Attached files

| file | filename |

|---|---|

| EX-32 - EXHIBIT 32 - DOVER Corp | a2015123110-kexhibit32.htm |

| EX-23 - EXHIBIT 23 - DOVER Corp | a2015123110-kexhibit23.htm |

| EX-21 - EXHIBIT 21 - DOVER Corp | a2015123110-kexhibit21.htm |

| EX-31.2 - EXHIBIT 31.2 - DOVER Corp | a2015123110-kexhibit312.htm |

| EX-31.1 - EXHIBIT 31.1 - DOVER Corp | a2015123110-kexhibit311.htm |

| EX-10.8 - EXHIBIT 10.8 - DOVER Corp | a2015123110-kexhibit108.htm |

| EX-10.34 - EXHIBIT 10.34 - DOVER Corp | a2015123110-kexhibit1034.htm |

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

For fiscal year ended December 31, 2015

Commission File Number: 1-4018

Dover Corporation

(Exact name of registrant as specified in its charter)

Delaware (State or other jurisdiction of incorporation or organization) | 53-0257888 (I.R.S. Employer Identification No.) | |

3005 Highland Parkway | ||

Downers Grove, Illinois 60515 | ||

(Address of principal executive offices) | ||

Registrant's telephone number: (630) 541-1540 | ||

Securities registered pursuant to Section 12(b) of the Act: | ||

Title of Each Class | Name of Each Exchange on Which Registered | |

Common Stock, par value $1 | New York Stock Exchange | |

2.125% Notes due 2020 | New York Stock Exchange | |

Securities registered pursuant to Section 12(g) of the Act: | ||

None | ||

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes þ No o

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes o No þ

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files.) Yes þ No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. þ

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer þ | Accelerated filer o | Non-accelerated filer o | Smaller reporting company o |

(Do not check if a smaller reporting company) | |||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No þ

The aggregate market value of the voting and non-voting common stock held by non-affiliates of the registrant as of the close of business on June 30, 2015 was $10,980,690,400. The registrant’s closing price as reported on the New York Stock Exchange-Composite Transactions for June 30, 2015 was $70.18 per share. The number of outstanding shares of the registrant’s common stock as of January 29, 2016 was 155,009,407.

Documents Incorporated by Reference: Part III — Certain Portions of the Proxy Statement for Annual Meeting of Shareholders to be held on May 5, 2016 (the “2016 Proxy Statement”).

Special Note Regarding Forward-Looking Statements

This Annual Report on Form 10-K, especially "Management’s Discussion and Analysis of Financial Condition and Results of Operations," contains "forward-looking" statements within the meaning of the Private Securities Litigation Reform Act of 1995, as amended. Such statements relate to, among other things, operating and strategic plans, income, earnings, cash flows, foreign exchange, changes in operations, acquisitions, industries in which Dover businesses operate, anticipated market conditions and our positioning, global economies, and operating improvements. Forward-looking statements may be indicated by words or phrases such as "anticipates," "expects," "believes," "suggests," "will," "plans," "should," "would," "could," and "forecast," or the use of the future tense and similar words or phrases. Forward-looking statements are subject to inherent risks and uncertainties that could cause actual results to differ materially from current expectations, including, but not limited to, oil and natural gas demand, production growth, and prices; changes in exploration and production spending by Dover’s customers and changes in the level of oil and natural gas exploration and development; changes in customer demand and capital spending; economic conditions generally and changes in economic conditions globally and in markets served by Dover businesses, including well activity and U.S. industrials activity; Dover’s ability to achieve expected savings from integration and other cost-control initiatives, such as lean and productivity programs as well as efforts to reduce sourcing input costs; the impact of interest rate and currency exchange rate fluctuations; the ability of Dover's businesses to expand into new geographic markets; Dover's ability to identify and successfully consummate value-adding acquisition opportunities or planned divestitures; the impact of loss of a significant customer, or loss or non-renewal of significant contracts; the ability of Dover's businesses to develop and launch new products, timing of such launches and risks relating to market acceptance by customers; the relative mix of products and services which impacts margins and operating efficiencies; increased competition and pricing pressures; the impact of loss of a single-source manufacturing facility; short-term capacity constraints; increases in the cost of raw materials; domestic and foreign governmental and public policy changes or developments, including environmental regulations, conflict minerals disclosure requirements, tax policies, and export/import laws; protection and validity of patent and other intellectual property rights; the impact of legal matters and legal compliance risks; conditions and events affecting domestic and global financial and capital markets; and a downgrade in Dover's credit ratings which, among other matters, could make obtaining financing more difficult and costly. Certain of these risks and uncertainties are described in more detail in "Item 1A. Risk Factors" of this Annual Report on Form 10-K. Dover undertakes no obligation to update any forward-looking statement, except as required by law.

The Company may, from time to time, post financial or other information on its Internet website, www.dovercorporation.com. The Internet address is for informational purposes only and is not intended for use as a hyperlink. The Company is not incorporating any material on its website into this report.

1

TABLE OF CONTENTS

2

PART I

ITEM 1. BUSINESS

Overview

Dover is a diversified global manufacturer delivering innovative equipment and components, specialty systems and support services through four major operating segments: Energy, Engineered Systems, Fluids, and Refrigeration & Food Equipment. The Company's entrepreneurial business model encourages, promotes, and fosters deep customer engagement and collaboration, which has led to Dover's well-established and valued reputation for providing superior customer service and industry-leading product innovation. Unless the context indicates otherwise, references herein to "Dover," "the Company," and words such as "we," "us," and "our" include Dover Corporation and its subsidiaries. Dover was incorporated in 1947 in the State of Delaware and became a publicly traded company in 1955. Dover is headquartered in Downers Grove, Illinois and currently employs approximately 26,000 people worldwide.

Dover's businesses are aligned in four segments and organized around our key end markets focused on growth strategies. The segment structure is also designed to provide increased opportunities to leverage Dover's scale and capitalize on productivity initiatives. Dover's four segments are as follows:

• | Our Energy segment, serving the Drilling & Production, Bearings & Compression, and Automation end markets, is a provider of customer-driven solutions and services for safe and efficient production and processing of fuels worldwide and has a strong presence in the bearings and compression components and automation markets. |

• | Our Engineered Systems segment is comprised of two platforms, Printing & Identification and Industrials, and is focused on the design, manufacture and service of critical equipment and components serving the fast-moving consumer goods, digital textile printing, vehicle service, environmental solutions and industrial end markets. |

• | Our Fluids segment, serving the Fluid Transfer and Pumps end markets, is focused on the safe handling of critical fluids across the retail fueling, chemical, hygienic, oil and gas and industrial end markets. |

• | Our Refrigeration & Food Equipment segment is a provider of innovative and energy efficient equipment and systems serving the commercial refrigeration and food service end markets. |

The following table shows the percentage of total revenue and segment earnings generated by each of our four segments for the years ended December 31, 2015, 2014 and 2013:

Revenue | Segment Earnings | ||||||||||||||||

2015 | 2014 | 2013 | 2015 | 2014 | 2013 | ||||||||||||

Energy | 21 | % | 26 | % | 26 | % | 17 | % | 34 | % | 35 | % | |||||

Engineered Systems | 34 | % | 31 | % | 30 | % | 36 | % | 29 | % | 27 | % | |||||

Fluids | 20 | % | 18 | % | 18 | % | 26 | % | 19 | % | 17 | % | |||||

Refrigeration & Food Equipment | 25 | % | 25 | % | 26 | % | 21 | % | 18 | % | 21 | % | |||||

Management Philosophy

Our businesses are committed to operational excellence and to being market leaders as measured by market share, customer service, growth, profitability, and return on invested capital. Our operating structure of four business segments allows for focused acquisition activity, accelerates opportunities to identify and capture operating synergies, including global sourcing and supply chain integration, and advances the development of our executive talent. Our segment and executive management set strategic direction, initiatives and goals for our operating companies, and also provide oversight, allocate and manage capital, are responsible for major acquisitions, and provide other services. We foster an operating culture with high ethical standards, trust, respect, and open communication, designed to allow individual growth and operational effectiveness.

In addition, we are committed to creating value for our customers, employees, and shareholders through sustainable business practices that protect the environment and the development of products that help our customers meet their sustainability goals.

3

We have accelerated our efforts and processes around innovation, focusing on technologies which create tangible value for our customers.

Our companies are increasing their focus on efficient energy usage, greenhouse gas reduction, and waste management as they strive to meet the global environmental needs of today and tomorrow.

Company Goals

We are committed to driving shareholder return through three key objectives. First, we are committed to achieving annual organic sales growth of 3% to 5% over a long-term business cycle, absent extraordinary economic conditions, complemented by acquisition growth. Second, we continue to focus on segment margin expansion through productivity initiatives, including supply chain activities, targeted, thoughtful restructuring activities, strategic pricing, and portfolio shaping. Third, we are committed to generating free cash flow as a percentage of sales greater than 11% through strong performance, productivity improvements, and active working capital management. We support these goals through (1) alignment of management compensation with financial objectives, (2) well-defined and actively managed merger and acquisition processes, and (3) talent development programs.

Business Strategy

To achieve our goals, we are focused on execution of the following three key business strategies:

Positioning ourselves for growth

We have aligned our business segments to focus on the needs of customers in key end markets that are well-positioned for future growth. We capitalize on our expertise while maintaining an intense focus on our customers and their needs. We maintain and emphasize our entrepreneurial culture and continuously innovate to address our customers’ needs to help them win in the markets they serve.

In particular, our businesses are well-positioned to capitalize on trends in the areas of global energy demand, continuous productivity improvement, sustainability, energy efficiency, consumer product safety, and growth of consumerism in emerging economies. For instance, our Energy segment, despite recent market trends, is focusing on expansion in high growth regions and technologies, accelerating capabilities to drive international growth, and increasing investment in innovation to drive customer productivity and cash flow. Our Engineered Systems segment combines its engineering technology, unique product advantages, and applications expertise to address market needs and requirements including digital conversion, productivity solutions, sustainability, consumer product safety, and growth in emerging economies. The Fluids segment is focused on accelerated growth within the chemical/plastics, retail fueling, fluid transfer, industrial, and hygienic markets as well as globalizing brands across geographies while expanding sales channels and engineering support. In particular, we are pursuing further growth in the hygienic and polymers/plastics markets. Our Refrigeration & Food Equipment segment is responding to our customers’ energy efficiency, sustainability and food safety concerns as a result of government regulations, with innovative new products. In addition, we are broadening our product offerings targeted toward retail refrigeration and food service customers with enhanced productivity and merchandising products.

Capturing the benefits of common ownership

We are committed to operational excellence through our Dover Excellence program. This program focuses on free cash flow generation, productivity to support the ongoing investment in product innovation and customer expansion activities, the continuous evaluation of operating efficiencies, and the continued consolidation of back office support. Through this program we have implemented various productivity initiatives, such as supply chain management and lean manufacturing to maximize our efficiency as well as workplace safety initiatives to help ensure the health and welfare of our employees. We foster the sharing of best practices throughout the organization. To ensure success, our businesses place strong emphasis on continual quality improvement and new product development to better serve customers and expand into new product and geographic markets. We have also developed regional support centers and shared manufacturing centers in the U.S., China, Brazil, and India. Further, we continue to make significant investments in talent development, recognizing that the growth and development of our employees are essential for our continued success.

4

Disciplined capital allocation

Our businesses generate annual free cash flow of approximately 11% of revenue. We are focused on the most efficient allocation of our capital to maximize investment returns. To do this, we grow and support our existing businesses, with average annual investment in capital spending approximating 2 - 2.5% of revenue with a focus on internal projects to expand markets, develop products, and boost productivity. We continue to evaluate our portfolio for strategic fit and intend to make additional acquisitions focused on our key growth markets which include printing and identification, refrigeration and food equipment, pumps and fluid transfers and select energy markets. We consistently provide shareholder returns by paying dividends, which have increased annually over each of the last 60 years. We will also continue to repurchase our shares to offset the impact of dilution, as a minimum.

Portfolio Development

Acquisitions

Our acquisition program has two key elements. First, we seek to acquire value creating add-on businesses that enhance our existing businesses either through their global reach and customers, or by broadening their product mix. Second, in the right circumstances, we will strategically pursue larger, stand-alone businesses that have the potential to either complement our existing businesses or allow us to pursue innovative technologies within our key growth spaces. Over the past three years (2013 – 2015), we have spent over $1.7 billion to purchase 21 businesses that strategically fit within our business model. In the fourth quarter of 2015, we acquired three businesses for an aggregate purchase price of $561.3 million. These businesses include Gala Industries and Reduction Engineering Scheer, expanding our Fluids segment's plastics and polymers product and integrated systems portfolio. In addition, we acquired JK Group, a global manufacturer and provider of innovative digital inks for the textile printing market, that compliments the Printing & Identification platform within our Engineered Systems segment. In 2014, we acquired Accelerated for approximately $435.7 million, expanding our artificial lift footprint within our Energy segment. Accelerated, now part of our Drilling and Production businesses, is an integrated provider of equipment, parts, and services for handling fluids in oil and gas production. In 2013, we acquired 10 businesses for aggregate consideration of $322.8 million, including Finder Pompe, which we acquired in the fourth quarter of 2013 for approximately $142.2 million to expand our Fluids portfolio.

Subsequent to year end, we acquired the dispenser and system businesses of Tokheim Group S.A.S. ("Tokheim") for a purchase price of approximately €411.3 million, or $448.7 million. Tokheim will be integrated with our Fluid Transfer end market within our Fluids segment and will enable us to provide the most complete solutions available for our retail fueling customers.

For more details regarding acquisitions completed over the past two years, see Note 2 Acquisitions in the Consolidated Financial Statements in Item 8 of this Form 10-K. Our future growth depends in large part on finding and acquiring successful businesses, as a substantial number of our current businesses operate in relatively mature markets. While we expect to generate annual organic growth of 3% - 5% over a long-term business cycle absent extraordinary economic conditions, sustained organic growth at these levels for individual businesses is difficult to achieve consistently each year. Our success is also dependent on the ability to successfully integrate our acquired businesses within our existing structure. To track post-merger integration and accountability, we utilize an internal scorecard and defined processes to help ensure expected synergies are realized and value is created.

Dispositions

We routinely review our portfolio to evaluate whether our businesses continue to be essential contributors to our long-term strategy. Occasionally, we may also make an opportunistic sale of one of our businesses based on specific market conditions and strategic considerations. Accordingly, in an effort to reduce our exposure to cyclical markets and focus on our higher margin growth spaces, during the past three years (2013 – 2015) we have sold five businesses for aggregate consideration of $957.1 million.

During 2015, we completed the sale of Datamax O'Neil and Sargent Aerospace. In addition, during the fourth quarter of 2015 we completed the divestiture of a product line within the Refrigeration and Food Equipment segment. We expect to make further dispositions in the future, none of which, individually, are expected to be significant.

The financial position and results of operations for Datamax O'Neil and Sargent Aerospace have been presented as discontinued operations for all periods presented. For more details, see Note 3 Disposed and Discontinued Operations in the Consolidated Financial Statements in Item 8 of this Form 10-K.

5

In addition, in February 2014, we divested of a significant portion of our technology business with the spin-off of Knowles as discussed below.

Spin-Off of Knowles

On February 28, 2014, we completed the separation of Knowles Corporation ("Knowles") from Dover through the pro rata distribution of 100% of the common stock of Knowles to Dover's stockholders of record as of the close of business on February 19, 2014. Each Dover shareholder received one share of Knowles common stock for every two shares of Dover common stock held as of the record date. As a result, Knowles became an independent, publicly traded company listed on the New York Stock Exchange, and Dover retains no ownership interest in Knowles. The distribution was structured to be tax-free to Dover and its shareholders for U.S. federal income tax purposes.

Business Segments

As noted previously, we currently operate through four business segments that are aligned with the key end markets they serve and comprise our operating and reportable segments: Energy, Engineered Systems, Fluids, and Refrigeration & Food Equipment. For financial information about our segments and geographic areas, see Note 16 Segment Information in the Consolidated Financial Statements in Item 8 of this Form 10-K.

Energy

Our Energy segment serves the Drilling & Production, Bearings & Compression, and Automation end markets. This segment is a provider of customer driven solutions and services for safe and efficient production and processing of fuels worldwide. This segment consists of the following end markets:

• | Drilling & Production – Our businesses serving the drilling and production end markets design and manufacture products that promote efficient and cost-effective drilling, including long-lasting polycrystalline diamond cutters ("PDCs") for applications in down-hole drilling tools and facilitate the extraction and movement of fuel from the ground, including steel sucker rods, down-hole rod pumps, electric submersible pumps, progressive cavity pumps and drive systems, and plunger lifts. In addition, these businesses manufacture winches, hoists, gear drives, and electronic monitoring solutions for energy, infrastructure, and recovery markets worldwide. |

• | Bearings & Compression – These businesses manufacture various compressor parts that are used in natural gas production, distribution, and oil refining markets. Product offerings include bearings, bearing isolators, seals and remote condition monitoring systems that are used for rotating machinery applications such as turbo machinery, motors, generators and compressors used in energy, utility, marine and other industries. |

• | Automation – These businesses design and manufacture products that promote efficient drilling and production of oil and gas including quartz pressure transducers and hybrid electronics used in down-hole monitoring devices, chemical injection pumps, automated pump controllers, artificial lift optimization software, diagnostic instruments for reciprocating machinery, and control valves. |

Our Energy segment’s sales are made directly to customers and through various distribution channels. We manufacture our products primarily in North America, and our sales are concentrated in North America with an increasing level of international sales directed primarily to Europe, Australia, and Asia.

Engineered Systems

Our Engineered Systems segment is focused on the design, manufacture and service of critical equipment and components within the Printing & Identification and Industrials platforms, as described below.

• | Printing & Identification – Printing & Identification is a worldwide supplier of precision marking and coding, digital textile printing, soldering and dispensing equipment, and related consumables and services. Our Printing & Identification platform primarily designs and manufactures equipment and consumables used for printing variable information (such as bar coding of dates and serial numbers) on fast moving consumer goods, capitalizing on expanding food and product |

6

safety requirements and growth in emerging markets. In addition, our businesses serving the textile market are benefiting from a significant shift from analog to digital printing, resulting from shorter runs and more complex fashion designs, as well as increasing regulatory and environmental standards.

• | Industrials – These businesses serve the vehicle service, industrial automation, and waste and recycling markets, providing a wide range of products and services which have broad customer applications. |

The businesses in the industrial automation market provide a wide range of modular automation components including manual clamps, power clamps, rotary and linear mechanical indexers, conveyors, pick and place units, glove ports and manipulators, as well as end-of-arm robotic grippers, slides, and end effectors. These products serve a very broad market including food processing, packaging, paper processing, medical, electronic, automotive, nuclear, and general industrial products.

Our businesses serving waste and recycling markets provide products and services for the refuse collection industry and for on-site processing and compaction of trash and recyclable materials. Products are sold to municipal customers, national accounts, and independent waste haulers through a network of distributors and directly in certain geographic areas.

Fluids

Our Fluids segment is focused on the safe handling of critical fluids across the retail fueling, chemical, hygienic, oil and gas, and industrial markets. The segment serves two broad global end markets: Fluid Transfer and Pumps.

• | Fluid Transfer – Providing fully integrated fluid handling solutions from refineries and chemical-processing plants through point-to-point transfers, transportation, and delivery to the final point of consumption at retail and commercial fueling operations around the globe. This end market also specializes in the manufacturing of connectors for use in a variety of bio-processing applications. We strive to optimize safety, efficiency, reliability, and environmental sustainability through innovative fluid handling and information management solutions. |

• | Pumps – The pumps and compressors are used to transfer liquid and bulk products and are sold to a wide variety of markets, including the refined fuels, LPG, food/sanitary, transportation, and chemical process industries. The pumps include positive displacement and centrifugal pumps that are used in demanding and specialized fluid transfer process applications. |

Fluids' products are manufactured primarily in the United States, Europe, and China, and are sold throughout the world directly and through a network of distributors.

Refrigeration & Food Equipment

Our Refrigeration & Food Equipment segment is a provider of innovative and energy efficient equipment and systems serving the commercial refrigeration and food service end markets.

• | Refrigeration – Our businesses manufacture refrigeration systems, refrigeration display cases, specialty glass, commercial glass refrigerator and freezer doors, and brazed heat exchangers used in industrial and climate control. |

• | Food Equipment – Our businesses manufacture electrical distribution products and engineering services, commercial food service equipment, cook-chill production systems, custom food storage and preparation products, kitchen ventilation systems, conveyer systems, beverage can-making machinery, and packaging machines used for meat, poultry, and other food products. |

The majority of the refrigeration/food systems and machinery that are manufactured or serviced by the Refrigeration & Food Equipment segment are used by the supermarket industry, including “big-box” retail and convenience stores, the commercial/industrial refrigeration industry, institutional and commercial food service and food production markets, and beverage can-making industries. Refrigeration & Food Equipment's products are manufactured primarily in North America, Europe, and Asia and are sold globally, directly and through a network of distributors.

7

Raw Materials

We use a wide variety of raw materials, primarily metals and semi-processed or finished components, which are generally available from a number of sources. As a result, shortages or the loss of any single supplier have not had, and are not likely to have, a material impact on operating profits. While the required raw materials are generally available, commodity pricing can be volatile, particularly for various grades of steel, copper, aluminum, and select other commodities. Although cost increases in commodities may be recovered through increased prices to customers, our operating results are exposed to such fluctuations. We attempt to control such costs through fixed-price contracts with suppliers and various other programs, such as our global supply chain activities.

Research and Development

Our businesses are encouraged to develop new products as well as to upgrade and improve existing products to satisfy customer needs, expand revenue opportunities domestically and internationally, maintain or extend competitive advantages, improve product reliability, and reduce production costs. During 2015, we spent $115.0 million for research and development, including qualified engineering costs. In 2014 and 2013, research and development spending totaled $118.4 million and $117.2 million, respectively.

Our Engineered Systems segment expends significant effort in research and development because the rate of product development by their customers is often quite high. Our businesses that develop product identification and printing equipment believe that their customers expect a continuing rate of product innovation, performance improvement, and reduced costs. The result has been that product life cycles in these markets generally average less than five years with meaningful sales price reductions over that time period.

Our other segments contain many businesses that are also involved in important product improvement initiatives. These businesses also concentrate on working closely with customers on specific applications, expanding product lines and market applications, and continuously improving manufacturing processes. Most of these businesses experience a much more moderate rate of change in their markets and products than is generally experienced by the Engineered Systems segment.

Intellectual Property and Intangible Assets

Our businesses own many patents, trademarks, licenses, and other forms of intellectual property, which have been acquired over a number of years and, to the extent relevant, expire at various times over a number of years. A large portion of our businesses’ intellectual property consists of patents, unpatented technology, and proprietary information constituting trade secrets that we seek to protect in various ways, including confidentiality agreements with employees and suppliers where appropriate. In addition, a significant portion of our intangible assets relate to customer relationships. While our intellectual property and customer relationships are important to our success, the loss or expiration of any of these rights or relationships, or any group of related rights or relationships, is not likely to materially affect our results on a consolidated basis. We believe that our commitment to continuous engineering improvements, new product development, and improved manufacturing techniques, as well as strong sales, marketing, and service efforts, are significant to our general leadership positions in the niche markets we serve.

Customers

We serve thousands of customers, none one of which accounted for more than 10% of our consolidated revenue in 2015. Given our diversity of served markets, customer concentrations are quite varied. Businesses supplying the waste and recycling, agricultural, defense, energy, automotive, and commercial refrigeration industries tend to deal with a few large customers that are significant within those industries. This also tends to be true for businesses supplying the power generation and chemical industries. In the other markets served, there is usually a much lower concentration of customers, particularly where the companies provide a substantial number of products and services applicable to a broad range of end-use applications.

8

Seasonality

In general, our businesses, while not strongly seasonal, tend to have stronger revenue in the second and third quarters, particularly those serving the transportation, construction, waste and recycling, petroleum, commercial refrigeration, and food service markets. Our businesses serving the major equipment markets, such as power generation, chemical, and processing industries, have longer lead times geared to seasonal, commercial, or consumer demands, and tend to delay or accelerate product ordering and delivery to coincide with those market trends that tend to moderate the aforementioned seasonality patterns.

Backlog

Backlog is more relevant to our businesses that produce larger and more sophisticated machines or have long-term contracts, primarily for the markets within our Fluids and Refrigeration & Food Equipment segments. Our total backlog relating to our continuing operations as of December 31, 2015 and 2014 was $1.0 billion and $1.2 billion, respectively.

Competition

Our competitive environment is complex because of the wide diversity of our products manufactured and the markets served. In general, most of our businesses are market leaders that compete with only a few companies, and the key competitive factors are customer service, product quality, price, and innovation. However, as we become increasingly global, we are exposed to more competition. A summary of our key competitors by end market within each of our segments follows:

Segment | End Market | Key Competitors | ||

Energy | Drilling & Production /Automation | DeBeers Group (Element Six), Schlumberger Ltd.,Weatherford International Ltd., General Electric (Lufkin), Baker Hughes, BORETS, and Novomet | ||

Bearings & Compression | Compression Products International, Hoerbiger Holdings AG, John Crane, Kingsbury | |||

Engineered Systems | Printing & Identification | Danaher Corp. (Videojet), Brother Industries Ltd (Domino Printing), Electronics for Imaging | ||

Industrials | Oshkosh Corp. (McNeilus), Siemens AG (Weiss GmbH), Challenger Lifts, Labrie Enviroquip Group, and numerous others | |||

Fluids | Fluid Transfer | Danaher Corp. (Gilbarco Veeder-Root), Franklin Electric, Gardner Denver, Inc. (Emco Wheaton), Wayne | ||

Pumps | IDEX Corp, Ingersoll Rand, ITT, SPX Corp. | |||

Refrigeration & Food Equipment | Refrigeration | Panasonic (Hussman Corp.), Lennox International (Kysor/Warren), Alfa Laval | ||

Food Equipment | Manitowoc Company, Illinois Tool, Middleby | |||

International

Consistent with our strategic focus on positioning our businesses for growth, we continue to increase our expansion into international markets, particularly in developing economies in South America, Asia, the Middle East, and Eastern Europe.

Most of our non-U.S. subsidiaries and affiliates are currently based in France, Germany, the Netherlands, Sweden, Switzerland, the United Kingdom and, with increasing emphasis, Australia, Canada, China, Malaysia, India, Mexico, Brazil, Eastern Europe, and the Middle East.

9

The following table shows annual revenue derived from customers outside the U.S. as a percentage of total annual revenue for each of the last three years, by segment and in total:

% Non-U.S. Revenue by Segment | ||||||||

Years Ended December 31, | ||||||||

2015 | 2014 | 2013 | ||||||

Energy | 26 | % | 28 | % | 33 | % | ||

Engineered Systems | 45 | % | 48 | % | 47 | % | ||

Fluids | 49 | % | 53 | % | 51 | % | ||

Refrigeration & Food Equipment | 33 | % | 35 | % | 36 | % | ||

Total percentage of revenue derived from customers outside of the U.S. | 39 | % | 40 | % | 41 | % | ||

Our international operations are subject to certain risks, such as price and exchange rate fluctuations and non-U.S. governmental restrictions, which are discussed further in "Item 1A. Risk Factors." For additional details regarding our non-U.S. revenue and the geographic allocation of the assets of our continuing operations, see Note 16 Segment Information to the Consolidated Financial Statements in Item 8 of this Form 10-K.

Environmental Matters

Sustainability

In response to our concerns around global sustainability, in 2010, we developed and implemented a process to conduct an inventory of greenhouse gas emissions. Since then, we have evaluated our climate change risks and opportunities and have developed an energy and climate change strategy that includes clearly defined goals and objectives, along with prioritized programs and projects for achieving energy use and greenhouse gas emissions reductions. To further promote our sustainability efforts, we have committed to reducing our overall energy and greenhouse gas intensity indexed to net revenue by 20% from 2010 to 2020. We have also participated as a voluntary respondent in the Carbon Disclosure Project since 2010.

All of our segments are investigating the energy efficiencies related to their operations and the use of their products and services by customers. In some instances, our businesses may be able to help customers reduce their energy needs. Increased demand for energy-efficient products, based on a variety of drivers (including, but not limited to, reduction of greenhouse gas emissions) could result in increased sales for a number of our businesses.

Other Matters

Our operations are governed by a variety of international, national, state, and local environmental laws. We are committed to continued compliance and believe our operations generally are in substantial compliance with these laws. In a few instances, particular plants and businesses have been the subject of administrative and legal proceedings with governmental agencies or private parties relating to the discharge or potential discharge of regulated substances. Where necessary, these matters have been addressed with specific consent orders to achieve compliance.

There have been no material effects upon our earnings and competitive position resulting from our compliance with laws or regulations enacted or adopted relating to the protection of the environment. We are aware of a number of existing or upcoming regulatory initiatives intended to reduce emissions in geographies where our manufacturing and warehouse/distribution facilities are located and have evaluated the potential impact of these regulations on our businesses. We anticipate that direct impacts from regulatory actions will not be significant in the short- to medium-term. We expect the regulatory impacts associated with climate change regulation would be primarily indirect and would result in "pass through" costs from energy suppliers, suppliers of raw materials, and other services related to our operations.

Employees

We had approximately 26,000 employees as of December 31, 2015.

10

Other Information

We make available through the "Financial Reports" link on our Internet website, http://www.dovercorporation.com, our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and any amendments to these reports. We post each of these reports on the website as soon as reasonably practicable after the report is filed with the Securities and Exchange Commission. The information on our Internet website is not incorporated into this Form 10-K.

11

ITEM 1A. RISK FACTORS

The risk factors discussed in this section should be considered together with information included elsewhere in this Form 10-K and should not be considered the only risks to which we are exposed. In general, we are subject to the same general risks and uncertainties that impact many other industrial companies such as general economic, industry and/or market conditions, and growth rates; the impact of natural disasters, and their effect on global markets; possible future terrorist threats and their effect on the worldwide economy; and changes in laws or accounting rules. Additional risks and uncertainties not currently known to us or that we currently believe are immaterial also may impair our business, including our results of operations, liquidity, and financial condition.

• | Our results may be impacted by current domestic and international economic conditions and uncertainties. |

Our businesses may be adversely affected by disruptions in the financial markets or declines in economic activity both domestically and internationally in those countries in which we operate. These circumstances will also impact our suppliers and customers in various ways which could have an impact on our business operations, particularly if global credit markets are not operating efficiently and effectively to support industrial commerce.

Our Energy segment is subject to risk due to the volatility of global energy prices and regulations that impact drilling and production, with overall demand for our products and services impacted by depletion rates, global economic conditions and related energy demands.

Negative changes in worldwide economic and capital market conditions are beyond our control, are highly unpredictable, and can have an adverse effect on our revenue, earnings, cash flows, and cost of capital.

• | Trends in oil and natural gas prices may affect the drilling and production activity, profitability and financial stability of our customers and therefore the demand for, and profitability of, our energy products and services, which could have a material adverse effect on our business, consolidated results of operations, and consolidated financial condition. |

The oil and gas industry historically has experienced periodic downturns, including the significant downturn experienced in 2015. Demand for our energy products and services is sensitive to the level of drilling and production activity of, and the corresponding capital spending by, oil and natural gas companies. The level of drilling and production activity is directly affected by trends in oil and natural gas prices, which have been recently volatile and may continue to be volatile. In particular, the prices of oil and natural gas were highly volatile in 2014 and 2015 and declined dramatically.

Prices for oil and natural gas are subject to large fluctuations in response to changes in the supply of and demand for oil and natural gas, market uncertainty, geopolitical developments and a variety of other factors that are beyond our control. Even the perception of longer-term lower oil and natural gas prices can reduce or defer major capital expenditures by our customers in the oil and gas industry. Given the long-term nature of many large-scale development projects, a significant downturn in the oil and gas industry could result in the reduction in demand for our energy and pumps products and services, and could have a material adverse effect on our financial condition, results of operations and cash flows.

• | We are subject to risks relating to our existing international operations and expansion into new geographical markets. |

Approximately 39% of our revenues from continuing operations for 2015 and 40% of our revenues for 2014 were derived outside the United States. We continue to focus on penetrating global markets as part of our overall growth strategy and expect sales from outside the United States to continue to represent a significant portion of our revenues. In addition, many of our manufacturing operations and suppliers are located outside the United States. Our international operations and our global expansion strategy are subject to general risks related to such operations, including:

12

o | political, social, and economic instability and disruptions; |

o | government embargoes or trade restrictions; |

o | the imposition of duties and tariffs and other trade barriers; |

o | import and export controls; |

o | limitations on ownership and on repatriation or dividend of earnings; |

o | transportation delays and interruptions; |

o | labor unrest and current and changing regulatory environments; |

o | increased compliance costs, including costs associated with disclosure requirements and related due diligence; |

o | the impact of loss of a single-source manufacturing facility; |

o | difficulties in staffing and managing multi-national operations; |

o | limitations on our ability to enforce legal rights and remedies; and |

o | access to or control of networks and confidential information due to local government controls and vulnerability of local networks to cyber risks. |

If we are unable to successfully manage the risks associated with expanding our global business or adequately manage operational risks of our existing international operations, the risks could have a material adverse effect on our growth strategy involving expansion into new geographical markets or our results of operations and financial position.

• | Our exposure to exchange rate fluctuations on cross-border transactions and the translation of local currency results into U.S. dollars could negatively impact our results of operations. |

We conduct business through our subsidiaries in many different countries, and fluctuations in currency exchange rates could have a significant impact on the reported results of operations, which are presented in U.S. dollars. For example, foreign exchange rates had an unfavorable impact on our revenue for the year ended December 31, 2015. A significant and growing portion of our products are manufactured in lower-cost locations and sold in various countries. Cross-border transactions, both with external parties and intercompany relationships, result in increased exposure to foreign exchange effects. Accordingly, significant changes in currency exchange rates, particularly the Euro, Pound Sterling, Swiss franc, Chinese Renminbi (Yuan), and the Canadian dollar, could cause fluctuations in the reported results of our businesses’ operations that could negatively affect our results of operations. Additionally, the strengthening of certain currencies such as the Euro and U.S. dollar potentially exposes us to competitive threats from lower cost producers in other countries. Our sales are translated into U.S. dollars for reporting purposes. The strengthening of the U.S. dollar could result in unfavorable translation effects as the results of foreign locations are translated into U.S. dollars.

• | Increasing product/service and price competition by international and domestic competitors, including new entrants, and our inability to introduce new and competitive products could cause our businesses to generate lower revenue, operating profits, and cash flows. |

Our competitive environment is complex because of the wide diversity of the products that our businesses manufacture and the markets they serve. In general, most of our businesses compete with only a few companies. Our ability to compete effectively depends on how successfully we anticipate and respond to various competitive factors, including new products and services that may be introduced by competitors, changes in customer preferences, new business models and technologies, and pricing pressures. If our businesses are unable to anticipate their competitors’ development of new products and services, and/or identify customer needs and preferences on a timely basis, or successfully introduce new products and services in response to such competitive factors, they could lose customers to competitors. If our businesses do not compete effectively, we may experience lower revenue, operating profits, and cash flows.

• | Our businesses and their profitability and reputation could be adversely affected by domestic and foreign governmental and public policy changes (including environmental and employment regulations and tax policies such as export subsidy programs, research and experimentation credits, carbon emission regulations, and other similar programs), risks associated with emerging markets, changes in statutory tax rates, and unanticipated outcomes with respect to tax audits. |

Our businesses’ domestic and international sales and operations are subject to risks associated with changes in local government laws (including environmental and export/import laws), regulations, and policies. Failure to comply with any of these laws could result in civil and criminal, monetary, and non-monetary penalties as well as potential damage to our reputation. In addition, we cannot provide assurance that our costs of complying with new and evolving regulatory reporting requirements and current or future laws, including environmental protection, employment, data security, data privacy, and

13

health and safety laws, will not exceed our estimates. In addition, we have invested in certain countries, including Brazil, Russia, India, and China, and may in the future invest in other countries, any of which may carry high levels of currency, political, compliance, or economic risk. While these risks or the impact of these risks are difficult to predict, any one or more of them could adversely affect our businesses and reputation.

Our effective tax rate is impacted by changes in the mix among earnings in countries with differing statutory tax rates, changes in the valuation allowance of deferred tax assets, and changes in tax laws. The amount of income taxes and other taxes paid can be adversely impacted by changes in statutory tax rates and laws and are subject to ongoing audits by domestic and international authorities. If these audits result in assessments different from amounts estimated, then our financial results may be adversely affected by unfavorable tax adjustments.

• | Some of our businesses may not anticipate, adapt to, or capitalize on technological developments and this could cause these businesses to become less competitive and lead to reduced market share, revenue, operating profits, and cash flows. |

Certain of our businesses sell their products in industries that are constantly experiencing change as new technologies are developed. In order to grow and remain competitive in these industries, they must adapt to future changes in technology to enhance their existing products and introduce new products to address their customers’ changing demands. If these businesses are unable to adapt to the rapid technological changes, it could adversely affect our consolidated results of operations, financial position, and cash flows.

• | We could lose customers or generate lower revenue, operating profits, and cash flows if there are significant increases in the cost of raw materials (including energy) or if we are unable to obtain raw materials. |

We purchase raw materials, sub-assemblies, and components for use in our manufacturing operations, which expose us to volatility in prices for certain commodities. Significant price increases for these commodities could adversely affect operating profits for certain of our businesses. While we generally attempt to mitigate the impact of increased raw material prices by hedging or passing along the increased costs to customers, there may be a time delay between the increased raw material prices and the ability to increase the prices of products, or we may be unable to increase the prices of products due to a competitor’s pricing pressure or other factors. In addition, while raw materials are generally available now, the inability to obtain necessary raw materials could affect our ability to meet customer commitments and satisfy market demand for certain products. Consequently, a significant price increase in raw materials, or their unavailability, may result in a loss of customers and adversely impact revenue, operating profits, and cash flows.

• | Our growth and results of operations may be adversely affected if we are unsuccessful in our capital allocation and acquisition program. |

We expect to continue our strategy of seeking to acquire value creating add-on businesses that broaden our existing position and global reach as well as, in the right circumstances, strategically pursue larger acquisitions that could have the potential to either complement our existing businesses or allow us to pursue a new platform. However, there can be no assurance that we will be able to continue to find suitable businesses to purchase, that we will be able to acquire such businesses on acceptable terms, or that all closing conditions will be satisfied with respect to any pending acquisition. If we are unsuccessful in our acquisition efforts, then our ability to continue to grow at rates similar to prior years could be adversely affected. In addition, we face the risk that a completed acquisition may underperform relative to expectations. We may be unable to achieve synergies originally anticipated, exposed to unexpected liabilities or unable to sufficiently integrate completed acquisitions into our current business and growth model. Further, if we fail to allocate our capital appropriately, in respect of either our acquisition program or organic growth in our operations, we could be overexposed in certain markets and geographies and unable to expand into adjacent products or markets. These factors could potentially have an adverse impact on our operating profits and cash flows.

• | Our operating profits and cash flows could be adversely affected if we cannot achieve projected savings and synergies. |

We are continually evaluating our cost structure and seeking ways to capture synergies across our operations. If we are unable to reduce costs and expenses through our various programs, it could adversely affect our operating profits and cash flows.

• | Unforeseen developments in contingencies such as litigation could adversely affect our financial condition. |

We and certain of our subsidiaries are, and from time to time may become, parties to a number of legal proceedings incidental to their businesses involving alleged injuries arising out of the use of their products, exposure to hazardous substances, or patent infringement, employment matters, and commercial disputes. The defense of these lawsuits may require significant

14

expenses and divert management’s attention, and we may be required to pay damages that could adversely affect our financial condition. In addition, any insurance or indemnification rights that we may have may be insufficient or unavailable to protect us against potential loss exposures.

• | The indemnification provisions of acquisition and disposition agreements by which we have acquired or sold companies may not fully protect us and may result in unexpected liabilities. |

Certain of the acquisition agreements by which we have acquired companies require the former owners to indemnify us against certain liabilities related to the operation of the company before we acquired it. In most of these agreements, however, the liability of the former owners is limited and certain former owners may be unable to meet their indemnification responsibilities. Similarly, the purchasers of our discontinued operations may from time to time agree to indemnify us for operations of such businesses after the closing. In addition, in connection with the spin-off, Knowles agreed to indemnify us for any losses relating to the conduct of the Knowles business. We cannot be assured that any of these indemnification provisions will fully protect us, and as a result we may face unexpected liabilities that adversely affect our profitability and financial position.

• | Failure to attract, retain, and develop personnel or to provide adequate succession plans for key management could have an adverse effect on our operating results. |

Our growth, profitability, and effectiveness in conducting our operations and executing our strategic plans depend in part on our ability to attract, retain, and develop qualified personnel, align them with appropriate opportunities, and maintain adequate succession plans for key management positions and support for strategic initiatives. If we are unsuccessful in these efforts, our operating results could be adversely affected and we could miss opportunities for growth and efficiencies.

• | Our business operations may be adversely affected by information systems interruptions or intrusion. |

We depend on various information technologies throughout our company to administer, store and support multiple business activities. If these systems are damaged, cease to function properly, or are subject to cyber-security attacks, such as those involving unauthorized access, malicious software and/or other intrusions, we could experience production downtimes, operational delays, other detrimental impacts on our operations or ability to provide products and services to our customers, the compromising of confidential or otherwise protected information, destruction or corruption of data, security breaches, other manipulation or improper use of our systems or networks, financial losses from remedial actions, loss of business or potential liability, and/or damage to our reputation. While we attempt to mitigate these risks by employing a number of measures, including employee training, technical security controls, and maintenance of backup and protective systems, our systems, networks, products and services remain potentially vulnerable to known or unknown threats, any of which could have a material adverse affect on our business, financial condition or results of operations.

• | Our reputation, ability to do business, and results of operations may be impaired by improper conduct by any of our employees, agents, or business partners. |

While we strive to maintain high standards, we cannot provide assurance that our internal controls and compliance systems will always protect us from acts committed by our employees, agents, or business partners that would violate U.S. and/or non-U.S. laws or fail to protect our confidential information, including the laws governing payments to government officials, bribery, fraud, anti-kickback and false claims rules, competition, export and import compliance, money laundering, and data privacy laws, as well as the improper use of proprietary information or social media. Any such violations of law or improper actions could subject us to civil or criminal investigations in the U.S. and in other jurisdictions, could lead to substantial civil or criminal, monetary and non-monetary penalties, and related shareholder lawsuits, could lead to increased costs of compliance and could damage our reputation.

• | Our revenue, operating profits, and cash flows could be adversely affected if our businesses are unable to protect or obtain patent and other intellectual property rights. |

Our businesses own patents, trademarks, licenses, and other forms of intellectual property related to their products. Our businesses employ various measures to maintain and protect their intellectual property. These measures may not prevent their intellectual property from being challenged, invalidated, or circumvented, particularly in countries where intellectual property rights are not highly developed or protected. Unauthorized use of these intellectual property rights could adversely impact the competitive position of our businesses and have a negative impact on our revenue, operating profits, and cash flows.

15

• | A significant decline in the future economic outlook of our businesses and expected future cash flows could result in goodwill or intangible asset impairment charges which would negatively impact our results of operations. |

We have significant goodwill and intangible assets on our balance sheet as a result of current and past acquisitions. The valuation and classification of these assets and the assignment of useful lives involve significant judgments and the use of estimates. The testing of goodwill and intangibles for impairment requires significant use of judgment and assumptions, particularly as it relates to the determination of fair market value. A decrease in the long-term economic outlook and future cash flows of our businesses could significantly impact asset values and potentially result in the impairment of intangible assets, including goodwill. Charges relating to such impairments could have a material adverse effect on our financial condition and results of operations in the periods recognized. Although fair values currently exceed carrying values in all of our businesses, the value of our businesses within the Energy segment were unfavorably impacted by the steep declines in revenue and order rates during the year as drilling and production activity fell due to unfavorable oil prices and lower U.S. rig counts.

• | Our borrowing costs may be impacted by our credit ratings developed by various rating agencies. |

Three major ratings agencies (Moody’s, Standard and Poor’s, and Fitch Ratings) evaluate our credit profile on an ongoing basis and have each assigned high ratings for our short-term and long-term debt as of December 31, 2015. Although we do not anticipate a material change in our credit ratings, if our current credit ratings deteriorate, then our borrowing costs could increase, including increased fees under our five-year credit facility, and our access to future sources of liquidity may be adversely affected.

• | Customer requirements and new regulations may increase our expenses and impact the availability of certain raw materials, which could adversely affect our revenue and operating profits. |

Our businesses use parts or materials that are impacted by the Dodd-Frank Wall Street Reform and Consumer Protection Act (the "Dodd-Frank Act") requirement for disclosure of the use of "conflict minerals" mined in the Democratic Republic of the Congo and adjoining countries. It is possible that some of our businesses' customers will require "conflict free" metals in products purchased from us. We are in the process of determining the country of origin of certain metals used by our businesses, as required by the Dodd-Frank Act. The supply chain due diligence and verification of sources may require several years to complete based on the current availability of smelter origin information and the number of vendors. We may not be able to complete the process in the time frame required because of the complexity of our supply chain. Other governmental social responsibility regulations also may impact our suppliers, manufacturing operations, and operating profits.

The need to find alternative sources for certain raw materials or products because of customer requirements and regulations may impact our ability to secure adequate supplies of raw materials or parts, lead to supply shortages, or adversely impact the prices at which our businesses can procure compliant goods.

ITEM 1B. UNRESOLVED STAFF COMMENTS

Not applicable.

16

ITEM 2. PROPERTIES

The number, type, location and size of the properties used by our operations as of December 31, 2015 are shown in the following charts, by segment:

Number and nature of facilities | Square footage (in 000s) | ||||||||||||||||

Manufacturing | Warehouse | Sales / Service | Total | Owned | Leased | ||||||||||||

Energy | 58 | 56 | 61 | 175 | 2,668 | 1,524 | |||||||||||

Engineered Systems | 38 | 33 | 81 | 152 | 3,176 | 1,688 | |||||||||||

Fluids | 40 | 13 | 21 | 74 | 7,756 | 2,429 | |||||||||||

Refrigeration & Food Equipment | 25 | 18 | 26 | 69 | 1,802 | 2,522 | |||||||||||

Locations | Expiration dates of leased facilities (in years) | |||||||||||||||||||

North America | Europe | Asia | Other | Total | Minimum | Maximum | ||||||||||||||

Energy | 125 | 5 | — | 4 | 134 | 1 | 15 | |||||||||||||

Engineered Systems | 42 | 43 | 42 | 1 | 128 | 1 | 12 | |||||||||||||

Fluids | 19 | 18 | 21 | 1 | 59 | 1 | 10 | |||||||||||||

Refrigeration & Food Equipment | 31 | 11 | 12 | 3 | 57 | 1 | 15 | |||||||||||||

We believe our owned and leased facilities are well-maintained and suitable for our operations.

ITEM 3. LEGAL PROCEEDINGS

A few of our subsidiaries are involved in legal proceedings relating to the cleanup of waste disposal sites identified under federal and state statutes which provide for the allocation of such costs among "potentially responsible parties." In each instance, the extent of the subsidiary’s liability appears to be very small in relation to the total projected expenditures and the number of other "potentially responsible parties" involved and it is anticipated to be immaterial to us on a consolidated basis. In addition, a few of our subsidiaries are involved in ongoing remedial activities at certain plant sites, in cooperation with regulatory agencies, and appropriate reserves have been established. At December 31, 2015 and 2014, we have reserves totaling $30.6 million and $32.9 million, respectively, for environmental and other matters, including private party claims for exposure to hazardous substances, that are probable and estimable.

The Company and certain of its subsidiaries are also parties to a number of other legal proceedings incidental to their businesses. These proceedings primarily involve claims by private parties alleging injury arising out of use of the Company’s products, exposure to hazardous substances, patent infringement, employment matters, and commercial disputes. Management and legal counsel, at least quarterly, review the probable outcome of such proceedings, the costs and expenses reasonably expected to be incurred and currently accrued to-date, and the availability and extent of insurance coverage. The Company has reserves for legal matters that are probable and estimable and not otherwise covered by insurance, and at December 31, 2015 and 2014, these reserves are not significant. While it is not possible at this time to predict the outcome of these legal actions, in the opinion of management, based on the aforementioned reviews, the Company is not currently involved in any legal proceedings which, individually or in the aggregate, could have a material effect on its financial position, results of operations, or cash flows.

ITEM 4. MINE SAFETY DISCLOSURES

Not applicable.

17

EXECUTIVE OFFICERS OF THE REGISTRANT

All of our officers are elected annually at the first meeting of the Board of Directors following our annual meeting of shareholders, and are subject to removal at any time by the Board of Directors. Our executive officers as of February 12, 2016, and their positions with Dover (and, where relevant, prior business experience) for the past five years, are as follows:

Name | Age | Positions Held and Prior Business Experience | ||

Robert A. Livingston | 62 | Chief Executive Officer and Director (since December 2008) and President (since June 2008). | ||

Ivonne M. Cabrera | 49 | Senior Vice President, General Counsel and Secretary of Dover (since January 2013); prior thereto Vice President, Deputy General Counsel, and Assistant Secretary of Dover (from November 2012 to December 2012); prior thereto Vice President, Business Affairs and General Counsel of Knowles Electronics, LLC (from February 2011 to December 2012); prior thereto Vice President (from May 2010 to February 2011), Deputy General Counsel and Assistant Secretary (from February 2004 to February 2011) of Dover. | ||

Brad M. Cerepak | 56 | Senior Vice President and Chief Financial Officer (since May 2011) of Dover; prior thereto Vice President and Chief Financial Officer (from August 2009 to May 2011) of Dover. | ||

C. Anderson Fincher | 45 | Vice President (since May 2011) of Dover and President and Chief Executive Officer (since February 2014) and Executive Vice President (from November 2011 to February 2014) of Dover Engineered Systems; prior thereto Executive Vice President (from May 2009 to November 2011) of Dover Industrial Products. | ||

Jay L. Kloosterboer | 55 | Senior Vice President, Human Resources (since May 2011) of Dover; prior thereto Vice President, Human Resources (from January 2009 to May 2011) of Dover. | ||

William C. Johnson | 52 | Vice President (since May 2014) of Dover and President and Chief Executive Officer (since February 2014) of Dover Refrigeration & Food Equipment; prior thereto President and Chief Executive Officer (from August 2006 to March 2014) of Hill Phoenix Inc. | ||

Stephen R. Sellhausen | 57 | Senior Vice President, Corporate Development (since May 2011) of Dover; prior thereto Vice President, Corporate Development (from January 2009 to May 2011) of Dover. | ||

Sivasankaran Somasundaram | 50 | Vice President (since January 2008) of Dover and President and Chief Executive Officer (since August 2013) of Dover Energy; prior thereto Executive Vice President (from November 2011 to August 2013) of Dover Energy; prior thereto Executive Vice President (from January 2010 to November 2011) of Dover Fluid Management; President (from January 2008 to December 2009) of Dover's Fluid Solutions Platform. | ||

William W. Spurgeon, Jr. | 57 | Vice President (since October 2004) of Dover and President and Chief Executive Officer (since February 2014) of Dover Fluids; prior thereto President and Chief Executive Officer (from August 2013 to February 2014) of Dover Engineered Systems; prior thereto President and Chief Executive Officer (from November 2011 to August 2013) of Dover Energy; prior thereto President and Chief Executive Officer (from July 2007 to November 2011) of Dover Fluid Management. | ||

Russell E. Toney | 46 | Senior Vice President, Global Sourcing (since February 2015) of Dover; prior thereto General Manager, Market Development (from January 2013 to February 2015) of GE Energy Management; prior thereto Commercial Leader (from January 2011 to January 2013) of GE Energy Global Industries; prior thereto General Manager, Global Sourcing (from March 2007 to January 2011) of GE Energy Services. | ||

Sandra A. Arkell | 47 | Vice President, Controller (since August 2015) of Dover; prior thereto Assistant Controller (2009 to August 2015) of Dover. | ||

Kevin P. Buchanan | 60 | Vice President, Tax (since July 2010) of Dover; prior thereto Deputy General Counsel, Tax (from November 2009 to June 2010) and Vice President, Tax (from May 2000 to October 2009) of Monsanto Company. | ||

18

Name | Age | Positions Held and Prior Business Experience | ||

Paul E. Goldberg | 52 | Vice President, Investor Relations (since November 2011) of Dover; prior thereto Treasurer and Director of Investor Relations (from February 2006 to November 2011) of Dover. | ||

James M. Moran | 50 | Vice President, Treasurer (since November 2015) of Dover; prior thereto Senior Vice President and Treasurer (June 2013 to August 2015) of Navistar International Corporation (“NIC”); prior thereto Vice President and Treasurer (2008 to June 2013) of NIC; also served as Senior Vice President and Treasurer of Navistar, Inc. (June 2013 to August 2015) and Vice President and Treasurer of Navistar, Inc. (2008 to June 2013); also served as Senior Vice President and Treasurer of Navistar Financial Corporation (“NFC”) (April 2013 to August 2015) and Vice President and Treasurer of NFC (January 2013 to April 2013). | ||

19

PART II

ITEM 5. MARKET FOR REGISTRANT'S COMMON EQUITY, RELATED SHAREHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

Market Information and Dividends

The principal market in which Dover common stock is traded is the New York Stock Exchange. Information on the high and low close prices of our stock and the frequency and the amount of dividends paid during the last two years is as follows:

2015 | 2014 | ||||||||||||||||||||||

Market Prices | Dividends per Share | Market Prices (1) | Dividends per Share | ||||||||||||||||||||

High | Low | High | Low | ||||||||||||||||||||

First Quarter | $ | 74.50 | $ | 68.59 | $ | 0.400 | $ | 81.02 | $ | 67.34 | $ | 0.375 | |||||||||||

Second Quarter | 77.77 | 69.40 | 0.400 | 90.11 | 79.69 | 0.375 | |||||||||||||||||

Third Quarter | 70.03 | 55.99 | 0.420 | 90.22 | 79.94 | 0.400 | |||||||||||||||||

Fourth Quarter | 66.57 | 56.51 | 0.420 | 82.76 | 67.76 | 0.400 | |||||||||||||||||

$ | 1.640 | $ | 1.550 | ||||||||||||||||||||

(1) | Due to the February 28, 2014 distribution of Knowles, the high and low close prices shown above for each quarter prior to the distribution have been adjusted for comparability purposes. |

Holders

The number of holders of record of Dover common stock as of January 29, 2016 was approximately 19,701. This figure includes participants in our domestic 401(k) program.

Securities Authorized for Issuance Under Equity Compensation Plans

Information regarding securities authorized for issuance under our equity compensation plans is contained in Part III, Item 12 of this Form 10-K.

Recent Sales of Unregistered Securities

None.

20

Issuer Purchases of Equity Securities

In January 2015, the Board of Directors approved a standing share repurchase authorization, whereby the Company may repurchase up to 15,000,000 shares of its common stock over the following three years. No repurchases were made in the fourth quarter of 2015. As of December 31, 2015, the number of shares still available for repurchase under the January 2015 share repurchase authorization was 6,771,458.

21

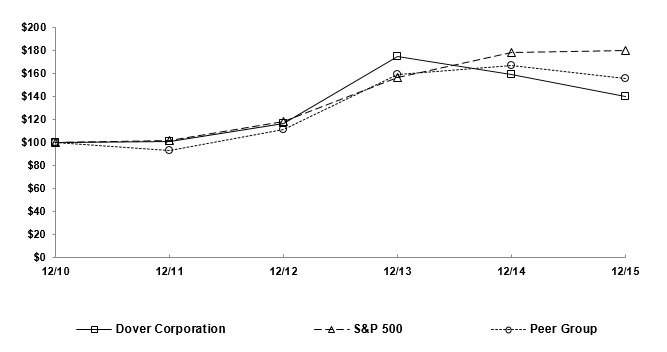

Performance Graph

This performance graph does not constitute soliciting material, is not deemed filed with the SEC, and is not incorporated by reference in any of our filings under the Securities Act of 1933 or the Exchange Act of 1934, whether made before or after the date of this Form 10-K and irrespective of any general incorporation language in any such filing, except to the extent we specifically incorporate this performance graph by reference therein.

Comparison of Five-Year Cumulative Total Return *

Dover Corporation, S&P 500 Index & Peer Group Index

Total Shareholder Returns

Data Source: Research Data Group, Inc

_______________________

*Total return assumes reinvestment of dividends.

This graph assumes $100 invested on December 31, 2010 in Dover Corporation common stock, the S&P 500 index, and a peer group index.

The 2015 peer index consists of the following 35 public companies selected by the Company.

3M Company | FMC Technologies Inc. | Rockwell Automation Inc. |

Actuant Corp. | Honeywell International Inc. | Roper Industries Inc. |

AMETEK Inc. | Hubbell Incorporated | Snap-On Inc. |

Amphenol Corp. | IDEX Corporation | SPX Corporation |

Cameron International Corp. | Illinois Tool Works Inc. | Teledyne Technologies Inc. |

Carlisle Companies Inc. | Ingersoll-Rand PLC | Textron Inc. |

Corning Inc. | Lennox International Inc. | The Timken Company |

Crane Company | Nordson Corp. | Tyco International Limited |

Danaher Corporation | Parker-Hannifin Corp. | United Technologies Corp. |

Eaton Corporation | Pentair Limited | Vishay Intertechnology Inc. |

Emerson Electric Co. | Precision Castparts Corp. | Weatherford International Limited |

Flowserve Corporation | Regal Beloit Corp. | |

22

ITEM 6. SELECTED FINANCIAL DATA

in thousands except per share data | 2015 | 2014 | 2013 | 2012 | 2011 | |||||||||||||||

Revenue | $ | 6,956,311 | $ | 7,752,728 | $ | 7,155,096 | $ | 6,626,648 | $ | 6,051,011 | ||||||||||

Earnings from continuing operations | 595,881 | 778,140 | 797,527 | 650,075 | 579,348 | |||||||||||||||

Net earnings | 869,829 | 775,235 | 1,003,129 | 811,070 | 895,243 | |||||||||||||||

Basic earnings (loss) per share: | ||||||||||||||||||||

Continuing operations | $ | 3.78 | $ | 4.67 | $ | 4.66 | $ | 3.58 | $ | 3.12 | ||||||||||

Discontinued operations | 1.74 | (0.02 | ) | 1.20 | 0.89 | 1.70 | ||||||||||||||

Net earnings | 5.52 | 4.65 | 5.86 | 4.47 | 4.82 | |||||||||||||||

Weighted average shares outstanding | 157,619 | 166,692 | 171,271 | 181,551 | 185,882 | |||||||||||||||

Diluted earnings (loss) per share: | ||||||||||||||||||||

Continuing operations | $ | 3.74 | $ | 4.61 | $ | 4.60 | $ | 3.53 | $ | 3.07 | ||||||||||

Discontinued operations | 1.72 | (0.02 | ) | 1.18 | 0.88 | 1.67 | ||||||||||||||

Net earnings | 5.46 | 4.59 | 5.78 | 4.41 | 4.74 | |||||||||||||||

Weighted average shares outstanding | 159,172 | 168,842 | 173,547 | 183,993 | 188,887 | |||||||||||||||

Dividends per common share | $ | 1.64 | $ | 1.55 | $ | 1.45 | $ | 1.33 | $ | 1.18 | ||||||||||

Capital expenditures | $ | 154,251 | $ | 166,033 | $ | 141,694 | $ | 146,502 | $ | 152,764 | ||||||||||

Depreciation and amortization | 327,089 | 307,188 | 278,033 | 229,934 | 193,353 | |||||||||||||||

Total assets | 8,619,763 | 9,030,291 | 10,801,659 | 10,394,628 | 9,430,884 | |||||||||||||||

Total debt | 2,768,464 | 3,030,997 | 2,828,479 | 2,800,116 | 2,187,252 | |||||||||||||||