Attached files

| file | filename |

|---|---|

| 8-K - 8-K - eHealth, Inc. | ehth-20210218.htm |

| EX-99.1 - EX-99.1 - eHealth, Inc. | exhibit9912020yeearningsre.htm |

February 18, 2021 Q4 2020 and FY 2020 Financial Results Conference Call Slides

Safe Harbor Statement Forward-Looking Statements This presentation includes forward-looking statements within the meaning of the federal securities laws. Forward-looking statements generally relate to future events or our future financial or operating performance. Forward-looking statements in this presentation include, but are not limited to, the following: our operational focus in 2021, including our plans to increase the effectiveness of our telesales organization, our marketing strategy and our online capabilities; our expected cash collections for Medicare Advantage plans and member turnover rate; and our guidance for the full year ending December 31, 2021, including our guidance for total revenue and revenue from our Medicare segment and our Individual, Family and Small Business segment, GAAP net income, Adjusted EBITDA, profit from our Medicare segment and our Individual, Family and Small Business segment, Corporate shared service expense, cash used in operations and cash used for capital expenditures, and GAAP net income per diluted share and non-GAAP net income per diluted share. Our expectations and beliefs regarding these matters may not materialize, and actual results in future periods are subject to risks and uncertainties that could cause actual results to differ materially from those projected. These risks include those set forth in our filings with the Securities and Exchange Commission, including our latest Form 10-Q and 10-K. The forward-looking statements in this presentation are based on information available to us as of today, and we disclaim any obligation to update any forward looking statements, except as required by law. Non-GAAP Information This presentation includes both GAAP and non-GAAP financial measures. The presentation of non-GAAP financial information is not intended to be considered in isolation or as a substitute for results prepared in accordance with GAAP. A reconciliation of the non-GAAP financial measures included in this presentation to the most directly comparable GAAP financial measures is available in the earnings release issued by eHealth, Inc. on February 18, 2021 announcing its fourth quarter and fiscal year 2020 results. Management uses both GAAP and non-GAAP information in evaluating and operating its business internally and as such has determined that it is important to provide this information to investors. 1

$22 $61 $113 $102 -$10M $30M $70M $110M $150M 2017 2018 2019 2020 176 240 435 503 0K 200K 400K 600K 2017 2018 2019 2020 118 148 280 388 0K 200K 400K 600K 2017 2018 2019 2020 eHealth: a Strong, Differentiated Growth Engine 2 Medicare Advantage Approved Members (In Thousands) Medicare Approved Members (In Thousands) Medicare Segment Profit (In Millions) Medicare Segment Revenue (In Millions) 3 Year CAGR: 49% 3 Year CAGR: 42% $142 $211 $405 $517 $0M $200M $400M $600M 2017 2018 2019 2020 3 Year CAGR: 54% 3 Year CAGR: 66% (1) FY 2019 revenue and adjusted EBITDA exclude the positive impact of $42.3 million in revenue resulting from a change in estimate for expected cash commission collections relating to existing Medicare Advantage plans enrolled in prior to the fourth quarter of 2019. (1) (1)

eHealth FY 2020 Highlights 3 FY 2020 results reflect continuing enrollment growth in our Medicare business accompanied by a meaningful increase in the number and percentage of major medical Medicare enrollments completed online(2) Medicare carrier advertising revenue grew 98% year-over-year Revenue of $583MM grew 26% compared to FY 2019(1) (1) Fourth quarter 2019 and FY 2019 revenue and adjusted EBITDA exclude the positive impact of $42.3 million in revenue resulting from a change in estimate for expected cash commission collections relating to existing Medicare Advantage plans enrolled in prior to the fourth quarter of 2019. (2) Major Medicare plans include Medicare Advantage and Medicare Supplement plans; Online % represents a combination of unassisted and partially agent-assisted online enrollments. 37% of Medicare major medical applications submitted online, compared to 27% in FY 2019(2) Estimated Trailing Twelve Month Turnover % for Medicare Advantage at 40% for Q4 20, compared to 42% in Q3 20 Net Income of $45.5M and Adjusted EBITDA of $83.7MM, compared to $66.9M and $90.9MM(1) in FY 2019 respectively Medicare Advantage approved members grew 39% year-over- year Implemented a multifaceted program to increase member retention

4 Q4 and FY 2020 Revenue Q4 and FY Revenue growth driven primarily by an increase in approved Medicare Advantage members of 30% in Q4 and 39% in FY 2020 compared to Q4 and FY 2019 Medicare carrier advertising revenue grew 107% in Q4 and 98% in FY 2020 compared to Q4 and FY 2019 Positive impact of Medicare enrollment growth was partially offset by a decline in Medicare Advantage LTVs of 10% in Q4 and 6% in FY 2020 compared to Q4 and FY 2019 Revenue in our Individual & Family and Small Business group segment grew 22% in Q4 and 11% in FY 2020 driven primarily by growth in tail revenue Revenue (1) Fourth quarter 2019 and FY 2019 revenue exclude the positive impact of $42.3 million in revenue resulting from a change in estimate for expected cash commission collections relating to existing Medicare Advantage plans enrolled in prior to the fourth quarter of 2019. $ 259.4 $ 293.3 Q4-FY19 Q4-FY20 Revenue ($MM) 13% $ 463.9 $ 582.8 FY 2019 FY 2020 Revenue ($MM) 26% (1) (1)

Q4 and FY 2020 Net Income and Adjusted EBITDA(1) (1) Adjusted EBITDA is calculated by excluding the impacts of interest income and expense, income tax expense (benefit), depreciation and amortization, stock-based compensation expense, change in fair value of earnout liability, restructuring and reorganization charges, purchase price adjustments, amortization of intangible assets, other income (expenses), net, convertible preferred stock dividends and other non-recurring charges to GAAP net income. Other non-recurring charges to GAAP net income may include transaction expenses in connection with capital raising transactions (whether debt, equity or equity-linked) and acquisitions, whether or not consummated, and the cumulative effect of a change in accounting principles. (2) Fourth quarter 2019 and FY 2019 adjusted EBITDA exclude the positive impact of $42.3 million in revenue resulting from a change in estimate for expected cash commission collections relating to existing Medicare Advantage plans enrolled in prior to the fourth quarter of 2019. Exceeded expectations due to significant growth in Medicare enrollments Net Income Adjusted EBITDA 5 $ 88.8 $ 59.9 Q4-FY19 Q4-FY20 Net Income ($MM) -33% $ 66.9 $ 45.5 FY 2019 FY 2020 Net Income ($MM) -32% $ 100.3 $ 84.2 Q4-FY19 Q4-FY20 Adjusted EBITDA ($MM) -16% $ 90.9 $ 83.7 FY 2019 FY 2020 Adjusted EBITDA ($MM) -8% (2) (2)

Q4 and FY 2020 Medicare Segment Revenue and Profit Medicare Segment Revenue grew 12% in Q4 and 28% in FY 2020 compared to 2019(1) Medicare Segment Profit declined 23% in Q4 and 10% in Q4 2020 compared to 2019 driven primarily by underperformance of external telesales agents Medicare Segment Revenue Medicare Segment Profit 6 $ 240.3 $ 269.9 Q4-FY19 Q4-FY20 Medicare Segment Revenue ($MM) 12% $ 404.7 $ 516.8 FY 2019 FY 2020 Medicare Segment Revenue ($MM) 28% $ 107.0 $ 82.6 Q4-FY19 Q4-FY20 Medicare Segment Profit ($MM) -23% $ 112.9 $ 102.0 FY 2019 FY 2020 Medicare Segment Profit ($MM) -10% (1) Fourth quarter 2019 and FY 2019 Medicare segment revenue and Medicare segment profit exclude the positive impact of $42.3 million in revenue resulting from a change in estimate for expected cash commission collections relating to existing Medicare Advantage plans enrolled in prior to the fourth quarter of 2019. (1) (1) (1) (1)

Q4 and FY 2020 Medicare Advantage Approved Members(1) and New Paying Members(2) FY 20 Medicare Advantage approved members grew 39% YoY and Medicare Advantage new paying members grew by 38% YoY (1) Approved members consist of the number of individuals on submitted applications that were approved by the relevant insurance carrier for the identified product during the period presented. Approved members may not pay for their plan and become paying members. (2) New Paying Members consist of approved members from the period presented and any periods prior to the period presented from whom we have received an initial commission payment during the period presented. Medicare Advantage Approved Members Medicare Advantage New Paying Members 7 167 217 Q4-FY19 Q4-FY20 Medicare Advantage Approved Members (000s) 30% 280 388 FY 2019 FY 2020 Medicare Advantage Approved Members (000s) 39% 116 137 Q4-FY19 Q4-FY20 Medicare Advantage New Paying Members (000s) 18% 236 325 FY 2019 FY 2020 Medicare Advantage New Paying Members (000s) 38%

Medicare Major Medical Online Application%(1) Achieved online penetration for FY 2020 of 37%, compared to 27% for FY 2019 (1) Major Medicare plans include Medicare Advantage and Medicare Supplement plans; online % represents a combination of unassisted and partially agent-assisted online enrollments. Medicare Major Medical Online Application % 8 12% 11% 21% 36% 27% 24% 30% 36% 43% 37% Q1 Q2 Q3 Q4 FY FY 19 FY 20

Trailing Twelve Months (“TTM”) Medicare Segment Commissions Cash Collections 9 Q4 20 TTM Medicare Segment commissions cash collections increased by 48% year-over-year Q4 20 TTM Medicare Segment commissions cash collections per MA equivalent member(1) of $367 grew 17% year-over- year +41% +45% +44% +37% +50% +49% +47% +48% +32% +32% +34% +46% +44% +37% +33% +23% $0 $50 $100 $150 $200 $250 $300 Q1 19 Q2 19 Q3 19 Q4 19 Q1 20 Q2 20 Q3 20 Q4 20 TTM Medicare Segment Commissions Cash Collections TTM Medicare Segment Commissions Cash Collections Y/Y % Estimated Medicare Membership Growth Y/Y % ($MM) TTM Medicare Segment Commissions Cash Collections (1) MA Equivalent member is calculated as the total number of estimated Medicare Advantage and Medicare Supplement membership and 25% of the estimated Medicare Part D membership during the period presented. (TTM)

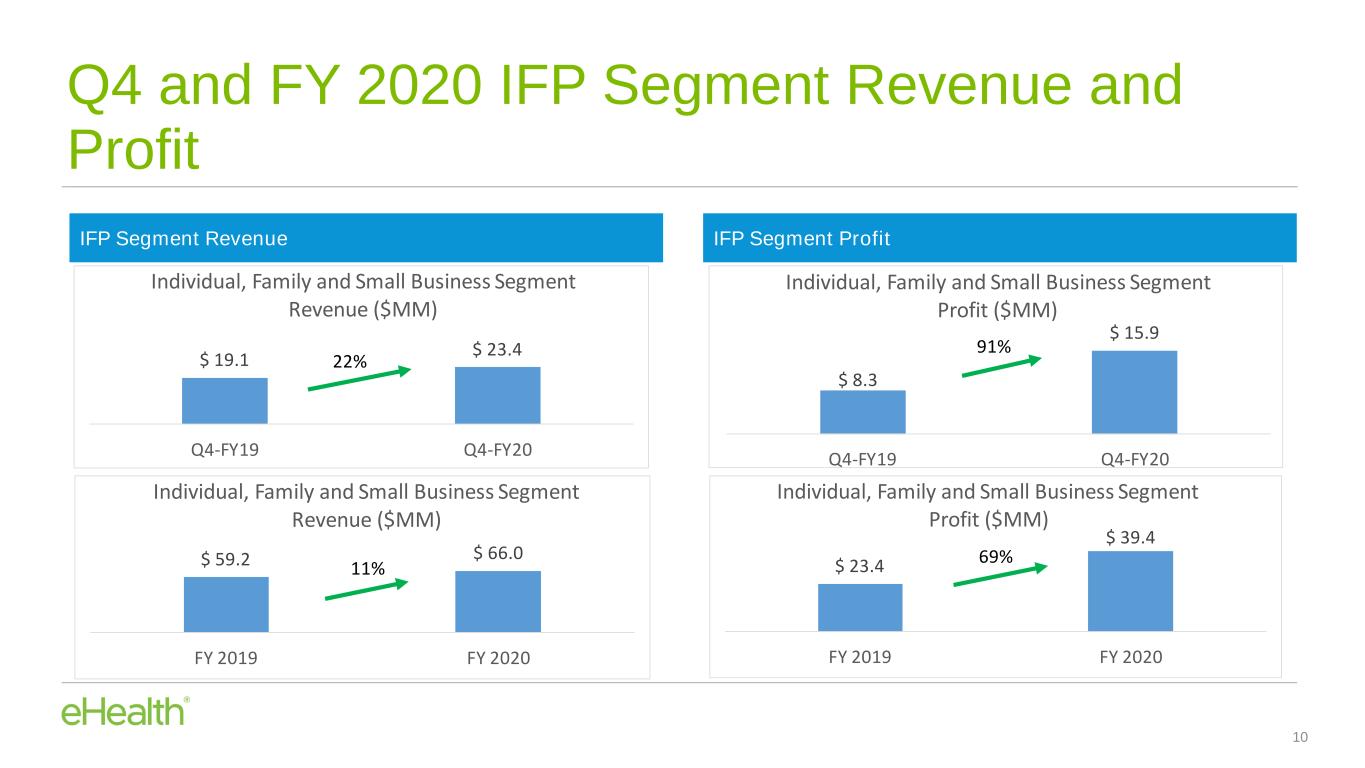

Q4 and FY 2020 IFP Segment Revenue and Profit IFP Segment Revenue IFP Segment Profit 10 $ 19.1 $ 23.4 Q4-FY19 Q4-FY20 Individual, Family and Small Business Segment Revenue ($MM) 22% $ 59.2 $ 66.0 FY 2019 FY 2020 Individual, Family and Small Business Segment Revenue ($MM) 11% $ 8.3 $ 15.9 Q4-FY19 Q4-FY20 Individual, Family and Small Business Segment Profit ($MM) 91% $ 23.4 $ 39.4 FY 2019 FY 2020 Individual, Family and Small Business Segment Profit ($MM) 69%

Medicare Advantage Plan Member Turnover Trend Since Q4 2018 11 MA Q4 2018 Q1 2019 Q2 2019 Q3 2019 Q4 2019 Q1 2020 Q2 2020 Q3 2020 Q42020 Approved Members (1) 83,376 40,741 36,576 35,171 167,073 64,898 60,477 44,999 217,278 Estimated Beginning (Paying) Membership (2) 235,269 276,357 280,763 291,171 309,180 404,694 404,262 407,243 421,237 New Paying Members (3) 62,817 49,531 36,122 33,974 116,351 86,299 57,232 44,528 136,857 Estimated Ending (Paying) Membership (4) 276,357 280,763 291,171 309,180 404,694 404,262 407,243 421,237 533,282 Medicare Advantage Plan Member Turnover (5) 21,729 45,125 25,714 15,965 20,837 86,731 54,251 30,534 24,812 Trailing Twelve Month Member Turnover (6) 95,066 89,358 102,403 108,533 107,641 149,247 177,783 192,353 196,328 Average Trailing Twelve Month Estimated Membership Plus New Paying Members (7) 262,856 276,949 296,491 316,501 348,362 389,638 425,791 457,447 490,588 Trailing Twelve Month Member Turnover Rate (8) 36% 32% 35% 34% 31% 38% 42% 42% 40%

Medicare Advantage Plan Member Turnover Trend Since Q4 2018 (cont’d) 12 (1) Approved members consist of the number of individuals on submitted applications that were approved by the relevant insurance carrier for the identified product during the period presented. Approved members may not pay for their plan and become paying members. (2) Estimated Beginning (Paying) Membership is the Estimated Ending Membership for the period prior to the period of estimation. Membership is estimated using the methodology described in our periodic filings with the Securities and Exchange Commission. (3) New Paying Members consist of approved members from the period presented and any periods prior to the period presented from whom we have received an initial commission payment during the period presented. (4) Estimated Ending (Paying) Membership is the number of members we estimate as of the end of the period. Membership is estimated using the methodology described in our periodic filings with the Securities and Exchange Commission. (5) Medicare Advantage Plan Member Turnover for the period is derived as follows: Estimated Beginning Membership plus New Paying Members minus Estimated Ending Membership. (6) Trailing Twelve Month Member Turnover is the sum of Medicare Advantage Plan Member Turnover for the prior twelve months. (7) Average Trailing Twelve Month Estimated Membership Plus New Paying Members is the sum of (i) trailing twelve month Estimated Beginning Membership, plus (ii) New Paying Members for the trailing twelve month, divided by 4. (8) Trailing Twelve Month Member Turnover Rate is Trailing Twelve Month Turnover divided by Average Trailing Twelve Month Estimated Membership Plus New Paying Members.

Key Areas of Operational Focus for 2021 13 • Increase effectiveness of our telesales organization ─ Shift to a predominately internal workforce ─ Enhance the agent onboarding and training process ─ Expand retention team • Enhance marketing strategies ─ Emphasize online and strategic partner channels characterized by attractive ROI ─ Reduce reliance on Direct TV channel ─ Shift from transaction-driven marketing to a focus on customer lifecycle. Broaden selection of ancillary products • Further expand our online/e-commerce capabilities with strong emphasis on personalization of consumer experience

2021 Guidance(1) For the full year ending December 31, 2021, we expect: Total revenue is expected in the range of $660M to $700M • Medicare segment revenue is expected in the range of $621M to $659M. • Individual, Family and Small Business segment revenue is expected in the range of $39M to $41M. GAAP net income is expected to be in the range of $42M to $57M GAAP net income per diluted share is expected to be in the range of $1.53 to $2.08. Adjusted EBITDA(2) is expected in the range of $100M to $115M. • Medicare segment profit(3) is expected in the range of $138M to $155M • Individual, Family and Small Business segment profit is expected in the range of $18M to $19M. • Corporate shared service expenses(4) is expected in the range of $56M to $59M Non-GAAP net income per diluted share(5) is expected to be in the range of $2.77 to $3.26. Cash used in operations is expected to be in the range of $85M to $95M, and cash used for capital expenditures in the range of $24M to $27M 14

2021 Guidance (cont’d) 15 (1) Guidance excludes the potential impact from the agreement with HIG Capital for a $225 million investment announced on January 29, 2021 (2) Adjusted EBITDA is calculated by excluding the impacts of interest income and expense, income tax expense (benefit), depreciation and amortization, stock-based compensation expense, change in fair value of earnout liability, restructuring and reorganization charges, purchase price adjustments, amortization of intangible assets, other income (expenses), net, convertible preferred stock dividends and other non- recurring charges to GAAP net income. Other non-recurring charges to GAAP net income may include transaction expenses in connection with capital raising transactions (whether debt, equity or equity-linked) and acquisitions, whether or not consummated, and the cumulative effect of a change in accounting principles. (3) Segment profit is calculated as revenue for the applicable segment less marketing and advertising, customer care and enrollment, technology and content and general and administrative operating expenses, excluding stock-based compensation expense, depreciation and amortization, restructuring charges, and amortization of intangible assets, that are directly attributable to the applicable segment and other indirect marketing and advertising, customer care and enrollment and technology and content operating expenses, excluding stock-based compensation expense, depreciation and amortization, restructuring charges, and amortization of intangible assets, allocated to the applicable segment based on usage. (4) Corporate consists of other indirect general and administrative operating expenses, excluding stock-based compensation expense and depreciation and amortization, which are managed in a corporate shared services environment and, because they are not the responsibility of segment operating management, are not allocated to the reportable segments. (5) Non-GAAP net income per diluted share consists of GAAP net income per diluted share excluding the following items: the effects of expensing stock-based compensation related to stock options and restricted stock units per diluted share, change in fair value of earnout liability per diluted share, restructuring and reorganization charges per diluted share, purchase price adjustments per diluted share, amortization of intangible assets per diluted share, other non-recurring charges per diluted share, and the income tax impact of non-GAAP adjustments per diluted share.