Attached files

| file | filename |

|---|---|

| EX-10.32 - EXHIBIT 10.32 - FIRMA HOLDINGS CORP. | ex10_32.htm |

| EX-10.39 - EXHIBIT 10.39 - FIRMA HOLDINGS CORP. | ex10_39.htm |

| EX-10.31 - EXHIBIT 10.31 - FIRMA HOLDINGS CORP. | ex10_31.htm |

| EXCEL - IDEA: XBRL DOCUMENT - FIRMA HOLDINGS CORP. | Financial_Report.xls |

| EX-31.1 - EXHIBIT 31.1 - FIRMA HOLDINGS CORP. | ex31_1.htm |

| EX-32.1 - EXHIBIT 32.1 - FIRMA HOLDINGS CORP. | ex32_1.htm |

| EX-32.2 - EXHIBIT 32.2 - FIRMA HOLDINGS CORP. | ex32_2.htm |

| EX-10.47 - EXHIBIT 10.47 - FIRMA HOLDINGS CORP. | ex10_47.htm |

| EX-10.46 - EXHIBIT 10.46 - FIRMA HOLDINGS CORP. | ex10_46.htm |

| EX-10.44 - EXHIBIT 10.44 - FIRMA HOLDINGS CORP. | ex10_44.htm |

| EX-31.2 - EXHIBIT 31.2 - FIRMA HOLDINGS CORP. | ex31_2.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

T ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE

ACT OF 1934

For the Fiscal Year Ended December 31, 2014

OR

£ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Commission file number 333-143512

FIRMA HOLDINGS CORP.

(Name of Small Business Issuer in its charter)

|

Nevada

|

20-5000381

|

|

|

(State of incorporation)

|

(IRS Employer Identification No.)

|

|

|

181 N. Arroyo Grande Blvd, Ste. 140B

Henderson, NV

|

89074

|

|

|

(Address of principal executive office)

|

(Zip Code)

|

Registrant's telephone number, including area code: (888) 901-4550

Securities registered pursuant to Section 12(b) of the Act: None

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes £ No T

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes £ No T

Indicate by check mark whether the registrant (1) has filed all reports to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes T No £

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes T No £

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K T

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer £

|

Non-accelerated filer £(Do not check if a smaller reporting company)

|

|

|

Accelerated filer £

|

Smaller reporting company T

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act): Yes £ No T

The aggregate market value of the voting stock held by non-affiliates of the Company on June 30, 2014, was approximately $11,169,287.

As of April 14, 2015, the Company had 100,845,696 issued and outstanding shares of common stock.

Documents incorporated by reference: None

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING INFORMATION

This report includes "forward-looking statements" within the meaning of Section 27A of the Securities Act of 1933, as amended, or the Securities Act, and Section 21E of the Securities Exchange Act of 1934, as amended, or the Exchange Act, which include but are not limited to, statements concerning our business strategy, plans and objectives, projected revenues, expenses, gross profit, income, and mix of revenue. These forward-looking statements are based on our current expectations, estimates and projections about our industry, management’s beliefs and certain assumptions made by us. Words such as “anticipates,” “expects,” “intends,” “plans,” “predicts,” “potential,” “believes,” “seeks,” “hopes,” “estimates,” “should,” “may,” “will,” “with a view to” and variations of these words or similar expressions are intended to identify forward-looking statements. These statements are not guarantees of future performance and are subject to risks, uncertainties and assumptions that are difficult to predict. Therefore, our actual results could differ materially and adversely from those expressed in any forward-looking statements.

Additional information on the various risks and uncertainties potentially affecting our operating results are discussed in this report and other documents we file with the Securities and Exchange Commission, or are available upon written request to our corporate secretary at 181 N. Arroyo Grande Blvd Ste. #140B, Henderson, NV. We undertake no obligation to revise or update publicly any forward-looking statements for any reason, except as required by law. Given these risks and uncertainties, readers are cautioned not to place undue reliance on these forward-looking statements.

As used in this report, “Firma Holdings,” “Company,” “we,” “our” and similar terms refer to Firma Holdings Corp. and its subsidiaries, unless the context indicates otherwise.

|

Page

|

|

|

PART I

|

|

|

5

|

|

|

15

|

|

|

15

|

|

|

15

|

|

|

15

|

|

|

16

|

|

|

PART II

|

|

|

16

|

|

|

16

|

|

|

16

|

|

|

23

|

|

|

24

|

|

|

58

|

|

|

58

|

|

|

58

|

|

|

PART III

|

|

|

59

|

|

|

60

|

|

|

64

|

|

|

64

|

|

|

65

|

|

|

PART IV

|

|

|

66

|

|

|

68

|

Firma Holdings Corp. (“Firma Holdings” or the “Company”), formerly known as Tara Minerals Corp. and formerly a subsidiary of Tara Gold Resources Corp. (“Tara Gold”), consists of three business segments: mining, packaging technology, and food manufacturing. We were incorporated in Nevada on May 12, 2006.

Tara Gold, which historically has been engaged in the exploration and development of mining properties in Mexico, divested its ownership in Firma Holdings in February 2015 by distributing out its ownership in Firma Holdings as a dividend to its shareholders.

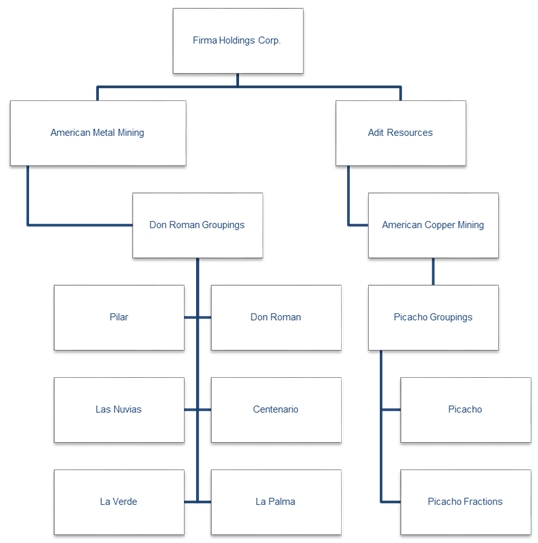

In 2006, Tara Gold formed Firma Holdings when it determined that some investors prefer lead, zinc and silver projects, rather than gold and silver projects, and that capital may be easier to obtain by separating gold properties from industrial metal properties. Although this was Tara Gold’s intention when it formed Firma Holdings, Firma Holdings nevertheless has interests in properties which may be productive of gold or silver. Firma Holdings formed Adit Resources Corp. (“Adit”) in 2009 to hold the Picacho Groupings, discussed further below, and to finance the exploration and development of the Picacho Groupings solely from the sale of Adit’s securities. Adit in turns owns 99.99% of American Copper Mining, S.A. de C.V. (“ACM”) (See Note 15). Firma Holdings owns 99.9% of the common stock of American Metal Mining S.A. de C.V. (“AMM”), a Mexican corporation and 87% of the common stock of Adit. Firma Holdings’ operations in Mexico are conducted through AMM and ACM, since Mexican law provides that only Mexican corporations are allowed to own mining properties.

Variable interest entities (“VIE”) over which control is achieved through means other than voting rights and where the Company is considered the primary beneficiary would be included in our consolidated financial statements in those periods in which this applies. When the Company is the primary beneficiary of the VIE, the Company consolidates the entity if control is achieved through means other than voting rights such as control of the Board, certain capital structures and contractual relationships. At December 31, 2014, the Company considered Tara Gold a VIE as defined above and has consolidated the related standalone financial statement of Tara Gold within the 2014 financial results. At December 31, 2013 the Company had no joint ventures or VIEs.

Unless otherwise indicated, all references to “Firma Holdings” or the “Company” include the properties and operations of Adit, AMM, ACM and Tara Gold.

Our mining business segment explores and develops mining properties which may be productive of gold, silver, copper, lead, zinc, iron, industrial metals, and other associated metals. The Company’s mining business segment is in the exploration stage.

Our packaging technology business segment owns the “SmartPacTM” technology. Purchased in May 2014, this technology can be used for the preservation and protection of fresh fruit, vegetables and flowers during extended periods of shipping and storage. The technology is comprised of patents, trademarks and other intellectual property pertaining to systems and methods for packaging bulk quantities of fresh produce and flowers incorporating modified atmosphere packaging.

SmartPacTM was developed to solve the problems of decay, moisture loss, infestation and food-borne disease that plague the fresh produce industry. SmartPacTM has the potential to reduce logistical, spoilage and handling costs; significantly reduce food safety risks, increase the value and export potential of developing countries; enable consumers to enjoy better tasting fresh food and decrease the food industry’s carbon footprint.

Produce begins to decay, and loses moisture and weight, as soon as it is harvested. This deterioration makes protracted shipping and storage impossible. Traditional life extension strategies - harvesting before produce is ripe and airfreight - are problematic and costly. Existing modified atmosphere systems need an extra level of packaging - a bag within a box, wrapping a complete pallet load or even a whole shipping container. They are ineffective, vulnerable to thermal abuse and non-compliant with existing infrastructure.

SmartPacTM technology is the solution. Breathable polymers are incorporated into corrugated linerboard to make SmartPacTM containers into a proprietary, industry compliant, design. These containers are covered with a patented PET plastic lid and hermetically sealed. This creates a “passive” modified atmosphere, in which the carbon dioxide increases and oxygen decreases until an equilibrium modified atmosphere, with high humidity, is established. This inhibits spoilage and reduces microbial growth as it retards ripening and softening of tissue and maintains cellular structure.

SmartPacTM also incorporates an anti-microbial delivery system to reduce mold, infestation and food-borne disease factors, thereby providing an “active” modified atmosphere. Thermodynamic cooling design combats temperature abuse.

Our food manufacturing business segment consists of 2015 acquisition of Sicilian Sun Limited, LLC, and wholly owned Italian subsidiary, Sicilian Sun Foods s.r.l., and two production facilities located in Alcamo and Catania on the island of Sicily. Through an agreement signed March 30, 2015, The Alcamo facility has been in operation for six years and consists of a state-of-the-art production factory encompassing 53,500 square feet. This BRC certified facility currently produces private label products for Carrefour – Italia as well as private and branded label products for Auchan, Conad and other major European retailers. The facility specializes in the manufacturing of three product categories: baked goods, frozen desserts, and semi-finished products made from natural ingredients. These products include assorted pastries, ricotta cannoli, as well as cakes, breads, rice balls, croissants, and a variety of other frozen and packaged items. Frozen desserts include gelato, tartufi, mousse, sorbets Italian ices and other frozen treats. Many of the products use proprietary formulas.

The new, state-of-the-art, Catania facility consists of 48,000 sq. ft., is BRC/IFS certified, and contains the latest in automated technology for the commercial production of artisanal gelato products.

In 2014, Sicilian Sun Foods used the services of food supplier La Petite Foods and global food broker Daymon Worldwide to secure orders to manufacture private label and branded products for major grocery chains in the United States.

Below is a chart which illustrates the Company’s mining properties as of April 14, 2015.

No properties were joint ventured as of April 14, 2015.

After acquiring a property and selecting a possible exploration area through its own efforts or with others, the Company will typically compile reports, past production records and geologic surveys concerning the area. The Company will then undertake a field exploration program to determine whether the area merits further work. Initial field exploration on a property normally consists of geologic mapping and geochemical and/or geophysical surveys, together with selected sampling to identify environments that may contain specific mineral occurrences. If an area shows promise, geologic drilling programs may be undertaken to further define the existence of any economic mineralization. If mineralization is identified, further work may be undertaken to estimate ore reserves, evaluate the feasibility for the development of the mining project, obtain permits for commercial development, and, if the project appears to be economically viable, proceed to place the mineral deposit into commercial production.

In connection with the acquisition of a property, the Company may conduct limited reviews of title and related matters and obtain representations regarding ownership. Although the Company plans to conduct reasonable investigations (in accordance with standard mining practice) of the validity of ownership, it may be unable to acquire good and marketable title to its properties.

The proposed exploration program for the Company’s properties will typically consist of rock-chip sampling, soil geochemistry, geological mapping, a geophysical survey, trenching, drilling, and resource calculation. The exploration program will take place in phases, with some phases occurring simultaneously. Rock-chip and soil geochemistry may be initiated first to test and define the mineralization. This may be followed up with a CSAMT (Controlled-Source Audio-Frequency Magneto Telluric) (or other appropriate geophysical methods) to test the extent and depth of sulfide mineralization which could host copper, lead or zinc. The CSAMT is an industry standard geophysical technique that has been used successfully to identify carbonate deposits in Mexico and other locations.

Upon completion of the exploration program, and if results are positive, a drilling program may begin. Split samples (i.e. samples cut in half) from logged cores will be sent for assay at the Company’s laboratory or at laboratories operated by third parties. Remaining cores will be saved for third party independent confirmation. Prospect samples will be assayed by the Company at its laboratory with occasional splits sent to third party labs for verification. Samples for mine production will be taken according to the standard methodology generally accepted for either drill cuttings or channel sampling. Samples for mine production will be assayed internally at the Company’s laboratory, with duplicate assaying of every twentieth sample. Splits of every twentieth sample will be sent to an outside laboratory for confirmation. After drilling results have been evaluated, a mineral resource calculation will be made.

The capital required for the exploration and development of mining properties is substantial. The Company plans to finance its future operations through joint venture arrangements with third parties (generally providing that the third party will obtain a specified percentage of the Company’s interest in a certain property in exchange for the expenditure of a specified amount), the sale of the Company’s properties, debt instruments which may or may not be convertible to the Company’s or its subsidiaries’ common stock, the sale of the Company’s and its subsidiaries’ common stock and any cash generated by the Company’s operations. If the capital required to develop its properties is not available, the Company may attempt to sell one or more of its properties.

The exploration and development of properties joint ventured with third parties may be managed by one of the joint venture participants which would be designated as the operator. The operator of a mining property generally provides all labor, equipment, supplies and management on a cost plus fee basis and generally must perform specific tasks over a specified time period. Separate fees may be charged to the joint venture by the operator and, once certain conditions are met, the joint venture participant is typically required to pay the costs in proportion to its interests in the property.

Mines have limited lives, an inherent risk in the mining business. Although the Company plans to acquire other mining properties, there is a limited supply of desirable mineral lands available in Mexico and the United States where the Company would consider conducting exploration and/or production activities. In addition, the Company faces strong competition for new properties from other mining companies, many of which have greater financial resources. Further, the Company may be unable to acquire attractive new mining properties on terms that are considered acceptable.

The Company’s operations have not been affected by the escalating conflicts in Mexico involving drug cartels.

As of April 14, 2015, the Company had interests in the mining properties listed below, which are located in Mexico. The Company’s interests in the properties are generally in the form of mining concessions or patented or unpatented mining claims granted by the respective governments. Although Mexican mining concessions are similar in some respects to unpatented mining claims in the U.S., there are differences. See “Mexican Mining Laws and Regulations” below for information regarding Mexican mining concessions.

Although the Company believes that each of its properties has deposits of silver, gold, copper, lead, zinc, or iron, the properties are in the exploration stage, do not have any proven reserves, and may never produce any of these metals in commercial quantities.

Firma Holdings’ mining properties are the Don Roman Groupings and the Picacho Groupings, described further below.

In Mexico, land size is denominated in hectares and weight is denominated in tonnes. One hectare is equal to approximately 2.47 acres and one tonne is equal to 2,200 pounds.

With the exception of the Don Roman Groupings, as of April 14, 2015, no plants or other facilities were located on any of the properties.

Firma Holdings will use its own employees, or contract with qualified personnel, to conduct and supervise all aspects of its exploration program.

Unless otherwise noted below, all of the properties below were purchased from non-related third parties.

Don Roman Groupings

The Don Roman Groupings, comprised of 10,680.1213 hectares, were acquired in October 2006, November 2008, and March and April 2011 for an effective purchase price of approximately $2,126,000, plus value-added tax of approximately $327,500. The Don Roman Groupings consist of the Pilar, Don Roman, Las Nuvias, Centenario, La Verde and La Palma prospects.

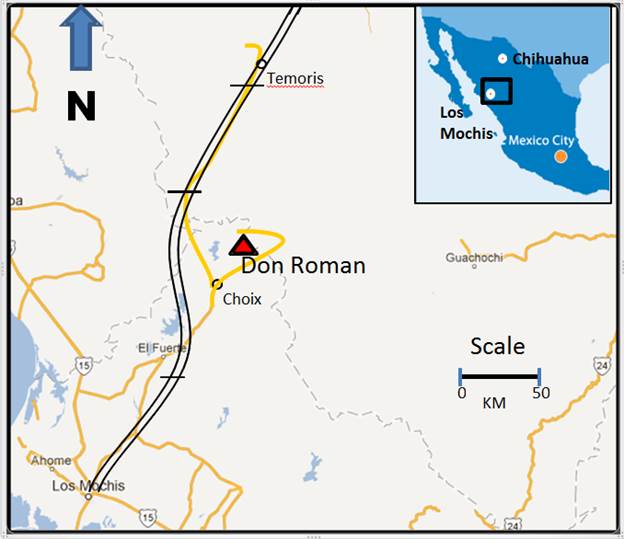

The Don Roman plant is 18 kilometers north from Choix, state of Sinaloa, Mexico. The plant is accessed by 18 kilometers of paved road. From the plant site, the closest concessions are the Don Roman Groupings which can be accessed with a regular pick-up truck through a Company maintained road. The Don Roman Groupings are in the heart of the La Reforma Mining District as well as the stated gold belt that stems from the state of Chihuahua.

The Don Roman Groupings are located in the northern part of the La Reforma mining district of northeastern Sinaloa State, Mexico. The predominant rocks in the area are Upper Jurassic-Lower Cretaceous carbonate (limestone) rocks and Tertiary granitic intrusives. The La Reforma mining district has been mined for more than 300 years, with substantial amounts of precious and base metals produced from numerous mines. In the opinion of the Company, the district has never been properly explored using present day, industry standard, exploration methods, including geochemistry, geophysics, and geology. The Company feels that this area may potentially host base metals that were never discovered or exploited due in part to market conditions, lack of technology, and lack of funding.

The Company’s justification for acquiring the Don Roman concessions based upon the types and occurrence of deposits that form around a typical “Porphyry Copper Deposit System.” The many large and small, high-grade poly-metallic veins in the district, which surround the known low-grade porphyry copper center, are typical of this type of system. These types of veins have been mined successfully in many other districts in the U.S. and Mexico. The percentage of poly-metallics, meaning zinc, lead, copper and iron, is buoyed by the presence of substantial silver and gold as subordinate metals in these veins. One of the veins obtained has been mined for 20 years. Several others have been mined off and on for many years. One of the veins, El Refugio, was first mined over 400 years ago and has seen mining as recently as 5 years ago.

Preliminary and continuing evaluation of the Don Roman Groupings have identified numerous mineralized systems at various locations on the property, some of which include a series of parallel northwest trending lead, zinc, silver structures that can be traced for more than 300 meters; an abandoned lead, zinc, silver mine; and historic vein-type gold mineralization. A number of these mineralized structures lie within a complex suite of volcanic-granitic and sedimentary (carbonate) rocks. Preliminary evaluation of the property has indicated the potential for five separate mineral systems each having varying mineral characteristics. Initial sampling has indicated the potential for two lead, zinc, silver systems; two gold copper systems; and one iron ore, gold, copper system.

The temporary permits previously held expired in the third quarter 2013. Without permits, the Company is allowed to perform the following:

|

|

·

|

Road maintenance/refurbishment of existing roads only

|

|

|

·

|

Living quarter construction/maintenance

|

|

|

·

|

Surveying

|

|

|

·

|

Surface sampling

|

|

|

·

|

Old workings exploration/identification and sampling

|

|

|

·

|

Mapping

|

|

|

·

|

Plant maintenance and refurbishment

|

|

|

·

|

Use of 900 kva electricity for plant testing during maintenance and refurbishment

|

|

|

·

|

Fencing, limiting identifying surface areas and general protection for all working and old working areas (safety)

|

|

|

·

|

Locating and drilling of a water well

|

Two circuits capable of producing a minimum of 200 tonnes per day are operational, with a third circuit that can be completed when production makes it necessary. An additional regrind circuit can also be implemented at the appropriate time. The plant, when all circuits are operational, is capable of processing approximately 400 tonnes per day.

In 2010, the Company began production at the Don Roman plant and extracted lead, zinc, and silver material from its mine and stockpiled it for future processing at the plant. During production in 2010, 181 tons of concentrate were produced and sold. In the fourth quarter of 2010, the plant activity ceased.

As of December 31, 2014, $7,878,000 has been spent on the mapping, sampling, trenching, plant facilities, processing equipment, and related mining equipment on the Don Roman property.

Exploration of the veins in the concessions will be multi-phased. The first phase will consist of drilling approximately 10 diamond core holes in the El Rosario vein system to accurately determine the total length, width and depth of the veins. This phase will further define the mineralized structure, which will then allow the concentration plant to be restarted.

Additional exploration phases will be conducted after the start of mining and will be paid with revenue generated by concentrate produced from the Don Roman plant.

To maintain the Company’s rights to the Don Roman mining concessions, the Company must:

|

|

·

|

make concession tax payment of approximately $48,200, payable in two installments due January and July of each year;

|

|

|

·

|

file yearly Statistical and Technical reports no later than January 31st of each year; and

|

|

|

·

|

file yearly Production/Works Reports no later than May 31st of each year

|

Property owned by Adit Resources

Picacho Groupings

On April 4, 2012 the Company sold 99.99% owned subsidiary, ACM to Yamana Mexico Holdings B.V. (“Yamana”). ACM’s primary asset is the Picacho Groupings. The Picacho Groupings consist of the Picacho and Picacho Fractions prospects. The Property does not have any proven reserves.

As consideration for the sale of ACM, Yamana paid $7.5 million, minus approximately $780,000 (the amount required to pay the Mexican government to release its tax lien on the Property). In addition, Yamana surrendered 500,000 Adit’s common shares, and warrants to purchase an additional 250,000 Adit’s common shares, upon the execution of the sale agreement.

Yamana had the option to terminate the Agreement within ten business days prior to May 7, 2013 for any reason. If the Agreement was terminated, Yamana would be required to return ownership of ACM and the underlying property to the Company in good standing. If this occurred, the first cash payment made by Yamana would be retained by the Company.

On May 7, 2013, the Company received notice that Yamana was terminating the purchase agreement and the Company regained possession of the property.

As of December 31, 2014, the Company has spent $1,394,000 exploring this property. Historical exploration was also performed by other third parties prior to the Company’s acquisition of this property.

To maintain the Company’s rights to the Picacho mining concessions, the Company must:

|

|

·

|

make concession tax payment of approximately $69,200, payable in two installments due January and July of each year;

|

|

|

·

|

file yearly Statistical and Technical reports no later than January 31st of each year; and

|

|

|

·

|

file yearly Production/Works Reports no later than May 31st of each year

|

U.S. Mining Laws and Regulations

In the U.S., unpatented mining claims on unappropriated federal land may be acquired pursuant to procedures established by the Mining Law of 1872 and other federal and state laws. These acts generally provide that a citizen of the U.S. (including a corporation) may acquire a possessory right to develop and mine valuable mineral deposits discovered upon appropriate federal lands, provided that such lands have not been withdrawn from mineral location, e.g., national parks, military reservations and lands designated as part of the National Wilderness Preservation System. The validity of all unpatented mining claims is dependent upon inherent uncertainties and conditions. These uncertainties relate to such non-record facts as the sufficiency of the discovery of minerals, proper posting and marking of boundaries, and possible conflicts with other claims not determinable from descriptions of record. Prior to discovery of a locatable mineral thereon, a mining claim may be open to location by others unless the owner is in possession of the claim.

To maintain its unpatented mining claims in good standing, the claim owner must file with the Bureau of Land Management (“BLM”) an annual maintenance fee ($140 for each claim, which may change year to year), a maintenance fee waiver certification, or proof of labor or affidavit of assessment work, all in accordance with the laws at the time of filing which may periodically change.

Any domestic exploration programs conducted by Firma Holdings will be subject to federal, state and local environmental regulations. The U.S. Forest Service and the BLM extensively regulate mining operations conducted on public lands. Most operations involving the exploration for minerals are subject to existing laws and regulations relating to exploration procedures, safety precautions, employee health and safety, air quality standards, pollution of stream and fresh water sources, odor, noise, dust, and other environmental protection controls adopted by federal, state, and local governmental authorities as well as the rights of adjoining property owners. Firma Holdings may be required to prepare and present to federal, state, or local authorities data pertaining to the effect or impact that any proposed exploration or production of minerals may have upon the environment. All requirements imposed by any such authorities may be costly and time-consuming, and may delay commencement or continuation of exploration or production operations.

Future legislation and regulations are expected to continue to emphasize the protection of the environment, and, as a consequence, the activities of the Company may be more closely regulated to further the cause of environmental protection. Such legislation and regulations, as well as future interpretation of existing laws, may require substantial increases in capital and operating costs to the Company and may result in delays, interruptions, or a termination of operations, the extent of which cannot be predicted.

Mining operations in the U.S. are subject to inspection and regulation by the Mine Safety and Health Administration of the Department of Labor (MSHA) under provisions of the Federal Mine Safety and Health Act of 1977.

The Company’s operations will also be subject to regulations under the Comprehensive Environmental Response, Compensation and Liability Act of 1980, as amended (CERCLA or Superfund), which regulates and establishes liability for the release of hazardous substances, and the Endangered Species Act (ESA), which identifies endangered species of plants and animals and regulates activities to protect these species and their habitats. The Company may incur expenditures for land reclamation pursuant to federal and state land restoration laws and regulations. Under certain circumstances, the Company may be required to close an operation until a particular problem is remedied or to undertake other remedial actions.

Mexican Mining Laws and Regulations

In Mexico, Article 27 of the Mexican Constitution grants the ownership of essentially all minerals to the Mexican nation. The right to exploit those minerals is given to private parties through concessions issued by the Mexican government. The current Mining Law of Mexico was enacted in 1992. Concessions are granted on mining lots, the sides of which measure 100 meters, or a multiple of 100, except when adjoining lots (granted when there were no size requirements) require a smaller size.

An exploration concession is granted to the first applicant that meets the requirements of the Mining Law, the most important of which is that the claimed area is deemed to be “free land”. Under the Mining Law, areas that are already covered by mining concessions or applications for mining concessions, as well as reserved areas such as the coast and the seabed, are not free.

Exploration mining concession applications are filed at government offices. Exploration concessions are valid for fifty years and give their holders the right to carry out exploration work and, if warranted, put into production any ore discovered on the concession.

Mining concessions do not grant the holder the right to enter or use the surface land of the mining lots. It is therefore necessary to obtain the permission of the surface owner for that purpose. Typically, a verbal authorization with no consideration is granted for prospecting and sample gathering. A simple letter agreement or contract is normally used for drilling, trenching, or basic road building. For more advanced exploration activities, a small monetary consideration is normally required. In some cases the concessionaire is also required to make minor improvements which benefit the local community such as fixing a road or fence or building an earthen dam. Building and operating a mine requires a more formal agreement. If an agreement cannot be reached with the surface owner, the Mining Law gives the concessionaire the right to request a temporary occupation of the land or an expropriation (or an easement for the construction of roads, power lines, water pipes, etc.). Compensation is set through an appraisal made by the federal government.

A concessionaire’s most important obligation is the performance of assessment work on the mining lots. A minimum amount of assessment work measured in monetary terms must be performed each year, depending on the size of the mining lot and, for an exploration mining concession, the number of years elapsed since its issue, pursuant to minimum investment tables established by the Mexican government. Assessment work may be done either through expenditures or the sale of minerals. Lack of performance of the minimum work will result in the cancellation of the concession; payment to the government in lieu of required assessment of work is not allowed.

To maintain its mining concessions in good standing, the holder of a mining concession must also:

|

|

·

|

Make semi-annual concession payments in January and July of each year;

|

|

|

·

|

File annual Statistical and Technical reports no later than January 31st of each year which must include the following:

|

|

|

§

|

Concession name title, surface area, and general identification of modifications to the concession. If purchased in the previous year, the contract information and from whom acquired, if the contract is still being paid, and general terms of contract and a disclosure if new minerals/metals have been found other than the ones in prior submissions.

|

|

|

·

|

File annual Production/Works Reports no later than May 31st of each year which must include the following:

|

|

|

§

|

Concession name, title surface area, identification of modifications to the concessions, abandonment, reduction whether in exploration or exploitation, tonnes produced, processed and what mineral/metal, whether it was smelted on location or where it was shipped to nationally for processing. Accounting information is used as support for the reports.

|

The exploration concessions in Mexico are valid for the period of 50 years from the date of issue. After 50 years, applications can be filed to continue the concession right for another 50 years. The concession rights to the Company’s Mexican properties expire between February 2047 and November 2061.

Concessionaires must comply with federal environmental regulations which generally require that mining activities be subject to an environmental impact statement authorization. Normally an environmental impact statement authorization can be obtained in six to twelve months from the date of its filing. However, environmental impact statements for mining operations that do not exceed levels established by the Mexican government are not required.

The Mining Law forbids concessionaires from removing mine timbering and supports and requires compliance with all safety rules promulgated by the Mexican government.

Mexican and foreign individuals, as well as Mexican corporations, are allowed to hold mining concessions. Although foreign corporations may not hold mining concessions, foreign corporations may, however, own Mexican corporations.

General

Firma Holdings’ offices are located at 181 N. Arroyo Grande Blvd., Ste. 140B, Henderson, NV 89074. The office space is supplied free of charge by Lynda R. Keeton-Cardno, Chief Financial Officer and Accounting of Firma Holdings.

As of April 14, 2015 Firma Holdings had 6 employees; and American Metal Mining had 1 employee.

Firma Holdings’ website is www.taraminerals.com

Not applicable.

Not applicable.

See Item 1.

In August 2011, Firma Holdings entered into an agreement with Carnegie Mining and Exploration, Inc. which provided Carnegie with the option to earn up to a 50% interest in Firma Holdings’ Don Roman and iron ore projects.

In order to earn an interest in the Don Roman project, Carnegie was required to spend certain amounts on the Don Roman property such that the Don Roman plant reached minimum production levels. Carnegie could earn a 50% interest in Firma Holdings’ iron ore projects by spending $1,000,000 toward the projects by November 6, 2011.

Carnegie did not spend the required amounts on either project and Firma Holdings terminated the option.

On November 10, 2011, Firma Holdings filed a complaint in Clark County, Nevada against Carnegie seeking a declaration that Carnegie failed to properly exercise its option to acquire an interest in the iron ore properties. Carnegie was required to respond to the complaint on or before March 21, 2012.

On December 9, 2011, Carnegie and a purported affiliate, Carnegie Operations, LLC filed a complaint in Texas state court against former employees of Carnegie. Although Firma Holdings was not initially named as a defendant, the substance of the state court complaint made it clear that the core issues were substantially similar to those raised in the Nevada litigation. The individual defendants removed the case to federal court in Dallas, Texas on December 22, 2011. Carnegie responded with a First Amended Complaint on January 31, 2012, which formally named Firma Holdings as a defendant. In its amended complaint, Carnegie sought an injunction against Firma Holdings in connection with its option on the iron ore properties, as well as damages for alleged fraud, trade secret theft, civil conspiracy, and tortuous interference with Carnegie’s employment contracts with the individual defendants.

On February 14, 2012, Firma Holdings moved the Texas court for a transfer of venue to Nevada so that the cases could be consolidated. In July 2012, the Texas Court granted Firma Holdings motion and transferred the case to Nevada.

All litigation related to the Don Ramon option was settled on March 15, 2013, pursuant to a Settlement Agreement and Release executed by all interested parties. In exchange for Carnegie’s acknowledgement that it has no rights under the Option, American Metal Mining (“AMM”) assigned its Champinon mining rights purchase contract, including all related obligations and acquisition payments, to Plathio Trading Mexico, SA de CV, Carnegie’s Mexican subsidiary, and the Company agreed to issue to Carnegie 500,000 restricted shares of the Company’s common stock, which may not be sold until the earlier of: (i) the Company’s shares reaching a minimum trading price of $1.00 per share; or (ii) two years from the date of the Agreement. Under the transfer agreement for the Champinon property, AMM retains mining and beneficial rights to known silver, zinc, and led vein structure present on the Champinon concession. The Agreement confirms Carnegie’s acknowledgement of the Company’s 100% ownership of the Don Roman property.

On February 15, 2015, Ben Renda filed a lawsuit against the Company in the Circuit Court of Cook County, Illinois requesting damages in the amount of approximately $209,000. In his complaint, Mr. Renda alleges that in 2012-2013 he was involved in negotiating a license pertaining to the SmartPac technology. Although the license was never finalized, Mr. Renda claims the work he performed aided the Company in acquiring the SmartPac technology, and therefore the Company somehow unjustly benefited from Renda’s work. Mr. Renda’s claim against the Company is subject to two pending motions to dismiss. Neither motion has been ruled on as of April 14, 2015.

Other than the foregoing, Firma Holdings is not involved in any legal proceedings and is not aware of any legal proceedings which are threatened or contemplated.

Not applicable.

Firma Holdings’ common stock is quoted on the OTC Bulletin Board under the symbol “FRMA”.

Shown below are the ranges of high and low closing prices for Firma Holdings’ common stock for the periods indicated as reported by FINRA and as reported on www.stockhouse.com. The market quotations reflect inter-dealer prices, without retail mark-up, mark-down or commissions and may not necessarily represent actual transactions.

|

Quarter Ended

|

High

|

Low

|

||||||

|

31-Mar-13

|

$ | 0.50 | $ | 0.25 | ||||

|

30-Jun-13

|

$ | 0.37 | $ | 0.16 | ||||

|

30-Sep-13

|

$ | 0.29 | $ | 0.16 | ||||

|

31-Dec-13

|

$ | 0.25 | $ | 0.10 | ||||

|

31-Mar-14

|

$ | 0.28 | $ | 0.14 | ||||

|

30-Jun-14

|

$ | 0.30 | $ | 0.14 | ||||

|

30-Sep-14

|

$ | 0.30 | $ | 0.20 | ||||

|

31-Dec-14

|

$ | 0.24 | $ | 0.17 | ||||

As of April 14, 2015 Firma Holdings had 100,845,696 outstanding shares of common stock and 251 shareholders of record.

We have not paid and do not expect to declare or pay any cash dividends on our common stock in the foreseeable future, and we currently intend to retain future earnings, if any, to finance the expansion of our business. The decision whether to pay cash dividends on our common stock will be made by our Board of Directors, in their discretion, and will depend on our financial condition, operating results, capital requirements and other factors deemed relevant by our Board of Directors.

Recent Sales of Unregistered Securities and Use of Proceeds

Firma Holdings relied upon the exemption provided by Section 4(2) of the Securities Act of 1933 with respect to the sale of these securities.

Not applicable.

The Company was incorporated on May 12, 2006 as Tara Minerals Corp. On June 3, 2014 the Company amended its Articles of Incorporation changing its name from Tara Minerals Corp. to Firma Holdings Corp.

Beginning in the second quarter of 2014 the Company had two operational business segments: mining and packaging technology. As of December 31, 2014 the packaging technology segment was in the planning stage with minimal activity, while the mining segment accounts for the majority of the Company’s results of operations in the accompanying financial statements and in the discussion below.

RESULTS OF OPERATIONS

Material changes of certain items in Firma Holdings’ Statement of Operations for the year ended December 31, 2014, as compared to the year ended December 31, 2013, are discussed below.

|

Year Ended

|

December 31, 2014

|

December 31, 2013

|

||||||

|

(In thousands of U.S. Dollars)

|

||||||||

|

Revenue

|

$ | 105 | $ | - | ||||

|

Cost of revenue

|

- | |||||||

|

Exploration expenses

|

536 | 1,734 | ||||||

|

Operating, general and administrative expenses

|

2,910 | 2,690 | ||||||

|

Net operating loss

|

$ | (3,340 | ) | $ | (4,424 | ) | ||

For the year ended December 31, 2014, ore from the exploration process at the Dixie Mining District was sold; compared to the year ended December 31, 2013, when the Company had no revenues from mining activity at any of its properties.

For the year ended December 31, 2014, the Company kept all mining concessions in dormant or inactive status while working toward further funding options resulting in exploration expenses for routine maintenance and employee costs; compared to the year ended December 31, 2013, when the Company focused primarily exploring the Dixie Mining District in Idaho. In 2013 exploration expenses included expenses for preproduction activities, geology consulting, assaying, field supplies and other mine expenses.

Material changes of certain items, or significant expenses, in Firma Holdings’ operating, general and administrative expenses for the year ended December 31, 2014, as compared to the year ended December 31, 2013, are discussed below.

|

Year Ended

|

December 31, 2014

|

December 31, 2013

|

||||||

|

(In thousands of U.S. Dollars)

|

||||||||

|

Bad debt expense

|

$ | 129 | $ | 178 | ||||

|

Investment banking and investor relations expense

|

100 | 366 | ||||||

|

Compensation, officer employment contracts and bonuses

|

1,227 | 667 | ||||||

|

Professional fees

|

641 | 619 | ||||||

|

Travel expense

|

48 | 98 | ||||||

Impuesto al Valor Agregado taxes (IVA) are recoverable value-added taxes charged by the Mexican government on goods sold and services rendered at a rate of 16%. Under certain circumstances, these taxes are recoverable by filing a tax return and as determined by the Mexican taxing authority. Each period, receivables are reviewed for collectability. When a receivable has doubtful collectability we allow for the receivable until we are either assured of collection (and reverse the allowance) or assured that a write-off is necessary. Bad debt expense decreased for the year ended December 31, 2014, compared to the year ended December 31, 2013 due to a lower volume of transactions that generate IVA receivables. In addition, allowance for doubtful accounts related to IVA decreased as a result of recoveries of IVA in the amount of $73,216 in 2014 through March 31, 2015.

Investment banking and investor relations expense for the year ended December 31, 2014, compared to the year ended December 31, 2013, significantly decreased due to the addition of our new agricultural business segment taking the time of our executives.

Compensation, officer employment contracts and bonuses increased due to stock based compensation expense of $405,931 for the year ended December 31, 2014 compared to $59,645 for the year ended December 31, 2013. Prior to 2014, total base salary for the Company’s officers was split per contract 2/3 Firma Holdings and 1/3 Tara Gold Resources, the former parent of Firma Holdings. This split between the two companies ceased when the officers resigned from Tara Gold Resources in February 2015 and the Board of Directors of the Company approved the assumption of all related accrued salary. The overall cash dollar compensation for the officers of the Company did not change between the two years, except for stock based compensation.

Professional fees for the year ended December 31, 2014, increased primarily due additional legal fees offset by lower accounting and security fees at the Mexico office. Legal services in 2014 relate to the intellectual property after acquisition; compared to the year ended December 31, 2013, which consisted of legal services related to the acquisition of additional acres added to the Dixie Mining District and the settlement agreement reached with Carnegie related to the Champinon mining concession. Though the dollar figures are relatively consistent year over year, the components of the legal fees within professional fees is materially different as the Company added a new business segment in 2014.

Travel expense for the year ended December 31, 2014, decreased due to limited travel to the Dixie Mining District compared to the year ended December 31, 2013, where there was extension travel to the Dixie Mining District.

Material changes of certain items in Firma Holdings’ other income/expenses for the year ended December 31, 2014, as compared to the year ended December 31, 2013, are discussed below.

|

Year Ended

|

December 31, 2014

|

December 31, 2013

|

||||||

|

(In thousands of U.S. Dollars)

|

||||||||

|

Interest income

|

$ | 650 | $ | 51 | ||||

|

Impairment of long lived assets

|

(11,313 | ) | (28 | ) | ||||

|

Loss on deconsolidation

|

(5,351 | ) | - | |||||

As of December 31, 2014, the Company was deconsolidated from Tara Gold who also divested its interested in its Mexican subsidiary Corporacion Amermin S.A. de C.V. (“Amermin”). Due to the change in organizational relationship the Company recognized items at December 31, 2014 which had previously been eliminated under the concepts of consolidation under generally accepted accounting principles. Transactions relating to this deconsolidation are not usual and not anticipated to reoccur. Additionally, the intercompany loan balances between Tara Gold and Amermin were converted to a note for $10,315,020 with an interest rate of 3.22%.

Interest income for the year ended December 31, 2014, increased due to the Company extending a note receivable for $530,500 and Tara Gold recognizing interest income on the note with Amermin referred to above. Interest income relating to related party notes receivable at AMM encompasses the entire year ended December 31, 2013 balance and is flat in comparison between the years ended December 31, 2014 and 2013.

Subsequent to year end but contemporaneous with preparing this annual report, the Company determined that the note receivable between Tara Gold and Amermin was likely not fully collectible as the Company no longer has any influence or insight over the operations of Amermin. As such the note was impaired as of December 31, 2014. Impairment of assets other than this note for the year ended December 31, 2014 relate to either adjusting the fair value of the Dixie Mining District to the amount the Company sold it for in February 2015 or the impairment of the Pirita mining concession in Mexico. The impairment of other mining concession in Mexico was $28,001 for the year ended December 31, 2013.

Lastly, upon Tara Gold ceasing to be the parent of the Company, a total loss on deconsolidation consisting of the write off approximately $415,000 in an intercompany payable to the Company and the fair value of its investment in the Company’s stock of approximately $4,935,000 was recognized.

LIQUIDITY AND CAPITAL RESOURCES

The following is an explanation of Firma Holdings’ material sources and (uses) of cash (in thousands of U.S. dollars) during the years ended December 31, 2014 and 2013:

|

December 31,

2014

|

December 31,

2013 |

|||||||

|

(In thousands of U.S. Dollars)

|

||||||||

|

Net cash used in operating activities

|

$ | (2,488 | ) | (3,126 | ) | |||

|

Acquisition of property, plant, equipment, mine development, and land

|

- | (217 | ) | |||||

|

Purchase of mining concession including mining deposits

|

- | (650 | ) | |||||

|

Acquisition of intellectual property

|

(559 | ) | - | |||||

|

Proceeds from the sale of assets

|

28 | - | ||||||

|

Cash from the sale of common stock and stock payable

|

3,739 | 2,274 | ||||||

|

Proceeds from notes payable

|

110 | 150 | ||||||

|

Payments towards notes payable

|

(718 | ) | (26 | ) | ||||

|

Change in due to/from related parties, net

|

229 | 746 | ||||||

|

Cash, beginning of period

|

77 | 907 | ||||||

Firma Holdings anticipates that its capital requirements during the year ending December 31, 2015 will be:

|

Exploration and Development – Don Roman Groupings

|

$ | 200,000 | ||

|

Exploration and Development – Picacho Groupings

|

160,000 | |||

|

Property taxes

|

125,000 | |||

|

Packaging technology business segment

|

1,950,000 | |||

|

Food manufacturing

|

3,000,000 | |||

|

General and administrative expenses

|

1,000,000 | |||

|

Total

|

$ | 6,435,000 |

The capital requirements shown above include capital required by Firma Holdings and subsidiaries.

In 2014 and early 2015 the Company negotiated and subsequently closed on the acquisition of two significant business opportunities in two distinctly different segments. The Company will now operate with three subsidiary companies in three segments. Gracepoint Mining, LLC will hold the Company’s mining assets; SmartPac Global, LLC will hold the SmartPacTM technology; Sicilian Sun Limited, LLC will hold the food manufacturing and sales business.

Each acquisition was made with a strategic focus on a combination of instant revenue, scalable revenue, and exponential valuation growth potential. The result is that the Company now has three distinct divisions: mining, packaging technology, and food manufacturing.

As the mining division of the Company continues to explore options to advance all projects, the Company took advantage of an opportunity to sell the Dixie Mining district in February 2015 for $450,000 cash and the assumption of certain payables related to doing business in the state of Idaho. Additionally, we continue to actively look for strategic partners to restart the operations at the Company’s Don Roman processing plant in Mexico and/or further develop the property.

The second division, SmartPac Global, is a packaging technology that can be used for the preservation and protection of fresh fruit, vegetables, and flowers during extended periods of shipping and storage. The packaging technology, currently named SmartPacTM, is comprised of patents, trademarks and other intellectual property pertaining to systems and methods for packaging bulk quantities of fresh produce and flowers incorporating modified atmosphere packaging.

SmartPac Global has engaged the services of a global distribution and logistics expert to introduce and enlist end users to its patented SmartPacTM Systems solution. These included introductions to major destination importers, retailers and food service distributors, in both Europe and Asia; communicating the significant value propositions offered by the SmartPacTM packaging system. As a result of these meetings, Firma was engaged to demonstrate the performance by shipping asparagus, avocados, limes, and honeydew melons, in SmartPacTM’s, to Japan and Europe. The demonstrations resulted is reducing transportation costs, spoilage, and handling costs while enabling consumers to enjoy better tasting fresh food.

Clients that have been engaged predominately import high value fresh fruit and vegetables from long distances, including the U.S., Mexico, Peru, and Chile. As an example, avocado fruit was shipped to Japan and the condition of the fruit was evaluated upon arrival by both the importer and Firma. The avocado fruit using SmartPacTM technology was found to have arrived in superior condition, and with increased yields when compared to cartons not packed using SmartPacTM technology. This has resulted in requests for additional shipments and preparations being made for meeting scaled demand. The Company now has the opportunity to begin SmartPacTM sales and continue to build out sales channels.

With these demonstrations, Firma has confirmed that the market demands an effective "per carton" solution that enables the retailer to capture and eliminate the costs associated with transportation and spoilage generated in their fruit and vegetable supply chains. As a result, in addition to seeking to fulfill current market requests and developing custom packaging, the Company is currently expanding its global dynamic demonstrations.

The third division was established with the 2015 acquisition of Sicilian Sun Limited, LLC., and its wholly owned subsidiary, Sicilian Sun Foods, s.r.l. The acquisition includes two production facilities located in Sicily, Italy, that encompass almost 100,000 square feet of factory space.

In 2014, Sicilian Sun Foods partnered with California based food supplier La Petite Foods and US based global food broker Daymon Worldwide. La Petite Food’s retail partnerships have included Trader Joes, Whole Foods, Walmart, Costco, Sam’s Club, UNFI Distributing and many other specialty markets. Daymon Worldwide operates on six continents, providing end-to-end retail services focused on Private Brand Development, Strategy & Branding, Sourcing & Logistics, and Retail Services & Consumer Experience Marketing. Sicilian Sun Foods utilized the services of La Petite Foods and Daymon Worldwide in contracting with major grocery chains consisting of thousands of retailers throughout the United States to manufacture private label and branded products. The initial stocking order, related to various frozen deserts, is scheduled to begin in June, 2015, with sales estimates of $3.5 million per quarter by the 4th quarter of 2015.

Firma Holdings will need to obtain additional capital if it is unable to generate sufficient cash from its operations or find joint venture partners to fund all or part of its exploration and development costs.

Firma Holdings does not know of any trends, events or uncertainties that have had, or are reasonably expected to have, a material impact on its sales, revenues or income from continuing operations, or liquidity and capital.

Firma Holdings’ future plans will be dependent upon the amount of capital available to Firma Holdings, the amount of cash provided by its operations, and the extent to which Firma Holdings is able to have joint venture partners pay the costs of exploring and developing its mining properties.

Firma Holdings does not have any commitments or arrangements from any person to provide Firma Holdings with any additional capital except as disclosed in the subsequent event footnote in the financial statement included in Item 8. If additional financing is not available when needed, Firma Holdings may continue to operate in its present mode. Firma Holdings does not have any plans, arrangements or agreements to sell its assets or to merge with another entity.

Off-Balance Sheet Arrangements

At December 31, 2014, Firma Holdings had no off-balance sheet arrangements that have, or are reasonably likely to have, a current or future material effect on our consolidated financial condition, results of operations, liquidity, capital expenditures or capital resources.

Critical Accounting Policies

The preparation of our consolidated financial statements in conformity with accounting principles generally accepted in the United States requires us to make estimates and judgments that affect our reported assets, liabilities, revenues, and expenses, and the disclosure of contingent assets and liabilities. We base our estimates and judgments on historical experience and on various other assumptions we believe to be reasonable under the circumstances. Future events, however, may differ markedly from our current expectations and assumptions. While there are a number of significant accounting policies affecting our consolidated financial statements, we believe the following critical accounting policies involve the most complex, difficult and subjective estimates and judgments.

Recoverable Value-Added Taxes (IVA) and Allowance for Doubtful Accounts

Impuesto al Valor Agregado taxes (IVA) are recoverable value-added taxes charged by the Mexican government on goods sold and services rendered at a rate of 16%. Under certain circumstances, these taxes are recoverable by filing a tax return and as allowed by the Mexican taxing authority.

Each period, receivables are reviewed for collectability. When a receivable has doubtful collectability we allow for the receivable until we are either assured of collection (and reverse the allowance) or assured that a write-off is necessary. Our allowance in association with our receivable from IVA from our Mexico subsidiaries is based on our determination that the Mexican government may not allow the complete refund of these taxes.

Property, Plant, Equipment, Mine Development and Land

Mining concessions and acquisitions, exploration and development costs relating to mineral properties with proven reserves are deferred until the properties are brought into production, at which time they will be amortized on the unit of production method based on estimated recoverable reserves. If it is determined that the deferred costs related to a property are not recoverable over its productive life, those costs will be written down to fair value as a charge to operations in the period in which the determination is made. The amounts at which mineral properties and the related deferred costs are recorded do not necessarily reflect present or future values.

The recoverability of the book value of each property is assessed at least annually for indicators of impairment such as adverse changes to any of the following:

• estimated recoverable ounces of copper, lead, zinc, gold, silver or other precious minerals

• estimated future commodity prices

• estimated expected future operating costs, capital expenditures and reclamation expenditures

A write-down to fair value is recorded when the expected future cash flow is less than the net book value of the property or when events or changes in the property indicate that carrying amounts are not recoverable. This analysis is completed as needed, and at least annually. As of the date of this filing no events have occurred that would require the write-down of any assets the Company intends to hold. In addition, the carrying amounts of the Company’s mining properties are reviewed at each balance sheet date to determine whether there is any indication of impairment. If such indication of impairment exists, the asset’s recoverable amount will be reduced to its estimated fair value. As of December 31, 2014 and 2013, respectively, no indications of impairment existed for any assets the Company intends to hold.

Certain mining plant and equipment included in mine development and infrastructure is depreciated on a straight-line basis over their estimated useful lives from 3 – 10 years. Other non-mining assets are recorded at cost and depreciated on a straight-line basis over their estimated useful lives from 3 – 10 years.

Intellectual Property

The Company capitalized the intellectual property underlying the SmartPacTM product. The intellectual property has an indefinite life and therefore under Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) 350-30-35 “General Intangibles Other than Goodwill, Subsequent Measurement” will not be amortized. The carrying amount of the Company’s intellectual property is reviewed at each balance sheet date to determine whether there is any indication of impairment. If such indication of impairment exists, the asset’s recoverable amount will be reduced to its estimated fair value. As of December 31, 2014 no indications of impairment existed for the intellectual property.

Financial and Derivative Instruments

The Company periodically enters into financial instruments. Upon entry, each instrument is reviewed for debt or equity treatment. In the event that the debt or equity treatment is not readily apparent, Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) 480-10-S99 is consulted for temporary treatment. Once an event takes place that removes the temporary element the Company appropriately reclassifies the instrument to debt or equity.

The Company periodically assesses its financial and equity instruments to determine if they require derivative accounting. Instruments which may potentially require derivative accounting are conversion features of debt, equity, and common stock equivalents in excess of available authorized common shares, and contracts with variable share settlements. In the event of derivative treatment, we mark the instrument to market.

Exploration Expenses and Technical Data

Exploration costs not directly associated with proven reserves on our mining concessions are charged to operations as incurred.

Technical data, including engineering reports, maps, assessment reports, exploration samples certificates, surveys, environmental studies and other miscellaneous information, may be purchased for our mining concessions. When purchased for concessions without proven reserves, the cost is considered research and development pertaining to a developing mine and is expensed when incurred.

Reclamation and Remediation Costs (asset retirement obligations)

Reclamation costs are allocated to expense over the life of the related assets and are periodically adjusted to reflect changes in the estimated present value resulting from the passage of time and revisions to the estimates of either the timing or amount of the reclamation and abandonment costs.

Future remediation costs for processing plant and buildings are accrued based on management’s best estimate, at the end of each period, of the undiscounted costs expected to be incurred at a site. Such cost estimates include, where applicable, ongoing remediation, maintenance and monitoring costs. Changes in estimates are reflected in earnings in the period an estimate is revised.

Stock Based Compensation

Stock based compensation is accounted for using the Equity-Based Payments to Non-Employee’s Topic of the FASB ASC, which establishes standards for the accounting for transactions in which an entity exchanges its equity instruments for goods or services. It also addresses transactions in which an entity incurs liabilities in exchange for goods or services that are based on the fair value of the entity’s equity instruments or that may be settled by the issuance of those equity instruments. We determine the value of stock issued at the date of grant. We also determine at the date of grant the value of stock at fair market value or the value of services rendered (based on contract or otherwise) whichever is more readily determinable.

Shares issued to employees are expensed upon issuance.

Stock based compensation for employees is accounted for using the Stock Based Compensation Topic of the FASB ASC. We use the fair value method for equity instruments granted to employees and will use the Black-Scholes model for measuring the fair value of options, if issued. The stock based fair value compensation is determined as of the date of the grant or the date at which the performance of the services is completed (measurement date) and is recognized over the vesting periods.

Income Taxes

Income taxes are provided for using the asset and liability method of accounting in accordance with the Income Taxes Topic of the FASB ASC. Deferred tax assets and liabilities are determined based on differences between the financial reporting and tax basis of assets and liabilities and are measured using the enacted tax rates and laws that will be in effect when the differences are expected to reverse. A valuation allowance is established when necessary to reduce deferred tax assets to the amount expected to be realized by management. Deferred tax assets are reduced by a valuation allowance when, in the opinion of management, it is more likely than not that some portion or all of the deferred tax assets will not be realized. The computation of limitations relating to the amount of such tax assets, and the determination of appropriate valuation allowances relating to the realization of such assets, are inherently complex and require the exercise of judgment. As additional information becomes available, management continually assesses the carrying value of our net deferred tax assets.

Item 7A. Quantitative and Qualitative Disclosure about Market Risk

Not applicable.

FIRMA HOLDINGS CORP. AND SUBSIDIARIES

(Formerly known as Tara Minerals Corp.)

(An Exploration Stage Company)

CONSOLIDATED FINANCIAL STATEMENTS

AS OF AND FOR

THE YEARS ENDED DECEMBER 31, 2014 AND 2013

TABLE OF CONTENTS

|

Page

|

|

|

25

|

|

|

FINANCIAL STATEMENTS:

|

|

|

27

|

|

|

28

|

|

|

29

|

|

|

31

|

|

|

33

|

To the Board of Directors and Stockholders

of the Firma Holdings Corp.

Henderson, Nevada

We have audited the accompanying consolidated balance sheets Firma Holdings Corp. (the "Company") as of December 31, 2014 and the related statements of operations and comprehensive loss, statements of cash flows, and statements of shareholders’ equity for the year then ended. These financial statements are the responsibility of the Company’s management. Our responsibility is to express an opinion on these financial statements based on our audit.

We conducted our audit in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audit provide a reasonable basis for our opinion.

In our opinion, the consolidated financial statements referred to above present fairly, in all material respects, the financial position of the Company as of December 31, 2014, and the related statements of operations and comprehensive loss, statements of cash flows, and statements of shareholders’ equity for the year then ended, in conformity with accounting principles generally accepted in the United States of America.

|

/s/ The Pun Group

|

|

The Pun Group

|

Santa Ana, California

April 14, 2015

Report of Independent Registered Public Accounting Firm

Board of Directors and Stockholders

Firma Holdings Corp.,

We have audited the accompanying consolidated balance sheets of Firma Holdings Corp. as of December 31, 2013, and the related statements of operations and comprehensive loss, statements of cash flows, and statements of shareholders’ equity for the year then ended. These financial statements are the responsibility of the entity’s management. Our responsibility is to express an opinion on these financial statements based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements referred to above present fairly, in all material respects, the consolidated financial position of Firma Holdings Corp. as of December 31, 2013, and the related statements of operations and comprehensive loss, statements of cash flows, and statements of shareholders’ equity for the year then ended, in conformity with accounting principles generally accepted in the United States of America.

|

/s/ StarkSchenkein, LLP

|

|

StarkSchenkein, LLP

|

Denver, Colorado

April 14, 2014

FIRMA HOLDINGS CORP. AND SUBSIDIARIES

(Formerly known as Tara Minerals Corp.)

|

December 31, 2014

|

December 31, 2013

|

|||||||

|

Assets

|

||||||||

|

Current assets:

|

||||||||

|

Cash

|

$

|

738,610

|

$

|

76,758

|

||||

|

Other receivables, net

|

20,446

|

73,106

|

||||||

|

Note receivable

|

594,485

|

-

|

||||||

|

Prepaid assets

|

134,666

|

114,425

|

||||||

|

Assets held for sale or disposal, net

|

|

450,000

|

679,262

|

|||||

|

Due from related parties

|

104,868

|

-

|

||||||

|

Other current assets

|

108,036

|

21,684

|

||||||

|

Total current assets

|

2,151,111

|

965,235

|

||||||

|

Property, plant, equipment, mine development, and land, net

|

6,107,441

|

6,694,419

|

||||||

|

Intellectual property

|

2,745,229

|

-

|

||||||

|

Total assets

|

$

|

11,003,781

|

$

|

7,659,654

|

||||

|

Liabilities and Stockholders’ Equity

|

||||||||

|

Current liabilities:

|

||||||||

|

Accounts payable and accrued expenses

|

$

|

1,680,408

|

$

|

1,410,281

|

||||

|

Notes payable, current portion

|

2,123,100

|

38,614

|

||||||

|

Convertible notes payable, net

|

260,000

|

75,652

|

||||||

|

Due to related parties, net

|

-

|

1,517,615

|

||||||

|

Total current liabilities

|

4,063,508

|

3,042,162

|

||||||

|

Notes payable, non-current portion

|

1,910,495

|

28,005

|

||||||

|

Total liabilities

|

5,974,003

|

3,070,167

|

||||||

|

Stockholders’ equity:

|

||||||||

|

Common stock: $0.001 par value; authorized 200,000,000 shares; issued and

outstanding 94,032,340 and 81,082,278 shares

|

94,032

|

81,082

|

||||||

|

Additional paid-in capital

|

40,984,888

|

37,191,859

|

||||||

|

Common stock payable

|

667,671

|

47,466

|

||||||

|

Accumulated deficit

|

(45,760,739

|

)

|

(35,757,123

|

)

|

||||

|

Accumulated other comprehensive income (loss)

|

153,923

|

(167,584

|

)

|

|||||

|

Total Firma Holdings stockholders’ (deficit) equity

|

(3,860,225

|

)

|

1,395,700

|

|||||

|

Non-controlling interest

|

8,890,003

|

3,193,787

|

||||||

|

Total stockholders’ equity

|

5,029,778

|

4,589,487

|

||||||

|

Total liabilities and stockholders’ equity

|

$

|

11,003,781

|

$

|

7,659,654

|

||||

See accompanying notes to these consolidated financial statements.

FIRMA HOLDINGS CORP. AND SUBSIDIARIES

(Formerly known as Tara Minerals Corp.)

AND COMPREHENSIVE LOSS

|

For the Years Ended

|

||||||||

|

December 31, 2014

|

December 31, 2013

|

|||||||

|

Mining revenues

|

$

|

105,316

|

$

|

-

|

||||

|

Cost of revenue

|

-

|

-

|

||||||

|

Gross margin

|

105,316

|

-

|

||||||

|

Exploration expenses

|

535,559

|

1,734,394

|

||||||

|

Operating, general and administrative expenses

|

2,910,137

|

2,689,898

|

||||||

|

Net operating loss

|

(3,340,380

|

)

|

(4,424,292

|

)

|

||||

|

Non-operating income (expense):

|

||||||||

|

Interest income

|

649,519

|

51,432

|

||||||

|

Interest expense

|

(219,417

|

)

|

(254,004

|

)

|

||||

|

Gain (loss) on debt due to extinguishment and conversion

|

5,000

|

(7,000