Attached files

| file | filename |

|---|---|

| EX-3.1 - EXHIBIT 3.1 - FIRMA HOLDINGS CORP. | ex3_1.htm |

| 8-K - FIRMA HOLDINGS CORP. | r10232008k.htm |

Exhibit 10.1

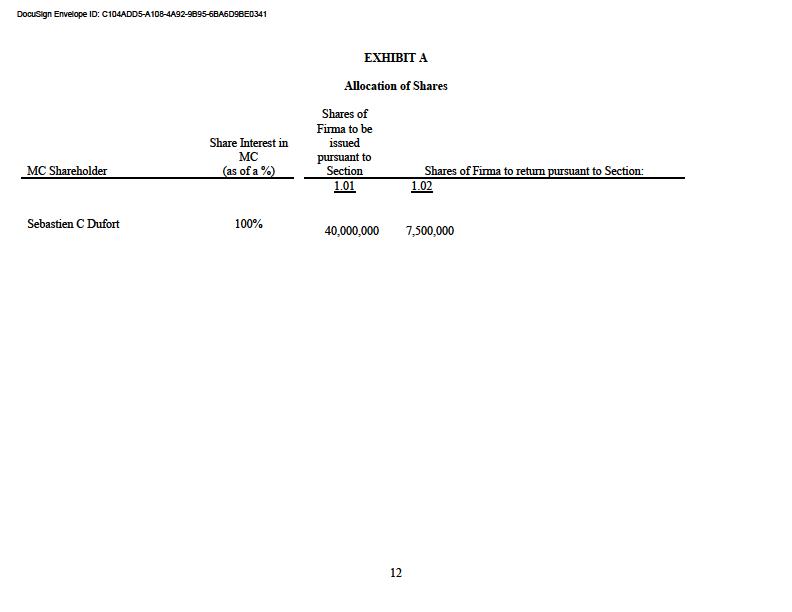

AGREEMENT RELATING TO THE ACQUISITION OF MONOCHROME CORP. BY FIRMA HOLDINGS CORP. (as amended) DocuSign Envelope ID: C104ADD5-A108-4A92-9B95-6BA6D9BE0341 2 This AGREEMENT, made this 15th day of July 2020, by and between Firma Holdings Corp. (“Firma”) and Monochrome Corp. (“MC”), and the shareholders of MC, is made for the purpose of setting forth the terms and conditions upon which Firma will acquire all of the outstanding shareholdership interests in of MC. In consideration of the mutual promises, covenants, and representations contained herein, THE PARTIES HERETO AGREE AS FOLLOWS: ARTICLE I ACQUISITION OF MC Subject to the terms and conditions of this Agreement, Firma agrees to acquire all of the outstanding shares of MC for the consideration shown below. 1.01 At Closing, MC will become a wholly owned subsidiary of Firma. In connection with the acquisition, Firma will issue 40,000,000 shares of common stock to the shareholders of MC in consideration for their interests in MC. 1.02 If the operations of MC do not generate, during the period ending one year after the Closing, but prior to the second anniversary of the Closing, more than $1,500,000 of gross revenue with EBITDA of at least $375,000, then the shareholders of MC will return to Firma 7,500,000 shares of common stock. 1.03 All shares of Firma’s common stock pursuant to Section 1.01, will be delivered, returned or paid, in accordance with Exhibit A. ARTICLE II REPRESENTATIONS AND WARRANTIES MC and the shareholders of MC, jointly and severally, represents and warrant to Firma that: 2.0l Organization. MC is a corporation duly organized, validly existing, and in good standing under the laws of Colorado, has all necessary powers to own its properties and to carry on its business as now owned and operated by it, and is duly qualified to do business and is in good standing in each of the states where its business requires qualification. 2.02 Capital. The shareholders of MC, and their respective shareholdership interests in MC, are shown on Exhibit A. No person has the right to acquire any additional shareholdership interests in MC. 2.03 Shareholders, Officers, Banks. Exhibit B to this Agreement contains: the names and the titles of all officers of MC DocuSign Envelope ID: C104ADD5-A108-4A92-9B95-6BA6D9BE0341 3 2.04 Absence of Changes. Since the date signified above, there has not been any change in the financial condition or operations of MC, except changes reflected on Exhibit C or changes in the ordinary course of business, which changes have not in the aggregate been materially adverse. 2.05 Investigation of Financial Condition. Without in any manner reducing or otherwise mitigating the representations contained herein, Firma shall have the opportunity to meet with MC's accountants and attorneys to discuss the financial condition of MC. MC shall make available to Firma the books and records of MC. The minutes of MC are a complete and accurate record of all meetings of the managers and shareholders of MC and accurately reflect all actions taken at such meetings. The signatures of the managers and shareholders on such minutes are the valid signatures of MC's managers and shareholders who were duly elected or appointed, or who held such shareholdership interests, on the dates that the minutes were signed by such persons. 2.06 Assets. Exhibit D attached hereto and made a part hereof lists all assets of MC. MC has good and marketable title to all of its assets, free and clear of all liens or encumbrances, other than those shown on Exhibit D. 2.07 Compliance with Laws. MC has complied with, and is not in violation of, applicable federal, state, or local statutes, laws, and regulations affecting its properties or the operation of its business, including but not limited to applicable federal and state securities laws. 2.08 Litigation. MC is not a party to any suit, action, arbitration, or legal, administrative, or other proceeding, or governmental investigation pending or, to the best knowledge of MC threatened, against or affecting MC or its business, assets, or financial condition. MC is not in default with respect to any order, writ, injunction, or decree of any federal, state, local, or foreign court, department, agency, or instrumentality. MC is not engaged in any legal action to recover moneys due to MC or damages sustained by MC. 2.09 Full Disclosure. None of representations and warranties made by MC, or in any certificate or memorandum furnished or to be furnished by MC, or on its behalf, contains or will contain any untrue statement of material fact, or omit any material fact the omission of which would be misleading. MC has disclosed to Firma all reasonably foreseeable contingencies which, if such contingencies transpired, would have a material adverse effect on MC's business. Firma represents and warrants to MC and the shareholders of MC that: 2A. Organization. Firma is a corporation duly organized, validly existing, and in good standing under the laws of Nevada, has all necessary corporate powers to own its properties and to carry on its business as now owned and operated by it, and is duly qualified to do business and is in good standing in each of the states where its business requires qualification, except in those states where the failure to be so qualified would not have a material adverse effect on Firma. 2B. Ability to Carry Out Obligations. Firma has the right, power, and authority to enter into, and perform its obligations under, this Agreement. The execution and delivery of this Agreement by Firma and the performance by Firma of its obligations hereunder will not cause, DocuSign Envelope ID: C104ADD5-A108-4A92-9B95-6BA6D9BE0341 4 constitute, or conflict with or result in (a) any breach or violation or any of the provisions of, or constitute a default under, any license, indenture, mortgage, charter, instrument, articles of incorporation, by-law, or other agreement or instrument to which Firma is a party, or by which it may be bound, nor will any consents or authorizations of any party other than those hereto be required, (b) an event that would permit any party to any agreement or instrument to terminate it or to accelerate the maturity of any indebtedness or other obligation of Firma, or (c) an event that would result in the creation or imposition or any lien, charge, or encumbrance on any asset of Firma or would create any obligations for which Firma would be liable, except as contemplated by this Agreement. 2C. Full Disclosure. None of the representations and warranties made by Firma, or in any certificate or memorandum furnished or to be furnished by Firma, or on its behalf, contains or will contain any untrue statement of material fact, or omit any material fact the omission of which would be misleading. Firma has disclosed to MC and the shareholders of MC all reasonably foreseeable contingencies which, if such contingencies transpired, would have a material adverse effect on Firma. DocuSign Envelope ID: C104ADD5-A108-4A92-9B95-6BA6D9BE0341 5 ARTICLE III REPRESENTATIONS 3.01 Authority. Each Officer and Director of MC represents to Firma that he or she has the right, power, and authority to enter into, and perform his or her obligations under this Agreement. The execution and delivery of this Agreement and the delivery by such member of his or her shareholdership interest in MC pursuant to Exhibit A will not cause, constitute, or conflict with or result in any breach or violation or any of the provisions of or constitute a default under any license, indenture, mortgage, charter, instrument, or agreement to which he or she is a party, or by which he or she may be bound, nor will any consents or authorizations of any party be required. Each member of MC represents and warrants to Firma that the member interests of MC that such holder will deliver at closing will be free of any liens or encumbrances. 3.02 Restrictions on Resale. Each member of MC understands that the shares being acquired from Firma represent restricted securities as that term is defined in Rule l44 of the Securities and Exchange Commission. 3.03 Intended Amendment. Each shareholder, director, or Officer of MC (Exhibit A), has the right to maintain interests in or operate other businesses. ARTICLE IV OBLIGATIONS BEFORE CLOSING 4.01 Investigative Rights. From the date of this Agreement until the date of closing, each party shall provide to the other party, and such other party's counsel, accountants, auditors, and other authorized representatives, full access during normal business hours to all of each party's properties, books, contracts, commitments, records and correspondence and communications with regulatory agencies for the purpose of examining the same. Each party shall furnish the other party with all information concerning each party's affairs as the other party may reasonably request. All confidential information obtained from any party in the course of such investigation shall be kept confidential, except for such information which is required to be disclosed by court order or decree or in compliance with applicable laws, rules or regulations of any government agency, or that otherwise becomes available in the public domain without the fault of the party conducting the investigation. 4.02 Conduct of Business. Prior to the closing, and except as contemplated by this Agreement, each party shall conduct its business in the normal course, and shall not sell, pledge, or assign any assets, without the prior written approval of the other party, except in the regular course of business. Except as contemplated by this Agreement, neither party to this Agreement shall amend its Articles of Incorporation, By-laws, articles of organization, or operating agreements, declare dividends, redeem or sell stock, limited liability interests or other securities, incur additional or newly-funded material liabilities, acquire or dispose of fixed assets, change senior management, change employment terms, enter into any material or long-term contract, guarantee obligations of any third party, settle or discharge any balance sheet receivable for less than its DocuSign Envelope ID: C104ADD5-A108-4A92-9B95-6BA6D9BE0341 6 stated amount, pay more on any liability than its stated amount, or enter into any other transaction other than in the regular course of business. ARTICLE V CONDITIONS PRECEDENT TO PERFORMANCE BY FIRMA 5.01 Conditions. Firma's obligations hereunder shall be subject to the satisfaction, at or before the Closing, of all the conditions set forth in this Article V. Firma may waive any or all of these conditions in whole or in part without prior notice; provided, however, that no such waiver of a condition shall constitute a waiver by Firma of any other condition of or any of Firma's other rights or remedies, at law or in equity, if MC of the shareholders of MC shall be in default of any of their representations, warranties, or covenants under this agreement. 5.02 Accuracy of Representations. Except as otherwise permitted by this Agreement, all representations and warranties by MC or the shareholders of MC in this Agreement or in any written statement that shall be delivered to Firma under this Agreement shall be true on and as of the closing date as though made at those times. 5.03 Performance. MC and the shareholders of MC shall have performed, satisfied, and complied with all covenants, agreements, and conditions required by this Agreement to be performed or complied with by them, on or before the Closing. MC and the shareholders of MC shall have obtained all necessary consents and approvals necessary to consummate the transactions contemplated hereby. 5.04 Absence of Litigation. No action, suit, or proceeding before any court or any governmental body or authority, pertaining to the transaction contemplated by this agreement or to its consummation, shall have been instituted or threatened on or before the closing. 5.05 Other. In addition to the other provisions of this Article V, Firma’s obligations hereunder shall be subject, at or before Closing, to the following: On the closing date MC will not have liabilities exceeding $10,000.00. MC will have delivered to Firma, in the form required by the rules and regulations of the Securities and Exchange Commission, the following financial statements: (i) financial statements, audited by an independent certified public accountanting firm, for its two full fiscal years prior to the date of this Agreement. (ii) interim financial statements for MC fiscal quarters since the date of the last audited financial statements of MC. (iii) proforma financial statements giving effect to the acquisition of MC. completion of business and legal review of MC, the results of which are satisfactory to Firma; DocuSign Envelope ID: C104ADD5-A108-4A92-9B95-6BA6D9BE0341 7 obtaining all required governmental consents and approvals; expiration of any required waiting periods; MC entering into employment agreements with its management on terms and conditions satisfactory to Firma; MC entering into non-competition agreements with Firma, pursuant to which they will agree not to engage in a business similar to the business of MC and not to solicit any customers, suppliers, employees or business prospects of MC for a period of five (2) years following the Closing; ARTICLE VI CONDITIONS PRECEDENT TO PERFORMANCE BY MC 6.01 Conditions. MC's obligations hereunder shall be subject to the satisfaction, at or before the Closing, of the conditions set forth in this Article VI. MC may waive any or all of these conditions in whole or in part without prior notice; provided, however, that no such waiver of a condition shall constitute a waiver by MC of any other condition of or any of MC's other rights or remedies, at law or in equity, if Firma shall be in default of any of its representations, warranties, or covenants under this agreement. 6.02 Accuracy of Representations. Except as otherwise permitted by this Agreement, all representations and warranties by Firma in this Agreement or in any written statement that shall be delivered to MC by Firma under this Agreement shall be true on and as of the closing date as though made at those times. 6.03 Performance. Firma shall have performed, satisfied, and complied with all covenants, agreements, and conditions required by this Agreement to be performed or complied with by it, on or before the closing. Firma shall have obtained all necessary consents and approvals necessary to consummate the transactions contemplated hereby. 6.04 Absence of Litigation. No action, suit, or proceeding before any court or any governmental body or authority, pertaining to the transaction contemplated by this agreement or to its consummation, shall have been instituted or threatened on or before the closing. 6.05 Other. In addition to the other provisions of this Article VI, the obligations of the shareholders of MC hereunder shall be subject, at or before the Closing, to the following: None DocuSign Envelope ID: C104ADD5-A108-4A92-9B95-6BA6D9BE0341 8 ARTICLE VII CLOSING 7.01 Closing. The closing of this transaction shall be held at the offices of Firma. Unless the closing of this transaction takes place before August 15, 2020, then either party may terminate this Agreement without liability to the other party, except as otherwise provided in Section 9.12. At the closing all representations, warranties, covenants, and conditions set forth in this Agreement on behalf of each party will true and correct as of, or will have been fully performed and complied with by, the closing date, except as may be disclosed in writing by one party to the other. 7.02 Exchange of Common Stock Interests. On the closing date, each outstanding shareholdership interest of MC will be exchanged for fully paid and nonassessable shares of Firma in accordance with Exhibit A to this Agreement. ARTICLE VIII REMEDIES 8.01 Arbitration. Any controversy or claim arising out of, or relating to, this Agreement, or the making, performance, or interpretation thereof, shall be settled by binding arbitration in Chicago, Illinois in accordance with the rules of the American Arbitration Association then existing, and judgment on the arbitration award may be entered in any court having jurisdiction over the subject matter of the controversy. 8.02 Costs. If any legal action or any arbitration or other proceeding is brought for the enforcement of this Agreement, or because of an alleged dispute, breach, default, or misrepresentation in connection with any of the provisions of this Agreement, the successful or prevailing party or parties shall be entitled to recover reasonable attorney's fees and other costs incurred in that action or proceeding, in addition to any other relief to which it or they may be entitled. 8.03 Termination. In addition to the other remedies, Firma or the shareholders of MC may on or prior to the closing date terminate this Agreement, without liability to the other party: (i) If any bona fide action or proceeding shall be pending against Firma, or MC, or the shareholders of MC on the closing date that could result in an unfavorable judgment, decree, or order that would prevent or make unlawful the carrying out of this Agreement or if any agency of the federal or of any state government shall have objected at or before the closing date to this acquisition or to any other action required by or in connection with this Agreement; (ii) If the legality and sufficiency of all steps taken and to be taken by each party in carrying out this Agreement shall not have been approved by the respective party's counsel, which approval shall not be unreasonably withheld. DocuSign Envelope ID: C104ADD5-A108-4A92-9B95-6BA6D9BE0341 9 (iv) If a party breaches any representation, warranty, covenant or obligation of such party set forth herein and such breach is not corrected within ten days of receiving written notice from the other party of such breach. (v) If it is determined that this transaction is not in the best interest of it’s shareholders ARTICLE IX MISCELLANEOUS 9.01 Captions and Headings. The Article and paragraph headings throughout this Agreement are for convenience and reference only, and shall in no way be deemed to define, limit, or add to the meaning of any provision of this Agreement. 9.02 No Oral Change. This Agreement and any provision hereof, may not be waived, changed, modified, or discharged orally, but only by an agreement in writing signed by the party against whom enforcement of any waiver, change, modification, or discharge is sought. 9.03 Non-Waiver. Except as otherwise expreMCy provided herein, no waiver of any covenant, condition, or provision of this Agreement shall be deemed to have been made unless expreMCy in writing and signed by the party against whom such waiver is charged; and (i) the failure of any party to insist in any one or more cases upon the performance of any of the provisions, covenants, or conditions of this Agreement or to exercise any option herein contained shall not be construed as a waiver or relinquishment for the future of any such provisions, convenants, or conditions, (ii) the acceptance of performance of anything required by this Agreement to be performed with knowledge of the breach or failure of a covenant, condition, or provision hereof shall not be deemed a waiver of such breach or failure, and (iii) no waiver by any party of one breach by another party shall be construed as a waiver with respect to any other or subsequent breach. 9.04 Time of Essence. Time is of the essence of this Agreement and of each and every provision hereof. 9.05 Entire Agreement. This Agreement contains the entire Agreement and understanding between the parties hereto, and supersedes all prior agreements, understandings and the letters of intent between the parties. 9.06 Governing Law. This Agreement and its application shall be governed by the laws of Nevada. 9.07 Counterparts. This Agreement may be executed simultaneously in one or more counterparts, each of which shall be deemed an original, but all of which together shall constitute one and the same instrument. Signature pages may be transmitted by facsimile or other electronice means. DocuSign Envelope ID: C104ADD5-A108-4A92-9B95-6BA6D9BE0341 10 9.08 Notices. All notices, requests, demands, and other communications under this Agreement shall be in writing and shall be deemed to have been duly given on the date of service if served personally on the party to whom notice is to be given, or on the third day after mailing if mailed to the party to whom notice is to be given, by first class mail, registered or certified, postage prepaid, and properly addressed as follows: Firma Holdings Corp. 181 Arroyo Grande Blvd., Suite. 140B Henderson, NV 89074 Monochrome Corp and its Shareholders 20 Danada Square, W. 214 Wheaton, IL 60189 9.09 Binding Effect. This Agreement shall inure to and be binding upon the heirs, executors, personal representatives, successors and assigns of each of the parties to this Agreement. 9.10 Effect of Closing. All representations, warranties, covenants, and agreements of the parties contained in this Agreement, or in any instrument, certificate, opinion, or other writing provided for in it, shall survive the closing of this Agreement. In the event there is any material misrepresentation or warranty of any party to this Agreement, then Firma (if such misrepresentation is made by MC or the MC shareholders) or the shareholders of MC ( if such misrepresentation is made by Firma) may recind this Agreement during the 90 day period following the closing of this Agreement. 9.11 Mutual Cooperation. The parties hereto shall cooperate with each other to achieve the purpose of this Agreement, and shall execute such other and further documents and take such other and further actions as may be necessary or convenient to effect the transaction described herein. Neither party will intentionally take any action, or omit to take any action, which will cause a breach of such party's obligations pursuant to this Agreement. MC and the shareholders of MC agree that, until the Closing or the Termination of this Agreement pursuant to Section 8.03, neither MC, nor the shareholders of MC, shall accept or induce an offer from a third party, enter into negotiations with any third party, or provide information to any third party in anticipation of negotiations with any third party, with respect to any possible sale of MC, its assets, rights or operations or any securities or other equity interests of MC or any other transaction that would have the effect of materially reducing the benefit of this Agreement to Firma. 9.12 Expenses. Each of the parties hereto agrees to pay all of its own expenses (including without limitation, attorneys' and accountants' fees) incurred in connection with this DocuSign Envelope ID: C104ADD5-A108-4A92-9B95-6BA6D9BE0341 11 Agreement, the transactions contemplated herein and negotiations leading to the same and the preparations made for carrying the same into effect. Each of the parties expreMCy represents and warrants that no finder or broker has been involved in this transaction and each party agrees to indemnify and hold the other party harmless from any commission, fee or claim of any person, firm or corporation employed or retained by such party (or claiming to be employed or retained by such party) to bring about or represent such party in the transactions contemplated by this Agreement. AGREED TO AND ACCEPTED as of the date first above written. FIRMA HOLDINGS CORP. By David Barefoot – Director / COO MONOCHROME CORP By Sebastien C. Dufort – Director / President DocuSign Envelope ID: C104ADD5-A108-4A92-9B95-6BA6D9BE0341 12 EXHIBIT A Allocation of Shares MC Shareholder Share Interest in MC (as of a %) Shares of Firma to be issued pursuant to Section Shares of Firma to return pursuant to Section: 1.01 1.02 Sebastien C Dufort 100% 40,000,000 7,500,000 DocuSign Envelope ID: C104ADD5-A108-4A92-9B95-6BA6D9BE0341 13 EXHIBIT B SHAREHOLDERS, OFFICERS, BANKS DocuSign Envelope ID: C104ADD5-A108-4A92-9B95-6BA6D9BE0341 14 EXHIBIT C MATERIAL CHANGES ( SECTION 2.04 ) DocuSign Envelope ID: C104ADD5-A108-4A92-9B95-6BA6D9BE0341 15 EXHIBIT D ASSETS All trademarks, trademark registrations or applications, trade names, service marks, copyrights, copyright registrations or applications which are owned by MC. No person other than MC owns any trademark, trademark registration or application, service mark, trade name, copyright, or copyright registration or application the use of which is necessary or contemplated in connection with the operation of MC's business. All contracts, leases, and other agreements of MC presently in existance or which have been agreed to by MC (whether written or oral). MC is not in default under of these agreements or leases. DocuSign Envelope ID: C104ADD5-A108-4A92-9B95-6BA6D9BE0341