Attached files

| file | filename |

|---|---|

| 8-K - 8-K - DOVER Corp | dov-20210128.htm |

Earnings Conference Call Fourth Quarter and Full Year 2020 January 28, 2021 – 9:00am CT Exhibit 99.1

2 Forward-Looking Statements and Non-GAAP Measures We want to remind everyone that our comments may contain forward-looking statements that are inherently subject to uncertainties and risks, including the impacts of the novel coronavirus (COVID-19) on the global economy and on our customers, suppliers, employees, operations, business, liquidity and cash flow. We caution everyone to be guided in their analysis of Dover Corporation by referring to the documents we file from time to time with the SEC, including our Annual Report on Form 10-K for 2019 and Quarterly Reports on Form 10-Q, for a list of factors that could cause our results to differ from those anticipated in any such forward-looking statements. We would also direct your attention to our website, dovercorporation.com, where considerably more information can be found. In addition to financial measures based on U.S. GAAP, Dover provides supplemental non-GAAP financial information. Management uses non-GAAP measures in addition to GAAP measures to understand and compare operating results across periods, make resource allocation decisions, and for forecasting and other purposes. Management believes these non-GAAP measures reflect results in a manner that enables, in many instances, more meaningful analysis of trends and facilitates comparison of results across periods and to those of peer companies. These non-GAAP financial measures have no standardized meaning presented in U.S. GAAP and may not be comparable to other similarly titled measures used by other companies due to potential differences between the companies in calculations. The use of these non-GAAP measures has limitations and they should not be considered as substitutes for measures of financial performance and financial position as prepared in accordance with U.S. GAAP. Reconciliations and definitions are included either in this presentation or in Dover’s earnings release and investor supplement for the fourth quarter, which are available on Dover’s website.

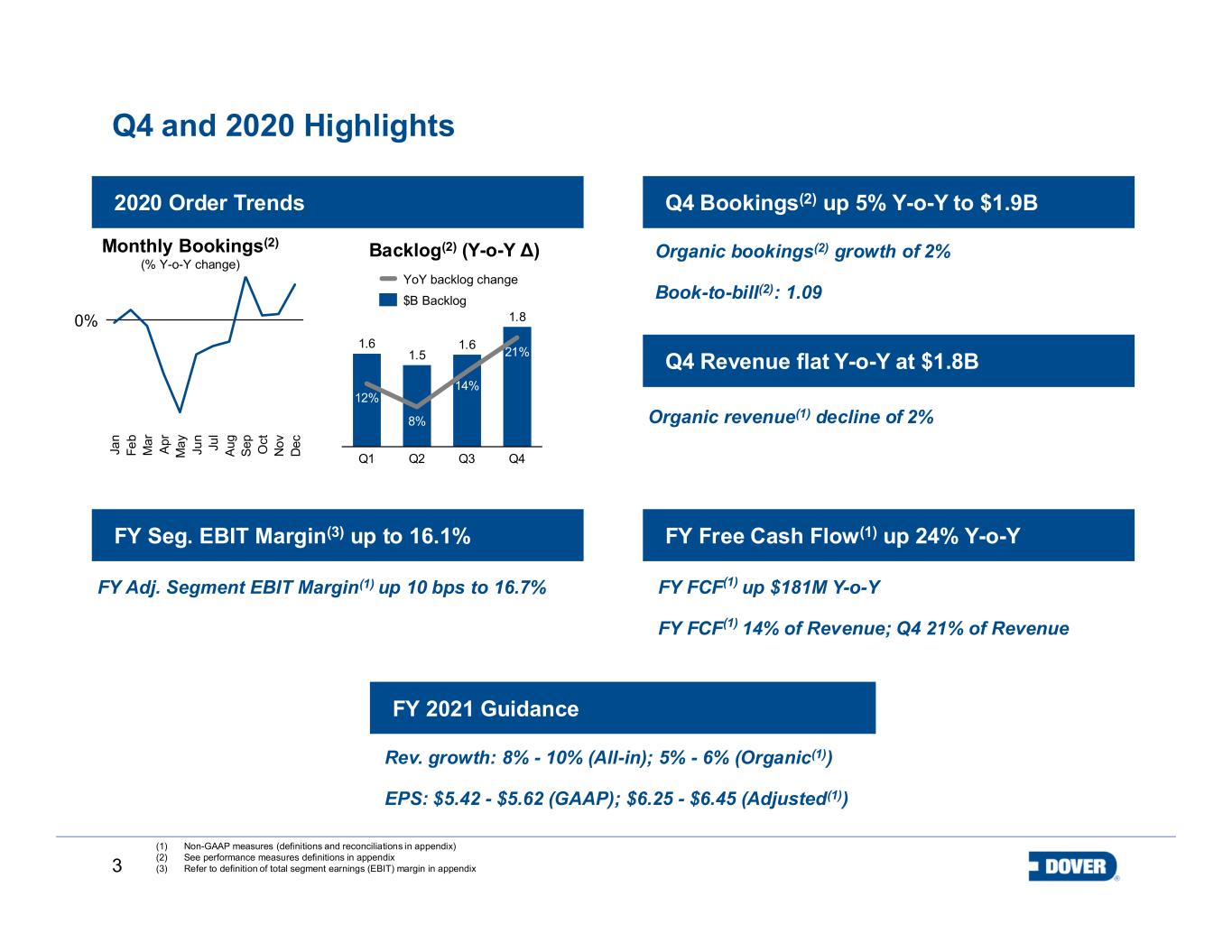

3 FY Seg. EBIT Margin(3) up to 16.1% Q4 Revenue flat Y-o-Y at $1.8B FY Free Cash Flow(1) up 24% Y-o-Y FY 2021 Guidance 2020 Order Trends Q4 Bookings(2) up 5% Y-o-Y to $1.9B Organic bookings(2) growth of 2% Book-to-bill(2): 1.09 Organic revenue(1) decline of 2% FY Adj. Segment EBIT Margin(1) up 10 bps to 16.7% FY FCF(1) up $181M Y-o-Y FY FCF(1) 14% of Revenue; Q4 21% of Revenue Q4 and 2020 Highlights (1) Non-GAAP measures (definitions and reconciliations in appendix) (2) See performance measures definitions in appendix (3) Refer to definition of total segment earnings (EBIT) margin in appendix Q4 21% Q2Q1 12% 14% 8% Q3 1.61.6 1.5 1.8 Ju n M a y Ja n F e b A p r M a r Ju l A u g S e p O ct N o v D e c YoY backlog change $B Backlog Monthly Bookings(2) (% Y-o-Y change) Backlog(2) (Y-o-Y ) 0% Rev. growth: 8% - 10% (All-in); 5% - 6% (Organic(1)) EPS: $5.42 - $5.62 (GAAP); $6.25 - $6.45 (Adjusted(1))

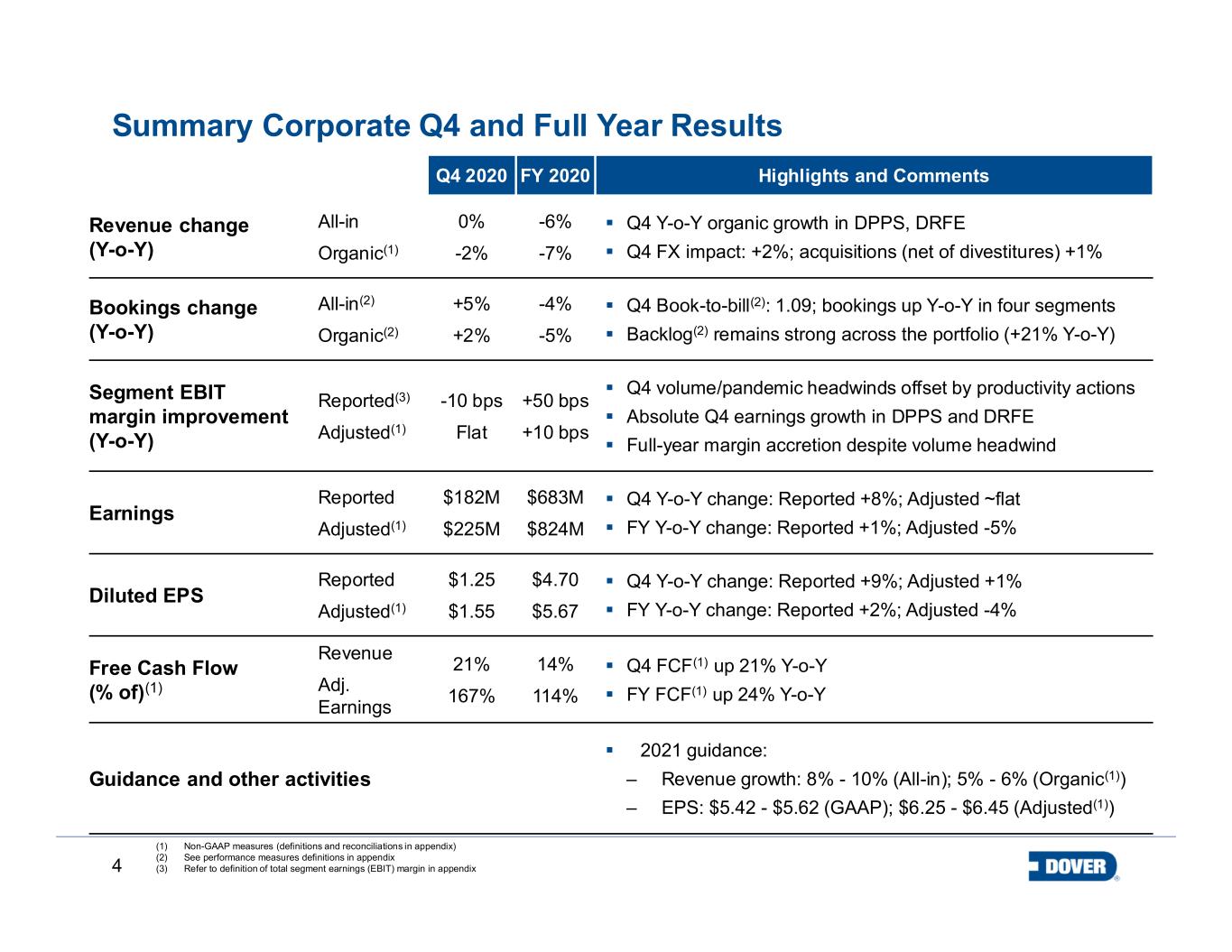

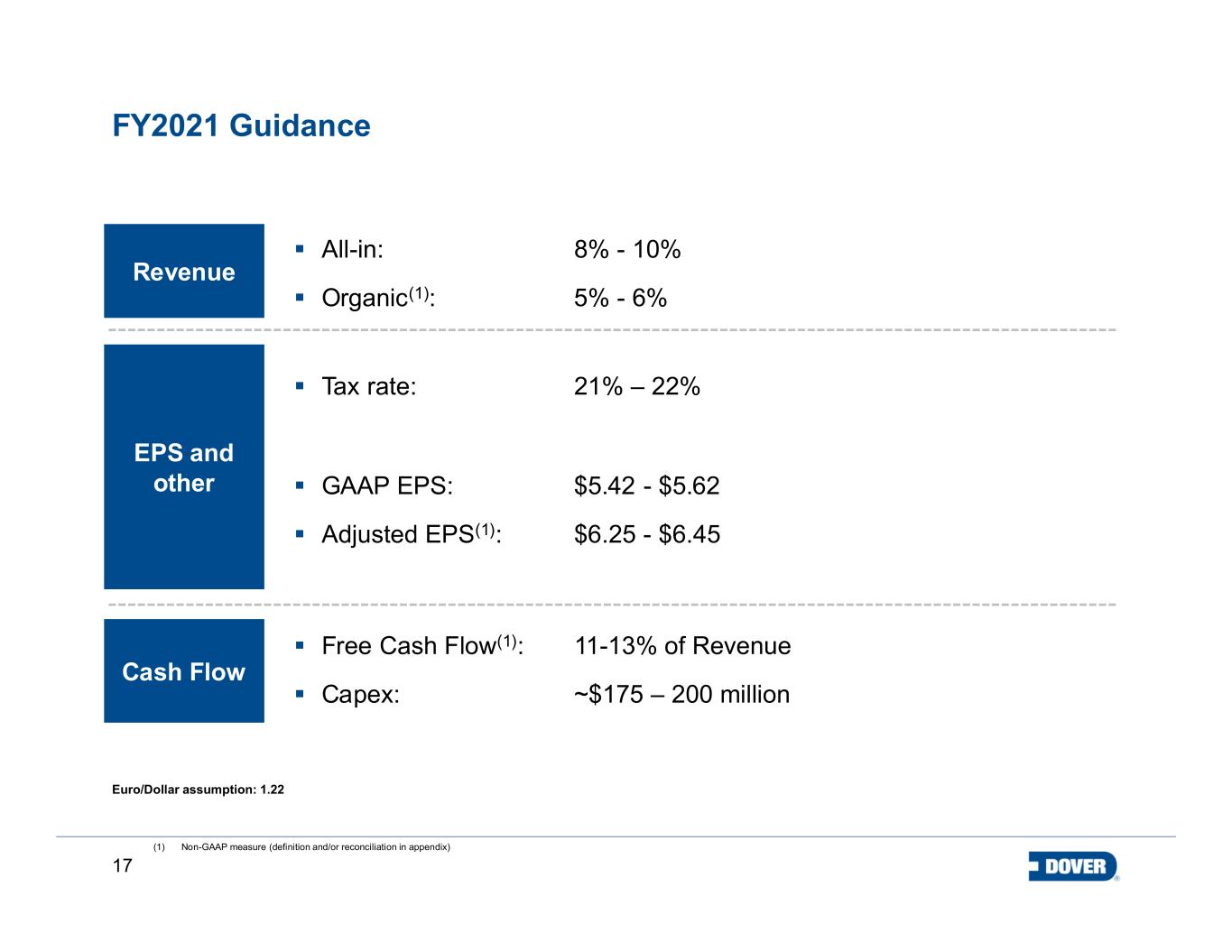

4 Summary Corporate Q4 and Full Year Results Q4 2020 FY 2020 Highlights and Comments Revenue change (Y-o-Y) All-in Organic(1) 0% -2% -6% -7% Q4 Y-o-Y organic growth in DPPS, DRFE Q4 FX impact: +2%; acquisitions (net of divestitures) +1% Bookings change (Y-o-Y) All-in(2) Organic(2) +5% +2% -4% -5% Q4 Book-to-bill(2): 1.09; bookings up Y-o-Y in four segments Backlog(2) remains strong across the portfolio (+21% Y-o-Y) Segment EBIT margin improvement (Y-o-Y) Reported(3) Adjusted(1) -10 bps Flat +50 bps +10 bps Q4 volume/pandemic headwinds offset by productivity actions Absolute Q4 earnings growth in DPPS and DRFE Full-year margin accretion despite volume headwind Earnings Reported Adjusted(1) $182M $225M $683M $824M Q4 Y-o-Y change: Reported +8%; Adjusted ~flat FY Y-o-Y change: Reported +1%; Adjusted -5% Diluted EPS Reported Adjusted(1) $1.25 $1.55 $4.70 $5.67 Q4 Y-o-Y change: Reported +9%; Adjusted +1% FY Y-o-Y change: Reported +2%; Adjusted -4% Free Cash Flow (% of)(1) Revenue Adj. Earnings 21% 167% 14% 114% Q4 FCF(1) up 21% Y-o-Y FY FCF(1) up 24% Y-o-Y Guidance and other activities 2021 guidance: Revenue growth: 8% - 10% (All-in); 5% - 6% (Organic(1)) EPS: $5.42 - $5.62 (GAAP); $6.25 - $6.45 (Adjusted(1)) (1) Non-GAAP measures (definitions and reconciliations in appendix) (2) See performance measures definitions in appendix (3) Refer to definition of total segment earnings (EBIT) margin in appendix

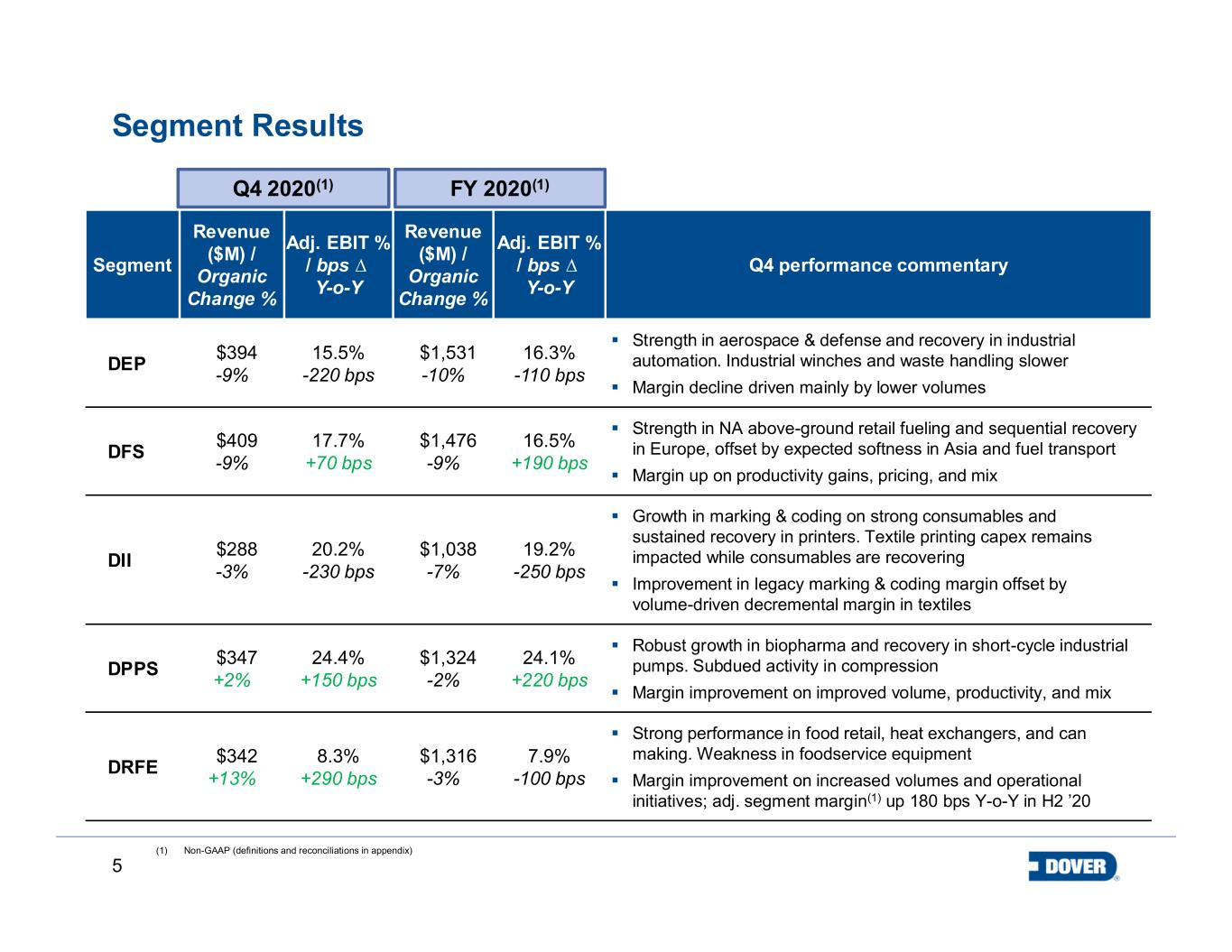

5 Segment Revenue ($M) / Organic Change % Adj. EBIT % / bps ∆ Y-o-Y Revenue ($M) / Organic Change % Adj. EBIT % / bps ∆ Y-o-Y Q4 performance commentary DEP $394 -9% 15.5% -220 bps $1,531 -10% 16.3% -110 bps Strength in aerospace & defense and recovery in industrial automation. Industrial winches and waste handling slower Margin decline driven mainly by lower volumes DFS $409 -9% 17.7% +70 bps $1,476 -9% 16.5% +190 bps Strength in NA above-ground retail fueling and sequential recovery in Europe, offset by expected softness in Asia and fuel transport Margin up on productivity gains, pricing, and mix DII $288 -3% 20.2% -230 bps $1,038 -7% 19.2% -250 bps Growth in marking & coding on strong consumables and sustained recovery in printers. Textile printing capex remains impacted while consumables are recovering Improvement in legacy marking & coding margin offset by volume-driven decremental margin in textiles DPPS $347 +2% 24.4% +150 bps $1,324 -2% 24.1% +220 bps Robust growth in biopharma and recovery in short-cycle industrial pumps. Subdued activity in compression Margin improvement on improved volume, productivity, and mix DRFE $342 +13% 8.3% +290 bps $1,316 -3% 7.9% -100 bps Strong performance in food retail, heat exchangers, and can making. Weakness in foodservice equipment Margin improvement on increased volumes and operational initiatives; adj. segment margin(1) up 180 bps Y-o-Y in H2 ’20 Segment Results Q4 2020(1) (1) Non-GAAP (definitions and reconciliations in appendix) FY 2020(1)

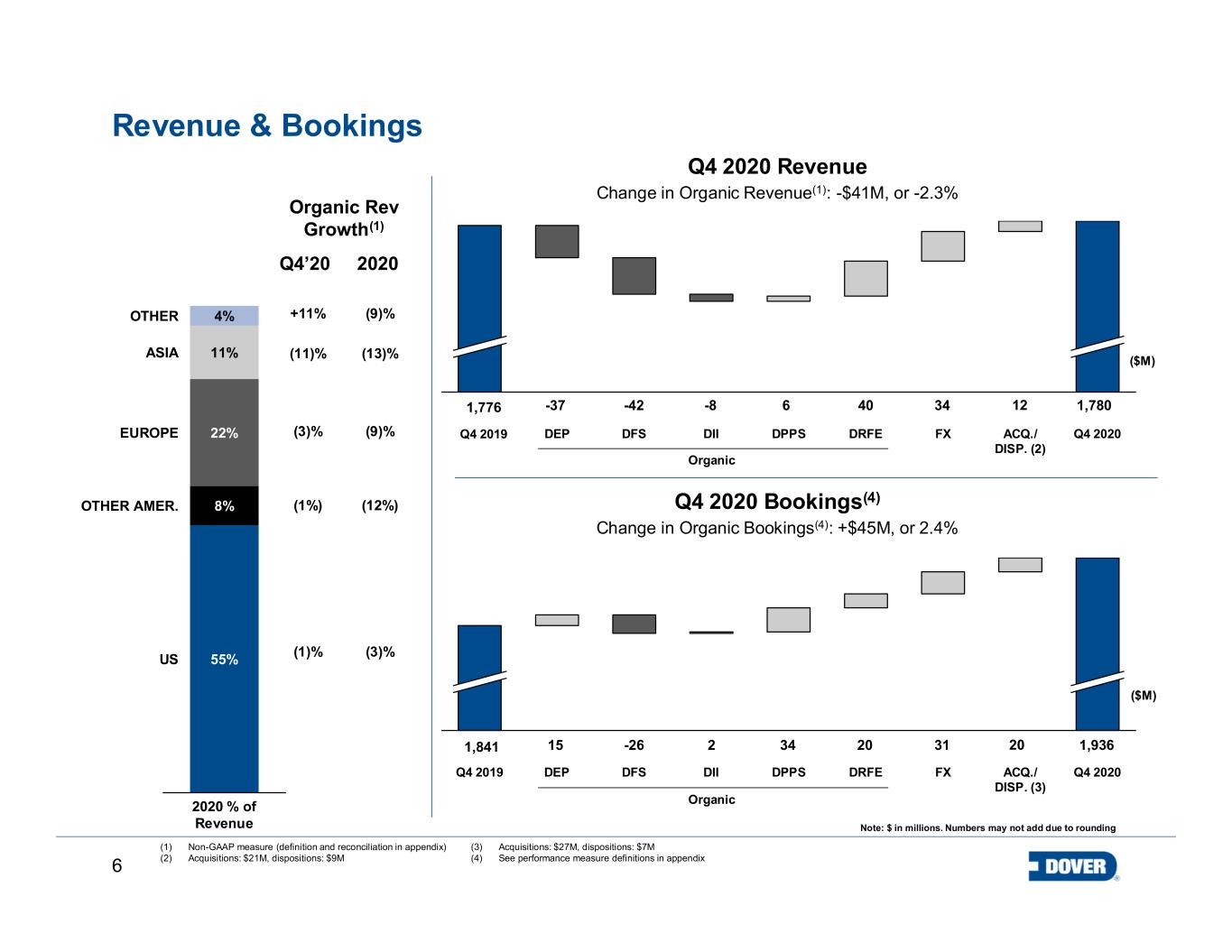

6 Q4 2019 Revenue & Bookings Q4 2020 Revenue Change in Organic Revenue(1): -$41M, or -2.3% DII DPPSDFS DRFE FX ACQ./ DISP. (2) Q4 2020 DEPQ4 2019 DFS DPPSDII DRFE FX ACQ./ DISP. (3) Q4 2020 Note: $ in millions. Numbers may not add due to rounding Q4 2020 Bookings(4) Change in Organic Bookings(4): +$45M, or 2.4% (1) Non-GAAP measure (definition and reconciliation in appendix) (2) Acquisitions: $21M, dispositions: $9M DEP ($M) 1,776 -42 34 1,78040-37 6-8 ($M) 12 -26 31 1,9362015 342 201,841 2020 % of Revenue 8% 22% 4% 55% 11%ASIA OTHER EUROPE OTHER AMER. US +11% (11)% (3)% (1%) (1)% Organic Rev Growth(1) Organic Organic (3) Acquisitions: $27M, dispositions: $7M (4) See performance measure definitions in appendix Q4’20 2020 (9)% (13)% (9)% (12%) (3)%

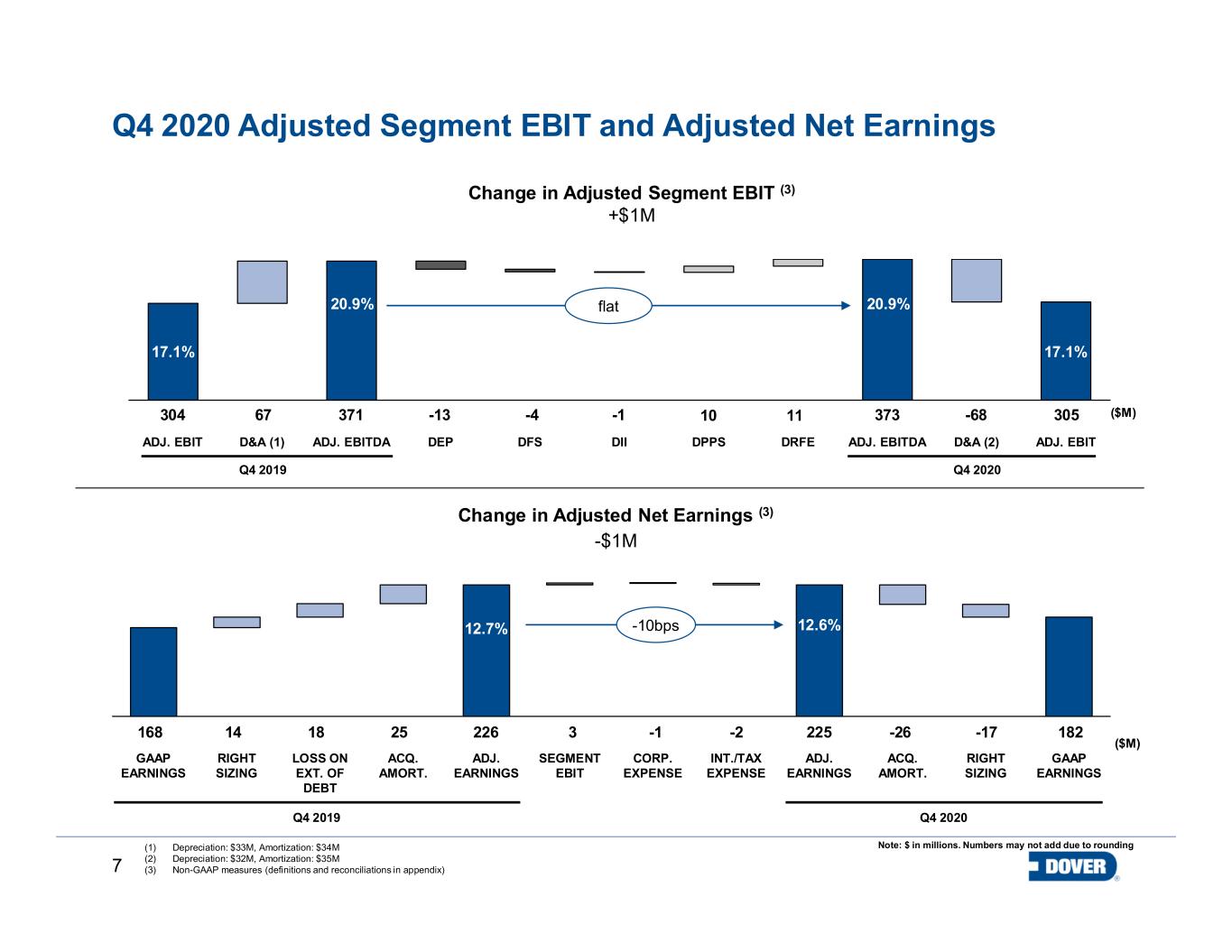

7 Q4 2020 Adjusted Segment EBIT and Adjusted Net Earnings CORP. EXPENSE GAAP EARNINGS RIGHT SIZING SEGMENT EBIT LOSS ON EXT. OF DEBT ADJ. EARNINGS ACQ. AMORT. INT./TAX EXPENSE ADJ. EARNINGS ACQ. AMORT. RIGHT SIZING GAAP EARNINGS Change in Adjusted Net Earnings (3) -$1M 168 14 18 25 226 3 -1 -2 225 -26 Q4 2019 Q4 2020 ($M) Note: $ in millions. Numbers may not add due to rounding 182-17 DPPSD&A (1)ADJ. EBIT ADJ. EBITDA DEP DFS D&A (2)DII DRFE ADJ. EBITDA ADJ. EBIT 20.9% 17.1% Change in Adjusted Segment EBIT (3) +$1M Q4 2020 304 371 -1-13 305 ($M)10 17.1% Q4 2019 -68-4 11 20.9% 37367 (1) Depreciation: $33M, Amortization: $34M (2) Depreciation: $32M, Amortization: $35M (3) Non-GAAP measures (definitions and reconciliations in appendix) 12.7% 12.6%-10bps flat

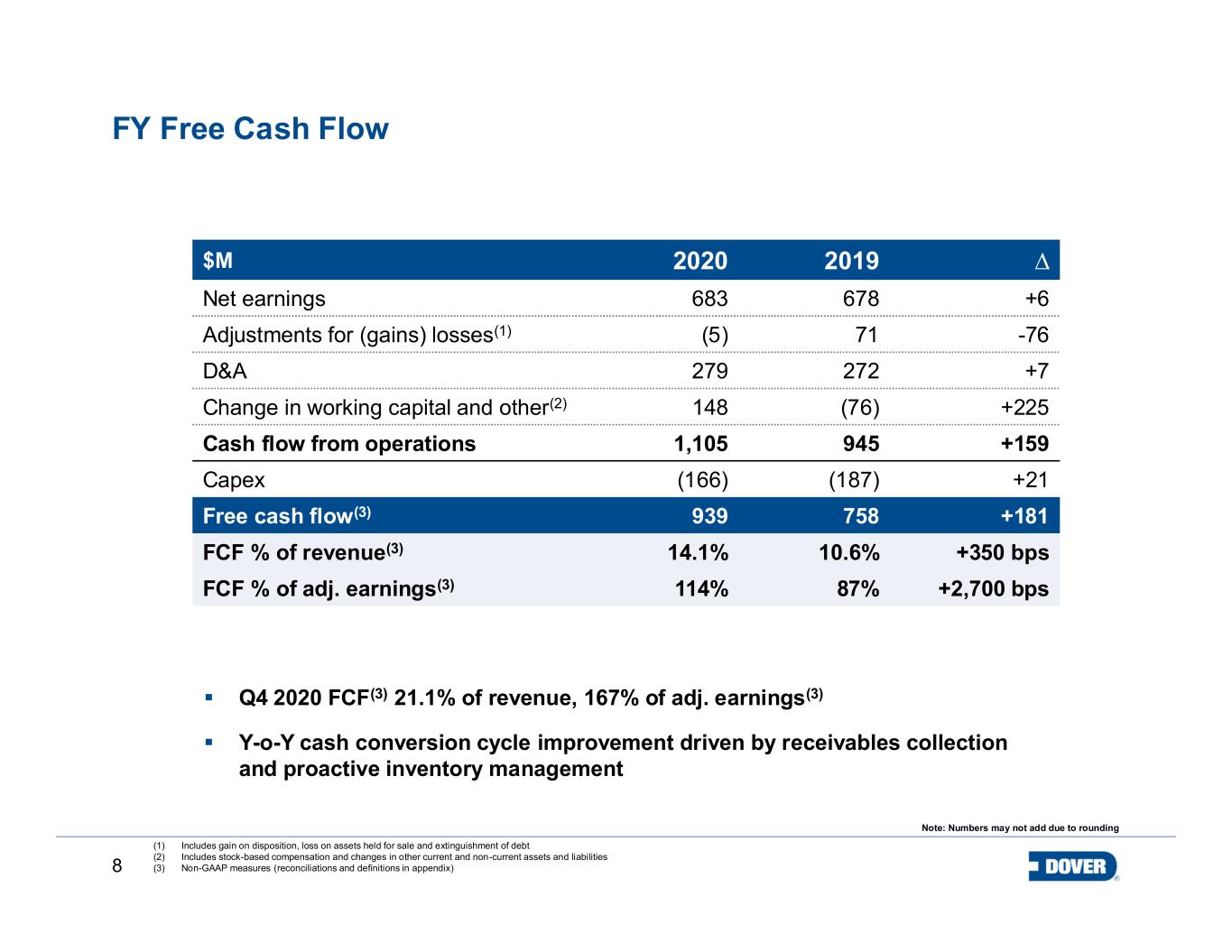

8 FY Free Cash Flow 12.3% (1) Includes gain on disposition, loss on assets held for sale and extinguishment of debt (2) Includes stock-based compensation and changes in other current and non-current assets and liabilities (3) Non-GAAP measures (reconciliations and definitions in appendix) $M 2020 2019 ∆ Net earnings 683 678 +6 Adjustments for (gains) losses(1) (5) 71 -76 D&A 279 272 +7 Change in working capital and other(2) 148 (76) +225 Cash flow from operations 1,105 945 +159 Capex (166) (187) +21 Free cash flow(3) 939 758 +181 FCF % of revenue(3) 14.1% 10.6% +350 bps FCF % of adj. earnings(3) 114% 87% +2,700 bps Note: Numbers may not add due to rounding Q4 2020 FCF(3) 21.1% of revenue, 167% of adj. earnings(3) Y-o-Y cash conversion cycle improvement driven by receivables collection and proactive inventory management

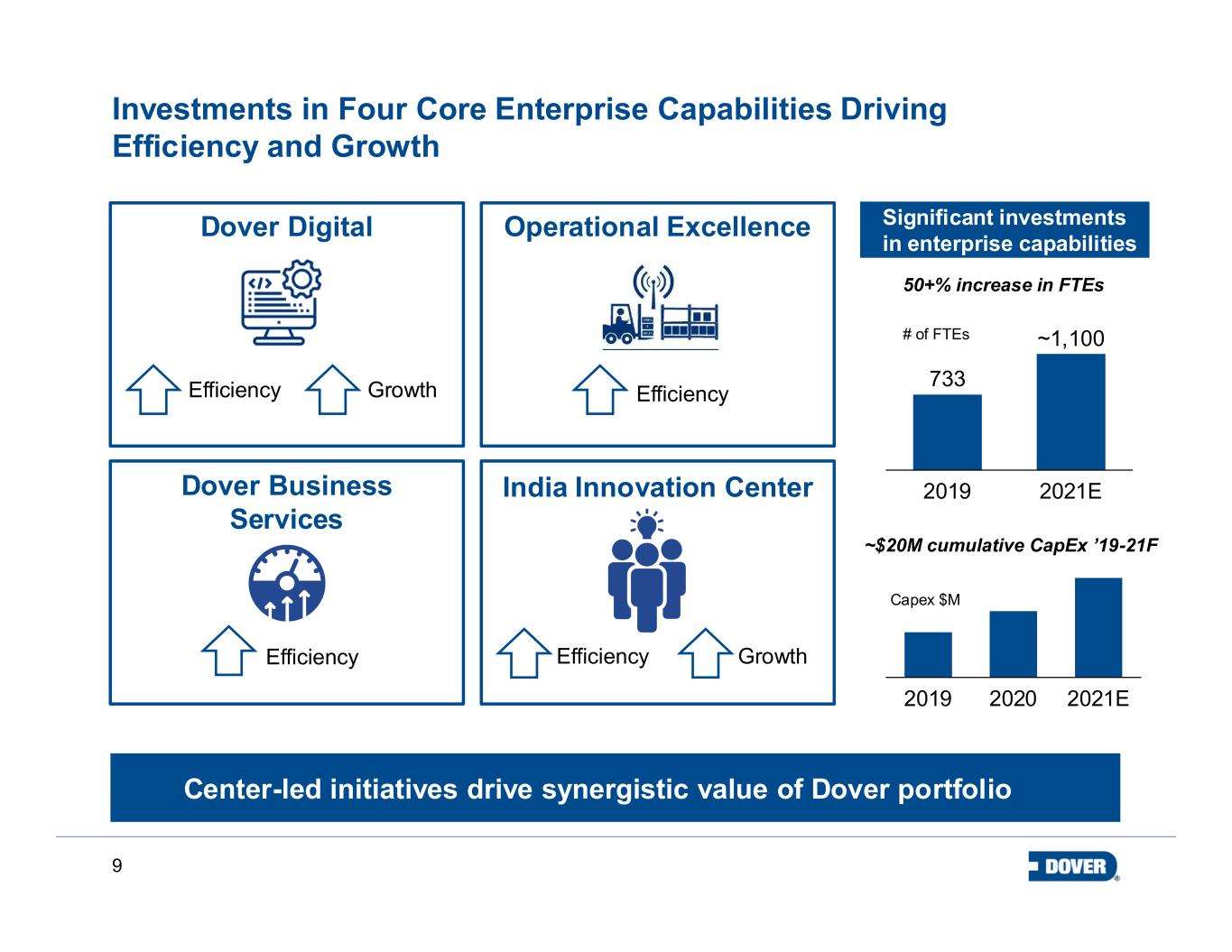

9 Investments in Four Core Enterprise Capabilities Driving Efficiency and Growth Dover Digital Operational Excellence Dover Business Services India Innovation Center Efficiency Growth Efficiency Efficiency Efficiency Growth Center-led initiatives drive synergistic value of Dover portfolio 733 2021E2019 ~1,100 50+% increase in FTEs 2019 2021E2020 ~$20M cumulative CapEx ’19-21F # of FTEs Capex $M Significant investments in enterprise capabilities

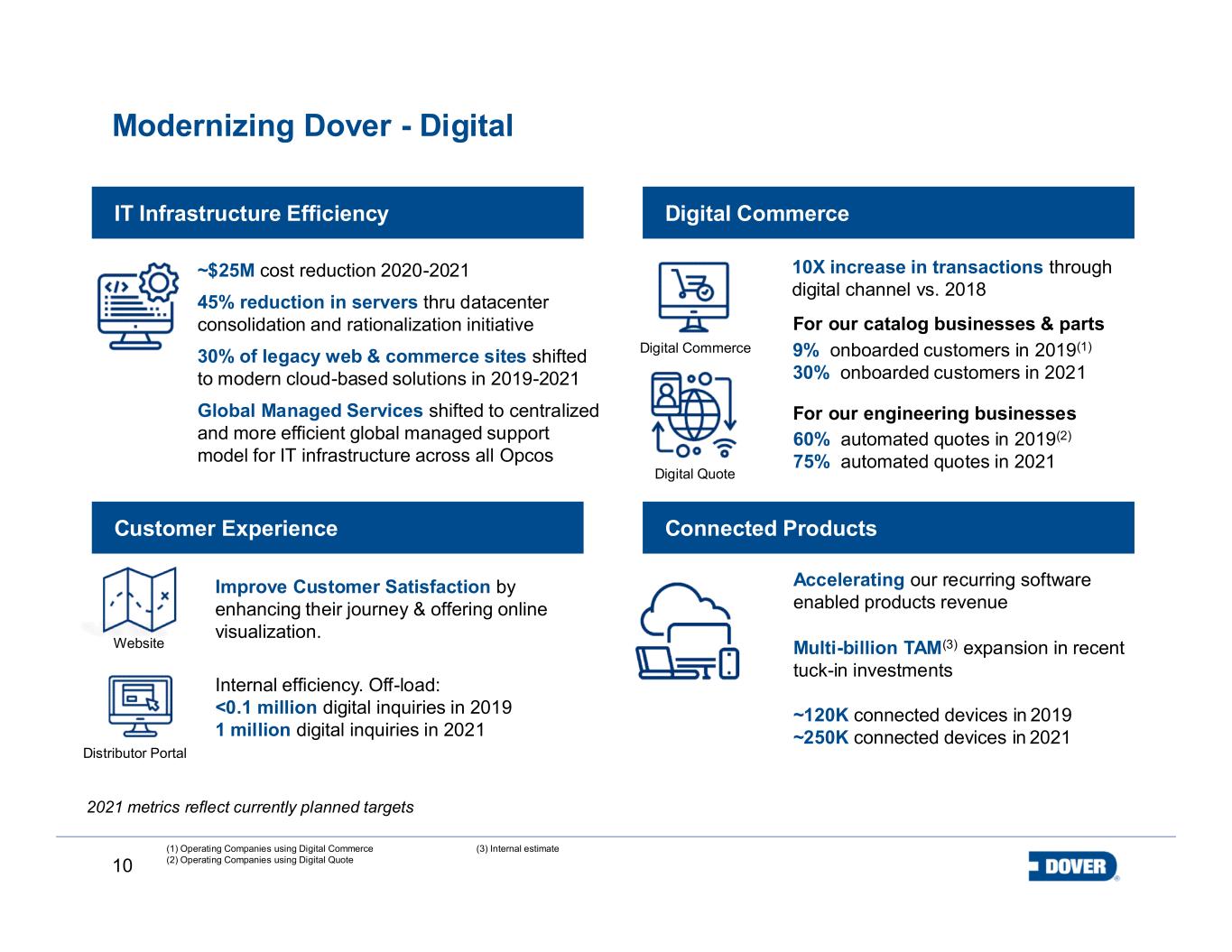

10 Modernizing Dover - Digital (1) Operating Companies using Digital Commerce (2) Operating Companies using Digital Quote Digital Commerce ~$25M cost reduction 2020-2021 45% reduction in servers thru datacenter consolidation and rationalization initiative 30% of legacy web & commerce sites shifted to modern cloud-based solutions in 2019-2021 Global Managed Services shifted to centralized and more efficient global managed support model for IT infrastructure across all Opcos 9% onboarded customers in 2019(1) 30% onboarded customers in 2021 Accelerating our recurring software enabled products revenue Multi-billion TAM(3) expansion in recent tuck-in investments ~120K connected devices in 2019 ~250K connected devices in 2021 Internal efficiency. Off-load: <0.1 million digital inquiries in 2019 1 million digital inquiries in 2021 Digital Quote For our catalog businesses & parts For our engineering businesses 60% automated quotes in 2019(2) 75% automated quotes in 2021 Improve Customer Satisfaction by enhancing their journey & offering online visualization. Distributor Portal Website 10X increase in transactions through digital channel vs. 2018 2021 metrics reflect currently planned targets IT Infrastructure Efficiency Digital Commerce Customer Experience Connected Products (3) Internal estimate

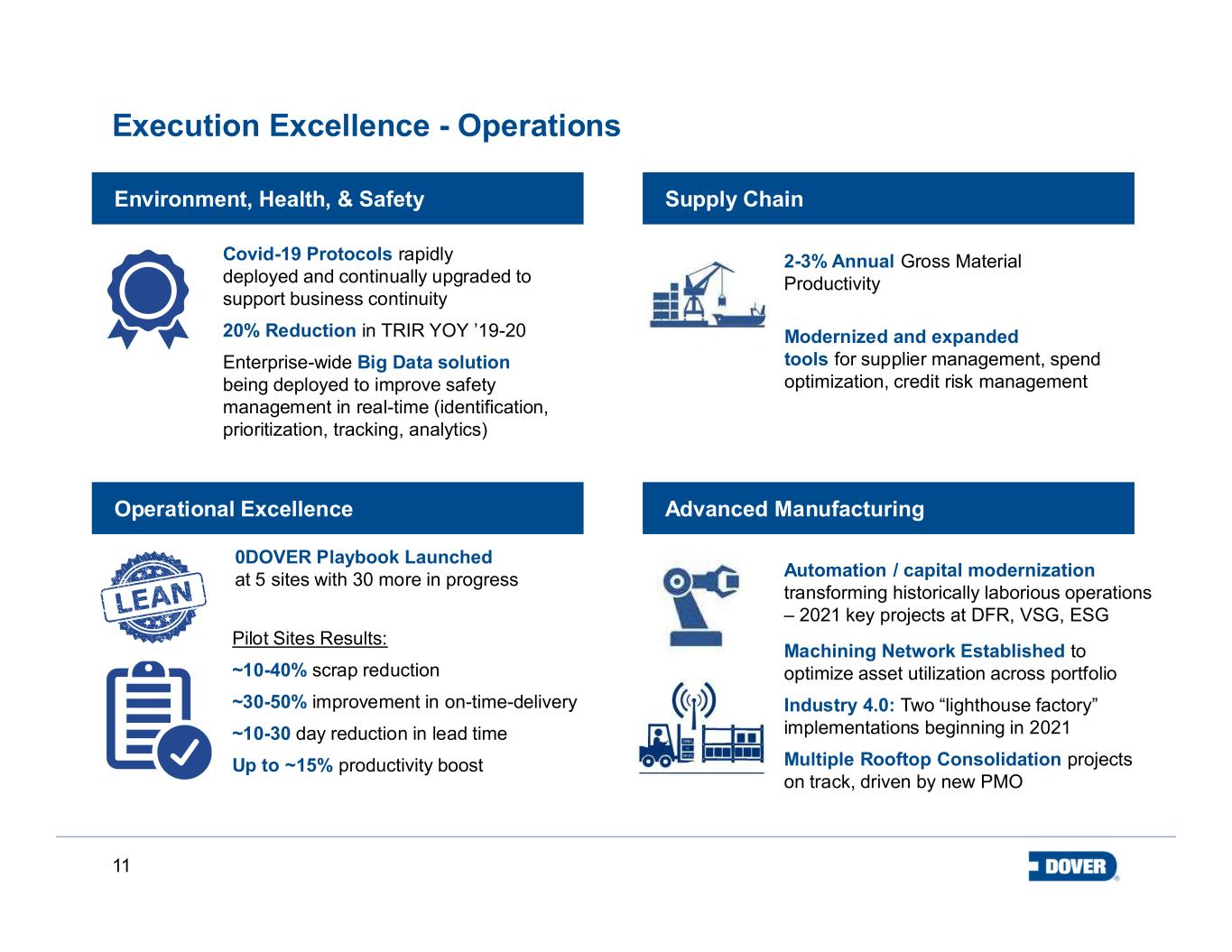

11 Execution Excellence - Operations Modernizing our Operational Approach Covid-19 Protocols rapidly deployed and continually upgraded to support business continuity 20% Reduction in TRIR YOY ’19-20 Enterprise-wide Big Data solution being deployed to improve safety management in real-time (identification, prioritization, tracking, analytics) 2-3% Annual Gross Material Productivity Automation / capital modernization transforming historically laborious operations – 2021 key projects at DFR, VSG, ESG Machining Network Established to optimize asset utilization across portfolio Industry 4.0: Two “lighthouse factory” implementations beginning in 2021 Multiple Rooftop Consolidation projects on track, driven by new PMO Pilot Sites Results: ~10-40% scrap reduction ~30-50% improvement in on-time-delivery ~10-30 day reduction in lead time Up to ~15% productivity boost Modernized and expanded tools for supplier management, spend optimization, credit risk management 0DOVER Playbook Launched at 5 sites with 30 more in progress Environment, Health, & Safety Supply Chain Operational Excellence Advanced Manufacturing

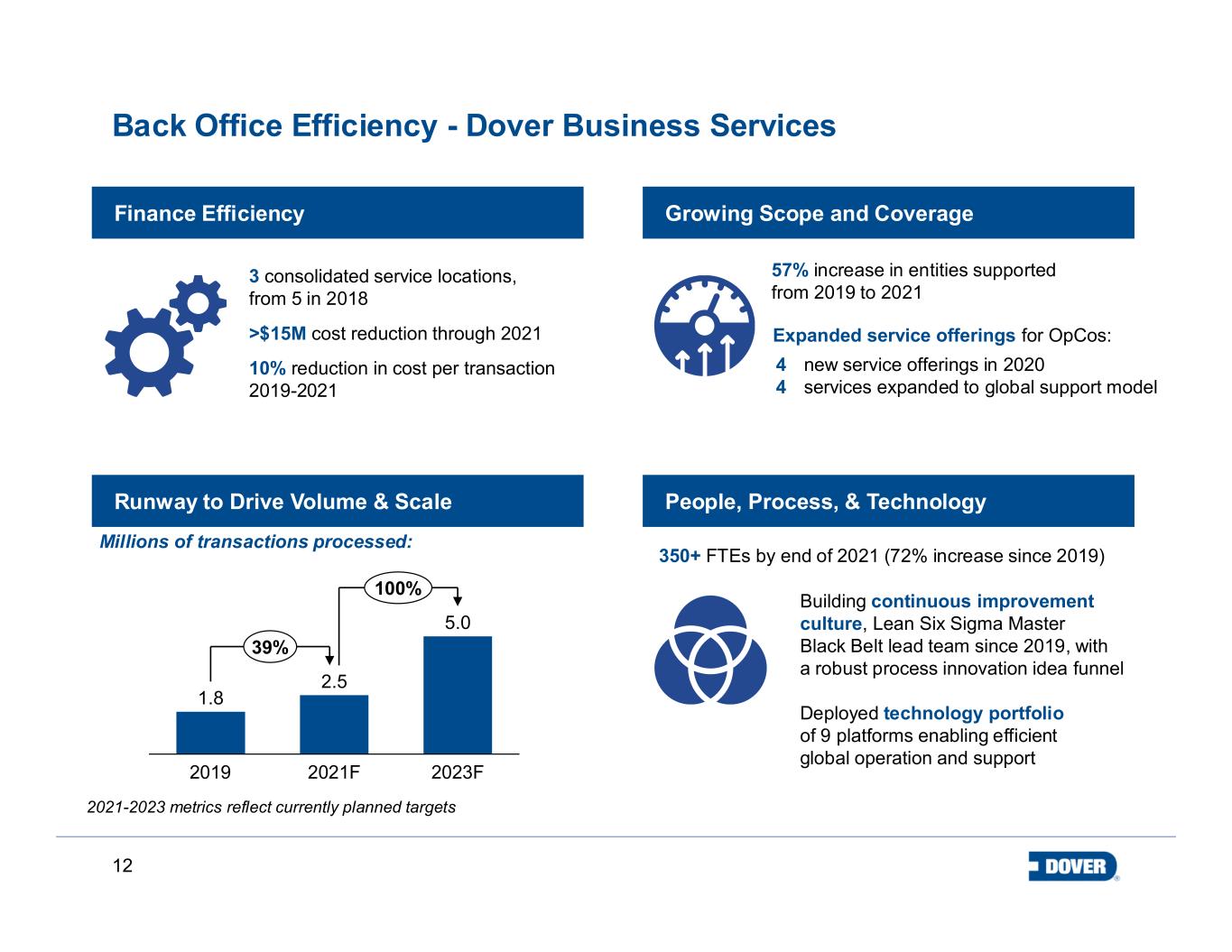

12 Back Office Efficiency - Dover Business Services 3 consolidated service locations, from 5 in 2018 >$15M cost reduction through 2021 10% reduction in cost per transaction 2019-2021 57% increase in entities supported from 2019 to 2021 350+ FTEs by end of 2021 (72% increase since 2019) Building continuous improvement culture, Lean Six Sigma Master Black Belt lead team since 2019, with a robust process innovation idea funnel Deployed technology portfolio of 9 platforms enabling efficient global operation and support 2021-2023 metrics reflect currently planned targets Finance Efficiency Growing Scope and Coverage Runway to Drive Volume & Scale People, Process, & Technology 1.8 2.5 5.0 2023F2021F2019 39% 100% Millions of transactions processed: Expanded service offerings for OpCos: 4 new service offerings in 2020 4 services expanded to global support model

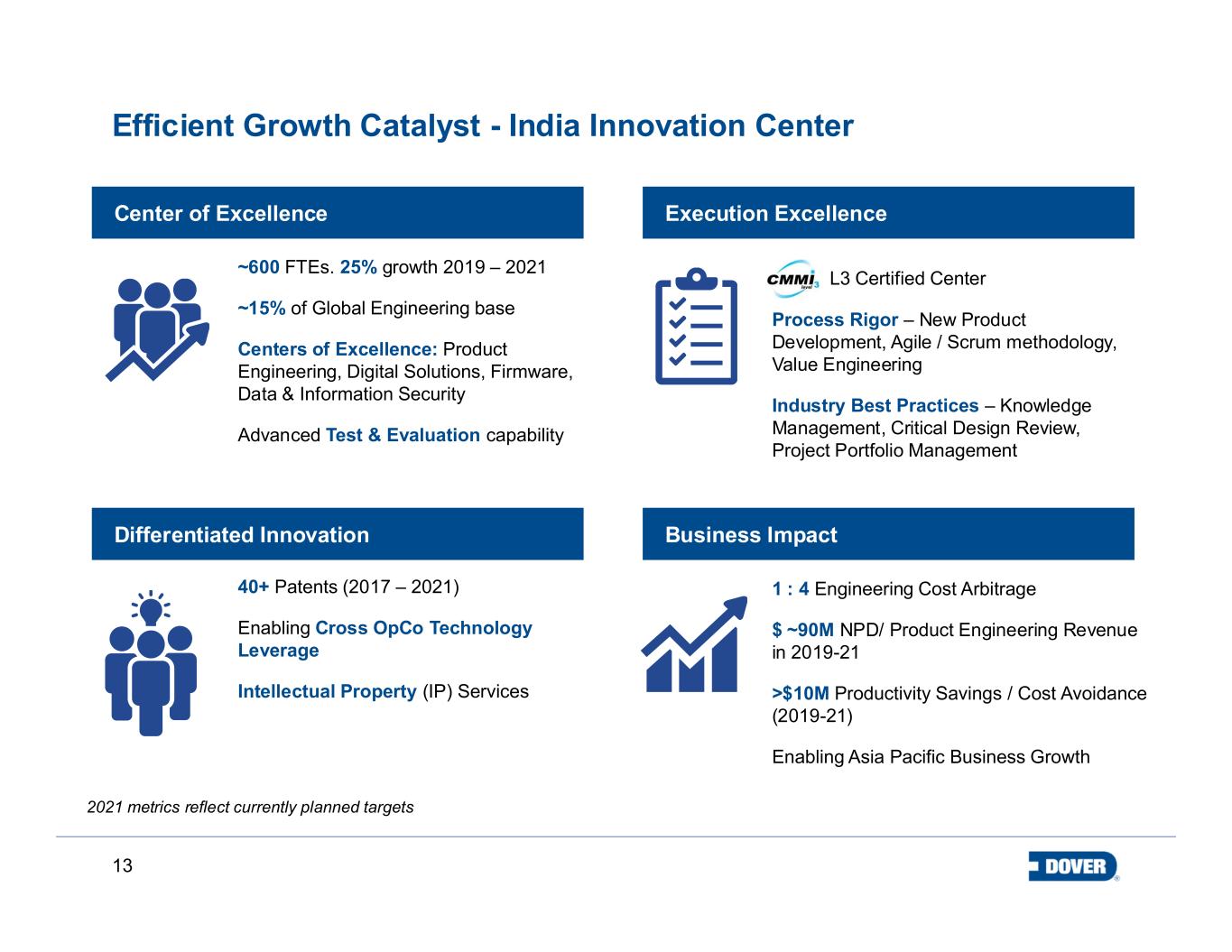

13 Efficient Growth Catalyst - India Innovation Center L3 Certified Center Process Rigor – New Product Development, Agile / Scrum methodology, Value Engineering Industry Best Practices – Knowledge Management, Critical Design Review, Project Portfolio Management 40+ Patents (2017 – 2021) Enabling Cross OpCo Technology Leverage Intellectual Property (IP) Services 1 : 4 Engineering Cost Arbitrage $ ~90M NPD/ Product Engineering Revenue in 2019-21 >$10M Productivity Savings / Cost Avoidance (2019-21) Enabling Asia Pacific Business Growth ~600 FTEs. 25% growth 2019 – 2021 ~15% of Global Engineering base Centers of Excellence: Product Engineering, Digital Solutions, Firmware, Data & Information Security Advanced Test & Evaluation capability 2021 metrics reflect currently planned targets Center of Excellence Execution Excellence Differentiated Innovation Business Impact

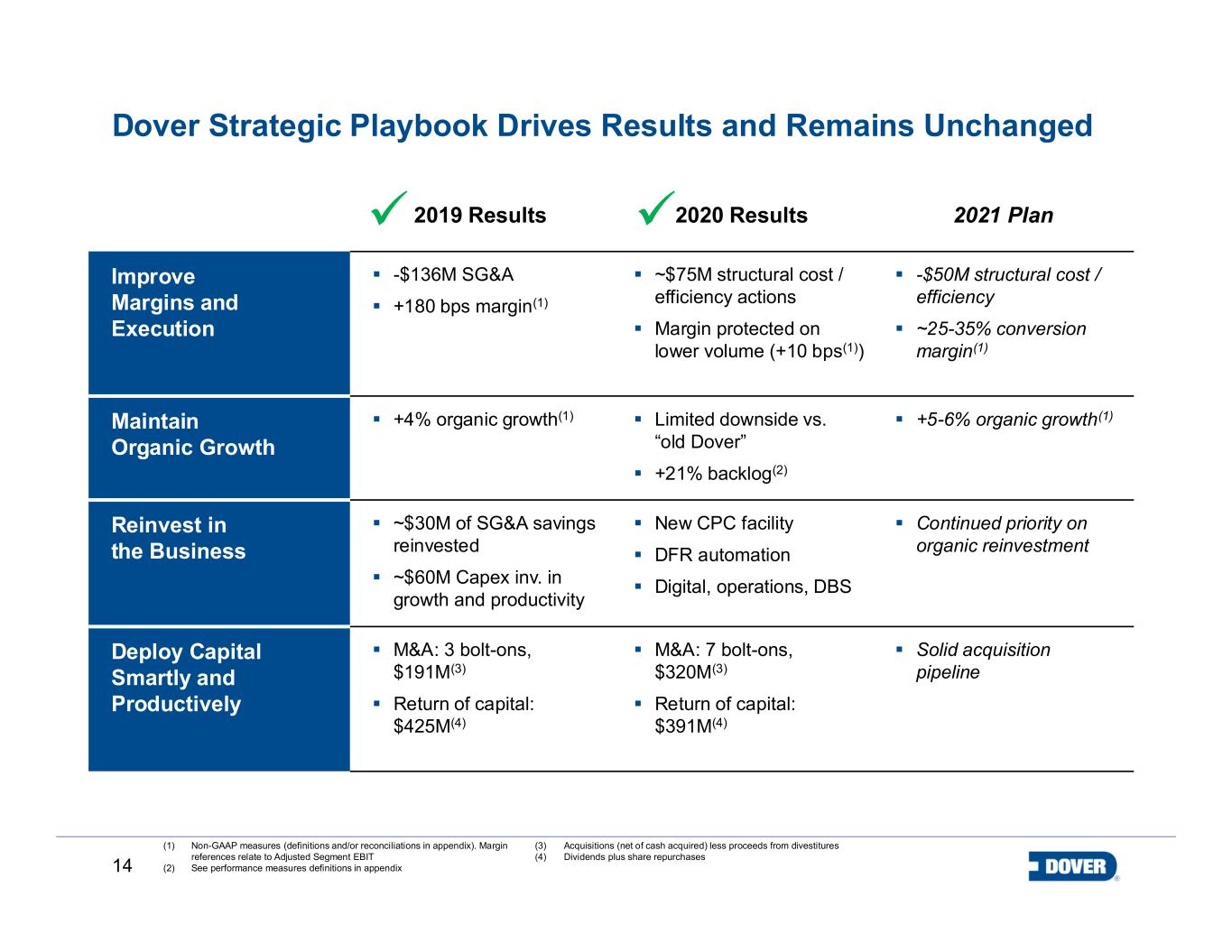

14 Dover Strategic Playbook Drives Results and Remains Unchanged (1) Non-GAAP measures (definitions and/or reconciliations in appendix). Margin references relate to Adjusted Segment EBIT (2) See performance measures definitions in appendix (3) Acquisitions (net of cash acquired) less proceeds from divestitures (4) Dividends plus share repurchases 2019 Results 2020 Results 2021 Plan Improve Margins and Execution -$136M SG&A +180 bps margin(1) ~$75M structural cost / efficiency actions Margin protected on lower volume (+10 bps(1)) -$50M structural cost / efficiency ~25-35% conversion margin(1) Maintain Organic Growth +4% organic growth(1) Limited downside vs. “old Dover” +21% backlog(2) +5-6% organic growth(1) Reinvest in the Business ~$30M of SG&A savings reinvested ~$60M Capex inv. in growth and productivity New CPC facility DFR automation Digital, operations, DBS Continued priority on organic reinvestment Deploy Capital Smartly and Productively M&A: 3 bolt-ons, $191M(3) Return of capital: $425M(4) M&A: 7 bolt-ons, $320M(3) Return of capital: $391M(4) Solid acquisition pipeline

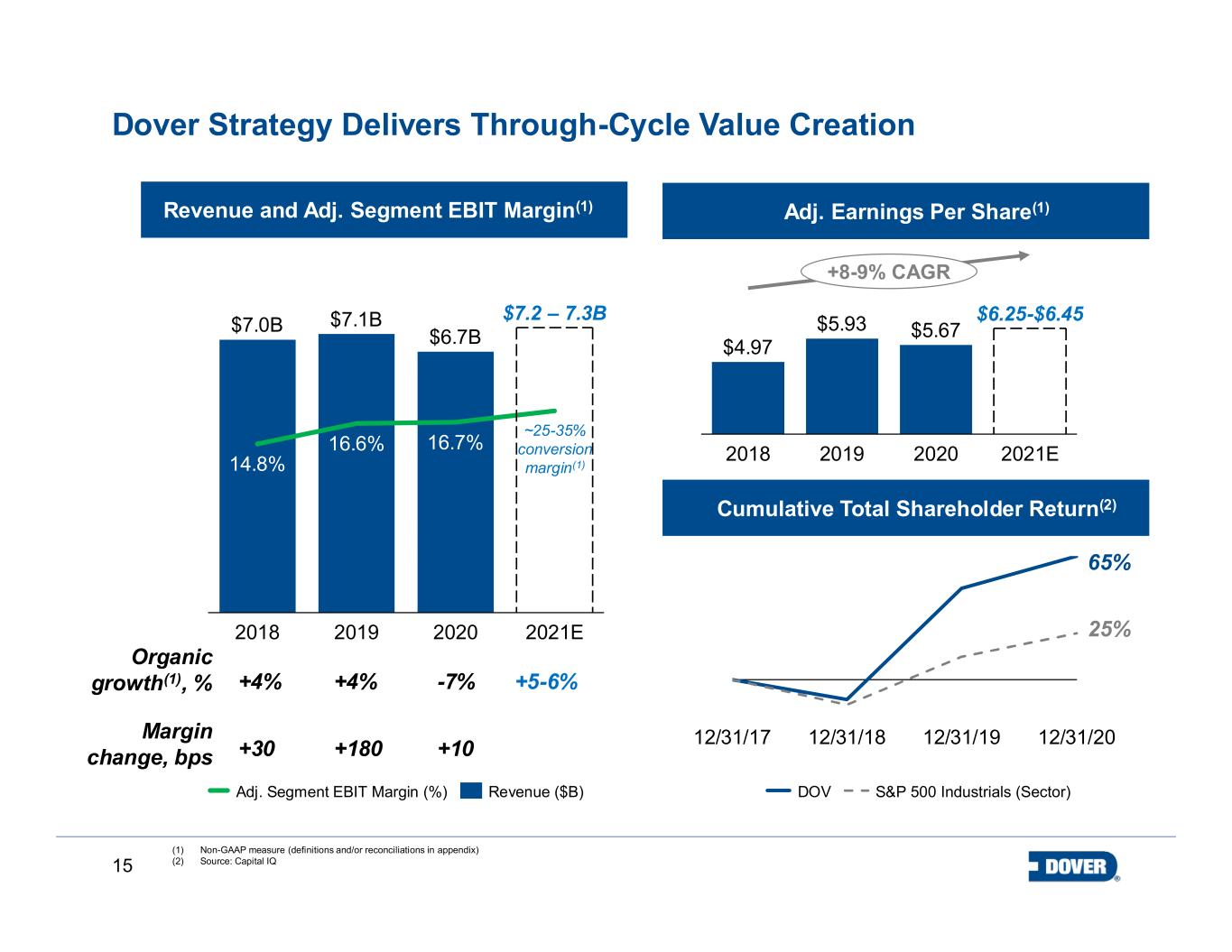

15 Dover Strategy Delivers Through-Cycle Value Creation $7.0B $7.1B $6.7B 2020 14.8% 20192018 16.6% 16.7% 2021E $7.2 – 7.3B Adj. Segment EBIT Margin (%) Revenue ($B) $4.97 $5.93 $5.67 2021E2018 2019 2020 $6.25-$6.45 +8-9% CAGR (1) Non-GAAP measure (definitions and/or reconciliations in appendix) (2) Source: Capital IQ +30 +180 +10 Margin change, bps +4% +4% -7% +5-6% Organic growth(1), % ~25-35% conversion margin(1) 12/31/1912/31/17 12/31/18 12/31/20 DOV S&P 500 Industrials (Sector) 65% 25% Revenue and Adj. Segment EBIT Margin(1) Cumulative Total Shareholder Return(2) Adj. Earnings Per Share(1)

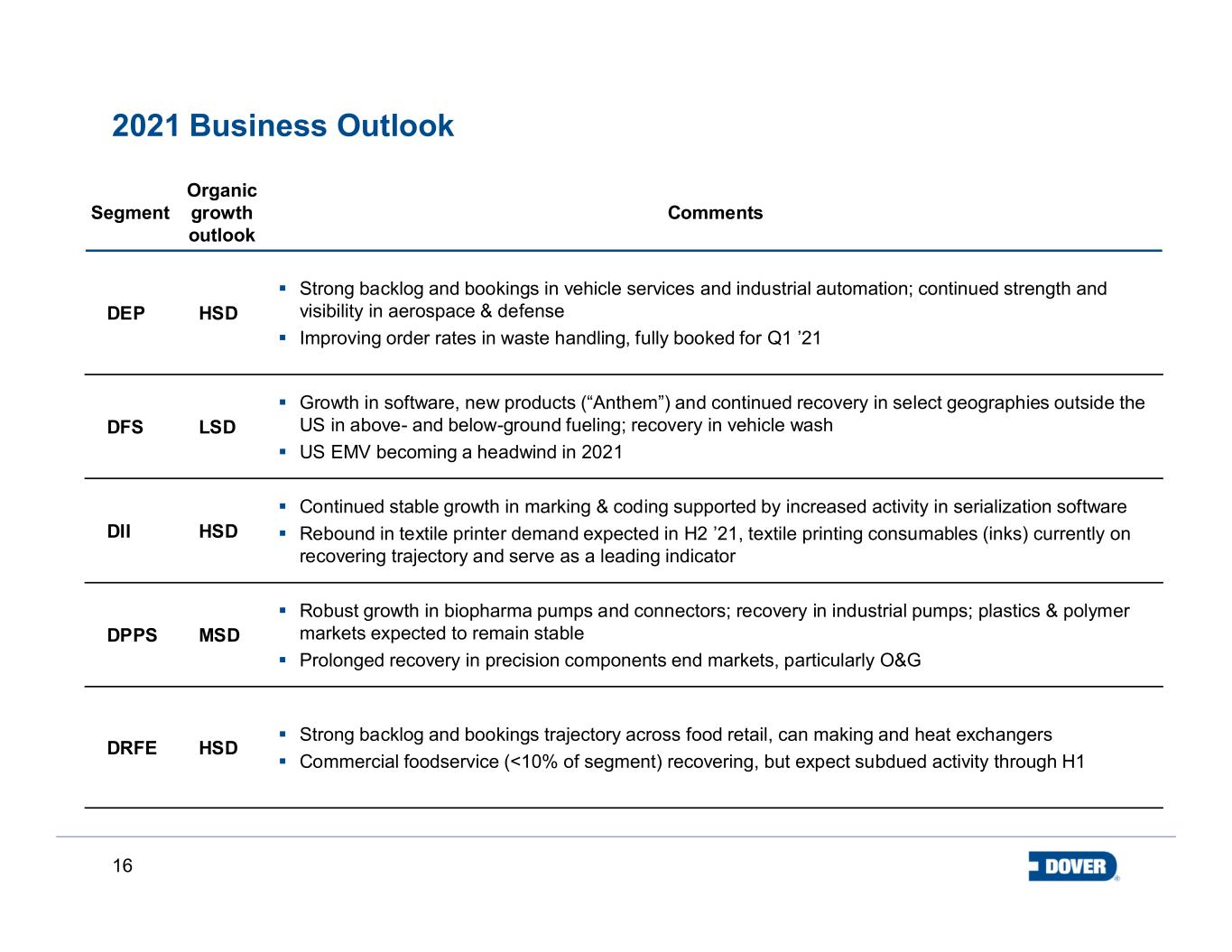

16 2021 Business Outlook Segment Organic growth outlook Comments DEP HSD Strong backlog and bookings in vehicle services and industrial automation; continued strength and visibility in aerospace & defense Improving order rates in waste handling, fully booked for Q1 ’21 DFS LSD Growth in software, new products (“Anthem”) and continued recovery in select geographies outside the US in above- and below-ground fueling; recovery in vehicle wash US EMV becoming a headwind in 2021 DII HSD Continued stable growth in marking & coding supported by increased activity in serialization software Rebound in textile printer demand expected in H2 ’21, textile printing consumables (inks) currently on recovering trajectory and serve as a leading indicator DPPS MSD Robust growth in biopharma pumps and connectors; recovery in industrial pumps; plastics & polymer markets expected to remain stable Prolonged recovery in precision components end markets, particularly O&G DRFE HSD Strong backlog and bookings trajectory across food retail, can making and heat exchangers Commercial foodservice (<10% of segment) recovering, but expect subdued activity through H1

17 FY2021 Guidance (1) Non-GAAP measure (definition and/or reconciliation in appendix) EPS and other Cash Flow Free Cash Flow(1): 11-13% of Revenue Capex: ~$175 – 200 million GAAP EPS: $5.42 - $5.62 Adjusted EPS(1): $6.25 - $6.45 Revenue All-in: 8% - 10% Organic(1): 5% - 6% Tax rate: 21% – 22% Euro/Dollar assumption: 1.22

18 Appendix

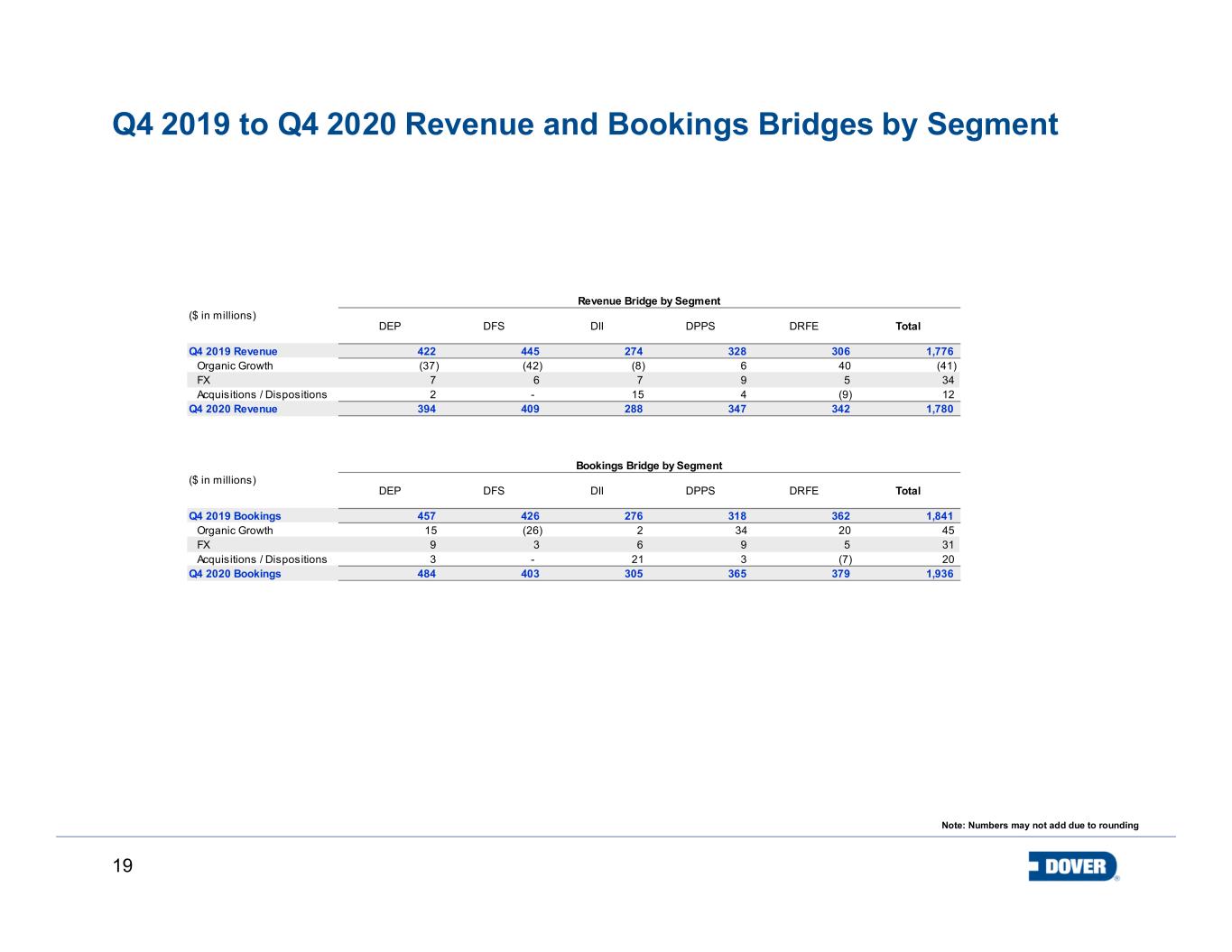

19 Q4 2019 to Q4 2020 Revenue and Bookings Bridges by Segment Note: Numbers may not add due to rounding DEP DFS DII DPPS DRFE Total 422 445 274 328 306 1,776 (37) (42) (8) 6 40 (41) 7 6 7 9 5 34 2 - 15 4 (9) 12 394 409 288 347 342 1,780 DEP DFS DII DPPS DRFE Total 457 426 276 318 362 1,841 15 (26) 2 34 20 45 9 3 6 9 5 31 3 - 21 3 (7) 20 484 403 305 365 379 1,936 FX Q4 2020 Bookings Q4 2019 Bookings Organic Growth Acquisitions / Dispositions ($ in millions) Q4 2019 Revenue Bookings Bridge by Segment ($ in millions) Acquisitions / Dispositions Q4 2020 Revenue Organic Growth FX Revenue Bridge by Segment

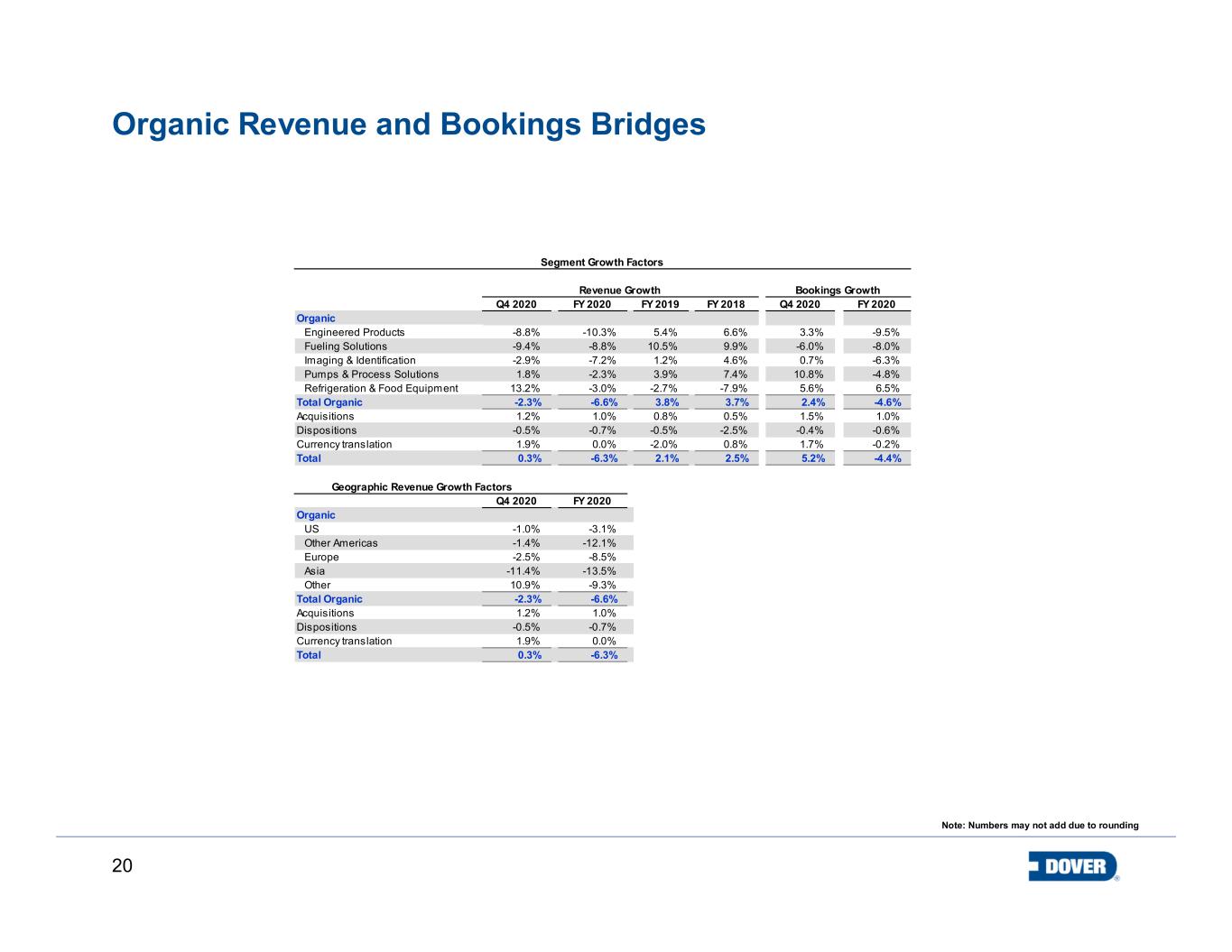

20 Organic Revenue and Bookings Bridges Q4 2020 FY 2020 FY 2019 FY 2018 Q4 2020 FY 2020 -8.8% -10.3% 5.4% 6.6% 3.3% -9.5% -9.4% -8.8% 10.5% 9.9% -6.0% -8.0% -2.9% -7.2% 1.2% 4.6% 0.7% -6.3% 1.8% -2.3% 3.9% 7.4% 10.8% -4.8% 13.2% -3.0% -2.7% -7.9% 5.6% 6.5% -2.3% -6.6% 3.8% 3.7% 2.4% -4.6% 1.2% 1.0% 0.8% 0.5% 1.5% 1.0% -0.5% -0.7% -0.5% -2.5% -0.4% -0.6% 1.9% 0.0% -2.0% 0.8% 1.7% -0.2% Total 0.3% -6.3% 2.1% 2.5% 5.2% -4.4% Geographic Revenue Growth Factors Q4 2020 FY 2020 -1.0% -3.1% -1.4% -12.1% -2.5% -8.5% -11.4% -13.5% 10.9% -9.3% -2.3% -6.6% 1.2% 1.0% -0.5% -0.7% 1.9% 0.0% Total 0.3% -6.3% Acquisitions Dispositions Currency translation Organic US Other Americas Europe Asia Other Total Organic Acquisitions Dispositions Currency translation Organic Refrigeration & Food Equipment Total Organic Engineered Products Pumps & Process Solutions Fueling Solutions Imaging & Identification Revenue Growth Bookings Growth Segment Growth Factors Note: Numbers may not add due to rounding

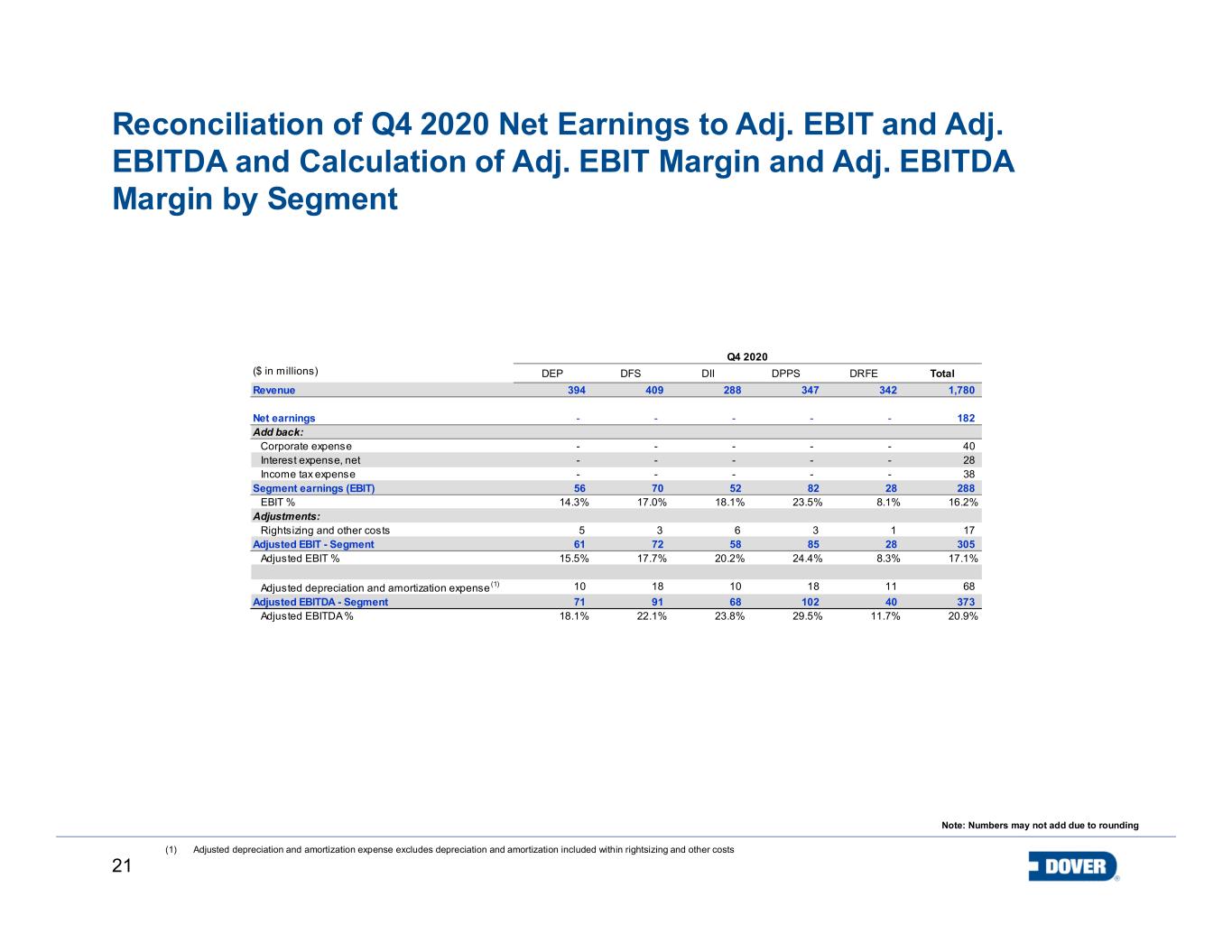

21 Reconciliation of Q4 2020 Net Earnings to Adj. EBIT and Adj. EBITDA and Calculation of Adj. EBIT Margin and Adj. EBITDA Margin by Segment (1) Adjusted depreciation and amortization expense excludes depreciation and amortization included within rightsizing and other costs DEP DFS DII DPPS DRFE Total 394 409 288 347 342 1,780 - - - - - 182 - - - - - 40 - - - - - 28 - - - - - 38 56 70 52 82 28 288 14.3% 17.0% 18.1% 23.5% 8.1% 16.2% 5 3 6 3 1 17 61 72 58 85 28 305 15.5% 17.7% 20.2% 24.4% 8.3% 17.1% 10 18 10 18 11 68 71 91 68 102 40 373 18.1% 22.1% 23.8% 29.5% 11.7% 20.9% Adjusted EBIT - Segment Corporate expense Adjusted EBIT % Adjusted depreciation and amortization expense(1) Interest expense, net Q4 2020 ($ in millions) Revenue Net earnings Add back: Adjusted EBITDA - Segment Adjusted EBITDA % Income tax expense Segment earnings (EBIT) EBIT % Adjustments: Rightsizing and other costs Note: Numbers may not add due to rounding

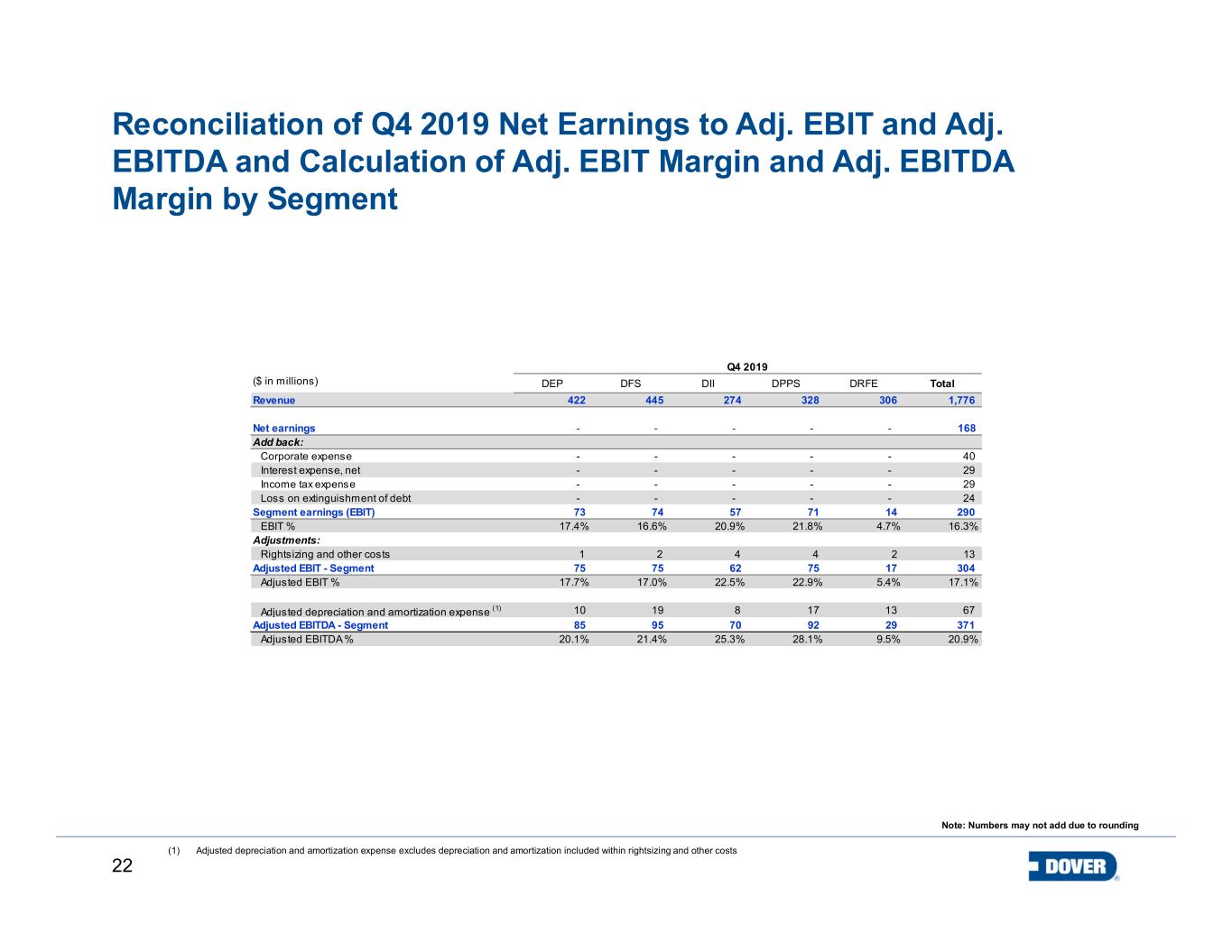

22 Reconciliation of Q4 2019 Net Earnings to Adj. EBIT and Adj. EBITDA and Calculation of Adj. EBIT Margin and Adj. EBITDA Margin by Segment DEP DFS DII DPPS DRFE Total 422 445 274 328 306 1,776 - - - - - 168 - - - - - 40 - - - - - 29 - - - - - 29 - - - - - 24 73 74 57 71 14 290 17.4% 16.6% 20.9% 21.8% 4.7% 16.3% 1 2 4 4 2 13 75 75 62 75 17 304 17.7% 17.0% 22.5% 22.9% 5.4% 17.1% 10 19 8 17 13 67 85 95 70 92 29 371 20.1% 21.4% 25.3% 28.1% 9.5% 20.9% Corporate expense Adjusted EBIT - Segment Adjusted EBIT % Adjusted depreciation and amortization expense (1) Interest expense, net Loss on extinguishment of debt Q4 2019 ($ in millions) Revenue Net earnings Add back: Adjusted EBITDA - Segment Adjusted EBITDA % Income tax expense Segment earnings (EBIT) EBIT % Adjustments: Rightsizing and other costs (1) Adjusted depreciation and amortization expense excludes depreciation and amortization included within rightsizing and other costs Note: Numbers may not add due to rounding

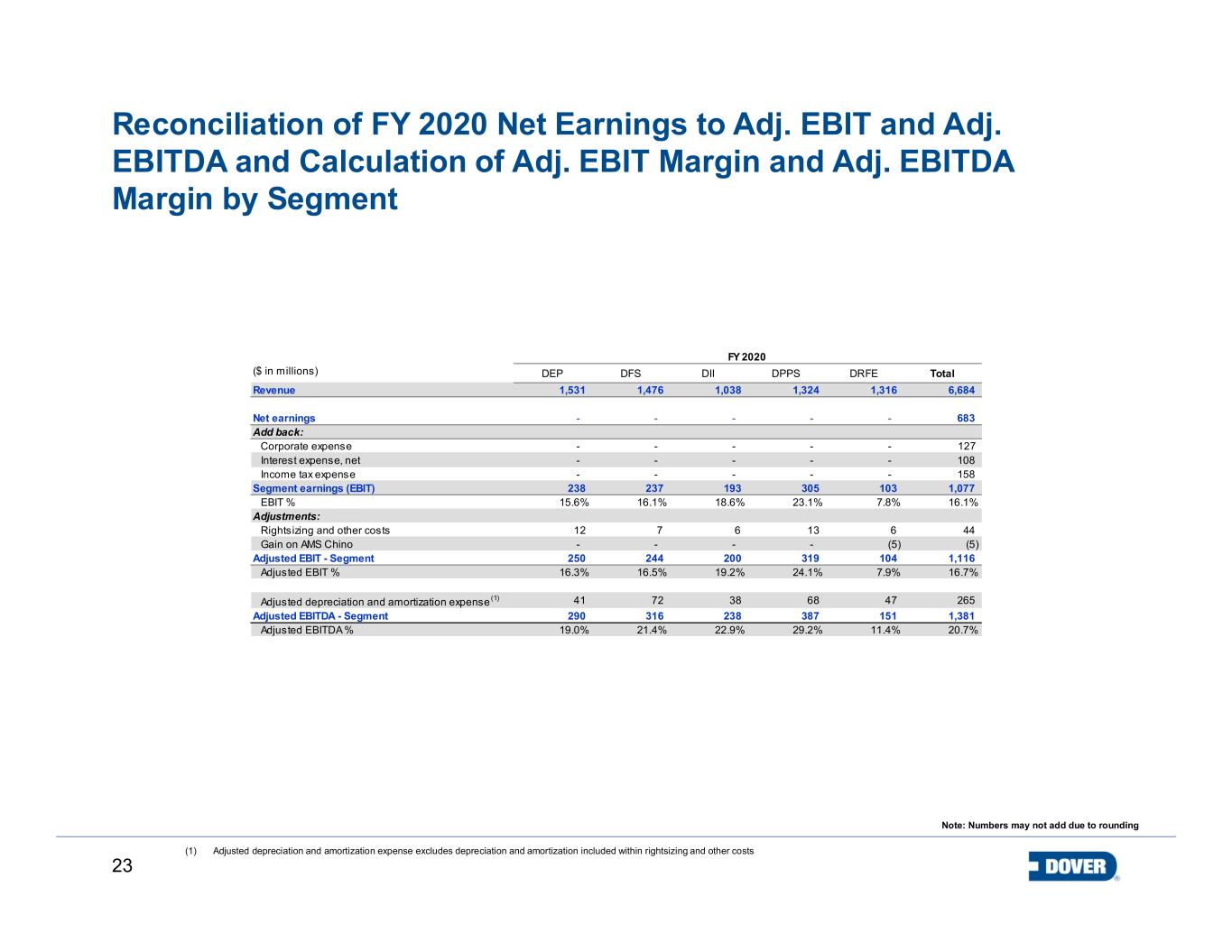

23 Reconciliation of FY 2020 Net Earnings to Adj. EBIT and Adj. EBITDA and Calculation of Adj. EBIT Margin and Adj. EBITDA Margin by Segment (1) Adjusted depreciation and amortization expense excludes depreciation and amortization included within rightsizing and other costs DEP DFS DII DPPS DRFE Total 1,531 1,476 1,038 1,324 1,316 6,684 - - - - - 683 - - - - - 127 - - - - - 108 - - - - - 158 238 237 193 305 103 1,077 15.6% 16.1% 18.6% 23.1% 7.8% 16.1% 12 7 6 13 6 44 - - - - (5) (5) 250 244 200 319 104 1,116 16.3% 16.5% 19.2% 24.1% 7.9% 16.7% 41 72 38 68 47 265 290 316 238 387 151 1,381 19.0% 21.4% 22.9% 29.2% 11.4% 20.7% Gain on AMS Chino Corporate expense Adjusted EBIT - Segment Adjusted EBIT % Adjusted depreciation and amortization expense(1) Interest expense, net FY 2020 ($ in millions) Revenue Net earnings Add back: Adjusted EBITDA - Segment Adjusted EBITDA % Income tax expense Segment earnings (EBIT) EBIT % Adjustments: Rightsizing and other costs Note: Numbers may not add due to rounding

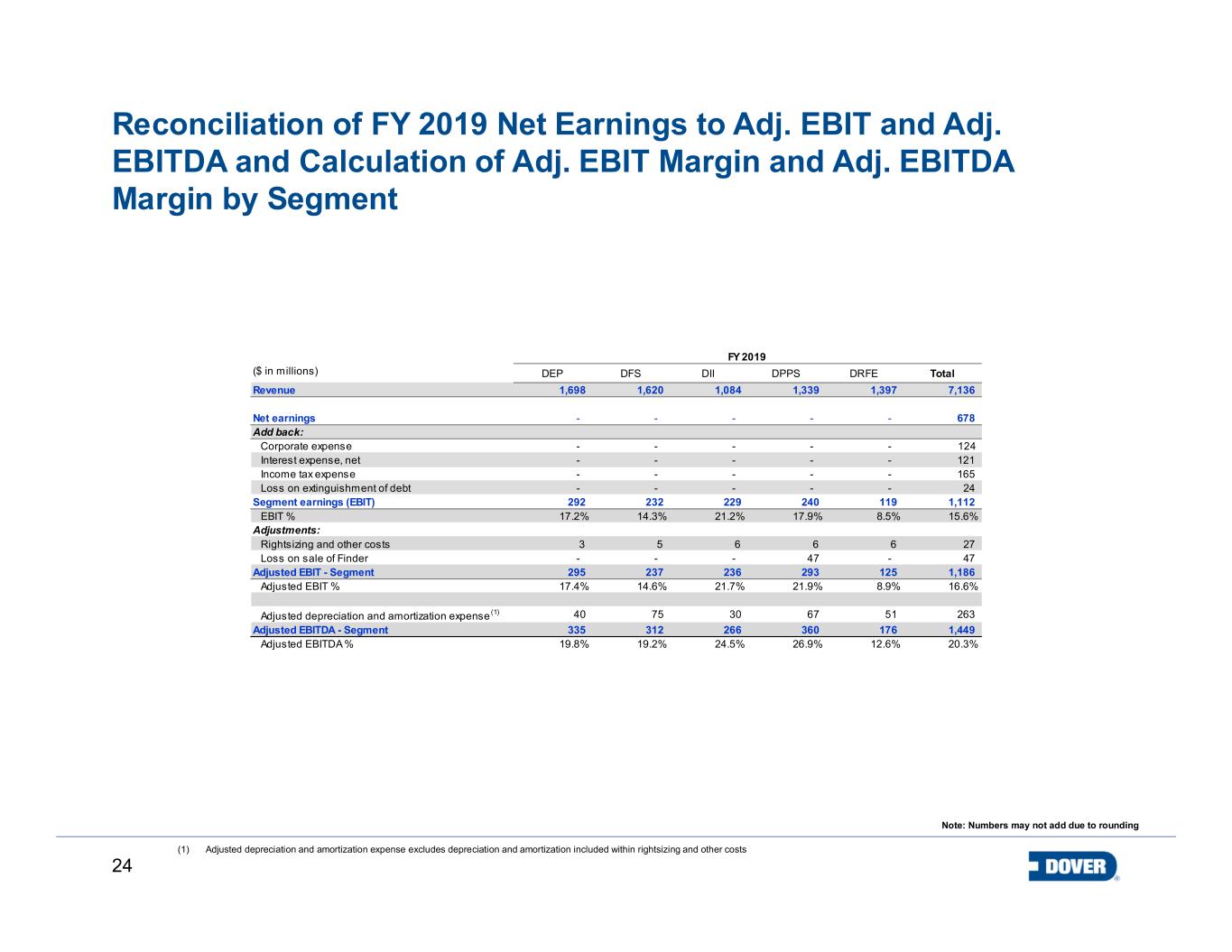

24 Reconciliation of FY 2019 Net Earnings to Adj. EBIT and Adj. EBITDA and Calculation of Adj. EBIT Margin and Adj. EBITDA Margin by Segment (1) Adjusted depreciation and amortization expense excludes depreciation and amortization included within rightsizing and other costs DEP DFS DII DPPS DRFE Total 1,698 1,620 1,084 1,339 1,397 7,136 - - - - - 678 - - - - - 124 - - - - - 121 - - - - - 165 - - - - - 24 292 232 229 240 119 1,112 17.2% 14.3% 21.2% 17.9% 8.5% 15.6% 3 5 6 6 6 27 - - - 47 - 47 295 237 236 293 125 1,186 17.4% 14.6% 21.7% 21.9% 8.9% 16.6% 40 75 30 67 51 263 335 312 266 360 176 1,449 19.8% 19.2% 24.5% 26.9% 12.6% 20.3% Loss on extinguishment of debt Loss on sale of Finder Corporate expense Adjusted EBIT - Segment Adjusted EBIT % Adjusted depreciation and amortization expense(1) Interest expense, net FY 2019 ($ in millions) Revenue Net earnings Add back: Adjusted EBITDA - Segment Adjusted EBITDA % Income tax expense Segment earnings (EBIT) EBIT % Adjustments: Rightsizing and other costs Note: Numbers may not add due to rounding

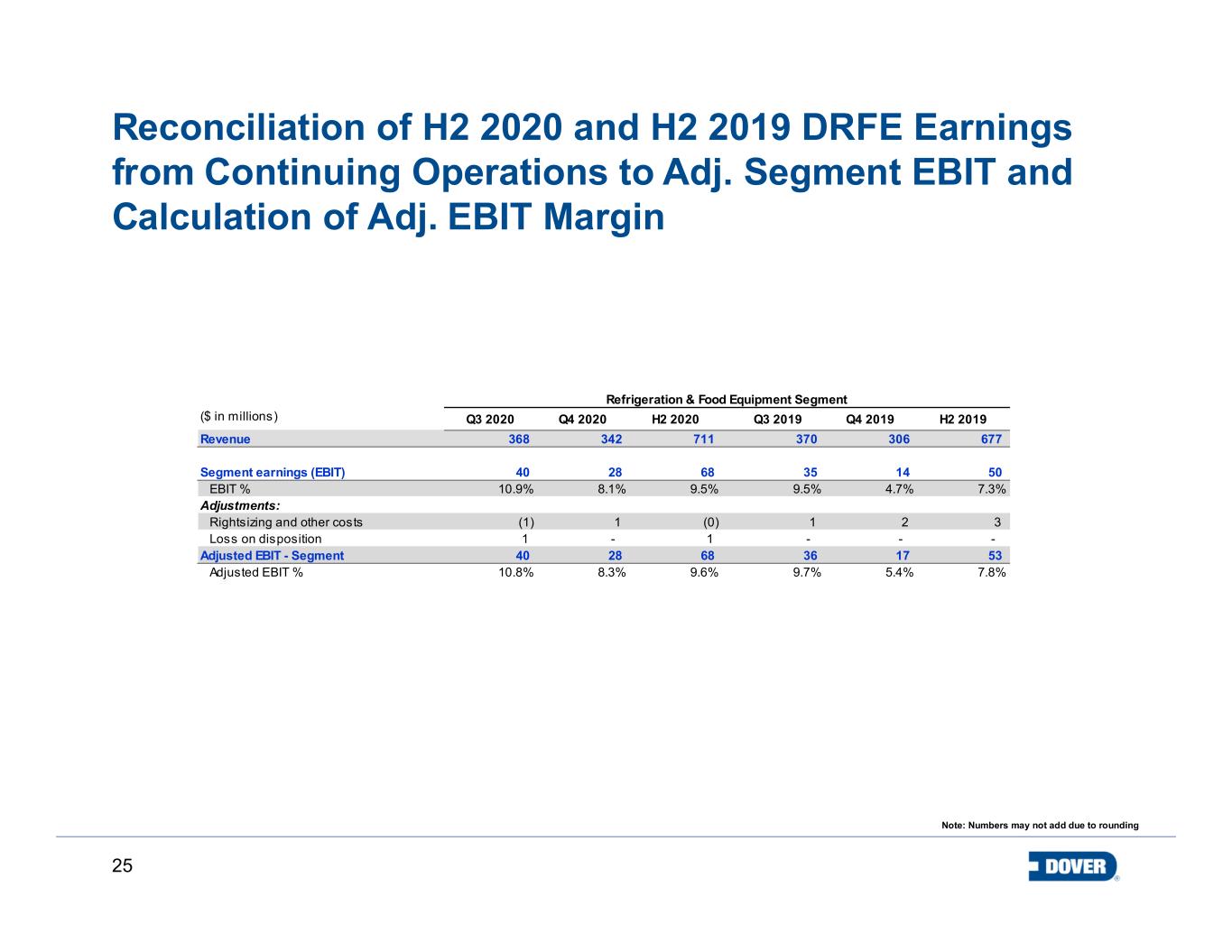

25 Reconciliation of H2 2020 and H2 2019 DRFE Earnings from Continuing Operations to Adj. Segment EBIT and Calculation of Adj. EBIT Margin Q3 2020 Q4 2020 H2 2020 Q3 2019 Q4 2019 H2 2019 368 342 711 370 306 677 40 28 68 35 14 50 10.9% 8.1% 9.5% 9.5% 4.7% 7.3% (1) 1 (0) 1 2 3 1 - 1 - - - 40 28 68 36 17 53 10.8% 8.3% 9.6% 9.7% 5.4% 7.8% ($ in millions) Revenue Segment earnings (EBIT) EBIT % Adjustments: Rightsizing and other costs Adjusted EBIT - Segment Adjusted EBIT % Refrigeration & Food Equipment Segment Loss on disposition Note: Numbers may not add due to rounding

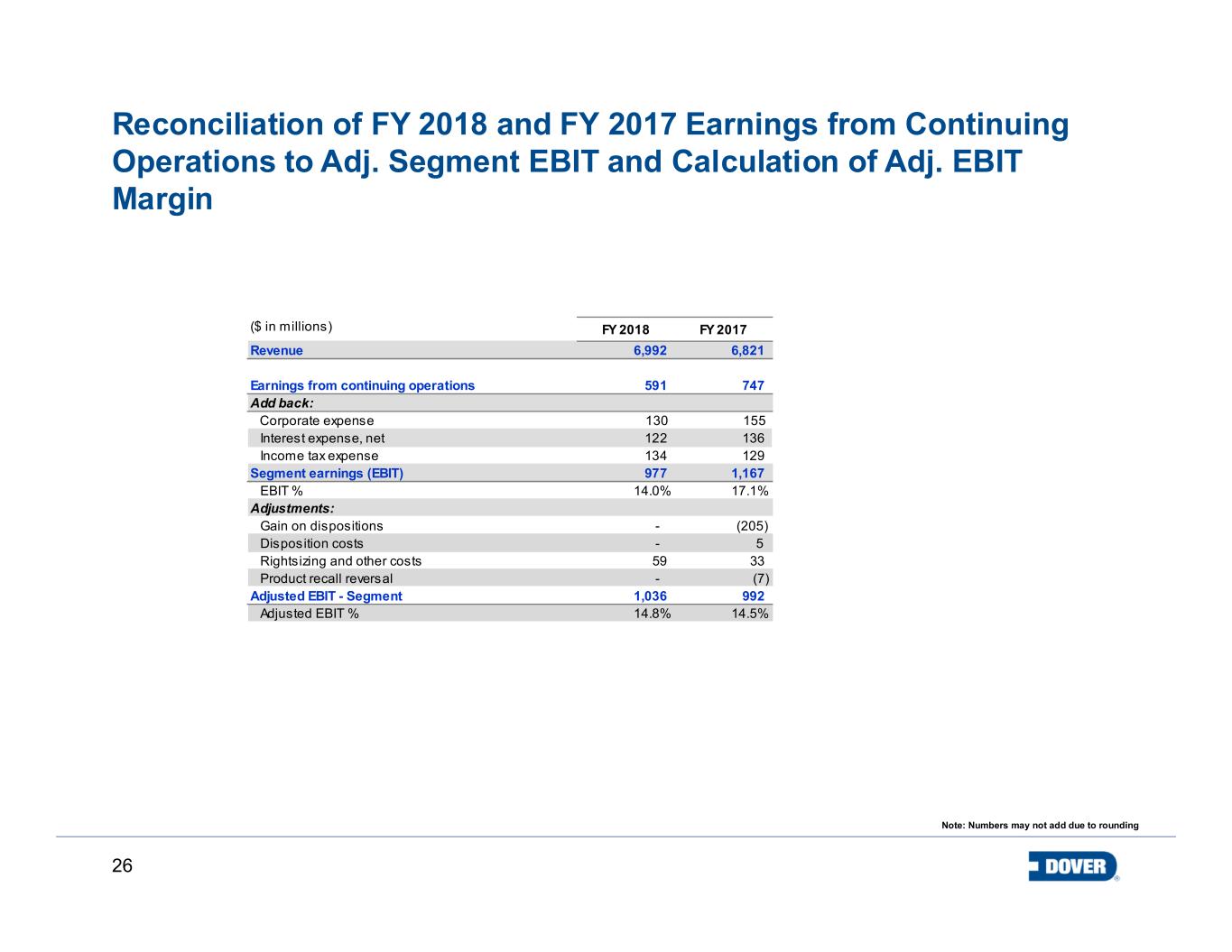

26 Reconciliation of FY 2018 and FY 2017 Earnings from Continuing Operations to Adj. Segment EBIT and Calculation of Adj. EBIT Margin FY 2018 FY 2017 6,992 6,821 591 747 130 155 122 136 134 129 977 1,167 14.0% 17.1% - (205) - 5 59 33 - (7) 1,036 992 14.8% 14.5% ($ in millions) Revenue Earnings from continuing operations Add back: Income tax expense Segment earnings (EBIT) EBIT % Adjustments: Rightsizing and other costs Gain on dispositions Corporate expense Adjusted EBIT - Segment Adjusted EBIT % Interest expense, net Disposition costs Product recall reversal Note: Numbers may not add due to rounding

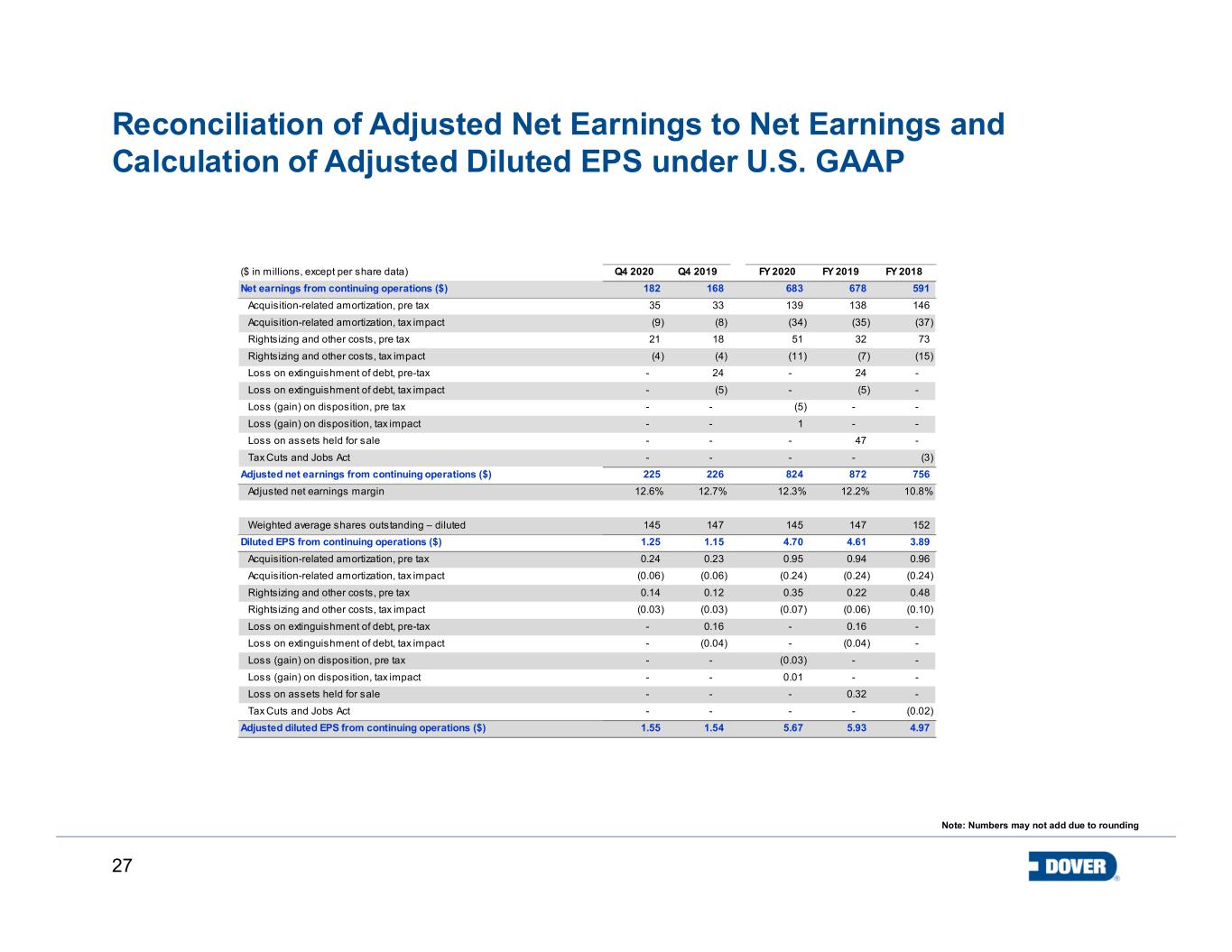

27 Reconciliation of Adjusted Net Earnings to Net Earnings and Calculation of Adjusted Diluted EPS under U.S. GAAP ($ in millions, except per share data) Q4 2020 Q4 2019 FY 2020 FY 2019 FY 2018 Net earnings from continuing operations ($) 182 168 683 678 591 Acquisition-related amortization, pre tax 35 33 139 138 146 Acquisition-related amortization, tax impact (9) (8) (34) (35) (37) Rightsizing and other costs, pre tax 21 18 51 32 73 Rightsizing and other costs, tax impact (4) (4) (11) (7) (15) Loss on extinguishment of debt, pre-tax - 24 - 24 - Loss on extinguishment of debt, tax impact - (5) - (5) - Loss (gain) on disposition, pre tax - - (5) - - Loss (gain) on disposition, tax impact - - 1 - - Loss on assets held for sale - - - 47 - Tax Cuts and Jobs Act - - - - (3) Adjusted net earnings from continuing operations ($) 225 226 824 872 756 Adjusted net earnings margin 12.6% 12.7% 12.3% 12.2% 10.8% Weighted average shares outstanding – diluted 145 147 145 147 152 Diluted EPS from continuing operations ($) 1.25 1.15 4.70 4.61 3.89 Acquisition-related amortization, pre tax 0.24 0.23 0.95 0.94 0.96 Acquisition-related amortization, tax impact (0.06) (0.06) (0.24) (0.24) (0.24) Rightsizing and other costs, pre tax 0.14 0.12 0.35 0.22 0.48 Rightsizing and other costs, tax impact (0.03) (0.03) (0.07) (0.06) (0.10) Loss on extinguishment of debt, pre-tax - 0.16 - 0.16 - Loss on extinguishment of debt, tax impact - (0.04) - (0.04) - Loss (gain) on disposition, pre tax - - (0.03) - - Loss (gain) on disposition, tax impact - - 0.01 - - Loss on assets held for sale - - - 0.32 - Tax Cuts and Jobs Act - - - - (0.02) Adjusted diluted EPS from continuing operations ($) 1.55 1.54 5.67 5.93 4.97 Note: Numbers may not add due to rounding

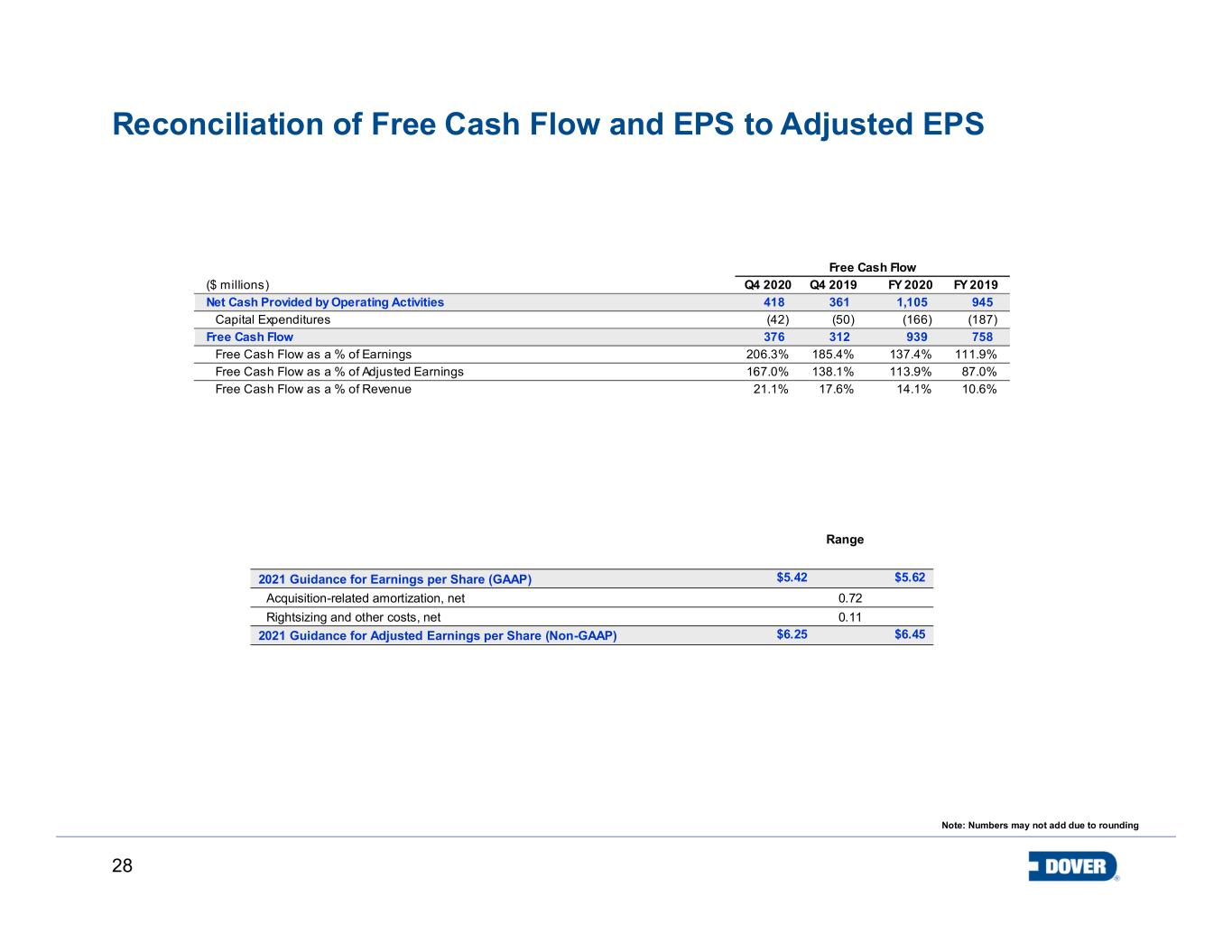

28 Reconciliation of Free Cash Flow and EPS to Adjusted EPS Range 2021 Guidance for Earnings per Share (GAAP) $5.42 $5.62 Acquisition-related amortization, net 0.72- Rightsizing and other costs, net 0.11- 2021 Guidance for Adjusted Earnings per Share (Non-GAAP) $6.25 $6.45 Note: Numbers may not add due to rounding ($ millions) Q4 2020 Q4 2019 FY 2020 FY 2019 Net Cash Provided by Operating Activities 418 361 1,105 945 Capital Expenditures (42) (50) (166) (187) Free Cash Flow 376 312 939 758 Free Cash Flow as a % of Earnings 206.3% 185.4% 137.4% 111.9% Free Cash Flow as a % of Adjusted Earnings 167.0% 138.1% 113.9% 87.0% Free Cash Flow as a % of Revenue 21.1% 17.6% 14.1% 10.6% Free Cash Flow

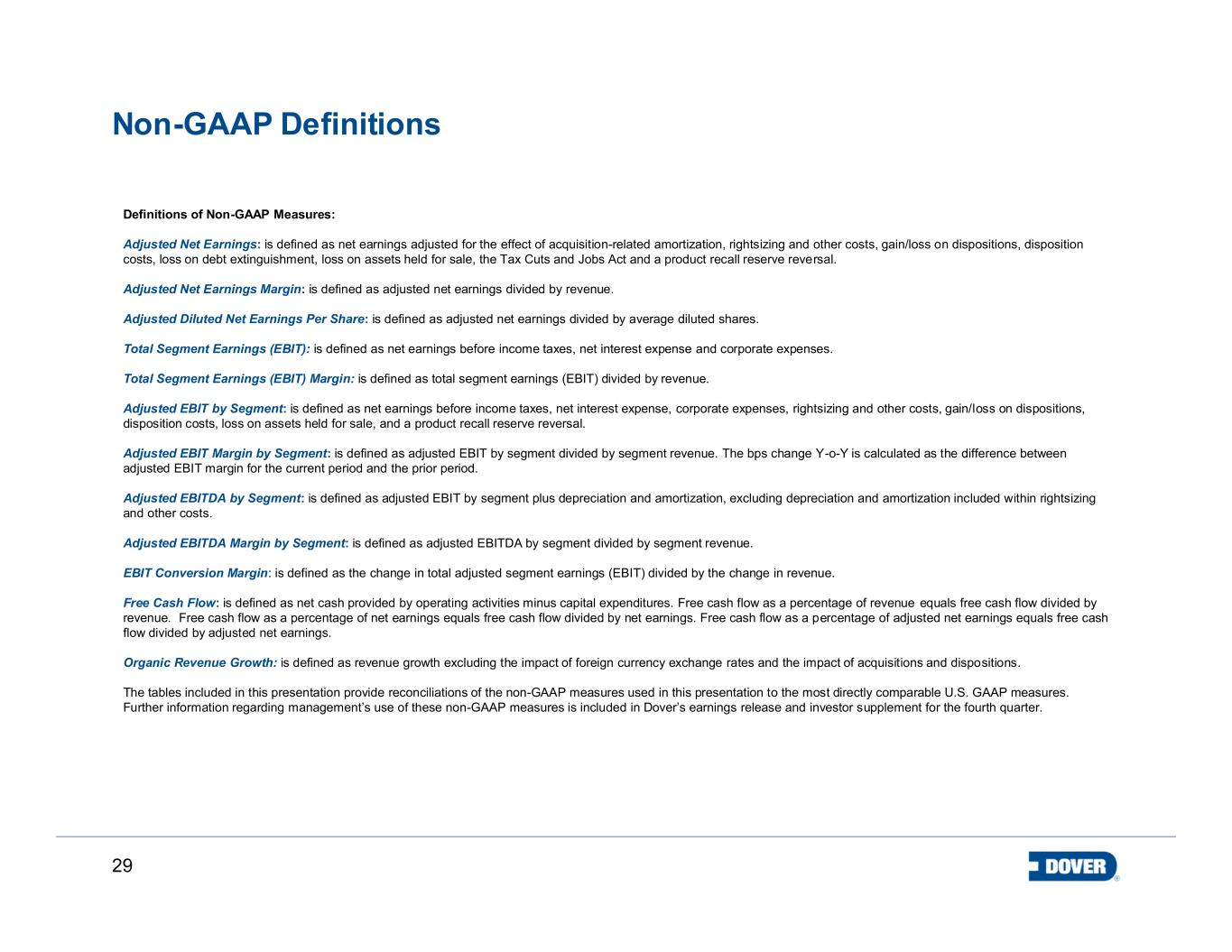

29 Non-GAAP Definitions Definitions of Non-GAAP Measures: Adjusted Net Earnings: is defined as net earnings adjusted for the effect of acquisition-related amortization, rightsizing and other costs, gain/loss on dispositions, disposition costs, loss on debt extinguishment, loss on assets held for sale, the Tax Cuts and Jobs Act and a product recall reserve reversal. Adjusted Net Earnings Margin: is defined as adjusted net earnings divided by revenue. Adjusted Diluted Net Earnings Per Share: is defined as adjusted net earnings divided by average diluted shares. Total Segment Earnings (EBIT): is defined as net earnings before income taxes, net interest expense and corporate expenses. Total Segment Earnings (EBIT) Margin: is defined as total segment earnings (EBIT) divided by revenue. Adjusted EBIT by Segment: is defined as net earnings before income taxes, net interest expense, corporate expenses, rightsizing and other costs, gain/loss on dispositions, disposition costs, loss on assets held for sale, and a product recall reserve reversal. Adjusted EBIT Margin by Segment: is defined as adjusted EBIT by segment divided by segment revenue. The bps change Y-o-Y is calculated as the difference between adjusted EBIT margin for the current period and the prior period. Adjusted EBITDA by Segment: is defined as adjusted EBIT by segment plus depreciation and amortization, excluding depreciation and amortization included within rightsizing and other costs. Adjusted EBITDA Margin by Segment: is defined as adjusted EBITDA by segment divided by segment revenue. EBIT Conversion Margin: is defined as the change in total adjusted segment earnings (EBIT) divided by the change in revenue. Free Cash Flow: is defined as net cash provided by operating activities minus capital expenditures. Free cash flow as a percentage of revenue equals free cash flow divided by revenue. Free cash flow as a percentage of net earnings equals free cash flow divided by net earnings. Free cash flow as a percentage of adjusted net earnings equals free cash flow divided by adjusted net earnings. Organic Revenue Growth: is defined as revenue growth excluding the impact of foreign currency exchange rates and the impact of acquisitions and dispositions. The tables included in this presentation provide reconciliations of the non-GAAP measures used in this presentation to the most directly comparable U.S. GAAP measures. Further information regarding management’s use of these non-GAAP measures is included in Dover’s earnings release and investor supplement for the fourth quarter.

30 Performance Measure Definitions Definitions of Performance Measures: Bookings represent total orders received from customers in the current reporting period. This metric is an important measure of performance and an indicator of revenue order trends. Organic Bookings represent total orders received from customers in the current reporting period excluding the impact of foreign currency exchange rates and the impact of acquisitions and dispositions. This metric is an important measure of performance and an indicator of revenue order trends. Backlog represents an estimate of the total remaining bookings at a point in time for which performance obligations have not yet been satisfied. This metric is useful as it represents the aggregate amount we expect to recognize as revenue in the future. Book-to-Bill is a ratio of the amount of bookings received from customers during a period divided by the amount of revenue recorded during that same period. This metric is a useful indicator of demand. We use the above operational metrics in monitoring the performance of the business. We believe the operational metrics are useful to investors and other users of our financial information in assessing the performance of our segments.