Attached files

Investor Presentation December

2020 Investor

Presentation January 2021 Driving Value to Dermatology Partners Matching Patients with Clinics Exhibit 99.3

Safe Harbor Statement This presentation includes “forward-looking statements” within the meaning of the

Private Securities Litigation Reform Act of 1995 that are subject to risks, uncertainties and other factors. All statements other than statements of historical fact are statements that are deemed to be forward-looking statements, including

any statements of the plans, strategies and objectives of management for future operations, any statements regarding revenue growth, ability to develop social media marketing campaigns, product development, product extensions, product

integration or product marketing, the Company’s ability to develop a business for home-based treatment of skin diseases, any statements regarding continued compliance with government regulations, changing legislation, insurance or regulatory

environments; any statements of expectation or belief and any statements of assumptions underlying any of the foregoing; any risks and uncertainties related to successfully integrating the products and employees of the Company, as well as the

ability to ensure continued regulatory compliance, performance and/or market growth and any impact from the length and severity of the COVID-19 pandemic. These risks, uncertainties and other factors, and the general risks associated with the

businesses of the Company described in the reports and other documents filed with the SEC, could cause actual results to differ materially from those referred to, implied or expressed in the forward-looking statements. The Company cautions

readers not to rely on these forward-looking statements. All forward-looking statements are based on information currently available to the Company and are qualified in their entirety by this cautionary statement. The Company anticipates that

subsequent events and developments will cause its views to change. The information contained in this presentation speaks as of the date hereof and the Company has and undertakes no obligation to update or revise these forward-looking

statements, whether as a result of new information, future events or otherwise. 2

A Win-Win-Win CompanyFor patients: safest, most effective treatment, no side effectsFor clinics: stable

increased revenue baseFor payers: the least expensive treatment availableLarge Market Opportunity 31 Million lives in the U.S.: $6 Billion annual revenue1Excimer Treatment modality use growing > 25% per year2Reimbursement: 3 unique CPT codes

Unique and Proven Business ModelProviding “business in a box” for dermatology practicesGrowing Install base: low hanging fruitDriving domestic + OUS recurring revenue model 3

Large Unmet Need in Common and Chronic Dermatologic Conditions 4 ATOPIC DERMATITIS

PSORIASIS VITILIGO PSORIASIS: Autoimmune disease that causes the skin to regenerate faster than normal rates characterized by red, itchy scaly patches (65% Mild; 25% Moderate; 10% Severe)~8 Million patients in the U.S.3 VITILIGO:

Autoimmune condition due to a loss of melanocytes characterized by patches of skin losing its pigment~5 Million patients in the U.S.4 ATOPIC DERMATITIS: Inflammatory condition characterized by red and itchy skin that flares-up periodically~18

Million patients in the U.S.5

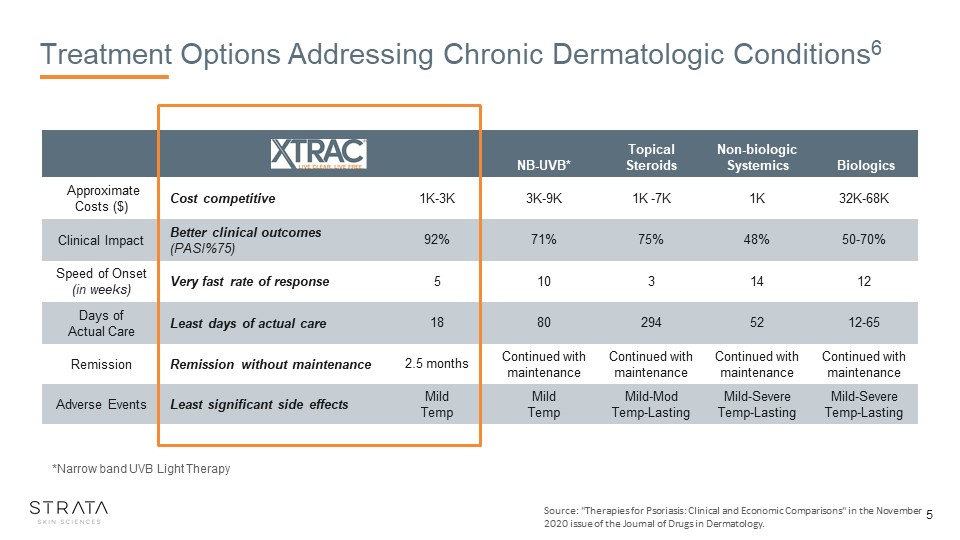

Treatment Options Addressing Chronic Dermatologic Conditions6 5 XTRAC NB-UVB* Topical

Steroids Non-biologic Systemics Biologics Approximate Costs ($) Cost competitive 1K-3K 3K-9K 1K -7K 1K 32K-68K Clinical Impact Better clinical outcomes (PASI%75) 92% 71% 75% 48% 50-70% Speed of Onset (in weeks) Very fast

rate of response 5 10 3 14 12 Days of Actual Care Least days of actual care 18 80 294 52 12-65 Remission Remission without maintenance 2.5 months Continued withmaintenance Continued withmaintenance Continued

withmaintenance Continued withmaintenance Adverse Events Least significant side effects MildTemp MildTemp Mild-ModTemp-Lasting Mild-SevereTemp-Lasting Mild-SevereTemp-Lasting *Narrow band UVB Light Therapy Source: "Therapies for

Psoriasis: Clinical and Economic Comparisons" in the November 2020 issue of the Journal of Drugs in Dermatology.

XTRAC: A True Partnership – A Complete Business Solution 6 Clinical Support Reimbursement

Support Call Center Support Field Service Support Consumables and Parts Laser Upgrades Co-pay Support DTC Marketing

Excimer Laser Technology for Dermatology Indications 7 #1 Targeted Therapy Prescribed by

Dermatologists FDA approved + established CPT codes150+ Peer-reviewed clinical studies2000+ device installed based, WW20+ million treatments performed WWExclusive license for treating Vitiligo Best-in-class Excimer TREATMENT

Re-established unique and proven strategic model to expand + drive sustainable growth

8 Leveraging a strong foundation to support fundamental growth initiatives Executing on direct-to-consumer strategy + recurring revenue model to drive growth Expanding installed base with comebacks and new PE-backed derm clinic

groups Targeting accretive acquisitions to grow platform portfolio 8

9 After 4 tx After 2 tx Baseline Clinical Protocol – 6.2 treatments to PASI 75 Beam of UVB

light applied to the affected area PASI - A 75% reduction in the Psoriasis Area and Severity Index (PASI) score (PASI 75) is the current benchmark of primary endpoints for most clinical trials of psoriasis XTRAC: The treatment for

Psoriasis Promotes immunosuppression UVB light induces apoptosis of the keratinocytes and T cells in the dermis Induces alterations in cytokine profile XTRAC: Psoriasis

XTRAC: Vitiligo 10 Beam of UVB light applied to the affected area XTRAC: The solution for

Vitiligo Results in re-pigmentation UVB light reduces the immune system’s attack on the melanocytes Simple, safe, effective + long-lastingExcimer laser Baseline After 18 tx After 29 tx Exclusive license for treatment of Vitiligo using

Excimer laser

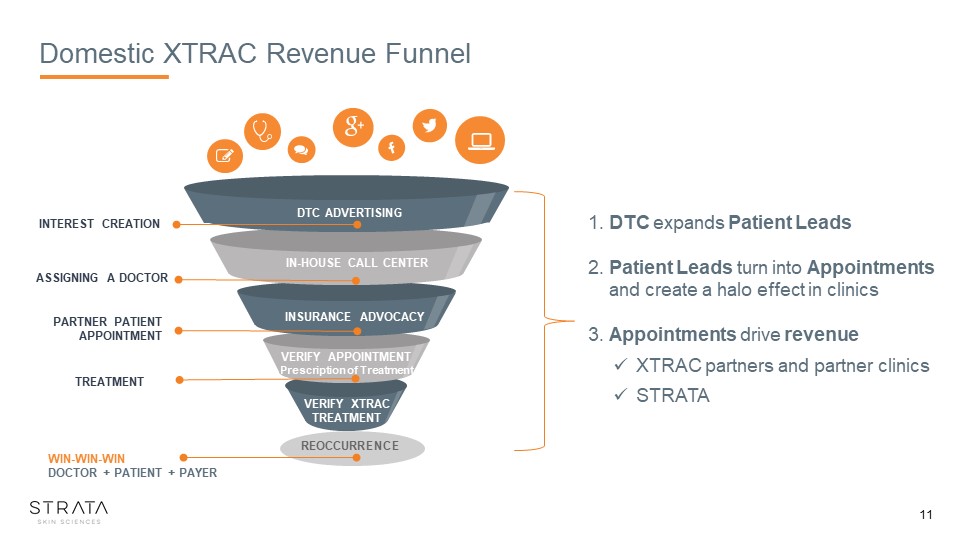

Domestic XTRAC Revenue Funnel 11 REOCCURRENCE DTC

ADVERTISING ASSIGNING A DOCTOR PARTNER PATIENTAPPOINTMENT TREATMENT WIN-WIN-WIN DOCTOR + PATIENT + PAYER INTEREST CREATION IN-HOUSE CALL CENTER INSURANCE ADVOCACY VERIFY XTRACTREATMENT VERIFY APPOINTMENTPrescription

of Treatment 1. DTC expands Patient Leads 2. Patient Leads turn into Appointments and create a halo effect in clinics3. Appointments drive revenueXTRAC partners and partner clinicsSTRATA

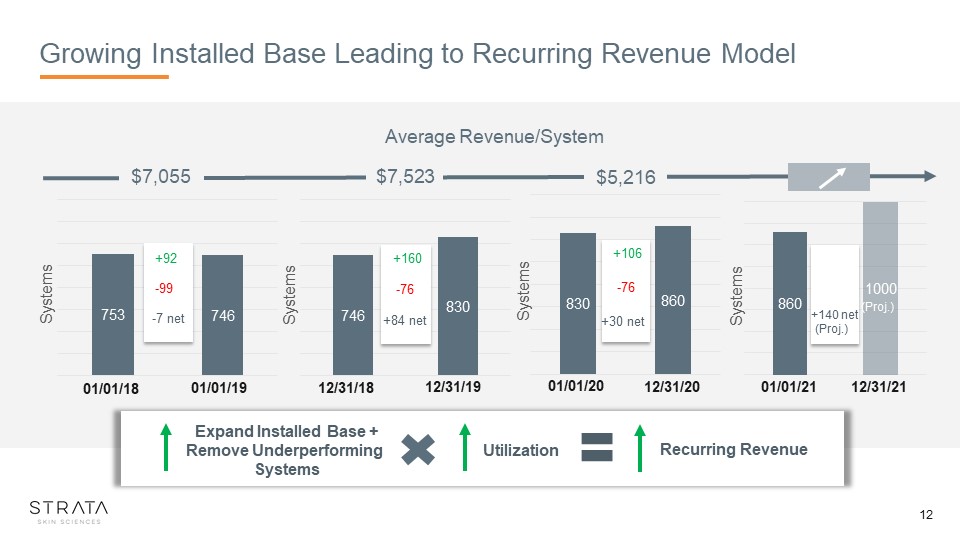

Growing Installed Base Leading to Recurring Revenue Model 12 01/01/18 +92 -99 -7 net Systems

01/01/19 12/31/18 12/31/19 +160 -76 +84 net Systems 12/31/20 01/01/20 +106 -76 +30 net Systems Average Revenue/System $7,055 $7,523 $5,216 Expand Installed Base +Remove Underperforming

Systems Utilization Recurring Revenue (Proj.) +140 net(Proj.) Systems 12/31/21 01/01/21

21% New Patient Growth in 2019; 86% Covered by Insurance1 196% of Psoriasis and 76% of Vitiligo patients

had XTRAC as a covered insurance benefit 2New Patients captured in STRATA reimbursement system 13 21%

Domestic Install Base Growth Drivers 832 1,962 251* XTRAC Partners Group Clinics As of

12/31/20 As of 12/31/19 1,962 clinics owned by 49 roll-up groups251 (13%) of which are XTRAC partnersSigned strategic expansion agreements with major groups Expansion into group clinic roll ups 300-400 clinics own Excimer lasers

Conversion to XTRAC partnership leads to immediate revenue15 Comebacks in 2018 (4 in 2017)19 Comebacks in 201923 Comebacks in 2020 Comebacks 14 * Combination of new XTRAC placements and Clinic acquisitions 820 1,673 221* 746 1,200

86* As of 12/31/18 XTRAC Growth in Groups

Domestic Market: Installed Base – Sales and Service Engine Overview832 Partner XTRAC Clinics160+ Sold

XTRAC5 Regions26 Sales Territories15 Field Service TechsIn-House Call Center to Qualify LeadsOnly One Competitor in U.S. 15 Territories color coded

International Market: Installed Base Strategic Growth TargetsMajor Markets: China, Japan, Saudi

Arabia, S. KoreaInsurance covered in most marketsUsage/device higher than domestic market1,300 OUS devices sold and in servicePlacement recurring revenue model agreement: Executed for South Korea (July 2019)Placement recurring revenue model

agreement: Executed for Japan (October 2020)28 International partner XTRAC clinics (up from 10 in

2019) 16

Partner Academic Institutions 17

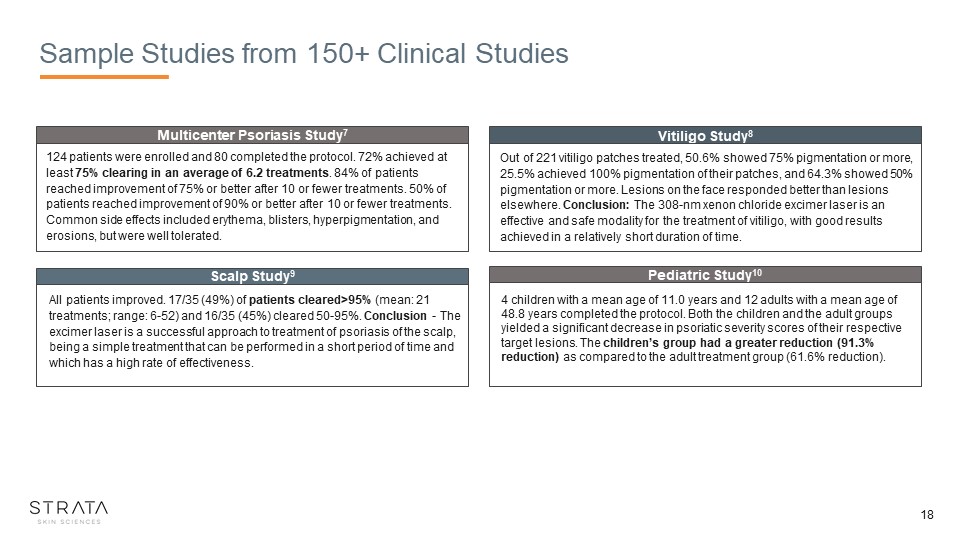

Multicenter Psoriasis Study7 Scalp Study9 124 patients were enrolled and 80 completed the

protocol. 72% achieved at least 75% clearing in an average of 6.2 treatments. 84% of patients reached improvement of 75% or better after 10 or fewer treatments. 50% of patients reached improvement of 90% or better after 10 or fewer treatments.

Common side effects included erythema, blisters, hyperpigmentation, and erosions, but were well tolerated. All patients improved. 17/35 (49%) of patients cleared>95% (mean: 21 treatments; range: 6-52) and 16/35 (45%) cleared 50-95%.

Conclusion - The excimer laser is a successful approach to treatment of psoriasis of the scalp, being a simple treatment that can be performed in a short period of time and which has a high rate of effectiveness. Sample Studies from 150+

Clinical Studies Vitiligo Study8 Out of 221 vitiligo patches treated, 50.6% showed 75% pigmentation or more, 25.5% achieved 100% pigmentation of their patches, and 64.3% showed 50% pigmentation or more. Lesions on the face responded better

than lesions elsewhere. Conclusion: The 308-nm xenon chloride excimer laser is an effective and safe modality for the treatment of vitiligo, with good results achieved in a relatively short duration of time. Pediatric Study10 4 children

with a mean age of 11.0 years and 12 adults with a mean age of 48.8 years completed the protocol. Both the children and the adult groups yielded a significant decrease in psoriatic severity scores of their respective target lesions. The

children’s group had a greater reduction (91.3% reduction) as compared to the adult treatment group (61.6% reduction). 18

Home by XTRAC Solution: At-home Treatment Option for Patients 19 In-house Call Center Access

to Providers Reimbursement Team At-home, insurance-reimbursed treatment option for patients with Vitiligo, Psoriasis + Atopic Dermatitis who do not qualify for in-office treatments Use in-house services to fulfill + support a comprehensive

patient journey Leverage existing DTC advertisingExpand with existing leadsMinimal cost to launchExpected to contribute to revenue and profitability in 2021

Providing Comprehensive Services on Patient Journey 20 1 2 3 4 5 2019 - 40,000+ XTRAC DTC

leads identified suitable for in-home treatment 6 Identify patients with needs Refer patients to medical providers for telehealth visits Obtain a prescription for Home by XTRAC solution when appropriate Confirm DME insurance

benefits Deliver Home by XTRAC, provide training Collect payment from insurance payers

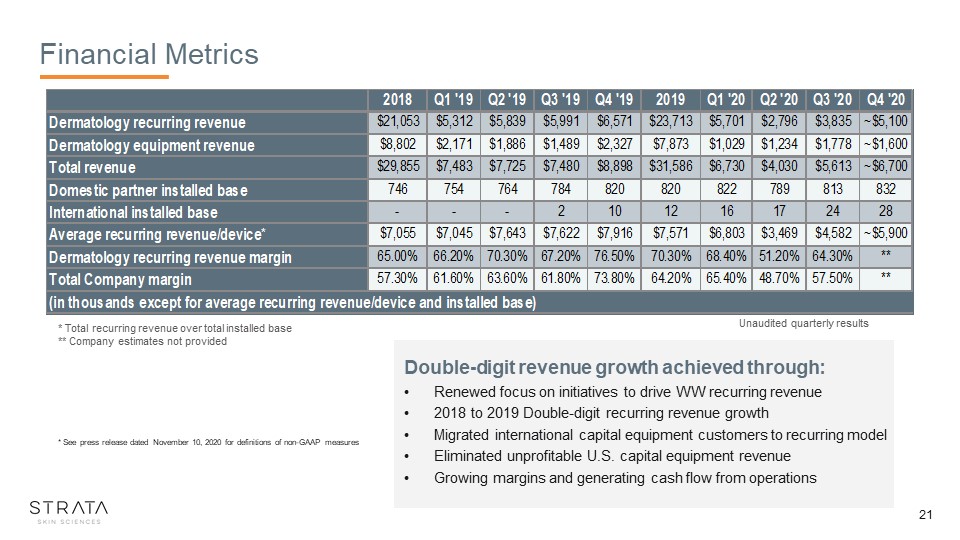

Financial Metrics 21 * Total recurring revenue over total installed base** Company estimates not

provided Unaudited quarterly results Double-digit revenue growth achieved through:Renewed focus on initiatives to drive WW recurring revenue2018 to 2019 Double-digit recurring revenue growthMigrated international capital equipment customers

to recurring modelEliminated unprofitable U.S. capital equipment revenueGrowing margins and generating cash flow from operations * See press release dated November 10, 2020 for definitions of non-GAAP measures

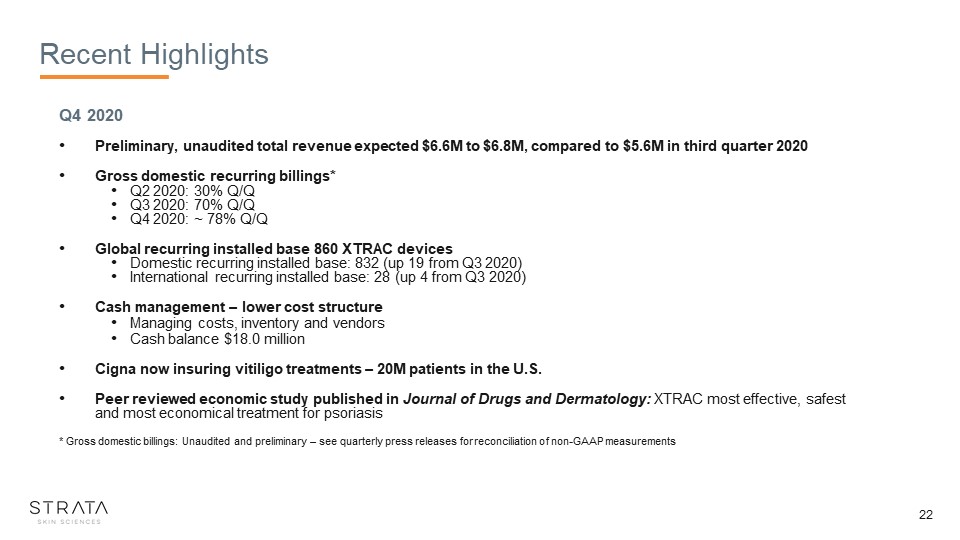

Recent Highlights Q4 2020Preliminary, unaudited total revenue expected $6.6M to $6.8M, compared to $5.6M

in third quarter 2020Gross domestic recurring billings*Q2 2020: 30% Q/QQ3 2020: 70% Q/QQ4 2020: ~ 78% Q/QGlobal recurring installed base 860 XTRAC devicesDomestic recurring installed base: 832 (up 19 from Q3 2020)International recurring

installed base: 28 (up 4 from Q3 2020)Cash management – lower cost structure Managing costs, inventory and vendorsCash balance $18.0 millionCigna now insuring vitiligo treatments – 20M patients in the U.S.Peer reviewed economic study published

in Journal of Drugs and Dermatology: XTRAC most effective, safest and most economical treatment for psoriasis* Gross domestic billings: Unaudited and preliminary – see quarterly press releases for reconciliation of non-GAAP measurements 22

STRATA Key Investment Takeaways 23 Differentiated Therapy providing a Win-Win-Win for Patients +

Clinics + Payers Addressing a Large Unmet Need + Growing Market Proven Business Model to Expand + Achieve Sustainable Growth

Investor Presentation December

2020 Thank

You

Investor Presentation December

2020 Appendix

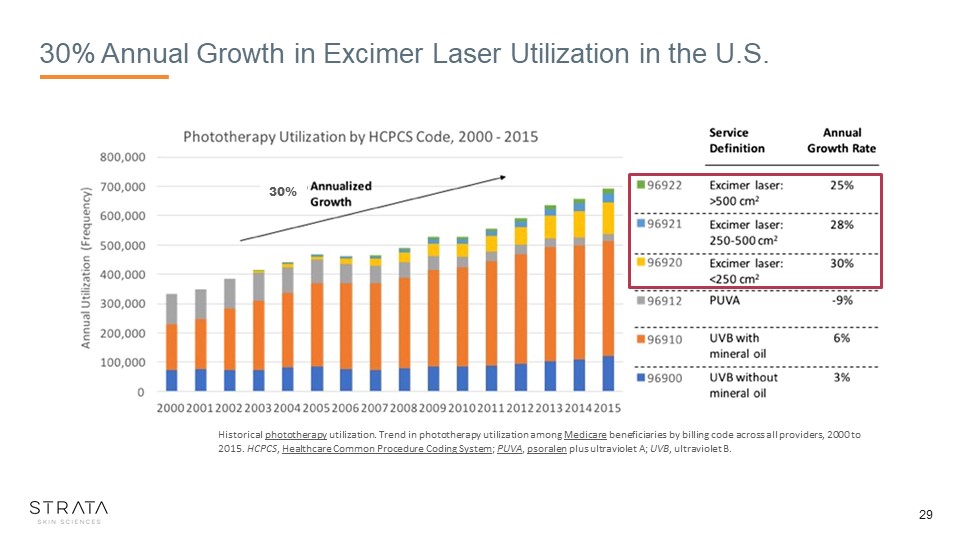

Footnotes Company estimatesHistorical phototherapy utilization. Trend in phototherapy utilization among

Medicare beneficiaries by billing code across all providers, 2000 to 2015. HCPCS, Healthcare Common Procedure Coding System; PUVA, psoralen plus ultraviolet A; UVB, ultraviolet B.National Eczema AssociationThe Vitiligo FoundationNational

Psoriasis Foundation"Therapies for Psoriasis: Clinical and Economic Comparisons" in the November 2020 issue of the Journal of Drugs in Dermatology Multicenter Psoriasis Study - Feldman SR, Mellen BG, Housman TS, Fitzpatrick RE, Geronemus RG,

Friedman PM, Vasily DB, Morison WL. Efficacy of the 308-nm excimer laser for treatment of psoriasis: Results of a multicenter study. J Am Acad of Dermatol; vol. 46, no. 6, June 2002, pp. 900-906 Vitiligo Study - Suhail Hadi, Patricia Tinio,

Khalid Al-Ghaithi, Haitham Al-Qari, Mohammad Al-Helalat, Mark Lebwohl, and James Spencer. Photomedicine and Laser Surgery. Treatment of Vitiligo Using the 308-nm Excimer Laser. Jun 2006.ahead of printhttp://doi.org/10.1089/pho.2006.24.354Scalp

Study - Morison WL, Atkinson DF and Werthman L. Effective treatment of scalp psoriasis using the excimer (308nm) laser. Photodermatol Photoimmunol Photomed 2006; 22: 181-183Pediatric Study - Pahlajani N, Katz BJ, Lonzano AM, Murphy F and

Gottlieb A. Comparison of the Efficacy and Safety of the 308nm Excimer laser for the Treatment of Localized Psoriasis in Adults and in Children: A Pilot Study. Pediatric Dermatology Vol. 22 No. 2, March/April 2005, pp. 161-165 26

(As of November 10, 2020) * Does not include 150K warrants that have a weighted average exercise price

of $5.60 as of September 30, 2020 of which 130K expired December 2020* Does not include 4.9M options that have a weighted average exercise price of $1.90 as of September 30, 2020 Cap Table - Shares and Share Equivalents 27 Common stock

outstanding* 33.8M

Additional Creative 28 https://youtu.be/LbmTKkN0Aq4

29 Historical phototherapy utilization. Trend in phototherapy utilization among Medicare beneficiaries

by billing code across all providers, 2000 to 2015. HCPCS, Healthcare Common Procedure Coding System; PUVA, psoralen plus ultraviolet A; UVB, ultraviolet B. 30% 30% Annual Growth in Excimer Laser Utilization in the U.S.

Source: Findings From the National Psoriasis Foundation Surveys, 2003-2011 (n=5604) Source: Real-world

health outcomes study sponsored by Eli Lilly (n=2200) Phototherapy has Highest Patient Perceived Treatment Effectiveness 30

Leads, Appointments, RDX

Charts 2015 2016 2017 2018 2019 2020 Leads 36,473 21,296 7,269 22,213 47,911 21,387 Appointments 10,032 6,524 2,563 3,856 5,924 2,609 RDX Charts 26,237 23,481 18,747 18,107 21,989 14,440 31

Total Calls in Call Center 32

XTRAC Adds (Delegated) Recurring Revenue Driver for its Partners Treatment Patient Type Reimbursement

Details Annual Revenue per Patient Can be delegated** XTRAC Mild / moderate / severe CPT Code 96920-96922 ($168-$251) average $186; 16 tx/course (2/yr) and Office Visit -$70 (2/Yr) $6,092 Phototherapy* Moderate / severe Office visit

- $70 (2/yr) $140 X Biologics Moderate / severe Office visit - $70 (6/yr) $420 X Systemics Moderate / severe Office visit - $70 (3/yr) $210 X Topicals Mild / moderate Office visit - $70 (3/yr) $210 X 33 CPT

CODE Description 2019 National AverageMedicare Payment Rate 96920 Laser treatment for inflammatory skin diseases, (psoriasis); total area less than 250 sq cm $167.22 96921 Laser treatment for inflammatory skin diseases, (psoriasis);

total area between 250 – 500 sq cm $183.44 96922 Laser treatment for inflammatory skin diseases, (psoriasis); total area greater than 500 sq cm $249.03 Number of Treatments / Weeks 20 30 # of Weeks / Year 48 48 Total # of

Treatments / Year 960 1,440 Average Revenue Per Treatment $186 $186 Physician Gross Revenue (Annual) $178,485 $267,728 *Phototherapy Center Revenue – CPT Code 96910 $40 per tx; 30 tx/course (2/yr) - $2,400**Subject to state

legislation 33

How XTRAC Works for Offices: $250 Revenue in Less than 7 Minutes Established CPT Codes 2019 National

Medicare Average Rate 96920 - $167.2296921 - $183.4496922 - $249.03 34

Continuous Technology Investment and Business Growth 35 510 (K) FDA

Approval AL-7000 Ultra Velocity 400 Velocity 700 Velocity 7 Series S3 2000 2005 2008 2010 2014 2018 CPT code Approval DTC platform creation 510 (K) FDA Approval (MMD)* Full Insurance

Reimbursement 2012 *MMD tip is a diagnostic accessory for XTRAC used in optimal therapeutic dose (OTD) protocol that helps patients achieve Optimal Clinical Outcomes leading to increased Patient Retention

Source: National Psoriasis Foundation XTRAC a Preferred Treatment for 90% of Psoriasis Patients (<10%

BSA) 36