Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - Crescent Capital BDC, Inc. | d942185dex991.htm |

| 8-K - 8-K - Crescent Capital BDC, Inc. | d942185d8k.htm |

Investor Presentation October 2020 Exhibit 99.2

Disclaimer and Forward-Looking Statement This presentation (the “Presentation”) has been prepared by Crescent Capital BDC, Inc. (together with its consolidated subsidiaries, “CCAP,” “Crescent BDC” or the “Company”) and may be used for informational purposes only. This Presentation contains summaries of certain financial and statistical information about the Company and should be viewed in conjunction with the Company’s most recent Quarterly Report on Form 10-Q and Annual Report on Form 10-K. The information contained herein may not be used, reproduced, referenced, quoted, linked by website, or distributed to others, in whole or in part, except as agreed in writing by the Company. This Presentation does not constitute a proxy solicitation or prospectus and should under no circumstances be understood as an offer to sell or the solicitation of a proxy or an offer to buy the Company’s common stock or any other securities nor will there be any sale of the common stock or any other securities in any state or jurisdiction in which such offer, solicitation or sale would be unlawful prior to the registration or qualification under the securities laws of such state or jurisdiction. This Presentation provides limited information regarding the Company and is not intended to be taken by, and should not be taken by, any individual recipient as investment advice, a recommendation to buy, hold or sell, or an offer to sell or a solicitation of offers to purchase, the Company’s common stock or any other securities that may be issued by the Company, or as legal, accounting or tax advice. An investment in securities of the type described herein presents certain risks. Footnotes contain important information about the definition of terms used herein, the composition of the investment portfolio and related performance information as well as unrealized investment valuations and should be carefully reviewed. Market data and information included herein (including information relating to portfolio companies) is based on various published and unpublished sources considered to be reliable, but has not been independently verified and there is no guarantee of its accuracy or completeness. Performance information contained herein is based in significant part on unrealized investment valuations which may not be achieved. We undertake no duty or obligation to publicly update or revise the information contained in this Presentation. Legal, tax and regulatory changes, as well as judicial decisions, both within and outside of the United States, could have an adverse impact on the Company and its investments. Instability in the securities markets may increase the risk inherent in CCAP’s investments in that the ability of issuers to refinance or redeem portfolio securities held may depend on their ability to sell new securities in the market. Future periods of uncertainty in the U.S. economy and the economies of other countries of issuers of securities and loans in which the Company may invest, and the possibility of increased volatility, default rates and deterioration in financial markets, may adversely affect the Company’s investment portfolio. This Presentation may contain forward-looking statements that involve substantial risks and uncertainties. You can identify these statements by the use of forward-looking terminology such as “anticipates,” “believes,” “expects,” “intends,” “will,” “should,” “may,” “plans,” “continue,” “believes,” “seeks,” “estimates,” “would,” “could,” “targets,” “projects,” “outlook,” “potential,” “predicts” and variations of these words and similar expressions to identify forward-looking statements, although not all forward-looking statements include these words. You should read statements that contain these words carefully because they discuss plans, strategies, prospects and expectations concerning CCAP’s business, operating results, financial condition and other similar matters. We believe that it is important to communicate our future expectations to our investors. There may be events in the future, however, that we are not able to predict accurately or control. You should not place undue reliance on these forward-looking statements, which speak only as of the date on which we make them. Factors or events that could cause our actual results to differ, possibly materially from our expectations, include, but are not limited to, the risks, uncertainties and other factors we identify in the sections entitled “Risk Factors” and “Cautionary Statement Regarding Forward-Looking Statements” in filings we make with the Securities and Exchange Commission (the “SEC”), and it is not possible for us to predict or identify all of them. We undertake no obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law. CCAP is managed by Crescent Cap Advisors, LLC (the “Investment Adviser”), an SEC-registered investment adviser and a subsidiary of Crescent Capital Group LP (together with its affiliates, “Crescent”). This Presentation contains information about the Company and certain of its affiliates and includes the Company’s historical performance. You should not view information related to the past performance of the Company as indicative of the Company’s future results, the achievement of which is dependent on many factors, many of which are beyond the control of the Company and the Investment Adviser and cannot be assured. There can be no assurances that future dividends will match or exceed historic rates or will be paid at all. Further, an investment in the Company is discrete from, and does not represent an interest in, any other Crescent entity. Nothing contained herein shall be relied upon as a promise or representation whether as to the past or future performance of the Company or any other Crescent entity.

Sun Life to Acquire Crescent Capital Group Management of Crescent Capital BDC, Inc. to Continue with Same Team, Greater Resources On October 21, 2020, Crescent Capital Group LP (“Crescent”), parent of the Advisor1 to Crescent Capital BDC, Inc. (“CCAP”), and Sun Life Financial Inc. (together with its subsidiaries and joint ventures, “Sun Life”) announced that they entered into a definitive agreement under which Sun Life will acquire a majority economic interest in Crescent (the “Acquisition”) Crescent will form part of SLC Management, Sun Life’s alternative investment management platform The same Crescent team that has been responsible for the investment operations of CCAP prior to the Acquisition will continue to focus on executing the same investment strategies and process In addition to continuing to benefit from Crescent’s significant experience in private credit origination and underwriting, CCAP stockholders will benefit from Sun Life’s global scale and platform CCAP is managed by Crescent Cap Advisors, LLC (the “Advisor” and formerly, CBDC Advisors, LLC), an investment adviser that is registered with the Securities and Exchange Commission (the “SEC”) under the Investment Advisers Act of 1940, as amended. Crescent is the majority member of the Advisor.

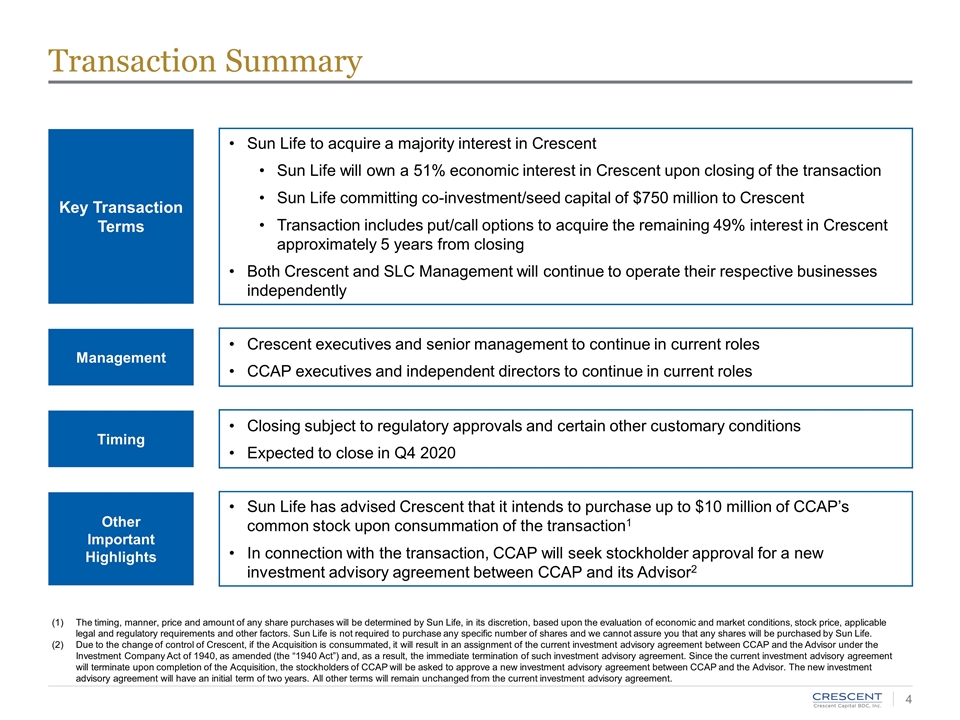

Transaction Summary Key Transaction Terms Sun Life to acquire a majority interest in Crescent Sun Life will own a 51% economic interest in Crescent upon closing of the transaction Sun Life committing co-investment/seed capital of $750 million to Crescent Transaction includes put/call options to acquire the remaining 49% interest in Crescent approximately 5 years from closing Both Crescent and SLC Management will continue to operate their respective businesses independently Management Crescent executives and senior management to continue in current roles CCAP executives and independent directors to continue in current roles Timing Closing subject to regulatory approvals and certain other customary conditions Expected to close in Q4 2020 Other Important Highlights Sun Life has advised Crescent that it intends to purchase up to $10 million of CCAP’s common stock upon consummation of the transaction1 In connection with the transaction, CCAP will seek stockholder approval for a new investment advisory agreement between CCAP and its Advisor2 The timing, manner, price and amount of any share purchases will be determined by Sun Life, in its discretion, based upon the evaluation of economic and market conditions, stock price, applicable legal and regulatory requirements and other factors. Sun Life is not required to purchase any specific number of shares and we cannot assure you that any shares will be purchased by Sun Life. Due to the change of control of Crescent, if the Acquisition is consummated, it will result in an assignment of the current investment advisory agreement between CCAP and the Advisor under the Investment Company Act of 1940, as amended (the “1940 Act”) and, as a result, the immediate termination of such investment advisory agreement. Since the current investment advisory agreement will terminate upon completion of the Acquisition, the stockholders of CCAP will be asked to approve a new investment advisory agreement between CCAP and the Advisor. The new investment advisory agreement will have an initial term of two years. All other terms will remain unchanged from the current investment advisory agreement.

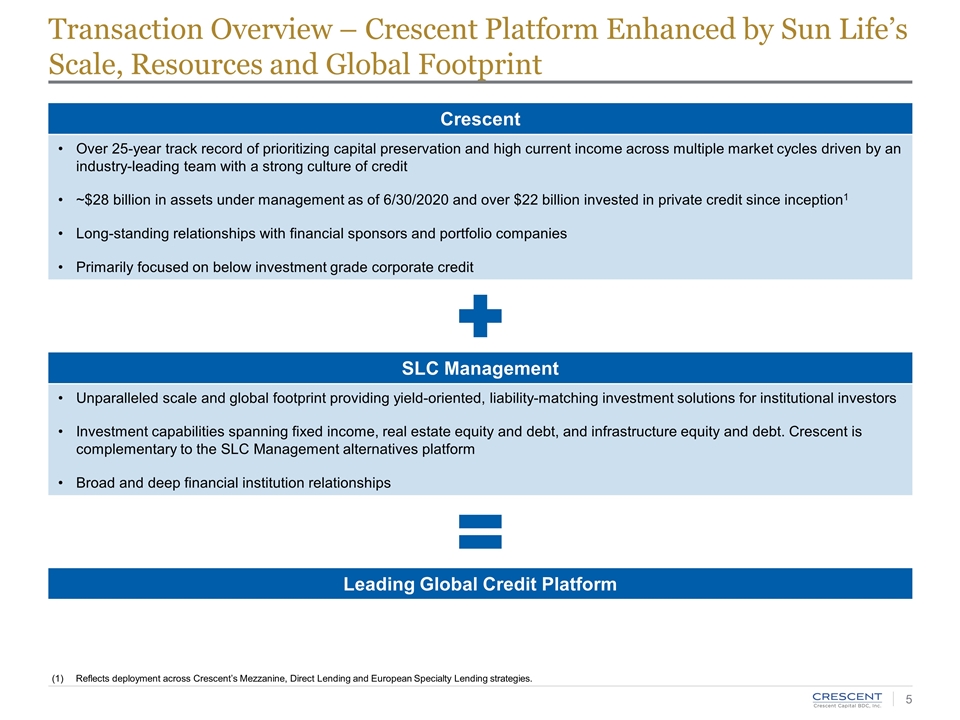

Transaction Overview – Crescent Platform Enhanced by Sun Life’s Scale, Resources and Global Footprint Reflects deployment across Crescent’s Mezzanine, Direct Lending and European Specialty Lending strategies. Crescent Over 25-year track record of prioritizing capital preservation and high current income across multiple market cycles driven by an industry-leading team with a strong culture of credit ~$28 billion in assets under management as of 6/30/2020 and over $22 billion invested in private credit since inception1 Long-standing relationships with financial sponsors and portfolio companies Primarily focused on below investment grade corporate credit SLC Management Unparalleled scale and global footprint providing yield-oriented, liability-matching investment solutions for institutional investors Investment capabilities spanning fixed income, real estate equity and debt, and infrastructure equity and debt. Crescent is complementary to the SLC Management alternatives platform Broad and deep financial institution relationships Leading Global Credit Platform

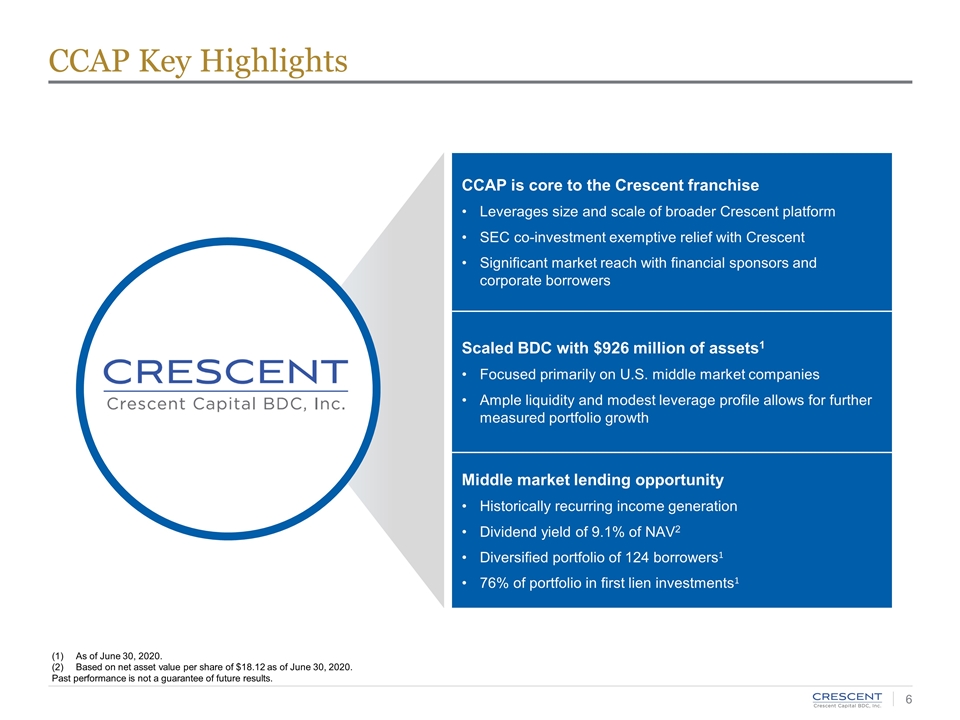

As of June 30, 2020. Based on net asset value per share of $18.12 as of June 30, 2020. Past performance is not a guarantee of future results. CCAP Key Highlights CCAP is core to the Crescent franchise Leverages size and scale of broader Crescent platform SEC co-investment exemptive relief with Crescent Significant market reach with financial sponsors and corporate borrowers Scaled BDC with $926 million of assets1 Focused primarily on U.S. middle market companies Ample liquidity and modest leverage profile allows for further measured portfolio growth Middle market lending opportunity Historically recurring income generation Dividend yield of 9.1% of NAV2 Diversified portfolio of 124 borrowers1 76% of portfolio in first lien investments1

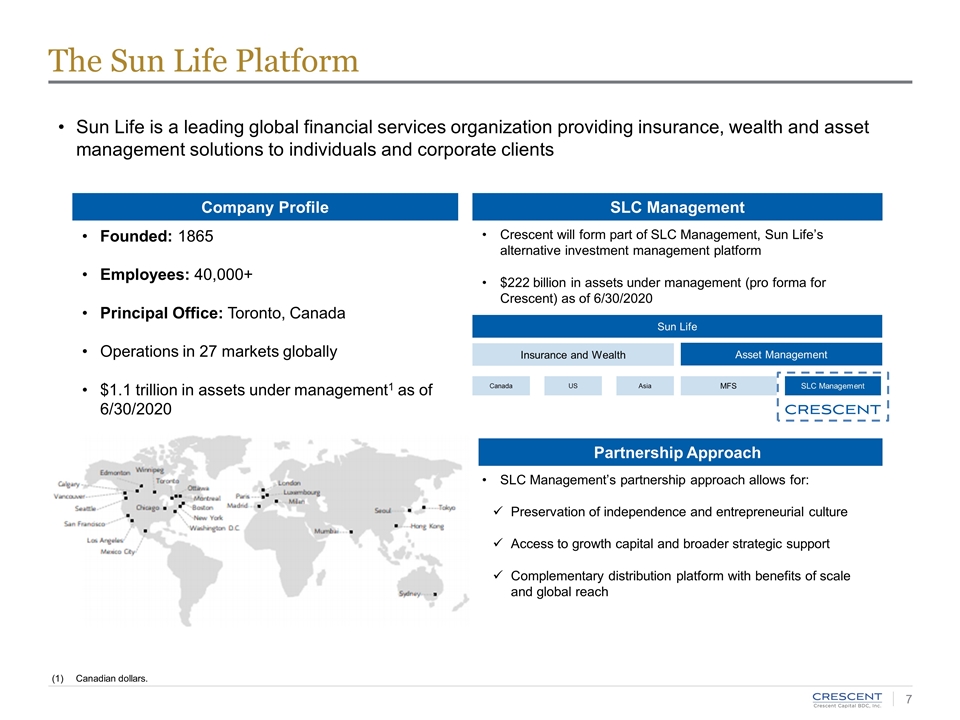

Sun Life is a leading global financial services organization providing insurance, wealth and asset management solutions to individuals and corporate clients The Sun Life Platform Company Profile Founded: 1865 Employees: 40,000+ Principal Office: Toronto, Canada Operations in 27 markets globally $1.1 trillion in assets under management1 as of 6/30/2020 SLC Management Crescent will form part of SLC Management, Sun Life’s alternative investment management platform $222 billion in assets under management (pro forma for Crescent) as of 6/30/2020 Sun Life Insurance and Wealth Asset Management US Canada Asia MFS Partnership Approach SLC Management’s partnership approach allows for: Preservation of independence and entrepreneurial culture Access to growth capital and broader strategic support Complementary distribution platform with benefits of scale and global reach SLC Management Canadian dollars.

Benefits for Crescent Crescent has been an industry leader in the below-investment grade market for over 25 years. Coupling Crescent’s longstanding experience in private credit origination and underwriting with Sun Life’s global scale and platform creates a compelling combination. Providing access to greater scale and resources needed to further augment global financial sponsor and corporate borrower reach Further improving access to capital markets Enhancing institutional relevance and market coverage This transaction with Sun Life enables us to continue to strengthen our competitive position by:

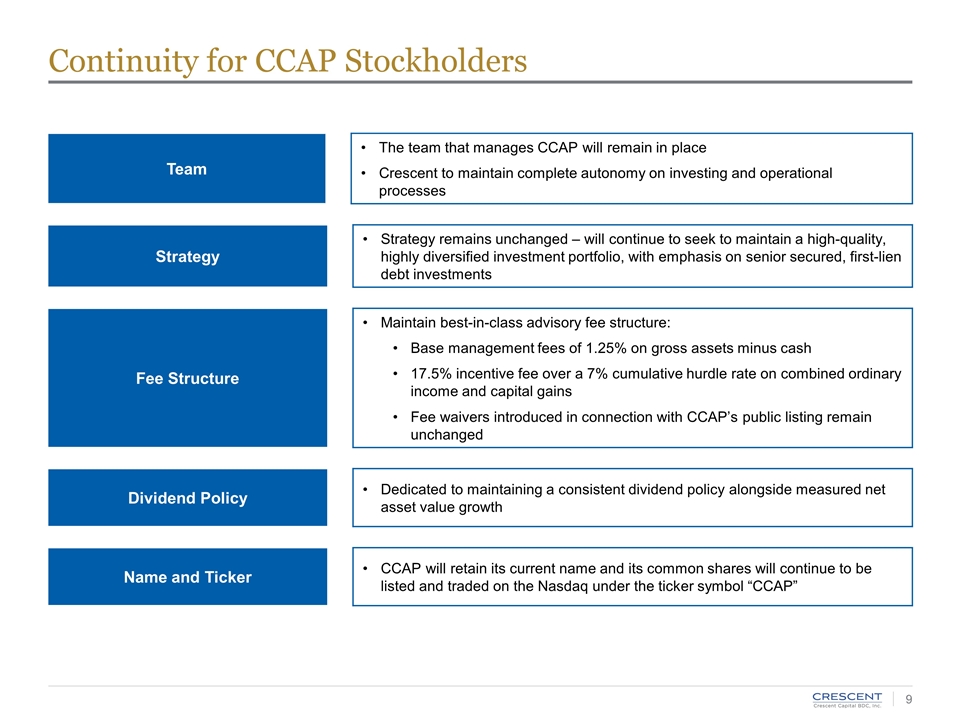

Continuity for CCAP Stockholders Team The team that manages CCAP will remain in place Crescent to maintain complete autonomy on investing and operational processes Strategy Strategy remains unchanged – will continue to seek to maintain a high-quality, highly diversified investment portfolio, with emphasis on senior secured, first-lien debt investments Fee Structure Maintain best-in-class advisory fee structure: Base management fees of 1.25% on gross assets minus cash 17.5% incentive fee over a 7% cumulative hurdle rate on combined ordinary income and capital gains Fee waivers introduced in connection with CCAP’s public listing remain unchanged Dividend Policy Dedicated to maintaining a consistent dividend policy alongside measured net asset value growth Name and Ticker CCAP will retain its current name and its common shares will continue to be listed and traded on the Nasdaq under the ticker symbol “CCAP”