Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - VARIAN MEDICAL SYSTEMS INC | exhibit99-1pressreleas.htm |

| 8-K - 8-K - VARIAN MEDICAL SYSTEMS INC | var-20201027.htm |

Fourth Quarter Fiscal Year 2020 October 27, 2020 Investor Relations

This presentation is intended exclusively for investors. It is not intended for use in Sales or Marketing. Forward-Looking Statements Except for historical information, this presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Statements concerning the timing of the company's acquisition by Siemens Healthineers, the company’s long-term growth and value creation strategies, future orders, backlog, liquidity, capital allocation priorities and the anticipated impact of the COVID-19 pandemic on our business; and any statements using the terms “could,” “believe,” “expect,” “promising,” “outlook,” “should,” “well-positioned,” “will” or similar statements are forward-looking statements that involve risks and uncertainties that could cause the company’s actual results to differ materially from those anticipated. Such risks and uncertainties include the future impact of the COVID-19 pandemic on our business, including but not limited to, the impact on our workforce, operations, supply chain, demand for our products and services, and our financial results and condition; our ability to successfully manage the challenges associated with the COVID-19 pandemic; our ability to achieve expected synergies from acquisitions; risks associated with integrating recent acquisitions; global economic conditions and changes to trends for cancer treatment regionally; currency exchange rates and tax rates; the impact of the Tax Cuts and Jobs Act; the impact of the Affordable Health Care for America Act (including excise taxes on medical devices) and any further healthcare reforms (including changes to Medicare and Medicaid), and/or changes in third-party reimbursement levels; recent and potential future tariffs, cross-border trade restrictions or a global trade war; demand for and delays in delivery of the company’s products; the company’s ability to develop, commercialize and deploy new products; the company’s ability to meet Food and Drug Administration (FDA) and other regulatory requirements, regulations or procedures; changes in regulatory environments; risks associated with the company providing financing for the construction and start-up operations of particle therapy centers, challenges associated with commercializing the company’s proton solutions business; challenges to public tender awards and the loss of such awards or other orders; the effect of adverse publicity; the company’s reliance on sole or limited-source suppliers; the company’s ability to maintain or increase margins; the impact of competitive products and pricing; the potential loss of key distributors or key personnel; challenges related to entering into new business lines; the occurrence of any event, change or other circumstances that could give rise to the termination of the merger agreement with Siemens Healthineers; the failure to obtain certain required regulatory approvals or the failure to satisfy any of the other closing conditions to the completion of the merger; risks related to disruption of management’s attention from the company’s ongoing business operations due to the merger; the effect of the announcement of the merger on the ability of the company to retain and hire key personnel and maintain relationships with its customers, suppliers, distributors and others with whom it does business, or on its operating results and business generally; the ability to meet expectations regarding the timing and completion of the merger; and the other risks listed from time to time in the company’s filings with the Securities and Exchange Commission, which by this reference are incorporated herein. For additional information concerning factors that could cause actual results and events to differ materially from those projected herein, please refer to our Form 10-K for the year ended September 27, 2019 and subsequent Forms 8-K and 10-Q filed with the Securities and Exchange Commission. The company assumes no obligation to update or revise the forward-looking statements in this release because of new information, future events, or otherwise. Reconciliations to GAAP financials can be found in our earnings press release at www.varian.com/investors and the appendix to this presentation. Varian has not filed its Form 10-K for the year ended October 2, 2020. As a result, all financial results described here should be considered preliminary, and are subject to change to reflect any necessary adjustments, completion of purchase accounting, or changes in accounting estimates, that are identified prior to the time the company files the Form 10-K. Medical Advice Disclaimer Varian as a medical device manufacturer cannot and does not recommend specific treatment approaches. Individual treatment results may vary. 2

Agenda Q4 FY 2020 earnings 1. Fourth Quarter Overview 2. Segment Performance 3. Appendix VARIAN CONFIDENTIAL/ PROPRIETARY: DISCLOSED SOLELY FOR IMMEDIATE RECIPIENT ONLY

Fourth Quarter Overview

Q4 FY 2020 key financial metrics $M Q4 Y/Y FY20 Y/Y Oncology Orders $1,041 (8%) $3,254 (4%) • Operating performance reflects COVID-19 impact across all geographies Revenues $850 (3%) $3,168 (2%) Oncology $800 (2%) $2,998 (2%) Proton Solutions $38 (8%) $121 (16%) • As previously announced on Other $12 (33%) $49 n/m August 2, 2020, Varian entered into a definitive agreement to combine with Siemens GAAP Operating Earnings $98 (11%) $323 (16%) Healthineers, which was % of Revenues 11.6% 10.2% approved by stockholders on Non-GAAP Operating Earnings $143 (10%) $478 (12%) October 15, 2020. The % of Revenues 16.8% 15.1% transaction is expected to close in the first half of calendar year 2021, subject to regulatory GAAP EPS $0.83 8% $2.94 (7%) approvals and other customary Non-GAAP EPS $1.12 (8%) $3.91 (16%) closing conditions. Cash Flows from Operations $266 126% $484 30% Note: Unless noted otherwise, all ‘Orders’ reflect Gross Orders, all growth rates are in dollars and year on year. N/M: 5 not meaningful

Operating performance reflects COVID-19 impact Total company results (GAAP) across all geographies • Revenues decline driven by inability to access sites Key P&L financial metrics and delays in pre-installation construction activities − Services Revenue growth reflects resilience of hardware and software services VARIAN $M Q4 FY20 Y/Y FY20 Y/Y • Gross Margin rate in the quarter primarily driven by benefits from portfolio mix and lower variable Gross Orders $1,089 (8%) $3,435 (4%) services costs offset by certain Proton Solutions Revenues $850 (3%) $3,168 (2%) charges; prior year comparable quarter included a Product $439 (11%) $1,588 (11%) benefit from tariff relief which was partially offset by Services $411 6% $1,580 10% inventory step-up Gross Margin $375 (3%) $1,377 0% • R&D spend driven by investments in strategic % of Revenues 44.1% 30 bps 43.5% 100 bps initiatives and key programs R&D $77 18% $281 13% • SG&A decline in the quarter due to management % of Revenues 9.1% 170 bps 8.9% 120 bps cost actions; for the full year, the increase was SG&A $199 (5%) $773 5% primarily driven by acquisitions % of Revenues 23.4% (30 bps) 24.4% 160 bps • GAAP Earnings and GAAP EPS for the fourth Operating Earnings $98 (11%) $323 (16%) quarter included a $15 million in gains on public and % of Revenues 11.6% (100 bps) 10.2% (180 bps) private equity investments, $11 million in acquisition expenses, $11 million in litigation charges and legal Diluted EPS ($) $0.83 8% $2.94 (7%) costs, and a $9 million impairment on our available- Installed Base (Linac) 8,717 3% for-sale investments. Note: Unless noted otherwise, all ‘Orders’ reflect Gross Orders, all growth rates are in dollars and year on year, and basis points (bps) are rounded to the nearest tens. • Reconciliation between GAAP and non-GAAP financials can be found in our appendix 6

Total company results (non-GAAP) Operating performance reflects COVID-19 impact Key P&L financial metrics across all geographies • Revenues decline driven by inability to access sites and delays in pre-installation construction activities VARIAN − Services Revenue growth reflects resilience of $M Q4 FY20 Y/Y FY20 Y/Y hardware and software services Gross Orders $1,089 (8%) $3,435 (4%) • Gross Margin rate in the quarter primarily driven by Revenues $850 (3%) $3,168 (2%) benefits from portfolio mix and lower variable Product $439 (11%) $1,588 (11%) services costs offset by certain Proton Solutions Services $411 6% $1,580 10% charges; prior year comparable quarter included a benefit from tariff relief Gross Margin1 $376 (5%) $1,384 (0%) % of Revenues 44.2% (90 bps) 43.7% 60 bps • R&D spend driven by investments in strategic R&D $77 18% $281 13% initiatives and key programs % of Revenues 9.1% 170 bps 8.9% 120 bps • SG&A decline in the quarter due to management SG&A2 $156 (9%) $626 4% cost actions; for the full year, the increase was % of Revenues 18.4% (120 bps) 19.8% 110 bps primarily driven by acquisitions Operating Earnings $143 (10%) $478 (12%) % of Revenues 16.8% (140 bps) 15.1% (170 bps) Diluted EPS ($) $1.12 (8%) $3.91 (16%) Installed Base (Linac) 8,717 3% Note: Unless noted otherwise, all ‘Orders’ reflect Gross Orders, all growth rates are in dollars and year on year, and basis points (bps) are rounded to the nearest tens. (1) Excludes the portion of amortization of intangible assets and inventory step-up recorded in cost of revenues. Refer to the non-GAAP reconciliation in the appendix. (2) Excludes amortization of intangible assets, acquisition and integration-related expenses or benefits, impairment charges, restructuring charges, litigation charges and legal costs, and other. Refer to the non-GAAP reconciliation in the appendix. 7

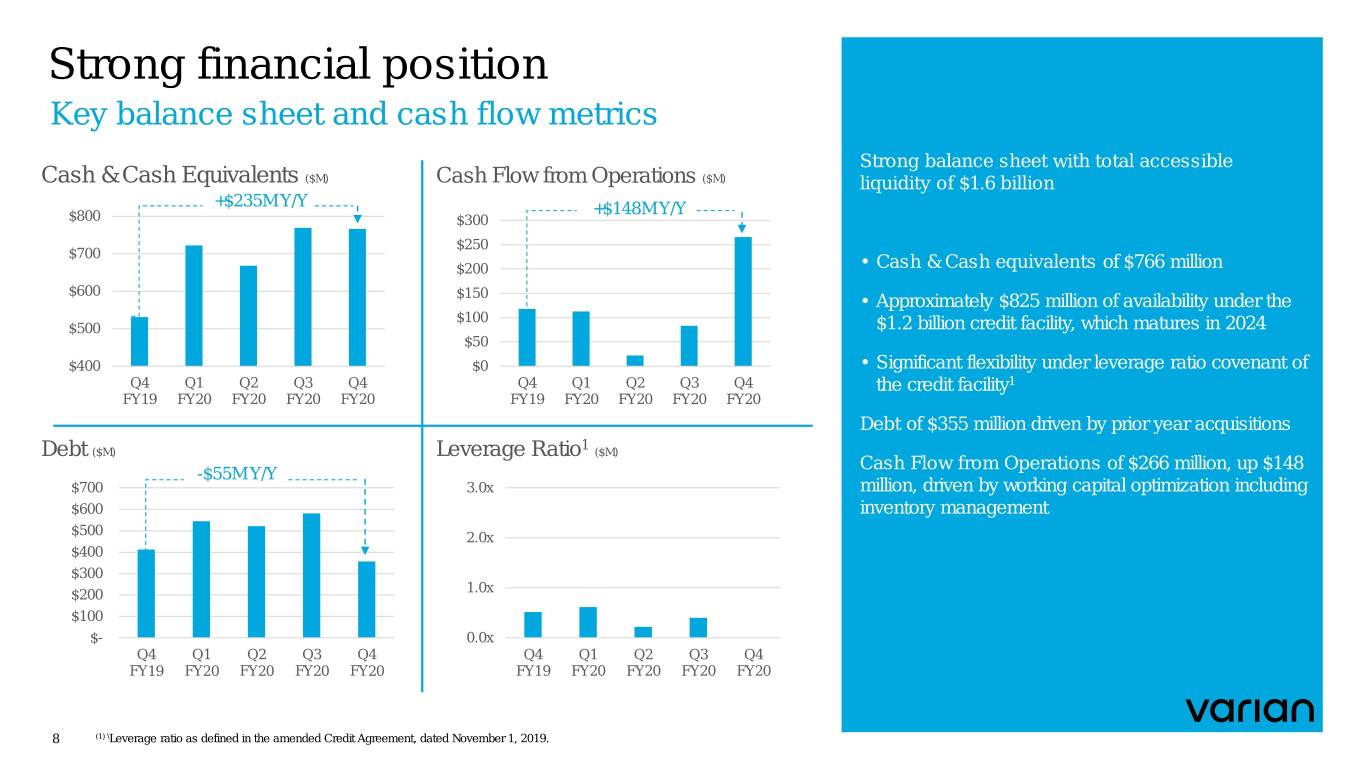

Strong financial position Key balance sheet and cash flow metrics Strong balance sheet with total accessible Cash & Cash Equivalents ($M) Cash Flow from Operations ($M) liquidity of $1.6 billion +$235M Y/Y +$148M Y/Y $800 $300 $250 $700 $200 • Cash & Cash equivalents of $766 million $600 $150 • Approximately $825 million of availability under the $100 $500 $1.2 billion credit facility, which matures in 2024 $50 $400 $0 • Significant flexibility under leverage ratio covenant of Q4 Q1 Q2 Q3 Q4 Q4 Q1 Q2 Q3 Q4 the credit facility1 FY19 FY20 FY20 FY20 FY20 FY19 FY20 FY20 FY20 FY20 Debt of $355 million driven by prior year acquisitions 1 Debt ($M) Leverage Ratio ($M) Cash Flow from Operations of $266 million, up $148 -$55M Y/Y $700 3.0x million, driven by working capital optimization including $600 inventory management $500 2.0x $400 $300 1.0x $200 $100 $- 0.0x Q4 Q1 Q2 Q3 Q4 Q4 Q1 Q2 Q3 Q4 FY19 FY20 FY20 FY20 FY20 FY19 FY20 FY20 FY20 FY20 8 (1) \Leverage ratio as defined in the amended Credit Agreement, dated November 1, 2019.

Long-term growth and value creation strategy Focusing on these strategic enablers will deliver core business growth, global expansion and new opportunities Innovate in radiation therapy Leverage artificial intelligence, machine learning and Global Leader cloud solutions Global Leader in in Radiation Multidisciplinary Cancer Care Therapy Grow emerging geographies, businesses and technologies Solutions Improve operational, financial, and capital efficiency 9

Segment Performance

Oncology Systems segment (GAAP) Key financial metrics VARIAN Operating performance reflects COVID-19 impact $M Q4 FY20 Y/Y FY20 Y/Y across all geographies Gross Orders $1,041 (8%) $3,254 (4%) Revenues $800 (2%) $2,998 (2%) • Gross Orders decreased 8% in the quarter and fell 4% in the full fiscal year Product $402 (8%) $1,455 (11%) Services $398 5% $1,542 9% • Revenues decline driven by inability to access sites and delays in pre-installation construction activities Gross Margin $368 (1%) $1,340 (1%) − % of Revenues 45.9% 70 bps 44.7% 60 bps Services Revenue growth reflects resilience of hardware and software services Operating Earnings1 $170 12% $518 (7%) % of Revenues 21.2% 270 bps 17.3% (90 bps) • Gross Margin rate in the quarter primarily driven by Installed Base (Linac) 8,717 3% benefits from portfolio mix and lower variable services costs; prior year comparable quarter Note: Unless noted otherwise, all ‘Orders’ reflect Gross Orders and all growth rates are in dollars and year on year, and basis points (bps) are rounded to the nearest tens. included a benefit from tariff relief (1) Operating earnings includes an allocation of corporate costs based on relative revenues between the operating segments. The allocated corporate costs excludes certain transactions or adjustments that are considered non-operational in nature, such as acquisition and integration-related expenses or benefits, impairment charges, restructuring charges, significant litigation charges or benefits and legal costs. 11

Oncology Systems gross orders by geography APAC AMERICAS +14% Q4 Y/Y -19% Q4 Y/Y1 (+12% cc) (-18% cc) +6% FY20 Y/Y -7% FY20 Y/Y1 (+6% cc) (-7% cc) (1) In North America, Q4 orders growth of -17% and FY20 orders growth of -7% EMEA -4% Q4 Y/Y (-8% cc) -6% FY20 Y/Y 12 (-6% cc)

Varian linac net installed base Installed base growth Varian strengthened its global leadership in radiation therapy 8,717 • Net installed base grew +3% or 221 units, driving +221 future recurring software and services revenues (+3%) 8,496 • Installed base grew across all three geographies Q4 FY19 Q4 FY20 13 Note: Net installed base is representative of total installed base net of replacements in the period.

Proton Solutions segment (GAAP) Key financial metrics VARIAN Operating performance reflects COVID-19 impact across all geographies $M Q4 FY20 Y/Y FY20 Y/Y Gross Orders $36 18% $132 (13%) • Gross Orders driven by one new order in the Revenues $38 (8%) $121 (16%) quarter for a total of four orders in the year Product $25 (29%) $83 (32%) • Product Revenues driven by a slower order run- Services $13 100% $38 76% rate in prior years Gross Margin ($1) (105%) $2 (90%) • Services Revenues driven by incremental rooms % of Revenues (1.4%) (2,690 bps) 1.5% (1,090 bps) coming off warranty Operating Earnings1 ($29) (358%) ($65) 33% • in the quarter benefited from % of Revenues (75.5%) (6,040 bps) (54.1%) 1,350 bps Operating Earnings higher service revenues offset by $14 million in Note: Unless noted otherwise, all ‘Orders’ reflect Gross Orders and all growth rates are in dollars and year on year, and basis points (bps) asset write-offs and bad debt reserves are rounded to the nearest tens. (1) Operating earnings includes an allocation of corporate costs based on relative revenues between the operating segments. The allocated corporate costs excludes certain transactions or adjustments that are considered non-operational in nature, such as acquisition and integration-related expenses or benefits, impairment charges, restructuring charges, significant litigation charges or benefits and legal costs. 14

ProBeam proton therapy system sites 29 81 40 ProBeam Total Operational Sites Rooms Rooms1 Operational centers Centers Under Development (1) Number of Operational Rooms may not sum up to the total number on the map due to some sites having rooms which are under development. 15

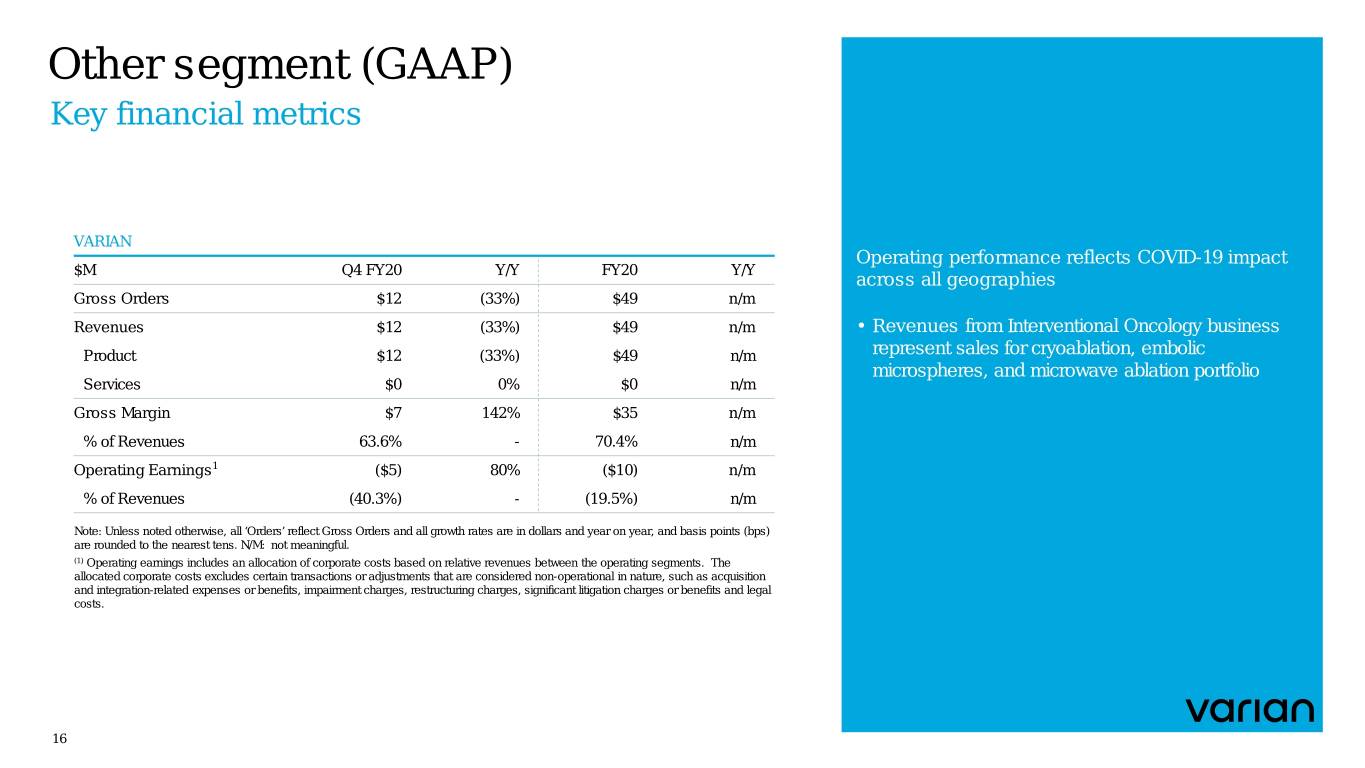

Other segment (GAAP) Key financial metrics VARIAN Operating performance reflects COVID-19 impact $M Q4 FY20 Y/Y FY20 Y/Y across all geographies Gross Orders $12 (33%) $49 n/m Revenues $12 (33%) $49 n/m • Revenues from Interventional Oncology business Product $12 (33%) $49 n/m represent sales for cryoablation, embolic microspheres, and microwave ablation portfolio Services $0 0% $0 n/m Gross Margin $7 142% $35 n/m % of Revenues 63.6% - 70.4% n/m Operating Earnings1 ($5) 80% ($10) n/m % of Revenues (40.3%) - (19.5%) n/m Note: Unless noted otherwise, all ‘Orders’ reflect Gross Orders and all growth rates are in dollars and year on year, and basis points (bps) are rounded to the nearest tens. N/M: not meaningful. (1) Operating earnings includes an allocation of corporate costs based on relative revenues between the operating segments. The allocated corporate costs excludes certain transactions or adjustments that are considered non-operational in nature, such as acquisition and integration-related expenses or benefits, impairment charges, restructuring charges, significant litigation charges or benefits and legal costs. 16

In summary, we are… Global leader in radiation therapy Growing our net installed base driving future recurring …Driving software and services revenues toward our vision Expanding into high growth, high margin businesses of a world without fear of cancer Winning in emerging markets with our strong value-based portfolio FOR INVESTOR USE ONLY 17

Appendix

Non-GAAP disclosure Discussion of Non-GAAP Financial Measures This presentation includes the following non-GAAP financial measures derived from our Condensed Consolidated Statements of Earnings: organic revenue growth, non-GAAP operating earnings, non-GAAP net earnings and non-GAAP net earnings per diluted share. We define organic revenue growth as revenue growth less the impact of revenue growth from our CTSI and Interventional Solutions business and adjusted for the impact of foreign exchange. We define non-GAAP operating earnings as operating earnings excluding amortization of intangible assets, amortization of inventory step-up, acquisition and integration-related expenses or benefits and in-process research and development, restructuring charges, impairment charges, significant litigation charges or benefits and legal costs. These measures are not presented in accordance with, nor are they a substitute for U.S. generally accepted accounting principles, or GAAP. In addition, these measures may be different from non-GAAP measures used by other companies, limiting their usefulness for comparison purposes. The non-GAAP financial measures should not be considered in isolation from measures of financial performance prepared in accordance with GAAP. Investors are cautioned that there are material limitations associated with the use of non-GAAP financial measures as an analytical tool. We have provided a reconciliation of each non-GAAP financial measure used in this earnings release to the most directly comparable GAAP financial measure. We have not provided a reconciliation of non-GAAP guidance measures to the corresponding GAAP measures on a forward-looking basis due to the potential significant variability and limited visibility of the excluded items discussed below. We utilize a number of different financial measures, both GAAP and non-GAAP, in analyzing and assessing the overall performance of our business, in making operating decisions, forecasting and planning for future periods, and determining payments under compensation programs. We consider the use of the non-GAAP measures to be helpful in assessing the performance of the ongoing operations of our business. We believe that disclosing non-GAAP financial measures provides useful supplemental data that, while not a substitute for financial measures prepared in accordance with GAAP, allows for greater transparency in the review of our financial and operational performance. We also believe that disclosing non-GAAP financial measures provides useful information to investors and others in understanding and evaluating our operating results and future prospects in the same manner as management and in comparing financial results across accounting periods and to those of peer companies. Non-GAAP operating earnings and non-GAAP net earnings exclude the following items, except for gain and losses on equity investments, and significant non-recurring tax expense or benefit, which are only excluded from non-GAAP net earnings: Amortization of intangible assets and amortization of inventory step-up: We do not acquire businesses and assets on a predictable cycle. The amount of purchase price allocated to intangible assets, the step-up of inventory values, and the term of amortization can vary significantly and are unique to each acquisition or purchase. We believe that excluding amortization of intangible assets and amortization of inventory step-up allows the users of our financial statements to better review and understand the historic and current results of our operations, and also facilitates comparisons to peer companies. Acquisition and integration-related expenses and in-process research and development: We incur expenses or benefits with respect to certain items associated with our acquisitions, such as transaction costs, hedging gains and losses, changes in the fair value of contingent consideration liabilities, gains or expenses on settlement of pre-existing relationships, integration costs, breakup fees, and the write-off of in-process research and development. We exclude such expenses or benefits as they are related to acquisitions and have no direct correlation to the operations of our on-going business. Impairment and restructuring charges: We incur impairment and restructuring charges that result from events, which arise from unforeseen circumstances and/or often occur outside of the ordinary course of our on- going business. Although these events are reflected in our GAAP financials, these unique transactions may limit the comparability of our on-going operations with prior and future periods. Significant litigation charges or benefits and legal costs: We may incur charges or benefits as well as legal costs from time to time related to litigation and other contingencies. We exclude these charges or benefits, when significant, as well as legal costs associated with significant legal matters, because we do not believe they are reflective of on-going business and operating results. Gains and losses on equity investments: We may incur gains and losses from the sale of our equity investments in public and privately-held companies. We do not trade equity investments, and we do not plan on these investments for the funding of ongoing operations. We exclude such gains and losses because we do not believe they are reflective of our core business. Significant non-recurring tax expense or benefit: We may incur a significant tax expense or benefit as a result of tax legislation and/or a change in judgment about the need for a valuation allowance that are generally unrelated to the level of business activity in the period in which these tax effects are reported. We exclude such expenses or benefits from our non-GAAP net earnings because we believe they do not accurately reflect the underlying performance of our continuing business operations. We apply our GAAP consolidated effective tax rate to our non-GAAP financial measures, other than when the underlying item has a materially different tax treatment. 19

Organic revenue growth reconciliation $M FY20 FY19 Percent Change Impact from Impact from Organic Growth Acquisitions Foreign Exchange Total Revenues $3,168.2 $3,225.1 (2)% (2)% — % (4)% 20

GAAP to non-GAAP reconciliation THE FOLLOWING TABLE RECONCILES GAAP AND NON-GAAP FINANCIAL MEASURES Dollars and shares in millions, except per share amounts 1Q FY20 2Q FY20 3Q FY20 4Q FY20 FY20 Non-GAAP adjustments Amortization of intangible assets and inventory step-up (1) $9.8 $9.1 $8.7 $8.6 $36.2 Restructuring charges — — 13.9 4.8 18.7 Acquisition-related expenses (benefits) (2) 12.7 (4.5) 5.2 11.2 24.6 Impairment charges (3) — 40.5 9.2 8.6 58.3 Litigation charge and legal costs 2.1 2.7 0.9 10.9 16.6 Total non-GAAP adjustments to operating earnings 24.6 47.8 37.9 44.1 154.4 (Gains) losses on equity investments (4) (1.4) — (25.7) (14.8) (41.9) Tax effects of non-GAAP adjustments (3.2) (13.4) (2.6) (6.9) (26.1) Tax effects of a change in law (5) (1.6) — — 3.8 2.2 Total net earnings impact from non-GAAP adjustments $18.4 $34.4 $9.6 $26.2 $88.6 Operating earnings reconciliation GAAP operating earnings $110.0 $54.9 $59.9 98.4 $323.2 Total operating earnings impact from non-GAAP adjustments 24.6 47.8 37.9 44.1 154.4 Non-GAAP operating earnings $134.6 $102.7 $97.8 $142.5 $477.6 Net earnings and net earnings per diluted share reconciliation GAAP net earnings from attributable to Varian $88.2 $43.2 $61.2 76.6 $269.2 Total net earnings impact from non-GAAP adjustments 18.4 34.4 9.6 26.2 88.6 Non-GAAP net earnings attributable to Varian $106.6 $77.6 $70.8 $102.8 $357.8 GAAP net earnings per share - diluted $0.96 $0.47 $0.67 $0.83 $2.94 Non-GAAP net earnings per share - diluted $1.16 $0.85 $0.78 $1.12 $3.91 Shares used in computing GAAP and non-GAAP net earnings per diluted share 91.7 91.4 91.2 91.9 91.5 1. Includes $2.2 million, $2.0 million, $1.6 million, $1.5 million and $7.3 million, respectively, in cost of revenues for the periods presented. 2. Includes an $8.8 million change in the fair value of contingent consideration in the first quarter of fiscal year 2020. Includes the release of $8.9 million in contingent consideration earnout liabilities in the second quarter of fiscal year 2020. 3. Includes a $40.5 million impairment of loans receivable from CPTC in the second quarter of fiscal year 2020. Includes a $9.2 million impairment to our available-for-sale securities in the third quarter of fiscal year 2020. Includes a $8.6 million impairment to our available-for-sale securities in the fourth quarter of fiscal year 2020. 4. Includes a $20.9 million gain on a public equity investment in the third quarter of fiscal year 2020. Includes $9.8 million in gains from privately-held companies and $4.6 million in net gains on public equity investments in 21 the fourth quarter of fiscal year 2020. 5. Represents a one-time tax effect of a change in legislation related to the U.S. Tax Cuts and Jobs Act.

Total revenues by sales classification $M 1Q FY20 2Q FY20 3Q FY20 4Q FY20 FY20 Product revenues $421.0 $407.3 $320.2 $439.3 $1,587.8 Y/Y 5 % (5)% (31)% (11)% (11)% Service revenues $407.9 $387.2 $374.1 $411.2 $1,580.4 Y/Y 20 % 11 % 3 % 6 % 10 % Total revenues $828.9 $794.5 $694.3 $850.5 $3,168.2 Y/Y 12 % 2 % (16)% (3)% (2)% Y/Y – CC 13 % 3 % (15)% (4)% (1)% Product revenues as a percentage of total revenues 51 % 51 % 46 % 52 % 50 % Service revenues as a percentage of total revenues 49 % 49 % 54 % 48 % 50 % CC – Constant currency 22

Total revenues by product type $M 1Q FY20 2Q FY20 3Q FY20 4Q FY20 4Q Y/Y FY20 FY20 Y/Y Hardware $359.0 $340.9 $264.0 $377.3 (12)% $1,341.2 (12)% Oncology Systems $320.0 $316.1 $234.3 $340.6 (10)% $1,211.0 (13)% Proton Solutions $20.1 $13.1 $22.6 $25.1 (26)% $80.9 (32)% Other $18.9 $11.7 $7.1 $11.6 (33)% $49.3 154 % Software1 $148.8 $154.7 $143.2 $152.0 4 % $598.7 4 % Oncology Systems $148.8 $153.2 $142.7 $151.7 5 % $596.4 4 % Proton Solutions $0.0 $1.5 $0.5 $0.3 (81)% $2.3 (23)% Service $321.1 $298.9 $287.1 $321.2 6 % $1,228.3 10 % Oncology Systems $313.6 $291.2 $277.5 $308.1 4 % $1,190.4 9 % Proton Solutions $7.5 $7.7 $9.6 $13.1 100 % $37.9 76 % Total revenues $828.9 $794.5 $694.3 $850.5 (3)% $3,168.2 (2)% Y/Y - CC (4)% (1)% Hardware as a percentage of total revenues 43 % 43 % 38 % 44 % 42 % Software as a percentage of total revenues 18 % 19 % 21 % 18 % 19 % Service as a percentage of total revenues 39 % 38 % 41 % 38 % 39 % (1) Includes software support agreements that are recorded in revenues from service, and software licenses that are recorded in revenues from product, in the Condensed Consolidated Statements of Earnings. CC – Constant currency 23

Total revenues by region $M 1Q FY20 2Q FY20 3Q FY20 4Q FY20 FY20 Americas revenues $402.2 $387.9 $337.5 $407.1 $1,534.7 Y/Y 15 % 4 % (16)% 1 % — % Y/Y – CC 15 % 5 % (16)% 1 % 1 % EMEA revenues $272.9 $250.9 $217.2 $259.1 $1,000.1 Y/Y 9 % (4)% (20)% (11)% (7)% Y/Y – CC 11 % (2)% (18)% (13)% (6)% APAC revenues $153.8 $155.7 $139.6 $184.3 $633.4 Y/Y 10 % 6 % (9)% — % 1 % Y/Y – CC 10 % 7 % (9)% (1)% 1 % Total revenues $828.9 $794.5 $694.3 $850.5 $3,168.2 Y/Y 12 % 2 % (16)% (3)% (2)% Y/Y – CC 13 % 3 % (15)% (4)% (1)% CC – Constant currency 24

Total Oncology Systems revenues by sales classification $M 1Q FY20 2Q FY20 3Q FY20 4Q FY20 FY20 Product revenues $382.0 $381.0 $290.0 $402.3 $1,455.3 Y/Y 4 % (5)% (33)% (8)% (11)% Y/Y – CC 5 % (4)% (33)% (9)% (11)% Service revenues $400.4 $379.5 $364.5 $398.1 $1,542.5 Y/Y 19 % 10 % 1 % 5 % 9 % Y/Y – CC 20 % 11 % 3 % 4 % 9 % Total revenues $782.4 $760.5 $654.5 $800.4 $2,997.8 Y/Y 11 % 2 % (17)% (2)% (2)% Y/Y – CC 12 % 3 % (17)% (3)% (2)% Product as a percentage of total Oncology Systems revenues 49 % 50 % 44 % 50 % 49 % Service as a percentage of total Oncology Systems revenues 51 % 50 % 56 % 50 % 51 % Oncology Systems revenues as a percentage of total revenues 95 % 96 % 94 % 94 % 95 % CC – Constant currency 25

Total Oncology Systems revenues by region $M 1Q FY20 2Q FY20 3Q FY20 4Q FY20 FY20 Americas revenues $378.9 $369.7 $318.1 $383.0 $1,449.7 Y/Y 15 % 4 % (18)% 1 % — % Y/Y – CC 15 % 4 % (17)% 2 % — % EMEA revenues $259.8 $240.9 $204.1 $237.3 $942.1 Y/Y 11 % (2)% (20)% (10)% (6)% Y/Y – CC 13 % — % (18)% (13)% (5)% APAC revenues $143.7 $149.9 $132.3 $180.1 $606.0 Y/Y 5 % 4 % (12)% 2 % (1)% Y/Y – CC 4 % 5 % (12)% 1 % (1)% Total revenues $782.4 $760.5 $654.5 $800.4 $2,997.8 Y/Y 11 % 2 % (17)% (2)% (2)% Y/Y – CC 12 % 3 % (17)% (3)% (2)% CC – Constant currency 26

Total Proton Solutions revenues by sales classification $M 1Q FY20 2Q FY20 3Q FY20 4Q FY20 FY20 Product revenues $20.1 $14.6 $23.1 $25.4 $83.2 Y/Y (40)% (48)% (9)% (29)% (32)% Service revenues $7.5 $7.7 $9.6 $13.1 $37.9 Y/Y 54 % 61 % 78 % 100 % 76 % Total revenues $27.6 $22.3 $32.7 $38.5 $121.1 Y/Y (28)% (32)% 6 % (8)% (16)% Proton Solutions revenues as a percentage of total revenues 3 % 3 % 5 % 5 % 4 % 27

Oncology Systems gross orders by region $M 1Q FY20 2Q FY20 3Q FY20 4Q FY20 FY20 Americas orders $359.5 $355.4 $329.1 $454.7 $1,498.7 Y/Y 7 % (3)% (8)% (19)% (7)% Y/Y – CC 7 % (3)% (8)% (18)% (7)% EMEA orders $236.7 $259.3 $191.1 $379.4 $1,066.5 Y/Y 8 % 11 % (32)% (4)% (6)% Y/Y – CC 11 % 13 % (30)% (8)% (6)% APAC orders $177.6 $158.7 $145.2 $206.9 $688.4 Y/Y 9 % (5)% 4 % 14 % 6 % Y/Y – CC 9 % (5)% 4 % 12 % 6 % Total orders $773.8 $773.4 $665.4 $1,041.0 $3,253.6 Y/Y 8 % 1 % (14)% (8)% (4)% Y/Y – CC 9 % 2 % (14)% (10)% (4)% CC – Constant currency 28

Condensed consolidated statements of cash flows $M 1Q FY20 2Q FY20 3Q FY20 4Q FY20 FY20 Net cash provided by Operating Activities $112.6 $21.9 $83.0 $266.0 $483.5 Net earnings 88.9 43.1 60.9 76.5 269.4 Share-based compensation expense 14.9 11.3 4.4 13.3 43.9 Depreciation 15.0 14.9 15.0 15.7 60.6 Amortization of intangible assets and inventory step-up 10.2 9.5 9.0 9.6 38.3 Changes in assets and liabilities, net (26.5) (79.8) (0.9) 115.7 8.5 Other, net 10.1 22.9 (5.4) 35.2 62.8 Net cash used in investing activities $(15.1) $(21.1) $(41.1) $(63.0) $(140.3) Purchases of property, plant and equipment (22.6) (14.4) (18.0) (29.3) (84.3) Acquisitions, net of cash acquired (1.7) (6.7) — (27.8) (36.2) Other, net 9.2 — (23.1) (5.9) (19.8) Net cash provided by (used in) financing activities $103.4 $(59.9) $67.8 $(204.4) $(93.1) Repurchases of common stock (43.8) (42.4) — — (86.2) Common stock to employees 19.7 12.4 19.3 24.6 76.0 Borrowings on credit facility, net 132.0 (22.0) 60.0 (225.0) (55.0) Other, net (4.5) (7.9) (11.5) (4.0) (27.9) Effects of exchange rate changes on cash $(2.8) $5.9 $(8.2) $(3.3) $(8.4) Net increase (decrease) in cash, cash equivalents, and restricted cash $198.1 $(53.2) $101.5 $(4.7) $241.7 Cash, cash equivalents, and restricted cash at beginning of period $544.1 $742.2 $689.0 $790.5 $544.1 Cash, cash equivalents, and restricted cash at end of period $742.2 $689.0 $790.5 $785.8 $785.8 29

Our promise People powering victories Imagine a world without fear of cancer. We do, every day. We innovate new technologies for treating cancer and for connecting clinical teams to advance patient outcomes. Through ingenuity we inspire new victories and empower people in the fight against cancer. We are Varian. 30