Attached files

| file | filename |

|---|---|

| EX-31.1 - PureBase Corp | ex31-1.htm |

| EX-32.2 - PureBase Corp | ex32-2.htm |

| EX-32.1 - PureBase Corp | ex32-1.htm |

| EX-31.2 - PureBase Corp | ex31-2.htm |

| EX-10.13 - PureBase Corp | ex10-13.htm |

| EX-10.12 - PureBase Corp | ex10-12.htm |

| EX-10.11 - PureBase Corp | ex10-11.htm |

| EX-4.1 - PureBase Corp | ex4-1.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

[X] ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the Fiscal Year Ended November 30, 2020

or

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from __________________________ to __________________________

Commission file number 000-55517

PUREBASE CORPORATION

(Exact name of registrant as specified in its charter)

| Nevada | 27-2060863 |

| (State or other jurisdiction | (I.R.S. Employer |

| of incorporation or organization) | Identification No.) |

8631 State Highway, 124 Ione, California |

95640 |

| (Address of Principal Executive Offices) | (Zip Code) |

(209) 274-9143

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading symbol(s) | Name of each exchange on which registered | ||

| None | N/A | N/A |

Securities registered pursuant to Section 12(g) of the Act:

Common Stock, par value $0.0001

(Title of class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes [ ] No [X]

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes [ ] No [X]

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes [X] No [ ]

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes [X] No [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a small reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” or an “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | [ ] | Accelerated filer | [ ] |

| Non-accelerated filer | [X] | Smaller reporting company | [X] |

| Emerging Growth company | [X] |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act: [ ]

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. [ ]

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes [ ] No [X]

The aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of the registrant’s most recently completed second fiscal quarter was $4,789,476.

As of March 16, 2021, there were 214,950,751 shares of the registrant’s common stock outstanding.

TABLE OF CONTENTS

| 2 |

Forward-Looking Statements

This Annual Report on Form 10-K includes forward-looking statements that reflect management’s current views with respect to future events and financial performance. Forward-looking statements are projections in respect of future events or our future financial performance. In some cases, you can identify forward-looking statements by terminology such as “may,” “should,” “expects,” “plans,” “anticipates,” “believes,” “estimates,” “predicts,” “potential” or “continue” or the negative of these terms or other comparable terminology. Those statements include statements regarding the intent, belief or current expectations of us and members of our management team, as well as the assumptions on which such statements are based. Current and prospective investors are cautioned that any such forward-looking statements are not guarantees of future performance and involve risk and uncertainties, and that actual results may differ materially from those contemplated by such forward-looking statements. These statements are only predictions and involve known and unknown risks, uncertainties and other factors, including the risks in the section entitled “Risk Factors” any of which may cause our company’s or our industry’s actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by these forward-looking statements. These risks include, by way of example and without limitation:

| ● | absence of contracts with customers or suppliers; |

| ● | our ability to maintain and develop relationships with customers and suppliers; |

| ● | the impact of competitive products and pricing; |

| ● | supply constraints or difficulties; |

| ● | the retention and availability of key personnel; |

| ● | general economic and business conditions; |

| ● | substantial doubt about our ability to continue as a going concern; |

| ● | our ability to successfully implement our business plan; |

| ● | our need to raise additional funds in the future; |

| ● | our ability to successfully recruit and retain qualified personnel in order to continue our operations; |

| ● | our ability to successfully acquire, develop or commercialize new products; |

| ● | the commercial success of our products; |

| ● | the impact of any industry regulation; |

| ● | our ability to develop existing mining projects or establish proven or probable reserves; |

| ● | our dependence on one vendor for our minerals for our products; |

| ● | the impact of potentially losing the rights to properties; |

| ● | the impact of the increase in the price of natural resources; and |

| ● | the continued impact of the COVID-19 pandemic. |

Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, or performance. Readers are urged to carefully review and consider the various disclosures made by us in this Report and in our other reports filed with the Securities and Exchange Commission (the “SEC”). We undertake no obligation to update or revise forward-looking statements to reflect changed assumptions, the occurrence of unanticipated events or changes in the future operating results over time except as required by law. We believe that our assumptions are based upon reasonable data derived from and known about our business and operations. However, no assurances are made that actual results of operations or the results of our future activities will not differ materially from our assumptions.

As used in this Annual Report on Form 10-K and unless otherwise indicated, the terms “Company,” “we,” “us,” and “our,” refer to PureBase Corporation and its wholly-owned subsidiaries, PureBase Agricultural, Inc., a Nevada corporation (“PureBase AG”) and U.S. Agricultural Minerals, LLC, a Nevada limited liability company (“USAM”).

| 3 |

Corporate History

The Company was incorporated in the State of Nevada on March 2, 2010, under the name Port of Call Online, Inc. to create a web-based service that would offer boaters an easy, convenient, fun, easy to use, online resource to help them plan and organize their boating trips. Pursuant to a corporate reorganization consummated on December 23, 2014, the Company changed its business focus to the identification, acquisition, development and full-scale exploitation of industrial and natural mineral properties in the United States for the development of products for the construction and agriculture markets. In line with this business focus, the Company changed its name to PureBase Corporation in January 2015.

The Company is headquartered in Ione, California.

Business Overview

The Company, through its two divisions, Purebase Ag and Purebase SCM, is engaged in the agricultural and construction-materials sectors. In the agricultural sector, the Company’s business is to develop specialized fertilizers, sun protectants, soil amendments, and bio-stimulants for organic and non-organic sustainable agriculture.

In the construction sector, the Company’s focus in 2020 has been to develop and test a kaolin-based product that will help create a lower CO2-emitting concrete (through the use of high-quality SCM’s.) The Company is developing a SCM that it believes can potentially replace up to 40% of cement, the most polluting part of concrete. As government agencies continue to enact stricter requirements for less-polluting forms of concrete, the Company believes there are significant opportunities for high-quality SCM products in the construction-materials sector.

In the agricultural sector, the Company has developed and will seek to develop additional products derived from mineralized materials of leonardite, kaolin clay, laterite, and other natural minerals. These mineral and soil amendments are used to protect crops, plants and fruits from the sun and winter damage, to provide nutrients to plants, and to improve dormancy and soil ecology to help farmers increase the yields of their harvests.

The Company is building a brand family under the parent trade name “Purebase,” consisting of its Purebase Shade Advantage WP product, a kaolin-clay based sun protectant for crops. It is also involved in the early testing of soil amendment products based on humic and fulvic acids derived from leonardite. Other agricultural products are in the development stage.

The Company utilizes the services of US Mine Corporation (“USMC”), a Nevada corporation, and a significant shareholder of the Company for the development and contract mining of industrial mineral and metal projects throughout North America, exploration drilling, preparation of feasibility studies, mine modeling, on-site construction, production, site reclamation and for product fulfillment. Exploration services include securing necessary permits, environmental compliance, and reclamation plans. In addition, a substantial portion of the minerals to be utilized by the Company is obtained from properties owned or controlled by USMC. A. Scott Dockter and John Bremer are officers, directors, and owners.

PureBase Shade Advantage WP

PureBase Shade Advantage WP is a natural mineral plant protectant that reduces sunburn damage to plant tissue (including fruits and nuts) exposed to UV and infrared radiation. The protection is achieved through the absorption and dissipation of ultraviolet and infrared radiation, which protects and reduces the stress on plants.

The anticipated benefits of this product include:

| ● | Adherences to plant tissue, fruit, and wood bark without the need for surfactants (stickers) |

| 4 |

| ● | Protection against sunburn of plant tissue and sun scalding of fruits, nuts, and vegetables |

| ● | Designed for application on organic and sustainable crops |

| ● | When sprayed on dormant trees, Shade Advantage WP has the potential of mitigating weather induced dormancy interference. |

Shade Advantage WP is available in 25 lb. bags.

To date, the Company distributes its products through the Aligned Ag Distributors, Helena Agri Enterprises and other distributors. It also private labels product for other agricultural companies. We have exported limited product to Vietnam, Laos, and Cambodia, and trials are being conducted in Peru to determine the effectiveness of Shade Advantage WP on bananas.

Employees

The Company currently has three full-time employees. We currently anticipate hiring additional employees for the Company’s production operations, subject to sufficient funding, if our products development and distribution programs continue to expand. The Company currently relies on USMC to provide the Company’s mining services.

Outside services, relating primarily to agricultural market research and product development, and the development and application of SCMs, as well as other technical matters related to product development and branding activities, will be provided by various independent contractors.

Competition in the Agricultural Sector

Major competitors with our agricultural products include:

| ● | PureShade with Calcium Carbonate: manufactured by Novasource, a division of the Tessenederlo Group. |

| ● | Surround: A kaolin-clay-based sun protectant manufactured by Novasource, a division of the Tessenderlo Group. |

| ● | BioFlora: a comprehensive agricultural products company based in Arizona. |

| ● | Mesa Verde Humates, a division of Bio Huma Netics, a manufacturer of humate-based products based in New Mexico. |

| ● | The Andersons Humic Solutions: A humic based products mining and manufacturing firm focused in the US Midwest, which produces highly competitive organic products which are sold and distributed throughout the United States. |

Agricultural Industry Overview

The Company’s current product, Shade Advantage WP, is a sun-protectant for various crops such as walnuts, watermelons, citrus, tomatoes, apples, cherries, and more. Under development is a number of organic products that will be classified as soil amendments. The overview below shows the size and scope of the crops that could potentially use products that we develop.

The Company’s agricultural products are primarily sold in the California market. According to the California Department of Food and Agriculture, in 2019 (the latest year for which statistics are available) California’s farms and ranches received more than $50 billion in cash receipts for their output. According to the University of California, Davis, Agricultural Issues Center. California agricultural exports totaled $21.7 billion in 2019. Top commodities for export included almonds, pistachios, dairy and dairy products, wine and walnuts. California organic product sales totaled more than $10.4 billion in 2019and organic production encompassed over 2.5 million acres in California, which is the only state with a USDA National Organic Program.

According to the California Department of Food and Agriculture, in its 2019 Crop year report, over a third of the country’s vegetables and two-thirds of the country’s fruits and nuts are grown in California. California’s top-10 valued commodities for the 2019 crop were:

| ● | Dairy Products, Milk — $7.34 billion |

| 5 |

| ● | Almonds — $6.09 billion |

| ● | Grapes — $5.41 billion |

| ● | Cattle and Calves — $3.06 billion |

| ● | Strawberries — $2.22 billion |

| ● | Pistachios — $1.94 billion |

| ● | Lettuce — $1.82 billion |

| ● | Walnuts — $1.29 billion |

| ● | Floriculture — $1.22 billion |

| ● | Tomatoes — $1.17 billion |

Construction Industry Overview

We are developing SCMs for the construction material markets, particularly the cement markets.

Domestic Production and Use:

According to the United States Geological Survey in a 2020 Mineral Commodity Summary, in 2019, U.S. portland cement production increased by 2.5% to 86 million tons, and masonry cement production continued to remain steady at 2.4 million tons. Portland cement is the most common type of cement in general use around the world as a basic ingredient of concrete, mortar, stucco, and non-specialty grout. Cement was produced at 96 plants in 34 States, and at 2 plants in Puerto Rico. U.S. cement production continued to be limited by closed or idle plants, underutilized capacity at others, production disruptions from plant upgrades, and relatively inexpensive imports.

In 2019, sales of cement increased slightly and were valued at $12.5 billion. Most cement sales were to make concrete, worth at least $65 billion. In 2019, it was estimated that 70% to 75% of sales were to ready-mixed concrete producers, 10% to concrete product manufactures, 8% to 10% to contractors, and 5% to 12% to other customer types. Texas, California, Missouri, Florida, Alabama, Michigan, and Pennsylvania were, in descending order of production, the seven leading cement-producing states and accounted for nearly 60% of U.S. production.

Construction spending decreased in 2019, due to a decline in private residential and nonresidential spending. Cement shipments into North Carolina and South Carolina increased due to reconstruction following a hurricane in 2018. The leading cement-consuming states were Texas, California, and Florida, in descending order by tonnage.

Most portland cement is used to make concrete, mortars, or stuccos, and competes in the construction sector with concrete substitutes, such as aluminum, asphalt, clay brick, fiberglass, glass, gypsum (plaster), steel, stone, and wood. Certain materials, especially fly ash and ground granulated blast furnace slag, develop good hydraulic cementitious properties by reacting with lime, such as that released by the hydration of portland cement. Where readily available (including as imports), these SCMs are increasingly being used as partial substitutes for portland cement in many concrete applications and are components of finished blended cements.

Competition in the Construction Materials Sector

Potential competitors in the SCM space include other kaolin producers that are located in the eastern U.S. (predominantly Georgia), including BASF, Thiele Kaolin Company, Active Minerals, Burgess Pigment, Imerys, and KaMin. Other potential competitors include fly ash distributors (primarily Boral), and existing coal burning power plants (which produces fly ash as a byproduct of energy production.)

| 6 |

Currently in the western U.S., there are coal burning plants in Nevada, Oregon, and Washington. There are coal burning plants in Mexico and India from which fly ash can be imported. Other potential competitors are steel mills from which slag is produced as a byproduct of production (which is also a material that can replace fly ash.)

Newer technology could produce further competition, such as CO2-entrained concrete products that are produced by companies like Carbon Cure, a new company that has received significant investments by Bill Gates, Microsoft, Amazon, and others.

Pricing Competition

Many of our competitors have greater exploration, production, and capital resources than we do, and may be able to compete more effectively in any of these areas. For example, these competitors may be able to spend greater amounts on acquisition of desirable mineral properties, on exploration of their mineral properties and on development of their mineral properties. This competition could result in competitors having mineral properties of greater quality and interest to prospective investors who may finance the exploration and development of their mineral properties. Our inability to secure capital to fund exploration and, if warranted, development costs for our mineral properties would create a competitive cost disadvantage in the marketplace which would have a material adverse effect on our operations and potential profitability.

Government Controls and Regulations

Natural resource exploration, mining and processing operations are subject to various federal, state and local laws and regulations governing prospecting, exploration, development, production, labor standards, occupational health, mine safety, control of toxic substances, and other matters involving environmental protection and employment. United States environmental protection laws address the maintenance of air and water quality standards, the preservation of threatened and endangered species of wildlife and vegetation, the preservation of certain archaeological sites, reclamation, and limitations on the generation, transportation, storage and disposal of solid and hazardous wastes, among other things. There can be no assurance that all the required permits and governmental approvals necessary for any mining project with which we may be associated can be obtained on a timely basis, or maintained in good standing. Delays in obtaining or failure to obtain necessary government permits and approvals may adversely impact our operations. The regulatory environment in which we operate could change in ways that would substantially increase costs to achieve compliance. In addition, significant changes in regulations could have a material adverse effect on our operations and ability to timely and effectively implement our drilling/mapping programs and develop our mining properties.

The following governmental controls and regulations materially affect the mining properties we or our third party mineral suppliers will seek to explore and develop.

Federal Regulation of Mining Activity

Mining operations are subject to numerous federal, state and local laws and regulations. At the federal level, mining properties are subject to inspection and regulation by the Division of Mine Safety and Health Administration of the Department of Labor (“MSHA”) under provisions of the Federal Mine Safety and Health Act of 1977. The Occupation and Safety Health Administration (“OSHA”) also has jurisdiction over certain safety and health standards not covered by MSHA. Mining operations and all proposed exploration and development will require a variety of permits. In addition, any mining operations occurring on federal property are subject to regulation and inspection by the Bureau of Land Management (“BLM”). While we have considerable experience in the mining permitting process, permitting procedures are complex, costly, time consuming and subject to potential regulatory delay. We currently own mining rights in several properties having existing permits in place or properties where existing permitting requirements and other applicable environmental protection laws and regulations would not pose a material hindrance to our ability to explore and develop such properties. As part of our initial evaluation of suitable projects, we will ascertain a property’s regulatory compliance status and any issues affecting current or future permitting requirements. However, we cannot be certain that future changes in laws and regulations would not result in significant additional expenses, capital expenditures, restrictions or delays associated with the exploration and development of our current or future projects. We cannot predict whether we will be able to obtain new permits or whether material changes in permit conditions will be imposed. Obtaining new mining permits or the imposition of additional conditions could have a material adverse effect on our ability to develop the mining properties in which we have an interest or ownership or could increase the costs charged by third party suppliers or decrease the amount of minerals available from third party suppliers.

| 7 |

Legislation to make significant revisions to the U.S. General Mining Law of 1872 would affect our potential development of unpatented mining claims on federal lands, including any royalty on mineral production. It cannot be predicted whether any of these proposals will become law. Any levy of the type proposed would only apply to unpatented federal lands and accordingly could adversely affect the profitability of any future mineral production from projects being explored by the Company on federal property.

All of our current mining projects are governed by the BLM and the US Forest Service. The Federal Land Policy and Management Act (1976) established the BLM’s multiple-use mandate to manage the public lands “in a manner that will protect the quality of scientific, scenic, historical, ecological, environmental, air and atmospheric, water resource, and archeological values; that, where appropriate, will preserve and protect certain public lands in their natural condition”. The Lands, Minerals & Water Rights branch coordinates with BLM planning and resource specialists to manage surface resources, minerals and water rights to ensure that authorized uses of public lands.

We may not be able to obtain permits required for our projects in a timely manner, on reasonable terms, or at all. If we, or our third-party suppliers, cannot obtain or maintain the necessary permits, or if there is a delay in receiving such permits, our timetable and business plan for development and mining of these properties or those of third party suppliers could be adversely affected.

Mining Environmental Regulations

Mining activities, including drilling, mapping and development and production activities are subject to environmental laws, policies and regulations. These laws, policies and regulations affect, among other matters, emissions to the air, discharges to water, management of waste, management of hazardous substances, protection of natural resources, protection of endangered species, protection of antiquities and reclamation of mined land. Legislation and implementation of regulations adopted or proposed by the United States Environmental Protection Agency (“EPA”), the BLM and by comparable agencies in various states, directly and indirectly affect the mining industry in the United States. These laws and regulations address the environmental impact of mining and mineral processing, including potential contamination of soil and water from tailings, discharges and other wastes generated by the mining process. In particular, legislation such as the Clean Water Act, the Clean Air Act, the Federal Resource Conservation and Recovery Act (“RCRA”), and the National Environmental Policy Act require analysis and/or impose effluent standards, new source performance standards, air quality standards and other design or operational requirements for various components of mining and mineral processing, including natural resource mining and processing of the type presently or to be conducted by the Company. Such statutes also may impose liability on mine developers for remediation of waste they have created.

Mining projects also are subject to regulations under (i) the Comprehensive Environmental Response, Compensation and Liability Act of 1980 (“CERCLA” or “Superfund”) which regulates and establishes liability for the release of hazardous substances and (ii) the Endangered Species Act (“ESA”) which identifies endangered species of plants and animals and regulates activities to protect these species and their habitats. Revisions to “CERCLA” and “ESA” are being considered by Congress; however, the impact of these potential revisions on our business is not clear at this time.

The Clean Air Act, as amended, mandates the establishment of a Federal air permitting program, identifies a list of hazardous air pollutants, including various metals and pollutants, and establishes new EPA enforcement authority. The EPA has published final regulations establishing the minimum elements of state operating permit programs. We will be required to comply with these EPA standards to the extent adopted by the State in which development projects are located.

| 8 |

Future regulations are unknown but expected to occur. The new U.S. Administration has rejoined the Paris Climate Accord and placed further restrictions on carbon-emitting activities. Future restrictions and higher standards could negatively impact our ability to bring new products to market, as well as bring new opportunities for products that can reduce cO2 emissions.

In addition, developing mining sites requires mitigation of long-term environmental impacts by stabilizing, contouring, re-sloping, and revegetating various portions of a site. While a portion of the required work can be performed concurrently with developing the property, completion of the environmental mitigation occurs once removal of all materials and facilities has been completed. These reclamation efforts are conducted in accordance with detailed plans which have been reviewed and approved by the appropriate regulatory agencies. The mining developer must ensure that all necessary cash deposits and financial resources to cover the estimated costs of such reclamation as required by permit are made.

We intend that any exploration and development of mining projects by the Company will be conducted in substantial compliance with federal and state regulations and be consistent with the need to remediate any environmental impact.

Agricultural Products Certifications

All sales of agricultural products have to be registered in order to be sold, distributed and /or applied in farming operations. Standards for registration are set and regulated by the United States Department of Agriculture (“USDA”) at the federal level. All state agencies must also comply with federal guidelines. There are guidelines for the registration and labelling of the products for agriculture use, some of which are federal, others are State. Our product(s) which are organic must meet several additional qualifications in order to become registered.

In California, for example, the task of regulating the registration processes is carried out by the California Department of Food and Agriculture (“CDFA”). There are some activities within the regulatory process that are executed by recognized and licensed private entities such as chemical laboratories and certifying laboratories. In some instances, in accordance with various international treaties, some of bilateral and some by regional structures (European Union, etc.) and some governmental and private organizations are recognized and licensed to play particular roles in certifying and/or in the certifying processes.

Currently we have one product fully registered as an organic plant protectant: PureBase Shade Advantage WP. The WP stands for Wettable Powder which means the powder goes into suspension when mixed with water. We have registration certificates for this product in several states including California and Washington. Our product is currently registered in the US and California as agricultural products.

An investment in our common stock involves a number of very significant risks. You should carefully consider the following risks and uncertainties in addition to other information in this report in evaluating our company and its business before purchasing shares of our common stock. Our business, operating results and financial condition could be seriously harmed due to any of the following risks. You could lose all or part of your investment due to any of these risks.

Risks Related to Our Business

The Company is a development stage company which makes the evaluation of its future business prospects difficult.

The Company changed its business focus to its current business of developing agricultural and natural resources as a result of a reorganization with its wholly owned subsidiary PureBase Ag which occurred in December 2014, and only commenced selling its agricultural products during 2017 and has not yet achieved profitable operations. In 2019, the Company began developing a SCM for the construction materials market. Final testing for two SCM products have been submitted to the California Department of Transportation for inclusion on its Approved Materials List.

| 9 |

Our recent operating history makes evaluation of our future business and prospects difficult. The Company’s success is dependent upon the successful development of suitable mineral projects, establishing its production capability and establishing a customer base for its agricultural products. Any future success will depend upon many factors, including factors beyond our control which cannot be predicted at this time. These factors may include changes in or increased levels of competition; the availability and cost of bringing mineral projects into production; the amount of agricultural and/or natural resources available and the market price of and the uses for such minerals. These factors may have a material adverse effect upon our business operating results and financial condition.

Our independent registered public accounting firm has expressed doubt about our ability to continue as a going concern.

Our audited consolidated financial statements as of November 30, 2020 have been prepared under the assumption that we will continue as a going concern. Our independent registered public accounting firm has issued a report that included an explanatory paragraph referring to our recurring losses from operations and net capital deficiency and expressing substantial doubt in our ability to continue as a going concern without additional capital becoming available. For the fiscal year ended November 30, 2020, we had a loss from operations of approximately $1,172,000 and negative cash flows from operations of approximately $1,265,000. We anticipate that we will continue to incur operating losses as we execute our development plans for 2021, as well as other potential strategic and business development initiatives. In addition, we expect to have negative cash flows from operations, at least into the near future. We have previously funded and plan to continue funding these losses primarily through the sale of equity and debt. Our ability to continue as a going concern is dependent upon our ability to obtain additional equity or debt financing, attain further operating efficiencies, reduce expenditures, and, ultimately, to generate revenue. There can be no assurance that we will be successful in raising capital and have adequate capital resources to fund our operations or that any additional funds will be available to us on favorable terms or in amounts required by us. If we are unable to obtain adequate capital resources to fund operations, we may be required to delay, scale back or eliminate some or all of our plan of operations, which may have a material adverse effect on our business, results of operations and ability to operate as a going concern. The consolidated financial statements do not include any adjustments that might result from the outcome of this uncertainty.

We will need to raise additional capital for the foreseeable future in order to continue operations and realize our business plans, the failure of which could adversely impact our operations.

Although we have started to generate revenue, such revenue is not sufficient to cover our operating expenses and financing costs. As of November 30, 2020, we had liabilities of $1,937,014 and a working capital deficiency of $1,792,674. To stay in business, we will need to raise additional capital through public or private sales of our securities, debt financing or short-term bank loans, or a combination of the foregoing. In the past, we have financed our operations by issuing secured and unsecured convertible debt and equity securities in private placements, in some cases with equity incentives for the investor in the form of warrants to purchase our common stock and have borrowed from related parties. We have sought and will continue to seek various sources of financing but there are no commitments from anyone to provide us with financing. We can provide no assurance as to whether our capital raising efforts will be successful or as to when, or if, we will be profitable in the future. Even if the Company achieves profitability, it may not be able to sustain such profitability. If we are unable to obtain financing or achieve and sustain profitability, we may have to suspend operations, sell assets and will not be able to execute our business plan. Failure to become and remain profitable may adversely affect the market price of our common stock and our ability to raise capital and continue operations.

We will need to grow the size and capabilities of our company, and we may experience difficulties in managing this growth.

If and when our marketing plans and business strategies develop, we may need to recruit additional managerial, operational, sales and marketing, financial, IT and other personnel. Future growth will impose significant added responsibilities on management which may divert a disproportionate amount of management’s attention away from day-to-day activities to devote a substantial amount of time to managing these growth activities.

| 10 |

We depend on third parties for services.

We currently rely, and for the foreseeable future will continue to rely, in substantial part on advisors and consultants to provide certain services. There can be no assurance that the services of these independent advisors and consultants will continue to be available to us on a timely basis when needed, or that we can find qualified replacements. In addition, if we are unable to effectively manage our outsourced activities or if the quality or accuracy of the services provided by consultants is compromised for any reason, our business operations may be interrupted. There can be no assurance that we will be able to manage our existing consultants or find other competent outside contractors and consultants on economically reasonable terms, if at all. If we are not able to effectively expand our company by hiring new employees and expanding our consultants and contractors, we may not be able to successfully implement the tasks necessary to achieve our marketing, research, development, and expansion goals, and we may face loss and be liable for deficiencies in service caused by the lack of capable personnel or errors made by third parties.

If we lose key employees and consultants or are unable to attract or retain qualified personnel, our business could suffer.

Our future success depends, in part, on our ability to attract, retain and motivate highly qualified technical, marketing, engineering, and management personnel. Any inability in hiring and retaining qualified personnel could result in delays in development or fulfillment of any current strategic and operational plans.

Our officers and directors are able to control the Company.

Our officer and directors and their affiliates control the vast majority of common stock of our company. As a result, they have significant influence over the management and affairs of the Company and control over matters requiring stockholder approval, including the election of directors and significant corporate transactions, such as a merger or other sale of our company or our assets. Their interests may differ from the interests of other stockholders and thus result in corporate decisions that are disadvantageous to other shareholders. This concentration of ownership may also have the effect of delaying or preventing a change in control of the Company that may be favored by other stockholders. This could prevent transactions in which stockholders might otherwise recover a premium for their shares over current market prices. This concentration of ownership and influence in management and board decision-making could also harm the price of our capital stock by, among other things, discouraging a potential acquirer from seeking to acquire shares of our capital stock (whether by making a tender offer or otherwise) or otherwise attempting to obtain control of our company.

Raising funds through debt or equity financings in the future, would dilute the ownership of our existing stockholders and possibly subordinate certain of their rights to the rights of new investors or creditors.

We hope to raise additional funds in debt or equity financings if available to us on terms we believe reasonable to provide for working capital, mining development and production programs, expansion of our marketing efforts or to make acquisitions. Any sales of additional equity or convertible debt securities would result in dilution of the equity interests of our existing stockholders, which could be substantial. Additionally, if we issue shares of preferred stock or convertible debt to raise funds, the holders of those securities might be entitled to various preferential rights over the holders of our common stock and such debt instruments may contain negative covenants restricting corporate actions which could have an adverse effect on the rights and the value of our common stock and our operations.

We face increased competition.

At the present time the Company is aware of other companies providing similar agricultural and natural resources to those of the Company’s. In addition, other entities not currently offering the minerals or product uses similar to the Company’s may enter the industrial and agricultural markets. The Company’s natural resources and products will also have to compete with established minerals (such as fly ash for use in making cement) which are already in commercial and agricultural use. Any such competitors would likely have greater financial, mining production, production facilities, marketing and sales resources than the Company. Increased competition may result in pricing pressures and the inability to increase market share, which may have an adverse effect on the Company’s business, operating results and financial condition.

| 11 |

At present, our sales are concentrated in a few customers.

The Company’s sales are presently concentrated within a few customers. If any of these customers, in particular, the customers that provide the most significant percentage of revenue, are no longer customers, for any reason, and these customers are not replaced, we will sustain additional losses as our fixed cost base will be left uncovered and consume working capital leading to significant cash flow problems.

An increase in the price of natural resources will adversely affect our chances of success.

The Company’s business plan is based on current development costs and current prices of the natural resources being developed or purchased by the Company. However, the price of minerals can be very volatile and subject to numerous factors beyond our control including industrial and agricultural demand, inflation, the supply of certain minerals in the market, and the costs of mining, refining and shipping of the minerals. Since the Company will be obtaining all of its minerals from third party suppliers, any significant increase in the price of these natural resources will have a materially adverse effect on the results of the Company’s operations unless it is able to offset such a price increase by implementing other cost cutting measures or passing such increases on to its customers. While the Company has attempted to secure stable pricing and supply pursuant to its agreement with USMC, there is no assurance that the Company will not incur future price increases or supply shortages of its raw materials.

We may lose rights to properties if we fail to meet payment requirements or development and/or production schedules.

We expect to acquire rights to some of our mineral properties from leaseholds or purchase mining rights that require the payment of royalties, rent, minimum development expenditures or other installment fees or specified expenditures. If we fail to make these payments/expenditures when they are due, our mineral rights to the property may be terminated. This would be true for any other mineral rights which require payments to be made in order to maintain such rights. Some contracts with respect to mineral rights we may acquire may require development or production schedules. If we are unable to meet any or all of the development or production schedules, we could lose all or a portion of our interests in such properties. Moreover, we may be required in certain instances to pay for government permitting or posting reclamation bonds in order to maintain or utilize our mineral rights in such properties. Because our ability to make some of these payments is likely to depend on our ability to generate internal cash flow or obtain external financing, we may not have the funds necessary to meet these development/production schedules by the required dates which would result in our inability to use the properties.

Management may be unable to implement its business strategy.

The Company’s business strategy is to develop and extract or obtain certain minerals which they believe can have significant commercial applications and value. The Company’s business strategy also includes developing new uses and products derived from these mineral resources, such as the use of pozzolan as an ingredient for cement or sulfate and Humate for agricultural uses. There is no assurance that we will be able to identify and/or develop commercially viable uses for the minerals we will be mining or obtaining. In addition, even if we identify and/or develop commercial uses and markets for our minerals, the time and cost of mining or otherwise obtaining, refining, blending and distributing such minerals may exceed our expectations or, when developed, the amount of minerals available may fall significantly short of our expectations thus providing a lower return on investment or a loss to the Company.

We have not yet established sustained and increasing sales from our customer base or distribution system.

During fiscal 2020 we established a customer base and distribution system for our agricultural products but have experienced a decrease in sales. However, we are now engaged in promoting sales and marketing in an effort to increase the sales revenue of our agricultural products to customers and through the distribution system. To date, we have one long term supply contract for our minerals and agricultural products with USMC. We have not yet entered into any agreements for the purchase of our minerals or SCM products nor have we established a distribution system to deliver our minerals and SCM products to customers. Our inability to attract additional customers for our agricultural products, to deliver products in a time and cost-effective manner or develop our SCM business would have an adverse effect on the growth of our business.

| 12 |

Mineral exploration and mining are highly regulated industries.

Mining is subject to extensive regulation by state and federal regulatory authorities. State and federal statutes regulate environmental quality, safety, exploration procedures, reclamation, employees’ health and safety, use of explosives, air quality standards, pollution of stream and fresh water sources, noxious odors, noise, dust, and other environmental protection controls as well as the rights of adjoining property owners. We strive to verify that projects currently owned or being considered, are currently operating or can be operated in substantial compliance with all known safety and environmental standards and regulations applicable to such mining properties and activities. We also seek suppliers and service providers, such as USMC, who we believe are operating in substantial compliance with all safety and environmental standards and regulations applicable to such mining properties and activities. However, there can be no assurance that our compliance efforts regarding our own properties would not be challenged or that future changes in federal or state laws, regulations or interpretations thereof will not have a material adverse effect on our ability to establish and sustain mining operations of our own properties or adversely affect the mining properties of our suppliers or service providers.

Certain of our current and proposed products will require certifications before being suitable for intended purposes.

Some of our agricultural products and our SCM’s will require certain certifications before being suitable for labeling and usage. For example, our SCM must be certified by the California Department of Transportation to meet certain strength standards to be certified for use in large government projects. Similarly, our agricultural products must be certified under US Department of Agriculture (“USDA”) and California Department Of Food and Agriculture (“CDFA”) specifications and properly labeled. While the Company has certified one of its agricultural products under USDA and CDFA specifications and is currently working with various laboratories and agencies to acquire future certifications, there is no assurance that future certifications will be obtained.

We incur increased costs as a result of being a public company.

We are a public “reporting company” with the Securities and Exchange Commission (“SEC”). As a public reporting company, we incur significant legal, accounting, reporting and other expenses not generally applicable to a private company. We also incur costs associated with corporate governance requirements, including requirements under the Sarbanes-Oxley Act of 2002 (“Sarbanes-Oxley”) as well as other rules implemented by the SEC. These rules and regulations increase our legal and financial compliance costs and make some activities more time-consuming and costly.

The outbreak of the COVID-19 coronavirus could continue to negatively impact our business and the global economy. In addition, the COVID-19 pandemic could negatively impact our ability to obtain financing when required.

The COVID-19 coronavirus has spread across the globe and is impacting worldwide economic activity. A pandemic, including COVID-19 or other public health epidemic, poses the risk that we or our employees, consultants, suppliers, customers, and other commercial partners may be prevented from conducting business activities for an indefinite period of time, including due to the spread of the disease or shutdowns requested or mandated by governmental authorities. While our operations have not been significantly affected by the COVID-19 pandemic, there can be no assurance that this trend will continue. COVID-19 has had an adverse impact on global economic conditions, which could impair our ability to raise capital when needed.

| 13 |

Risks Related to Our Common Stock and Its Market Value

Our common stock is subject to the “penny stock” rules of the SEC and the trading market in our securities is limited, which makes transactions in our stock cumbersome and may reduce the value of an investment in our stock.

SEC Rule 15g-9 establishes the definition of a “penny stock,” for the purposes relevant to us, as any equity security that has a market price of less than $5.00 per share or with an exercise price of less than $5.00 per share, subject to certain exceptions. For any transaction involving a penny stock, unless exempt, the rules require:

| ● | that a broker or dealer approve a person’s account for transactions in penny stocks; and |

| ● | the broker or dealer receives from the investor a written agreement to the transaction, setting forth the identity and quantity of the penny stock to be purchased. |

In order to approve a person’s account for transactions in penny stocks, the broker or dealer must:

| ● | obtain financial information and investment experience objectives of the person; and |

| ● | make a reasonable determination that the transactions in penny stocks are suitable for that person and the person has sufficient knowledge and experience in financial matters to be capable of evaluating the risks of transactions in penny stocks. |

The broker or dealer must also deliver, prior to any transaction in a penny stock, a disclosure schedule prescribed by the SEC relating to the penny stock market, which, in highlight form:

| ● | sets forth the basis on which the broker or dealer made the suitability determination; and |

| ● | that the broker or dealer received a signed, written agreement from the investor prior to the transaction. |

Generally, brokers may be less willing to execute transactions in securities subject to the “penny stock” rules. This may make it more difficult for investors to dispose of our common stock and cause a decline in the market value of our stock.

Our securities are covered by the penny stock rules, which impose additional sales practice requirements on broker-dealers who sell to persons other than established customers and “accredited investors.” The term “accredited investor” refers generally to institutions with assets in excess of $5,000,000 or individuals with a net worth in excess of $1,000,000 or annual income exceeding $200,000 or $300,000 jointly with their spouse. The penny stock rules require a broker-dealer, prior to a transaction in a penny stock not otherwise exempt from the rules, to deliver a standardized risk disclosure document in a form prepared by the SEC which provides information about penny stocks and the nature and level of risks in the penny stock market. The broker-dealer also must provide the customer with current bid and offer quotations for the penny stock, the compensation of the broker-dealer and its salesperson in the transaction and monthly account statements showing the market value of each penny stock held in the customer’s account. The bid and offer quotations, and the broker-dealer and salesperson compensation information, must be given to the customer orally or in writing prior to effecting the transaction and must be given to the customer in writing before or with the customer’s confirmation. In addition, the penny stock rules require that prior to a transaction in a penny stock not otherwise exempt from these rules, the broker-dealer must make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser’s written agreement to the transaction. These disclosure requirements may have the effect of reducing the level of trading activity in the secondary market for the stock that is subject to these penny stock rules. Consequently, these penny stock rules may affect the ability of broker-dealers to trade our securities.

Our securities are quoted on the OTCQB, which may not provide us as much liquidity for our investors as an exchange, such as the NASDAQ Stock Market or other national or regional exchanges.

Our securities are quoted on the OTCQB, which provides significantly less liquidity than the NASDAQ Stock Market or other national or regional exchanges. Securities quoted on the OTC are usually thinly traded, highly volatile, have fewer market makers and are not followed by analysts. The SEC’s order handling rules, which apply to NASDAQ-listed securities, do not apply to securities quoted on the OTCQB. Quotes for stocks included on the OTC markets are not listed in newspapers. Therefore, prices for securities traded solely on the OTC Market may be difficult to obtain and holders of our securities may be unable to resell their securities at or near their original acquisition price, or at any price. We cannot assure you a liquid public trading market will develop.

| 14 |

The market price of our common stock may be adversely affected by several factors.

The market price of our common stock could fluctuate significantly in response to various factors and events, including:

| ● | our ability to execute our business plan; |

| ● | operating results below expectations; |

| ● | announcements of technological innovations or new products by us or our competitors; |

| ● | loss of any strategic relationship; |

| ● | industry developments; |

| ● | economic and other external factors; and |

| ● | period-to-period fluctuations in our financial results. |

In addition, the securities markets have, at times, experienced significant price and volume fluctuations that are unrelated to the operating performance of particular companies. These market fluctuations may also materially and adversely affect the market price of our common stock.

Because we are not subject to compliance with rules requiring the adoption of certain corporate governance measures, our stockholders have limited protections against interested director transactions, conflicts of interest and similar matters.

Sarbanes-Oxley, as well as rule changes proposed and enacted by the SEC, the New York Stock Exchange, the Amex Equities Exchanges and NASDAQ, as a result of Sarbanes-Oxley, require the implementation of various measures relating to corporate governance. These measures are designed to enhance the integrity of corporate management and the securities markets and apply to securities which are listed on those exchanges or the NASDAQ. Because we will not be seeking to be listed on any of the exchanges in the near term, we are not presently required to comply with many of the corporate governance provisions. We do not currently have independent audit or compensation committees. Until then, the directors who are part of management have the ability, among other things, to determine their own level of compensation. Until we comply with such corporate governance measures, regardless of whether such compliance is required, the absence of such standards of corporate governance may leave our stockholders without protections against interested director transactions, conflicts of interest and similar matters and investors may be reluctant to provide us with funds necessary to expand our operations.

We have not paid dividends in the past and do not expect to pay dividends in the foreseeable future. Any return on investment may be limited to the value of our common stock.

We have never paid cash dividends on our capital stock and do not anticipate paying cash dividends on our capital stock in the foreseeable future. The payment of dividends on our capital stock will depend on our earnings, financial condition and other business and economic factors affecting us at such time as the board of directors may consider relevant. If we do not pay dividends, our common stock may be less valuable because a return on any investment in our common stock will only occur if our common stock price appreciates.

A sale of a substantial number of shares of our common stock may cause the price of our common stock to decline.

If our stockholders sell substantial amounts of our common stock in the public market under Rule 144 or upon the exercise of outstanding options or warrants, it could create a circumstance commonly referred to as an “overhang” and in anticipation of which the market price of our common stock could fall. The existence of an overhang, whether or not sales have occurred or are occurring, also could make more difficult our ability to raise additional financing through the sale of equity or equity-related securities in the future at a time and price that we deem reasonable or appropriate.

| 15 |

We may, in the future, issue additional shares of common stock, which would reduce the percent of ownership held by current stockholders.

Our Articles of Incorporation authorizes the issuance of 520,000,000 shares of common stock of which as of March 16, 2021, 214,950,751 shares are issued and outstanding. The future issuance of common stock may result in substantial dilution in the percentage of our common stock held by our then existing stockholders. We may value any common stock issued in the future on an arbitrary basis. The issuance of common stock for future services or acquisitions or other corporate actions may have the effect of diluting the value of the shares held by our investors and may have an adverse effect on any trading market of our common stock.

Compliance with changing regulations concerning corporate governance and public disclosure may result in additional expenses.

In recent years, there have been several changes in laws, rules, regulations, and standards relating to corporate governance and public disclosure, including the Dodd-Frank Wall Street Reform and Consumer Protection Act (the “Dodd-Frank Act”), Sarbanes-Oxley and various other new regulations promulgated by the SEC and rules promulgated by the national securities exchanges. The Dodd-Frank Act, enacted in July 2010, expands federal regulation of corporate governance matters and imposes requirements on publicly-held companies, including us, to, among other things, provide stockholders with a periodic advisory vote on executive compensation and also adds compensation committee reforms and enhanced pay-for-performance disclosures. Sarbanes-Oxley specifically requires, among other things, that we maintain effective internal control over financial reporting and disclosure of controls and procedures. Compliance may result in higher costs necessitated by ongoing revisions to disclosure and governance practices. Our efforts to comply with evolving laws, regulations and standards are likely to continue to result in increased general and administrative expenses and a diversion of management time and attention from revenue-generating activities to compliance activities.

Compliance with new rules may make it more difficult to attract and retain directors.

Compliance with new and existing laws, rules, regulations and standards may make it more difficult and expensive for us to maintain director and officer liability insurance, and we may be required to accept reduced coverage or incur substantially higher costs to obtain coverage. Members of our board of directors and our principal executive officer and principal financial officer could face an increased risk of personal liability in connection with the performance of their duties. As a result, we may have difficulty attracting and retaining qualified directors and executive officers, which could harm our business. We continually evaluate and monitor regulatory developments and cannot estimate the timing or magnitude of additional costs we may incur as a result.

We have reported material weaknesses in internal controls in the past.

We have reported material weaknesses in internal controls over financial reporting as of November 30, 2020, and we cannot provide any assurances that additional material weaknesses will not be identified in the future or that we can effectively remediate our reported weaknesses. If our internal controls over financial reporting or disclosure controls and procedures are not effective, there may be errors in our financial statements that could require a restatement, or our filings may not be timely, and investors may lose confidence in our reported financial information.

Section 404 of Sarbanes-Oxley requires us to evaluate the effectiveness of our internal control over financial reporting every quarter and as of the end of each year, and to include a management report assessing the effectiveness of our internal controls over financial reporting in each Annual Report on Form 10-K. Our management, including our Chief Executive Officer, and Chief Financial Officer, do not expect that our internal control over financial reporting will prevent all errors and all fraud. A control system, no matter how well designed and operated, can provide only reasonable, not absolute, assurance that the control system’s objectives will be met. Furthermore, the design of a control system must reflect the fact that there are resource constraints, and the benefits of controls must be considered relative to their costs. Controls can be circumvented by the individual acts of some persons, by collusion of two or more people, or by management override of the controls. Over time, controls may become inadequate because changes in the conditions or deterioration in the degree of compliance with policies or procedures may occur. Because the inherent limitations in a cost-effective control system, misstatements due to error or fraud may occur and not be detected.

| 16 |

As a result, we cannot assure you that additional significant deficiencies or material weaknesses in our internal control over financial reporting will not be identified in the future or that we can effectively remediate our reported weaknesses. Any failure to maintain or implement required new or improved controls, or any difficulties we may encounter in their implementation, could result in significant deficiencies or material weaknesses, cause us to fail to timely meet our periodic reporting obligations, or result in material misstatements in our consolidated financial statements. Any such failure could also adversely affect the results of periodic management evaluations regarding disclosure controls and the effectiveness of our internal control over financial reporting required under Section 404 of the Sarbanes-Oxley Act of 2002 and the rules promulgated thereunder. The existence of material weaknesses could result in errors in our consolidated financial statements and subsequent restatements of our consolidated financial statements, cause us to fail to timely meet our reporting obligations and cause investors to lose confidence in our reported financial information.

ITEM 1B. UNRESOLVED STAFF COMMENTS

None.

Office Facilities

The Company’s principal offices are located at 8631 State Highway 124 Ione, California 95640. The office space is leased from USMC for $1,500 per month. A. Scott Dockter, our President, and Chief Executive Officer, and John Bremer, a director own USMC.

Mineral Properties and Interests

Company Right to Acquire Properties

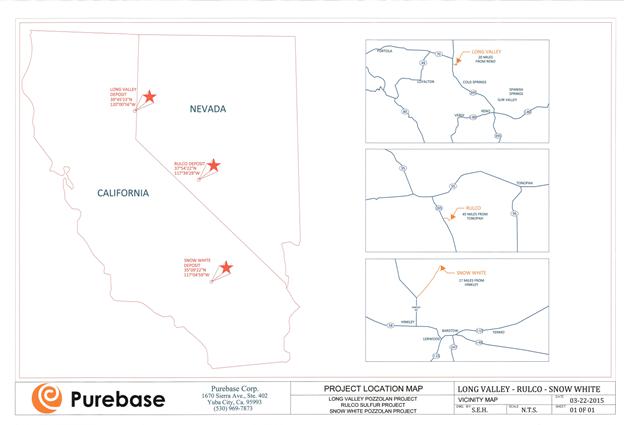

Snow White Mine in San Bernardino County, CA

On November 28, 2014 U.S. Mining and Minerals Corporation, a Nevada company, sold its fee simple property interest and certain mining claims relating to its Snow White Mine property to USMC for a purchase price of $650,000. On December 1, 2014, USMC assigned its rights to the Company pursuant to an Assignment of Purchase Agreement at which time the Company paid a $50,000 down payment to US Mining and Minerals Corporation. As a result of the Assignment, the Company assumed the purchaser position under the Purchase Agreement and the obligation to pay the remaining $600,000 of the purchase price. There was a delay in the original seller, Joseph Richard Mathewson, in receiving a clear title to the property and a fully permitted project, both of which were conditions to closing. Considering the foregoing and upon the payment of an additional $25,000 (which was advanced by John Bremer), the parties agreed to extend the closing. Due to delays in the Company securing the necessary funding to close the purchase of the Snow White Mine property, John Bremer acquired the property on October 15, 2015 for the remaining purchase price balance of $575,000. During the year ended November 30, 2017, USMC agreed to offset the $75,000 deposit against money owed to USMC. As a result, the purchase price to be paid to Mr. Bremer is $650,000. Upon payment by the Company of $650,000 plus expenses incurred while holding the Snow White property, title to the property will be transferred to the Company. Mr. Bremer has permitted the Company to continue its exploration on the property. The mining claims require a minimum royalty payment of $3,500 per year.

The Snow White Mine property consists of approximately 280 acres of mining property containing 5 placer mining claims known as the Snow White Mine. The Snow White Mine property is located 17 miles north of Hinkley, California in San Bernardino County. This 280 acre combination of owned property (80 acres) and Non-Patented Placer Claims (200 acres) includes 8.33 acres which are conditionally permitted and ready for further development. The project entry is made on Hinkley Road which is a 4 mile paved county-maintained road which converts to an existing unpaved road for the remaining 13 miles to the mine site.

The property is covered by a Conditional Use Permit allowing the mining of the property and a Plan of Operation and Reclamation Plan has been approved by San Bernardino County and the BLM. The fee property comes with clear title to surface and mineral rights. The claims are situated on federal BLM land. These claims are held with annual maintenance payments to the BLM and annual filings of intent to hold and affidavit assessment work. There is no expiration date on ownership of the leases as long as the annual payments are made and the annual filings are completed. They are both current. There is no equipment present at the claims location. No improvements have been made at the claims location. Power when needed, is from portable generators. Processing equipment when onsite is self-powered.

| 17 |

On September 5, 2019, the Company discontinued all mining related activities at the Snow White Mine property. On April 1, 2020, the Company entered into a purchase and sale agreement with the Bremer Family 1995 Living Family Trust (the “Trust”) pursuant to which the Company will purchase the Snow White Mine property and all mineral rights for $836,000, with interest of 5% per annum, with the closing to occur within two years. As of the date of this Annual Report, the Company has not closed the purchase.

PureBase Ag Properties

Placer Mining Claims USMC 1-50

On July 30, 2014 PureBase Ag entered into a Placer Claims Assignment Agreement pursuant to which A. Scott Dockter and Teresa Dockter assigned their rights to certain Placer Mining Claim Notices filed and recorded with the BLM relating to 50 Placer mining claims identified as “USMC 1” thru “USMC 50” (the “USMC Placer Claims”) for which PureBase Ag issued 12,118,000 shares of its common stock to A. Scott Dockter and Teresa Dockter in exchange for these mining rights.

The Placer Mining Claims is a placer claims resource covering 1,145 acres of mining property located in Lassen County, California and in an area known as the “Long Valley Pozzolan Deposit”. PureBase Ag holds non-patented mining rights to the property consisting of contiguous placer claims within the boundaries of a known and qualified Pozzolan deposit. This property can be accessed at multiple entry points. At the northern portion of the property at the intersection of Highway 70 and Highway 395 there is a paved entrance that leads to an off-road entry to the claims area. At the southern end of the property there is a paved entry off the Highway that leads to an off-road entry to the site. Approximately 6.5 miles north of the California and Nevada state line is this southern paved Highway entrance that also permits access to the property. These claims are situated on federal BLM land requiring annual maintenance payments to the BLM and annual filings of intent to hold and affidavit assessment work. There is no expiration date on ownership of the leases as long as the annual payments are made and the annual filings are completed. They are both current. There have been no previous operators at these claim locations, consequently no improvements have been made. There is no equipment present at the claims location. Power when needed, is from portable generators. Processing equipment when onsite is self-powered.

On September 5, 2019, the Company discontinued all mining and related activities at the Long Valley property. As a result, the claims have reverted back to the BLM.

Federal Mineral Preference Rights Lease in Esmeralda County, Nevada

On October 6, 2014, PureBase Ag entered into an Assignment of Lease from USMC pursuant to which PureBase Ag acquired the rights to a Preference Rights Lease granted by the BLM covering approximately 2,500 acres of land located on the western side of the Weepah Hills in the Mount Diablo Meridian area of Esmeralda County, Nevada (the “Esmeralda Project”). In exchange for the Assignment of Lease, PureBase Ag assumed the obligation to pay all future annual lease payments of $7,503 and all other ongoing fees and expenses relating to the development of the Esmeralda Project.

Contained in the Esmeralda Project’s leased property is the mining property known as the “Chimney 1 Potassium/Sulfur Deposit” which consists of 15.5 acres of land fully permitted for mining operation which is situated within the 2,500 acres under a Federal Mineral Preference Rights Lease. There are annual minimum royalty and rental payments. The project has an approved Reclamation Plan – Nevada Division of Environmental Protection Permit #0192 – and an approved Plan of Operations, BLM Case Number N65-99-001P. There is a reclamation bond in place in the amount of $47,310.30. The BLM is the bond holder.

| 18 |

The current operation is an open pit mine site which is fully permitted and partially developed. The total allowed disturbed acreage for the existing and approved reclamation plan is 14.45 acres. The site entrance is located approximately 10 miles south of Highway 95/6 on Highway 265 on the east side of the Highway. The mine site location is 3.4 miles of unpaved road from the Highway. The existing site equipment consists of a 40’ storage container, an 8,000 gallon water tank and portable single axle truck scale. Pit development has begun and rectified drawings have been recorded to the existing site disturbance. Power when needed, is from portable generators. Processing equipment when onsite is self-powered.

According to records publicly available, the property is known to contain large amounts of altered volcanic tuff composed of Alunite, K-Alum, Jarosite, Gypsum, Native Sulfur and K-feldspar. The geology of the area around the mine site includes deposits of potassium and sulfur described as being in an elongated dike like or neck like mass of rhyolite having the appearance of being intrusive into gently folded white and red sedimentary rhyolitic tuffs of Tertiary age. Sulfur occurs in this area as irregular seams and blebs in altered Tertiary sedimentary rocks and welded tuffs (Albers and Stewart 1972). The area has been mapped as Tertiary Esperanza Formation. Much of the area is covered with quaternary alluvium partially obscuring the relationships of the underlying rocks. It appears that these fumarolic deposits are related to plutonic outcrops in the area, specifically the Weepah Hills Pluton.

Except as described below, there are no material pending legal proceedings in which we or any of our subsidiaries is a party or in which any director, officer or affiliate of ours, any owner of record or beneficially of more than 5% of any class of our voting securities, or security holder is a party adverse to us or has a material interest adverse to us.

On September 21, 2016, the Company terminated its employment agreement with its then President, David Vickers (“Vickers”). Subsequently, Vickers alleged claims of age discrimination, fraud in the inducement, violation of California Labor Code §970 and breach of contract against the Company (collectively, the “Vicker Claims”). On April 14,2017, Vickers served the Company with a demand for arbitration of the Vicker Claims before the Judicial Arbitration and Mediation Services, Inc. On June 5, 2018, the parties participated in a voluntary mediation but were unable to reach a resolution. An arbitration hearing was held on August 6, 2019 to August 8, 2019. An interim-preliminary decision was rendered in connection with the arbitration however, a final award was not determined and judicial proceedings were not initiated. On June 25, 2020, the parties entered into a written settlement agreement pursuant to which the Company agreed to pay Vickers the sum of $580,976, including interest of $13,079, (the “Settlement Sum”) in exchange for a general release of all Vicker Claims and a covenant to forebear all litigation against Company. The Company timely paid the Settlement Sum and the case was terminated effective November 25, 2020.

| 19 |

On July 8, 2020, our former Chief Financial Officer, Al Calvanico (“Calvanico”), filed a demand for arbitration alleging retaliation, wrongful termination, and demand for a minimum amount of $600,000 in alleged stock value, plus interest, recovery of past and future wages, attorneys’ fees, and punitive damages (collectively, the “Calvanico Claims”). The Company denied all Calvanico Claims. The Company believes Calvanico is owed nothing because it takes the position that Calvanico was not terminated, but rather, his employment contract expired on September 21, 2019 in the normal course, and was not renewed by Company and because Calvanico never exercised his stock options. On February 14, 2020, the Company requested in writing that Calvanico exercise his stock options within 30 days. Calvanico failed to do so. To date, Calvanico has not exercised his stock options. This dispute is currently in the early stages of arbitration. An arbitration hearing date has not yet been assigned.

On August 30, 2018 the Company was named as a defendant in a complaint filed by Tessenderlo Kerley, Inc. (“Tessenderlo”) in the United States District Court for the District of Arizona (Case # CV-18-2756-PHX-DJH) alleging trademark infringement relating to the plaintiff’s trademark PURSHADE and the Company’s product PureBase Shade Advantage. The Company filed its answer on September 21, 2018, denying the allegations set forth in the complaint. A settlement conference was held on June 11, 2019. The Company entered into a settlement agreement and release (the “Settlement Agreement”) with Tessenderlo effective July 8, 2019. Pursuant to the Settlement Agreement the Company agreed, among other requirements for dissemination of information with its product, to make various changes to the packaging of its Purebase Shade Advantage products relating to the visual representation of the product’s names. Under the Settlement Agreement, each party fully released the other party from all existing claims and liabilities. There were no monetary damages as part of the Settlement Agreement. As a result of the Settlement Agreement, the case was dismissed on July 9, 2019.