Attached files

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR

15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2020

or

☐ TRANSITION

REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE

ACT OF 1934

For the transition period from _________ to _________

Commission File Number: 000-55038

LIQUIDVALUE DEVELOPMENT INC.

(Exact name of registrant as specified in its charter)

|

Nevada

|

|

27-1467606

|

|

(State or other jurisdiction of

incorporation or organization)

|

|

(I.R.S. Employer Identification Number)

|

|

4800

Montgomery Lane, Suite 210

|

|

|

|

Bethesda, MD 20814

|

|

301-971-3940

|

|

(Address of Principal Executive Offices)

|

|

Registrant’s telephone number,

including area code

|

Securities registered pursuant to Section 12(b) of the Act:

None

Securities registered pursuant to section 12(g) of the Act: Common

Stock, $0.001 par value

Indicate by check mark if the registrant is a well-known seasoned

issuer, as defined in Rule 405 of the Securities

Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file

reports pursuant to Section 13 or Section 15(d) of the Exchange

Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all

reports required to be filed by Section 13 or 15(d) of the

Securities Exchange Act of 1934 during the preceding 12 months (or

for such shorter period that the registrant was required to file

such reports), and (2) has been subject to such filing requirements

for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted

electronically every Interactive Data File required to be submitted

pursuant to Rule 405 of Regulation S-T (§ 229.405 of this

chapter) during the preceding 12 months (or for such shorter period

that the registrant was required to submit such

files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large

accelerated filer, an accelerated filer, a non-accelerated filer,

or a smaller reporting company. See the definitions of “large

accelerated filer,” “accelerated filer” and

“smaller reporting company” in Rule 12b-2 of the

Exchange Act.

|

Large accelerated filer ☐

|

|

Accelerated filer ☐

|

|

Non-accelerated filer ☐

|

|

Smaller reporting company ☒

|

|

|

|

Emerging

growth company ☐

|

If an emerging growth company, indicate by check mark if the

registrant has elected not to use the extended transition period

for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange

Act. ☐

Indicate

by check mark whether the registrant has filed a report on and

attestation to its management’s assessment of the

effectiveness of its internal control over financial reporting

under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b))

by the registered public accounting firm that prepared or issued

its audit report. ☐

Indicate by check mark whether the registrant is a shell company

(as defined in Rule 12b-2 of the Exchange

Act). Yes ☐ No ☒

State the aggregate market value of the voting and non-voting

common equity held by non-affiliates computed by reference to the

price at which the common equity was last sold, or the average bid

and asked price of such common equity, as of the last business day

of the registrant’s most recently completed second fiscal

quarter. The Company’s common stock did not trade during the

year ended December 31, 2020.

Indicate the number of shares outstanding of each of the

registrant’s classes of common stock, as of the latest

practicable date. As of March 22, 2021, there were 704,043,324

shares outstanding of the registrant’s common stock, $0.001

par value.

DOCUMENTS INCORPORATED BY REFERENCE

None.

Throughout this Report on Form 10-K, the terms the

“Company,” “we,” “us,” and

“our” refer to LiquidValue Development Inc., and

“our board of directors” refers to the board of

directors of LiquidValue Development Inc.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING

INFORMATION

This Annual Report on Form 10-K contains forward-looking statements

regarding, among other things, our future operating results and

financial position, our business strategy, and other objectives for

our future operations. The words “anticipate,”

“believe,” “intend,” “expect,”

“may,” “estimate,” “predict,”

“project,” “potential” and similar

expression are intended to identify forward-looking statements,

although not all forward-looking statements contain these

identifying words. We have based these forward-looking statements

largely on our current expectations and projections about future

events and financial trends that we believe may affect our

business, financial condition and results of operations. There are

a number of important risks and uncertainties that could cause our

actual results to differ materially from those indicated by

forward-looking statements. We may not actually achieve the plans,

intentions or expectations disclosed in our forward-looking

statements, and you should not place undue reliance on our

forward-looking statements. Actual results or events could differ

materially from the plans, intentions and expectations disclosed in

the forward-looking statements we make. Our forward-looking

statements do not reflect the potential impact of any future

acquisitions, mergers, dispositions, joint ventures or investments

that we may make.

You should read this Report on Form 10-K and the documents that we

have filed as exhibits to this Report on Form 10-K completely

and with the understanding that our actual future results may be

materially different from what we expect. The forward-looking

statements contained in this Report on Form 10-K are made as of the

date of this Report on Form 10-K, and we do not assume

any obligation to update any forward-looking statements, whether as

a result of new information, future events or otherwise, except as

required by applicable law.

LiquidValue

Development Inc.

Form

10-K

For the

Year Ended December 31, 2020

Table

of Contents

|

|

|

Page

|

|

|

|

|

|

2

|

||

|

11

|

||

|

17

|

||

|

17

|

||

|

17

|

||

|

17

|

||

|

|

|

|

|

|

|

|

|

18

|

||

|

18

|

||

|

19

|

||

|

24

|

||

|

25

|

||

|

44

|

||

|

44

|

||

|

44

|

||

|

|

|

|

|

|

|

|

|

45

|

||

|

49

|

||

|

51

|

||

|

52

|

||

|

54

|

||

|

|

|

|

|

|

|

|

|

55

|

||

|

57

|

||

|

58

|

||

1

PART I

General

LiquidValue Development Inc. (the “Company”), formerly

known as SeD Intelligent Home Inc. and Homeownusa, was incorporated

in the State of Nevada on December 10, 2009. Our address is 4800

Montgomery Lane, Suite 210, Bethesda, MD, 20814. Our telephone

number is 301-971-3940.

On December 22, 2016 Alset International Limited (formerly known as

Singapore eDevelopment Limited and referred to herein as

“Alset International”) acquired 74,015,730 shares of

the Company’s common stock. Alset International subsequently

contributed its ownership in the Company to its subsidiary SeD

Intelligent Home Inc, formerly known as SeD Home International,

Inc. (which also owned Alset EHome Inc. until December 29, 2017, at

which time SeD Intelligent Home Inc. contributed its shares of

Alset EHome Inc. to the Company). On January 10, 2017, our board of

directors appointed Fai H. Chan as Director. On March 10, 2017,

Rongguo (Ronald) Wei was appointed as Chief Financial Officer of

the Company.

On September 5, 2017, the Company changed its name to SeD

Intelligent Home Inc., and increased its number of authorized

shares to 1,000,000,000 (the par value per share remained $.001).

On July 7, 2020, the Company changed its name to LiquidValue

Development Management Inc.

On December 29, 2017, the Company, SeD Acquisition Corp., a

Delaware corporation and wholly-owned subsidiary of the Company

(the “Merger Sub”), Alset EHome Inc. (formerly known as

Alset iHome Inc, SeD Home & REITs Inc. and SeD Home, Inc., and

referred to herein as “Alset EHome”), a Delaware

corporation, and SeD Intelligent Home Inc., a Delaware corporation

entered into an Acquisition Agreement and Plan of Merger (the

“Agreement”) pursuant to which the Merger Sub was

merged with and into Alset EHome, with Alset EHome surviving as a

wholly-owned subsidiary of the Company. The closing of this

transaction (the “Closing”) also took place on December

29, 2017. The Company ceased to be a “shell company” as

that term is defined in Rule 405 of the Securities Act and Rule

12b-2 of the Exchange Act. The Company’s business operations

became those operations that Alset EHome was

conducting.

In connection with the acquisition of Alset EHome, the Company

appointed new officers and directors. Fai H. Chan and Moe T. Chan

serve as co-Chief Executive Officers; Rongguo (Ronald) Wei

and Alan W. L. Lui serve as Co-Chief Financial Officers, and

our Board of Directors includes Fai H. Chan, Moe T. Chan, Conn

Flanigan and Charles MacKenzie.

Alset EHome was incorporated in Delaware on February 24, 2015, and

was named SeD Home USA, Inc. before changing its name in May of

2015 to SeD Home, Inc. On February 6, 2020, this name was

changed to SeD Home & REITs Inc., on July 7, 2020 the name was changed to Alset

iHome Inc. and on December 9, 2020 it was changed to Alset EHome

Inc. Prior to the Closing, the officers and directors of Alset

EHome are the same six individuals who are the officers and

directors of the Company.

With the completion of the Company’s acquisition of Alset

EHome, we entered into the business of land development. While the

Company will own real estate, the Company does not intend to be a

REIT for federal tax purposes. Alset EHome’s Lakes at Black

Oak (referred to herein as “Black Oak”) project

is a 162-acre land sub-division development located north of

Houston, Texas. Alset EHome’s Ballenger Run project is a

197-acre sub-division development near Washington D.C. in Frederick

County, Maryland. Alset EHome conducts its operations through

twelve wholly and partially owned subsidiaries. Alset EHome’s

affiliates provide project and asset management via separate

agreements with consultants.

The land development business involves converting undeveloped land

into buildable lots. When possible, in future projects we will

attempt to mitigate risk by attempting to enter into contracts with

strategic home building partners for the sale of lots to be

developed. In such circumstances, it is our intention that (i) we

will conduct a feasibility study on a particular land development;

(ii) both Alset EHome and the strategic home building partners will

work together in connection with acquisition of the appropriate

land; (iii) strategic home building partners will typically agree

to enter into agreements to purchase up to 100% of the buildable

lots to be developed; (iv) Alset EHome and the strategic home

building partners will enter into appropriate agreements; and (v)

Alset EHome will proceed to acquire the land for development and

will be responsible for the infrastructure development, ensuring

the completion of the project and delivery of buildable lots to the

strategic home building partner.

2

We also intend, to the fullest extent practicable, to source land

where local government agencies (including county, district and

other municipalities) and public authorities, such as improvement

districts, will reimburse the majority of infrastructure costs

incurred by the land developer for developing the land to build

taxable properties. The developers and public authorities enter

into agreements whereby the developers are reimbursed for their

costs of infrastructure.

The Company will also consider the potential to purchase

foreclosure property development projects from banks, if attractive

opportunities should arise.

The Company, utilizing the extensive business network of its

management and majority shareholder, may from time to time attempt

to forge joint ventures with other parties. Through its

subsidiaries, Alset EHome may manage such joint

ventures.

In addition to the completion of our current projects, we intend to

seek additional land development projects in diverse regions across

the United States. Such projects may be within both the for sale

and for rent markets, and we may expand from residential properties

to other property types, including but not limited to commercial

and retail properties. We will consider projects in diverse regions

across the United States, however, Alset EHome and its management

and consultants have longstanding relationships with local owners,

brokers, managers, lenders, tenants, attorneys and accountants to

help it source deals throughout Maryland and Texas. Alset EHome

will continue to focus on off-market deals and raise appropriate

financing.

Alset EHome, via a subsidiary, is presently exploring opportunities

to expand its current portfolio by developing communities solely

designed for renters. Alset EHome is exploring the potential to

pursue this new endeavor in part to improve cash flow and smooth

out the inconsistencies of income in residential land development.

Alset EHome will continue to attempt to mitigate risk and maximize

returns.

Entering into the business of building homes with the intention of

owning and renting those homes would provide an opportunity for

Alset EHome to create value by (i) acquiring properties for

horizontal and vertical development; (ii) providing fee generation

via property management and leasing; and (iii) capturing rent

escalations over long term periods. Alset EHome and its affiliates

would provide property management for customers seeking to offload

home maintenance and lawn care.

Through

our subsidiaries, we will explore the potential to pursue other

business opportunities related to real estate. The Company is

evaluating the potential to enter into activities related to solar

energy and energy efficient products as well as smart home

technologies, although we note that these potential opportunities

remain at the exploratory stage, and we may not pursue these

opportunities at the discretion of our management. Through the

Company’s eco-systems of businesses based around sustainable,

healthy living communities, Alset EHome intends to develop single

family homes which are eco-friendly. They will be fitted out with

solar energy products such as photovoltaic systems, battery

systems, and car charging ports for sustainable transport as well

as other energy efficient systems. The Company also envisions

acquiring land surrounding its communities for solar farm projects

to power these communities. Alset EHome has commenced the

infrastructure design and engineering for this sustainable, healthy

living community concept within the Black Oak project outside of

Houston, Texas. The company intends to bring this concept to other

strategic parts of the US as well as markets abroad.

We also intend to enlarge the scope of property-related services.

Additional planned activities, which we intend to be carried out

through Alset EHome, include financing, home management, realtor

services, insurance and home title validation. We may particularly

provide these services in connection with homes we build. These

activities are also in the planning stages.

As of December 31, 2020, we had total assets of $29,219,785 and

total liabilities of $2,691,098. Total assets as of December 31,

2019 were $30,785,232 and total liabilities were

$4,065,484.

Employees

At the present time, the Company has four full time employees. Much

of our work is done by contractors retained for projects, and at

the present time we have no part-time employees.

3

Compliance with Government Regulation

The development of our real estate projects will require the

Company to comply with federal, state and local environmental

regulations. In connection with this compliance, our real

estate acquisition and development projects will require

environmental studies. To date, the Company has spent approximately

$42,356 on environmental studies and compliance. Such costs

are reflected in construction progress costs in our financial

statements.

The cost of complying with governmental regulations

is significant and will increase if we add additional real

estate projects and become involved in homebuilding in the future

and are required to comply with certain due diligence procedures

related to third party lenders.

At the present time, we believe that we have all of the material

government approvals that we need to conduct our business as

currently conducted. We are subject to periodic local permitting

that must be addressed, but we do not anticipate that such

requirements for government approval will have a material impact on

our business as presently conducted. We are required to comply with

government regulations and to make filings from time to time with

various government entities. Such work is typically handled by

outside contractors we retain.

Impact of Recent Public Health Events

In December 2019, a novel strain of coronavirus (COVID-19) was

first identified in Wuhan, Hubei Province, China, and has since

spread to a number of other countries, including the United States.

The COVID-19 pandemic, or other adverse public health developments,

could have a material and adverse effect on our business

operations.

In the year ended December 31, 2020, the COVID-19 pandemic did not

have a material impact on our operations. However, the extent to

which the COVID-19 pandemic and the related economic decline that

occurred in the United States in March of 2020 may impact our

business in the future will depend on developments which are highly

uncertain and cannot be predicted. The COVID-19 pandemic’s

far-reaching impact on the global economy could negatively affect

various aspects of our business, including demand for real estate.

From March through December 2020, we continued to sell lots at our

Ballenger Run project (in Maryland) for the construction of homes

to NVR. Sales of such homes by NVR were at the same level in 2020

as in the 2019. In 2020 we sold 121 lots to NVR and in 2019, 123

lots. Such homes are often a first home that generally did not

require buyers to sell an existing home. We believe low interest

rates have encouraged home sales. Many buyers opted to see home

models at the project virtually. This technology allowed them to

ask questions to sales staff and see the homes. Home closings were

able to occur electronically.

We have received strong indications that buyers and renters across

the country are expressing interest in moving from more densely

populated urban areas to the suburbs. We believe that our Ballenger

Run project is well suited and positioned to accommodate those

buyers. Our latest phase for sale at Ballenger Run, involving

single-family homes, has seen a high number of interested potential

buyers signing up for additional information and updates on home

availability.

The COVID-19 pandemic could impact the ability of our staff and

contractors to continue to work, and our ability to conduct our

operations in a prompt and efficient manner. We have experienced a

slowdown in the planned construction of a clubhouse at the

Ballenger Run project which was completed behind schedule. We

believe this delay was caused in part by policies requiring lower

numbers of contractors working in indoor

spaces.

The COVID-19 pandemic may adversely impact the timeliness of local

government in granting required approvals. Accordingly, COVID-19

may cause the completion of important stages in our real estate

projects to be delayed.

At our Black Oak project in Texas, we have strategically redesigned

the lots over the past year for a smaller “starter

home” products that we believe will be more resilient in

fluctuating markets. Should we initiate sales at Black Oak, we

believe the same implications described above regarding our

Ballenger Run project may apply to our Black Oak project (including

the general trend of customers’ interest shifting from urban

to suburban areas). In addition, Houston and its surrounding areas

were economically impacted by the decline in energy prices in 2020.

Unlike our Ballenger Run project, our Black Oak project may include

our involvement in single family rental home

development.

4

Impact on Staff

Most of our staff works out of our Bethesda, Maryland office. Our

staff has shifted to mostly working from home since March 2020, but

this has had minimal impact on our operations to date. The COVID-19

pandemic has also impacted the frequency with which our management

would otherwise travel to the Black Oaks project; however, we have

a contractor in Texas providing supervision of the project.

Management continues to regularly supervise the Ballenger Run

project. Limitations on the mobility of our management and staff

may slow down our ability to enter into new transactions and expand

existing projects.

We have not reduced our staff in connection with the COVID-19

pandemic. To date, we did not have to expend significant resources

related to employee health and safety matters related to the

COVID-19 pandemic. We have a small staff, however, and the

inability of any significant number of our staff to work due to

illness or the illness of a family member could adversely impact

our operations.

Intellectual Property

At the present time, the Company does not own any trademarks, but

we anticipate filing trademark applications as we expand into new

areas of business.

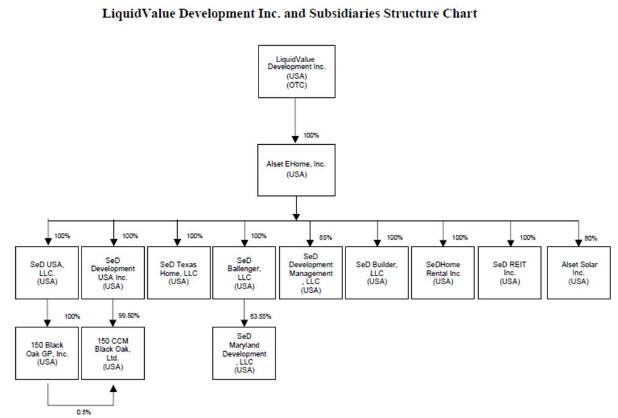

Corporate Organization

The following chart describes the Company’s ownership of

various subsidiaries:

5

Black Oak

Our Black Oak project is a 162-acre land infrastructure development

and sub-division project situated in Magnolia, Texas north of

Houston. 150 Black Oak, Ltd. was a partnership formed by our

former partner prior to our investment in this project. Black Oak

had contracts to purchase seven contiguous parcels of land. Our

initial equity investment was US$4.3 million for ownership of 60%

of the partnership. Upon this initial investment in February 2014,

we changed the name of the partnership to 150 CCM Black Oak, Ltd

(“Black Oak”) and subsequently increased our ownership

to 69%. On July 23, 2018, SeD Development USA, LLC, a wholly owned

subsidiary of the Company, entered into two Partnership Interest

Purchase Agreements through which it purchased an aggregate of 31%

of Black Oak. Prior to the Partnership Interest Purchase

Agreements, the Company owned and controlled Black Oak through its

68.5% limited partnership interest and its ownership of the General

Partner, 150 Black Oak GP, Inc, a 0.5% owner in Black Oak. As a

result of the purchase, the Company, through its subsidiaries, now

owns 100% of Black Oak. 150 Black Oak GP, Inc. is wholly owned by

SeD USA, LLC, which in turn is wholly owned by Alset EHome. The

limited partnership interests are owned by SeD Development USA,

Inc., which is wholly owned by Alset EHome. 150 Black Oak GP, Inc.

was previously jointly owned with a partner, but is now entirely

owned by SeD USA, LLC.

In October 2015, the project obtained a $6.0 million construction

loan from Revere High Yield Fund, LP. This loan was paid off in

October of 2017. Currently the Black Oak project does not have any

financing from third parties.

The site plan at Black Oak allows for approximately 550-600

residential lots of varying sizes. We anticipate that our

involvement in land development aspects of this project will take

approximately three to five additional years to complete. Since

February of 2015, we have completed several important tasks related

to the project, including clearing certain portions of the

property, paving certain roads within the project and complying

with the local improvement district to ensure reimbursement of

these costs.

The

estimated construction costs (not including the cost of land and

financing costs) and completion date for each phase are as follows.

Please note that the following is subject to change based on our

single family for sale and for rent models:

|

Black

Oak

|

Estimated

Construction Costs

|

Expected

Completion Date

|

|

Phase

1

|

$7,080,000

|

Completed

|

|

Phase

2

|

330,671

|

November

2022

|

|

Phase

3

|

422,331

|

November

2022

|

|

Phase

4

|

142,788

|

November

2022

|

|

Phase

5

|

3,293,000

|

April

2022

|

|

Total

|

$11,268,790

|

|

On July

3, 2018, 150 CCM Black Oak Ltd. entered into a Purchase and Sale

Agreement with Houston LD, LLC for the sale of 124 lots within the

Black Oak project (the “Black Oak Purchase Agreement”).

Pursuant to the Black Oak Purchase Agreement, it was agreed that

124 lots would be sold for a range of prices based on the lot type.

In addition, Houston LD, LLC agreed to contribute a

“community enhancement fee” for each lot, collectively

totaling $310,000 which was held in escrow. 150 CCM Black Oak, Ltd.

agreed to apply these funds exclusively towards an amenity package

on the property. The closing of the transactions contemplated by

the Black Oak Purchase Agreement was subject to Houston LD, LLC

completing due diligence to its satisfaction.

On

October 12, 2018, 150 CCM Black Oak, Ltd. entered into an Amended

and Restated Purchase and Sale Agreement (the “Amended and

Restated Black Oak Purchase Agreement”) for these 124 lots.

Pursuant to the Amended and Restated Black Oak Purchase Agreement,

the purchase price remained at $6,175,000. 150 CCM Black Oak, Ltd.

was required to meet certain closing conditions and the timing for

the closing was extended.

On

January 18, 2019, the sale of 124 lots at Black Oak was completed

for $6,175,000 and the community enhancement fee equal to $310,000

was delivered to the escrow account, which was later drawn and

closed. An impairment of real estate of approximately $2.4 million

related to this sale was recorded on December 31, 2018. The revenue

was recognized in January, 2019, when the sale was closed, and no

gain or loss was recognized in January, 2019.

6

On July

20, 2018, Black Oak Ltd received $4,592,079 of district

reimbursement for previous construction costs incurred in the land

development. Of this amount, $1,650,000 remained on deposit in the

District’s Capital Projects Fund for the benefit of Black Oak

Ltd and to be released upon receipt of the evidence of the: (a)

execution of a purchase agreement between Black Oak Ltd and a home

builder with respect to the Black Oak development and (b) of the

completion, finishing and making ready for home construction of at

least 105 unfinished lots in the Black Oak development. After

entering the purchase agreement with Houston LD, LLC, the above

requirements were met. The amount of the deposit was released to

the Company after presenting the invoices paid for land

development. After releasing funds to the Company, the amount on

deposit was $0 and $90,394 on December 31, 2020 and December 31,

2019, respectively.

On

September 30, 2019, the Company recorded approximately $4.7 million

of impairment on the Black Oak project based on discounted

estimated future cash flows.

On

December 31, 2019, the Company recorded approximately $1.2 million

of additional impairment on the Black Oak project based on

discounted estimated future cash flows.

On January 13, 2021, 150 CCM Black Oak, Ltd. purchased an

approximately 6.297 acre tract of land in Montgomery County, Texas.

The Company’s strategic acquisition contiguous to the Black

Oak project is intended to provide additional lot yield, potential

additional amenities and/or a solar farm to support the

Company’s sustainable, healthy living

concept.

At the present time, the Company is also considering expanding its

current policy of selling buildable lots to include a strategy of

building housing for sale or rent, particularly at our Black Oak

property.

Ballenger Run

In November 2015, we completed the $15.65 million acquisition of

Ballenger Run, a 197-acre land sub-division development located in

Frederick County, Maryland. Previously, on May 28, 2014, the

RBG Family, LLC entered into the Assignable Real Estate Sales

Contract with NVR, Inc. (“NVR”) by which RBG Family,

LLC would sell the 197 acres for $15 million to NVR. On December

10, 2014, NVR assigned this contract to SeD Maryland Development,

LLC in the Assignment and Assumption Agreement and entered into a

series of Lot Purchase Agreements by which NVR would purchase

subdivided lots from SeD Maryland Development, LLC.

SeD Maryland Development’s acquisition of the 197

acres was funded in part from a $5.6 million deposit from NVR

Inc. (“NVR”). The balance of $10.05 million was derived

from a total equity contribution of $15.2 million by SeD Ballenger

LLC (“SeD Ballenger”) and CNQC Maryland Development LLC

(a unit of Qingjian International Group Co, Ltd, China,

“CNQC”). The project is owned by SeD Maryland

Development, LLC (“SeD Maryland”). SeD Maryland is

83.55% owned by SeD Ballenger and 16.45% by CNQC.

SeD Maryland entered into a Project Development and Management

Agreement for Ballenger Run with MacKenzie Development Company, LLC

and Cavalier Development Group, LLC on February 25, 2015. MacKenzie

Development Company, LLC assigned its rights and obligations to

this agreement to Adams Aumiller Properties, LLC on September 9,

2017. Pursuant to this Project Development and Management

Agreement, Adams Aumiller, LLC and Cavalier Development Group, LLC

coordinate and manage the construction, financing, and development

of Ballenger Run. SeD Maryland compensates Adams Aumiller LLC and

Cavalier Development Group, LLC with a monthly aggregate fee of

$14,667 until all single family and townhome lots are sold. The

monthly aggregate fee will then be adjusted to $11,000 which will

continue for approximately eight months to allow all close out

items to be finished, including the release of guarantees and

securities as required by government authorities. The Project

Development and Management Agreement for Ballenger Run also

requires SeD Maryland to pay a fee of $1,200 and $500 for each

single-family and townhome, respectively, sold to a third party.

SeD Maryland also paid a fee of $50,000 after the sale of the

parcel underlying the multi-family lots in August

2018.

This property was initially zoned for 443 entitled Residential

Lots, 210 entitled Multifamily Units and 200 entitled continuing

care retirement community units approved for twenty (20) years from

the date of a Developers Rights & Responsibilities Agreement

dated October 8, 2014, as amended on September 6, 2016. In July

2019 we received required government approval to revise the zoning

of this property to include 479 entitled residential lots and 210

entitled multi-family units, with no entitled continuing care

retirement community units. We anticipate that the completion of

our involvement in this project will take approximately 12-18

months from the date of this Annual Report.

7

Revenue from Ballenger Run is anticipated to come from three main

sources:

●

The

sale of 479 entitled and constructed residential lots to

NVR;

●

The

sale of the lot for the 210 entitled multi-family units;

and

●

The

sale of 479 front foot benefit assessments.

Revenues may be adversely impacted, if we fail to attain certain

goals, meet certain conditions or if market prices for this

development unexpectedly begin to drop.

The

Company anticipates that the estimated construction costs (not

including land costs and financing costs) for the final phases of

the Ballenger Run project will be $4,179,000. The expected

completion date for the final phases of the Ballenger Run project

is June of 2022.

Financing from Union Bank (f/k/a The Bank of Hampton Roads, Shore

Bank and Xenith Bank) closed simultaneous with the settlement on

the land on November 23, 2015, pursuant to a subsequent amendment

to the terms of this loan, the loan provides (i) for a maximum of

$11 million outstanding; (ii) that the maturity of this loan will

be December 31, 2019; and (iii) includes an $800,000 letter of

credit facility, with an annual rate of 1.5% on all issued letters

of credit.

This loan is to fund the development of the first 276 lots, the

multi-family parcel and senior living parcel, the amenities

associated with these phases, and certain road improvements. The

Union Bank Revolving Loan was repaid in January 2019.

On April 17, 2019, SeD Maryland Development LLC entered into a

Development Loan Agreement with Manufacturers and Traders Trust

Company (“M&T Bank”) which is comprised of: (1) a

Note in the principal amount not to exceed at any one time

outstanding the sum of $8,000,000, with a cumulative loan advance

amount of $18,500,000, and (2) a letter of credit facility in an

aggregate amount of up to $900,000 (the “L/C

Facility”). The Note bears an interest rate of the one month

LIBOR plus 375 basis points. Commissions on each letter of credit

(“L/C”) will be 1.5% per annum on the face amount of

the L/C. Other standard lender fees will apply in the event L/C is

drawn down. The Note is a revolving line of credit. The L/C

Facility is not a revolving loan, and amounts advanced and repaid

may not be re-borrowed. Repayment of the Development Loan Agreement

is secured by $2,600,000 collateral fund and a Deed of Trust issued

to M&T Bank on the property owned by SeD Maryland. As of

December 31, 2020 and 2019, the outstanding balance of the

revolving loan was $0.

On April 17, 2019, SeD Maryland Development LLC and Union Bank

terminated the Revolving Credit Note. After termination, Union Bank

still held $602,150 as collateral for these outstanding Letters of

Credit (L/C). The L/C collateral was released in June 2019, when

all L/Cs were transferred to the M&T Bank L/C

Facility.

Expenses from Ballenger Run include, but are not limited to costs

associated with land prices, closing costs, hard development costs,

cost in lieu of construction, soft development costs and interest

costs. We presently estimate these costs to be between $56 and $57

million. We may also encounter expenses which we have not

anticipated, or which are higher than presently

anticipated.

8

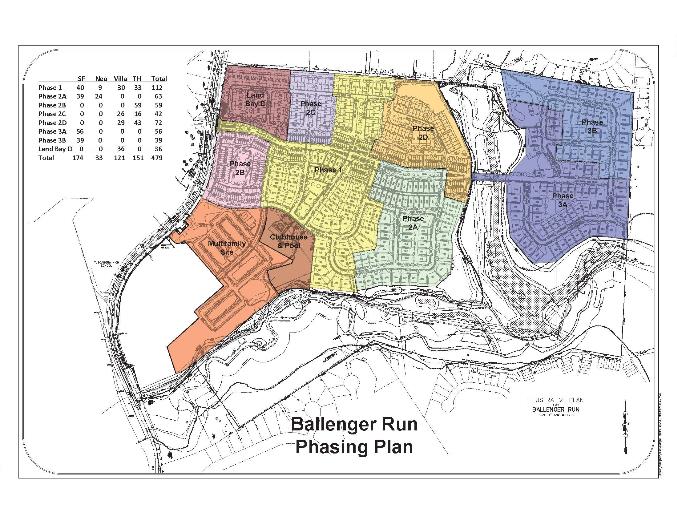

The initial phases of this project have been completed and we are

currently in the final phases of this project. The following chart

describes the various phases of this project:

Phase 1 construction of all infrastructure was completed in 2017.

The initial model lot sales with NVR began in May 2017 and all lot

sales of varying types as outlined in the chart set forth above are

continuing through the first quarter of 2018. In the fourth quarter

of 2017 all improvement plans and cost estimates were approved for

Phases 2A, 2B, 2C and 2D. Phase 2B is the next phase of lot

takedowns for NVR. Phase 2B plat recordation and final construction

began in March of 2018. Lot sales to NVR also began in March of

2018. Phases 2A and 2C plat recordation and construction began in

June of 2018 and were completed in December 2018 Phase 2D

construction began in September 2018 and was completed in June

2019. Phase 3A construction began in June 2020 and NVR is currently

building in this Phase. Phase 3B construction began in August 2020

and was completed in December 2020. The Clubhouse and pool began

construction in Fall 2019 and was completed in June

2020.

Sale of Residential Lots

The 479 Residential Lots were contracted for sale under a Lot

Purchase Agreement to NVR, a company based in the US and listed on

the New York Stock Exchange. NVR is a home builder which is engaged

in the construction and sale of single-family detached homes,

townhouses and condominium buildings. It also operates a mortgage

banking and title services business. Under the Lot Purchase

Agreements, NVR provided Alset EHome with an upfront deposit

of $5.6 million and has agreed to purchase the lots at a range

of prices. The lot types and quantities to be sold to NVR under the

Lot Purchase Agreements include the following:

|

Lot Type

|

Quantity

|

|

Single

Family Detached Large

|

85

|

|

Single

Family Detached Small

|

89

|

|

Single

Family Detached Neo Traditional

|

33

|

|

Single

Family Attached 28’ Villa

|

121

|

|

Single

Family Attached 20’ End Unit

|

46

|

|

Single

Family Attached 16’ Internal Unit

|

105

|

|

Total

|

479

|

There are five different types of Lot Purchase Agreements

(“LPAs”), which are essentially the same except for the

price and unit details for each type of lot. Under the LPAs, NVR

shall purchase 30 available lots per quarter. The LPAs provide

several conditions related to preparation of the lots which must be

met so that a lot can be made available for sale to NVR. SeD

Maryland is to provide customary lot preparation including but not

limited to survey, grading, utilities installation, paving, and

other infrastructure and engineering. In the event NVR does not

purchase the lots under the LPAs, SeD Maryland would be entitled to

keep the NVR deposit and terminate the LPAs. Should SeD Maryland

breach the LPAs, it would have to return the remainder of the NVR

deposit that has not already been credited to NVR for any sales of

lots under the LPAs and NVR would be able to seek specific

performance of the LPAs as well as any other rights available at

law or in equity.

The sale of 13 model lots to NVR began in May of 2017. 121 lots

were sold in the year ended December 31, 2020, compared to 123 lots

sold in the year ended December 31, 2019. As of December 31, 2020,

388 lots have been sold to NVR with 91 remaining for the duration

of the project. NVR continues to market and sell

homes.

9

Sale of Lots for the Multi-family Units

In June

2016, SeD Maryland entered into a lot purchase agreement with

Orchard Development Corporation relating to the sale of 210

multifamily units in the Ballenger Run Project for a total purchase

price of $5,250,000, which closed on August 7, 2018.

Sale of the Front Foot Benefit Assessments

We have established a front foot benefit (“FFB”)

assessment on all of the lots sold to NVR. This is a 30-year annual

assessment allowed in Frederick County which requires homeowners to

reimburse the developer for the costs of installing public water

and sewer to the lots. These assessments become effective as homes

are settled, at which time we can sell the collection rights to

investors who will pay an upfront lump sum, enabling us to more

quickly realize the revenue. The selling prices range from $3,000

to $4,500 per home depending the type of the home. Our total

expected revenue from the front foot benefit assessment is

approximately $1 million. To recognize revenue of the FFB

assessment, both our and NVR’s performance obligations have

to be satisfied. Our performance obligation is completed once we

complete the construction of water and sewer facilities and close

the lot sales with NVR, which inspects these water and sewer

facilities prior to the close of lot sales to ensure all

specifications are met. NVR’s performance obligation is to

sell homes they build to homeowners. Our FFB revenue is recognized

upon NVR’s sales of homes to homeowners. The agreement with

these FFB investors is not subject to amendment by regulatory

agencies and thus our revenue from FFB assessment is not either.

During the years ended December, 2020 and 2019, we recognized

revenue in the amounts of $273,620 and $548,457 from FFB

assessments, respectively.

Wetland Impact Permit

The Ballenger Run project required a joint wetland impact permit,

which requires the review of several state and federal agencies,

including the U.S. Army Corps of Engineers and Maryland Department

of the Environment. The permit is primarily required for Phase 3 of

construction but it also affects a pedestrian trail at the

Ballenger Run project and the multi-family sewer connection. The

U.S. Army Corps of Engineers allowed us to proceed with

construction on Phase 1 but required archeological testing. In

November 2018, the archeological testing was completed with no

further recommendations on Phase 1 of the project. Required

architectural studies on the final phase of development will likely

result in the loss of only one lot, however, we cannot be certain

of future reviews and their impact on the project.

The U.S. Army Corps of Engineers and

Maryland Department of the Environment permits were issued in June

2019. A modification to the permit for a temporary stream crossing

was also issued in October 2019 allowing for the commencement of

construction on Phase 3.

K-6 Grade School Site

In connection with getting the necessary approvals for the

Ballenger Project, we agreed to transfer thirty acres of land that

abuts the development for the construction of a local K-6 grade

school. We will not be involved in the construction of such

school.

Home Incubation Project

Recognizing that large land sub-division projects have a longer

time horizon, we previously introduced a home incubation initiative

to market completed U.S. single-family homes, with existing

tenants, to investors in Asia. Under this project, we purchased 27

homes, mostly located in Texas. We sold 24 of the homes by the end

of 2016, an additional two in 2017 and the last one in December of

2019.

Competition

There are a number of companies engaged in the development of land.

Should we expand our operations into the business of constructing

homes ourselves, we will face increased competition, including

competition from large, established and well-financed companies,

some of which may have considerable ties and experience in the

geographical areas in which we seek to operate. Similarly, as we

consider other opportunities, we may wish to pursue in addition to

our current land development business, we anticipate that we will

face experienced competitors.

We will compete in part on the basis of the skill, experience and

innovative nature of our management team, and their track record of

success in diverse industries.

10

Item

1A. Risk

Factors.

An investment in our common stock involves a high degree of risk.

You should carefully consider the risks described below and the

other information in this report before making a decision to invest

in our common stock. If any of the following risks and

uncertainties develop into actual events, our business, results of

operations and financial condition could be adversely affected. In

those cases, the trading price of our common stock could decline

and you may lose all or part of your investment.

Risks Related to Our Company

Management has identified a material

weakness in the design and effectiveness of our internal

controls, which, if not remediated, could affect the

accuracy and timeliness of our financial reporting and result in

misstatements in our financial statements.

In connection with the preparation of our Report on Form 10-K, an

evaluation was carried out by management, with the participation of

our Co-Chief Executive Officers and Co-Chief Financial Officers, of

the effectiveness of our disclosure controls and procedures (as

defined in Rules 13a-15(e) and 15d-15(e) under the Securities

Exchange Act of 1934 (the “Exchange Act”) as of

December 31, 2020. Disclosure controls and procedures are designed

to ensure that information required to be disclosed in reports

filed or submitted under the Exchange Act is recorded, processed,

summarized and reported within the time periods specified, and that

such information is accumulated and communicated to management,

including the Co-Chief Executive Officers and Co-Chief Financial

Officers, to allow timely decisions regarding required

disclosure.

During evaluation of disclosure controls and procedures as of

December 31, 2020, conducted as part of our annual audit and

preparation of our annual financial statements, management

conducted an evaluation of the effectiveness of the design and

operations of our disclosure controls and procedures and concluded

that our disclosure controls and procedures were not effective.

Management determined that at December 31, 2020, we had a material

weakness that relates to the relatively small number of staff who

have bookkeeping and accounting experience. This limited number of

staff prevents us from segregating duties within our internal

control system.

This

material weakness, which remained unremedied by the company as of

December 31, 2020, could result in a misstatement to the accounts

and disclosures that would result in a material misstatement to our

annual or interim consolidated financial statements that would not

be prevented or detected. If we do not remediate the material

weakness or if other material weaknesses are identified in the

future, we may be unable to report our financial results accurately

or to report them on a timely basis, which could result in the loss

of investor confidence and have a material adverse effect on our

stock price as well as our ability to access capital and lending

markets.

We will need additional capital to expand our current operations or

to enter into new fields of operations.

Both the expansion of our current land development operations into

new geographic areas and the proposed expansion of the Company into

new businesses in the real estate industry will require additional

capital. We will need to seek additional financing either through

borrowing, private offerings of our securities or through strategic

partnerships and other arrangements with corporate partners. We

cannot be assured that additional financing will be available to

us, or if available, will be available to us on terms favorable to

us. If adequate additional financing is not available on acceptable

terms, we may not be able to implement our business development

plan or expand our operations.

We must retain key personnel for the success of our

business.

Our success is highly dependent on the skills and knowledge of our

management team, including their knowledge of our projects and

network of relationships. If we are unable to retain the members of

such team, or adequate substitutes, this could have a material

adverse effect on our business and financial

condition.

11

If we fail to effectively manage our growth our future business

results could be harmed and our managerial and operational

resources may be strained.

As we proceed with the expansion of our operations, we expect to

experience significant and rapid growth in the scope and complexity

of our business. We will need to hire additional personnel in order

to successfully advance our operations. This growth is likely to

place a strain on our management and operational resources. The

failure to develop and implement effective systems, or to hire and

retain sufficient personnel for the performance of all of the

functions necessary to effectively service and manage our potential

business, or the failure to manage growth effectively, could have a

materially adverse effect on our business and financial

condition.

There are risks related to conflicts of interest with our partners

in the Ballenger Run Project.

The Company owns the Ballenger Run Project with another LLC member.

This entity is controlled, however, by the Company not only through

the Company’s majority voting interest in such project, but

also through the control of the entity responsible for such

project’s day-to-day operations. The project will be

dependent upon SeD Development Management LLC, a subsidiary of

Alset EHome, for the services required for its operations. The

Company’s control of both the voting control of this project

as well as the control of the entity responsible for the day-to-day

interests of the project could create conflicts of interest between

our Company and our partner in the project. SeD Maryland, the owner

of the project, has no employees, and this project will be

dependent upon SeD Development Management LLC and its affiliates

for the services required for its operations.

The terms of the Management Agreement between SeD Maryland and SeD

Development Management LLC were not negotiated at

arm’s-length, although it was adopted by CNQC, the other

member. Pursuant to the Management Agreement, the owners of SeD

Maryland, SeD Ballenger and CNQC, have delegated the day-to-day

operations of developing Ballenger Run to SeD Development

Management, LLC.

Despite this delegation, potential conflict between CNQC and SeD

Development Management, LLC regarding the management of day-to-day

operations of Ballenger Run could undermine our ability to

effectively implement our vision for these projects, and could

result in costly and time-consuming litigation.

Members of our management may face competing demands relating to

their time, and this may cause our operating results to

suffer.

Fai H. Chan, one of our Co-Chief Executive Officers, is both an

officer and director of Alset International, the entity which owns

SeD Intelligent Home Inc., our majority shareholder. Mr Chan is

also the Chairman and Chief Executive Officer of Alset EHome

International Inc., a Nasdaq listed company that owns the majority

of Alset International. Mr. Chan is involved in a number of other

projects other than our Company’s real estate business and

will continue to be so involved. Moe T. Chan, our other Co-Chief

Executive Officer, is both an officer and director of Alset

International and will also be involved in projects other than our

Company’s real estate business. Both of our Co-Chief

Executive Officers have their primarily residences and business

offices in Asia, and accordingly, there will be limits on how often

they are able to visit the locations of our real estate projects.

Similarly, our Co-Chief Financial Officers are both engaged in

non-real estate activities of Alset International and Alset EHome

International Inc., and only one of our Co-Chief Financial Officers

resides and works in the United States (at an office located in

Bethesda, MD).

Since some members of our board of directors are not residents of

the United States, shareholders may not be able to enforce a U.S.

judgment for claims brought against such directors.

Several members of our senior management team, including our

Co-Chief Executive Officers, have their primary residences and

business offices in Asia, and some portion of the assets of these

directors are located outside the United States. As a result, it

may be more difficult for shareholders to enforce a lawsuit within

the United States against these non-U.S. residents than if they

were residents of the United States. Also, it may be more difficult

for shareholders to enforce any judgment obtained in the United

States against the assets of our non-U.S. resident management

located outside the United States than if these assets were located

within the United States. A foreign court may not enforce

liabilities predicated on U.S. federal securities laws in original

actions commenced in certain foreign jurisdictions, or judgments of

U.S. courts obtained in actions based upon the civil liability

provisions of U.S. federal securities laws.

12

Concentration of ownership of our common stock by our majority

shareholder will limit other investors from influencing significant

corporate decisions.

Our majority shareholder will be able to make decisions such as (i)

making amendments to our certificate of incorporation and by-laws,

(ii) whether to issue additional shares of common stock and

preferred stock, (iii) employment decisions, including compensation

arrangements, (iv) whether to enter into material transactions with

related parties, (v) election and removal of directors and (vi) any

merger or other significant corporate transactions. The interests

of our majority shareholder may not coincide with the interests of

other shareholders.

Our relationship with our majority shareholder and its parent and

affiliates may be on terms which are perceived by investors as more

or less favorable than those that could be obtained from third

parties.

Our majority shareholder, SeD Intelligent Home Inc., presently owns

99.99% of our issued and outstanding common stock. While we

anticipate that such percentage will be diluted over time, our

majority shareholder, its parent and affiliates will be perceived

as having influence over our management and operations, and any

loans or other agreements which we may enter into with our majority

shareholder and its parent and affiliates may be perceived by

investors as being on terms that are less favorable than we could

otherwise receive; such perception could adversely impact the price

of our common stock. Similarly, such agreements could be perceived

as being on terms more favorable than those that could be obtained

from third parties, and any unwillingness by our majority

shareholder and its parent and affiliates to engage with our common

stock could discourage investors.

Risks Relating to the Real Estate Industry

The market for real estate is subject to fluctuations that may

impact the value of the land or housing inventory that we hold,

which may impact the price of our common stock.

Investors should be aware that the value of any real estate we own

may fluctuate from time to time in connection with broader market

conditions and regulatory issues which we cannot predict or

control, including interest rates, the availability of credit, the

tax benefits of homeownership and wage growth, unemployment and

demographic trends in the regions in which we conduct business.

Should the price of real estate decline in the areas in which we

have purchased land, the price at which we will be able to sell

lots to home builders, or if we build houses, the price at which

can sell such houses to buyers, will decline.

The coronavirus or other adverse public health developments could

have a material and adverse effect on our business operations,

financial condition and results of operations.

In

December 2019, a novel strain of coronavirus was first identified

in Wuhan, Hubei Province, China, and has since spread to a number

of other countries, including the United States. The coronavirus,

or other adverse public health developments, could have a material

and adverse effect on our business operations. The

coronavirus’ far-reaching impact on the global economy could

negatively affect various aspects of our business, including demand

for real estate. In addition, the coronavirus could directly impact

the ability of our staff and contractors to continue to work, and

our ability to conduct our operations in a prompt and efficient

manner. The coronavirus may adversely impact the timeliness of

local government in granting required approvals. Accordingly,

the coronavirus may cause the completion of important stages in our

projects to be delayed. The extent to which the coronavirus

may impact our business will depend on future developments, which

are highly uncertain and cannot be predicted. For more information on this matter, see

“Management’s Discussion and Analysis of Financial

Condition and Results of Operations- Financial Impact of the

COVID-19 Pandemic.”

The regulation of mortgages could adversely impact home

buyers’ willingness to buy new homes which we may be involved

in building and selling.

If we become active in the construction and sale of homes to

customers, the ability of home buyers to get mortgages could have

an impact on our sales, as we anticipate that the majority of home

buyers will be financed through mortgage financing.

13

An increase in interest rates will cause a decrease in the

willingness of buyers to purchase land for building homes and

completed homes.

An increase in interest rates will likely impact sales, reducing

both the number of homes and lots we can sell and the price at

which we can sell them.

Our business, results of operations and financial condition could

be adversely impacted by significant inflation or

deflation.

Significant inflation could have an adverse impact on us by

increasing the costs of land, materials and labor. We may not be

able to offset cost increases caused by inflation. In addition, our

costs of capital, as well as those of our future business partners,

may increase in the event of inflation, which may cause us to need

to cancel projects. Significant deflation could cause the value of

our inventories of land or homes to decline, which could sharply

impact our profits.

New environmental regulations could create new costs for our land

development business, and other business in which we may commence

operations.

At the present time, we are subjected to a number of environmental

regulations. If we expand into the business of building homes

ourselves, we will be subjected to an increasing number of

environmental regulations. The number and complexity of local,

state and federal regulations may increase over time. Additional

environmental regulations can add expenses to our existing

business, and to businesses which we may enter into the future,

which may reduce our profits.

Zoning and land use regulations impacting the land development and

homebuilding industries may limit our activities and increase our

expenses, which would adversely affect our profits.

We must comply with zoning and land use regulations impacting the

land development and home building industries. We will need to

obtain the approval of various government agencies to expand our

operations as currently into new areas and to commence the building

of homes. Our ability to gain the necessary approvals is not

certain, and the expense and timing of approval processes may

increase in ways that adversely impact our profits.

The availability and cost of skilled workers in the building trades

may impact the timing and profitability of projects that we

participate in.

Should there be a lack of skilled workers to be retained by our

Company and its partners, the ability to complete land development

and potential construction projects may be delayed.

Shortages in required materials could impact the profitability of

construction partnerships we may participate in.

Should a shortage of required materials occur, such shortage could

cause added expense and delays that will undermine our

profits.

Our ability to have a positive relationship with local communities

could impact our profits.

Should we develop a poor relationship with the communities in which

we will operate, such relationship will impact our

profits.

We may face litigation in connection with either our current

activities or activities which we may conduct in the

future.

As we expand our activities, the likelihood of litigation shall

increase. The expenses of such litigation may be substantial. We

may be exposed to litigation for environmental, health, safety,

breach of contract, defective title, construction defects, home

warranty and other matters. Such litigation could include expensive

class action matters. We could be responsible for matters assigned

to subcontractors, which could be both expensive and difficult to

predict.

14

As we expand operations, we will incur greater insurance costs and

likelihood of uninsured losses.

If we expand our operations into home building, we may experience

material losses for personal injuries and damage to property in

excess of insurance limits. In addition, our premiums may

raise.

Health and safety incidents that occur in connection with our

potential expansion into the home building business could be

costly.

If we commence operations in the homebuilding business, we will be

exposed to the danger of health and safety risks to our employees

and contractors. Health and safety incidents could result in the

loss of the services of valued employees and contractors and expose

us to significant litigation and fines. Insurance may not cover, or

may be insufficient to cover, such losses.

Adverse weather conditions, natural disasters and man-made

disasters may delay our projects or cause additional

expenses.

The land development operations which we currently conduct and the

construction projects which we may become involved in at a later

date may be adversely impacted by unexpected weather and natural

disasters, including but not limited to storms, hurricanes,

tornados, floods, blizzards, fires or earthquakes. Man-made

disasters including terrorist attacks, electrical outages and

cyber-security incidents may also impact the costs and timing of

the completion of our projects. Cyber-security incidents, including

those that result in the loss of financial or other personal data,

could expose us to litigation and reputational damage. If insurance

is unavailable to us on acceptable terms, or if our insurance is

not adequate to cover business interruptions and losses from the

conditions described above and similar incidents, or results of

operations will be adversely affected. In addition, damage to new

homes caused by these conditions may cause our insurance costs to

increase.

We have a concentration of revenue and credit risk with one

customer.

We have been highly dependent on sales of residential lots to NVR.

Pursuant to agreements between NVR and SeD Maryland Development,

LLC, NVR will be the sole purchaser of 479 residential lots at our

Ballenger Project. During 2019 and 2020, we received $15.9 million

and $15.4 million in revenue from lot sales to NVR, respectively.

Therefore, at the present time, a significant portion of our

business depends largely on NVR’s continued relationship with

us. A decision by NVR to discontinue or limit its relationship with

us could have a material adverse impact on the

Company.

Risks Associated with Real Estate Related Debt and Other

Investments

Any real estate debt security that we originate or purchase is

subject to the risks of delinquency and foreclosure.

We may originate and purchase real estate debt securities, which

are subject to numerous risks including delinquency and

foreclosure. We will not have recourse to the personal assets of

our tenants. The ability of a lessee to pay rent depends primarily

upon the successful operation of the property, rather than upon the

existence of independent income or assets of the

tenant.

Any hedging strategies we utilize may not be successful in

mitigating our risks.

We may enter into hedging transactions to manage, for example, the

risk of interest rate or price changes. To the extent that we may

occasionally use derivative financial instruments, we will be

exposed to credit, basis and legal enforceability risks. Derivative

financial instruments may include interest rate swap contracts,

interest rate cap or floor contracts, futures or forward contracts,

options or repurchase agreements. In this context, credit risk is

the failure of the counterparty to perform under the terms of the

derivative contract. If the fair value of a derivative contract is

positive, the counterparty owes us, which creates credit risk for

us. Basis risk occurs when the index upon which the contract is

based is more or less variable than the index upon which the hedged

asset or liability is based, thereby making the hedge less

effective. Finally, legal enforceability risks encompass general

contractual risks, including the risk that the counterparty will

breach the terms of, or fail to perform its obligations under, the

derivative contract. We may not be able to manage these risks

effectively.

15

Risks Related to Our Potential Expansion into New Fields of

Operations

If we pursue the development of new technologies, we will be

required to respond to rapidly changing technology and customer

demands.

In the event that the Company enters the business of developing

“Smart Home” and similar technologies (an area which we

are presently exploring), the future success of such operation will

depend on our ability to adapt to technological advances,

anticipate customer demands and develop new products. We may

experience technical or other difficulties that could delay or

prevent the development, introduction or marketing of products.

Also, we may not be able to adapt new or enhanced services to

emerging industry standards, and our new products may not be

favorably received.

Risks Related to Our Common Stock

The shares of our common stock are currently not being traded and

there can be no assurance that there will be an active market in

the future.

Our shares of common stock are not publicly traded, and if trading

commences, the price may not reflect our value. There can be no

assurance that there will be an active market for our shares of

common stock in the future. As a result, investors may not be able

to liquidate their investment or liquidate it at a price that

reflects the value of the business.

It is possible that we will not establish an active market unless

our stock is listed for trading on an exchange, and we cannot

assure shareholders that we will ever satisfy exchange listing

requirements.

It is possible that a significant trading market for our shares

will not develop unless the shares are listed for trading on a

national exchange. Exchange listing would require us to satisfy a

number of tests as to corporate governance, public float,

shareholders, equity, assets, market makers and other matters, some

of which we do not currently meet. We cannot assure shareholders

that we will ever satisfy listing requirements for a national

exchange or that there ever will be significant liquidity in our

shares.

If we issue additional shares of our common stock, shareholders

will experience dilution of their ownership interest.

We may issue shares of our authorized but unissued equity

securities in the future. Such shares may be issued in connection

with raising capital, acquiring assets or firing or retaining

employees or consultants. If we issue such shares,

shareholders’ ownership will be diluted.

We do not intend to pay dividends in the foreseeable future, and

investors should not purchase our stock expecting to receive

dividends.

We have not paid any dividends on our common stock in the past, and

we do not anticipate that we will pay dividends in the foreseeable

future. Accordingly, some investors may decline to invest in our

common stock, and this may reduce the liquidity of our

stock.

The limitations on liability for officers, directors and employees

under the laws of the State of Nevada and the existence of

indemnification rights for our officers, directors and employees

could result in substantial expenditures by the Company and could

discourage lawsuits against our officers, directors and

employees.

Our Articles of Incorporation contain a specific provision that

eliminates the liability of our officers and directors for monetary

damages to our company and shareholders. Further, we intend to

provide indemnification to our officers and directors to the

fullest extent permitted by the laws of the State of Nevada. We may

also enter into employment and other agreements in the future

pursuant to which we will have indemnification obligations. The

foregoing indemnification obligations could result in the Company

incurring substantial expenditures to cover the cost of settlement

or damage awards against officers and directors. These obligations

may discourage the filing of derivative litigation by our

shareholders against our officers and directors even where such

litigation may be perceived as beneficial by our

shareholders.

16

Item

1B. Unresolved Staff

Comments.

Not Applicable.

Item

2. Properties.

Black Oak

The

Black Oak property is located in Montgomery County in Magnolia,

Texas. This property is located east of FM 2978 via Standard Road

to Dry Creek Road and South of the Woodlands, one of the most

successful, fastest growing master planned communities in Texas.

This residential land development consisted of approximately 162

acres. On January 13, 2021, 150 CCM Black Oak, Ltd. purchased

an approximately 6.297 acre tract of land in Montgomery County. The

Company’s strategic acquisition contiguous to the Black Oak

project is intended to provide additional lot yield, potential

additional amenities and/or a solar farm to support the

Company’s sustainable, healthy living concept. Together with

the additional tract of land there are approximately 648 lots to be

platted for the Company’s future endeavors. This does not

include the 124 lots sold to Rausch Coleman in Phase I.

150 CCM Black Oak Ltd is the primary developer responsible for all

infrastructure development. This property is included in Harris

County Improvement District #17.

Ballenger Run

Ballenger Run is a residential land development project located in

Frederick County in Frederick, Maryland. This property is located

approximately 40 miles from Washington, DC, 50 miles from Baltimore

and is located less than four miles from I-70 and I-270. Ballenger

Run is situated on approximately 197 acres of land and entitled for

689 residential units consisting of 479 residential Lots and 210

multi-family units. SeD Maryland Development, LLC is the primary

developer responsible for all infrastructure

development.

Development of Properties

At the present time, the Company is considering expanding its

current policy of selling buildable lots to include a strategy of

building housing for sale or rent, particularly at our Black Oak

property.

Office Space

At the present time, the Company is renting offices in Houston,

Texas and Bethesda, Maryland through Alset EHome. At the present

time, our office space is sufficient for our operations as

presently conducted, however, as we expand into new projects and

into new areas of operations, we anticipate that we will require

additional office space.

Item

3. Legal

Proceedings.

The Company is not a party to any pending legal proceedings, and no

such proceedings are known to be contemplated.

There are no material proceedings to which any director, officer or

affiliate of the Company, or any owner of record or beneficially of

more than five percent of any class of voting securities of the

Company, or any associate of any such director, officer, affiliate

of the Company, or security holder is a party adverse to the

Company or any of its subsidiaries or has a material interest

adverse to the Company or any of its subsidiaries.

Item

4. Mine Safety

Disclosures

Not applicable.

17

PART II

Item

5. Market for Company’s

Common Equity, Related Stockholder Matters and Small Business

Issuer Purchases of Equity Securities

Market Information

There is presently no established public trading market for our

shares of common stock. We plan to reapply for quoting of our

common stock on the OTC Bulletin Board. However, we can provide no

assurance that our shares of common stock will be quoted on

the Bulletin Board or, if traded, that a public market will