Attached files

| file | filename |

|---|---|

| 8-K - 8-K - DZS INC. | dzsi-8k_20201029.htm |

| EX-99.2 - EX-99.2 - DZS INC. | dzsi-ex992_187.htm |

Exhibit 99.1

Q3 2020 Quarterly Stockholder Letter

Thursday, October 29, 2020

DZS stockholders and prospective stockholders,

I am pleased to share with you our inaugural DZS quarterly stockholder letter. Moving forward, we will use this vehicle to provide a quarterly market, business and financial stockholder update.

Growing demand for our disruptive and leading-edge mobile transport solutions, and continued demand for our fiber-based broadband access and customer premises solutions, resulted in record quarterly revenue in the third quarter of 2020 of $93.9 million, up 33% compared with $70.5 million in the second quarter of 2020 and 31% compared with $71.5 million in the third quarter of 2019.

One of the most important technology, business, and go-to-market strategy assessments stockholders should understand and appreciate about DZS is the company’s expansion plan targeting the North America, Latin America, Europe, Middle East, and Africa (EMEA) regions. Over the past decade, countries such as South Korea and Japan have been widely recognized as leading the world in the rapid evolution towards ultra

high-speed broadband and mobile services. These countries have often led the lists of the most connected nations, with the highest average broadband speeds and wide adoption of many of the world’s most advanced broadband applications. Much of this success has been achieved by utilizing regional access vendors based in Asia and leveraging the deep relationships these companies have with

local service providers.

Despite innovative technologies and compelling products, it has historically been challenging for western-based technology companies to compete, partner, and succeed in the most advanced Asian

markets. What sets DZS apart from many of our peers is that we are an American company, headquartered in Plano, Texas, and already an established technology leader and widely deployed in many of Asia’s most connected countries.

1

We see this as a key advantage, as DZS is well-positioned to exploit and leverage its market-leading fixed wireline, mobile transport and connected premises innovations that have been successfully deployed in these advanced broadband markets, and to catalyze our expansion in North America, Latin America, and EMEA markets.

One recent example is our Japanese customer, Rakuten. This e-commerce distruptor has been actively architecting and deploying a next generation mobile network based on the Open RAN (O-RAN) architectural framework. Backed by our shared entrepreneurial mindset, DZS has become an integral technology partner to Rakuten as they build out and deploy the world’s first commercial O-RAN network, which has reportedly scaled to over 1 million subscribers. DZS’ mobile RAN fronthaul and backhaul products are used to aggregate and manage Rakuten’s 4G and 5G traffic. We anticipate that service providers from around the world will consider this O-RAN architecture as they seek to benefit from new business, financial, and technology advantages compared to proprietary and closed mobile network architectures.

A second but equally important value proposition to understand and appreciate is that DZS is an innovative, valued, and trusted incumbent spanning both the fixed wireline and wireless network domains, and one of the few fiber access systems vendors not based in China. Our established expertise and history of success in both fixed wireline and wireless networks uniquely positions DZS to become a strategic technology partner as 5G becomes mainstream, especially when considering that fixed wireline and wireless networks are symbiotic. The expected densification associated with 5G deployments will promote and validate an accelerated upgrade cycle to fiber access and transport solutions. We believe the connected consumer experience of the future will also create demand for a seamless and integrated fixed-wireless convergence.

Across the Americas and EMEA, we are fueling the fast growth of fiber overbuilders and alternative broadband providers. These customer relationships are particularly strategic considering the role many of these communications providers will play in the deep fiber proliferation necessary to achieve a world-class 5G service experience.

As a trusted technology partner to the broader communications ecosystem, DZS continues to amplify a customer-first culture.

While Nokia and Huawei have historically been market share leaders in the fixed wireline and wireless network domains due to their global scale, we attribute the vendor concentration and consolidation that has occurred with Nokia as well as the recent geopolitical and security concerns with Huawei as a growth opportunity for DZS, allowing us to leverage our extensive product portfolio, global reach, and America-based headquarters to our advantage.

2

Interactive gaming, social networking, streaming video, augmented/virtual reality, Internet of Things, and smart homes, buildings, and cities are among a few of the prevailing market trends that are creating incremental network capacity demands on the fixed and mobile networks. Adding to the above emerging broadband access network trends, the COVID-19 pandemic has prompted employees to work from home, students

to learn from home, and patients to receive medical consultation from home, further increasing the network capacity demands which are accelerating fixed wireline and mobile network upgrade cycles.

Despite limited face-to-face customer contact because of the ongoing COVID-19 pandemic, DZS secured 15 new service provider and enterprise customers during the third quarter with continued strength in Asia and momentum in North America, Latin America, and EMEA. With over 1,000 service providers, system integrator/distributor partners, and enterprise customers, 20 million products in service spanning more than 100 countries, DZS is competing at the intersection of emerging frontiers in 5G ultra-low latency transport, 10 Gigabit-class PON for the home and the enterprise, and Wi-Fi6 or mesh wireless networking in virtually every type of premises.

DZS’ technology advancements and sales strategy underway are well timed to expand our market-leading broadband access, mobile transport, and enterprise optical LAN solutions anchored amongst leading customers throughout the world. Our strategic value and trusted alignment with these service providers uniquely positions DZS to differentiate, accelerate, and leverage our innovation for the fiber-based broadband access, mobile transport, and the enterprise optical LAN markets we are pursuing around the world.

Many of the leading GDP countries across Asia have been among the world’s leading broadband and mobile innovators over the past decade. DZS has the unique opportunity as an American-based company, and with research and development in the United States, Germany, South Korea, and Vietnam to compete and support our customers and prospective customers globally.

In addition, governments around the world have taken steps to proactively address unserved and underserved broadband regions within their respective countries with the creation of formal programs and policies that encourage the expansion of high capacity broadband access networks. The United States has been one of the leaders in this area, designating over $20 billion through the Rural Digital Opportunity Fund (RDOF), to spur broadband expansion in broadband-starved rural communities.

This week, the RDOF program kicked off with a reverse auction of subsidies to drive up to gigabit capable services for approximately 6 million homes and businesses throughout the United States. Historically, approximately 10% of funds from such government subsidized broadband incentive programs are spent on broadband access equipment. With our world headquarters in the United States, DZS is in a strong position to capture valuable RDOF award recipient network expansion and upgrade projects leveraging our world-class gigabit-level services broadband access portfolio.

3

The following is a map of U.S. census blocks eligible for RDOF grants:

Source: FCC – Blue Areas Eligible for Grants

With 30 years of IT/access networking experience accumulated from blue-chip technology leaders such as IBM and Motorola and from disruptive standard setting access networking pioneers Ascend Communications (acquired by Lucent Technology, today Nokia) and GENBAND (today Ribbon Communications), I was appointed President and Chief Executive Officer of DZS to integrate the company, accelerate the growth expansion opportunity in North America, Latin America, EMEA, and India as well as foster further innovation

in the areas of mobile transport, fiber access, and optical LAN. Since my appointment, we have expanded an extraordinary team of industry leaders at all levels of the company strengthening our executive leadership talent in the areas of technology, IT, legal, supply chain, and sales. Our new leadership team, with an impressive history of innovation and experience within the communications equipment and networking sectors, has embarked on several valuable and strategic initiatives to target growth and margin expansion opportunity across the global communications infrastructure markets.

4

Below is the executive leadership team, with notable new hires highlighted in blue:

Other senior leaders who recently joined DZS include:

+Miguel Alonso, Product Management (Calix and Advanced Fibre Communications)

+Doron Paz, Research and Development (Nortel and Zhone)

+Ken Stumpf, Business Development (Metaswitch and IBM).

+Anna Klosterman, North America Sales (Sandvine and Ribbon Communications)

+Meggin Sawyer, North America Sales (ADTRAN and Sprint)

+Bethe Strickland, North America Sales (ADTRAN, Microsoft and Mavenir)

With a balanced and experienced leadership team in-place, we intend to leverage our success in Asia to the rest of the world. Approximately half of our revenue is derived from Asia, demonstrating DZS’ compelling and advanced technology, service, and support capabilities. Our close alignment and trusted partnership with these service provider and market leaders has prepared DZS to expand throughout the rest of the world.

Over the past several months, we have rationalized and accelerated our commitment to our technology roadmaps, aligned with a bold vision and strategy to capture market share in the burgeoning 5G, Fiber to the Premises (FTTP), and smart home, cities, and buildings market segments. As our customers prepare for the next chapter of hyper-fast broadband access, DZS is well-positioned to participate with its market-leading and evolving mobile transport, broadband access, switching and routing, and connected home/enterprise portfolio of products and services.

5

With the confluence of events occurring throughout the world, communication service providers have experienced significant changes in demand and usage patterns. Global carriers are faced with significantly greater network capacity requirements at the network edge as the world increasingly adopts more remote work and learning models. Additionally, and while early in its global deployment, implementations of 5G have validated that wireless technologies can effectively compete with traditional fixed wireline services to deliver high-speed bandwidth services. Fixed wireline networks are also being enhanced and transformed with fiber-based upgrades such as 10G PON technology offering new categories of advanced services and performance. These technologies are intersecting at the remote worker, where network traffic has multiplied, representing an incremental opportunity for DZS Fiber to the Premises and Connected Home products

and solutions.

With a number of customer success stories in new markets such as mobile transport and passive optical LAN, we have been able to demonstrate success expanding beyond our broadband access and customer premises equipment heritage into the 5G mobile transport and enterprise markets. This has created new opportunities to expand and diversify future revenue. We are one of the few vendors in the world with deep expertise across both wireless and wireline technologies at the network edge.

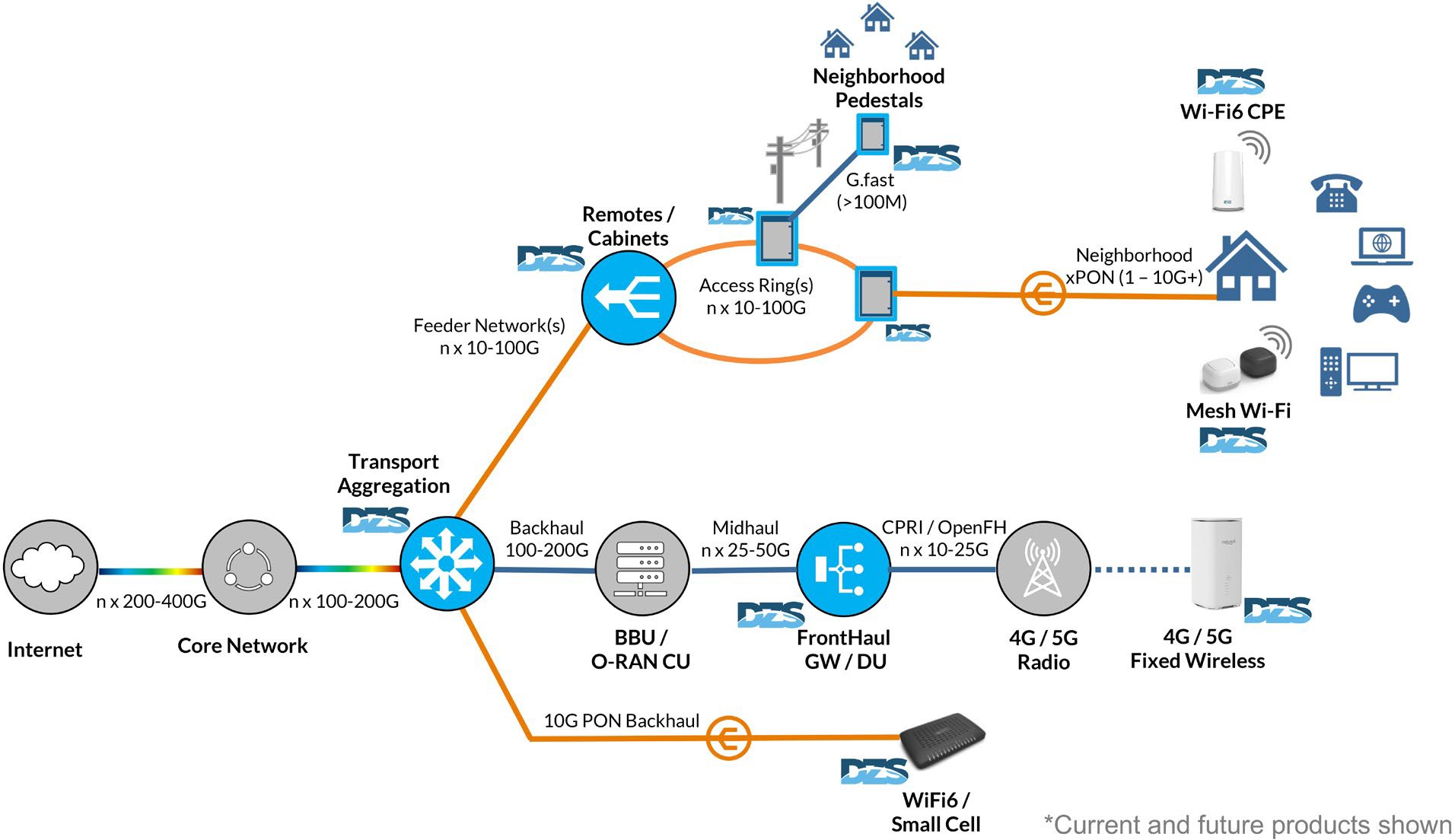

The following is an illustration of DZS technology solution areas and representative products:

Our vision and technology differentiation are underscored by our renewed focus on innovation, validated by a range of new products introduced in 2020 and dozens of active customer trials. Geopolitical influences on the competitive landscape fueled by vendor security concerns and initiatives supporting vendor choice through interoperability and open standards have created new and incremental opportunities for DZS globally.

6

Mobile Transport

The future state of mobile network architecture has an exponential growth opportunity for mobile operators and their supplier partner ecosystem. 5G creates one of the most significant growth opportunities since the “smartphone” was introduced over a decade ago. For the first time, mobile operators and Mobile Virtual Network Operators (MVNOs) will be able to effectively compete with traditional fixed wireline broadband

access service providers, offering a fiber-like end-user experience that delivers a 10-25 times improvement in performance compared with typical present-day 4G service.

The 5G network architecture allows for a substantial increase in base station density relative to 4G networks, enabling more capacity and new use cases. This creates a significant opportunity for our mobile transport portfolio. As 4G networks evolve and new mobile operators begin to deploy 5G services, DZS is in a strong position to participate in the $9 billion mobile transport market. Our expansion into the 5G market creates an incremental opportunity complementing our fiber to the premises and enterprise optical LAN businesses.

We expect that our innovative mobile access and transport portfolio will forge new opportunities with mobile operators globally as well as foster strategic partnerships with the broader mobile, optical, and cloud-based supplier ecosystem.

The following is an illustration of an Open Radio Access Network (O-RAN) aligned architecture, highlighting areas where DZS equipment is deployed:

Rakuten, which I referenced above, is a prime example of this value proposition and field proven approach.

7

Broadband Access

In addition to the well-publicized spike in broadband Internet traffic since the beginning of the COVID-19 pandemic, we anticipate that the work-, learn-, and tele-health-from-home trends will have long-term favorable impacts on our growth prospects as fixed and mobile service providers, fiber over-builders, and utility providers accelerate their fiber buildout upgrade cycle to align with the surge in broadband access demands.

The following is an illustration of a typical copper/fiber broadband access architecture highlighting areas where DZS equipment is deployed:

The following is an illustration of a typical copper/fiber broadband access architecture highlighting areas where DZS equipment is deployed:

Converged Networks

As noted, we anticipate demand as traditional wireline broadband operators are increasingly called upon to provide fiber-fed connectivity to new 5G and Wi-Fi6 base stations and access points in licensed and unlicensed spectrum.

In many parts of the world, our major customers have significant, complementary businesses as both Mobile Network Operators and as wireline broadband network or optical transport service providers. The need for coexistence and integration of these networks has given rise to a number of industry initiatives to devise standards and technologies that support what is being called “Fixed Mobile Convergence,” or the ability to operate the complementary businesses and technology efficiently and effectively.

Many service providers are pursuing converged network architectures to implement fixed broadband and mobile transport solutions. We also anticipate a continued trend of service provider, fiber overbuilder and utility consolidation to maximize economies of scale and competitive economics for services.

8

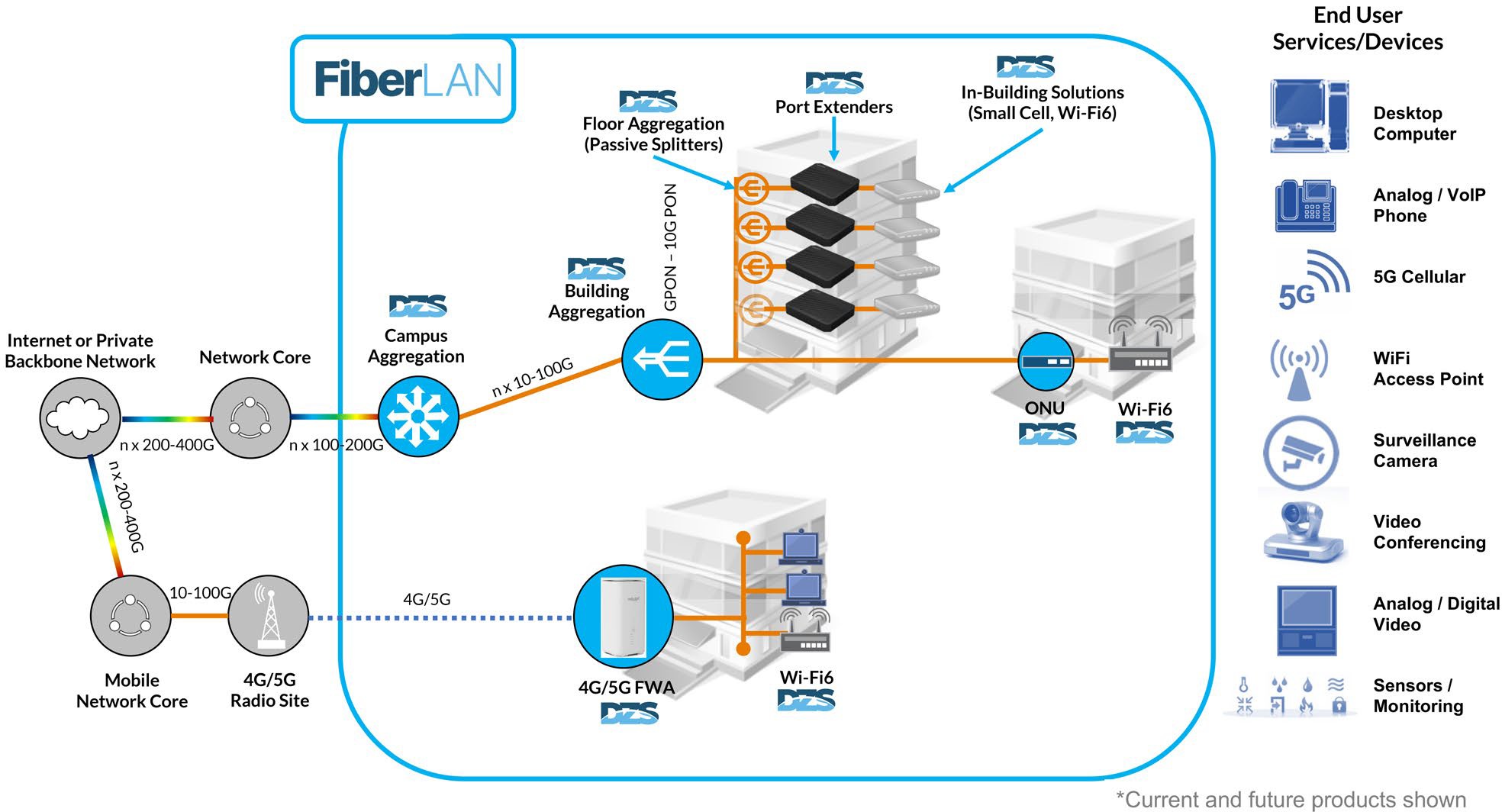

The following is an illustration of a converged network architecture highlighting areas in blue where DZS equipment is deployed:

Enterprise

Highlighted in earlier segments of this letter, the broader macro-trends evolving across the industry are directly affecting enterprise users of broadband services. These include the growing dependence on cloud-based Infrastructure-as-a-Service (IaaS), or Software-as-a-Service (SaaS) applications in place of traditional

on-site datacenters. Additionally, the proliferation of interactive online collaboration platforms, associated HD or UHD quality streaming video services, and the implementation of data analysis, artificial intelligence (AI), and machine learning (ML) frameworks to support businesses with operations based on an Internet of Things (IoT) are increasingly a factor.

These trends are all contributing to rapid network traffic growth and the need for higher network capacity, lower latency, and always-on access in homes and businesses as new, changing patterns emerge for the location and style of work. We also see significant adoption of high-density wireless LAN-centric access models in enterprises driving a need for cost effective fiber-fed capacity and coverage beyond the bounds of traditional wired LAN systems.

9

Subsegments of these markets, including large in-building and campus networks, require specialized solutions that are well-suited by minor extensions of our higher-performance fiber access technologies and products. Our FiberLAN solutions strategy targets this opportunity, and we expect to see increased momentum in this area building on successful deployments at numerous sports venues, hospitality, universities, healthcare facilities, and multi-dwelling units.

As building occupancy trends continue to recover globally, we expect that enterprises across the board will stimulate growth in the optical LAN market.

The following is an illustration of how an enterprise network architecture is being transformed by the deployment of PON and advanced wireless technologies, including the highlighted area in blue where DZS equipment is leveraged:

10

Third Quarter Financial Results

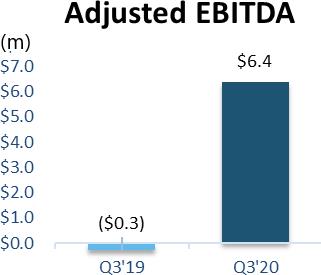

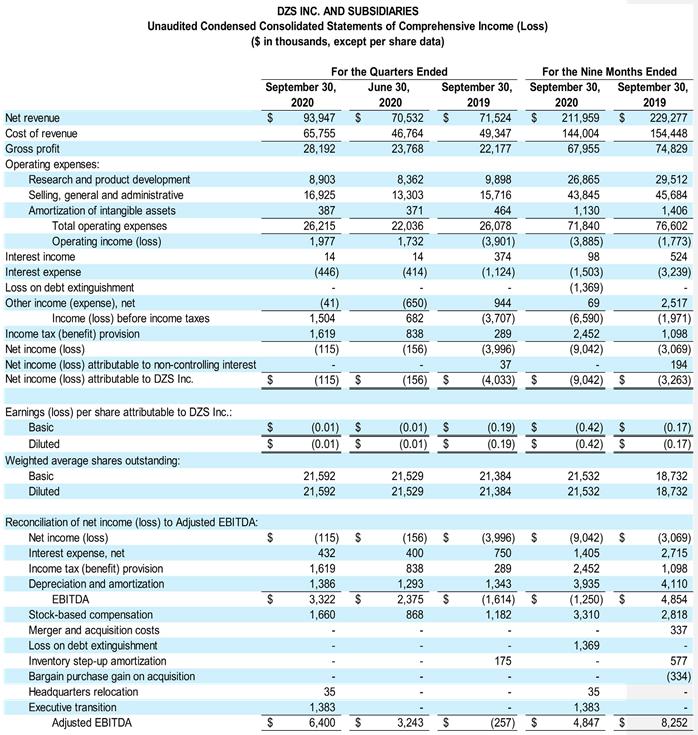

We are pleased to report a strong third quarter of 2020, with record revenue of $93.9 million and adjusted EBITDA of $6.4 million, well ahead of our $74-79 million revenue guidance and our $(0.5) - $2.5 million adjusted EBITDA guidance. These strong numbers delivered adjusted net income (loss) per share of $0.20.

Net revenue increased 31.4% compared with the third quarter of 2019 and 33.2% sequentially. Both the year-over-year and the sequential revenue increase was

Net revenue increased 31.4% compared with the third quarter of 2019 and 33.2% sequentially. Both the year-over-year and the sequential revenue increase was

the result of demand for our next generation mobile transport products, which accelerated following previously delayed projects and activities that initially slowed the pace of deployment activity due largely to the COVID-19 pandemic.

As a result of our continued momentum in Asia fueled by our next generation

mobile transport, fiber broadband access, and connected premises solutions and incumbency positions in South Korea, Japan, and Vietnam, Asia represented 61% of our net revenue in the third quarter, or $57.0

million compared with $38.9 million in the second quarter of 2020 and $38.7 million in the third quarter of 2019.

Revenue Mix by Geographic Region

11

America’s revenue was $17.0 million in the third quarter of 2020, representing 18% of revenue and increasing 9.8% from $15.4 million in the second quarter of 2020, and was flat compared with in the third quarter of

last year.

EMEA revenue was $19.9 million or 21% of total revenue in the third quarter of 2020, up 23.1% from $16.2 million in the second quarter of 2020, and up 25.7% from $15.8 million in the third quarter of 2019.

Adjusted gross margin, which excludes depreciation and amortization, stock-based compensation, and inventory step-up amortization was 30.6%.

Adjusted gross margin, which excludes depreciation and amortization, stock-based compensation, and inventory step-up amortization was 30.6%.

This compares to 34.4% in the second quarter of 2020 and 32.0% in the third quarter of last year. Our gross margin was unfavorably impacted by supply chain disruptions and certain component lead time shortages resulting in unexpected costs to expedite shipments.

GAAP operating expense was $26.2 million, compared to $22.0 million in the second quarter of 2020 and $26.1 million in the third quarter of 2019. On a

sequential basis, the increased GAAP operating expenses was largely the result of executive transition costs (including stock compensation expense), increased sales commissions, and the relocation of our corporate headquarters to Plano, Texas.

Adjusted operating expense, which excludes depreciation and amortization, and stock-based compensation, as well as executive transition costs, and the cost to relocate our headquarters, was $22.3 million compared with $20.4 million in the prior quarter and $24.1 million in the third quarter of 2019. The higher adjusted operating expense sequentially was the result of increased sales volumes and higher executive headcount while the year-over-year decline in adjusted operating expense was primarily due to effective cost control measures in the quarter, as well as the benefit of restructuring measures taken in the second half of last year.

Adjusted operating income was $6.4 million in the third quarter of 2020, or 6.9% of revenue, which is an improvement from $3.9 million, or 5.5% of revenue, in the second quarter of 2020. In the third quarter of 2019, DZS reported an adjusted operating loss of $(1.2) million, or (1.7%) of revenue.

12

The sequential improvement in our third quarter revenue generated near-record adjusted EBITDA of $6.4 million, or 6.8% of revenue. This compares to adjusted EBITDA of $3.2 million in the prior quarter and a negative adjusted EBITDA of $(0.3) million in the third quarter of last year.

Our GAAP net loss was $(115,000), or one cent loss per diluted share. This compares to a GAAP net loss of

$(156,000), or a one cent loss per diluted share in the second quarter of 2020, and a net loss of $(4.0) million, or nineteen cents per diluted share, in the third quarter of last year.

After removing depreciation and amortization, stock-based compensation, and costs associated with our headquarters relocation from California to Texas and our executive transitions, Adjusted Net Income in the third quarter of 2020 was $4.3 million, or $0.20 per share. By comparison, Adjusted Net Income was $2.0 million, or $0.09 in the second quarter of 2020 and a net loss of $(1.3) million, or $(0.06) per share in the third quarter of 2019.

Balance Sheet Highlights

At September 30, 2020, cash and cash equivalents, including restricted cash, totaled $40.4 million, compared to $47.2 million at the end of the prior quarter. The sequential decrease was due largely to a reduction in short term debt as we began to pay down the debt we incurred at the outset of the COVID-19 crisis, and to a lesser extent, from changes in working capital. Total debt at September 30, 2020 was $51.5 million, as compared to

$56.8 million at June 30, 2020.

Our days sales outstanding at the end of the third quarter of 2020 was 105 days compared to 129 days in the second quarter of 2020 and 139 days in the third quarter of 2019. We will continue to focus on and emphasize working capital improvement in the coming quarters.

13

Fourth Quarter 2020 Guidance:

Looking forward to our fourth quarter 2020 financial outlook, our backlog as of October 1, 2020 was approximately $70 million, and we remain optimistic about our long-term growth prospects and the opportunities noted above. With our improved process, procedures, and daily sales and supply chain cadence, we were able to exceed customer expectations in the third quarter by pulling forward and delivering unplanned for demand for our service provider and enterprise integrator partners in the third quarter of

2020. With the recent rise in COVID-19 cases across the various regions we serve and the potential risk and disruption to our supply chain and deployment schedule, we are taking a cautionary outlook to our fourth quarter guidance.

With that backdrop, we are providing revenue and earnings guidance for the fourth quarter of 2020 as follows:

With that backdrop, we are providing revenue and earnings guidance for the fourth quarter of 2020 as follows:

Our guidance for the fourth quarter of 2020, reflects our outlook as of the date of this stockholder letter. These expectations reflect the normal seasonality in our business as well as our current estimate of the global impacts from the COVID-19 pandemic.

Summary

We are pleased with what we have accomplished over the past three months under our newly enhanced leadership team and the opportunities before us. Our company’s vision, mission, and go-to-market strategy starts with the executive management team. We have assembled an extremely talented and experienced team that is prepared and enthusiastic about the future state of our business. We have high expectations and we are moving quickly to the next level, starting with a new company brand, DZS, and optimizing the business and its cost structure to drive sustainable earnings and cash generation. As we streamline the organization over the coming months, we will leverage our market-leading product innovation aligning with service provider and enterprise investment cycles at the network edge and on-premises. Our sequential and year-over-year bookings and revenue growth demonstrate customer and partner loyalty, and demand for our mobile, fiber access, and connected home/enterprise solutions.

14

As our industry experiences disruption resulting from a tidal wave of technology shifts, accelerated network capacity requirements driven by an increasing number of people working, learning, and experiencing tele- health from home, as well as favorable geopolitical dynamics, we remain optimistic about the long-term prospects for DZS. We have a clear vision and strategy and applaud the great work our employees are delivering for our customers every day.

We value our customers and our stockholders for their loyalty, continued support and the future opportunities they represent for us.

Sincerely,

Sincerely,

Charlie VogtTom Cancro

President & CEOChief Financial Officer

Conference Call

DZS will host a conference call to discuss its third quarter financial results the following morning on Friday, October 30, 2020 at 8:30 a.m. (ET).

Conference call details:

Date: Friday, October 30, 2020 Time: 8:30 a.m. Eastern time zone

U.S. dial-in number: 877-742-9182 International number: +1-602-563-8857 Conference ID: 6457133

Webcast link: https://edge.media-server.com/mmc/p/tesy77vz

Investor Inquiries Ted Moreau

Vice President, Investor Relations

ir@dzsi.com

15

About DZS

DZS Inc. (NSDQ: DZSI) is a broadband access innovator and global market leader spanning fixed and mobile optical transport and connected premises solutions for service providers, fiber overbuilders, and enterprises. A pioneer in broadband access and mobile AnyHaul platforms with over 20 million products shipped, service and alternative providers and enterprises look to DZS for the innovation that leads to future-proof networks and outstanding performance. Over 1,000 service providers, operators, and enterprises in over 100 countries have leveraged DZS innovation, open solutions, and agility to arm them with the network resources and deployment freedom they need to lead in their markets and deliver an unrivaled communications experience. With manufacturing, engineering, service and support centers of excellence spread across the globe,

DZS is positioned to bring next-generation technologies and world-class solutions to service providers and enterprises who are poised to transform, compete and win.

DZS, the DZS logo, and all DZS product names are trademarks of DZS Inc. Other brand and product names are trademarks of their respective holders. Specifications, products, and/or product names are all subject

to change.

Forward-Looking Statements

Statements made in this stockholder letter and the earnings call contains forward-looking statements regarding future events and our future results that are subject to the safe harbors created under the Private Securities Litigation Reform Act of 1995. These statements reflect the beliefs and assumptions of the Company’s management as of the date hereof. Words such as “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “forecast,” “goal,” “intend,” “may,” “plan,” “project,” “seek,” “should,” “target,” “will,” “would,” variations of such words, and similar expressions are intended to identify forward-looking statements. In addition, statements that refer to projections of earnings, revenue, operating expenses, gross profit, costs or other financial items (including non-GAAP measures) in future periods are forward-looking statements.

Readers are cautioned that these forward-looking statements are only predictions and are subject to risks, uncertainties and assumptions that are difficult to predict. The Company’s actual results could differ materially and adversely from those expressed in or contemplated by the forward-looking statements. In addition to the factors discussed in this stockholder letter, factors that could cause actual results to differ include, but are not limited to, those risk factors contained in the Company’s SEC filings available at www.sec.gov, including without limitation, the Company’s annual report on Form 10-K, quarterly reports on Form 10-Q and subsequent filings. In addition, additional or unforeseen affects from the COVID-19 pandemic and global economic climate may give rise to, or amplify, many of these risks. Readers are cautioned not to place undue reliance on any

forward-looking statements, which speak only as of the date on which they are made. The Company undertakes no obligation to update or revise any forward-looking statements for any reason.

16

Use of Non-GAAP Financial Information

To supplement DZS’s consolidated financial statements presented in accordance with GAAP, DZS reports Adjusted Cost of Revenue, Adjusted Gross Margin, Adjusted Operating Expenses, Adjusted Operating Income (Loss), Adjusted (Non-GAAP) Net Income attributable to DZS (including on a per share basis), EBITDA, and Adjusted EBITDA, which are non-GAAP measures DZS believes are appropriate to provide meaningful comparison with, and to enhance an overall understanding of DZS’s past financial performance and prospects for the future. DZS believes these non-GAAP financial measures provide useful information to both management and investors by excluding specific expenses and gains that DZS believes are not

indicative of core operating results. Further, each of these are non-GAAP measures of operating performance used by management, as well as industry analysts, to evaluate operations and operating performance

and is widely used in the telecommunications and manufacturing industries. Other companies in the telecommunications and manufacturing industries may calculate these metrics differently than DZS does. The presentation of this additional information is not meant to be considered in isolation or as a substitute for measures of financial performance prepared in accordance with GAAP.

DZS defines Adjusted Cost of Revenue as GAAP Cost of Revenue less (i) depreciation and amortization,

(ii) stock based compensation, and (iii) the impact of material transactions or events that we believe are not indicative of our core product cost, such as, inventory step-up amortization, any of which may or may not be recurring in nature. We believe Adjusted Cost of Revenue provides the investor more accurate information regarding the actual cost of our products and services, excluding the impact of costs of revenue that are not routine components of our core product cost, for better comparability of our costs of revenue between periods and to other companies.

DZS defines Adjusted Gross Margin as GAAP Gross Margin less (i) depreciation and amortization, (ii) stock based compensation, and (iii) the impact of material transactions or events that we believe are not indicative of our core operating performance, such as, inventory step-up amortization, any of which may or may not be recurring in nature. We believe Adjusted Gross Margin provides the investor more accurate information regarding our core profit margin on sales, excluding the impact of cost of revenue that are not routine components of our core product cost, for better comparability of gross margin between periods and to other companies.

DZS defines Adjusted Operating Expenses as GAAP operating expenses plus or minus (as applicable) (i) depreciation and amortization, (ii) stock based compensation, and (iii) the impact of material transactions or events that we believe are not indicative of our core operating performance, such as merger and acquisition costs, purchase price adjustment, goodwill impairment, impairment of long-lived assets or loss on debt

17

extinguishment, restructuring and other charges, any of which may or may not be recurring in nature. We believe Adjusted Operating Expenses provides the investor more accurate information regarding our core operating expenses, which include research and development costs, selling, general and administrative costs, and amortization of intangible assets, excluding the impact of charges that are not routine components of our core operating expenses, for better comparability between periods and to other companies.

DZS defines Adjusted Operating Income (Loss) as GAAP Operating Income (Loss) plus or minus (as applicable) (i) depreciation and amortization, (ii) stock based compensation, and (iii) the impact of material transactions or events that we believe are not indicative of our core operating performance, such as merger and acquisition costs, purchase price adjustment, goodwill impairment, impairment of long-lived assets or loss on debt extinguishment, restructuring and other charges, any of which may or may not be recurring

in nature. We believe Adjusted Operating Income (Loss) provides the investor more accurate information regarding our core operating Income (Loss), excluding the impact of charges that are not routine components of our core operating expenses, for better comparability between periods and to other companies.

DZS defines Non-GAAP net income (loss) attributable to DZS as GAAP Net Income plus or minus (as applicable) (i) depreciation and amortization, (ii) stock based compensation, and (iii) the impact of material transactions or events that we believe are not indicative of our core operating performance, such as merger and acquisition costs, inventory step-up amortization, purchase price adjustment, goodwill impairment, impairment of long-lived assets or loss on debt extinguishment, restructuring and other charges, any of which may or may not be recurring in nature. We believe Non-GAAP net income (loss) attributable to DZS provides the investor more accurate information regarding our core income, excluding the impact of charges that

are not routine components of our core product cost or core operating expenses, for better comparability between periods and to other companies.

DZS defines EBITDA as net income (loss) plus or minus (as applicable) (i) interest expense, net, (ii) income tax provision (benefit), and (iii) depreciation and amortization expense. DZS defines Adjusted EBITDA as EBITDA plus or minus (as applicable) (i) stock-based compensation expenses, and (ii) the impact of material transactions or events that we believe are not indicative of our core operating performance, such as merger and acquisition transaction costs, inventory step-up amortization, purchase price adjustment, goodwill impairment, gain or (loss) on sale of assets, impairment of long-lived assets or loss on debt extinguishment, any of which may or may not be recurring in nature. DZS believes that EBITDA and Adjusted EBITDA

are useful measures because they provide supplemental information to assist investors in comparing the Company’s performance across reporting periods on a consistent basis by excluding items that the Company does not believe are indicative of its core operating performance, as well as in assessing the sustainable

cash-generating ability of the business. In addition, DZS believes these measures are of importance to investors and lenders in assessing the Company’s overall capital structure and its ability to borrow additional funds.

18

A reconciliation of EBITDA and Adjusted EBITDA to each of their respective GAAP counterparts for the three months ended September 30, 2020, December 31, 2019 and September 30, 2019 is included at the end of the Unaudited Condensed Consolidated Statements of Comprehensive Income (Loss) below. Reconciliations of the other Non-GAAP measures included herein to their GAAP counterparts are provided in the section below entitled “Reconciliation of GAAP to Non-GAAP Results” and “Reconciliation of GAAP to Non-GAAP Financial Guidance”.

19

20

21

22