Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - HERITAGE FINANCIAL CORP /WA/ | a8-kexhibit991093020.htm |

| 8-K - 8-K - HERITAGE FINANCIAL CORP /WA/ | hfwa-20201022.htm |

Investor Presentation Q3 2020 1

Forward – Looking Statement The COVID-19 pandemic is adversely affecting us, our customers, counterparties, employees, and third-party service providers, and the ultimate extent of the impacts on our business, financial position, results of operations, liquidity, and prospects is uncertain. Other factors that could cause or contribute to such differences include, but are not limited to: • the credit risks of lending activities, including changes in the level and trend of loan delinquencies and write-offs and changes in our allowance for credit losses ("ACL") on loans and provision for credit losses on loans that may be effected by deterioration in the housing and commercial real estate markets, which may lead to increased losses and nonperforming assets in our loan portfolio, and may result in our ACL on loans no longer being adequate to cover actual losses, and require us to increase our ACL on loans; • changes in general economic conditions either nationally or in our market areas; • changes in the levels of general interest rates, and the relative differences between short and long term interest rates, deposit interest rates, our net interest margin and funding sources; • risks related to acquiring assets in or entering markets in which we have not previously operated and may not be familiar; • fluctuations in the demand for loans, the number of unsold homes and other properties and fluctuations in real estate values in our market areas; • results of examinations of us by the bank regulators, including the possibility that any such regulatory authority may, among other things, initiate an enforcement action against the Company or our bank subsidiary which could require us to increase our ACL on loans, write-down assets, change our regulatory capital position, affect our ability to borrow funds or maintain or increase deposits, or impose additional requirements on us, any of which could affect our ability to continue our growth through mergers, acquisitions or similar transactions and adversely affect our liquidity and earnings; • our ability to control operating costs and expenses; • increases in premiums for deposit insurance; • the use of estimates in determining fair value of certain of our assets, which estimates may prove to be incorrect and result in significant declines in valuation; • staffing fluctuations in response to product demand or the implementation of corporate strategies that affect our workforce and potential associated charges; • disruptions, security breaches, or other adverse events, failures or interruptions in, or attacks on, our information technology systems or on the third-party vendors who perform several of our critical processing functions; • our ability to retain key members of our senior management team; • costs and effects of litigation, including settlements and judgments; • our ability to successfully integrate any assets, liabilities, customers, systems, and management personnel we may acquire into our operations and our ability to realize related revenue synergies and cost savings within expected time frames or at all, and any goodwill charges related thereto and costs or difficulties relating to integration matters, including but not limited to customer and employee retention, which might be greater than expected; • increased competitive pressures among financial service companies; • adverse changes in the securities markets; • inability of key third-party providers to perform their obligations to us; • changes in accounting policies and practices, as may be adopted by the financial institution regulatory agencies or the FASB, including additional guidance and interpretation on accounting issues and details of the implementation of new accounting methods; and • other economic, competitive, governmental, regulatory, and technological factors affecting our operations, pricing, products and services, including from the COVID-19 pandemic, and the other risks detailed from time to time in our filings with the SEC including our 2019 Annual Form 10-K and Quarterly Form 10-Qs. The Company cautions readers not to place undue reliance on any forward-looking statements. Moreover, you should treat these statements as speaking only as of the date they are made and based only on information then actually known to the Company. The Company does not undertake and specifically disclaims any obligation to revise any forward-looking statements to reflect the occurrence of anticipated or unanticipated events or circumstances after the date of such statements. These risks could cause our actual results for future periods to differ materially from those expressed in any forward-looking statements by, or on behalf of, us, and could negatively affect the Company’s operating results and stock price performance. 2

Company Overview - All dollars in thousands unless otherwise noted, except per share amounts. 3

Overview Overview NASDAQ Symbol HFWA Stock Price(1) $20.32 Market Capitalization(1) $729.2 million Institutional Ownership(1) 81.5% Headquarters Olympia, WA # of Branches 62 Year Established 1927 Q3 2020 Financial Highlights Assets $6.69 billion Deposits $5.69 billion Loans $4.67 billion Net Income $16.6 million Pre-tax, Pre-provision Income(2) $21.8 million Net Interest Margin 3.38% Efficiency Ratio 62.27% Tier 1 Leverage Ratio 8.8% HFWA Branch Total Risk Based Capital Ratio 13.4% Map obtained from S&P Global Market Intelligence. (1) Market information as of October 19, 2020. (2) Non-GAAP financial measure. Refer to Appendix for calculation. 4

COVID-19 Response Activated our Business Continuity Plan Employees Approximately 60% have remote capabilities; 37% are fully remote Revised policies on paid-leave and additional pay for front-line employees Nearly all branch lobbies remain closed; operate by drive-thru or by appointment Facilities Practice recommended CDC guidelines for social distancing and disinfecting Loan modification programs Customers Early CD withdrawal, overdraft and other fee waivers(1) SBA Paycheck Protection Program and other government sponsored programs Consistent monitoring/analysis to identify potential at-risk/higher-risk industries Daily monitoring of credit draws Commercial and consumer underwriting changes Loan Portfolio Concentration loan-type limit changes Increased Special Asset Group staffing levels Discontinue indirect consumer lending business On-going discussions with customers about credit needs Suspended repurchase program on March 18 No change to cash dividends, at this time Capital and Liquidity Well-capitalized across all regulatory capital ratios Ample balance sheet liquidity, including cash, securities and borrowing capacity (1) Evaluated on a case-by-case basis. 5

Company Strategy Be the "acquirer of choice" in the Pacific Northwest Active and disciplined in M&A Most acquisitive bank in Oregon and Washington since 2012 with 5 acquisitions Target Metrics = IRR of >15% with earnbacks < 3 years Successful hiring of individuals and teams of bankers in high-growth and dynamic Seattle and Allocate capital to organically grow our core Portland markets banking business Disciplined approach to concentration risk and active portfolio management Achieving increased efficiencies with operational scale, internal focus on improving processes and technology solutions Improve operational efficiencies and rationalize branch network Closed/Consolidated 22 branches since beginning of 2010; announced upcoming consolidation of one branch during Q4 2020 and eight branches during Q1 2021 1.25% return on average assets in 2019 Generate strong profitability and risk (1) adjusted returns Total annual shareholder return of 13.2% over the past 5 years vs. KBW Regional Bank Index annual total return of 8.9% Maintain conservative underwriting Long track record of strong underwriting standards and actively manage the portfolio Disciplined approach to concentration risk 35.0% noninterest demand deposits to total deposits Focus on core deposits is key to franchise value over the long term Noninterest demand deposit CAGR of 22% since 2015 0.19% cost of total deposits; top 20% in the country among publicly traded banks History of increasing regular dividends and utilizing special dividends to manage capital Proactive capital management Approved stock repurchase plan Strong capital ratios: Tier 1 Leverage Ratio = 8.8%; Total Risk Based Capital Ratio = 13.4% (1) Total shareholder return for the period 12/31/2014 - 12/31/2019. (2) Per S&P Global Market Intelligence for Q2'2020 and includes banks nationwide with shares on NASDAQ or NYSE and total assets less than $100 billion. 6

Technology Strategy Objective: Invest in technology to enable Community Banking at Scale Implement “Heritage Direct,” a full suite of upgraded treasury management tools for commercial customers, including online banking, ACH, wires, positive pay, remote deposit Transform Products capture and merchant services Robust, integrated and application programming Deploy a state of the art omni-channel new account opening solution interface- (“API”) driven digital solutions Develop “widgets” to support exceptional service delivery and tailored user experience in consumer and commercial online banking platforms Deploy a bank-wide business process management (“BPM”) solution to enable real-time transparency into every major process across the company Continued development of bespoke customer relationship management (“CRM”) solution on Empower Employees Bank proprietary application framework, delivering unprecedented software integration and Train and equip with digital tools and know-how efficiency Train and enable employees to run data-centric, instrumented processes Deep, API-based integration between Bank application framework and core vendor platforms to enable “first-contact” resolution BPM and CRM integration to enable automation and transparency of “customer journeys” through all key banking activities Engage Customers Leverage data to offer personalized service Omni-channel account opening, robust online/mobile offerings, chatbot and other call center upgrades, and first contact resolution tools to enable the Bank to deliver banking where and when the customer needs us Proprietary Commercial Loan Origination System to automate lending processes Optimize Operations Develop an integrated Treasury Management origination system to automate sales, Integrate systems, automate & instrument onboarding and on-going support processes processes API-based integrations with vendor solutions to enable sustainable process automation 7

Strong and Diverse Economic Landscape Companies Headquartered in Pacific Northwest • The Seattle and Portland MSAs are thriving local economies with major Fortune 500 companies which include Alaska Air, Amazon, Costco, Expedia, Microsoft, Nike, Nordstrom, Starbucks and Weyerhaeuser • Washington and Oregon rank #5 and #7 for best economy in CNBC’s list of “America’s Top States for Business in 2019”(1) • Seattle has the best market for STEM professionals (science, technology, education and math)(2) • High levels of migration into Portland – population is expected to grow 6.1% by 2025(3) • Median household income for Seattle and Bellevue are 48% and 95% higher, as compared to the nationwide average(3) • Household income in the Portland MSA is 22% higher than the nationwide average, and is expected to grow by 15.8% through 2025(3) • King County, WA ranks as the 2nd fastest growing county in the U.S.(4) • Washington County and Multnomah County are the fastest growing counties in the state of Oregon(4) Map obtained from S&P Global Market Intelligence. (1) www.cnbc.com (2) www.wallethub.com (3) Per S&P Global Market Intelligence, Claritas. (4) Bureau of Economic Analysis; 2019 Local Area Gross Domestic Product Report; rank among metros with GDP greater than $30 billion. 8

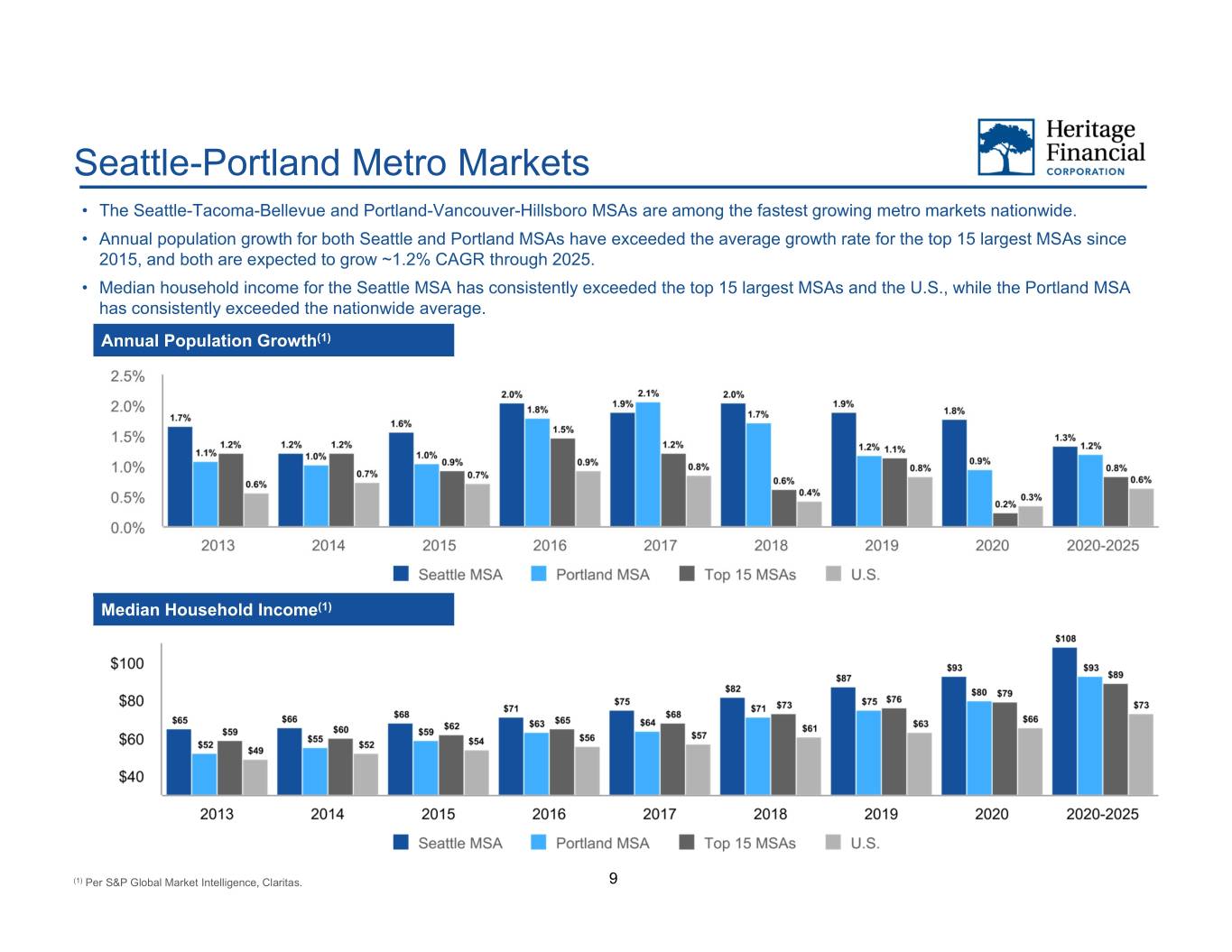

Seattle-Portland Metro Markets • The Seattle-Tacoma-Bellevue and Portland-Vancouver-Hillsboro MSAs are among the fastest growing metro markets nationwide. • Annual population growth for both Seattle and Portland MSAs have exceeded the average growth rate for the top 15 largest MSAs since 2015, and both are expected to grow ~1.2% CAGR through 2025. • Median household income for the Seattle MSA has consistently exceeded the top 15 largest MSAs and the U.S., while the Portland MSA has consistently exceeded the nationwide average. Annual Population Growth(1) Median Household Income(1) (1) Per S&P Global Market Intelligence, Claritas. 9

Seattle MSA Funds Under Management MSA Market Funds Under Management = Gross Loans + Deposits • 28 branches in the Seattle MSA market • Loans include $461.4 million and $460.7 million of SBA PPP loans at September 30, 2020 and June 30, 2020, respectively, which also had a significant impact on deposit growth HFWA Branch Map obtained from S&P Global Market Intelligence. (1) Prior period information includes branches that were closed or consolidated prior to September 30, 2020. 10

Portland MSA Funds Under Management MSA Market Funds Under Management = Gross Loans + Deposits HFWA Branch • 9 branches in the Portland MSA market • Loans include $194.3 million and $192.5 million of SBA PPP loans at September 30, 2020 and June 30, 2020, respectively, which also had a significant impact on deposit growth Map obtained from S&P Global Market Intelligence. 11

Future Growth and Opportunities Pacific Northwest Banking Landscape(1) Expected Consolidation and Future Opportunities • Significant number of banks remaining in HFWA footprint, further consolidation is expected – 8 banks(2) between $150 and $500 million in assets – 9 banks(2) between $500 million and $1.0 billion in assets – 6 banks(2) between $1.0 billion and $2.0 billion in assets • HFWA positioned to be the acquiror of choice in the Pacific Northwest • Financial parameters include 15% IRR and earnback of < 3 years • Preferred targets to have commercial relationship banking focus with efficient branch network along the I-5 corridor Target bank headquarters Map obtained from S&P Global Market Intelligence. (1) Certain locations of bank headquarters overlap on the map. (2) Target financial information as of the most recent quarter publicly available. 12

Historical Growth – Organic and Acquisitive • In addition to organic growth, HFWA has completed 5 whole bank mergers and 2 FDIC-assisted transactions since 2008. Completed acquisition of Puget Sound Bancorp and Premier Commercial Bancorp with $639M and $440M in assets, including goodwill, respectively. Merger with Washington Banking Company with $1.7B in assets, including goodwill, respectively. Acquired Valley Community Bancshares, Inc. and Northwest Commercial Bank with $254M and $65M in assets, including goodwill, respectively. Completed 2 FDIC deals - Pierce Commercial Bank and Cowlitz Bank, acquiring $211M and $345M in assets, including goodwill, respectively. 13

Deposit Market Share(1) Washington & Oregon - 2008 Washington & Oregon - 2013 Washington & Oregon - 2020 Deposits in Deposits in Deposits in Market Market Market Market Market Market Rank Institution (State) (in thousands) Share Rank Institution (State) (in thousands) Share Rank Institution (State) (in thousands) Share 1 Bank of America Corporation (NC) $32,880,496 20.36 % 1 Bank of America Corporation (NC) $34,290,015 19.44 % 1 Bank of America Corporation (NC) $53,875,256 22.05 % 2 U.S. Bancorp (MN) 18,200,191 11.27 % 2 U.S. Bancorp (MN) 24,912,264 14.12 % 2 U.S. Bancorp (MN) 39,363,813 16.11 % 3 Washington Mutual Inc. (WA) 18,044,059 11.17 % 3 Wells Fargo & Co. (CA) 22,985,222 13.03 % 3 Wells Fargo & Co. (CA) 37,357,367 15.29 % 4 Wells Fargo & Co. (CA) 13,983,430 8.66 % 4 JPMorgan Chase & Co. (NY) 15,638,062 8.87 % 4 JPMorgan Chase & Co. (NY) 33,918,863 13.88 % 5 KeyCorp (OH) 11,282,327 6.99 % 5 KeyCorp (OH) 11,805,664 6.69 % 5 KeyCorp (OH) 20,339,619 8.33 % 6 Sterling Financial Corp. (WA) 6,314,532 3.91 % 6 Washington Federal Inc. (WA) 6,216,841 3.52 % 6 Umpqua Holdings Corp. (OR) 16,007,112 6.55% 7 Washington Federal Inc. (WA) 4,697,167 2.91 % 7 Columbia Banking System Inc. (WA) 5,840,021 3.31 % 7 Columbia Banking System Inc. (WA) 12,461,960 5.10 % 8 Umpqua Holdings Corp. (OR) 3,683,451 2.28 % 8 Umpqua Holdings Corp. (OR) 5,499,385 3.12 % 8 Banner Corp. (WA) 9,267,305 3.79 % 9 Banner Corp. (WA) 3,511,650 2.17 % 9 Sterling Financial Corp. (WA) 5,203,136 2.95 % 9 Washington Federal Inc. (WA) 8,458,020 3.46 % 10 Frontier Financial Corp. (WA) 3,303,562 2.05 % 10 Mitsubishi UFJ Financial Group Inc. 3,474,540 1.97 % 10 W.T.B. Financial Corp. (WA) 6,521,602 2.67 % 11 Columbia Banking System Inc. (WA) 2,401,217 1.49 % 11 Banner Corp. (WA) 3,255,301 1.85 % 11 Heritage Financial Corp. (WA) 5,587,287 2.29 % 12 W.T.B. Financial Corp. (WA) 2,355,857 1.46 % 12 W.T.B. Financial Corp. (WA) 3,180,411 1.80 % 12 HomeStreet Inc. (WA) 3,935,194 1.61 % 13 West Coast Bancorp (OR) 2,082,385 1.29 % 13 HomeStreet Inc. (WA) 1,612,978 0.91 % 13 BNP Paribas 3,236,708 1.32 % 14 HomeStreet Inc. (WA) 1,268,125 0.79 % 14 SKBHC Holdings LLC (WA) 1,550,759 0.88 % 14 Mitsubishi UFJ Financial 2,986,808 1.22 % 15 Cascade Bancorp (OR) 1,142,435 0.71 % 15 Washington Banking Co. (WA) 1,410,804 0.80 % 15 First Interstate BancSystem (MT) 2,920,782 1.20 % 16 AmericanWest Bancorp. (WA) 1,100,332 0.68 % 16 Yakima Federal S&L Assoc. (WA) 1,402,048 0.79 % 16 HSBC Holdings 2,094,816 0.86 % 17 Horizon Financial Corp. (WA) 1,097,107 0.68 % 17 BNP Paribas SA 1,314,955 0.75 % 17 Peoples Bancorp (WA) 2,042,495 0.84 % 18 Yakima Federal S&L Assoc. (WA) 1,094,393 0.68 % 18 Heritage Financial Corp. (WA) 1,227,045 0.70 % 18 FS Bancorp Inc. (WA) 1,618,253 0.66 % 19 BNP Paribas SA 1,001,691 0.62 % 19 Peoples Bancorp (WA) 1,119,301 0.63 % 19 Cashmere Valley Bank (WA) 1,585,447 0.65 % 20 Cascade Financial Corp. (WA) 993,356 0.62 % 20 Cashmere Valley Bank (WA) 1,094,353 0.62 % 20 East West Bancorp Inc. (CA) 1,498,607 0.61 % 21 City Bank (WA) 955,179 0.59 % 21 Pacific Continental Corp. (OR) 1,074,590 0.61 % 21 First Repub Bank (CA) 1,399,364 0.57 % 22 Columbia Bancorp (OR) 939,992 0.58 % 22 Opus Bank (CA) 968,148 0.55 % 22 Yakima FS&LA (WA) 1,376,884 0.56 % 23 Venture Financial Group Inc. (WA) 916,882 0.57 % 23 East West Bancorp Inc. (CA) 924,708 0.52 % 23 Zions Bancorp. NA (UT) 1,342,480 0.55 % 24 First Financial Northwest Inc. (WA) 867,502 0.54 % 24 Olympic Bancorp Inc. (WA) 807,112 0.46 % 24 Timberland Bancorp Inc. (WA) 1,319,048 0.54 % 25 Peoples Bancorp (WA) 845,949 0.52 % 25 HSBC Holdings PLC 801,732 0.45 % 25 Coastal Financial Corp. (WA) 1,312,246 0.54 % 26 Cashmere Valley Financial Corp. (WA) 841,611 0.52 % 26 Cascade Bancorp (OR) 799,971 0.45 % 26 Olympic Bancorp Inc. (WA) 1,214,210 0.50 % 27 Heritage Financial Corp. (WA) 802,020 0.50 % 27 Zions Bancorp. NA (UT) 774,168 0.44 % 27 First Northwest Bancorp (WA) 1,181,630 0.48 % 28 Liberty Financial Group Inc. (OR) 778,222 0.48 % 28 Skagit Bancorp Inc. (WA) 666,659 0.38 % 28 Riverview Bancorp Inc. (WA) 1,167,155 0.48 % 29 Washington Banking Co. (WA) 733,643 0.45 % 29 Riverview Bancorp Inc. (WA) 660,249 0.37 % 29 First Financial Northwest Inc (WA) 1,147,742 0.47 % 30 First Indep. Investment Group Inc. (WA) 684,404 0.42 % 30 First Financial Northwest Inc. (WA) 642,130 0.36 % 30 Pacific Premier Bancorp (CA) 1,008,108 0.41 % 31 Pacific Continental Corp. (OR) 676,993 0.42 % 31 First Fed. S&L Assoc. of Port Angeles (WA) 598,820 0.34 % 31 Pacific Financial Corp. (WA) 995,159 0.41 % 32 PremierWest Bancorp (OR) 664,006 0.41 % 32 Timberland Bancorp Inc. (WA) 596,187 0.34 % 32 Citizens Bancorp (OR) 798,620 0.33 % 33 Riverview Bancorp Inc. (WA) 630,220 0.39 % 33 Pacific Financial Corp. (WA) 591,430 0.34 % 33 Glacier Bancorp Inc. (MT) 732,045 0.30 % 34 Olympic Bancorp Inc. (WA) 626,828 0.39 % 34 Baker Boyer Bancorp (WA) 467,717 0.27 % 34 Sound Financial Bancorp Inc. (WA) 698,527 0.29 % 35 Zions Bancorp. NA (UT) 571,565 0.35 % 35 Olympia Federal S&L Association (WA) 464,913 0.26 % 35 First Citizens BancShares Inc. (NC) 649,359 0.27 % 36 Whitman Bancorp. Inc. (WA) 527,546 0.33 % 36 Home Federal Bancorp Inc. (ID) 451,386 0.26 % 36 Olympia FS&LA (WA) 616,144 0.25 % 37 Washington First Financial Group Inc. (WA) 514,572 0.32 % 37 First Citizens BancShares Inc. (NC) 415,562 0.24 % 37 Seattle Bank (WA) 606,235 0.25 % 38 First Fed. S&L Assoc. of Port Angeles (WA) 495,891 0.31 % 38 Citizens Bancorp (OR) 404,324 0.23 % 38 Cathay General Bancorp (CA) 600,144 0.25 % 39 Skagit Bancorp Inc. (WA) 486,490 0.30 % 39 Coastal Financial Corp. (WA) 349,343 0.20 % 39 Baker Boyer Bancorp (WA) 598,602 0.25 % 40 Timberland Bancorp Inc. (WA) 480,261 0.30 % 40 Evergreen Federal Bank (OR) 335,918 0.19 % 40 Summit Bank (OR) 587,947 0.24 % Total For Institutions In Market $161,492,273 Total For Institutions In Market $176,371,225 Total For Institutions In Market $294,671,611 Out of 148 Institutions Out of 120 Institutions Out of 85 Institutions (1) Per S&P Global Market Intelligence as of June 30 for the year indicated. 14

Financial Update - All dollars in thousands unless otherwise noted, except per share amounts. 15

Financial Update – Q3 2020 • Net income was $16.6 million, or $0.46 per diluted share for the quarter ended September 30, 2020, compared to a net loss of $6.1 million, or $0.17 per diluted share, for the linked-quarter ended June 30, 2020 and net income of $17.9 million, or $0.48 per diluted share, for the quarter ended September 30, 2019. • Return on average assets was 1.00% for the quarter ended September 30, 2020. • Provision for credit losses was $2.7 million for the quarter ended September 30, 2020 compared to $28.6 million for the linked-quarter ended June 30, 2020. • Total deposits increased $121.3 million, or 2.2%, to $5.69 billion at September 30, 2020 from $5.57 billion at June 30, 2020; non-maturity deposits as a percentage of total deposits increased to 92.2% at September 30, 2020 from 91.2% at June 30, 2020. • Heritage declared a regular cash dividend of $0.20 per common share on October 21, 2020. • Capital remains strong with Tier 1 leverage capital to average quarterly assets of 8.8% at September 30, 2020 compared to 9.1% at June 30, 2020 and total capital to risk-weighted assets of 13.4% at September 30, 2020 compared to 13.1% at June 30, 2020. • Heritage announces plan to consolidate nine branches resulting in a 15% decrease in total branch locations. (1) Non-GAAP financial measure. Refer to Appendix for calculation. (2) Current quarter ratios are estimates pending completion and filing of the Company’s regulatory reports. 16

Loan Portfolio Loan Portfolio Composition Loan Balances and Loan Yields Loan Portfolio Repricing Schedule (excluding SBA PPP loans) • $959.0 million (25% of portfolio, excluding SBA PPP loans) of floating and adjustable loans were at their respective interest rate floor as of September 30, 2020. • Consumer loans decreasing due to cessation of indirect auto lending business. (1) lncludes Loans held for sale. (2) Loan yields include the average balance of Loans receivable, net and Loans held for sale. (3) Non-GAAP financial measure. Refer to Appendix for calculation. 17

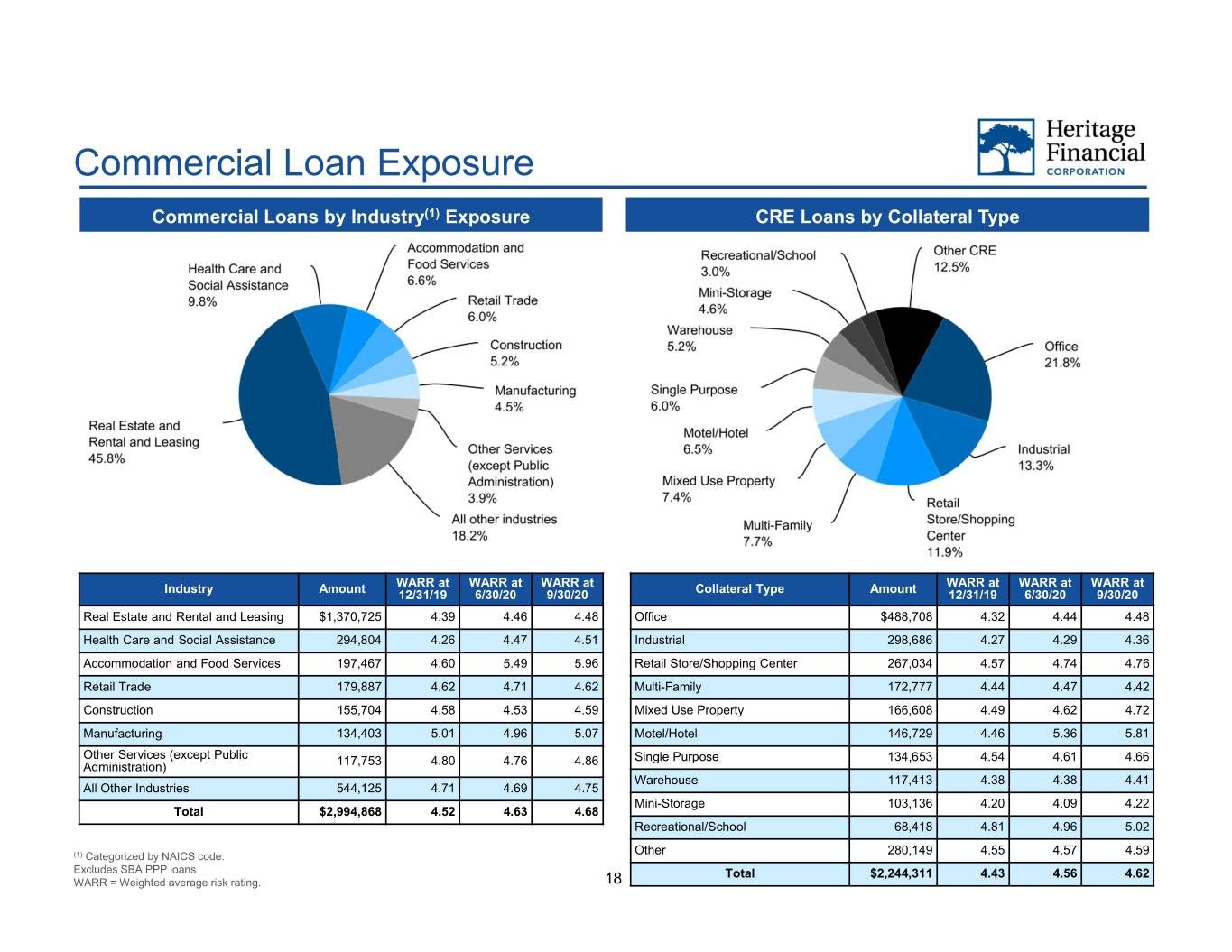

Commercial Loan Exposure Commercial Loans by Industry(1) Exposure CRE Loans by Collateral Type WARR at WARR at WARR at WARR at WARR at WARR at Industry Amount 12/31/19 6/30/20 9/30/20 Collateral Type Amount 12/31/19 6/30/20 9/30/20 Real Estate and Rental and Leasing $1,370,725 4.39 4.46 4.48 Office $488,708 4.32 4.44 4.48 Health Care and Social Assistance 294,804 4.26 4.47 4.51 Industrial 298,686 4.27 4.29 4.36 Accommodation and Food Services 197,467 4.60 5.49 5.96 Retail Store/Shopping Center 267,034 4.57 4.74 4.76 Retail Trade 179,887 4.62 4.71 4.62 Multi-Family 172,777 4.44 4.47 4.42 Construction 155,704 4.58 4.53 4.59 Mixed Use Property 166,608 4.49 4.62 4.72 Manufacturing 134,403 5.01 4.96 5.07 Motel/Hotel 146,729 4.46 5.36 5.81 Other Services (except Public Single Purpose 134,653 4.54 4.61 4.66 Administration) 117,753 4.80 4.76 4.86 Warehouse 117,413 4.38 4.38 4.41 All Other Industries 544,125 4.71 4.69 4.75 Mini-Storage 103,136 4.20 4.09 4.22 Total $2,994,868 4.52 4.63 4.68 Recreational/School 68,418 4.81 4.96 5.02 Other 280,149 4.55 4.57 4.59 (1) Categorized by NAICS code. Excludes SBA PPP loans Total $2,244,311 4.43 4.56 4.62 WARR = Weighted average risk rating. 18

SBA PPP Loans Management Commentary Funded SBA PPP Loans(1) by Industry(2) • Over 4,600 loans totaling $897.4 million was funded over the duration of the SBA's PPP. • Approximately 21% of loans were issued to new customers. • Earn 1.0% interest plus a portion of an origination fee over the duration of the respective loans. SBA PPP Loans by Size at September 30, 2020 • Expecting SBA PPP Remaining forgiveness to begin during the Balance % of SBA PPP Count Deferred Fee quarter ended December 31, Less than $50,000 $43,674 5.0 % 2,020 $1,436 2020. $50,000 to $100,000 57,939 6.7 836 2,169 $100,000 to $350,000 207,382 23.9 1,145 7,890 • 44% by count are less than $350,000 to $2,000,000 406,838 46.9 566 9,327 $50,000 and qualify for a streamlined forgiveness Greater than $2,000,000 151,949 17.5 50 1,193 process. Total $867,782 100.0 % 4,617 $22,015 (1) Reflects the funded balance of all SBA PPP loans originated by the Bank over the duration of the SBA's PPP. (2) Categorized by NAICS code. 19

COVID-19 related Modifications Management Commentary Active Payment Deferral Modifications(2) • Bank completed modifications on 1,972 Interest Only Payment Deferral Total loans with a March 31, 2020 balance of $636.9 million. Balance Count Balance Count Balance Count • Approximately 80% of loans with payment Hotels (except Casino Hotels) and $12,573 3 $22,266 8 $34,839 11 deferral modifications are no longer on Motels Real Estate and Rental and 16,113 16 17,588 8 33,701 24 payment deferral status. Leasing • Active payment deferral modification Restaurants 1,507 6 11,510 15 13,017 21 statistics: Parking Lots and Garages 2,779 2 7,018 2 9,797 4 Arts, Entertainment, and 7,168 5 61 1 7,229 6 ◦ Represents 3.1% of loan Recreation portfolio, excluding SBA PPP All Other 8,669 49 9,828 145 18,497 194 loans. Total $48,809 81 $68,271 179 $117,080 260 ◦ Includes 14 loans totaling $17.2 million on nonaccrual status. % of Active Payment Deferral Modification Status by Risk Rating ◦ 81% were in their second modification, generally 90-day deferral for each modification. ◦ $95.4 million secured by real estate, including $34.8 million of hotel/motels. ◦ Real Estate and Rental and Leasing include $12.3 million of industrial, $8.6 million of office, and $5.5 million of retail/shopping facilities. (1) COVID-19 modifications as of September 30, 2020. (2) Categorized by NAICS code. 20

Higher Risk Industries(1) at September 30, 2020 Hotels Real Estate and Rental and Leasing Restaurants • Balance of $125.0 million, or 3.3% of • Balance of $1.51 billion, or 39.8% of • Balance of $75.1 million, or 2.0% of loan loan portfolio loan portfolio portfolio • Unfunded commitment $9.7 million • Unfunded commitment $199.1 million • Unfunded commitment $7.7 million • $86.2 million were granted a COVID-19 • $206.4 million were granted a COVID-19 • $35.8 million were granted a COVID-19 modification and $34.8 million are in modification and $33.7 million are in modification and $12.8 million are in active payment deferral status active payment deferral status active payment deferral status • 100% of balance is secured by real • 97% of balance is secured by real estate • 60% of balance is secured by real estate estate • Weighted average risk rating of 4.51 • Weighted average risk rating of 6.07 • Weighted average risk rating of 6.27 (compared to 4.39 at June 30, 2020) (compared to 5.77 at June 30, 2020) (compared to 5.69 at June 30, 2020) • Average loan size of $980,000; top 3 • Average loan size of $218,000; top 3 • Average loan size of $3.1 million; top 3 loans total $51.9 million loans total $8.9 million loans total $43.8 million • $8.9 million classified as nonaccrual; • $6.8 million classified as nonaccrual; • $3.6 million classified as nonaccrual; no $5.4 million classified as performing $457,000 classified as performing TDR TDRs TDR • All loans are current • All loans are current • Largest collateral type is offices (including office condos), securing • $10.5 million classified as potential • $34.2 million classified as potential $337.7 million of balance problem loans problem loans • Retail store/shopping centers collateralize $183.0 million of balance (1) Categorized by NAICS code and excluding SBA PPP loans. 21

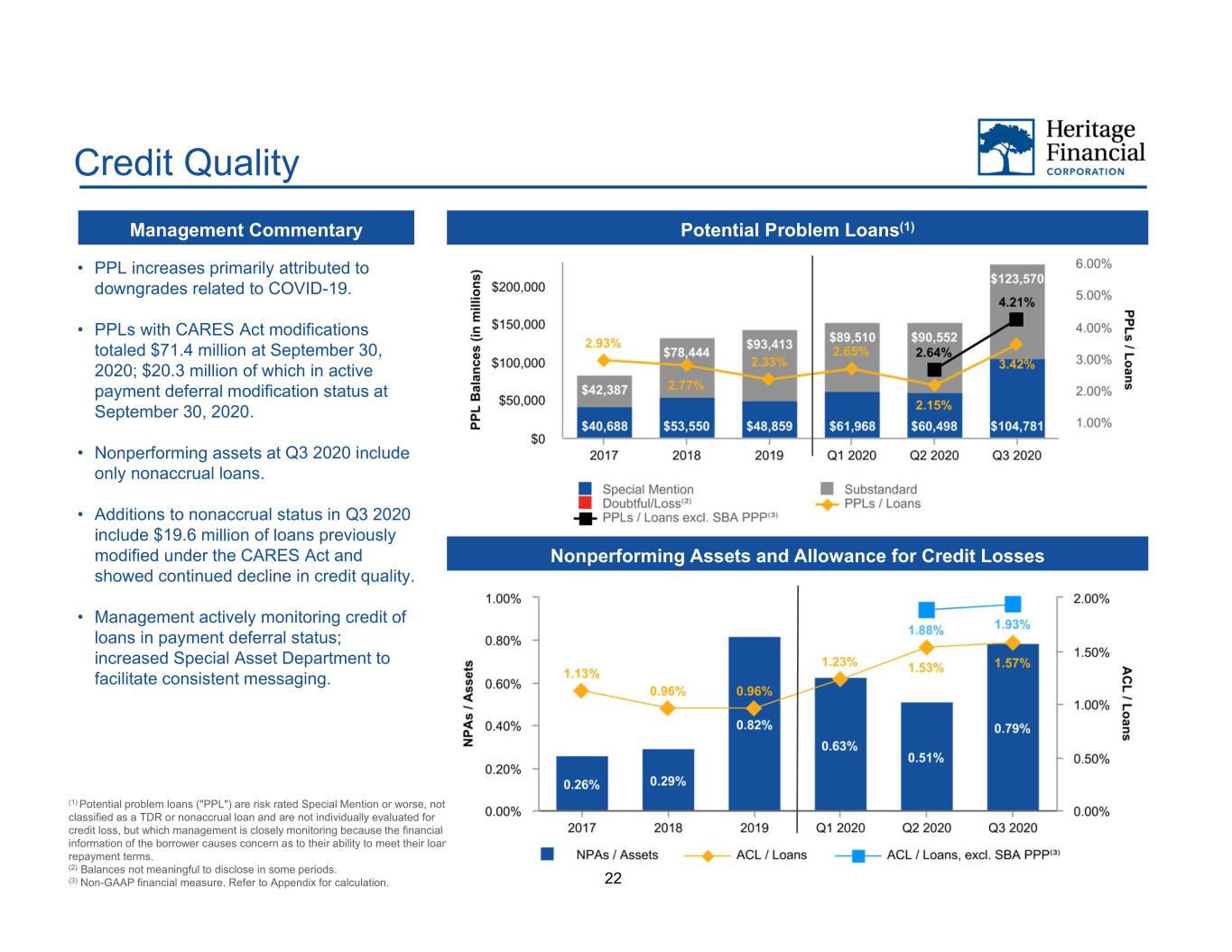

Credit Quality Management Commentary Potential Problem Loans(1) • PPL increases primarily attributed to downgrades related to COVID-19. • PPLs with CARES Act modifications totaled $71.4 million at September 30, 2020; $20.3 million of which in active payment deferral modification status at September 30, 2020. • Nonperforming assets at Q3 2020 include only nonaccrual loans. • Additions to nonaccrual status in Q3 2020 include $19.6 million of loans previously modified under the CARES Act and Nonperforming Assets and Allowance for Credit Losses showed continued decline in credit quality. • Management actively monitoring credit of loans in payment deferral status; increased Special Asset Department to facilitate consistent messaging. (1) Potential problem loans ("PPL") are risk rated Special Mention or worse, not classified as a TDR or nonaccrual loan and are not individually evaluated for credit loss, but which management is closely monitoring because the financial information of the borrower causes concern as to their ability to meet their loan repayment terms. (2) Balances not meaningful to disclose in some periods. (3) Non-GAAP financial measure. Refer to Appendix for calculation. 22

Allowance for Credit Losses Management Commentary Allowance for Credit Losses on Loans • Overall, increase in ACL due to impacts of COVID-19. Macroeconomic forecast implies recession and long recovery. • Provision for credit losses on loans in Q3 2020 necessary for increase in ACL on individually evaluated loans due to additions to nonaccrual status. • Macroeconomic forecast for Q3 2020 showing positive improvements from prior forecast, reducing the ACL on collectively evaluated loans. Allowance for Credit Losses on Unfunded Commitments • ACL on unfunded commitments increased due to change in mix of unfunded balances while the overall utilization remained unchanged. • No ACL on investment securities available for sale. 23

Deposits Deposit Composition Deposit Balances and Cost of Total Deposits Deposit Composition • 92.2% of deposits are non-maturity. • 35.0% of deposits are noninterest demand deposits. • Increase in total deposits due primarily to new deposit relationships obtained in conjunction with the SBA PPP lending process and existing customers maintaining higher cash balances. 24

Net Interest Margin Total Asset Composition Net Interest Margin Average Interest Earning Assets Composition • 82.0% Loan to deposit ratio. • 21.1% of assets are cash and cash equivalents and investment securities. • Decrease in margin due partially to SBA PPP loans and significant cash balances. (1) Non-GAAP financial measure. Refer to Appendix for calculation. 25

Profitability Trends ROAA ROATCE(1) Noninterest Expense/Avg. Assets Net Income and Pre-tax, Pre-provision Income (1) Non-GAAP financial measure. Refer to Appendix for calculation. 26

Strong Capital and Sources of Liquidity Tangible Common Equity/Tangible Assets Tier 1 Leverage Ratio(1) Total Risk Based Capital(1) Primary and Secondary Sources of Liquidity Source September 30, 2020 Cash and Cash Equivalents $576,242 Unencumbered Securities 570,748 FHLB and FRB Borrowing Availability 946,666 Fed Fund Lines 215,000 Brokered CD Capacity 850,482 Total $3,159,138 (1) Current quarter ratios are estimates pending completion and filing of the Company’s regulatory reports. (2) Non-GAAP financial measure. Refer to Appendix for calculation. (3) Represents FDIC minimum and well-capitalized ratio thresholds for banks. The minimum capital ratio requirement for Tier 1 Leverage and Total Risk Based Capital is 4.0% and 8.0%, respectively. 27

Shareholder Return - All dollars in thousands unless otherwise noted, except per share amounts. 28

Total Shareholder Return Stock Summary(1) Total Return – Last 36 Months(1) Ticker HFWA Exchange NASDAQ Stock Price $20.32 Market Cap. (in millions) $729.2 Dividend Yield (Regular Div. Only) 3.94% Average Daily Volume (3 Mo.) Avg. Daily Volume (Shares) 167,923 Avg. Daily Volume ($000s) $3,412 52-Week High and Low Price 52-Week High (12/20/2019) 29.25 52-Week Low (5/14/2020) 14.65 Per Share Tg. Book Value Per Share $14.98 Dividends Per Share(2) EPS - 2020E $1.04 EPS - 2021E $1.14 Number of Research Analysts 5 Valuation Ratios Price / Tg. Book Value 135.6% Price / 2020E EPS 19.5x Price / 2021E EPS 17.8x (1) As of October 19, 2020. (2) As of October 21, 2020. 29

Appendix - Reconciliations of Non-GAAP Financial Measures - All dollars in thousands unless otherwise noted, except per share amounts. 30

Non-GAAP Financial Measures 2020 2017 2018 2019 Q1 Q2 Q3 Pre-tax, Pre-provision Income: Net income (loss) (GAAP) $41,791 $53,057 $67,557 $12,191 $(6,139) $16,636 Exclude (add) income tax (benefit) expense 18,356 11,238 13,488 640 (936) 2,477 Exclude provision for credit losses 4,220 5,129 4,311 7,946 28,563 2,730 Pre-tax, pre-provision income (non-GAAP) $64,367 $69,424 $85,356 $20,777 $21,488 $21,843 Loan Yield, excluding SBA PPP Loans, Annualized: Interest and fees on loans (GAAP) $129,213 $175,466 $189,515 $46,277 $48,404 $47,647 Exclude impact on loan yield from SBA PPP loan interest and fees — — — — (4,923) (5,810) Adjusted interest and fees on loans (GAAP) $129,213 $175,466 $189,515 $46,277 $43,481 $41,837 Average loans receivable, net (GAAP) $2,703,934 $3,414,424 $3,668,665 $3,748,573 $4,442,108 $4,605,389 Exclude average SBA PPP loans — — — — (667,390) (863,127) Adjusted average loans receivable, net (non-GAAP) $2,703,934 $3,414,424 $3,668,665 $3,748,573 $3,774,718 $3,742,262 Loan yield, annualized (GAAP) 4.78 % 5.14 % 5.17 % 4.97 % 4.38 % 4.12 % Loan yield, excluding SBA PPP loans, annualized (non-GAAP) 4.78 % 5.14 % 5.17 % 4.97 % 4.63 % 4.45 % ACL on Loans to Loans Receivable, excluding SBA PPP Loans: Allowance for credit losses on loans $32,086 $35,042 $36,171 $47,540 $71,501 $73,340 Loans receivable (GAAP) $2,849,071 $3,654,160 $3,767,879 $3,852,376 $4,666,333 $4,666,730 Exclude SBA PPP loans — — — — (856,490) (867,782) Loans receivable, excluding SBA PPP (non-GAAP) $2,849,071 $3,654,160 $3,767,879 $3,852,376 $3,809,843 $3,798,948 ACL on loans to Loans receivable (GAAP) 1.13 % 0.96 % 0.96 % 1.23 % 1.53 % 1.57 % ACL on loans to Loans receivable, excluding SBA PPP loans (non- GAAP) 1.13 % 0.96 % 0.96 % 1.23 % 1.88 % 1.93 % 31

Non-GAAP Financial Measures 2020 2017 2018 2019 Q1 Q2 Q3 Potential Problem Loans to Loans Receivable, excluding SBA PPP Loans: Potential problem loans $83,543 $101,320 $87,888 $102,167 $100,554 $159,764 Loans receivable (GAAP) $2,849,071 $3,654,160 $3,767,879 $3,852,376 $4,666,333 $4,666,730 Exclude SBA PPP loans — — — — (856,490) (867,782) Loans receivable, excluding SBA PPP (non-GAAP) $2,849,071 $3,654,160 $3,767,879 $3,852,376 $3,809,843 $3,798,948 Potential problem loans to loans receivable (GAAP) 2.93 % 2.77 % 2.33 % 2.65 % 2.15 % 3.42 % Potential problem loans to loans receivable, excluding SBA PPP (non-GAAP) 2.93 % 2.77 % 2.33 % 2.65 % 2.64 % 4.21 % Net Interest Margin, excluding Incremental Accretion on Purchased Loans, Annualized: Net interest income (GAAP) $139,363 $186,993 $199,682 $48,551 $50,313 $49,678 Exclude incremental accretion on purchased loans (6,320) (7,964) (4,876) (1,012) (696) (944) Adjusted net interest income (non-GAAP) $133,043 $179,029 $194,806 $47,539 $49,617 $48,734 Average total interest earning assets, net $3,547,786 $4,358,643 $4,729,885 $4,811,769 $5,552,494 $5,855,240 Net interest margin, annualized (GAAP) 3.93 % 4.29 % 4.22 % 4.06 % 3.64 % 3.38 % Net interest margin, excluding incremental accretion on purchased loans, annualized (non-GAAP) 3.75 % 4.11 % 4.12 % 3.98 % 3.59 % 3.32 % Return on Average Tangible Common Equity: Net Income (GAAP) $41,791 $53,057 $67,557 $12,191 $(6,139) $16,636 Add amortization of intangible assets 1,286 3,819 4,001 903 903 860 Exclude tax effect of adjustment (450) (802) (840) (190) (190) (181) Tangible net income (non-GAAP) $42,627 $56,074 $70,718 $12,904 $(5,426) $17,315 Average stockholders' equity (GAAP) $499,776 $687,094 $789,502 $806,071 $807,539 $799,738 Exclude average intangible assets (125,774) (230,282) (259,667) (257,234) (256,338) (255,453) Average tangible common stockholders' equity (non-GAAP) $374,002 $456,812 $529,835 $548,837 $551,201 $544,285 32

Non-GAAP Financial Measures 2020 2017 2018 2019 Q1 Q2 Q3 Return on Average Tangible Common Equity continued: Return on average equity, annualized (GAAP) 8.36 % 7.72 % 8.56 % 6.08 % (3.06) % 8.28 % Return on average tangible common equity, annualized (non- GAAP) 11.40 % 12.28 % 13.35 % 9.46 % (3.96) % 12.66 % Tangible Common Equity to Tangible Assets: Total stockholders' equity (GAAP) $508,305 $760,723 $809,311 $798,438 $793,652 $803,129 Exclude intangible assets (125,117) (261,553) (257,552) (256,649) (255,746) (254,886) Tangible common equity (non-GAAP) $383,188 $499,170 $551,759 $541,789 $537,906 $548,243 Total assets (GAAP) $4,113,270 $5,316,927 $5,552,970 $5,587,300 $6,562,359 $6,685,889 Exclude intangible assets (125,117) (261,553) (257,552) (256,649) (255,746) (254,886) Tangible assets (non-GAAP) $3,988,153 $5,055,374 $5,295,418 $5,330,651 $6,306,613 $6,431,003 Total assets (GAAP) $4,113,270 $5,316,927 $5,552,970 $5,587,300 $6,562,359 $6,685,889 Exclude intangible assets (125,117) (261,553) (257,552) (256,649) (255,746) (254,886) Exclude SBA PPP loans — — — — (856,490) (867,782) Tangible assets, excluding SBA PPP loans (non-GAAP) $3,988,153 $5,055,374 $5,295,418 $5,330,651 $5,450,123 $5,563,221 Stockholders' equity to total assets (GAAP) 12.4 % 14.3 % 14.6 % 14.3 % 12.1 % 12.0 % Tangible common equity to tangible assets (non-GAAP) 9.6 % 9.9 % 10.4 % 10.2 % 8.5 % 8.5 % Tangible common equity to tangible assets, excluding SBA PPP loans (non-GAAP) 9.6 % 9.9 % 10.4 % 10.2 % 9.9 % 9.9 % 33

Questions and Answers 34