Attached files

| file | filename |

|---|---|

| 8-K - 8-K - COMPUTER TASK GROUP INC | d127992d8k.htm |

Exhibit 99.1

March 10, 2021

Fellow CTG Shareholders:

Over the last year, we have all been subject to the unprecedented and difficult environment resulting from the global COVID-19 pandemic. We express our sympathies and well wishes to all those who have suffered hardship or loss. We also want to thank those who are working to protect and care for the wellbeing of all of the communities around the world in which we live and operate.

As we are a global enterprise, the COVID-19 pandemic created many challenges for us, but at the same time created multiple opportunities driven by the surge in the usage of digital technologies due to worldwide lockdowns and increasing work from remote locations. People and organizations all over the world have had to adjust to new ways of work and life, and our teams and capabilities are critical to enabling them to function in this ‘new world order’.

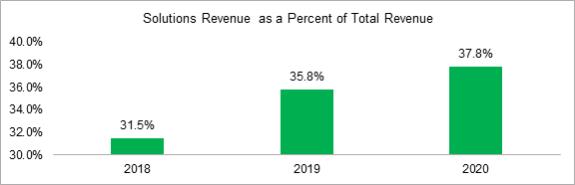

Despite the challenges across all industries and ultimately to the broader economy, our team delivered outstanding financial results during 2020. A few examples include Solutions revenue growth as a percent of our overall business mix, gross profit margin improvements and material earnings growth over 2019. Revenue from Solutions grew 5.4% to 37.8% of total revenue, while the gross profit margin on our Solutions business grew 5.7% to 27.3%, and our GAAP and non-GAAP net income grew 85% and 34%, respectively, year-over-year.

Our strong results for the year serve as an important validation that our existing solutions strategy is working and yielding the anticipated outcomes. To continue driving long-term success, we recently announced a major initiative to accelerate digital transformation (DT) services to our clients. This initiative will enable CTG to capitalize on significant market opportunities as we continue to invest in sales and business development resources, enhanced solutions offerings, and global delivery network capabilities.

Digital Transformation – Core of Solutions Strategy

The priority of our updated brand and new tagline, “Transformation Accelerated,” is to deliver digital solutions to our clients, enabling them to continue serving the evolving needs of their customers at the speed required for them to compete successfully.

Market disruptors are driving broad evolution and transformation, promoting social and economic change at a rapidly increasing pace. At CTG, we are focused on providing the technologies and methodologies to meet our clients’ evolving needs in areas such as Artificial Intelligence and machine learning to the Internet of Things and cloud computing platforms.

In light of the pandemic and the adoption of remote and digital work, businesses across most industries need to increase their focus on DT. We are operating in a fast-paced market with

1

significant demand where DT initiatives are viewed as a top business priority. Our strong geographic footprint and OneCTG focus allow us to capitalize on these changes and optimize a scalable global delivery network to create adaptable solutions for our clients while minimizing overall delivery costs.

2023 Vision

We have a unique competitive advantage as a trusted and reliable partner in today’s business landscape given our ability to swiftly provide solutions to our clients as promised. In today’s marketplace, the majority of digital technology projects fail to deliver their intended value. We see this as an opportunity to capitalize on our ability to deliver repeatable digital solutions faster, improve profitability, and solidify our position as a recognized expert for DT momentum and success.

As we continue to adapt to our clients’ evolving needs and provide them with the services and solutions they need to meet their own business challanges, we are confident in our ability to achieve the following objectives through 2023:

| • | 50+% of overall revenue is solutions-based; |

| • | $250M+ in Solutions revenue; and |

| • | $35M EBITDA. |

Exceptional 2020 Results in a Challenging Environment

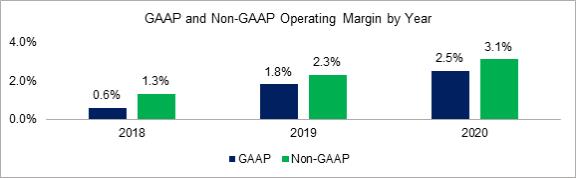

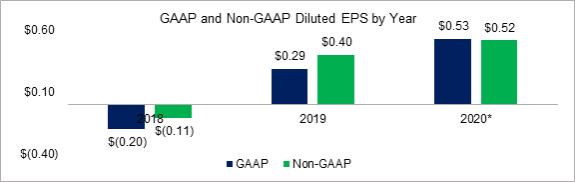

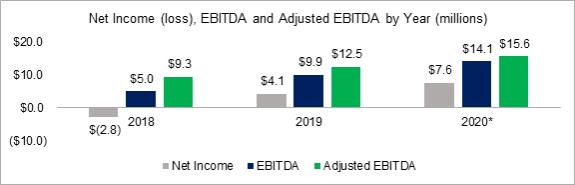

This past year has put the execution of our strategy to the ultimate test and we are proud that we have delivered strong financial and operational results. Key highlights from the past three years include significant improvements in our non-GAAP operating margin, diluted EPS, adjusted EBITDA and solutions revenue as a percentage of total revenue:

2

| * | 2020 GAAP net income per diluted share includes a total of $0.10 from the sale of a building and non-taxable life insurance gains. Both GAAP and non-GAAP diluted EPS include $0.08 of tax benefit from a change in legislation |

| * | Net income includes a total of $1.4 million from the sale of a building and non-taxable life insurance gains, and $1.1 million tax benefit from a change in legislation |

Our exceptional performance throughout the year was also a result of the immediate actions we took at the outset of the pandemic. To reinforce the financial health of CTG, we:

| • | Secured additional liquidity from banking partners and accelerated collection of receivables; |

| • | Implemented a 20% furlough for nearly all non-billable employees, including senior management, but excluding business development and global solutions team members. This furlough was in place for about six months through the end of the 2020 third quarter; |

3

| • | Eliminated all discretionary spending and restricted business travel; and |

| • | Participated in government-backed programs in Belgium, Luxembourg and France that provided meaningful financial assistance which largely offset the bench costs associated with inactive employees in our European operations. |

As we progressed through the year, challenging operating conditions highlighted the importance of disciplined execution. In support of accelerating our digital solutions strategy, we continued to identify new opportunities to expand our capabilities and expertise and invest in CTG’s future as a leading accelerator of digital transformation.

We invested in key areas across our sales and business development organizations, developed new, innovative digital solutions offerings to expand our product portfolio, and expanded our Global Delivery Network capabilities to continue delivering high-quality, cost-effective business and IT services and solutions to our clients. Beyond these measures, we added to our highly talented global solutions group and now have a senior team comprised of eight leaders in design and delivery of DT services. New additions in the past fifteen months include:

| • | Phaedra Divras, a leader with valuable experience delivering cloud transformation consulting and managed services, joined CTG in October 2020. As we continue to strengthen our digital solutions strategy, Phaedra will support our growing Solutions team in North America. |

| • | Brett Hunt, a seasoned IT solutions and services executive, was appointed in July 2020 to lead and accelerate growth of our North American Solutions team through the development of key partnerships and rapid adoption of CTG’s Delivery Center model. |

| • | Tanya Johnson, an application testing and training expert, joined the CTG team in November 2019 to strengthen our North American Solutions leadership and continue to advance our solutions portfolio. |

Strategic Acquisitions Contribute to Enhanced Global Market Presence

In March 2020, we completed our acquisition of StarDust, a small but leading digital testing and quality assurance company with operations in France and Canada. This strategic transaction was immediately accretive to our operating results, and supported our strategy of expanding Global Testing DT Solutions across the geographies we serve. Through this transaction, we increased CTG’s presence in the high-growth global testing market, including the launch of application testing solutions in the United States and Canada.

With StarDust, our services now include crowdtesting providing a faster, more flexible testing solution that differentiates CTG from many of our competitors. Given the success of our recent investments through strategic acquisitions, we plan to continue to evaluate potential synergistic transactions that are accretive to earnings and provide opportunities to further accelerate our DT strategy.

4

Corporate Governance Enhancements

Corporate governance is a key aspect of our values-driven business operations and corporate culture. In 2020, the CTG Board focused on enhancing governance practices and diversifying its members in terms of gender, race, experience, skills and tenure.

In December 2020, we added Raj Rajgopal to the CTG Board, further expanding our expertise and commitment to maintaining a Board with diverse backgrounds and perspectives. Raj brings valuable experience to the Board in the implementation of digital strategies and a proven track record of leading business transformation.

As a result of Raj’s appointment, the CTG Board has temporarily expanded to seven directors until our 2021 Annual Meeting, at which time Dan Sullivan, current Chairman, will step down, consistent with the Company’s retirement age guidelines. At our 2021 Annual Meeting, the CTG Board will comprise of six directors, five of whom are independent and two of whom have been appointed over the last three years.

Additionally, following our annual review of Board compensation with a third party expert and in recognition of shareholder feedback, we made the decision to change independent director base compensation in 2021 to 40% cash and 60% stock from 100% stock in recent years.

Building on Our Positive Momentum

CTG’s success will continue to be driven by the primary objectives underlying our strategic plan, including to:

| • | Immediately improve margins and earnings; |

| • | Generate longer-term revenue growth above that of our served markets, targeting higher-margin digital solution business; and |

| • | Optimally allocate capital in support of continued operating improvement and strategic acquisitions that accelerate the expansion of our digital solutions portfolio. |

Although the COVID-19 pandemic continues, driving uncertainty in the markets in which we serve, we are excited with the momentum we have created during 2020, and we will not be slowing down. Our strong financial performance this past year demonstrates the disciplined execution of our strategic plan has been effective. We are further committed to executing on our 2023 vision, promoting transformational growth and positioning CTG as a premier global solutions provider. To that end, we continue to make the necessary investments to drive near- and long-term success, as we deliver on our absolute commitment of value creation for shareholders.

5

We are confident that CTG will successfully leverage its competitive advantage in the digital solutions space, differentiating our offerings from those of our competitors and meeting the ever-evolving needs of our clients.

On behalf of the CTG Board and management team, we thank you for your investment in CTG and the continued support that you have extended to us, especially over this past difficult year.

| /S/ Daniel J. Sullivan | /S/ Filip Gydé | |||||

| Chairman of the Board | President and Chief Executive Officer |

6

Reconciliation of GAAP to Non-GAAP Information

The Company has referenced non-GAAP information in this shareholder letter. The Company believes that the use of non-GAAP financial information provides useful information to investors and management to gain an overall understanding of its current financial performance and prospects. In addition, non-GAAP financial measures are used by management for forecasting, facilitating ongoing operating decisions, and measuring the Company’s overall performance. The Company believes that these non-GAAP measures align closely with its internal measurement processes and are reflective of the Company’s core operating results.

A reconciliation of GAAP to non-GAAP information is included in the financial tables below. The non-GAAP financial information is presented using a consistent methodology from year-to-year. These measures should be considered in addition to results prepared in accordance with GAAP. In addition, these non-GAAP financial measures are not based on any comprehensive set of accounting rules or principles. The Company believes that non-GAAP financial measures have limitations in that they do not reflect all amounts associated with the Company’s results of operations as determined in accordance with GAAP and that these measures should only be used to evaluate the Company’s results of operations in conjunction with the corresponding GAAP financial measures. As such, the non-GAAP financial measures disclosed by the Company should not be considered a substitute for or superior to financial measures calculated in accordance with GAAP, and reconciliations between GAAP and non-GAAP financial measures included in this shareholder letter should be carefully evaluated.

The non-GAAP information below excludes gains from non-taxable life insurance and on the sale of a building, and costs associated with severance and certain acquisition-related expenses. The acquisition-related expenses consist of due diligence costs, amortization of intangible assets, and changes in the value of earn-out payments upon the achievement of certain financial targets from the Company’s recent acquisitions.

The reconciliation of GAAP to non-GAAP operating margin by year is as follows:

| For the Year Ended | ||||||||||||

| Dec. 2018 |

Dec. 2019 |

Dec. 2020 |

||||||||||

| GAAP Operating Margin |

0.6 | % | 1.8 | % | 2.5 | % | ||||||

| Acquisition-related expenses |

0.5 | % | 0.5 | % | 0.4 | % | ||||||

| Severance |

0.2 | % | 0.0 | % | 0.2 | % | ||||||

|

|

|

|

|

|

|

|||||||

| Non-GAAP Operating Margin |

1.3 | % | 2.3 | % | 3.1 | % | ||||||

|

|

|

|

|

|

|

|||||||

7

The reconciliation of GAAP to non-GAAP diluted earnings per share by year is as follows:

| For the Year Ended | ||||||||||||

| Dec. 2018 |

Dec. 2019 |

Dec. 2020 |

||||||||||

| GAAP Diluted EPS** |

$ | (0.20 | ) | $ | 0.29 | $ | 0.53 | |||||

| Acquisition-related expenses |

0.11 | 0.11 | 0.07 | |||||||||

| Severance |

0.04 | — | 0.02 | |||||||||

| Gain on sale of building |

— | — | (0.03 | ) | ||||||||

| Non-taxable life insurance gain |

(0.06 | ) | — | (0.07 | ) | |||||||

|

|

|

|

|

|

|

|||||||

| NON-GAAP Diluted EPS** |

$ | (0.11 | ) | $ | 0.40 | $ | 0.52 | |||||

|

|

|

|

|

|

|

|||||||

| ** | GAAP and non-GAAP diluted EPS in 2020 includes a $0.08 tax benefit from a change in legislation |

Reconciliation of Net income to EBITDA and Adjusted EBITDA, which includes earnings before interest, taxes, depreciation and amortization, equity-based compensation, severance, non-taxable life insurance gains, gain on sale of building, and acquisition-related expenses by year is as follows:

| For the Year Ended | ||||||||||||

| (in millions) | Dec. 2018 |

Dec. 2019 |

Dec. 2020 |

|||||||||

| Net income*** |

$ | (2.8 | ) | $ | 4.1 | $ | 7.6 | |||||

| Taxes |

5.1 | 2.2 | 3.0 | |||||||||

| Interest |

0.2 | 0.3 | 0.2 | |||||||||

| Depreciation and amortization |

2.5 | 3.3 | 3.3 | |||||||||

|

|

|

|

|

|

|

|||||||

| EBITDA |

$ | 5.0 | $ | 9.9 | $ | 14.1 | ||||||

| Equity-based compensation expense |

2.4 | 1.7 | 2.5 | |||||||||

| Severance |

0.7 | — | 0.6 | |||||||||

| Non-taxable life insurance gain |

— | — | (1.0 | ) | ||||||||

| Gain on sale of building |

— | — | (0.8 | ) | ||||||||

| Acquisition-related expenses |

1.2 | 0.9 | 0.2 | |||||||||

|

|

|

|

|

|

|

|||||||

| Adjusted EBITDA |

$ | 9.3 | $ | 12.5 | $ | 15.6 | ||||||

|

|

|

|

|

|

|

|||||||

| *** | Net income in 2020 includes a $1.1 million tax benefit from a change in legislation |

Safe Harbor Statement

This document contains certain forward-looking statements concerning the Company’s current expectations as to future growth, financial outlook, business strategy and performance expectations for future years and statements related to cost control, new business opportunities, financial performance, market demand, and other attributes of the Company. These statements are based upon the Company’s expectations and assumptions, a review of industry reports, current business conditions in the areas where the Company does business, feedback from

8

existing and potential new clients, a review of current and proposed legislation and governmental regulations that may affect the Company and/or its clients, and other future events or circumstances. Actual results could differ materially from the outlook guidance, expectations, and other forward-looking statements as a result of a number of factors, including among others, the effects of the COVID-19 pandemic and the regulatory, social and business responses thereto on the Company’s business, operations, employees, contractors and clients, the availability to the Company of qualified professional staff, domestic and foreign industry competition for clients and talent, increased bargaining power of large clients, the Company’s ability to protect confidential client data, the partial or complete loss of the revenue the Company generates from International Business Machines Corporation (IBM), the ability to integrate businesses when acquired and retain their clients while achieving cost reduction targets, the uncertainty of clients’ implementations of cost reduction projects, the effect of healthcare reform and initiatives, the mix of work between solutions and staffing, currency exchange risks, risks associated with operating in foreign jurisdictions, renegotiations, nullification, or breaches of contracts with clients, vendors, subcontractors or other parties, the change in valuation of capitalized software balances, the impact of current and future laws and government regulation, as well as repeal or modification of such, affecting the information technology (IT) solutions and staffing industry, taxes and the Company’s operations in particular, industry and economic conditions, including fluctuations in demand for IT services, consolidation among the Company’s competitors or clients, the need to supplement or change our IT services in response to new offerings in the industry or changes in client requirements for IT products and solutions, actions of activist shareholders, and other factors that involve risk and uncertainty including those listed in the Company’s reports filed with the Securities and Exchange Commission as of the date of this document. Such forward-looking statements should be read in conjunction with the Company’s disclosures set forth in the Company’s Form 10-K for the year ended December 31, 2019, which is incorporated by reference, and other reports that may be filed from time to time with the Securities and Exchange Commission. The Company assumes no obligation to update the forward-looking information contained in this document.

9