Attached files

| file | filename |

|---|---|

| 8-K/A - 8-K/A - COMMERCE BANCSHARES INC /MO/ | cbsh-20210120.htm |

COMMERCE BANCSHARES, INC. EARNINGS HIGHLIGHTS 4th Quarter 2020

CAUTIONARY STATEMENT 2 A number of statements we will be making in our presentation and in the accompanying slides are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, such as statements of the Corporation’s plans, goals, objectives, expectations, projections, estimates and intentions. These forward- looking statements involve significant risks and uncertainties and are subject to change based on various factors (some of which are beyond the Corporation’s control). Factors that could cause the Corporation’s actual results to differ materially from such forward- looking statements made herein or by management of the Corporation are set forth in the Corporation’s 2019 Annual Report on Form 10-K, 3RD Quarter 2020 Report on Form 10-Q and the Corporation’s Current Reports on Form 8-K.

$1.11 EPS 3 • Allowance for credit losses on loans to total loans decreased to 1.35% – Decreased to 1.48% excluding Paycheck Protection Program (“PPP”) loans. • Net charge-offs to total loans of .19% and Non-performing assets to total loans of .16%. • Loans on deferral of .6% of total loans. • Non-interest income to total revenue of 39.2%. • Non-interest income up 4.3% over Q3. • QTD average loans flat to Q3 at $16.4B. • QTD average deposits increased by $843MM in Q4 compared to Q3. • Tangible common equity to tangible assets of 9.92%. • Net interest margin decreased 17 bps from Q3 to 2.80% (8 bps excluding adjustments4). • Wealth management client assets increased in Q4 by 11.9% to $61.2B. Highlights Well-positioned in a challenging environment 4Q2020 EARNINGS HIGHLIGHTS $148.6 million PPNR1 $15.5 million decrease Allowance for Credit Losses on Loans $129.9 million Income Available to Common 15.49% ROACE $1.2 billion Deposit Growth3 1 See the non-GAAP reconciliation on page 13; 2 Compared to 3Q2020; 3 Compared to 3Q2020, based on period-end balances; 4 Adjustments include a -$3.5 million adjustment to premium amortization on mortgage-backed securities for prepayment speed changes and a -$2.1 million decrease in inflation income on our Treasury inflation-protected securities. 1.63% ROAA

Average Balances Change vs. $ in millions 4Q20 3Q20 4Q19 Highlights Commercial1 $10,643.0 $(30.2) $1,559.4 • Linked quarter reflects lower business loans offset by higher construction and business real estate • YoY reflects PPP Consumer 5,718.3 25.5 358.2 • Linked quarter reflects higher personal real estate partially offset by lower auto, credit card, home equity Total Loans $16,361.3 $(4.7) $1,917.6 Investment Securities $12,302.5 $846.9 $3,480.2 • Reflects net purchase activity Interest Earning Deposits with Banks $1,082.6 $58.2 $692.5 • Reflects liquidity from deposit growth Deposits $25,590.7 $843.3 $5,433.9 • 3.4% quarterly growth, 27% annual growth Equity $3,336.1 $(30.0) $204.6 • Linked quarter reflects Q3 redemption of preferred stock Book Value per Common Share2 $29.03 $0.80 $3.60 • 2.8% quarterly growth, 14.2% annual growth BALANCE SHEET HIGHLIGHTS 4 1 PPP average balances were $1,476.2 million and $1,505.7 million as of December 31, 2020 and September 30, 2020, respectively 2 For the quarters ended December 31, 2020

$13.6 $14.9 $15.3 $6.6 $9.8 $10.3 3Q204Q19 4Q20 $20.2 $24.7 $25.6 +27% $9.1 $10.6 $10.6 $5.4 $5.7 $5.7 3Q204Q19 4Q20 $14.5 $16.3 $16.3 +13% BALANCE SHEET 5 Loans Consumer Loans Commercial Loans Loan Yield Deposits QTD Average Balances $ billions Non-Interest Bearing Interest Bearing Deposit Interest Bearing Deposit Yield QTD Average Balances $ billions 4.47% 3.69% 3.69% 0.52% 0.18% 0.12%

Change vs. $ in millions 4Q20 3Q20 4Q19 Highlights Net Interest Income $209.8 $(6.2) $7.1 • Linked quarter (LQ) decline due to lower earning asset yields partially offset by lower deposit costs and larger balance sheet. Non-Interest Income $135.1 $5.5 $(8.3) • LQ increase in bank card, trust fees and mortgage loan sales. • Excluding the one-time gain of the corporate trust business sale in Q419, non-interest income grew $3.1MM, or 2.4%. Non-Interest Expense $196.3 $5.5 $1.1 • Increase of 2.9% over LQ, .6% over prior year. • LQ increase due to higher incentive compensation. Pre-Tax, Pre-Provision Net Revenue1 $148.6 $(6.1) $(2.4) Investment Securities Gains (Losses), Net $12.3 $(3.8) $12.6 • Q4 fair value gains on private equity portfolio and MBS sale gains. Provision for Credit Losses $(4.4) $(7.5) $(19.6) • Declines primarily driven by improvement in economic forecast Net-Income Available to Common Shareholders $129.9 $4.9 $25.3 4Q20 3Q20 4Q19 Net Income per Common Share – Diluted $1.11 $1.06 $.88 Efficiency Ratio 56.68% 55.00% 56.29% • Continued expense discipline Net Yield on Interest Earning Assets 2.80% 2.97% 3.36% • Lower earning asset yields partially offset by lower deposit costs. INCOME STATEMENT HIGHLIGHTS 61 See the non-GAAP reconciliation on page 13

7 PRE-TAX, PRE-PROVISION NET REVENUE (PPNR) $143 $151 $203 $195 4Q2019 $346 $130 $155 $216 $191 3Q2020 $346 $135 $149 $210 $196 4Q2020 $345 Non-Interest Income (+) Net Interest Income (+) Non-Interest Expense (-) Pre-Tax, Pre-Provision Net Revenue (=) 4Q2020 Comparison vs. 4Q2019 -1.6% vs. 3Q2020 -3.9% See the non-GAAP reconciliation on page 13

Average Loan to Deposit Ratio3 SOUND CAPITAL AND LIQUIDITY POSITION 8 Total Risk-Based Capital Ratio1 1S&P Global Market Intelligence, Information as of September 30, 2020 2Period-end balances, as of December 31, 2020 3Includes loans held for sale, for the quarter ended December 31, 2020 15.8% 15.3% 15.1% 15.0% 14.7% 14.6% 14.3% 14.2% 14.2% 14.2% 14.1% 13.8% 13.8% 13.7% 13.5% 12.9% 12.9% 12.8% 12.4% 12.2% UBSI SFNC UMPQ OZK FULT CFR PB CBSH VLY FCNC.A PNFP BXS UMBF BOKF ASB WBS HWC ONB WTFC FNB Peer Median: 14.1% Core Deposits $25.1 Billion2 Large, stable deposit base and low loan to deposit ratio Loan to Deposit Ratio Total Deposits 64% Average Loan to Deposit Ratio190%Peer Average Commerce 93%7% Core Deposits - Non-Interest Bearing - Interest Checking - Savings and Money Market Certificates of Deposit

$15.2 $7.6 $8.0$8.3 $10.4 4Q19 3Q20 4Q20 MAINTAINING STRONG CREDIT QUALITY 9 Net Loan Charge-Offs (NCOs) $ in millions NCOs- CBSH NCOs - Peer Average NCO/Average Loans1 - CBSH $160.7 $236.4 $220.8 $143.0 $301.8 4Q203Q204Q19 Allowance for Credit Losses on Loans (ACL) $ in millions ACL - CBSH ACL - Peer Average ACL / Total Loans - CBSH $10.2 $40.3 $26.5 $121.1 $150.7 3Q204Q19 4Q20 Non-Performing Loans (NPLs) $ in millions NPLs - CBSH NPLs - Peer Average 15.7x 5.9x 8.3x 1.5x 2.7x 4Q19 3Q20 4Q20 Allowance for Credit Losses on Loans (ACL) to NPLs ACL / NPLs - CBSH ACL / NPLs - Peer Average Percentages are illustrative and not to scale; Peer Banks include: ASB, BOKF, BXS CFR, FCNC.A, FNB, FULT, HWC, ONB, OZK, PB, PNFP, SFNC, UBSI, UMBF, UMPQ, VLY, WBS, WTFC 1As a percentage of average loans (excluding loans held for sale) NPLs / Total Loans - CBSH NCO/Average Loans1 – Peer Average .07% NPLs / Total Loans – Peer Average .25% .16% .65% .71% ACL / Total Loans – Peer Average 1.09% 1.44% 1.35% .73% 1.42% .42% .18% .19%.18% .18%

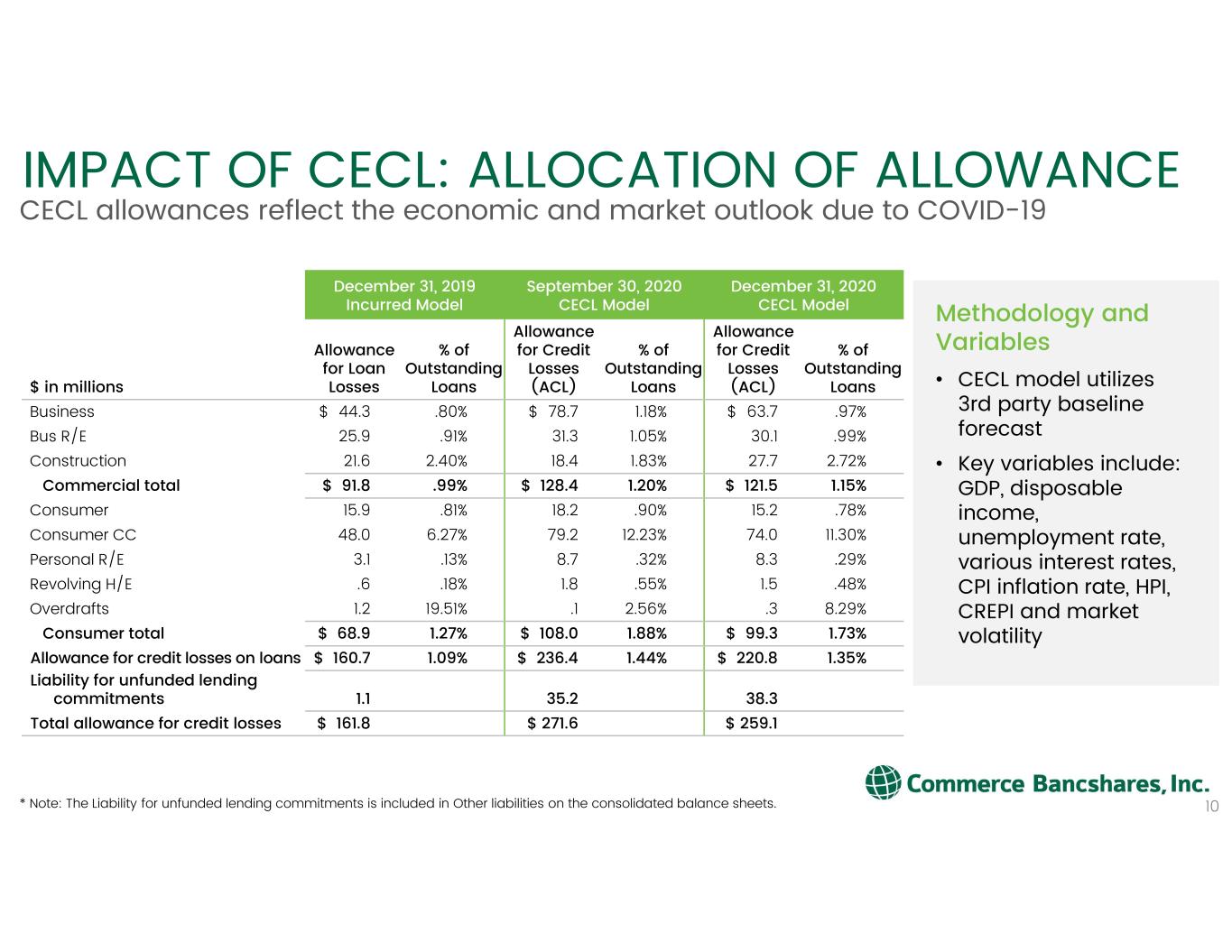

IMPACT OF CECL: ALLOCATION OF ALLOWANCE 10 Methodology and Variables • CECL model utilizes 3rd party baseline forecast • Key variables include: GDP, disposable income, unemployment rate, various interest rates, CPI inflation rate, HPI, CREPI and market volatility CECL allowances reflect the economic and market outlook due to COVID-19 * Note: The Liability for unfunded lending commitments is included in Other liabilities on the consolidated balance sheets. December 31, 2019 Incurred Model September 30, 2020 CECL Model December 31, 2020 CECL Model $ in millions Allowance for Loan Losses % of Outstanding Loans Allowance for Credit Losses (ACL) % of Outstanding Loans Allowance for Credit Losses (ACL) % of Outstanding Loans Business $ 44.3 .80% $ 78.7 1.18% $ 63.7 .97% Bus R/E 25.9 .91% 31.3 1.05% 30.1 .99% Construction 21.6 2.40% 18.4 1.83% 27.7 2.72% Commercial total $ 91.8 .99% $ 128.4 1.20% $ 121.5 1.15% Consumer 15.9 .81% 18.2 .90% 15.2 .78% Consumer CC 48.0 6.27% 79.2 12.23% 74.0 11.30% Personal R/E 3.1 .13% 8.7 .32% 8.3 .29% Revolving H/E .6 .18% 1.8 .55% 1.5 .48% Overdrafts 1.2 19.51% .1 2.56% .3 8.29% Consumer total $ 68.9 1.27% $ 108.0 1.88% $ 99.3 1.73% Allowance for credit losses on loans $ 160.7 1.09% $ 236.4 1.44% $ 220.8 1.35% Liability for unfunded lending commitments 1.1 35.2 38.3 Total allowance for credit losses $ 161.8 $ 271.6 $ 259.1

PROVIDING RELIEF TO OUR CUSTOMERS Active deferral exposure reduced as pandemic continues 11 Payment Relief Requests 1Deferrals are defined as modifications, payment deferrals, forbearance agreements, or change in terms, % of Portfolio calculated on Total Loans (excluding PPP loans); 2 No direct consumer credit exposure Active deferrals1 as of September 30, 2020 Active deferrals1 as of December 31, 2020 Loan Type Number of Requests % of Portfolio (by $ amount) Total Amount of Requests Number of Requests % of Portfolio (by $ amount) Total Amount of Requests Commercial 11 .5% $48MM 8 .6% $57MM Mortgage 111 1.0% $25MM 86 .7% $18MM Consumer Card 73 .1% $0.5MM 93 .1% $0.6MM Installment 553 .8% $11MM 500 .6% $8MM Med/HSF2 76 .1% $0.2MM 109 .1% $0.3MM TOTAL 824 .6% $85MM 796 .6% $84MM

LOAN PORTFOLIO: LIMITED EXPOSURE TO PANDEMIC-SENSITIVE INDUSTRIES 12 While we expect nearly every industry to be impacted to some degree by Coronavirus-related disruptions, we have identified eight industries that will be most impacted. Highest Impacted Industries $ in millions 9/30 $ in millions 12/31 % of Loan Portfolio 12/31 Hospitals $758 $729 4.9% Multifamily / Student Housing 608 550 3.7% CRE Retail 389 387 2.6% Senior Living 310 311 2.1% Hotels 291 303 2.0% Energy 150 173 1.1% Retail Stores 141 111 .7% Restaurants 67 67 .4% Total $2,714 $2,631 17.5% 18% 82% Highest Impacted Industries All Other Loans Industry breakdowns represent outstanding balances, excluding PPP loans, as of December 31, 2020, segmented by NAICS codes Loan Portfolio Outstandings

NON-GAAP RECONCILIATIONS 13 For The Three Months Ended (DOLLARS IN THOUSANDS) Dec. 31, 2020 Sept. 30, 2020 Dec. 31, 2019 A Net Interest Income $ 209,763 $ 215,962 $ 202,659 B Non-Interest Income $ 135,117 $ 129,572 $ 143,461 C Non-Interest Expense $ 196,310 $ 190,858 $ 195,174 Pre-Provision Net Revenue (A+B-C) $ 148,570 $ 154,676 $ 150,946 Pre-tax, Pre-provision Net Revenue