Attached files

| file | filename |

|---|---|

| 8-K - 8-K - LINDSAY CORP | d49657d8k.htm |

| EX-99.1 - EX-99.1 - LINDSAY CORP | d49657dex991.htm |

4th Quarter Fiscal 2020 Earnings Slide Deck Exhibit 99.2

Safe-Harbor Statement This presentation contains forward-looking statements that are subject to risks and uncertainties and which reflect management’s current beliefs and estimates of future economic circumstances, industry conditions, Company performance, financial results and planned financing. You can find a discussion of many of these risks and uncertainties in the annual, quarterly and current reports that the Company files with the Securities and Exchange Commission. Investors should understand that a number of factors could cause future economic and industry conditions, and the Company’s actual financial condition and results of operations, to differ materially from management’s beliefs expressed in the forward-looking statements contained in this presentation. These factors include but are not limited to those outlined in the “Risk Factors” sections of the Company’s most recent annual report on Form 10-K filed with the Securities and Exchange Commission and the Company’s quarterly report on Form 10-Q for the fiscal quarter ended February 29, 2020, and investors are urged to review these factors when considering the forward-looking statements contained in this presentation. For these statements, the Company claims the protection of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995. For full financial statement information, please see the Company’s earnings release dated October 22, 2020.

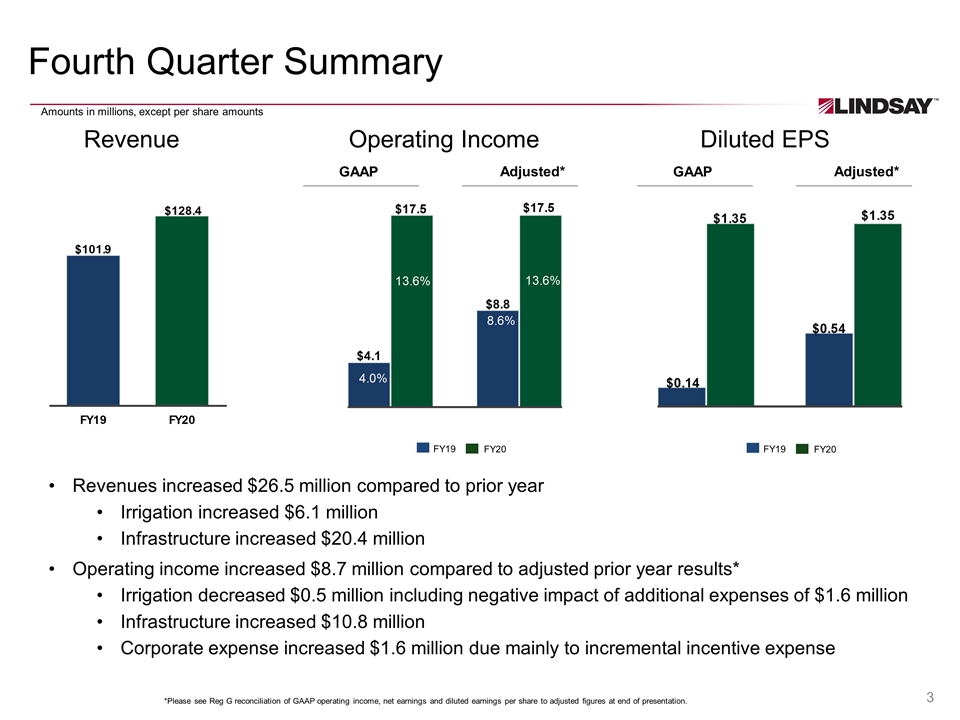

Fourth Quarter Summary *Please see Reg G reconciliation of GAAP operating income, net earnings and diluted earnings per share to adjusted figures at end of presentation. Revenue Operating Income Diluted EPS Revenues increased $26.5 million compared to prior year Irrigation increased $6.1 million Infrastructure increased $20.4 million Operating income increased $8.7 million compared to adjusted prior year results* Irrigation decreased $0.5 million including negative impact of additional expenses of $1.6 million Infrastructure increased $10.8 million Corporate expense increased $1.6 million due mainly to incremental incentive expense GAAP Adjusted* GAAP Adjusted* Amounts in millions, except per share amounts FY19 FY20 FY19 FY20

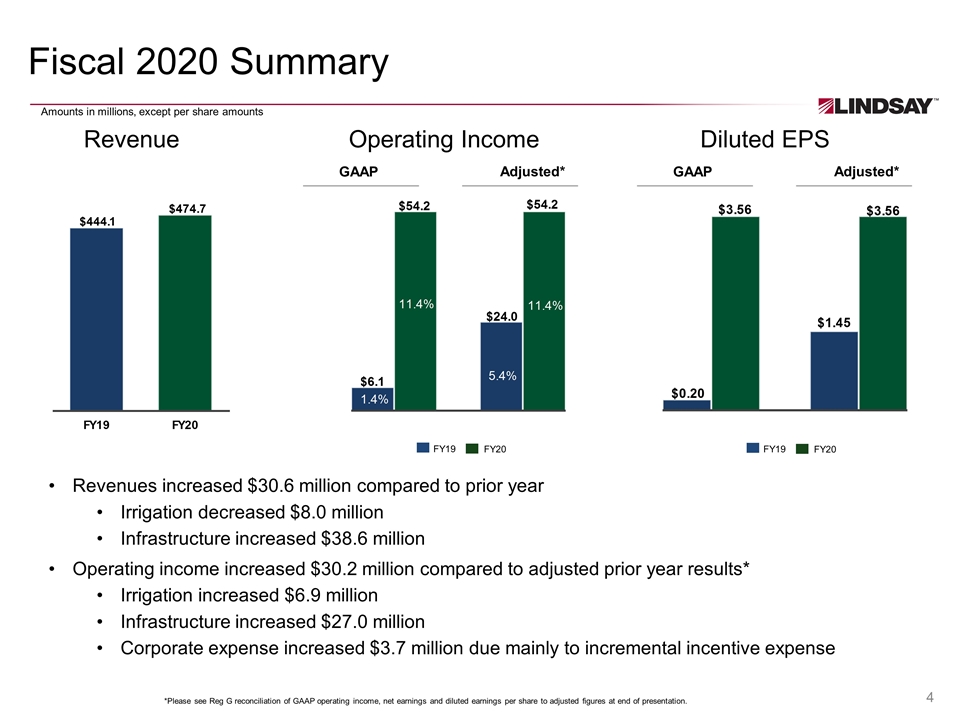

Fiscal 2020 Summary *Please see Reg G reconciliation of GAAP operating income, net earnings and diluted earnings per share to adjusted figures at end of presentation. Revenue Operating Income Diluted EPS Revenues increased $30.6 million compared to prior year Irrigation decreased $8.0 million Infrastructure increased $38.6 million Operating income increased $30.2 million compared to adjusted prior year results* Irrigation increased $6.9 million Infrastructure increased $27.0 million Corporate expense increased $3.7 million due mainly to incremental incentive expense GAAP Adjusted* GAAP Adjusted* Amounts in millions, except per share amounts FY19 FY20 FY19 FY20

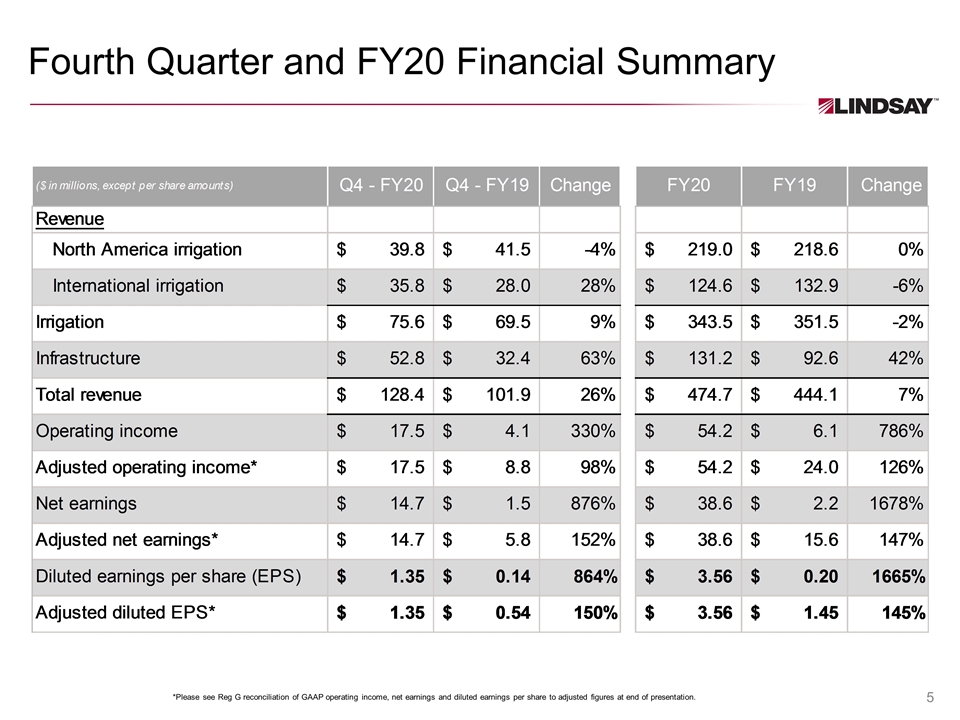

Fourth Quarter and FY20 Financial Summary *Please see Reg G reconciliation of GAAP operating income, net earnings and diluted earnings per share to adjusted figures at end of presentation.

Current Market Factors Global commodity prices declined significantly earlier in the year as a result of the COVID-19 pandemic but have recently recovered as the demand environment has improved and production estimates from the U.S. harvest have declined. 2020 Net Farm Income is projected by the USDA to be $102.7 billion, an increase of 22.7% from 2019. The increase is coming primarily from higher Federal government direct farm program payments. Under the U.S.-China Phase 1 trade deal, China pledged to increase purchases of U.S. agricultural products by $32 billion over two years. Year-to-date exports to China have increased over the prior year but remain below commitments in the trade deal. Ethanol demand has improved since falling earlier in the year but remains lower than a year ago. Food security has become an increased concern in certain international markets. Irrigation Infrastructure The five-year $305 billion U.S. highway bill enacted in December 2015 (the “FAST Act”) was set to expire September 30, however Congress and the Administration have approved the Continuing Appropriations Act, which extended the FAST Act for one year. This provides funding certainty for road and bridge projects over this period. Construction activity has slowed globally because of the COVID-19 pandemic. Our “shift left” strategy continues to gain traction in increasing the addressable market for Road Zipper System® sales and lease opportunities. States continue the transition to new federal MASH testing standards for road safety products. Almost all our road safety product offerings in the U.S. have now received MASH eligibility but are pending approval in certain states.

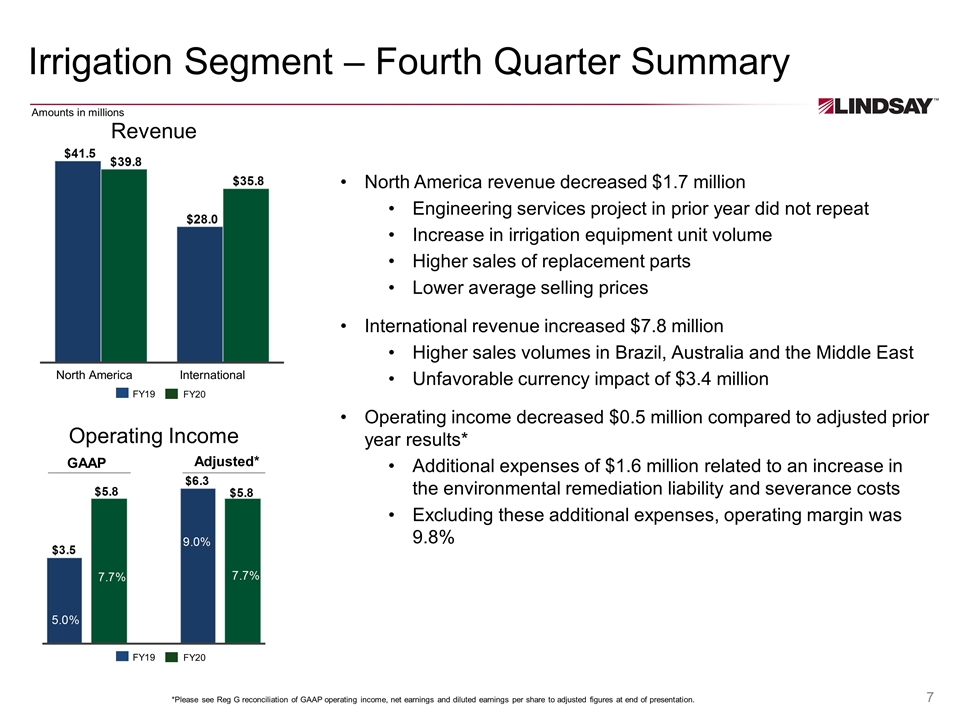

Irrigation Segment – Fourth Quarter Summary 7 North America revenue decreased $1.7 million Engineering services project in prior year did not repeat Increase in irrigation equipment unit volume Higher sales of replacement parts Lower average selling prices International revenue increased $7.8 million Higher sales volumes in Brazil, Australia and the Middle East Unfavorable currency impact of $3.4 million Operating income decreased $0.5 million compared to adjusted prior year results* Additional expenses of $1.6 million related to an increase in the environmental remediation liability and severance costs Excluding these additional expenses, operating margin was 9.8% Revenue Operating Income GAAP Adjusted* North America International FY19 FY20 FY19 FY20 *Please see Reg G reconciliation of GAAP operating income, net earnings and diluted earnings per share to adjusted figures at end of presentation. Amounts in millions

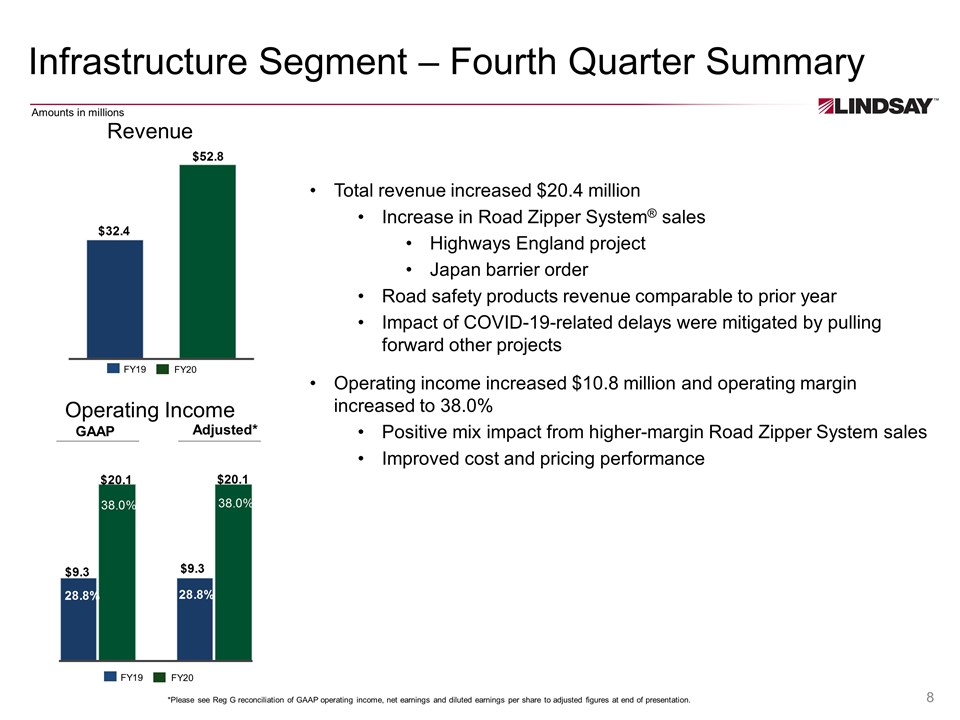

Infrastructure Segment – Fourth Quarter Summary Total revenue increased $20.4 million Increase in Road Zipper System® sales Highways England project Japan barrier order Road safety products revenue comparable to prior year Impact of COVID-19-related delays were mitigated by pulling forward other projects Operating income increased $10.8 million and operating margin increased to 38.0% Positive mix impact from higher-margin Road Zipper System sales Improved cost and pricing performance Revenue Operating Income GAAP Adjusted* FY19 FY20 FY19 FY20 *Please see Reg G reconciliation of GAAP operating income, net earnings and diluted earnings per share to adjusted figures at end of presentation. Amounts in millions

COVID-19 Update Innovative Market Leader – Sustainable Solutions Lindsay’s products and technologies support the following critical infrastructure sectors as defined by the Department of Homeland Security (CISA.gov) and other global government agencies: Food and Agriculture – our irrigation business supports the production of food and the conservation of water and energy Transportation Systems – our infrastructure business supports the movement of people and goods efficiently, safely and securely Lindsay’s production facilities are considered “business essential” and will remain operational as long as we 1) have demand for our products, 2) are allowed to remain open by local governments, and 3) can provide for the safety of our employees. At the present time, all of our facilities are operational. Other potential business impacts associated with COVID-19 include but are not limited to: additional facility closures and the duration of such closures, supply chain disruption and additional costs, logistics delays, border closures, workforce disruption, reduced demand for our products and services, delay in the implementation of projects and other effects that may result from a general economic downturn. Lindsay is well positioned with a strong balance sheet and sufficient liquidity as we face the uncertainty and challenges presented by the COVID-19 pandemic. As of August 31, 2020 we have: Available liquidity of $190.9 million, with $140.9 million in cash, cash equivalents and marketable securities and $50.0 million available under revolving credit facility Total debt of $115.9 million, of which $115.0 million matures in 2030 A funded debt to EBITDA leverage ratio (as defined in our credit agreements) of 1.5 compared to a covenant limit of 3.0

COVID-19 Protocols in Place Innovative Market Leader – Sustainable Solutions Protecting the health and well-being of our employees is a top priority, as is maintaining frequent communication and providing important updates. Since the outset of the pandemic, we have: Created a global task force and communication strategy Implemented social distancing protocols Initiated remote work strategy for employees not essential to factory operations Restricted domestic and international travel for business-essential purposes Completed an electrostatic spray deep clean at our global headquarters Placed certain limitations on visitors to all our facilities Conducted screening questionnaires for all facility visitors Increased frequency and intensity of disinfecting all high-touch areas Implemented temperature checks at facilities in high risk locations Implemented staggered breaks in our factory operations Created a COVID-19 Manager at each facility to ensure rigid discipline of protocols Established protocols in the event of a confirmed COVID-19 diagnosis Implemented virtual or phone meeting protocols

Executing Long-Term Value Creation Innovative Market Leader – Sustainable Solutions Deepening customer relationships through technology differentiation Solutions and growth aligned to market megatrends…. designed to sustain and protect our evolving world Foundation for Growth initiative driving margin expansion Empowered global culture through Vision, Values and Behaviors Framework Innovative Market Leader – Sustainable Solutions ONE LINDSAY

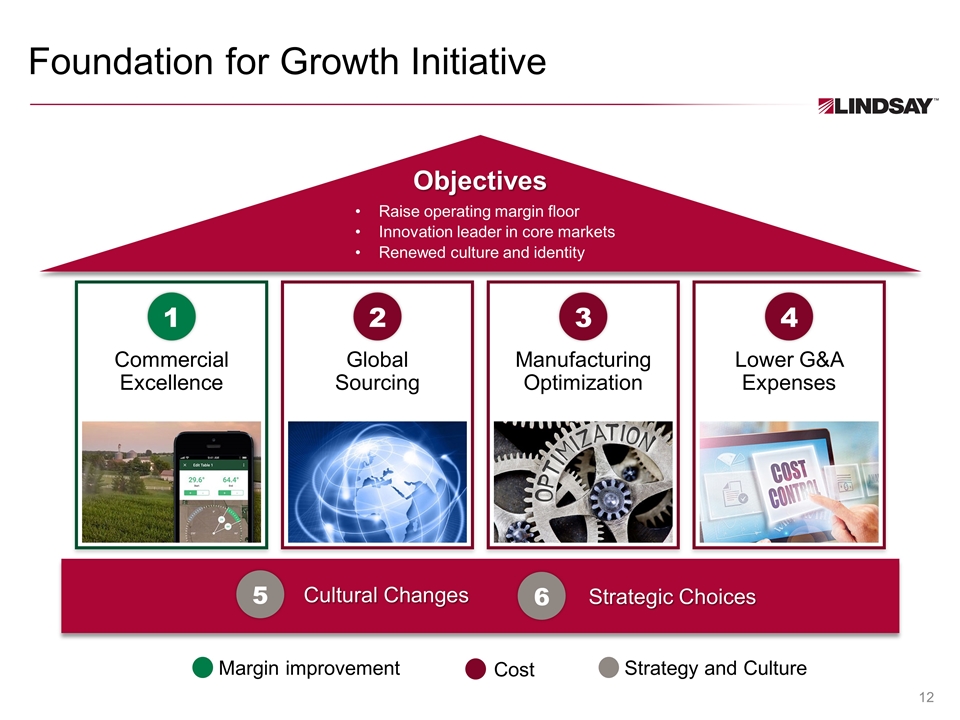

Foundation for Growth Initiative Margin improvement Cost Strategy and Culture Objectives Raise operating margin floor Innovation leader in core markets Renewed culture and identity 1 2 3 4 5 6 Commercial Excellence Global Sourcing Manufacturing Optimization Lower G&A Expenses Cultural Changes Strategic Choices

Foundation for Growth Execution Accomplishments through Fiscal 2020 Divested four non-core businesses; acquired Net Irrigate, LLC ü Established a centralized sourcing & shared services organization ü Closed and sold an infrastructure facility; consolidated activity into an existing irrigation facility ü Achieved 1st quartile ranking in organizational health assessment ü Delivered 11.4% operating margin ü

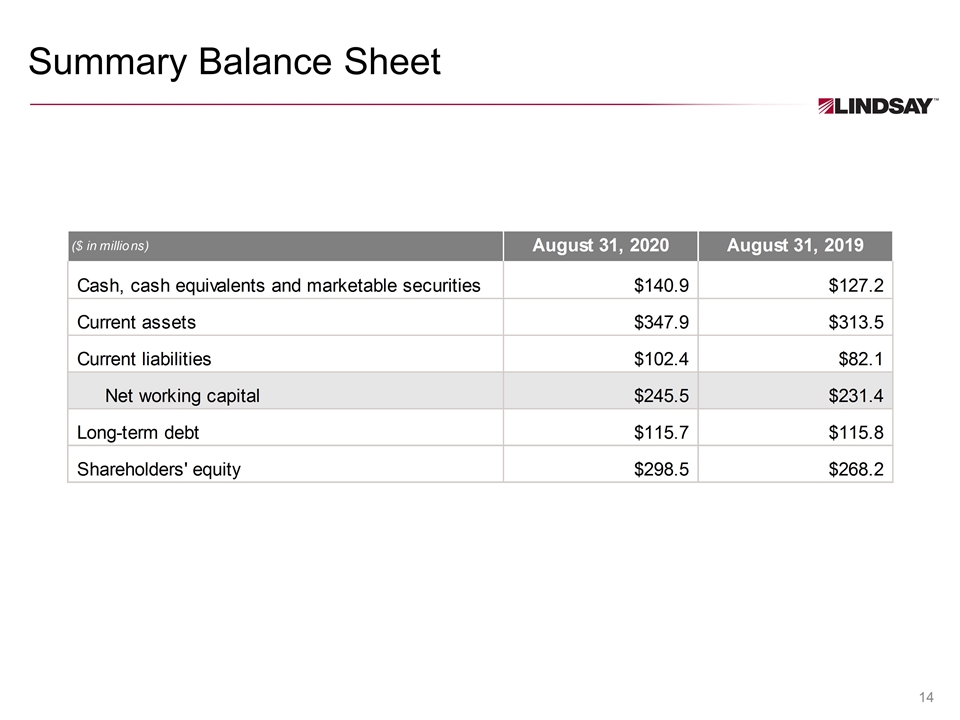

Summary Balance Sheet

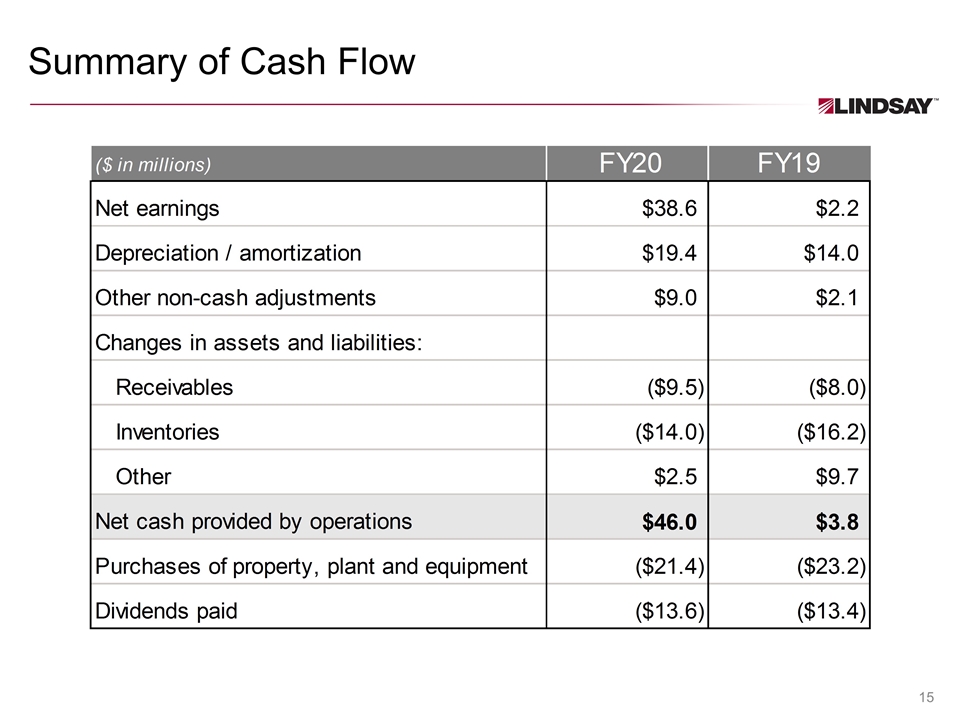

Summary of Cash Flow 15

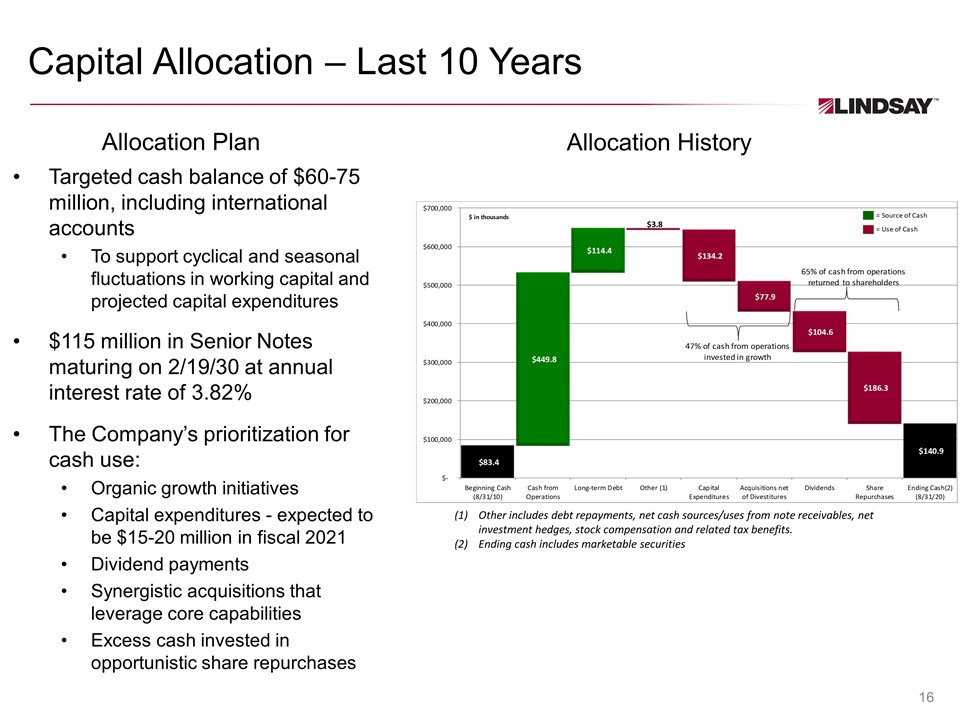

Capital Allocation – Last 10 Years Allocation History Other includes debt repayments, net cash sources/uses from note receivables, net investment hedges, stock compensation and related tax benefits. Ending cash includes marketable securities Targeted cash balance of $60-75 million, including international accounts To support cyclical and seasonal fluctuations in working capital and projected capital expenditures $115 million in Senior Notes maturing on 2/19/30 at annual interest rate of 3.82% The Company’s prioritization for cash use: Organic growth initiatives Capital expenditures - expected to be $15-20 million in fiscal 2021 Dividend payments Synergistic acquisitions that leverage core capabilities Excess cash invested in opportunistic share repurchases Allocation Plan

Attractive Long-Term Megatrends Water Conservation Alternative Fuels Increase Yields Improve Road Safety Population Growth Advancing Technology

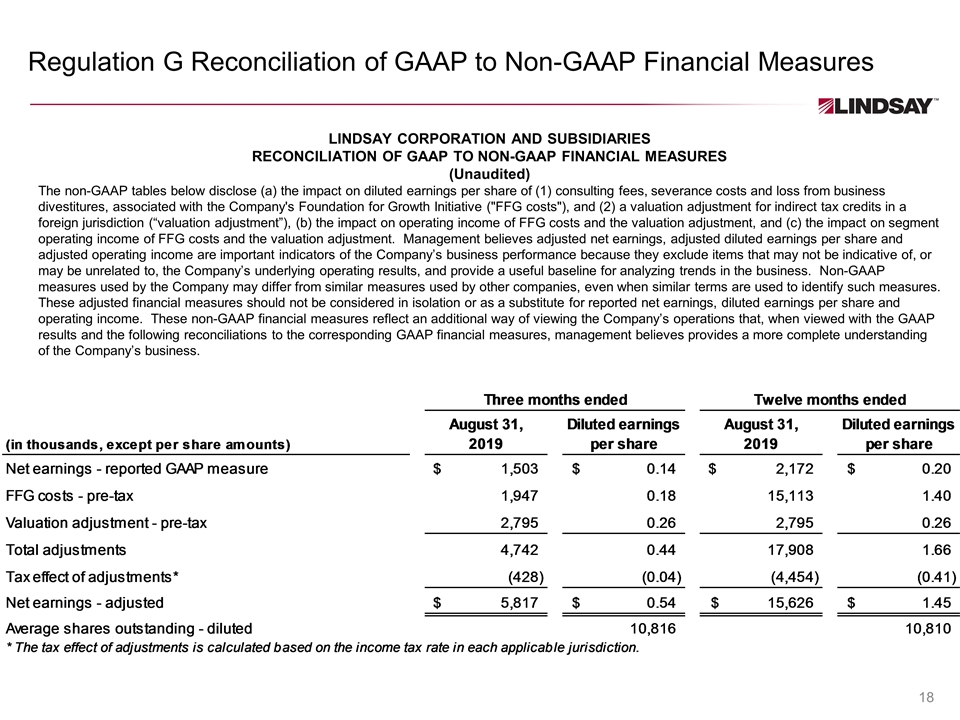

Regulation G Reconciliation of GAAP to Non-GAAP Financial Measures LINDSAY CORPORATION AND SUBSIDIARIES RECONCILIATION OF GAAP TO NON-GAAP FINANCIAL MEASURES (Unaudited) The non-GAAP tables below disclose (a) the impact on diluted earnings per share of (1) consulting fees, severance costs and loss from business divestitures, associated with the Company's Foundation for Growth Initiative ("FFG costs"), and (2) a valuation adjustment for indirect tax credits in a foreign jurisdiction (“valuation adjustment”), (b) the impact on operating income of FFG costs and the valuation adjustment, and (c) the impact on segment operating income of FFG costs and the valuation adjustment. Management believes adjusted net earnings, adjusted diluted earnings per share and adjusted operating income are important indicators of the Company’s business performance because they exclude items that may not be indicative of, or may be unrelated to, the Company’s underlying operating results, and provide a useful baseline for analyzing trends in the business. Non-GAAP measures used by the Company may differ from similar measures used by other companies, even when similar terms are used to identify such measures. These adjusted financial measures should not be considered in isolation or as a substitute for reported net earnings, diluted earnings per share and operating income. These non-GAAP financial measures reflect an additional way of viewing the Company’s operations that, when viewed with the GAAP results and the following reconciliations to the corresponding GAAP financial measures, management believes provides a more complete understanding of the Company’s business.

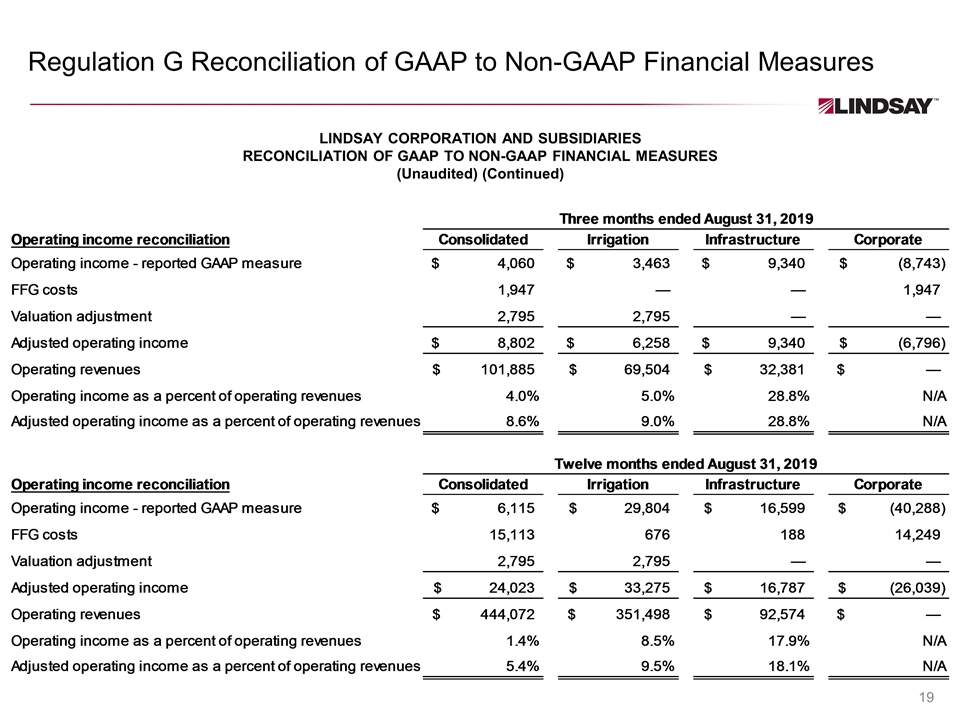

Regulation G Reconciliation of GAAP to Non-GAAP Financial Measures LINDSAY CORPORATION AND SUBSIDIARIES RECONCILIATION OF GAAP TO NON-GAAP FINANCIAL MEASURES (Unaudited) (Continued)