Attached files

| file | filename |

|---|---|

| 8-K - 8-K - GRAY TELEVISION INC | d101407d8k.htm |

Gray Television, Inc. Investor Presentation NYSE:GTN March 2021 Updated for December 31, 2020 Financial Information 4370 Peachtree Road, NE, Atlanta, GA 30319 | P 404.504.9828 | F 404.261.9607 | www.gray.tv Exhibit 99.1

GRAY TELEVISION, INC. Financial data reflects results “as reported” except where “Combined Historical Basis” (or “CHB”) is noted. Revenue is presented net of agency commissions. Ratings data derived from Comscore, Inc. (“Comscore”). ”Completed Transactions” includes all acquisitions or dispositions completed as of December 31, 2020. See Glossary at end for definitions. If Appendix is not included, see full presentation located at www.gray.tv for Non-GAAP Reconciliations.

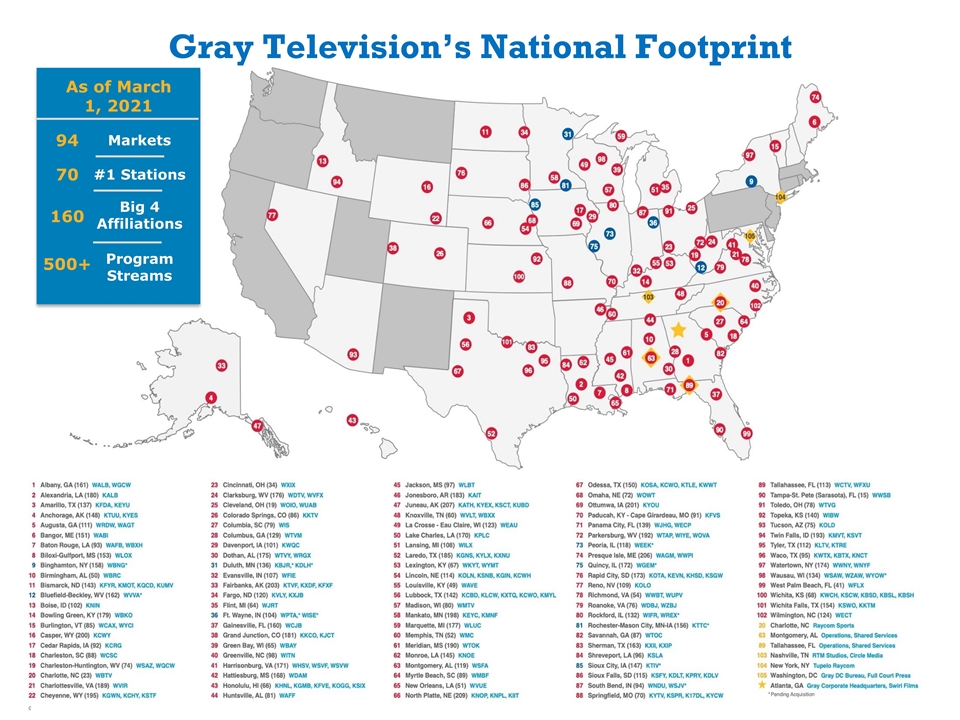

Gray Television’s National Footprint Big 4 Affiliations 500+ Program Streams 160 Markets 94 As of March 1, 2021 #1 Stations 70

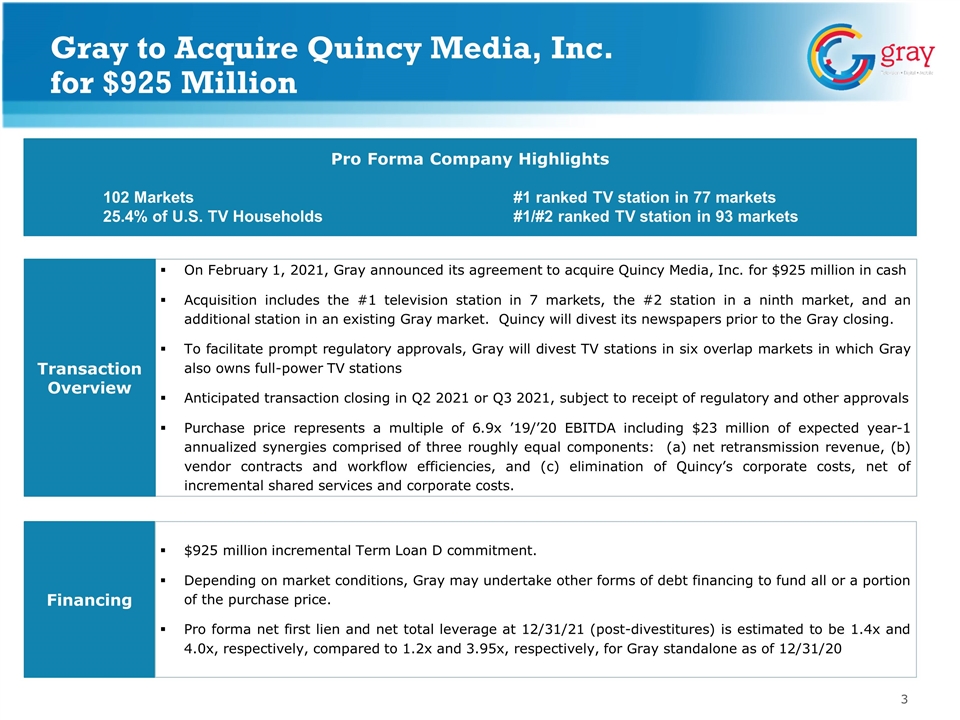

Gray to Acquire Quincy Media, Inc. for $925 Million Financing $925 million incremental Term Loan D commitment. Depending on market conditions, Gray may undertake other forms of debt financing to fund all or a portion of the purchase price. Pro forma net first lien and net total leverage at 12/31/21 (post-divestitures) is estimated to be 1.4x and 4.0x, respectively, compared to 1.2x and 3.95x, respectively, for Gray standalone as of 12/31/20 On February 1, 2021, Gray announced its agreement to acquire Quincy Media, Inc. for $925 million in cash Acquisition includes the #1 television station in 7 markets, the #2 station in a ninth market, and an additional station in an existing Gray market. Quincy will divest its newspapers prior to the Gray closing. To facilitate prompt regulatory approvals, Gray will divest TV stations in six overlap markets in which Gray also owns full-power TV stations Anticipated transaction closing in Q2 2021 or Q3 2021, subject to receipt of regulatory and other approvals Purchase price represents a multiple of 6.9x ’19/’20 EBITDA including $23 million of expected year-1 annualized synergies comprised of three roughly equal components: (a) net retransmission revenue, (b) vendor contracts and workflow efficiencies, and (c) elimination of Quincy’s corporate costs, net of incremental shared services and corporate costs. Transaction Overview Pro Forma Company Highlights 102 Markets#1 ranked TV station in 77 markets 25.4% of U.S. TV Households#1/#2 ranked TV station in 93 markets

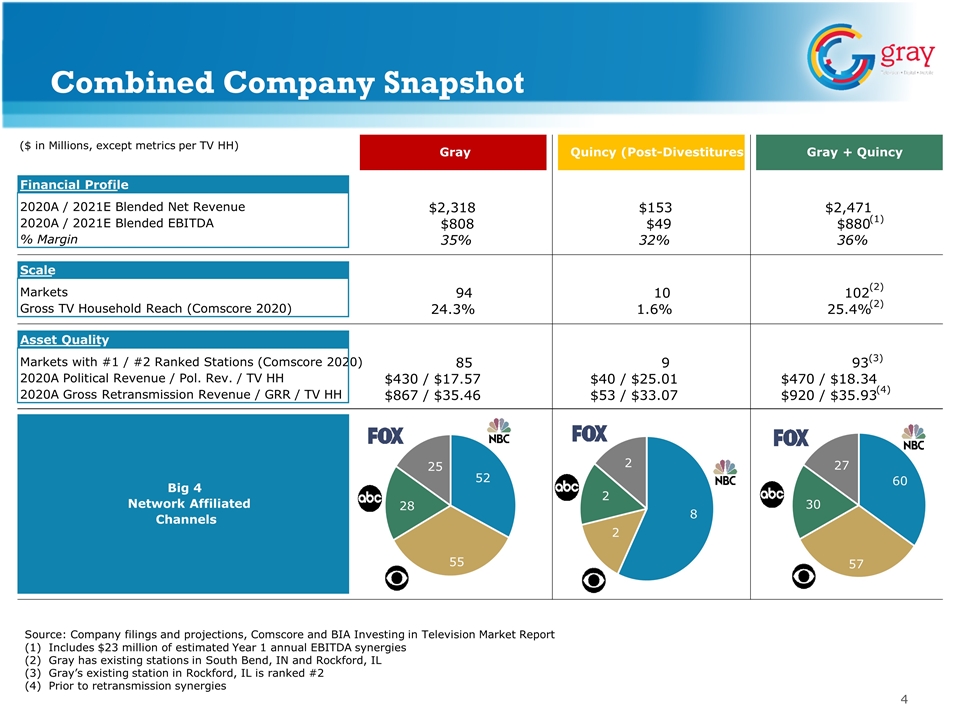

Combined Company Snapshot Source: Company filings and projections, Comscore and BIA Investing in Television Market Report Includes $23 million of estimated Year 1 annual EBITDA synergies Gray has existing stations in South Bend, IN and Rockford, IL Gray’s existing station in Rockford, IL is ranked #2 Prior to retransmission synergies ($ in Millions, except metrics per TV HH) Financial Profile 2020A / 2021E Blended Net Revenue $2,318 $153 $2,471 2020A / 2021E Blended EBITDA $808 $49 $880 % Margin 35% 32% 36% Scale Markets 94 10 102 Gross TV Household Reach (Comscore 2020) 24.3% 1.6% 25.4% Asset Quality Markets with #1 / #2 Ranked Stations (Comscore 2020) 85 9 93 2020A Political Revenue / Pol. Rev. / TV HH $430 / $17.57 $40 / $25.01 $470 / $18.34 2020A Gross Retransmission Revenue / GRR / TV HH $867 / $35.46 $53 / $33.07 $920 / $35.93 Gray Quincy (Post-Divestitures) Gray + Quincy Big 4 Network Affiliated Channels 52 55 28 25 (1) (4) 8 2 2 2 60 57 30 27 (2) (2) (3)

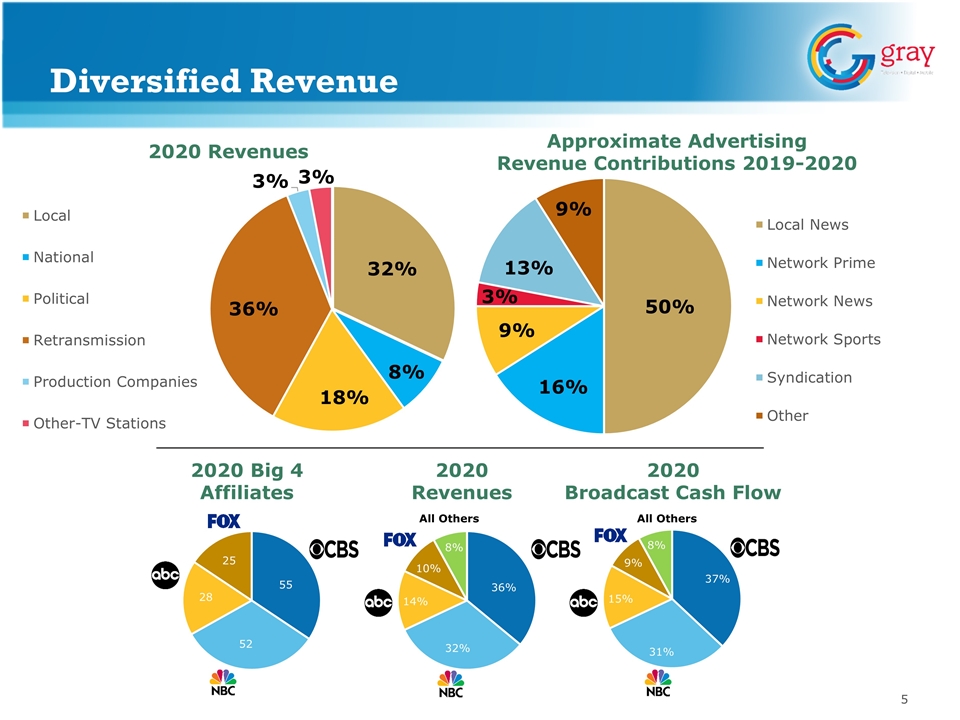

Diversified Revenue 2020 Big 4 Affiliates 2020 Revenues 2020 Broadcast Cash Flow All Others All Others 50% 9% 16%

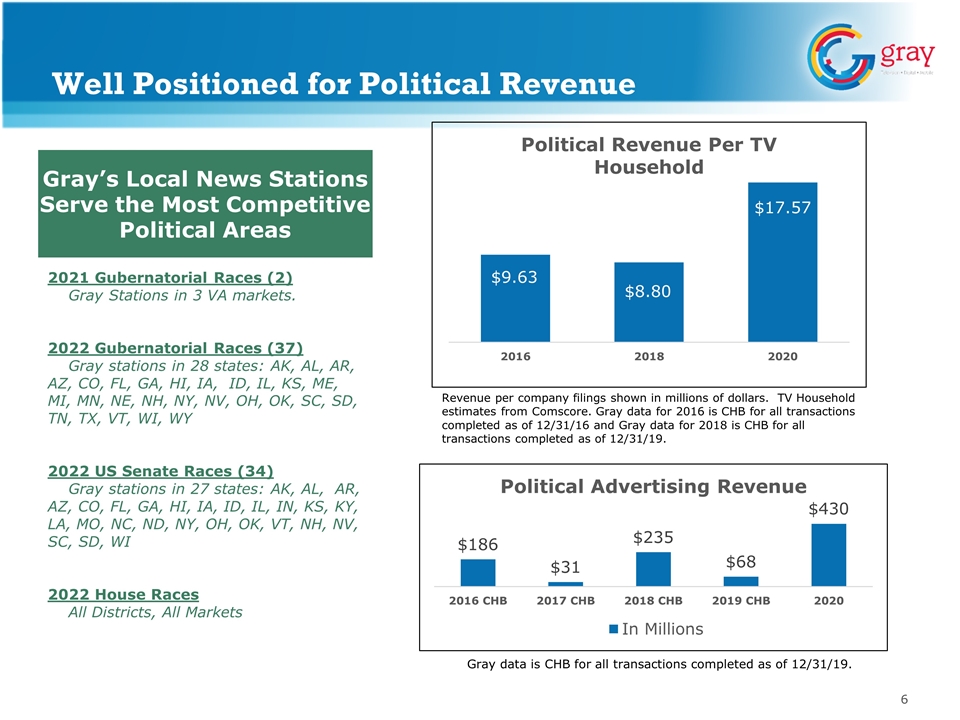

Well Positioned for Political Revenue 2021 Gubernatorial Races (2) Gray Stations in 3 VA markets. 2022 Gubernatorial Races (37) Gray stations in 28 states: AK, AL, AR, AZ, CO, FL, GA, HI, IA, ID, IL, KS, ME, MI, MN, NE, NH, NY, NV, OH, OK, SC, SD, TN, TX, VT, WI, WY 2022 US Senate Races (34) Gray stations in 27 states: AK, AL, AR, AZ, CO, FL, GA, HI, IA, ID, IL, IN, KS, KY, LA, MO, NC, ND, NY, OH, OK, VT, NH, NV, SC, SD, WI 2022 House Races All Districts, All Markets Gray’s Local News Stations Serve the Most Competitive Political Areas Revenue per company filings shown in millions of dollars. TV Household estimates from Comscore. Gray data for 2016 is CHB for all transactions completed as of 12/31/16 and Gray data for 2018 is CHB for all transactions completed as of 12/31/19. Gray data is CHB for all transactions completed as of 12/31/19.

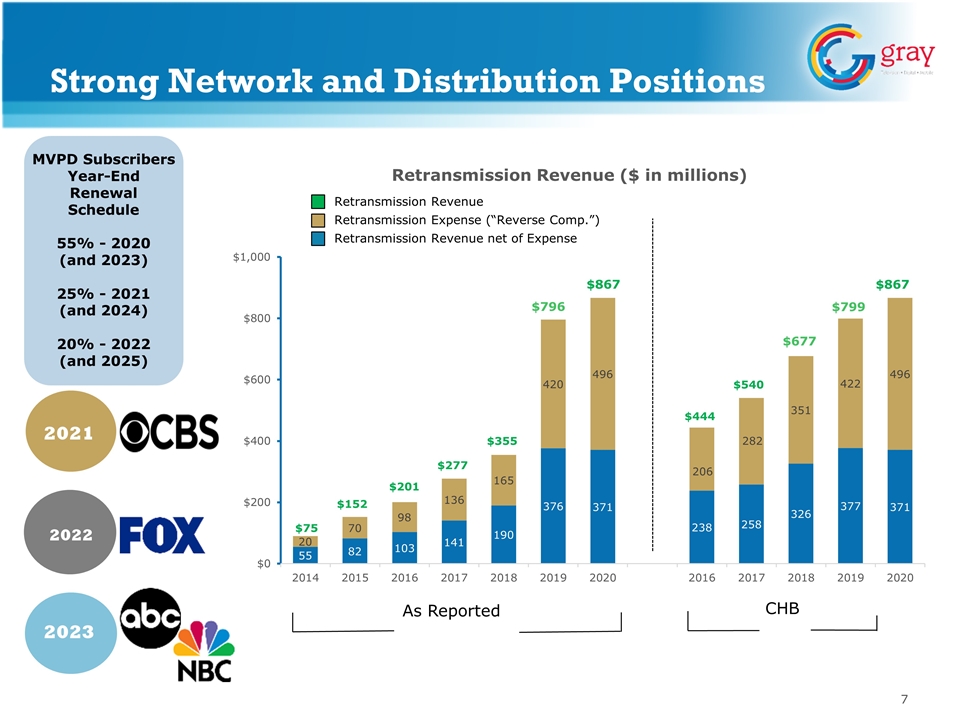

2021 2023 2022 Retransmission Revenue Retransmission Expense (“Reverse Comp.”) Retransmission Revenue net of Expense Strong Network and Distribution Positions MVPD Subscribers Year-End Renewal Schedule 55% - 2020 (and 2023) 25% - 2021 (and 2024) 20% - 2022 (and 2025) As Reported CHB $677 $796 $867

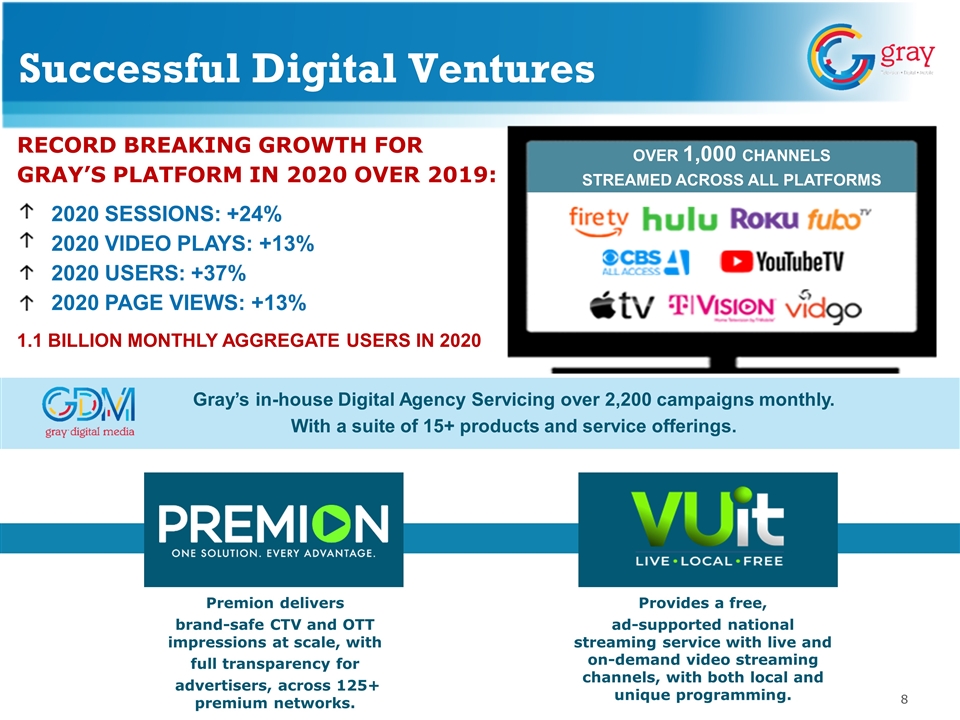

OVER 1,000 CHANNELS STREAMED ACROSS ALL PLATFORMS RECORD BREAKING GROWTH FOR GRAY’S PLATFORM IN 2020 OVER 2019: Successful Digital Ventures 2020 SESSIONS: +24% 2020 VIDEO PLAYS: +13% 2020 USERS: +37% 2020 PAGE VIEWS: +13% 1.1 BILLION MONTHLY AGGREGATE USERS IN 2020 Gray’s in-house Digital Agency Servicing over 2,200 campaigns monthly. With a suite of 15+ products and service offerings. Premion delivers brand-safe CTV and OTT impressions at scale, with full transparency for advertisers, across 125+ premium networks. Provides a free, ad-supported national streaming service with live and on-demand video streaming channels, with both local and unique programming.

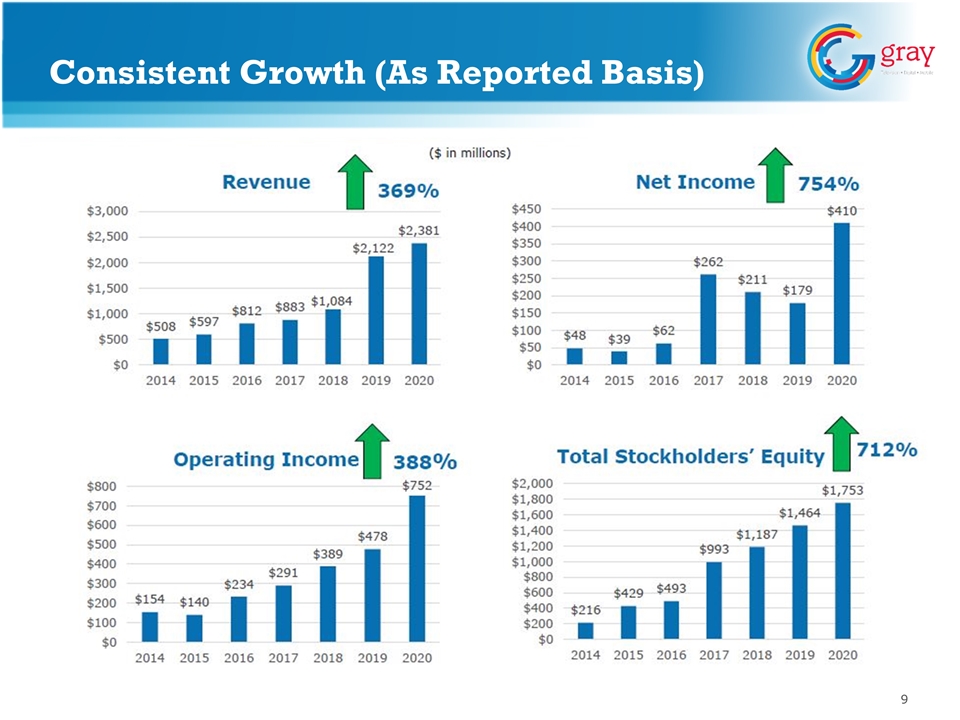

Consistent Growth (As Reported Basis)

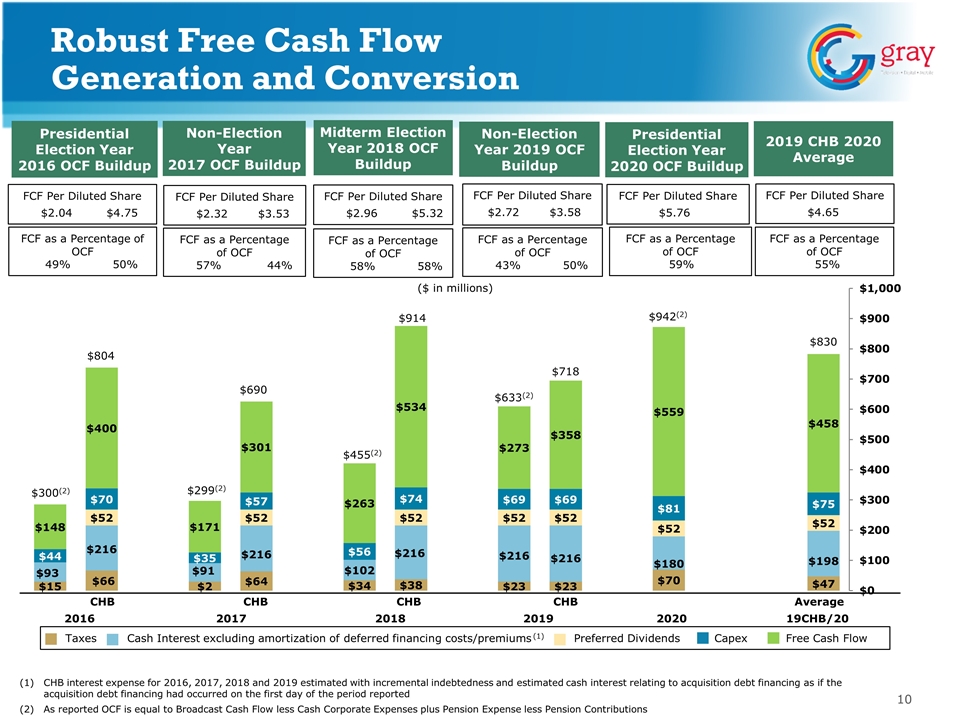

$299(2) Robust Free Cash Flow Generation and Conversion CHB interest expense for 2016, 2017, 2018 and 2019 estimated with incremental indebtedness and estimated cash interest relating to acquisition debt financing as if the acquisition debt financing had occurred on the first day of the period reported As reported OCF is equal to Broadcast Cash Flow less Cash Corporate Expenses plus Pension Expense less Pension Contributions Taxes Cash Interest excluding amortization of deferred financing costs/premiums (1) Preferred Dividends Capex Free Cash Flow $690 $455(2) $914 ($ in millions) $830 $300(2) $804 $633(2) $718 2019 CHB 2020 Average Presidential Election Year 2016 OCF Buildup FCF Per Diluted Share $2.04 $4.75 FCF as a Percentage of OCF 49% 50% Non-Election Year 2017 OCF Buildup FCF Per Diluted Share $2.32 $3.53 FCF as a Percentage of OCF 57% 44% Midterm Election Year 2018 OCF Buildup FCF Per Diluted Share $2.96 $5.32 FCF as a Percentage of OCF 58% 58% 2019 CHB 2020 Average FCF Per Diluted Share $4.65 FCF as a Percentage of OCF 55% Non-Election Year 2019 OCF Buildup FCF Per Diluted Share $2.72 $3.58 FCF as a Percentage of OCF 43% 50% Presidential Election Year 2020 OCF Buildup FCF Per Diluted Share $5.76 FCF as a Percentage of OCF 59%

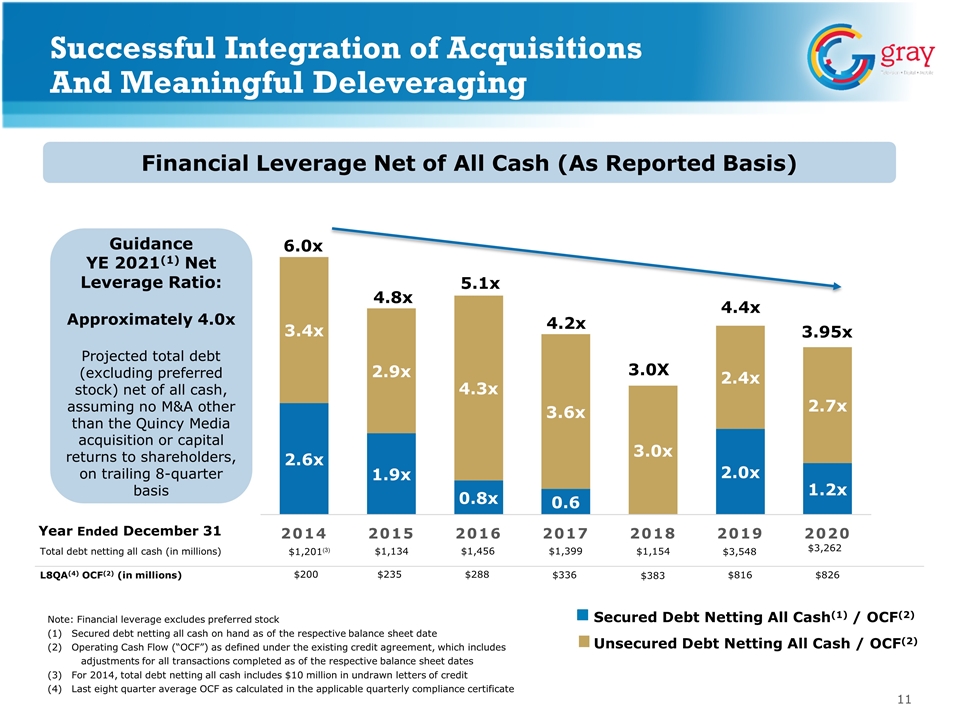

Note: Financial leverage excludes preferred stock Secured debt netting all cash on hand as of the respective balance sheet date Operating Cash Flow (“OCF”) as defined under the existing credit agreement, which includes adjustments for all transactions completed as of the respective balance sheet dates For 2014, total debt netting all cash includes $10 million in undrawn letters of credit Last eight quarter average OCF as calculated in the applicable quarterly compliance certificate Successful Integration of Acquisitions And Meaningful Deleveraging $1,134 7.1 $288 Total debt netting all cash (in millions) $1,201(3) L8QA(4) OCF(2) (in millions) $200 $235 $1,456 Year Ended December 31 $336 $1,399 $1,154 $383 Secured Debt Netting All Cash(1) / OCF(2) Unsecured Debt Netting All Cash / OCF(2) Guidance YE 2021(1) Net Leverage Ratio: Approximately 4.0x Projected total debt (excluding preferred stock) net of all cash, assuming no M&A other than the Quincy Media acquisition or capital returns to shareholders, on trailing 8-quarter basis Financial Leverage Net of All Cash (As Reported Basis) $3,262 $826 $3,548 $816

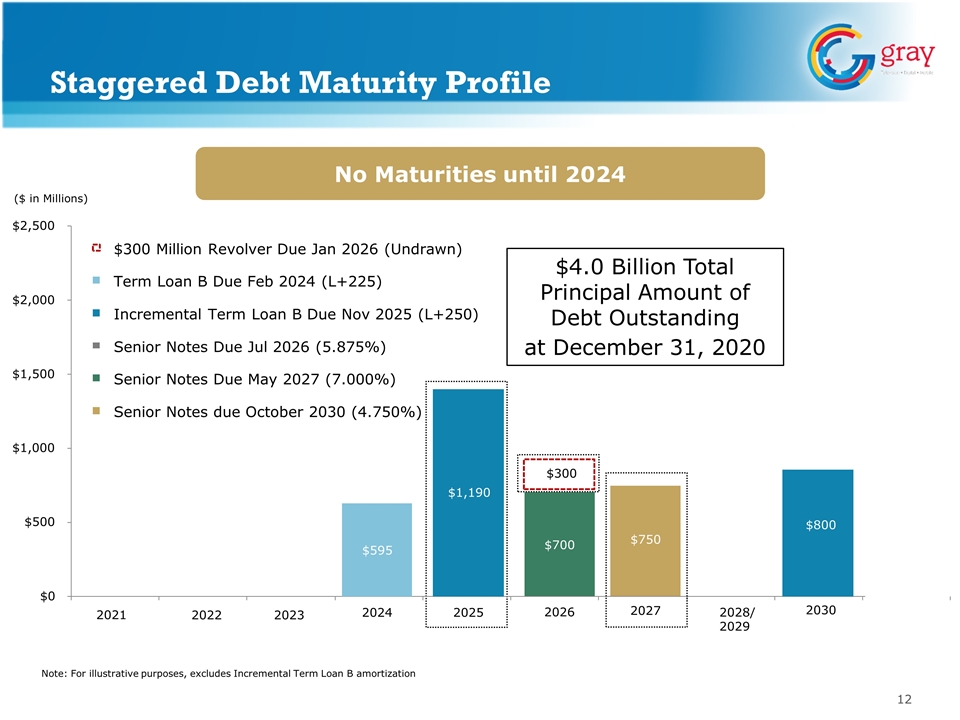

Note: For illustrative purposes, excludes Incremental Term Loan B amortization Staggered Debt Maturity Profile ($ in Millions) No Maturities until 2024 Term Loan B Due Feb 2024 (L+225) $0 $500 $1,000 $1,500 $2,000 $2,500 2021 2022 2023 $595 2024 $1,190 2025 $700 $300 2026 $300 Million Revolver Due Jan 2026 (Undrawn) Incremental Term Loan B Due Nov 2025 (L+250) Senior Notes Due Jul 2026 (5.875%) Senior Notes Due May 2027 (7.000%) Senior Notes due October 2030 (4.750%) $750 2027 $4.0 Billion Total Principal Amount of Debt Outstanding at December 31, 2020 2028/ 2029 $800 2030

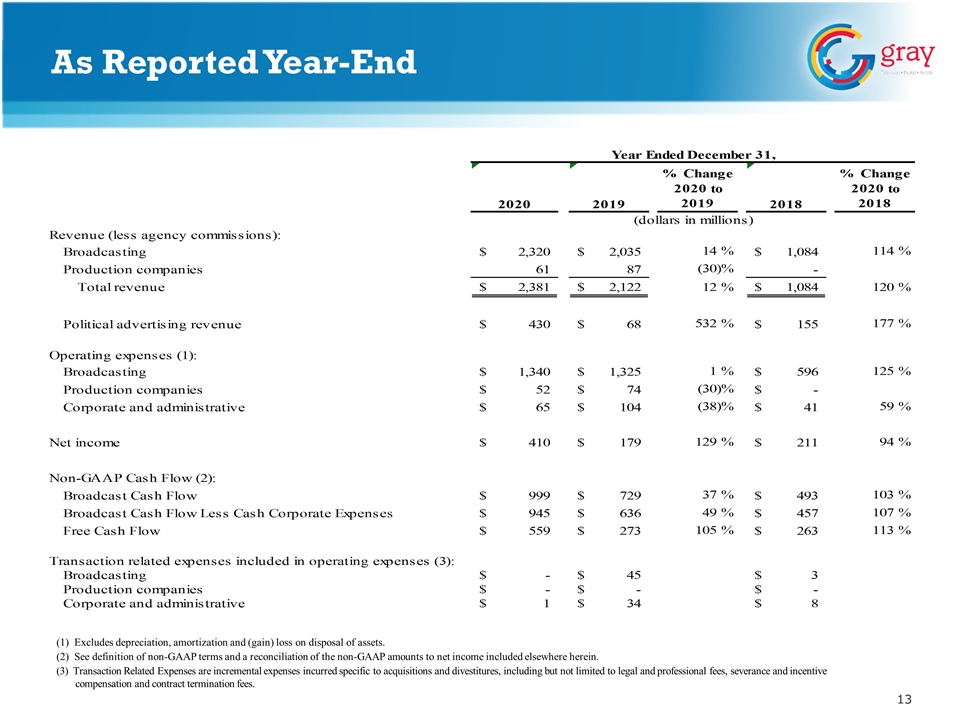

(1) Excludes depreciation, amortization and (gain) loss on disposal of assets. (2) See definition of non-GAAP terms and a reconciliation of the non-GAAP amounts to net income included elsewhere herein. (3) Transaction Related Expenses are incremental expenses incurred specific to acquisitions and divestitures, including but not limited to legal and professional fees, severance and incentive compensation and contract termination fees. As Reported Year-End

Appendix: Non-GAAP Reconciliations, Disclaimers, and Definitions

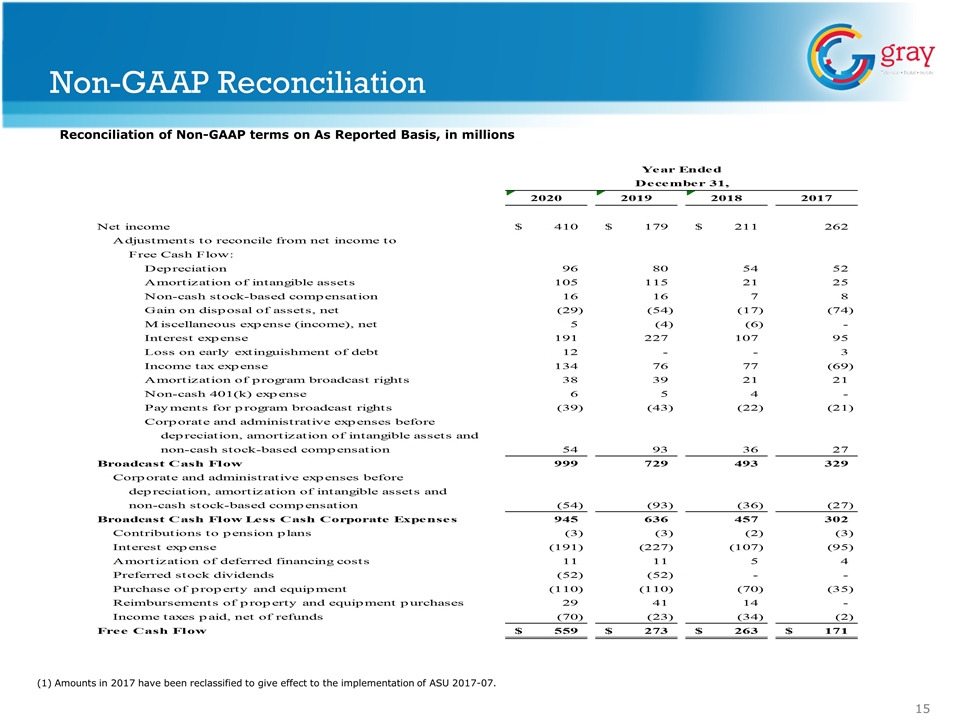

Reconciliation of Non-GAAP terms on As Reported Basis, in millions Non-GAAP Reconciliation 15 (1) Amounts in 2017 have been reclassified to give effect to the implementation of ASU 2017-07.

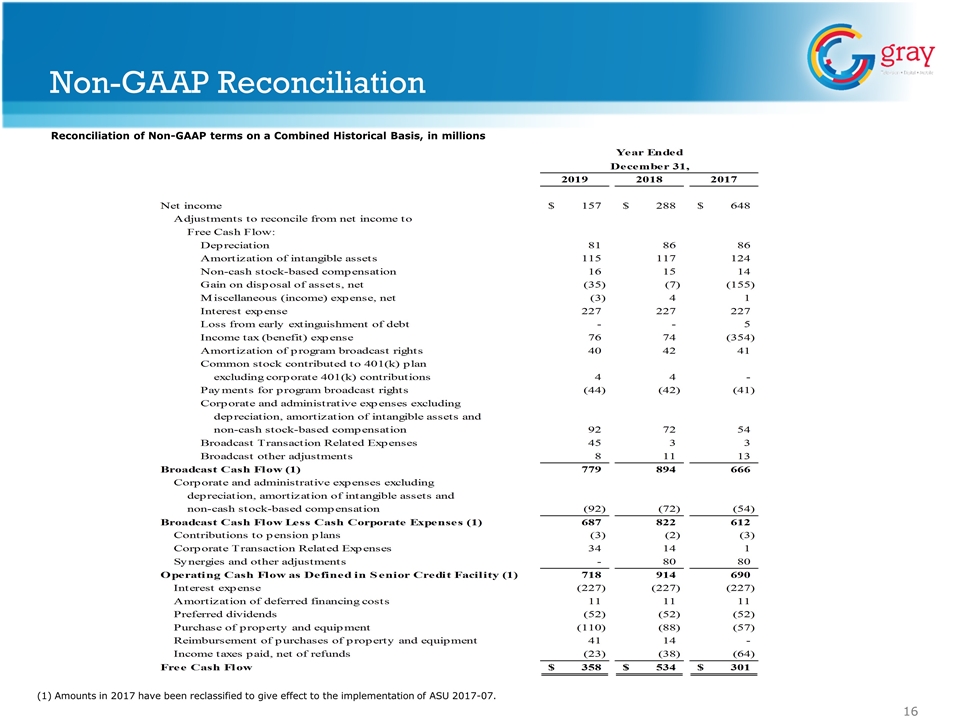

Non-GAAP Reconciliation 16 Reconciliation of Non-GAAP terms on a Combined Historical Basis, in millions (1) Amounts in 2017 have been reclassified to give effect to the implementation of ASU 2017-07.

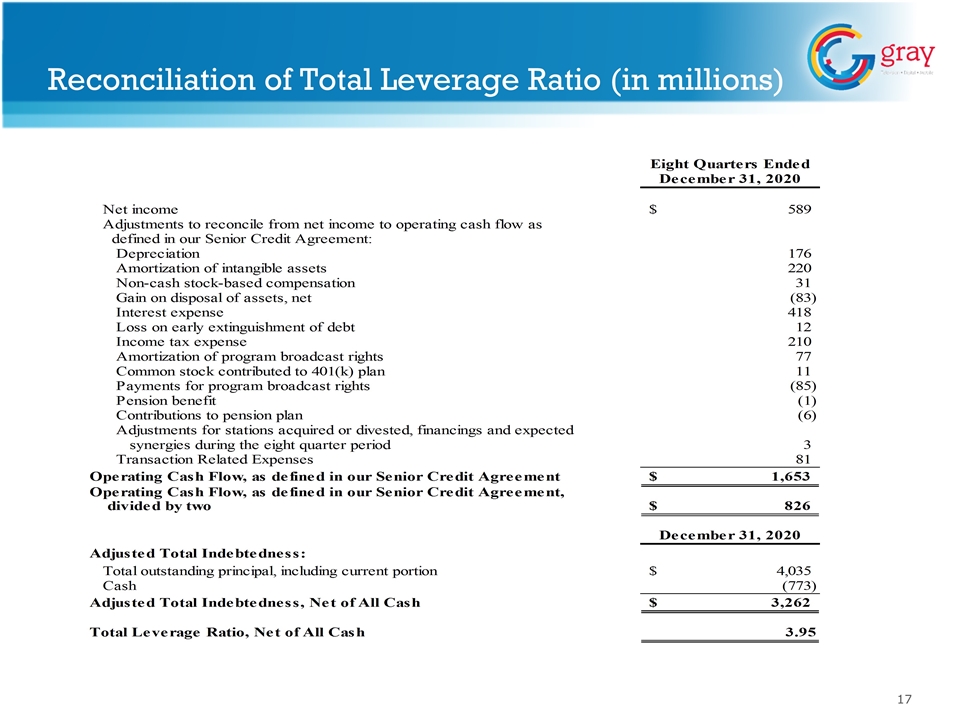

Reconciliation of Total Leverage Ratio (in millions)

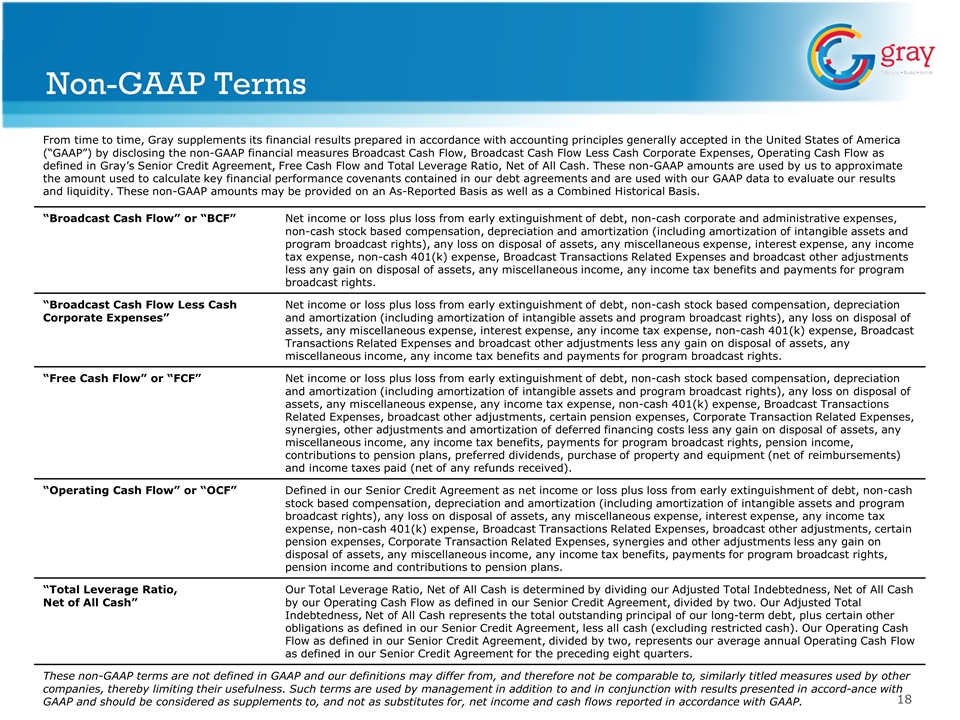

From time to time, Gray supplements its financial results prepared in accordance with accounting principles generally accepted in the United States of America (“GAAP”) by disclosing the non-GAAP financial measures Broadcast Cash Flow, Broadcast Cash Flow Less Cash Corporate Expenses, Operating Cash Flow as defined in Gray’s Senior Credit Agreement, Free Cash Flow and Total Leverage Ratio, Net of All Cash. These non-GAAP amounts are used by us to approximate the amount used to calculate key financial performance covenants contained in our debt agreements and are used with our GAAP data to evaluate our results and liquidity. These non-GAAP amounts may be provided on an As-Reported Basis as well as a Combined Historical Basis. “Broadcast Cash Flow” or “BCF” Net income or loss plus loss from early extinguishment of debt, non-cash corporate and administrative expenses, non-cash stock based compensation, depreciation and amortization (including amortization of intangible assets and program broadcast rights), any loss on disposal of assets, any miscellaneous expense, interest expense, any income tax expense, non-cash 401(k) expense, Broadcast Transactions Related Expenses and broadcast other adjustments less any gain on disposal of assets, any miscellaneous income, any income tax benefits and payments for program broadcast rights. “Broadcast Cash Flow Less Cash Corporate Expenses” Net income or loss plus loss from early extinguishment of debt, non-cash stock based compensation, depreciation and amortization (including amortization of intangible assets and program broadcast rights), any loss on disposal of assets, any miscellaneous expense, interest expense, any income tax expense, non-cash 401(k) expense, Broadcast Transactions Related Expenses and broadcast other adjustments less any gain on disposal of assets, any miscellaneous income, any income tax benefits and payments for program broadcast rights. “Free Cash Flow” or “FCF” Net income or loss plus loss from early extinguishment of debt, non-cash stock based compensation, depreciation and amortization (including amortization of intangible assets and program broadcast rights), any loss on disposal of assets, any miscellaneous expense, any income tax expense, non-cash 401(k) expense, Broadcast Transactions Related Expenses, broadcast other adjustments, certain pension expenses, Corporate Transaction Related Expenses, synergies, other adjustments and amortization of deferred financing costs less any gain on disposal of assets, any miscellaneous income, any income tax benefits, payments for program broadcast rights, pension income, contributions to pension plans, preferred dividends, purchase of property and equipment (net of reimbursements) and income taxes paid (net of any refunds received). “Operating Cash Flow” or “OCF” Defined in our Senior Credit Agreement as net income or loss plus loss from early extinguishment of debt, non-cash stock based compensation, depreciation and amortization (including amortization of intangible assets and program broadcast rights), any loss on disposal of assets, any miscellaneous expense, interest expense, any income tax expense, non-cash 401(k) expense, Broadcast Transactions Related Expenses, broadcast other adjustments, certain pension expenses, Corporate Transaction Related Expenses, synergies and other adjustments less any gain on disposal of assets, any miscellaneous income, any income tax benefits, payments for program broadcast rights, pension income and contributions to pension plans. “Total Leverage Ratio, Net of All Cash” Our Total Leverage Ratio, Net of All Cash is determined by dividing our Adjusted Total Indebtedness, Net of All Cash by our Operating Cash Flow as defined in our Senior Credit Agreement, divided by two. Our Adjusted Total Indebtedness, Net of All Cash represents the total outstanding principal of our long-term debt, plus certain other obligations as defined in our Senior Credit Agreement, less all cash (excluding restricted cash). Our Operating Cash Flow as defined in our Senior Credit Agreement, divided by two, represents our average annual Operating Cash Flow as defined in our Senior Credit Agreement for the preceding eight quarters. These non-GAAP terms are not defined in GAAP and our definitions may differ from, and therefore not be comparable to, similarly titled measures used by other companies, thereby limiting their usefulness. Such terms are used by management in addition to and in conjunction with results presented in accord-ance with GAAP and should be considered as supplements to, and not as substitutes for, net income and cash flows reported in accordance with GAAP. Non-GAAP Terms

Disclaimers, Definitions, and Non-GAAP Financial Data This presentation contains certain forward looking statements that are based largely on Gray Television, Inc.’s (“Gray”, “Gray Television”, “GTN” or the “Company”) current expectations and reflect various estimates and assumptions by Gray. These statements may be identified by words such as “estimates”, “expect,” “anticipate,” “will,” “implied,” “assume” and similar expressions. Forward looking statements are subject to certain risks, trends and uncertainties that could cause actual results and achievements to differ materially from those expressed in such forward looking statements. Such risks, trends and uncertainties which in some instances are beyond Gray’s control, include Gray’s inability to complete its pending acquisition of Quincy, on the terms and within the timeframe currently contemplated, any material regulatory or other unexpected requirements in connection therewith, or the inability to achieve expected synergies therefrom on a timely basis or at all, the impact of recently completed transactions, estimates of future retransmission revenue, future expenses and other future events therefrom on a timely basis or at all, estimates of future retransmission revenue, future expenses and other future events. Gray is subject to additional risks and uncertainties described in Gray’s quarterly and annual reports filed with the Securities and Exchange Commission from time to time, including in the “Risk Factors,” and management’s discussion and analysis of financial condition and results of operations sections contained therein. Any forward looking statements in this presentation should be evaluated in light of these important risk factors. This presentation reflects management’s views as of the date hereof. Except to the extent required by applicable law, Gray undertakes no obligation to update or revise any information contained in this presentation beyond the published date, whether as a result of new information, future events or otherwise. Combined Historical Basis reflects financial results that have been compiled by adding Gray’s historical revenue and broadcast expenses to the historical revenue and broadcast expenses of the stations acquired in the completed transactions and subtracting the historical revenues and broadcast expenses of stations divested in the completed transactions as if they had been acquired or divested, respectively, on January 1, 2016 (the beginning of the earliest period presented). Combined Historical Basis financial information does not include any adjustments for other events attributable to the completed transactions except “Broadcast Cash Flow,” “Broadcast Cash Flow Less Cash Corporate Expenses,” “Operating Cash Flow,” “Operating Cash Flow as Defined in the Senior Credit Agreement” and “Total Leverage Ratio, Net of All Cash” each give effect to expected synergies, and “Free Cash Flow” on a Combined Historical Basis gives effect to the financings and certain expected operating synergies related to the completed transactions. “Operating Cash Flow,” “Operating Cash Flow as Defined in the Senior Credit Agreement” and “Total Leverage Ratio, Net of All Cash” on a Combined Historical Basis also reflect the add-back of legal and other professional fees incurred in completing acquisitions. Certain of the Combined Historical Basis financial information has been derived from, and adjusted based on, unaudited, unreviewed financial information prepared by other entities, which Gray cannot independently verify. We cannot assure you that such financial information would not be materially different if such information were audited or reviewed and no assurances can be provided as to the accuracy of such information, or that our actual results would not differ materially from the Combined Historical Basis financial information if the completed transactions had been completed at the stated date. In addition, the presentation of Combined Historical Basis, “Broadcast Cash Flow,” “Broadcast Cash Flow Less Cash Corporate Expenses,” “Operating Cash Flow,” “Operating Cash Flow as Defined in the Senior Credit Agreement,” “Total Leverage Ratio, Net of All Cash,” “Free Cash Flow,” and the adjustments to such information, including expected synergies resulting from such transactions, may not comply with GAAP or the requirements for pro forma financial information under Regulation S-X under the Securities Act.

Gray Television, Inc. 4370 Peachtree Rd., NE Atlanta, Georgia 30319 www.gray.tv