Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 PRESS RELEASE - CB Financial Services, Inc. | a20210223ex991branchoptimi.htm |

| 8-K - 8-K - CB Financial Services, Inc. | cbfv-20210223.htm |

Moving Forward – Building a Stronger CommunityInvestor Presentation February 2021

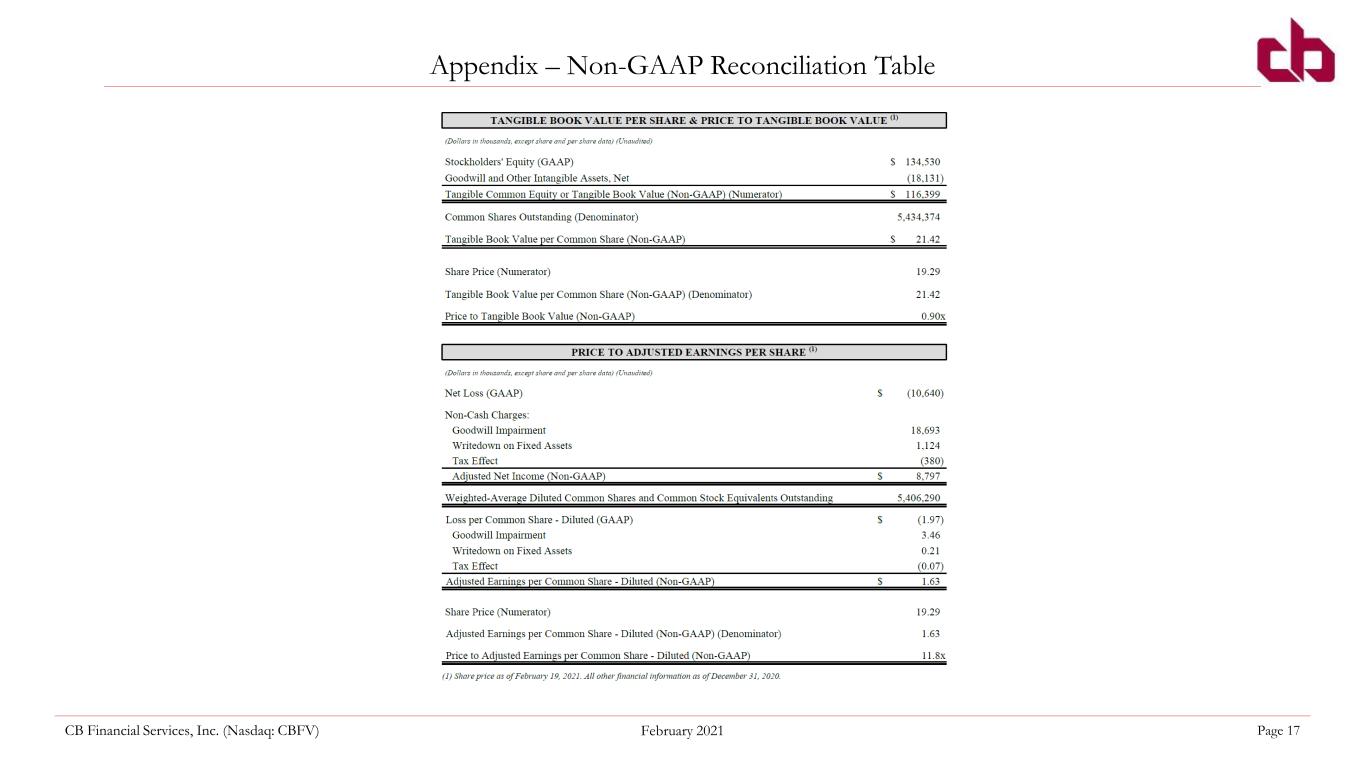

CB Financial Services, Inc. (Nasdaq: CBFV) February 2021 Page 2 Forward-Looking Statement Statements contained in this investor presentation that are not historical facts may constitute forward-looking statements as that term is defined in the Private Securities Litigation Reform Act of 1995 (the “Act”). Such forward-looking statements are subject to significant risks and uncertainties. CB Financial Services, Inc. (the “Company”) intends such forward-looking statements to be covered by the safe harbor provisions contained in the Act. The Company’s ability to predict results or the actual effect of future plans or strategies is inherently uncertain. Factors which could have a material adverse effect on the operations and future prospects of the Company and its subsidiaries include, but are not limited to, changes in market interest rates, general economic conditions, changes in federal and state regulation, actions by our competitors, loan delinquency rates, our ability to control costs and expenses, and other factors that are described in the Company’s periodic reports as filed with the Securities and Exchange Commission. These risks and uncertainties should be considered in evaluating forward-looking statements and undue reliance should not be placed on such statements. The Company assumes no obligation to update any forward-looking statement except as may be required by applicable law or regulation. Non-GAAP Financial Measures This presentation contains non-GAAP financial measures, which management believes may be helpful in understanding the Company's results of operations and financial position and when comparing results over different periods. Non-GAAP measures eliminate the impact of certain items such as intangible assets (when calculating Tangible Book Value). Non-GAAP financial measures should not be viewed as a substitute for operating results determined in accordance with GAAP, nor are they necessarily comparable to non-GAAP performance measures that may be presented by other banks and financial institutions. Please see the non-GAAP reconciliations table included in the Appendix to this investor presentation.

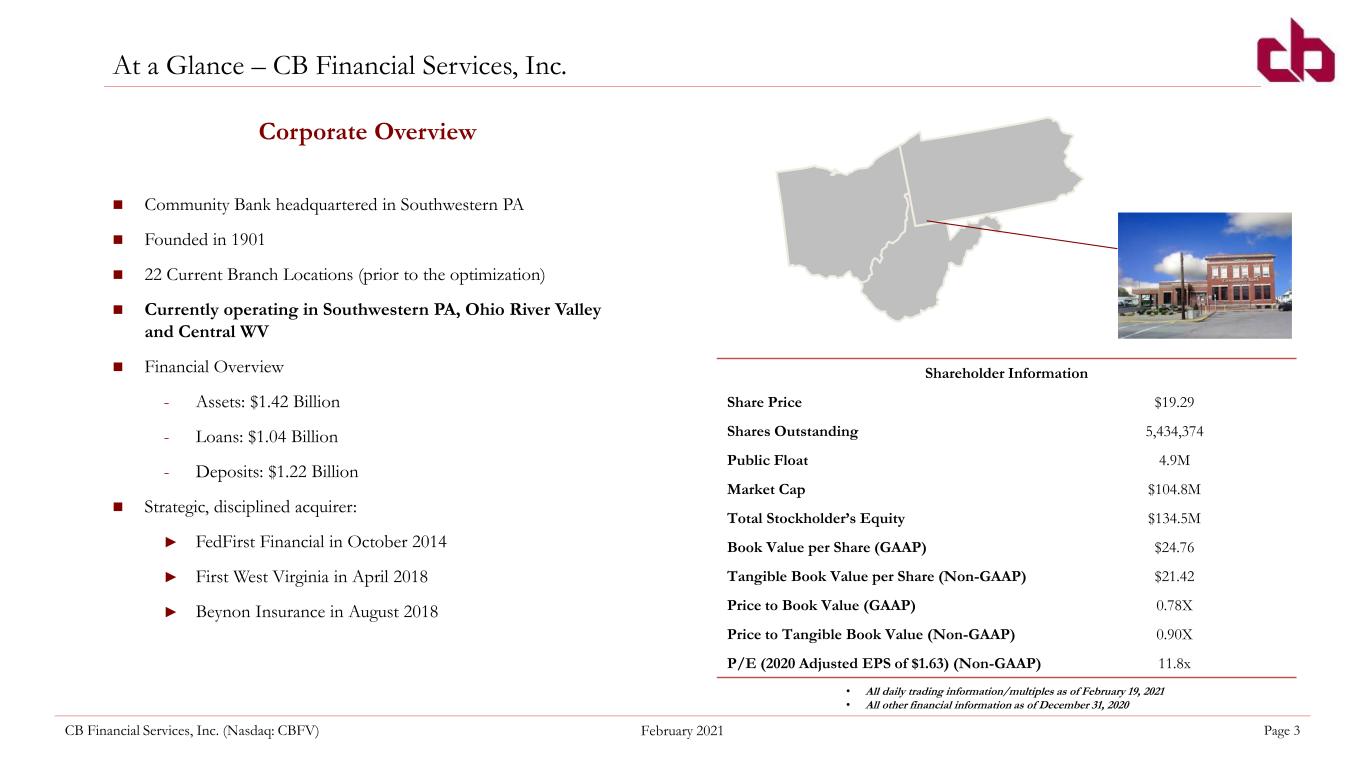

CB Financial Services, Inc. (Nasdaq: CBFV) February 2021 Page 3 At a Glance – CB Financial Services, Inc. Shareholder Information Share Price $19.29 Shares Outstanding 5,434,374 Public Float 4.9M Market Cap $104.8M Total Stockholder’s Equity $134.5M Book Value per Share (GAAP) $24.76 Tangible Book Value per Share (Non-GAAP) $21.42 Price to Book Value (GAAP) 0.78X Price to Tangible Book Value (Non-GAAP) 0.90X P/E (2020 Adjusted EPS of $1.63) (Non-GAAP) 11.8x ◼ Community Bank headquartered in Southwestern PA ◼ Founded in 1901 ◼ 22 Current Branch Locations (prior to the optimization) ◼ Currently operating in Southwestern PA, Ohio River Valley and Central WV ◼ Financial Overview - Assets: $1.42 Billion - Loans: $1.04 Billion - Deposits: $1.22 Billion ◼ Strategic, disciplined acquirer: ► FedFirst Financial in October 2014 ► First West Virginia in April 2018 ► Beynon Insurance in August 2018 Corporate Overview • All daily trading information/multiples as of February 19, 2021 • All other financial information as of December 31, 2020

CB Financial Services, Inc. (Nasdaq: CBFV) February 2021 Page 4 Diversified Business ▪ Growing presence within the Pittsburgh MSA ▪ Well positioned to serve the needs of small and medium sized businesses across our footprint ▪ Strong asset quality Commercial Banking Retail Banking & Wealth Management Mortgage Banking Insurance Brokerage ▪ Active mortgage origination platform with dedicated mortgage originators ▪ Robust housing market ▪ Expanding mortgage banking platform into legacy markets and new markets ▪ Subsidiary led by Rich Boyer, Senior Vice President – Insurance Operations & Director, a 30+ year industry veteran ▪ Continued momentum and growth following the Beynon Insurance acquisition in August 2018 ▪ Complementary to commercial and retail banking business ▪ Excellent branch coverage surrounding core Southwestern PA market ▪ Wealth management services

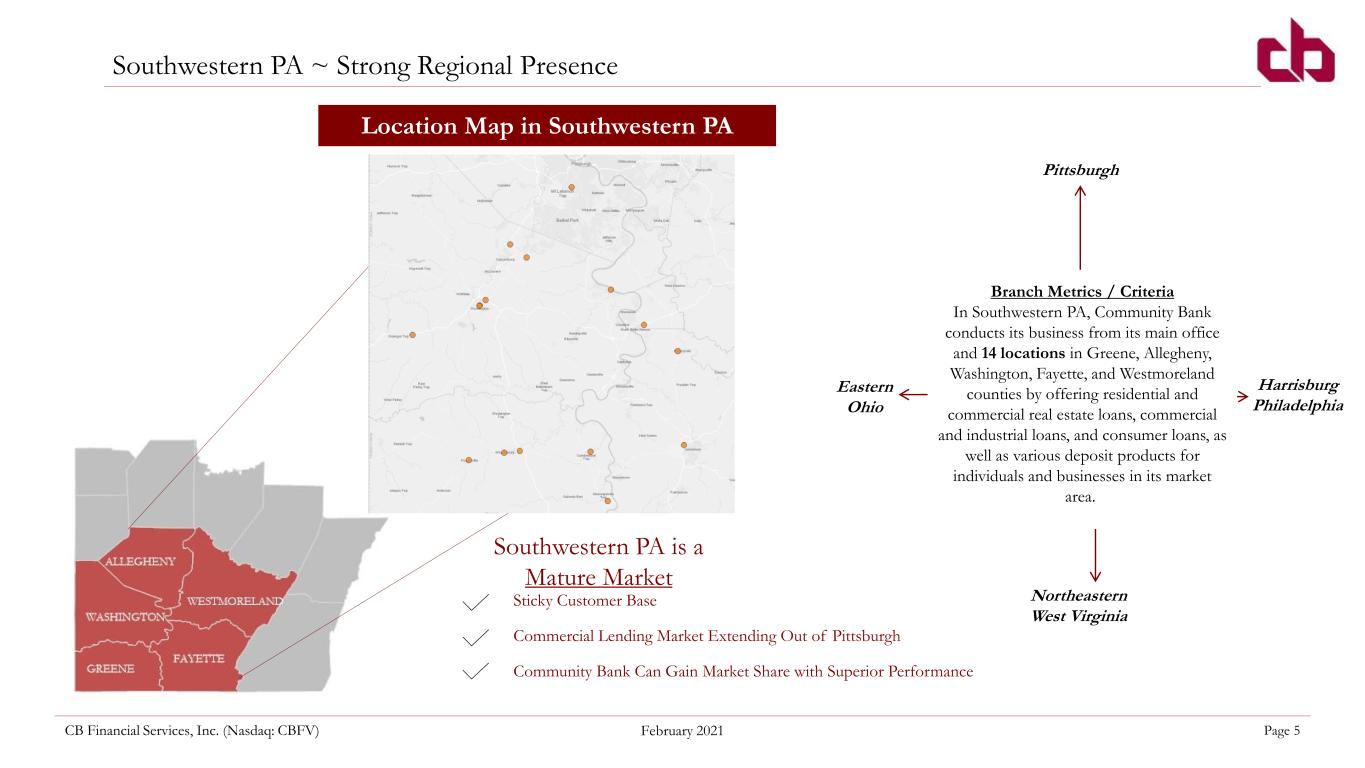

CB Financial Services, Inc. (Nasdaq: CBFV) February 2021 Page 5 Southwestern PA ~ Strong Regional Presence Branch Metrics / Criteria In Southwestern PA, Community Bank conducts its business from its main office and 14 locations in Greene, Allegheny, Washington, Fayette, and Westmoreland counties by offering residential and commercial real estate loans, commercial and industrial loans, and consumer loans, as well as various deposit products for individuals and businesses in its market area. Pittsburgh Northeastern West Virginia Southwestern PA is a Mature Market Location Map in Southwestern PA Eastern Ohio Harrisburg Philadelphia Sticky Customer Base Commercial Lending Market Extending Out of Pittsburgh Community Bank Can Gain Market Share with Superior Performance

CB Financial Services, Inc. (Nasdaq: CBFV) February 2021 Page 6 ◼ Population of approximately 2.3 million with a median household income of nearly $64,000, which is projected to increase 10.2% in the next 5 years ◼ Large market for energy, healthcare, technology, and manufacturing companies(1) ◼ Highly educated labor force from Carnegie Mellon University, University of Pittsburgh, and Duquesne University(1) ◼ Fortune 500 companies headquartered in Pittsburgh MSA include: Kraft Heinz, PNC Financial Services, PPG Industries, U.S. Steel, Alcoa, Dick’s Sporting Goods, and WESCO International(2) ◼ Carnegie Mellon University and the University of Pittsburgh have helped to bring tech jobs and innovation to the area and tech giants like Uber and Facebook have opened offices in Pittsburgh ◼ Substantial medical services investment is happening regionally: ➢ UPMC is investing $2 billion in 3 new specialty hospitals in Pittsburgh and is constructing a new hospital facility in Washington County, PA Large Employers in Operating AreaPittsburgh Metropolitan Area Attractive Operating Markets (1) https://datausa.io/profile/geo/pittsburgh-pa-metro-area/ (2) http://fortune.com/fortune500/

CB Financial Services, Inc. (Nasdaq: CBFV) February 2021 Page 7 Community Bank Mission Statement Community Bank is an exceptional, independent financial institution. We will provide our customers with valuable, appropriate products and outstanding personal service. Community Bank strives to continue to grow and continue to create value for our shareholders. Our employees will be treated fairly and given opportunities for personal growth. We will be closely involved in improving our communities.

CB Financial Services, Inc. (Nasdaq: CBFV) February 2021 Page 8 Leveraging a Rich History and Community Presence 1901 1987 2006 2007-2019 2020 2021 - The Bank was originally chartered in 1901 as The First National Bank of Carmichaels, serving southwestern PA and local community Changed name to Community Bank, National Association Community Bank weathered the financial crisis, continued to expand its community presence, and launched new insurance and wealth management services The onset of COVID-19 increased demand for fintech solutions and mobile banking services Community Bank Appoints John Montgomery President & CEO The Beginning and Formation of the Bank 20+ Branch Network Supporting SW Pennsylvania, WV, and OH Global Pandemic Accelerates Need for Revitalization Completed a charter conversion from a national bank to a Pennsylvania- chartered commercial bank wholly-owned by the Company On February 23, 2021, Community Bank announced initiatives to optimize its current branch network through the consolidation of six branch locations and the possible divestiture of others, while expanding technology and infrastructure investments in its remaining locations Community Bank has engaged with third- party workflow optimization experts to assist in implementing a number of robotic process automations (RPAs) and more effective sales management that it expects will improve operational efficiencies in the near and long-term. Implementation of Strategic Initiatives Aimed at Optimizing Branch Network and Positioning Community Bank for the Future

CB Financial Services, Inc. (Nasdaq: CBFV) February 2021 Page 9 ZIRR Creates NIM Pressures on All Banks Disruption by Technology and FinTech Online and Mobile Delivery of Services is Essential Evaluating Market Changes ~ Need to Adapt Changing Consumer Behavior Requirements for Instant Service to Fulfill Expectations (One Click) 0%

CB Financial Services, Inc. (Nasdaq: CBFV) February 2021 Page 10 Evaluating Branch Network ◼ Customer engagement / loyalty ◼ Good credit quality ◼ Generally low-cost deposits ◼ Employees focused on customers / clients Strengths of Existing Network Areas for Improvement ◼ Technological advancements ◼ Need to right size costs ◼ Increased efficiency ◼ Retain the ability to move quickly into new markets CONCLUSION: Community Bank must become more efficient so investments can be made without permanently increasing operating costs. Support Brand While Enhancing Customer Loyalty and Engagement From the Top of the Organization to Every ATM!

CB Financial Services, Inc. (Nasdaq: CBFV) February 2021 Page 11 Branch Optimization Strategy Management has identified six branches for consolidation while exploring the divestiture of others: ◼ Monongahela, PA ◼ Perryopolis, PA ◼ Pioneer, PA ◼ Southpointe, PA ◼ Bellaire, OH ◼ Wellsburg, WV A comprehensive review of Community Bank’s branch network has been completed with the following priorities: ◼ Improve profitability ◼ Improve efficiency ◼ Identify areas for investment in digital marketing and technology ◼ Identify infrastructure improvements ◼ Client experience improvements ◼ Employees focused on customers / clients Review of Network Branch Consolidation or Potential Divestitures Company expects to implement changes beginning in Q1 2021 Anticipates non-recurring pre-tax costs during 2021 of up to $6.1 million. This estimated cost excludes the impact of any premium from sale of branches, and assumes no salvage value, lease termination, severance, and other costs associated with the consolidations or sales; however, the Company does anticipate some recovery of these costs over time.

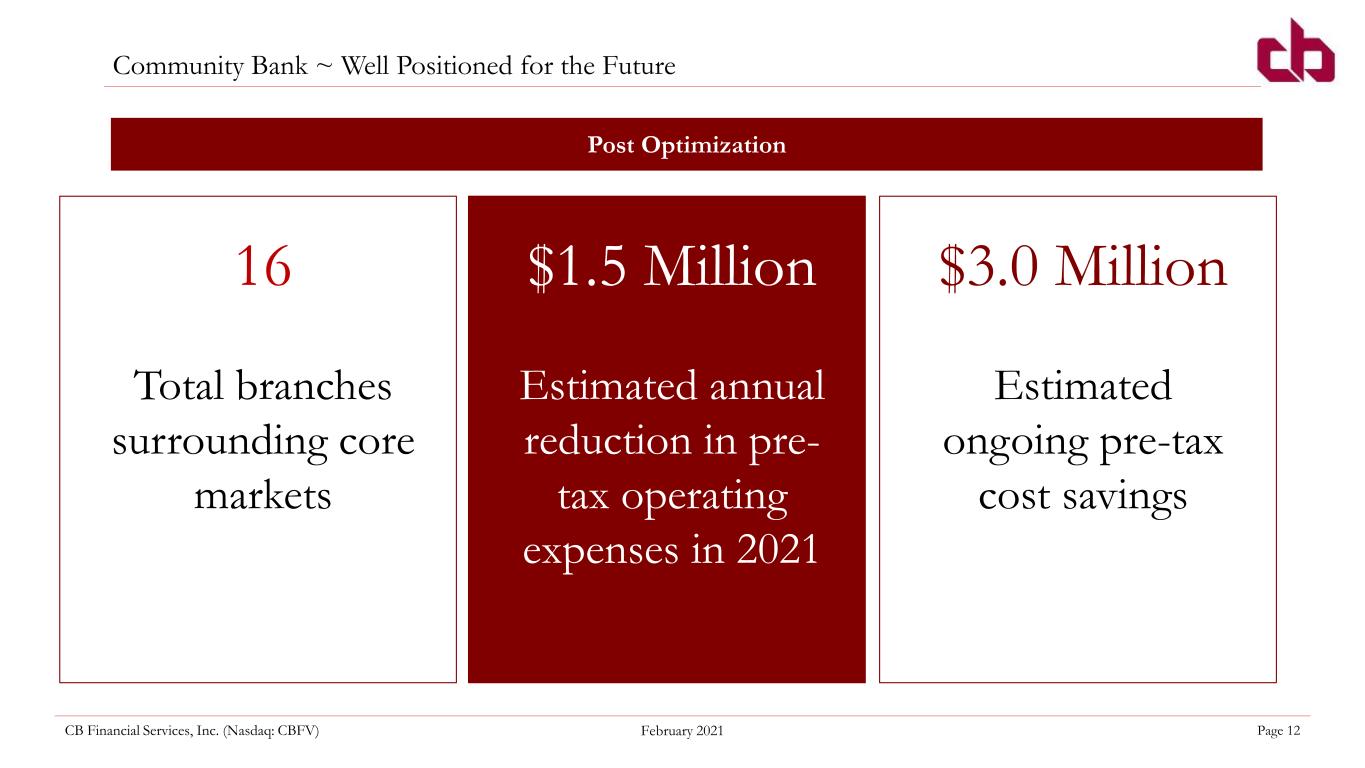

CB Financial Services, Inc. (Nasdaq: CBFV) February 2021 Page 12 Community Bank ~ Well Positioned for the Future Post Optimization 16 Total branches surrounding core markets $1.5 Million Estimated annual reduction in pre- tax operating expenses in 2021 $3.0 Million Estimated ongoing pre-tax cost savings

CB Financial Services, Inc. (Nasdaq: CBFV) February 2021 Page 13 ◼ Empower our experienced, high quality employees to provide superior customer service in all aspects of our business ◼ Create a sales and service culture which builds full relationships with our customers ◼ Utilize technology investments to enhance speed of process while improving customer experience ◼ Enhance profitability and efficiency potential while continuing to invest for future growth ◼ Continue our track record of opportunistic growth in the robust Pittsburgh MSA and across our footprint ◼ Evolve toward more electronic/digital products and processes driving greater efficiency and expand our brand awareness in our market by utilizing digital and other outlets ◼ Leverage our credit culture and strong loan underwriting to uphold our asset quality metrics Building on Core Strengths Be the Community Bank of choice across our footprint for residents and small and medium sized businesses

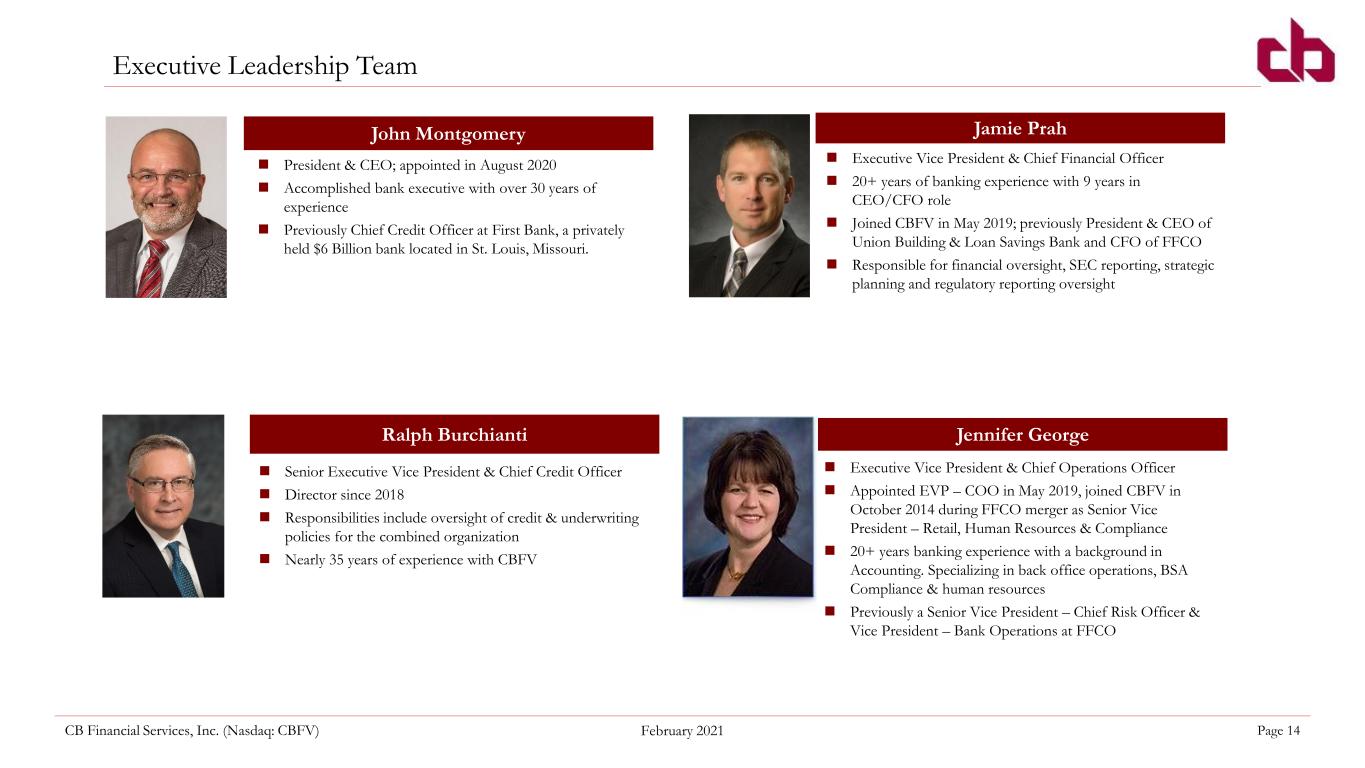

CB Financial Services, Inc. (Nasdaq: CBFV) February 2021 Page 14 ◼ President & CEO; appointed in August 2020 ◼ Accomplished bank executive with over 30 years of experience ◼ Previously Chief Credit Officer at First Bank, a privately held $6 Billion bank located in St. Louis, Missouri. Jamie Prah ◼ Executive Vice President & Chief Financial Officer ◼ 20+ years of banking experience with 9 years in CEO/CFO role ◼ Joined CBFV in May 2019; previously President & CEO of Union Building & Loan Savings Bank and CFO of FFCO ◼ Responsible for financial oversight, SEC reporting, strategic planning and regulatory reporting oversight John Montgomery Jennifer GeorgeRalph Burchianti ◼ Senior Executive Vice President & Chief Credit Officer ◼ Director since 2018 ◼ Responsibilities include oversight of credit & underwriting policies for the combined organization ◼ Nearly 35 years of experience with CBFV ◼ Executive Vice President & Chief Operations Officer ◼ Appointed EVP – COO in May 2019, joined CBFV in October 2014 during FFCO merger as Senior Vice President – Retail, Human Resources & Compliance ◼ 20+ years banking experience with a background in Accounting. Specializing in back office operations, BSA Compliance & human resources ◼ Previously a Senior Vice President – Chief Risk Officer & Vice President – Bank Operations at FFCO Executive Leadership Team

Moving Forward – Building a Stronger Community Investing for the Future Adaptive to New Consumer Expectations Engaging with Loyal Customers and Winning New Ones

CB Financial Services, Inc. (Nasdaq: CBFV) February 2021 Page 16 Contact Information Company Contact: John H. Montgomery President and Chief Executive Officer Phone: (724) 225-2400 Investor Relations Adam Prior Phone: (212) 836-9606 Email: aprior@equityny.com Media Relations Chris Murray Phone: (610) 864-9123 Email: cmurray@btcmarketing.com NASDAQ Capital Market: CBFV 100 N. Market Street Carmichaels, PA 15320 Phone: 724-966-5041 Fax: 724-966-7867

CB Financial Services, Inc. (Nasdaq: CBFV) February 2021 Page 17 Appendix – Non-GAAP Reconciliation Table