Attached files

| file | filename |

|---|---|

| 8-K - 8-K - First Internet Bancorp | inbk-20210201.htm |

Investor Presentation Fourth Quarter 2020 Exhibit 99.1

Forward-Looking Statements This presentation may contain forward-looking statements with respect to the financial condition, results of operations, trends in lending policies, plans, objectives, future performance or business of the Company. Forward- looking statements are generally identifiable by the use of words such as “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “intend,” “may,” “optimistic,” “pending,” “plan,” “position,” “preliminary,” “remain,” “should,” “will,” “would” or other similar expressions. Forward-looking statements are not a guarantee of future performance or results, are based on information available at the time the statements are made and involve known and unknown risks, uncertainties and other factors that could cause actual results to differ materially from the information in the forward-looking statements. The COVID-19 pandemic continues to impact general business and economic conditions as well as our customers, counterparties, employees, and third-party service providers. Continued uncertainty in market conditions could adversely affect our revenues and the values of our assets and liabilities, reduce the availability of funding, lead to a tightening of credit and further increase stock price volatility. In addition, changes to statutes, regulations, or regulatory policies or practices as a result of, or in response to COVID-19, could affect us in substantial and unpredictable ways. The ultimate magnitude and duration of the pandemic is still unknown at this time, therefore, the extent of the impact on our business, financial position, results of operations, liquidity and prospects remains uncertain. Other factors that may cause such differences include: failures or breaches of or interruptions in the communications and information systems on which we rely to conduct our business; failure of our plans to grow our commercial real estate, commercial and industrial, public finance, SBA and healthcare finance loan portfolios; competition with national, regional and community financial institutions; the loss of any key members of senior management; fluctuations in interest rates; general economic conditions; risks relating to the regulation of financial institutions; and other factors identified in reports we file with the U.S. Securities and Exchange Commission. All statements in this presentation, including forward-looking statements, speak only as of the date they are made, and the Company undertakes no obligation to update any statement in light of new information or future events. 2

Non-GAAP Financial Measures 3 This presentation contains financial information determined by methods other than in accordance with U.S. generally accepted accounting principles (“GAAP”). Non-GAAP financial measures, specifically tangible common equity, tangible assets, tangible common equity to tangible assets, net interest income – FTE, net interest margin – FTE, adjusted noninterest expense, adjusted noninterest expense/average assets, adjusted net income, adjusted diluted earnings per share, average tangible common equity, adjusted return on average assets, return on average tangible common equity, adjusted return on average tangible common equity, tangible book value per common share and allowance for loan losses to loans, excluding PPP loans are used by the Company’s management to measure the strength of its capital and analyze profitability, including its ability to generate earnings on tangible capital invested by its shareholders. Although management believes these non-GAAP measures are useful to investors by providing a greater understanding of its business, they should not be considered a substitute for financial measures determined in accordance with GAAP, nor are they necessarily comparable to non-GAAP performance measures that may be presented by other companies. Reconciliations of these non-GAAP financial measures to the most directly comparable GAAP financial measures are included on the slide at the end of this presentation entitled “Reconciliation of Non-GAAP Financial Measures.”

• Digital bank with unique business model and over 20 years of operations • Highly scalable technology driven business • Nationwide deposit gathering and asset generation platforms • Attractive lending niches with growth opportunities • History of strong growth and a clear pathway to greater profitability 4 $4.2B Assets $3.1B Loans $3.3B Deposits A Pioneer in Branchless Banking

Nationwide Branchless Deposit Franchise 5 $3.3 Billion Total Deposits* $678.2 million 20.7% $285.3 million 8.7% $1,230.0 million 37.6% $592.8 million 18.1% $484.8 million 14.8% * As of December 31, 2020; $117 million of brokered deposits and $2.1 million of balances in US territories/Armed Forces included in headquarters/Midwest balance 27.9% 5-year CAGR Nationwide consumer, small business and commercial deposit base Innovative technology and convenience supported by exceptional service Digital business model minimized operational disruptions due to COVID-19

Multiple Opportunities to Grow Deposits 6 Capitalize on the enduring trend toward branchless banking – consumers and small business are increasingly moving their banking business online, especially following the experience of COVID-19 Generate an increased level of lower-cost deposits as expansion of small-business, municipal and commercial relationships continue Selectively target consumer deposits in tech-centric markets – building off success with Gen-Xers Draw on over 20 years of branchless banking experience to attract more customers with best practices such as dedicated online relationship bankers delivering a superior client experience

7 Commercial - National Commercial - Regional DIVERSIFIED ASSET GENERATION PLATFORM C&I – Central Indiana C&I – Arizona Investor CRE – Central Indiana Construction – Central Indiana Single tenant lease financing Small business lending Public finance Healthcare finance (via relationship with Lendeavor) Digital direct-to-consumer mortgages Specialty lending – horse trailers and RVs Consumer - National National and Regional Asset Generation Platform

Small Business, Big Opportunity Complementary to existing business lines Diversifies revenue in a capital efficient manner Opportunities on both sides of the balance sheet 8 Enhanced Treasury Management Capabilities Upgraded Digital Account Access SBA Lending

9 Entrepreneurial Culture Key to Success First Internet Bank has been recognized for its innovation and is consistently ranked among the best banks to work for, enhancing its ability to attract and retain top talent American Banker’s “Best Banks to Work For” Eight years in a row “Top Workplaces in Indianapolis” The Indianapolis Star Seven years in a row including being #8 in 2020, #1 in 2019, #4 in 2018 and #2 on the list in 2017 “Best Places to Work in Indiana” Five of last seven years “Best Small Business Checking Account” – Newsweek ranking of “America’s Best Banks 2021” “Best Online Banks 2021” – Bankrate and GoBanking Rates annual “Best Banking” awards Top Rated Online Business Bank in 2017 – Advisory HQ TechPoint 2016 Mira Award “Tech-enabled Company of the Year” Magnify Money ranked #1 amongst 2016 Best Banking Apps (Banker’s “Online Direct Banks”) Mortgage Technology 2013 awarded top honors in the Online Mortgage Originator category

Loan Deferral Summary 10 Deferrals (Dollars in millions) As of May 15, 2020 As of July 17, 2020 As of August 28, 2020 As of October 16, 2020 As of January 15, 2021 % of Balances with Deferrals1 Commercial and industrial $15.9 $1.7 $0.5 $0.7 $0.1 0.2% Single tenant lease financing $259.0 $276.8 $27.8 $5.4 - - Owner-occupied CRE $16.2 $19.3 $5.7 $6.2 - - Investor CRE $0.4 $0.4 $0.4 - - - Healthcare finance $297.0 $57.8 $7.7 $2.3 $0.6 0.1% Small business $23.7 $1.8 - $3.4 $5.0 3.9% Total commercial $612.2 $357.8 $42.1 $18.0 $5.7 0.2% Residential mortgage $12.0 $5.6 $2.2 $2.3 $1.9 1.0% Home equity $0.4 $0.2 $0.1 - - - Other consumer $9.0 $2.2 $0.8 $0.5 $0.7 0.2% Total consumer $21.4 $8.0 $3.1 $2.8 $2.6 0.5% Total loans with deferrals $633.6 $365.8 $45.2 $20.8 $8.3 0.3% As a % of total loans 21.9% 12.6% 1.6% 0.7% 0.3% Loan deferral balances are now 27 bps of total loans, down significantly from the peak in late-May 1 Deferral balances as of January 15, 2021 and total loan balances as of December 31, 2020.

Near-term Profitability Drivers Continued deposit repricing opportunity combined with stabilized asset yields provides significant opportunity to increase net interest income and net interest margin Annual interest expense savings of approximately $25 million expected for 2021 SBA platform is hitting its stride following last year’s accelerated sales and operations hiring SBA gain on sale revenue expected to be in the range of $14 million - $15 million for 2021 Mortgage banking revenue expected to remain strong in the near-term Continue to remain cautiously optimistic regarding the impact of the COVID-19 pandemic on the credit quality of the loan portfolio 11

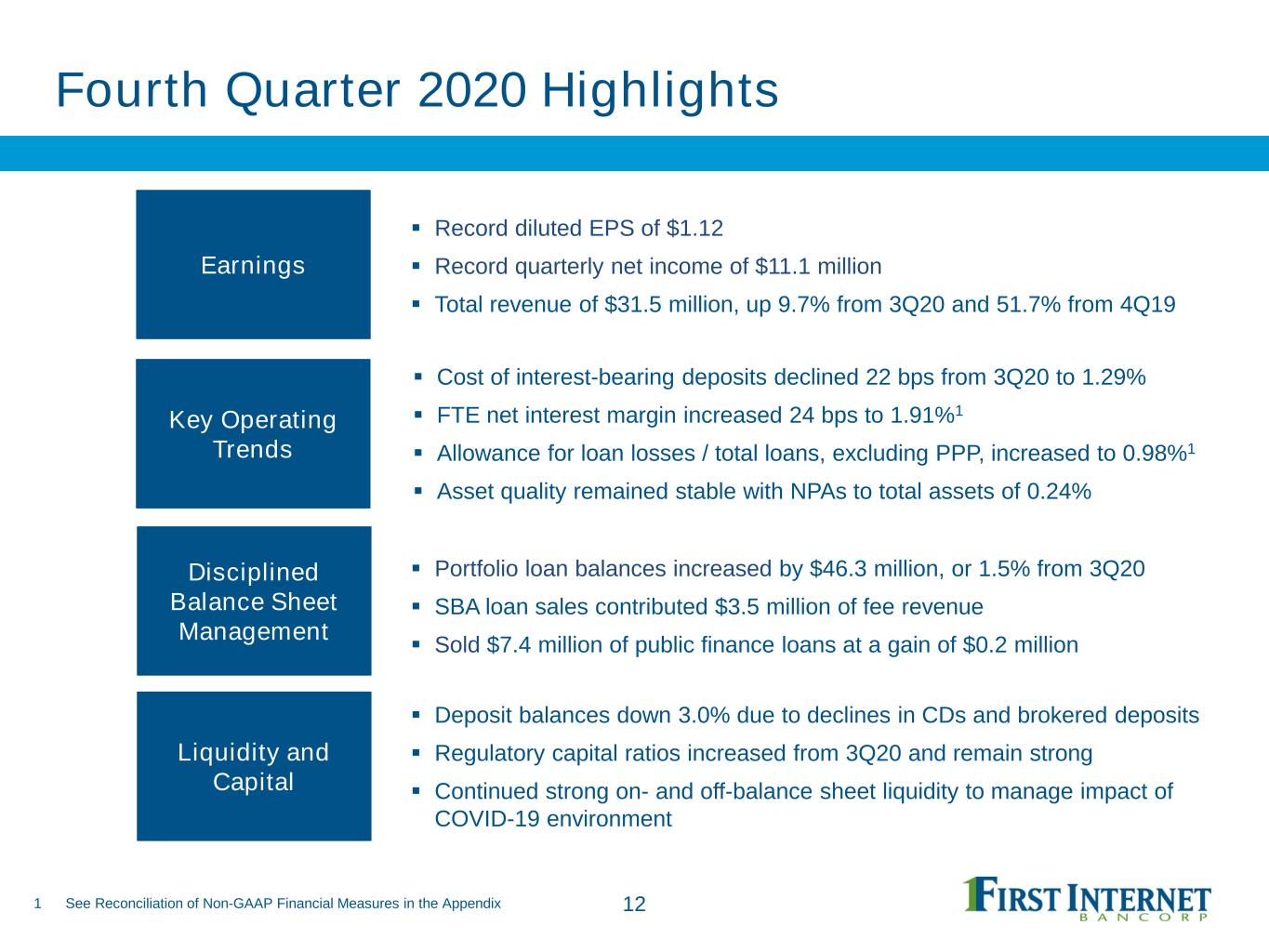

Fourth Quarter 2020 Highlights 12 Earnings Portfolio loan balances increased by $46.3 million, or 1.5% from 3Q20 SBA loan sales contributed $3.5 million of fee revenue Sold $7.4 million of public finance loans at a gain of $0.2 million Deposit balances down 3.0% due to declines in CDs and brokered deposits Regulatory capital ratios increased from 3Q20 and remain strong Continued strong on- and off-balance sheet liquidity to manage impact of COVID-19 environment Cost of interest-bearing deposits declined 22 bps from 3Q20 to 1.29% FTE net interest margin increased 24 bps to 1.91%1 Allowance for loan losses / total loans, excluding PPP, increased to 0.98%1 Asset quality remained stable with NPAs to total assets of 0.24% Record diluted EPS of $1.12 Record quarterly net income of $11.1 million Total revenue of $31.5 million, up 9.7% from 3Q20 and 51.7% from 4Q19 12 Key Operating Trends Disciplined Balance Sheet Management Liquidity and Capital 1 See Reconciliation of Non-GAAP Financial Measures in the Appendix

13 Meaningful Outperformance vs. Peers Total Deposit Cost Change1 Revenue % Change1 Net Interest Margin Change1 Share Price % Change2 13% 40% 52% $3 - $7bn asset banks Top quartile INBK (in bps) 1 Change from 4Q19 – 4Q20; Orange indicates median of publicly traded $3-$7bn asset U.S. banks, green represents median of top quartile; peer data includes FTE net interest margin data if available 2 Change from 12/31/2019 – 12/31/2020; Orange indicates median of publicly traded $3-$7bn asset U.S. banks, green represents median of top quartile (in bps) -53 -85 -106 $3 - $7bn asset banks Top quartile INBK -18% -1% 21% $3 - $7bn asset banks Top quartile INBK Source: S&P Global Market Intelligence; data available as of 1/30/21 -24 24 24 $3 - $7bn asset banks Top quartile INBK

$954 $1,251 $2,091 $2,716 $2,964 $3,059 2015 2016 2017 2018 2019 2020 vs. Peers1 at 15.3% $956 $1,463 $2,085 $2,671 $3,154 $3,271 2015 2016 2017 2018 2019 2020 $104 $154 $224 $289 $305 $331 2015 2016 2017 2018 2019 2020 Dollars in millions Total Assets Total Loans Total Deposits Shareholders’ Equity History of Strong Organic Growth 14 Execution of the business strategy has driven consistent and sustained balance sheet growth CAGR: 27.3% CAGR: 26.2% CAGR: 27.9% CAGR: 26.1% 1 Source: S&P Global Intelligence; peer data represents median value of publically traded Small Cap banks with a market capitalization between $250 million and $1.0 billion as of September 30, 2020. Dollars in millions Dollars in millions Dollars in millions vs. Peers1 at 13.6% vs. Peers1 at 14.3% $1,270 $1,854 $2,768 $3,542 $4,100 $4,246 2015 2016 2017 2018 2019 2020

9.33% 10.12% 8.77% 8.60% 8.65% 9.53% 9.84% 9.35% 10.06% 2015 2016 2017 2018 2019 2020 0.81% 0.74% 0.66% 0.72% 0.65% 0.69% 0.74% 0.78% 0.73% 2015 2016 2017 2018 2019 2020 $8,929 $12,074 $15,226 $23,814 $25,239 $29,453 $17,072 $21,900 $31,084 2015 2016 2017 2018 2019 2020 15 Capital has been deployed into new loan verticals, driving earnings growth 1 See Reconciliation of Non-GAAP Financial Measures in the Appendix. 2 2017 reported net income of $15.2 million included the revaluation of the Company’s net deferred tax asset which reduced net income by $1.8 million and negatively impacted Net Income, EPS, ROAA and ROATCE. 3 2018 reported net income of $21.9 million included a write-down of legacy other real estate owned which reduced net income by $1.9 million and negatively impacted Net Income, EPS, ROAA and ROATCE. 4 2020 reported net income of $29.5 million included a write-down of legacy other real estate owned which reduced net income by $1.6 million and negatively impacted Net Income, EPS, ROAA and ROATCE. Net Income1,2,3,4 Diluted EPS1,2,3,4 Return on Average Assets1,2,3,4 Return on Average Tangible Common Equity1,2,3,4 Dollars in thousands $1.96 $2.30 $2.13 $2.30 $2.51 $2.99 $2.39 $2.50 $3.16 2015 2016 2017 2018 2019 2020 Profitability Driven by Capital Deployment

Growth Drives Economies of Scale 16 Scalable, technology-driven model has delivered increasing efficiency and is a key component driving improved operating leverage 1 See Reconciliation of Non-GAAP Financial Measures in the Appendix. 2 3Q20 results included a write-down of legacy other real estate owned which increased noninterest expense by $2.1 million. $2.4 $3.5 $5.6 $5.4 $6.2 $5.0 $12.5 $12.7 1Q19 2Q19 3Q19 4Q19 1Q20 2Q20 3Q20 4Q20 Dollars in millions Noninterest Income Noninterest Expense1,2 $11.1 $11.7 $11.7 $13.5 $13.2 $14.3 $12.6 $14.5 1Q19 2Q19 3Q19 4Q19 1Q20 2Q20 3Q20 4Q20 Dollars in millions $16.4 Noninterest Expense / Average Assets1,2 1.24% 1.23% 1.11% 1.22% 1.31% 1.21% 1.34% 1.51% 1Q19 2Q19 3Q19 4Q19 1Q20 2Q20 3Q20 4Q20 1.32% Total Assets Per FTE $17.6 $18.4 $18.6 $17.9 $17.4 $17.4 $17.4 $16.6 1Q19 2Q19 3Q19 4Q19 1Q20 2Q20 3Q20 4Q20 Dollars in millions

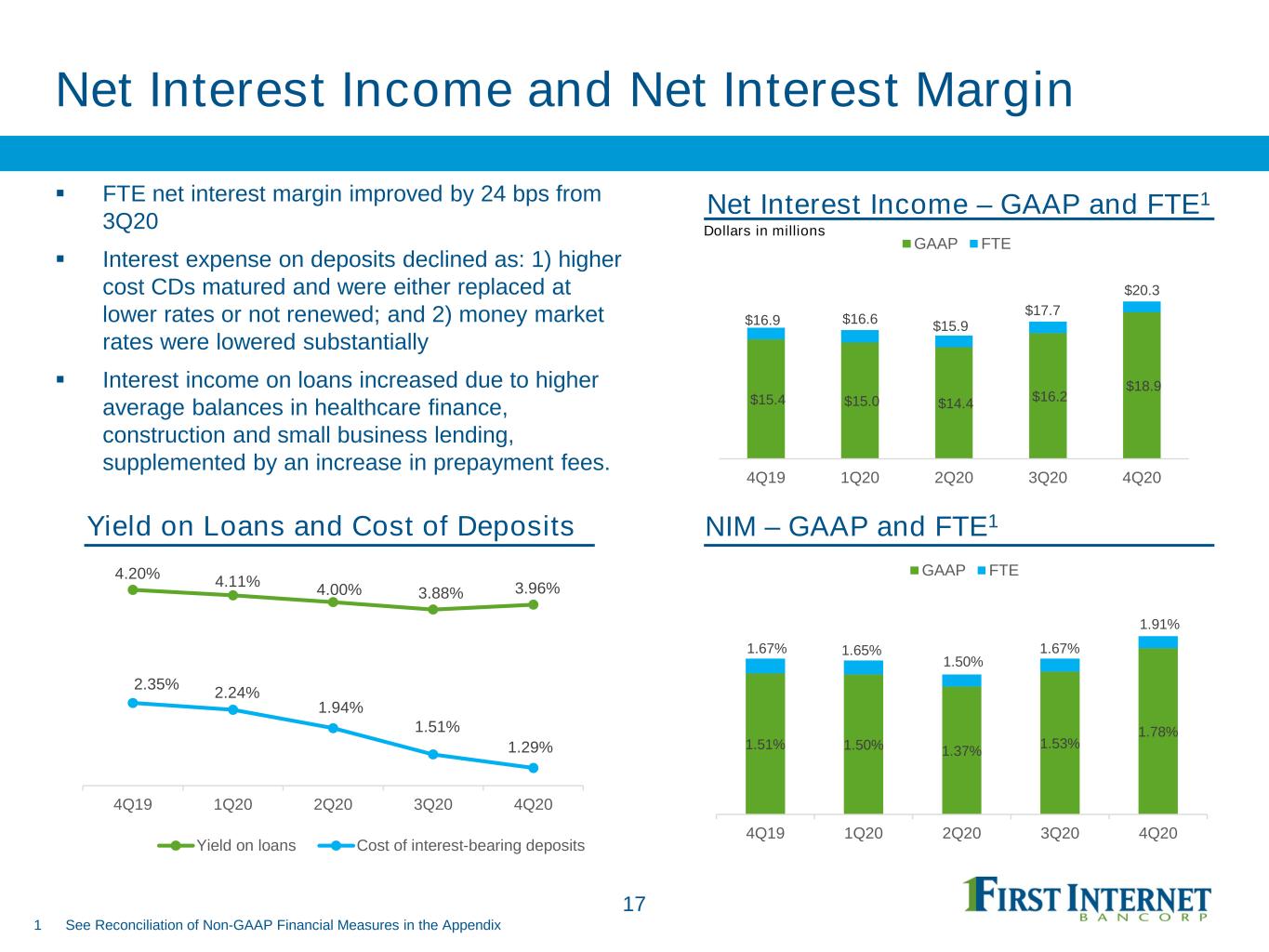

17 1 See Reconciliation of Non-GAAP Financial Measures in the Appendix Yield on Loans and Cost of Deposits Dollars in millions NIM – GAAP and FTE1 FTE net interest margin improved by 24 bps from 3Q20 Interest expense on deposits declined as: 1) higher cost CDs matured and were either replaced at lower rates or not renewed; and 2) money market rates were lowered substantially Interest income on loans increased due to higher average balances in healthcare finance, construction and small business lending, supplemented by an increase in prepayment fees. Net Interest Income – GAAP and FTE1 Net Interest Income and Net Interest Margin 4.20% 4.11% 4.00% 3.88% 3.96% 2.35% 2.24% 1.94% 1.51% 1.29% 4Q19 1Q20 2Q20 3Q20 4Q20 Yield on loans Cost of interest-bearing deposits $15.4 $15.0 $14.4 $16.2 $18.9 $16.9 $16.6 $15.9 $17.7 $20.3 4Q19 1Q20 2Q20 3Q20 4Q20 GAAP FTE 1.51% 1.50% 1.37% 1.53% 1.78% 1.67% 1.65% 1.50% 1.67% 1.91% 4Q19 1Q20 2Q20 3Q20 4Q20 GAAP FTE

Net Interest Margin Drivers 18 1 See Reconciliation of Non-GAAP Financial Measures in the Appendix NIM – FTE1 Linked-Quarter Change Monthly Rate Paid on Int. Bearing-Deposits Linked quarter NIM improvement was primarily attributable to the continued impact of lower deposit costs and higher loan yields Interest-earning asset yields increased 8 bps from 3Q20 and are expected to remain relatively stable in the near-term. Ongoing opportunity to continue lowering deposit costs $917 million of CDs with a weighted average cost of 1.87% mature in the next twelve months – replacement cost is currently less than 50 bps Lowered money market rates 15 - 20 bps during the quarter 2.33% 2.16% 1.80% 1.42% 1.34% 1.30% 1.23% Dec-19 Mar-20 Jun-20 Sep-20 Oct-20 Nov-20 Dec-20 1.67% 1.91% +18 bps +12 bps -3 bps -3 bps

Deposit Composition 19 Total Deposits - $3.3B as of 12/31/20 Total Non-Time Deposits - $1.7B as of 12/31/201 $96.8 3% $188.6 6% $43.2 1% $1,350.6 41% $1,591.7 49% Noninterest-bearing deposits Interest-bearing demand deposits Savings accounts Money market accounts Certificates and brokered deposits $265.6 16% $122.0 7% $691.7 41% $599.8 36% Commercial Public funds Small business Consumer 1 Total non-time deposits excludes brokered non-time deposits Total deposits declined $101.5 million, or 3.0%, compared to 3Q20, and increased $116.9 million, or 3.7%, year-over-year Demand deposits increased $44.3 million compared to 3Q20, including $10.7 million of noninterest- bearing deposits CD and brokered deposit balances decreased $130.5 million compared to 3Q20 Cost of interest-bearing deposits declined 22 bps from 3Q20 to 1.29% Dollars in millionsDollars in millions

Liquidity and Capital 20 1 See Reconciliation of Non-GAAP Financial Measures 2 Regulatory capital ratios are preliminary pending filing of the Company’s and Bank’s regulatory reports Regulatory Capital Ratios – December 31, 20202Tangible Book Value Per Share1 Regulatory capital ratios remained strong at the Company and Bank levels Strong capital generation during the quarter resulted in the tangible common equity to tangible assets ratio increasing 45 bps to 7.69% Continued to have sufficient liquidity to handle the current economic impact of COVID-19 Company Bank Total shareholders' equity to assets 7.79% 8.64% Tangible common equity to tangible assets1 7.69% 8.54% Tier 1 leverage ratio 7.95% 8.78% Common equity tier 1 capital ratio 11.31% 12.49% Tier 1 capital ratio 11.31% 12.49% Total risk-based capital ratio 14.91% 13.47% $19.38 $20.74 $22.24 $23.04 $26.09 $27.93 $30.82 $33.29 2013 2014 2015 2016 2017 2018 2019 2020

Loan Portfolio Overview 21 Total portfolio loans increased $46.3 million, or 1.5%, compared to 3Q20, and increased $95.7 million, or 3.2%, year-over-year Commercial loan balances increased $73.1 million, or 3.0%, compared to 3Q20 driven by growth in healthcare finance and construction lending Consumer loan balances declined $25.3 million, or 5.0%, due primarily to increased prepayment activity in the residential mortgage portfolio Loan Portfolio Mix 1 Includes commercial and industrial and owner-occupied commercial real estate balances 14% 11% 10% 10% 10% 19% 16% 16% 11% 8% 1% 2% 4%2% 4% 11% 17%22% 26% 24% 20% 49% 38% 34% 34% 31% 5% 2% 2% 2% 4% 13% 9% 7% 6% 6% $1,250.8 $2,091.0 $2,716.2 $2,963.5 $3,059.2 2016 2017 2018 2019 2020 Commercial and Industrial Commercial Real Estate Single Tenant Lease Financing Public Finance Healthcare Finance Small Business Lending Residential Mortgage/HE/HELOCs Consumer 1 Dollars in millions

12% 24% 22% 37% 5% Single Tenant Lease Financing 22 7% 7% 6% 5% 4% 4% 4% 4% 2%2% 55% Red Lobster ICWG Wendy's Burger King Walgreens Bob Evans Dollar General CVS 7-Eleven Taco Bell Other 24% 22% 15% 10% 10% 7% 6% 2% 2% 2% Quick Service Restaurants Full Service Restaurants Auto Parts/ Repair/Car Wash Convenience/Fuel Pharmacies Specialty Retailers Dollar Stores Medical Bank Branches Other Portfolio Mix by Geography $950.2 million in balances as of December 31, 2020 Long term financing of single tenant properties occupied by historically strong national and regional tenants Weighted-average portfolio LTV of 49% Average loan size of $1.4 million Strong historical credit performance All loans previously on deferral programs have resumed payment No delinquencies for performing loans Portfolio Mix by Major Vertical Portfolio Mix by Major Tenant

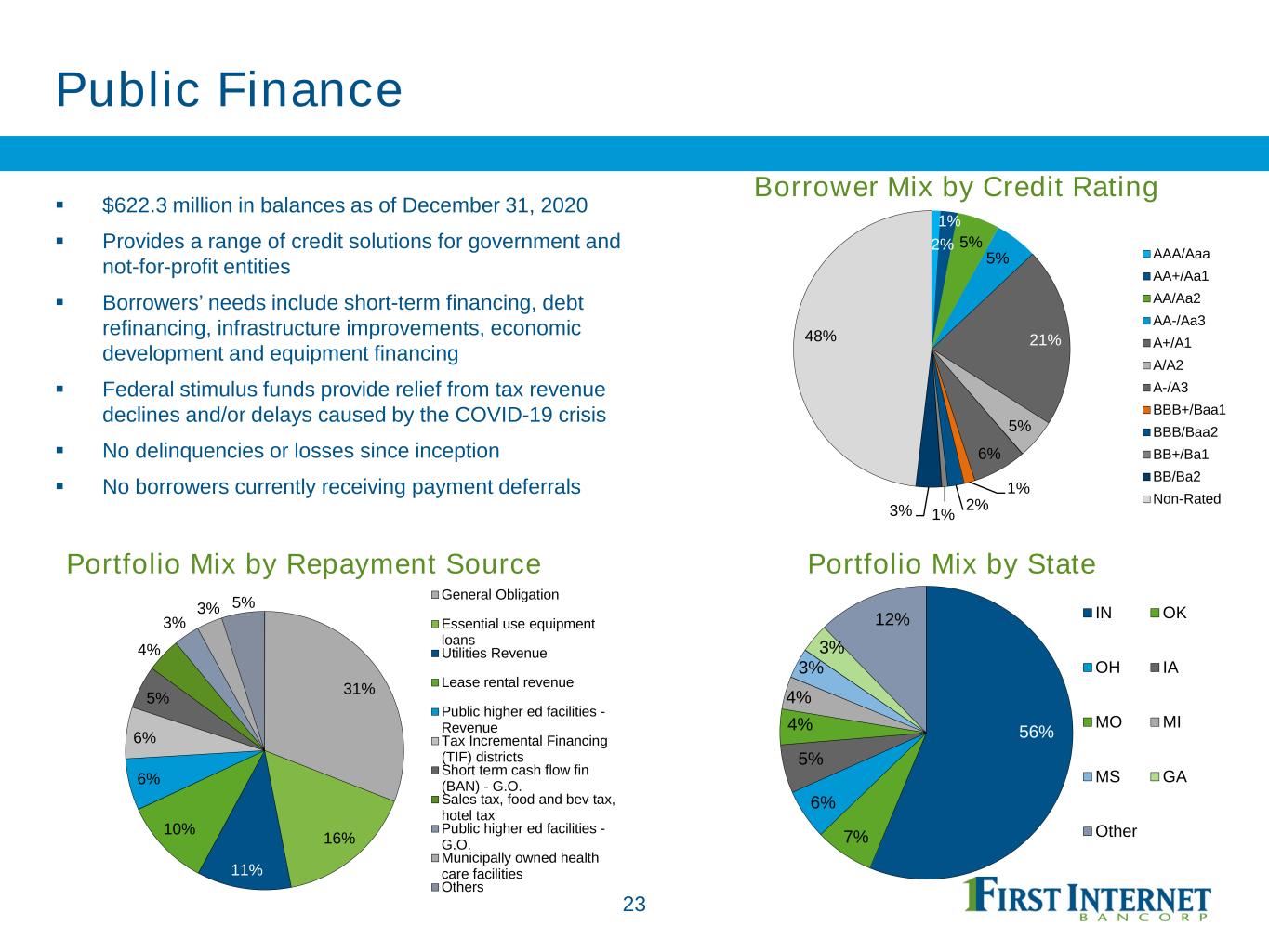

Public Finance 23 1% 2% 5% 5% 21% 5% 6% 1% 2%1%3% 48% AAA/Aaa AA+/Aa1 AA/Aa2 AA-/Aa3 A+/A1 A/A2 A-/A3 BBB+/Baa1 BBB/Baa2 BB+/Ba1 BB/Ba2 Non-Rated 31% 16% 11% 10% 6% 6% 5% 4% 3% 3% 5% General Obligation Essential use equipment loans Utilities Revenue Lease rental revenue Public higher ed facilities - Revenue Tax Incremental Financing (TIF) districts Short term cash flow fin (BAN) - G.O. Sales tax, food and bev tax, hotel tax Public higher ed facilities - G.O. Municipally owned health care facilities Others $622.3 million in balances as of December 31, 2020 Provides a range of credit solutions for government and not-for-profit entities Borrowers’ needs include short-term financing, debt refinancing, infrastructure improvements, economic development and equipment financing Federal stimulus funds provide relief from tax revenue declines and/or delays caused by the COVID-19 crisis No delinquencies or losses since inception No borrowers currently receiving payment deferrals Portfolio Mix by Repayment Source Borrower Mix by Credit Rating 56% 7% 6% 5% 4% 4% 3% 3% 12% IN OK OH IA MO MI MS GA Other Portfolio Mix by State

Healthcare Finance $528.2 million in balances as of December 31, 2020 Loan portfolio focused primarily on dental practices with some exposure to veterinary practices and other specialties Borrowers’ needs include practice finance or acquisition, acquiring or refinancing owner-occupied CRE, equipment purchases and project loans Average loan size of $631,000 Only one loan remains on deferral, down from late-May peak of approximately 79% of the portfolio 24 Portfolio Mix by Borrower Use Portfolio Mix by Borrower 86% 7% 7% Dentists Veterinarians Other 29% 11% 5%5%4%4% 4% 38% CA TX NY AZ FL NJ WA Other Portfolio Mix by State 80% 15% 3% 2% Practice Refi or Acquisition Owner Occupied CRE Project Equipment and Other

C&I and Owner-Occupied Commercial Real Estate $165.2 million in combined balances as of December 31, 2020 Current C&I LOC utilization of 45% Average loan sizes C&I: $287,000 Owner-occupied CRE: $897,000 Exited relationships totaling in excess of $65 million over the last two years to de-risk the portfolio Only one loan is currently on a payment deferral program 25 32% 15% 11% 9% 8% 6% 19% Services Construction Real Estate and Rental and Leasing Retail Trade Manufacturing Wholesale Trade Other Portfolio Mix by Major Industry Portfolio Mix by State Portfolio by Loan Type 52% 26% 6% 5% 3% 8% IN AZ IL OH FL Other 55%35% 10% Owner Occupied CRE C&I - Term Loans C&I - Lines of Credit

Small Business Lending $125.6 million in balances as of December 31, 2020 Current balance of $51.2 million outstanding under the Paycheck Protection Program 3.9% of balances are currently on payment deferral programs SBA sales, credit and operations teams continue to expand as origination volumes ramp up 26 22% 16% 15% 10% 10% 9% 18% Services Accommodation and Food Services Health Care and Social Assistance Retail Trade Manufacturing Construction Other Portfolio Mix by Major Industry Portfolio Mix by State 35% 16%9% 5% 4% 3% 28% IN IL CA FL AZ OR Other 1 Excludes PPP loans Dollars in millions Managed SBA 7(a) Loans1 $47.8 $54.1 $59.6 $64.9 $74.5 $104.0 $103.9 $113.9 $131.5 $166.0 $34.8 $11.6 $11.6 $151.8 $158.0 $173.5 $231.2 $252.1 3Q19 4Q19 1Q20 2Q20 3Q20 4Q20 Retained Balance Servicing Portfolio Held For Sale

Residential Mortgage $206.6 million in balances as of December 31, 2020 (includes home equity balances) Direct-to-consumer originations centrally located at corporate headquarters Focused on high quality borrowers Avg. loan size of $164,000 Avg. credit score at orig. of 770 Avg. LTV at origination of 66% Strong historical credit performance Approximately 1% of balances are currently on payment deferral programs 27 23% 2% 59% 7% 9% National Portfolio with Midwest Concentration Concentration by State State Percentage Indiana 56% California 18% New York 4% Florida 3% Virginia 2% All other states 17% Loan Type Percentage Single Family Residential 75% SFR Construction to Permanent 15% Home Equity – LOC 8% Home Equity – Closed End 2% Concentration by Loan Type

Specialty Consumer Geographically Diverse Portfolio Concentration by State State Percentage Texas 15% California 12% Florida 6% North Carolina 4% Colorado 3% All other states 60% 28 $275.7 million in balances as of December 31, 2020 Direct-to-consumer and nationwide dealer network originations Focused on high quality borrowers Avg. credit score at orig. of 779 Avg. loan size of $19,437 Strong historical credit performance Less than 0.2% of balances are currently on payment deferral programs Loan Type Percentage Trailers 53% Recreational Vehicles 34% Other consumer 13% 22% 22% 19% 28% 9% Concentration by Loan Type

Excellent Asset Quality 29 Asset quality remains among the best in the industry driven by a strong credit culture and lower-risk asset classes NPAs / Total Assets NPLs / Total Loans Allowance for Loan Losses / NPLs Net Charge-Offs (Recoveries) / Average Loans 0.37% 0.31% 0.21% 0.10% 0.22% 0.24% 2014 2015 2016 2017 2019 2020 0.02% 0.09% 0.04% 0.03% 0.23% 0.33% 2014 2015 2016 2017 2019 2020 5,001% 1,014% 1,784% 2,013% 324% 290% 2014 2015 2016 2017 2019 2020 0.05%(0.07%) 0.15% 0.04% 0.04% 0.06% 2014 2015 2016 2017 2019 2020

30 Appendix

31 1 Includes carrying value adjustments of $42.7 million, $44.3 million and $46.0 million related to terminated interest rate swaps associated with public finance loans as of December 31, 2020, September 30, 2020 and June 30, 2020, respectively, and $44.6 million, $21.4 million, $5.0 million and $0.3 million as of March 31, 2020, December 31, 2019, December 31, 2018 and December 31, 2017, respectively, related to interest rate swaps associated with public finance loans. Loan Portfolio Composition Dollars in thousands 2017 2018 2019 1Q20 2Q20 3Q20 4Q20 Commercial loans Commercial and industrial 121,966$ 107,405$ 96,420$ 95,227$ 81,687$ 77,116$ 75,387$ Owner-occupied commercial real estate 71,872 77,569 86,726 87,956 86,897 89,095 89,785 Investor commercial real estate 7,273 5,391 12,567 13,421 13,286 13,084 13,902 Construction 49,213 39,916 60,274 64,581 77,591 92,154 110,385 Single tenant lease financing 803,299 919,440 995,879 972,275 980,292 960,505 950,172 Public finance 438,341 706,342 687,094 627,678 647,107 625,638 622,257 Healthcare finance 31,573 117,007 300,612 372,266 380,956 461,740 528,154 Small business lending 4,870 17,370 46,945 54,056 118,526 123,168 125,589 Total commercial loans 1,528,407 1,990,440 2,286,517 2,287,460 2,386,342 2,442,500 2,515,631 Consumer loans Residential mortgage 299,935 399,898 313,849 218,730 208,728 203,041 186,787 Home equity 30,554 28,735 24,306 23,855 22,640 22,169 19,857 Trailers 101,369 136,620 146,734 148,700 147,326 145,775 144,493 Recreational vehicles 69,196 91,912 102,702 103,868 102,088 96,910 94,405 Other consumer loans 56,968 51,239 45,873 44,037 42,218 39,765 36,794 Total consumer loans 558,022 708,404 633,464 539,190 523,000 507,660 482,336 Net def. loan fees, prem., disc. and other 1 4,764 17,384 43,566 65,443 64,332 62,754 61,264 , 65, 3 Total loans 2,091,193$ 2,716,228$ 2,963,547$ 2,892,093$ 2,973,674$ 3,012,914$ 3,059,231$

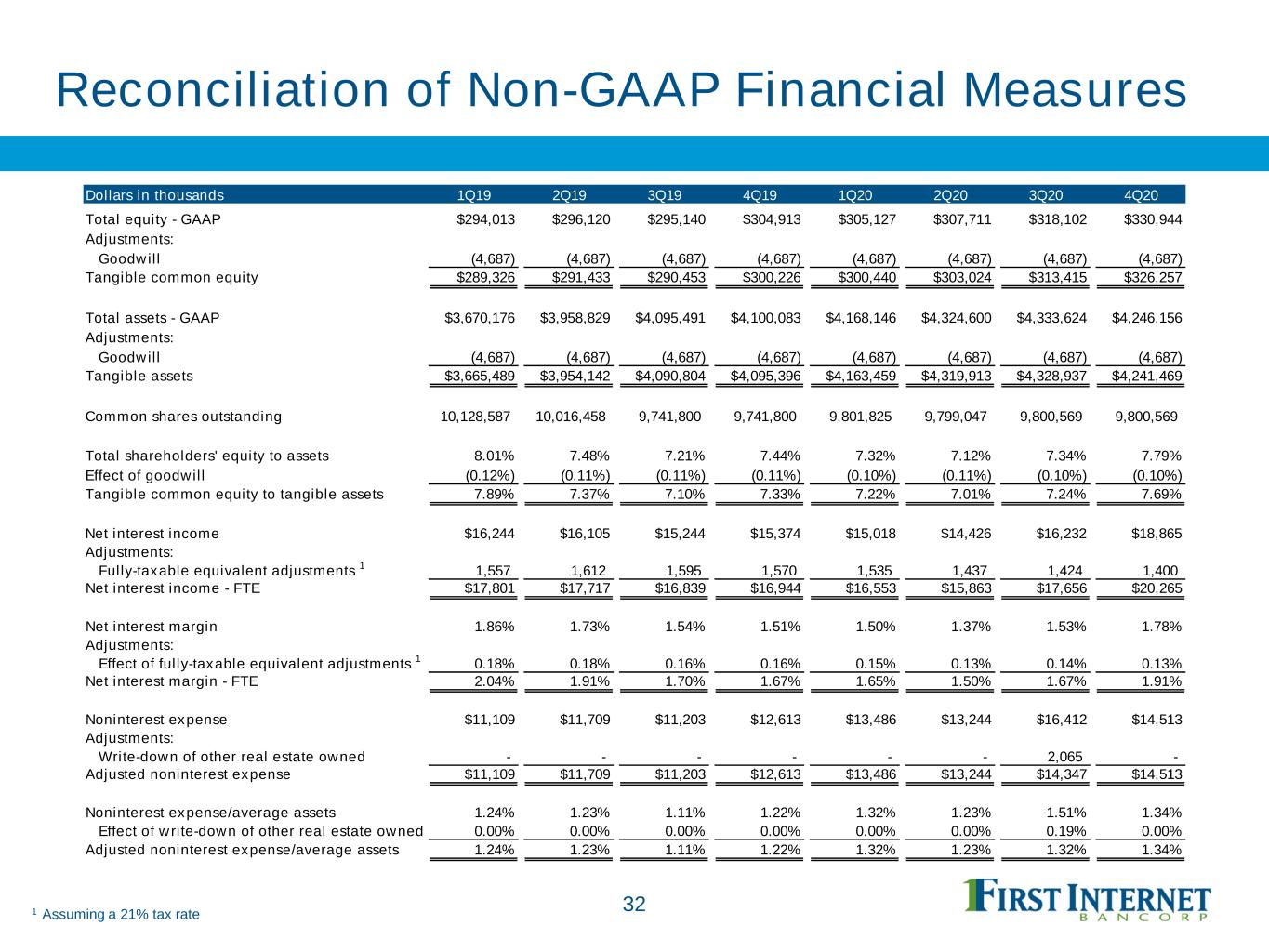

Reconciliation of Non-GAAP Financial Measures 321 Assuming a 21% tax rate Dollars in thousands 1Q19 2Q19 3Q19 4Q19 1Q20 2Q20 3Q20 4Q20 Total equity - GAAP $294,013 $296,120 $295,140 $304,913 $305,127 $307,711 $318,102 $330,944 Adjustments: Goodwill (4,687) (4,687) (4,687) (4,687) (4,687) (4,687) (4,687) (4,687) Tangible common equity $289,326 $291,433 $290,453 $300,226 $300,440 $303,024 $313,415 $326,257 Total assets - GAAP $3,670,176 $3,958,829 $4,095,491 $4,100,083 $4,168,146 $4,324,600 $4,333,624 $4,246,156 Adjustments: Goodwill (4,687) (4,687) (4,687) (4,687) (4,687) (4,687) (4,687) (4,687) Tangible assets $3,665,489 $3,954,142 $4,090,804 $4,095,396 $4,163,459 $4,319,913 $4,328,937 $4,241,469 Common shares outstanding 10,128,587 10,016,458 9,741,800 9,741,800 9,801,825 9,799,047 9,800,569 9,800,569 Total shareholders' equity to assets 8.01% 7.48% 7.21% 7.44% 7.32% 7.12% 7.34% 7.79% Effect of goodwill (0.12%) (0.11%) (0.11%) (0.11%) (0.10%) (0.11%) (0.10%) (0.10%) Tangible common equity to tangible assets 7.89% 7.37% 7.10% 7.33% 7.22% 7.01% 7.24% 7.69% Net interest income $16,244 $16,105 $15,244 $15,374 $15,018 $14,426 $16,232 $18,865 Adjustments: Fully-taxable equivalent adjustments 1 1,557 1,612 1,595 1,570 1,535 1,437 1,424 1,400 Net interest income - FTE $17,801 $17,717 $16,839 $16,944 $16,553 $15,863 $17,656 $20,265 Net interest margin 1.86% 1.73% 1.54% 1.51% 1.50% 1.37% 1.53% 1.78% Adjustments: Effect of fully-taxable equivalent adjustments 1 0.18% 0.18% 0.16% 0.16% 0.15% 0.13% 0.14% 0.13% Net interest margin - FTE 2.04% 1.91% 1.70% 1.67% 1.65% 1.50% 1.67% 1.91% Noninterest expense $11,109 $11,709 $11,203 $12,613 $13,486 $13,244 $16,412 $14,513 Adjustments: Write-down of other real estate owned - - - - - - 2,065 - Adjusted noninterest expense $11,109 $11,709 $11,203 $12,613 $13,486 $13,244 $14,347 $14,513 Noninterest expense/average assets 1.24% 1.23% 1.11% 1.22% 1.32% 1.23% 1.51% 1.34% Effect of write-down of other real estate owned 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.19% 0.00% Adjusted noninterest expense/average assets 1.24% 1.23% 1.11% 1.22% 1.32% 1.23% 1.32% 1.34%

Reconciliation of Non-GAAP Financial Measures 33 2015 2016 2017 2018 2019 2020 Net income - GAAP $8,929 $12,074 $15,226 $21,900 $25,239 $29,453 Adjustments: Write-down of other real estate owned - - - 1,914 - 1,631 Net deferred tax asset revaluation - - 1,846 - - - Adjusted net income $8,929 $12,074 $17,072 $23,814 $25,239 $31,084 Diluted average common shares outstanding 4,554,219 5,239,082 7,149,302 9,508,653 10,044,483 9,842,425 Diluted earnings per share - GAAP $1.96 $2.30 $2.13 $2.30 $2.51 $2.99 Adjustments: Effect of write-down of other real estate owned - - - 0.20 - 0.17 Effect of net deferred tax asset revaluation - - 0.26 - - - Adjusted diluted earnings per share $1.96 $2.30 $2.39 $2.50 $2.51 $3.16 Total average equity - GAAP $100,428 $124,023 $178,212 $259,416 $296,382 $313,763 Adjustments: Average goodwill (4,687) (4,687) (4,687) (4,687) (4,687) (4,687) Average tangible common equity $95,741 $119,336 $173,525 $254,729 $291,695 $309,076 Return on average assets 0.81% 0.74% 0.66% 0.72% 0.65% 0.69% Effect of write-down of other real estate owned 0.00% 0.00% 0.00% 0.06% 0.00% 0.04% Effect of net deferred tax asset revaluation 0.00% 0.00% 0.08% 0.00% 0.00% 0.00% Adjusted return on average assets 0.81% 0.74% 0.74% 0.78% 0.65% 0.73% Return on average shareholders' equity 8.89% 9.74% 8.54% 8.44% 8.52% 9.39% Effect of goodwill 0.44% 0.38% 0.23% 0.16% 0.13% 0.14% Return on average tangible common equity 9.33% 10.12% 8.77% 8.60% 8.65% 9.53% Return on average tangible common equity 9.33% 10.12% 8.77% 8.60% 8.65% 9.53% Effect of write-down of other real estate owned 0.00% 0.00% 0.00% 0.75% 0.00% 0.53% Effect of net deferred tax asset revaluation 0.00% 0.00% 1.07% 0.00% 0.00% 0.00% Adjusted return on average tangible common equity 9.33% 10.12% 9.84% 9.35% 8.65% 10.06%

Reconciliation of Non-GAAP Financial Measures 34 Dollars in thousands 2013 2014 2015 2016 2017 2018 2019 4Q20 Total equity - GAAP $90,908 $96,785 $104,330 $153,942 $224,127 $288,735 $304,913 $330,944 Adjustments: Goodwill (4,687) (4,687) (4,687) (4,687) (4,687) (4,687) (4,687) (4,687) Tangible common equity $86,221 $92,098 $99,643 $149,255 $219,440 $284,048 $300,226 $326,257 Common shares outstanding 4,448,326 4,439,575 4,481,347 6,478,050 8,411,077 10,170,778 9,741,800 9,800,569 Book value per common share $20.44 $21.80 $23.28 $23.76 $26.65 $28.39 $31.30 $33.77 Effect of goodwill (1.06) (1.06) (1.04) (0.72) (0.56) (0.46) (0.48) (0.48) Tangible book value per common share $19.38 $20.74 $22.24 $23.04 $26.09 $27.93 $30.82 $33.29 Allowance for loan losses 5,426$ 5,800$ 8,351$ 10,981$ 14,970$ 17,896$ 21,840$ 29,484$ Loans 501,153 732,426 953,859 1,250,789 2,091,193 2,716,228 2,963,547 3,059,231 Adjustments: PPP loans - - - - - - - (50,554) Loans, excluding PPP loans 501,153$ 732,426$ 953,859$ 1,250,789$ 2,091,193$ 2,716,228$ 2,963,547$ 3,008,677$ Allownace for loan losses to loans 1.08% 0.79% 0.88% 0.88% 0.72% 0.66% 0.74% 0.96% Effect of PPP loans 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.02% Allowance for loan losses to loans, excluding PPP loans 1.08% 0.79% 0.88% 0.88% 0.72% 0.66% 0.74% 0.98%