Attached files

| file | filename |

|---|---|

| EX-32 - EX-32 - Exceed World, Inc. | ex32.htm |

| EX-31 - EX-31 - Exceed World, Inc. | ex31.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

| [X] ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934. |

FOR THE FISCAL YEAR ENDED September 30, 2020

OR

| [ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

COMMISSION FILE NUMBER: 000-55377

Exceed World, Inc.

(Exact name of registrant as specified in its charter)

| Delaware | 47-3002566 | ||

|

(State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) | ||

|

1-23-38-6F, Esakacho, Suita-shi, Osaka Japan |

564-0063 | ||

| (Address of Principal Executive Offices) | (Zip Code) |

Securities to be registered under Section 12(b) of the Act: None

Securities to be registered under Section 12(g) of the Exchange Act:

| Title of each class |

Name of each exchange on which our share are traded |

|||

| Common Stock, $0.0001 | OTC Markets |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

[ ] Yes [X] No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

[ ] Yes [X] No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

[X] Yes [ ] No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

[X] Yes [ ] No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K.

[ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ☐ | Accelerated filer ☐ | Non-accelerated filer ☒ | ||

| Smaller reporting company ☒ | Emerging growth company ☒ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. [ ]

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

[ ] Yes [X] No

As of March 31, 2020, the aggregate market value of the voting common stock held by non-affiliates of the Registrant (without admitting that any person whose shares are not included in such calculation is an affiliate) was approximately $1,176,060 based on a market price per share of $0.51.

As of January 13, 2021, there were 32,700,000 shares of the Registrant’s common stock, par value $0.0001 per share, issued and outstanding. As of the same date there were no shares of preferred stock issued and outstanding.

TABLE OF CONTENTS

FORWARD LOOKING STATEMENTS

This prospectus contains forward-looking statements that involve risk and uncertainties. We use words such as “anticipate”, “believe”, “plan”, “expect”, “future”, “intend”, and similar expressions to identify such forward-looking statements. Investors should be aware that all forward-looking statements contained within this filing are good faith estimates of management as of the date of this filing. Our actual results could differ materially from those anticipated in these forward-looking statements for many reasons, including the risks faced by us as described in the “Risk Factors” section and elsewhere in this prospectus.

PART I

Corporate History

The Company was originally incorporated with the name Brilliant Acquisition, Inc., under the laws of the State of Delaware on November 25, 2014, with an objective to acquire, or merge with, an operating business. On January 12, 2016, Thomas DeNunzio of 780 Reservoir Avenue, #123, Cranston, RI 02910, the sole shareholder of the Company, entered into a Share Purchase Agreement with e-Learning Laboratory Co., Ltd., a Japan corporation (“e-Learning”). Pursuant to the Agreement, Mr. DeNunzio transferred to e-Learning, 20,000,000 shares of our common stock which represents all of our issued and outstanding shares. Following the closing of the share purchase transaction, e-Learning gained a 100% interest in the issued and outstanding shares of our common stock and became the controlling shareholder of the Company.

On January 12, 2016, the Company changed its name to Exceed World, Inc. and filed with the Delaware Secretary of State, a Certificate of Amendment. On January 12, 2016, Mr. Thomas DeNunzio resigned as our Chief Executive Officer, Chief Financial Officer, President, Director, Secretary, and Treasurer. Also, on January 12, 2016, Mr. Tomoo Yoshida was appointed as our Chief Executive Officer, Chief Financial Officer, President, Director, Secretary, and Treasurer.

On February 29, 2016, the Company entered into a Stock Purchase Agreement with Tomoo Yoshida, our Chief Executive Officer, Chief Financial Officer, President, Director, Secretary, and Treasurer. Pursuant to this Agreement, Tomoo Yoshida transferred to Exceed World, Inc., 10 shares of the common stock of E&F Co., Ltd., a Japan corporation (“E&F”), which represents all of its issued and outstanding shares in consideration of $4,835 (JPY 500,000). Following the effective date of the share purchase transaction on February 29, 2016, Exceed World, Inc. gained a 100% interest in the issued and outstanding shares of E&F’s common stock and E&F became a wholly owned subsidiary of Exceed World. On August 4, 2016, the E&F changed its name to School TV Co., Ltd (“School TV”) and filed with the Legal Affairs Bureau in Osaka, Japan.

On April 1, 2016, e-Learning entered into stock purchase agreements with 7 Japanese individuals. Pursuant to these agreements, e-Learning sold 140,000 shares of common stock in total to these individuals and received $270 as aggregate consideration. Each paid JPY0.215 per share. At the time of purchase the price paid per share by each was the equivalent of about $0.002. This sale of shares was exempt from registration in accordance with Regulation S of the Securities Act of 1933, as amended ("Regulation S") because the above sales of the stock were made to non-U.S. persons as defined under Rule 902 section (k)(2)(i) of Regulation S, pursuant to offshore transactions, and no directed selling efforts were made in the United States by the issuer, a distributor, any of their respective affiliates, or any person acting on behalf of any of the foregoing.

On August 1, 2016, the Company changed its fiscal year end from November 30 to September 30.

On August 9, 2016, e-Learning entered into stock purchase agreements with 33 Japanese individuals. Pursuant to these agreements, e-Learning sold 3,300 shares of common stock in total to these individuals and received $330 as aggregate consideration. Each paid JPY10 per share. At the time of purchase the price paid per share by each shareholder was the equivalent to about $0.1. These shares were sold pursuant to the Company’s effective S-1 Registration Statement deemed effective on July 20, 2016 at 4pm EST.

On October 28, 2016, the Company, with the approval of its board of directors and its majority shareholders by written consent in lieu of a meeting, authorized the cancellation of shares owned by e-Learning. e-Learning consented to the cancellation of shares. The total number of shares cancelled was 19,000,000 shares which was comprised of 16,500,000 restricted common shares and 2,500,000 free trading shares.

On October 28, 2016, every one (1) share of common stock, par value $.0001 per share, of the Company issued and outstanding was automatically reclassified and changed into twenty (20) shares fully paid and non-assessable shares of common stock of the Company, par value $.0001 per share. (“20-for-1 Forward Stock Split”) No fractional shares were issued. The authorized number of shares, and par value per share, of common stock are not affected by the 20-for-1 Forward Stock Split.

During July 2017 and August 2017, e-Learning entered into stock purchase agreements with 24 Japanese individuals. Pursuant to these agreements, e-Learning sold 2,240,000 shares of its common stock in total to these individuals and received $38,263 as aggregate consideration.

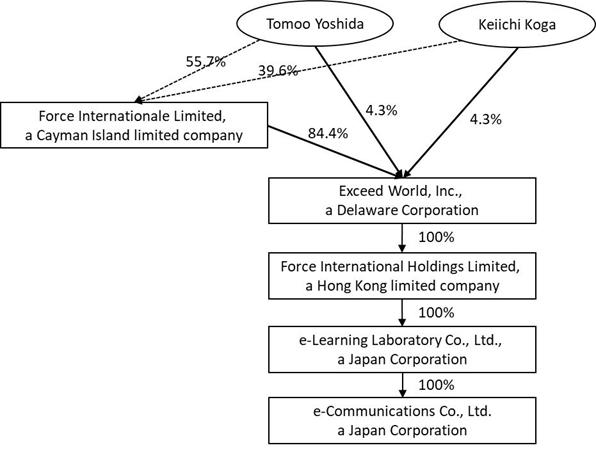

On September 26, 2018, Force Internationale Limited, a Cayman Island limited company (“Force Internationale”) entered into a Share Purchase Agreement with its wholly-owned subsidiary, e-Learning and 74.5% owner of the Company. Under this Share Purchase Agreement, e-Learning transferred its 74.5% interest in the Company to Force Internationale. As consideration for this transfer, Force Internationale paid $26,000.00 to e-Learning. Immediately subsequent, the Company entered into a Share Purchase Agreement with Force Internationale, to acquire 100% of Force Holdings and 100% direct owner of e-Learning. In consideration of this agreement, the Company issued 12,700,000 common shares to Force Internationale. The result of these transaction is that Force Internationale is a 84.4% owner of the Company, the Company is a 100% owner of Force Holdings, and Force Holdings is a 100% owner of e-Learning. Prior to the Share Purchase Agreements, Force Internationale was an indirect owner of 74.5% of the Company and subsequent to the Share Purchase Agreements, Force Internationale is a direct owner of 84.4% of the Company. The Share Purchase Agreements were approved by the boards of directors of each of the Company, Force Internationale, Force Holdings, and e-Learning.

On December 6, 2018, the Company entered into a share contribution agreement (the “Contribution Agreement”) with Force Internationale. Under this Agreement, the Company transferred 100% of the equity interest of School TV Co., Ltd. ("School TV"), to Force Internationale without consideration. This Contribution Agreement was approved by the board of directors of the Company, Force Internationale and School TV. Upon the completion of the disposal, School TV was deconsolidated from the Company's consolidated financial statements.

Overview

Our principal executive offices are located at 1-1-36, 1-2-38-6F, Esaka-cho, Suita-shi, Osaka 564-0063, Japan. Our phone number is +81-6-6339-4177.

The Company has elected September 30th as its fiscal year end.

Currently, we own the following wholly owned affiliated entities:

| Name of Subsidiary | State or Other Jurisdiction of Incorporation or Organization |

| Force International Holdings Limited | Hong Kong |

| e-Learning Laboratory Co., Ltd. | Japan |

| e-Communications Co., Ltd. | Japan |

* The following chart illustrates the structure of our consolidated affiliated entities:

Currently, the number of the employees of the Company is 38.

- 1 -

e-Learning Business

With the completion of the Company’s acquisition of Force Holdings and its subsidiaries (Hereinafter, collectively referred to as the “Group”), we are in the business of providing education services.

The Company is an education service provider in Japan and it offers a range of e-learning education programs as well as supporting services to complement such education programs through an internet platform named “Force Club” (“Force Club”), which was launched in 2007. The Company has offered e-learning programs through “Force Club”, all of which were procured from independent third-party software developers, including pre-school learning resources, learning resources supplementing elementary school, junior high school and senior high school curriculum, preparation courses for university entrance examinations and professional qualification examinations, and English learning, appealing to a diverse customer base from pre-school children to students and adult learners. A list of the Company’s e-learning programs, target customer group and release date are set out below. The e-learning programs of Force Club mainly serve as supplemental learning resources and self-learning tools for students and adult learners.

| No. | Content Name | Target | Compatible Devices | Release Date |

| 1 | ENGLISH MONSTERS | Primary school student | iOS smartphone / tablet | 2013 |

| Android smartphone / tablet | ||||

| 2 | Romantic English Conversation - London Ver. | Age 18 and over | iOS smartphone / tablet | 2013 |

| Android smartphone / tablet | ||||

| 3 | Romantic English Conversation - College Life Ver. | Age 18 and over | iOS smartphone / tablet | 2013 |

| Android smartphone / tablet | ||||

| 4 | ENGLISH MONSTERS AR | Primary school student | iOS smartphone / tablet | 2013 |

| Android smartphone / tablet | ||||

| 5 | The Blue Danube | Infants | iOS smartphone / tablet | 2012 |

| Android smartphone / tablet | 2014 | |||

| 6 | The Nutcracker | Infants | iOS smartphone / tablet | 2012 |

| Android smartphone / tablet | 2014 | |||

| 7 | Peter & the Wolf | Infants | iOS smartphone / tablet | 2012 |

| Android smartphone / tablet | 2014 | |||

| 8 | The Four Seasons | Infants | iOS smartphone / tablet | 2012 |

| Android smartphone / tablet | 2014 | |||

| 9 | The Carnival of the Animals | Infants | iOS smartphone / tablet | 2012 |

| Android smartphone / tablet | 2014 | |||

| 10 | Play A,B,C on the Keyboard | Infants | iOS smartphone / tablet | 2012 |

| Android smartphone / tablet | 2014 | |||

| 11 | Say Hello to English Words! | Infants | iOS smartphone / tablet | 2012 |

| Android smartphone / tablet | 2014 | |||

| 12 | Force Paint | Infants | iOS smartphone / tablet | 2012 |

| Android smartphone / tablet | 2014 | |||

| 13 | Force Musician | Infants | iOS smartphone / tablet | 2012 |

| 14 | Sign Language Course | Adult | PC | 2014 |

| 15 | University Entrance Exam Preparation Course | High school student / | PC | 2008 |

| Those who prepare for entrance exam | Android smartphone / tablet | 2014 | ||

| 16 | High School Student-oriented e-learning | High school student | PC | 2009 |

| Android smartphone / tablet | 2014 | |||

| 17 | Folstar | Adult | Feature Phone | 2008 |

| 18 | Qualification Attainment Strategies Course | Adult | iOS smartphone / tablet | 2015 |

| Android smartphone / tablet | ||||

| 19 | School TV | Primary school student / Middle school student | PC | 2015 |

| iOS smartphone / tablet | ||||

| Android smartphone / tablet | ||||

| 20 | English Monsters app | Main: High school student / College student | iOS smartphone / tablet | 2015 |

| (However, primary school student, middle school student, and adults are also included as targets.) | ||||

| 21 | ForceMart | Force Club Members | PC | 2017 |

| iOS smartphone / tablet | ||||

| Android smartphone / tablet |

The Company’s e-learning programs are offered to its customers who have to be first registered as a member of Force Club. Since 2002, the Company began to offer its e-learning programs to its customers in CD-ROMs with pre-loaded learning content until 2007. Due to the popular trend for internet, starting from 2007, the Company has made its e-learning programs available on its website for its customers, and the customers need to pay a monthly fee in order to access and view the most up-to-date content on the website of the Company. At the advent of digital technology in recent years and in view of the increasing popularity of tablet devices, the Company has released its e-learning programs on smartphones and tablet devices for customer use since 2012 to cater for the popular demand of young learners and users in rural areas of Japan. The e-learning programs of Force Club are targeted at residents of Japan, and thus the e-learning programs are presented in Japanese only and no translated version is available. Since 2015, in addition to e-learning, the Company has started offline business which attracts public attentions such as Abacus School and Robot Programming School. The Company also opened “ixi After School” in Tokyo, which provides after school care services to children. Through these offline business, the Company has provided services to general users.

The Company regularly updates its e-learning materials and programs. In particular, the learning resources supplementing elementary school, junior high school and senior high school curriculum would be overhauled to correspond to any revision in school curriculum, which generally takes place once in a four-year period. In addition, most of preparation courses for the university entrance examinations and professional qualification examinations would be revised at one to two year intervals to cater for any changes to the examination syllabus. The website of the Company is updated from time to time to reflect the updates and changes to the learning materials and programs and for users with smartphones and tablet devices, these updates can also be downloaded from the website of the Company.

-2-

Business Model

Apart from using a conventional direct sales marketing strategy, the Company has also adopted multilevel marketing (“MLM”), via the Premium Membership in the Force Club, in operating its businesses.

Since 2002, the Company has adopted a direct sales marketing strategy to market its e-learning programs. Subsequently, in 2007, the Company gradually changed its marketing strategy from direct sales to MLM for the purposes of (i) establishing its brand name and penetrating into the rural areas of Japan; (ii) promoting its products to wider customer groups through premium members; and (iii) incentivizing premium members to recruit new members to join Force Club in order to increase the sales of its products and maximize profits for the Company. Currently, the Company has no retail shops or other point-of-sale for its products (e-learning courses).

MLM was adopted by the Company in order to expand the sales of its e-learning programs through its Force Club members. There are two tiers of Force Club members, namely standard members and premium members. Among Force Club members, premium members get a tablet device which entitles the premium members to life-time access of all of the Company’s e-learning educational content. Since the Company’s e-learning education programs are distributed in the form of online downloads, it can be used both online and offline.

Force Club Membership

Force Club members are those who intend to use products and services the Company offers. There are two tiers of Force Club members, namely standard members and premium members. Premium members are those who wish to engage in recruiting new members (“Premium Members”).

Premium Members have to join a premium plan under which members are given rights to use all products and services of the Company, and engage in activities to recruit new Force Club members and obtain monetary rewards and bonuses (special income or commissions) from such activities. The Company enters into a contract (the “Premium Member Contract”) with each of its Premium Members. The salient terms of the Premium Member Contract are as follows:

Eligibility - the following individuals/corporations are eligible to register as the Company’s Premium Members:

(i) Individuals (other than students) who are 20 years old or above and are residents of Japan; and

(ii) Corporations established in Japan.

Applicants are required to provide proof of identity, such as driver’s license, passport or resident card for individual members or a certified copy of the commercial registration for corporate members.

Payments – an applicant who wishes to be a Force Club Premium Member has to join the premium plan and pay an initial payment of JPY420,000 (exclusive of sales tax), comprising:

(i) The one-off registration fee of JPY10,000;

(ii) The premium package fee of JPY390,000; and

(iii)An advanced payment of monthly membership fees for the initial two months amounting to JPY20,000.

Standard members pay the same registration fee, but a reduced monthly rate and no premium package fee. Monthly membership fees payable from the third month onwards will be automatically transmitted from a member’s bank account until termination of membership.

Based on provisions described fully in the Premium Member Contract there are fees related to, but not exclusively limited to, cancellation of membership and other stipulations pursuant to certain actions. If a Premium Member does not pay the monthly membership fee before the prescribed due date, such Premium Member will be disqualified and will not be paid any commission with respect to his/her recruitment performance in the preceding month, and Force Club services for such Premium Member will be suspended in the following month. The commission and Force Club services for such Premium Member will be resumed in the subsequent month if the monthly membership fee is paid within three months from the due date. Otherwise, the Premium Member is deemed to have withdrawn from his membership if the monthly membership fee is not paid for three consecutive months after the payment due date.

In addition, the Premium Member Contract sets out the rules of conduct required to be observed by Premium Members in recruiting new members to join Force Club. The Company is entitled to suspend a Premium Member’s business activities, suspend his or her commission, demand return of commission(s), remove his or her title, or terminate his or her membership if such Premium Member violates or infringes the rules of conduct or other related laws or regulations, and/or acts in a way that is offensive to public order and morals.

Upon registration as Force Club members, applicants will be given a user ID to gain access to the e-learning programs through Force Club platform. Force Club members will be given additional four user IDs after registration so that they can use a total of five user IDs for accessing e-learning content through Force Club platform.

The number of Force Club members has increased from approximately 3,989 as of September 30, 2008 to approximately 10,101 as of the date of this report.

Competition

We believe that our main competitors are those provide similar e-learning product offerings in Japan. Specifically, we believe our biggest competitors at present are Recruit Marketing Partners Co., Ltd., which provides "Study Supplements", JustSystem Corporation, which provides "Smile Zemi", Benesse Corporation which provides "Challenge Touch" and SuRaLa Net Co., Ltd. which provides "SuRaLa", whose product offerings are also consistent of e-learning programs and services.

Current Advertising

Our advertising expenses are primarily comprised of, but not limited to, sales events hosted for sales agents, exhibitions to promote and display company product offerings, signboards, and public relations activities.

Future Plans

Over the course of the next twelve months, the Company intends to focus on expanding its sales network in order to strengthen its business activities. Currently, revenue is derived primarily from sales of the premium package. While it is the intention of the Company to maintain this revenue stream, and to further increase the number of premium members of the Force Club, the Company also intends to diversify its operations and develop additional business activities.

In order to do so, the Company intends to focus on development of an online educational platform on which additional advertising income can be generated. At present, there are no definitive plans that have been made regarding the implementation or direction of this future online educational platform. However, we intend to begin efforts to hire additional personnel with extensive experience in web marketing in order to assist in the development of our future platform.

In addition to e-learning business, the Company has also been engaged in physical school business. Currently, we open “ixi Robot School” which provides robot programming training to children and “Kodomo Mirai Career” Which children can learn the social structure.

Employees

The number of the employees of the Company, and all subsidiaries, as of the filing date is thirty-eight. All thirty-eight employees are considered full-time employees. We do not presently have pension, health, annuity, insurance, stock options, profit sharing, or similar benefit plans; however, we may adopt plans in the future. There are presently no personal benefits available to our officers/or directors and or employees.

Government Regulations

Companies in Japan are regulated by the “Act on Specified Commercial Transactions in Japan.” The Company believes it is fully in compliance with this Act, which outlines the rules and regulation regarding transactions arising from door-to-door sales, mail order sales, telemarketing sales, and multilevel marketing transactions, among other transactions defined in the Act.

The Company has legal counsel in Japan whom provides instruction, direction, and reviews Company activities to ensure, to the best of Legal Counsel’s knowledge, that the Company is in compliance with the aforementioned Act.

-3-

As a smaller reporting company, as defined in Rule 12b-2 of the Exchange Act, we are not required to provide the information called for by this Item.

Item 1B. Unresolved Staff Comments.

None.

Exceed World, Inc. is provided office space rent free from e-Learning Laboratory Co., Ltd. at the address of 1-23-38-6F, Esakacho, Suita-shi.

e-Communications Co., Ltd, a Japan corporation, is a wholly owned subsidiary of e-Learning Laboratory Co, Ltd., a Japan corporation.

e-Communications sub-leases (rents) office space from its parent company, e-Learning Laboratory Co, Ltd., a Japan corporation at the following addresses:

1-23-38-1F, Esakacho, Suita-shi, Osaka Japan 1-23-38-6F, Esakacho, Suita-shi, Osaka Japan 1-23-38-8F, Esakacho, Suita-shi, Osaka Japan 1-8-40-1F, Konan, Minato-ku, Tokyo, Japan. The aforementioned office spaces are shared by both e-Communications Co., Ltd. and e-Learning Laboratory Co., Ltd.

The following table details the terms of the lease agreements for various properties leased by our wholly owned subsidiary, Force International Holdings Limited, a Hong Kong company, and its wholly owned subsidiary, e-Learning Laboratory Co., Ltd., a Japan company.

| Work space | Address | Lessee | Lessor | Monthly Rent | Term (Expiration of Lease) |

| Esaka, Osaka, 1st floor | 1-23-38-1F, Esakacho, Suita-shi, Osaka Japan | e-Learning Laboratory Co., Ltd. | F&M Co., Ltd. | JPY662,200 | May 31, 2021 |

| ($6,811) | |||||

| Esaka, Osaka, 6th floor | 1-23-38-6F, Esakacho, Suita-shi, Osaka Japan | e-Learning Laboratory Co., Ltd. | F&M Co., Ltd. | JPY 1,102,500 | April 17, 2021 |

| ($11,340) | |||||

| Esaka, Osaka, 8th floor | 1-23-38-8F, Esakacho, Suita-shi, Osaka Japan | e-Learning Laboratory Co., Ltd. | F&M Co., Ltd. | JPY614,935 | October 31, 2022 |

| ($5,857) | |||||

| Tokyo | 1-8-40-1F, Konan, Minato-ku, Tokyo, Japan | e-Learning Laboratory Co., Ltd. | Tokyu Community Corp. | JPY 1,834,921 | August 31, 2023 |

| ($17,475) |

For the year ended September 30, 2020, the Company has settled two legal cases in total amount of approximately JPY4.7 million (approximately $44,000) related to the cancellation of contracts. From October 1, 2020 to the filing date, the Company has settled three cases under the same nature with an aggregate amount of approximately JPY6.8 million (approximately $65,000). As of the filing date, the Company had 23 pending legal cases, claiming a damage of approximately JPY143.1 million (approximately $1.4 million) under the same nature. Our legal counsel estimated a probable settlement of these cases with total settlement amount of approximately JPY53.8 million (approximately $510,000). The Company has recorded JPY 60.6 million (approximately $574,000) as contingency liability as of September 30, 2020 for these pending cases and cases settled in subsequent period.

During the past ten (10) years, none of our directors, persons nominated to become directors, executive officers, promoters or control persons was involved in any of the legal proceedings listen in Item 401 (f) of Regulation S-K.

Item 4. Mine Safety Disclosures.

Not applicable.

-4-

PART II

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities.

Market Information

We are currently quoted on the OTC Marketplace. Our ticker symbol is EXDW.

Holders

Currently, as of the date of this report, and as of our fiscal year end, there are approximately 60 shareholders of record of our common stock and 32,700,000 shares of common stock deemed issued and outstanding.

Dividends and Share Repurchases

We have not paid any dividends to our shareholder. There are no restrictions which would limit our ability to pay dividends on common equity or that are likely to do so in the future.

Issuer Purchases of Equity Securities

None.

Equity Compensation Plan Information

Not applicable.

Recent Sales of Unregistered Securities; Uses of Proceeds from Registered Securities

None.

Item 6. Selected Financial Data.

No applicable because the Company is a smaller reporting company.

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations.

Liquidity and Capital Resources

As of September 30, 2020 and September 30, 2019, we had cash and cash equivalents in the amount of $19,370,086 and $20,198,362, respectively. The decrease in cash is attributed to decrease of accounts payable and increase of inventories. These accounts payable were mainly unpaid commissions to Force Club premium members and these payments were completed as of the date of this report. Currently, our cash balance is sufficient to fund our operations without the need for additional funding.

Revenues

We recorded revenue of $21,019,454 for the year ended September 30, 2020 as opposed to $28,393,548 for the year ended September 30, 2019. The decrease in revenue, in our opinion, is attributed to a decrease in recruitment activities of premium force club members.

Net loss

We recorded net loss of $962,278 for the year ended September 30, 2020 and net loss of $132,017 for the year ended September 30, 2019. The increase in net loss is attributed to a decrease in revenue from 2019 to 2020.

Cash flow

For the year ended September 30, 2020, we had negative cash flows from operations in the amount of $621,048. For the year ended September 30, 2019, we had negative cash flows from operations in the amount of $4,365,066. The decrease in negative operating cash flow, in our opinion, is attributed to less payments made to settle outstanding accounts payable and collection of revenue proceeds in advance included in deferred income.

Working capital

As of September 30, 2020 and 2019, we had working capital of $14,083,699 and $15,318,405, respectively.

Advertising

Advertising costs are expensed as incurred and included in selling and distributions expenses. Advertising expenses were $1,009,721 and $1,908,950 for the years ended September 30, 2020 and 2019, respectively.

Advertising expenses were comprised of, but not limited to, sales events hosted for sales agents, exhibitions to promote and display company product offerings, signboards, and public relations activities.

Future Plans

Over the course of the next twelve months, the Company intends to focus on expanding its sales network in order to strengthen its business activities. Currently, revenue is derived primarily from sales of the premium package. While it is the intention of the Company to maintain this revenue stream, and to further increase the number of premium members of the Force Club, the Company also intends to diversify its operations and develop additional business activities.

In order to do so, the Company intends to focus on development of an online educational platform on which additional advertising income can be generated. At present, there are no definitive plans that have been made regarding the implementation or direction of this future online educational platform. However, we intend to begin efforts to hire additional personnel with extensive experience in web marketing in order to assist in the development of our future platform.

In addition to e-learning business, the Company has also been engaged in physical school business. Currently, we open “ixi Robot School” which provides robot programming training to children and “Kodomo Mirai Career” Which children can learn the social structure.

Impact of COVID-19

In the Company’s financial year of 2020, the global outbreak of the coronavirus disease 2019 (“COVID-19”) has significantly affected economy in Japan, where the Company mainly operates its business. Especially since February 2020, the economy has rapidly declined due to limited economic activity caused by COVID-19. The Company implemented some measures to prevent infection including shortening business hours and restricting movements of employees. Our Force Club Members’ activities, which is our main sales resources, have also been limited due to travel restrictions and social distance rules implemented nationwide and globally. Consequently, the COVID-19 pandemic has adversely affected the Company’s business operations, financial condition and operating results for 2020, including but not limited to material negative impact to the Company’s total revenues, and these effects may continue in 2021. Due to the high uncertainty of the evolving situation, the Company has limited visibility on the full impact brought upon by the COVID-19 pandemic and the related financial impact to future periods cannot be estimated at this time.

Item 7A. Quantitative and Qualitative Disclosures about Market Risk.

As a “smaller reporting company”, we are not required to provide the information required by this Item.

-5-

Item 8. Financial Statements and Supplementary Data.

Exceed World, Inc.

FINANCIAL STATEMENTS

INDEX TO FINANCIAL STATEMENTS

| Pages | ||

| Report of Independent Registered Public Accounting Firm | F2 | |

| Consolidated Balance Sheets | F3 | |

| Consolidated Statements of Operations and Comprehensive Income (Loss) | F4 | |

| Consolidated Statements of Changes in Shareholders' Equity | F5 | |

| Consolidated Statements of Cash Flows | F6 | |

| Notes to Consolidated Financial Statements | F7-F10 |

-F1-

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Shareholders and Board of Directors of

Exceed World, Inc.

Opinion on the Financial Statements

We have audited the accompanying consolidated balance sheets of Exceed World, Inc. and its subsidiaries (collectively, the “Company”) as of September 30, 2020 and 2019, and the related consolidated statements of operations and comprehensive income (loss), changes in shareholders’ equity, and cash flows for the years then ended, and the related notes (collectively referred to as the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the financial position of the Company as of September 30, 2020 and 2019, and the results of its operations and its cash flows for the years then ended, in conformity with accounting principles generally accepted in the United States of America.

Basis for Opinion

These financial statements are the responsibility of the Company’s management. Our responsibility is to express an opinion on the Company’s financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) ("PCAOB") and are required to be independent with respect to the Company in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud. The Company is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. As part of our audits we are required to obtain an understanding of internal control over financial reporting but not for the purpose of expressing an opinion on the effectiveness of the Company's internal control over financial reporting. Accordingly, we express no such opinion.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audits provide a reasonable basis for our opinion.

/s/ MaloneBailey, LLP

www.malonebailey.com

We have served as the Company's auditor since 2019.

Houston, Texas

January 13, 2021

-F2-

| EXCEED WORLD, INC. | |||||

| CONSOLIDATED BALANCE SHEETS | |||||

| As of | As of | ||||

| September 30, 2020 | September 30, 2019 | ||||

| ASSETS | |||||

| Current Assets | |||||

| Cash and cash equivalents | $ | 19,370,086 | $ | 20,198,362 | |

| Marketable securities | 1,123,696 | 1,156,108 | |||

| Accounts receivable | 68,086 | 2,344 | |||

| Income tax recoverable | 140,725 | - | |||

| Prepaid expenses | 61,687 | 865,274 | |||

| Inventories | 1,243,228 | 626,142 | |||

| Due from related party | - | 92,524 | |||

| Other current assets | 40,553 | 453,291 | |||

| TOTAL CURRENT ASSETS | 22,048,061 | 23,394,045 | |||

| Non-current Assets | |||||

| Property, plant and equipment, net | 629,784 | 792,452 | |||

| Software, net | 1,267,150 | 1,051,398 | |||

| Operating lease right-of-use assets | 849,062 | - | |||

| Other intangible assets, net | 174,911 | 176,897 | |||

| Long-term prepaid expenses | 58,465 | 84,968 | |||

| Deferred tax assets | 132,239 | 134,936 | |||

| Long-term loan receivable from related party | - | 232,128 | |||

| Insurance funds | 201,377 | 91,161 | |||

| Security deposits | 269,367 | - | |||

| TOTAL NON-CURRENT ASSETS | 3,582,355 | 2,563,940 | |||

| TOTAL ASSETS | $ | 25,630,416 | $ | 25,957,985 | |

| LIABILITIES AND SHAREHOLDERS' EQUITY | |||||

| Current Liabilities | |||||

| Accounts payable | $ | 823,448 | $ | 1,226,111 | |

| Accrued expenses and other payables | 446,281 | 565,506 | |||

| Contingency liability | 574,484 | 409,428 | |||

| Income tax payable | 1,328 | 287,301 | |||

| Deferred income | 3,571,723 | 3,267,399 | |||

| Finance lease obligations, current | 30,263 | 28,683 | |||

| Operating lease liabilities, current | 363,651 | - | |||

| Due to related parties | 761,040 | 814,153 | |||

| Due to director | 741,248 | 741,133 | |||

| Other current liabilities | 650,896 | 735,926 | |||

| TOTAL CURRENT LIABILITIES | 7,964,362 | 8,075,640 | |||

| Non-current Liabilities | |||||

| Finance lease obligations, non-current | 97,472 | 98,964 | |||

| Operating lease liabilities, non-current | 445,443 | - | |||

| TOTAL NON-CURRENT LIABILITIES | 542,915 | 98,964 | |||

| TOTAL LIABILITIES | 8,507,277 | 8,174,604 | |||

| Shareholders' Equity | |||||

| Preferred stock ($0.0001 par value, 20,000,000 shares authorized; | |||||

| none issued and outstanding as of September 30, 2020 and 2019) | - | - | |||

| Common stock ($0.0001 par value, 500,000,000 shares authorized, | |||||

| 32,700,000 shares issued and outstanding as of September 30, 2020 and 2019) | 3,270 | 3,270 | |||

| Additional paid-in capital | 103,840 | 261,516 | |||

| Retained earnings | 15,802,004 | 16,764,282 | |||

| Accumulated other comprehensive income | 1,214,025 | 754,313 | |||

| TOTAL SHAREHOLDERS' EQUITY | 17,123,139 | 17,783,381 | |||

| TOTAL LIABILITIES AND SHAREHOLDERS' EQUITY | $ | 25,630,416 | $ | 25,957,985 | |

| The accompanying notes are an integral part of these consolidated financial statements. | |||||

-F3-

| EXCEED WORLD, INC. | |||||

| CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE INCOME (LOSS) | |||||

| Year Ended | Year Ended | ||||

| September 30, 2020 | September 30, 2019 | ||||

| Revenues | $ | 21,019,454 | $ | 28,393,548 | |

| Cost of revenues | 10,535,859 | 16,105,594 | |||

| Gross profit | 10,483,595 | 12,287,954 | |||

| Operating expenses | |||||

| Selling and distribution expenses | 1,009,721 | 1,908,950 | |||

| Administrative expenses | 10,342,023 | 10,853,331 | |||

| Total operating expenses | 11,351,744 | 12,762,281 | |||

| Loss from operations | (868,149) | (474,327) | |||

| Other income (expense) | |||||

| Other income | 321,667 | 1,270,353 | |||

| Other expenses | (344,660) | (845,289) | |||

| Change in fair value of marketable securities | (59,894) | 365,026 | |||

| Interest expenses | (2,717) | (1,513) | |||

| Total other income (expense) | (85,604) | 788,577 | |||

| Net income (loss) before tax | (953,753) | 314,250 | |||

| Income tax expense | 8,525 | 446,267 | |||

| Net loss | $ | (962,278) | $ | (132,017) | |

| Comprehensive income (loss) | |||||

| Net loss | $ | (962,278) | $ | (132,017) | |

| Other comprehensive income | |||||

| Foreign currency translation adjustment | 459,712 | 926,301 | |||

| Total comprehensive income (loss) | $ | (502,566) | $ | 794,284 | |

| Loss per common share | |||||

| Basic | $ | (0.03) | $ | (0.00) | |

| Diluted | $ | (0.03) | $ | (0.00) | |

| Weighted average common shares outstanding | |||||

| Basic | 32,700,000 | 32,700,000 | |||

| Diluted | 32,700,000 | 32,700,000 | |||

| The accompanying notes are an integral part of these consolidated financial statements. | |||||

-F4-

| EXCEED WORLD, INC. | |||||||||||

| STATEMENTS OF CHANGES IN SHAREHOLDERS’ EQUITY | |||||||||||

| ADDITIONAL | ACCUMULATED | ||||||||||

| COMMON STOCK | PAID-IN | OTHER COMPREHENSIVE | RETAINED | ||||||||

| NUMBER | AMOUNT | CAPITAL | INCOME (LOSS) | EARNINGS | TOTAL | ||||||

| Balance – September 30, 2018 (Restated) | 32,700,000 | $ | 3,270 | $ | 99,440 | $ | (171,988) | $ | 16,896,299 | $ | 16,827,021 |

| Disposal of subsidiary | - | - | 162,076 | - | - | 162,076 | |||||

| Net loss | - | - | - | - | (132,017) | (132,017) | |||||

| Foreign currency translation | - | - | - | 926,301 | - | 926,301 | |||||

| Balance – September 30, 2019 | 32,700,000 | $ | 3,270 | $ | 261,516 | $ | 754,313 | $ | 16,764,282 | $ | 17,783,381 |

| Forgiveness of loans made to a related party | - | - | (157,676) | - | - | (157,676) | |||||

| Net loss | - | - | - | - | (962,278) | (962,278) | |||||

| Foreign currency translation | - | - | - | 459,712 | - | 459,712 | |||||

| Balance – September 30, 2020 | 32,700,000 | $ | 3,270 | $ | 103,840 | $ | 1,214,025 | $ | 15,802,004 | $ | 17,123,139 |

| The accompanying notes are an integral part of these consolidated financial statements. | |||||||||||

-F5-

| EXCEED WORLD, INC. | |||||

| CONSOLIDATED STATEMENTS OF CASH FLOWS | |||||

| Year Ended | Year Ended | ||||

| September 30, 2020 | September 30, 2019 | ||||

| CASH FLOWS FROM OPERATING ACTIVITIES | |||||

| Net loss | $ | (962,278) | $ | (132,017) | |

| Adjustments to reconcile net loss to net cash used in operating activities: | |||||

| Depreciation and amortization | 786,519 | 1,482,474 | |||

| Loss (gain) on disposal of property, plant and equipment | 147,448 | (8,178) | |||

| Change in fair value of marketable securities | 59,894 | (365,026) | |||

| Loss (gain) on company owned life insurance policies | 172,665 | (1,106,958) | |||

| Deferred income taxes | 5,928 | 164,108 | |||

| Noncash lease expense | 463,575 | - | |||

| Changes in operating assets and liabilities: | |||||

| Accounts receivable | (64,234) | (2,018) | |||

| Income tax recoverable | (137,619) | 439,331 | |||

| Prepaid expenses | 162,452 | 118,102 | |||

| Inventories | (588,193) | (299,412) | |||

| Other current assets | 414,684 | (182,333) | |||

| Long-term prepaid expenses | 27,983 | (23,241) | |||

| Security deposits | (263,421) | - | |||

| Accounts payable | (423,681) | (3,513,357) | |||

| Accrued expenses and other payables | 206,198 | 539,697 | |||

| Income tax payable | (286,669) | 282,158 | |||

| Deferred income | 217,914 | (1,398,006) | |||

| Operating lease liabilities | (459,110) | - | |||

| Other current liabilities | (101,103) | (360,390) | |||

| Net cash used in operating activities | (621,048) | (4,365,066) | |||

| CASH FLOWS FROM INVESTING ACTIVITIES | |||||

| Collection of short-term loan receivable | 278,216 | 408,905 | |||

| Loan made to third party | (278,216) | - | |||

| Purchase of property, plant and equipment | (29,656) | (224,865) | |||

| Proceeds from disposal of property, plant and equipment | 22,409 | 8,178 | |||

| Purchase of intangible assets | (256,190) | (613,812) | |||

| Proceeds from sale of securities | - | 87,333 | |||

| Purchase of company-owned life insurance policies | (278,225) | (442,744) | |||

| Proceeds from company-owned life insurance policies | - | 1,460,173 | |||

| Collection from related party loans | 37,095 | - | |||

| Disposal of a subsidiary, net of cash disposed of | - | (79,876) | |||

| Net cash provided by (used in) investing activities | (504,567) | 603,292 | |||

| CASH FLOWS FROM FINANCING ACTIVITIES | |||||

| Repayment of finances lease obligations | (70,590) | (12,113) | |||

| Proceeds from related parties | - | 185,525 | |||

| Repayments to related parties and director | (106,068) | (58,723) | |||

| Net cash provided by (used in) financing activities | (176,658) | 114,689 | |||

| Net effect of exchange rate changes on cash | 473,997 | 1,107,692 | |||

| Net change in cash and cash equivalents | |||||

| Cash and cash equivalents - beginning of year | 20,198,362 | 22,737,755 | |||

| Net decrease in cash | (828,276) | (2,539,393) | |||

| Cash and cash equivalents - end of year | $ | 19,370,086 | $ | 20,198,362 | |

| NON-CASH INVESTING AND FINANCING TRANSACTIONS | |||||

| Equipment obtained in connection with finance lease | $ | 70,268 | $ | 84,675 | |

| Liabilities assumed in connection with purchase of intangible asset | $ | - | $ | 59,714 | |

| Operating right-of-use assets obtained in exchange for new operating lease liabilities | $ | 596,487 | $ | - | |

| Intangible assets transferred from prepaid expenses | $ | 600,946 | $ | - | |

| Forgiveness of loans made to a related party | $ | 157,676 | $ | - | |

| Operating expense paid by related parties and director | $ | 185,650 | $ | 405,835 | |

| SUPPLEMENTAL DISCLOSURES OF CASH FLOW INFORMATION | |||||

| Interest paid | $ | 2,705 | $ | - | |

| Income taxes paid | $ | 426,885 | $ | 1,908 | |

| The accompanying notes are an integral part of these consolidated financial statements. | |||||

-F6-

EXCEED WORLD, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

AS OF SEPTEMBER 30, 2020

NOTE 1 – ORGANIZATION, DESCRIPTION OF BUSINESS AND BASIS OF PRESENTATION

Exceed World, Inc. (the “Company”), was incorporated under the laws of the State of Delaware on November 25, 2014.

On September 26, 2018, e-Learning Laboratory Co., Ltd. (“e-Learning”), a direct wholly owned subsidiary of Force International Holdings Limited, which was incorporated in Hong Kong with limited liability (“Force Holdings”), entered into a share purchase agreement with Force Internationale Limited (“Force Internationale”), the holding company of Force Holdings, in which e-Learning agreed to sell and Force Internationale agreed to purchase 74.5% equity interest of the Company at a consideration of US$26,000.

On September 26, 2018, the same date, Force Internationale entered into a share purchase agreement with the Company, in which Force Internationale agreed to sell and the Company agreed to purchase 100% equity interest of Force Holdings. In consideration of the agreement, the Company issued 12,700,000 common stock at US$1 each to Force Internationale. The results of these transactions are that Force Internationale is an 84.4% owner of the Company and the Company is a 100% owner of Force Holdings (the “Reorganization”).

On December 6, 2018, the Company entered into a share contribution agreement (the “Agreement”) with Force Internationale. Under this Agreement, the Company transferred 100% of the equity interest of School TV Co., Ltd. ("School TV"), to Force Internationale without consideration. This Agreement was approved by the board of directors of the Company, Force Internationale and School TV. Upon the completion of the disposal, School TV was deconsolidated from the Company's consolidated financial statements.

As of September 30, 2020, the Company operates through our wholly owned subsidiaries, which are engaged in provision of the educational services through an internet platform called “Force Club”.

The Company has elected September 30th as its fiscal year end.

The accompanying unaudited financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America (“U.S. GAAP”). Results for the interim periods presented are not necessarily indicative of the results that might be expected for the entire fiscal year. When used in these notes, the terms "Company", "we", "us" or "our" mean the Company.

NOTE 2 - SIGNIFICANT ACCOUNTING POLICIES

PRINCIPLES OF CONSOLIDATION

The accompanying consolidated financial statements include the accounts of the Company and its subsidiaries. Inter-company accounts and transactions have been eliminated. The results of subsidiaries disposed during the respective periods are included in the consolidated statements of operations and comprehensive income up to the effective date of disposal.

| Name of Subsidiary | Place of Organization |

Percentage of Effective Ownership |

| Force International Holdings Limited (“Force Holdings”) | Hong Kong | 100% |

| e-Learning Laboratory Co., Ltd. (“e-Learning”) | Japan | 100% (*1) |

| e-Communications Co., Ltd. (“e-Communications”) | Japan | 100% (*2) |

(*1) Wholly owned subsidiary of Force Holdings

(*2) Wholly owned subsidiary of e-Learning

RECLASSIFICATIONS

Certain prior year amounts have been reclassified to conform to the current period presentation. These reclassifications had no impact on net earnings and financial position.

USE OF ESTIMATES

The presentation of financial statements and related disclosures in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosures of contingent assets and liabilities as the date of the financial statements and the reported amounts of revenue and expenses reported in those financial statements. Certain significant accounting policies that contain subjective management estimates and assumptions include those related to valuation allowance on deferred income tax, write-down in value of inventory, useful lives and impairment of long-lived assets and legal contingencies. The extent to which the COVID-19 pandemic may directly or indirectly impact our business, financial condition, and results of operations is highly uncertain and subject to change. Due to the high uncertainty of the evolving situation, the Company has limited visibility on the full impact brought upon by the COVID-19 pandemic and the related financial impact cannot be estimated at this time. Operating results in the future could vary from the amounts derived from management's estimates and assumptions.

RELATED PARTY TRANSACTION

A related party is generally defined as (i) any person that holds 10% or more of the Company’s securities and their immediate families, (ii) the Company’s management, (iii) someone that directly or indirectly controls, is controlled by or is under common control with the Company, or (iv) anyone who can significantly influence the financial and operating decisions of the Company. A transaction is considered to be a related party transaction when there is a transfer of resources or obligations between related parties.

Transactions involving related parties cannot be presumed to be carried out on an arm's-length basis, as the requisite conditions of competitive, free market dealings may not exist. Representations about transactions with related parties, if made, shall not imply that the related party transactions were consummated on terms equivalent to those that prevail in arm's-length transactions unless such representations can be substantiated.

CASH EQUIVALENTS

The Company considers all highly liquid investments with maturities of three months or less at the date of purchase as cash equivalents.

ACCOUNTS RECEIVABLE AND ALLOWANCE

Accounts receivable are recognized and carried at the original invoice amount less allowance for any uncollectible amounts. An estimate for doubtful accounts is made when collection of the full amount is no longer probable. Bad debts are recorded corresponding to the allowance when identified.

INVESTMENTS

The Company's investments in marketable securities are accounted for pursuant to ASC 321 and reported at their readily determinable fair values as quoted by market exchanges in the consolidated balance sheets with changes in fair value recognized in earnings.

The Company also has investments in corporate-owned life insurance policies to insure its CEO and key employees. These insurance policies are recorded at their cash surrender values in the consolidated balance sheets with change in the cash surrender value during the period recorded in earnings.

INVENTORIES

Inventories, consisting of mainly educational products accounted for using the weighted average method and health related products accounted for using the first-in, first-out method, are valued at the lower of cost and market value.

For the year ended September 30, 2020, 26% and 74% of the inventories of educational products were purchased from supplier A and B, respectively.

PROPERTY, PLANT AND EQUIPMENT

Property, plant and equipment are stated at cost less depreciation and impairment loss. Depreciation is calculated using the straight-line method or declining balance method at the following estimated useful life:

| Building | 47 years on straight-line method |

| Leasehold improvement | 10 years on straight-line method |

| Equipment | 2 to 15 years on declining balance method or straight-line method |

| Vehicle | 6 years on straight-line method |

Assets held under finance leases are depreciated over their expected useful lives on the same basis as owned assets.

INTANGIBLE ASSETS

Intangible assets consist of internal use software, membership and land.

The Company capitalizes certain costs related to obtaining or developing software for internal use. Costs incurred during the application development stage internally or externally are capitalized and amortized on a straight-line basis over the expected useful life of five years. The application development stage includes design of chosen path, software configuration and integration, coding, hardware installation and testing. Costs incurred during the preliminary project stage and post implementation-operation stage are expensed as incurred.

Membership and land have indefinite useful life, and the balance was $174,911 and $176,897 as of September 30, 2020 and 2019, respectively, included in other intangible assets.

IMPAIRMENT OF LONG-LIVED ASSETS

The carrying value of property, plant and equipment and intangible assets subject to depreciation and amortization is evaluated whenever events or changes in circumstances indicate that the carrying amount of the asset may not be recoverable. An impairment loss would be measured by the amount by which the carrying value of the asset exceeds the fair value of the asset.

-F7-

FOREIGN CURRENCY TRANSLATION

The Company maintains its books and records in its local currencies, Japanese YEN (“JPY”) , Hong Kong Dollars (“HK$”) and United States Dollars (“US$”), which are the functional currencies as being the primary currencies of the economic environment in which their operations are conducted. Transactions denominated in currencies other than the functional currency are translated into the functional currency at the exchange rates prevailing at the dates of the transaction. Monetary assets and liabilities denominated in currencies other than the functional currency are translated into the functional currency using the applicable exchange rates at the balance sheet dates. The resulting exchange differences are recorded in the consolidated statements of operations and comprehensive income.

The reporting currency of the Company is US$ and the accompanying consolidated financial statements have been expressed in US$. In accordance with ASC Topic 830-30, Translation of Financial Statement, assets and liabilities of the Company whose functional currency is not US$ are translated into US$, using the exchange rate on the balance sheet date. Revenues and expenses are translated at average rates prevailing during the period. Shareholders’ equity is translated at historical exchange rate at the time of transaction. The gains and losses resulting from translation of financial statements are recorded as a separate component of accumulated other comprehensive income within the consolidated statements of shareholders’ equity.

Translation of amounts from the local currency of the Company into US$1 has been made at the following exchange rates:

| September 30, 2020 | September 30, 2019 | ||

| Current JPY: US$1 exchange rate | 105.45 | 108.08 | |

| Average JPY: US$1 exchange rate | 107.83 | 110.05 | |

| Current HK$: US$1 exchange rate | 7.80 | 7.80 | |

| Average HK$: US$1 exchange rate | 7.80 | 7.80 |

REVENUE RECOGNITION

The Company operates and manages multilevel marketing (“MLM”) in operating its businesses as the Force Club Membership and generates revenues primarily by providing the rights to access the Company’s educational content and to recruit new members.

The Company recognizes revenue by applying the following steps in accordance with ASC 606 - Revenue from contracts with Customers. The Company recognizes revenue upon transfer of control of promised products or services to customers in an amount that reflects the consideration we expect to be entitled to receive in exchange for those products or services.

- Identification of the contract, or contracts, with a customer

- Identification of the performance obligations in the contract

- Determination of the transaction price

- Allocation of the transaction price to the performance obligations in the contract

- Recognition of revenue when (or as) we satisfy the performance obligation

Force Club Membership fee

Nature of operation

Our revenue generated from Force Club Membership arrangements accounted for substantially all of our revenues during the year ended September 30, 2020. Generally, the Company grants Force Club members the rights to access the Company’s educational content. There are two tiers of members, namely standard members and premium members.

The premium members are granted full access to the Company’s educational content and the right to recruit prospect customers to become the Company’s members. Each premium member needs to purchase a premium pack, containing promotional materials aiding the recruiting process, from the Company. The standard members are granted limited access to the Company’s educational content.

Revenue from the premium pack is recognized at a point in time upon delivery. Revenue from the right to access the Company’s educational content is recognized over a period of time ratably over the effective period.

The Company's chief operating decision make reviews results analyzed by customers and the analysis is only presented at the revenue level with no allocation of direct or indirect costs. The Company determines that it has only one operating segment. Consequently, the Company does not disaggregate revenue recognized from contracts with customers. Substantially all of the Company’s revenue was generated in Japan.

Contract asset and liability

Deferred income is recorded when consideration is received from a member prior to the goods were delivered or the access was granted. As of September 30, 2020 and 2019, the Company's deferred income was $3,571,723 and $3,267,399, respectively. During the year ended September 30, 2020, the Company recognized $3,267,399 of deferred income in the opening balance.

The Company does not have any contract asset.

ADVERTISING

Advertising costs are expensed as incurred and included in selling and distributions expenses. Advertising expenses were $1,009,721 and $1,908,950 for the years ended September 30, 2020 and 2019, respectively.

Advertising expenses were comprised of, but not limited to, sales events hosted for sales agents, exhibitions to promote and display company product offerings, signboards, and public relations activities.

EARNINGS PER SHARE

The Company computes basic and diluted earnings per share in accordance with ASC Topic 260, Earnings per Share. Basic earnings per share is computed by dividing net income by the weighted average number of common stock outstanding during the reporting period. Diluted earnings per share reflects the potential dilution that could occur if stock options and other commitments to issue common stock were exercised or equity awards vest resulting in the issuance of common stock that could share in the earnings of the Company.

The Company does not have any potentially dilutive instruments as of September 30, 2020 and 2019 and, thus, anti-dilution issues are not applicable.

INCOME TAXES

The provision for income taxes includes income taxes currently payable and those deferred as a result of temporary differences between the financial statements and the income tax basis of assets and liabilities. Deferred income tax assets and liabilities are measured using enacted income tax rates expected to apply to taxable income in the years in which those temporary differences are expected to be recovered or settled. The effect of a change in income tax rates on deferred income tax assets and liabilities is recognized in income or loss in the period that includes the enactment date. A valuation allowance is provided to reduce deferred tax assets to the amount of future tax benefit when it is more likely than not that some portion or all of the deferred tax assets will not be realized. Projected future taxable income and ongoing tax planning strategies are considered and evaluated when assessing the need for a valuation allowance. Any increase or decrease in a valuation allowance could have a material adverse or beneficial impact on the Company’s income tax provision and net income or loss in the period the determination is made.

The Company recognizes the tax benefit from an uncertain tax position claimed or expected to be claimed on a tax return only if it is more likely than not that the tax position will be sustained on examination by taxing authorities, based on the technical merits of the position. The tax benefits recognized in the financial statements from such a position are measured based on the largest benefit that has a greater than fifty percent likelihood of being realized upon ultimate settlement. Penalties and interest incurred related to underpayment of these uncertain tax positions are classified as income tax expense in the period incurred. No such penalties and interest incurred during the years ended September 30, 2020 and 2019.

LEASES

In February 2016, the FASB issued ASU 2016-02, Leases (together with all amendments subsequently issued thereto, “ASC Topic 842”). Under ASC 842, lessees will be required to recognize all qualified operating leases at the commencement date including a lease liability, which is a lessee’s obligation to make lease payments arising from a lease, measured on a discounted basis; and a right-of-use (ROU) asset, which is an asset that represents the lessee’s right to use, or control the use of, a specified asset for the lease term.

The standard was effective for the Company beginning October 1, 2019, with early adoption permitted. The Company adopted the standard on October 1, 2019 on a modified retrospective basis and will not restate comparable periods. The Company elected the package of practical expedients permitted under the transition guidance, which allows the Company to carry forward the historical lease classification, the assessment whether a contract is or contains a lease and initial direct costs for any leases that exist prior to adoption of the new standard. The Company also elected the practical expedient not to separate lease and non-lease components for certain classes of underlying assets and the short-term lease exemption for contracts with lease terms of 12 months or less. The Company recognizes lease expenses for such leases on a straight-line basis over the lease term. In addition, the Company elected the land easement transition practical expedient and did not reassess whether an existing or expired land easement is a lease or contains a lease if it has not historically been accounted for as a lease.

The initial lease liability is equal to the future fixed minimum lease payments discounted using the Company’s incremental borrowing rate, on a secured basis. The lease term includes option renewal periods and early termination payments when it is reasonably certain that the Company will exercise those rights. The initial measurement of the ROU asset is equal to the initial lease liability plus any initial direct costs and prepayments, less any lease incentives.

The primary impact of applying ASC Topic 842 is the initial recognition of approximately $652,000 of lease liabilities and corresponding right-of-use assets of approximately $696,000 on the Company’s consolidated balance sheet as of October 1, 2019, for leases classified as operating leases under ASC Topic 840, as well as enhanced disclosure of the Company’s leasing arrangements. There is no cumulative effect to retained earnings or other components of equity recognized as of October 1, 2019 and the adoption of this standard did not have a material impact on the presentation of the Company’s consolidated statement of operations and comprehensive income (loss) or consolidated statement of cash flows of the Company. The Company’s accounting treatment for its finance leases remains unchanged.

RECENT ACCOUNTING PRONOUNCEMENTS

In June 2016, the FASB issued ASU 2016-13, Financial Instruments – Credit Losses (Topic 326): Measurement of Credit Losses on Financial Instruments, which eliminates the probable recognition threshold for credit impairments. The new guidance broadens the information that an entity must consider in developing its expected credit loss estimate for assets measured either collectively or individually to include forecasted information, as well as past events and current conditions. There is no specified method for measuring expected credit losses, and an entity is allowed to apply methods that reasonably reflect its expectations of the credit loss estimate. ASU 2016-13 will be effective for the Company beginning on October 1, 2023. The Company is in the process of evaluating the impact of the adoption of this pronouncement on its consolidated financial statements.

In August 2018, the FASB issued ASU 2018-13, Fair Value Measurement (Topic 820) - Changes to the Disclosure Requirements for Fair Value Measurement, which modifies the disclosure requirements for fair value measurements by removing, modifying, or adding certain disclosures. ASU 2018-13 is effective for all entities for fiscal years, and interim periods within those fiscal years, beginning after December 15, 2019. The Company does not expect the adoption to have a material impact on its consolidated financial statements.

In December 2019, the FASB issued ASU 2019-12, Income Taxes (Topic 740): Simplifying the Accounting for Income Taxes (“ASU 2019-12”) as part of its overall simplification initiative to reduce costs and complexity of applying accounting standards. ASU 2019-12 removes certain exceptions from Topic 740, Income Taxes, including (i) the exception to the incremental approach for intra period tax allocation; (ii) the exception to accounting for basis differences when there are ownership changes in foreign investments; and (iii) the exception in interim period income tax accounting for year-to-date losses that exceed anticipated losses. ASU 2019-12 also simplifies GAAP in several other areas of Topic 740 such as (i) franchise taxes and other taxes partially based on income; (ii) transactions with a government that result in a step up in the tax basis of goodwill; (iii) separate financial statements of entities not subject to tax; and (iv) enacted changes in tax laws in interim periods. ASU 2019-12 is effective for public entities for annual reporting periods and interim periods within those years beginning after December 15, 2020, and early adoption is permitted. The Company is currently evaluating the impact of adopting ASU 2019-12 on its consolidated financial statements.

-F8-

NOTE 3 - FAIR VALUE MEASUREMENT

FASB ASC 820, Fair Value Measurements and Disclosures, ("ASC 820") defines fair value as the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. ASC 820 also establishes a fair value hierarchy that prioritizes the inputs used in valuation methodologies into three levels:

Level 1: Quoted prices in active markets for identical assets or liabilities.

Level 2: Significant other inputs that are directly or indirectly observable in the marketplace.

Level 3: Significant unobservable inputs which are supported by little or no market activity.

The Company considers the carrying amount of its financial assets and liabilities, which consist primarily of cash and cash equivalents, accounts receivable, income tax recoverable, inventories, prepaid expense s, other current assets, accounts payable, income tax payable, contingency liabilities, deferred income, accrued expenses and other payables, other current liabilities and current portion of operating and finance lease obligations approximate the fair value of the respective assets and liabilities as of September 30, 2020 and 2019 owing to their short-term or present value nature or present value of the assets and liabilities.

The following table presents information about the Company’s assets that are measured at fair value as of September 30, 2020 and 2019, and indicates the fair value hierarchy of the valuation.

| Quoted Prices in Active Markets for Identical Assets (Level 1) |

Significant Other Observable Inputs (Level 2) |

Significant Unobservable Inputs (Level 3) |

Total Balance | |||||

| Marketable Securities: | ||||||||

| Publicly held equity securities | ||||||||

| As of September 30, 2020 | $ | 1,123,696 | - | - | 1,123,696 | |||

| As of September 30, 2019 | $ | 1,156,108 | - | - | 1,156,108 |

NOTE 4 - INCOME TAXES

For the year ended September 30, 2020, the provision of income tax expense was $8,525, consisting of current portion of $2,597 and deferred portion of $5,928.

Japan

The Company conducts its major businesses in Japan and e-Learning and e-Communications (“Japanese Subsidiaries”) are subject to tax in this jurisdiction. As a result of its business activities, Japanese Subsidiaries file tax returns that are subject to examination by the local tax authority.

Japanese Subsidiaries are subject to a number of income taxes, which, in aggregate, represent a statutory tax rate approximately as follows:

| Company’s assessable profit | ||||||

| For the year ended September 30, | Up to JPY 4 million | Up to JPY 8 million | Over JPY 8 million | |||

| 2019 | 21.42% | 23.20% | 33.80% | |||

| 2020 | 21.59% | 23.40% | 34.11% | |||

Open tax years in Japan are five years. As of September 30, 2020, the Company’s earliest open tax year for Japanese income tax purposes is its fiscal year ended September 30, 2015. The Company's tax attributes from prior periods remain subject to adjustment.

The reconciliations of the Japanese statutory income tax rate and the Company’s effective income tax rate are as follows:

|

Year Ended September 30, 2020 |

Year Ended September 30, 2019 | |||

| Japanese statutory tax rate | 33.80% | 33.80% | ||

| Income tax difference under different tax jurisdictions | (2.53)% | 49.50% | ||

| Additional deduction allowed for tax | - | (9.58)% | ||

| Deferred tax adjustments | - | 59.83% | ||

| Effect of valuation allowance on deferred income tax assets | (24.52)% | - | ||

| Other adjustments | (7.64)% | 8.46% | ||

| Total | (0.89)% | $ | 142.01% |

Hong Kong

Force Holdings, a direct wholly owned subsidiary of the Company in Hong Kong, is engaged in investment holding. Hong Kong profits tax has been provided at the rate of 16.5% on the estimated assessable profit arising in Hong Kong.

No provision for the Hong Kong profits tax has been made as Force Holdings did not generate any estimated assessable profits in Hong Kong during the years ended September 30, 2020 and 2019.

Open tax year in Hong Kong is six years after the relevant year of assessment. This may be extended to ten years in the case of fraud of willful evasion of taxes. There are no provisions that govern the time limit for tax collection.

United States

Exceed World, Inc., which acts as a holding company on a non-consolidated basis, does not plan to engage any business activities and current or future loss will be fully allowed. For the years ended September 30, 2020 and 2019, Exceed World, Inc., as a holding company registered in the state of Delaware, has incurred net loss and, therefore, has no tax liability. The net deferred tax asset generated by the loss carry forward has been fully reserved.

The Company is a Delaware corporation that is subject to U.S. corporate income tax on its taxable income at a rate of up to 21% for taxable years beginning after December 31, 2017. Recent U.S. federal tax legislation, commonly referred to as the Tax Cuts and Jobs Act (the “2017 Act”), was signed into law on December 22, 2017. The 2017 Act significantly modified the U.S. Internal Revenue Code by, among other things, reducing the statutory U.S. federal corporate income tax rate from 35% to 21% for taxable years beginning after December 31, 2017; limiting and/or eliminating many business deductions; migrating the U.S. to a territorial tax system with a one-time transition tax on a mandatory deemed repatriation of previously deferred foreign earnings of certain foreign subsidiaries; subject to certain limitations, generally eliminating U.S. corporate income tax on dividends from foreign subsidiaries; and providing for new taxes on certain foreign earnings. Taxpayers may elect to pay the one-time transition tax over eight years or in a single lump sum.

The 2017 Act also includes provisions for a new tax on the Global Intangible Low-taxed Income (“GILTI”) effective for tax years of foreign corporations beginning after December 31, 2017. The GILTI provisions impose a tax on foreign income in excess of a deemed return on tangible assets of controlled foreign corporations (“CFCs”), subject to the possible use of foreign tax credits and a deduction equal to 50 percent to offset the income tax liability, subject to some limitations. The Company elected to account for GILTI tax in the period the tax is incurred, and no provision is made during the year ended September 30, 2020.