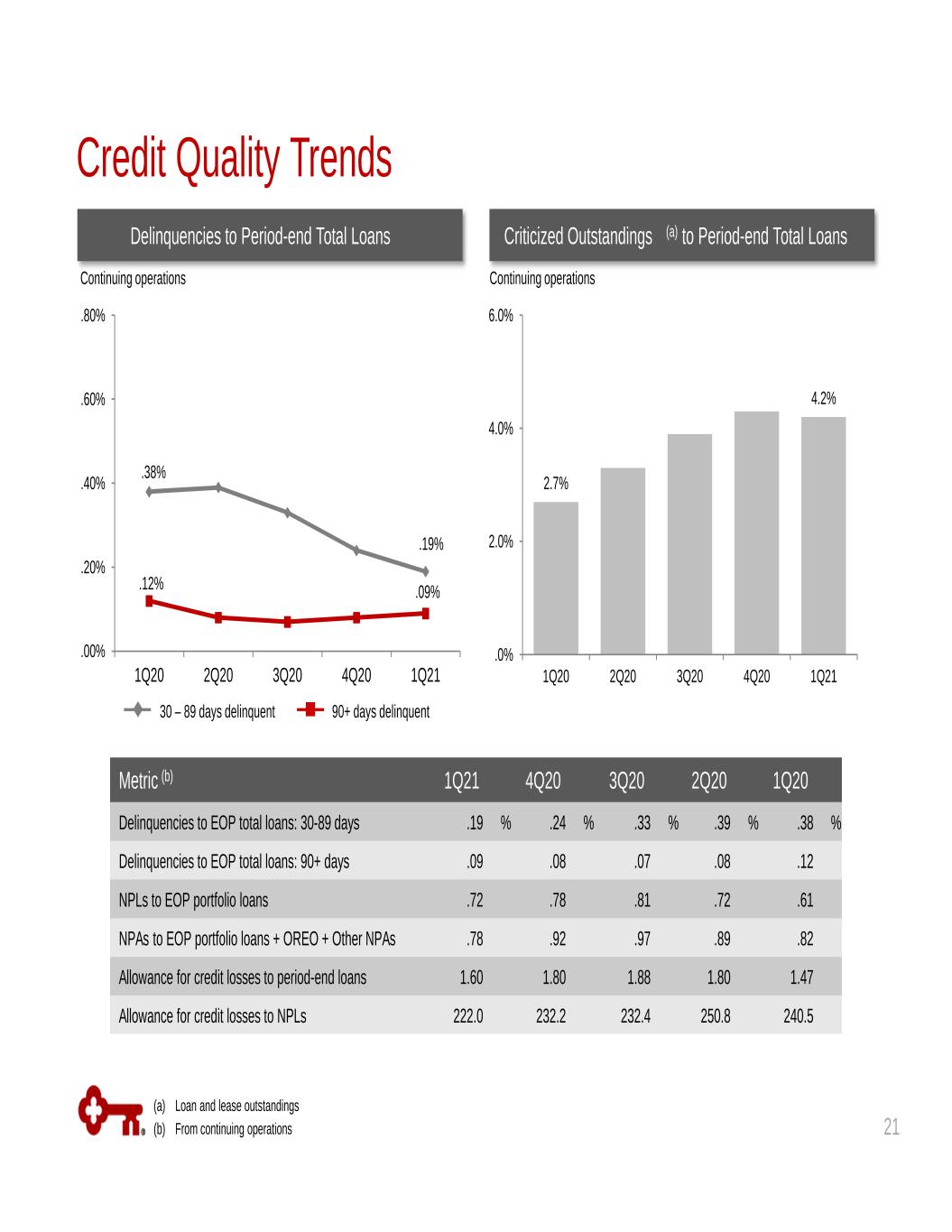

Criticized Outstandings (a) to Period-end Total LoansDelinquencies to Period-end Total Loans Credit Quality Trends (a) Loan and lease outstandings (b) From continuing operations 30 – 89 days delinquent 90+ days delinquent .38% .19% .12% .09% .00% .20% .40% .60% .80% 1Q20 2Q20 3Q20 4Q20 1Q21 2.7% 4.2% .0% 2.0% 4.0% 6.0% 1Q20 2Q20 3Q20 4Q20 1Q21 Metric (b) 1Q21 4Q20 3Q20 2Q20 1Q20 Delinquencies to EOP total loans: 30-89 days .19 % .24 % .33 % .39 % .38 % Delinquencies to EOP total loans: 90+ days .09 .08 .07 .08 .12 NPLs to EOP portfolio loans .72 .78 .81 .72 .61 NPAs to EOP portfolio loans + OREO + Other NPAs .78 .92 .97 .89 .82 Allowance for credit losses to period-end loans 1.60 1.80 1.88 1.80 1.47 Allowance for credit losses to NPLs 222.0 232.2 232.4 250.8 240.5 Continuing operations Continuing operations 21

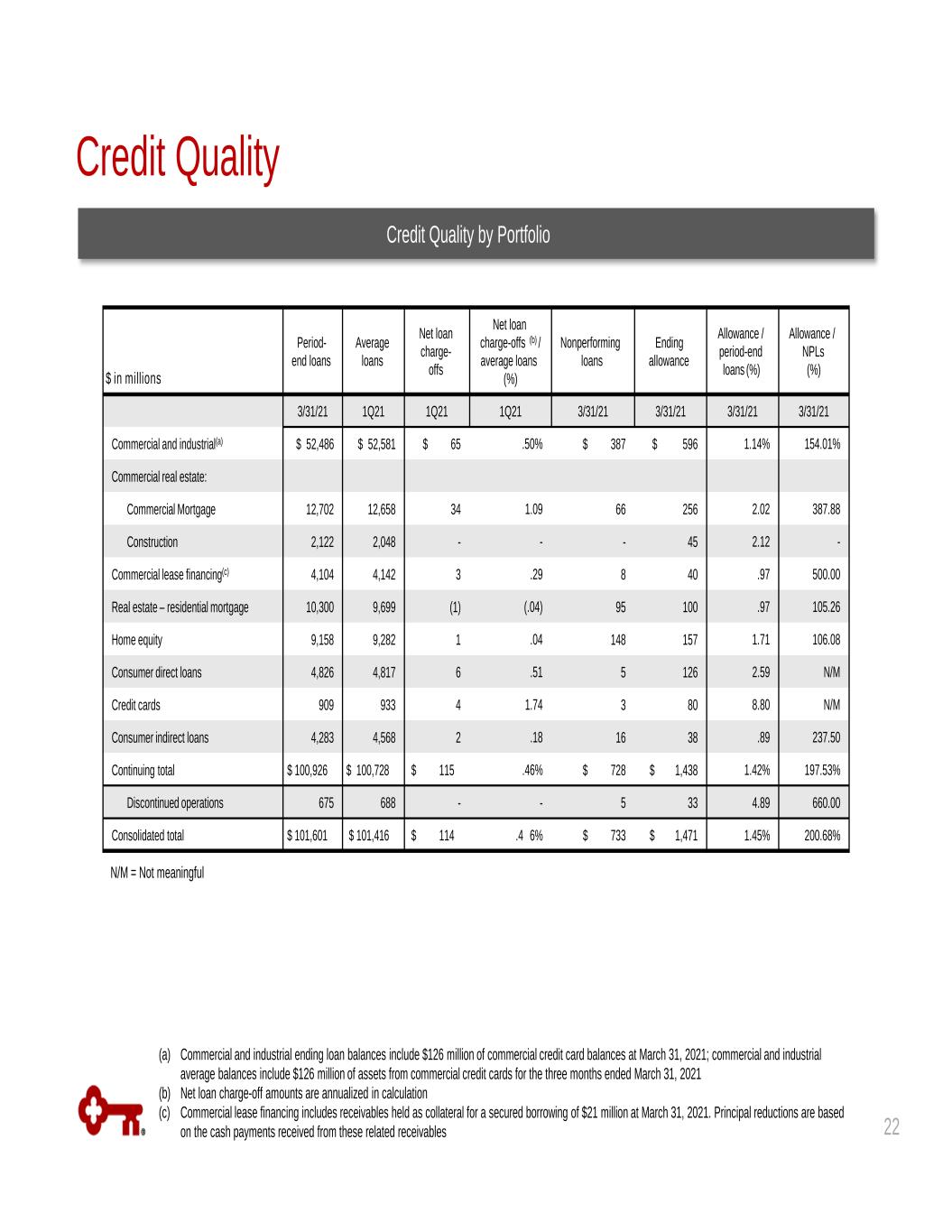

Period- end loans Average loans Net loan charge- offs Net loan charge-offs (b) / average loans (%) Nonperforming loans Ending allowance Allowance / period-end loans (%) Allowance / NPLs (%) 3/31/21 1Q21 1Q21 1Q21 3/31/21 3/31/21 3/31/21 3/31/21 Commercial and industrial(a) $ 52,486 $ 52,581 $ 65 .50% $ 387 $ 596 1.14% 154.01% Commercial real estate: Commercial Mortgage 12,702 12,658 34 1.09 66 256 2.02 387.88 Construction 2,122 2,048 - - - 45 2.12 - Commercial lease financing(c) 4,104 4,142 3 .29 8 40 .97 500.00 Real estate – residential mortgage 10,300 9,699 (1) (.04) 95 100 .97 105.26 Home equity 9,158 9,282 1 .04 148 157 1.71 106.08 Consumer direct loans 4,826 4,817 6 .51 5 126 2.59 N/M Credit cards 909 933 4 1.74 3 80 8.80 N/M Consumer indirect loans 4,283 4,568 2 .18 16 38 .89 237.50 Continuing total $ 100,926 $ 100,728 $ 115 .46% $ 728 $ 1,438 1.42% 197.53% Discontinued operations 675 688 - - 5 33 4.89 660.00 Consolidated total $ 101,601 $ 101,416 $ 114 .4 6% $ 733 $ 1,471 1.45% 200.68% Credit Quality by Portfolio Credit Quality $ in millions N/M = Not meaningful (a) Commercial and industrial ending loan balances include $126 million of commercial credit card balances at March 31, 2021; commercial and industrial average balances include $126 million of assets from commercial credit cards for the three months ended March 31, 2021 (b) Net loan charge-off amounts are annualized in calculation (c) Commercial lease financing includes receivables held as collateral for a secured borrowing of $21 million at March 31, 2021. Principal reductions are based on the cash payments received from these related receivables 22

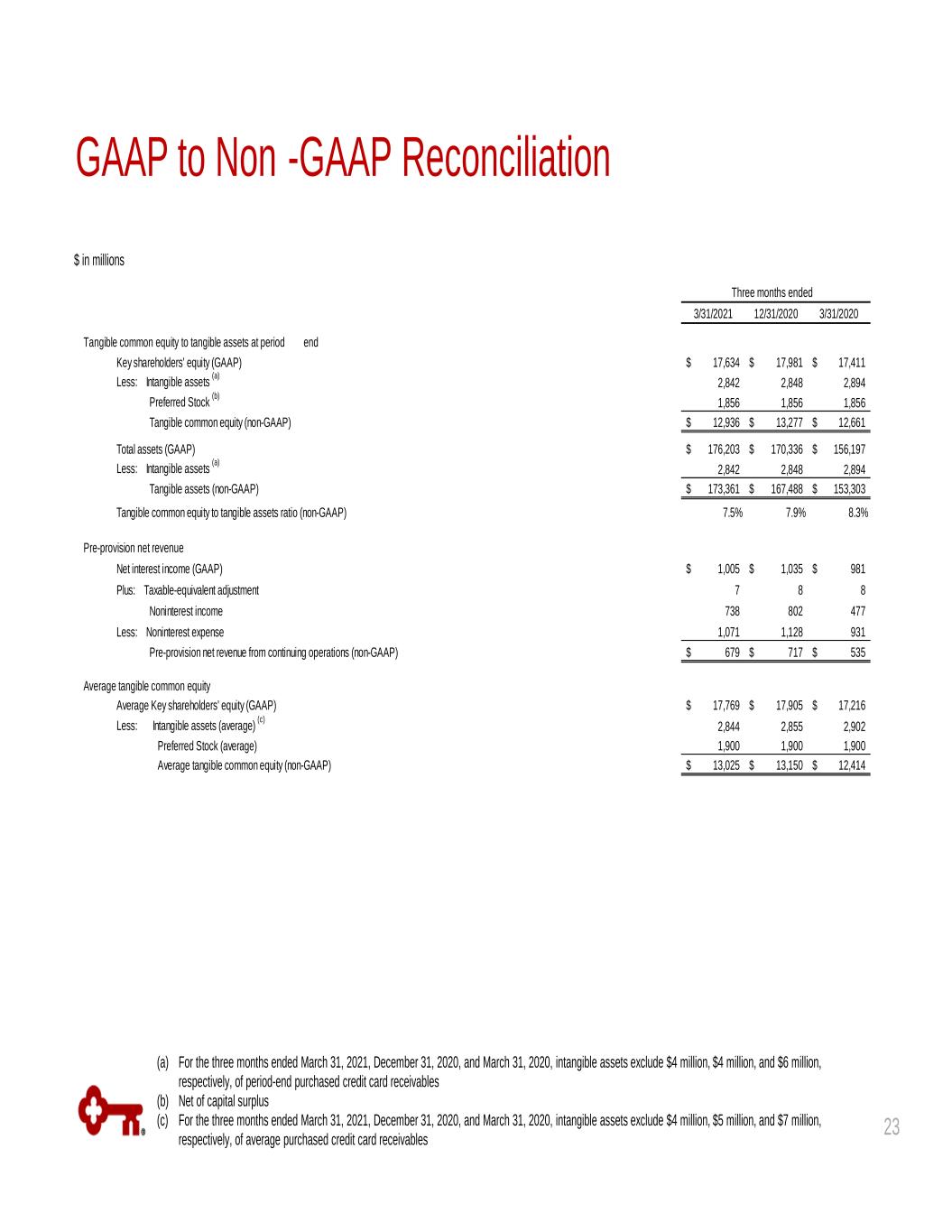

GAAP to Non -GAAP Reconciliation (a) For the three months ended March 31, 2021, December 31, 2020, and March 31, 2020, intangible assets exclude $4 million, $4 million, and $6 million, respectively, of period-end purchased credit card receivables (b) Net of capital surplus (c) For the three months ended March 31, 2021, December 31, 2020, and March 31, 2020, intangible assets exclude $4 million, $5 million, and $7 million, respectively, of average purchased credit card receivables $ in millions 23 3/31/2021 12/31/2020 3/31/2020 Tangible common equity to tangible assets at period end Key shareholders' equity (GAAP) 17,634$ 17,981$ 17,411$ Less: Intangible assets (a) 2,842 2,848 2,894 Preferred Stock (b) 1,856 1,856 1,856 Tangible common equity (non-GAAP) 12,936$ 13,277$ 12,661$ Total assets (GAAP) 176,203$ 170,336$ 156,197$ Less: Intangible assets (a) 2,842 2,848 2,894 Tangible assets (non-GAAP) 173,361$ 167,488$ 153,303$ Tangible common equity to tangible assets ratio (non-GAAP) 7.5% 7.9% 8.3% Pre-provision net revenue Net interest income (GAAP) 1,005$ 1,035$ 981$ Plus: Taxable-equivalent adjustment 7 8 8 Noninterest income 738 802 477 Less: Noninterest expense 1,071 1,128 931 Pre-provision net revenue from continuing operations (non-GAAP) 679$ 717$ 535$ Average tangible common equity Average Key shareholders' equity (GAAP) 17,769$ 17,905$ 17,216$ Less: Intangible assets (average) (c) 2,844 2,855 2,902 Preferred Stock (average) 1,900 1,900 1,900 Average tangible common equity (non-GAAP) 13,025$ 13,150$ 12,414$ Three months ended

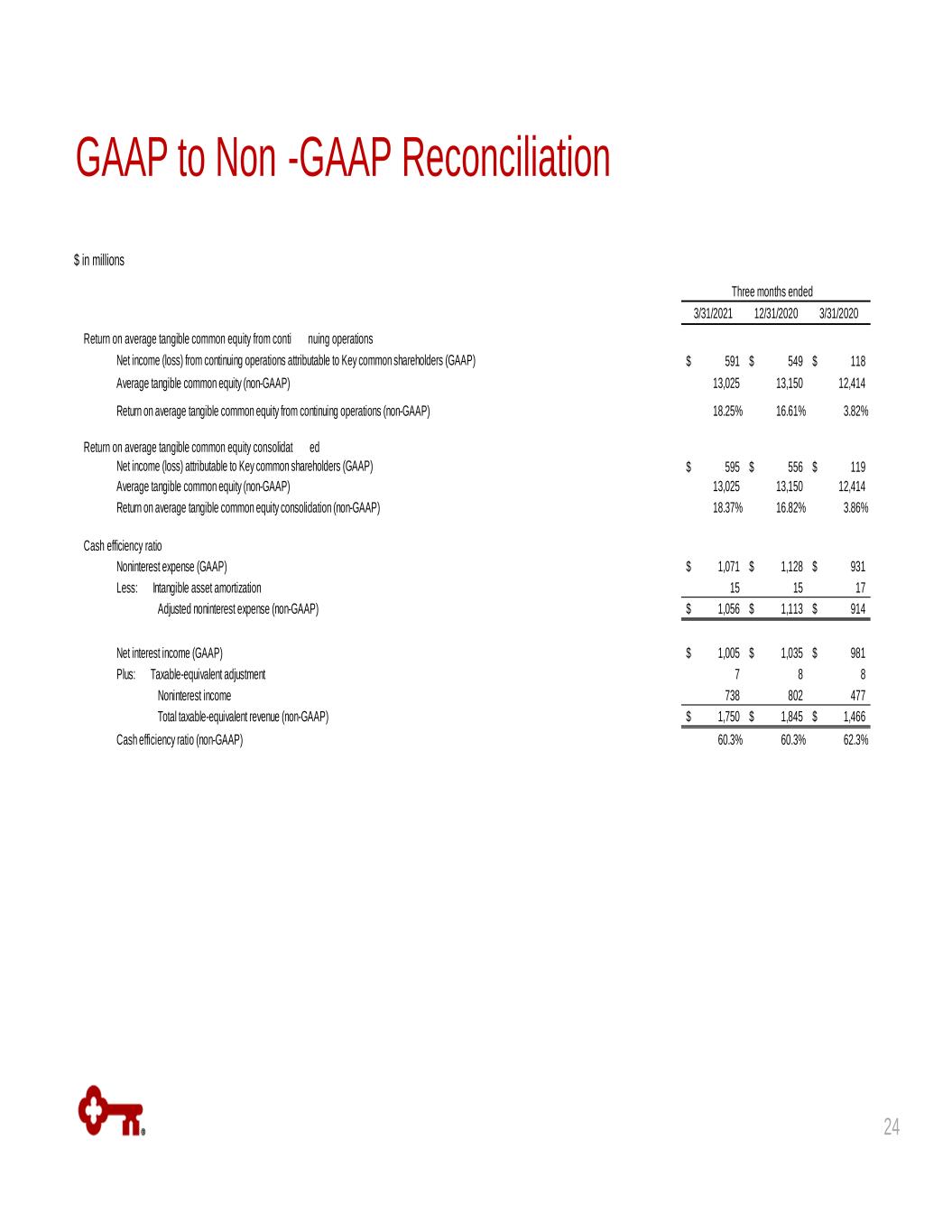

GAAP to Non -GAAP Reconciliation 24 3/31/2021 12/31/2020 3/31/2020 Return on average tangible common equity from conti nuing operations Net income (loss) from continuing operations attributable to Key common shareholders (GAAP) 591$ 549$ 118$ Average tangible common equity (non-GAAP) 13,025 13,150 12,414 Return on average tangible common equity from continuing operations (non-GAAP) 18.25% 16.61% 3.82% Return on average tangible common equity consolidat ed Net income (loss) attributable to Key common shareholders (GAAP) 595$ 556$ 119$ Average tangible common equity (non-GAAP) 13,025 13,150 12,414 Return on average tangible common equity consolidation (non-GAAP) 18.37% 16.82% 3.86% Cash efficiency ratio Noninterest expense (GAAP) 1,071$ 1,128$ 931$ Less: Intangible asset amortization 15 15 17 Adjusted noninterest expense (non-GAAP) 1,056$ 1,113$ 914$ Net interest income (GAAP) 1,005$ 1,035$ 981$ Plus: Taxable-equivalent adjustment 7 8 8 Noninterest income 738 802 477 Total taxable-equivalent revenue (non-GAAP) 1,750$ 1,845$ 1,466$ Cash efficiency ratio (non-GAAP) 60.3% 60.3% 62.3% Three months ended $ in millions