Attached files

| file | filename |

|---|---|

| 8-K - 8-K - GLACIER BANCORP, INC. | gbci-20210203.htm |

FEBRUARY INVESTOR PRESENTATION February 2021

1 Forward-Looking Statements This presentation may contain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements include, but are not limited to, statements about management’s plans, objectives, expectations and intentions that are not historical facts, and other statements identified by words such as “expects,” “anticipates,” “intends,” “plans,” “believes,” “should,” “projects,” “seeks,” “estimates”, or words of similar meaning. These forward-looking statements are based on current beliefs and expectations of management and are inherently subject to significant business, economic and competitive uncertainties and contingencies, many of which are beyond the Company’s control. In addition, these forward-looking statements are subject to assumptions with respect to future business strategies and decisions that are subject to change. The following factors, among others, could cause actual results to differ materially from the anticipated results or other expectations in the forward-looking statements, including those set forth in this presentation: 1) the risks associated with lending and potential adverse changes of the credit quality of loans in the Company’s portfolio; 2) changes in trade, monetary and fiscal policies and laws, including interest rate policies of the Board of Governors of the Federal Reserve System or the Federal Reserve Board, which could adversely affect the Company’s net interest income and profitability; 3) changes in the cost and scope of insurance from the FDIC and other third parties; 4) legislative or regulatory changes, such as the recently adopted CARES Act addressing the economic effects of the COVID-19 pandemic, as well as increased banking and consumer protection regulation that adversely affect the Company’s business, both generally and as a result of the Company exceeding $10 billion in total consolidated assets; 5) ability to complete pending or prospective future acquisitions; 6) costs or difficulties related to the completion and integration of acquisitions; 7) the goodwill the Company has recorded in connection with acquisitions could become impaired, which may have an adverse impact on earnings and capital; 8) reduced demand for banking products and services; 9) the reputation of banks and the financial services industry could deteriorate, which could adversely affect the Company's ability to obtain (and maintain) customers; 10) competition among financial institutions in the Company's markets may increase significantly; 11) the risks presented by continued public stock market volatility, which could adversely affect the market price of the Company’s common stock and the ability to raise additional capital or grow the Company through acquisitions; 12) the projected business and profitability of an expansion or the opening of a new branch could be lower than expected; 13) consolidation in the financial services industry in the Company’s markets resulting in the creation of larger financial institutions who may have greater resources could change the competitive landscape; 14) dependence on the CEO, the senior management team and the Presidents of Glacier Bank divisions; 15) material failure, potential interruption or breach in security of the Company’s systems and technological changes which could expose us to new risks (e.g., cybersecurity), fraud or system failures; 16) natural disasters, including fires, floods, earthquakes, and other unexpected events; 17) the Company’s success in managing risks involved in the foregoing; and 18) the effects of any reputational damage to the Company resulting from any of the foregoing. The Company does not undertake any obligation to publicly correct, revise, or update any forward-looking statement if it later becomes aware that actual results are likely to differ materially from those expressed in such forward-looking statement, except as required under federal securities laws.

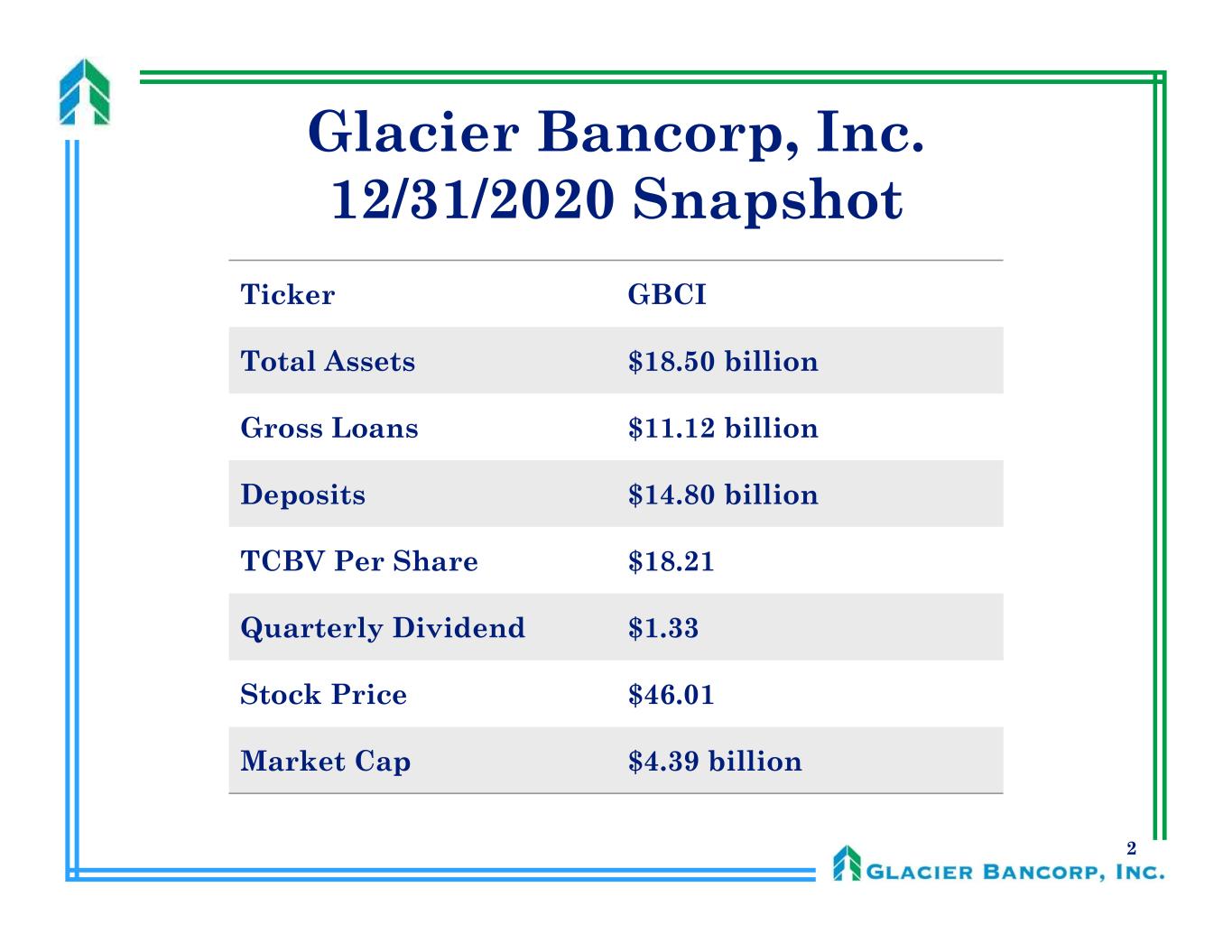

2 Glacier Bancorp, Inc. 12/31/2020 Snapshot Ticker GBCI Total Assets $18.50 billion Gross Loans $11.12 billion Deposits $14.80 billion TCBV Per Share $18.21 Quarterly Dividend $1.33 Stock Price $46.01 Market Cap $4.39 billion

3 Differentiated Bank Model Genuine community banking model Backed by resources and support of Glacier Bancorp Strategy of growth through acquisitions and organically

4 Glacier is a “Company of Banks”

5 Recent Acquisition Highlights

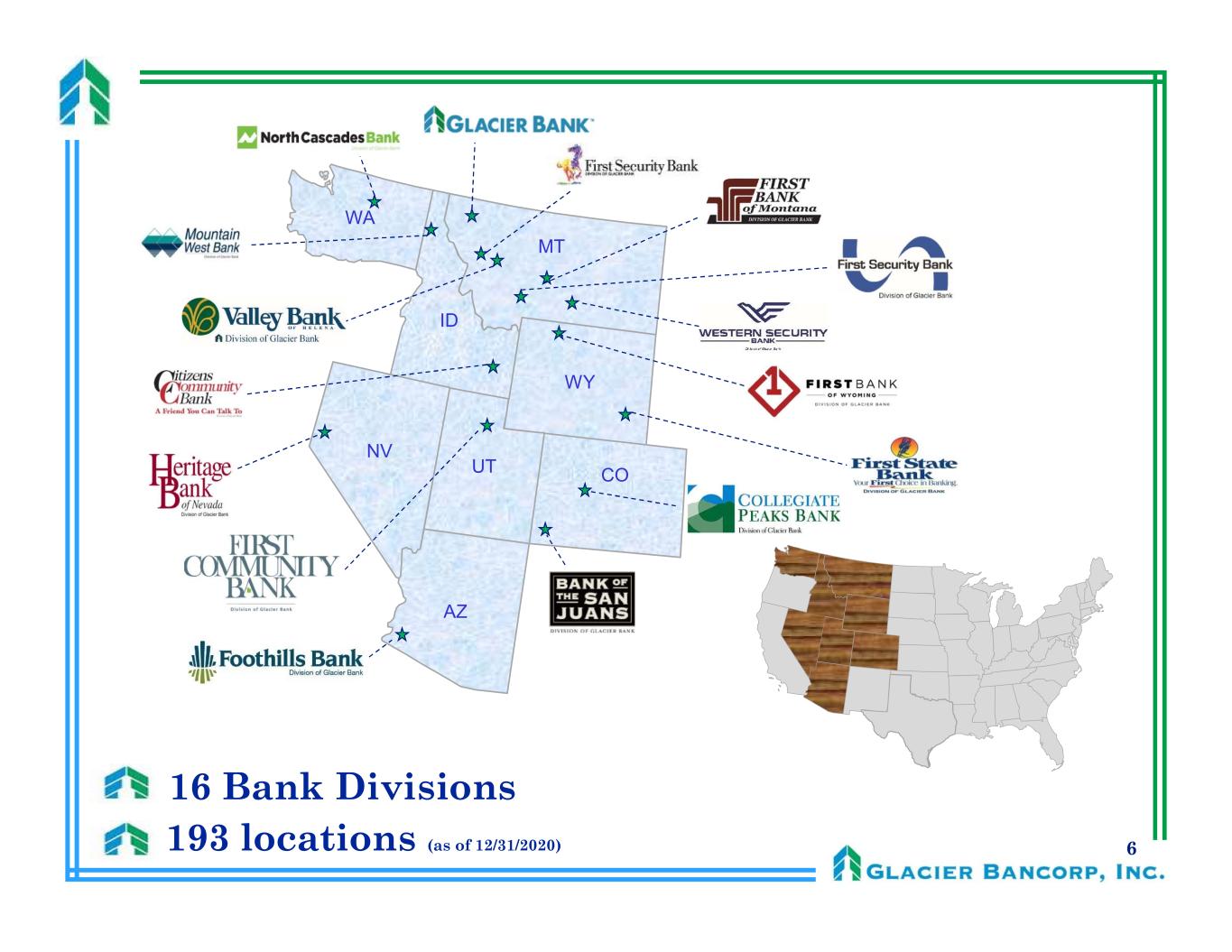

6 WY ID UT AZ NV WA CO MT 16 Bank Divisions 193 locations (as of 12/31/2020)

7 12/31/20 GBCI Geography Total chartered banks 314 Total target banks 217 Assets under $1B 192 Assets $1 – $3.5B 25

8 Solid Financial Results

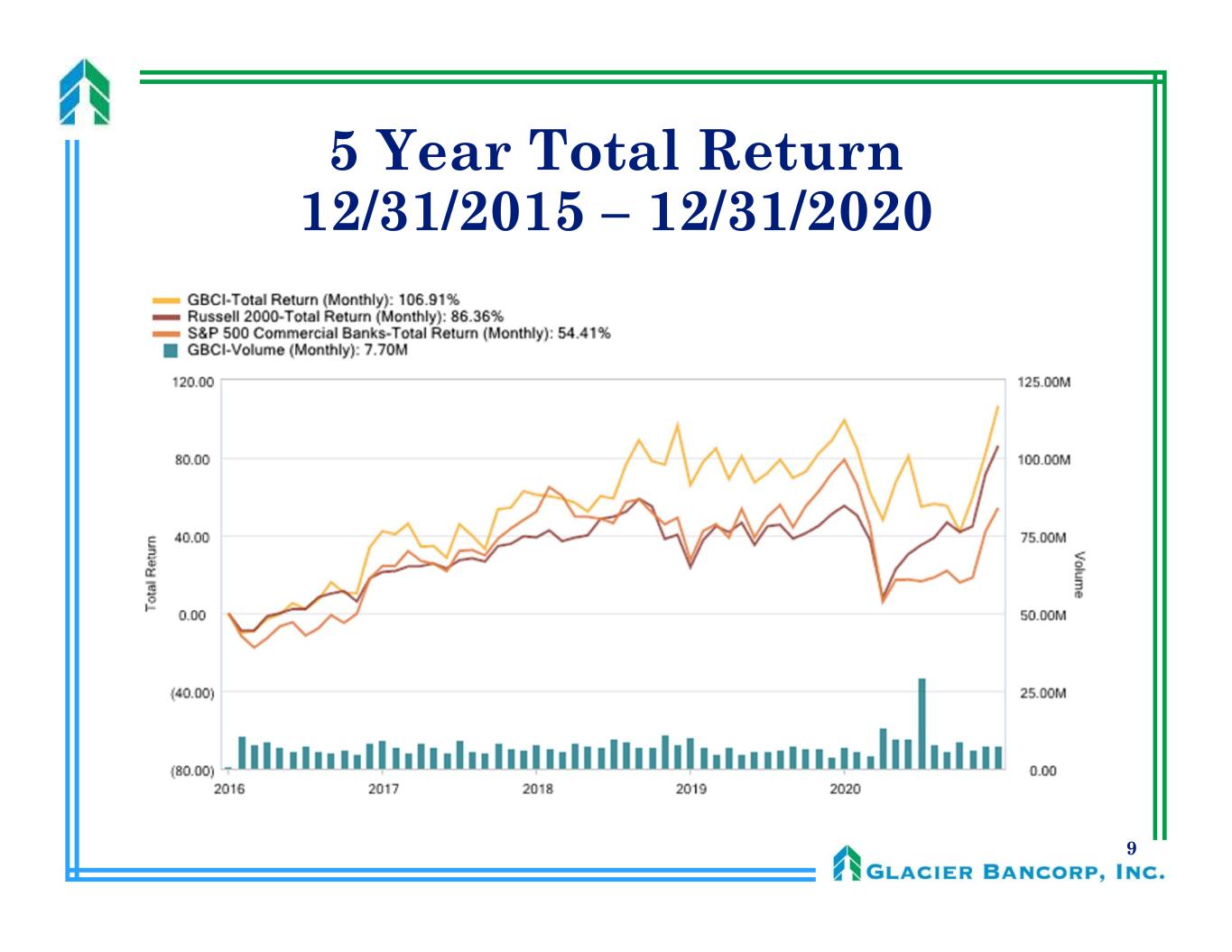

9 5 Year Total Return 12/31/2015 – 12/31/2020

10 1 Year Total Return 12/31/2019 – 12/31/2020

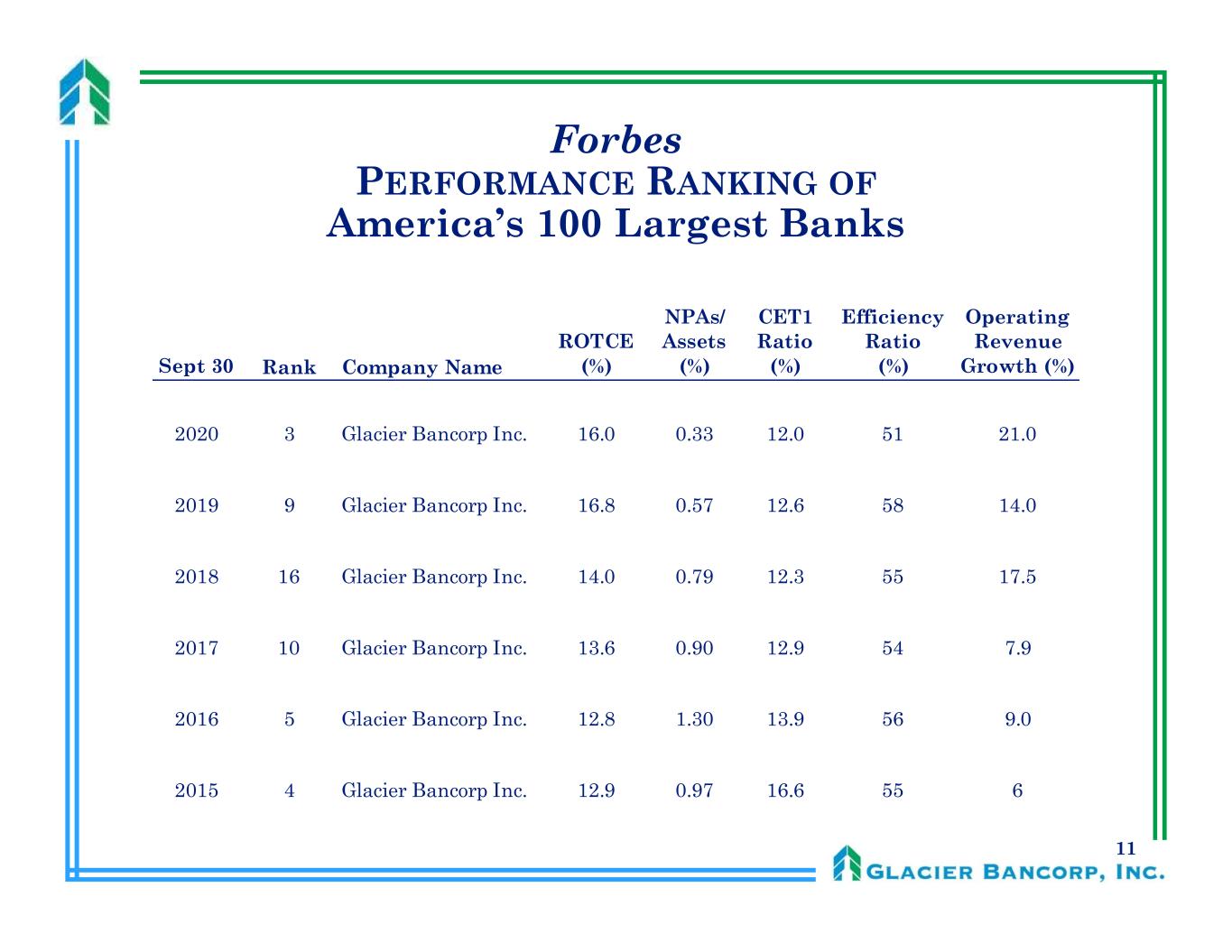

11 Forbes PERFORMANCE RANKING OF America’s 100 Largest Banks Sept 30 Rank Company Name ROTCE (%) NPAs/ Assets (%) CET1 Ratio (%) Efficiency Ratio (%) Operating Revenue Growth (%) 2020 3 Glacier Bancorp Inc. 16.0 0.33 12.0 51 21.0 2019 9 Glacier Bancorp Inc. 16.8 0.57 12.6 58 14.0 2018 16 Glacier Bancorp Inc. 14.0 0.79 12.3 55 17.5 2017 10 Glacier Bancorp Inc. 13.6 0.90 12.9 54 7.9 2016 5 Glacier Bancorp Inc. 12.8 1.30 13.9 56 9.0 2015 4 Glacier Bancorp Inc. 12.9 0.97 16.6 55 6

12 Bank Director BANK PERFORMANCE SCORECARD $5 Billion up to $50 Billion Year Ending Rank Company Name Core ROAA (%) Core ROAE (%) TCE/ Tang Assets (%) NPAs/ Loans & REO (%) NCOs/ Avg Loans (%) 2019 4 Glacier Bancorp Inc. 1.78 12.99 10.95 0.35 0.08 2018 16 Glacier Bancorp Inc. 1.67 13.21 9.99 0.91 0.11 2017 17 Glacier Bancorp Inc. 1.44 11.75 10.58 1.47 0.17 2016 9 Glacier Bancorp Inc. 1.40 11.39 10.31 2.12 0.05 2015 16 Glacier Bancorp Inc. 1.39 11.14 10.31 2.74 0.05

13 Reconciliation of 2017 Non-GAAP Measures to GAAP In addition to the results presented in accordance with accounting principles generally accepted in the United States of America (“GAAP”), this presentation contains certain non-GAAP financial measures. The Company believes that providing these non-GAAP financial measures provides investors with information useful in understanding the Company's financial performance, performance trends, and financial position. While the Company uses these non- GAAP measures in its analysis of the Company's performance, this information should not be considered an alternative to measurements required by GAAP. This table provides a reconciliation of certain GAAP financial measures to non-GAAP financial measures. The reconciling item between the GAAP and non-GAAP financial measures was the current quarter one-time tax expense of $19.7 million. The one-time tax expense was driven by the Tax Cuts and Job Act (“Tax Act”) and the change in the current year federal marginal rate of 35 percent to 21 percent for future years, which resulted in revaluation of deferred tax assets and deferred tax liabilities (“net deferred tax asset”). The Company believes that the financial results are more comparable excluding the impact of the revaluation of the net deferred tax asset. (Dollars in thousands, except per share data) December 31 2017 Earnings per share YTD (GAAP) 1.50$ Tax Act adjustment (GAAP) 0.25 Earnings per share YTD (non-GAAP) 1.75$ Return on assets (GAAP) 1.20% Tax Act adjustment (GAAP) 0.21% Return on assets (non-GAAP) 1.41% Return on tangible equity (GAAP) 11.70% Tax Act adjustment (GAAP) 1.96% Return on tangible equity (non-GAAP) 13.66%

14 Diluted Earnings Per Share $0.00 $0.50 $1.00 $1.50 $2.00 $2.50 $3.00 2015 2016 2017 2018 2019 2020 $1.54 $1.59 $1.75* $2.17 $0.58 $0.46 $0.61 $0.66 $0.57 $0.81 $0.62 $0.86 $2.38 2020 earnings per share of $2.81 increased $0.43 per share, or 18%, over prior year earnings per share of $2.38 2020 earnings include: Gain on sale of loans of $99.5 million, an increase of $65.4 million, or 192%, compared to 2019 Interest income of $38.2 million from PPP loans Credit loss expense of $39.8 million due to CECL Acquisition-related expenses of $7.8 million *Non-GAAP (see reconciliation on slide 13) $2.81

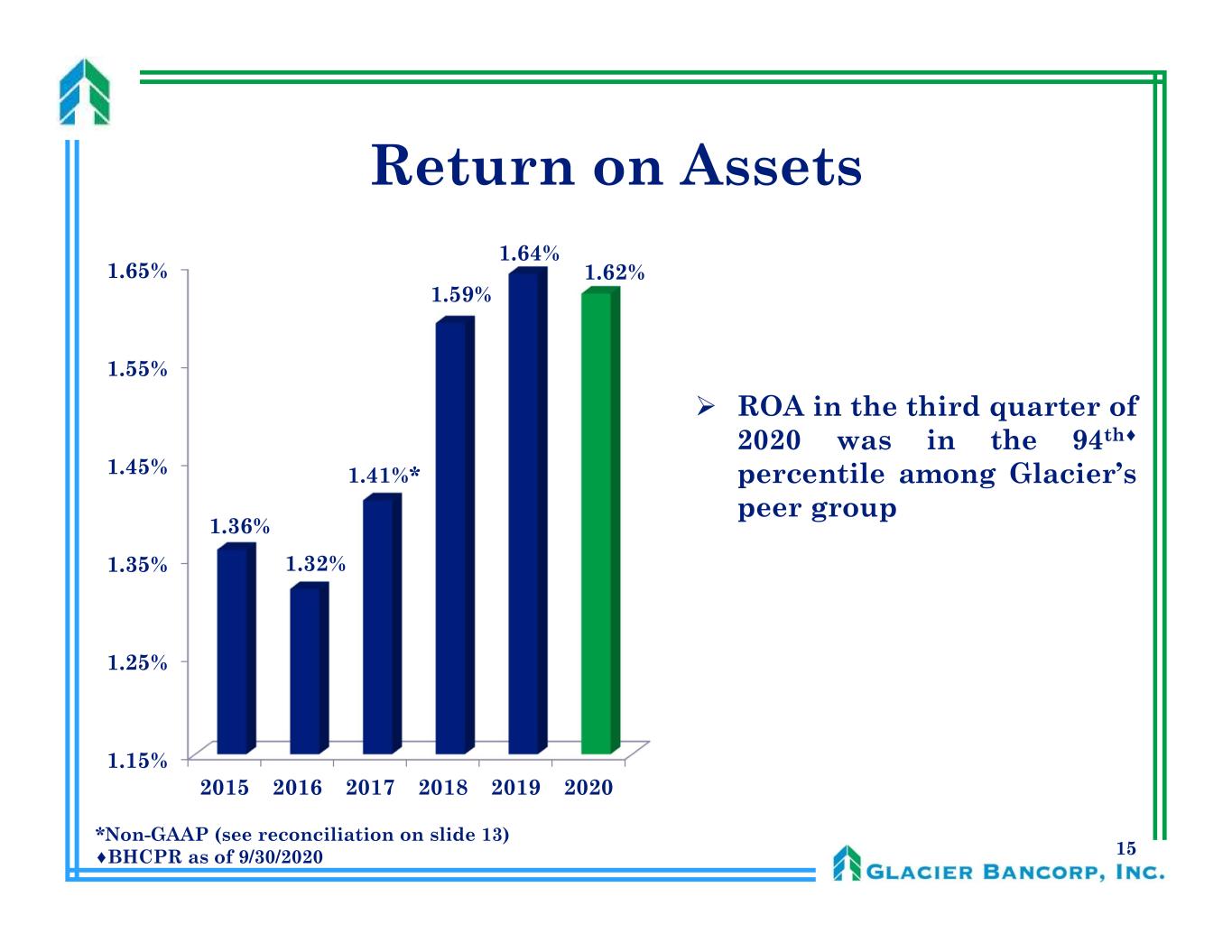

15 1.15% 1.25% 1.35% 1.45% 1.55% 1.65% 2015 2016 2017 2018 2019 2020 1.36% 1.32% 1.41%* 1.59% 1.64% 1.62% ROA in the third quarter of 2020 was in the 94th♦ percentile among Glacier’s peer group Return on Assets *Non-GAAP (see reconciliation on slide 13) ♦BHCPR as of 9/30/2020

16 Return on Tangible Equity 10.00% 11.00% 12.00% 13.00% 14.00% 15.00% 16.00% 17.00% 18.00% 2015 2016 2017 2018 2019 2020 12.71% 12.71% 13.66%* 16.42% 16.15% 16.85% The Company’s historically high capital levels have made it more difficult to produce higher ROTE *Non-GAAP (see reconciliation on slide 13)

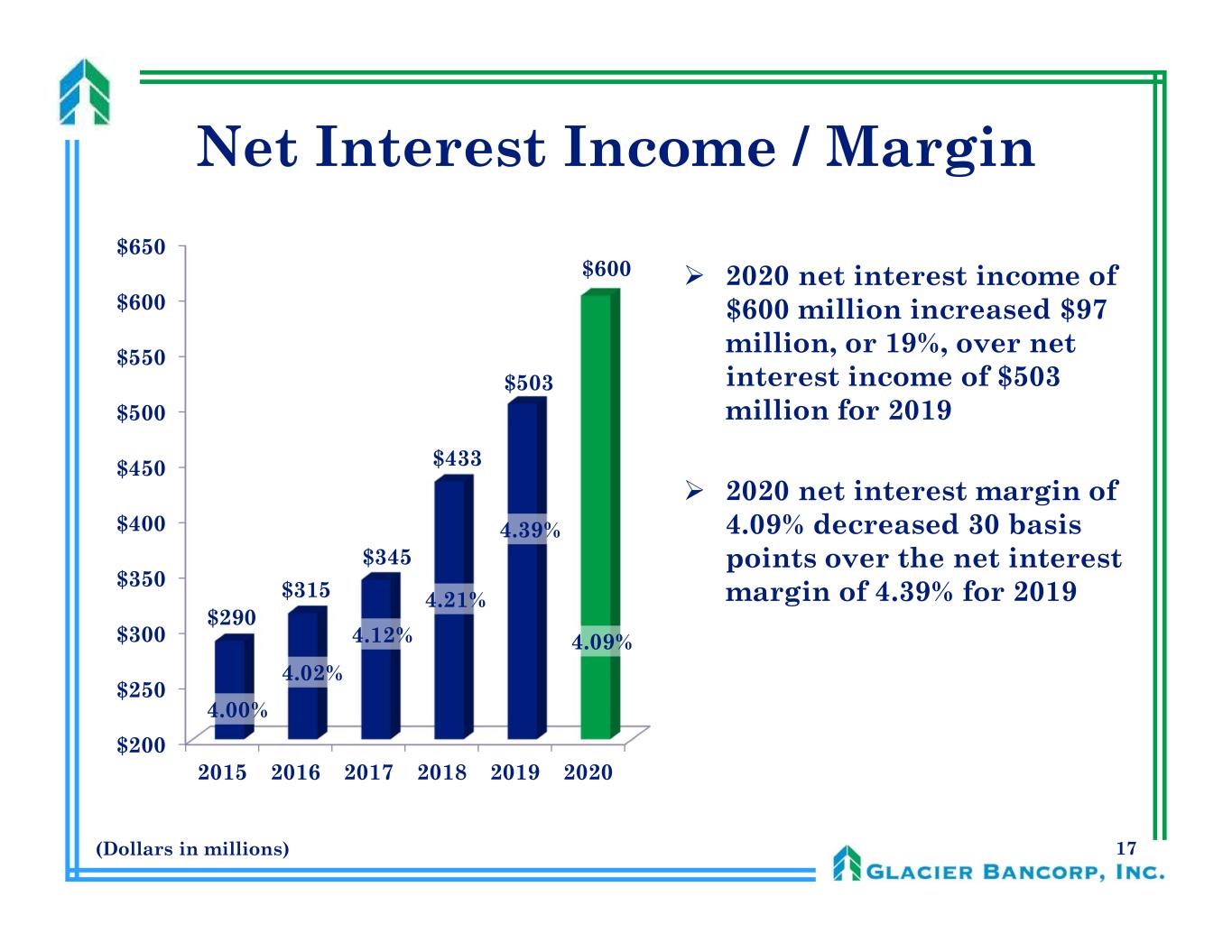

17 Net Interest Income / Margin $200 $250 $300 $350 $400 $450 $500 $550 $600 $650 2015 2016 2017 2018 2019 2020 $290 $315 $345 $433 $503 $600 4.00% 4.02% 4.12% 4.21% 4.39% 4.09% 2020 net interest income of $600 million increased $97 million, or 19%, over net interest income of $503 million for 2019 2020 net interest margin of 4.09% decreased 30 basis points over the net interest margin of 4.39% for 2019 (Dollars in millions)

18 Efficiency Ratio 49.0% 50.0% 51.0% 52.0% 53.0% 54.0% 55.0% 56.0% 57.0% 58.0% 59.0% 60.0% 2015 2016 2017 2018 2019 2020 55.4% 55.9% 53.9% 54.7% 57.8% 50.0% The efficiency ratio improvement in 2020 was driven primarily by the combined increases in gain on sale of loans and net interest income that more than offset the decrease in service fee income (due to the Durbin amendment) and increased compensation expense Excluding $18.9 million of expenses(*) incurred in the third quarter of 2019, the 2019 efficiency ratio would be 54.7% *$5.4 million of accelerated stock compensation expense from the Heritage acquisition *$3.5 million write-off of deferred prepayment penalties on FHLB advances *$10.0 million loss on early termination of interest rate swaps

19 Strong Balance Sheet

20 Asset Trends $9,089 $9,451 $9,706 $12,115 $13,684 $18,504 $9,000 $10,000 $11,000 $12,000 $13,000 $14,000 $15,000 $16,000 $17,000 $18,000 $19,000 $20,000 2015 2016 2017 2018 2019 2020 Total assets increased $4.8 billion, or 35%, during 2020, including $745 million from State Bank of Arizona Total assets grew $1.6 billion, or 13%, in 2019, including $379 million from First National Bank of Layton and $978 million from Heritage Bank of Nevada (Dollars in millions)

21 Capital Ratios Relative to Peers♦ 0.00% 3.00% 6.00% 9.00% 12.00% 15.00% 18.00% Tier 1 Leverage CET1 Tier 1 RBC Total RBC 9.1% 12.3% 13.0% 15.1% 9.5% 12.5% 12.5% 14.8% Peers Glacier Total risk-based capital ranks in the 53rd percentile among Glacier’s peer group Capacity to add $3.0 billion of assets and still maintain an 8% leverage ratio ♦BHCPR as of 9/30/2020

22 Ample Liquidity of $12.2 Billion Ready access to liquidity totaling $9.0 billion $5.1 billion in available borrowing capacity o Fed Discount Window: $1.2 billion o Fed PPP Liquidity Facility: $0.9 billion (Based on PPP loans funded as of December 31, 2020) o FHLB: $2.4 billion o Correspondent banks: $0.6 billion $3.3 billion of unpledged marketable securities Cash of $0.6 billion Additional liquidity totaling $3.2 billion Access to brokered deposits: $2.7 billion Over-pledged marketable securities: $0.2 billion Loans eligible for pledging at FHLB: $0.3 billion Core deposit growth remains strong

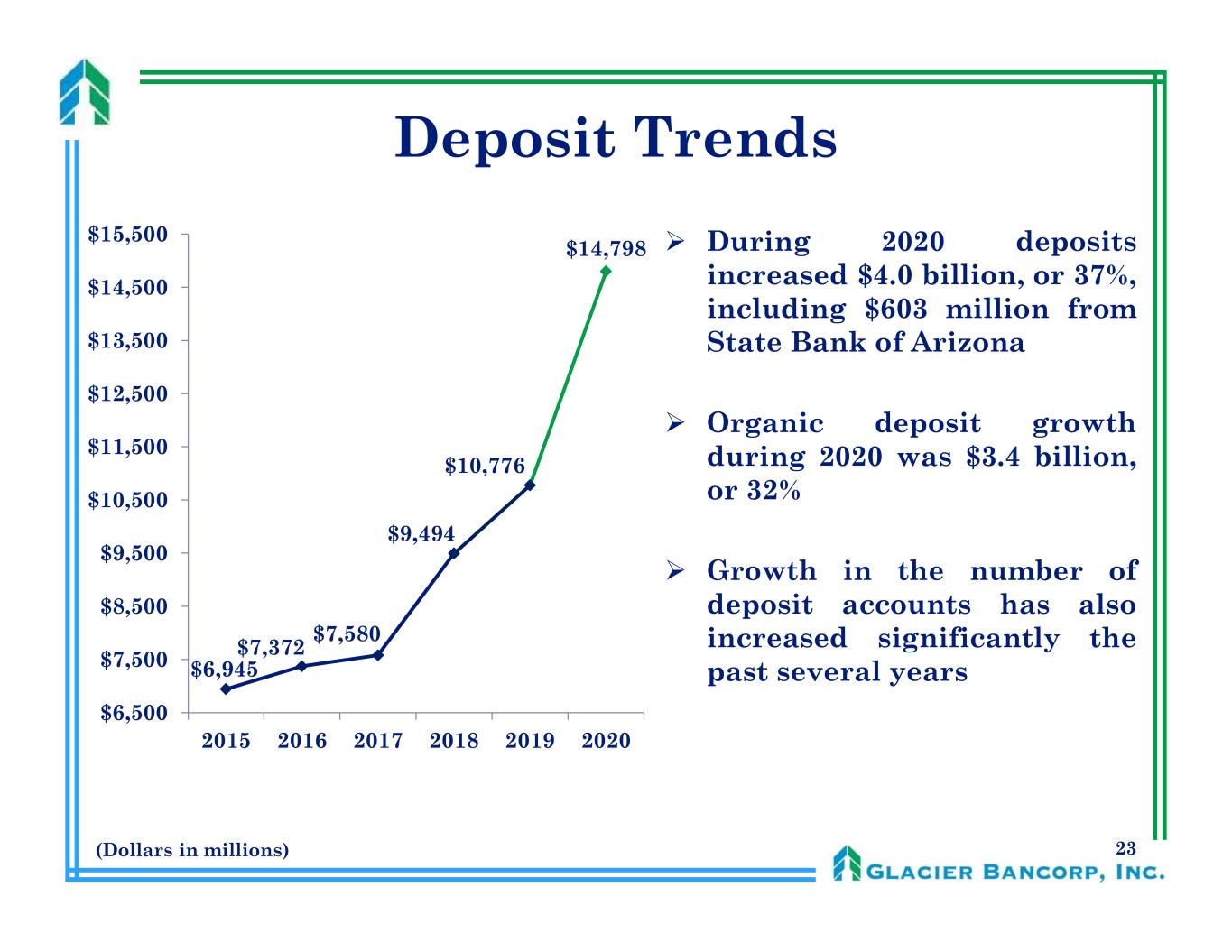

23 Deposit Trends $6,945 $7,372 $7,580 $9,494 $10,776 $14,798 $6,500 $7,500 $8,500 $9,500 $10,500 $11,500 $12,500 $13,500 $14,500 $15,500 2015 2016 2017 2018 2019 2020 During 2020 deposits increased $4.0 billion, or 37%, including $603 million from State Bank of Arizona Organic deposit growth during 2020 was $3.4 billion, or 32% Growth in the number of deposit accounts has also increased significantly the past several years (Dollars in millions)

24 Deposit Composition Non- Interest Bearing 34% NOW and DDA 25% Savings 14% MMDA 18% CDs 9% Wholesale 0% 12/31/2019 Non- Interest Bearing 37% NOW and DDA 25% Savings 13% MMDA 18% CDs 7% Wholesale 0% 12/31/2020

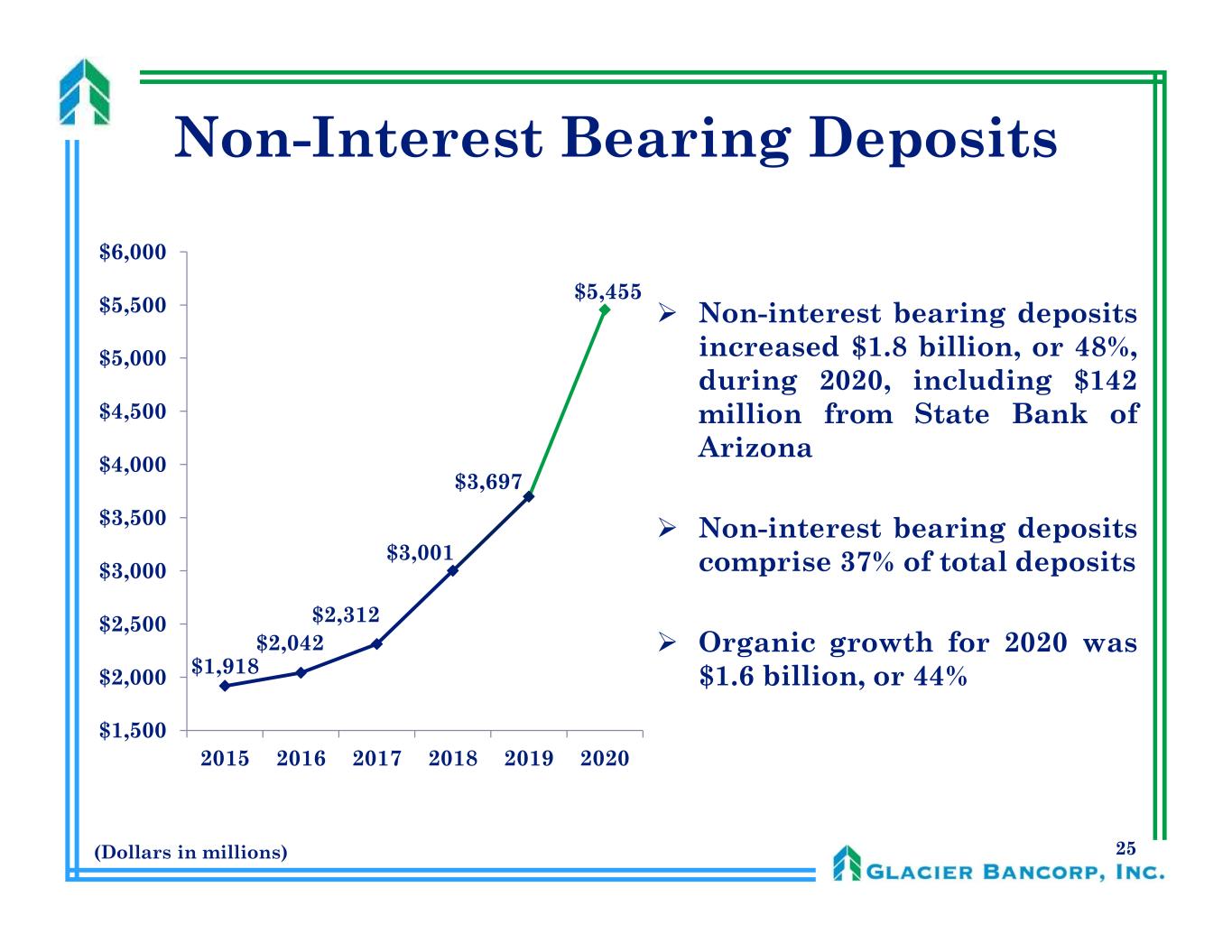

25 Non-Interest Bearing Deposits $1,918 $2,042 $2,312 $3,001 $3,697 $5,455 $1,500 $2,000 $2,500 $3,000 $3,500 $4,000 $4,500 $5,000 $5,500 $6,000 2015 2016 2017 2018 2019 2020 Non-interest bearing deposits increased $1.8 billion, or 48%, during 2020, including $142 million from State Bank of Arizona Non-interest bearing deposits comprise 37% of total deposits Organic growth for 2020 was $1.6 billion, or 44% (Dollars in millions)

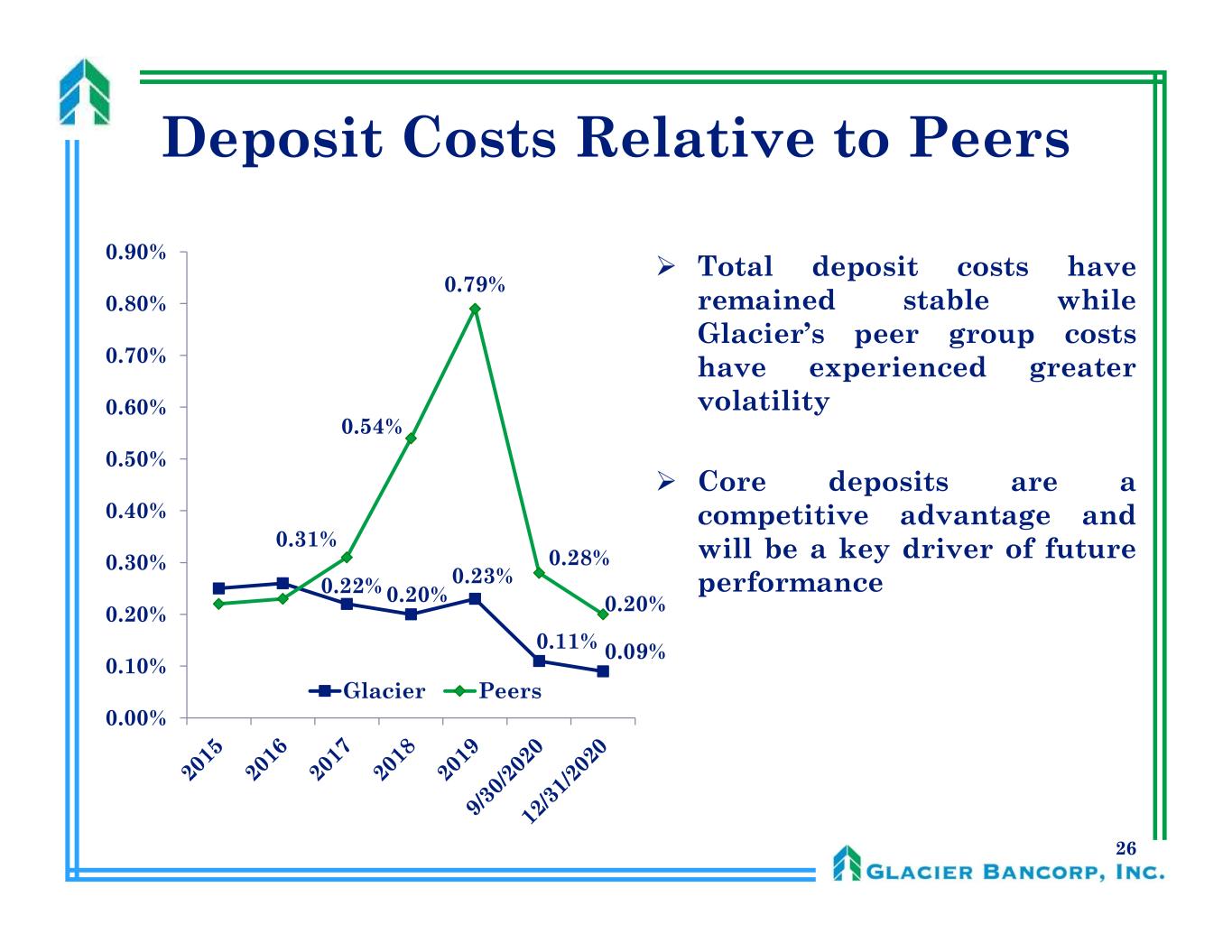

26 Deposit Costs Relative to Peers 0.22% 0.20% 0.23% 0.11% 0.09% 0.31% 0.54% 0.79% 0.28% 0.20% 0.00% 0.10% 0.20% 0.30% 0.40% 0.50% 0.60% 0.70% 0.80% 0.90% Glacier Peers Total deposit costs have remained stable while Glacier’s peer group costs have experienced greater volatility Core deposits are a competitive advantage and will be a key driver of future performance

27 Loan Trends $5,079 $5,684 $6,578 $8,288 $9,513 $11,123 $4,000 $5,000 $6,000 $7,000 $8,000 $9,000 $10,000 $11,000 $12,000 2015 2016 2017 2018 2019 2020 Gross loans increased $1.610 billion, or 17%, during 2020 including $452 million from State Bank of Arizona Excluding $909.2 million of PPP loans, the loan portfolio increased $43.2 million, or 0.42%, during 2020 (Dollars in millions)

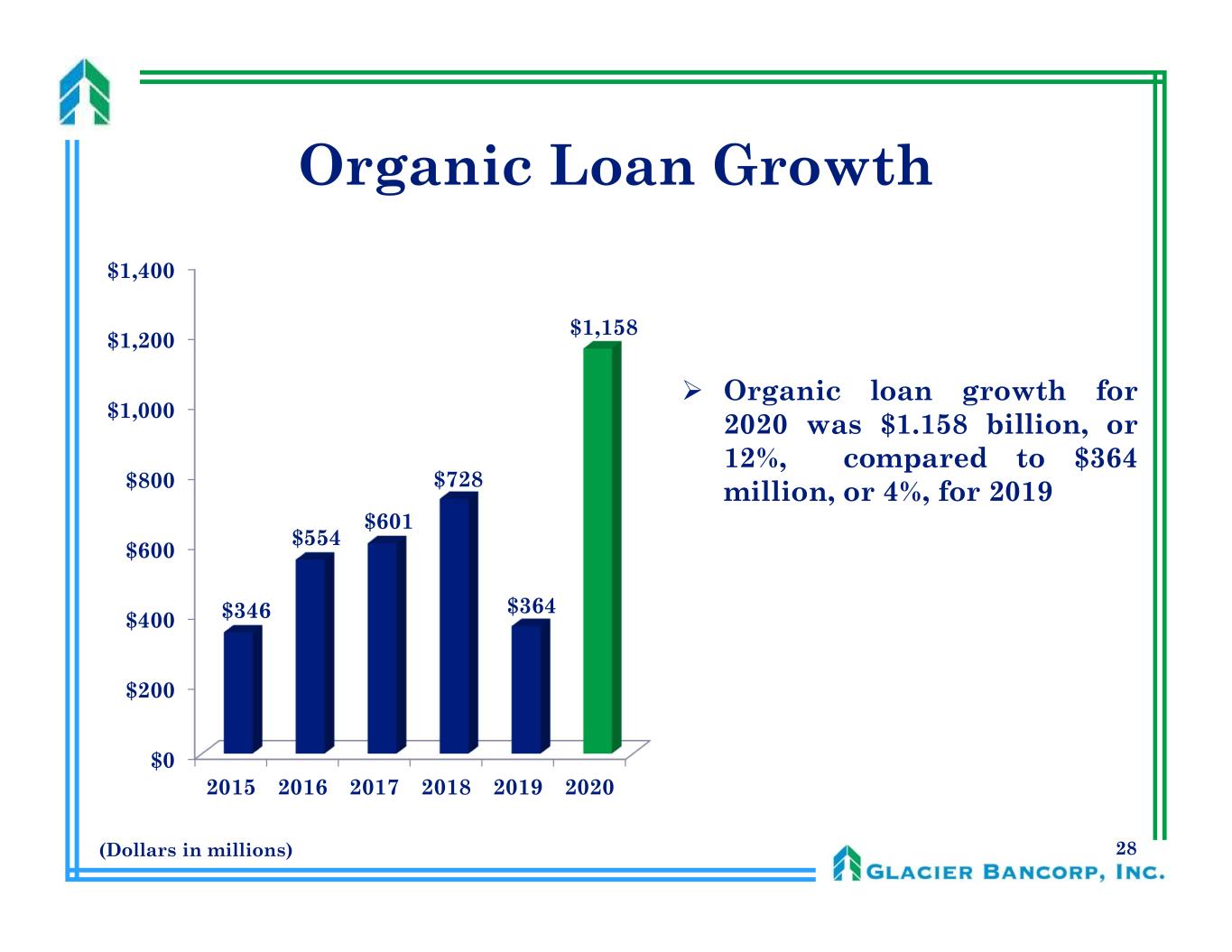

28 $0 $200 $400 $600 $800 $1,000 $1,200 $1,400 2015 2016 2017 2018 2019 2020 $346 $554 $601 $728 $364 $1,158 Organic loan growth for 2020 was $1.158 billion, or 12%, compared to $364 million, or 4%, for 2019 Organic Loan Growth (Dollars in millions)

29 Loan Composition Residential Real Estate 10% CRE 59% Other Commerical 22% HELOC 6% Other Consumer 3% 12/31/2019 Residential Real Estate 7% CRE 57% Other Commerical 27% HELOC 6% Other Consumer 3% 12/31/2020

30 Geographic Loan Dispersion 12/31/202012/31/2009

31 COVID-19 High Risk Industries Enhanced-Monitoring Conducting ongoing portfolio reviews and monitoring for potential credit impacts from COVID-19 $23 million of modifications made in the enhanced-monitoring loan portfolio 25% of total modifications of $95 million (Dollars in Thousands) Hotel and motel 428,868$ 4.20% 6,074 7,958 14,032 3.27% 50,770$ 4.15% 12.02% Restaurant 154,055 1.51% 2,054 5,945 7,999 5.19% 19,152 1.37% 13.78% Travel and tourism 22,018 0.22% - - - 0.00% 5,002 0.19% 25.36% Gaming 14,220 0.14% - - - 0.00% 1,101 0.14% 7.59% Oil & Gas 23,158 0.23% 494 941 1,435 6.20% 1,474 0.22% 6.65% Total 642,319 6.29% 8,622 14,844 23,466 3.65% 77,499 6.08% 12.54% Percent of Total Loans Receivable, Net of PPP Loans Loan Modifications (Amount) as a Percent of Enhanced Monitoring Loans Receivable, Net of PPP Loans September 30, 2020December 31, 2020 Amount of Remaining Loan Modifications Loan Modifications (Amount) as a Percent of Enhanced Monitoring Loans Receivable, Net of PPP Loans Amount of Remaining Loan Modifications Amount of Re-deferral Loan Modifications Amount of Unexpired Original Loan Modifications Percent of Total Loans Receivable, Net of PPP Loans Enhanced Monitoring Total Loans Receivable, Net of PPP Loans

32 COVID-19 Bank Loan Modifications (Dollars in Thousands) Residential real estate 802,508$ 4,322 - 4,322 0.54% 28,571$ 3.31% Commercial real estate and other commercial Real estate rental and leasing 3,484,537 39,329 3,984 43,313 1.24% 206,838 6.15% Accommodation and food services 657,770 8,151 13,903 22,054 3.35% 82,182 12.75% Healthcare 835,642 1,043 88 1,131 0.14% 43,253 5.23% Manufacturing 182,565 6,806 2,682 9,488 5.20% 18,559 9.61% Retail and wholesale trade 471,282 2,655 - 2,655 0.56% 15,853 3.36% Construction 758,308 927 - 927 0.12% 14,525 1.88% Other 2,071,435 216 10,039 10,255 0.50% 50,588 2.44% Home equity and other consumer 949,476 705 - 705 0.07% 5,767 0.60% Total 10,213,523 64,154 30,696 94,850 0.93% 466,136 4.58% December 31, 2020 September 30, 2020 Total Loans Receivable, Net of PPP Loans Amount of Unexpired Original Loan Modifications Amount of Re-deferral Loan Modifications Amount of Remaining Loan Modifications Loan Modifications (Amount) as a Percent of Enhanced Monitoring Loans Receivable, Net of PPP Loans Loan Modifications (Amount) as a Percent of Enhanced Monitoring Loans Receivable, Net of PPP Loans Amount of Remaining Loan Modifications

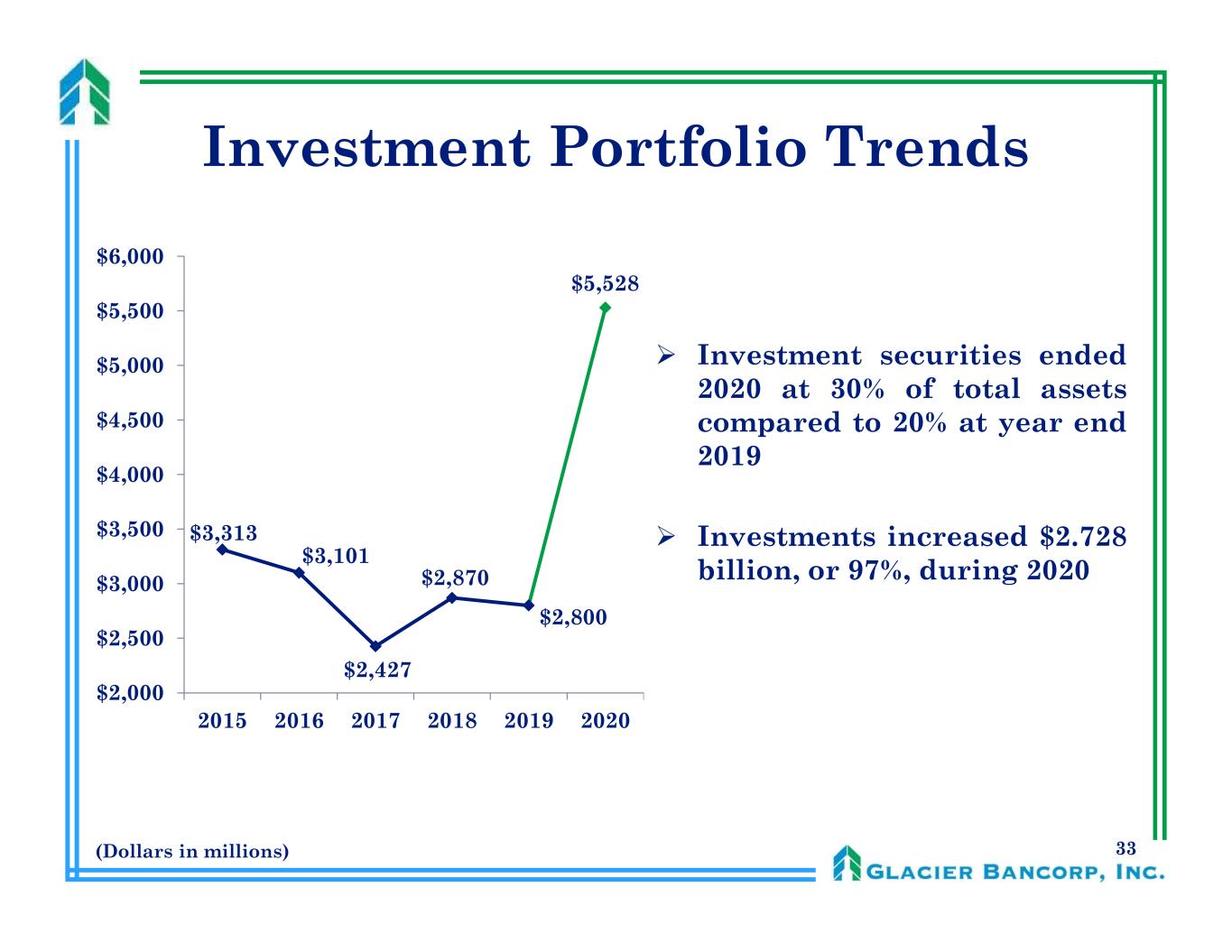

33 Investment Portfolio Trends $3,313 $3,101 $2,427 $2,870 $2,800 $5,528 $2,000 $2,500 $3,000 $3,500 $4,000 $4,500 $5,000 $5,500 $6,000 2015 2016 2017 2018 2019 2020 Investment securities ended 2020 at 30% of total assets compared to 20% at year end 2019 Investments increased $2.728 billion, or 97%, during 2020 (Dollars in millions)

34 Investment Composition US Gov't & Federal Agency 1% US Gov't Sponsored Enterprises 1% State & Local Gov'ts 33% Corporate Bonds 6% Residential MBS 26% Commercial MBS 33% 12/31/2019 US Gov't & Federal Agency 1% US Gov't Sponsored Enterprises 0% State & Local Gov'ts 29% Corporate Bonds 6% Residential MBS 42% Commercial MBS 22% 12/31/2020

35 Improved Credit Quality

36 NPAs to Bank Assets 0.00% 0.25% 0.50% 0.75% 1.00% 2015 2016 2017 2018 2019 2020 0.88% 0.76% 0.68% 0.47% 0.27% 0.19% NPAs decreased $2 million during 2020 to 0.19% of Bank assets compared to the $19 million decrease in 2019 to 0.27% of Bank assets

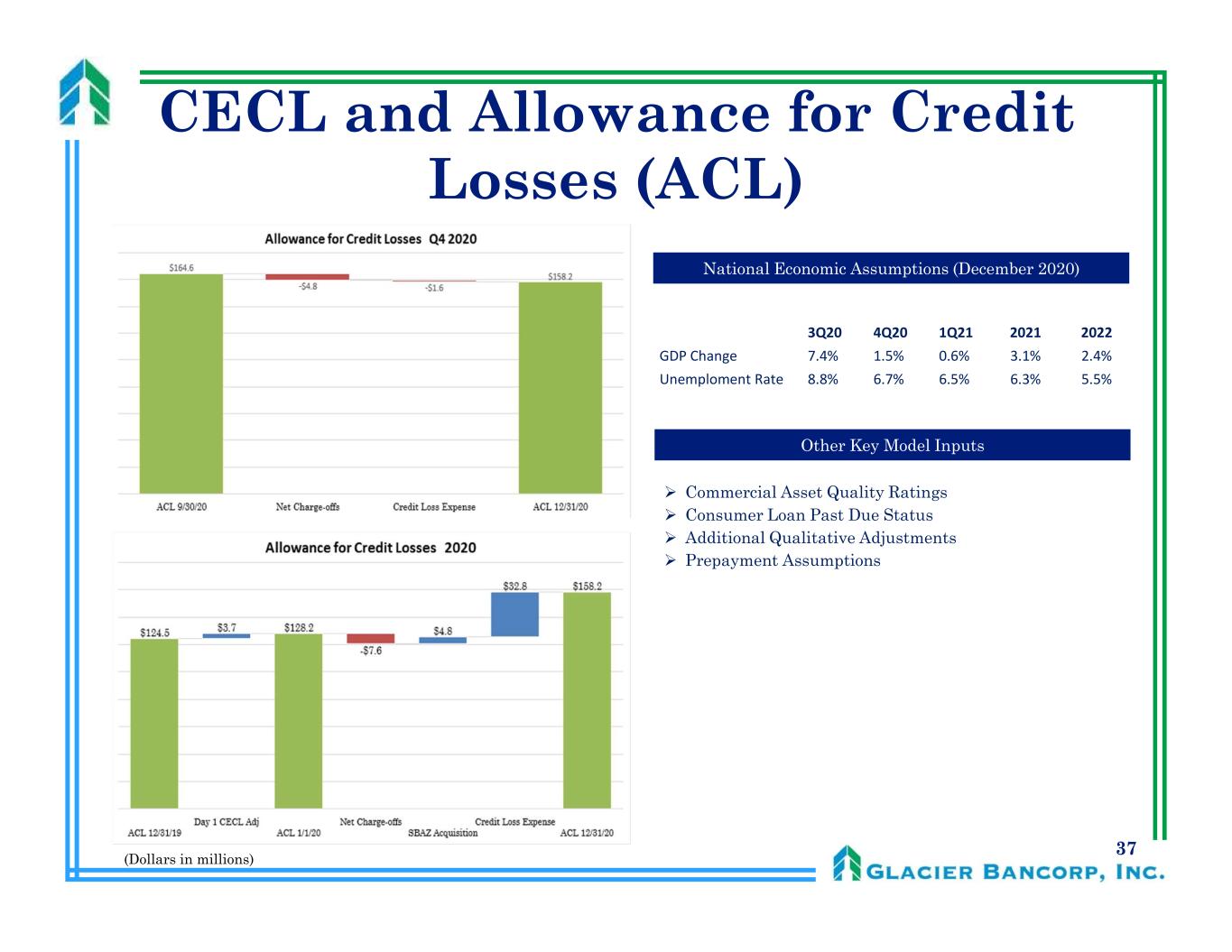

37 CECL and Allowance for Credit Losses (ACL) (Dollars in millions) Commercial Asset Quality Ratings Consumer Loan Past Due Status Additional Qualitative Adjustments Prepayment Assumptions Other Key Model Inputs National Economic Assumptions (December 2020) 3Q20 4Q20 1Q21 2021 2022 GDP Change 7.4% 1.5% 0.6% 3.1% 2.4% Unemploment Rate 8.8% 6.7% 6.5% 6.3% 5.5%

38 Credit Loss Expense $0 $5,000 $10,000 $15,000 $20,000 $25,000 $30,000 $35,000 $40,000 $45,000 2015 2016 2017 2018 2019 2020 $2,284 $2,333 $10,824 $9,953 $57 $37,637 $2,128 Loan portfolio growth and credit quality considerations will determine the level of credit loss expense (Dollars in thousands) $39,765 Unfunded Loan Commitments Loan Portfolio

39 Net Charge-Offs $0 $2,500 $5,000 $7,500 $10,000 $12,500 2015 2016 2017 2018 2019 2020 $2,340 $2,458 $10,828 $8,282 $6,806 $7,653 For 2020, net charge-offs as a percentage of total loans were 0.07% which was the same for 2019 (Dollars in thousands)

40 ACL as a Percentage of Loans 1.25% 1.50% 1.75% 2.00% 2.25% 2.50% 2.75% 3.00% 2015 2016 2017 2018 2019 2020 2.55% 2.28% 1.97% 1.58% 1.31% 1.42% ACL was in the 43rd♦ percentile of Glacier’s peer group for 2020 Excluding PPP loans, the ACL was 1.55% of loans at year end 2020 compared to 1.31% at the end of 2019 As credit trends change, expect the ACL to adjust accordingly ♦BHCPR as of 9/30/2020

41 Shareholder Return

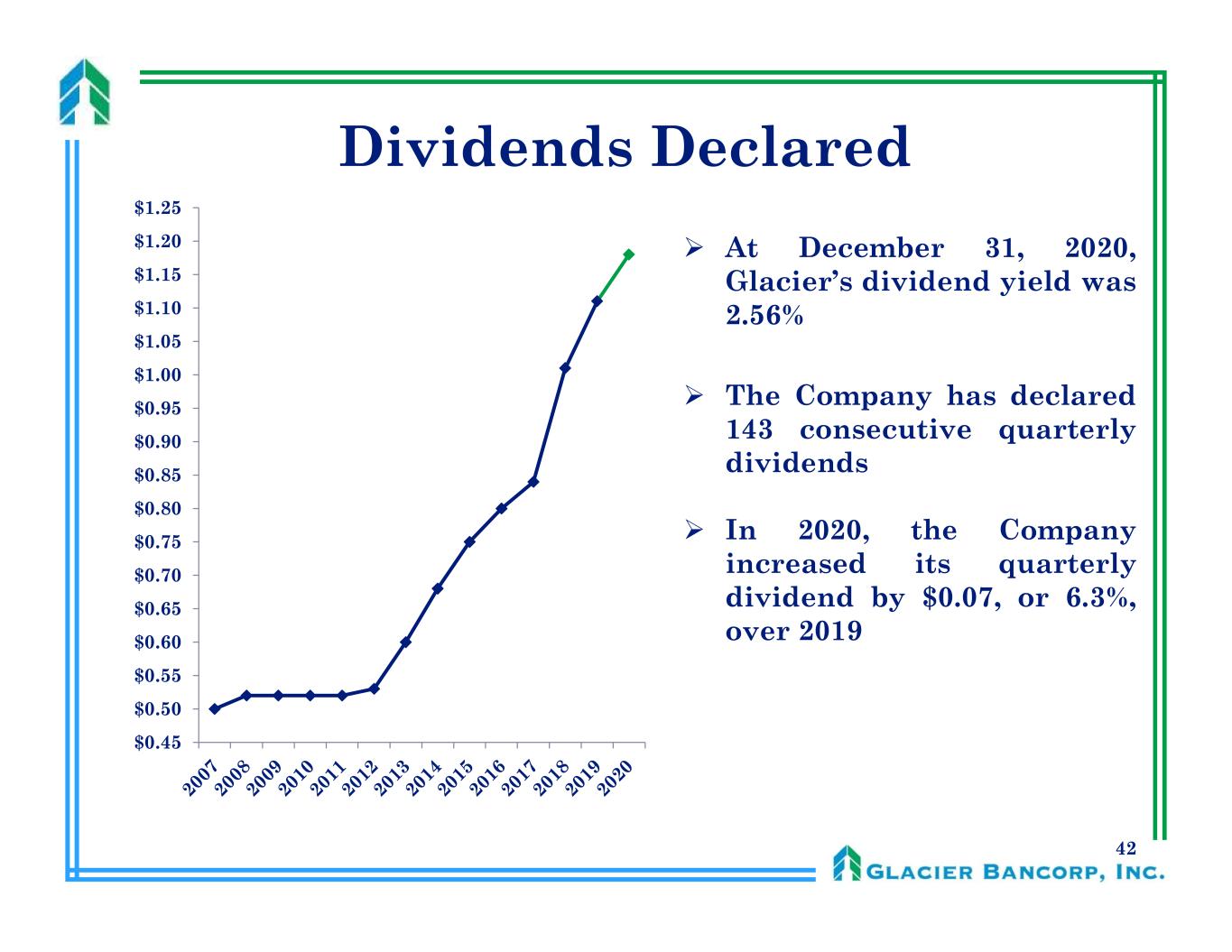

42 Dividends Declared At December 31, 2020, Glacier’s dividend yield was 2.56% The Company has declared 143 consecutive quarterly dividends In 2020, the Company increased its quarterly dividend by $0.07, or 6.3%, over 2019 $0.45 $0.50 $0.55 $0.60 $0.65 $0.70 $0.75 $0.80 $0.85 $0.90 $0.95 $1.00 $1.05 $1.10 $1.15 $1.20 $1.25

43 Long-Term Performance Since 1984 Strong consistent performance over the past 36 years Long-term goal is to produce double digit dividend growth Annual Total Return * 15.7% Annual EPS Growth Rate 10.5% Annual Dividend Growth Rate 12.2% * Reflects results through 12/31/2020, assuming no reinvestment of dividends Compounded Rates