Attached files

| file | filename |

|---|---|

| 8-K - 8-K - VERINT SYSTEMS INC | vrnt-20210111.htm |

1 January 2021 Investor Presentation

2 Disclaimers Forward Looking Statements This presentation contains "forward-looking statements," including statements regarding expectations, predictions, views, opportunities, plans, strategies, beliefs, and statements of similar effect relating to Cognyte Software Ltd. These forward-looking statements are not guarantees of future performance and they are based on management's expectations that involve a number of known and unknown risks, uncertainties, assumptions, and other important factors, any of which could cause our actual results to differ materially from those expressed in or implied by the forward-looking statements. The forward-looking statements contained in this presentation are made as of the date of this presentation and, except as required by law, Cognyte assumes no obligation to update or revise them, or to provide reasons why actual results may differ. For a more detailed discussion of how these and other risks, uncertainties, and assumptions could cause Cognyte’s actual results to differ materially from those indicated in its forward- looking statements, see Cognyte’s filings with the Securities and Exchange Commission. Projections This presentation contains projected financial information with respect to Cognyte. Such projected financial information constitutes forward-looking information, and is for illustrative purposes only and should not be relied upon as necessarily being indicative of future results. The assumptions and estimates underlying such financial forecast information are inherently uncertain and are subject to a wide variety of significant business, economic, competitive and other risks and uncertainties. See “Forward-Looking Statements” above. Actual results may differ materially from the results contemplated by the financial forecast information contained in this presentation, and the inclusion of such information in this presentation should not be regarded as a representation by any person that the results reflected in such forecasts will be achieved. Non-GAAP Financial Measures This presentation includes financial measures which are not prepared in accordance with generally accepted accounting principles (“GAAP”), including certain constant currency measures. For a description of these non-GAAP financial measures, including the reasons management uses each measure, and reconciliations of these non-GAAP financial measures to the most directly comparable financial measures prepared in accordance with GAAP, please see the appendices to this presentation as well as the GAAP to non-GAAP reconciliation found under the Investor Relations tab on Cognyte’s website Cognyte.com.

3 Agenda Introduction Solutions Overview Market Opportunity Growth Strategy Financial Summary

4 Introduction

5 Today’s speakers Elad Sharon Chief Executive Officer David Abadi Chief Financial Officer

6 Leader in security analytics software WHO WE ARE + A global leader in security analytics software that empowers governments and enterprises with Actionable Intelligence for a safer world WHAT WE DO + Help security organizations accelerate security investigations to identify, neutralize, and prevent national security, business continuity and cyber threats HOW WE DO IT + Fuse and analyze disparate data at scale powered by an open modular software platform and a broad portfolio of security analytics software solutions WHY WE ARE UNIQUE + Track record of solving complex security challenges with cutting edge analytics software + Unparalleled domain experience working with 1,000+ security organizations globally

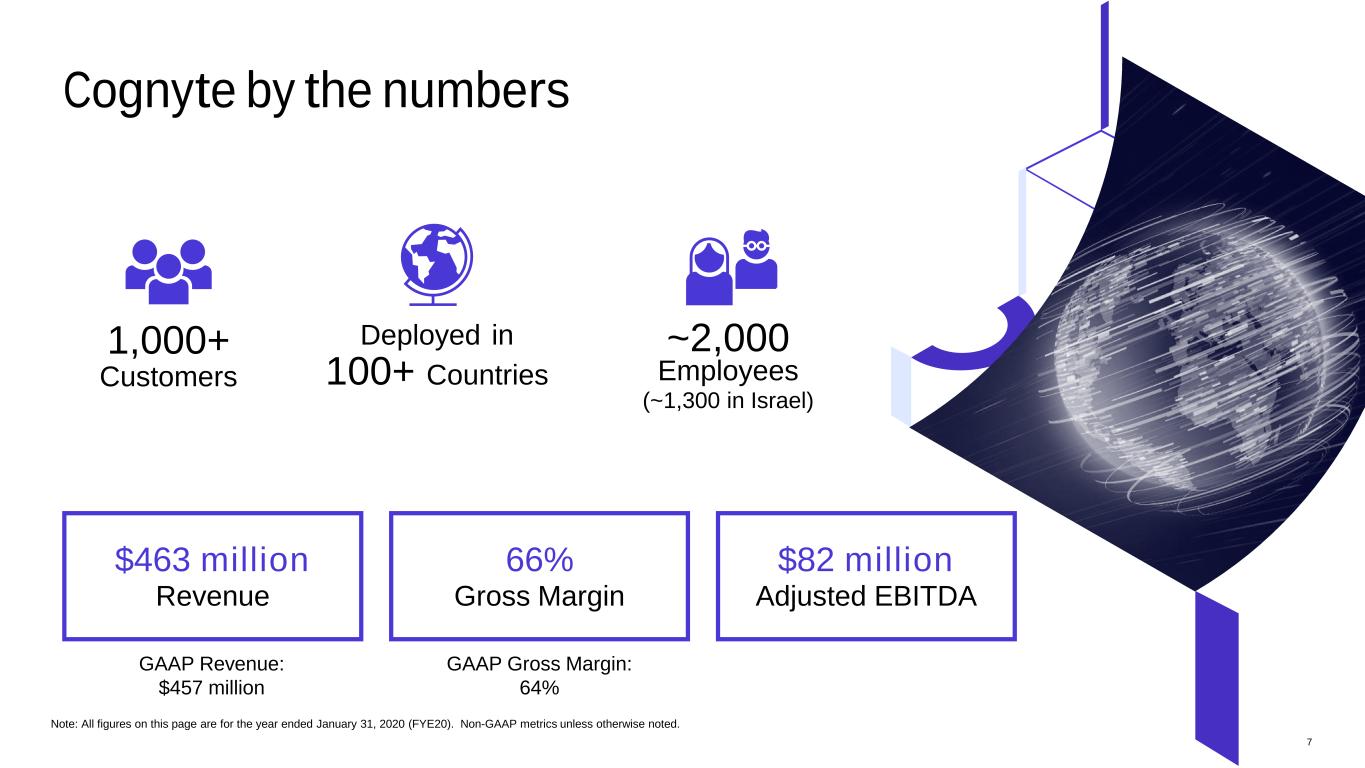

7 Cognyte by the numbers Note: All figures on this page are for the year ended January 31, 2020 (FYE20). Non-GAAP metrics unless otherwise noted. 1,000+ Customers Deployed in 100+ Countries ~2,000 Employees (~1,300 in Israel) $463 million Revenue 66% Gross Margin $82 million Adjusted EBITDA GAAP Revenue: $457 million GAAP Gross Margin: 64%

8 Key investment highlights Leader in security analytics software Seasoned management team with strong track record Large addressable market with favorable industry trends Multiple vectors drive strong top-line profitable growth Cutting edge security analytics and AI technology Strong relationships across a diverse customer base

9 Market Opportunity

10 Market trends driving demand for security analytics Security challenges are becoming more complex Data is growing rapidly and is highly fragmented across organizations Security organizations increasingly adopt open analytics software

11 Large and growing security analytics software market ~$30bn Addressable Market ~10% growth per year Criminal Investigations National Security Cyber Intelligence People safety and asset protection Representative Government and Enterprise Use Cases Note: Sources include International Monetary Fund, IDC, CGNT management estimates

12 Buyers of security analytics and their growing challenges National security and Enterprise organizations Head of Investigation Head of Operations CIO Operational Security Challenges Changing Technology Dynamics Elongated and inconclusive investigations Mission critical real time intelligence Timely threat detection and mitigation Connecting organizational silos Managing data at scale Fusing data across silos Generating real-time insights Producing high quality analysis

13 Solutions Overview

14 Our open analytics software Powered by an open analytics platform Broad portfolio designed to address complex security challenges ANALYTICS PLATFORM Operational Intelligence Real Time Insights Advanced data fusion technologies Data analytics engines Artificial intelligence and machine learning models Intuitive and efficient workflows and visualization Full governance and security protection Investigations Speed and Resolution Threat Intelligence Detect and Mitigate

15 Generating Actionable Intelligence through data science Example: Predictive Analytics Provides answers to critical security questions CLASSIFICATION associate data in categories based on learning from historical data FORECASTING predicting values based on past learning OUTLIERS detecting anomaly within datasets TIME SERIES predicting behavior based on prior data RELATIONSHIPS relations between connected entities What is the suspect’s next move? How can I identify threats before they unfold? Where can I find evidence to accelerate the investigation?

16 Cognyte in action – Government use case Head of Investigation The Investigation Challenge A national security organization received a lead to a suspect, previously unknown to them, potentially connected to an extremist group The Cognyte Solution Applying Cognyte predictive analytics, the investigation was able to connect the suspect to a terror funding network Tangible Customer Value Cognyte’s platform connected the dots and the investigations were concluded faster than ever before resulting in tangible evidence and multiple arrests

17 Cognyte in action – Enterprise use case The Security Threat A world leading semiconductor company spent significant time and resources to safeguard their intellectual property and critical assets The Cognyte Solution Deploying Cognyte analytics in their SOC, their security analysts saw a dramatic increase in their ability to detect anomalies and investigate potential insider threats Tangible Customer Value Leveraging real time insights from Cognyte analytics the company was able to drive mitigating action and avoid significant losses related to IP theft and reputational damage CIOHead of Operations

18 Strong differentiation in the security analytics market Big Data Analytics Vendors Point Solution Vendors Home Grown Development Government and Enterprise Focus Scalability Security Domain Expertise and Focus Breadth of Security Challenges Addressed Real-Time Analytics Predictive Analytics Anomaly Detection Analytics Easy to Update/ Maintain * * * Representative competitors

19 Cognyte’s differentiation - why we win Technology Strength Market Leadership + Strong analytics software, open and highly interoperable + Real time actionable insights + Broad portfolio addresses a wide range of security challenges + 1,000+ customers in 100+ countries + Successful track record working with governments and enterprises + Deep domain expertise built through collaboration with customers

20 Growth Strategy

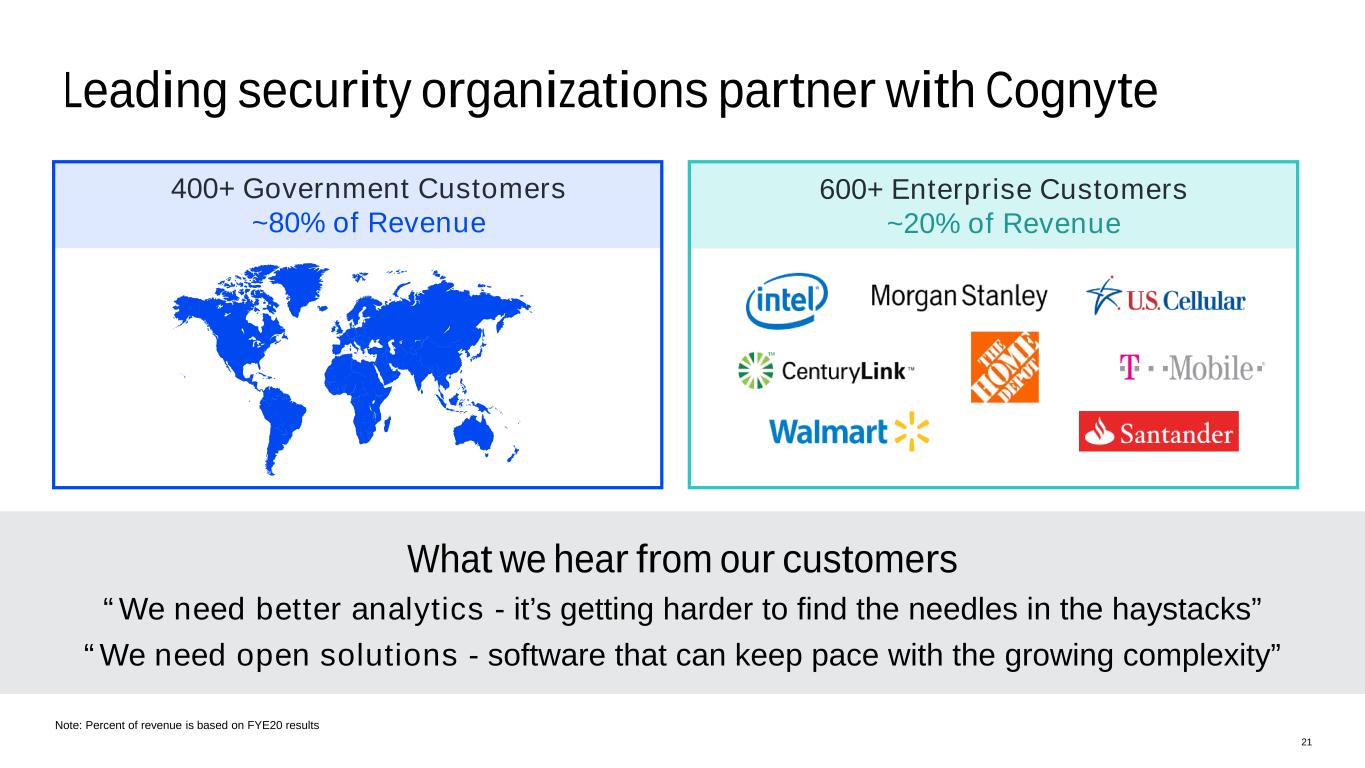

21 600+ Enterprise Customers ~20% of Revenue 400+ Government Customers ~80% of Revenue Leading security organizations partner with Cognyte What we hear from our customers “We need better analytics - it’s getting harder to find the needles in the haystacks” “We need open solutions - software that can keep pace with the growing complexity” Note: Percent of revenue is based on FYE20 results

22 Our growth strategy Offering strategy + Lead with our open platform + Sustain our analytics leadership + Stay ahead of the demand curve GTM strategy + Go deeper and wider with existing customers + Land and expand with new customers + Develop partners to expand presence in enterprise

23 Financial Summary

24 Strong historical adjusted EBITDA growth $238 $267 $304 FYE18 FYE19 FYE20 Software/Services Mix Shift 60% 62% 66% $52 $66 $82 FYE18 FYE19 FYE20 Operating Leverage with Scale 13% 15% 18% $395 $434 $463 FYE18 FYE19 FYE20 Open Analytics Adoption Gross Margin Adjusted EBITDA Margin Revenue Gross profit Adjusted EBITDA Note: In millions of USD. Non-GAAP metrics unless otherwise noted. Cognyte’s fiscal year ends on January 31st. FYE18 gross profit, adjusted EBITDA and operating loss represent Verint’s accounting allocation methodology. $395 $433 $457GAAP Revenue $219; 55% $257; 59% $293; 64% GAAP Gross Profit and Gross Margin ($5); -1% $19; 4% $27; 6% GAAP Operating (Loss) Income and Margin

25 $13 $26 $27 1QFYE21 2QFYE21 3QFYE21 $70 $75 $84 1QFYE21 2QFYE21 3QFYE21 $103 $106 $114 1QFYE21 2QFYE21 3QFYE21 FYE21 first three quarters Sequential growth throughout year after initial COVID impact YTD: 7% y-o-y gross profit growth YTD: 27% y-o-y adjusted EBITDA growth Revenue Gross profit Adjusted EBITDA 69% 71% 74% 12% 24% 24% Gross Margin Adjusted EBITDA Margin Note: Non-GAAP metrics unless otherwise noted. Millions of USD. $101 $105 $113GAAP Revenue $69; 68% $73; 70% $82; 73%GAAP Gross Profit and Gross Margin ($3); -3% $11; 11% $10; 9%GAAP Operating (Loss) Income and Margin

26 $95 $105 $120 FYE19 FYE20 FYE21P 81% 82% 84% FYE19 FYE20 FYE21P FYE21 annual guidance – software model FYE21 guidance: $445 million of revenue and $90 million of Adjusted EBITDA at midpoint % of Revenue Generated From Software R&D Return Favorable Software/Services Mix Sift Substantially Completed R&D Investment for Margin Expansion Note: Non-GAAP metrics unless otherwise noted. Millions of USD. FY21P is a projection for the year ending January 31, 2021 Percentage of revenue generated from software is the same on a GAAP and non-GAAP basis. GAAP gross margin for FYE19 and FYE20 was 59% and 64%, respectively. GAAP research and development expense, net for FYE19 and FYE20 was $100 million and $111 million, respectively. 70%GrossMargin 66%62%

27 90% 90% Low 90%s FYE19 FYE20 FYE21P $570 $582 ~$580 FYE19 FYE20 FYE21P 38% 42% ~50% FYE19 FYE20 FYE21P FYE21 annual guidance – strong visibility FYE21 guidance: $445 million of revenue and $90 million of Adjusted EBITDA at midpoint % of Revenue that is Recurring(1) % of Revenue that is from Repeat Customers(2) RPO Increasing Recurring Revenue Strong Repeat Business Significant Backlog Note: Millions of USD. FY21P is a projection for the year ending January 31, 2021. (1) Recurring Revenue primarily consists of initial and renewal support, subscription software licenses and SaaS in certain circumstances. (2) Revenue that is from Repeat Customers is defined as those customers that generate revenue in the current year and in one or more of the past three years.

28 FYE22 outlook: 14% normalized adjusted EBITDA growth $395 $434 $463 $445 FYE18 FYE19 FYE20 FYE21P FYE22P $238 $267 $304 $314 $350 FYE18 FYE19 FYE20 FYE21P FYE22P $37 $51 $67 $75 $85 $52 $66 $82 $90 FYE18 FYE19 FYE20 FYE21P FYE22P Note: Non-GAAP metrics unless otherwise noted. Millions of USD. FYE22 gross profit and adjusted EBITDA forecasts are at the mid-point of the respective revenue guidance ranges. The “P” indicates the value is a projection. (1) FYE18 through FYE21 adjusted EBITDA values in black font are proforma for $15 million of public company costs. The adjusted EBITDA values in white font exclude any adjustment for the spin dis-synergies. GAAP operating (loss) income for FYE18, FYE19 and FYE20 were ($5) million, $19 million and $27 million, respectively. FYE18 gross profit, operating (loss) income and adjusted EBITDA represent Verint’s accounting allocation methodology. FYE22 Diluted EPS Outlook: $0.80 Revenue Gross profit Adjusted EBITDA and Normalized Adjusted EBITDA (1) $490 +/- 2% FYE18 – FYE21 normalized for $15 million of Verint separation dis-synergies to be incurred in FYE22 $395 $433 $457GAAP Revenue $219 $257 $293GAAP Gross Profit

29 3-year targets: Revenue and Adjusted EBITDA growth Open Analytics Software Double Digit Revenue Growth and Improving + Improvement driven by faster adoption of open analytics software + Revenue growth: low-to-mid teens growth rate in FYE24 Expanding Margins from Continued Revenue Mix Improvement + Adjusted EBITDA Growth Acceleration + FYE23: Mid-teens growth + FYE24: 20% growth

30 Spin update Timing: Expect to complete spin shortly after year-end (1/31/21) Corporate Status: 20-F Filer Exchange: NASDAQ, ticker CGNT Expected Balance Sheet: Working capital + $100 million revolver Shares Outstanding: 69.5 million

31 Key investment highlights Leader in security analytics software Seasoned management team with strong track record Large addressable market with favorable industry trends Multiple vectors to drive strong top-line profitable growth Cutting edge security analytics and AI technology Strong relationships across a diverse customer base

32 Thank you cognyte.com

33 Appendix

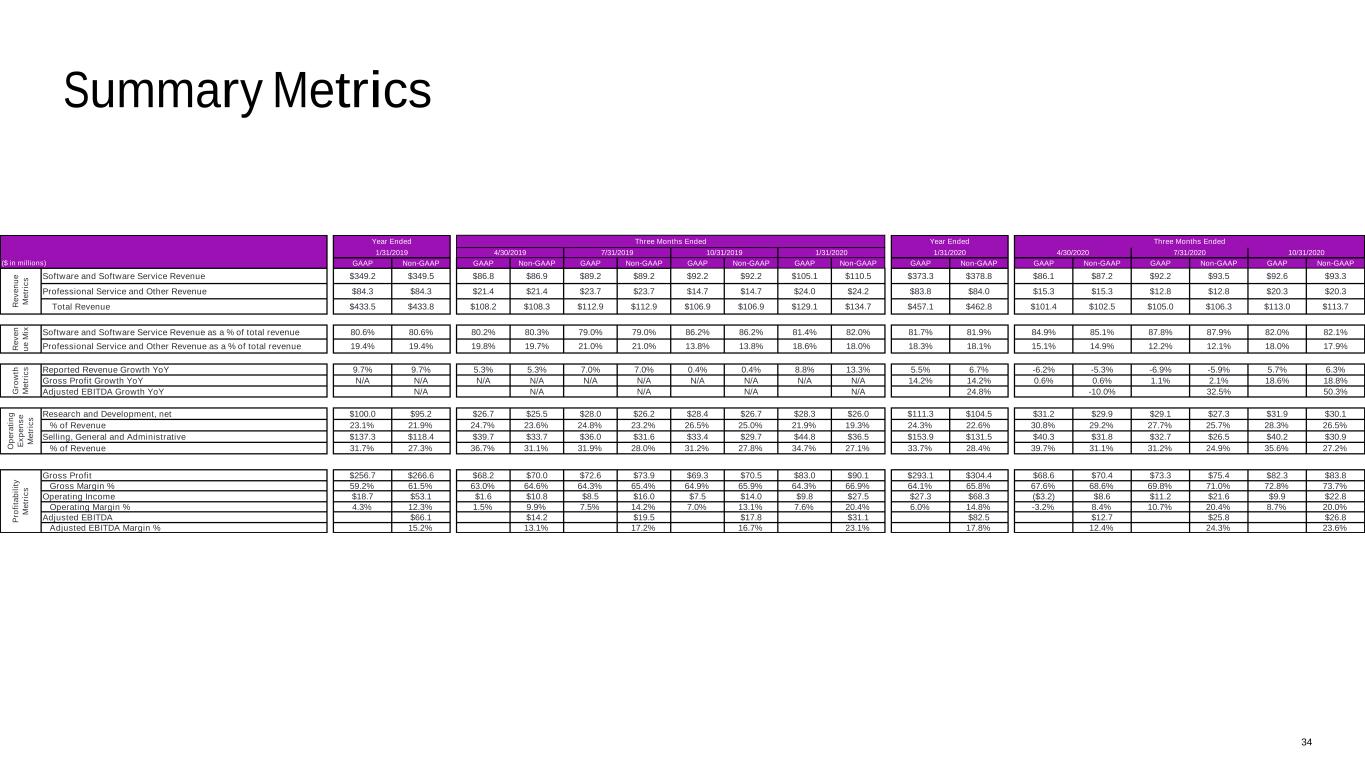

34 Summary Metrics GAAP Non-GAAP GAAP Non-GAAP GAAP Non-GAAP GAAP Non-GAAP GAAP Non-GAAP GAAP Non-GAAP GAAP Non-GAAP GAAP Non-GAAP GAAP Non-GAAP Software and Software Service Revenue $349.2 $349.5 $86.8 $86.9 $89.2 $89.2 $92.2 $92.2 $105.1 $110.5 $373.3 $378.8 $86.1 $87.2 $92.2 $93.5 $92.6 $93.3 Professional Service and Other Revenue $84.3 $84.3 $21.4 $21.4 $23.7 $23.7 $14.7 $14.7 $24.0 $24.2 $83.8 $84.0 $15.3 $15.3 $12.8 $12.8 $20.3 $20.3 Total Revenue $433.5 $433.8 $108.2 $108.3 $112.9 $112.9 $106.9 $106.9 $129.1 $134.7 $457.1 $462.8 $101.4 $102.5 $105.0 $106.3 $113.0 $113.7 Software and Software Service Revenue as a % of total revenue 80.6% 80.6% 80.2% 80.3% 79.0% 79.0% 86.2% 86.2% 81.4% 82.0% 81.7% 81.9% 84.9% 85.1% 87.8% 87.9% 82.0% 82.1% Professional Service and Other Revenue as a % of total revenue 19.4% 19.4% 19.8% 19.7% 21.0% 21.0% 13.8% 13.8% 18.6% 18.0% 18.3% 18.1% 15.1% 14.9% 12.2% 12.1% 18.0% 17.9% Reported Revenue Growth YoY 9.7% 9.7% 5.3% 5.3% 7.0% 7.0% 0.4% 0.4% 8.8% 13.3% 5.5% 6.7% -6.2% -5.3% -6.9% -5.9% 5.7% 6.3% Gross Profit Growth YoY N/A N/A N/A N/A N/A N/A N/A N/A N/A N/A 14.2% 14.2% 0.6% 0.6% 1.1% 2.1% 18.6% 18.8% Adjusted EBITDA Growth YoY N/A N/A N/A N/A N/A 24.8% -10.0% 32.5% 50.3% Research and Development, net $100.0 $95.2 $26.7 $25.5 $28.0 $26.2 $28.4 $26.7 $28.3 $26.0 $111.3 $104.5 $31.2 $29.9 $29.1 $27.3 $31.9 $30.1 % of Revenue 23.1% 21.9% 24.7% 23.6% 24.8% 23.2% 26.5% 25.0% 21.9% 19.3% 24.3% 22.6% 30.8% 29.2% 27.7% 25.7% 28.3% 26.5% Selling, General and Administrative $137.3 $118.4 $39.7 $33.7 $36.0 $31.6 $33.4 $29.7 $44.8 $36.5 $153.9 $131.5 $40.3 $31.8 $32.7 $26.5 $40.2 $30.9 % of Revenue 31.7% 27.3% 36.7% 31.1% 31.9% 28.0% 31.2% 27.8% 34.7% 27.1% 33.7% 28.4% 39.7% 31.1% 31.2% 24.9% 35.6% 27.2% Gross Profit $256.7 $266.6 $68.2 $70.0 $72.6 $73.9 $69.3 $70.5 $83.0 $90.1 $293.1 $304.4 $68.6 $70.4 $73.3 $75.4 $82.3 $83.8 Gross Margin % 59.2% 61.5% 63.0% 64.6% 64.3% 65.4% 64.9% 65.9% 64.3% 66.9% 64.1% 65.8% 67.6% 68.6% 69.8% 71.0% 72.8% 73.7% Operating Income $18.7 $53.1 $1.6 $10.8 $8.5 $16.0 $7.5 $14.0 $9.8 $27.5 $27.3 $68.3 ($3.2) $8.6 $11.2 $21.6 $9.9 $22.8 Operating Margin % 4.3% 12.3% 1.5% 9.9% 7.5% 14.2% 7.0% 13.1% 7.6% 20.4% 6.0% 14.8% -3.2% 8.4% 10.7% 20.4% 8.7% 20.0% Adjusted EBITDA $66.1 $14.2 $19.5 $17.8 $31.1 $82.5 $12.7 $25.8 $26.8 Adjusted EBITDA Margin % 15.2% 13.1% 17.2% 16.7% 23.1% 17.8% 12.4% 24.3% 23.6% P ro fit ab ili ty M et ri cs O pe ra tin g E xp en se M et ri cs 10/31/20201/31/2020 4/30/2020 G ro w th M et ri cs ($ in millions) R ev en ue M et ri cs R ev en ue M ix Three Months Ended Year Ended 1/31/2019 Year Ended 7/31/2020 Three Months Ended 4/30/2019 7/31/2019 10/31/2019 1/31/2020

35 Revenue Metrics Year Ended Year Ended ($ in millions) 1/31/2019 4/30/2019 7/31/2019 10/31/2019 1/31/2020 1/31/2020 4/30/2020 7/31/2020 10/31/2020 Software and software service revenue - GAAP 349.2 86.8 89.2 92.2 105.1 373.3 86.1 92.2 92.6 Professional service and other revenue - GAAP 84.3 21.4 23.7 14.7 24.0 83.8 15.3 12.8 20.3 Total revenue - GAAP 433.5 108.2 112.9 106.9 129.1 457.1 101.4 105.0 113.0 Estimated software and software service revenue adjustments 0.3 0.1 0.0 - 5.4 5.5 1.1 1.2 0.7 Estimated professional service and other revenue adjustments 0.0 - - - 0.2 0.2 - - - Total estimated revenue adjustments 0.3 0.1 0.0 - 5.6 5.7 1.1 1.2 0.7 Software and software service revenue - non-GAAP 349.5 86.9 89.2 92.2 110.5 378.8 87.2 93.5 93.3 Professional service and other revenue - non-GAAP 84.3 21.4 23.7 14.7 24.2 84.0 15.3 12.8 20.3 Total revenue - non-GAAP 433.8 108.3 112.9 106.9 134.7 462.8 102.5 106.3 113.7 Three Months EndedThree Months Ended

36 Gross Profit Year Ended Year Ended ($ in millions) 1/31/2019 4/30/2019 7/31/2019 10/31/2019 1/31/2020 1/31/2020 4/30/2020 7/31/2020 10/31/2020 Total GAAP revenue 433.5$ 108.2$ 112.9$ 106.9$ 129.1$ 457.1$ 101.4$ 105.0$ 113.0$ Software, Software service, Professional service and other costs 161.8 36.4 37.3 34.8 43.2 151.7 30.7 30.1 28.3 Amortization of acquired technology 7.4 1.3 0.4 0.4 0.4 2.4 0.3 0.2 0.2 Stock-based compensation expenses (1) 2.2 0.4 0.8 0.7 1.1 2.9 0.4 0.6 0.6 Shared support expenses allocation (2) 5.3 2.0 1.8 1.7 1.5 7.0 1.4 0.7 1.6 Total GAAP cost of revenue 176.8$ 40.0$ 40.3$ 37.6$ 46.1$ 164.0$ 32.9$ 31.7$ 30.7$ Total GAAP gross profit 256.7$ 68.2$ 72.6$ 69.3$ 83.0$ 293.1$ 68.6$ 73.3$ 82.3$ Total GAAP gross margin 59.2% 63.0% 64.3% 64.9% 64.3% 64.1% 67.6% 69.8% 72.8% Revenue adjustments 0.3 0.1 0.0 - 5.6 5.7 1.1 1.2 0.7 Amortization of acquired technology 7.4 1.3 0.4 0.4 0.4 2.4 0.3 0.2 0.2 Stock-based compensation expenses (1) 2.2 0.4 0.8 0.7 1.1 2.9 0.4 0.6 0.6 Acquisition expenses, net (3) (0.0) - - 0.0 0.0 0.0 - - - Restructuring expenses (3) - - 0.1 0.1 0.0 0.2 (0.0) - - Separation expenses (6) - - - - - - - - 0.0 Total non-GAAP gross profit 266.6$ 70.0$ 73.9$ 70.5$ 90.1$ 304.4$ 70.4$ 75.4$ 83.8$ Total non-GAAP gross margin 61.5% 64.6% 65.4% 65.9% 66.9% 66% 68.6% 71.0% 73.7% Software and Software Service Gross profit - GAAP 263.8$ 67.7$ 69.8$ 72.9$ 81.9$ 292.3$ 67.5$ 72.9$ 74.5$ Gross margin - GAAP 75.6% 78.0% 78.2% 79.0% 77.9% 78.3% 78.4% 79.0% 80.4% Gross profit adjustments 1.3 0.3 0.5 0.4 5.8 6.9 1.3 1.6 1.0 Gross profit - non-GAAP 265.1$ 68.0$ 70.2$ 73.2$ 87.7$ 299.2$ 68.8$ 74.5$ 75.5$ Gross margin - non-GAAP 75.9% 78.2% 78.7% 79.4% 79.4% 79.0% 78.9% 79.7% 80.9% Professional Service and Other Gross profit - GAAP 0.3$ 1.7$ 3.2$ (3.2)$ 1.5$ 3.2$ 1.3$ 0.7$ 8.0$ Gross margin - GAAP 0.3% 8.2% 13.4% -21.4% 6.2% 3.9% 8.5% 5.4% 39.2% Gross profit adjustments 1.2 0.2 0.5 0.4 0.9 2.0 0.2 0.3 0.3 Gross profit - non-GAAP 1.5$ 2.0$ 3.6$ (2.7)$ 2.4$ 5.2$ 1.5$ 1.0$ 8.2$ Gross margin - non-GAAP 1.8% 9.2% 15.4% -18.6% 9.7% 6.2% 10.1% 7.6% 40.5% Three Months EndedThree Months Ended

37 Operating Expenses Year Ended Year Ended ($ in millions) 1/31/2019 4/30/2019 7/31/2019 10/31/2019 1/31/2020 1/31/2020 4/30/2020 7/31/2020 10/31/2020 Research and Development, net 80.7$ 21.8$ 22.3$ 22.8$ 23.5$ 90.4$ 25.3$ 23.4$ 26.1$ Stock-based compensation expenses (4) 4.9 1.0 1.7 1.5 2.1 6.3 1.2 1.5 1.7 Shared support service allocation (5) 14.5 3.9 3.9 4.1 2.7 14.6 4.7 4.2 4.2 GAAP research and development, net 100.0$ 26.7$ 28.0$ 28.4$ 28.3$ 111.3$ 31.2$ 29.1$ 31.9$ as a % of GAAP revenue 23.1% 24.7% 24.8% 26.5% 21.9% 24.3% 30.8% 27.7% 28.3% Stock-based compensation expenses (4) (4.9) (1.0) (1.7) (1.5) (2.1) (6.3) (1.2) (1.5) (1.7) Acquisition expenses, net (6) (0.0) (0.0) (0.0) (0.1) (0.1) (0.3) (0.1) (0.1) - Restructuring expenses (6) 0.0 (0.1) - (0.1) (0.0) (0.2) 0.0 (0.1) (0.3) Other Adjustments (6) - - - - - - - (0.1) 0.1 Non-GAAP research and development, net 95.2$ 25.5$ 26.2$ 26.7$ 26.0$ 104.5$ 29.9$ 27.3$ 30.1$ as a % of non-GAAP revenue 21.9% 23.6% 23.2% 25.0% 19.3% 22.6% 29.2% 25.7% 26.5% Selling, General and Administrative expenses 79.2$ 24.2$ 19.1$ 18.1$ 27.9$ 89.2$ 22.7$ 17.1$ 19.6$ Stock-based compensation expenses (4) 18.4 4.3 5.5 5.0 7.0 21.8 4.7 4.7 5.2 Shared support service allocation (5) 39.7 11.2 11.5 10.3 9.9 42.9 12.9 10.9 15.4 GAAP selling, general and administrative expenses 137.3$ 39.7$ 36.0$ 33.4$ 44.8$ 153.9$ 40.3$ 32.7$ 40.2$ as a % of GAAP revenue 31.7% 36.7% 31.9% 31.2% 34.7% 33.7% 39.7% 31.2% 35.6% Stock-based compensation expenses (4) (18.4) (4.3) (5.5) (5.0) (7.0) (21.8) (4.7) (4.7) (5.2) Acquisition expenses, net (6) (0.7) (0.9) 3.3 2.0 0.4 4.8 0.1 0.7 1.9 Restructuring expenses (6) (0.4) (0.1) (0.2) (0.0) (0.1) (0.4) (0.9) (0.2) (0.5) Separation expenses (6) (0.1) 0.0 (0.1) (0.5) (1.6) (2.2) (2.9) (2.5) (5.6) Other adjustments (6) 0.7 (0.7) (1.9) (0.1) 0.0 (2.7) 0.0 0.4 0.1 Non-GAAP selling, general and administrative expenses 118.4$ 33.7$ 31.6$ 29.7$ 36.5$ 131.5$ 31.8$ 26.5$ 30.9$ as a % of non-GAAP revenue 27.3% 31.1% 28.0% 27.8% 27.1% 28.4% 31.1% 24.9% 27.2% Three Months EndedThree Months Ended

38 Operating and Adjusted EBITDA Margins Year Ended Year Ended ($ in millions) 1/31/2019 4/30/2019 7/31/2019 10/31/2019 1/31/2020 1/31/2020 4/30/2020 7/31/2020 10/31/2020 GAAP operating income (loss) 18.7$ 1.6$ 8.5$ 7.5$ 9.8$ 27.3$ (3.2)$ 11.2$ 9.9$ GAAP operating margin 4.3% 1.5% 7.5% 7.0% 7.6% 6.0% -3.2% 10.7% 8.7% Revenue adjustments 0.3 0.1 0.0 - 5.6 5.7 1.1 1.2 0.7 Amortization of acquired technology 7.4 1.3 0.4 0.4 0.4 2.4 0.3 0.2 0.2 Amortization of other acquired intangible assets 0.7 0.1 0.1 0.1 0.2 0.6 0.3 0.3 0.3 Stock-based compensation expenses 25.5 5.7 8.0 7.2 10.2 31.0 6.3 6.8 7.5 Acquisitions expenses, net 0.6 1.0 (3.3) (1.9) (0.2) (4.5) 0.0 (0.6) (1.9) Restructuring expenses 0.4 0.2 0.3 0.2 0.1 0.8 0.9 0.3 0.8 Separation expenses 0.1 (0.0) 0.1 0.5 1.6 2.2 2.9 2.5 5.6 Impairment charges - - - - - - - - - Other adjustments (0.7) 0.7 1.9 0.1 (0.0) 2.7 (0.0) (0.3) (0.2) Non-GAAP operating income 53.1$ 10.8$ 16.0$ 14.0$ 27.5$ 68.3$ 8.6$ 21.6$ 22.8$ Depreciation and amortization (7) 12.9 3.4 3.5 3.8 3.6 14.2 4.2 4.1 4.0 Adjusted EBITDA 66.1$ 14.2$ 19.5$ 17.8$ 31.1$ 82.5$ 12.7$ 25.8$ 26.8$ Non-GAAP operating margin 12.3% 9.9% 14.2% 13.1% 20.4% 14.8% 8.4% 20.4% 20.0% Adjusted EBITDA margin 15.2% 13.1% 17.2% 16.7% 23.1% 17.8% 12.4% 24.3% 23.6% Three Months EndedThree Months Ended

39 Other Income, Taxes and Net Income Year Ended Year Ended ($ in millions) 1/31/2019 4/30/2019 7/31/2019 10/31/2019 1/31/2020 1/31/2020 4/30/2020 7/31/2020 10/31/2020 Other Income (Expense) Reconciliation GAAP other income, net 1.3$ 0.9$ 1.4$ 1.1$ (0.8)$ 2.6$ 0.1$ 0.9$ 3.3$ Change in fair value of equity investment - - - - - - - - (3.8) Other adjustments 0.1 - - - - - - - Non-GAAP other income (expenses), net 1.4$ 0.9$ 1.4$ 1.1$ (0.8)$ 2.6$ 0.1$ 0.9$ (0.5)$ Tax Provision (Benefit) Reconciliation GAAP provision (benefit) for income taxes 7.6$ 2.8$ (4.6)$ 1.4$ 3.0$ 2.6$ (1.0)$ 4.4$ 4.0$ GAAP effective income tax rate 38.2% 111.9% -46.4% 15.9% 33.2% 8.6% 30.8% 36.0% 30.4% Non-GAAP tax adjustments (0.0) (1.2) 6.9 0.7 0.7 7.1 1.6 (2.6) (2.2) Non-GAAP provision for income taxes 7.6$ 1.6$ 2.4$ 2.1$ 3.6$ 9.6$ 0.7$ 1.8$ 1.7$ Non-GAAP effective income tax rate 13.9% 13.6% 13.6% 13.6% 13.6% 13.6% 7.8% 7.8% 7.8% Net Income (Loss) Reconciliation GAAP net income (loss) 12.3$ (0.3)$ 14.4$ 7.3$ 6.0$ 27.4$ (2.2)$ 7.8$ 9.2$ Total GAAP net income (loss) adjustments 34.4 10.4 0.6 5.9 17.1 33.9 10.2 13.0 11.4 Non-GAAP net income 46.8$ 10.1$ 15.0$ 13.1$ 23.1$ 61.3$ 8.0$ 20.8$ 20.5$ Net income attributable to noncontrolling interest 3.6$ 2.1$ 1.7$ 1.8$ 1.7$ 7.2$ 1.8$ 1.8$ 1.3$ Net Income (Loss) Attributable to Verint Systems Inc. Common Shares Reconciliation GAAP net income (loss) attributable to Cogynte Software Ltd. common shares 8.7$ (2.4)$ 12.8$ 5.5$ 4.3$ 20.2$ (4.0)$ 6.0$ 7.8$ Total GAAP net income (loss) adjustments 34.4 10.4 0.6 5.9 17.1 33.9 10.2 13.0 11.4 Non-GAAP net income attributable to Cognyte Software Ltd common shares 43.2$ 8.0$ 13.4$ 11.4$ 21.4$ 54.1$ 6.2$ 19.0$ 19.2$ Three Months EndedThree Months Ended

40 FYE18 Non-GAAP Reconciliation As Reported By Verint for the Cyber Intelligence Solutions Segment Revenue Metrics Year Ended ($ in millions) 1/31/2018 Recurring revenue - GAAP 130.6$ Nonrecurring revenue - GAAP 264.5 Total revenue - GAAP 395.1 Estimated recurring revenue adjustments 0.2 Estimated nonrecurring revenue adjustments 0.2 Total estimated revenue adjustments 0.4 Recurring revenue - non-GAAP 130.8 Nonrecurring revenue - non-GAAP 264.7 Total revenue - non-GAAP 395.5$ Gross Profit Year Ended ($ in millions) 1/31/2018 Total GAAP revenue 395.1$ Segment product costs 92.3 Segment service expenses 62.3 Amortization of acquired technology 16.0 Stock-based compensation expenses (8) 1.6 Shared support expenses allocation (8) 4.0 Total GAAP cost of revenue 176.2$ GAAP gross profit 218.9$ GAAP gross margin 55.4% Revenue adjustments 0.4 Amortization of acquired technology 16.0 Stock-based compensation expenses (8) 1.6 Acquisition expenses, net (8) - Restructuring expenses (8) 0.7 Separation expenses (8) - Impairment charges (8) - Estimated fully allocated non-GAAP gross profit 237.6$ Estimated fully allocated non-GAAP gross margin 60.1% Operating Expenses Year Ended ($ in millions) 1/31/2018 Research and Development, net Segment expenses 74.5$ Stock-based compensation expenses (8) 4.5 Shared support service allocation (8) 6.4 GAAP research and development, net 85.4$ as a % of GAAP revenue 21.6% Stock-based compensation expenses (8) (4.5) Acquisition expenses, net (8) - Restructuring expenses (8) (0.4) Separation expenses (8) - Other Adjustments (8) - Estimated fully allocated non-GAAP research and development, net 80.5$ as a % of non-GAAP revenue 20.4% Selling, General and Administrative expenses Segment expenses 74.1$ Stock-based compensation expenses (8) 16.4 Shared support service allocation (8) 47.5 GAAP selling, general and administrative expenses 138.0$ as a % of GAAP revenue 34.9% Stock-based compensation expenses (8) (16.4) Acquisition expenses, net (8) (0.5) Restructuring expenses (8) (3.6) Separation expenses (8) (0.4) Impairment charges (8) (1.1) Other adjustments (8) (0.3) Estimated fully allocated non-GAAP selling, general and administrative expenses 115.7$ as a % of non-GAAP revenue 29.2%

41 FYE18 Non-GAAP Reconciliation As Reported By Verint for the Cyber Intelligence Solutions Segment Operating and EBITDA Margins Year Ended ($ in millions) 1/31/2018 GAAP operating income (5.4)$ GAAP operating margin -1.4% Revenue adjustments 0.4 Amortization of acquired technology 16.0 Amortization of other acquired intangible assets 0.9 Stock-based compensation expenses 22.5 Acquisitions expenses, net 0.5 Restructuring expenses 4.5 Separation expenses 0.4 Impairment charges 1.1 Other adjustments 0.4 Estimated fully non-GAAP allocated operating income 41.3$ Depreciation and amortization (8) 10.5 Estimated adjusted EBITDA 51.8$ Estimated fully allocated non-GAAP operating margin 10.5% Estimated fully allocated adjusted EBITDA margin 13.1%

42 Footnotes Note: Amounts may not foot throughout the workbook due to rounding. (1) Represents the Verint stock-based compensation expenses applicable to cost of revenue, allocated to Cognyte based on specific identification where possible, with the remainder being allocated on the basis of revenue as a relevant measure, which we believe provides a reasonable approximation for purposes of understanding the relative GAAP and non-GAAP gross margins of our business. (2) Represents the portion of Verint shared support expenses (as disclosed in Footnote 3 in Form 20-F ) applicable to cost of revenue, allocated to Cognyte on the basis of revenue as a relevant measure, which we believe provides a reasonable approximation for purposes of understanding the relative GAAP and non-GAAP gross margins of our businesses. (3) Represents the portion of Verint acquisition expenses, net and restructuring expenses applicable to cost of revenue, allocated to Cognyte based on specific identification where possible, with the remainder being allocated on the basis of revenue as a relevant measure, which we believe provides a reasonable approximation for purposes of understanding the relative GAAP and non-GAAP gross margins of our business. (4) Represents the Verint stock-based compensation expenses applicable to research and development, net and selling, general and administrative, allocated to Cognyte based on specific identification where possible, with the remainder being allocated on the basis of revenue as a relevant measure, which we believe provides a reasonable approximation for purposes of understanding the relative non-GAAP operating margins of our business. (5) Represents Verint shared support expenses (as disclosed in Footnote 3 in Form 20-F), including general and administrative shared services acquisition expenses, net and restructuring expenses, separation expenses and other adjustments, allocated to Cognyte based on specific identification where possible, with the remainder being allocated on the basis of revenue as a relevant measure, which we believe provides a reasonable approximation for purposes of understanding the relative non-GAAP operating margin of our business. (6) Represents the portion of our acquisition expenses, net, restructuring expenses, separation expenses and other adjustments, allocated to Cognyte based on specific identification where possible, with the remainder being allocated on the basis of revenue as a relevant measure, which we believe provides a reasonable approximation for purposes of understanding the relative GAAP and non-GAAP gross margin of our business. (7) Represents certain depreciation and amortization expenses, which are otherwise included in our non-GAAP operating income, allocated to Cognyte based on specific identification where possible, with the remainder being allocated on the basis of revenue as a relevant measure, which we believe provides a reasonable approximation for purposes of understanding the relative adjusted EBITDA of our business. (8) Financial results for the year ended January 31st 2018 are as originally reported by Verint for the Cyber Intelligence business. Stock based compensation expenses, shared support service allocation, acquisition expenses, net, restructuring expenses, separation expenses, impairment charges, other adjustments, and depreciations and amortization of Verint and Cognyte for this period were allocated based on Verint estimated allocations (stock based compensation expenses applicable to cost of revenue allocated proportionally based on Verint prior full year ended, annual segment operations and service expense wages, and all other items allocated proportionally based upon Verint prior full year ended, annual non-GAAP segment revenue) which differ from the allocation methodology mentioned above. Allocations for financial periods beyond January 31st, 2018 are consistent with our Form 20-F reporting for the applicable periods.

43 Supplemental Information about Non-GAAP Measures

44 Supplemental Information about Non-GAAP Measures

45 FYE21 Outlook Disclosure Our non-GAAP outlook for the year ending January 31, 2021 excludes the following GAAP measures which we are able to quantify with reasonable certainty: • Amortization of intangible assets of approximately $2 million • Costs to separate Verint into two independent public companies of approximately $17 million Our non-GAAP outlook for the year ending January 31, 2021 excludes the following GAAP measures for which we are able to provide a range of probable significance: • Revenue adjustments are expected to be between $3 million and $4 million • Stock-based compensation is expected to be between $22 million and $26 million Our non-GAAP outlook does not include the potential impact of any in-process business acquisitions that may close after the date hereof, and, unless otherwise specified, reflects foreign currency exchange rates approximately consistent with current rates. We are unable, without unreasonable efforts, to provide a reconciliation for other GAAP measures which are excluded from our non-GAAP outlook, including the impact of future business acquisitions or acquisition expenses, future restructuring expenses, and non-GAAP income tax adjustments due to the level of unpredictability and uncertainty associated with these items. For these same reasons, we are unable to assess the probable significance of these excluded items.

46 FYE22 Outlook Disclosure Our non-GAAP outlook for the year ending January 31, 2022 excludes the following GAAP measures which we are able to quantify with reasonable certainty: • Amortization of intangible assets of approximately $2 million Our non-GAAP outlook for the year ending January 31, 2022 excludes the following GAAP measures for which we are able to provide a range of probable significance: • Revenue adjustments are expected to be between $1 million and $2 million • Stock-based compensation is expected to be between $31 million and $35 million Our non-GAAP outlook does not include the potential impact of any in-process business acquisitions that may close after the date hereof, and, unless otherwise specified, reflects foreign currency exchange rates approximately consistent with current rates. We are unable, without unreasonable efforts, to provide a reconciliation for other GAAP measures which are excluded from our non-GAAP outlook, including the impact of future business acquisitions or acquisition expenses, future restructuring expenses, remaining costs to separate Verint into two independent public companies and non-GAAP income tax adjustments due to the level of unpredictability and uncertainty associated with these items. For these same reasons, we are unable to assess the probable significance of these excluded items.