Attached files

| file | filename |

|---|---|

| EX-32.1 - Save Foods Inc. | ex32-1.htm |

| EX-31.1 - Save Foods Inc. | ex31-1.htm |

| EX-21.1 - Save Foods Inc. | ex21-1.htm |

| EX-4.1 - Save Foods Inc. | ex4-1.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

[X] ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the Fiscal Year Ended December 31, 2020

or

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from _______________ to _______________

Commission file number 000-56100

SAVE FOODS, INC.

(Exact name of registrant as specified in its charter)

| Delaware | 26-468460 | |

State or other jurisdiction of incorporation or organization |

(I.R.S. Employer Identification No.) |

Kibbutz Alonim, Israel, 3657700

(Address of principal executive offices) (Zip Code)

(347) 468 9583

Registrant’s telephone number, including area code

Securities registered pursuant to Section 12(b) of the Act: None

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||

| N/A | N/A | N/A |

Securities registered pursuant to Section 12(g) of the Act:

Common Stock, $0.0001 Par Value

(Title of class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes [ ] No [X]

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes [ ] No [X]

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes [X] No [ ]

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes [X] No [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer”, “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | [ ] | Accelerated filer | [ ] |

| Non-accelerated filer | [X] | Smaller reporting company | [X] |

| Emerging growth company | [ ] |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. [ ]

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. [ ]

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes [ ] No [X]

The aggregate market value of the voting and non-voting stock held by non-affiliates of the registrant as of June 30, 2020, based on the price at which the common equity was last sold on the OTC Market, Pink Tier, on such date, was $11,740,910. For purposes of this computation only, all officers, directors and 10% or greater stockholders of the registrant are deemed to be affiliates.

As of March 29, 2021, there were 1,606,760 shares of the registrant’s common stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

None.

TABLE OF CONTENTS

| 2 |

This Annual Report on Form 10-K (the “Annual Report”) includes a number of forward-looking statements that reflect management’s current views with respect to future events and financial performance. Forward-looking statements are projections in respect of future events or our future financial performance. In some cases, you can identify forward-looking statements by terminology such as “may,” “should,” “expects,” “plans,” “anticipates,” “believes,” “estimates,” “predicts,” “potential” or “continue” or the negative of these terms or other comparable terminology. Those statements include statements regarding the intent, belief or current expectations of our Company and members of our management team as well as the assumptions on which such statements are based. Prospective investors are cautioned that any such forward-looking statements are not guarantees of future performance and involve risks and uncertainties, and that actual results may differ materially from those contemplated by such forward-looking statements.

These statements are only predictions and involve known and unknown risks, uncertainties and other factors. Readers are urged to carefully review and consider the various disclosures made by us in this Annual Report and in our other reports filed with the Securities and Exchange Commission. We undertake no obligation to update or revise forward-looking statements to reflect changed assumptions, the occurrence of unanticipated events or changes in future operating results over time except as required by law. We believe that our assumptions are based upon reasonable data derived from and known about our business and operations. No assurances are made that actual results of operations or the results of our future activities will not differ materially from our assumptions.

As used in this Annual Report and unless otherwise indicated, the terms “Save Foods,” “we,” “us,” “our,” or “our Company” refer to Save Foods, Inc. Unless otherwise specified, all dollar amounts are expressed in United States dollars.

All information in this Annual Report relating to shares or price per share reflects the 1-for-7 reverse stock split effected by us on February 23, 2021.

| 3 |

Company Overview

We develop eco-friendly “green” solutions for the food industry. Our solutions are developed to improve the food safety and shelf life of fresh produce. We do this by controlling human and plant pathogens, thereby reducing spoilage, and in turn, reducing food loss.

Our products are based on a proprietary blend of food acids which have a synergistic effect when combined with certain types of oxidizing agent-based sanitizers and fungicides at low concentrations. Our “green” products are capable of cleaning, sanitizing and controlling pathogens on fresh produce with the goal of making them safer for human consumption and extending their shelf life by reducing their decay. One of the main advantages of our products is that our active ingredients do not leave any toxicological residues on the fresh produce we treat. In contrary, by forming a temporary protective shield around the fresh produce we treat, our products make it difficult for pathogens to develop and potentially provide protection which also reduces cross-contamination.

The U.S. Food and Drug Administration (the “FDA”) Food Safety Modernization Act (the “FSMA”) is transforming the United States’ food safety system by shifting the focus from responding to foodborne illness to preventing it. According to the recent data from the Centers for Disease Control and Prevention, approximately 48 million people in the United States get sick each year from foodborne diseases. We believe this is a significant public health burden that is largely preventable. Since 2011, the FDA has had a legislative mandate to require comprehensive, science-based preventive controls across the food supply. In the context of fresh produce at packing houses, FDA’s final produce safety rule (with an initial compliance date of January 26, 2018) provides for the use of sanitizers to ensure produce is cleaned from human pathogens.

In addition, most conventional chemical pesticides (fungicides), which are currently used to protect fresh produce from microbial spoilage and reduce food waste, are potentially toxic, they remain on fruit peel and present health concerns, while also polluting the environment. Therefore, the use of these products is strictly regulated and their residue on food and on the environment are carefully monitored. Today’s trends led by both consumers and regulatory bodies are to significantly reduce the use of fungicides and switch to greener solutions In a series of studies conducted in collaboration with a large post-harvest service company during the second quarter of 2020, our products have shown impressive results in extending the shelf life of fresh produce in “organic” (where no fungicides are used at the post-harvest stage) and conventional (where fungicides are being used at the post-harvest stage) settings. On average, our products may reduce the rotten fruits at the retail level by 50%.

We have a unique opportunity to make a positive difference throughout the food value chain from field to fork and address two of the major’s challenges in the food industry today — safety and waste. We target major markets that use conventional chemical pesticides and sanitizers, including the pre- and post-harvest market, the greenhouse market and the fresh-cut market, where our “green” products are used as alternatives for, or mixed with, conventional products in order to reduce (i) health and environmental concerns, and/or (ii) microbial resistance that has reduced the efficacy of conventional chemical pesticides.

Recent Developments

On March 16, 2021, we filed a registration statement on Form S-1 with the U.S. Securities and Exchange Commission in connection with a proposed public offering of our common stock, par value $0.0001 per share (the “Common Stock”, and collectively the “Current Offering”). On January 12, 2021, we applied to list our Common Stock on the Nasdaq Capital Market.

Industry Overview and Market Opportunity

Background

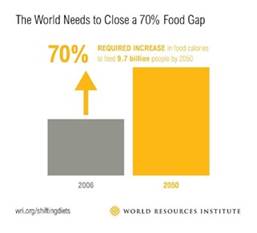

The world’s population is expected to grow to almost 10 billion people by 2050, boosting agricultural demand by some 50%. Providing healthy and safe food to feed the world’s population is one of the biggest challenges of the twenty first century, accentuated with the backdrop of a of a fragile global economy. Globally, around one-third of the food produced (estimated at circa 1.3 billion tons), is lost or wasted along the food chain – from production to consumption.

| 4 |

Fruits and vegetables are considered essential food commodities and demonstrate their best benefits especially when consumed fresh. Consumption as well as production of fresh fruit and vegetables is growing globally; in 2018, the global production of fresh fruit amounted to about 868 million tons, while the production of fresh vegetable amounted to about 1.09 billion tons. According to a report published by technavio in October 2020, the fresh food market size has the potential to grow by 337.76 million tons from 2020 to 2024, growing at a CAGR of almost 3% during the forecast period, and the market’s growth momentum will accelerate during the forecast period due to the steady increase in year-over-year growth. In the United States, according to a report by Grand View Research, increasing health awareness among the U.S population and potential development of secondary diseases due to obesity and unhealthy eating habits are propelling the market of fruit and vegetables to reach an estimated $1.1 billion by 2025.

Food Safety and Food Loss

Food Safety

We believe foodborne diseases are a significant public health concern globally. Hundreds of diseases are caused by eating contaminated food. Many diseases are spread through unwashed or untreated produce. With approximately 48 million people in the United States (one in six) getting sick, 128,000 hospitalized, and 3,000 die each year from foodborne diseases, according to recent data published by the FDA, and 23 million in the European region getting sick due to food borne disease, food safety is another major concern and source of waste, placing a material burden on public health and significant healthcare cost. The economic burden of foodborne illness has been estimated to be as high as $90 billion annually.

When considering the farm-to-fork chain, microbial contamination of fresh produce can occur at multiple steps. Contamination can take place during the cultivation of fresh produce, at harvest, during preparation/washing, within distribution chains and transport to shops, and even at the final step in the consumers’ kitchen. We believe this is a significant public health burden that is largely preventable. The FSMA is transforming the United States food safety system by shifting the focus from responding to foodborne illness to preventing it. The Produce Safety rule of the FSMA establishes, for the first time, science-based minimum standards for the safe growing, harvesting, packing, and holding of fruits and vegetables grown for human consumption. The final rule went into effect on January 26, 2016. Sanitization is a cornerstone of FSMA compliance, which requires preventing or eliminating food safety hazards or reducing such hazards to a minimal level.

Markets require many types of produce to be washed prior to sale in order to remove dirt and other debris. Produce can be contaminated with foodborne pathogens before it enters the packing house, and these pathogens cannot be seen with the naked eye. Inability to visually spot pathogens makes the washing step one of the most important steps in packing because, if washing process is not controlled, it can become a source of cross-contamination (when foodborne pathogens fall off contaminated produce into the water where they can contaminate more produce). These washing steps are defined by the packing house safety managers as critical point because water mixed with organic materials are good conditions for pathogens to develop. Therefore, the use of sanitizers should be introduced during the washing step because they are, most of the time, one of the last treatments applied before the produce meets with the consumer. Sanitizers are designed to inactivate/kill any bacteria in the water, drastically reducing the possibility of cross-contamination. We believe this represents a significant opportunity for us.

| 5 |

Food Loss

The Food and Agriculture Organization of United Nations predicts that about third of the food produced globally are wasted or lost every year. Approximately 644 million tons of fruits and vegetables are thrown away each year (representing 42% of the total food wasted every year). A report published in April 2020, generated by the European Innovation Partnership Agricultural Productivity and Sustainability, estimates that in Europe an estimated 9 million tons of food is lost at the production stage (farm), while up to 16.9 million tons are lost at the processing stage (packing houses, etc.).

Much of this loss is caused by spoilage, which can be caused by microorganisms – primarily bacteria and mold. In addition, bacteria and fungi represent the highest numbers of incidents of post-harvest microbial diseases in fresh produce worldwide. Taken together, it is estimated that nearly a third of all food grown is lost between the time that it is grown and harvested and the time that it is packaged for retail sale. Such waste equates to roughly $680 billion in industrialized countries and $310 billion in developing countries.

Post-harvest losses due to spoilage represent a significant problem along the supply chain and lead to profit losses in the millions. The main causes of these losses are pest or disease infestation and incorrect storage conditions, which lead to rotting or loss of fresh mass due to respiration and evaporation. Fruits and vegetables are largely damaged after harvest by fungi and bacteria . It is estimated that an average of 45% of harvested fruit and vegetables are lost globally. Post-harvest diseases have been identified as the greatest cause of post-harvest losses in fruits and vegetables, causing significant economic losses. It is estimated that approximately 20 to 25% of the fruit and vegetables harvested are lost due to microbial spoilage during post-harvest handling in developed countries. Furthermore, the demand for fresh fruits and vegetables, especially exotic tropical fruit has contributed to the demand for post-harvest treatments to increase shelf life and maintain quality, resulting in more efficient export trade.

The most common way to protect fresh produce and prevent loss is the use of hazardous chemicals such as fungicides in post-harvest applications. Post-harvest diseases are generally controlled by fungicides. Systemic (non-organic) fungicides, are one of the most commonly used fungicides, for example, citrus fruits in California are completely covered by the fungicides, and the residue is persistent for the life of the fruit providing protection. However, as they tend to affect a single biochemical pathway within the pathogen, fungi may readily develop resistance to systemic fungicides. To avoid potential issues with resistance, maximum concentration of fungicides will be generally used to ensure highly efficient eradication of the targeted pathogen which leaves high residue level on the treated produce.

However, these chemical agents have been applied for many years with few or limited success due to the development of resistance. Further they have severe negative effects on human health, and the environment mainly due to the carcinogenic and/or teratogenic properties of the compounds, and by their cumulative toxic effects.

The effects of exposure to these hazardous chemicals on humans and the environment are a continuing concern as they are intrinsically toxic and pollute the environment through wastewater discharge from the packing house or a discarded fruit. Therefore, the agricultural use of certain pesticides (in the field or in the packing house) has been abandoned in some countries leaving the growers with significant challenges.

| 6 |

To control and monitor the potential negative impacts pesticides might have over time, regulatory agencies that regulate pesticides – for example, the United States Environmental Protection Agency (the “EPA”), the Pest Management Authority Agency in Canada, and the European Food Safety Authority (“EFSA”) in Europe, have defined a maximum residue level (the “MRL”) that can be present on the treated produce. Additionally, more countries require an MRL for the commodity to be imported into their country. As there is increased awareness regarding compliance with MRLs, MRLs have become a much greater concern. These changes have also impacted the market and we believe that consumers spearheaded this change by demanding organic or pesticide-free foods. Consumers have recently increasingly want to understand where and how their food is grown. Retailers and processors have capitalized on what they view as an opportunity to offer more information to consumers. It is more common now for retailers and processors to ask which products have been used on the commodities they are purchasing. There are also retailers and processors banning the use of certain products, requiring any residues to be below the established MRLs. The reduction in MRLs results in lower efficacy of fungicide and increased loss.

We believe that the rising demand for healthy food among the global population will trigger the market’s growth in the forthcoming years. Over the last decade, the organic market in Europe continued to grow and reached €40.7 billion in 2018 with 15.6 million hectares (approximately 38,548,439 acres) (including 2.2 million hectares in Spain, the largest organic area in Europe, followed by 2.0 million hectares in France and 2.0 million hectares in Italy), providing farmers with further added value on their production. The strong growth rates in both production and consumption indicate that the organic market has not yet reached its peak and further growth can still be expected. Organic farming is already responding to further emerging consumer trends such as veganism and demand for locally produced food products, turning these challenges into opportunities.

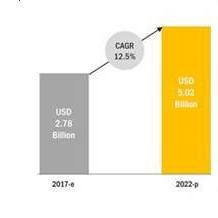

As consumer demand for organic fruits and vegetables is increasing globally and there is an increasing promotion by government organizations for the adoption of environmentally friendly pesticides, the biorational pesticides market estimated at $2.78 billion in 2017 is projected to reach a value of $5.02 billion by 2022, at a compound annual growth rate (the “CAGR”) of 12.5% from 2017. A biorational pesticide is a term used to define any pesticide material that causes relatively no harm to humans or animals and does little or no damage to the environment. We believe that our products could be defined as biorational products.

Analysts have predicted that the organic fresh food market will reach a CAGR of almost 15% by 2023. The market size will increase by $62.23 billion during the forecast period from 2019 to 2023. In addition, strict regulations have been imposed on the usage of pesticides and GMO-produced crops worldwide. This, in turn, has influenced consumer demand for organic fruits and vegetables.

Case Study – Citrus Fruit

Citrus fruit, which represent one of the main fruit produce worldwide with more than 100 million tons produced worldwide, can be infected by many fungal pathogens, and these pathogens can cause considerable losses during storage and transportation. Losses are mainly caused by Penicillium digitatum, P. italicum, Aspergillus flavus and Alternaria alternata for citrus fruit. Post-harvest treatments such as thiabendazole, imazalil, sodium ortho-phenil phenate or other active ingredients have been used for many years. They are currently the most commonly used fungicides effective for controlling post-harvest fungal pathogens in citrus and they are used in citrus packing houses to maintain fresh fruit, control post-harvest decay, and extend fruit shelf life. However, significant problems such as environmental issues and health concerns have risen in the citrus industry due to chemical residues or the occurrence of pathogenic resistant strains which require the use of even higher concentration of these post-harvest treatments. However, currently, the residues of imazalil on citrus fruits is being revised by the European Commission. The EFSA put forward a proposal in 2018 to cut the MRL for imazalil from 5 milligrams per kilogram to 0.01 milligrams per kilogram, causing worry among Europe’s main citrus producing countries and packers exporting their produce to European countries. Due to the significant impact this proposal could have on the citrus industry, the European Council has decided, in the meantime, to start reducing imazalil residues to four milligrams per kilogram for citrus fruit for a limited period of time to allow the citrus industry an extra time to find green and safe alternatives. Our product PeroStar/SaveProtect has already shown its benefits in reducing significantly the residues of imazalil while maintaining the produce shelf life.

| 7 |

Current Market Drivers and Trends

In addition to food safety and food waste concerns, the following market drivers are also shaping the food industry by setting standards and conditions on the main actors in the industry:

| ● | Focus of consumers on health characteristics: consumers are more aware and conscious of the health characteristics of the food they consume. Consumers pay more attention to the qualities of the fresh produce they buy. Particularly in the United States and Europe, products such as berries, avocados, mangoes, pomegranates, papayas and sweet potatoes are gaining popularity and considered “super foods,” and these products are showing a strong annual import growth of 10% to 20%. | |

| ● | Increasing demand for organic produce: the demand for organic products is growing rapidly particularly in Europe and North America, and is closely related to consumer interest in healthy and pure eating. While the increasing demand created potential for oversees supply, it can be challenging and expansive for exporters in tropical climates to comply with the increasingly demanding organic standards. | |

| ● | Success of retailers determined by quality of produce: a recent report by Fruit Logistica published in 2019, based on consumer surveys that involved almost 7,000 consumers in 14 different markets across Europe and North America, demonstrated the increased importance of fresh produce for the profitability of food retailers. According to the report, when choosing the place to buy their groceries, consumers focus on the quality of the stores’ fresh food, with freshness of fruits and vegetable being their top priority. The report also showed that customers who are satisfied with the store’s fresh food quality, would visit the store more frequently than those who are not. In addition, consumers are also willing to pay more for better-quality produce and their basked will be 4% larger. | |

| ● | Promoting sustainability: a large range of sustainability aspects are directly related and affected by the fresh produce industry. Food waste accounts for 8% of global greenhouse gas emissions. Both consumers and businesses, are becoming more aware of the growing importance of sustainability issues. As consumers increasingly embrace social causes, they seek products and brands that align with their values. According to a recent analysis published by Research Insights, nearly six in 10 consumers surveyed are willing to change their shopping habits to reduce environmental impact, nearly eight in 10 respondents indicated sustainability is important for them, and among those respondents that indicated that sustainability is very or extremely important, over 70% indicated that they would pay a premium of 35%, on average, for brands that are sustainable and environmentally responsible. Increasing number of companies in the fresh food sector are investing in sustainability. Survey conducted by Champions 12.3 in 2017 showed that 99% of businesses that invested in reduction of food loss and waste, received a net positive financial return. Primary production companies are investing in aspects of food losses, energy efficiency and carbon footprint, through innovations such as drying produce, on-farm and off-grid cold rooms and post-harvest treatments. | |

| ● | Food retailers seek to reduce their waste and maximize their revenues: more than eight million tons of food are wasted every year in the United States in the retail sector alone, which translates into $18 billion in lost value (cost of waste) every year. Some retailers, including Walmart, have already committed to implement a zero-waste policy by 2025. Prevention solutions across the retail value chain offer the highest returns to retailers and are growing the fastest. | |

| ● | Regulators are promoting the use of safer chemical-based product: for example, the EPA offers a “Safer Choice” label that product manufacturers may use on qualifying products to help consumers and commercial buyers identify products with safer chemical ingredients. The EPA requires that every chemical, regardless of percentage, in a Safer Choice-certified product is evaluated and only the safest ingredients are allowed. |

| 8 |

| ● | Increasing investment in foodtech and agritech companies: according to a recent report published by AgFunder, a venture capital firm active in the foodtech and agritech, startups developing agrifoodtech solutions and products, raised approximately $26.1 billion in 2020, a 15.5% year-over-year increase. Reduction of food waste, extension of the shelf life of fresh produce and reduction of the use of pesticides are main focus of the industry and many companies are addressing these objectives, including: |

| ● | Apeel Sciences, a company developing an edible coating to extend the shelf life of fruit and vegetables, secured in May 2020 a $250 million investment from a leading venture capital, based on a firm valuation of more than $1 billion; | |

| ● | Lineage Logistics, an expert in cold chain management for food, raised $1.6 billion in September 2020. | |

| ● | Zymergen, an expert in biofacturing with applications also for the agricultures with the goal to develop safer crop protection and pest control using their natural products, secured in September 2020 an investment in a total amount of $300 million. | |

| ● | GreenLight Biosciences, an RNA based pest control reducing the use of toxic pesticides, secured in June 2020 an investment of $102 million. | |

| ● | Provivi, a company developing sustainable and safer pest control based on pheromones, closed a $45.5 million financing round in December 2020. | |

| ● | Enko Chem, a company using AI to develop green insecticides, fungicides, and herbicides, announced in June an investment of $45 million. | |

| ● | PeroxyChem, a manufacturer of hydrogen peroxide and peracetic acid and a well-positioned in high-margin specialty applications and applications for environmentally friendly disinfectants, was successfully acquired by Evonik for $640 million. |

The increased consumption of fruits and vegetables in combination with the current regulation and consumers’ demand for healthier food has placed a greater burden on the fresh produce industry to provide food products that are fresher in quality, demonstrate an extended shelf life and are safer to consume.

The aforementioned changes provide a unique opportunity for us to introduce our products. We are aiming to become a significant player in post-harvest green produce treatment, fully responsive to the world’s ongoing change in fruit and vegetables consumption, food safety requirements as well as regulations and consumer demand to eliminate the use of hazardous chemicals.

| 9 |

Our Core Products

Our innovative products address what we believe to be two of the most significant challenges in the food industry: increase food safety and reduce food loss. Our main product lines consist of a proprietary blend of organic food acids applied in post-harvest applications designed to ensure food safety and increase fruit and vegetable’ shelf life by reducing microbial spoilage.

The main steps in post-harvest applications are cleaning, sanitization, and coating (wax). Our products address the cleaning and sanitization application points which are the critical first steps for preserving the quality of fresh produce by controlling microbial contamination related to food safety (e.g., Listeria, Salmonella, E. coli) and food loss due to microbial spoilage (e.g., fungi, mold and yeast). In general, the current process includes an initial washing step to remove soil and other debris, which improves the product appearance and lowers the product temperature. The next step includes sanitation or disinfection methods combined with fungicides that can further reduce the presence and prevent the transfer of spoilage and pathogenic microorganisms on fresh produce surfaces. The last step usually includes application of wax sometimes combined with an additional application of fungicides to prevent or reduce physiological changes and risks of spoilage. Our main products are applied at the cleaning and sanitization steps.

One of the main advantages of our food acid blend is its non-toxic residues that are providing protection to the treated produce. And we believe that all the blend ingredients are recognized by the FDA as GRAS when used as intended in fruit and vegetable wash applications. Moreover, they significantly reduce or eliminate the need for additional post-harvest applications with conventional fungicide by at least 50%, and in some cases entirely, and can reduce food waste due to spoilage by up to 50% (see results below on easy peelers and mango). Our main products are:

| ● | Processing Aids – SavePROTECT or PeroStar: post-harvest treatment added to fruit and vegetable wash water as a processing aid to increase the efficiency of the oxidizing agent present in the water tank against plant pathogens to reduce produce loss; and | |

| ● | Sanitizers - SF3HS and SF3H: post-harvest cleaning and sanitizing solution to control both plant and foodborne pathogens to ensure both food safety as well as increase produce’s shelf life. |

Processing Aids – SavePROTECT or PeroStar

Processing aids are products that are intended to be used with other products to aid the application or enhance the effect of that product. Save Foods processing aids, which are marketed as SavePROTECT in the United States and as PeroStar in Spain Israel and Italy, are based on our proprietary blend of food acids and are added to the wash water at the cleaning and sanitization stages simultaneously with a low concentration of peracetic acid (“PAA”), a sanitizing agent. This food acid blend serves several functions:

| ● | SavePROTECT/PeroStar keeps the process wash waters at a relatively low stable pH level. We have observed that low pH levels strengthen the effectiveness of the PAA and the fungicide used which result in increased sanitation and biocide activity; | |

| ● | PAA-based products are used as disinfectant in wash water. When used with PAA-based products, SavePROTECT/PeroStar may optimize the efficacy of PAA and eliminates the strong odor of PAA, creating a more friendly and safe working environment; | |

| ● | When used with fungicides, including imidazole, imazillil, thiabendazole, etc. – most commonly used fungicides – SavePROTECT/PeroStar may optimize the efficacy of the fungicides used and prevent resistance buildup; | |

| ● | SavePROTECT/PeroStar helps to clean the fruit surface and can improve the performance of the wax applied leading to an improved appearance of treated fruit by leaving a glossy finish on the outer skin of the fruit; and | |

| ● | SavePROTECT/PeroStar helps to extend shelf life. |

During 2020, we ran a series of proof of concept and small trials in collaboration with commercial partners on pears, avocado, easy peelers, lime, mango, bell pepper, lemons, fresh cut vegetables and figs. In February 2021, we initiated a proof of concept in bananas.

| 10 |

Results on Easy Peelers

Easy peelers are citrus fruits that are easier to peel, such as tangerines, mandarins, satsumas, and clementines. As previously described, imazalil is currently one the most commonly used fungicide that is effective in controlling post-harvest fungal pathogens in citrus. Currently, the residues of imazalil on citrus fruit is being revised by the European Commission and have already been reduced, and this reduction poses challenges, especially to packing houses exporting to Europe.

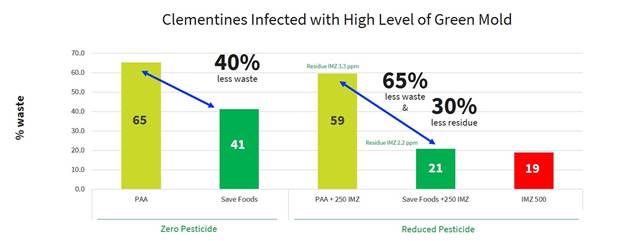

Between February and June 2020, we collaborated with the Israeli branch of one of the largest worldwide post-harvest service companies to demonstrate the safety and ability of PeroStar to meet the new requirement of reduced residue level of imazalil and efficiently control decay against the most common pathogens attacking citrus fruit such as Green mold (Penecillium digitatum) and sour rot (Geotrichum candidum). The experiment simulated the applications in a packing house which tested the use of imazalil with and without our products. The reference used in the trials to compare the results was the maximum amount of imazalil allowed and the current treatment in the packing house which is a combination of PAA and imazalil as well as PAA alone to simulate treatment in organic settings.

To ensure the efficacy of the products, it is customary to deliberately infect the fruit with the target pathogen at a concentration of around 105 and to inoculate it for 16 to 24 hours before treatment. Following the treatments, the fruit was stored in cold storage for between 9 to 21 days and then stored in room temperature for shelf-life evaluation.

During these months, we ran a series of trials from small scale/lab test (between 350 to 500 fruits per trial) to semi-commercial application (more than 1000 fruits per trial). The semi-commercial pilots were run in Ashkelon, Israel on the packing line of Mehadrin in Israel, a well-know and recognized citrus packer.

The results of the trials have shown that PeroStar significantly reduced the need for additional post-harvest applications with imazalil by at least 50%, and in some cases entirely while improving the fruit shelf life, reducing waste). In addition, the use of PeroStar allows the packing house to meet the new limitations of imazalil utilization as well as meet its goal to apply greener and safer products (see graph below).

In addition, over the 2018 to 2019 and 2019 to 2020 citrus fruit seasons in the State of California, the safety of our products was demonstrated on more than 100,000 tons of fresh produce in the aggregate, which, according to the biannual report “Citrus: World Markets and Trade” published in July 2020 by the United States Department of Agriculture, represent more than 12% of the total production in the United States of mandarins/tangerines. The United States is ranked as the number six producer worldwide with around 800,000 tons, while Israel is ranked number ten with around 200,000 tons.

| 11 |

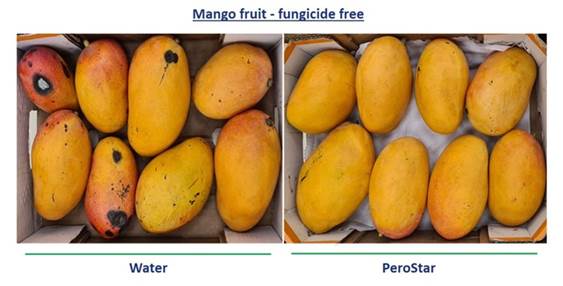

Results on Mangos

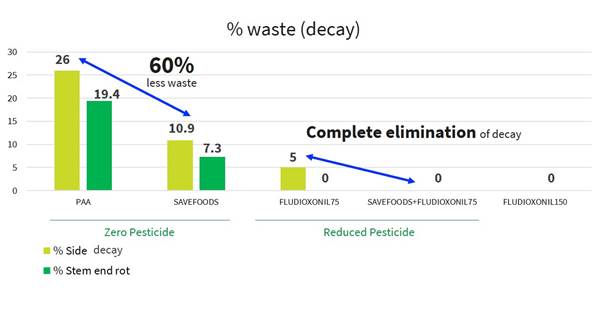

We have recently tested our PeroStar on mangos in collaboration with the Israeli-based Volcani Center for Agricultural Research. The goal of the test was to evaluate the effectiveness of PeroStar in preventing decay in harvested mangos in comparison with fludioxonil. Fludioxonil is a fungicide that is commercially available in Israel at a level of 250 to 300 parts per million. Fludioxonil is deemed to be an effective fungicide against fungi that attack the mango post-harvest, yet there is a growing need for “greener” solutions, given Fludioxonil’s level of toxicity.

Mangos was stored for three weeks after treatment at 12°C and an additional week of shelf life at 20°C in what would typically simulate a mango crate shipment to Europe and retailers in similarly distanced markets.

Results after evaluation have shown us that the treatment with PeroStar, improved the biocide activity of the PAA, which resulted in a reduction in both side decay and stem-end rot (common pathogens in mango) leading to an extended shelf life with no use of fungicide (as demonstrated in the picture below). In addition, the results also showed that the combination of PeroStar with a low concentration of fludioxonil reduced the post-harvest decay to zero. The results (as presented in the graph below) demonstrate that applying PeroStar enables mango producers to achieve an improved shelf life of produce compared to the current treatment while reducing the use of conventional chemical pesticides.

| 12 |

Commercialization Stage

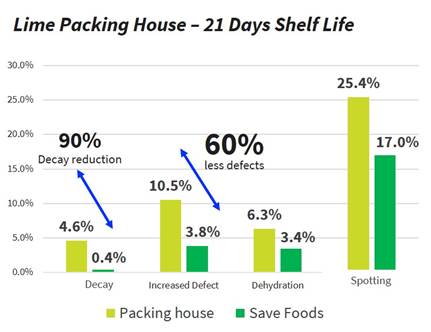

Following a successful pilot in Mexico on Persian lime (where SavePROTECT has reduced to zero the fruit decay after 21 days as shown in the graph below), the packing house has bought a first batch to start the utilization of our product.

| 13 |

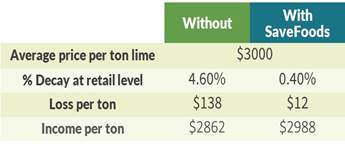

Based on these results, food retailers may benefit from additional income of up to $126 per ton of limes assuming a conservative price of $3,000 per ton lime (based on an average price per pound lime of $1.49 in 2019), as presented in the graph below.

The European Union is a significant target market for our organic food acid blends because of strict regulations that are being imposed on the use of pesticides and GMO-produced crops, as well as health conscious consumers who represent a growing demand for organic fruits and vegetables. In August 2020, we submitted a regulatory dossier for our PeroStar as a processing aid to be used with PAA in Spain and Italy, two of the largest fruit and vegetables producers in Europe. See “Government Regulation and Product Approval” below.

In Israel, with the start of the citrus season, Safe-Pack (Decco Israel) is using our product under a white label name in one of the largest packing house in Israel.

| 14 |

Sanitizer – SF3HS or SF3H

Post-harvest sanitizers are considered a pesticide and regulated by the EPA in the United States. The EPA will review toxicity data and results from tests to show how well the product kills bacteria to determine if the product should be approved. See “Government Regulation and Product Approval” below.

This sub-category of products is based on our proprietary blend of food acids combined with hydrogen peroxide as the oxizider and includes SF3HS and SF3H. We believe that this category of products will be an improved sanitizer as compared to traditional sanitizers. SF3HS and SF3H are public health antimicrobial pesticide products that bear a claim to control by at least a 3 log10 reduction (99.9%) pest microorganisms that pose a threat to human health (foodborne pathogens), and whose presence cannot readily be observed by the consumer.

After we have finalized our toxicological studies, we conducted a series of microbial trials in laboratories in both the United States and Israel in non-Good Laboratory Practice (“non-GLP”) settings in order to evaluate the efficacy of SF3H as an antimicrobial agent to reduce foodborne pathogenic bacteria in “processing water” for fruit and vegetables. We used a modification of the Association of Official Agricultural Chemists Germicidal and Detergent Sanitizing Action of Disinfectants method and test protocol EN1276 (European standard for the evaluation of chemical disinfectant or antiseptic for bactericidal activity). The tested organisms are Listeria monocytogenes, Salmonella enterica and Escherichia coli O157:H7.

The last test was performed by Analytical Lab Group on a mix culture of Listeria monocytogenes with an exposure time of 30 seconds. The results showed more than 99.99999% (>7.51 Log10) reduction. In Israel, the tests were performed by the Institute for Food Microbiology and Consumer Good Health on a single strain for each pathogen (Listeria monocytogenes, Salmonella typhimurium and E. coli) with exposure time of 30 seconds and the results have shown between 99.99% to 99.9999% reduction. Exposure time is a key parameter in sanitization process, therefore allowing a short contact time is a significant advantage over the competition where the current minimum contact time available is 45 seconds.

We plan to conduct GLP efficacy studies during the first half of 2021 to complete our regulatory dossier for the EPA and the FDA to obtain the appropriate regulatory approvals for our products to be marketed and used as “sanitizers” to claim control of foodborne pathogens (food safety) as well as plant pathogens (food loss reduction). We plan to submit our regulatory dossier during the second half of 2021. It is planned that SF3HS/SF3H will be used in post-harvest to control both plant and foodborne pathogens for fruit and vegetables (including microgreens). For additional information regarding the regulatory approval process see “Government Regulation and Product Approval” below.

Results on Avocados

We have tested the efficacy of our SF3H and SF3HS products against Listeria on 40 avocados of which 10 avocados were treated with our SF3H and SF3HS products. The peel of the avocado was punctured and infected with high level of Listeria. The results have shown a 99.99% reduction within fifteen seconds of exposure time. In addition, we have also tested the efficacy of SF3H on avocado’s shelf life compared to current treatments (12 avocados per treatment). The results (demonstrated below) show that after 18 days in room temperature the treated avocados display material reduction in microbial spoilage as compared to avocados treated with water and chlorine, a well-known sanitizer.

| 15 |

Results on Microgreens

An increasing number of studies point to the growing demand for locally sourced, organic vegetables. Various types of “young vegetables,” such as sprouts, microgreens and baby greens, are becoming increasingly popular due to their high nutritional value. Microgreens are deemed premium products and command higher retail value. They also belong to a group of “functional foods” and have high levels of bioactive compounds, while requiring less water and energy to grow, which they do year-round. Currently, microgreens are largely being cultivated in major greenhouses across the United States. According to Agrilyst, an agro-intelligence platform, greenhouse cultivation of microgreens was the highest in South and North East regions, each accounting for 71% and 59% in 2017. While consumers in the United States are more focused on growing leafy greens and microgreens than any other vegetables.

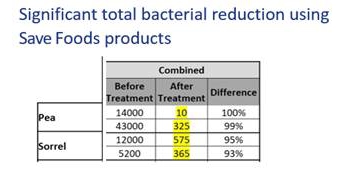

We have tested the efficacy of our SF3H products to control and prevent potential pathogen contamination on microherbs (pea and sorrel) produced by Israeli-based microgreens exporter 2BFresh. Our treatment combined a post-harvest spray application and a fogging treatment to be used in the cooldown storage room. In order to determine the efficacy of the product, 25 swabs were taken across 18 trays (nine of each microgreen species). The results (as presented herein) show more than a 90% reduction of the total bacterial load post-treatment (see table).

We believe that our SF3HS and SF3H provide improved sanitization of bacteria (including E. coli, Salmonella and Listeria) while leaving no toxic residues on fruits and vegetables.

We expect the first commercialization of SF3H and SF3HS at the earliest by the end of the first half of 2022.

Other Products

Our product portfolio also includes the SpuDefender and FreshProtect.

SpuDefender

SpuDefender is one of our EPA-registered products which targets and is designed to control the post-harvest potato sprout. Due to the European Commission’s decision on January 1, 2020 to no longer allow the use of the herbicide chlorpropham (the “CIPC”), the post-harvest potato industry is looking for new solutions. For over 50 years, CIPC was widely used as a sprout suppressing agrochemical agent applied to potatoes that were stored in processing facilities.

| 16 |

Following recent discussions with post-harvest experts and potential customers, we believe our SpuDefender product may offer a successful alternative to CIPC. During 2021, we plan to initiate pilot tests with potential customers to treat potatoes pre-storage (three to six months storage in average).

FreshProtect

FreshProtect is our second EPA registered product, which targets and is designed to control spoilage-creating microorganisms on post-harvest citrus fruit. The registered label of the product only allows us to market and sell our FreshProtect in the United States (excluding California). However, we believe our FreshProtect has a significant potential in reducing the bacterial load entering the packing house in the pre-harvest market. The non-toxicity of our FreshProtect allows its application up to the day of harvest (0-day pre-harvest interval), which is critical to prolong crop protection and reduce microbial spoilage.

We recently ran a proof of concept study under a controlled group environment of different plant fungi responsible for decay which showed promising initial results.

We also conducted a series of smaller studies, consisting of laboratory tests and tests on a limited number of lemon trees whereby we demonstrated significant reduction of decay in treated fruit and reduction in bacterial populations.

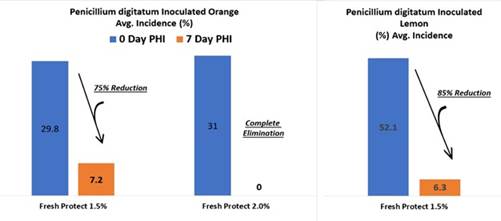

The main conclusions of the trials were that FreshProtect with concentration of 1% and 2% applied at 400 gallons per acre materially reduced sour-rot on inoculated fruit. While both rates were also effective against fruit inoculated with P. digitatum, (i.e. fungus found in the soil of citrus-producing areas and major source of post-harvest decay), the 2% concentration of FreshProtect demonstrated significantly more efficacy at reducing sour-rot. Natural incidence of Penicillium spp. (a family of fungi) was also reduced on fruit inoculated with G. candidum, fungus that is a member of the human microbiome.

Furthermore, FreshProtect can be used in combination with several different kinds of pesticides and fertilizers which allows the application of more than one pesticide at once. This in turn reduces cost and facilitates implementation. The graph below summarize these results:

The regulation for pre-harvest (in the field) application especially in California as well as in Israel may take more time than post-harvest application due the potential impact on the environment. Therefore, we expect the product to reach the market during 2022.

| 17 |

Our Strengths

We believe that our main strengths include:

| ● | Strong Management Team with Commitment to Green Products. Led by a team with over 30 years of experience in developing sanitization products and solutions for the agriculture industry, we plan on becoming a significant player in providing consumers with healthy and green fresh produce from farm to fork while endeavoring to ensure food safety and reducing food waste. We believe that our proprietary blend of food acids provides protection to the treated produce and works in synergy with well-known fungicides and sanitizers. This synergy allows us to significantly reduce the concentration of the fungicides that are heavily regulated in several countries and, in certain countries, outright banned and meet the food trends of sustainable and green produce. | |

| ● | Multi-Purpose Products that Simplify Crop Treatment Routine and Save Money. While most chemicals marketed in the industry address either food safety or food waste, our multi-purpose products are intended to provide a solution for both problems, while simplifying crop treatment and achieving cost saving. Our products are capable of cleaning and controlling pathogens that would otherwise render fresh produce as unsafe for human consumption. Our proprietary blend of food acids combined with well-known sanitizers are very efficient against foodborne pathogens like E. coli, Salmonella and Listeria as well as plant pathogens in short contact time (99.999% reduction within 30 seconds of contact). In addition, with multipurpose products, there is no need to order, ship or dispose of bottles of product, resulting in less energy consumed, less CO2, less fuel, and less waste. We believe our focus on natural product chemistries will allow us to continually drive lower costs, higher product gross margins and efficacy through longer shelf life and reduction of food waste. | |

| ● | Strong Intellectual Property Portfolio. We believe that we have built a strong intellectual property position throughout the food chain (from field to fork) as our patents claim compositions and methods that can be used to protect food and agricultural products from decay. We rely on a combination of important intellectual property assets, to protect our innovation. Our employees, consultants, customers, and vendors are subject to confidentiality agreements that protect our proprietary manufacturing processes. Our patent portfolio includes granted patents in the United States, Europe, and Israel, as well as several priority applications, across several patent families, including composition-of-matter claims, methods of use claims, including for treating edible matter, for improving the appearance of edible plant matter, and sterilization methods, as well as for articles for implementing these methods. These patents directly protect a proprietary method for extending life shelf and reducing edible matter from microbial decay. | |

| ● | Commercially Available Products and Seamless Implementation. One of the oxidizers being used with our products is PAA, a well-known and widely used sanitizer. Following the enforcement of the FSMA in connection with the use of sanitizers, more and more packers have been choosing this healthy and eco-friendly sanitizer over chlorine, and this choice facilitates implementation of our products. In addition, the application of our products does not require special equipment as they are used in combination with or replace existing products applied on the packing line or in the mix tank in the field. This allows a relatively cheap, seamless and fast implementation. | |

| ● | Significant Reduction of Hazardous Chemicals Food Residue. All the ingredients of our blend of food acids are recognized by the FDA as GRAS when used as intended in fruit and vegetable wash applications, while oxidizers we use such as hydrogen peroxide rapidly decompose into water and oxygen.. The absence of toxicological residues not only improves food quality but also promotes occupational safety for the employees of packing houses, contributing to a friendlier and safer working environment. |

| 18 |

Our Strategy

In September 2018, the Company changed its organizational structure and management team. After reviewing the Company’s then existing strategy and results of operation, as well as examining the market opportunities, the new management team decided to update the Company’s strategy, reduce the marketing and sales of its existing products, and focus the Company’s efforts and financial resources in developing its next generation products. During the years 2019 and 2020, we developed, validated and tested the efficacy of our next generation product – a blend of food acids – on a variety of crops in small and large scale commercial pilots.

Our strategy is to develop and commercialize our products through strategic partnerships with global post-harvest service companies and with large food distributors and retailers with the intent of: (i) extending the shelf life of fresh produce while reducing (and even eliminating) the use of harmful chemicals (fungicides); (ii) ensuring food safety and shelf life by controlling foodborne pathogens and allow our customers to meet FSMA regulatory requirements; (iii) reducing food loss and the associated carbon “footprint.” Our ultimate goal is to eventually gain presence in a variety of businesses compromising the food industry, including pre-harvest, post-harvest, retail and consumer businesses.

In order to achieve our goals, we intend to:

| ● | Advance our Breakthrough Technologies and Commercialization Efforts. During the first half of 2021, we plan to run a series of additional pilot studies in various commercial collaborations with post-harvest service vendors packing houses and food retailers. | |

| ● | Develop a Strong Marketing Message Around Promoting Safe Food While Avoiding Food Waste. We plan to brand our fresh produce with a “chemical residues free” seal of approval and we believe that like-minded fruit packers around the globe will seek to differentiate themselves from their competitors by obtaining this seal. | |

| ● | Acquire or License Complementary Products and Technologies. We actively search for products and technologies that can enhance our portfolio and grow our business to address all the post-harvest treatments such as fruit coating products or technologies. | |

| ● | Expand to Additional Produce and Geographies. Our plan is to focus first on key countries and regions with the largest markets for our crops, including Mexico, Spain, Italy, Israel and key markets in the United States such as California, Florida and Texas. We are also plan to increase the variety of crops that can be treated with our products, to include produce such as apples, bell peppers, tomatoes and papayas. | |

| ● | Leverage Our Products Through Collaborations. Our focus and expertise in the development of green products for the agritech industry and in post-harvest treatments allow us to be a partner of choice for other businesses looking for development partners and for larger companies wanting to leverage their product such as PAA into new combination products. For example, companies selling or owning fungicides, the MRL of which is being reduced, and that are working in synergy with our products are good partners. This type of collaboration could allow them to continue selling their product. | |

| Our selling and marketing strategy is twofold: | ||

| ● | Establish Collaborations with Food Retailers. Large food retailers play an important role in influencing the decisions of key suppliers down the food chain (i.e. they can dictate to their suppliers which cleaning solutions they will use when treating the fresh produce at their packing house). Food retailers must ensure food safety as well as reducing food loss occurring during distribution, storage and retail. In the United States alone, 4.65 million tons of fresh produce were thrown away at the retail level. This waste cost $8.9 billion and amounted to 12% of the U.S. fresh fruit supply and 10% of the fresh vegetable supply. With an average percentage of 5% of all strawberries, apples, avocadoes, tomatoes and broccoli in the United Kingdom and 12% and 10% of the fresh fruit supply and fresh vegetable supply in the United States, respectively, wasted at the retail and/or distribution level, we believe even a small reduction in fresh produce loss can generate large savings. | |

| 19 |

| ● | Partner with Service Vendors to Fruit and Vegetable Packing Houses. Post-harvest service companies provide packing houses with the necessary machinery and products, such as sanitizers and fungicides to enable the packing houses to treat the produce. Post-harvest service companies face competition due to the current regulations that dictate specific types of treatment products and set tolerable residue levels. In addition, these companies must provide their packing houses with state of the art, cost effective and green product to incentivize the packing houses to build long-term business relationship with them. Moreover, service vendors are important because they have strong influence on the decision of which cleaners, sanitizers, fungicides and waxes that the fruit and vegetable packing houses will use. Additional benefit of partnering with post-harvest service company is their strong global market presence in the relevant geography. In addition, both food retailers and post-harvest service companies have a significant interest in green and efficient post-harvest solutions. |

Selling and Marketing

We concentrate our marketing efforts on high value crops, such as avocado, mango, citrus, apples, pears, bananas, papaya, bell pepper, lettuce and tomatoes and target large producers of these crops as well as large food distributors and retailers. We are currently exploring collaboration opportunities for our SavePROTECT or PeroStar with producers in the United States, Spain, Israel, Italy and Mexico. And we intend during the next 12 months to initiate commercial collaboration with local packers and retailers in our first targeted location previously mentioned.

The table below summarizes the market opportunities for selected produce in our target markets.

| Bananas | Apples and Pears | Avocados | Citrus | Mangos | Papayas | Tomatos | Lettuce and Chicory | Chilli and Green Peppers | Total (in milion tons) | |||||||||||||||||||||||||||||||

| Global Production of the Crop (in million ton)1 | 114.2 | 108.2 | 6.0 | 147.9 | 52.3 | 13.1 | 180.5 | 27.5 | 35.8 | 685.5 | ||||||||||||||||||||||||||||||

| Production of the Crop in the Company’s Target Markets 2 (in million ton) | 2.9 | 10.5 | 2.4 | 25.6 | 2.3 | 1.0 | 28.0 | 6.5 | 5.6 | 84.7 | ||||||||||||||||||||||||||||||

| Production of the Crop in the Company’s Target Markets (in %) | 2.5 | % | 9.7 | % | 39.8 | % | 17.3 | % | 4.3 | % | 7.6 | % | 15.5 | % | 23.6 | % | 15.7 | % | 12.4 | % | ||||||||||||||||||||

| 1. | Average global production for the years 2016, 2017 and 2018. | |

| 2. | Our target markets include Israel, Italy, Mexico, Spain and the United States. |

To support our efforts, we will increase our marketing and sales team as well as services in our target location to support all our efforts.

| 20 |

United States

The first market we target for the sale and distribution of SavePROTECT is the post-harvest citrus industry in the State of California, which alone accounts for approximately 80% of all fruits and vegetables in the United States.

Over the last three years, we have treated more than 180,000 tons of citrus fruit with the different version of our SavePROTECT product. Under the supervision of a world leading packing house to the citrus fruit industry, we evidenced SavePROTECT utility as having a good safety profile, ensuring food safety and in controlling microbial spoilage. We plan to leverage this collaboration in order to further penetrate the citrus based fruit packing industry, both in California and beyond.

The Post-harvest treatment market for fruits and vegetables, which is projected to grow from $1.5 billion in 2019 to $2.3 billion by 2026, growing at a CAGR of 6.5% during the forecast period, is led globally by select companies, including DECCO U.S. Post-Harvest, Inc., (United States), Pace International, (United States), Xeda International (France), John Bean Technologies (United States), and Agrofresh (United States).

Once we have completed our studies and secured the appropriate regulatory approvals, we plan to further penetrate this market. We currently focus on post-harvest treatment for the citrus industry (as well as mangos and avocados) but are conducting pilot studies with leading players in the industry to evaluate and validate our products formulations.

We plan on commencing one commercial pilot study with a global food retailer by the end of the first quarter of 2021.

Israel

On September 11, 2020, we signed a five-year exclusive distribution agreement (the “Distribution Agreement”) with Safe-Pack Products Ltd. (“Safe-Pack”), according to which we granted Safe-Pack an exclusive right to resell, distribute, advertise, and market ours products in the citrus industry in Israel and Palestine. In addition, we agreed to grant Safe-Pack a right of first refusal to be designated as an exclusive distributor of ours in certain agreed upon territory for additional products of ours in the post-harvest market. In consideration for the above rights granted to Safe-Pack, Safe-Pack will submit to us purchase orders of our products at a price specified in the Distribution Agreement. Commencing upon the second calendar year of the agreement, Safe-Pack is required to meet a minimum purchase quota, as shall be mutually agreed upon between the parties. In the event that the parties fail to agree on a quota, the quota shall be equal to last year quota plus 3%.

Spain

We have been collaborating with one of the world’s leading post-harvest treatment service vendors in Spain since June 2020, where we are examining our product on citrus fruit. We believe our product could be an improved alternative to current fungicides that will soon be significantly reduced in this market.

Mexico

We are planning a series of studies in which our SavePROTECT will be applied on tomatoes, bananas, lemons, bell peppers and avocados. The first study to ensure safety of avocados is planned for the first quarter of 2021.

| 21 |

Between August and October of 2020, we have conducted three successful trials in Mexico, on more than 200 kilograms of Persian limes. The results have shown that the addition of SavePROTECT to current treatments extend shelf life. Shelf life was tested for 25 days and results have shown that SavePROTECT substantially reduces decay. Mexico is the largest producer of Persian limes and is deemed to be that country’s second most important citrus fruit.

Intellectual Property

We rely on patents and trade secret protection laws to protect our proprietary products and intellectual property. We entered into confidentiality agreements with our employees, consultants, customers, service providers and vendors that cover, inter alia, our technology and proprietary manufacturing processes.

We currently own five issued patents, one allowed patent, and seven pending patent applications, four of which may be submitted worldwide. Expiration dates of our patents, and any patents which may be granted under our pending patent applications, are from 2031 through 2041. Our patent family includes patents granted in Israel, the United States and Europe.

Compositions and Methods of Treating Edible Matter and Substrates Therefor

This patent family includes granted patents in the United States, Israel, and an allowed application in Europe and is directed to a method for protecting edible matter from decay by applying to the edible matter a disinfecting composition containing, among other things, (1) phosphonic or phosphoric acid, (2) a carboxylic acid, (3) performic acid, (4) a performic acid source (such as formic acid) and an oxidizer (such as hydrogen peroxide).

| File Number | Country | Type | Status | Application/Patent Number | Priority Date | |||||||||||

| SVF-P-001-EP | Europe | Patent | Allowed | 11825901.9 | September 14, 2010 | |||||||||||

| SVF-P-001-IL | Israel | Patent | Issued | 225247 | September 14, 2010 | |||||||||||

| SVF-P-001-IL1 | Israel | Patent | Pending | 254909 | September 14, 2010 | |||||||||||

| SVF-P-001-US1 | United States | Patent | Issued | 10,212,956 | September 14, 2010 | |||||||||||

| SVF-P-001-US2 | United States | Patent | Pending | 16/278,108 | September 14, 2010 | |||||||||||

Methods for Improving the Appearance of Edible Plant Matter

This patent family includes a granted patent in Israel and is directed to a method of improving the appearance of edible plant matter either during the pre-harvest or post-harvest stage. The method includes applying a composition based on phosphonic acid to the edible plant matter.

| File Number | Country | Type | Status | Application/Patent Number | Priority Date | |||||||||||||

| SVF-P-002-IL | Israel | Patent | Issued | 229724 | May 30, 2011 | |||||||||||||

Method and Apparatus for Maintaining Fresh Produce in a Transportation Container

This patent family includes granted patents in Israel and in the United States. The patent family is related to a method of using thereof for maintaining fresh produce stored in a transportation container. The apparatus is configured to generate an aerosol of one or more liquid pesticides, thereby reducing pathogenic contamination within the transportation container. This patent family covers any liquid pesticide for use in the above-mentioned apparatus.

| File Number | Country | Type | Status | Application/Patent Number | Priority Date | |||||||||||

| SVF-P-003-IL | Israel | Patent | Issued | 227328 | June 23, 2013 | |||||||||||

| SVF-P-003-US | United States | Patent | Issued | 9,487,350 | June 23, 2013 | |||||||||||

| 22 |

Sterilization Compositions and Methods for Use Thereof

This patent family is directed to compositions and methods for reducing pathogen load within a container or on a surface, including inter alia the surface of an edible plant matter. Furthermore, the application is directed to compositions and methods for disinfection of cooling systems.

| File Number | Country | Type | Status | Application/Patent Number | Priority Date | |||||

| SVF-P-004-USP | United States | Patent | Pending | 63/111,197 | November 9, 2020 |

Sterilization Devices and Methods for Use Thereof

This patent family is directed to a device for controlling pathogen load within a container or on a surface by spraying a disinfecting composition in response to a trigger, such as increased pathogenic contamination.

| File Number | Country | Type | Status | Application/Patent Number | Priority Date | |||||

| SVF-P-005-USP | United States | Patent | Pending | 63/111,220 | November 9, 2020 |

Compositions Comprising of Several Organic Acids and Use Thereof

This patent family is directed to kits and methods for controlling pathogen load within or on the surface of an edible plant matter.

| File Number | Country | Type | Status | Application/Patent Number | Priority Date | |||||

| SVF-P-006-PCT | International application | Patent | Pending | PCT/IL2021/050229 | March 1, 2020 |

Combined Fungicidal Preparations and Methods for Use Thereof

This patent family is directed to compositions and to methods for reducing pathogen load on a substrate.

| File Number | Country | Type | Status | Application/Patent Number | Priority Date | |||||

| SVF-P-007-USP | United States | Patent | Pending | 63/042,622 | June 23, 2020 | |||||

| SVF-P-007-USP1-07931-P0004B | United States | Patent | Pending | 63/126,649 | December 17, 2020 |

We cannot be sure that any patent will be granted with respect to any of our pending patent applications or with respect to any patent applications filed by us in the future. There is also a significant risk that any issued patents will have substantially narrower claims than those that are currently sought.

Competition

Given that the market for the use of green and “residue free” solutions is evolving, we are continually facing growing competition. The market for post-harvest solutions is fragmented and includes various regional suppliers. The market of post-harvest treatments for fruits and vegetables is dominated by five large players with wide reach across the globe. We believe that a market edge will be given to a company that can solidify its reputation, product quality, customer service and customer intimacy, product innovation, technical service and value creation. Based on these variables, we believe that we compete favorably when compared with the global competition in this market.

Currently, our main competitors are companies providing PAA, chlorine and other sanitization solutions, such as Ozone as well as technology companies developing new biorational fungicides.

| 23 |

We also compete with heavily diversified multi-national chemical conglomerates, who produce various biocide formulations designed to kill or deactivate pathogenic micro-organisms. Of these, two companies are the most significant:

| ● | Peroxychem: Peroxychem is a subsidiary of Evonik Industries AG (Germany). It is a significant worldwide producer of hydrogen peroxide, persulfates and PAA. Peroxychem expected revenue of approximately $300 million in 2018; and | |

| ● | Solvay (Belgium): Similar to Evonik Industries, Solvay is a heavily diversified multinational chemical conglomerate. In fiscal year 2019, the company had approximately €10.2 billion in net sales, spread across the breadth of their product lines. Most relevant to us is their blends of PAA and hydrogen peroxide, sold in two primary formulations – OXYSTRONG for water treatment and PROXITANE for the food industry. |

In addition, we have several indirect competitors, which are companies with whom we seek to make strategic partnerships – large companies specializing in post-harvest solutions for the agricultural industry. Such companies include:

| ● | Decco US Post-Harvest: Decco is a subsidiary of Decco Worldwide, which itself is a division of United Phosphorous Ltd. Decco provides a variety of solutions, both mechanical and chemical, for the post-harvest industry. They produce conventional fungicides (imazalil, thiabendizole, etc.), as well as produce coatings; and | |

| ● | Pace International: Pace International is a subsidiary of the Sumitomo Chemical Company. Similar to Decco, it provides a variety of solutions – primarily in the realm of conventional fungicides and carnauba wax coatings for fruit. |

We also consider Xeda International, JBT and Agrofresh as our indirect competitors (and current or potential collaborators).

The organic market offers a huge trade and income potential for producers, processors and trading companies globally. The rising demand of various organic products has driven the demand of organic post-harvest treatments. Green and organic technologies are increasingly being developed in a global market and several conventional post-harvest product and equipment suppliers, such as Citrosol, Fomesa and Peroxychem, have taken the opportunity and are starting to develop natural products.

Research and Development

In the last two years we spent an aggregate of $1,032,623 on research and development. We focus on developing innovative solutions consisting of new generation, patented products that address immediate and long-term needs. Our research efforts are aimed at optimizing the application protocols of our existing core products such as PeroStar/SavePROTECT for new crops, developing new blend of acids and enhancing our SF3H/SF3HS products’ antimicrobial efficacy while taking into account costs, consumers trends and preferences, which will give the extra value needed to separate our products from those of our competitors in the marketplace.

| 24 |

Post-Harvest

We are currently working on the compatibility and synergistic effect of our processing aids products SavePROTECT/PeroStar with additional post-harvest treatments used in the packing house to provide an efficient, greener and cost-effective solution.

We are also focused on the characterization of our new sanitizers including the identification, improvement and other validations of our formulas. These products are based on a unique stabilization process that blends hydrogen peroxide and food acids to create a broad-spectrum, safe and eco-friendly solution for killing germs. The synergistic effects of combining hydrogen peroxide with food acids produce a stable yet environmentally safe and easy to handle sanitizer. We use a network of experts in related fields, such as microbiology, and food chemistry to obtain all the required regulatory approvals.

In addition, we are in the initial stages of development of natural antimicrobial edible coatings for microbial safety and food quality enhancement comprising our acid blend.

To accurately test the strength of a sanitizing solution, we are working on developing quantitative methods. Similarly, we are developing analytical methods that will enable rapid and effective monitoring of the active ingredients through a novel and improved testing kit that allows for testing at a faster pace and with greater certainty.

Pre-Harvest – FreshProtect

We are also focused on developing new eco-friendly pre-harvest products which will improve post-harvest management practices by reduction of total microbial load, before even entering the packing house. An effective pre-harvest treatment may reduce the need for post-harvest chemical fungicides while increasing profit through reduced spoilage in supply chains. In addition, the potential of addressing pre-harvest treatment might offer new opportunities for treating crops, such as rice and wheat, with large market potential.

In pre-harvest application, one of the main advantages of our products is the non-toxicity of its ingredients, allowing its application up to the day of harvest (0-day pre-harvest interval), which is critical to prolonged crop protection and reduced microbial spoilage while reducing the total bacterial load entering the packing house. Field studies are conducted by Dr. James E. Adaskeveg from University of California, Riverside and the largest grower cooperative in CA in the United States on citrus trees to determine the effectiveness, optimize use protocol and effect on the environment.

Production

In Israel, we work with SasaTech, a reputable chemical production company. Based on our formulation and guidance, SasaTech is producing our PeroStar and any other small-scale formulation that we might need for research and development purposes and trials. SasaTech is particularly regarded for its deep understanding and experience working with oxidizer like hydrogen peroxide and PAA. We also work with Zohar Dalia which we engage on a case-by-case basis.

In the United States we work with Seeler Industries, a national leader in marketing, handling, and in the termination of hydrogen peroxide. Both Seeler and SasaTech, purchase all raw materials necessary for the production of our products.

All ingredients and/or raw materials that are used in the creation of our products are commodities and are readily available for purchase off the shelf.

| 25 |

Government Regulation and Product Approval

Our products are subject to national, state and local government regulations. Based on the product claims and classification, different regulatory and registration requirements may apply at the state, provincial or federal level.

Regulation of our Sanitizers – SF3H and SF3HS

In the United States, the primary federal laws that regulate the sale and distribution of our sanitizer products are the Federal Insecticide, Fungicide and Rodenticide Act (“FIFRA”) and the Federal Food, Drug and Cosmetic Act (“FFDCA”).

FIFRA is the federal law that regulates the sale and distribution of pesticides and is administered by the EPA. Products that claim or are otherwise intended to control microorganisms on inanimate surfaces, in water and on raw agricultural commodities are regulated, under FIFRA, as pesticides. FIFRA generally requires the pre-market registration of pesticide products. To register a pesticide product, we are required to provide test data and related information to demonstrate that the product is safe and effective under the conditions of use, as specified on the product label. The cost and timeframe to achieve EPA product registration depends on the type of product and the claims made for the product. Registered products are also subject to a number of recordkeeping and reporting obligations which require constant product oversight by companies.

Pursuant to FIFRA and Section 408 of the FFDCA, EPA establishes tolerances for pesticide chemical residues that could remain in or on food, including raw agricultural commodities. A tolerance is the EPA established maximum residue level of a specific pesticide chemical that is permitted in or on a human or animal food in the United States. Generally, any pesticide chemical residue must have either a tolerance or an exemption from the requirement to have a tolerance in order to be permitted in or on human or animal food. FDA enforces the tolerances pursuant to its authority under the FFDCA.