Attached files

| file | filename |

|---|---|

| EX-32 - CERTIFICATION - MAGELLAN GOLD Corp | magellan_ex3200.htm |

| EX-31.1 - CERTIFICATION - MAGELLAN GOLD Corp | magellan_ex3100.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

☒ ANNUAL REPORT UNDER SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2020

☐ TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

For the transition period from ____________ to ____________

Commission file number 000-54658

MAGELLAN GOLD CORPORATION

(Name of Registrant in its Charter)

| Nevada (State or other jurisdiction of incorporation or organization) |

27-3566922 I.R.S. Employer Identification Number |

602 Cedar Street, Ste. 205, Wallace,

ID 83873

(Address of principal executive offices) (Zip Code)

Registrant's telephone number, including area code: (707) 291-6198

Securities registered under Section 12(b) of the Exchange Act: None

Securities registered under Section 12(g) of the Exchange Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically, every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☒

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definition of “large accelerated filer”, “accelerated filer” and” smaller reporting company” in Rule 12b-2 of the Exchange Act (check one):

| Large accelerated filer ☐ | Accelerated filer ☐ |

| Non-accelerated filer ☒ | Smaller Reporting Company ☒ |

| Emerging growth company ☒ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. Yes ☐ No ☒

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

The aggregate market value of the 2,727,240 shares of voting and non-voting common equity held by non-affiliates of the Company calculated by taking the last sales price of the Company's common stock of $0.75 on June 30, 2020 was $2,045,430.

The number of shares outstanding of the registrant’s common stock, as of April 9, 2021 is 7,626,599.

List hereunder the following documents if incorporated by reference and the Part of the Form 10-K ( e.g., Part I, Part II, etc.) into which the document is incorporated: (1) Any annual report to security holders; (2) Any proxy or information statement; and (3) Any prospectus filed pursuant to Rule 424(b) or (c) under the Securities Act of 1933. The listed documents should be clearly described for identification purposes:

None.

| i |

In General

This report contains statements that plan for or anticipate the future. In this report, forward-looking statements are generally identified by the words "anticipate," "plan," "believe," "expect," "estimate," and the like.

With respect to our mineral exploration business, these forward-looking statements include, but are not limited to, statements regarding the following:

| * | the risk factors set forth below under “Risk Factors”; | |

| * | risks and hazards inherent in the mining business (including environmental hazards, industrial accidents, weather or geologically related conditions); | |

| * | uncertainties inherent in our exploratory and developmental activities, including risks relating to permitting and regulatory delays; | |

| * | our future business plans and strategies; | |

| * | our ability to commercially develop our mining interests.; | |

| * | changes that could result from our future acquisition of new mining properties or businesses; | |

| * | expectations regarding competition from other companies; | |

| * | effects of environmental and other governmental regulations; | |

| * | the worldwide economic downturn and difficult conditions in the global capital and credit markets; and | |

| * | our ability to raise additional financing necessary to conduct our business. |

Forward looking statements may include estimated mineral reserves and resources which could differ materially from those projected in the forward-looking statements. The factors that could cause actual results to differ materially from those projected in the forward-looking statements include:

| * | the risk factors set forth below under “Risk Factors”; | |

| * | changes in the market prices of precious minerals, including gold; and | |

| * | uncertainties inherent in the estimation of ore reserves. |

In addition to the foregoing, the ongoing COVID-19 pandemic poses significant risks and uncertainties in numerous areas, including the availability of labor and materials to explore our mineral interests, risks impacting the cost and availability of insurance and the markets for precious metals. We cannot predict with any certainty the nature and extent of the impact that the pandemic will have on our business plan and operations.

Readers are cautioned not to put undue reliance on forward-looking statements. We disclaim any intent or obligation to update publicly these forward-looking statements, whether as a result of new information, future events or otherwise.

In light of the significant uncertainties inherent in the forward-looking statements made in this Report, the inclusion of this information should not be regarded as a representation by us or any other person that our objectives and plans will be achieved.

| ii |

ITEM 1. DESCRIPTION OF BUSINESS

THE COMPANY

The Company was formed and organized on September 28, 2010 under the laws of the State of Nevada. We are an exploration stage company and our principal business is the acquisition and exploration of mineral resources in Idaho initially, and elsewhere in the future. We have not presently determined whether the property to which we have mining rights contain mineral deposits that are economically recoverable.

The Company's head office is located at 602 Cedar Street, Suite 205, Wallace, Idaho 83873.

Center Star Mine Project

Background

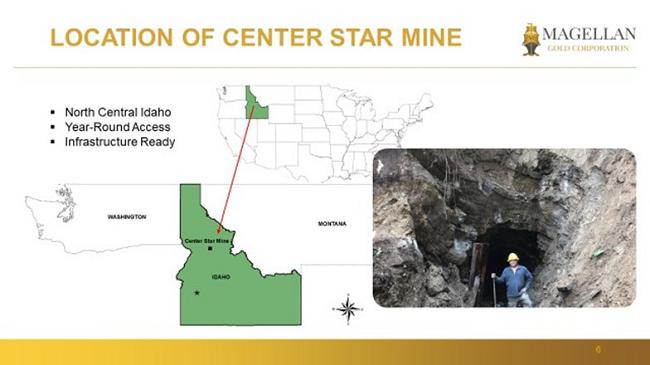

Effective July 1, 2020, Magellan entered into a stock purchase agreement to acquire Clearwater Gold Mining Corporation (“Clearwater”) which owns certain unpatented mining claims in Idaho County. Idaho that include the historic Center Star Gold Mine near Elk City, Idaho. The Center Star Mine hosts high grade gold mineralization that was discovered in the early 1900’s. There was periodic historic production and development work done under different ownership through the 1980s. With the high-grade gold mineralization present, Magellan will be evaluating the historic mine data to assess the potential to develop a gold resource at Center Star. The project area is located 45 miles from Grangeville, Idaho and near the town of Elk City, Idaho.

In consideration for 100% of the issued and outstanding shares of Clearwater, Magellan has agreed to pay its sole shareholder 1,000,000 shares of Magellan common stock and $150,000 in cash. Of the 1,000,000 shares, 750,000 shares have been issued and 250,000 shares will be issued two years from the closing concurrent with the pay-off of the secured promissory note. The cash consideration of $25,000 was paid and the balance of $125,000 is evidenced by a secured promissory note due in two years. The Note is secured by the Clearwater shares and assets.

Based upon our research, gold mineralization at Center Star Mine is hosted in multiple parallel quartz veins in a banded gneiss. Like many of the historic mines in the Elk City area the gold is present in steeply dipping quartz veins. The gold at the Center Star Mine occurs in high grade veins that trend north-easterly and dip steeply to the south east. These veins are present in a 75’ to 100’ wide sheer zone hosting quartz veins and breccia. It is believed the gold bearing veins vary from inches to 20 feet in width and contain gold from .35 ounce per ton gold to multi ounce per ton gold based on historic mine data. The property was historically developed by various owners and has had some production history of gold and silver production. The Center Star Mine has not had any exploration or development work conducted in the last 35 years.

| 3 |

The BLM Mining Claims

The following table contains a description of our BLM unpatented mining claims which comprise the Center Star Mine;

| Center Star Unpatented Mining Claims | ||

| Claim Name | BLM Serial No. | |

| DORE 3 | IMC 200 854 | |

| DORE 4 | IMC 200 855 | |

| DORE 5 | IMC 200 856 | |

| DORE 6 | IMC 200 857 | |

| DORE 7 | IMC 231 494 | |

| DORE 8 | IMC 231 495 | |

| DORE 9 | IMC 231 496 | |

| DORE 10 | IMC 231 499 | |

| DORE 13 | IMC 200 864 | |

| DORE 14 | IMC 200 865 | |

| DORE 15 | IMC 200 866 | |

| DORE 16 | IMC 200 867 | |

| DORE 17 | IMC 200 868 | |

| DORE 18 | IMC 200 869 | |

| DORE 19 | IMC 231 498 | |

| DORE 20 | IMC 231 499 | |

| DORE 21 | IMC 200 872 | |

| DORE 22 | IMC 200 873 | |

| DORE 23 | IMC 200 874 | |

| DORE 24 | IMC 200 875 | |

| DORE 25 | IMC 200 876 | |

| DORE 26 | IMC 231 500 | |

| DORE 27 | IMC 231 501 | |

| DORE 28 | IMC 231 502 | |

| DORE 29 | IMC 231 503 | |

| DORE 30 | IMC 231 504 | |

| DORE 31 | IMC 231 505 | |

| DORE 32 | IMC 231 506 | |

| DORE 33 | IMC 231 507 | |

| DORE 34 | IMC 231 508 | |

| DORE 35 | IMC 231 509 | |

| 4 |

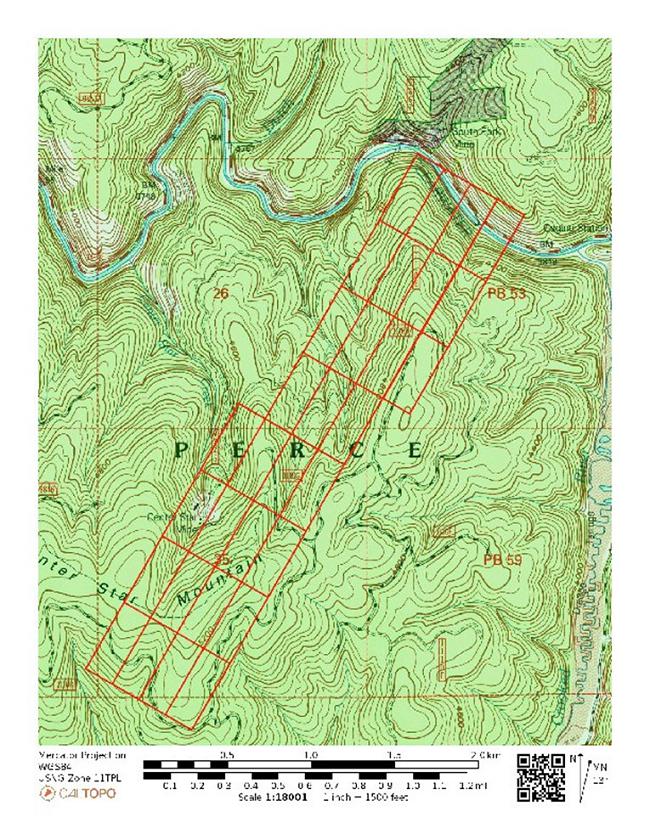

The following topographical map shows the location of the BLM claims:

| 5 |

Unpatented Mining Claims: The Mining Law of 1872

Except for the Langtry Property, our mineral rights consist of leases covering "unpatented" mining claims created and maintained in accordance with the U.S. General Mining Law of 1872, or the “General Mining Law.” Unpatented mining claims are unique U.S. property interests, and are generally considered to be subject to greater title risk than other real property interests because the validity of unpatented mining claims is often uncertain. The validity of an unpatented mining claim, in terms of both its location and its maintenance, is dependent on strict compliance with a complex body of federal and state statutory and decisional law that supplement the General Mining Law. Also, unpatented mining claims and related rights, including rights to use the surface, are subject to possible challenges by third parties or contests by the federal government. In addition, there are few public records that definitively control the issues of validity and ownership of unpatented mining claims. We have not filed a patent application for any of our unpatented mining claims that are located on federal public lands in the United States and, under possible future legislation to change the General Mining Law, patents may be difficult to obtain.

Location of mining claims under the General Mining Law, is a self-initiation system under which a person physically stakes an unpatented mining claim on public land that is open to location, posts a location notice and monuments the boundaries of the claim in compliance with federal laws and regulations and with state location laws, and files notice of that location in the county records and with the BLM. Mining claims can be located on land as to which the surface was patented into private ownership under the Stockraising Homestead Act of 1916, 43 U.S.C. §299, but the mining claimant cannot injure, damage or destroy the surface owner's permanent improvements and must pay for damage to crops caused by prospecting. Discovery of a valuable mineral deposit, as defined under federal law, is essential to the validity of an unpatented mining claim and is required on each mining claim individually. The location is made as a lode claim for mineral deposits found as veins or rock in place, or as a placer claim for other deposits. While the maximum size and shape of lode claims and placer claims are established by statute, there are no limits on the number of claims one person may locate or own. The General Mining Law also contains provision for acquiring five-acre claims of non-mineral land for millsite purposes. A mining operation typically is comprised of many mining claims.

The holder of a valid unpatented mining claim has possessory title to the land covered thereby, which gives the claimant exclusive possession of the surface for mining purposes and the right to mine and remove minerals from the claim. Legal title to land encompassed by an unpatented mining claim remains in the United States, and the government can contest the validity of a mining claim. The General Mining Law requires the performance of annual assessment work for each claim, and subsequent to enactment of the Federal Land Policy and Management Act of 1976, 43 U.S.C. §1201 et seq., mining claims are invalidated if evidence of assessment work is not timely filed with BLM. However, in 1993 Congress enacted a provision requiring payment of $140 per year claim maintenance fee in lieu of performing assessment work, subject to an exception for small miners having less than 10 claims. No royalty is paid to the United States with respect to minerals mined and sold from a mining claim.

The General Mining Law provides a procedure for a qualified claimant to obtain a mineral patent (i.e., fee simple title to the mining claim) under certain conditions. It has become much more difficult in recent years to obtain a patent. Beginning in 1994, Congress imposed a funding moratorium on the processing of mineral patent applications which had not reached a designated stage in the patent process at the time the moratorium went into effect. Additionally, Congress has considered several bills in recent years to repeal the General Mining Law or to amend it to provide for the payment of royalties to the United States and to eliminate or substantially limit the patent provisions of the law.

Mining claims are conveyed by deed, or leased by the claimant to the party seeking to develop the property. Such a deed or lease (or memorandum of it) needs to be recorded in the real property records of the county where the property is located, and evidence of such transfer needs to be filed with BLM. It is not unusual for the grantor or lessor to reserve a royalty, which as to precious metals often is expressed as a percentage of net smelter returns.

| 6 |

Location, History and Geology of our Property

Center Star Mine

The property is located near Elk City, Idaho on the south side of the Clearwater River about 42 miles southeast of Grangeville, Idaho. The property consists of 31 unpatented lode claims totaling 620 acres. The company owns 100% of the property.

Location and Access

The property, Center Star Mine, is located 42 miles southeast of Grangeville, Idaho in Section 26 and 35 of Township 29 N, Range 7 E.B.M. in the Ten Mile Mining District.

Access to the property is gained by a paved state highway connecting Grangeville and Elk City. A good mountain road approximately 5 miles in length extends from the highway to the mine. The mountain road is of a sufficient quality to transport equipment and materials to the mine. The road is typically snowed in during certain winter months but could be maintained to allow for year-round access.

| 7 |

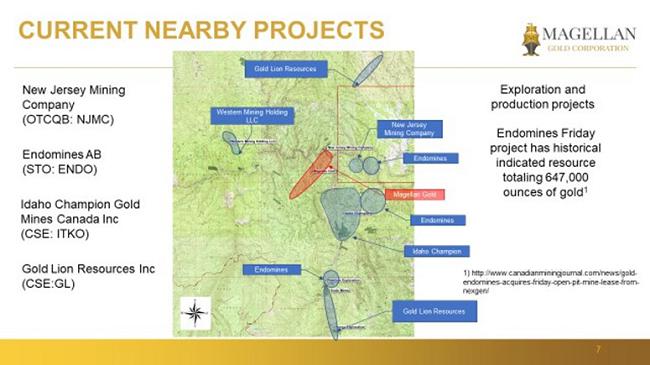

The Center Star Mine is located in an area that currently has significant interest from other junior exploration companies, as shown in the map below:

History

The Center Star deposit was discovered by Jim Murphy, a pocket hunter, who found rich float in the gulch below the mine. Herman Brown and later Charles Tiedeman acquired interests in the property. These men did the first development work on the property by first trenching on the hillsides and then driving the Murphy crosscut. They encountered a mineralized zone about 30 feet wide which contained veins of varying width and which averaged from 0.8 to 1 ounce of gold per ton. In 1915, Tiedeman installed a 1-stamp mill and milled some ore from the Murphy crosscut but he netted only about a 50% recovery. About 1917, an interested party including one Mr. Weiss drove a crosscut into the ore zone about 100 feet below the Murphy level and did some drifting. Here they found the ore contained more sulfides with an increase of silver and copper. H. L. Day and associates on their own account did additional exploratory work in 1930 and 1931 which included the sinking of an incline winze to a depth of 150 feet. Because there was no road to or mill on the property plus the fact that the price of gold was only $20.00 an ounce, Mr. Day abandoned the project in 1931.

In 1934 Mr. and Mrs. M. F. Ward of Lewiston, Idaho acquired an option on the property and built the present road to the mine. In 1938 they purchased a 1/ 3 interest in the property and financed the construction of the mill and other buildings. During the period 1939 to 1942, Messrs. Ward and William Walker leased the remaining two-thirds interest in the mine from Brown and Tiedeman.

The first production of concentrates from this mill was made late in 1939 and was continued on a limited basis until the Gold Closing Order L-208 forced the stoppage of operations in 1942. During this period there was considerable development work done.

| 8 |

During a roughly 33-month time frame from 1939 to 1942 the mine produced about 5,000 ounces of gold and 6,000 ounces of silver.

In 1946 and 1947, Mr. and Mrs. Ward purchased the remaining 2/ 3 interest in the claims and continued to maintain the property. Except for 1959-1960 when about $5,000.00 worth of concentrates were produced there has been no other production since 1946. Following Mr. Ward's death in November 1958, a rehabilitation and modernization program was planned by Mrs. Ward with the assistance of Harold C. Lynch.

In 1961 the Center Start Gold Mine, Inc was incorporated, and the property was acquired from Mrs. Genevieve (Ward) Lynch.

In 1968 Center Star Gold Mines, Inc. completed a public offering and the Center Star Mine was reactivated. Also, in 1968 a 6,800-foot power line was constructed and put into operation bringing electric power to the site.

From 1968 to 1970 the underground workings were advanced an additional 500 feet. In 1971 the Center Mine was placed on standby awaiting more favorable gold prices.

In 1980 the Center Star Mine was reopened. Between 1980 and 1981 the Center Star completed a $500,000 mine renovation, sampling and drilling program. Over 2,000 samples were taken from various areas of the mine and the drill program resulted in defining an ore block estimated at 30,000 tons with grades between .46 and .63 ounces to the ton.

At some point between 1983 and 1984 the Center Star was once a gain placed on standby due to low gold prices.

In 1985 mill and equipment and several buildings on the property were removed and salvaged.

At some point between 1986 and 1987 the property was acquired by Mariner Explorations, Inc. Mariner Explorations did an extensive sapling and mapping of the area on the property adjacent to existing working.

At some point subsequent to Mariner Explorations surface exploration work the property was acquired by Gregory Schifrin, who sold the property to Magellan Gold in 2020.

Power and Water

Power to the mine site will initially be provided by a diesel generator and a diesel compressor. In 1968 the mine site was connected to a 3-phase electrical power line. The power line is no longer operable but can be replaced in the future.

Water to the site is available from a year-round mountain stream that should be adequate to meet the properties’ needs.

Geology

The Center Star Mine is located in Idaho about midway between Golden and Elk City. It appears to be in the Central Idaho Belt series and is in the Ten-mile Mining District. The mine area is composed of banded Pre-Cambrian Belt gneisses and schists. The general area has been faulted; intrusions of granite dikes and hornblendite sills are prominent.

| 9 |

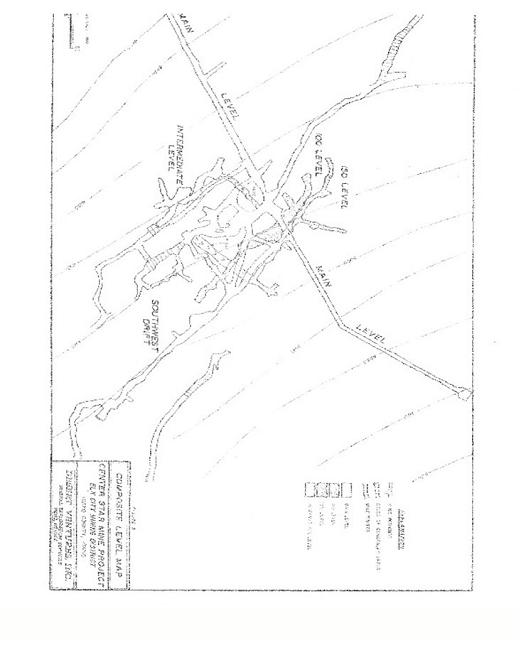

The following composite level map shows the extent of known historical workings at the mine:

| 10 |

The country rock is well-banded quartz biotite gneiss. Near quartz intrusions the country rock is highly silicified and in fractured zones is brecciated. The regional trend of the county rock foliation is approximately north and south.

A series of faults and brecciated zones cuts through the country rock. The general trend of the faulted areas is approximately north 70 degrees east and dips 40 degrees or more to the southeast.

Quartz follows faulted zones, forming elongated veins and is also found as a replacement of gneiss. However, gneissic banding is preserved in the quartz and the wall rock is not easily distinguished from the quartz in the replacement zones. These zones show a gradation from quartz, to gneissic banded quartz to silicified gneiss, to gneiss. Along some faults, gouge and brecciated wall rock is more than two feet thick. Quartz usually shows more brecciation than silicified gneiss. Quartz is also greatly shattered in the fractured zones.

Sulfides are disseminated in the vein quartz and silicified wall rock and fill small fractures and shattered zones. The most abundant of these are pyrite and chalcopyrite. However, galena and sphalerite are commonly exposed in brecciated zones of quartz and wall rock.

The ore is found as irregular and generally elongated bodies following faults which strike approximately N 70 degrees E. A shear zone 100 feet wide, extending from about 240 feet in the Weiss tunnel contains all the ore to be seen in the present mine workings. A series of faults parallel each other within this zone. The country rock, surrounding the shear zone, is composed of schist and gneiss. Intrusions of granite cutting the country rock are exposed in the Weiss tunnel. The schists and gneisses grade into silicified rock at the contact of the shear zone.

Drifting followed quartz veins which vary in thickness from one inch to ten feet, averaging about five feet. The quartz veins pinch and swell throughout their exposed length with alternate brecciation. Gouge of varying thickness follows both walls of the quartz veins. Brecciation of the quartz and silicification of the gneisses and schists presumably took place at the time of later faulting and fracturing. Later quartz introduction apparently occurred periodically; this later quartz contains most of the sulfides and gold. Quartz in some zones grades gradually into silicified all rock; in these zones no contact can be established between silicified wall rock and quartz. However, quartz veinlets were observed extending into the wall rock. These veinlets contain sulfides and some gold.

No Proven or Probable Mineral Reserves/Exploration Stage Company

We are considered an exploration stage company under SEC criteria since we have not demonstrated the existence of proven or probable mineral reserves at any of our properties. In Industry Guide 7, the SEC defines a “reserve” as that part of a mineral deposit which could be economically and legally extracted or produced at the time of the reserve determination. Proven or probable mineral reserves are those reserves for which (a) quantity is computed and (b) the sites for inspection, sampling, and measurement are spaced so closely that the geologic character is defined and size, shape and depth of mineral content can be established (proven) or the sites are farther apart or are otherwise less adequately spaced but high enough to assume continuity between observation points (probable).

Mineral Reserves cannot be considered proven or probable unless and until they are supported by a feasibility study, indicating that the mineral reserves have had the requisite geologic, technical and economic work performed and are economically and legally extractable.

We have not completed a feasibility study with regard to all or a portion of any of our properties to date. Any mineralized material discovered or extracted by us should not be considered proven or probable mineral reserves. As of the date of this Memorandum, none of our mineralized material met the definition of proven or probable mineral reserves. We expect to remain an exploration stage company for the foreseeable future, even though we were extracting and processing mineralized material. We will not exit the exploration stage until such time, if ever, that we demonstrate the existence of proven or probable mineral reserves that meet the guidelines under SEC Industry Guide

| 11 |

OUR EXPLORATION PROCESS

Our exploration program is designed to acquire, explore and evaluate exploration properties in an economically efficient manner. We have not at this time identified or delineated any mineral reserves on any of our properties.

We expect our exploration work on a given property to proceed generally in three phases. Decisions about proceeding to each successive phase will take into consideration the completion of the previous phases and our analysis of the results of those phases.

The first phase is intended to determine whether a prospect warrants further exploration and involves:

| · | researching the available geologic literature; |

| · | interviewing geologists, mining engineers and others familiar with the prospect sites; |

| · | conducting geologic mapping, geophysical testing and geochemical testing; |

| · | examining any existing workings, such as trenches, prospect pits, shafts or tunnels; |

| · | digging trenches that allow for an examination of surface vein structures as well as for efficient reclamation, contouring and re-seeding of disturbed areas; and, |

| · | analyzing samples for minerals that are known to have occurred in the test area. |

Subject to obtaining the necessary permits in a timely manner, the first phase can typically be completed on an individual property in several months at a cost of less than $200,000.

The second phase is intended to identify any mineral deposits of potential economic importance and would involve:

| · | examining underground characteristics of mineralization that were previously identified; |

| · | conducting more detailed geologic mapping; |

| · | conducting more advanced geochemical and geophysical surveys; |

| · | conducting more extensive trenching; and |

| · | conducting exploratory drilling. |

| 12 |

Subject to obtaining the necessary permits in a timely manner, the second phase can typically be completed on an individual property in nine to twelve months at a cost of less than $1 million. None of our properties has reached the second phase.

The third phase is intended to precisely define depth, width, length, tonnage and value per ton of any deposit that has been identified and would involve:

| · | drilling to develop the mining site; |

| · | conducting metallurgical testing; and |

| · | obtaining other pertinent technical information required to define an ore reserve and complete a feasibility study depending upon the nature of the particular deposit, the third phase on any one property could take one to five years or more and cost well in excess of $1 million. None of our properties has reached the third phase. |

We intend to explore and develop our properties ourselves, although our plans could change depending on the terms and availability of financing and the terms or merits of any joint venture proposals.

Our Exploration Plans

Past exploration, development and production on the property has identified a number of ore bodies and targets for future exploration. Potential for additional mineralization is very good as known veins and ore bodies appear to be open in all directions. We will use known mineralization areas from previous geological reports to identify exploration targets.

We are developing a geological mapping, with rock sampling and assaying programs that will focus on taking samples from previously sampled high-grade areas to test and verify historical geological reports. Successful completion of the mapping and sampling program will help guide a drilling program to better define historically reported ore blocks and resource estimates.

Subject to securing the necessary, we have budgeted $500,000 for exploration work over the next 6 to 12 months. Comprising of $150,000 for sampling, assaying, mapping and computer modeling and $300,000 for diamond drilling, assaying and mapping.

We anticipate the exploration program will be supervised by Gregory Schifrin, a director of the company.

MARKETING

All of our mining operations, if successful, will produce gold or silver in doré form or a concentrate that contains gold or silver.

We plan to market our refined metal and doré to credit worthy bullion trading houses, market makers and members of the London Bullion Market Association, industrial companies and sound financial institutions. The refined metals will be sold to end users for use in electronic circuitry, jewelry, silverware, and the pharmaceutical and technology industries. Generally, the loss of a single bullion trading counterparty would not adversely affect us due to the liquidity of the markets and the availability of alternative trading counterparties.

We plan to refine and market its precious metals doré and concentrates using a geographically diverse group of third party smelters and refiners. The loss of any one smelting and refining client may have a material adverse effect if alternate smelters and refiners are not available. We believe there is sufficient global capacity available to address the loss of any one smelter.

| 13 |

GOVERNMENT REGULATION

General

Our activities are and will be subject to extensive federal, state and local laws governing the protection of the environment, prospecting, mine development, production, taxes, labor standards, occupational health, mine safety, toxic substances and other matters. The costs associated with compliance with such regulatory requirements are substantial and possible future legislation and regulations could cause additional expense, capital expenditures, restrictions and delays in the development and continued operation of our properties, the extent of which cannot be predicted. In the context of environmental permitting, including the approval of reclamation plans, we must comply with known standards and regulations which may entail significant costs and delays.

Although we are committed to environmental responsibility and believe we are in substantial compliance with applicable laws and regulations, amendments to current laws and regulations, more stringent implementation of these laws and regulations through judicial review or administrative action or the adoption of new laws could have a materially adverse effect upon our results of operations.

Federal Environmental Laws

Certain mining wastes from extraction and beneficiation of ores are currently exempt from the extensive set of Environmental Protection Agency (“EPA”) regulations governing hazardous waste, although such wastes may be subject to regulation under state law as a solid or hazardous waste. The EPA has worked on a program to regulate these mining wastes pursuant to its solid waste management authority under the Resource Conservation and Recovery Act (“RCRA”). Certain ore processing and other wastes are currently regulated as hazardous wastes by the EPA under RCRA. If our future mine wastes, if any, were treated as hazardous waste or such wastes resulted in operations being designated as a “Superfund” site under the Comprehensive Environmental Response, Compensation and Liability Act (“CERCLA” or “Superfund”) for cleanup, material expenditures would be required for the construction of additional waste disposal facilities or for other remediation expenditures. Under CERCLA, any present owner or operator of a Superfund site or an owner or operator at the time of its contamination generally may be held liable and may be forced to undertake remedial cleanup action or to pay for the government’s cleanup efforts. Such owner or operator may also be liable to governmental entities for the cost of damages to natural resources, which may be substantial. Additional regulations or requirements may also be imposed upon our future tailings and waste disposal, if any, in Nevada under the Federal Clean Water Act (“CWA”) and state law counterparts. We have reviewed and considered current federal legislation relating to climate change and we do not believe it to have a material effect on our operations. Additional regulation or requirements under any of these laws and regulations could have a materially adverse effect upon our results of operations.

| 14 |

| ITEM 1A | RISK FACTORS. |

Our business faces many risks. Any of the risks discussed below, or elsewhere in this report or in our other filings with the SEC, could have a material impact on our business, financial condition, or results of operations.

An investment in our securities is speculative and involves a high degree of risk. Please carefully consider the following risk factors, as well as the possibility of the loss of your entire investment, before deciding to invest in our securities.

Risks Related to our Business

Due to our history of operating losses our auditors are uncertain that we will be able to continue as a going concern.

Our financial statements have been prepared assuming that we will continue as a going concern. Due to our continuing operating losses and negative cash flows from our operations, the reports of our auditors issued in connection with our consolidated financial statements for the fiscal years ended December 31, 2020 and 2019, contain explanatory paragraphs indicating that the foregoing matters raised substantial doubt about our ability to continue as a going concern. We cannot provide any assurance that we will be able to continue as a going concern.

Uncontrollable events like the COVID-19 pandemic may negatively impact our operations.

The occurrence of an uncontrollable event such as the COVID-19 pandemic may negatively affect our operations. A pandemic typically results in social distancing, travel bans and quarantine, and this may limit access to our facilities, customers, management, support staff and professional advisors. These factors, in turn, may not only impact our operations, financial condition and demand for our goods and services but our overall ability to react timely to mitigate the impact of this event. Also, it may hamper our efforts to comply with our filing obligations with the Securities and Exchange Commission.

We have no history of and limited experience in mineral production.

We have no history of and limited experience in producing gold or other metals. In addition, our management has limited technical training and experience with exploring for, starting and/or operating a mine. Our management may not be fully aware of many of the specific requirements related to working within this industry. Their decisions and choices may not take into account standard engineering or managerial approaches mineral exploration companies commonly use. Our operations, earnings and ultimate financial success could suffer due to our management’s limited experience in this industry. As a result, we would be subject to all of the risks associated with establishing a new mining operation and business enterprise. We may never successfully establish mining operations, and any such operations may not achieve profitability.

We have no proven or probable reserves.

We are currently in the exploration stage and have no proven or probable reserves, as those terms are defined by the Securities and Exchange Commission (“SEC”) on any of our properties.

| 15 |

In order to demonstrate the existence of proven or probable reserves under SEC guidelines, it would be necessary for us to advance the exploration of our Properties by significant additional delineation drilling to demonstrate the existence of sufficient mineralized material with satisfactory continuity which would provide the basis for a feasibility study which would demonstrate with reasonable certainty that the mineralized material can be economically extracted and produced. We do not have sufficient data to support a feasibility study with regard to the Properties, and in order to perform the drill work to support such feasibility study, we must obtain the necessary permits and funds to continue our exploration efforts. It is possible that, even after we have obtained sufficient geologic data to support a feasibility study on the Properties, such study will conclude that none of the identified mineral deposits can be economically and legally extracted or produced. If we cannot adequately confirm or discover any mineral reserves of precious metals on the Properties, we may not be able to generate any revenues. Even if we discover mineral reserves on the Properties in the future that can be economically developed, the initial capital costs associated with development and production of any reserves found is such that we might not be profitable for a significant time after the initiation of any development or production. The commercial viability of a mineral deposit once discovered is dependent on a number of factors beyond our control, including particular attributes of the deposit such as size, grade and proximity to infrastructure, as well as metal prices. In addition, development of a project as significant as the ones we might be planning will likely require significant debt financing, the terms of which could contribute to a delay of profitability.

The exploration of mineral properties is highly speculative in nature, involves substantial expenditures and is frequently non-productive.

Mineral exploration is highly speculative in nature and is frequently non-productive. Substantial expenditures are required to:

| · | establish ore reserves through drilling and metallurgical and other testing techniques; | |

| · | determine metal content and metallurgical recovery processes to extract metal from the ore; and, | |

| · | design mining and processing facilities. |

If we discover ore at the Properties, we expect that it would be several additional years from the initial phases of exploration until production is possible. During this time, the economic feasibility of production could change. As a result of these uncertainties, there can be no assurance that our exploration programs will result in proven and probable reserves in sufficient quantities to justify commercial operations.

Even if our exploration efforts at the Properties are successful, we may not be able to raise the funds necessary to develop the Properties.

If our exploration efforts at our prospects are successful, of which there can be no assurance, our current estimates indicate that we may be required to raise substantial external financing to develop and construct the mines. Sources of external financing could include bank borrowings and debt and equity offerings, but financing has become significantly more difficult to obtain in the current market environment. The failure to obtain financing would have a material adverse effect on our growth strategy and our results of operations and financial condition. We currently have no specific plan to obtain the necessary funding and there exist no agreements, commitments or arrangements to provide us with the financing that we may need. There can be no assurance that we will commence production at any of our Properties or generate sufficient revenues to meet our obligations as they become due or obtain necessary financing on acceptable terms, if at all, and we may not be able to secure the financing necessary to begin or sustain production at the Properties. Our failure to raise needed funding could also result in our inability to meet our future royalty and work commitments under our mineral leases, which could result in a forfeiture of our mineral interest altogether and a default under other financial commitments. In addition, should we incur significant losses in future periods, we may be unable to continue as a going concern, and we may not be able to realize our assets and settle our liabilities in the normal course of business at amounts reflected in our financial statements included or incorporated herein by reference.

We may not be able to obtain permits required for development of the Properties.

In the ordinary course of business, mining companies are required to seek governmental permits for expansion of existing operations or for the commencement of new operations. We will be required to obtain numerous permits for our Properties. Obtaining the necessary governmental permits is a complex and time-consuming process involving numerous jurisdictions and often involving public hearings and costly undertakings. Our efforts to develop the Properties may also be opposed by environmental groups. In addition, mining projects require the evaluation of environmental impacts for air, water, vegetation, wildlife, cultural, historical, geological, geotechnical, geochemical, soil and socioeconomic conditions. An Environmental Impact Statement would be required before we could commence mine development or mining activities. Baseline environmental conditions are the basis on which direct and indirect impacts of the Properties are evaluated and based on which potential mitigation measures would be proposed. If the Properties were found to significantly adversely impact the baseline conditions, we could incur significant additional costs to avoid or mitigate the adverse impact, and delays in the development of Properties could result.

| 16 |

Permits would also be required for, among other things, storm-water discharge; air quality; wetland disturbance; dam safety (for water storage and/or tailing storage); septic and sewage; and water rights appropriation. In addition, compliance must be demonstrated with the Endangered Species Act and the National Historical Preservation Act.

The mining industry is intensely competitive.

The mining industry is intensely competitive. We may be at a competitive disadvantage because we must compete with other individuals and companies, many of which have greater financial resources, operational experience and technical capabilities than we do. Increased competition could adversely affect our ability to attract necessary capital funding or acquire suitable producing properties or prospects for mineral exploration in the future. We may also encounter increasing competition from other mining companies in our efforts to locate acquisition targets, hire experienced mining professionals and acquire exploration resources.

Our future success is subject to risks inherent in the mining industry.

Our future mining operations, if any, would be subject to all of the hazards and risks normally incident to developing and operating mining properties. These risks include:

| · | insufficient ore reserves; |

| · | fluctuations in metal prices and increase in production costs that may make mining of reserves uneconomic; |

| · | significant environmental and other regulatory restrictions; |

| · | labor disputes; geological problems; |

| · | failure of underground stopes and/or surface dams; |

| · | force majeure events; and |

| · | the risk of injury to persons, property or the environment. |

Our future profitability will be affected by changes in the prices of metals.

If we establish reserves, and complete development of a mine, our profitability and long-term viability will depend, in large part, on the market price of gold. The market prices for metals are volatile and are affected by numerous factors beyond our control, including:

| · | global or regional consumption patterns; |

| · | supply of, and demand for, gold and other metals; |

| · | speculative activities; |

| · | expectations for inflation; and, |

| · | political and economic conditions. |

| 17 |

The aggregate effect of these factors on metals prices is impossible for us to predict. Decreases in metals prices could adversely affect our ability to finance the exploration and development of our properties, which would have a material adverse effect on our financial condition and results of operations and cash flows. There can be no assurance that metals prices will not decline.

The price of gold may decline in the future. If the price of gold and silver is depressed for a sustained period, we may be forced to suspend operations until the prices increase, and to record asset impairment write-downs. Any continued or increased net losses or asset impairments would adversely affect our financial condition and results of operations.

We are subject to significant governmental regulations.

Our operations and exploration and development activities are subject to extensive federal, state, and local laws and regulations governing various matters, including:

| · | environmental protection; |

| · | management and use of toxic substances and explosives; |

| · | management of natural resources; |

| · | exploration and development of mines, production and post-closure reclamation; |

| · | taxation; |

| · | labor standards and occupational health and safety, including mine safety; and |

| · | historic and cultural preservation. |

Failure to comply with applicable laws and regulations may result in civil or criminal fines or penalties or enforcement actions, including orders issued by regulatory or judicial authorities enjoining or curtailing operations or requiring corrective measures, installation of additional equipment or remedial actions, any of which could result in us incurring significant expenditures. We may also be required to compensate private parties suffering loss or damage by reason of a breach of such laws, regulations or permitting requirements. It is also possible that future laws and regulations, or a more stringent enforcement of current laws and regulations by governmental authorities, could cause additional expense, capital expenditures, restrictions on or suspensions of any future operations and delays in the exploration of our properties.

Changes in mining or environmental laws could increase costs and impair our ability to develop our properties.

From time to time the U.S. government may determine to revise U.S. mining and environmental laws. It remains unclear to what extent new legislation or regulations may affect existing mining claims or operations. The effect of any such revisions on our operations cannot be determined conclusively until such revision is enacted; however, such legislation could materially increase costs on properties located on federal lands, such as ours, and such revision could also impair our ability to develop the Properties and to explore and develop other mineral projects.

| 18 |

Compliance with environmental regulations and litigation based on environmental regulations could require significant expenditures.

Mining exploration and mining are subject to the potential risks and liabilities associated with pollution of the environment and the disposal of waste products occurring as a result of mineral exploration and production. Insurance against environmental risk (including potential liability for pollution or other hazards as a result of the disposal of waste products occurring from exploration and production) is not generally available to us (or to other companies in the minerals industry) at a reasonable price.

Environmental regulations mandate, among other things, the maintenance of air and water quality standards and land reclamation. They also set forth limitations on the generation, transportation, storage and disposal of solid and hazardous waste. Environmental legislation is evolving in a manner which will require stricter standards and enforcement, increased fines and penalties for non-compliance, more stringent environmental assessments of proposed projects, and a heightened degree of responsibility for companies and their officers, directors and employees.

To the extent we are subject to environmental liabilities, the settlement of such liabilities or the costs that we may incur to remedy environmental pollution would reduce funds otherwise available to us and could have a material adverse effect on our financial condition and results of operations. If we are unable to fully remedy an environmental problem, it might be required to suspend operations or enter into interim compliance measures pending completion of the required remedy. The environmental standards that may ultimately be imposed at a mine site impact the cost of remediation and may exceed the financial accruals that have been made for such remediation. The potential exposure may be significant and could have a material adverse effect on our financial condition and results of operations.

Moreover, governmental authorities and private parties may bring lawsuits based upon damage to property and injury to persons resulting from the environmental, health and safety impacts of our operations, which could lead to the imposition of substantial fines, remediation costs, penalties and other civil and criminal sanctions. Substantial costs and liabilities, including for restoring the environment after the closure of mines, are inherent in our proposed operations

Some mining wastes are currently exempt to a limited extent from the extensive set of federal Environmental Protection Agency (“EPA”) regulations governing hazardous waste under the Resource Conservation and Recovery Act (“RCRA”). If the EPA designates these wastes as hazardous under RCRA, we may be required to expend additional amounts on the handling of such wastes and to make significant expenditures to construct hazardous waste disposal facilities. In addition, if any of these wastes causes contamination in or damage to the environment at a mining facility, such facility may be designated as a “Superfund” site under the Comprehensive Environmental Response, Compensation and Liability Act (“CERCLA”). Under CERCLA, any owner or operator of a Superfund site since the time of its contamination may be held liable and may be forced to undertake extensive remedial cleanup action or to pay for the government’s cleanup efforts. Such owner or operator may also be liable to governmental entities for the cost of damages to natural resources, which may be substantial. Additional regulations or requirements are also imposed under the federal Clean Water Act (“CWA”). The Company considers the current proposed federal legislation relating to climate change and its potential enactment may have future impacts to the Company’s operations in the United States.

In addition, there are numerous legislative and regulatory proposals related to climate change, including legislation pending in the U.S. Congress to require reductions in greenhouse gas emissions. The Company has reviewed and considered current federal legislation relating to climate change and does not believe it to have a material effect on its operations, however, additional regulation or requirements under any of these laws and regulations could have a materially adverse effect upon the Company and its results of operations.

Compliance with CERCLA, the CWA and state environmental laws could entail significant costs, which could have a material adverse effect on our operations.

In the context of environmental permits, including the approval of reclamation plans, we must comply with standards and regulations which entail significant costs and can entail significant delays. Such costs and delays could have a dramatic impact on our operations. There is no assurance that future changes in environmental regulation, if any, will not adversely affect our operations. We intend to fully comply with all applicable environmental regulations.

We are required to obtain government permits to begin new operations. The acquisition of such permits can be materially impacted by third party litigation seeking to prevent the issuance of such permits. The costs and delays associated with such approvals could affect our operations, reduce our revenues, and negatively affect our business as a whole.

Mining companies are required to seek governmental permits for the commencement of new operations. Obtaining the necessary governmental permits is a complex and time-consuming process involving numerous jurisdictions and often involving public hearings and costly undertakings. The duration and success of permitting efforts are contingent on many factors that are out of our control. The governmental approval process may increase costs and cause delays depending on the nature of the activity to be permitted, and could cause us to not proceed with the development of a mine. Accordingly, this approval process could harm our results of operations.

| 19 |

Mineral exploration and development inherently involves significant and irreducible financial risks. We may suffer from the failure to find and develop profitable mineral deposits.

The exploration for and development of mineral deposits involves significant financial risks, which even a combination of careful evaluation, experience and knowledge may not eliminate. Unprofitable efforts may result from the failure to discover mineral deposits. Even if mineral deposits are found, such deposits may be insufficient in quantity and quality to return a profit from production, or it may take a number of years until production is possible, during which time the economic viability of the project may change. Few properties which are explored are ultimately developed into producing mines. Mining companies rely on consultants and others for exploration, development, construction and operating expertise.

Substantial expenditures are required to establish ore reserves, extract metals from ores and, in the case of new properties, to construct mining and processing facilities. The economic feasibility of any development project is based upon, among other things, estimates of the size and grade of ore reserves, proximity to infrastructures and other resources (such as water and power), metallurgical recoveries, production rates and capital and operating costs of such development projects, and metals prices. Development projects are also subject to the completion of favorable feasibility studies, issuance and maintenance of necessary permits and receipt of adequate financing.

Once a mineral deposit is developed, whether it will be commercially viable depends on a number of factors, including: the particular attributes of the deposit, such as size, grade and proximity to infrastructure; government regulations including taxes, royalties and land tenure; land use, importing and exporting of minerals and environmental protection; and mineral prices. Factors that affect adequacy of infrastructure include: reliability of roads, bridges, power sources and water supply; unusual or infrequent weather phenomena; sabotage; and government or other interference in the maintenance or provision of such infrastructure. All of these factors are highly cyclical. The exact effect of these factors cannot be accurately predicted, but the combination may result in not receiving an adequate return on invested capital.

Significant investment risks and operational costs are associated with our exploration activities. These risks and costs may result in lower economic returns and may adversely affect our business.

Mineral exploration, particularly for gold, involves many risks and is frequently unproductive. If mineralization is discovered, it may take a number of years until production is possible, during which time the economic viability of the project may change.

Development projects may have no operating history upon which to base estimates of future operating costs and capital requirements. Development project items such as estimates of reserves, metal recoveries and cash operating costs are to a large extent based upon the interpretation of geologic data, obtained from a limited number of drill holes and other sampling techniques, and feasibility studies. Estimates of cash operating costs are then derived based upon anticipated tonnage and grades of ore to be mined and processed, the configuration of the ore body, expected recovery rates of metals from the ore, comparable facility and equipment costs, anticipated climate conditions and other factors. As a result, actual cash operating costs and economic returns of any and all development projects may materially differ from the costs and returns estimated, and accordingly, our financial condition and results of operations may be negatively affected.

Our failure to satisfy the financial commitments under the agreements controlling our rights to explore on our current prospects could result in our loss of those potential opportunities.

We hold all of our mineral interests under agreements and commitments that require ongoing financial obligations, including work commitments. Our failure to satisfy those obligations could result in a loss of those interests. In such an event, we would be required to recognize an impairment of the assets currently reported in our financial statements.

| 20 |

We are required to obtain government permits to begin new operations. The acquisition of such permits can be materially impacted by third party litigation seeking to prevent the issuance of such permits. The costs and delays associated with such approvals could affect our operations, reduce our revenues, and negatively affect our business as a whole.

Mining companies are required to seek governmental permits for the commencement of new operations. Obtaining the necessary governmental permits is a complex and time-consuming process involving numerous jurisdictions and often involving public hearings and costly undertakings. The duration and success of permitting efforts are contingent on many factors that are out of our control. The governmental approval process may increase costs and cause delays depending on the nature of the activity to be permitted, and could cause us to not proceed with the development of a mine. Accordingly, this approval process could harm our results of operations.

Any of our future acquisitions may result in significant risks, which may adversely affect our business.

An important element of our business strategy is the opportunistic acquisition of operating mines, properties and businesses or interests therein within our geographical area of interest. While it is our practice to engage independent mining consultants to assist in evaluating and making acquisitions, any mining properties or interests therein we may acquire may not be developed profitably or, if profitable when acquired, that profitability might not be sustained. In connection with any future acquisitions, we may incur indebtedness or issue equity securities, resulting in increased interest expense, or dilution of the percentage ownership of existing shareholders. We cannot predict the impact of future acquisitions on the price of our business or our common stock. Unprofitable acquisitions, or additional indebtedness or issuances of securities in connection with such acquisitions, may impact the price of our common stock and negatively affect our results of operations.

Our ability to find and acquire new mineral properties is uncertain. Accordingly, our prospects are uncertain for the future growth of our business.

Because mines have limited lives based on proven and probable ore reserves, we may seek to replace and expand our future ore reserves, if any. Identifying promising mining properties is difficult and speculative. Furthermore, we encounter strong competition from other mining companies in connection with the acquisition of properties producing or capable of producing gold. Many of these companies have greater financial resources than we do. Consequently, we may be unable to replace and expand future ore reserves through the acquisition of new mining properties or interests therein on terms we consider acceptable. As a result, our future revenues from the sale of gold or other precious metals, if any, may decline, resulting in lower income and reduced growth.

Corporate and securities laws and regulations are likely to increase our costs.

The Sarbanes-Oxley Act of 2002 (“SOX”), which became law in July 2002, has impacted our corporate governance, securities disclosure and compliance practices. In response to the requirements of SOX, the SEC and major stock exchanges have promulgated rules and listing standards covering a variety of subjects. Compliance with these rules and listing standards are likely to increase our general and administrative costs, and we expect these to continue to increase in the future. In particular, we are required to include the management report on internal control as part of our annual reports pursuant to Section 404 of SOX. We have evaluated our internal control systems in order (i) to allow management to report on our internal controls, as required by these laws, rules and regulations, (ii) to provide reasonable assurance that our public disclosure will be accurate and complete, and (iii) to comply with the other provisions of Section 404 of SOX. We cannot be certain as to the timing of the completion of our evaluation, testing and remediation actions or the impact these may have on our operations. Furthermore, there is no precedent available by which to measure compliance adequacy. If we are not able to implement the requirements relating to internal controls and all other provisions of Section 404 in a timely fashion or achieve adequate compliance with these requirements or other requirements of SOX, we might become subject to sanctions or investigation by regulatory authorities such as the SEC or FINRA. Any such action may materially adversely affect our reputation, financial condition and the value of our securities, including our common stock. SOX and these other laws, rules and regulations have increased legal and financial compliance costs and have made our corporate governance activities more difficult, time-consuming and costly.

| 21 |

If we fail to maintain an effective system of internal controls, we may not be able to accurately report our financial results or prevent fraud. As a result, current and potential shareholders could lose confidence in our financial reporting, this would harm our business and the trading price of our stock.

Effective internal controls are necessary for us to provide reliable financial reports and effectively prevent fraud. If we cannot provide financial reports or prevent fraud, our business reputation and operating results could be harmed. Inferior internal controls could also cause investors to lose confidence in our reported financial information, which could have a negative effect on the trading price of our stock.

Nevada law and our by-laws protect our directors from certain types of lawsuits.

Nevada law provides that our directors will not be liable to us or our stockholders for monetary damages for all but certain types of conduct as directors. Our by-laws require us to indemnify our directors and officers against all damages incurred in connection with our business to the fullest extent provided or allowed by law. The exculpation provisions may have the effect of preventing shareholders from recovering damages against our directors caused by their negligence, poor judgment or other circumstances. The indemnification provisions may require us to use our assets to defend our directors and officers against claims, including claims arising out of their negligence, poor judgment, or other circumstances.

The Company is subject to extensive government regulations and permit requirements.

Operations, development and exploration on the Company’s properties are affected to varying degrees by political stability and government regulations relating to such matters as environmental protection, health, safety and labour, mining law reform, restrictions on production, price controls, tax increases, maintenance of claims, tenure, and expropriation of property. Failure to comply with applicable laws and regulations may result in fines or administrative penalties or enforcement actions, including orders issued by regulatory or judicial authorities enjoining or curtailing operations or requiring corrective measures, installation of additional equipment or remedial actions, any of which could result in the Company incurring significant expenditures.

The activities of the Company require licenses and permits from various governmental authorities. The Company currently has been granted the requisite licenses and permits to enable it to carry on its existing business and operations. There can be no assurance that the Company will be able to obtain all the necessary licenses and permits which may be required to carry out exploration, development and mining operations for its projects in the future. The Company might find itself in situations where the state of compliance with regulation and permits can be subject to interpretation and challenge from authorities that could carry risk of fines or temporary stoppage.

Opposition of the Company’s exploration, development and operational activities may adversely affect the Company’s reputation, its ability to receive mining rights or permits and its current or future activities.

Maintaining a positive relationship with the communities in which the Company operates is critical to continuing successful exploration and development. Community support for operations is a key component of a successful exploration or development project. Various international and national laws, codes, resolutions, conventions, guidelines and other materials relating to corporate social responsibility (including rights with respect to health and safety and the environment) may also require government consultation with communities on a variety of issues affecting local stakeholders, including the approval of mining rights or permits.

The Company may come under pressure in the jurisdictions in which it explores or develops to demonstrate that other stakeholders benefit and will continue to benefit from its commercial activities. Local stakeholders and other groups may oppose the Company’s current and future exploration, development and operational activities through legal or administrative proceedings, protests, roadblocks or other forms of public expression against the Company’s activities. Opposition by such groups may have a negative impact on the Company’s reputation and its ability to receive necessary mining rights or permits. Opposition may also require the Company to modify its exploration, development or operational plans or enter into agreements with local stakeholders or governments with respect to its projects, in some cases causing considerable project delays. Any of these outcomes could have a material adverse effect on the Company’s business, financial condition, results of operations and Common Share price.

| 22 |

The title to the Company’s properties could be challenged or impugned.

Although the Company has or will receive title opinions for any properties in which it has a material interest, there is no guarantee that title to such properties will not be challenged or impugned. The Company has not conducted surveys of the claims in which it holds direct or indirect interests and, therefore the precise area and location of the properties may be in doubt. The Company’s properties may be subject to prior unregistered agreements or transfers or native land claims and title may be affected by unidentified or unknown defects. Title insurance is generally not available for mineral properties and the Company’s ability to ensure that it has obtained secure claims to individual mineral properties or mining concessions may be constrained. A successful challenge to the Company’s title to a property or to the precise area and location of a property could cause delays or stoppages to the Company’s exploration, development or operating activities without reimbursement to the Company. Any such delays or stoppages could have a material adverse effect on the Company’s business, financial condition and results of operations.

Risks Related to Our Stock

Future issuances of our common stock could dilute current shareholders and adversely affect the market if it develops.

We have the authority to issue up to one billion shares of common stock and 25 million shares of preferred stock and to issue options and warrants to purchase shares of our common stock, without shareholder approval. Future share issuances are likely due to our need to raise additional working capital in the future. Those future issuances will likely result in dilution to our shareholders. In addition, we could issue large blocks of our common stock to fend off unwanted tender offers or hostile takeovers without further shareholder approval, which would not only result in further dilution to investors in this offering but could also depress the market value of our common stock, if a public trading market develops.

We may issue preferred stock that would have rights that are preferential to the rights of our common stock that could discourage potentially beneficial transactions to our common shareholders.

An issuance of shares of preferred stock could result in a class of outstanding securities that would have preferences with respect to voting rights and dividends and in liquidation over our common stock and could, upon conversion or otherwise, have all of the rights of our common stock. Our Board of Directors' authority to issue preferred stock could discourage potential takeover attempts or could delay or prevent a change in control through merger, tender offer, proxy contest or otherwise by making these attempts more difficult or costly to achieve. The issuance of preferred stock could impair the voting, dividend and liquidation rights of common stockholders without their approval.

There is currently an illiquid market for our common shares, and shareholders may be unable to sell their shares for an indefinite period of time.

There is presently an illiquid market for our common shares. There is no assurance that a liquid market for our common shares will ever develop in the United States or elsewhere, or that if such a market does develop that it will continue.

Over-the-counter stocks are subject to risks of high volatility and price fluctuation.

We have not applied to have our shares listed on any stock exchange or on the NASDAQ Capital Market, and we do not plan to do so in the foreseeable future. The OTC market for securities has experienced extreme price and volume fluctuations during certain periods. These broad market fluctuations and other factors, such as commodity prices and the investment markets generally, as well as economic conditions and quarterly variations in our results of operations, may adversely affect the market price of our common stock and make it more difficult for investors to sell their shares.

| 23 |

Trading in our securities is on an electronic bulletin board established for securities that do not meet NASDAQ listing requirements. As a result, investors will find it substantially more difficult to dispose of our securities. Investors may also find it difficult to obtain accurate information and quotations as to the price of, our common stock.

Our stock price may be volatile and as a result, shareholders could lose all or part of their investment. The value of our shares could decline due to the impact of any of the following factors upon the market price of our common stock:

| · | failure to meet operating budget; |

| · | decline in demand for our common stock; |

| · | operating results failing to meet the expectations of securities analysts or investors in any quarter; |

| · | downward revisions in securities analysts' estimates or changes in general market conditions; |

| · | investor perception of the mining industry or our prospects; and |

| · | general economic trends. |

In addition, stock markets have experienced extreme price and volume fluctuations and the market prices of securities have been highly volatile. These fluctuations are often unrelated to operating performance and may adversely affect the market price of our common stock.

Outstanding shares that are eligible for future sale could adversely impact a public trading market for our common stock.

All of the shares of common stock that were distributed under the Athena spin-off dividend are free-trading shares. In addition, in the future, we may offer and sell shares without registration under the Securities Act. All of such shares will be "restricted securities" as defined by Rule 144 ("Rule 144") under the Securities Act and cannot be resold without registration except in reliance on Rule 144 or another applicable exemption from registration. Under Rule 144, our non-affiliates (who have not been affiliates within the past 90 days) can sell restricted shares held for at least six months, subject only to the restriction that we made available public information as required by Rule 144 (which restriction is not applicable after the shares have been held by non-affiliates for at least 12 months). Our affiliates can sell restricted securities after they have been held for six months, subject to compliance with manner of sale, volume restrictions, Form 144 filing and current public information requirements.

No prediction can be made as to the effect, if any, that future sales of restricted shares of common stock, or the availability of such common stock for sale, will have on the market price of the common stock prevailing from time to time. Sales of substantial amounts of such common stock in the public market, or the perception that such sales may occur, could adversely affect the then prevailing market price of the common stock.

Owners of our common stock are subject to the “penny stock” rules.

Since our shares are not listed on a national stock exchange or quoted on the Nasdaq Market within the United States, trading in our shares on the OTC market is subject, to the extent the market price for our shares is less than $5.00 per share, to a number of regulations known as the "penny stock rules". The penny stock rules require a broker-dealer to deliver a standardized risk disclosure document prepared by the SEC, to provide the customer with additional information including current bid and offer quotations for the penny stock, the compensation of the broker-dealer and its salesperson in the transaction, monthly account statements showing the market value of each penny stock held in the customer's account, and to make a special written determination that the penny stock is a suitable investment for the investor and receive the investor’s written agreement to the transaction. To the extent these requirements may be applicable they will reduce the level of trading activity in the secondary market for our shares and may severely and adversely affect the ability of broker-dealers to sell our shares, if a publicly traded market develops.

| 24 |

We do not expect to pay cash dividends in the foreseeable future. Any return on investment may be limited to the value of our stock.

We have never paid any cash dividends on any shares of our capital stock, and we do not anticipate that we will pay any dividends in the foreseeable future. Our current business plan is to retain any future earnings to finance the expansion of our business. Any future determination to pay cash dividends will be at the discretion of our Board of Directors, and will be dependent upon our financial condition, results of operations, capital requirements and other factors as our board of directors may deem relevant at that time. If we do not pay cash dividends, our stock may be less valuable because a return on your investment will only occur if our stock price appreciates.

Nevada law and our by-laws protect our directors from certain types of lawsuits.