Attached files

| file | filename |

|---|---|

| EX-10.5 - EX-10.5 - ReShape Lifesciences Inc. | rsls-20201231ex105a4eef7.htm |

| EX-32.2 - EX-32.2 - ReShape Lifesciences Inc. | rsls-20201231ex322d8c679.htm |

| EX-32.1 - EX-32.1 - ReShape Lifesciences Inc. | rsls-20201231ex321fa6327.htm |

| EX-31.2 - EX-31.2 - ReShape Lifesciences Inc. | rsls-20201231ex312c513e1.htm |

| EX-31.1 - EX-31.1 - ReShape Lifesciences Inc. | rsls-20201231ex311b0ae54.htm |

| EX-23.1 - EX-23.1 - ReShape Lifesciences Inc. | rsls-20201231ex231d37625.htm |

| EX-21.1 - EX-21.1 - ReShape Lifesciences Inc. | rsls-20201231ex21178ae19.htm |

| EX-10.4 - EX-10.4 - ReShape Lifesciences Inc. | rsls-20201231ex104eed482.htm |

| EX-4.1 - EX-4.1 - ReShape Lifesciences Inc. | rsls-20201231ex418952190.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form

10-K

(Mark one)

☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2020

or

◻ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number: 1-33818

RESHAPE LIFESCIENCES INC.

(Exact name of registrant as specified in its charter)

Delaware | 48-1293684 |

(State or other jurisdiction of incorporation or organization) | (IRS Employer Identification No.) |

1001 Calle Amanecer, San Clemente, California 92673

(Address of principal executive offices, including zip code)

(949) 429-6680

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

Title of Each Class | Trading Symbol | Name of Each Exchange on which Registered |

|---|---|---|

Common stock, $0.001 par value per share | RSLS | OTCQB Market |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ◻ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ◻ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ◻

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ◻

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer ◻ | Accelerated filer ◻ |

Non-accelerated filer ☒ | Smaller reporting company ☒ |

| Emerging growth company ◻ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ◻

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ◻

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ◻ No ☒

At June 30, 2020, the last business day of the registrant’s most recently completed second fiscal quarter, the aggregate market value of the registrant’s common stock held by non-affiliates of the registrant, based upon the closing price of a share of the registrant’s common stock as reported by the OTCQB Market on that date was $1,769,725.

As of March 8, 2021, 6,166,554 shares of the registrant’s Common Stock were outstanding.

Documents Incorporated by Reference

None.

RESHAPE LIFESCIENCES INC.

FORM 10-K

Registered Trademarks and Trademark Applications: In the United States we have registered trademarks for LAP-BAND®, LAP-BAND AP®, LAP BAND SYSTEM®, RAPIDPORT®, RESHAPE® and RESHAPE MEDICAL®, each registered with the United States Patent and Trademark Office, and trademark applications for RESHAPE VEST, and RESHAPE LIFESCIENCES. In addition, some or all of the marks LAP-BAND, LAP-BAND AP, LAP-BAND SYSTEM, RAPIDPORT, RESHAPE, RESHAPE MEDICAL, RESHAPE VEST, and RESHAPE LIFESCIENCES are the subject of either a trademark registration or an application for registration in Australia, Canada, the European Community, Mexico, Saudi Arabia, South Korea, and the United Arab Emirates. We believe that we have common law trademark rights to RESHAPE VEST. This Annual Report on Form 10-K contains other trade names and trademarks and service marks of ReShape Lifesciences and of other companies.

Our Company

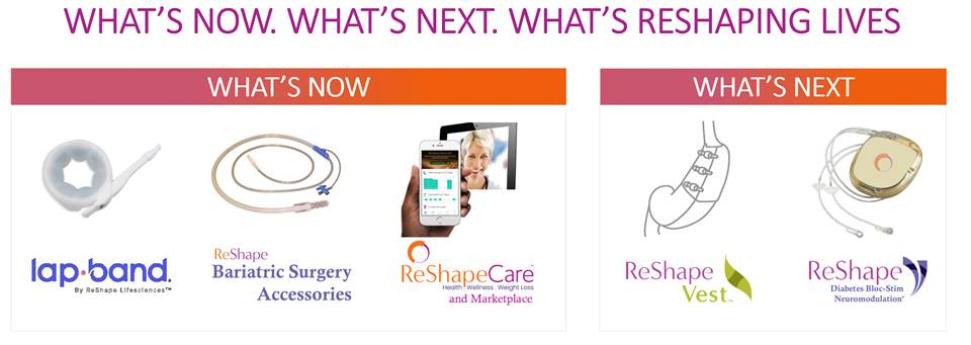

ReShape Lifesciences Inc. is a premier global weight-loss solutions company, offering an integrated portfolio of proven products and services that manage and treat obesity and associated metabolic disease.

Our current portfolio includes the FDA-approved LAP-BAND® system, which provides minimally invasive, long-term treatment of obesity and is an alternative to more invasive and extreme surgical stapling procedures such as the gastric bypass or sleeve gastrectomy. The recently launched ReShapeCareTM virtual health coaching program is a novel reimbursed telehealth weight-management program that supports healthy lifestyle changes for all medically managed weight-loss patients, not just the LAP-BAND, further expanding our reach and market opportunity. The ReShape VestTM system is an investigational (outside the U.S.) minimally invasive, laparoscopically implanted medical device that wraps around the stomach, emulating the gastric volume reduction effect of conventional weight-loss surgery. It helps enable rapid weight loss in obese and morbidly obese patients without permanently changing patient anatomy. The Diabetes Bloc-Stim Neuromodulation is a technology under development as a new treatment for type 2 diabetes mellitus. ReShape’s Diabetes Bloc-Stim Neuromodulation is expected to use bioelectronics to manage blood glucose in treatment of diabetes and individualized 24/7 glucose control. Additional products and accessories from the Company facilitate alternative gastric surgical procedures and ongoing product support for healthcare practitioners and patients (adjustments, etc.).

Proposed Merger with Obalon Therapeutics, Inc.

On January 19, 2021, we entered into an Agreement and Plan of Merger (the “Merger Agreement”) with Obalon Therapeutics, Inc., a Delaware corporation (“Obalon”), and Optimus Merger Sub, Inc., a Delaware corporation and a wholly-owned subsidiary of Obalon (“Merger Sub”), pursuant to which Merger Sub will merge with and into ReShape, with ReShape as the surviving corporation and a wholly-owned subsidiary of Obalon (the “Merger”). As a result of the Merger, Obalon will be renamed “ReShape Lifesciences Inc.”

Subject to the terms and conditions of the Merger Agreement, at the closing of the Merger, each outstanding share of ReShape common stock and series B convertible preferred stock will be converted into the right to receive shares of common stock of Obalon (“Obalon Shares”) based on the exchange ratio set forth in the Merger Agreement. Upon completion of the Merger, ReShape stockholders will own approximately 51% of the combined company’s outstanding common stock and Obalon stockholders will own approximately 49%, subject to the terms of the Merger Agreement. Obalon will, at the effective time of the Merger, assume the outstanding warrants and series C convertible preferred stock of ReShape, subject to the terms of the Merger Agreement. All outstanding stock options of ReShape will be cancelled and terminated at the effective time of the Merger without any right to receive any consideration. No fractional shares will be issued in connection with the Merger and Obalon will pay cash in lieu of any such fractional shares. The Merger is intended to qualify for federal income tax purposes as a tax-free reorganization under the provisions of Section 368(a) of the Internal Revenue Code of 1986, as amended.

Consummation of the Merger is subject to certain closing conditions, including, among other things, approval by the stockholders of ReShape and Obalon and the NASDAQ Stock Market’s approval of (i) the Listing of Additional Shares Notice covering the Obalon Shares to be issued in the Merger and (ii) the continued listing of the combined company following completion of the Merger ((i) and (ii) together, the “NASDAQ Approvals”). Pursuant to the Merger Agreement, ReShape has agreed to exercise its reasonable best efforts to take all necessary steps to obtain the NASDAQ Approvals following the execution of the Merger Agreement, which may include procuring additional equity or debt investments, financings or other capital raising efforts. The Merger Agreement contains specified termination rights for both ReShape and Obalon. If Obalon terminates the Merger Agreement as a result of ReShape’s breach of its covenant to use its reasonable best efforts to obtain the NASDAQ Approvals, or if either party terminates the Merger Agreement because the NASDAQ Approvals have not been obtained within 30 days following the later of the Obalon Stockholders’ Meeting and the ReShape Stockholders’ Meeting, then ReShape will be required to pay Obalon a $1.0 million termination fee, which amount has been deposited with a third-party escrow agent.

See “Part I—Item 1A Risk Factors” for a discussion of certain risks related to the Merger.

1

Our Product Portfolio

Lap-Band System

The Lap-Band system, which we acquired from Apollo Endosurgery, Inc. (“Apollo”), in December 2018, is designed to provide minimally invasive long-term treatment of severe obesity and is an alternative to more invasive surgical stapling procedures such as the gastric bypass or sleeve gastrectomy. The Lap-Band system is an adjustable saline-filled silicone band that is laparoscopically placed around the upper part of the stomach through a small incision, creating a small pouch at the top of the stomach, which slows the passage of food and creates a sensation of fullness. The procedure can normally be performed as an outpatient procedure and patients can go home the day of the procedure without the need for an overnight hospital stay.

The Lap-Band system has been in use in Europe since 1993 and received the CE mark in 1997 and approved in Australia in 1994, by the TGA. FDA approved the Lap-Band system for use the U.S. in 2001. The Lap-Band system has been approved in 21 countries and more than 1,000,000 Lap-Band systems have been sold worldwide.

The Lap-Band system was approved for use in the U.S. for patients with a Body Mass Index (“BMI”) greater than or equal to 40 or a BMI greater than or equal to 30 with one or more obesity-related comorbidity conditions.

The Lap-Band system has been subject to more than 400 peer-reviewed publications and extensive real-world experience. Adjustable gastric banding using the Lap-Band system has been reported to be significantly safer than gastric bypass while statistically producing the same weight loss five years after surgery when accompanied by an appropriate post-operative follow-up and adjustment protocol. Studies have reported sustained resolution or improvement in type 2 diabetes, gastroesophageal reflux, obstructive sleep apnea, asthma, arthritis, hypertension and other pre-existing obesity related comorbidities following gastric banding. The gastric banding surgical procedure is generally reimbursed by most payors and insurance programs that cover bariatric surgery.

Benefits. Lap-Band system offers the following benefits:

| ● | Minimally Invasive. The Lap-Band system does not change anatomy and is removable or reversible. |

| ● | Lifestyle Enhancing. The Lap-Band system helps patients lose weight and live a more comfortable life and potentially reduces co-morbidities from excess weight. |

| ● | Durable Weight Loss. The Lap-Band system offers a sustainable solution that helps patients achieve long-term success. |

ReShapeCare

ReShapeCare is a HIPAA-compliant, virtual coaching program delivered through our innovative app which enhances behavior change through engagement. ReShapeCare is prescribed by a patient’s physician and may be covered by insurance for up 26 visits per reimbursement year.

The program is based on four established dimensions of successful behavior change—sleep, nutrition, exercise, stress—and is designed to provide flexible structure and support from a live certified health coach in a manner that is simple and practical.

Clinical studies prove that online health coaching leads to higher patient satisfaction, more successful weight loss outcomes, and improvements in metabolic health and enhances quality of life. ReShapeCare is appropriate for all weight loss patients, medical weight loss patients, and pre- and post-surgical bariatric patients.

The program is designed to ReShape the patient’s life through better sleep, nutrition, exercise, and stress management. Patients get paired with a ReShapeCare certified health coach who will be with them every step of the way through their journey, including through daily text messaging or live phone or video calls. The web and mobile app make it easy to increase positive actions and awareness by receiving daily educational content, personalized exercise, and progress reports. This program creates an atmosphere of community with social support from peers and by joining group sessions. When it comes to nutrition, patients can utilize an easy-to-follow, personalized nutrition plan with a

2

recipe library and restaurant guide. Tracking your food is as easy as taking a snapshot from your phone and sending it to your coach. Patients can connect their own devices to automatically track sleep, stress, and weight. This real-time health data can be used to optimize the program to get the best possible results.

ReShape Vest

The ReShape Vest is an investigational, minimally invasive, laparoscopically implanted medical device being studied for weight loss in morbidly obese adults with a BMI of at least 35. The device wraps around the stomach, emulating the effect of conventional weight loss surgery, and is intended to enable gastric volume reduction. This device is designed to restrict the intake of food and provide the feeling of fullness without cutting or permanently removing portions of the stomach, or bypassing any portion of the gastrointestinal tract. The implantation of the device mimics a traditional weight-loss surgery, it is anatomy sparing and may not require vitamin supplementation.

In a small pilot study conducted outside the United States, at 12 months, ReShape Vest patients demonstrated a mean percent excess weight loss of 85% and a mean percent total body weight loss of 30.2%, an average waist circumference reduction of approximately 15 inches, an average drop in HbA1c (Hemoglobin A1c) of 2.1 points, an average decrease of systolic blood pressure of 13mmHg, and an average increase in HDL “good cholesterol” of 29 mg/dl.

Benefits. The ReShape Vest, once approved for sale, would offer an additional weight loss solution that emulates the effect of conventional weight loss surgery through a procedure that is minimally invasive and anatomy sparing. The ReShape Vest potentially offers the following benefits:

| ● | Minimizes Changes to Normal Anatomy. The ReShape Vest emulates the effects of conventional weight-loss surgery without stapling, cutting or removing any portion of the stomach. |

| ● | Permanent Physical Restriction of the Stomach. The stomach has the capacity to expand over time through overeating. The ReShape Vest provides physical restriction that maintains the reshaped stomach at a consistent size, as long as the device remains in the patient. |

| ● | Removable/Reversible. The ReShape Vest is designed to be removed laparoscopically, permitting the removal of the device at a later time, if that is desired. |

| ● | Allows Normal Ingestion and Digestion of Foods Found in a Typical, Healthy Diet. The ReShape Vest leaves the digestive anatomy largely unaltered, hence patients are able to maintain a more consistent nutritional balance compared with conventional bariatric surgical approaches. This feature allows patients to affect positive changes in their eating behavior in a non-forced and potentially more consistent way. |

Evaluation of the ReShape Vest has been underway in a pivotal clinical investigation with a planned 95-subject enrollment in Belgium, Czech Republic, Spain and The Netherlands. Enrollment had been completed in Spain shortly before the COVID-19 pandemic affected Spain and the rest of Europe. This pandemic has impacted our ability to complete enrollment in the remaining countries and impeded clinical follow up with enrolled patients of the Spanish cite. Considering the unpredictability of and efforts to control this pandemic through 2021, we are continuing to work with identified clinical sites to determine when we will resume enrollment and subsequent filing for CE certification.

Diabetes Bloc-Stim Neuromodulation Device

The ReShape Diabetes Bloc-Stim Neuromodulation is a technology under development as a new treatment for type 2 diabetes mellitus (T2DM). It combines ReShape Lifesciences’ proprietary Vagus Nerve Block (vBloc) technology platform in combination with Vagus nerve stimulation. This new dual Vagus nerve neuromodulation selectively modulates vagal block and stimulation to the liver and pancreas to manage blood glucose. ReShape’s Diabetes Bloc-Stim Neuromodulation is expected to use bioelectronics to manage blood glucose in treatment of diabetes and individualized 24/7 glucose control. The goal is to reduce costs of treatment and complications that arise from poorly controlled blood glucose and non-compliance to T2DM medication.

3

ReShape’s Diabetes Bloc-Stim Neuromodulation technology is in preclinical development. It has demonstrated safety and efficacy through experiments in diabetic swine utilizing Phase I funding from an NIH Small Business Innovation Research Grant.

Our Strategic Focus

Develop and Commercialize a Differentiated Portfolio of Products/Therapies

An overarching strategy for our company is to develop and commercialize a product, program and services portfolio that is differentiated from our competition by offering transformative technologies that consists of a selection of patient-friendly, non-anatomy changing, lifestyle enhancing products, programs and services that provide alternatives to traditional bariatric surgery that help patients achieve durable weight loss. With the Lap-Band system, accessories, ReShapeCare virtual coaching program, and the ReShape Vest and Diabetes Bloc-Stim Neuromodulation (if approved for commercial use), we believe we have multiple compelling and differentiated medical devices. We believe that we are well positioned for the existing market and can serve more of the overweight and obese population with our solutions and thereby help expand the addressable market for obesity.

Drive the Adoption of Our Portfolio through Obesity Therapy Experts and Patient Ambassadors

Our clinical development strategy is to collaborate closely with regulatory bodies, healthcare providers, obesity therapy lifestyle experts and others involved in the obesity management process, patients and their advocates and scientific experts. We have established relationships with obesity therapy experts and healthcare providers, including physicians and hospitals, and have identified Lap-Band patient ambassadors and we believe these individuals will be important in promoting patient awareness and gaining widespread adoption of the Lap-Band, it’s accessories, ReShapeCare and the ReShape Vest. Additionally, with these relationships we believe we will be able to expand the awareness of the Diabetes Bloc-Stim Neuromodulation technology to patients with type 2 diabetes mellitus.

Expand and Protect Our Intellectual Property Position

We believe that our issued patents and our patent applications encompass a broad platform of therapies focused on obesity, diabetes, hypertension and other gastrointestinal disorders. We intend to continue to pursue further intellectual property protection through U.S. and foreign patent applications.

Alternative Weight Loss Solutions

ReShapeCare, provides a weight loss solution through behavioral changes, improving the patients’ sleep, nutrition, exercise and stress. ReShapeCare is appropriate for all weight loss patients, medical weight loss patients, and pre- and post-surgical bariatric patients.

If we are able to commercialize the ReShape Vest, we believe that we will be able to offer three distinct weight loss treatment solutions that may be selected by the physician depending on the severity of the patient’s BMI or

4

condition. Together, the Lap-Band, ReShapeCare and ReShape Vest provide a minimally-invasive continuum of care for bariatric patients and their care providers.

Our Market

The Obesity and Metabolic Disease Epidemic

Obesity is a disease that has been increasing at an alarming rate with significant medical repercussions and associated economic costs. The World Health Organization (“WHO”) currently estimates that more than 2.1 billion adults, approximately 30% of the global population, are overweight. The global economic impact of obesity is approximately $2.0 trillion, or approximately 2.8% of global GDP. Healthcare costs for severely or morbidly obese adults are 81% higher than for healthy weight adults and obesity is responsible for 5% of deaths worldwide. We believe our product and programs and product candidates could address a $1.64 billion per year global surgical device market.

We believe that this epidemic will continue to grow worldwide given dietary trends in developed nations that favor highly processed sugars, larger meals and fattier foods, as well as increasingly sedentary lifestyles. Despite the growing obesity rate, increasing public interest in the obesity epidemic and significant medical repercussions and economic costs associated with obesity, there continues to be a significant unmet need for effective treatments.

The United States Market

Obesity has been identified by the U.S. Surgeon General as the fastest growing cause of disease and death in the United States, and according to a 2014 McKinsey Report is the leading cause of preventable death in the U.S. Currently, it is estimated that approximately 160 million American adults are overweight or obese, 74 million American adults are overweight, 78 million American adults are obese or severely obese, and 24 million American adults are morbidly obese. It is estimated that if obesity rates stay consistent, 51% of the U.S. population will be obese by 2030. According to data from the U.S. Department of Health and Human Services, almost 80% of adults with a BMI above 30 have comorbidity, and almost 40% have two or more of these comorbidities. According to The Obesity Society and the CDC, obesity is associated with many significant weight-related comorbidities including Type 2 diabetes, high blood-pressure, sleep apnea, certain cancers, high cholesterol, coronary artery disease, osteoarthritis and stroke. According to the American Cancer Society, 572,000 Americans die of cancer each year, over one-third of which are linked to excess body weight, poor nutrition and/or physical inactivity. Over 75% of hypertension cases are directly linked to obesity, and more than 90% of the approximately 28 million U.S. adults with Type 2 diabetes are overweight or have obesity.

Currently, medical costs associated with obesity in the U.S. are estimated to be up to $210.0 billion per year and nearly 21% of medical costs in the U.S. can be attributed to obesity. Approximately $1.5 billion was spent in 2015 alone in the U.S. on approximately 200,000 bariatric surgical procedures to treat obesity. By 2025, it is estimated that up to $3.8 billion will be spent in the U.S. on approximately 800,000 bariatric surgical procedures to treat obesity. Researchers estimate that if obesity trends continue, obesity-related medical costs could rise by another $44-$66 billion each year in the U.S. by 2030. The medical costs paid by third-party payers for people who are obese were $2,741 per year, or 42% higher than those of people who are normal weight and the average cost to employers is $6,627 to $8,067 per year per obese employee (BMI of 35 to 40 and higher).

Current Treatment Options and Their Limitations

We believe existing bariatric surgery and endoscopic procedural options for the treatment of obesity have seen limited adoption to date, with approximately 1% of the obese population qualifying for treatment actually seeking treatment, due to patient concerns and potential side effects including permanently altered anatomy and morbidity.

The principal treatment alternatives available today for obesity include:

| ● | Behavioral modification. Behavioral modification, which includes diet and exercise, is an important component in the treatment of obesity; however, most obese patients find it difficult to achieve and maintain significant weight loss with a regimen of diet and exercise alone. |

| ● | Pharmaceutical therapy. Pharmaceutical therapies often represent a first option in the treatment of obese patients but carry significant safety risks and may present troublesome side effects and compliance issues. |

| ● | Bariatric Surgery and Endoscopic Procedures. In more severe cases of obesity, patients may pursue more aggressive surgical treatment options such as sleeve gastrectomy and gastric bypass. These procedures promote weight loss by surgically restricting the stomach’s capacity and outlet size. While largely effective, these procedures generally result in major lifestyle changes, including dietary restrictions and food intolerances, and they may present substantial side effects and carry short- and long-term safety and side effect risks that have limited their adoption. |

Our Research and Development

Current R&D Focus

We have an experienced research and development team, including clinical, regulatory affairs and quality assurance, comprised of scientists and mechanical engineers with significant clinical knowledge and expertise. Our research and development efforts are focused in the following major areas:

| ● | supporting the current Lap-Band system; |

| ● | expanding and improving on the Lap-Band portfolio; |

| ● | gaining clinical evidence to the efficacy of the ReShape Vest; |

| ● | testing and developing the Diabetes Bloc-Stim Neuromodulation device; and |

| ● | suction and calibration tubing line for gastric and bariatric surgeries. |

We have spent a significant portion of our capital resources on research and development. Our research and development expenses were $3.5 million in 2020 and $3.1 million in 2019.

Our Competition

The market for obesity treatments is competitive, subject to technological change and significantly affected by new product development. Our primary competition in the obesity treatment market is currently from bariatric surgical and endoscopic procedures.

Our Lap-Band system competes, and we expect that our ReShape Vest system will compete, with surgical obesity procedures, including gastric bypass, gastric balloons, sleeve gastrectomy and the endoscopic sleeve. These current surgical procedures are performed in less than 1% of all eligible obese patients today. Current manufacturers of gastric balloon and suturing products that are approved in the United States include Apollo (ORBERA Intragastric Balloon System and OverStitch Endoscopic Suturing System) and Obalon Therapeutics, Inc. (Obalon Balloon System).

In June 2016, Aspire Bariatrics, Inc. received FDA approval for the Aspire Assist® System, an endoscopic alternative to weight loss surgery for people with moderate to severe obesity. We are also aware that GI Dynamics, Inc. has received approvals in various international countries to sell its EndoBarrier Gastrointestinal Liner.

We also compete against the manufacturers of pharmaceuticals that are directed at treating obesity and the 99% of obese patients eligible for surgery that are not willing to pursue a surgical option. We are aware of a number of drugs that are approved for long-term treatment of obesity in the United States: Orlistat, marketed by Roche as Xenical and GlaxoSmithKline as Alli, Belviq marketed by Arena Pharmaceuticals, Inc., Qsymia, marketed by VIVUS, Inc. and Contrave, marketed by Orexigen Therapeutics, Inc. In addition, we are aware of a pivotal trial for GELESIS100 that is being conducted by Gelesis, Inc.

In addition to competition from surgical obesity procedures, we compete with several private early-stage companies developing neurostimulation devices for application to the gastric region and related nerves for the treatment of obesity. Further, we know of two intragastric balloon companies either in clinical trials or working toward clinical trials in the U.S: Spatz3 Adjustable Balloon and Allurion Technology’s Elipse Balloon. These companies may prove to be significant competitors, particularly through collaborative arrangements with large and established companies. They

6

also compete with us in recruiting and retaining qualified scientific and management personnel, establishing clinical trial sites and subject registration for clinical trials, as well as in acquiring technologies and technology licenses complementary to our programs or advantageous to our business.

We believe that the principal competitive factors in our market include:

| ● | acceptance by healthcare professionals, patients and payers; |

| ● | published rates of safety and efficacy; |

| ● | reliability and high-quality performance; |

| ● | effectiveness at controlling comorbidities such as diabetes and hypertension; |

| ● | invasiveness and the inherent reversibility of the procedure or device; |

| ● | cost and average selling price of products and relative rates of reimbursement; |

| ● | effective marketing, training, education, sales and distribution; |

| ● | regulatory and reimbursement expertise; |

| ● | technological leadership and superiority; and |

| ● | speed of product innovation and time to market. |

Many of our competitors are larger than we are and are either publicly-traded or are divisions of publicly-traded companies, and they enjoy several competitive advantages over us, including:

| ● | stronger name recognition; |

| ● | existing relations with healthcare professionals, customers and third-party payers; |

| ● | established distribution networks; |

| ● | significant experience in research and development, manufacturing, preclinical testing, clinical trials, obtaining regulatory approvals, obtaining reimbursement and marketing approved products; and |

| ● | greater financial and human resources. |

As a result, we cannot assure you that we will be able to compete effectively against these companies or their products.

Market Opportunity

Given the limitations of behavioral modification, pharmaceutical therapy and traditional bariatric surgical approaches, we believe there is a substantial need for patient-friendly, safer, effective and durable solutions that:

| ● | provide proven, long-term weight loss; |

| ● | preserve normal anatomy; |

| ● | are “non-punitive” in that they support continued ingestion and digestion of foods and micronutrients such as vitamins and minerals found in a typical, healthy diet while allowing the user to modify his or her eating |

7

| behavior appropriately without inducing punitive physical restrictions that physically force a limitation of food intake; |

| ● | diminish undesirable side-effects; |

| ● | facilitate outpatient surgical procedures; |

| ● | minimize the risks of re-operations, malnutrition and mortality; and |

| ● | reduce the natural hunger drive of patients. |

Our Intellectual Property

In order to remain competitive, we must develop and maintain protection of the proprietary aspects of our technologies. We rely on a combination of patents, trademarks, trade secret laws and confidentiality and invention assignment agreements to protect our intellectual property rights. Our patent applications may not result in issued patents and our patents may not be sufficiently broad to protect our technology. Any patents issued to us may be challenged by third parties as being invalid or unenforceable, or third parties may independently develop similar or competing technology that does not infringe our patents. The laws of certain foreign countries do not protect our intellectual property rights to the same extent as do the laws of the United States.

Lap-Band

As of December 31, 2020, we had 48 total U.S. and foreign patents and patent applications related to our Lap-Band system. The international patents and patent applications are in regions including Germany, France, Spain, the United Kingdom, Mexico, Canada, Italy, the Netherlands, Portugal, Ireland, Belgium, Poland, Australia, and South Korea. The issued patents expire between the years 2021 and 2031.

We also have 48 total U.S. and international trademarks for the LAP-BAND brand name.

ReShape Vest

As of December 31, 2020, we had four granted U.S. patents and four granted foreign patents in China, Israel, Canada and Australia related to our ReShape Vest and 12 pending patents in the U.S. and foreign countries. The patents expire between the years 2028 and 2038.

We also have U.S. and international trademark applications for the RESHAPE VEST brand name.

ReShapeCare

As of December 31, 2020, we applied for two U.S. trademarks related to the ReShapeCare™ logo and name. The trademarks cover electronic pedometers and electronic day planners for tracking food, body weight, pre-recorded nutritional and fitness; as well as nutritional and medical counseling and services.

Diabetes Bloc-Stim Neuromodulation Device

As of December 31, 2020, we filed a trademark application for Bloc-Stim Neuromodulation. The USPTO Examiner is reviewing the application and provided the Company with a disclaimer being required for “Neuromodulation”, as this a standard requirement for words that are in the standard vernacular.

Sales and Distribution

We market directly to patients but sell the Lap-Band system to select surgical centers throughout the U.S. and internationally having patients that would like to treat obesity and its comorbidities. The surgical centers then perform the LAP-BAND procedure and are most-commonly reimbursed by leading insurance providers. Alternatively, surgical

8

centers can offer the LAP-BAND as a cash-pay procedure. Our sales representatives are supported by field clinical experts who provide training, technical support, and other support services at various implant centers. Our sales representatives help implement consumer marketing programs and provide surgical centers and implanting surgeons with educational patient materials.

In order to support our Lap-Band sales efforts, we have seven dedicated team members to support the US Region. We have also launched marketing campaigns in several top strategic accounts that allow us to partner with clinics in marketing efforts and use digital and traditional marketing to drive qualified leads to physicians. During 2020, our international sales efforts were through a combination of direct and distributor sales channels, with a focus on top Lap-Band customers in Australia, The Middle East and strategic countries in Europe.

Our Manufacturers and Suppliers

To date, all of the materials and components for our products, as well as any related outside services, are procured from qualified suppliers and contract manufacturers in accordance with our proprietary specifications. All of our key manufacturers and suppliers have experience working with commercial implantable device systems, are ISO certified and are regularly audited by various regulatory agencies including the FDA. Our key manufacturers and suppliers have a demonstrated record of compliance with international regulatory requirements.

Given that we rely on third-party manufacturers and suppliers for the production of our products, our ability to increase production going forward will depend upon the experience, certification levels and large-scale production capabilities of our suppliers and manufacturers. Qualified suppliers and contract manufacturers have been and will continue to be selected to supply products on a commercial scale according to our proprietary specifications. Our FDA approval process required us to name and obtain approval for the suppliers of key components of the Lap-Band system.

Many of our parts are custom designed and require custom tooling and, as a result, we may not be able to quickly qualify and establish additional or replacement suppliers for the components of our products. Any new approvals of vendors required by the FDA or other regulatory agencies in other international markets for our products as a result of the need to qualify or obtain alternate vendors for any of our components would delay our ability to sell and market our products and could have a material adverse effect on our business.

We believe that our current manufacturing and supply arrangements will be adequate to continue our ongoing commercial sales and our ongoing and planned clinical trials. In order to produce our products in the quantities we anticipate to meet future market demand, we will need our manufacturers and suppliers to increase, or scale up, manufacturing production and supply arrangements by a significant factor over the current level of production. There are technical challenges to scaling up manufacturing capacity and developing commercial-scale manufacturing facilities that may require the investment of substantial additional funds by our manufacturers and suppliers and hiring and retaining additional management and technical personnel who have the necessary experience. If our manufacturers or suppliers are unable to do so, we may not be able to meet the requirements to expand the launch of the product in the United States or launch the product internationally or to meet future demand, if at all. We may also represent only a small portion of our suppliers’ or manufacturers’ business and if they become capacity constrained, they may choose to allocate their available resources to other customers that represent a larger portion of their business. If we are unable to obtain a sufficient supply of our product, our revenue, business and financial prospects would be adversely affected.

Government Regulations

Device Classification and Regulations

United States

Our products and products under development are regulated by the FDA as medical devices under the Federal Food, Drug, and Cosmetic Act (“FFDCA”) and the regulations promulgated under the FFDCA. Pursuant to the FFDCA, the FDA regulates the research, design, testing, manufacture, safety, labeling, storage, record keeping, advertising, sales and distribution, post-market adverse event reporting, production and advertising and promotion of medical devices in the United States. Noncompliance with applicable requirements can result in warning letters, fines, injunctions, civil

9

penalties, recall or seizure of products, total or partial suspension of production, failure of the government to grant premarket approval for devices and criminal prosecution.

Medical devices in the United States are classified into one of three classes, Class I, II or III, on the basis of the amount of risk and the controls deemed by the FDA to be necessary to reasonably ensure their safety and effectiveness. Class I, low risk, devices are subject to general controls (e.g., labeling and adherence to good manufacturing practices). Class II, intermediate risk, devices are subject to general controls and to special controls (e.g., performance standards, and premarket notification). Generally, Class III devices are those which must receive premarket approval by the FDA to ensure their safety and effectiveness (e.g., life-sustaining, life-supporting and implantable devices, or new devices), and require clinical testing to validate safety and effectiveness and FDA approval prior to marketing and distribution. The FDA also has the authority to require clinical testing of Class II devices. In both the United States and certain international markets, there have been a number of legislative and regulatory initiatives and changes, such as the Modernization Act and the EU-Medical Device Regulations, which could and have altered the healthcare system in ways that could impact our ability to sell our medical devices profitably.

The FFDCA provides two basic review processes for medical devices. Certain products (Class II) may qualify for a submission authorized by Section 510(k) of the FFDCA, where the manufacturer submits to the FDA a premarket notification of the manufacturer’s intention to commence marketing the product. The manufacturer must, among other things, establish that the product to be marketed is substantially equivalent to another legally marketed product. Marketing may commence when the FDA issues a letter finding the subject device is subject device is substantially equivalent to a legally marketed predicate device. If a medical device does not qualify for the 510(k) procedure (Class III), the manufacturer must file a Premarket Approval Application (“PMA”) with the FDA. This procedure requires more extensive pre-filing clinical and preclinical testing than the 510(k) processes and involves a significantly longer FDA review process. A PMA is required to establish the safety and effectiveness of the device and a key component of a PMA submission is the pivotal clinical trial data, as discussed in more detail below.

Premarket Approval

The ReShape vBloc® and the Lap-Band system are medical devices that required a PMA submission from the FDA to market in the United States. The FDA approved ReShape vBloc in January of 2015 and the Lap-Band system in 2001 with post-approval conditions intended to ensure the safety and effectiveness of the devices. Failure to comply with the conditions of approval can result in material adverse enforcement action, including the loss or withdrawal of the approvals. Referenced in the FDA Guidance, after a device achieves initial PMA approval, any additional significant modifications to the manufacturing process, labeling, use and design of a device requires a PMA supplement to be submitted and approved through the premarket approval process. Premarket approval supplements often require submission of the same type of information as a PMA except that the supplement is limited to information needed to support any changes from the device covered by the original PMA. In addition, holders of an approved PMA are required to submit annual reports to the FDA that include relevant information on the continued use of the device. In September 2018, ReShape Lifesciences made a financial decision to stop the manufacturing and commercializing the vBloc product line in the US. This business decision was not related to the safety or efficacy of the device. On January 27, 2021, FDA accepted a PMA amendment to formally withdraw the vBloc PMA. On February 2, 2021, FDA accepted the PMA amendment for ReCharge Post Approval Study closure and the study status is marked “Completed” on the FDA Post-Approval Studies webpage. On March 4, 2021, FDA accepted the PMA amendment for ReNew Post Approval Study termination and the study status is marked “Terminated” on the FDA Post-Approval Studies webpage.

The ReShape Vest with weight loss indication will be considered a Class III Long Term Implantable product by the FDA requiring the PMA path. A pivotal trial for the ReShape Vest will likely include approximately 250 implanted patients monitored up to three years. Other implantable devices for the treatment of obesity relied on twelve-month endpoints for the PMA submission with annual follow-up visits up to five years and we expect the pivotal trial for the ReShape Vest to be similar. A U.S. pivotal trial requires FDA Investigational Device Exemption (“IDE”) submission and approval.

Clinical Trials

A clinical trial is almost always required to support a PMA or certain 510(K) submissions. Clinical trials for a “significant risk” device such as ours require submission to the FDA of an application for an IDE for clinical studies to be conducted within the United States. The IDE application must be supported by appropriate data, such as animal and

10

laboratory testing results, showing that it is safe to test the device in humans and that the testing protocol is scientifically sound. In the United States, a clinical trial for a significant risk device may begin once the IDE application is approved by the FDA and by the Institutional Review Boards (“IRBs”) overseeing the clinical trial at the various investigational sites.

Clinical trials require extensive recordkeeping and detailed reporting. Our clinical trials must be conducted under the oversight of an IRB for each participating clinical trial site and in accordance with applicable regulations and policies including, but not limited to, the FDA’s good clinical practice IDE requirements. ReShape Lifesciences, the trial Data Safety Monitoring Board, the FDA or the IRB for each site at which a clinical trial is being performed may suspend a clinical trial at any time for various reasons, including a belief that the risks to study subjects outweigh the anticipated benefits.

Pervasive and Continuing U.S. Regulation

Numerous regulatory requirements apply. These include:

| ● | Quality System Regulation, which requires manufacturers to follow design, testing, control, documentation, complaint handling and other quality assurance procedures during the design and manufacturing processes; |

| ● | regulations which govern product labels and labeling, prohibit the promotion of products for unapproved or “off-label” uses and impose other restrictions on labeling and promotional activities; |

| ● | medical device reporting regulations, which require that manufacturers report to the FDA if their device may have caused or contributed to a death or serious injury or malfunctioned in a way that would likely cause or contribute to a death or serious injury if it were to recur; |

| ● | notices of correction or removal and recall regulations; |

| ● | periodic reporting of progress related to clinical trials, post approval studies required as conditions of PMA approval and relevant changes to information contained within the PMA approval; and |

| ● | reporting of transfers of value and payments to physicians and teaching hospitals. |

Advertising and promotion of medical devices are also regulated by the Federal Trade Commission and by state regulatory and enforcement authorities. Recently, some promotional activities for FDA-regulated products have resulted in enforcement actions brought under healthcare reimbursement laws and consumer protection statutes. In addition, under the federal Lanham Act, competitors and others can initiate litigation relating to advertising claims.

Compliance with regulatory requirements is enforced through periodic facility inspections by the FDA, which may be unannounced. Because we rely on contract manufacturing sites and service providers, these additional sites are also subject to these FDA inspections. Failure to comply with applicable regulatory requirements can result in enforcement action, which may include any of the following sanctions:

| ● | warning letters or untitled letters; |

| ● | fines, injunction and civil penalties; |

| ● | recall or seizure of our products; |

| ● | customer notification, or orders for repair, replacement or refund; |

| ● | operating restrictions, partial suspension or total shutdown of production or clinical trials; |

| ● | refusing our request for premarket approval of new products; |

| ● | withdrawing premarket approvals that are already granted; and |

11

| ● | criminal prosecution. |

International Regulations

International sales of medical devices are subject to foreign government regulations, which vary substantially from country to country. The time required to obtain approval by a foreign country may be longer or shorter than that required for FDA approval/clearance, and the requirements may differ. The primary regulatory environment in Europe is that of the European Union (“EU”), which consists of 27 member states encompassing nearly all the major countries in Europe. Additional countries that are not part of the EU, but are part of the European Economic Area (“EEA”), and other countries, such as Switzerland, have voluntarily adopted laws and regulations that mirror those of the EU with respect to medical devices. The EU has adopted Directive 90/385/EEC as amended by 2007/47/EC for active implantable medical devices and numerous standards that govern and harmonize the national laws and standards regulating the design, manufacture, clinical trials, labeling and adverse event reporting for medical devices that are marketed in member states. Medical devices that comply with the requirements of the national law of the member state in which their Notified Body is located will be entitled to bear CE marking, indicating that the device conforms to applicable regulatory requirements, and, accordingly, can be commercially marketed within the EU and other countries that recognize this mark for regulatory purposes.

The Lap-Band system was CE marked in 1997. The method of assessing conformity with applicable regulatory requirements varies depending on the class of the device, but for our Lap-Band system, the method involved a combination issuance of declaration of conformity by the manufacturer of the safety and performance of the device, and a third-party assessment by a Notified Body of the design of the device and of our quality system. A Notified Body is a private commercial entity that is designated by the national government of a member state as being competent to make independent judgments about whether a product complies with applicable regulatory requirements. The assessment included, among other things, a clinical evaluation of the conformity of the device with applicable regulatory requirements. We use BSI as the Notified Body for our CE marking approval process.

Continued compliance with CE marking requirements is enforced through periodic facility inspections by the Notified Body, which may be unannounced. Because we rely on contract manufacturing sites and service providers, these additional sites may also be subject to these Notified Body inspections.

Since the beginning of 2020, the COVID-19 pandemic slowed most of the economy in the European Union. This resulted in many different challenges ranging from notified bodies that were no longer able to perform audits, to manufacturers that were forced to increase their production beyond their existing capabilities or forced to stop their production all together. The original date of application of Regulation (EU) 2017/745 on medical device (MDR) was May 26, 2020. Due to COVID-19 pandemic the date of application for MDR was postponed to May 26, 2021. The Company will continue to implement changes across our quality systems to become compliant with the new MDR.

Patient Privacy Laws

United States and various international laws have been evolving to protect the confidentiality of certain patient health information, including patient medical records. These laws restrict the use and disclosure of certain patient health information. Enforcement actions, including financial penalties, related to patient privacy issues are globally increasing. The management of patient data may have an impact on certain clinical research activities and product design considerations.

Employees

As of December 31, 2020, we had 37 employees, all of which were full-time. All of these employees are located in the U.S.

From time to time we also employ independent contractors, consultants and temporary employees to support our operations. None of our employees are subject to collective bargaining agreements. We have never experienced a work stoppage and believe that our relations with our employees are good.

12

Information About our Executive Officers

The following table sets forth information regarding our executive officers as of March 1, 2021:

Name |

| Age |

| Position |

Barton P. Bandy |

| 60 |

| President and Chief Executive Officer |

Thomas Stankovich |

| 60 |

| Senior Vice President and Chief Financial Officer |

Barton P. Bandy has served as our President and Chief Executive Officer since April 1, 2019. Mr. Bandy has extensive leadership experience in health care and specifically in the obesity and bariatric space. Most recently, Mr. Bandy was President and Chief Executive Officer of BroadSpot Imaging Corporation, a developer of medical devices for eye care, since April 2017. From April 2013 to August 2016, Mr. Bandy was President of Wellness at Alphaeon Corporation, where he was responsible for business development, commercial activities, strategy and acquisition integration. He previously spent 10 years as the senior executive leading the Inamed and Allergan Health Divisions through the launch, growth and transition of the Lap-Band.

Thomas Stankovich has served as our Chief Financial Officer since October 30, 2019. Mr. Stankovich has extensive leadership experiences as the CFO for multiple public and private healthcare companies. Mr. Stankovich has spent the past nine years as the Global Senior Vice President and Chief Financial Officer of MP Biomedicals, a life science and molecular biology-diagnostics company. Prior to MP Biomedicals, Mr. Stankovich served as Chief Financial Officer at Response Genetics where he successfully led the company through their initial public offering. Additionally, Mr. Stankovich served as Chief Financial Officer for Ribapham Inc., where he also led the company through their initial public offering, which at the time became the second largest ever initial public offering in the biotechnology sector. Mr. Stankovich also held the Chief Financial Officer position at ICN International which later changed its name to Valeant Pharmaceuticals.

Our Corporate Information

We were originally incorporated in the state of Minnesota in December 2002 and reincorporated in the state of Delaware in July 2004. In 2017, we changed our name from EnteroMedics Inc. to ReShape Lifesciences Inc. Our shares of common stock trade on the OTCQB Market under the symbol RSLS.

We file reports and other information with the Securities and Exchange Commission (“SEC”) including annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and proxy or information statements. Those reports and statements as well as all amendments to those documents filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended (1) are available at the SEC’s Public Reference Room at 100 F Street, N.E., Washington, DC 20549, (2) may be obtained by sending an electronic message to the SEC at publicinfo@sec.gov or by sending a fax to the SEC at 1-202-777-1027, (3) are available at the SEC’s internet site (http://www.sec.gov), which contains reports, proxy and information statements and other information regarding issuers that file electronically with the SEC and (4) are available free of charge through our website as soon as reasonably practicable after electronic filing with, or furnishing to, the SEC.

Our principal executive offices are located at 1001 Calle Amanecer, San Clemente, California 92673, and our telephone number is (949) 429-6680. Our website address is www.reshapelifesciences.com. The information on, or that may be accessed through, our website is not incorporated by reference into this Annual Report on Form 10-K and should not be considered a part of this Annual Report on Form 10-K.

13

Summary of risk Factors

The following is a summary of the principal risks and uncertainties that could materially adversely affect our business, results of operations, financial condition, cash flows, prospects and/or the price of our outstanding securities, and make an investment in our securities speculative or risky. You should read this summary together with the more detailed description of each risk factor contained below.

Risks Related to Our Proposed Merger with Obalon

| ● | Fluctuations in the market price of Obalon Shares will affect the value of the Merger consideration. |

| ● | The Merger may not be consummated unless important conditions are satisfied or waived and there can be no assurance that the Merger will be consummated. |

| ● | There can be no assurance that the Obalon Shares to be issued in the Merger will be on the Nasdaq Stock Market or, if listed, that the combined company will be able to comply with the continued listing standards. |

| ● | The Merger Agreement contains provisions that could discourage a potential competing acquirer of either ReShape or Obalon. |

| ● | The pendency of the Merger could materially adversely affect the business, financial condition, results of operations or cash flows of ReShape or Obalon. |

| ● | ReShape directors and executive officers and Obalon directors and executive officers have interests in the Merger that may be different from, or in addition to, the interests of ReShape stockholders and Obalon stockholders. |

| ● | Failure to consummate the Merger could negatively impact respective future stock prices, operations and financial results of ReShape and Obalon. |

| ● | Financial projections regarding ReShape may not prove accurate. |

| ● | The Merger may disrupt attention of ReShape management and Obalon management from ongoing business operations. |

| ● | The market price for Obalon Shares following completion of the Merger will continue to fluctuate and may be affected by factors different from those that historically have affected Obalon Shares and ReShape Shares. |

Risks Related to Our Business and Industry

| ● | We may be unable to attract and retain management and other personnel we need to succeed. |

| ● | Our ReShape Vest product is in the early stages of clinical evaluation. If the clinical trial is not successfully completed or any required regulatory approvals are not obtained, the ReShape Vest may not be commercialized and our business prospects may suffer. |

| ● | The shares of series C convertible preferred stock issued in connection with our acquisition of ReShape Medical have certain rights and preferences senior to our common stock, including a liquidation preference that is senior to our common stock. |

| ● | We are a medical device company with a limited history of operations and sales, and we cannot assure you that we will ever generate substantial revenue or be profitable. |

| ● | During the second quarter of 2019 we recorded a non-cash indefinite-lived intangible assets impairment loss, which significantly impacted our results of operations, and we may be exposed to additional impairment losses that could be material. |

| ● | We will need substantial additional funding and may be unable to raise capital when needed, which would force us to delay, reduce or eliminate our product development programs or liquidate some or all of our assets. |

| ● | We incur significant costs as a result of operating as a public company, and our management is required to devote substantial time to compliance initiatives. |

| ● | General economic and political conditions could have a material adverse effect on our business. |

| ● | We face significant uncertainty in the industry due to government healthcare reform. |

| ● | We are subject, directly or indirectly, to United States federal and state healthcare fraud and abuse and false claims laws and regulations. Prosecutions under such laws have increased in recent years and we may become subject to such litigation. If we are unable to, or have not fully complied with such laws, we could face substantial penalties. |

| ● | Failure to protect our information technology information technology infrastructure against cyber-based attacks, network security breaches, service interruptions or data corruption could materially disrupt our operations and adversely affect our business. |

14

| ● | We operate in a highly competitive industry that is subject to rapid change. If our competitors are able to develop and market products that are safer or more effective than our products, our commercial opportunities will be reduced or eliminated. |

Risks Associated with Development and Commercialization of the Lap-Band System, ReShapeCare, ReShape Vest and Diabetes Bloc-Stim Neuromodulation

| ● | Our efforts to increase revenue from our Lap-Band system and ReShapeCare, and commercialize the ReShape Vest, Diabetes Bloc-Stim Neuromodulation and expanded line of bariatric surgical accessories may not succeed or may encounter delays which could significantly harm our ability to generate revenue. |

| ● | We may not be able to obtain required regulatory approvals for our ReShape Vest and/or Diabetes Bloc-Stim Neuromodulation in a cost-effective manner or at all, which could adversely affect our business and operating results. |

| ● | We depend on clinical investigators and clinical sites to enroll patients in our clinical trials, and on other third parties to manage the trials and to perform related data collection and analysis, and, as a result, we may face costs and delays that are outside of our control. |

| ● | Modifications to the Lap-Band system may require additional approval from regulatory authorities, which may not be obtained or may delay our commercialization efforts. |

| ● | If we or our suppliers fail to comply with ongoing regulatory requirements, or if we experience unanticipated product problems, our Lap-Band system could be subject to restrictions or withdrawal from the market. |

| ● | We may be unable to manage our growth effectively. |

| ● | We face the risk of product liability claims that could be expensive, divert management’s attention and harm our reputation and business. We may not be able to obtain adequate product liability insurance. |

Risks Related to Intellectual Property

| ● | If we are unable to obtain or maintain intellectual property rights relating to our technology and neuroblocking therapy, the commercial value of our technology and any future products will be adversely affected and our competitive position will be harmed. |

| ● | Many of our competitors have significant resources and incentives to apply for and obtain intellectual property rights that could limit or prevent our ability to commercialize our current or future products in the United States or abroad. |

| ● | If we are unable to protect the confidentiality of our proprietary information and know-how, the value of our technology and products could be adversely affected. |

| ● | Intellectual property litigation is a common tactic in the medical device industry to gain competitive advantage. If we become subject to a lawsuit, we may be required to expend significant financial and other resources and our management’s attention may be diverted from our business. |

Risks Relating to Ownership of Our Common Stock

| ● | Our common stock trades on an over-the-counter market. |

| ● | Our common stock may be deemed to be a “penny stock” and broker-dealers who make a market in our stock may be subject to additional compliance requirements. |

| ● | The trading price of our common stock has been volatile and is likely to be volatile in the future. |

| ● | Sales of a substantial number of shares of our common stock in the public market by existing stockholders, or the perception that they may occur, could cause our stock price to decline. |

| ● | We have a significant number of outstanding warrants, which may cause significant dilution to our stockholders, have a material adverse impact on the market price of our common stock and make it more difficult for us to raise funds through future equity offerings. |

| ● | You may experience future dilution as a result of future equity offerings. |

| ● | Since our securities are quoted on the OTCQB market, our stockholders may face significant restrictions on the resale of our securities due to state “blue sky” laws. |

| ● | Our organizational documents and Delaware law make a takeover of our company more difficult, which may prevent certain changes in control and limit the market price of our common stock. |

| ● | We have not paid dividends in the past and do not expect to pay dividends in the future, and any return on investment may be limited to the value of our common stock. |

15

RISK FACTORS

Risks Related to Our Proposed Merger with Obalon

Fluctuations in the market price of Obalon Shares will affect the value of the Merger consideration.

At the effective time, each share of ReShape common stock and series B preferred stock (the “ReShape Shares”) (other than shares held by Obalon, Merger Sub, any wholly-owned subsidiary of Obalon or ReShape, or by ReShape as treasury shares, which will be canceled and retired and cease to exist) will be converted into the right to receive a number of Obalon Shares, according to a ratio determined at least 10 days prior to the Obalon special meeting of stockholders to be held to approve such share issuance, that will result in the holders of such ReShape Shares owning 51% of the outstanding shares of common stock of the combined company immediately after the effective time of the Merger.

Because the exact number of Obalon Shares that will be issued in exchange for each ReShape Share will not be determined until a later date, the market value of the Merger consideration that ReShape stockholders will receive will depend both on the number of Obalon Shares to be issued and the price per Obalon Share at the effective time of the Merger. The exact number of Obalon Shares to be issued and the market price per Obalon Share is not currently known and may be less or more than the current market price.

Stock price changes may result from a variety of factors, including general market, industry and economic conditions, changes in the respective businesses, operations and prospects of ReShape and Obalon, regulatory considerations, results of the ReShape Special Meeting and the Obalon Special Meeting, announcements with respect to the Merger or any of the foregoing, and other factors beyond the control of ReShape or Obalon. You should obtain current market price quotations for ReShape Shares and for Obalon Shares, but as indicated above, the prices at the time the Merger is consummated may be greater than, the same as or less than such price quotations.

The Merger may not be consummated unless important conditions are satisfied or waived and there can be no assurance that the Merger will be consummated.

The Merger Agreement contains a number of conditions that must be satisfied or waived (to the extent permitted by applicable law) to consummate the Merger. Those conditions include, among others:

| ● | the required approvals of the Obalon and ReShape stockholders; |

| ● | approval of the ReShape Merger Proposal by the ReShape stockholders; |

| ● | the absence of any adverse law or order promulgated, entered, enforced, enacted, or issued by any government entity that prohibits, restrains, or makes illegal the consummation of the Merger or the other transactions contemplated by the Merger Agreement; |

| ● | the effectiveness of a registration statement on Form S-4, which shall include this joint proxy statement/prospectus, under the Securities Act and the absence of any stop order issued by the SEC suspending the use of such registration statement; |

| ● | the Obalon Shares to be issued in the Merger being approved for listing on The Nasdaq Capital Market and approval of the combined company’s continued listing on The Nasdaq Capital Market (certain risks related to obtaining such approvals are described below); |

| ● | subject to certain materiality exceptions, the accuracy of certain representations and warranties of each of Obalon and ReShape contained in the Merger Agreement and the compliance by each party with the covenants contained in the Merger Agreement; and |

| ● | the absence of a material adverse effect with respect to each of Obalon and ReShape. |

These conditions to the consummation of the Merger may not be satisfied or waived (to the extent permitted by applicable law) and, as a result, the Merger may not be consummated at the time expected, or at all. In addition, ReShape or Obalon may elect to terminate the Merger Agreement in certain other circumstances.

16

There can be no assurance that the Obalon Shares to be issued in the Merger will be on the Nasdaq Stock Market or, if listed, that the combined company will be able to comply with the continued listing standards.

Nasdaq has determined that the proposed transaction constitutes a business combination that results in a change of control pursuant to its listing rules. Accordingly, the combined company will be required to satisfy all of Nasdaq’s initial listing criteria and to complete Nasdaq’s initial listing process in order for the Obalon Shares to be listed on Nasdaq. An application to list the Obalon Shares on The Nasdaq Capital Market upon consummation of the Merger has been filed as required by The Nasdaq Capital Market. Since Obalon went public in 2016, it has twice fallen below Nasdaq’s minimum required level for stockholder equity and minimum bid price requirement. Obalon was downlisted in November 2020 from Nasdaq’s Global Market to its Capital Market though it is currently in compliance with the continued listing standards of the Nasdaq Capital Market.

Nasdaq’s approval of the listing application is a condition to the closing of the Merger and while ReShape and Obalon can each terminate the Merger Agreement if the condition is not satisfied (in which case, a $1 million termination fee may be payable to Obalon by ReShape), the parties can also each choose to waive the condition and consummate the Merger without Nasdaq’s approval of the listing application. In the event ReShape and Obalon waive that condition and consummate the Merger without Nasdaq’s approval of the listing application, the combined company would not be listed on The Nasdaq Capital Market.

In addition, if after listing, The Nasdaq Capital Market delists the Obalon Shares from trading on its exchange for failure to meet the continued listing standards, the combined company and its stockholders could face significant material adverse consequences including:

| ● | a limited availability of market quotations for its securities; |

| ● | a determination that its common stock is a “penny stock” which will require brokers trading in its common stock to adhere to more stringent rules, possibly resulting in a reduced level of trading activity in the secondary trading market for its common stock; |

| ● | a limited amount of analyst coverage; and |

| ● | a decreased ability to issue additional securities or obtain additional financing in the future. |

The Merger Agreement contains provisions that could discourage a potential competing acquirer of either ReShape or Obalon.

The Merger Agreement contains “no shop” provisions that restrict each of Obalon’s and ReShape’s ability to solicit, initiate or knowingly encourage and induce, or take any other action designed to facilitate competing third-party proposals relating to a merger, reorganization or consolidation of the company or an acquisition of the company’s stock or assets. In addition, the other party generally has an opportunity to offer to modify the terms of the Merger in response to any competing acquisition proposals before the board of directors of the company that has received a third-party proposal may withdraw or qualify its recommendation with respect to the Merger.

The Merger Agreement does not permit either Obalon or ReShape to terminate the Merger Agreement in order to pursue a superior proposal. These provisions could discourage a potential third-party acquirer that might have an interest in acquiring all or a significant portion of Obalon or ReShape from considering or proposing an acquisition, even if it were prepared to pay consideration with a higher per share cash or market value than the market value proposed to be received or realized in the Merger.

The pendency of the Merger could materially adversely affect the business, financial condition, results of operations or cash flows of ReShape or Obalon.

The announcement and pendency of the Merger could disrupt ReShape’s or Obalon’s businesses, in any of the following ways, among others:

| ● | ReShape’s employees may experience uncertainty about their future roles with the combined company, which might adversely affect each company’s ability to retain and hire key managers and other employees; |

17

| ● | the attention of ReShape management or Obalon management may be directed toward completion of the Merger, integration planning and transaction-related considerations and may be diverted from the company’s day-to-day business operations and, following the completion of the Merger, the attention of the combined company’s management may also be diverted to such matters; |

| ● | vendors, suppliers, business partners or others may seek to modify or terminate their business relationship with ReShape or Obalon or the combined company following completion of the Merger; |

| ● | ReShape or Obalon, or the combined company following completion of the Merger, and their respective directors could become subject to lawsuits relating to the Merger; and |

| ● | ReShape or Obalon may experience negative reactions from their stockholders and the medical community, among others. |

These disruptions could be exacerbated by a delay in the completion of the Merger or termination of the Merger Agreement. Additionally, if the Merger is not consummated, each company will have incurred significant costs and diverted the time and attention of management. A failure to consummate the Merger may also result in negative publicity, reputational harm, litigation against ReShape or Obalon or their respective directors and officers, and a negative impression of the companies in the financial markets. The occurrence of any of these events individually or in combination could have a material adverse effect on either or both companies’ financial statements and stock price.

In addition, the Merger Agreement restricts Obalon and ReShape from taking certain actions until the Effective Time without the consent of the other party, including, among others: the payment of dividends; the issuance of equity (including certain equity incentive awards); certain increases to employee compensation and benefits; capital expenditures; the incurrence of indebtedness; acquisitions and divestitures; and the entry into or amending certain material contracts. Obalon and ReShape are required to conduct business in the ordinary course consistent with past practice. The restrictive covenants, which are subject to various specific exceptions, may prevent Obalon or ReShape from pursuing attractive business opportunities that may arise prior to the consummation of the Merger. Although Obalon and ReShape may be able to pursue such activities with the other company’s consent, the other company may not be willing to provide its consent.

ReShape directors and executive officers and Obalon directors and executive officers have interests in the Merger that may be different from, or in addition to, the interests of ReShape stockholders and Obalon stockholders.

Certain of the directors and executive officers of ReShape and certain of the directors and executive officers of Obalon negotiated the terms of the Merger Agreement and these individuals have interests in the Merger that may be different from, or in addition to, those of ReShape stockholders and Obalon stockholders, respectively. These interests include, but are not limited to, the continued service of certain of these ReShape individuals as directors and executive officers of Obalon after the date of the consummation of the Merger, certain other compensation arrangements with the Obalon directors and executive officers, and provisions in the Merger Agreement regarding continued indemnification of and advancement of expenses of the directors and executive officers of ReShape and Obalon.

Failure to consummate the Merger could negatively impact respective future stock prices, operations and financial results of ReShape and Obalon.

If the Merger is not consummated for any reason, ReShape and Obalon may be subjected to a number of material risks, including the following:

| ● | a decline in the market prices of the shares of ReShape Common Stock or Obalon Shares to the extent that their current market prices reflect a market assumption that the Merger will be consummated and will be beneficial to the value of the business of Obalon after the Closing Date; |