Attached files

| file | filename |

|---|---|

| 8-K - 8-K - UNITED INSURANCE HOLDINGS CORP. | uihc-20210224.htm |

| EX-99.1 - EX-99.1 - UNITED INSURANCE HOLDINGS CORP. | exh991er31dec20.htm |

United Insurance Holdings Corporation (NASDAQ: UIHC) Investor Presentation February 24, 2021

Table of Contents 2 Content Pages Q4 2020 Supplemental Information 3-12 Strategic Overview 13-27 Cautionary Statements 28

Supplement to Fourth Quarter 2020 Results

Q4-2020 Executive Summary 4 Underlying Results Improving Reducing CAT Retentions • Core income excluding named windstorms $3.3m or $0.08/share, up $18m y/y • Underlying gross loss ratio of 21.5% improved 10.7 points y/y • Underlying combined ratio of 88.5% improved 14.6 points y/y • Ceding more premium & retaining less loss due to quota share placed at 12.31.20 • All Other Perils (AOP) CAT program retention lowered to $15m at 1.1.21 • Focused on ceding more volatility to Core CAT (hurricane) program at 6.1.21 Underwriting Actions Taken Are Significant • Additional rate increases planned in FL, LA, NC & TX • Restricted new business and allowing renewal attrition to curb overall exposure • Scheduled non-renewals targeting PML drivers to improve profitability 1 2 3 Capital Secure • RBC over 300% for all companies and holding co. liquidity remains sufficient • As direct writings are right sized to capital, quota share may be reduced over time • Allocating capital to E&S and direct-to-consumer capabilities for future growth 4 We remain optimistic about our strategy despite the unprecedented hurricane activity in 2020

Q4-2020 Results 5 Underlying results improved nearly $18m y/y excluding named storms Improvement due primarily to $33m decline in underlying loss costs Q4-20 Q4-19 Change Core income (loss) $ (58,093) $ (15,235) -281.3% per diluted share (CEPS) $ (1.35) $ (0.36) Included the following items Net current year catastrophe loss & LAE incurred $ 107,618 $ 19,248 Net (favorable) unfavorable reserve development $ (621) $ (82) Total items $ 106,997 $ 19,166 Core income (loss) excluding named windstorms $ 3,298 $ (14,544) 122.7% CEPS excluding named windstorm $ 0.08 $ (0.34) Gross underlying loss & LAE ratio 21.5% 32.1% (10.7) pts Gross expense ratio 27.2% 23.9% 3.3 pts Net loss & LAE ratio 92.6% 69.3% Net expense ratio 49.5% 44.0% Combined ratio 142.1% 113.3% 28.9 pts Net current year catastrophe loss & LAE incurred -53.9% -10.2% Net favorable (unfavorable) reserve development 0.3% 0.0% Underlying combined ratio 88.5% 103.1% (14.6) pts Named = $77.7m vs. $0.9 AOP = $29.9m vs. $18.4m $88.4m increase in CAT y/y

Results Improved Each Quarter vs. 2019 6 We have positive core earnings momentum excluding the noise from named storms +203% +475% +433% +123% $0.07 $0.21 $(0.08) $0.30 $(0.11) $0.35 $(0.34) $0.08 $(0.49) $0.94 $(0.60) $(0.40) $(0.20) $- $0.20 $0.40 $0.60 $0.80 $1.00 $1.20 Q1-19 Q1-20 Q2-19 Q2-20 Q3-19 Q3-20 Q4-19 Q4-20 FY19 FY20 Q1-19 Q1-20 Change Q2-19 Q2-20 Change Q3-19 Q3-20 Change Q4-19 Q4-20 Change FY19 FY20 Change Core income(loss) $ 3,202 $ 9,129 $ 5,927 $ (3,459) $ 8,816 $ 12,275 $ (29,222) $ (83,847) $ (54,625) $ (15,235) $ (58,093) $ (42,858) $ (46,173) $ (123,995) $ (77,822) per share $ 0.07 $ 0.21 $ 0.14 $ (0.08) $ 0.20 $ 0.28 $ (0.68) $ (1.95) $ (1.27) $ (0.36) $ (1.35) $ (1.00) $ (1.08) $ (2.89) $ (1.81) Named Storm Loss, net $ - $ - $ - $ - $ 4,207 $ 4,207 $ 24,723 $ 98,846 $ 74,123 $ 691 $ 61,392 $ 60,701 $ 25,414 $ 164,444 $ 139,029 per share $ - $ - $ - $ - $ 0.10 $ 0.10 $ 0.58 $ 2.30 $ 1.73 $ 0.02 $ 1.43 $ 1.42 $ 0.59 $ 3.83 $ 3.24 Excluding named windstorm $ 3,202 $ 9,129 $ 5,927 $ (3,459) $ 13,023 $ 16,482 $ (4,499) $ 14,999 $ 19,498 $ (14,544) $ 3,298 $ 17,842 $ (20,759) $ 40,449 $ 61,208 per share $ 0.07 $ 0.21 $ 0.14 $ (0.08) $ 0.30 $ 0.38 $ (0.11) $ 0.35 $ 0.45 $ (0.34) $ 0.08 $ 0.42 $ (0.49) $ 0.94 $ 1.43 +295%

FY-2020 Results 7 Underlying results improved over $61m y/y excluding named storms FY20 FY19 Change Core income (loss) $ (123,995) $ (46,173) -168.5% per diluted share (CEPS) $ (2.89) $ (1.08) Included the following items Net current year catastrophe loss & LAE incurred $ 294,536 $ 96,874 Net (favorable) unfavorable reserve development $ (6,786) $ 33,134 Total items $ 287,750 $ 130,008 Core income (loss) excluding named windstorms $ 40,449 $ (20,759) 294.8% CEPS excluding named windstorm $ 0.94 $ (0.49) Gross underlying loss & LAE ratio 22.8% 27.7% (4.9) pts Gross expense ratio 25.7% 26.1% (0.5) pts Net loss & LAE ratio 79.4% 66.4% Net expense ratio 47.1% 46.3% Combined ratio 126.6% 112.7% 13.9 pts Net current year catastrophe loss & LAE incurred -38.5% -12.9% Net favorable (unfavorable) reserve development 0.9% -4.4% Underlying combined ratio 88.9% 95.4% (6.5) pts Improvement due primarily to $89m decline in underlying loss costs offset by $21.7 increase in AOP CAT Named = $208.2m vs. $32.2 AOP = $86.4m vs. $64.7m $191.2m increase in CAT y/y

Controlling Expenses 8 Significant investments in people and technology have been made 28.9% 26.2% 26.1% 25.7%

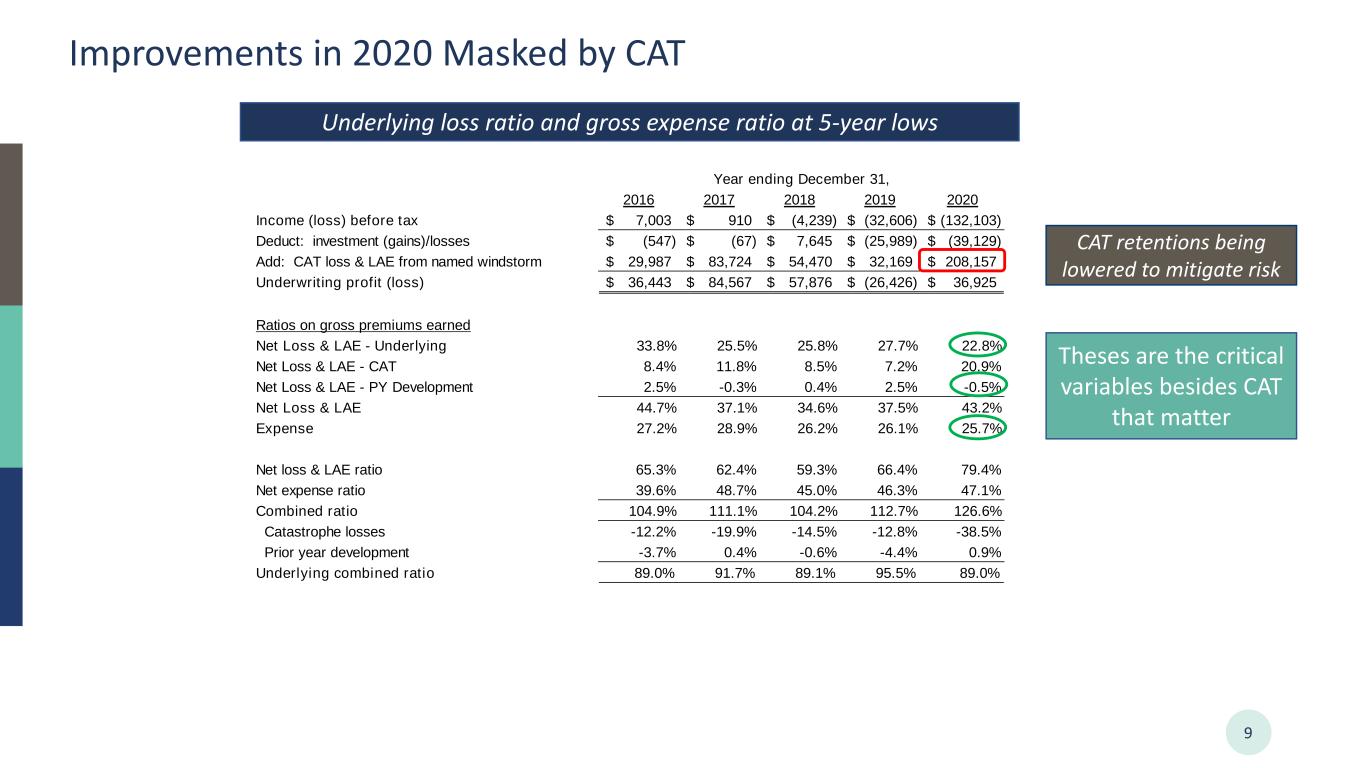

Improvements in 2020 Masked by CAT 9 Underlying loss ratio and gross expense ratio at 5-year lows 2016 2017 2018 2019 2020 Income (loss) before tax 7,003$ 910$ (4,239)$ (32,606)$ (132,103)$ Deduct: investment (gains)/losses (547)$ (67)$ 7,645$ (25,989)$ (39,129)$ Add: CAT loss & LAE from named windstorm 29,987$ 83,724$ 54,470$ 32,169$ 208,157$ Underwriting profit (loss) 36,443$ 84,567$ 57,876$ (26,426)$ 36,925$ Ratios on gross premiums earned Net Loss & LAE - Underlying 33.8% 25.5% 25.8% 27.7% 22.8% Net Loss & LAE - CAT 8.4% 11.8% 8.5% 7.2% 20.9% Net Loss & LAE - PY Development 2.5% -0.3% 0.4% 2.5% -0.5% Net Loss & LAE 44.7% 37.1% 34.6% 37.5% 43.2% Expense 27.2% 28.9% 26.2% 26.1% 25.7% Net loss & LAE ratio 65.3% 62.4% 59.3% 66.4% 79.4% Net expense ratio 39.6% 48.7% 45.0% 46.3% 47.1% Combined ratio 104.9% 111.1% 104.2% 112.7% 126.6% Catastrophe losses -12.2% -19.9% -14.5% -12.8% -38.5% Prior year development -3.7% 0.4% -0.6% -4.4% 0.9% Underlying combined ratio 89.0% 91.7% 89.1% 95.5% 89.0% Year ending December 31, Theses are the critical variables besides CAT that matter CAT retentions being lowered to mitigate risk

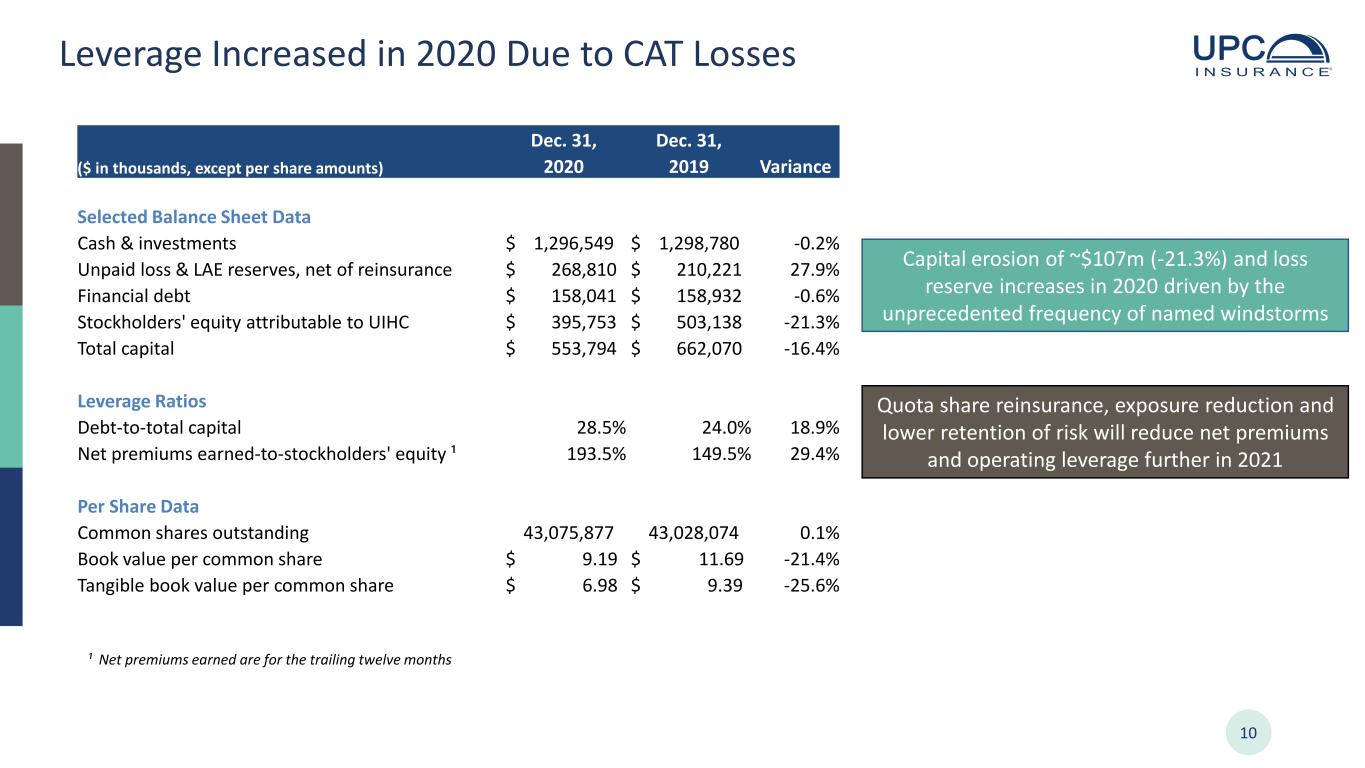

Leverage Increased in 2020 Due to CAT Losses 10 Capital erosion of ~$107m (-21.3%) and loss reserve increases in 2020 driven by the unprecedented frequency of named windstorms Quota share reinsurance, exposure reduction and lower retention of risk will reduce net premiums and operating leverage further in 2021 ¹ Net premiums earned are for the trailing twelve months Dec. 31, Dec. 31, ($ in thousands, except per share amounts) 2020 2019 Variance Selected Balance Sheet Data Cash & investments $ 1,296,549 $ 1,298,780 -0.2% Unpaid loss & LAE reserves, net of reinsurance $ 268,810 $ 210,221 27.9% Financial debt $ 158,041 $ 158,932 -0.6% Stockholders' equity attributable to UIHC $ 395,753 $ 503,138 -21.3% Total capital $ 553,794 $ 662,070 -16.4% Leverage Ratios Debt-to-total capital 28.5% 24.0% 18.9% Net premiums earned-to-stockholders' equity ¹ 193.5% 149.5% 29.4% Per Share Data Common shares outstanding 43,075,877 43,028,074 0.1% Book value per common share $ 9.19 $ 11.69 -21.4% Tangible book value per common share $ 6.98 $ 9.39 -25.6%

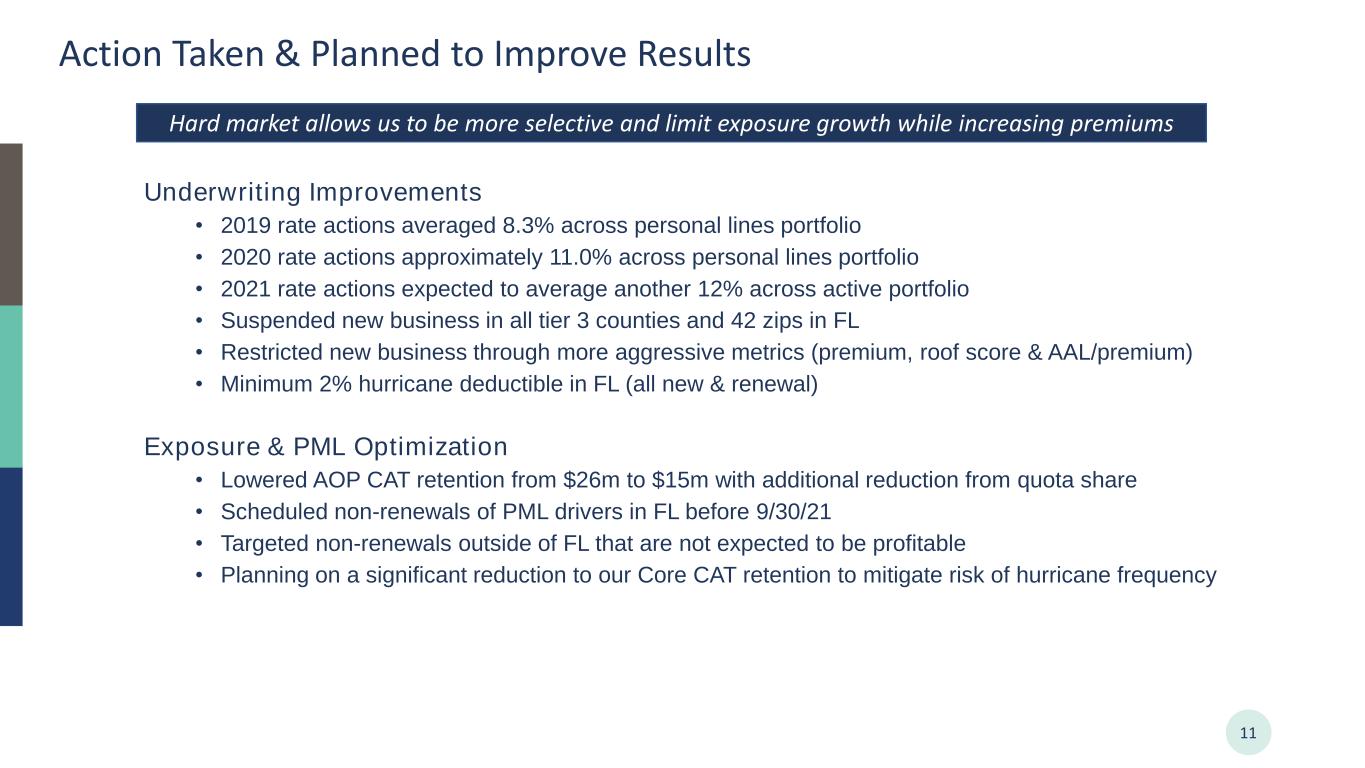

Action Taken & Planned to Improve Results 11 Hard market allows us to be more selective and limit exposure growth while increasing premiums Underwriting Improvements • 2019 rate actions averaged 8.3% across personal lines portfolio • 2020 rate actions approximately 11.0% across personal lines portfolio • 2021 rate actions expected to average another 12% across active portfolio • Suspended new business in all tier 3 counties and 42 zips in FL • Restricted new business through more aggressive metrics (premium, roof score & AAL/premium) • Minimum 2% hurricane deductible in FL (all new & renewal) Exposure & PML Optimization • Lowered AOP CAT retention from $26m to $15m with additional reduction from quota share • Scheduled non-renewals of PML drivers in FL before 9/30/21 • Targeted non-renewals outside of FL that are not expected to be profitable • Planning on a significant reduction to our Core CAT retention to mitigate risk of hurricane frequency

Exposure Management Reducing Operating Leverage 12 The renewal rights sale and underwriting action expected to also improve efficiency State Product Count Premium TIV CT HO-3 8,788 11,090,424$ 5,884,521,500$ MA DP-3, HO-3, HO-4, HO-5, HO-6 29,973 52,745,705$ 23,816,052,972$ NJ DP-3, HO-3, HO-4, HO-5, HO-6 37,098 38,071,094$ 19,192,513,401$ RI DP-3, HO-3, HO-4, HO-5, HO-6 16,586 28,095,424$ 10,148,947,391$ Sub-total NE states (16 products) 92,445 130,002,647$ 59,042,035,264$ % of total in-force at 12.31.20 14.7% 9.3% 15.7% FL DP-1, HO-4, WDP-2, WHO-2, WHO-6 6,098 9,896,503$ 1,683,627,919$ GA HO-4, HO-5, HO-6 450 251,426$ 75,347,530$ HI DP-3, HO-3, HO-4, HO-6, HU-3 2,068 1,882,007$ 1,077,023,580$ LA HO-4 562 133,269$ 17,429,880$ NC DP-3, HO-4, HO-6 2,779 1,033,360$ 189,269,553$ Sub-total active states (17 products) 11,957 13,196,565$ 3,042,698,462$ % of total in-force at 12.31.20 1.9% 0.9% 0.8% Grand Total (33 products) 104,402 143,199,212$ 62,084,733,726$ % of total in-force at 12.31.20 16.5% 10.3% 16.5% Discontinuing 17 products that are less that 1% of premium and TIV reduction > premium Renewal Rights Underwriting Action In-force data as of 12.31.2020

Strategic Overview

Company Overview 14 UPC Insurance is a specialty underwriter of catastrophe exposed property insurance in the U.S. United Insurance Holding Corp. (NASDAQ: UIHC) was founded in 1999 and is the insurance holding company for 5 P&C carriers and operating affiliates operating under the brand UPC Insurance (UPC). UPC has the #1 market share of commercial residential property insurance (commercial lines) in Florida with nearly 6,000 policies and $350 million of premium in-force. Journey Insurance Company, our AM Best rated carrier formed in partnership with Tokio Marine Kiln, has expanded our commercial underwriting capabilities into Texas and South Carolina and is poised for profitable growth. UPC’s homeowners & fire insurance products (personal lines) are now focused on New York and 6 southeastern coastal states, with roughly 536,000 policies and $900 million of premium in-force.² UIHC as of December 31, 2020 Total Assets: $2.85 billion Total Equity: $396 million Premium in-Force: $1.39 billion Employees: 473 Headquarters: St. Petersburg, FL Financial Strength Ratings: A- (Kroll) A- (AM Best) ¹ A (Demotech) 1 AM Best rating for Journey Insurance Company only 2 Excludes discontinued products & territories or where renewal rights have been sold Specialty Commercial Property Underwriters Specialty Homeowners Underwriters

Purpose & Vision 15 To serve society by offering valuable insurance protection for people’s homes against the risk of loss from natural catastrophes and other perils Our Purpose To be the premier provider of property insurance in catastrophe-exposed areas Our Vision

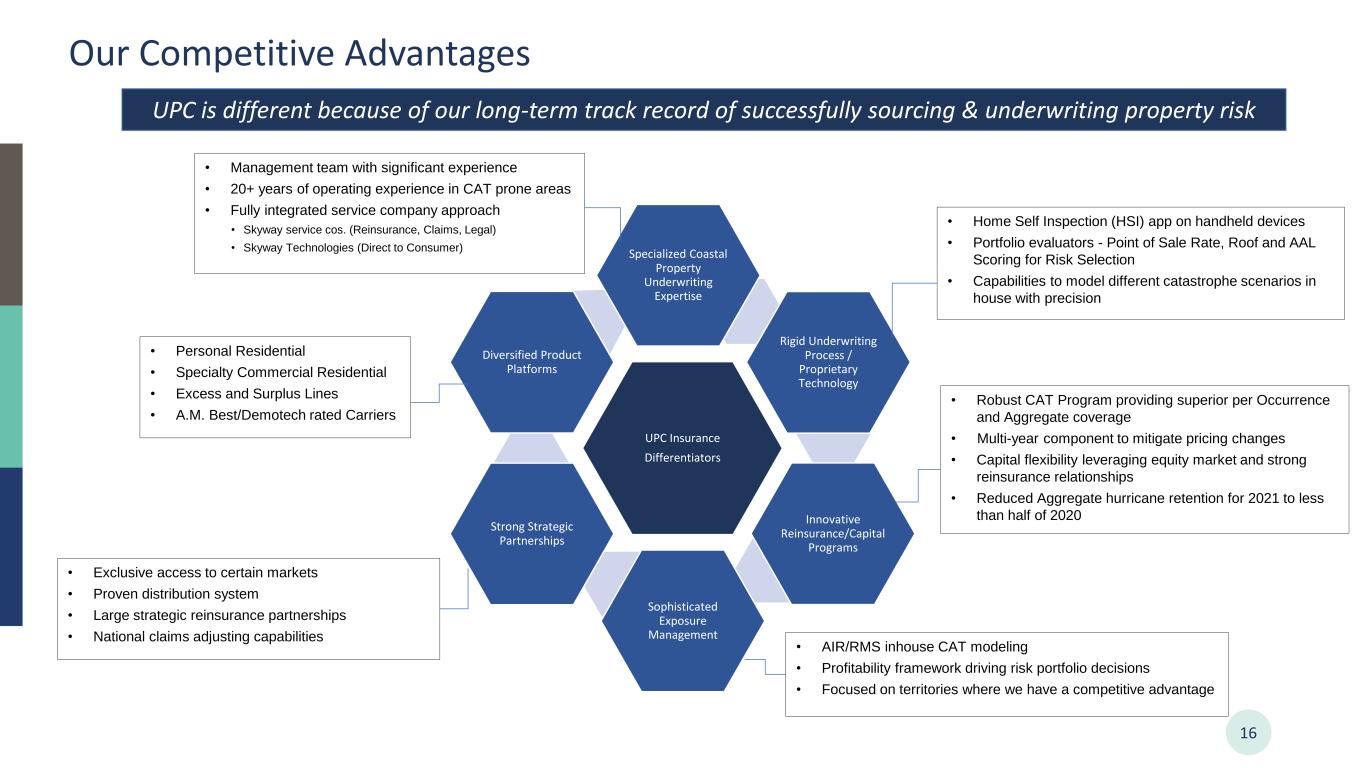

16 Our Competitive Advantages UPC is different because of our long-term track record of successfully sourcing & underwriting property risk UPC Insurance Differentiators Specialized Coastal Property Underwriting Expertise Rigid Underwriting Process / Proprietary Technology Innovative Reinsurance/Capital Programs Sophisticated Exposure Management Strong Strategic Partnerships Diversified Product Platforms • Robust CAT Program providing superior per Occurrence and Aggregate coverage • Multi-year component to mitigate pricing changes • Capital flexibility leveraging equity market and strong reinsurance relationships • Reduced Aggregate hurricane retention for 2021 to less than half of 2020 • AIR/RMS inhouse CAT modeling • Profitability framework driving risk portfolio decisions • Focused on territories where we have a competitive advantage • Personal Residential • Specialty Commercial Residential • Excess and Surplus Lines • A.M. Best/Demotech rated Carriers • Management team with significant experience • 20+ years of operating experience in CAT prone areas • Fully integrated service company approach • Skyway service cos. (Reinsurance, Claims, Legal) • Skyway Technologies (Direct to Consumer) • Exclusive access to certain markets • Proven distribution system • Large strategic reinsurance partnerships • National claims adjusting capabilities • Home Self Inspection (HSI) app on handheld devices • Portfolio evaluators - Point of Sale Rate, Roof and AAL Scoring for Risk Selection • Capabilities to model different catastrophe scenarios in house with precision

UIHC Snapshot 17 $- $200,000.0 $400,000.0 $600,000.0 $800,000.0 $1,000,000.0 $1,200,000.0 $1,400,000.0 $1,600,000.0 2018 2019 2020 Gross Premium Earned Personal Lines Commercial Lines E&S Gross Premium Revenue UPC Insurance has maintained a strong position in the personal and commercial residential property markets while growing its asset base, book value and dividend over time Cash & Invested Assets Book Value per Share ($ in ‘000s) ($ in ‘000s) Dividend per Share 9% CAGR 6% CAGR

Our Strategy to Create Shareholder Value 18 o Rates – increased focus, rigid schedule, and pro-active approach to stay ahead of trends o Best-in-Class Risks - low frequency, with manageable and consistent severity o Underwriting rules: deductible changes, increased inspections (HSI tool) & focus on roof condition o Forms: ACV for roofs, sub-limits, disease exclusions, and appraisal language o Focus on peril of named windstorm where we have a competitive advantage o Continue to insource core insurance functions of claims adjudication and underwriting o Profitability framework designed to identify undesirable risk for non-renewal o Eliminate legacy products and territories that lack volume and/or profitability o Reduce and re-focus agency force o Continue to improve risk selection tools at the point of sale (New Business Gate) o Sunset legacy policy system technology and continue migration to Agent Connect (Duck Creek) o Establish direct-to-consumer distribution channel with Skyway Technologies o Improve predictive analytics and data science capabilities to control loss costs Focused Underwriting De-Risk and Simplify Leverage Technology

Focused Underwriting 19 • Forced ranked all policies using Profitability Framework to target non-renewal business in bottom decile by state • Robust home self inspection (HSI) process • Implementing new underwriting specific selection requirements and coverage restrictions • Point of Sale tools in place to control growth • Strong pipeline despite rigid underwriting requirements and pricing • Implemented strict thresholds in Tier 1 and 2 counties • Indefinite stoppage of new business in inland business • Average premium/policy up (23% FL,15% all states) while accepted risks down (85% FL, 80% all states) • Expecting strong double-digit renewal book rate increases to continue in 2021 New business average premium/policy up (23% FL,15% all states) while accepted risks down (85% FL, 80% all states) Significant rate increases earning into renewal book of business

De-Risk and Simplify • Exposure Reduction • Reduced geographic exposure from 12 states to 7 states • Reducing TIV through targeted non-renewals of PML drivers while increasing average premium per risk • Focus on Efficiency • Discontinued 33 of 58 products in states that lack scale and profitability (nearly 60% of products, but only 10% of premium) • Consolidation of systems and insourcing of critical functions in claims and underwriting • Agency Management • Refining commission schedules to better align with market conditions • Leveraging agency profitability and tiering to focus on further developing strategic agency partners while terminating underperformers 20 Rate changes are sticking while risk exposures are shrinking The declining trend in PML & AAL relative to premium is the best evidence that the expected underwriting profitability of the Company’s risk portfolio is improving over time

Leveraging Technology • Skyway Technologies is a newly formed InsurTech MGA that will focus on the direct-to-consumer channel • Powered by proprietary technology built around the Duck Creek Technology platform • Leveraging significant investments in systems and software that have already been made • Digital underwriting innovation • Home Self Inspection (HSI) technology – fraction of the cost and inspect every property 21 Customers will be able to easily get a quote in seconds and bind and pay for that policy within minutes. The site will utilize APIs to call the UPC API Network, interfacing directly with the CAT Insights API and APIs to Duck Creek and other external data sources for rating, rules, underwriting, payments, and forms. HSI technology allows for better Underwriting insights through extensive and cost-efficient inspections

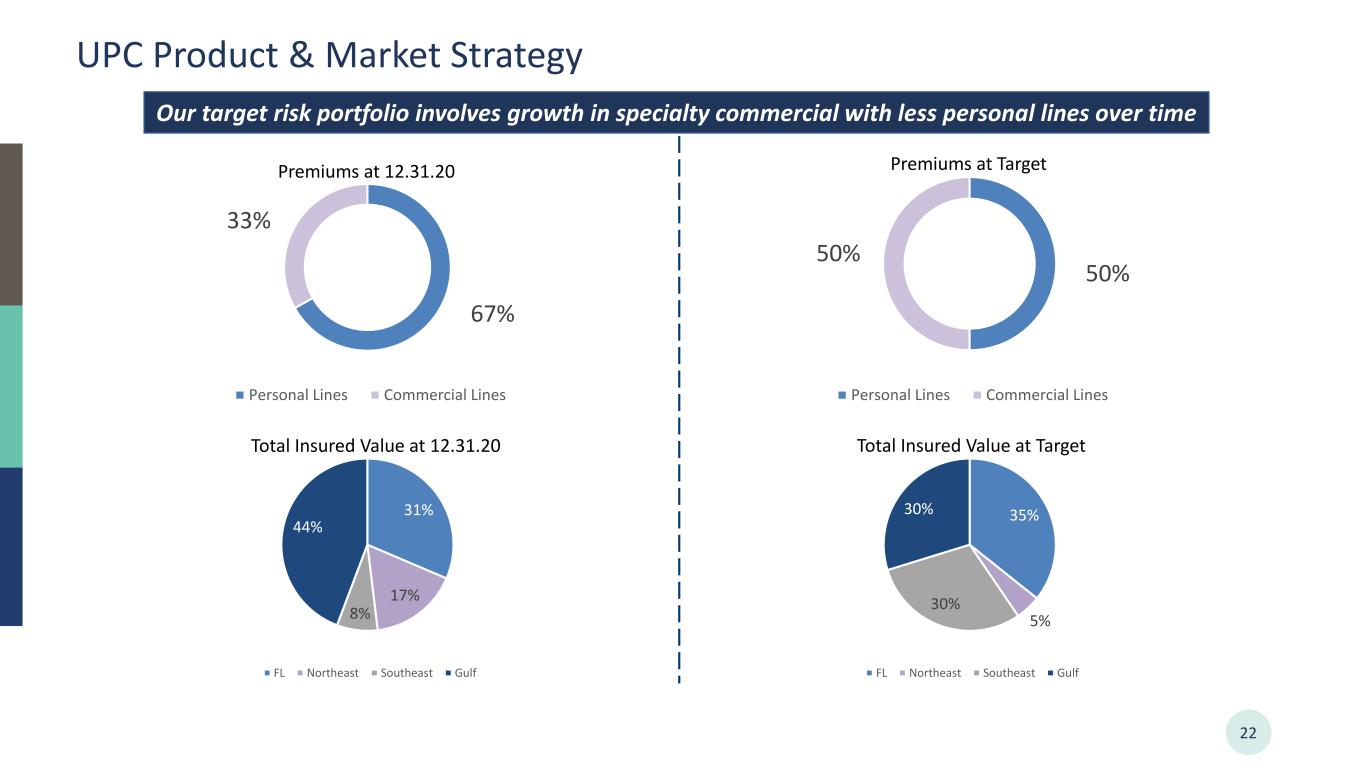

UPC Product & Market Strategy 22 Our target risk portfolio involves growth in specialty commercial with less personal lines over time 67% 33% Personal Lines Commercial Lines 50% 50% Personal Lines Commercial Lines 31% 17% 8% 44% FL Northeast Southeast Gulf Premiums at 12.31.20 Premiums at Target Total Insured Value at 12.31.20 Total Insured Value at Target 35% 5% 30% 30% FL Northeast Southeast Gulf

A Closer Look at Underlying Results 23 Specialty commercial residential property maintained its earning power in 2020 despite record named storm activity and is well positioned to grow in the current hard market A key component of UPC’s product strategy is to unlock the profit potential in Commercial Residential 2020 Core Income(Loss) by Line 2020 Core Income(Loss) by Line – excluding named windstorms Personal lines underwriting profitability is expected to improve over time due to underwriting actions, approved rate increases, exposure reductions and lower CAT retentions Note: E&S business above represents business assumed through our Blueline captive insurance arrangements which are in runoff

Developing Direct E&S Underwriting Capabilities 24 UIHC is forming a new E&S carrier named Journey Specialty Insurance Company UIHC maintains its 66.7% ownership Journey Specialty Insurance Company ¹ (E&S) Journey Insurance Company (Admitted) Tokio Marine maintains its 33.3% non- controlling interest Journey Insurance Holdings ¹ Pooling Agreement The capital of Journey Insurance Company is being bi-furcated to provide us admitted and E&S capabilities to optimize capital allocation, maintain our A.M. Best rating and grow our specialty commercial property business Assumed E&S premiums written historically through Blueline (via quota share reinsurance) have been placed into run-off as we seek to access the risk directly through our own platform where we have more control and lower costs ¹ New entities being formed/domiciled in Delaware

Commercial Underwriting Approach is Unique 25 Underwriting Expertise • Underwriters average 17+ years in industry • Teams organized around product specialization Large Capacity • $300 million CAT capacity per risk transaction. AmRisc provides a single "Basket of Securities" solution to meet the coverage needs of agents and policyholders with up to $2.5 billion TIV • Leverage capacity of several A-rated carriers, which provides policyholders with the coverage and capacity they need on a single policy (shared and layered approach to spread risk) Proprietary Modeling Techniques • Utilize a combination of commercially available modeling systems (RMS and AIR) and internal state-of- the-art processing system • Unparalleled evaluation of secondary characteristics through creation of the industry-leading AmRisc statement of values (SOV) Advanced Reporting Capabilities • Utilize proprietary processing system (RiscTrack) to execute portfolio PML management • A technical model price and return on capital is calculated to price each individual risk • Tracking market trends such as rate movements, coverages and deductibles to respond quickly throughout the cycle AmRisc, UPC’s cornerstone underwriting partner, is an industry leading underwriter of specialty commercial property in the U.S.

Compelling Case for UIHC 26 Underlying fundamentals, enhanced by new strategic initiatives, expected to grow book value over time Factors supporting UIHC value proposition include: ✓ Strong product demand in a hard market ✓ Proprietary risk analytics/selection/underwriting tools ✓ Shifting toward higher margin specialty commercial E&S property ✓ Approved double digit rate increases earning into current book ✓ Skyway Technologies launching direct-to-consumer channel in 2021 ✓ Volatility addressed by higher rates, portfolio management and a more conservative risk retention position over time As of February 23, 2020, UIHC stock closed at $5.62 (0.61 P/B) down over 40% in the last 12 months. UIHC’s average P/B market multiple of 1.21 since becoming a public company in 2008 indicates significant upside potential UIHC price-to-book is currently well below long-term average of 1.2x

Final Thoughts 27 Hard market in property expected for at least 2-3 years Reduction in net premium risk expected to improve capital adequacy Much lower CAT retentions expected to limit downside Growth in E&S commercial property expected to improve returns on capital UIHC’s valuation may be near the bottom of the cycle Underwriting profitability is now our #1 priority

Cautionary Statements 28 This presentation contains "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995. These forward looking statements include expectations regarding our diversification, growth opportunities, retention rates, liquidity, investment returns and our ability to meet our investment objectives and to manage and mitigate market risk with respect to our investments. These statements are based on current expectations, estimates and projections about the industry and market in which we operate, and management's beliefs and assumptions. Without limiting the generality of the foregoing, words such as "may," "will," "expect," "endeavor," "project," "believe," "anticipate," "intend," "could," "would," "estimate," or "continue" or the negative variations thereof, or comparable terminology, are intended to identify forward-looking statements. Forward-looking statements are not guarantees of future performance and involve certain known and unknown risks and uncertainties that could cause actual results to differ materially from those expressed or implied by such statements. The risks and uncertainties include, without limitation: the regulatory, economic and weather conditions in the states in which we operate; the impact of new federal or state regulations that affect the property and casualty insurance market; the cost, variability and availability of reinsurance; assessments charged by various governmental agencies; pricing competition and other initiatives by competitors; our ability to attract and retain the services of senior management; the outcome of litigation pending against us, including the terms of any settlements; dependence on investment income and the composition of our investment portfolio and related market risks; our exposure to catastrophic events and severe weather conditions; downgrades in our financial strength ratings; risks and uncertainties relating to our acquisitions including our ability to successfully integrate the acquired companies; and other risks and uncertainties described in the section entitled "Risk Factors" and elsewhere in our filings with the Securities and Exchange Commission (the "SEC"), including our Annual Report in Form 10-K for the year ended December 31, 2019 and 2020 once available and our Form 10-Q for the periods ending March 31, 2020, June 30, 2020 and September 30, 2020. We caution you not to place undue reliance on these forward looking statements, which are valid only as of the date they were made. Except as may be required by applicable law, we undertake no obligation to update or revise any forward-looking statements to reflect new information, the occurrence of unanticipated events, or otherwise. This presentation contains certain non-GAAP financial measures. See our earnings release, Form 10-K ,and Form 10-Q for further information regarding these non-GAAP financial measures. The information in this presentation is confidential. Any photocopying, disclosure, reproduction or alteration of the contents of this presentation and any forwarding of a copy of this presentation or any portion of this presentation to any person is prohibited.