Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - Arlington Asset Investment Corp. | ai-ex991_7.htm |

| 8-K - 8-K - Arlington Asset Investment Corp. | ai-8k_20210216.htm |

Investor Presentation Fourth Quarter 2020 Exhibit 99.2

Information Related to Forward-Looking Statements Statements concerning interest rates, portfolio allocation, financing costs, portfolio hedging, prepayments, dividends, book value, utilization of loss carryforwards, any change in long-term tax structures (including any REIT election), use of equity raise proceeds and any other guidance on present or future periods constitute forward-looking statements that are subject to a number of factors, risks and uncertainties that might cause actual results to differ materially from stated expectations or current circumstances. These factors include, but are not limited to, the uncertainty and economic impact of the ongoing coronavirus (COVID-19) pandemic and the measures taken by the government to address it, including the impact on our business, financial condition, liquidity and results of operations due to a significant decrease in economic activity and disruptions in our financing operations, among other factors, changes in interest rates, increased costs of borrowing, decreased interest spreads, credit risks underlying the Company’s assets, especially related to the Company’s mortgage credit investments, changes in political and monetary policies, changes in default rates, changes in prepayment rates and other assumptions underlying our estimates related to our projections of future core earnings, changes in the Company’s returns, changes in the use of the Company’s tax benefits, the Company’s ability to qualify and maintain qualification as a REIT, changes in the agency MBS asset yield, changes in the Company’s monetization of net operating loss carryforwards, changes in the Company’s investment strategy, changes in the Company’s ability to generate cash earnings and dividends, preservation and utilization of the Company’s net operating loss and net capital loss carryforwards, impacts of changes to and changes by Fannie Mae and Freddie Mac, actions taken by the U.S. Federal Reserve, the Federal Housing Finance Agency and the U.S. Treasury, availability of opportunities that meet or exceed the Company’s risk adjusted return expectations, ability and willingness to make future dividends, ability to generate sufficient cash through retained earnings to satisfy capital needs, and general economic, political, regulatory and market conditions. These and other material risks are described in the Company's most recent Annual Report on Form 10-K and any other documents filed by the Company with the SEC from time to time, which are available from the Company and from the SEC, and you should read and understand these risks when evaluating any forward-looking statement. All forward-looking statements speak only as of the date on which they are made. New risks and uncertainties arise over time, and it is not possible to predict those events or how they may affect the Company. Except as required by law, the Company is not obligated to, and does not intend to, update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

Contents

COMPANY SNAPSHOT

Publicly Traded Capital Class A Common Stock Ticker: AAIC Exchange: NYSE Market Capitalization: $130 million (1) Senior Notes Due 2023 Ticker: AIW Exchange: NYSE Per Annum Interest Rate: 6.625% Current Strip Yield per Annum: 7.14%(1)(2) Maturity Date: May 1, 2023 Senior Notes Due 2025 Ticker: AIC Exchange: NYSE Per Annum Interest Rate: 6.75% Current Strip Yield per Annum: 7.36%(1)(2) Maturity Date: March 15, 2025 Series B Cumulative Perpetual Redeemable Preferred Stock Ticker: AAIC PrB Exchange: NYSE Per Annum Dividend Rate: 7.00% Payable Quarterly Current Strip Yield per Annum: 7.91%(1)(2) As of February 12, 2021. Source: Bloomberg Series C Fixed-to-Floating Rate Cumulative Redeemable Preferred Stock Ticker: AAIC PrC Exchange: NYSE Per Annum Dividend Rate: 8.25% Payable Quarterly Current Strip Yield per Annum: 9.34%(1)(2)

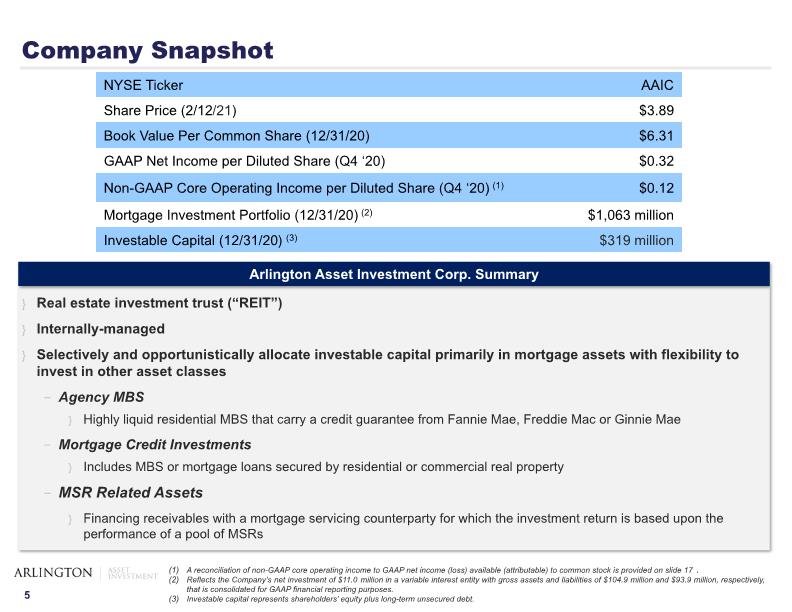

Company Snapshot Real estate investment trust (“REIT”) Internally-managed Selectively and opportunistically allocate investable capital primarily in mortgage assets with flexibility to invest in other asset classes Agency MBS Highly liquid residential MBS that carry a credit guarantee from Fannie Mae, Freddie Mac or Ginnie Mae Mortgage Credit Investments Includes MBS or mortgage loans secured by residential or commercial real property MSR Related Assets Financing receivables with a mortgage servicing counterparty for which the investment return is based upon the performance of a pool of MSRs A reconciliation of non-GAAP core operating income to GAAP net income (loss) available (attributable) to common stock is provided on slide 17. Reflects the Company’s net investment of $11.0 million in a variable interest entity with gross assets and liabilities of $104.9 million and $93.9 million, respectively, that is consolidated for GAAP financial reporting purposes. Investable capital represents shareholders’ equity plus long-term unsecured debt. Arlington Asset Investment Corp. Summary

Q4 2020 FINANCIAL RESULTS AND PORTFOLIO UPDATE

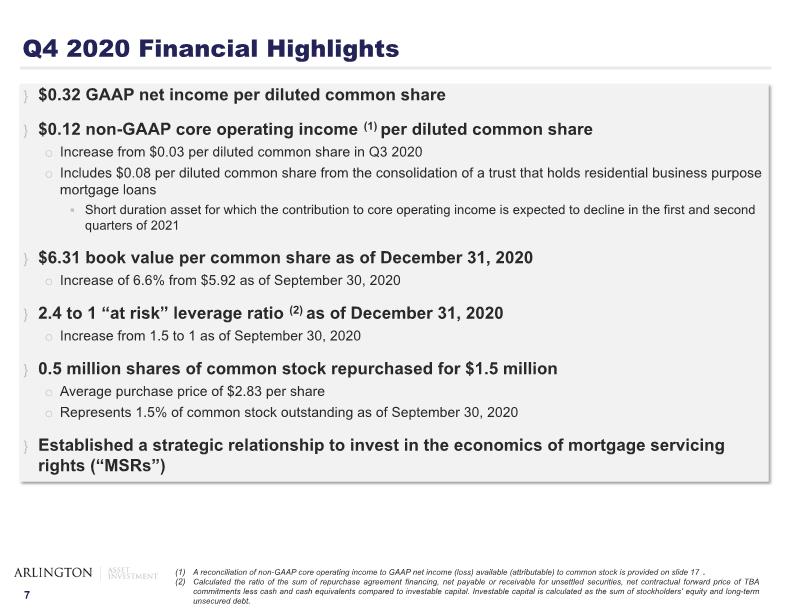

Q4 2020 Financial Highlights $0.32 GAAP net income per diluted common share $0.12 non-GAAP core operating income (1) per diluted common share Increase from $0.03 per diluted common share in Q3 2020 Includes $0.08 per diluted common share from the consolidation of a trust that holds residential business purpose mortgage loans Short duration asset for which the contribution to core operating income is expected to decline in the first and second quarters of 2021 $6.31 book value per common share as of December 31, 2020 Increase of 6.6% from $5.92 as of September 30, 2020 2.4 to 1 “at risk” leverage ratio (2) as of December 31, 2020 Increase from 1.5 to 1 as of September 30, 2020 0.5 million shares of common stock repurchased for $1.5 million Average purchase price of $2.83 per share Represents 1.5% of common stock outstanding as of September 30, 2020 Established a strategic relationship to invest in the economics of mortgage servicing rights (“MSRs”) A reconciliation of non-GAAP core operating income to GAAP net income (loss) available (attributable) to common stock is provided on slide 17. Calculated the ratio of the sum of repurchase agreement financing, net payable or receivable for unsettled securities, net contractual forward price of TBA commitments less cash and cash equivalents compared to investable capital. Investable capital is calculated as the sum of stockholders’ equity and long-term unsecured debt.

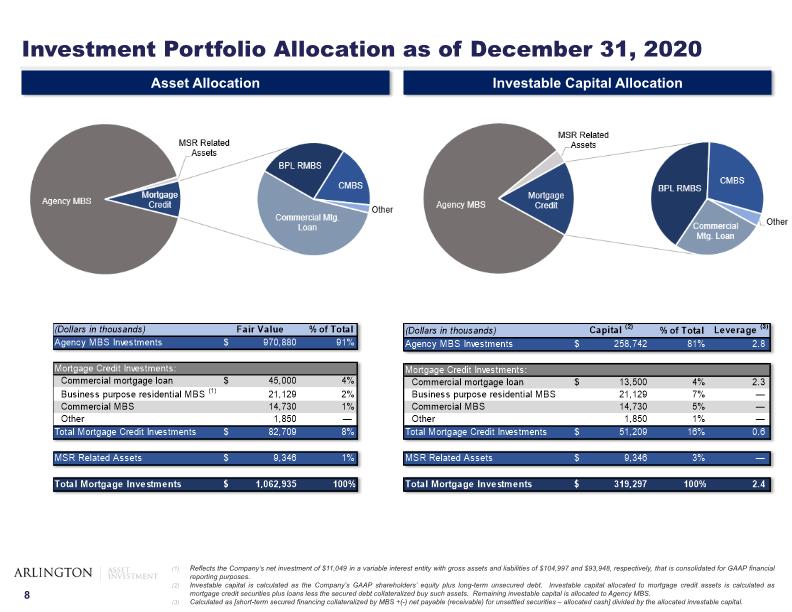

Investment Portfolio Allocation as of December 31, 2020 Asset Allocation Investable Capital Allocation Reflects the Company’s net investment of $11,049 in a variable interest entity with gross assets and liabilities of $104,997 and $93,948, respectively, that is consolidated for GAAP financial reporting purposes. Investable capital is calculated as the Company’s GAAP shareholders’ equity plus long-term unsecured debt. Investable capital allocated to mortgage credit assets is calculated as mortgage credit securities plus loans less the secured debt collateralized buy such assets. Remaining investable capital is allocated to Agency MBS. Calculated as [short-term secured financing collateralized by MBS +(-) net payable (receivable) for unsettled securities – allocated cash] divided by the allocated investable capital.

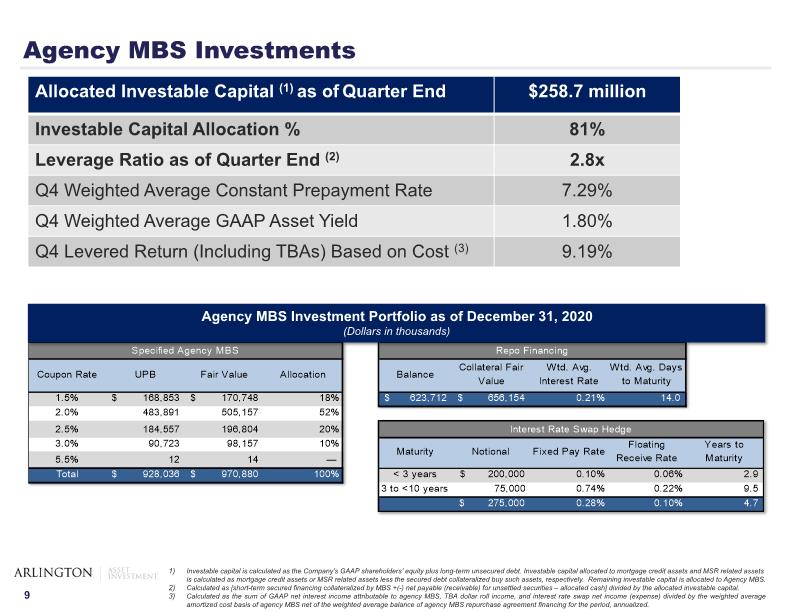

Agency MBS Investments Agency MBS Investment Portfolio as of December 31, 2020 (Dollars in thousands) Investable capital is calculated as the Company’s GAAP shareholders’ equity plus long-term unsecured debt. Investable capital allocated to mortgage credit assets and MSR related assets is calculated as mortgage credit assets or MSR related assets less the secured debt collateralized buy such assets, respectively. Remaining investable capital is allocated to Agency MBS. Calculated as [short-term secured financing collateralized by MBS +(-) net payable (receivable) for unsettled securities – allocated cash] divided by the allocated investable capital. Calculated as the sum of GAAP net interest income attributable to agency MBS, TBA dollar roll income, and interest rate swap net income (expense) divided by the weighted average amortized cost basis of agency MBS net of the weighted average balance of agency MBS repurchase agreement financing for the period, annualized.

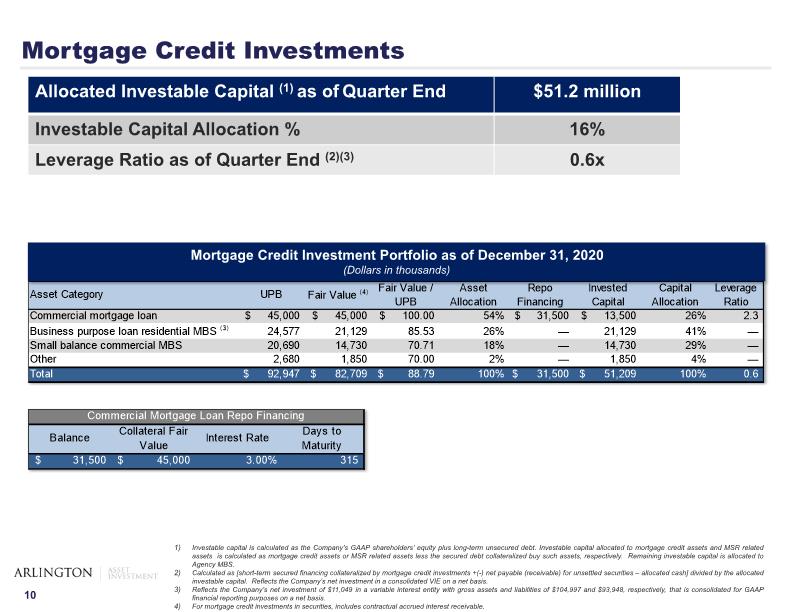

Mortgage Credit Investments Investable capital is calculated as the Company’s GAAP shareholders’ equity plus long-term unsecured debt. Investable capital allocated to mortgage credit assets and MSR related assets is calculated as mortgage credit assets or MSR related assets less the secured debt collateralized buy such assets, respectively. Remaining investable capital is allocated to Agency MBS. Calculated as [short-term secured financing collateralized by mortgage credit investments +(-) net payable (receivable) for unsettled securities – allocated cash] divided by the allocated investable capital. Reflects the Company’s net investment in a consolidated VIE on a net basis. Reflects the Company’s net investment of $11,049 in a variable interest entity with gross assets and liabilities of $104,997 and $93,948, respectively, that is consolidated for GAAP financial reporting purposes on a net basis. For mortgage credit investments in securities, includes contractual accrued interest receivable. Mortgage Credit Investment Portfolio as of December 31, 2020 (Dollars in thousands)

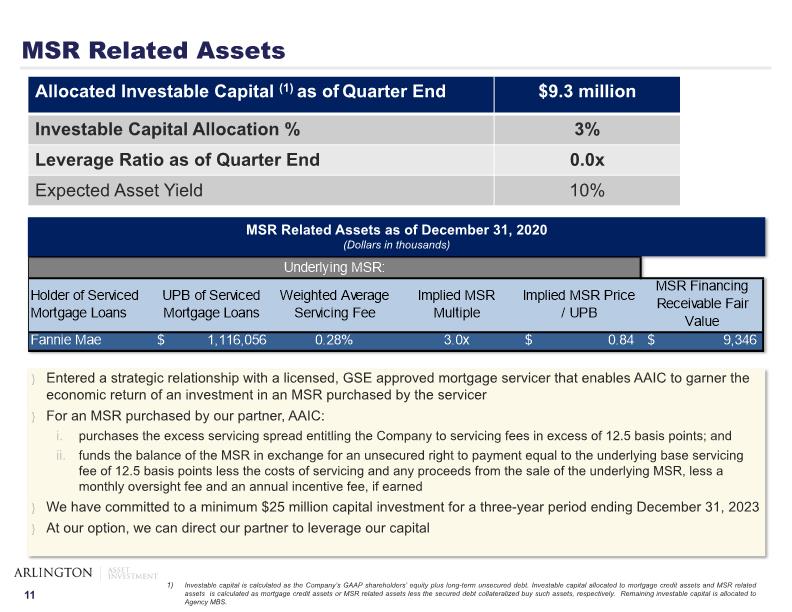

MSR Related Assets Entered a strategic relationship with a licensed, GSE approved mortgage servicer that enables AAIC to garner the economic return of an investment in an MSR purchased by the servicer For an MSR purchased by our partner, AAIC: purchases the excess servicing spread entitling the Company to servicing fees in excess of 12.5 basis points; and funds the balance of the MSR in exchange for an unsecured right to payment equal to the underlying base servicing fee of 12.5 basis points less the costs of servicing and any proceeds from the sale of the underlying MSR, less a monthly oversight fee and an annual incentive fee, if earned We have committed to a minimum $25 million capital investment for a three-year period ending December 31, 2023 At our option, we can direct our partner to leverage our capital Investable capital is calculated as the Company’s GAAP shareholders’ equity plus long-term unsecured debt. Investable capital allocated to mortgage credit assets and MSR related assets is calculated as mortgage credit assets or MSR related assets less the secured debt collateralized buy such assets, respectively. Remaining investable capital is allocated to Agency MBS.

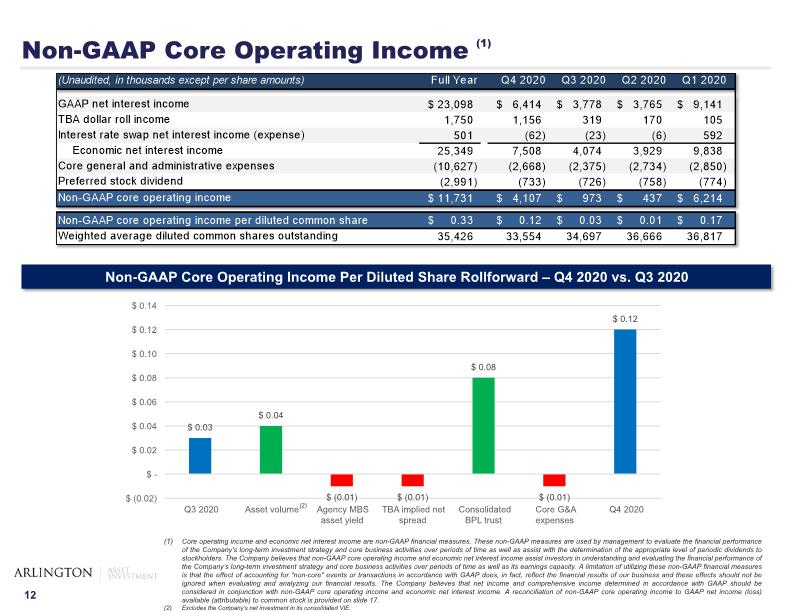

Non-GAAP Core Operating Income (1) Core operating income and economic net interest income are non-GAAP financial measures. These non-GAAP measures are used by management to evaluate the financial performance of the Company’s long-term investment strategy and core business activities over periods of time as well as assist with the determination of the appropriate level of periodic dividends to stockholders. The Company believes that non-GAAP core operating income and economic net interest income assist investors in understanding and evaluating the financial performance of the Company’s long-term investment strategy and core business activities over periods of time as well as its earnings capacity. A limitation of utilizing these non-GAAP financial measures is that the effect of accounting for “non-core” events or transactions in accordance with GAAP does, in fact, reflect the financial results of our business and these effects should not be ignored when evaluating and analyzing our financial results. The Company believes that net income and comprehensive income determined in accordance with GAAP should be considered in conjunction with non-GAAP core operating income and economic net interest income. A reconciliation of non-GAAP core operating income to GAAP net income (loss) available (attributable) to common stock is provided on slide 17. Excludes the Company’s net investment in its consolidated VIE. Non-GAAP Core Operating Income Per Diluted Share Rollforward – Q4 2020 vs. Q3 2020 (2)

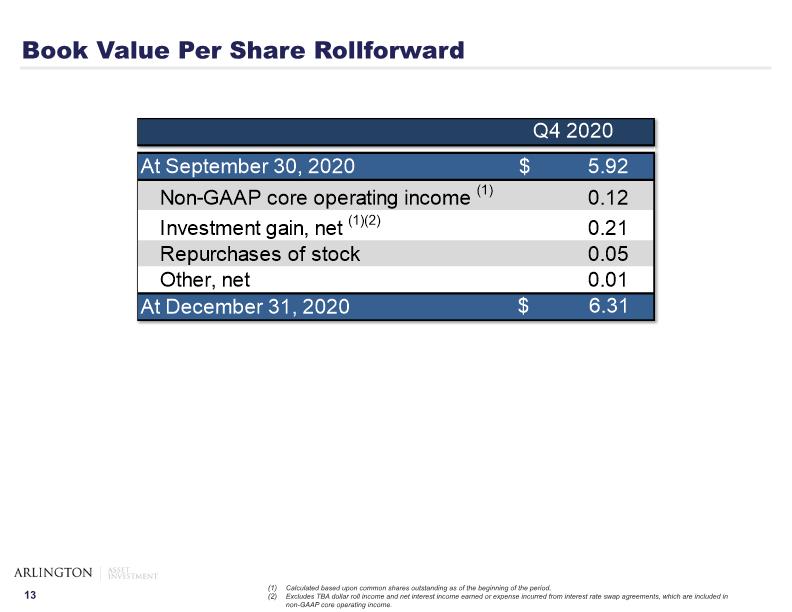

Book Value Per Share Rollforward Calculated based upon common shares outstanding as of the beginning of the period. Excludes TBA dollar roll income and net interest income earned or expense incurred from interest rate swap agreements, which are included in non-GAAP core operating income.

ADDITIONAL MARKET DATA AND FINANCIAL INFORMATION

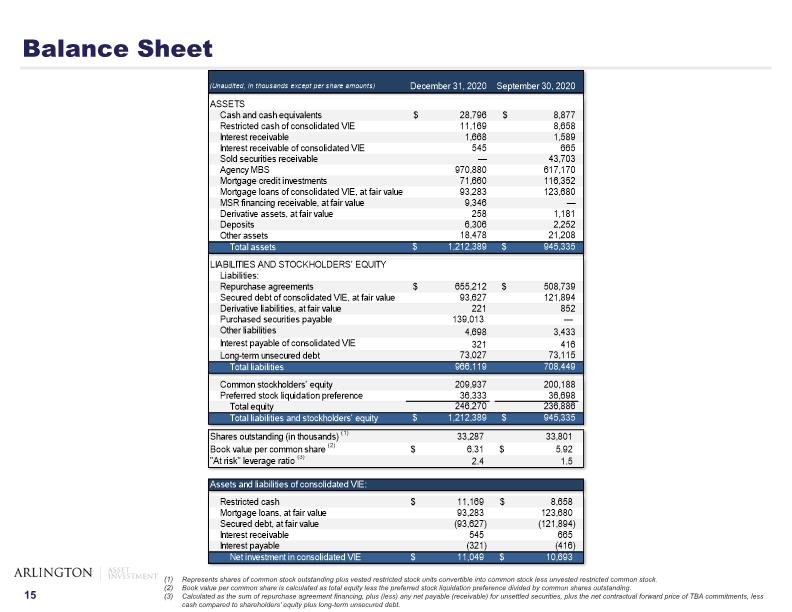

Balance Sheet Represents shares of common stock outstanding plus vested restricted stock units convertible into common stock less unvested restricted common stock. Book value per common share is calculated as total equity less the preferred stock liquidation preference divided by common shares outstanding. Calculated as the sum of repurchase agreement financing, plus (less) any net payable (receivable) for unsettled securities, plus the net contractual forward price of TBA commitments, less cash compared to shareholders’ equity plus long-term unsecured debt.

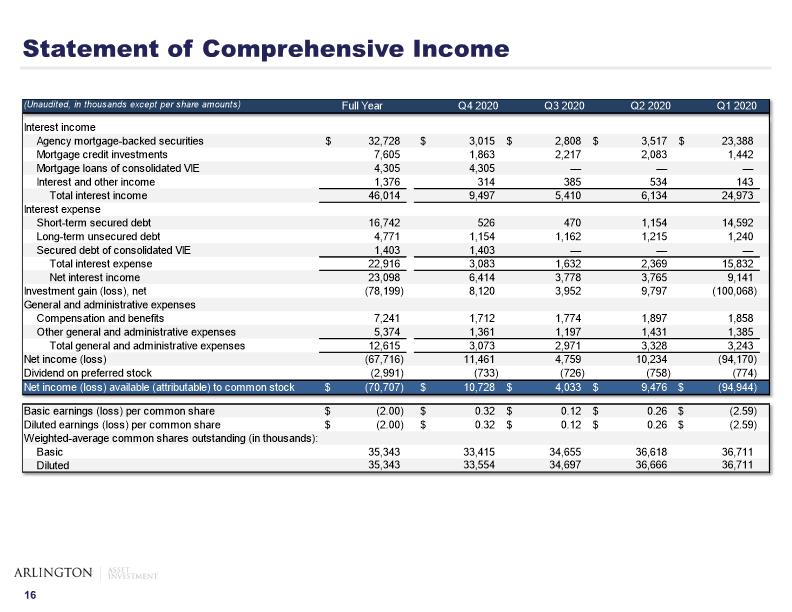

Statement of Comprehensive Income

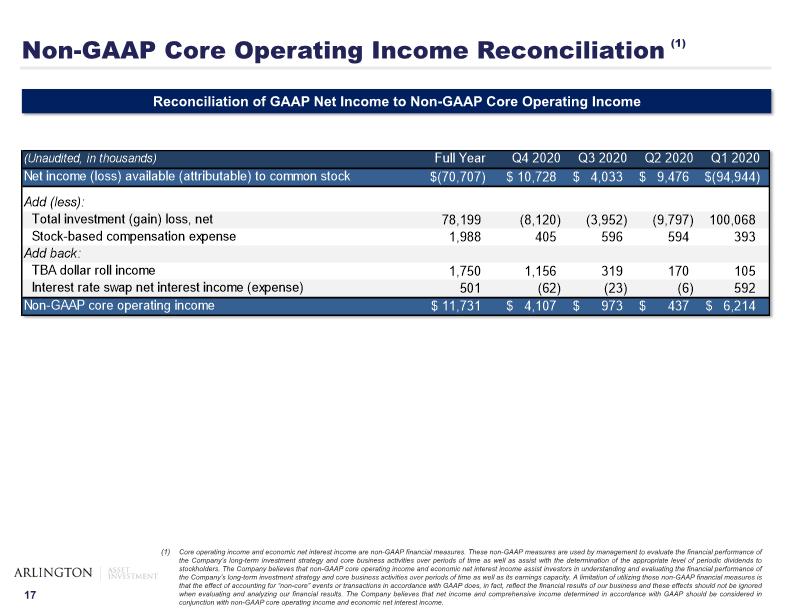

Non-GAAP Core Operating Income Reconciliation (1) Core operating income and economic net interest income are non-GAAP financial measures. These non-GAAP measures are used by management to evaluate the financial performance of the Company’s long-term investment strategy and core business activities over periods of time as well as assist with the determination of the appropriate level of periodic dividends to stockholders. The Company believes that non-GAAP core operating income and economic net interest income assist investors in understanding and evaluating the financial performance of the Company’s long-term investment strategy and core business activities over periods of time as well as its earnings capacity. A limitation of utilizing these non-GAAP financial measures is that the effect of accounting for “non-core” events or transactions in accordance with GAAP does, in fact, reflect the financial results of our business and these effects should not be ignored when evaluating and analyzing our financial results. The Company believes that net income and comprehensive income determined in accordance with GAAP should be considered in conjunction with non-GAAP core operating income and economic net interest income. Reconciliation of GAAP Net Income to Non-GAAP Core Operating Income

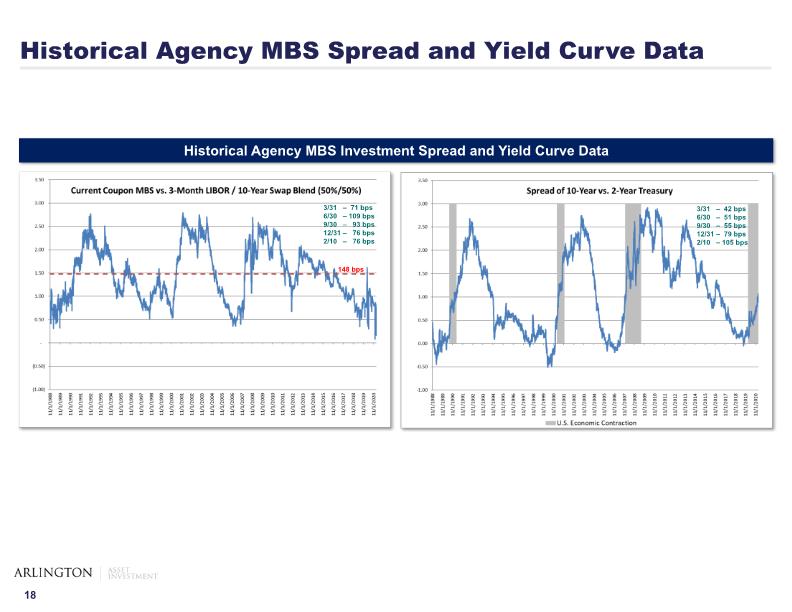

Historical Agency MBS Investment Spread and Yield Curve Data 148 bps 3/31 – 71 bps 6/30 – 109 bps 9/30 – 93 bps 12/31 – 76 bps 2/10 – 76 bps 3/31 – 42 bps 6/30 – 51 bps 9/30 – 55 bps 12/31 – 79 bps 2/10 – 105 bps Historical Agency MBS Spread and Yield Curve Data

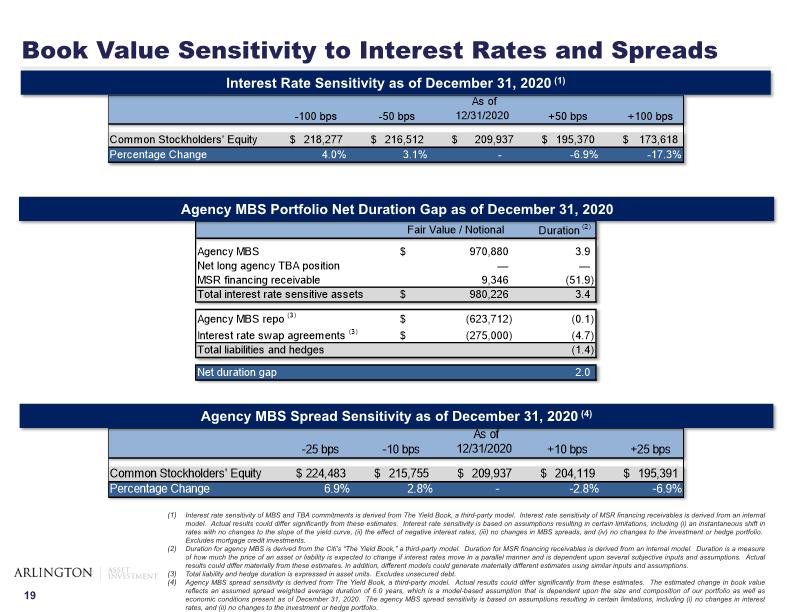

Interest rate sensitivity of MBS and TBA commitments is derived from The Yield Book, a third-party model. Interest rate sensitivity of MSR financing receivables is derived from an internal model. Actual results could differ significantly from these estimates. Interest rate sensitivity is based on assumptions resulting in certain limitations, including (i) an instantaneous shift in rates with no changes to the slope of the yield curve, (ii) the effect of negative interest rates, (iii) no changes in MBS spreads, and (iv) no changes to the investment or hedge portfolio. Excludes mortgage credit investments. Duration for agency MBS is derived from the Citi’s “The Yield Book,” a third-party model. Duration for MSR financing receivables is derived from an internal model. Duration is a measure of how much the price of an asset or liability is expected to change if interest rates move in a parallel manner and is dependent upon several subjective inputs and assumptions. Actual results could differ materially from these estimates. In addition, different models could generate materially different estimates using similar inputs and assumptions. Total liability and hedge duration is expressed in asset units. Excludes unsecured debt. Agency MBS spread sensitivity is derived from The Yield Book, a third-party model. Actual results could differ significantly from these estimates. The estimated change in book value reflects an assumed spread weighted average duration of 6.0 years, which is a model-based assumption that is dependent upon the size and composition of our portfolio as well as economic conditions present as of December 31, 2020. The agency MBS spread sensitivity is based on assumptions resulting in certain limitations, including (i) no changes in interest rates, and (ii) no changes to the investment or hedge portfolio. Interest Rate Sensitivity as of December 31, 2020 (1) Book Value Sensitivity to Interest Rates and Spreads Agency MBS Spread Sensitivity as of December 31, 2020 (4) Agency MBS Portfolio Net Duration Gap as of December 31, 2020

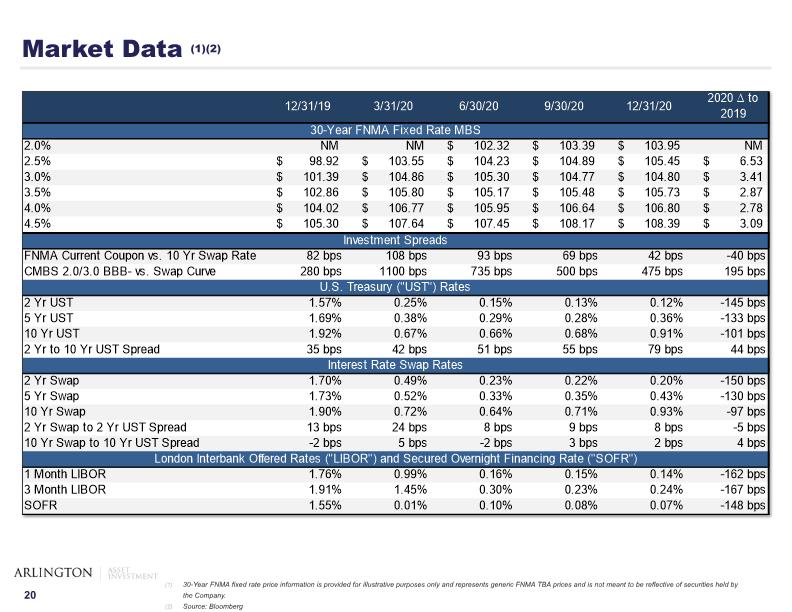

Market Data (1)(2) 30-Year FNMA fixed rate price information is provided for illustrative purposes only and represents generic FNMA TBA prices and is not meant to be reflective of securities held by the Company. Source: Bloomberg