Attached files

| file | filename |

|---|---|

| 8-K - 8-K - APARTMENT INVESTMENT & MANAGEMENT CO | d35704d8k.htm |

Table of Contents

Exhibit 99.1

November 30, 2020

Dear AIMCO Properties, L.P. Unitholder and Future Aimco OP L.P. Unitholder,

The general partner of AIMCO Properties, L.P. (which is expected to be renamed Apartment Income, L.P. after a customary transitional period, “AIR OP”) has announced a plan to create Aimco OP L.P. (“New OP”) by separating assets representing approximately 10% of the total estimated value (“gross asset value” or “GAV”), as of March 31, 2020, of Apartment Investment and Management Company (“Aimco”). The separation will result in two, focused and independent companies:

| • | “New” Aimco, which will own New OP, with assets approximating 10% of Aimco’s GAV, as of March 31, 2020, is expected to continue the business of redeveloping and developing apartment communities, while also pursuing other accretive transactions. Aimco’s shares will continue to be traded on the NYSE under the ticker symbol “AIV.” |

| • | Apartment Income REIT Corp. (“AIR”), which will own AIR OP, with assets approximating 90% (prior to giving effect to certain transactions, which proceeds are intended to reduce leverage) of Aimco’s GAV, as of March 31, 2020, is expected to provide a simple and transparent way to invest in the multifamily sector, combining (i) a narrow focus on allocating capital only to stabilized apartment communities; (ii) a high-quality and diversified portfolio of stabilized multifamily properties, (iii) best-in-class property operations, (iv) low financial leverage, (v) limited execution risk, (vi) low overhead costs as a percentage of GAV, and (vii) public market liquidity for its shares, which are expected to be traded on the New York Stock Exchange (the “NYSE”) under the ticker symbol “AIRC.” |

The Aimco board of directors believes that the two businesses, each with a clear focus, strong, independent boards of directors, dedicated management teams, and strengthened balance sheets, will create greater equityholder value as two companies than as one. Importantly, the separation will provide each equityholder the opportunity to make an individual allocation of capital to one or both of the two differentiated businesses, each with a distinct investment risk/return profile: ownership of stabilized apartment communities through an investment in AIR and AIR OP; or redevelopment, development, and transactions through an investment in Aimco and New OP.

The decision by the Aimco board of directors was unanimous and is a result of years of ordinary course strategic review, many months of intensive meetings this calendar year, advice from financial, legal, tax, and accounting experts, and, most importantly, regular conversations with Aimco’s stockholders. Having listened to stockholders and recognizing the disconnect between the Aimco share price and Net Asset Value, or “NAV” (as defined in the enclosed information statement), per share, the board’s goal is to simplify the business, reduce execution risk, reduce financial risk, and increase Funds From Operations (“FFO”) and cash dividends by reducing the vacancy loss and overhead costs incurred during redevelopment and development. During the board’s deliberations, it saw the opportunity to replenish the income tax basis of Aimco properties by structuring the separation to be taxable. After further discussion with Aimco’s stockholders, the board saw the opportunity to make other changes, enhancing governance while providing stability to operations during a turbulent time.

About “new” Apartment Investment and Management Company and Aimco OP L.P.

The business plan for “new” Aimco will be to: (i) focus on redevelopment and development projects, including those sourced by Aimco, those in collaboration with IQHQ, a leading developer of life science properties, and those leased from AIR; (ii) undertake complex transactions when warranted by risk-adjusted returns, including the opportunity for additional pipelines of redevelopment or development opportunities; (iii) capitalize its redevelopment, development, and acquisition activities primarily with private, project, or activity-specific capital; and (iv) rely on a relatively small executive team engaging with qualified partners to execute its redevelopment, development and acquisition activities.

i

Table of Contents

Aimco and New OP will own the redevelopment and development business and a portfolio of assets that is expected to consist of 11 stabilized multifamily properties, primarily located in the Boston and San Diego areas, as well as: (i) Aimco’s loan to, and equity option in, the partnership owning Parkmerced Apartments located in southwest San Francisco, California; (ii) Hamilton on the Bay, a multifamily property located on the waterfront in Miami, Florida, with 271 apartment homes as well as the land and zoning to construct 389 additional apartment homes; and (iii) the assemblage of 1001 Brickell Bay Drive, a 350,000 square foot office building located in Miami Beach, Florida, and the Yacht Club multifamily property adjacent to 1001 Brickell Bay Drive.

Aimco will be well-capitalized with an estimated GAV of $1.3 billion, and an estimated NAV of $1.2 billion, each as of March 31, 2020 (in each case, without giving effect to the value of the Initial Leased Properties or the Separate Portfolio Assets (each as defined below)). Aimco and New OP are also expected to own a separate portfolio of 16 assets (the “Separate Portfolio Assets”) with an estimated GAV of $0.9 billion, securing property debt of approximately $0.7 billion, including purchase money notes payable to AIR of approximately $0.5 billion.

Aimco will employ approximately 50 of Aimco’s existing employees. It is expected to be governed by an independent board of directors, including six new, independent directors, and two independent directors from the AIR board: Bob Miller, who will be elected Chairman of the Aimco board of directors, and Mike Stein. I, too, will be a member of Aimco’s board of directors with specific responsibilities during the next two years to support the establishment and growth of the Aimco business, reporting directly to the Aimco board of directors. Wes Powell, now Aimco’s Executive Vice President—Redevelopment, will also be a member of Aimco’s board of directors and will serve as Aimco’s Chief Executive Officer. Senior management will include Lynn Stanfield as Chief Financial Officer and Jennifer Johnson as General Counsel and Chief Administrative Officer.

To provide sufficient time for the Aimco board of directors and the senior management team to establish and execute the “new” Aimco business plan of long-cycle redevelopment and development, and because individual projects most often require three to five years from inception to completion, the Aimco board of directors unanimously determined to opt into the Maryland Unsolicited Takeover Act (“MUTA”) effective as of the separation and to classify the new Aimco board of directors so that only one-third of the directors stand for election at each annual meeting until Aimco’s 2024 annual meeting, at which time all directors will stand for election annually.

The Aimco board of directors believes that the separation and associated transactions will provide a number of benefits to Aimco, AIR, New OP, AIR OP, and their respective equityholders. We believe that expected benefits to Aimco, New OP, and their respective equityholders include:

| • | Opportunity: A pipeline of redevelopment and development opportunities including those sourced by Aimco, those in collaboration with IQHQ, and those leased from AIR; |

| • | Investment Flexibility: A broader menu of investment choices, now eschewed by AIR that includes transactions that are short-term dilutive, longer-term to value realization, more complicated, better measured by NAV creation than FFO, or that involve more non-recourse leverage and that may result in higher investment returns; and |

| • | Independence: “New” Aimco, with a board of directors and management team independent from AIR, will be incentivized to make decisions that are in the best interests of Aimco. |

About Apartment Income REIT Corp. and AIMCO Properties, L.P.

The AIR business plan is to: (i) invest only in stabilized apartment communities; (ii) own a high-quality and diversified portfolio of stabilized multifamily properties; (iii) emphasize its comparative advantage in property operations, with high customer-defined satisfaction and retention, low rate of growth in controllable operating expenses, and high operating margins; (iv) maintain a strong balance sheet with leverage, net of cash and

ii

Table of Contents

receivables, and weighted average interest expense, net of interest income, comparable to or lower than peers; (v) reduce execution risk through elimination of redevelopment and development activities; and (vi) operate with overhead costs estimated at about 15 basis points of GAV, lower than peers as a percentage of GAV. AIR has sold or will sell assets sufficient to reduce financial leverage by approximately $2 billion.

The AIR and AIR OP portfolio is expected to include 98 apartment communities, which had 26,599 apartment homes as of September 30, 2020, diversified by both geography and price point. The AIR and AIR OP portfolio will include garden style, mid-rise, and high-rise apartment communities with eight important geographic concentrations: Boston; Philadelphia; Washington D.C.; Miami; Denver; the San Francisco Bay Area; Los Angeles; and San Diego; and a focus on properties with high land value located in submarkets with outsized growth prospects. The Aimco board of directors believes the geographic and price point diversification will reduce the volatility of AIR’s rental revenue by avoiding undue concentration in any particular market and by exposure to a range of price-points that have different advantages over various economic and housing cycles. AIR is expected to own properties with an estimated GAV of $10.4 billion, and an estimated NAV of $7.8 billion, in each case, as of March 31, 2020.

AIR and New OP do not intend to redevelop or develop apartment communities, reducing the execution risk, overhead costs, and vacancy expense associated with redevelopment and development, construction, and lease-ups. At the time of the separation, four AIR properties are expected to be under construction or in lease-up, including North Tower at Flamingo Point in Miami Beach, Florida, The Fremont on the Anschutz Medical Campus in Aurora, Colorado, Prism in Cambridge, Massachusetts, and 707 Leahy Apartments in Redwood City, California (collectively, the “Initial Leased Properties”). These properties will be leased to Aimco and, under each such lease, the terms thereof will be on an arm’s-length basis, including the initial term and extensions and the initial annual rent, which will be based on the then-current fair market value of the leased property and market NOI cap rates, subject to certain adjustments and periodic escalation as set forth in such lease. Further, under the terms of the leases, Aimco will have the option to complete the on-going redevelopment and development of such properties and their lease-ups.

AIR will retain substantially all of Aimco’s existing employees, including its property management team. Tom Keltner will be elected Chairman of the AIR board of directors. I will be a member of the AIR board of directors and will also serve as AIR’s Chief Executive Officer, working with an experienced executive team wholly dedicated to AIR, including Lisa Cohn, as President and General Counsel, Keith Kimmel, as President, Property Operations, Paul Beldin, as Executive Vice President and Chief Financial Officer, and Conor Wagner, as Senior Vice President and Chief Investment Officer.

The separation will increase the tax basis of AIR’s properties based on the value of the shares of AIR common stock when distributed to stockholders. This is expected to enhance AIR’s ability to allocate capital by reducing tax friction. It is also expected to reduce the need for taxable stock dividends.

AIR’s governance will be improved by the separation of the roles of Chairman of the board of directors and Chief Executive Officer, and by withdrawal from MUTA. To enable AIR’s management team to prioritize operations during a turbulent economy and to execute a smooth transition to a pure-play business model, the Aimco board of directors decided unanimously to classify the AIR board of directors for two years. Class I will serve until the 2021 annual meeting of stockholders, and all classes will stand for annual election at the 2022 annual meeting and thereafter. By having opted out of MUTA, AIR will not be able to reclassify its board without stockholder approval.

The Aimco board of directors believes that the separation and associated transactions will provide a number of benefits to Aimco, AIR, New OP, AIR OP and their respective equityholders. We believe that expected benefits to AIR, AIR OP, and their respective equityholders include:

| • | Simplicity: A simplified business focused solely on the ownership and active management of stabilized apartment communities; |

iii

Table of Contents

| • | Transparency: A business that is more readily understood and valued by investors; |

| • | Predictability: A business that is more predictable due to strong operations and reduced exposure to the execution risk of redevelopment and development; |

| • | Lower Leverage: A strong balance sheet with leverage, net of cash and loans receivable, and a weighted average interest expense, net of interest income, at or below peer averages, and with AIR expected to issue corporate level debt when its cost is lower than that of non-recourse property debt; |

| • | Higher Operating Income: FFO is expected to be increased by (i) the elimination of earnings dilution from properties with reduced or no earnings during their development, redevelopment, or lease-up, and (ii) lower overhead costs (expected to be approximately 15 bps of GAV) due primarily to the elimination of overhead costs related to redevelopment and development activities; |

| • | Growth: AIR expects to grow through (i) the continuous enhancement of its operating properties; and (ii) the acquisition of stabilized apartment communities when AIR has a favorable cost of capital, including the use of units in its operating partnership as an acquisition currency; |

| • | Refreshed Tax Basis: A refreshed tax basis reduces the tax costs of future property sales and so enhances portfolio management, makes cash dividends more likely to be a return of capital or capital gains for tax purposes, increasing their after-tax value for taxable investors, and reduces the need for taxable stock dividends; |

| • | Higher Dividends: Higher FFO supports higher dividends, while FFO made more predictable due to lower leverage and reduced exposure to redevelopment and development, supports a higher payout ratio; and |

| • | Independence: AIR, with a board of directors and management team independent from Aimco, will be incentivized to make decisions that are in the best interests of AIR. |

Separation of AIR and “New” Aimco

AIR and Aimco will provide for clear separation between the two businesses, after a defined transition period, by providing that: (i) the shared services agreements will be subject to cancellation by either party upon reasonable notice; (ii) the purchase money notes between AIR and Aimco, with a three-year maturity, is expected to be the sole financial obligation expected between AIR and Aimco (except for customary indemnifications and leases for the purposes of redevelopment and development of AIR properties); and (iii) AIR’s commitment to lease certain properties to Aimco, and Aimco’s commitment to lease such leased properties from AIR (with the right to cause their development, redevelopment and/or lease-up), will be limited to four specific properties for which the interruption of the redevelopment and development process would be inefficient, costly, and wasteful to stockholder value and where construction has begun or is expected to begin before June 30, 2022.

Reasons for the Timing of the Separation

The Aimco board of directors carefully considered the timing of the separation. In particular, the board considered the following concerns of Aimco stockholders:

| • | Lower Leverage: we expect a reduction of approximately $1 billion in leverage as a result of the separation; |

| • | Increased FFO and cash dividends: we expect a significant reduction in costs and an increase in FFO and cash dividends as a result of the separation; and |

| • | Increased flexibility: we expect that the separation will provide stockholders with the flexibility to make individual decisions regarding capital allocation between the business of ownership of stabilized apartment communities, and the business of redevelopment, development, and transactions. |

iv

Table of Contents

After the completion of the distribution of New OP Units (as defined below), current AIR OP equityholders will own the same properties before and after the separation, only in two simpler, more focused, and less levered entities.

Finally, the Aimco board of directors considered the priority of providing certainty and time for management to address the challenges of managing the business during a turbulent economy, and a time of government intervention in the setting and collection of rents, universities operating virtually and businesses whose employees work from home, and business sectors that remain severely stressed.

Mechanics of the Separation

The separation will be completed, first, through a pro rata distribution of all of the outstanding common partnership units in New OP (“New OP Units”) to holders of AIR OP common limited partnership units and AIR OP Class I High Performance partnership units (collectively, “AIR OP Common Units”) of record as of the close of business on December 5, 2020, the record date for the separation and, second, through a pro rata distribution of all of the outstanding shares of AIR common stock to Aimco stockholders of record as of the close of business on the record date. Each holder of AIR OP Common Units will receive one New OP Unit for each one AIR OP Common Unit held as of the close of business on the record date. The number of AIR OP Common Units you own will not change as a result of the distribution of New OP Units.

Immediately following the transactions, it is expected that approximately 95% of the New OP Units will be held by Aimco, directly or through its subsidiaries and approximately 95% of the AIR OP Common Units will be held by AIR, directly or through its subsidiaries. If you hold AIR OP Common Units as of the close of business on the record date for the distribution of New OP Units, upon completion of the distribution, you will hold your AIR OP Common Units and you also will hold New OP Units.

As more specifically described in the enclosed information statement, if you hold AIR OP Common Units on the record date, you will receive New OP Units in the distribution. You will generally not recognize taxable gain in connection with the distribution unless gain is triggered as a result of contributions of appreciated property you made to AIR OP within seven years of the separation. In general, unless you have made a contribution of appreciated property to AIR OP within seven years of the distribution, you will have a basis in the New OP Units you receive equal to the lesser of (i) the tax basis that AIR OP has in such units immediately prior to the separation and (ii) the tax basis you had in your AIR OP Common Units immediately prior to the separation. The tax basis you will have in your AIR OP Common Units following the separation will generally equal the tax basis you had in such units immediately prior to the separation reduced by the tax basis attributable to the New OP Units you receive in the distribution. Although there will be little or no taxable income associated with the distribution of New OP Units, substantial taxable income is expected from certain property sales (including the taxable transfers of units in the partnership that directly or indirectly holds the Separate Portfolio Assets), most of which have already closed or are under contract to close.

No vote of the holders of AIR OP limited partnership units is required or being sought in connection with the separation. Therefore, we are not asking you for a proxy, and you are requested not to send us a proxy. You do not need to make any payment, surrender or exchange your AIR OP Common Units, or take any other action to receive your New OP Units.

The enclosed information statement, which is being made available to all holders of AIR OP Common Units, describes the transactions in detail and contains important information about Aimco and New OP and their business after the completion of the separation. We urge you to read the information statement in its entirety.

v

Table of Contents

On behalf of my colleagues, I thank you for your investment in AIR OP. We look forward to serving you as you become an equityholder of New OP.

| Sincerely, |

| Terry Considine Chairman of the Board

and General Partner |

vi

Table of Contents

INFORMATION STATEMENT

AIMCO OP L.P.

Common Limited Partnership Units

This information statement is being furnished in connection with (i) the pro rata distribution (the “New OP Separation”) by AIMCO Properties, L.P. (which is expected to be renamed Apartment Income, L.P. after a customary transitional period, “AIR OP”), the operating partnership of Apartment Investment and Management Company (“Aimco”), to the holders of AIR OP common limited partnership units (including Apartment Income REIT Corp., a Maryland corporation wholly owned by Aimco (formerly named Aimco-LP, Inc., “AIR”)), and the holders of AIR OP Class I High Performance partnership units (“AIR OP HP Units” and, collectively with the common limited partnership units, “AIR OP Common Units”), of all of the common limited partnership units of Aimco OP L.P. (“New OP Units”), a new Delaware limited partnership owned by AIR OP and formed to hold the businesses and portfolio of assets described below (formerly named Durango OP, LP, “New OP”), and (ii) the pro rata distribution (the “AIR Separation” and collectively with the New OP Separation and the related transactions, the “Separation”) by Aimco to its stockholders of all of the outstanding shares of Class A common stock of AIR (“AIR Common Stock”).

If you hold AIR OP Common Units as of the close of business on the record date, upon completion of the Separation, you will hold AIR OP Common Units and New OP Units. In addition, current AIR OP equityholders will own the same properties before and after the Separation, only in two simpler, more focused, and less levered entities.

The separation of assets representing approximately 10% of the total estimated value (“gross asset value” or “GAV”), as of March 31, 2020, of Aimco, will result in two, focused and independent companies: (I) “New” Aimco, which will own New OP, with assets approximating 10% of Aimco’s GAV, as of March 31, 2020, which is expected to continue the business of redeveloping and developing apartment communities, while also pursuing other accretive transactions; and (II) AIR, which will own AIR OP, with assets approximating 90% (prior to giving effect to certain transactions, which proceeds are intended to reduce leverage) of Aimco’s GAV, as of March 31, 2020, which is expected to provide a simple and transparent way to invest in the multifamily sector, combining (i) a narrow focus on allocating capital only to stabilized apartment communities; (ii) a high-quality and diversified portfolio of stabilized multifamily properties, (iii) best-in-class property operations, (iv) low financial leverage, (v) limited execution risk, (vi) low overhead costs as a percentage of GAV, and (vii) public market liquidity for its shares. The Aimco board of directors believes that the two businesses, each with a clear focus, strong, independent boards of directors, dedicated management teams, and strengthened balance sheets, will create greater equityholder value as two companies than as one. The separation will provide each equityholder the opportunity to make an individual allocation of capital to one or both of the two differentiated businesses, each with a distinct investment risk/return profile: ownership of stabilized apartment communities through an investment in AIR and AIR OP; or redevelopment, development, and transactions through an investment in Aimco and New OP.

Aimco and New OP will own the redevelopment and development business and a portfolio of assets that is expected to consist of 11 stabilized multifamily properties, primarily located in the Boston and San Diego areas, as well as: (i) Aimco’s loan to, and equity option in, the partnership owning Parkmerced Apartments located in southwest San Francisco, California (the “Parkmerced Loan”); (ii) Hamilton on the Bay, a multifamily property located on the waterfront in Miami, Florida, with 271 apartment homes as well as the land and zoning to construct 389 additional apartment homes; and (iii) the assemblage of 1001 Brickell Bay Drive, a 350,000 square foot office building located in Miami Beach, Florida, and the Yacht Club multifamily property adjacent to 1001 Brickell Bay Drive. Aimco will be well-capitalized with an estimated GAV of $1.3 billion, and an estimated Net Asset Value, or “NAV” (as defined below) of $1.2 billion, each as of March 31, 2020 (in each case, without giving effect to the value of the Initial Leased Properties or the Separate Portfolio Assets (each as defined below)). Aimco and New OP are also expected to own a separate portfolio of 16 assets (the “Separate Portfolio Assets”) with an estimated GAV of $0.9 billion, securing property debt of approximately $0.7 billion, including purchase money notes payable to AIR of approximately $0.5 billion.

Table of Contents

The AIR and AIR OP portfolio is expected to include 98 apartment communities, which had 26,599 apartment homes as of September 30, 2020, diversified by both geography and price point. The AIR and AIR OP portfolio will include garden style, mid-rise, and high-rise apartment communities with eight important geographic concentrations: Boston; Philadelphia; Washington D.C.; Miami; Denver; the San Francisco Bay Area; Los Angeles; and San Diego; and a focus on properties with high land value located in submarkets with outsized growth prospects. The Aimco board of directors believes the geographic and price point diversification will reduce the volatility of AIR’s rental revenue by avoiding undue concentration in any particular market and by exposure to a range of price-points that have different advantages over various economic and housing cycles. AIR is expected to own properties with an estimated GAV of $10.4 billion, and an estimated NAV of $7.8 billion, in each case, as of March 31, 2020.

The assets that will be allocated to AIR and New OP, as applicable, were selected based on the go-forward business plans of each company. Assets that are allocated to New OP are primarily either undergoing redevelopment, development, or lease-up, or are expected to provide stabilized income to help meet New OP’s ongoing liquidity needs. Assets that are allocated to AIR are primarily stabilized multifamily properties located in varying geographies that are intended to provide AIR with the blend and balance of assets to support its strategic goals.

AIR and New OP do not intend to redevelop or develop apartment communities, reducing the execution risk, overhead costs, and vacancy expense associated with redevelopment and development, construction, and lease-ups. At the time of the Separation, four AIR properties are expected to be under construction or in lease-up, including North Tower at Flamingo Point in Miami Beach, Florida, The Fremont on the Anschutz Medical Campus in Aurora, Colorado, Prism in Cambridge, Massachusetts, and 707 Leahy Apartments in Redwood City, California (collectively, the “Initial Leased Properties”). These properties will be leased to Aimco and, under each such lease, the terms thereof will be on an arm’s-length basis, including the initial term and extensions and the initial annual rent, which will be based on the then-current fair market value of the leased property and market NOI cap rates, subject to certain adjustments and periodic escalation as set forth in such lease. Further, under the terms of the leases, Aimco will have the option to complete the on-going redevelopment and development of such properties and their lease-ups (provided that once Aimco elects to commence the same, it will use commercially reasonable efforts to diligently pursue it to completion).

AIR and AIR OP will retain substantially all of Aimco’s existing employees, including its property management team, and Aimco and New OP will employ approximately 50 of Aimco’s existing employees. AIR and AIR OP will initially provide Aimco and New OP with property management services and customary administrative and support services.

Each holder of AIR OP Common Units will receive one New OP Unit for each one AIR OP Common Unit held as of the close of business on December 5, 2020 (the “record date”). The date on which the New OP Units will be distributed to you (the “distribution date”) is expected to be December 15, 2020. After the Separation is completed, New OP and AIR OP will be two, focused and independent companies, and it is expected that approximately 95% of the New OP Units will be held by Aimco, directly or through its subsidiaries and approximately 95% of the AIR OP units will be held by AIR, directly or through its subsidiaries.

No vote of the holders of AIR OP limited partnership units is required or being sought in connection with the Separation. Therefore, we are not asking you for a proxy, and you are requested not to send us a proxy. You will not be required to make any payment, surrender or exchange your AIR OP Common Units, or take any other action to receive your New OP Units in connection with the New OP Separation.

There is no current trading market for New OP Units. New OP has no plans to list any New OP Units on a securities exchange. It is unlikely that any person will make a market in the New OP Units or that an active market for the New OP Units will develop.

ii

Table of Contents

New OP is an “emerging growth company,” as defined in the Jumpstart Our Business Startups Act of 2012 (the “JOBS Act”), and, as such, is allowed to provide in this information statement more limited disclosures than an issuer that would not so qualify. Although New OP may choose to take advantage of certain limited exceptions from investor protection laws such as the Sarbanes-Oxley Act of 2002, as amended (the “Sarbanes-Oxley Act”), and the Investor Protection and Securities Reform Act of 2010, for so long as New OP remains an emerging growth company, New OP does not intend to take advantage of these exceptions after the effectiveness of the registration statement on Form 10, of which this information statement is a part. See “Summary—Emerging Growth Company Status.”

In reviewing this information statement, you should carefully consider the matters described under “Risk Factors ” beginning on page 31.

Neither the Securities and Exchange Commission (the “SEC”) nor any state securities commission has approved or disapproved these securities or determined if this information statement is truthful or complete. Any representation to the contrary is a criminal offense.

This information statement does not constitute an offer to sell or the solicitation of an offer to buy any securities.

This information statement will be first made available to holders of AIR OP Common Units beginning on or about December 5, 2020.

The date of this information statement is November 30, 2020.

iii

Table of Contents

TRADEMARKS AND SERVICE MARKS

Aimco and its subsidiaries own or have rights to various trademarks, logos, service marks, and trade names that each entity uses in connection with the operation of its business. Aimco and its subsidiaries also own or have the rights to copyrights that protect the content of their respective products. Solely for convenience, the trademarks, service marks, trade names, and copyrights referred to in this prospectus are listed without the ™, ®, and © symbols, but such references do not constitute a waiver of any rights that might be associated with the respective trademarks, service marks, trade names, and copyrights included or referred to in this information statement.

Table of Contents

| 1 | ||||

| SUMMARY HISTORICAL COMBINED AND UNAUDITED PRO FORMA FINANCIAL INFORMATION |

27 | |||

| 31 | ||||

| 51 | ||||

| 53 | ||||

| 64 | ||||

| 65 | ||||

| 66 | ||||

| 67 | ||||

| 73 | ||||

| MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

75 | |||

| 93 | ||||

| 105 | ||||

| SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT |

115 | |||

| 116 | ||||

| 117 | ||||

| DESCRIPTION OF NEW OP UNITS AND SUMMARY OF NEW OP PARTNERSHIP AGREEMENT |

122 | |||

| 134 | ||||

| 142 | ||||

| 160 | ||||

| F-1 | ||||

Table of Contents

The following is a summary of material information included in this information statement. This summary may not contain all of the details concerning the Separation or other information that may be important to you. To better understand the Separation and Aimco’s and New OP’s business, you should carefully review this entire information statement.

Unless otherwise indicated or the context otherwise requires, any references in this information statement to: (i) “we,” “our,” “us,” the “Company,” and “Aimco” refer collectively to Aimco, New OP, and their consolidated subsidiaries (other than AIR, AIR OP, and their consolidated subsidiaries after the completion of the Separation); and (ii) “AIR,” refers collectively to AIR, AIR OP, and their consolidated subsidiaries (other than New OP and its consolidated subsidiaries after the completion of the Separation).

This information statement has been prepared on a prospective basis on the assumption that, among other things, the Separation will be consummated as contemplated by this information statement. There can be no assurance, however, that the Separation will occur or will occur as so contemplated.

You should not assume that the information contained in this information statement is accurate as of any date other than the date set forth on the cover or as of any earlier date as of which such information is given, as applicable. Changes to the information contained in this information statement may occur after that date, and we undertake no obligation to update the information, except in the normal course of our public disclosure obligations as required by applicable law. In particular, a number of matters contained in this information statement relate to agreements or arrangements that have not yet been finalized and expectations of what may occur. Prior to the completion of the Separation, it is possible that these agreements, arrangements, and expectations may change.

Our Company

The general partner of AIR OP has announced a plan to create New OP by separating assets representing approximately 10% of the GAV, as of March 31, 2020, of Aimco. The Separation will result in two, focused and independent companies: (I) “New” Aimco, which will own New OP, with assets approximating 10% of Aimco’s GAV, as of March 31, 2020, which is expected to continue the business of redeveloping and developing apartment communities, while also pursuing other accretive transactions; and (II) AIR, which will own AIR OP, with assets approximating 90% (prior to giving effect to certain transactions, which proceeds are intended to reduce leverage) of Aimco’s GAV, as of March 31, 2020, which is expected to provide a simple and transparent way to invest in the multifamily sector, combining (i) a narrow focus on allocating capital only to stabilized apartment communities; (ii) a high-quality and diversified portfolio of stabilized multifamily properties, (iii) best-in-class property operations, (iv) low financial leverage, (v) limited execution risk, (vi) low overhead costs as a percentage of GAV, and (vii) public market liquidity for its shares.

Each of Aimco (and New OP) and AIR (and AIR OP) will have its own distinctive focus. The business plan for “new” Aimco will be to: (i) focus on redevelopment and development projects, including those sourced by Aimco, those in collaboration with IQHQ, a leading developer of life science properties, and those leased from AIR; (ii) undertake complex transactions when warranted by risk-adjusted returns, including the opportunity for additional pipelines of redevelopment or development opportunities; (iii) capitalize its redevelopment, development, and acquisition activities primarily with private, project, or activity-specific capital; and (iv) rely on a relatively small executive team engaging with qualified partners to execute its redevelopment, development and acquisition activities. Aimco is expected to benefit from a pipeline of redevelopment and development opportunities including those soured by Aimco, those sourced in collaboration with IQHQ, and those leased from AIR. In addition, Aimco is expected to benefit from a broader menu of investment choices, now eschewed by

1

Table of Contents

AIR that includes transactions that are short-term dilutive, longer-term to value realization, more complicated, better measured by NAV creation than Funds From Operations (“FFO”), or that involve more non-recourse leverage and that may result in higher investment returns.

AIR and AIR OP will retain substantially all of Aimco’s existing employees, including its property management team, and Aimco and New OP will employ approximately 50 of Aimco’s existing employees. Aimco, directly and through subsidiaries in which it owns all of the outstanding common equity, will be the general and special limited partner of New OP. New OP will hold substantially all of Aimco’s assets and manage the daily operations of Aimco’s business directly and indirectly through certain subsidiaries and by engaging AIR to initially provide customary administrative and support services, and property management services.

Aimco is expected to be governed by an independent board of directors, including six new, independent directors, and two independent directors from the AIR board: Bob Miller, who will be elected Chairman of the Aimco board of directors, and Mike Stein. Mr. Considine will be a member of Aimco’s board of directors with specific responsibilities during the next two years to support the establishment and growth of the Aimco business, reporting directly to the Aimco board of directors. Wes Powell, now Aimco’s Executive Vice President—Redevelopment, will also be a member of Aimco’s board of directors and will serve as Aimco’s Chief Executive Officer. Senior management will include Lynn Stanfield as Chief Financial Officer and Jennifer Johnson as General Counsel and Chief Administrative Officer. In addition, Terry Considine will be a member of AIR’s board of directors and also will be AIR’s Chief Executive Officer.

Aimco and New OP will own the redevelopment and development business and a portfolio of assets that is expected to consist of (i) Royal Crest Estates (Warwick), located in Warwick, Rhode Island; Royal Crest Estates (Marlboro), located in Marlborough, Massachusetts; Waterford Village, located in Bridgewater, Massachusetts; Wexford Village, located in Worchester, Massachusetts; Royal Crest Estates (Nashua), located in Nashua, New Hampshire; The Bluffs at Pacifica, located in San Francisco, California; St. George Villas, located in St. George, South Carolina; Casa del Hermosa, located in San Diego, California; Casa del Sur, located in San Diego, California; Casa del Norte, located in San Diego, California; and Casa del Mar, located in San Diego, California (collectively, the “Stabilized Seed Properties”), which are stabilized multifamily properties primarily located in the Boston and San Diego areas; and (ii) certain other investments, consisting of the Parkmerced Loan; Hamilton on the Bay, a multifamily property located on the waterfront in Miami, Florida, with 271 apartment homes as well as the land and zoning to construct 389 additional apartment homes; and the assemblage of 1001 Brickell Bay Drive, a 350,000 square foot office building located in Miami Beach, Florida, and the Yacht Club multifamily property adjacent to 1001 Brickell Bay Drive. We refer to Hamilton on the Bay, 1001 Brickell Bay Drive, the Yacht Club, and the Stabilized Seed Properties, collectively, as the “Owned Properties.” The Stabilized Seed Properties and the Parkmerced Loan will serve as “seed” assets and provide us with revenue from rent collection and interest payments to help meet Aimco’s ongoing liquidity needs. We intend to complete redevelopment of Hamilton on the Bay, 1001 Brickell Bay Drive, Yacht Club at Brickell, and North Tower at Flamingo Point, and to lease-up Prism, The Fremont, and 707 Leahy.

Aimco will be well-capitalized with an estimated GAV of $1.3 billion, and an estimated NAV of $1.2 billion, each as of March 31, 2020 (in each case, without giving effect to the value of the Initial Leased Properties or the Separate Portfolio Assets).

Aimco and New OP are also expected to own the Separate Portfolio Assets with an estimated GAV of $0.9 billion, securing property debt of approximately $0.7 billion, including purchase money notes payable to AIR of approximately $0.5 billion.

The AIR and AIR OP portfolio is expected to include 98 apartment communities, which had 26,599 apartment homes as of September 30, 2020, diversified by both geography and price point. The AIR and AIR OP

2

Table of Contents

portfolio will include garden style, mid-rise, and high-rise apartment communities with eight important geographic concentrations: Boston; Philadelphia; Washington D.C.; Miami; Denver; the San Francisco Bay Area; Los Angeles; and San Diego; and a focus on properties with high land value located in submarkets with outsized growth prospects. The Aimco board of directors believes the geographic and price point diversification will reduce the volatility of AIR’s rental revenue by avoiding undue concentration in any particular market and by exposure to a range of price-points that have different advantages over various economic and housing cycles.

AIR is expected to own properties with an estimated GAV of $10.4 billion, and an estimated NAV of $7.8 billion, in each case, as of March 31, 2020.

AIR and New OP do not intend to redevelop or develop apartment communities, reducing the execution risk, overhead costs, and vacancy expense associated with redevelopment and development, construction, and lease-ups. At the time of the Separation, the Initial Leased Properties are expected to be under construction or in lease-up, including North Tower at Flamingo Point in Miami Beach, Florida, The Fremont on the Anschutz Medical Campus in Aurora, Colorado, Prism in Cambridge, Massachusetts, and 707 Leahy Apartments in Redwood City, California. These properties will be leased to Aimco and, under each such lease, the terms thereof will be on an arm’s-length basis, including the initial term and extensions and the initial annual rent, which will be based on the then-current fair market value of the leased property and market NOI cap rates, subject to certain adjustments and periodic escalation as set forth in such lease. Further, under the terms of the leases, Aimco will have the option to complete the on-going redevelopment and development of such properties and their lease-ups (provided that once Aimco elects to commence the same, it will use commercially reasonable efforts to diligently pursue it to completion).

Aimco’s and New OP’s expected business activities following the completion of the Separation are summarized below.

Redevelopment and Development

We intend to redevelop and develop apartment communities and other real estate. We plan to undertake ground-up development when warranted by risk-adjusted investment returns, either directly or in connection with the redevelopment of an existing property. When warranted, we will rely on the expertise and credit of a third-party developer familiar with the local market to limit our exposure to construction risk. We also expect to undertake a range of redevelopments, including: those in which buildings or exteriors are renovated without the need to vacate a significant percentage of apartment homes, or short-cycle redevelopments; those in which significant renovation of apartment homes may be accomplished upon lease expiration and turnover; and those in which an entire building or community is vacated, or long-cycle redevelopments. We may execute redevelopment using various strategies, which will depend on the needs of the party for whom we are doing the redevelopment or development work. For example, we may take a phased approach, in which we renovate a property in stages. Alternatively, we may intend to complete the redevelopment project on an accelerated timeline, with the goal of commencing the lease-up phase and returning the improvements to the other party rapidly to quicken our return on investment. Redevelopment work may include seeking entitlements from local governments, which enhance the value of our existing portfolio by increasing density; that is, the right to add apartment homes to a site.

We expect to complete the redevelopment of certain of our Owned Properties after the completion of the Separation. These properties include Hamilton on the Bay, 1001 Brickell Bay Drive, and Yacht Club at Brickell. We may also source our own opportunities and acquire other properties or portfolios from third parties that we believe can be redeveloped or developed or leased-up to become stabilized properties, and sell such properties to AIR once the redevelopment and development and lease-ups are completed. If AIR agrees, subject to its discretion, to acquire any such properties, AIR will acquire such property from us at then-current fair market value. If AIR does not acquire such properties, we will be permitted to sell such properties to third parties.

3

Table of Contents

In addition, we will be collaborating with IQHQ, a leading life sciences real estate developer, on mixed-use projects across the United States. The agreement between us and the developer provides us with the opportunity (subject to pricing) to develop multifamily properties that are co-located with commercial life science uses built by the developer. We also intend to seek opportunities to collaborate with other third parties, including other developers, and to seek to provide redevelopment and development services to other third parties, including through joint ventures, partnerships with AIR, or other transactions, to expand our investment prospects.

We also expect to benefit from a pipeline of redevelopment and development opportunities that may be sourced from AIR, and to provide improved stabilized properties to AIR at a favorable price by redeveloping and developing properties and increasing occupancy at properties that are not stabilized due to a recently completed redevelopment or development, in each case, that are owned by AIR and leased by us, commencing with the Initial Leased Properties. We expect to lease the Initial Leased Properties (and additional properties if and as may be mutually agreed between us and AIR in the future, subject to the approval of each of AIR’s and Aimco’s independent directors) pursuant to leases entered into in accordance with the Master Leasing Agreement (as defined below) for a percentage of then-current fair market value and redevelop, develop or lease-up the property with the goal of maximizing long-term value of the community. Upon completion of the redevelopment and development and lease-up, we will have the option, but not an obligation, to terminate any of the leases for these properties once they reach and maintain stabilization (so long as the fair market value of the property at stabilization is not less than the fair market value of such property at lease inception), and receive payment for the redevelopment or development-related improvements, either by payment from AIR of a sum equal to 95% of the difference between the then-current fair market value of the property less the fair market value of the property at the time of lease inception if AIR exercises an option to pay such fee, or through a sale of the property to a third party (by AIR and Aimco), with AIR guaranteed to receive an amount attributable to the fair market value of the property at the time of lease inception and Aimco retaining any excess proceeds. In the event of such sale of the property, Aimco may also elect to purchase the property at a purchase price equal to the fair market value thereof at the time of lease inception (and may subsequently sell the property to a third party, subject to AIR’s right of first refusal during the first year following Aimco’s acquisition). If AIR elects not to pay the fee for the redevelopment or development-related improvements, and we decline to purchase the property or cause its sale to a third party, we may elect to rescind our termination of the applicable lease and instead continue such lease in effect in accordance with its terms. If we do not exercise (or we rescind) our option to terminate a lease, we will have the option to assign the lease to a third party, subject to AIR’s consent and right of first refusal. Our redevelopment and development projects are expected to be funded using our balance sheet or equity from joint ventures.

Other Real Estate

We will initially own the Stabilized Seed Properties. In the future, we may also acquire additional properties. The Stabilized Seed Properties and any additional stabilized properties we may acquire are expected to provide us with a base of steady revenue through rent collection, to help balance the cyclical and more unpredictable nature of our redevelopment and development business. These properties also may serve as sources of collateral and liquidity for our future funding needs. In addition to rent collection, we may extract capital from these assets through investments by third parties for partial ownership or through an outright sale. We will provide AIR a right of first offer to acquire additional stabilized properties that we are under contract to purchase from third parties for 101% of the sum of the agreed-upon purchase price plus out of pocket costs. We may use that capital to invest in properties that we expect will be higher returning, value-add properties. See “Business and Properties—Properties” for more information on the Stabilized Seed Properties.

Additionally, we may undertake other real estate investment transactions, including, but not limited to, investments in joint ventures (including with AIR), serving as a developer for a broader development project, property acquisitions, and the acquisition of general or limited partner positions in partnerships.

4

Table of Contents

We also will own the Parkmerced Loan, which consists of a five-year, $275 million mezzanine loan at a 10% annual rate to the partnership owning the Parkmerced Apartments (secured by a second-priority deed of trust) and a 10-year option to acquire a 30% interest in the partnership at an exercise price of $1 million, increased by 30% of future capital spending to progress redevelopment and development of the Parkmerced Apartments. We expect that the Parkmerced Loan will provide us an attractive return with limited expected downside risk. The option is expected to provide us with an opportunity to participate in substantial value creation from the vested development rights. See “Business and Properties—Properties—Parkmerced Loan” for more information on the Parkmerced Loan.

AIR will Manage a Majority of our Properties

After the Separation, AIR will have the responsibility of managing and operating our stabilized properties. AIR initially will provide property management and certain other property-related services to us for the majority of our properties, and we will generally be obligated to pay to AIR a property management fee based on an agreed percentage of revenue collected and such other fees as may be mutually agreed for various other services. See “Our Relationship with AIR Following the Separation.”

Our Management Team

In connection with the Separation, AIR and AIR OP will retain substantially all of Aimco’s existing employees, including its property management team, and Aimco and New OP will employ approximately 50 of Aimco’s existing employees. Each of Aimco and AIR will have senior management teams focused on the performance of each company’s respective businesses and value-creation opportunities. We believe that the separation of the Aimco and AIR portfolios, and an experienced senior management team at each of Aimco and AIR, will result in the respective businesses each receiving the senior management focus and attention required for each business to realize its potential.

Our senior management team has a collective track record of successful redevelopment and development projects, active management of real estate operations or real estate portfolio management, all within a REIT (as defined below) environment. In addition, we will have access to AIR’s property management team, who will initially manage and operate the majority of the apartment communities in our portfolio pursuant to the Property Management Agreements (as defined below).

Bob Miller will be elected Chairman of the Aimco board of directors. Wes Powell, now Aimco’s Executive Vice President—Redevelopment, will also be a member of Aimco’s board of directors and will serve as Aimco’s Chief Executive Officer. Mr. Powell has served as Executive Vice President—Redevelopment since January 2018, and we believe has the experience to continue serving Aimco as its Chief Executive Officer. Terry Considine will resign as Chief Executive Officer of Aimco in connection with the Separation and will continue to serve Aimco with specific responsibilities during the next two years to support the establishment and growth of the Aimco business, reporting directly to the Aimco board of directors. During the two years when Mr. Considine will have specific responsibilities to the Aimco board of directors, he will not accept compensation from Aimco that would serve to increase his current compensation, provided that, AIR and Aimco have agreed that following the Separation, Aimco will reimburse AIR for base salary, short-term incentive amounts, and long-term incentive amounts paid by AIR to Mr. Considine under his employment agreement with AIR that are in excess of $1 million annually. In addition, Mr. Considine will serve on the boards of directors of both AIR and Aimco, but will not serve as Chairman of either. Mr. Considine (in addition to any other directors serving on both boards of directors) will recuse himself from voting as a member of either board of directors during the approval or disapproval of any transactions between the two companies. In addition, our senior management team will include Lynn Stanfield, as Executive Vice President and Chief Financial Officer, and Jennifer Johnson, as Executive Vice President, Chief Administrative Officer and General Counsel, each of whom has more than 16 years of experience.

5

Table of Contents

Management’s compensation is designed to be aligned with strategy and performance and to incentivize growth and returns. See “Management—Executive Compensation.”

In addition, Aimco has, and after the completion of the Separation is expected to have, a board of directors that meets the NYSE independence requirements, including being comprised of a majority of independent directors, and Aimco will separate the roles of Chairman of the board of directors and Chief Executive Officer. To provide sufficient time for the Aimco board of directors and the senior management team to establish and execute the “new” Aimco business plan of long-cycle redevelopment and development, and because individual projects most often require three to five years from inception to completion, the Aimco board of directors unanimously determined to opt into the Maryland Unsolicited Takeover Act (“MUTA”) effective as of the Separation and to classify the new Aimco board of directors so that only one-third of the directors stand for election at each annual meeting until Aimco’s 2024 annual meeting, at which time all directors will stand for election annually.

A wholly owned subsidiary of Aimco will be the general partner of New OP. Except as otherwise expressly provided in the New OP partnership agreement, all management powers over the business and affairs of New OP are exclusively vested in the general partner. New OP will have no directors or executive officers.

Overview of the Separation

The general partner of AIR OP has announced a plan to create New OP by separating assets representing approximately 10% of the GAV, as of March 31, 2020, of Aimco. The Separation will result in two, focused and independent companies:

| • | “New” Aimco, which will own New OP, with assets approximating 10% of Aimco’s GAV, as of March 31, 2020, which is expected to continue the business of redeveloping and developing apartment communities, while also pursuing other accretive transactions; and |

| • | AIR, which will own AIR OP, with assets approximating 90% (prior to giving effect to certain transactions, which proceeds are intended to reduce leverage) of Aimco’s GAV, as of March 31, 2020, which is expected to provide a simple and transparent way to invest in the multifamily sector, combining (i) a narrow focus on allocating capital only to stabilized apartment communities; (ii) a high-quality and diversified portfolio of stabilized multifamily properties, (iii) best-in-class property operations, (iv) low financial leverage, (v) limited execution risk, (vi) low overhead costs as a percentage of GAV, and (vii) public market liquidity for its shares. |

Upon the completion of the Separation, Aimco will own, directly and through subsidiaries in which it will own all of the common equity, the general partnership interest and special limited partnership interest in New OP, which will also have minority third-party limited partners, and AIR will own, through subsidiaries in which it will own all of the common equity, the general partner interest and special limited partner interest in AIR OP, which will also have minority third-party limited partners.

Immediately prior to the New OP Separation, New OP will receive, by contribution from AIR OP, certain properties, assets, and liabilities related to the Aimco business in exchange for New OP Units. Following such contribution by AIR OP, on the distribution date, AIR OP will distribute its New OP Units to holders of AIR OP Common Units, including AIR and AIMCO-GP, Inc., a Delaware corporation and the general partner of AIR OP (“AIR OP GP”) (with AIR and AIR OP GP further distributing their New OP Units to Aimco), on a pro rata basis. You will not be required to make any payment, or surrender or exchange your AIR OP Common Units, or take any other action to receive your New OP Units in connection with the New OP Separation.

AIR will contribute a portion of its interests in AIR OP and all of its interests in AIR OP GP to two newly formed subsidiary REITs in a taxable transaction in exchange for common and preferred stock in each REIT.

6

Table of Contents

Aimco will then distribute on a pro rata basis to all holders of shares of common stock of Aimco (“Aimco Common Stock”) the AIR Common Stock.

On the distribution date, each Aimco common stockholder will receive from Aimco one share of AIR Common Stock for each one share of Aimco Common Stock held as of the close of business on the record date. Following such distribution by AIR OP, New OP and AIR OP will be two focused and independent companies.

The following transactions also have occurred, or are expected to occur concurrently with, prior to or immediately following the completion of the Separation (collectively, the “Restructuring”):

| • | Aimco OP GP, LLC (“New OP GP”) was formed as a Delaware limited liability company on August 11, 2020 with Aimco as its initial member. New OP was formed as a Delaware limited partnership on August 11, 2020, with AIR OP as its sole initial limited partner and New OP GP as its initial general partner. |

| • | AIR OP’s limited partnership agreement is expected to be amended to provide, among other things, that all redemption and exchange rights related to the units of AIR OP will be denominated in AIR Common Stock rather than Aimco Common Stock if the Separation is consummated. |

| • | In accordance with the terms of the Separation and Distribution Agreement (the “Separation Agreement”), AIR OP will cause the Aimco business (other than (i) a portion of the 16 Separate Portfolio Assets and (ii) its interests in AIMCO Royal Crest – Nashua L.L.C., the Delaware limited liability company that owns Royal Crest Estates (Nashua) (“Royal Crest Nashua LLC”), which entity will be transferred to New OP for no consideration immediately after the New OP Separation pursuant to a binding agreement entered into prior to the New OP Separation) and certain other assets to be contributed to New OP in exchange for 100% of the outstanding New OP Units. |

| • | It is expected that certain entities that will be subsidiaries of New OP after the separation will assume or retain a certain amount of existing secured property-level indebtedness related to the Aimco business, while entities that will be subsidiaries of AIR will assume or retain a certain amount of existing secured property-level indebtedness related to the AIR business. |

| • | It is expected that Aimco and its subsidiaries (including New OP) will enter into a new revolving secured credit facility. |

| • | Substantially all of Aimco’s (and its subsidiaries’) employees will become or remain employees of AIR OP (and its subsidiaries), while approximately 50 of Aimco’s (and its subsidiaries’) employees will become or remain employees of New OP (and its subsidiaries). |

| • | In accordance with the Separation Agreement, AIR OP will distribute 100% of the outstanding New OP Units to the holders of AIR OP Common Units (including AIR and AIR OP GP) pro rata with respect to their ownership of AIR OP Common Units as of the close of business on the record date. Each of the holders of AIR OP Common Units will be entitled to receive one New OP Unit for each one AIR OP Common Unit held as of the close of business on the record date. |

| • | AIR and AIR OP GP will distribute their New OP Units to Aimco. |

| • | AIR OP will transfer its interests in Royal Crest Nashua LLC to New OP. |

| • | New OP or its subsidiaries and AIR OP and its subsidiaries will contribute the Separate Portfolio Assets to a partnership (“James-Oxford LP”) in exchange for common and preferred interests in James-Oxford LP. New OP will then contribute its interests in James-Oxford LP to Aimco JO Intermediate Holdings, LLC (“Aimco JO”) a new subsidiary of Aimco REIT Sub, LLC (“New Sub REIT”), a new subsidiary REIT of New OP. AIR OP and its subsidiaries will sell their interests in James-Oxford LP (other than a less than 5% common interest) to Aimco JO in exchange for notes payable to subsidiaries |

7

Table of Contents

| of AIR of $0.5 billion and certain other obligations. The transactions described above are intended to constitute taxable transactions with respect to the interests in James-Oxford LP. |

| • | Aimco will contribute its interest in AIR OP GP to AIR. |

| • | On November 5, 2020, AIR REIT Sub 1, LLC (“Sub REIT 1”) and AIR REIT Sub 2, LLC (“Sub REIT 2”), each Delaware limited liability companies, were formed. Sub REIT 1 and Sub REIT 2 will each elect to be treated as a REIT for U.S. federal income tax purposes commencing with its initial taxable year ending December 31, 2020. AIR will contribute an amount of AIR OP Common Units representing an approximately 34% limited partner interest in AIR OP to Sub REIT 1, and will contribute AIR OP Common Units representing an approximately 34% limited partner interest in AIR OP and its interests in AIR OP GP to Sub REIT 2, each in exchange for common and preferred interests in Sub REIT 1 and Sub REIT 2 (as applicable), which transactions are intended to trigger gain for U.S. federal income tax purposes. Sub REIT 1 and Sub REIT 2 are each expected to also have approximately 125 third-party holders of a nominal amount of non-participating non-voting preferred stock with an aggregate initial liquidation preference of approximately $125,000 to satisfy certain requirements for qualifying as a REIT for U.S. federal income tax purposes, and AIR OP is expected to issue a new series of preferred limited partnership units of AIR OP to each of Sub REIT 1 and Sub REIT 2 with terms substantially the same as such non-participating non-voting preferred stock. |

| • | Aimco Development Company, LLC (formerly named AIVTRS I, LLC, “Redev/Dev TRS”) was formed as a Delaware limited liability company on August 21, 2020 with AIR OP as its initial member. Redev/Dev TRS has elected to be treated as a corporation for U.S. federal income tax purposes, and Redev/Dev TRS and Aimco have jointly filed an election to treat Redev/Dev TRS as a taxable REIT subsidiary of Aimco. New OP will then contribute the redevelopment and development business to Redev/Dev TRS. |

| • | AIR Property Management TRS, LLC (“Property Management TRS”) was formed as a Delaware limited liability company on October 29, 2020 with AIR OP as its initial member. AIR OP will form AIR Property Management Company, LLC (“Property Management LLC”) as a Delaware limited liability company. Property Management TRS will elect to be treated as a corporation for U.S. federal income tax purposes. AIR OP will then contribute its property management business to Property Management LLC and Property Management TRS. New OP and New Sub REIT will each contribute cash to Property Management TRS in exchange for preferred interests. Property Management TRS will jointly elect with AIR, Aimco, and their applicable subsidiary REITs to be treated as a taxable REIT subsidiary of such entities. |

| • | AIR will issue $2 million in Class A preferred stock in AIR (“Class A Preferred Stock”) to Aimco, subject to a binding commitment to sell such Class A Preferred Stock to unrelated investors, and AIR OP will issue $2 million in a new series of preferred limited partnership units of AIR OP to AIR with terms substantially the same as the terms of the Class A Preferred Stock. |

| • | In accordance with the Separation Agreement, Aimco will distribute all of the outstanding AIR Common Stock to Aimco common stockholders as of the record date on a pro rata basis. Each Aimco common stockholder will be entitled to receive one share of AIR Common Stock for each one share of Aimco Common Stock held by such stockholder as of the record date. |

| • | Aimco will sell its Class A Preferred Stock in AIR to unrelated investors. |

| • | In addition to the Separation Agreement, AIR and AIR OP (or their applicable subsidiaries), on the one hand, and Aimco and New OP (or their applicable subsidiaries), on the other hand, as well as James-Oxford LP (or its applicable subsidiaries) in certain instances, will enter into an Employee Matters Agreement (as defined below), Property Management Agreements, a Master Services Agreement (as defined below), and a Master Leasing Agreement, each as further described below, and certain other agreements as further described below. |

8

Table of Contents

Until the Separation has occurred, Aimco has the right to terminate the Separation, even if all of the conditions have been satisfied, if the board of directors of Aimco determines, in its sole discretion, that the Separation is not in the best interests of Aimco and its stockholders or that market conditions or other circumstances are such that the Separation is no longer advisable at that time. We cannot provide any assurances that the Separation will be completed. For a more detailed description of these conditions, see “The Separation—Conditions to the Separation.”

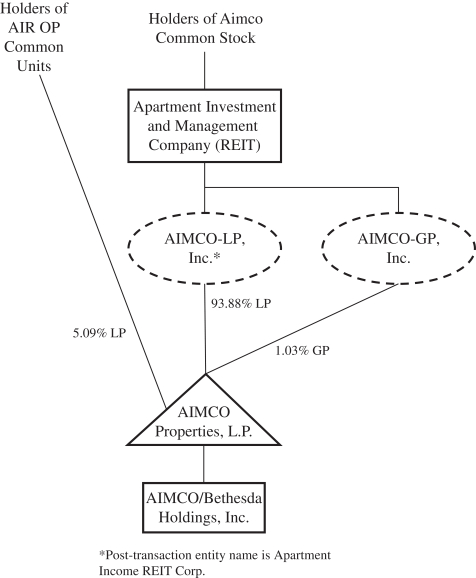

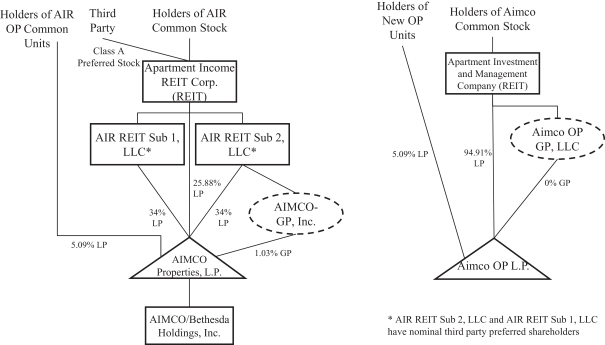

Organizational Structure

In general, Aimco intends to own its assets and conduct substantially all of its business through New OP and its subsidiaries. The following chart depicts a simplified graphical representation of the relevant portion of Aimco’s corporate structure before and after the Separation:

Before the Separation

9

Table of Contents

After the Separation

Reasons for the Separation

The decision by the Aimco board of directors was unanimous and is a result of years of ordinary course strategic review, many months of intensive meetings this calendar year, advice from financial, legal, tax, and accounting experts, and regular conversations with Aimco’s stockholders. Having listened to stockholders and recognizing the disconnect between the Aimco share price and NAV, the board’s goal is to simplify the business, reduce execution risk, reduce financial risk, and increase FFO and cash dividends by reducing the vacancy loss and overhead costs incurred during redevelopment and development. During the board’s deliberations, it saw the opportunity to replenish the income tax basis of Aimco’s properties by structuring the Separation to be taxable. After further discussion with Aimco’s stockholders, the board saw the opportunity to make other changes, enhancing governance while providing stability to operations during a turbulent time.

Consistent with Aimco’s ongoing strategic planning, Aimco’s management and board of directors thoroughly evaluated a range of alternatives and transactions, and determined that the Separation is the best path forward to enhance value for all stockholders for a number of reasons, including the following:

| • | Creates two, focused and independent companies, each with the opportunity to pursue growth through the execution of distinctly different business plans. We believe that having two, focused and independent companies with distinct investment profiles will maximize the strategic focus and financial flexibility of each company to grow and return capital to stockholders. The Aimco board of directors believes that the two businesses, each with a clear focus, strong, independent boards of directors, dedicated management teams, and strengthened balance sheets, will create greater stockholder value as two companies than as one. The business plan for “new” Aimco will be to: (i) focus on redevelopment and development projects, including those sourced by Aimco, those in collaboration with IQHQ, a leading developer of life science properties, and those leased from AIR; (ii) undertake complex transactions when warranted by risk-adjusted returns, including the opportunity for |

10

Table of Contents

| additional pipelines of redevelopment or development opportunities; (iii) capitalize its redevelopment, development, and acquisition activities primarily with private, project, or activity-specific capital; and (iv) rely on a relatively small executive team engaging with qualified partners to execute its redevelopment, development and acquisition activities. Aimco’s focus is expected to create long-term value for real estate investors and will provide Aimco with flexibility to pursue broader opportunities, including those that are short-term dilutive, longer-term to value realization, more complicated, better measured by NAV creation than FFO, or that involve more, non-recourse leverage. The AIR business plan is to: (i) invest only in stabilized apartment communities; (ii) own a high-quality and diversified portfolio of stabilized multifamily properties; (iii) emphasize its comparative advantage in property operations, with high customer-defined satisfaction and retention, low rate of growth in controllable operating expenses, and high operating margins; (iv) maintain a strong balance sheet with leverage, net of cash and receivables, and weighted average interest expense, net of interest income, comparable to or lower than peers; (v) reduce execution risk through elimination of redevelopment and development activities; and (vi) operate with overhead costs estimated at about 15 basis points of GAV, lower than peers as a percentage of GAV. AIR has sold or will sell assets sufficient to reduce financial leverage by approximately $2 billion. AIR’s focus on the ownership of stabilized properties and active management is expected to result in higher and more predictable earnings, measured by FFO. |

| • | Enhances investor transparency, better highlights the attributes of both companies, and provides investors with the option to invest in one or both companies. The Separation will provide each stockholder the opportunity to make an individual allocation of capital to one or both of the two differentiated businesses, each with a distinct investment risk/return profile: ownership of stabilized apartment communities through an investment in AIR; or redevelopment, development, and transactions through an investment in Aimco. The separation will enable potential investors and the financial community to evaluate Aimco and AIR separately and assess the merits, performance, and future prospects of their respective businesses. In addition, we believe the Separation will make AIR and Aimco more competitive and appealing to a broader investor audience moving forward, providing them with the opportunity to invest in two companies with compelling value propositions and distinct investment strategies. Aimco’s business is expected to be less predictable in terms of quarter over quarter activity but to also have higher long-term target returns commensurate with such level of risk. Investors can increase their allocation to Aimco or to AIR, depending on their preference. AIR is expected to have higher dividends, with FFO made more predictable due to lower leverage and reduced exposure to redevelopment and development. Investors can increase their allocation to Aimco or to AIR, depending on their preference. |

| • | Limits AIR’s exposure to risks associated with the redevelopment and development business. AIR will be able to invest in stabilized properties that it believes will better support its underlying business. AIR is expected to have limited to no risk of earnings or cash flow dilution from non-earning assets, and to have limited execution risk for redevelopment, development, and lease-ups, low leverage and lower overhead costs (both in total dollars and as a percentage of gross asset value). Through its relationship with Aimco, AIR is expected to retain access to some of the advantages of Aimco’s redevelopment and development business, such as newly developed and stabilized properties, without the execution risk, leverage or associated costs. |

| • | Provides our management teams with the ability to focus on our distinct businesses and be more closely aligned with the needs of investors. Each of AIR and Aimco will have an independent board of directors and independent management and will be incentivized to make decisions that are in the best interests of its respective business. The separation of the businesses will give each senior management team the opportunity to focus on the goals and expectations of each company’s investors. We expect that the separation of the experienced senior management teams and other key personnel operating our |

11

Table of Contents

| businesses will result in the ability for each company to better satisfy the needs of its respective stockholders. |

| • | Improves AIR’s access to capital markets. Aimco’s share price has traded at a consistent discount to NAV, making it difficult for Aimco to grow through raising new primary equity capital. The Separation is expected to increase FFO and Adjusted Funds From Operations (“AFFO”) at AIR and produce a better price to FFO ratio than has previously been given to Aimco while it owned all of the businesses of Aimco and AIR. In addition, we expect that de-leveraging and the prospect of a rating upgrade at AIR after the Separation are likely to provide AIR with enhanced access to corporate unsecured debt issuances at more favorable interest rates. As a result of the separation, we expect AIR will have improved access to the capital markets and a strong capital structure tailored to its strategic goals, enabling investment in the acquisition of properties to grow its portfolio. |

| • | Increases financial flexibility. Aimco’s board of directors believes that a taxable separation will increase AIR’s strategic and financial flexibility to grow, earn competitive returns on capital, and create long-term value for stockholders. The Separation will result in a refreshed tax basis for AIR, which enhances AIR’s ability to allocate capital by reducing tax friction and reduces the tax costs of future property sales and therefore enhances portfolio management. We also expect that this will reduce the need for future stock dividends and make cash dividends more likely to be a return of capital or capital gains for tax purposes, increasing their after-tax value for taxable investors. |

The board of directors of Aimco also considered certain potentially negative factors associated with the Separation, including the risk that the benefits of the Separation may not be realized, the risk that there may be disruptions to the business as a result of the Separation, the one-time costs of the separation, the fact that there may be conflicts between AIR and Aimco, and the fact that the separation as structured is expected to result in certain tax liabilities for Aimco stockholders, which it determined were outweighed by the benefits of the transaction.

For more information, please refer to the sections entitled “The Separation—Reasons for the Separation” and “Risk Factors” included elsewhere in this information statement.

Our Relationship with AIR Following the Separation