Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Infinera Corp | infn-20210223.htm |

| EX-99.1 - EX-99.1 - Infinera Corp | infn-2232021xex991.htm |

Fourth Quarter 2020 Financial Results February 23, 2021

2 © 2021 Infinera. All rights reserved. Safe Harbor Forward-Looking Statements This presentation contains forward-looking statements, including those related to Infinera’s expectations regarding its business model, market opportunities, competition and customers; its expectations regarding the timing of its new products being available in the market; its ability to win new customers; its visibility into the performance of its business in future quarters based on the unpredictability of the macro-economic environment and the COVID-19 pandemic; and its financial outlook for the first quarter of 2021. All statements other than statements of historical fact could be deemed forward-looking, including, but not limited to, statements made about future market, financial and operating performance; statements regarding future products or technology, as well as the timing to market of any such products or technology; any statements about historical results that may suggest trends for Infinera’s business; and any statements of assumptions underlying any of the items mentioned. These statements are based on estimates and information available to Infinera at the time of this presentation and are not guarantees of future performance; actual results could differ materially from those stated or implied due to risks and uncertainties. The risks and uncertainties that could cause Infinera’s results to differ materially from those expressed or implied by such forward-looking statements include the effect of the COVID-19 pandemic on Infinera’s business, results of operations, financial condition, stock price and personnel; the effect of global and regional economic conditions on Infinera’s business, including effects on purchasing decisions by customers; Infinera’s future capital needs and its ability to generate the cash flow or otherwise secure the capital necessary to make anticipated capital expenditures; Infinera's ability to service its debt obligations and pursue its strategic plan; delays in the development and introduction of new products or updates to existing products; market acceptance of Infinera’s end-to-end portfolio; Infinera's reliance on single and limited source suppliers; fluctuations in demand, sales cycles and prices for products and services, including discounts given in response to competitive pricing pressures, as well as the timing of purchases by Infinera's key customers; the effect that changes in product pricing or mix, and/or increases in component costs, could have on Infinera’s gross margin; Infinera’s ability to respond to rapid technological changes; aggressive business tactics by Infinera’s competitors; the effects of customer consolidation; the impacts of foreign currency fluctuations; Infinera’s ability to protect its intellectual property; claims by others that Infinera infringes their intellectual property; Infinera’s ability to successfully integrate its enterprise resource planning system and other management systems; impacts of the recent change in presidential administration in the United States; war, terrorism, public health issues, natural disasters and other circumstances that could disrupt the supply, delivery or demand of Infinera's products; and other risks and uncertainties detailed in Infinera’s SEC filings from time to time. More information on potential factors that may impact Infinera’s business are set forth in its Annual Report on Form 10-K for the year ended on December 28, 2019 as filed with the SEC on March 4, 2020, and its Quarterly Report on Form 10-Q for the quarter ended September 26, 2020 as filed with the SEC on November 5, 2020, as well as subsequent reports filed with or furnished to the SEC from time to time. These reports are available on Infinera’s website at www.infinera.com and the SEC’s website at www.sec.gov. Infinera assumes no obligation to, and does not currently intend to, update any such forward-looking statements set forth in this presentation.

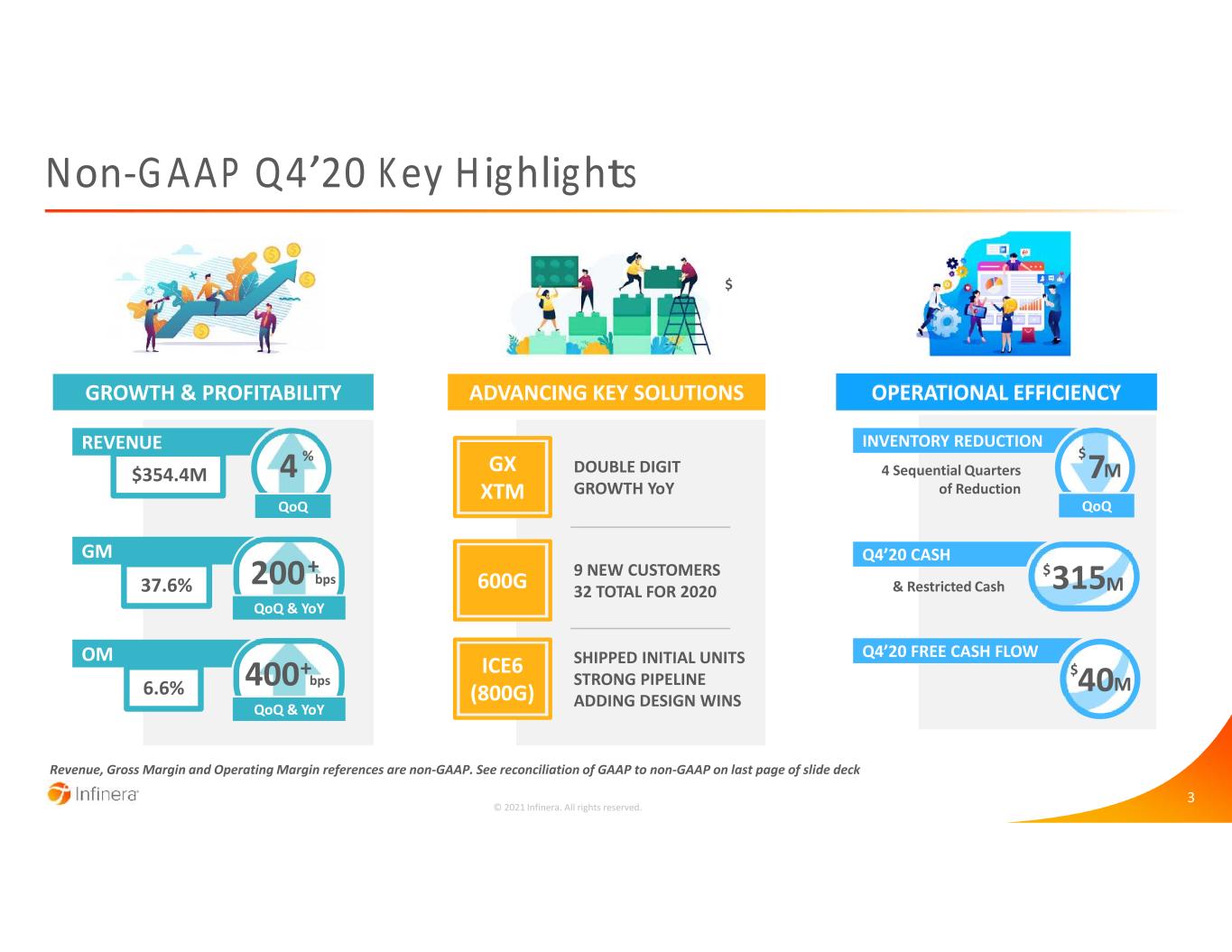

3 © 2021 Infinera. All rights reserved. GM 37.6% GROWTH & PROFITABILITY OPERATIONAL EFFICIENCYADVANCING KEY SOLUTIONS Revenue, Gross Margin and Operating Margin references are non-GAAP. See reconciliation of GAAP to non-GAAP on last page of slide deck DOUBLE DIGIT GROWTH YoY Non-GAAP Q4’20 Key Highlights $354.4M REVENUE OM 6.6% 4 % QoQ GX XTM 600G 9 NEW CUSTOMERS32 TOTAL FOR 2020 SHIPPED INITIAL UNITS STRONG PIPELINE ADDING DESIGN WINS 200 bps+ QoQ & YoY 400 bps QoQ & YoY ICE6 (800G) INVENTORY REDUCTION 7M$ QoQ Q4’20 CASH 315M$& Restricted Cash Q4’20 FREE CASH FLOW $ 40M$+ 4 Sequential Quarters of Reduction

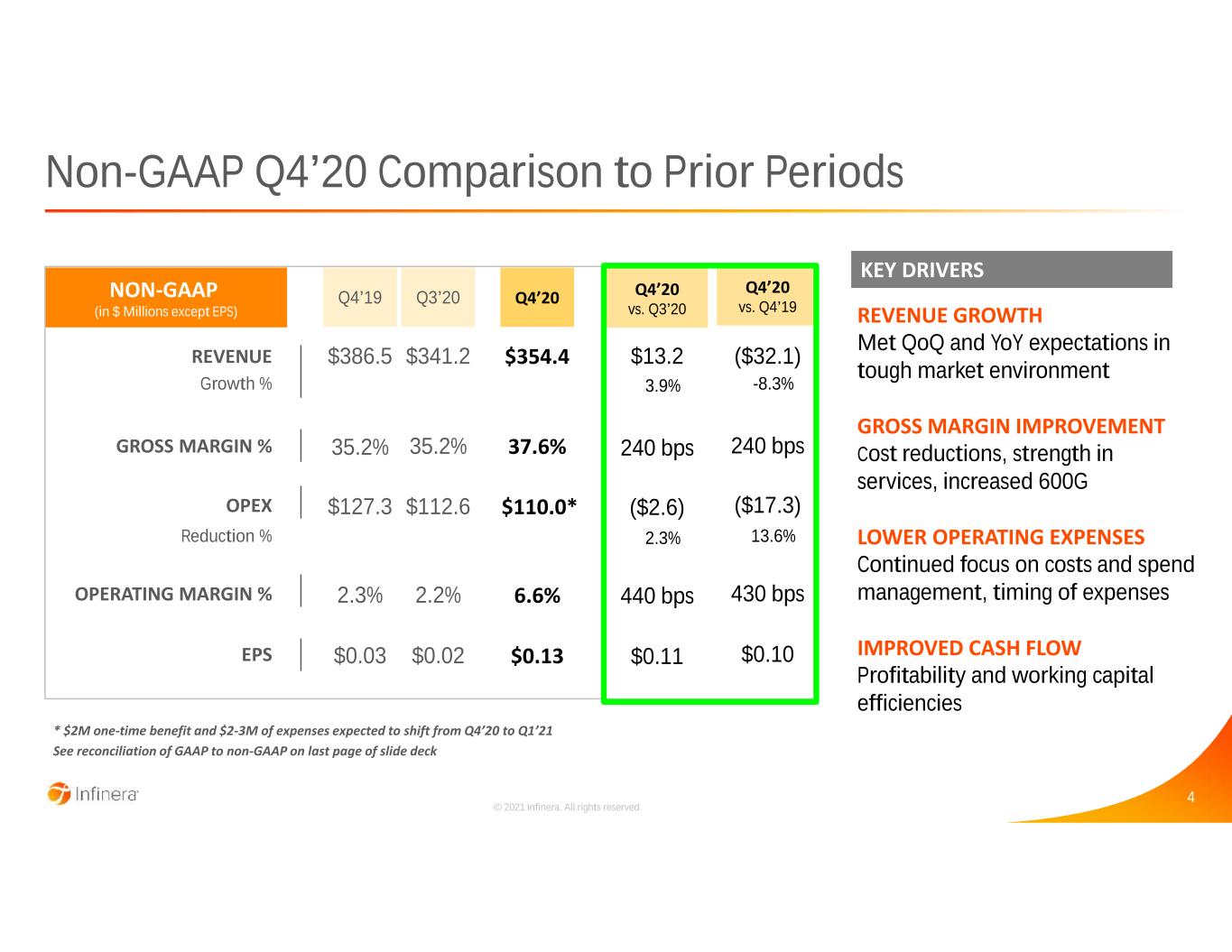

4 © 2021 Infinera. All rights reserved. Non-GAAP Q4’20 Comparison to Prior Periods * $2M one-time benefit and $2-3M of expenses expected to shift from Q4’20 to Q1’21 See reconciliation of GAAP to non-GAAP on last page of slide deck NON-GAAP (in $ Millions except EPS) REVENUE Growth % GROSS MARGIN % OPEX OPERATING MARGIN % EPS $354.4 37.6% $110.0* 6.6% $0.13 Q4’20 $386.5 35.2% $127.3 2.3% $0.03 Q4’19 $341.2 35.2% $112.6 2.2% $0.02 Q3’20 ($32.1) -8.3% 240 bps ($17.3) 430 bps $0.10 Q4’20 vs. Q4’19 $13.2 3.9% 240 bps ($2.6) 440 bps $0.11 Q4’20 vs. Q3’20 Reduction % 13.6%2.3% REVENUE GROWTH Met QoQ and YoY expectations in tough market environment GROSS MARGIN IMPROVEMENT Cost reductions, strength in services, increased 600G LOWER OPERATING EXPENSES Continued focus on costs and spend management, timing of expenses IMPROVED CASH FLOW Profitability and working capital efficiencies KEY DRIVERS

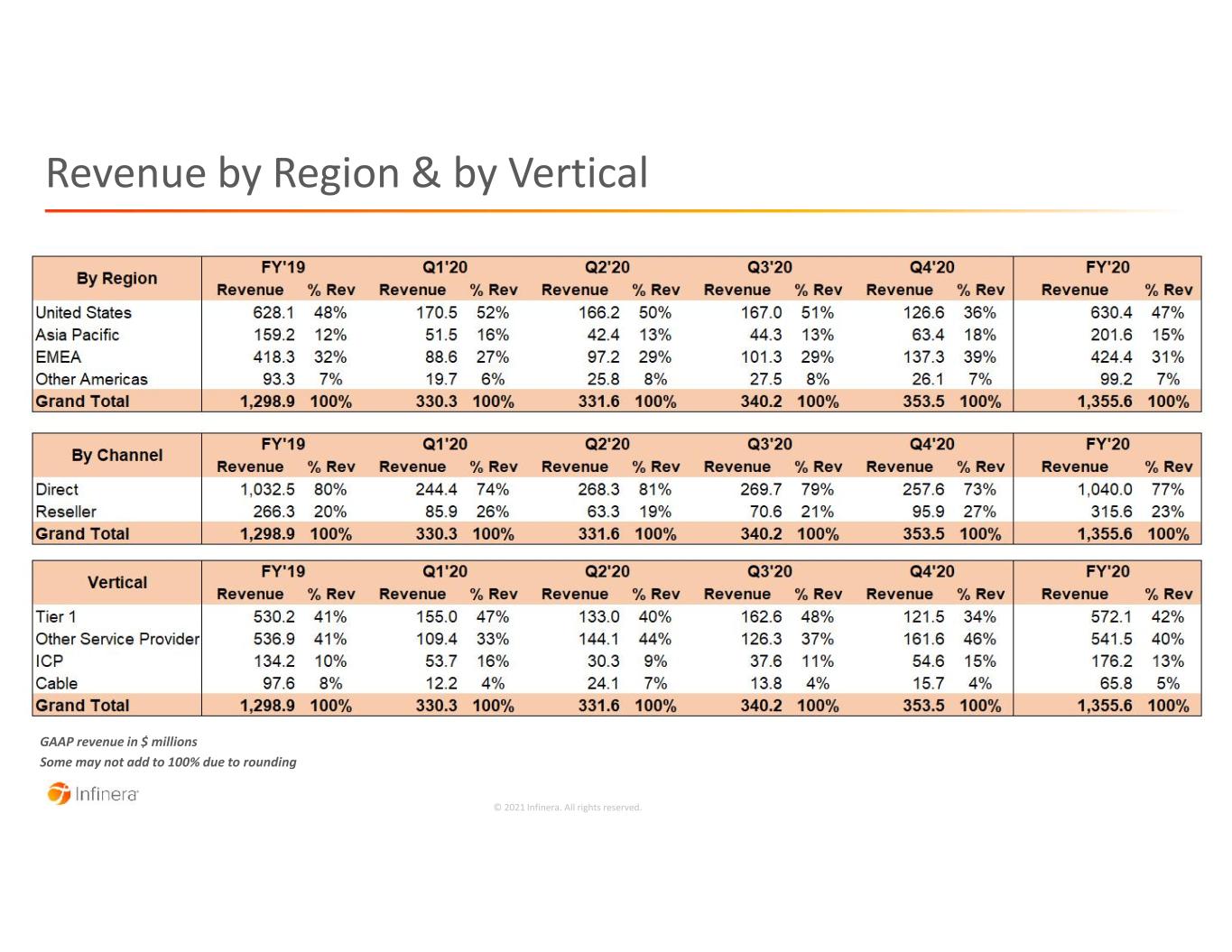

5 © 2021 Infinera. All rights reserved. Revenue by Region & by Vertical GAAP revenue in $ millions Some may not add to 100% due to rounding

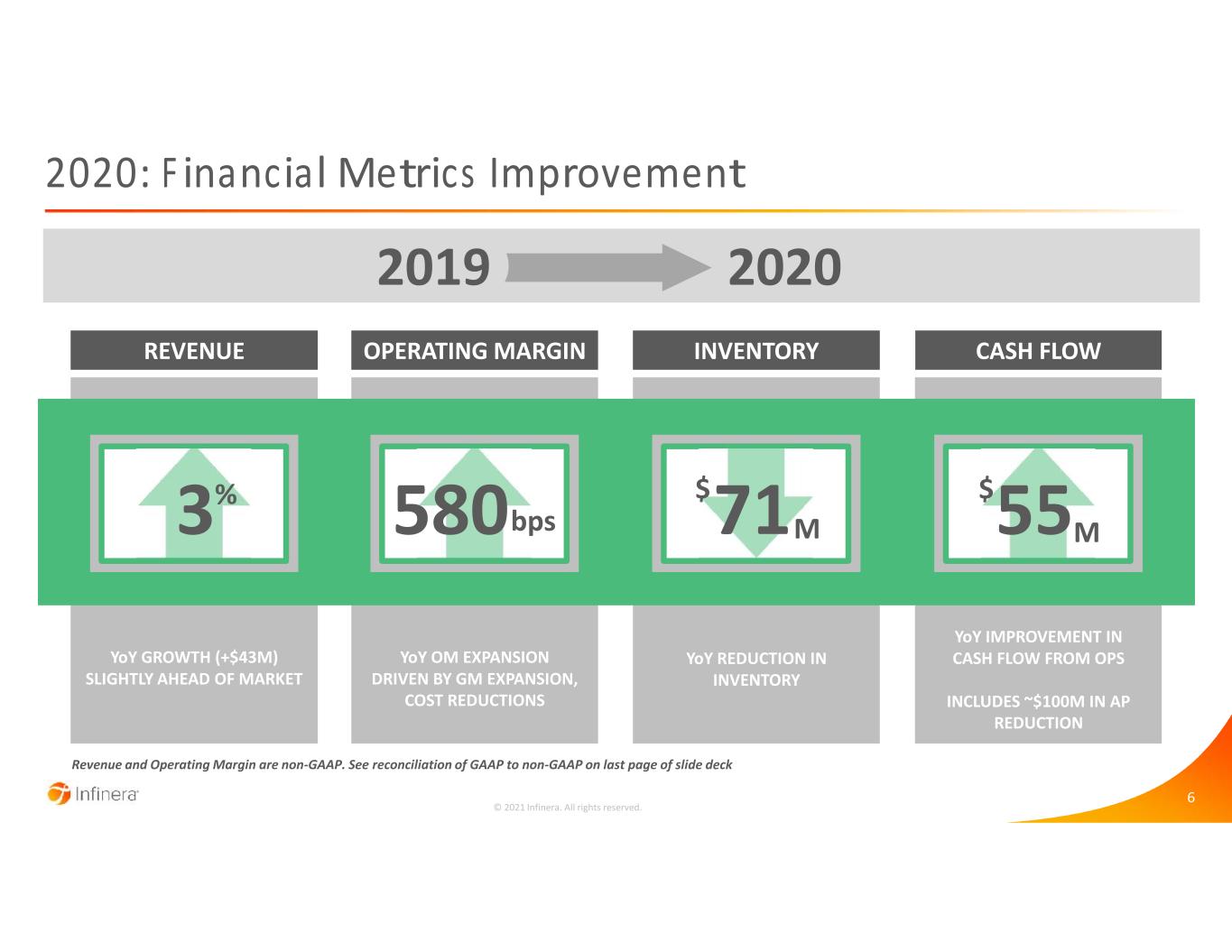

6 © 2021 Infinera. All rights reserved. REVENUE OPERATING MARGIN INVENTORY CASH FLOW 2020: Financial Metrics Improvement 20202019 YoY GROWTH (+$43M) SLIGHTLY AHEAD OF MARKET YoY OM EXPANSION DRIVEN BY GM EXPANSION, COST REDUCTIONS 580bps YoY REDUCTION IN INVENTORY 71M$ YoY IMPROVEMENT IN CASH FLOW FROM OPS INCLUDES ~$100M IN AP REDUCTION 55M$3% Revenue and Operating Margin are non-GAAP. See reconciliation of GAAP to non-GAAP on last page of slide deck

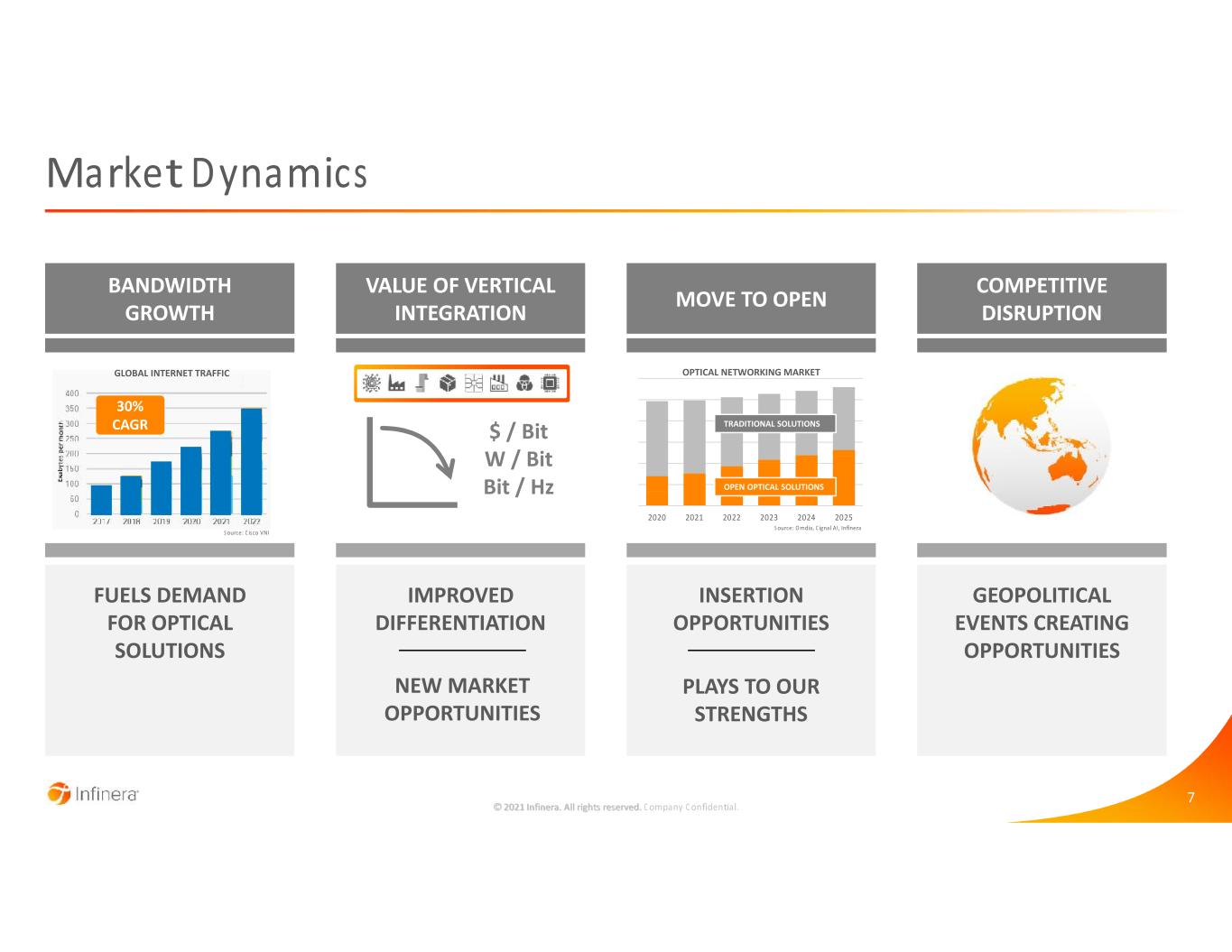

7 © 2021 Infinera. All rights reserved. 2020 2021 2022 2023 2024 2025 GEOPOLITICAL EVENTS CREATING OPPORTUNITIES COMPETITIVE DISRUPTION INSERTION OPPORTUNITIES MOVE TO OPEN IMPROVED DIFFERENTIATION VALUE OF VERTICAL INTEGRATION FUELS DEMAND FOR OPTICAL SOLUTIONS BANDWIDTH GROWTH 30% CAGR OPEN OPTICAL SOLUTIONS TRADITIONAL SOLUTIONS Company Confidential. Market Dynamics Source: Cisco VNI Source: Omdia, Cignal AI, Infinera OPTICAL NETWORKING MARKET PLAYS TO OUR STRENGTHS NEW MARKET OPPORTUNITIES GLOBAL INTERNET TRAFFIC $ / Bit W / Bit Bit / Hz

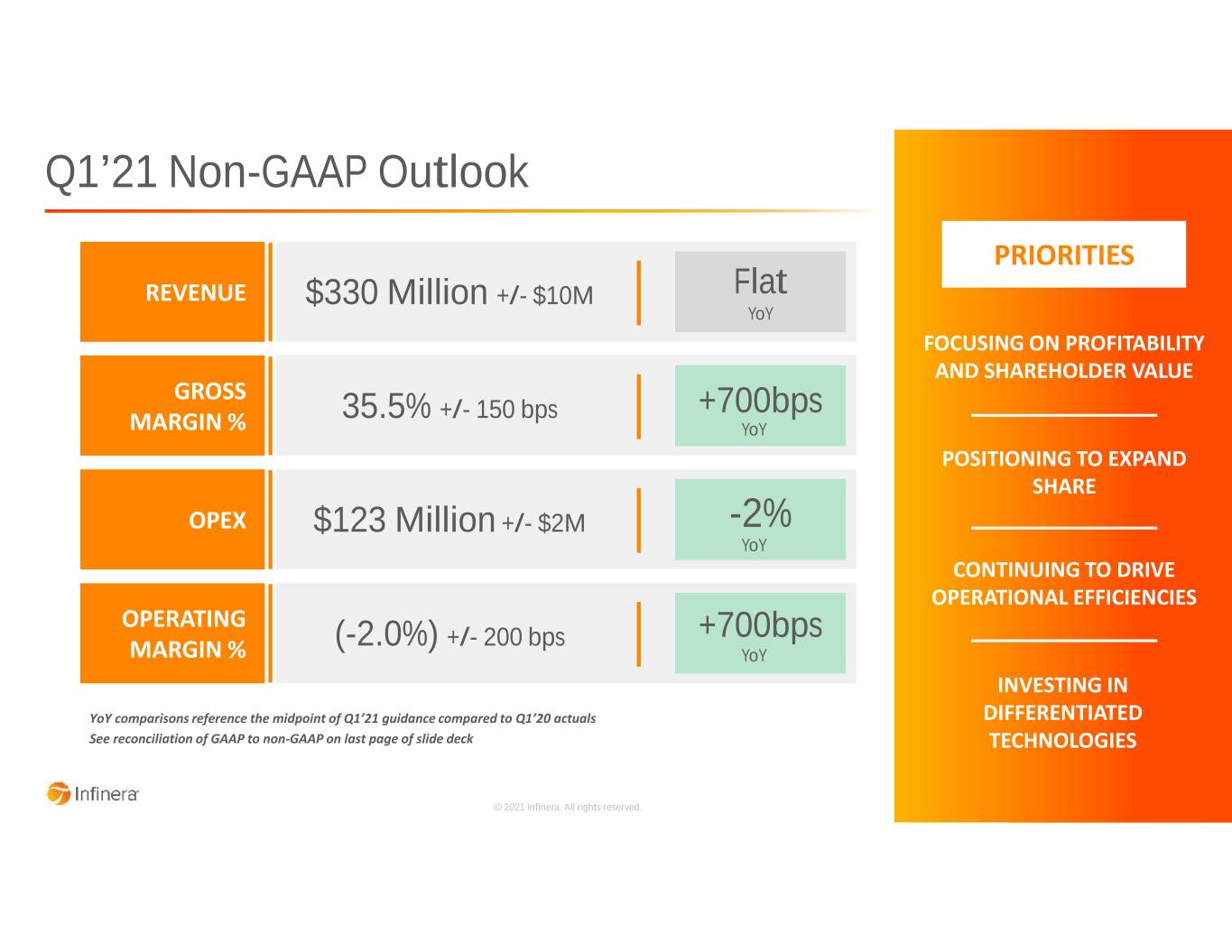

8 © 2021 Infinera. All rights reserved. Q1’21 Non-GAAP Outlook 7 PRIORITIES FOCUSING ON PROFITABILITY AND SHAREHOLDER VALUE CONTINUING TO DRIVE OPERATIONAL EFFICIENCIES INVESTING IN DIFFERENTIATED TECHNOLOGIES POSITIONING TO EXPAND SHARE YoY comparisons reference the midpoint of Q1’21 guidance compared to Q1’20 actuals See reconciliation of GAAP to non-GAAP on last page of slide deck REVENUE $330 Million +/- $10M Flat YoY OPERATING MARGIN % (-2.0%) +/- 200 bps +700bps GROSS MARGIN % 35.5% +/- 150 bps +700bps OPEX $123 Million +/- $2M -2% YoY YoY YoY

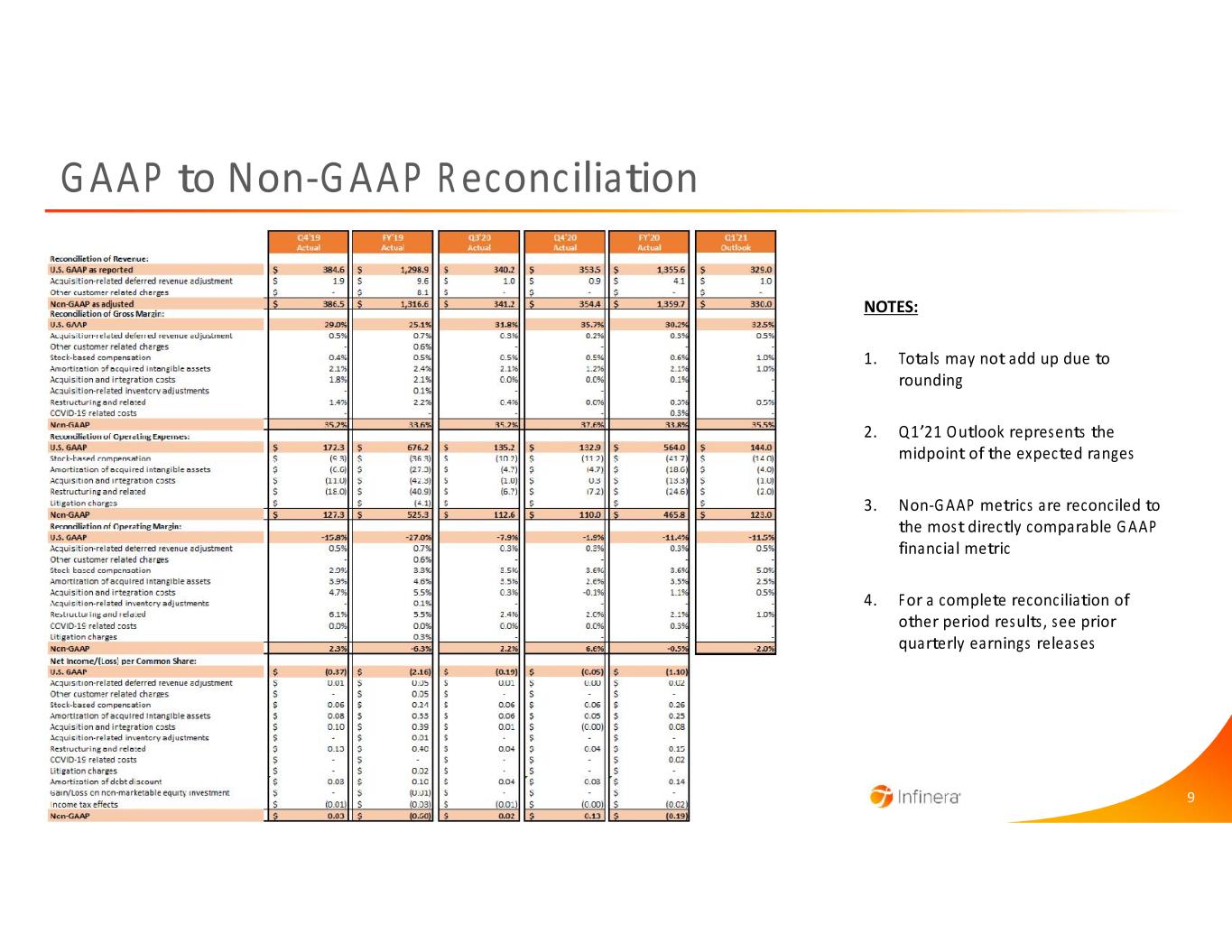

9 © 2021 Infinera. All rights reserved. NOTES: 1. Totals may not add up due to rounding 2. Q1’21 Outlook represents the midpoint of the expected ranges 3. Non-GAAP metrics are reconciled to the most directly comparable GAAP financial metric 4. For a complete reconciliation of other period results, see prior quarterly earnings releases GAAP to Non-GAAP Reconciliation

Thank You