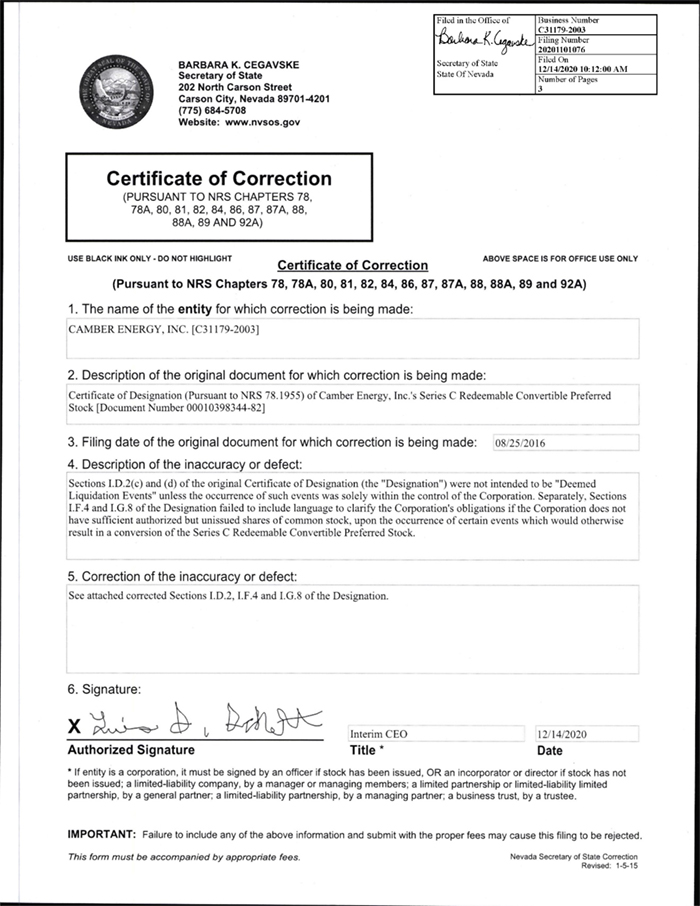

Attached files

Exhibit 3.23

Section I.D.2 of the Designation is corrected to read:

“2. A “Deemed Liquidation Event” will mean: (a) a merger or consolidation in which the Corporation is a constituent party or a subsidiary of the Corporation is a constituent party and the Corporation issues shares of its capital stock pursuant to such merger or consolidation, except (i) any such merger or consolidation involving the Corporation or a subsidiary in which the Corporation is the surviving or resulting corporation, (ii) any merger effected exclusively to change the domicile of the Corporation, (iii) any transaction or series of transactions in which the holders of the voting securities of the Company outstanding immediately prior to such transaction continue to retain more than 50% of the total voting power of such surviving entity, or (iv) the Acquisition; (b) Corporation issues convertible or equity securities that are senior to the Series C Preferred Stock in any respect, (c) Holder does not receive the number of Conversion Shares stated in a Delivery Notice with 5 Trading Days of the Notice Time, due to the occurrence of an event that is solely within the control of the Corporation and excluding any event that is not solely within the control of the Corporation; (d) trading of the Common Stock is halted or suspended by the Trading Market or any U.S. governmental agency for 10 or more consecutive trading days, due to the occurrence of an event that is solely within the control of the Corporation and excluding any event that is not solely within the control of the Corporation; (e) the sale, lease, transfer, exclusive license or other disposition, in a single transaction or series of related transactions, by the Corporation or any subsidiary of the Corporation of all or substantially all the assets of the Corporation and its subsidiaries taken as a whole, or the sale or disposition (whether by merger or otherwise) of one or more subsidiaries of the Corporation if substantially all of the assets of the Corporation and its subsidiaries taken as a whole are held by such subsidiary or subsidiaries, except where such sale, lease, transfer, exclusive license or other disposition is to a wholly owned subsidiary of the Corporation.”

Section I.F.4 of the Designation is corrected to read:

“4. Mandatory Redemption. If the Corporation determines to liquidate, dissolve or wind-up its business and affairs, or upon closing or occurrence of any Deemed Liquidation Event, the Corporation will after the redemption of the Series E and Series F Preferred Stock for ownership of Lineal Holdings, LLC, to the extent allowed under applicable law, but thereafter, prior to or concurrently with the closing, effectuation or occurrence any such action, redeem the Series C Preferred Stock for cash, by wire transfer of immediately available funds to an account designated by Holder, at the Early Redemption Price set forth in Section I.F.2 if the event is prior to the Dividend Maturity Date, or at the Liquidation Value if the event is on or after the Dividend Maturity Date. The Corporation will not be required to redeem any shares of Series C Preferred Stock for cash solely because the Corporation does not have sufficient authorized but unissued shares of Common Stock to issue upon receipt of a Delivery Notice or upon a maturity conversion.”

Page 1 of 2

Section I.G.8 of the Designation is corrected to read:

“8. Conversion at Maturity. On the Dividend Maturity Date, all remaining outstanding Series C Preferred Stock will automatically be converted into shares of Common Stock, to the extent the Corporation has sufficient authorized but unissued shares of Common Stock available for issuance upon conversion.”

Page 2 of 2