Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - Altra Industrial Motion Corp. | aimc-ex991_6.htm |

| 8-K - 8-K - Altra Industrial Motion Corp. | aimc-8k_20210212.htm |

Fourth-Quarter 2020 Results February 12, 2021 1 Exhibit 99.2

2 Q4 2020 Conference Call Details Live Webcast February 12, 2021 10:00 AM ET Dial-In Number (866) 209-9085 Domestic (647) 689-5687 International Webcast at www.altramotion.com Replay (800) 585-8367 Domestic* (416) 621-4642 International* Conference ID: 9897386 *Phone replay through Feb. 26, 2021 Webcast replay also available at www.altramotion.com

Safe Harbor Statement Forward-Looking Statements All statements, other than statements of historical fact included in this release are forward-looking statements, as that term is defined in the Private Securities Litigation Reform Act of 1995. These statements include, but are not limited to, any statement that may predict, forecast, indicate or imply future results, performance, achievements or events. Forward-looking statements can generally be identified by phrases such as “believes,” “expects,” “potential,” “continues,” “may,” “should,” “seeks,” “predicts,” “anticipates,” “intends,” “projects,” “estimates,” “plans,” “could,” “designed”, “should be,” and other similar expressions that denote expectations of future or conditional events rather than statements of fact. Forward-looking statements also may relate to strategies, plans and objectives for, and potential results of, future operations, financial results, financial condition, business prospects, growth strategy and liquidity, and are based upon financial data, market assumptions and management's current business plans and beliefs or current estimates of future results or trends available only as of the time the statements are made, which may become out of date or incomplete. Forward looking statements are inherently uncertain, and investors must recognize that events could differ significantly from our expectations. These statements include, but may not be limited to, the statements under “Business Outlook,” and statements regarding (a) the Company’s strategic priorities continuing to be managing costs, driving margin enhancement, de-levering its balance sheet and positioning the Company to grow and thrive as a premier industrial company for the long term, (b) the Company taking a cautious approach to its initial outlook for 2021, (c) the Company being hopeful that market conditions improve sooner than guidance currently assumes and the Company’s plans to revisit its outlook appropriately as it gain better visibility, (d) the Company’s confidence regarding its talent, financial discipline and market strength to continue to navigate the current environment while advancing its strategic priorities to solidify the Company as a world-class premier industrial company and (e) assumptions underlying the Company’s guidance, including assumptions that the general industrial economy will not begin to recover until late in 2021 and that approximately $40 million of cost savings realized in 2020 will gradually phase back in throughout 2021, with the full effect of the costs coming back by the second half of the year. In addition to the risks and uncertainties noted in this release, there are certain factors that could cause actual results to differ materially from those anticipated by some of the statements made. These include: (1) competitive pressures, (2) changes in political and economic conditions in the United States and abroad and the cyclical nature of our markets, (3) loss of distributors, (4) the ability to develop new products and respond to customer needs, (5) risks associated with international operations, including currency risks, and the effects of tariffs and other trade actions taken by the United States and other countries, (6) accuracy of estimated forecasts of OEM customers and the impact of the current global economic environment on our customers, (7) risks associated with a disruption to our supply chain, (8) fluctuations in the costs of raw materials used in our products, (9) product liability claims, (10) work stoppages and other labor issues involving the Company’s facilities or the Company’s customers, (11) changes in employment, environmental, tax and other laws and changes in the enforcement of laws, (12) loss of key management and other personnel, (13) risks associated with compliance with environmental laws, (14) the ability to successfully execute, manage and integrate key acquisitions and mergers, (15) failure to obtain or protect intellectual property rights, (16) impairment or reduction of goodwill or intangible assets, (17) failure of operating equipment or information technology infrastructure, including cyber-attacks or other security breaches, and failure to comply with data privacy laws or regulations, (18) risks associated with our debt leverage, (19) risks associated with restrictions contained in the agreements governing Altra’s $400 million aggregate principal amount of 6.125% senior notes due 2026 and Altra’s revolving credit facility and term loan facility, (20) risks associated with compliance with tax laws, (21) risks associated with the global recession and volatility and disruption in the global financial markets, (22) risks associated with implementation of our enterprise resource planning system, (23) risks associated with the Svendborg, Stromag, and A&S acquisitions and integration and other acquisitions, (24) risks associated with certain minimum purchase agreements we have with suppliers, (25) risks related to our relationships with strategic partners, (26) our ability to offset increased commodity and labor costs with increased prices, (27) risks associated with our exposure to variable interest rates and foreign currency exchange rates, (28) swap counterparty credit risk, including interest rate swap contracts, cross-currency swap contracts and hedging arrangements, (29) risks associated with our exposure to renewable energy markets, (30) risks related to regulations regarding conflict minerals, (31) risks related to restructuring and plant consolidations, (32) risks related to our acquisition of A&S, including (a) the possibility that we may be unable to achieve expected synergies and operating efficiencies in connection with the transaction within the expected time-frames or at all and to successfully integrate A&S, (b) expected or targeted future financial and operating performance and results, (c) operating costs, customer loss and business disruption (including, without limitation, difficulties in maintaining relationships with employees, customers, clients or suppliers) being greater than expected following the transaction, (d) our ability to retain key executives and employees, (e) slowdowns or downturns in economic conditions generally and in the markets in which the A&S businesses participate specifically, (f) lower than expected investments and capital expenditures in equipment that utilizes components produced by us or A&S, (g) lower than expected demand for our or A&S’s repair and replacement businesses, (h) our ability to successfully integrate the merged assets and the associated technology and achieve operational efficiencies, (i) the integration of A&S being more difficult, time-consuming or costly than expected, (j) the inability to undertake certain corporate actions that otherwise could be advantageous to comply with certain tax covenants, (k) potential unknown liabilities and unforeseen expenses related to the acquisition and (l) the impact on our internal controls and compliance with the regulatory requirements under the Sarbanes-Oxley Act of 2002, (33) exposure to United Kingdom political developments, including the effect of its withdrawal from the European Union, and the uncertainty surrounding the implementation and effect of Brexit and related negative developments in the European Union and elsewhere, (34) Altra’s ability to achieve the efficiencies, savings and other benefits anticipated from its cost reduction, margin improvement, restructuring, plant consolidation and other business optimization initiatives, (35) the risks associated with transitioning from LIBOR to a replacement alternative reference rate, (36) the scope and duration of the COVID-19 global pandemic and its impact on global economic systems and our employees, sites, operations, customers and supply chain, including the impact of the pandemic on manufacturing and supply capabilities throughout the world, (37) adverse conditions in the credit and capital markets limiting or preventing the Company’s and its customers’ and suppliers’ ability to borrow or raise capital, (38) the Company’s ability to invest in new technologies and manufacturing techniques and to develop or adapt to changing technology and manufacturing techniques, (39) defects, quality issues, inadequate disclosure or misuse with respect to our products and capabilities, (40) changes in labor or employment laws, (41) the Company’s ability to recruit, retain and motivate key sales, marketing or engineering personnel, (42) unplanned repairs or equipment outages, (43) changes in the Company’s tax rates, including enactment of the 2017 Tax Act, or exposure to additional income tax liabilities or assessments, as well as audits by tax authorities, (44) the risks associated with the Company’s ability to successfully divest or otherwise dispose of businesses that that are deemed not to fit with our strategic plan or are not achieving the desired return on investment and (45) other risks, uncertainties and other factors described in the Company's quarterly reports on Form 10-Q and annual reports on Form 10-K and in the Company's other filings with the U.S. Securities and Exchange Commission (SEC) or in materials incorporated therein by reference. Except as required by applicable law, Altra does not intend to update or alter its forward-looking statements, whether as a result of new information, future events or otherwise. 3

Agenda and Speakers Executive Overview Market Review Q4 & 2020 Financial Review, 2021 Guidance Concluding Remarks Q&A Carl Christenson Chairman & Chief Executive Officer Christian Storch Executive Vice President & Chief Financial Officer 4

5 SAFETY FIRST FINANCIAL FLEXIBILITY Managing operations to minimize customer disruption, ensure continuity of supply and maximize business opportunities. Took aggressive actions to reduce cost, maintain a strong balance sheet and manage leverage. BUSINESS CONTINUITY Prioritizing safety with work-from-home policy, safety practices at all locations and restricting non-essential travel. Resilient and Nimble COVID-19 Response PLAYING OFFENSE Positioning Altra to emerge a stronger company.

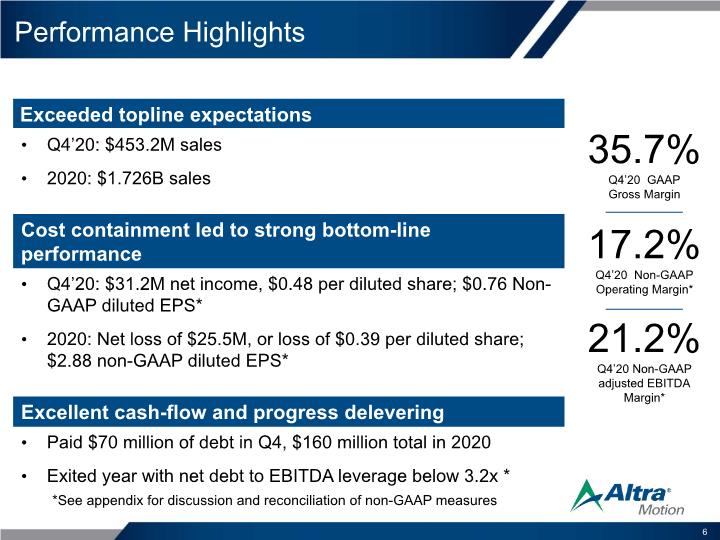

Performance Highlights 35.7% Q4’20 GAAP Gross Margin 17.2% Q4’20 Non-GAAP Operating Margin* 21.2% Q4’20 Non-GAAP adjusted EBITDA Margin* *See appendix for discussion and reconciliation of non-GAAP measures 6

1 2 3 4 Advancing Altra’s Strategic Priorities 7 5

Q4 2020 Key End-Market Drivers Transportation up high single digits with strong demand in China and NA for Class 8 trucks Turf & Garden up low double digits as the housing market remained strong and our customers accelerated purchasing after slow 1H20 Medical Equipment up low double digits year over year and sequentially flat Renewable Energy up low single digits driven by strong wind demand, down sequentially Distribution up low single digits, expect to track with general industrial activity Ag up double digits year over year and sequentially Defense up double digits due to strong OEM performance, Aero down mid-single digits Factory Automation & Specialty Machinery flat year over year and down low single digits sequentially Metals down low double digits, up sequentially due to mill capacity utilization improvements Mining down double digits impacted by commodity prices Oil and Gas down double digits year over year and up low single digits sequentially 8

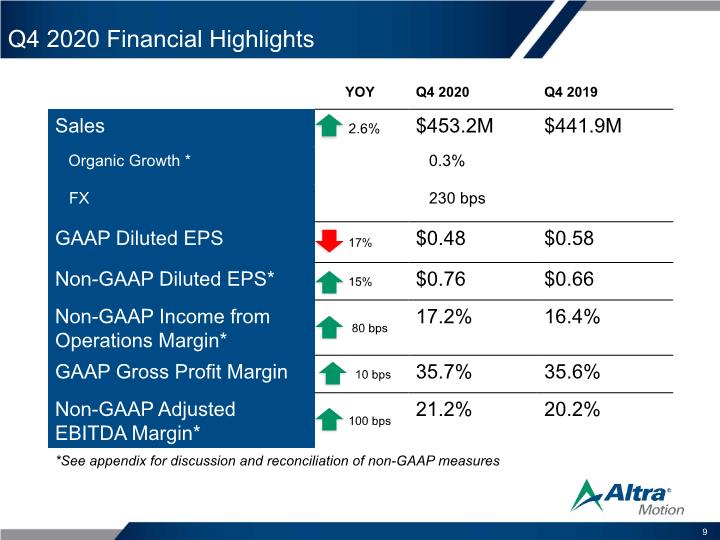

Q4 2020 Financial Highlights *See appendix for discussion and reconciliation of non-GAAP measures 9

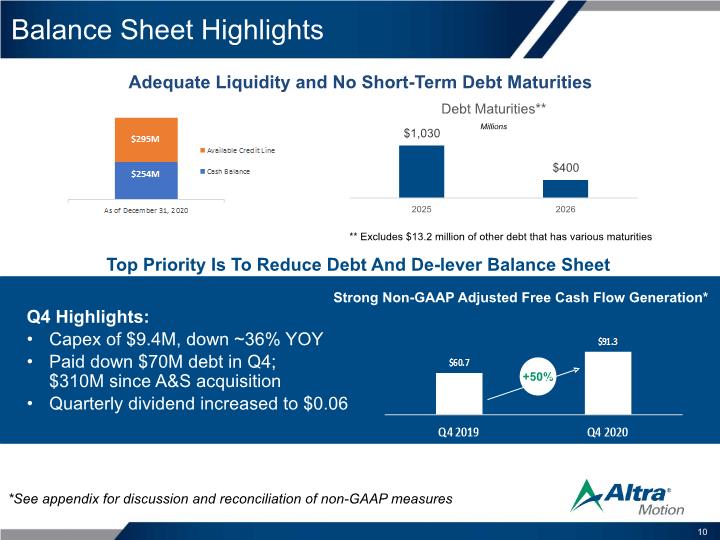

Balance Sheet Highlights 10 Top Priority Is To Reduce Debt And De-lever Balance Sheet Adequate Liquidity and No Short-Term Debt Maturities ** Excludes $13.2 million of other debt that has various maturities Millions Q4 Highlights: Capex of $9.4M, down ~36% YOY Paid down $70M debt in Q4; $310M since A&S acquisition Quarterly dividend increased to $0.06 Strong Non-GAAP Adjusted Free Cash Flow Generation* +50% *See appendix for discussion and reconciliation of non-GAAP measures 10

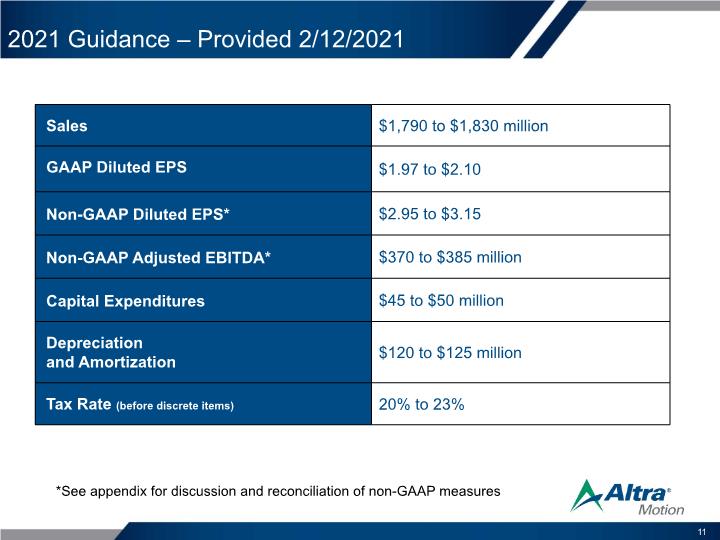

2021 Guidance – Provided 2/12/2021 *See appendix for discussion and reconciliation of non-GAAP measures 11

Optimistic for Altra’s Future Cash-generative business model is highly resilient Combination of PTT and A&S businesses has been a strategic success Poised to benefit from strong demand across several diverse end markets Value proposition is resonating with customer base 12

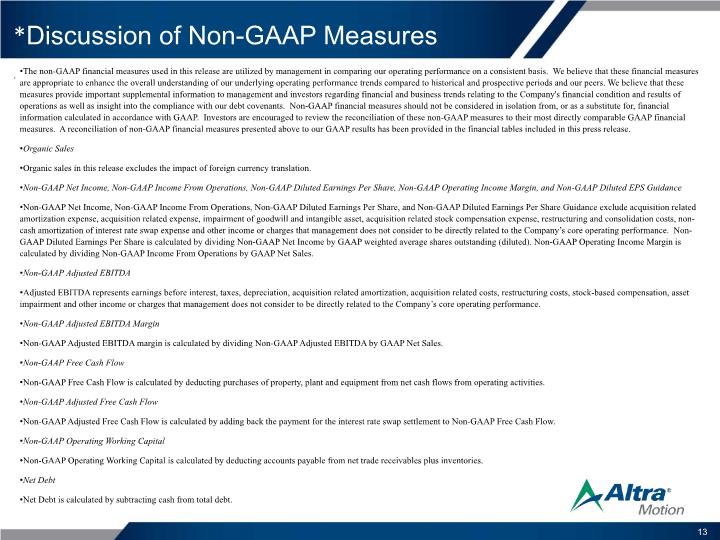

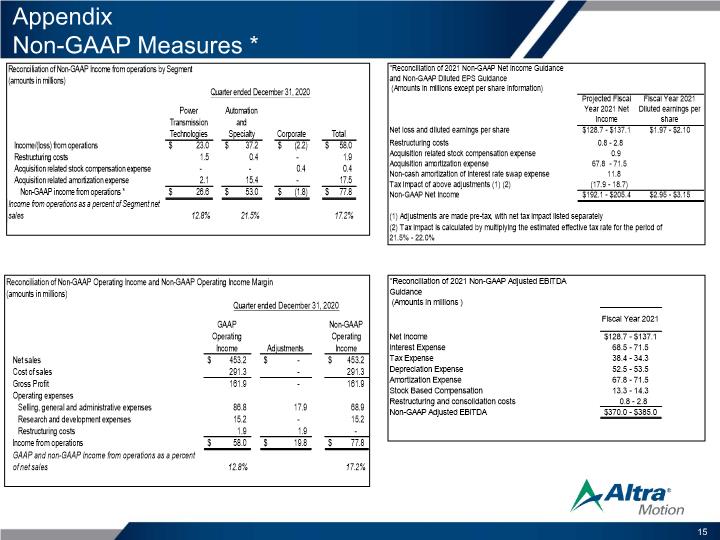

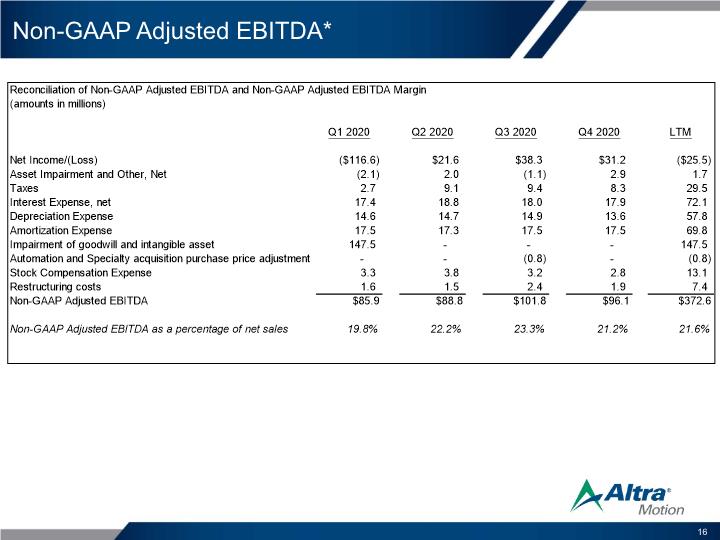

*Discussion of Non-GAAP Measures . The non-GAAP financial measures used in this release are utilized by management in comparing our operating performance on a consistent basis. We believe that these financial measures are appropriate to enhance the overall understanding of our underlying operating performance trends compared to historical and prospective periods and our peers. We believe that these measures provide important supplemental information to management and investors regarding financial and business trends relating to the Company's financial condition and results of operations as well as insight into the compliance with our debt covenants. Non-GAAP financial measures should not be considered in isolation from, or as a substitute for, financial information calculated in accordance with GAAP. Investors are encouraged to review the reconciliation of these non-GAAP measures to their most directly comparable GAAP financial measures. A reconciliation of non-GAAP financial measures presented above to our GAAP results has been provided in the financial tables included in this press release. Organic Sales Organic sales in this release excludes the impact of foreign currency translation. Non-GAAP Net Income, Non-GAAP Income From Operations, Non-GAAP Diluted Earnings Per Share, Non-GAAP Operating Income Margin, and Non-GAAP Diluted EPS Guidance Non-GAAP Net Income, Non-GAAP Income From Operations, Non-GAAP Diluted Earnings Per Share, and Non-GAAP Diluted Earnings Per Share Guidance exclude acquisition related amortization expense, acquisition related expense, impairment of goodwill and intangible asset, acquisition related stock compensation expense, restructuring and consolidation costs, non-cash amortization of interest rate swap expense and other income or charges that management does not consider to be directly related to the Company’s core operating performance. Non-GAAP Diluted Earnings Per Share is calculated by dividing Non-GAAP Net Income by GAAP weighted average shares outstanding (diluted). Non-GAAP Operating Income Margin is calculated by dividing Non-GAAP Income From Operations by GAAP Net Sales. Non-GAAP Adjusted EBITDA Adjusted EBITDA represents earnings before interest, taxes, depreciation, acquisition related amortization, acquisition related costs, restructuring costs, stock-based compensation, asset impairment and other income or charges that management does not consider to be directly related to the Company’s core operating performance. Non-GAAP Adjusted EBITDA Margin Non-GAAP Adjusted EBITDA margin is calculated by dividing Non-GAAP Adjusted EBITDA by GAAP Net Sales. Non-GAAP Free Cash Flow Non-GAAP Free Cash Flow is calculated by deducting purchases of property, plant and equipment from net cash flows from operating activities. Non-GAAP Adjusted Free Cash Flow Non-GAAP Adjusted Free Cash Flow is calculated by adding back the payment for the interest rate swap settlement to Non-GAAP Free Cash Flow. Non-GAAP Operating Working Capital Non-GAAP Operating Working Capital is calculated by deducting accounts payable from net trade receivables plus inventories. Net Debt Net Debt is calculated by subtracting cash from total debt. 13

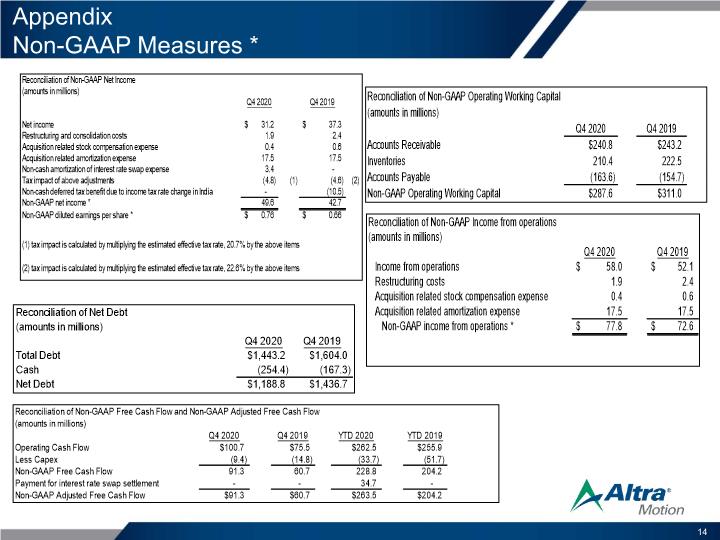

Appendix Non-GAAP Measures * 14

Appendix Non-GAAP Measures * 15

Non-GAAP Adjusted EBITDA* 16