Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - BANC OF CALIFORNIA, INC. | ex991q32020earningsrel.htm |

| 8-K - 8-K - BANC OF CALIFORNIA, INC. | banc-20201022.htm |

INVESTOR D PRESENTATIONbancofcal.com 2020 Third Quarter Earnings bancofcal.com

FORWARD LOOKING STATEMENTS When used in this presentation and in documents filed with or furnished to the Securities and Exchange Commission (the “SEC”), in press releases or other public stockholder communications, or in oral statements made with the approval of an authorized executive officer, the words or phrases “believe,” “will,” “should,” “will likely result,” “are expected to,” “will continue,” “is anticipated,” “estimate,” “project,” “plans,” or similar expressions are intended to identify “forward-looking statements” within the meaning of the "Safe- Harbor" provisions of the Private Securities Litigation Reform Act of 1995. You are cautioned not to place undue reliance on any forward-looking statements. These statements may relate to future financial performance, strategic plans or objectives, revenue, expense or earnings projections, or other financial items of Banc of California Inc. and its affiliates (“BANC,” the “Company,” “we,” “us” or “our”), as well as the continuing effects of the COVID-19 pandemic on the Company’s business, operations, financial performance and prospects. By their nature, these statements are subject to numerous uncertainties that could cause actual results to differ materially from those anticipated in the statements. Factors that could cause actual results to differ materially from the results anticipated or projected include, but are not limited to, the following: (i) the costs and effects of litigation generally, including legal fees and other expenses, settlements and judgments; (ii) the effect of the novel coronavirus (COVID-19) pandemic and steps taken by governmental and other authorities to contain, mitigate and combat the pandemic on our business, operations, financial performance and prospects; (iii) the risk that the benefits we realize from exiting the third party mortgage origination and brokered single-family residential lending business will be less than anticipated and that the costs we incur from exiting that business will be greater than anticipated; (iv) the risk that we will not be successful in the implementation of our capital utilization strategy and our other strategies for transitioning to a traditional community bank; (v) risks that the Company’s merger and acquisition transactions may disrupt current plans and operations and lead to difficulties in customer and employee retention, risks that the costs, fees, expenses and charges related to these transactions could be significantly higher than anticipated and risks that the expected revenues, cost savings, synergies and other benefits of these transactions might not be realized to the extent anticipated, within the anticipated timetables, or at all; (vi) the credit risks of lending activities, which may be affected by deterioration in real estate markets and the financial condition of borrowers, and the operational risk of lending activities, including but not limited to the effectiveness of our underwriting practices and the risk of fraud, any of which may lead to increased loan and lease delinquencies, losses and nonperforming assets in our loan and lease portfolio, and may result in our allowance for credit losses not being adequate and require us to materially increase our loan and lease loss reserves; (vii) the quality and composition of our securities portfolio; (viii) changes in general economic conditions, either nationally or in our market areas, or changes in financial markets; (ix) continuation of or changes in the short-term interest rate environment, changes in the levels of general interest rates, volatility in the interest rate environment, the relative differences between short- and long-term interest rates, deposit interest rates, our net interest margin and funding sources; (x) fluctuations in the demand for loans, and fluctuations in commercial and residential real estate values in our market area; (xi) our ability to develop and maintain a strong core deposit base or other low cost funding sources necessary to fund our activities; (xii) results of examinations of us by regulatory authorities and the possibility that any such regulatory authority may, among other things, limit our business activities, require us to change our business mix, restrict our ability to invest in certain assets, increase our allowance for credit losses, write-down asset values or increase our capital levels, affect our ability to borrow funds or maintain or increase deposits, or impose fines, penalties or sanctions, any of which could adversely affect our liquidity and earnings; (xiii) legislative or regulatory changes that adversely affect our business, including, without limitation, changes in tax laws and policies, changes in privacy laws, and changes in regulatory capital or other rules, and the availability of resources to address or respond to such changes; (xiv) our ability to control operating costs and expenses; (xv) staffing fluctuations in response to product demand or the implementation of corporate strategies that affect our work force and potential associated charges; (xvi) the risk that our enterprise risk management framework may not be effective in mitigating risk and reducing the potential for losses; (xvii) errors in estimates of the fair values of certain of our assets and liabilities, which may result in significant changes in valuation; (xviii) failures or security breaches with respect to the network and computer systems on which we depend, including but not limited to, due to cybersecurity threats; (xix) our ability to attract and retain key members of our senior management team; (xx) increased competitive pressures among financial services companies; (xxi) changes in consumer spending, borrowing and saving habits; (xxii) the effects of severe weather, natural disasters, pandemics, acts of war or terrorism and other external events on our business; (xxiii) the ability of key third-party providers to perform their obligations to us; (xxiv) changes in accounting policies and practices, as may be adopted by the financial institution regulatory agencies or the Financial Accounting Standards Board or their application to our business, including additional guidance and interpretation on accounting issues and details of the implementation of new accounting methods; (xxv) continuing impact of the new accounting standard adopted by the Financial Accounting Standards Board, referred to as Current Expected Credit Loss, which requires financial institutions to determine periodic estimates of lifetime expected credit losses on loans, and provide for the expected credit losses as allowances for loan losses; (xxvi) share price volatility and reputational risks, related to, among other things, speculative trading and certain traders shorting our common shares and attempting to generate negative publicity about us; (xxvii) our ability to obtain regulatory approvals or non-objection to take various capital actions, including the payment of dividends by us or our bank subsidiary or repurchases of our common or preferred stock; and (xxviii) other economic, competitive, governmental, regulatory, and technological factors affecting our operations, pricing, products and services and the other risks described from time to time in other documents that we file with or furnish to the SEC. Third Quarter 2020 | 1

THIRD QUARTER 2020 RESULTS ($ in Thousands Except EPS) 3Q20 2Q20 3Q19 Net interest income $ 55,855 $ 55,315 $ 58,915 Provision for credit losses $ 1,141 $ 11,826 $ 38,607 Net income (loss) $ 15,913 $ (18,449) $ (14,132) Net income (loss) available to common stockholders $ 12,084 $ (21,936) $ (22,722) Pre-tax pre-provision (loss) income(1) $ 19,415 $ (11,927) $ 18,856 Adjusted pre-tax pre-provision income(1) $ 18,861 $ 16,029 $ 21,210 Earnings / (Loss) Per Diluted Share $ 0.24 $ (0.44) $ (0.45) Average assets $ 7,687,105 $ 7,740,206 $ 8,695,638 Net interest margin 3.09% 3.09% 2.86% Allowance for credit losses coverage ratio 1.66% 1.68% 1.05% Common equity tier 1 11.64% 11.68% 10.34% Tangible common equity per common share $ 12.92 $ 12.37 $ 13.16 Noninterest-bearing deposits as % of total deposits 24.1% 23.0% 19.2% Core deposits as % of total deposits 98.5% 97.0% 98.4% (1) Denotes a non-GAAP financial measure; see “Non-GAAP Reconciliation” slides at end of presentation Third Quarter 2020 | 2

DELIVERING ANTICIPATED EARNINGS IMPROVEMENT 3rd Quarter 2020 Summary • Net income of $15.9 million, or $0.24 per diluted share Significant Increase • Net income includes an effective tax rate of 12.9%, a benefit of $0.04 per diluted share if adjusted for an effective tax rate of 25% in Profitability • Adjusted pre-tax pre-provision income(1) of $18.9 million, an increase of 17.7% from 2Q20 Continued • Fifth consecutive quarter of DDA growth; noninterest-bearing deposits Improvement in increased $59.2mm to represent 24% of total deposits Deposit Mix • Cost of deposits spot rate at September 30, 2020 was 39 bps; the average Resulting in Stable cost of deposits declined to 51 bps in 3Q20 from 71 bps in 2Q20 Net Interest Margin • Net interest margin remained stable at 3.09% Increasing Commercial • Commercial loans increased $191 million or 4.5% from end of prior quarter Loan Growth Reduced • Operating costs(1) declined $2.1 million from 2Q20 Expense Levels • Positive trends in asset quality and proactive reserve building in 1H 2020 Strong Asset Quality resulted in lower 3Q20 provision expense (1) Denotes a non-GAAP financial measure; see “Non-GAAP Reconciliation” slides at end of presentation Third Quarter 2020 | 3

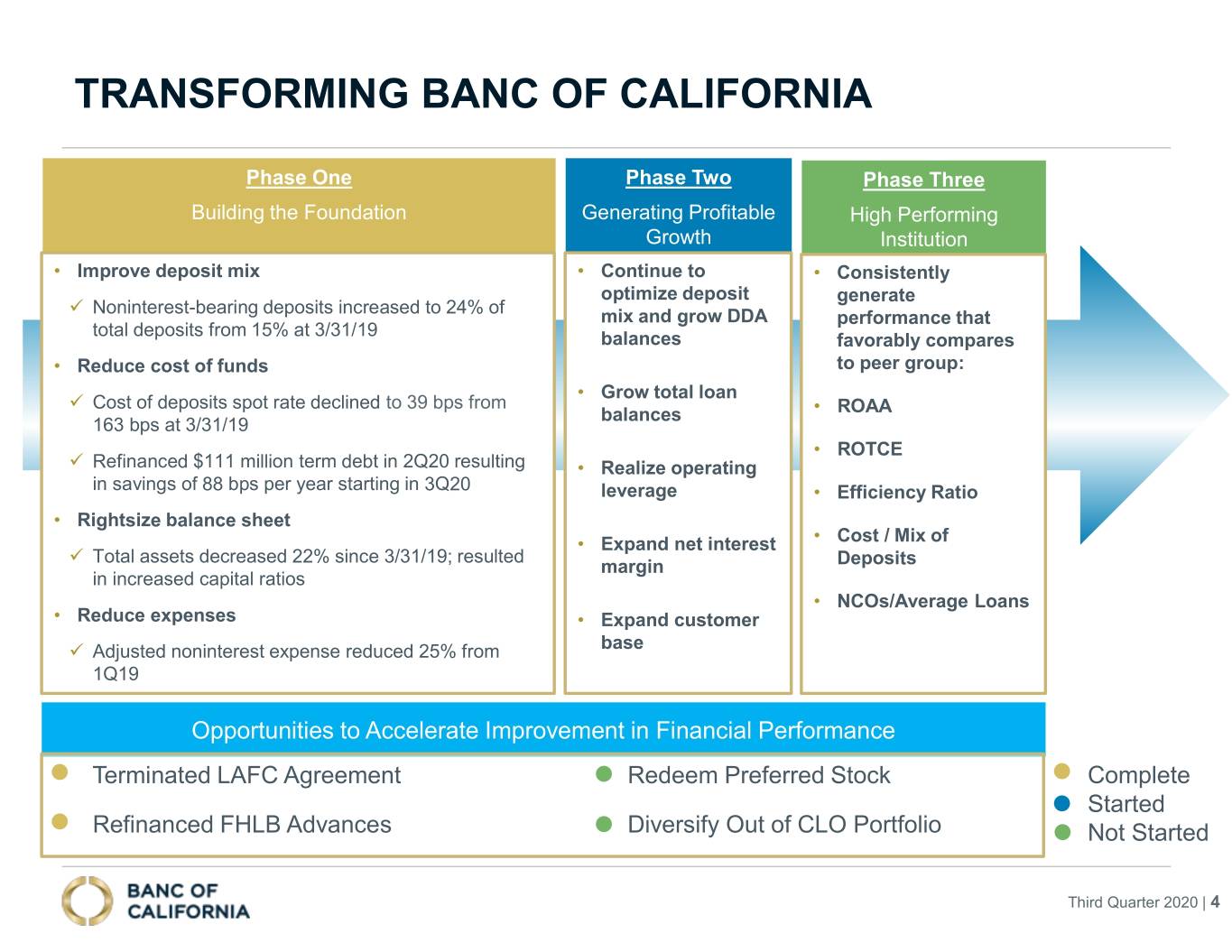

TRANSFORMING BANC OF CALIFORNIA Phase One Phase Two Phase Three Building the Foundation Generating Profitable High Performing Growth Institution • Improve deposit mix • Continue to • Consistently optimize deposit generate � Noninterest-bearing deposits increased to 24% of mix and grow DDA performance that total deposits from 15% at 3/31/19 balances favorably compares • Reduce cost of funds to peer group: • Grow total loan � Cost of deposits spot rate declined to 39 bps from balances • ROAA 163 bps at 3/31/19 • ROTCE � Refinanced $111 million term debt in 2Q20 resulting • Realize operating in savings of 88 bps per year starting in 3Q20 leverage • Efficiency Ratio • Rightsize balance sheet • Expand net interest • Cost / Mix of � Total assets decreased 22% since 3/31/19; resulted margin Deposits in increased capital ratios • NCOs/Average Loans • Reduce expenses • Expand customer � Adjusted noninterest expense reduced 25% from base 1Q19 Opportunities to Accelerate Improvement in Financial Performance • Terminated LAFC Agreement • Redeem Preferred Stock Complete Started • Refinanced FHLB Advances • Diversify Out of CLO Portfolio Not Started Third Quarter 2020 | 4

PROVEN EARNINGS GROWTH TRAJECTORY Adjusted Pre-tax Pre-provision Income (1) ($ in millions) 0.98% 0.83% $18.9 $16.0 0.66% 0.65% $13.2 $12.2 4Q19 1Q20 2Q20 3Q20 Adjusted Pre-tax, pre-provision income Adjusted PTPP Income / Avg. Assets (1) Denotes a non-GAAP financial measure; see “Non-GAAP Reconciliation” slides at end of presentation Third Quarter 2020 | 5

STABILIZED AND GROWING CORE EARNINGS ($ in millions) 3Q20 • 17.7% increase in adjusted Adjusted PTPP ROAA: pre-tax pre-provision 0.98% (PTPP) income $19.4 $18.9 • PTPP ROAA increased to $0.0 $0.0 $1.2 $(1.4) $(0.3) $0.0 0.98% due to higher core earnings 3Q20 PTPP LAFC Debt Non- Gain on Gain on sale Gain on sale 3Q20 • Higher adjusted PTPP Income Restructure retirement Core alternative of loans of securities Adjusted driven by stable net interest expense Expense energy PTPP Income(1) partnerships margin due to improved 2Q20 Adjusted earning asset mix and lower PTPP ROAA: funding costs, and ongoing 0.83% operating efficiencies $0.9 $(0.2) $(0.0) $16.0 $2.5 $(2.0) • Non-core expense relates to indemnified legal expenses net of recoveries $26.8 $(11.9) 2Q20 LAFC Debt Non- Gain on alt. Gain on sale Gain on sale 2Q20 PTPP Loss Restructure retirement Core energy of loans of securities Adjusted (1) expense Expense partnerships PTPP Income (1) Denotes a non-GAAP financial measure; see “Non-GAAP Reconciliation” slides at end of presentation Third Quarter 2020 | 6

RAPIDLY IMPROVING DEPOSIT FRANCHISE Average Cost of deposits Money Market & Savings • $59.2 million quarterly Noninterest-bearing Brokered CDs increase in noninterest- 1.48% Interest-bearing checking CDs bearing deposits 1.27% Spot 1.11% Rate • Large percentage of 0.39% noninterest-bearing and 0.71% low-cost deposits 0.51% 19% 15% 14% 24% 22% 3% 1% • Targeted deposit strategy 1% 0% 4% 28% 27% resulting in lower deposit 30% 30% 26% costs over time Cost of Deposits 31% 34% 26% 28% 28% • Spot rate at September 30, 19% 20% 23% 23% 24% 2020 was 39 bps 3Q19 4Q19 1Q20 2Q20 3Q20 Category 3Q19 4Q19 1Q20 2Q20 3Q20 $ in millions Noninterest-bearing checking $1,107.4 $1,088.5 $1,256.1 $1,391.5 $1,450.7 Interest-bearing checking 1,503.2 1,533.9 1,572.4 1,846.7 2,045.1 Demand deposits 2,610.7 2,622.4 2,828.5 3,238.2 3,495.9 Savings 1,042.2 885.2 877.9 939.0 946.3 Money Market 695.5 715.5 575.8 765.9 689.8 Non-maturity deposits 1,737.7 1,600.7 1,453.8 1,704.9 1,636.1 CDs 1,367.3 1,204.0 1,071.9 924.6 820.5 Brokered CDs 54.4 00.0 208.7 169.8 79.8 Total(1) $5,770.1 $5,427.2 $5,562.8 $6,037.5 $6,032.3 (1) Reflects balance as of period end Third Quarter 2020 | 7

ALL BUSINESS UNITS SHOWING SOLID DEPOSIT GROWTH Period end balances ($ in millions) +34% $3,496 $3,238 $2,828 $924 $2,611 $2,622 $904 $770 $775 $758 $2,128 $1,908 $1,580 $1,500 $1,545 $302 $296 $457 $399 $416 $33 $24 $22 $27 $28 3Q19 4Q19 1Q20 2Q20 3Q20 Community & Business Banking Commercial Real Estate & Banking Private & Specialty Banking Other Third Quarter 2020 | 8

DIVERSIFIED LOAN PORTFOLIO MITIGATES RISK AND IS HOLDING YIELD 3rd Quarter 2020 2nd Quarter 2020 Change Loan Segment $(1) % Av g. Yie ld $1 % Av g. Yie ld $ % Av g. Yie ld $ in Millions C&I $ 1,587 28% 4.43% $ 1,437 26% 4.45% $ 150 2% -0.02% Multifam ily 1,477 26% 4.72% 1,434 25% 4.50% 43 1% 0.22% CRE 827 15% 4.69% 823 15% 4.86% 4 0% -0.17% Construction 198 3% 5.00% 213 4% 5.30% (15) -1% -0.30% SBA 321 6% 4.35% 311 6% 5.64% 10 0% -1.29% SFR 1,234 22% 4.00% 1,371 24% 4.03% (136) -2% -0.03% Consumer 35 1% 5.04% 39 1% 4.44% (4) 0% 0.60% Total Loans HFI $ 5,678 100% 4.46% $ 5,628 100% 4.49% 50 N/A -0.03% Real Estate Secured with Low LTVs PPP Loan Overview • 67% of loan portfolio is secured by residential real • As of September 30th, PPP loans net of fees estate (primary residences) comprised $256 million of the SBA portfolio • Weighted average LTV’s of 57% • Of the 1,128 PPP loans funded, 44% are under $50k and represent 4% of the PPP loan portfolio • ~90% of all real estate secured loans have loan-to- balance values (LTVs) of less than 70% • As of October 16, 2020, 313 PPP loans, or 27% • ~86% of the SFR portfolio have LTVs of less than of the loan count, representing $86 million, or 70% 33% of the funded PPP loans, are actively in the forgiveness process (1) Reflects balance as of period end Third Quarter 2020 | 9

FORBEARANCE AND DEFERMENTS DECLINE ($ in millions) Deferrals by Loan Type as of 9/30/20(1),(2) Approved or Booked Under Review(3) Total Deferrals % of % of % of Change in Total $ # Portfolio $ # Portfolio $ # Portfolio Deferral Balance Portfolio Deferred Deferred Deferred from 6/30/20 1-4 Family Residential $ 138 123 11% $ - 0 0% $ 138 123 $ 1,234 11% $ (26) Multifamily 18 1 1% 0 1 <1% 18 2 1,477 1% (96) CRE 80 10 10% 9 5 1% 89 15 827 11% (129) Construction & Dev. - 0 0% - 0 0% - 0 198 0% (32) Commercial & Industrial 1 3 <1% 18 9 1% 19 12 1,587 1% (34) Other Consumer 1 3 2% - 0 0% 1 3 35 2% (0) SBA - 0 0% 18 3 6% 18 3 321 6% (4) Total $ 238 140 4% $ 45 18 <1% $ 283 158 $ 5,678 5% $ (321) Total loan deferrals and forbearances declined $321 million from 2Q20 • $138 million, or 49%, of deferments/forbearances at the end of 3Q20 relate to legacy 1-4 Family Residential loans • $107 million, or 38%, of total 3Q20 amounts are secured by CRE Retail, Office, and Multifamily properties with low loan-to values • 16 initial deferment/forbearance requests received in 3Q20 -53% $604 $164 SFR Non-SFR $283 $440 $138 $145 6/30/2020 9/30/2020(3) (1) Excludes loans in forbearance that are current and loans delinquent prior to COVID-19 (2) Deferments for SFR portfolio are forbearances Third Quarter 2020 | 10 (3) Loans in the process of deferment or forbearance are not reported as delinquent

ASSET QUALITY DECLINING LEVELS OF NPLS, DELINQUENCIES, AND CLASSIFIED LOANS Delinquencies ($ in millions) Criticized and Classified Loans ($ in millions) SFR Delinquencies Criticized Loans Delinquencies (ex-SFR) Classified Loans -8.52% Delinquencies /Total Loans 1.69% $195 1.50% 1.46% $186 $170 $167 $170 0.88% 0.97% $129 $95.2 $112 $111 $85.0 $102 $83.0 $87 $56.3 $57.6 $70.3 $71.4 $71.1 $45.4 $43.4 $10.9 $14.2 $13.6 $24.9 $12.0 3Q19 4Q19 1Q20 2Q20 3Q20 3Q19 4Q19 1Q20 2Q20 3Q20 Non-performing Loans (NPLs) ($ in millions) ACL / Non-performing Loans (NPLs) ($ in millions) SFR NPLs ACL / NPLs NPLs (ex-SFR) ACL NPLs/Total Loans-HFI 149% 142% 145% 141% 1.29% 130% 1.00% 1.18% 0.71% 0.73% $72.7 $66.9 $56.5 $28.5 $45.2 $43.4 $26.3 $24.4 $82.1 $94.6 $94.1 $15.6 $18.6 $67.3 $61.7 $44.2 $40.6 $29.6 $24.7 $32.1 3Q19 4Q19 1Q20 2Q20 3Q20 3Q19 4Q19 1Q20 2Q20 3Q20 Third Quarter 2020 | 11

NON-PERFORMING & DELINQUENT LOANS ROLLFORWARD TOP 10 RELATIONSHIPS Non-performing Loans ($ in thousands) 3Q 3Q Loan 2Q • Non-performing loans # 2Q20 Delta 3Q20 Accrual Delinquency Category Accrual Status Status Status decreased $5.8 million to $66.9 1 $ 16,353 $ (206) $ 16,147 C&I Non-Accrual Non-Accrual Current million of which 47% are in 2 11,482 (1,843) 9,639 CRE / SFR Non-Accrual Non-Accrual Current 3 9,065 - 9,065 SFR Non-Accrual Non-Accrual 90+ current payment status 4 3,658 (68) 3,589 C&I Non-Accrual Non-Accrual 90+ 5 3,253 - 3,253 SFR Non-Accrual Non-Accrual 90+ • Largest 3 NPLs total $34.9 6 2,729 (43) 2,686 CRE Non-Accrual Non-Accrual Current 7 2,486 - 2,486 SFR Non-Accrual Non-Accrual 90+ million, or 52%, and relate to 8 1,975 (11) 1,965 SFR Non-Accrual Non-Accrual 90+ one $16.1 million legacy shared 9 1,881 - 1,881 SFR Non-Accrual Non-Accrual 90+ national credit, a $9.6 million 10 - 1,496 1,496 SFR Accrual Non-Accrual 90+ 11+ 19,821 (5,145) 14,676 legacy relationship well-secured Total $ 72,703 $ (5,819) $ 66,884 by CRE and SFR properties Delinquent Loans ($ in thousands) (1) with a 51% average LTV, and 2Q 3Q Loan 3Q # 2Q20 Delta 3Q20 Delinquency Delinquency Category Accrual Status one $9.1 million SFR mortgage Status Status 1 $ 9,065 - $ 9,065 SFR Non-Accrual 90+ 90+ with a 58% LTV 2 3,658 (68) 3,589 C&I Non-Accrual 90+ 90+ 3 3,253 - 3,253 SFR Non-Accrual 90+ 90+ • Delinquencies decreased $12.2 4 2,986 - 2,986 SFR Accrual 30-59 30-59 5 2,980 - 2,980 SFR Accrual 30-59 30-59 million as $30.0 million loans 6 2,954 - 2,954 SFR Accrual 30-59 30-59 returned to current status 7 2,486 - 2,486 SFR Non-Accrual 90+ 90+ partially offset by $18.0 million 8 2,486 (0) 2,486 SFR Accrual 30-59 30-59 9 - 2,156 2,156 SFR Accrual Current 30-59 of additions 10 2,077 - 2,077 SFR Accrual 30-59 30-59 11+ 63,248 (14,244) 49,005 Total $ 95,194 $ (12,156) $ 83,038 (1) Certain loans in the process of deferment are not reflected in the delinquency statistics. Third Quarter 2020 | 12

ALLOWANCE FOR CREDIT LOSSES WALK $100.0 $ in millions $94.6 $0.9 $1.2 $95.0 $94.1 ($1.6) ($1.0) $90.0 $85.0 1.68%(1),(2) 1.66%(1),(2) $80.0 $75.0 $70.0 ACL Portfolio Charge-offs Specific Economic Forecast ACL (6/30/20) Changes (net of Recoveries) Reserves and Other (9/30/20) ● Q3 ‘20: The Allowance for Credit Losses (ACL) reserve decreased $0.5 million due to (1) lower general reserves from improved forecasted economic factors, offset by modest loan growth, (2) higher specific reserves of $1.2mm, and (3) net charge-offs of $1.6mm – The economic forecasts released during September included higher GDP growth rates and lower unemployment rates compared to the June forecast. While the September forecasts were more favorable than the June forecasts, the foreseeable future economic environment is very uncertain and the ultimate result of the recession is unknown at this time. Accordingly, our economic view reflects this uncertainty. – The reserve included qualitative factors to account for our visibility of actual conditions related to our loan portfolio – Our ACL methodology uses a nationally-recognized, third party model that includes many assumptions based on our and peer historical loss data, our current loan portfolio risk profile, and economic forecasts ● ACL includes Reserve for Unfunded Loan Commitments (RUC) (1) Coverage percentage equals ACL to Total Loans (2) ACL coverage ratio 8 bps higher at 6/30/20 and 9/30/20 when PPP loans are excluded Third Quarter 2020 | 13

CONTINUED FOCUS ON EXPENSE MANAGEMENT • Adjusted noninterest expense(1) decreased $2 million from prior quarter with a 1% decrease in average assets • Non-core expense/benefits relates to: 1) timing of indemnified legal costs/recoveries, 2) the impact of the LAFC agreement termination, 3) debt restructure expense, and 4) loss/gain on investments in alternative energy partnerships(2) • Adjusted noninterest expense decreased 13% versus 3Q19 Noninterest Expense to Average Assets Adjusted Noninterest Expense to Average Assets ($ millions) ($ millions) 3.78% 2.41% 2.37% 2.50% 2.30% 2.22% 1.97% $72.8 2.09% 2.13% 2.10% $43.2 $47.5 $46.9 $42.8 $40.4 -13% $48 $46.6 $48.4 $43.3 $40.7 $47 $43 $43 $41 $30.0 -$3.4 -$0.9 $3.6 -$0.3 3Q19 4Q19 1Q20 2Q20 3Q20 3Q19 4Q19 1Q20 2Q20 3Q20 Total Non-Core expense Noninterest Expense / Average Assets Adjusted Noninterest Expense Adjusted Noninterest Expense Adjusted Noninterest Expense / Average Assets (1) Denotes a non-GAAP financial measure; see “Non-GAAP Reconciliation” slides at end of presentation (2) Loss on investments in alternative energy partnerships create tax credits to offset expense incurred Third Quarter 2020 | 14

STRONG CAPITAL BASE 3Q20 2Q20 1Q20 4Q19 3Q19 Common Equity Tier 1 11.64% 11.68% 11.58% 11.56% 10.34% Tier 1 Risk-based Capital 14.98% 15.10% 14.91% 14.83% 13.32% Leverage Ratio 10.83% 10.56% 11.20% 10.89% 9.84% Tangible Equity / Tangible Assets(1) 10.84% 10.43% 10.42% 11.12% 10.01% Tangible Common Equity / Tangible 8.43% 8.04% 7.96% 8.68% 7.80% Assets(1) • Strategic decision to exit non-franchise enhancing assets resulted in build up of significant capital and steadily improving ratios • Capital provides a buffer for the uncertain outlook and optionality to deploy for benefit of shareholders (1) Denotes a non-GAAP financial measure; see “Non-GAAP Reconciliation” slides at end of presentation Third Quarter 2020 | 15

2020 STRATEGIC OBJECTIVES • Heightened monitoring for signs of stress in well-underwritten loan portfolio mainly secured by Heightened Focus CA-based real estate with relatively low LTVs on Credit • Maintain a high level of reserves given uncertain environment • New production focused on high quality relationship loans in our footprint • Growing noninterest-bearing and DDA deposits improves deposit mix and drives net interest margin expansion Build High Quality • Cost of deposits actively managed down to achieve peer median, with longer term goal of Deposit Base reaching below peer median • High touch relationship-banking for businesses and entrepreneurs driving value creation and growth Diversify Balance • Lending teams gaining traction after joining in 2H19 • Loan demand picking up with stronger borrowers capitalizing on investment opportunities Sheet and Accelerate • Commercial loan growth expected to more than offset legacy SFR and Multifamily payoffs in Loan Growth 2H20, resulting in flattish balance sheet year over year • High capital from reduction in balance sheet plus credit reserves provides strong buffer in Optimize Use uncertain environment • Evaluating uses of capital that will enhance earnings and improve franchise for the long-term of Capital • Opportunity to redeem preferred stock at appropriate time • Stock repurchases paused to preserve capital and provide flexibility 2020 objectives effectively transformed the Company in terms of strategic focus, balance sheet composition, and capital levels. With strong capital, improving deposit franchise and relationship focus, progress on 2020 objectives should position the company for solid performance in 2021 and beyond. Third Quarter 2020 | 16

APPENDIX bancofcal.com

LOAN PORTFOLIO CHARACTERISTICS Loan Portfolio by Segment Loan Portfolio by Geography $ in millions $ in millions Northeast Midwest Northern California (1) $151 SBA South $120 $382 $414 3% 2% $321 Consumer 7% Central 6% 7% Single Family Res. $35 California $1,234 1% Other West $172 3% Construction 22% $307 5% $198 3% C&I CRE $1,587 $827 28% 14% Multifamily Southern California $1,477 $4,133 26% 73% 93% in California 83% in California Loan Segment Avg. Yield Key Commentary C&I 4.43% • 67% of loan portfolio is secured by residential Multifam ily 4.72% real estate (primary residences) CRE 4.69% • Weighted average LTV’s of 57% Construction 5.00% SBA 4.35% • ~90% of all real estate secured loans have loan- Single Family Res. 4.00% to-values (LTVs) of less than 70% Consumer 5.04% • ~86% of the SFR portfolio have LTVs of less Total Loans HFI 4.46% than 70% (1) Includes $256 million of PPP loans. Third Quarter 2020 | 18

REAL ESTATE LOAN PORTFOLIO HAS LOW LTVS (1) Real Estate Loan Balances(1) Real Estate LTVs $ % Count $ in Millions $ in millions $4,459 <50% $ 1,004 27% 884 $4,135 $3,971 $3,841 $3,736 50% to 60% 988 26% 537 70% 69% 70% 68% 66% 60% to 70% 1,379 37% 621 70% to 80% 258 7% 154 >80% 106 3% 79 Total $ 3,736 100% 2,275 • ~90% of all real estate secured loans have loan-to-values (LTVs) of less than 70% 3Q19 4Q19 1Q20 2Q20 3Q20 • Weighted average LTV is 57% RE Loans / Loans-HFI RE Loans SFR LTVs $ % Count SFR Portfolio by LTV $ in Millions <50% $ 372 30% 490 >80% 50% to 60% 337 27% 325 70% to 80% <50% 60% to 70% 355 29% 340 70% to 80% 135 11% 124 >80% 36 3% 46 60% to 70% Total $ 1,235 100% 1,325 • ~86% of all existing SFR have loan-to-values 50% to 60% (LTVs) of less than 70% • Weighted average LTV is 56% (1) Excludes credit facilities Third Quarter 2020 | 19

CALIFORNIA-CENTRIC CRE AND MULTIFAMILY PORTFOLIOS HAVE LOW WEIGHTED-AVERAGE LTV CRE & Multifamily by Collateral Type Strip Center Other 8.1% 2.9% Multi Tenant Other 47.5% Industrial Single Tenant 8.8% 16.7% 4.0% Hospitality Mixed Use Other 0.3% 2.4% 0.2% Neighborhood Shopping Center 24.9% Retail Owner Occupied 13.3% 11.2% Office Multifamily 9.6% 64.1% Residential Non Owner 97.4% Occupied 88.8% Collateral Type Count Balance Av g. Loan Siz e W.A. LT V W.A. DSCR $ in thousands MultiFam ily 647 $ 1,476,803 $ 2,283 59.9% 1.3x Office 53 220,392 4,158 54.8% 1.8x Retail 87 306,568 3,524 53.4% 1.7x Hospitality 6 6,931 1,155 46.1% 1.6x Industrial 41 91,206 2,225 54.2% 1.7x Other 64 201,586 3,150 60.9% 2.3x Total CRE & MF 898 $ 2,303,486 $ 2,565 58.4% 1.5x Third Quarter 2020 | 20

CONSTRUCTION PORTFOLIO Construction Portfolio Use Construction Portfolio Income Land C&I Buildings Health Facility 6% 4% 3% SFR Income 39% 55% Multi-Family 93% • As of 3Q20, Construction Portfolio was $198mm and represented 3% of total HFI loans • Weighted average LTV is 53% Third Quarter 2020 | 21

DIVERSIFIED AND LOW AVERAGE BALANCE C&I PORTFOLIO Professional Services Transportation Accomodations • ~72% C&I Concentration toward Food Services 1% 0.3% 0.1% 2% Businesses focused on Finance and Television / Motion Pictures All Other Insurance, and Real Estate and Rental 2% C&I Other Retail 6% Leasing Trade 2% Whole Sale • Limited Exposure to High Stressed Trade 3% Finance and Business Industries Healthcare Insurance Real Estate & Rental • 2% Television / Motion Pictures 4% 59% Manufacturing Leasing 13% • 2% Food Services 3% • <1% Transportation Gas Stations 5% • <1% in Accommodations NAICS Industry Count $ Avg. Loan Size • All Other C&I includes a diverse mix of $ in thousands industry sectors Finance and Insurance(1) 170 $ 932,887 $ 5,488 • 2% Administrative and Support Real Estate & Rental Leasing 148 204,182 1,380 • 1% Management of Companies Gas Stations 53 70,630 1,333 Manufacturing 58 50,747 875 • 1% Education Services Healthcare 44 67,789 1,541 • <1% Arts / Recreation Wholesale trade 36 40,232 1,118 Other Retail Trade 39 37,157 953 • <1% Construction / Contracting Television / Motion Pictures 25 31,310 1,252 Food Services 20 29,835 1,492 Professional Services 48 13,878 289 Transportation 12 5,480 457 Accommodations 5 1,473 295 All Other C&I 121 101,222 837 Total C&I 779 $ 1,586,824 $ 2,037 (1) Includes Warehouse lending Third Quarter 2020 | 22

STRONG ALLOWANCE COVERAGE RATIO; ALLOCATION OF RESERVE BY LOAN TYPE ACL Composition 3Q20 2Q20 At CECL Adoption 4Q19 ($ in thousands) Amount % of Loans Amount % of Loans Amount % of Loans Amount % of Loans Commercial real estate $ 19,373 2.34% $ 17,372 2.11% $ 10,788 1.32% $ 5,941 0.73% Multifamily 25,559 1.73% 25,105 1.75% 13,214 0.88% 11,405 0.76% Construction 6,205 3.14% 6,675 3.13% 4,009 1.73% 3,906 1.69% Commercial and industrial 26,591 1.68% 26,618 1.85% 23,015 1.36% 22,353 1.32% SBA 3,557 1.11% 4,184 1.35% 3,508 4.94% 3,120 4.40% Total commercial loans 81,285 1.84% 79,954 1.90% 54,534 1.27% 46,725 1.08% Single family residential mortgage 8,976 0.73% 9,665 0.71% 10,066 0.63% 10,486 0.66% Other consumer 666 1.90% 751 1.91% 658 1.21% 438 0.81% Total consumer loans 9,642 0.76% 10,416 0.74% 10,724 0.65% 10,924 0.66% Allowance for loan losses 90,927 1.60% 90,370 1.61% 65,258 1.10% 57,649 0.97% Reserve for unfunded commitments 3,206 0.06% 4,195 0.07% 2,838 0.05% 4,064 0.07% Allowance for credit losses $ 94,133 1.66% $ 94,565 1.68% $ 68,096 1.14% $ 61,713 1.04% ● Allowance for Credit Losses (ACL) includes Reserve for Unfunded Commitments ● Excluding PPP loans, the ACL coverage increases from 1.66% to 1.74% at the end of 3Q20 Third Quarter 2020 | 23

SECURITIES PORTFOLIO Securities Portfolio Detail(1) Fair Value Fair Value QoQ Duration Security Type 2Q20 3Q20 Change 3Q20 Gov’t & Agency (MBS, CMO, & $ 307 $ 344 $ 37 7.41 SBA) CLOs 668 686 18 0.07 Municipal 57 69 12 7.69 Corporate Securities 144 147 3 7.44 Total Securities $ 1,176 $ 1,246 $ 70 3.28 ● The quarter over quarter change is due to $48.5 million in purchases and lower unrealized net losses of $23.9 million. The fair value improved to an unrealized net gain of $1.8 million as of 3Q20 from an unrealized net loss of $22.1 million as of 2Q20. The CLOs included an unrealized loss of $17.7 million as of 3Q20, down from $35.3 million as of 2Q20 Portfolio Profile(1) Portfolio Average Balances & Yields Credit Rating Composition $1,191 BBB Munis $1,105 $1,064 12% Corporates 6% $953 12% $834 3.60% 3.72% AAA AA 3.30% CLO 2.95% 2.26% 32% 56% 55% Gov’t & AGC 27% 3Q19 4Q19 1Q20 2Q20 3Q20 Average Balance ($ in millions) Yield (1) Dollars in millions. Values that are greater than $0.0 million (or 0.0%) but less than $0.5 million (or 0.5%) are not shown. Third Quarter 2020 | 24

CLO PORTFOLIO HAS DIVERSIFIED EXPOSURE CREDIT ENHANCEMENT PROVIDES SIGNIFICANT PRINCIPAL PROTECTION CLO Industry Breakdown • CLO portfolio has underlying diversified exposure with largest segment in Healthcare $686 million at September 30, 2020 & Pharmaceuticals at 13% (net of $17.7 million unrealized loss) • Limited exposure to severely stressed industries Aerospace & Defense 3% Other • AA and AAA holdings provide principal Healthcare & 17% Pharmaceuticals protection – exposure to underlying credit Construction & 13% Building losses would require a combination of 3% High Tech Industries lifetime defaults (25-35% CDR), loss severity Containers, 10% Packaging & Glass (40-50%), and prepayment assumptions (0- 3% 10% CPR) Automotive Services - Business 3% 9% • Under these assumptions, the underlying Capital Equipment 3% securities would need to take losses of Chemicals, approximately 25% before we would Retail FIRE - Banking, Finance, Plastics, & 3% Insurance & Real Estate anticipate incurring losses on principal Rubber 7% 3% Media - Broadcasting & • 3Q20 average CLO Portfolio yield of 2.16% Subscription 4% Hotel, Gaming & Services Consumer • Quarterly reset based on 3 Month Libor + Beverage, Leisure 4% Food & 5% 1.64% Telecommunications Tobacco 5% 4% Third Quarter 2020 | 25

ACTIVE MANAGEMENT OF DEPOSIT COSTS IS DRIVING DOWN COST OF FUNDS Cost of Funds Drivers 3.10% 2.85% 2.86% 2.74% 2.75% 2.34% 2.10% 1.78% 1.65% 1.57% 1.61% 1.75% 1.41% 1.55% 1.32% 1.48% 1.41% 1.27% 1.03% 1.11% 0.93% 0.82% 0.66% 0.71% 0.51% 3Q19 4Q19 1Q20 2Q20 3Q20 Cost of Interest-bearing deposits LT FHLB borrowings Cost of funds(1) ST FHLB borrowings Cost of total deposits (1) Cost of funds includes senior debt with a fixed rate of 5.45% Third Quarter 2020 | 26

DECLINING DEPOSIT COSTS PROTECT NET INTEREST MARGIN(1) Net Interest Margin Drivers 4.50% 4.50% 4.27% 4.06% 3.86% 3.09% 3.09% 3.04% 2.97% 2.86% 2.03% 1.85% 2.00% 1.75% 1.71% 1.29% 1.02% 0.25% 0.25% 0.25% 3Q19 4Q19 1Q20 2Q20 3Q20 Earning Asset Yield Net Interest Margin Fed Funds Rate Interest-Bearing Liabilities (1) PPP loans improve NIM by 3 bps Third Quarter 2020 | 27

INTEREST RATE RISK MANAGEMENT – EARNING ASSETS ANALYSIS Assets Repricing/Maturing by Duration ($millions) Repricing/Maturity by Product Type ($millions) $1,600 $1,400 $1,200 $1,000 $3,128 $3,408 43% $800 47% $600 $400 $200 $683 10% - < 1 Year 1 - 2 Years > 2 Years Variable Rate Loan Floors & Assets ($millions) < 1 Year 1 - 2 Years > 2 Years Category Total Balance % of Total Assets $ in millions • $3.81B (53%) of earning assets mature or have rate resets 100+ bps $ 56 0.8% 50-100 bps 48 0.7% <2 years 25-50 bps 160 2.2% 0-25 bps 105 1.4% • Earning assets with effective rate resets <2 years include: No Floor 276 3.8% Sub total Non-Floor Variable $ 645 8.9% • $2,697mm of loans Floor 1,243 17.2% • $821mm of securities (primarily CLO’s) Variable Loans $ 1,888 26.2% Hybrid Loans $ 2,654 36.8% • $292mm of interest-bearing cash deposits Fixed Loans $ 1,136 15.7% Total HFI Loans $ 5,678 78.7% • $3.41B (47%) of earning assets mature or have rate resets Total HFS Loans $ 2 0.0% Total Gross Loans $ 5,680 78.7% >2 years Fixed Securities $ 252 3.5% Variable Securities $ 994 13.8% Total Securities $ 1,246 17.3% Other Interest-Earning Assets $ 292 4.1% Total Earning Assets $ 7,218 100.0% Third Quarter 2020 | 28

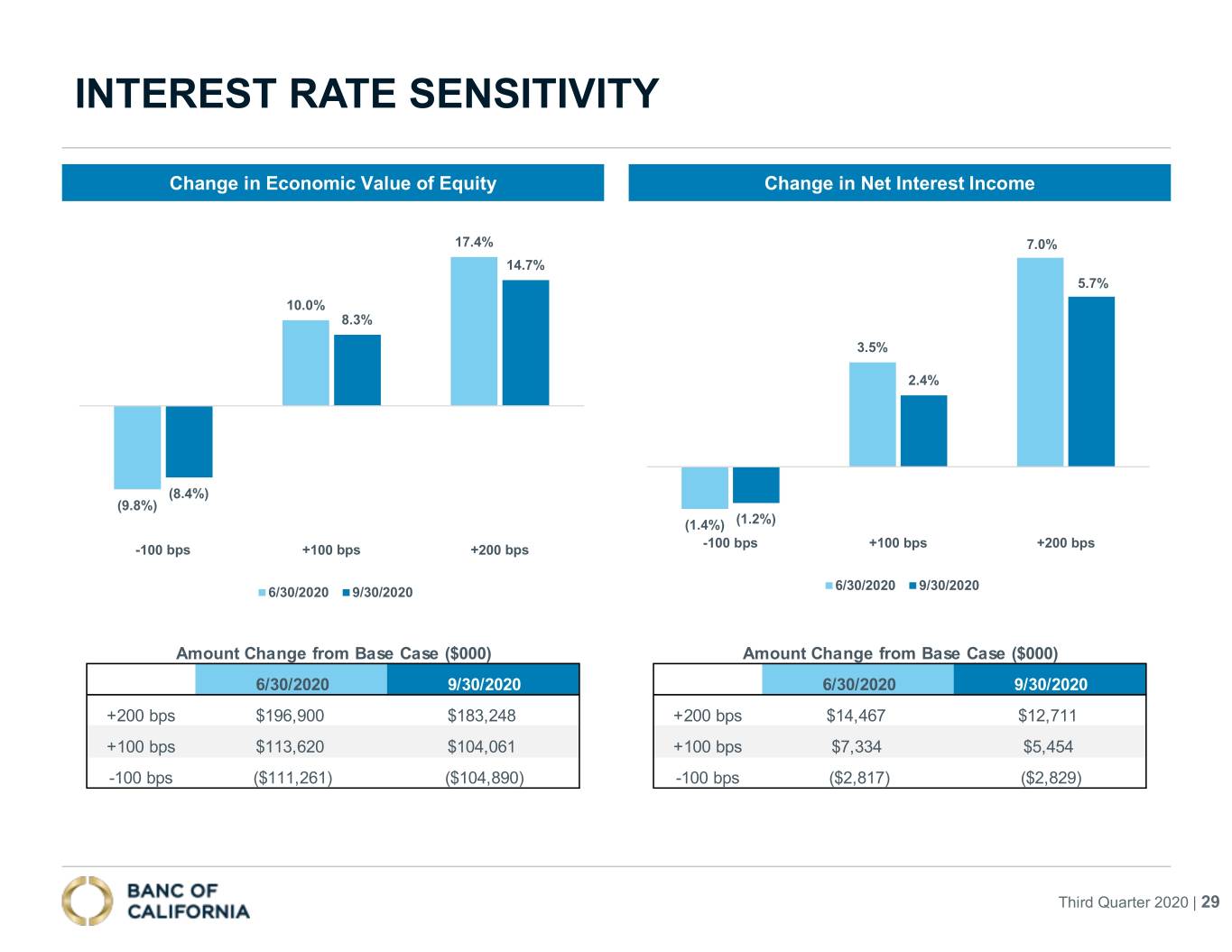

INTEREST RATE SENSITIVITY Change in Economic Value of Equity Change in Net Interest Income 17.4% 7.0% 14.7% 5.7% 10.0% 8.3% 3.5% 2.4% (8.4%) (9.8%) (1.4%) (1.2%) -100 bps +100 bps +200 bps -100 bps +100 bps +200 bps 6/30/2020 9/30/2020 6/30/2020 9/30/2020 Amount Change from Base Case ($000) Amount Change from Base Case ($000) 6/30/2020 9/30/2020 6/30/2020 9/30/2020 +200 bps $196,900 $183,248 +200 bps $14,467 $12,711 +100 bps $113,620 $104,061 +100 bps $7,334 $5,454 -100 bps ($111,261) ($104,890) -100 bps ($2,817) ($2,829) Third Quarter 2020 | 29

BANC FAST FACTS (Dollars in millions(1)) 3Q20 2Q20 1Q20 4Q19 3Q19 Total assets $ 7,738 $ 7,770 $ 7,663 $ 7,828 $ 8,625 Securities available-for-sale 1,246 1,176 969 913 776 Loans receivable 5,678 5,628 5,667 5,952 6,383 Total deposits 6,032 6,037 5,563 5,427 5,770 Net interest income 55.9 55.3 51.9 56.7 58.9 Total noninterest income 4.0 5.5 2.1 4.9 3.2 Total revenue 59.8 60.8 53.9 61.6 62.1 Noninterest expense(3),(4) 41.8 72.9 45.0 46.4 44.2 (Gain) loss on investments in alternative energy partnerships (1.4) (0.2) 1.9 1.0 (0.9) Total noninterest expense 40.4 72.8 46.9 47.5 43.2 Pre-tax pre-provision income(5) 19.4 (11.9) 7.0 14.1 18.9 Provision for (reversal of) credit losses 1.1 11.8 15.8 (3.0) 38.6 Net income (loss) 15.9 (18.4) (6.6) 14.3 (14.1) Preferred dividend and other adjustments 3.8 3.5 3.1 3.9 8.6 Net income (loss) available to common stockholders $ 12.1 $ (21.9) $ (9.7) $ 10.4 $ (22.7) Diluted earnings (loss) per common share $ 0.24 $ (0.44) $ (0.19) $ 0.20 $ (0.45) Return on average assets(2) 0.82% (0.96%) (0.35%) 0.71% (0.64%) Adjusted efficiency ratio(2),(5) 68.30% 119.55% 86.54% 74.51% 70.00% Class / CUSIP Issue Date Par Value Dividend Rate First Callable Date Preferred Equity Series ($000) / Coupon (%) Preferred Equity: Non-Cumulative, Perpetual D 05990K882 4/8/2015 $ 93,270,000 7.375% 6/15/2020 Preferred Equity: Non-Cumulative, Perpetual E 05990K874 2/8/2016 98,702,000 7.000% 3/15/2021 Total Preferred Equity $ 191,972,000 (1) All figures from reported operations unless noted; dollars in millions unless noted per share or percentage (2) Consolidated operations; Efficiency ratio adjusted for including the pre-tax effect of investments in alternative energy partnerships (3) Excluding loss on investments in alternative energy partnerships (4) Non-GAAP measure, reconciliation in table above (5) Non-GAAP financial Third Quarter 2020 | 30 measure; see “Non-GAAP Reconciliation” slides at end of presentation

NON-GAAP FINANCIAL INFORMATION This presentation contains certain financial measures determined by methods other than in accordance with U.S. generally accepted accounting principles (GAAP). These measures include noninterest expense to average assets, pre-tax pre-provision income, pre-tax pre-provision return on average assets, noninterest expense from core operations, operating expense from core operations, adjusted pre-tax pre-provision income, adjusted pre-tax pre-provision return on average assets, and diluted earnings per common share from core operations, adjusted for non-core items, each excluding loss on investments in alternative energy partnerships and the latter four measurements adjusted for non-core items. Management believes that these particular measures provide useful supplemental information in understanding our core operating performance. These measures should not be viewed as substitutes for measures determined in accordance with GAAP, nor are they necessarily comparable to non-GAAP measures that may be presented by other companies. Reconciliations of these measures to measures determined in accordance with GAAP are contained on slides 32-36 of this presentation. Non-GAAP measures in this presentation also include tangible equity to tangible assets, tangible common equity to tangible assets, return on average tangible common equity, and adjusted efficiency ratio including the pre-tax effect of investments in alternative energy partnerships. These particular measures are used by management in its analysis of the Company's capital strength and the performance of the Company’s businesses. Banking and financial institution regulators also exclude goodwill and other intangible assets from total stockholders' equity when assessing the capital adequacy of a financial institution. Management believes the presentation of these measures excluding the impact of these items provides useful supplemental information that is essential to a proper understanding of the capital and financial strength of the Company and the performance of its businesses. These measures should not be viewed as substitutes for results determined in accordance with GAAP, nor are they necessarily comparable to non-GAAP measures that may be presented by other companies. Reconciliations of these measures to measures determined in accordance with GAAP are contained on slides 32-36 of this presentation. Third Quarter 2020 | 31

NON-GAAP RECONCILIATION (Dollars in thousands) 3Q20 2Q20 1Q20 4Q19 3Q19 Noninterest expense $ 40,394 $ 72,770 $ 46,919 $ 47,483 $ 43,240 (Loss) gain on investments in alternative energy partnerships (1,430) (167) 1,905 1,039 (940) Adjusted noninterest expense 41,824 72,937 45,014 46,444 44,180 Net interest income 55,855 55,315 51,861 56,660 58,915 Noninterest income 3,954 5,528 2,061 4,930 3,181 Total revenue 59,809 60,843 53,922 61,590 62,096 Tax credit from investments in alternative energy partnerships - - - 1,689 77 Deferred tax expense on investments in alternative energy - - - (177) (8) partnerships Tax effect on tax credit and deferred tax expense - - - 267 7 Gain (loss) on investments in alternative energy partnerships 1,430 167 (1,905) (1,039) 940 Total pre-tax adjustments for investments in alternative energy 1,430 167 (1,905) 740 1,016 partnerships Adjusted total revenue $ 61,239 $ 61,010 $ 52,017 $ 62,330 $ 63,112 Efficiency Ratio 67.54% 119.60% 87.01% 77.10% 69.63% Adjusted efficiency ratio including the pre-tax effect of 68.30% 119.55% 86.54% 74.51% 70.00% investments in alternative energy partnerships Effective tax rate utilized for calculating tax effect on tax credit N/A N/A N/A 15.00% 9.36% and deferred tax expense Third Quarter 2020 | 32

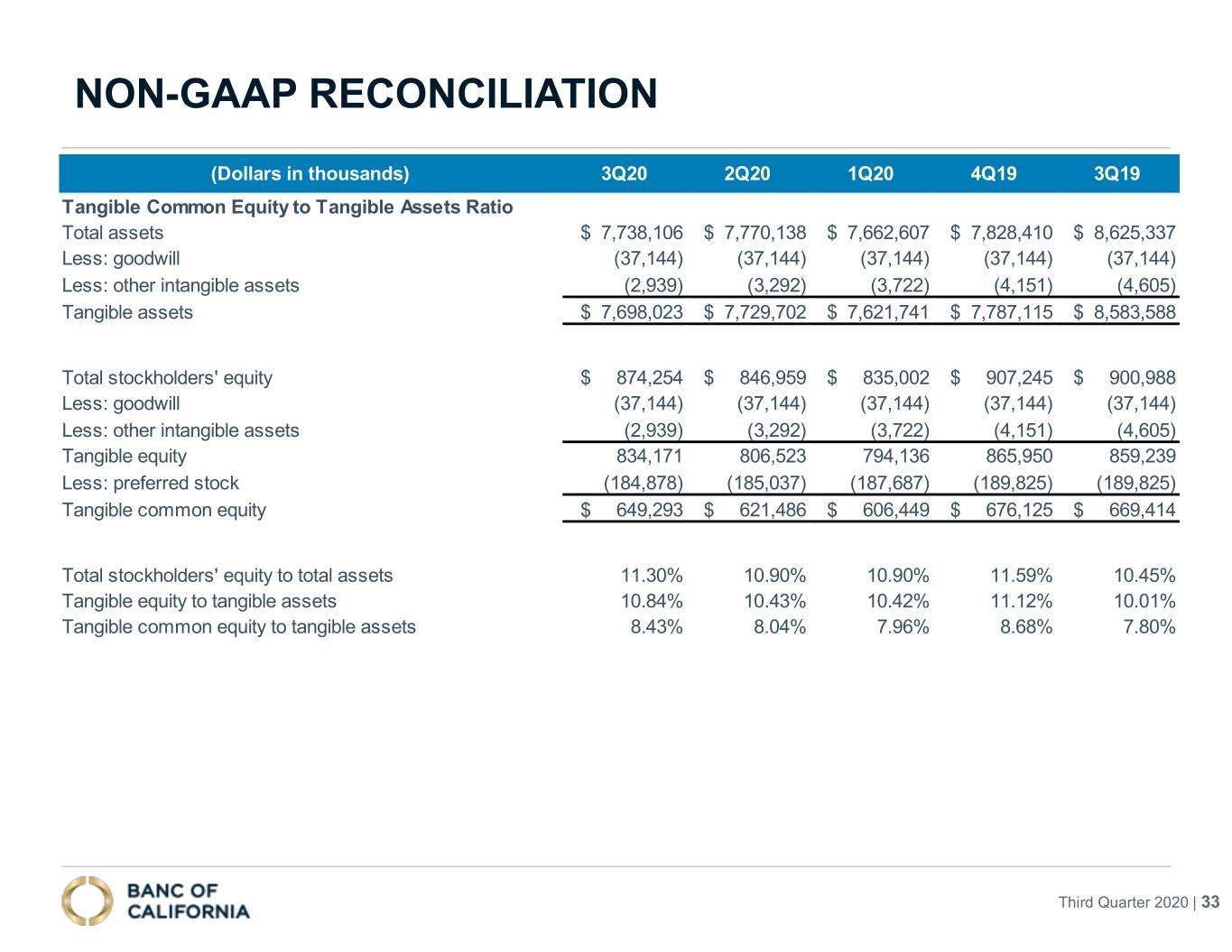

NON-GAAP RECONCILIATION (Dollars in thousands) 3Q20 2Q20 1Q20 4Q19 3Q19 Tangible Common Equity to Tangible Assets Ratio Total assets $ 7,738,106 $ 7,770,138 $ 7,662,607 $ 7,828,410 $ 8,625,337 Less: goodwill (37,144) (37,144) (37,144) (37,144) (37,144) Less: other intangible assets (2,939) (3,292) (3,722) (4,151) (4,605) Tangible assets $ 7,698,023 $ 7,729,702 $ 7,621,741 $ 7,787,115 $ 8,583,588 Total stockholders' equity $ 874,254 $ 846,959 $ 835,002 $ 907,245 $ 900,988 Less: goodwill (37,144) (37,144) (37,144) (37,144) (37,144) Less: other intangible assets (2,939) (3,292) (3,722) (4,151) (4,605) Tangible equity 834,171 806,523 794,136 865,950 859,239 Less: preferred stock (184,878) (185,037) (187,687) (189,825) (189,825) Tangible common equity $ 649,293 $ 621,486 $ 606,449 $ 676,125 $ 669,414 Total stockholders' equity to total assets 11.30% 10.90% 10.90% 11.59% 10.45% Tangible equity to tangible assets 10.84% 10.43% 10.42% 11.12% 10.01% Tangible common equity to tangible assets 8.43% 8.04% 7.96% 8.68% 7.80% Third Quarter 2020 | 33

NON-GAAP RECONCILIATION (Dollars in thousands) 3Q20 2Q20 1Q20 4Q19 3Q19 Return on tangible common equity Average total stockholders' equity $ 865,406 $ 854,250 $ 916,047 $ 912,749 $ 961,739 Less: Average preferred stock (184,910) (185,471) (189,607) (189,824) (213,619) Less: Average goodwill (37,144) (37,144) (37,144) (37,144) (37,144) Less: Average other intangible assets (3,172) (3,574) (4,003) (4,441) (4,935) Average tangible common equity $ 640,180 $ 628,061 $ 685,293 $ 681,340 $ 706,041 Net income (loss) $ 15,913 $ (18,449) $ (6,593) $ 14,272 $ (14,132) Less: Preferred stock dividends and impact of preferred (3,454) (3,393) (3,007) (3,540) (8,496) stock redemption Add: Amortization of intangible assets 353 430 429 454 500 Less: Tax effect on amortization of intangible assets (74) (90) (90) (95) (105) Net (loss) income available to common stockholders $ 12,738 $ (21,502) $ (9,261) $ 11,091 $ (22,233) Return on average equity 7.32% (8.69%) (2.89%) 6.20% (5.83%) Return on average tangible common equity 7.92% (13.77%) (5.44%) 6.46% (12.49%) Statutory tax rate utilized for calculating tax effect on 21.00% 21.00% 21.00% 21.00% 21.00% amortization of intangible assets Third Quarter 2020 | 34

NON-GAAP RECONCILIATION (Dollars in thousands) 3Q20 2Q20 1Q20 4Q19 3Q19 Adjusted Noninterest Expense Total noninterest expense $ 40,394 $ 72,770 $ 46,919 $ 47,483 $ 43,240 Less: non-core items Naming rights termination - (26,769) - - - Debt retirement expense - (2,515) - - - Data processing fees - - - - - Professional fees (1,172) (875) (1,678) 3,557 2,615 Restructuring expense - - - (1,626) - Other expense - - - - (131) Total non-core adjustments (1,172) (30,159) (1,678) 1,931 2,484 Less: gain/(loss) on investments in alternative 1,430 167 (1,905) (1,039) 940 energy partnerships Total adjustments 258 (29,992) (3,583) 892 3,424 Adjusted noninterest expense $ 40,652 $ 42,778 $ 43,336 $ 48,375 $ 46,664 Average assets $7,687,105 $7,740,206 $7,562,942 $7,954,591 $8,695,638 Noninterest expense / Average assets 2.09% 3.78% 2.50% 2.37% 1.97% Adjusted noninterest expense / Average assets 2.10% 2.22% 2.30% 2.41% 2.13% Third Quarter 2020 | 35

NON-GAAP RECONCILIATION (Dollars in thousands) 3Q20 2Q20 1Q20 4Q19 3Q19 Net interest income $ 55,855 $ 55,315 $ 51,861 $ 56,660 $ 58,915 Noninterest income 3,954 5,528 2,061 4,930 3,181 Total revenue 59,809 60,843 53,922 61,590 62,096 Noninterest expense 40,394 72,770 46,919 47,483 43,240 Pre-tax pre-provision income 19,415 (11,927) 7,003 14,107 18,856 Net interest income 55,855 55,315 51,861 56,660 58,915 Noninterest income 3,954 5,528 2,061 4,930 3,181 Adjustments for non-core items - noninterest income (296) (2,036) 1,586 (33) 5,778 Adjusted noninterest income 3,658 3,492 3,647 4,897 8,959 Total revenue 59,513 58,807 55,508 61,557 67,874 Noninterest expense 40,394 72,770 46,919 47,483 43,240 Total noninterest expense adjustments 258 (29,992) (3,583) 892 3,424 Adjusted noninterest expense 40,652 42,778 43,336 48,375 46,664 Adjusted pre-tax pre-provision income $ 18,861 $ 16,029 $ 12,172 $ 13,182 $ 21,210 Average Assets $ 7,687,105 $ 7,740,206 $ 7,562,942 $ 7,954,591 $ 8,695,638 Pre-tax pre-provision ROAA 1.00% (0.62%) 0.37% 0.70% 0.86% Adjusted pre-tax pre-provision ROAA 0.98% 0.83% 0.65% 0.66% 0.97% Third Quarter 2020 | 36

bancofcal.com bancofcal.com